1. Introduction

“The opportunity to create sustainable value—shareholder wealth that simultaneously drives us toward a more sustainable world—is huge”

Mergers and acquisitions (M&A) are becoming essential strategic choices for companies, greatly affecting their long-term success (

Lindner et al., 2025;

Carline et al., 2009). Recent Goldman Sachs research shows that 47% of surveyed clients expect strategic growth and acquiring new capabilities to be the main reasons for M&A decisions in 2025 (

Goldman, 2025). Additionally, about one-third of M&A are cross-border, adding more risk and complexity (

Lindner et al., 2025). These international acquisitions can significantly influence a firm’s market value and collaborative synergies. Conversely,

Lewis and McKone (

2016) estimate that more than half of M&A deals ultimately destroy value. Although many studies in international business and corporate finance have examined M&A deals for global expansion, according to

Lindner et al. (

2025), there is a lack of empirically confirmed long-term benefits of cross-border acquisitions.

Furthermore,

Arjona et al. (

2023) highlight that Environmental, Social, and Governance (ESG) considerations are becoming important drivers for M&A activities. ESG-focused acquisitions aim to go beyond simply reducing risks and complying with regulations. Instead, they focus on proactive strategies that allow the merging companies to create additional market value through ESG-based synergies. In this context, acquirers can promote sustainability goals and ensure that the combined value of the merging partners exceeds the sum of their individual values.

A recent study by BCG showed that transactions prioritizing ESG factors generally deliver higher Total Shareholder Returns (TSR) compared to other deals (

Kengelbach et al., 2022). Additionally, Deloitte’s research found that nearly seventy percent of those involved in M&A strategy and deal-making now consider ESG highly strategic (

Lightle, 2024). To the best of the author’s knowledge, however, there is a lack of empirically verified ESG synergism in cross-border acquisitions. Against this background, this paper addresses two gaps in the literature: the inclusion of VaR in real option valuation (ROV) of collaborative synergies in cross-border acquisitions and ESG-based synergy valuation through real option application.

Integrating Value-at-Risk (VaR) into ROV enhances risk management in cross-border M&A, providing a more comprehensive approach to assessing collaborative synergies, which has been underexplored in previous research. This paper examines the ROV of ESG-based collaborative synergies by exploring how incorporating ESG factors into ROV frameworks improves the evaluation of collaborative synergies and sustainability outcomes in M&A deals involving multinational corporations (MNCs) in the beauty industry.

Furthermore, AI can play a crucial role in various parts of this acquisition, such as improving ESG, sharing knowledge, planning market entry, and restructuring global supply chains. AI can enhance an acquirer’s ESG performance by tracking environmental factors, analyzing ecological impacts, and strengthening social programs by identifying where the combined company can contribute more effectively to community well-being. Additionally, AI helps ensure compliance by maintaining adherence to regulatory standards and ethical guidelines.

This approach aligns value-based management with broader sustainability goals, filling a notable gap in the literature on the intersection of ESG practices and ROV. By combining financial and non-financial metrics, these contributions help connect traditional financial risk management with modern sustainability needs. The result is a more comprehensive framework for assessing cross-border M&A transactions and internationalization strategies.

The paper asks three research questions.

First, how can ESG-based collaborative synergies be measured using ROV?

Second, how can an acquirer incorporate the ESG scores of a target into ROV when evaluating ESG-based collaborative synergies in international M&A transactions?

Third, how can the integration of Artificial Intelligence (AI) improve ESG performance and operational efficiency in MNCs, especially in the context of M&A?

The role of MNCs in promoting sustainable practices is difficult to overstate. When Unilever acquired Ben & Jerry’s in 2000, they aligned their shared values related to social responsibility, environmental sustainability, and ethical governance. Ben & Jerry’s dedication to social causes, such as donating a portion of profits to support various initiatives, was preserved and integrated into Unilever’s broader ESG strategy (

Noghrehkar, 2023).

Additionally, Goldman Sachs’ acquisition of NN Investment Partners from NN Group N.V. for €1.7 billion in 2022 demonstrates the integration of ESG strategies into mainstream investing and the aim among major asset managers to grow their ESG investment platforms (

Brownstein et al., 2022). Goldman Sachs utilized the expertise of NN Investment Partners to enhance its existing investment processes, strengthen ESG integration across its product range, and meet clients’ sustainable investment goals (

Goldman, 2022).

In this context, L’Oréal’s recent acquisition of Aesop for

$2.525 billion provides a convenient case study to address these research questions. M&A activities like this enable companies to expand their market presence, diversify their product offerings (

Čirjevskis, 2020), and create ESG-based collaborative synergies.

L’Oréal recognized the growing demand for sustainable and ethically produced beauty products, and Aesop’s strong commitment to using natural ingredients and sustainable sourcing aligned well with L’Oréal’s sustainability goals. For L’Oréal, acquiring Aesop, a brand known for its high-quality, sustainable products, supports its aim to lead the luxury beauty market (

Klasa & Abboud, 2023). In this context, the ESG synergies of this acquisition can be examined through the concepts of Value-at-Risk (VAR) and ROV.

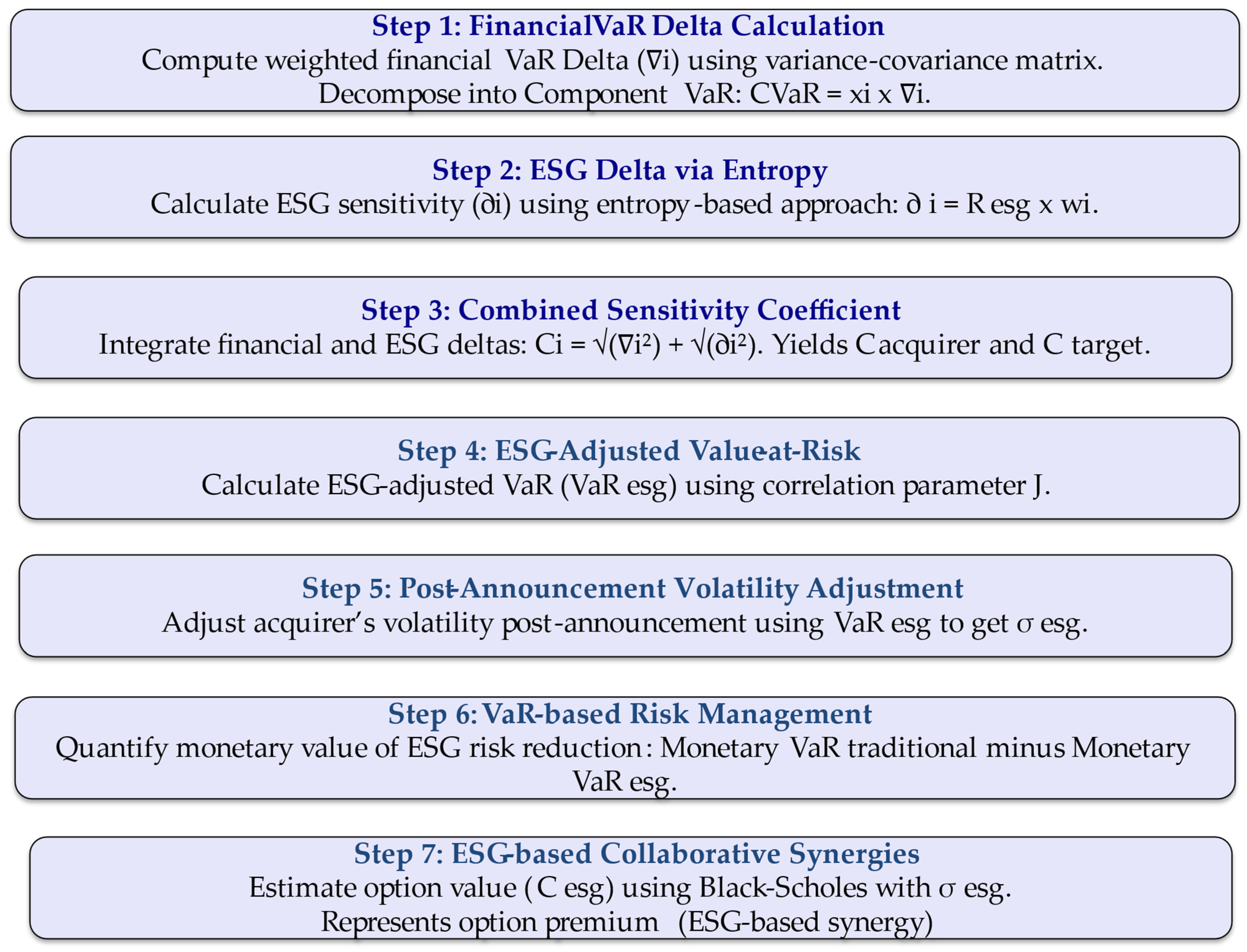

The paper starts by emphasizing the strategic importance and inherent risks of cross-border M&A. It then introduces an innovative method—ROV enhanced with VaR and ESG metrics. The next section focuses on creating ESG-based collaborative synergies and examining how Artificial Intelligence (AI) helps achieve ESG goals. Finally, the framework is applied to a real-world case study (L’Oréal’s acquisition of Aesop), providing empirical insights and a comprehensive model for evaluating risk and ESG-driven synergies in cross-border M&A. Below is a flow diagram of the paper’s methodological structure to help readers quickly understand the overall approach, as shown in

Figure 1.

The flow chart in

Figure 1 visually outlines the logical progression and methodological structure of this research on ESG-based synergy valuation in cross-border M&A. It serves as a conceptual roadmap, guiding the reader through the key components and innovations of this study.

The rest of this paper is structured as follows: Section Key Literature review explores the sources of ESG-based synergies in M&A deals, the ROV approach to collaborative synergies using VaR and ESG-based VaR methods, and formulates three theoretical propositions. The Section Method outlines the data and research methodology, while the next section presents data analysis and interpretation. The final sections provide research findings, discussion, conclusion, research limitations, and future work.

3. Method

The Method section is explicitly designed to also address the third proposition, which examines how incorporating sustainability into ROV may influence the value of those options. The connection between ESG performance and corporate financial outcomes has been studied through both theoretical and empirical approaches, utilizing a variety of indicators and models to analyze their interaction (

Mandas et al., 2023).

However, this relationship closely aligns with real options theory, which provides a framework for making investment decisions under uncertainty—especially relevant for sustainability initiatives that involve long-term commitments and unpredictable outcomes. ROV helps quantify these uncertainties, incorporate them into strategic decision-making, and ensure that sustainability efforts are valued appropriately. Such initiatives can also reduce risks related to ESG factors.

This research builds on two key theoretical foundations. First, it incorporates the integration of VaR into ROV, as proposed by

Alesii (

2005) and

Fortin et al. (

2007). VaR is a statistical measure used to estimate potential losses in a company’s market value over a defined period under normal market conditions (

Hull, 2015).

Alesii (

2005) demonstrated that combining VaR with real options enhances operational risk management and shareholder value.

Fortin et al. (

2007) introduced a framework that merges real options analysis with Conditional Value-at-Risk (CVaR) portfolio optimization, particularly for evaluating investments in the electricity sector under uncertainty, showing how carbon pricing policies influence technology diversification and risk strategies.

Second, the research introduces a new risk metric—VaR ESG (VaR ESG)—developed by

Capelli et al. (

2023,

2024). This metric combines traditional market risk measures with ESG factors using the variance-covariance method. Capelli and colleagues argue that their predictive model, which merges financial VaR with ESG risk, provides a more conservative and precise estimate of expected losses by including sustainability-related risks.

In this context, the paper presents a new method for breaking down VaR ESG by calculating Component VaR ESG (CVaR ESG) for both the acquirer’s and target’s market values, similar to the assessment of a multi-asset financial portfolio (

Capelli et al., 2023,

2024).

The following seven steps outline a multi-step approach for calculating a combined risk sensitivity measure (Ci) that incorporates both financial and ESG aspects in the context of valuing ESG-based collaborative synergies in cross-border M&A.

Step 1: Financial VaR Delta Calculation. The process starts with calculating the weighted financial VaR Delta, denoted as ∇i, for both the acquiring and target firms. This is done using the variance-covariance matrix of asset returns. According to

Capelli et al. (

2023, p. 200), VaR can be broken down into Component VaR (CVaR), where each component is defined as: CVaR = xi·∇i. This breakdown enables a detailed evaluation of individual asset contributions to the overall portfolio financial risk.

Step 2: ESG Delta via Entropy. Next, the ESG sensitivity component (∂i∂i) is calculated using an entropy-based approach. The ESG delta is defined as: = × , where represents the entropy of ESG scores—a non-variance-based risk measure—and wi denotes the weight of the asset in the portfolio.

Step 3: Combined Sensitivity Coefficient. The combined risk sensitivity coefficient CiCi is then computed by integrating both financial and ESG deltas using the following formula: Ci = + . This yields the composite risk coefficients for the acquirer and the target, denoted as and , respectively.

Step 4: ESG-Adjusted VaR. To further refine the risk assessment, an ESG-adjusted Value-at-Risk is calculated. This incorporates a correlation parameter J, which captures the degree of co-movement between ESG risk factors across portfolio components.

Step 5: Post-Announcement Volatility Adjustment. The acquirer’s stock volatility is adjusted post-announcement using the ESG-adjusted VaR scores . The resulting volatility, , reflects the market’s updated perception of financial and ESG-related risks.

Step 6: VaR-based Risk Management. The incremental value generated through the integration of ESG practices in M&A. To quantify the monetary value of the risk reduction attributable to the integration of ESG practices in M&A, the difference between traditional and ESG-adjusted monetary VaR: Monetary minus Monetary .

Step 7: ESG-based Collaborative Synergies. ESG-based collaborative synergies ( are estimated using the Black-Scholes model. This involves substituting the traditional volatility with the ESG-adjusted volatility.. The results are then interpreted to assess the financial implications of integrating ESG into M&A strategies. This represents the deferral option premium as the value of management’s flexibility to adapt to future market conditions, expand into new areas, or develop new products/services, given the ESG-adjusted risk profile.

The metrics in Steps 6 and 7 have complementary roles: Step 6 evaluates risk mitigation, while Step 7 measures the value of ESG-driven collaborative synergies, as shown in Comparative

Table 1.

The new methodology can improve risk management, enhance decision-making, and provide strategic flexibility in cross-border M&A transactions. This integrated approach to ROV of collaborative synergies makes sure that ESG factors are properly valued and included in M&A deal assessments, ultimately supporting sustainable growth and competitive edge.

This methodology provides a more integrated and accurate approach to valuing acquisition synergies and related risks by including ESG factors. It allows for the identification of risks associated with environmental impact, social responsibility, and governance practices—elements often overlooked by traditional financial models like Discounted Cash Flow (DCF) or simple real options analysis. By adjusting conventional valuation frameworks to incorporate ESG dimensions (

Chau et al., 2025;

Aydoğmuş et al., 2022), the methodology improves the evaluation of potential investment opportunities for value creation.

Incorporating ESG considerations into ROV provides investors with deeper insights into long-term value creation and risk reduction. This paper advances the theoretical foundation for integrating sustainability into real options analysis, establishing a basis for future empirical testing. The following section offers quantitative evidence supporting the effectiveness of the proposed method.

4. Empirical Context: L’Oréal’s 2023 Acquisition of Aesop—Data Analysis and Interpretation

On 3 April 2023, L’Oréal announced its acquisition of Aesop, a high-end Australian skincare brand, from the Brazilian parent company Natura & Co. The deal was valued at

$2.525 billion (

Guilbault, 2023). During Natura & Co’s ownership from 2012 to 2022, Aesop grew from over 80 stores in 14 countries to 269 stores in 27 countries, with revenue increasing from

$28 million to

$537 million (

BSIC, 2023).

Although relatively small compared to L’Oréal’s market capitalization of around €222 billion at the time, this was the company’s largest acquisition ever, surpassing its

$1.7 billion purchase of YSL Beauty in 2008. Over the past decade, Aesop’s revenue increased from

$22 million to

$537 million, its store count grew from 52 to 395, and its global presence expanded from 8 to 29 countries (

BSIC, 2023).

Aesop’s biggest growth opportunity is in China, the world’s largest and fastest-growing luxury and cosmetics market. After opening its first store there, China is expected to significantly boost Aesop’s revenue and help L’Oréal elevate the brand to its “billionaire brands” category—those that generate over

$1 billion in annual sales (

May, 2024).

MNCs like L’Oréal play a key role in advancing sustainability by setting industry standards, investing in green technologies, and influencing supply chains. L’Oréal’s “L’Oréal for the Future” program demonstrates its commitment to reducing environmental impact and promoting social equity. The acquisition of Aesop, known for its vegan and eco-friendly formulations, aligns with L’Oréal’s ESG strategy and boosts its sustainability credentials. By incorporating Aesop’s practices, L’Oréal can support plant-based ingredients, sustainable packaging, and ethical sourcing across its portfolio, strengthening its leadership in responsible beauty (

L’Oréal Group, 2023). Therefore, L’Oréal can leverage Aesop’s practices to enhance its overall sustainability efforts and create ESG-based collaborative synergies.

This acquisition also advances L’Oréal’s broader ESG objectives, which include climate action, circular innovation, and social inclusion. The company emphasizes that “sustainable business is good business,” and considers ESG integration as a key factor for long-term value, consumer trust, and competitive edge (

Forbes, 2023). Aesop’s brand identity and operations provide L’Oréal with a platform to deepen the integration of ESG principles into its global strategy.

L’Oréal has adopted artificial intelligence (AI) to improve both its recruitment processes and customer experience. By integrating AI tools, the company has streamlined operations, enhanced personalization, and stayed competitive in the beauty industry. When it comes to AI in recruiting and hiring, L’Oréal uses My chatbot, which automates early-stage candidate interactions by answering questions and verifying details such as availability and visa status. Additionally, L’Oréal Seedlink is an AI software that assesses responses to open-ended interview questions, helping identify promising candidates who might be overlooked through traditional resume screening (

Marr, 2019).

Furthermore, after acquiring ModiFace, L’Oréal introduced SkinConsultAI, an AI-driven skin diagnostic tool. This innovation merges deep learning and augmented reality (AR) with L’Oréal’s expertise in skin aging and its photo database. Customers can upload selfies to get personalized skincare advice, improving the beauty experience through technology. Originally launched in Canada, the tool is expected to go global (

Marr, 2019). In this context, L’Oréal’s advanced AI use can greatly benefit Aesop after the acquisition by boosting operational efficiency, customer engagement, and aligning the brand with sustainability and luxury.

According to the valuation framework discussed earlier, the first step is identifying real options. Through this acquisition, L’Oréal has expanded its international presence, entered new markets, and added complementary product lines, potentially increasing revenue and market share. The company also maintains the flexibility to wait for ESG-based collaborative synergies to develop over time, using shared VRIN resources, core competencies in sustainable practices, and dynamic capabilities in responsible beauty. This deferral option enables strategic value creation. Therefore, L’Oréal’s acquisition of Aesop presents a deferral option for gaining ESG-based collaborative synergies.

The next step involves determining the parameters for valuing these real options. The relevant parameters and valuation data are presented in

Table 2.

Having used traditional valuation of volatility (σ = 22.15%), the measurement of collaborative synergies from this deal was conducted using deferred options with the application of the Black–Scholes Options Pricing Model (BSOPM), following the seminal recommendation of

Dunis and Klein (

2005).

In the Black-Scholes model, has a specific and powerful interpretation, particularly in the context of real options and probability. In the original Black-Scholes model for financial options, is often interpreted as the risk-neutral probability of the option expiring “in-the-money.” That is, it’s the probability that the final asset price will be greater than the strike price, adjusted for the risk-free rate.

When applied to real options,

represents the risk-neutral probability that the synergy will be realized. A

value of 1.027 is a statistical value that can be looked up in a standard normal distribution table to find this probability. A

of 1.027 corresponds to a probability of approximately 84.77% (e.g.,

Hull, 2005, p. 533). This probability (84.77%) is not the absolute, real-world probability. It is a “risk-neutral” probability, which is a key assumption of the Black-Scholes model. The interpretation is that, under a risk-neutral scenario, there is a very high likelihood that the conditions will be favorable enough for L’Oréal to exercise this deferral option and move forward with realizing the collaborative synergies.

Regarding the interpretation of In ROV and M&As context, reflects the risk-adjusted likelihood that the option (i.e., the M&A investment) will be profitable. In real options, is interpreted as the Delta of the option, i.e., the sensitivity of the option value to changes in the underlying asset. A high value of 1.248 implies that the expected value of synergies is significantly higher than the cost of investment, the call option is deep in-the-money, meaning the deal is likely to be beneficial, and the acquirer has strong strategic flexibility and favorable timing to defer getting collaborative synergies.

A

of 1.248 corresponds to a probability of approximately 88.4% (e.g.,

Hull, 2005, p. 533). This supports the strategic use of deferral options, allowing the acquirer to wait for more favorable conditions before committing. The Black–Scholes option pricing model, as applied in the current research, aligns with real options theory and the recommendations of

Dunis and Klein (

2005).

Subsequently, a sensitivity analysis was carried out using the Greeks (

Hull, 2015) to assess how changes in key parameters affect option values. This analysis, combined with the application of the Black-Scholes model for option valuation as shown in

Figure 2, offers insights into the stability of the valuation results and highlights the most influential factors impacting option pricing from a risk management perspective.

Both the Black-Scholes Option Pricing Model (BSOPM) and the sensitivity analysis conducted using DerivaGem 2.0 produced an identical valuation for the deferral option (representing collaborative synergies), estimated at USD 53.7 billion. DerivaGem 2.0 was used to analyze key risk metrics such as delta, gamma, vega, theta, and rho, which capture various dimensions of financial risk within a portfolio. Delta measures how much the price of an option changes for a

$1 change in the price of the underlying asset (So). Gamma measures the sensitivity of delta, or the rate of change of delta with respect to changes in the underlying asset’s price (So). Vega measures how much the price of an option changes with a 1% change in implied volatility (sigma). Theta measures how much the price of an option decreases as time passes (T), assuming all other factors remain constant. Rho measures how much the price of an option changes in response to a 1% change in the risk-free interest rate (r) (

Hull, 2015).

While delta–gamma–vega analysis generates a wide range of risk indicators throughout the year, it does not offer a consolidated measure of the overall risk exposure associated with an M&A transaction, as given in

Table 3. To address this, VaR is employed as a single, comprehensive metric that summarizes total portfolio risk (

Hull, 2015, p. 494). The following section outlines the process of determining the parameters required for calculating VaR in ESG-focused M&A deals and introduces both the traditional VaR and ESG-adjusted VaR (

Metrics.

In the L’Oréal–Aesop acquisition, the Greeks offer a multidimensional perspective on risk and strategic flexibility. Delta and gamma emphasize the sensitivity to synergy valuation, vega measures the impact of uncertainty (especially ESG-related), theta indicates the cost of waiting, and rho demonstrates how macroeconomic changes (like interest rates) affect the timing of the deal. While these metrics provide detailed insights, they are supplemented by VaR to give a comprehensive view of total risk exposure.

In the current research, using changes in market value as a proxy for returns in VaR calculations can be justified under certain conditions, especially when dealing with annual data and non-public companies. Having used market value changes, there are some key points to support this approach. The first is an annual data context for long-term horizons. When calculating VaR over extended time horizons (e.g., annually), shifts in market value can offer a more comprehensive view of a company’s performance and risk exposure. In this context,

Blake et al. (

2000) argued that using the square-root rule to estimate 10-day VaR, as suggested by the

Basle Committee on Banking Supervision (

1996, p. 44), may significantly overstate risk.

Similarly,

Dowd et al. (

2004) argued that applying the square-root-of-time rule to long-term VaR is not appropriate, as it can be misleading—even over relatively short periods—and becomes more inaccurate over longer horizons. A long-term VaR approach, by contrast, captures the cumulative effects of market fluctuations over the entire period, providing a more comprehensive view of potential losses than short-term estimates.

The second is aggregate impact: Annual changes in market value reflect the combined effect of various factors, including market sentiment, operational performance, and strategic decisions. The third is the applicability of this approach for non-public companies. For non-public companies like Aesop, detailed share price data may not be available. Using changes in market value can be a practical alternative to estimate returns and volatility. Market value changes can serve as a proxy for volatility, indicating the overall risk profile of the company.

Returns are based on changes in market value, usually calculated as the percentage change in an asset’s price over time. This core concept is implicit in financial research, such as

Fama and French’s (

1988). Their findings highlight that predictable price fluctuation explains a large part of long-term return variability, strengthening the connection between price movements and return patterns. Therefore, changes in market value offer a comprehensive view of a company’s financial health and market stance, which is essential for accurate risk evaluation. Consequently, using market value changes as a proxy for returns in VaR calculations is justified, particularly for annual data and non-public companies. This method ensures consistency, offers a complete perspective, and aligns with best practices in risk management.

In this context, using annual changes in market value for L’Oréal and Aesop provides a practical and consistent way to estimate returns and calculate VaR. This method aligns with the requirement for annual data in ROV and addresses the limitations caused by the lack of data for non-public companies. Market capitalization data for L’Oréal was obtained from the CompaniesMarketcap.com website (

CompaniesMarketcap.com, 2025), which is generally considered a reputable and reliable platform for tracking stock market capitalization and company valuations. Investors and analysts frequently use it for quick market cap comparisons.

For Aesop, market value was estimated using annual net revenue data from Statista (

Statista, 2025), combined with Bloomberg Intelligence’s recommendation that the acquisition price reflects a revenue multiple of 4.2× (

Rozario, 2023). The Brazilian real figures were converted into U.S. dollars using exchange rate data from Trading Economics (

Trading Economics, 2025a).

To determine the VaR related to L’Oréal’s acquisition of Aesop, the mean, standard deviation, and correlation of the market capitalizations for both L’Oréal (LL) and Aesop (AA) were calculated using Microsoft Excel on Windows 11, as shown in

Appendix A.

The correlation (

of the returns of both L’Oréal (LL) and Aesop (AA) is 0.62. Portfolio means of returns L’Oréal (LL) and Aesop (AA) of was calculated assuming the acquisition is weighted by the 2023 market capitalizations as shown in Formulas (4)–(6).

Thus, portfolio means return:

Now consider a portfolio comprising

$US 226.25 M in L’Oréal and

$US 2.53 M in Aesop, based on their respective market values. Assume that the returns of two these two assets follow a bivariate normal distribution with a correlation of 0.62. According to

Hull (

2005, pp. 392–393), if the standard deviations of L’Oréal and Aesop are denoted by

and

respectively, the correlation between them is

, then the portfolio variance (

and standard deviation of the combined portfolio (

is given by

This matches the standard deviation of the portfolio

) as follows:

The use of the minimum variance portfolio concept (the combination of assets that results in the lowest possible portfolio volatility) in this context does not imply an optimal investment strategy but aims to quantify the risk of the combined entity after acquisition. By considering L’Oréal and Aesop as parts of a portfolio, an analyst can utilize portfolio theory to estimate the combined volatility and VaR of M&A deals. This method helps evaluate how the acquisition influences L’Oréal’s overall risk profile when Aesop is integrated, considering their respective market capitalizations and return characteristics.

Finally, using a 95% confidence level (z-score = 1.65), the VaR associated with L’Oréal’s acquisition of Aesop was calculated:

At 95% confidence, the portfolio will not lose more than 33.3% of market value in one year. Notably, the portfolio’s standard deviation of 20.2%

) is close to L’Oréal’s historical volatility of 22.15%, observed during the first week following the acquisition announcement on 11 April 2023 (source:

V-Lab, 2025).

According to

Capelli et al. (

2023, p. 1), ESG risks should be regarded as an additional category of financial risks that need to be incorporated into traditional VaR measures. The calculation of ESG VaR relies on an entropy function derived from ESG scores. This method allows a transition from basic ESG attributes of asset portfolios to a more accurate assessment of ESG-related risks. Entropy, which indicates the level of “disorder” in a financial portfolio concerning the ESG traits of its components, is widely recognized as a measure of diversification (

Bera & Park, 2008;

Meucci, 2009).

In this context, the entropic method serves as an alternative tool for estimating the portfolio volatility (

Sheraz et al., 2015). Research has indicated that portfolios composed of companies with stronger ESG performance tend to exhibit lower market risk and reduced volatility (

Capelli et al., 2023;

López Prol & Kim, 2022). High entropy means the ESG data is diverse or inconsistent, suggesting greater uncertainty in how ESG issues might affect financial risk. Low entropy means the ESG data is more uniform or predictable, indicating lower uncertainty.

The paper employed the ESG entropy

Formula (10) as recommended by

Capelli et al. (

2023), based on Shannon’s paper (

Shannon, 1948), where

represents disorder associated with the different ESG characteristics of L’Oréal and Aesop. Following Shannon’s recommendations (

Shannon, 1948, p. 11), the entropy

in the case of two assets with weight

and

, namely:

thus,

4.1. Employing ESG Rating Scores

This study assesses the ESG performance of Aesop and L’Oréal for 2023. Because there is no publicly available ESG performance data specific to Aesop for that year, this study uses the ESG score of its parent company, Natura & Co, as a substitute. Aesop was a fully owned subsidiary within the Natura & Co group, and its sustainability practices were influenced by the parent company’s governance, strategic choices, and reporting methods. This proxy approach is supported by research showing that ESG disclosures at the parent level can greatly affect the legitimacy and financial success of subsidiaries, especially in MNCs (

Sun et al., 2025).

The idea of legitimacy spillover suggests that stakeholders often link the sustainability reputation of a parent company to its subsidiaries, especially when there is strong organizational integration and brand alignment (

Sun et al., 2025). This aligns with findings that subsidiaries may adopt or mirror the CSR and ESG strategies of their parent companies to protect against reputational risks or to gain from the parent’s established legitimacy (

Zhou & Wang, 2020). Additionally, ESG performance is often influenced by internal corporate factors such as leadership, governance structures, and strategic priorities, which are usually managed centrally at the parent company level (

Grace & Gehman, 2023).

While using proxy data introduces limitations—such as possible differences in operational scope or geographic focus—it remains a valid methodological approach when the subsidiary operates under the ethical and strategic oversight of the parent firm. This aligns with broader practices in sustainability research, where proxy indicators are used to fill data gaps while maintaining analytical rigor (

Christensen et al., 2021).

Natura &Co Holding SA has been recognized by Standard & Poor’s Global for its sustainability performance, with an ESG rating of 60, labeled “very high” (

S&P Global, 2024), and the Sustainalytics ESG Risk Rating for Natura &Co Holding SA was 24.4, indicating “medium risk” (

Sustainalytics, 2025b).

L’Oréal has been recognized by Standard & Poor’s Global for its sustainability performance, earning a strong ESG (Environment, Social, Governance) rating of 85 out of 100 (

Clichy, 2023). Sustainalytics’ ESG Risk rating for L’Oréal is 19.00, indicating a low risk (

Sustainalytics, 2025a). In 2023, L’Oréal was rated AA (on a scale from AAA to CCC) as a leader by MSCI (

L’Oréal Group, 2025).

4.2. Interpretation of ESG Ratings

The ESG ratings for Natura & Co and L’Oréal across three major rating agencies—S&P Global, Sustainalytics, and MSCI—show a consistent pattern in assessing corporate sustainability. While both companies are recognized for their ESG efforts, L’Oréal consistently outperforms Natura & Co in all categories.

S&P Global gives Natura & Co. a score of 60 (“Very High”), while L’Oréal scores 85 (“Strong”). Sustainalytics rates Natura & Co at 24.4 (“Medium Risk”) and L’Oréal at 19.0 (“Low Risk”). MSCI assigns L’Oréal an AA rating (“Leader”), showing strong ESG performance; no MSCI rating was found for Natura & Co.

These results indicate that while Natura & Co. exhibits strong ESG practices, L’Oréal is rated more favorably across all rating agencies. The consistency of L’Oréal’s high ratings across various methods—score-based (S&P), risk-based (Sustainalytics), and letter-grade (MSCI)—strengthens the credibility of these evaluations. In this context, Natura & Co.’s ESG score can reasonably act as a proxy for Aesop, considering their corporate integration and shared governance structures. This method aligns with academic practices that use parent company ESG data to estimate subsidiary performance when direct data is unavailable (

Sun et al., 2025).

4.3. Defining ESG Risk Measures

Recent research (e.g.,

López Prol & Kim, 2022) has found that high-ESG portfolios tend to exhibit lower risk and returns, resulting in lower Sharpe ratios. In line with this, the ESG risk measure

increases when a portfolio includes more low-ESG-rated assets and decreases with higher ESG-rated ones. Therefore, following the guidance of

Capelli et al. (

2023, p. 2), a corrective factor (

is introduced in the context of M&A deals. It penalizes the portfolio based on the minimum ESG rating among the merging partners (e.g., Aesop), multiplied by the weight (

of that asset in the portfolio. This adjustment improves the accuracy of the

calculation, as shown below:

where

is Aesop ESG score 0.60 (

S&P Global, 2024) is the lowest, driving penalty.

Capelli et al. (

2021) argue that ESG factors complement traditional financial indicators. Consequently, VaR and ESG-adjusted returns

are orthogonal, as are the assets they represent. Representing the gradient of VaR as

and that of

as

Capelli et al. (

2023, p. 2) propose a risk coefficient based on the Pythagorean theorem:

Ci =

+

, meaning

Why is ∇ orthogonal to ∂? Orthogonality means that financial VaR risk and ESG risk are statistically independent (no overlap in their drivers). This justifies combining them via the Pythagorean theorem

Capelli et al. (

2023,

2024). The formulation treats the combined risk as the hypotenuse of a right triangle formed by VaR and

as independent risk components.

According to

Capelli et al. (

2023), VaR is decomposable in terms of Component VaR (CVaR), where each CVaR =

×

, where

is the vector of portfolio weights or positions and

measures the sensitivity of VaR to changes in portfolio weights or positions. In other words,

quantifies the marginal contribution of each asset to the portfolio’s total VaR. Moreover,

is also decomposable in

(Component

) and it equals

∗

.

To calculate C

i as a combined risk sensitivity measure, first, financial Var Delta

was computed with application of a variance–covariance matrix of assets return

employing an alternative VAR formula. VAR can be expressed by the formula (

Capelli et al., 2023) as follows:

A variance-covariance matrix of assets return (∑x) displays the variability of individual assets return and the relationships between them. Financial analysts use it to assess how closely the returns of different investment options are linked.

Using original volatilities (

20.3%,

= 19.2%) and correlation (

0.62), the covariance matrix

is computed as given in Formula (14):

Thereby, Var = Z ∗

= 1.65 ∗ 0.2021 = 0.333 meaning that at 95% confidence, the portfolio will not lose more than 33.33% in one year. Even though the result is the same in Formulas (8) and (9), there is a difference between Hull’s VaR (

Hull, 2015) and VaR Delta (∇

i) (

Capelli et al., 2023).

Hull (

2015) provides the computation of absolute VaR portfolio. This is a classic delta-normal VaR calculation for the entire portfolio, not individual contributions. Whereas VaR delta (

measures how much each asset contributes to the portfolio’s overall risk as given in Formula (15):

where, according to

Capelli et al. (

2023, p. 2) VaR is decomposable in terms of Component VaR (CVaR), where each

CVaR = xi·∇

i. The theoretical difference between the two approaches is summarized in

Table 4.

Capelli et al. defined that “VaR is decomposable in terms of Component VaR (CVaR), where each CVaR

i = x

i·∇

i (

Capelli et al., 2023, p. 20). Here, ∇

i is the partial derivative of the portfolio VaR with respect to the weight of asset i, i.e., how much the portfolio VaR changes when the weight of asset

i changes slightly. Given the classic parametric VaR formula: VaR = Z

, where

(read as

x transpose) refers to the transpose of the portfolio weights vector, the delta for assets

i is

where,

is

i-th element of the ∑x, x is the vector of portfolio weight,

is the variance-covariance matrix, and Z-score is 95% confidence level. The computation of

:These are the marginal covariances of each asset with the portfolio (0.0411 and 0.0241), used to compute their respective VaR deltas. Using Formula (16), the computation of VaR deltas is as follows:

These values represent the marginal contribution to VaR from each asset at 95% confidence. These show how much each asset contributes to the portfolio’s total risk (

):

Sum of

= 0.3333, which matches the portfolio standard deviation as expected. When it comes to the computation of ESG delta, this is a scalar measure derived from entropy, which is inherently additive and linear in this context. Since entropy is a non-variance-based measure, there’s no need to consider correlations or covariances. Therefore, the formula used weights directly (e.g., 98.9% and 1.1%) to compute a weighted entropy (

using

Formula (12):

Having used a combined sensitivity formula

Ci =

+

, a risk coefficient was calculated for the acquirer and the target (

;

:

In modeling the ESG-adjusted VaR for L’Oréal following its acquisition of Aesop, the choice of the correlation parameter

J is critical.

Capelli et al. (

2023) recommend a baseline value of

J = 0.5 under normal market conditions and

J = 1.0 during crisis periods, reflecting typical interdependencies between ESG risk factors and financial returns (

Capelli et al., 2023;

Magnani et al., 2024)

Although historical data from 2017 to 2023 indicate a correlation () of 0.62 between the market value changes of L’Oréal and Aesop, this figure is no longer considered reliable post-acquisition. The acquisition represents a structural break in the relationship between the two entities, fundamentally altering their financial and operational interdependence. Aesop is no longer an independent firm, but a subsidiary integrated into L’Oréal’s corporate structure, which invalidates the assumption of a stable, symmetric correlation based on pre-acquisition data.

Moreover, the lack of sufficient post-acquisition data prevents the estimation of a new, empirically grounded correlation coefficient. In such cases, using a standardized and conservative assumption like

J = 0.5 is methodologically sound. This approach aligns with Capelli et al.’s framework and ensures consistency with broader ESG-VaR modeling practices (e.g.,

Magnani et al., 2024)

From a risk management perspective, adopting J = 0.5 also reflects a prudent middle ground. It avoids the potential underestimation of risk that could arise from using an outdated or inflated correlation (e.g., 0.62), while not assuming full contagion or crisis-level interdependence (as would be implied by J = 1.0). This is particularly important in ESG contexts, where non-financial risks (e.g., reputational, regulatory, or environmental) may propagate differently than traditional financial shocks.

Finally, the use of J = 0.5 supports comparability and transparency in ESG risk modeling, especially when results are intended for benchmarking, regulatory reporting, or academic replication. Until a sufficient post-acquisition time series is available to reassess the correlation empirically, this assumption remains both theoretically justified and practically robust. In this vein, the research employs J = 0.5 to emphasize ESG interdependence for calculation.

The ESG-adjusted Value-at-Risk

is computed using the framework proposed by

Capelli et al. (

2023), where the correlation parameter

J is introduced to account for the degree of co-movement between ESG risk factors across portfolio components:

where,

is the portfolio weight and

is is the combined sensitivity of asset

i to financial and ESG risks. This formulation allows for a flexible adjustment of risk aggregation depending on market conditions,

J = 0.5 under normal conditions and

J = 1.0 during crises, reflecting partial or full correlation among ESG risk factors (

Capelli et al., 2023).

This method ensures that ESG-related risks are integrated into the VaR framework in a statistically coherent and scalable manner (

Capelli et al., 2023). Thus,

The classic VaR formula includes the Z value explicitly because it’s derived from the distribution of returns (usually assuming normal). In the

model,

Capelli et al. (

2023) decomposed VaR into component contributions (CVaR) and combined them geometrically with the ESG risk component using the Pythagorean theorem. The financial component

already includes the Z-value implicitly, as it’s derived from traditional VaR calculation. Therefore, adding another Z-value would double-count the confidence level adjustment.

Alesii (

2005) integrated VaR and Cash Flow-at-Risk (CVaR) into real options analysis. Alesii’s research demonstrates that incorporating real options into investment valuation not only increases the expanded NPV of the project but also reduces its downside risk, as measured by VaR and Conditional Value at Risk (CFVaR). Alesii simulated the distribution of cash flows and NPVs under optimal decision rules derived from real options (

Alesii, 2005). This enables the calculation of VaR and Cash Flow at Risk (p. 22) under realistic, path-dependent scenarios.

So, applying this to

model in the current paper would involve adjusting the acquirer’s stock volatility after announcement with

scores instead of cash-flow volatility adjustment with VaR in

Alesii’s (

2005) research. Thereby, the paper uses

scores to adjust acquirer’s stock volatility

within four weeks after announcement according to recommendations of

Dunis and Klein (

2005) in the Black-Scholes model. Since VaR is directly related to volatility in parametric models, we can infer the effective ESG-adjusted volatility from calculated

. Volatility is the critical variable to adjust when incorporating ESG risks and using a metric like

.

Traditional VaR calculations are directly derived from the standard deviation (volatility) of returns. By integrating ESG factors into VaR (as ), Capelli et al. are, in effect, proposing a method to derive a more accurate, “prudential” and “accurate” measure of risk that implicitly (or explicitly, depending on the exact mathematical derivation within their full model) modifies the perceived volatility due to ESG influences. Volatility is the core input in option pricing that captures the uncertainty of the underlying asset’s future value, and this is precisely what ESG factors (and a metric like ) aim to refine a comprehensive risk assessment. In the context of ROV using models like Black-Scholes, the crucial adjustment is to the volatility () input.

The adjustment is to use the implied volatility from the

calculation. If Capelli et al.’s method gives

23.7% (as a loss percentage with

J = 0.5), and the z-score used is 1.65, corresponding with a 95% confidence level, the analyst can solve for the volatility input (

). If

= Z ×

, then

=

.

If, as per Capelli et al.’s findings, ESG factors lead to a reduction in overall uncertainty (reflected in a lower , and thus a lower implied , then the flexibility provided by the real option becomes less valuable because the future is more predictable. In this vein, to quantify the financial impact of sustainable practices in M&A, two valuation scenarios can be compared using real options analysis: a baseline scenario without ESG risk adjustment, and an ESG-adjusted Value at Risk approach under normal market conditions.

4.4. Justification of Theoretical Propositions

Justification of the first theoretical proposition: ESG-based synergy represents the immediate incremental value created in M&A through the integration of two firms’ ESG practices. This additional value can be assessed through risk mitigation measures.

To justify the first theoretical proposition and to quantify the synergistic added value of this deal, the research used the monetary and monetary for the L’Oréal-Aesop acquisition, and a market value of the combined entities (So) as the base, along with the given volatilities and an computed mean return (.

If smaller than traditional VaR (e.g., 23.7% vs. 33.3%), it explicitly indicates that integrating ESG factors into risk assessment reveals a more robust and less risky profile for the underlying asset or merger. The difference (the reduction in potential loss) directly shows the added value of sustainability in terms of risk mitigation and improved financial stability. Sustainability makes the acquisition more resilient to adverse events. This reduced risk, as captured by a lower , translates to a lower ESG-adjusted volatility () (as given: 14.4% vs. historical : 20.2%). This lower volatility implies less “disorder” or uncertainty, which is a valuable outcome.

Based on the provided information: So Cumulated market values of L’Oréal and Aesop as separate entities before announcement (

So): USD 228.78 billion; Z-score for 95% confidence (left tail), and two value at risk:

and

(33.3% and 23.7%), Monetary

and Monetary

were calculated:

The difference between these two figures ($US 76.2 billion − $US 54.2 billion = USD 22.0 billion) represents the monetary value of the risk reduction attributable to the integration of ESG factors in this acquisition, at a 95% confidence level over a one-year horizon. This substantial difference quantifies the incremental financial benefit created in M&A through the combination of two firms’ ESG practices and the synergistic value that is quantified using valuation methods. This represents the monetary value of the risk reduction attributable to ESG factors, demonstrating a more stable and predictable outcome and a substantial financial benefit from increased sustainability, even with the updated return.

ESG-based synergy refers to the added value created when companies collaborate by integrating ESG principles, resulting in improved performance, reduced risks, and enhanced reputation (

Henisz et al., 2019). Reducing VaR (

−

) unequivocally represents additional value created, as it signifies that more value has become safe and resilient. Let’s break down the proof and then formulate the definition of ESG-based synergy based on this robust understanding.

The reduction in Value at Risk ( − ) directly quantifies the financial benefit of integrating ESG principles into an acquisition or collaborative strategy. Research computations showed, for instance, a difference of $US 22.03 billion ($US 76.2 billion − $US 54.2 billion). This is not just a percentage difference; it is a monetary value. This result represents the substantial amount of potential downside loss that the combined entity is estimated to avoid at a 95% confidence level over a one-year horizon, purely due to the adoption of ESG principles that improve its risk profile.

The core concept of VaR is the maximum potential loss. From an environmental and social perspective, reducing this maximum potential loss makes an investment or project significantly safer. Resilience is the ability to withstand and recover from shocks or adverse events. When VaR decreases due to ESG integration, it indicates that the company has become more resilient to market, operational, regulatory, and reputational risks.

From a governance perspective, investors and stakeholders see an asset or entity that is safer and more resilient as inherently more valuable. This value appears in several ways. Resilience results in more secure expected free cash flows and a lower chance of severe negative outcomes, which in turn reduces the cost of capital. When risk is lowered, the cost of capital decreases, leading to a lower discount rate and increasing the Net Present Value (NPV) of acquisitions.

Therefore, the monetary reduction in VaR (

−

) is a direct and quantifiable measure of the additional value created by an ESG-based acquisition or collaborative synergy. It represents the increased financial safety and resilience of the combined entity. Building on the existing understanding of ESG-based synergies from

Eccles et al. (

2014) and

Henisz et al. (

2019), and incorporating these research results and the validated logic of risk reduction as a core value driver, the paper provides an extended definition of ESG-based collaborative synergies.

ESG-based synergy refers to the additional, measurable value created when partners strategically incorporate ESG principles into their business activities, investments, or strategies. This value is reflected not only through improved financial, reputational, societal, and governance benefits but also, importantly, through a noticeable reduction in the combined entity’s VaR, showing greater financial safety and resilience against potential losses. This results in a stronger and more predictable value proposition. In summary, ESG-based synergy describes the extra value generated when two companies (for example, in a merger or acquisition) combine their ESG strengths, leading to lower VaR and attracting ESG-focused investors or customers.

Justification of the second proposition: The incorporation of VaR in ROV of ESG-based collaborative synergies in M&A enhances the robustness and credibility of real option analysis. In essence, the research proves that the ESG-based merger adds value by demonstrating that the underlying asset (the merged entity and its synergies) becomes intrinsically less risky and more stable due to sustainability, as evidenced by the lower (derived from a smaller . The ROV calculation, using this refined , provides a more accurate and reliable valuation of strategic flexibility. While the numerical option value might be lower, this reflects a healthier underlying asset with less need for excessive risk management, making the overall investment more resilient. If ESG factors make the integration safer, or enhance market reception, it increases the likelihood that the forecasted collaborative synergies materialize, which is a significant value add. By focusing on the reduction in underlying risk (via ) and the strategic flexibility to generate ESG-based collaborative synergies, the merging corporation can demonstrate the added value of sustainability within an ROV framework, even if the option premium itself is lower, as it demonstrates further.

Justification of the third proposition: Incorporating sustainability into the measurement of ESG-based synergies of merging MNCs through ROV may inadvertently decrease the value of these real options. The lower

can conceptually imply a higher probability of realizing the expected ESG-based collaborative synergies (

from the merger and, what is more, can be directly captured in the Black-Scholes volatility input as shown below in formulas. For applying ESG considerations from a

perspective within the Black-Scholes model for ROV, the most direct and impactful adjustment would be to the volatility

(sigma) parameter, using an ESG-enhanced volatility

derived from

Capelli et al. (

2023) proposed models. Below is the recalculation of ESG-based collaborative synergies (

using the Black-Scholes model with adjusted

:

When traditional volatility (

is applied, the option value is USD 53.7 billion, reflecting the impact of market volatility and downside exposure. However, incorporating ESG-adjusted risk using the

methodology and, particularly, ESG-based volatility (

) the option value decreased to USD 51.42 billion. This suggests that sustainable practices and ESG alignment between collaborative partners can mitigate downside risk but inadvertently decrease the value of these real options that justified the third theoretical proposition. These findings align with recent research highlighting the role of ESG disclosures and practices in reducing perceived risk and improving capital allocation efficiency (

Frankel et al., 2025).

5. Discussion

In recent years, real options have been widely used in M&A decision-making, offering a strong framework for evaluating strategic flexibility and the potential value of such transactions. This study makes a notable contribution by combining real options theory and VaR with an ESG framework to analyze synergies in M&A deals. This innovative approach broadens traditional views on strategic synergy in M&A research by applying real options. The proposed framework provides a new theoretical basis for ESG-based strategic decision-making in M&A deals, emphasizing important theoretical contributions to real options theory and its practical relevance in M&A activities.

The paper utilizes VaR to estimate the maximum potential loss within a specified time period and confidence level. In M&A, VaR can be employed to evaluate the risk related to the merger, including market volatility and integration challenges. Incorporating ESG components into VaR and ROV can improve the assessment of risks and opportunities, supporting a more sustainable and responsible approach to M&A. By integrating ESG aspects into VaR and ROV, L’Oréal can adopt a comprehensive and sustainable strategy for its acquisition of Aesop, maximizing economic value while reducing risk and fostering responsible business practices.

As an alternative approach, ESG-based collaborative synergies () are estimated using the Black-Scholes option pricing model but also can be defined with application of Binomial Option Pricing Model and Mote Carlo simulation. This involves substituting the traditional volatility with the ESG-adjusted volatility (). The results are then interpreted to assess the financial implications of ESG integration in M&A strategies.

The Black-Scholes option pricing model using instead of traditional volatility quantifies the value of strategic flexibility (the real option premium) inherent in the acquisition, considering the ESG-adjusted risk profile. Because ESG integration leads to lower volatility ), the option premium calculated by Black-Scholes will typically be lower than if it were calculated with higher, traditional volatility. This is because options derive value from uncertainty; less uncertainty means less value from the option to exploit extreme outcomes or hedge against significant downsides.

The reduction in VaR ( − ) highlights the “Value of Safety and Resilience”: It demonstrates, in concrete monetary terms, how much potential loss you avoid due to being a more sustainable and less risky entity. This is a direct financial benefit. The ESG-based collaborative synergies result () highlights the “Value of Optimized Flexibility”: It illustrates that because the underlying asset (the merged entity) is now more stable and less prone to extreme fluctuations (due to ESG), the “speculative upside” provided by the real option is now less needed, or less pronounced. The value of flexibility becomes more refined and grounded in a less uncertain reality.

In essence, the reduction in VaR ( − ) proves the “added value” by quantifying the reduced downside risk, making the acquisition inherently safer and more resilient. The ESG-based collaborative synergies result () then uses this improved risk profile to provide a more accurate (and potentially lower) valuation of the strategic flexibility, reflecting that a more stable underlying asset diminishes the value of hedging against extreme uncertainty. Both steps contribute to a comprehensive understanding of how ESG integration creates value in cross-border M&A deals.

This outcome suggests that for this acquisition, the value derived from strategic flexibility and future growth opportunities (as captured by the ROV) is USD 51.4 bn, which is significantly greater than the direct monetary benefit of reducing downside risk, USD 22 bn. While the lower volatility () can lead to a lower stand-alone option premium (compared to a traditional-volatile scenario), a still high Value of in absolute terms suggests that the underlying value of the future opportunities (the So in the Black-Scholes model for these growth options) must be very substantial.

This could suggest that ESG integration is not merely about risk reduction but also actively driving new growth opportunities or improving existing strategic choices. Potentially, strong ESG credentials could grant access to new green markets or customer segments, increasing the value of expansion options. Improved reputation through ESG leadership might speed up market entry or justify premium pricing. Better ESG performance could attract more capital or secure more favorable financing terms, supporting larger strategic investments. Ultimately, ESG could foster innovation, leading to new product lines or technologies.

Having answered the first and second research questions, the author introduces a conceptual framework that proposes a method for incorporating VaR into evaluating ESG-driven collaborative synergies in cross-border acquisitions, using a real options approach as shown in

Figure 3.

6. Conclusions, Contributions, Limitations, and Future Work

There is a growing demand for responsible investment. Many institutional investors and individual shareholders prefer to invest in companies that align with their values, especially regarding environmental sustainability, social responsibility, and good governance practices (

Stanton Chase, 2022). The paper shows how financial tools like VaR and real options can be used to support long-term ESG goals, helping to achieve Sustainable Development Goals (SDGs) such as global partnerships (SDG 17).

In this vein, the increasing integration of real options with various managerial approaches is highly significant. Besides offering new insights into specific strategic initiatives, this combination can also improve understanding of optimal business strategies in uncertain environments and provide managers with innovative tools for strategic planning (

Chintakananda et al., 2025, p. 198). Specifically, combining ESG-based VaR with ROV in the context of environmentally focused M&A enhances both the theoretical and practical use of real options in global and strategic management.

6.1. Theoretical and Empirical Contributions

This paper introduces fresh perspectives on the role of real options in enhancing collaborative synergies and advancing sustainable practices, with a dual focus: quantifying present risk mitigation through ESG-adjusted Value at Risk and evaluating future growth potential via ESG-based Real Option Value ().

The first finding demonstrates that ESG integration offers more than immediate risk hedging or cost synergies—it actively reduces downside risk. The second finding reveals the strategic value of ESG-based synergies, unlocking long-term potential and optionality. Notably, the analysis shows that the value of is twice the reduction in VaR, indicating that ESG-driven acquisitions are not solely about risk reduction. Instead, they provide a resilient and strategically agile foundation for future value creation (synergies), with ESG principles serving as a catalyst for unlocking high-value opportunities.

The strategic flexibility built into the merged entity proves to be far more valuable than just risk mitigation. These two viewpoints—risk control and strategic synergy—are not in opposition but rather support each other, providing a complete view of ESG’s role. This research offers a meaningful contribution both theoretically and empirically to corporate finance and strategic management by emphasizing the complex, multidimensional nature of value creation in ESG-focused cross-border M&A transactions.

6.2. Practical and Social Implications for Policy Measures Targeting Regulators, Companies, and Investors

Regulators can play a crucial role by establishing standardized ESG reporting frameworks. These standards would enhance consistency and comparability among companies, making it simpler to assess the ESG performance of potential M&A targets. To promote sustainable investments, regulators might provide tax incentives or subsidies to companies involved in M&A activities that support sustainability and the Sustainable Development Goals (SDGs). Furthermore, enforcing transparency in reporting the ESG impact of M&A deals would ensure stakeholders are well-informed and that environmental, social, and governance factors are thoroughly evaluated.

Investors should consider ESG performance a crucial factor in their investment choices, favoring companies with strong sustainability practices and long-term growth potential. By actively engaging with their portfolio companies, investors can encourage the adoption of ESG principles and the incorporation of sustainable practices into their business models. Supporting green M&A initiatives through capital allocation can further advance sustainability and emphasize the long-term advantages of such investments.

Companies are encouraged to incorporate ESG considerations into their core strategies and M&A decision-making processes to align with long-term sustainability goals. Senior management can use real options frameworks to evaluate strategic flexibility and potential synergies in M&A deals, especially those centered on sustainability. Developing dynamic capabilities to address ESG risks and opportunities—such as employee training and creating specialized teams—can further enhance this approach.

In summary, promoting collaborative synergies through sustainable M&A practices can strengthen the competitive advantage of both acquiring and target companies. These policy measures help create a more resilient and sustainable business environment, encouraging long-term value creation and deeper integration of ESG factors in M&A activities.

6.3. Artificial Intelligence (AI) Implications on ESG Advancement: Final Thoughts

Having addressed the third research question, it is important to note that integrating Artificial Intelligence (AI) into ESG frameworks is transforming how organizations pursue sustainability and ethical responsibility. As shown by L’Oréal’s initiatives above, AI improves ESG performance through environmental monitoring, social impact analysis, and governance automation. These AI-driven capabilities allow for more precise tracking of community engagement efforts and easier compliance with changing regulations.

AI also plays a crucial role in optimizing global value chains, increasing supply chain transparency, and enabling predictive risk management. Tools such as predictive analytics and real-time customer segmentation not only enhance market strategies but also align business growth with sustainability goals (

Lee et al., 2025).

Artificial Intelligence (AI) can boost ESG advancement for merging companies. SkinConsultAI can be customized for Aesop’s product line, providing personalized skincare diagnostics through selfies and skin analysis. This supports Aesop’s premium, customer-focused approach and can enhance the digital luxury experience for its customers. Tools like Seedlink and My Chatbot can help improve Aesop’s hiring process, making recruitment more efficient and less biased while upholding the brand’s cultural and ethical standards. This is especially important as Aesop expands globally under L’Oréal.

AI can assist Aesop in optimizing inventory, supply chain, and demand forecasting, thereby reducing waste and supporting its sustainability commitment. Integration with L’Oréal’s AI systems will enable data-driven decision-making throughout Aesop’s operations. AI tools can also help track and report ESG metrics, aiding Aesop in maintaining transparency and aligning with L’Oréal’s broader sustainability objectives. This approach supports both regulatory compliance and consumer confidence in environmentally conscious practices. Additionally, leveraging ModiFace’s augmented reality (AR) capabilities, Aesop could provide virtual product trials or immersive storytelling in stores and online, enriching the luxury retail experience.

However, adopting AI in ESG comes with risks. High energy use, data privacy issues, algorithmic bias, and job losses are major challenges. Recent studies highlight the need for responsible AI governance and transparency (

Lim, 2024). Regulatory frameworks like the EU AI Act, OECD AI Principles, and the UN PRI are increasingly influencing how AI is used in ESG settings.

Recent research introduces structured frameworks for evaluating AI’s material ESG impacts. For instance, the ESG-AI framework developed by

Lee et al. (

2025) provides a comprehensive tool for assessing corporate AI practices and guiding ethical AI investments. Likewise, case studies by JLL and a.s.r. real estate show how AI improves ESG data collection and forecasting accuracy, supporting better investment choices (

INREV, 2025).

Future research at the intersection of AI, ESG, and ROV in M&A is expected to draw interest from both scholars and practitioners, particularly regarding AI- and sustainability-driven synergies.

6.4. Limitations of Application and Future Work

A promising avenue for future research is integrating ESG metrics into ROV models. This method would enable companies to evaluate the strategic flexibility of sustainability investments amid uncertainty, capturing both financial and non-financial value. AI can assist by modeling complex ESG scenarios and measuring their effects on long-term value creation.

While VaR is a common tool for measuring financial risk, it has significant limitations and should be used as part of a broader risk management strategy. Recognizing and addressing these limitations helps institutions better manage their risks and make more informed decisions.

One major limitation is that VaR often assumes asset returns follow a normal distribution, which may not accurately reflect actual market behavior—especially during extreme events. VaR estimates potential losses up to a specific confidence level but does not capture the magnitude of losses beyond that threshold, thus ignoring tail risk. Also, VaR is usually calculated over a fixed time frame, which does not consider the changing nature of market conditions.

Another concern is VaR’s dependence on historical data, which may not accurately forecast future risks, especially in volatile or rapidly changing environments. It also lacks the ability to perform scenario analysis or stress testing, both of which are crucial for assessing the impact of rare but severe events. By reducing risk to a single number, VaR can oversimplify complex risk profiles and potentially give a false sense of security.

The accuracy of VaR heavily relies on the selected model and its assumptions. Different models can produce very different results, which introduces model risk. Additionally, VaR does not account for liquidity risk, which becomes especially important during market downturns when assets might be hard to sell without significant losses. Although VaR is often used for regulatory purposes, it may not fully reflect the risk profile of complex portfolios or institutions.

To address these shortcomings, senior management should supplement VaR with additional tools such as stress testing, scenario analysis, and Expected Shortfall (ES) to obtain a more comprehensive view of risk. Regular updates to VaR models, including current market data and revisiting assumptions, are essential. Moreover, the proposed methodology in this context cannot be applied to firms without ESG scores, highlighting a gap for future research. Exploring how to extend risk models to such companies would be a valuable contribution. The summary table, which organizes the theoretical and empirical contributions alongside the practical and social implications of this research, with added recommendations for clarity and usability, is provided in

Appendix B.

Furthermore, the connection between ESG practices and firm value is influenced by institutional norms, cultural influences, and regulatory settings—elements that should be taken into account in future research.