1. Introduction

Sustainability reporting has become a cornerstone of contemporary corporate responsibility and strategic management, as the point of intersection of accounting, finance, and governance. During the last two decades, organizations have faced growing pressure from investors, regulators, and other stakeholders to disclose their Environmental, Social, and Governance (ESG) performance, adopt integrated reporting practices, and move towards circular economy (CE) business models. These frameworks—ESG, integrated reporting (IR), and CE—together form a broad landscape of sustainability reporting that is crucial for both scholars and practitioners. For scholars of sustainability accounting and finance, these concerns present opportunities to investigate how disclosures impact corporate conduct, risk management, or value creation (

Friede et al., 2015). For practitioners, including corporate managers and policymakers, understanding this landscape is important for developing reporting strategies that meet emerging regulatory requirements and stakeholder expectations, ultimately guiding more sustainable decision-making (

Tsang et al., 2023). In this context, placing the research within a broad context underscores its relevance: mapping the intellectual terrain of ESG, IR, and CE disclosure will not only incorporate academic knowledge but also contribute towards practical work for improving corporate transparency and sustainability performance.

ESG disclosure has become a central pillar in the evaluation of corporate performance concerning environmental stewardship, social responsibility, and governance practices. Rooted in earlier frameworks of corporate social responsibility and the “triple bottom line” (

Elkington, 1997), ESG has gained particular prominence in capital markets as investors integrate sustainability metrics into valuation and risk analysis. Over the past decade, voluntary and mandatory ESG disclosure has surged globally, driven by initiatives such as the Global Reporting Initiative and recent regulations (

Tsang et al., 2023). Correspondingly, academic research on ESG disclosure has grown exponentially. Early evidence established that firms with strong ESG profiles often enjoy improved financial outcomes and lower risk, encouraging further disclosure; for example, a seminal meta-analysis of over 2000 studies found that the majority reported a non-negative or positive relationship between ESG performance and financial performance (

Friede et al., 2015). Recent comprehensive reviews continue to synthesize this evolving literature, organizing it around motivations for ESG disclosure and its consequences for firm value, cost of capital, and stakeholder trust (

Tsang et al., 2023). Top contributors in this domain have examined how ESG transparency is linked to competitive advantage and market value (

Gillan et al., 2021) and how regulatory mandates affect disclosure quality and comparability (

Sneideriene & Legenzova, 2025;

Szczepankiewicz & Mućko, 2016). Notably, emerging studies have started to apply bibliometric methods to the ESG disclosure literature itself. For instance,

Khamisu et al. (

2024) employed bibliometric analysis to uncover key themes and the performance structure of research on ESG reporting, reflecting the maturity and diversification of this field (

Khamisu et al., 2024). Overall, ESG disclosure research highlights that providing high-quality environmental and social information is increasingly seen as integral to good governance and essential for meeting the information needs of investors and stakeholders in sustainable finance (

Eccles et al., 2014;

Tsang et al., 2023).

In parallel with the rise of ESG, integrated reporting (IR) has emerged as an innovative corporate reporting model that seeks to integrate financial and non-financial information into a single, cohesive narrative about an organization’s value creation over time. Introduced by the International Integrated Reporting Council (IIRC) through its 2013 framework (

IIRC, 2013), IR is built on principles of integrated thinking, emphasizing how strategy, governance, performance, and prospects relate to the six capitals (financial, manufactured, intellectual, human, social, natural) that a firm uses and affects. The adoption of IR by companies worldwide (especially large publicly listed firms and state-owned enterprises in some countries) has been driven by the promise of enhanced transparency, more holistic risk management, and improved stakeholder communication (

Eccles & Krzus, 2010). Academic interest in IR has been substantial since its inception, with scholars examining its implementation and impacts. Foundational works by

De Villiers et al. (

2014) outlined the early insights and research agenda for this “rapidly emerging field,” highlighting both the potential of IR to transform corporate reporting and the gaps in understanding its outcomes (

De Villiers et al., 2014). Subsequent studies have focused on IR quality—the extent to which integrated reports fully and faithfully represent an organization’s strategy and performance. For example,

Zhou et al. (

2017) found that higher-quality integrated reports (measured by the completeness and balance of content) are associated with greater analyst following and liquidity, suggesting capital market benefits when firms genuinely embrace integrated reporting (

Zhou et al., 2017). Other researchers have identified internal and external determinants of IR quality: firm size, profitability, and effective governance tend to improve the richness of integrated reports, while country-level factors like investor protection and reporting norms also play a role (

Vitolla et al., 2020). Top authors in this area (

Lámfalusi et al., 2024;

Nguyen et al., 2020;

Vitolla et al., 2020;

Wang et al., 2020) have contributed numerous studies on how board characteristics, ownership structure, or assurance services influence the credibility and quality of integrated reports. Overall, the literature underscores that IR, by combining ESG disclosures with financial narrative, can enhance corporate accountability and stakeholder decision-usefulness, but its effectiveness hinges on the quality of reporting and true integration of sustainability into corporate strategy (

De Villiers et al., 2014;

Melloni et al., 2017).

The circular economy (CE) has gained traction as a paradigm for sustainable development that challenges the traditional “take–make–dispose” linear model of production and consumption. A CE emphasizes the designing out of waste, maintaining products and materials in use, and regenerating natural systems. For businesses, the adoption of the CE typically involves radical business model transformations—ideas of how value is created and delivered, such as applying strategies that encompass reuse of resources, repairing, remanufacturing, recycling, and sharing (

Bocken et al., 2016;

Geissdoerfer et al., 2020). Academic research on the CE has grown, with a focus on its principles, metrics, and implementation across industries. As

Kirchherr et al. (

2017) report, the concept of the CE has been interpreted in 114 different ways, but the one common thread is to achieve both environmental sustainability and economic advantages through CE practices (

Kirchherr et al., 2017). In the business context, authors such as

Bocken et al. (

2018) and

Linder and Williander (

2017) have specifically explored circular business models, categorizing how firms can innovate their value propositions and supply chains to support circularity (

Bocken et al., 2018;

Linder & Williander, 2017). These studies indicate that transitioning to a circular model requires changes in product design, customer engagement (e.g., shifting from product ownership to service models), and cross-sector collaboration, which can be challenging but also offer competitive advantage and new market opportunities. In terms of reporting, corporate commitment to CE initiatives is increasingly being communicated through sustainability reports and integrated reports, as companies highlight circular projects (such as closed-loop recycling programs or circular product lines) as part of their ESG performance. But very recent research identifies a gap in the integration of CE metrics with standard ESG reporting:

Menichini et al. (

2025) argue that current ESG disclosure frameworks do not fully capture how a firm’s CE practices contribute to sustainable development, calling for more explicit integration of CE indicators into sustainability reporting (

Menichini et al., 2025). This indicates an important intersection between the CE and ESG/IR domains—one that this study expects to illuminate by mapping the knowledge landscape where these frameworks converge.

Many governments and industries now regard the CE as a pillar of sustainable policy and a driver of the ecological transition toward global sustainability. According to the

European Commission (

2023), the circular economy has evolved into a comprehensive framework that enables economic growth while aiming to optimize the consumption chain of biological and technical materials (

European Commission, 2023). This updated framework builds upon the earlier initiatives outlined in “Closing the Loop—An EU Action Plan for the Circular Economy” (2014), reinforcing the shift from a linear model to a regenerative system focused on reducing, reusing, recycling, and recovering materials (

European Commission, 2015). Together, ESG criteria, IR, and CE initiatives reflect an integrated thinking approach: they converge on the goal of embedding sustainability into corporate decision-making and disclosure.

Despite the common vision of these frameworks, sustainability reporting practices remain diverse and continuously evolving. Companies and regulators have introduced a variety of standards and guidelines, including the Global Reporting Initiative (GRI), the Integrated Reporting Framework (IIRC), and, more recently, the European Union’s comprehensive regulatory suite: the Corporate Sustainability Reporting Directive (CSRD), the European Sustainability Reporting Standards (ESRS), the EU Taxonomy for Sustainable Activities, and the Sustainable Finance Disclosure Regulation (SFDR). These instruments are reshaping how firms disclose ESG information, particularly in the financial and real economy sectors. Additional developments, such as the Omnibus Regulation, aim to harmonize and consolidate the EU’s sustainable finance framework, increasing the coherence and enforceability of sustainability-related disclosures. However, despite these efforts, no universally accepted reporting system exists, and many organizations still struggle with inconsistent or non-comparable disclosures.

From an academic standpoint, the literature on these topics has expanded rapidly in separate streams—ESG performance (

Stewart, 2025;

Sun et al., 2024), IR practices (

Abeywardana et al., 2023;

Erin et al., 2025), and CE strategies (

Krmela & Šimberová, 2023)—without always intersecting. Recent years have seen a surge in studies for each domain, yet comprehensive insights that span across these interrelated areas are still limited. In response to this gap, the present study undertakes a bibliometric analysis to map the intellectual landscape of sustainability reporting across the ESG, CE, and IR domains. Bibliometric analysis is a rigorous method that “summarizes large quantities of scientific data to present the state of the intellectual structure and emerging trends of a research topic or field” (

Donthu et al., 2021). By applying this approach, we quantitatively review the global research output on these three sustainability paradigms, covering their evolution, key themes, influential publications, and collaborative networks.

ESG, IR, and CE have emerged as separate frameworks contributing to the broader goal of corporate sustainability. ESG disclosure presents a broad range of performance measures—involving environmental influence indicators, social impacts, and governance structures—that often include data on circular activities such as waste reduction and the improvement of resource utilization, although not necessarily described as “circular economy” initiatives. IR enables companies to connect their financial performance with ESG results and strategic goals, creating a comprehensive perspective that can include natural CE operations where appropriate or relevant. In turn, a company’s advancement toward CE goals can strengthen its environmental and social results, thus reinforcing ESG metrics and presenting concrete proof of its sustainability strategy in integrated reports (

Menichini et al., 2025). Although these frameworks are conceptually aligned, in practice they have appeared together in the academic literature with minimal inter-stream crossover. Researchers focused on ESG disclosure emphasize investor reactions and transparency excellence (

Tsang et al., 2023), and researchers dealing with IR explore innovative reporting strategies and governance (

De Villiers et al., 2014), while CE researchers have an interest in business model transformation and supply chain redesign (

Bocken et al., 2016;

Kirchherr et al., 2017). This fragmented approach reveals a gap in understanding of how the frameworks interact across different contexts.

The present study contributes to bridging this gap by mapping the conceptual and methodological intersections among ESG disclosure, IR, and CE practices through a bibliometric approach. Its distinctive added value lies in the sectoral perspective, comparing the thematic evolution and integration patterns across the real economy, banking and finance, and public sector domains. This lens enables a deeper understanding of how sustainability reporting practices vary by industry, uncovering overlooked interconnections and pointing to areas in need of further integrative research.

Bibliometric analysis provides an effective means of quantitatively mapping the landscape of publications and identifying intersections across all three areas. This method enables us to identify the most influential papers, authors, and journals, as well as thematic clusters and citation networks that show where ESG, IR, and CE research intersects. Prior studies have demonstrated the value of bibliometrics in synthesizing rapidly growing fields: for example,

Zupic and Čater (

2015) illustrated how bibliometric methods add objectivity by revealing the structure of a knowledge domain (

Zupic & Čater, 2015), and

Donthu et al. (

2021) provided guidelines for using performance analysis and science mapping to understand research trends (

Donthu et al., 2021). In the context of sustainability, bibliometric reviews have been conducted separately on topics like ESG–corporate performance links (

Cardillo & Basso, 2025), circular economy in management research (

Santibanez Gonzalez et al., 2023), and the evolution of the integrated reporting literature (

Rinaldi et al., 2018). However, to the best of our knowledge, no study has yet applied bibliometric analysis to examine ESG, IR, and CE in an integrated manner. This represents a notable gap, given that the future of corporate sustainability likely depends on how these frameworks inform and reinforce each other.

A contribution of this study is its sector-specific perspective. Sustainability reporting is not one-size-fits-all; the emphasis and challenges of ESG, IR, and CE can differ significantly by sector. Companies in the real economy (manufacturing, energy, consumer goods, etc.) often face direct environmental impacts and have been early adopters of circular economy practices to improve their resource efficiency. In contrast, the banking and financial sector approaches sustainability reporting through the lens of sustainable finance, climate risk disclosure, and responsible investment principles, with frameworks like ESG being used to assess portfolio exposure to sustainability risks. Meanwhile, the public sector (including government agencies and state-owned enterprises) has begun exploring integrated reporting and other non-financial reporting formats to enhance public accountability and demonstrate contributions to sustainable development goals (

Manes-Rossi et al., 2020). Despite these differences, few bibliometric studies (if any) have compared how research on ESG, IR, and CE unfolds across different sectors. By stratifying the analysis to consider sectoral contexts, this paper provides nuanced insights—for instance, identifying which topics are predominant in banking sector sustainability research versus in real economy industries or the public sector. This sectoral angle is highly relevant for practitioners: regulators and standard-setters can tailor guidance by sector, and managers can benchmark their reporting practices against sectoral trends. For scholars, it opens new questions about the transferability of sustainability practices across sectors and highlights areas where cross-sector learning could be beneficial.

In summary, the present study addresses a timely and important need to map the landscape of sustainability reporting research by uniting the ESG, integrated reporting, and circular economy strands of the literature, and by doing so with an unprecedented sector-specific analysis. Through a bibliometric analysis of the Scopus-indexed literature, we quantitatively reveal the structure and evolution of this knowledge domain, identifying core themes, influential authors, and potential research gaps. The findings are expected to advance scholarly understanding of how these frameworks interconnect, and to provide practitioners with a consolidated view of current research insights that can inform policy and strategy in sustainability accounting and governance.

Research Aim and Questions: The overall aim of this study is to develop a comprehensive bibliometric map of academic research spanning ESG disclosure, circular economy business models, and integrated reporting, with particular attention to differences and commonalities across the real economy, banking, and public sectors. In pursuit of this aim, this article is guided by five specific research questions:

RQ1: What are the trends in publishing academic literature on ESG, IR and CE (individually and combined), and how have they evolved over time?

RQ2: Who are the most influential authors, institutions, and journals, and what are the key academic works that constitute the intellectual foundation of any framework in the scientific field?

RQ3: What major thematic clusters or research themes can be identified in the sustainability reporting literature, and how are these themes interconnected?

RQ4: In what ways are the ESG, IR, and CE frameworks interconnected in the literature, showing an integrated landscape of sustainability reporting research?

RQ5: How does the focus of sustainability reporting research differ across sectors (real economy, banking/finance sector, public sector), and what sector-specific insights or gaps are revealed by bibliometric analysis?

To ensure methodological transparency and coherence, the relationships between the research questions, applied bibliometric instruments, and corresponding results are presented in

Table 1.

2. Materials and Methods

This study follows a systematic literature review and bibliometric analysis approach, structured according to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) 2020 protocol (

Page et al., 2021). The goal is to explore the intellectual landscape and thematic development of the sustainability reporting literature by analyzing academic outputs that intersect the domains of ESG disclosure, circular economy, and integrated reporting, with an emphasis on sectoral perspectives (real economy, banking, public sector).

The data were extracted from Scopus, one of the most comprehensive abstract and citation databases, providing robust metadata, wide journal coverage, and analytical tools ideal for bibliometric studies (

Donthu et al., 2021;

Vieira & Gomes, 2009). At this moment Scopus contains over 100 million documents back to the year 1788, over 2.4 billion cited references back to the year 1970, over 20.5 million author profiles, and over 7000 publishers, including those in the field of social sciences. Despite the comprehensive coverage with open-access content, Scopus provides a wide range of metrics and tools to evaluate the research impact and collaborating author profiles and create collaboration networks. At this stage of the scientific research, we determined a series of keywords and terms and a search field in the database, along with a selection of additional search criteria; we also generated a sample containing data about the research.

The search was conducted on 19 May 2025, using a carefully constructed search string developed through a panel discussion with academic and practitioner experts in the fields of sustainability, accounting, and circular economy.

The final search query was as follows: “TITLE-ABS-KEY (“ESG reporting” OR “environmental social governance” OR “integrated reporting” OR “circular economy”) AND TITLE-ABS-KEY (“sustainability” OR “sustainable development” OR “sustainable reporting”) AND TITLE-ABS-KEY (“sector*” OR “industry” OR “banking” OR “public sector” OR “corporate”)”.

This query, applied to the Scopus fields “Title”, “Abstract”, and “Keywords”, initially yielded 9968 records.

The selected PRISMA 2020 protocol provides for the definition of additional search criteria to limit the sample. The criteria were selected using the search filters proposed in the Scopus database.

Depending on the number and type of documents in the sample, the criteria that outline it can be inclusion or exclusion criteria.

The selected exclusion criteria options limit the sample to the following:

Open Access—All OA articles (result: 4265 records);

Publication Year—2016–2025 (result: 4242 records);

Subject Areas—“Business, Management and Accounting”; “Social Sciences”; “Economics, Econometrics and Finance” (result: 2078 records);

Document Type—Articles only (result: 1690 records);

Publication Stage—Final publication stage (result: 1669 records);

Source Type—Journal articles (result: 1666 records);

Language—English only (result: 1611 records).

These filters ensured a final dataset of 1611 peer-reviewed journal articles.

No filters were applied to author name, source title, affiliation, country, or funding sponsor, which could serve as inclusion criteria in later analyses.

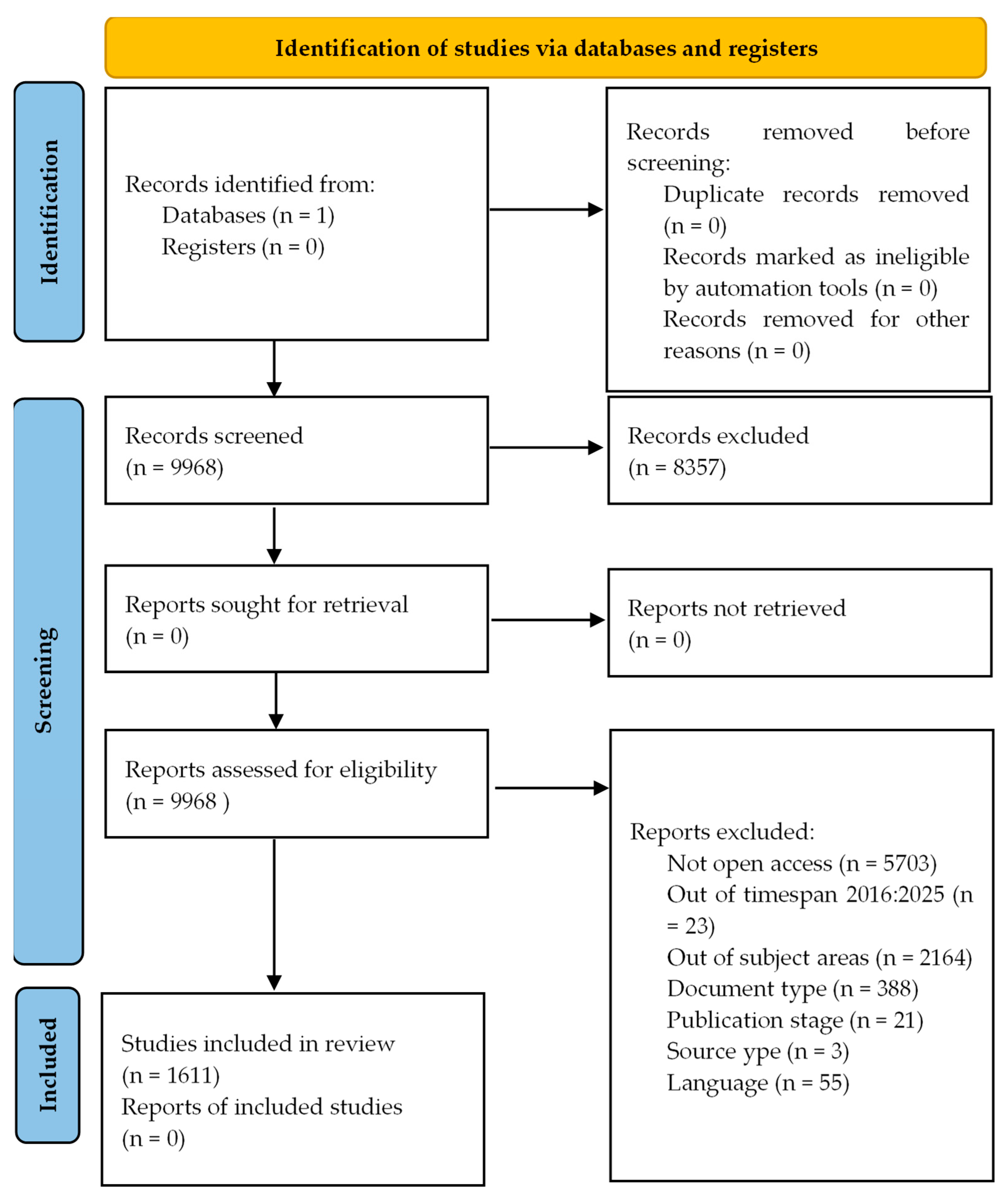

The full selection process is summarized in the PRISMA 2020 flow diagram (

Figure 1).

Descriptive Analysis—Tracking publication trends, prolific authors and institutions, and citation performance.

Application of Bibliometric Tools—Employing dedicated software platforms (e.g., Biblioshiny, VOSviewer) to systematically retrieve, organize, and analyze bibliographic data across multiple dimensions.

Science Mapping—Identifying intellectual, conceptual, and social structures of the field.

For the visual and structural analysis, this study employed Biblioshiny (v4.1)—a web-based interface for bibliometric analysis built on the R Bibliometrix package (

Aria & Cuccurullo, 2017)—and VOSviewer (v1.6.19) to generate network visualizations for co-citation, bibliographic coupling, keyword co-occurrence, and authorship collaborations.

The selected keywords were the result of a structured expert consensus process, combining theoretical relevance and technical effectiveness for Scopus querying. The Boolean operators (“OR”, “AND”), quotation marks, wildcards (‘*’), and parentheses were strategically applied to maximize precision and recall.

The PRISMA flow diagram (

Page et al., 2021) illustrates the selection process, from initial identification to final inclusion. Records were exported in “.csv” format with full metadata (e.g., author names, affiliations, citations, abstract text, keywords). Duplicates and non-relevant entries were manually screened during preprocessing in R.

This systematic and reproducible methodology ensures transparency, replicability, and academic rigor, consistent with best practices in bibliometric research. The systematic review protocol has been retrospectively registered in the Open Science Framework (OSF) (

Krasteva-Hristova, 2025) and is publicly accessible at

https://osf.io/2nu59 (accessed on 9 July 2025).

3. Results

The results are organized into four main parts: descriptive and performance indicators, thematic structure mapping, framework interconnection analysis, and sector-specific patterns. This arrangement allows for a detailed examination of both quantitative metrics and conceptual relationships in the literature.

3.1. Performing Descriptive and Performance Analysis

3.1.1. Publication Output and Authorship Patterns

This subsection provides an overview of the publication activity in the dataset, describing the temporal distribution of articles, the number of contributing authors, and the general authorship configuration observed across the analyzed period.

The current analysis is based on a dataset comprising 1611 scientific articles authored by a total of 5340 researchers from diverse academic and institutional backgrounds worldwide. This highlights a remarkable degree of scholarly engagement and global collaboration in the field.

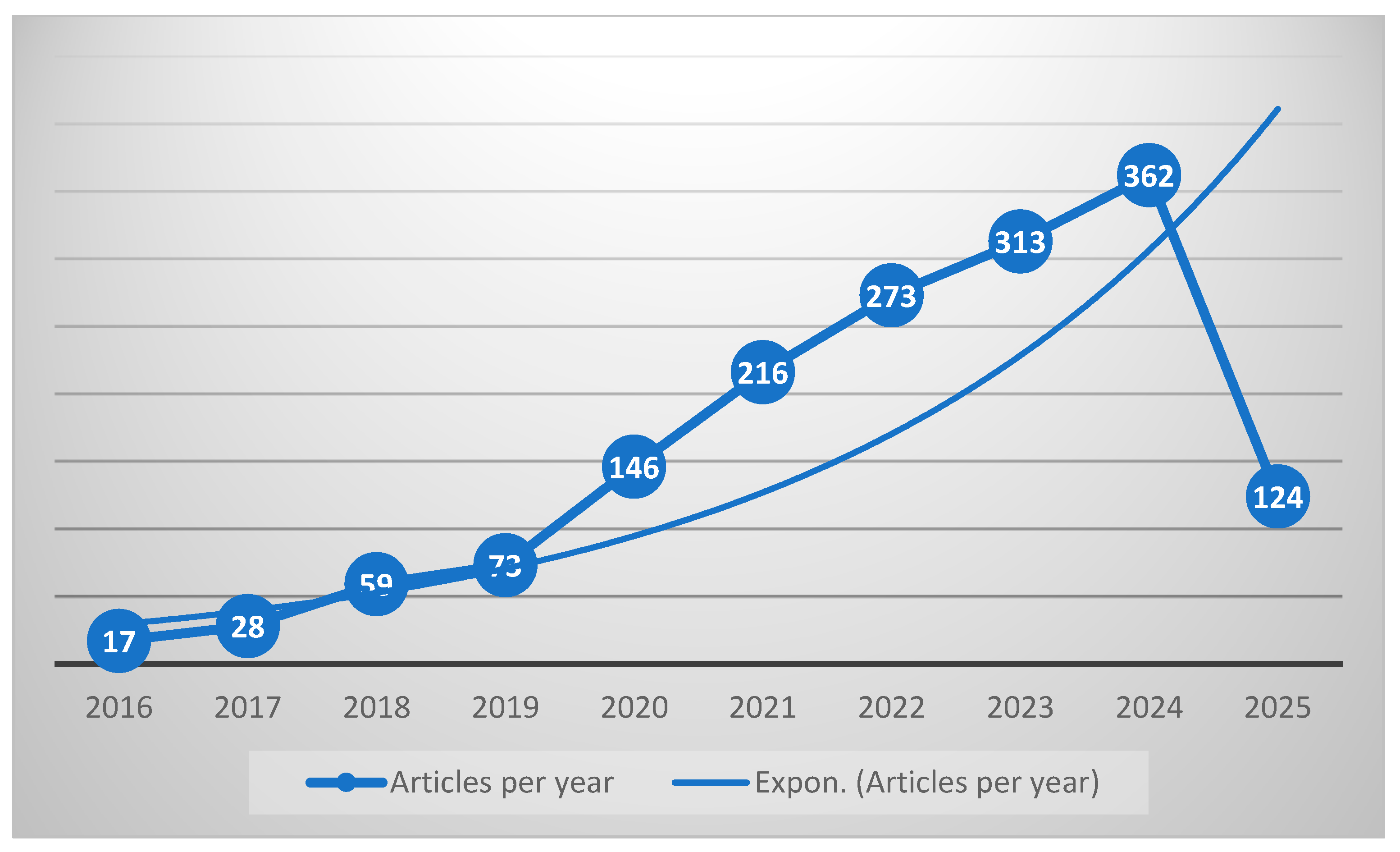

The timespan of this study covers ten consecutive years between 2016 and 2025. The average number of articles published per year is approximately 161 (specifically, 161.1 articles).

Among the 1611 publications, 1490 were produced through collaboration (co-authored), while only 121 were single-authored, representing about 7.5% of the dataset. These 121 papers were written by 114 unique authors, indicating that several researchers have contributed more than once as sole authors. Specifically, five authors (M. A. Camilleri, K. Govindan, H. Kopnina, P. Velte and Z. Wysokińska) each published two individual articles, while Roberta De Angelis stands out with three single-authored documents. This small group of recurrent solo contributors suggests a sustained individual engagement with the topic and a potential leadership role in advancing specific perspectives within the field.

Figure 2 below illustrates the annual scientific production of articles included in the dataset (n = 1611), covering the period from 2016 to 2025.

Overall, these authorship metrics highlight a vibrant and collaborative research environment in the sustainability reporting domain, where multi-author teams are predominant and recurring single-author contributions remain comparatively rare.

3.1.2. Collaboration Indicators

In this subsection, key metrics are presented to characterize the degree of collaboration among authors, including the Collaboration Index (CI), the Collaborative Coefficient (CC), and the distribution of single- versus multi-authored contributions.

The analysis of collaboration patterns is further refined using the Collaboration Index (CI), the Collaborative Coefficient (CC), the number of cited articles, and the proportion of publications that have received at least one citation (

Atanasov et al., 2023).

The Collaboration Index (CI) measures the average number of authors per multi-authored article. It reflects the intensity of research collaboration but does not follow a normalized scale (e.g., 0 to 1), which can complicate comparative interpretation. This metric also illustrates the widespread adoption of teamwork and interdisciplinary perspectives.

In this dataset, the CI is 3.51, indicating that research teams typically consist of three to four contributors. The CI is calculated by dividing the total number of authors of multi-authored papers (TAMAA) by the total number of multi-authored publications (TMAA), following the approach suggested by

Elango and Rajendran (

2012) (Equation (1)) (

Elango & Rajendran, 2012):

Based on the data from this study, the CI is calculated as follows (Equation (2)):

Another important metric is the Collaborative Coefficient (CC), which measures the extent of joint authorship within the academic output concerning the integration of digital technologies into corporate social responsibility (CSR) practices. The CC ranges between 0 and 1, where values above 0.5 suggest a relatively strong degree of collaboration among researchers, while values closer to 0 indicate a more individualistic research pattern.

In the present study, the CC was calculated at 0.65, suggesting a moderately high level of collaboration among contributing authors. The computation follows the methodology proposed by

Ajiferuke et al. (

1988), which adjusts for both single- and multi-authored works to quantify the collaborative tendency in the dataset (Equations (3)) (

Ajiferuke et al., 1988):

Based on the data from this study, the CC is calculated as follows (Equation (4)):

In the formula used for calculating the Collaborative Coefficient (CC), j represents the number of co-authors on a given publication, Fj denotes the frequency of articles authored by j individuals, N is the total number of publications in the dataset, and k refers to the maximum number of authors observed in any single paper. These parameters are detailed in

Table 2.

It is worth noting that the Collaborative Coefficient can also be computed at the individual author level. In such cases, the dataset is restricted to publications in which the given researcher has participated, thereby providing insight into that author’s collaborative tendencies across their contributions.

Taken together, the citation and publication statistics confirm the high academic visibility of this field, demonstrating that research on ESG, integrated reporting, and circular economy has generated substantial scholarly impact over the last decade.

3.1.3. Citation Performance

Regarding citation performance, the dataset includes 1473 articles that have received at least one citation, accounting for approximately 91.4% of the total publications. The cumulative citation count for these works is 55,402, yielding an average of 37.61 citations per cited article. This high proportion of cited publications demonstrates the strong scholarly visibility and influence of research on ESG, IR, and CE over the last decade.

Table 3 presents the five most cited authors in the dataset, highlighting their academic influence and research visibility in the field of sustainability reporting.

Figure 3 shows the average number of citations per year for the articles published between 2016 and 2025.

Table 4 summarizes the main descriptive and performance indicators derived from the dataset.

In summary, the observed temporal trends in publication volume and citation dynamics reflect both the rapid maturation of sustainability reporting research and the continued relevance of foundational studies published in earlier years.

3.2. Thematic Mapping and Conceptual Structure Analysis

This subsection aims to uncover the underlying conceptual structure of the literature by applying co-word analysis, thematic mapping, and conceptual clustering techniques. Using Biblioshiny and VOSviewer, we explored the frequency and co-occurrence of author keywords and Keywords Plus to identify predominant themes, emerging research areas, and the interrelationships among core topics in sustainability reporting.

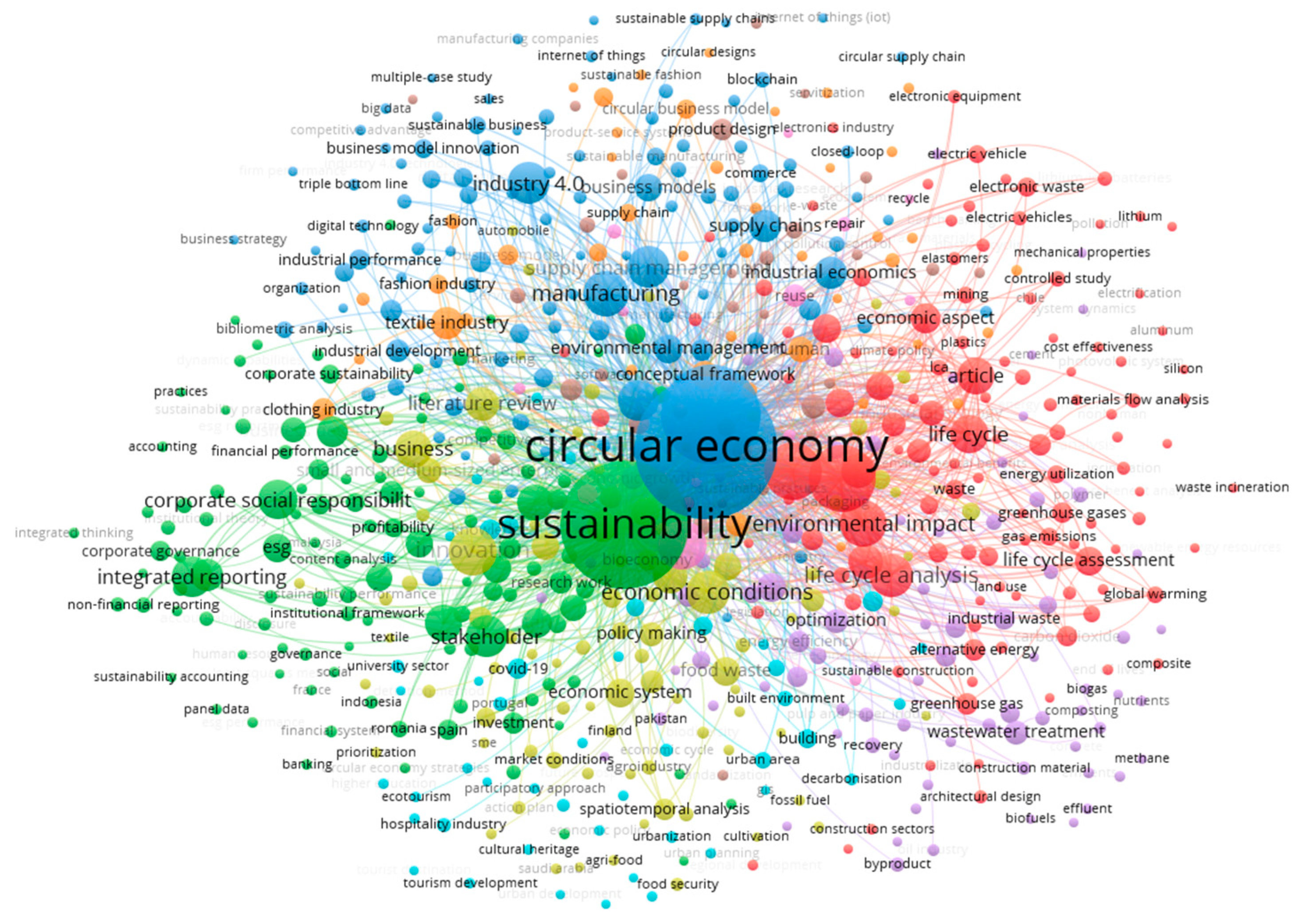

The keyword co-occurrence analysis was conducted using VOSviewer, resulting in a network visualization comprising 656 unique keywords grouped into nine distinct thematic clusters.

Figure 4 illustrates this network, where each node represents a keyword and the size of the node corresponds to its frequency across the dataset. Links between nodes indicate co-occurrences within the same articles, suggesting conceptual proximity.

Cluster 1 (red) focuses on the environmental and economic impacts of circular economy practices. Core keywords such as life-cycle assessment, carbon footprint, renewable energy, and eco-efficiency reflect research concerned with measuring and optimizing environmental performance, while terms like economic impact, cost-effectiveness, and socioeconomics highlight the economic dimensions.

Cluster 2 (green) encompasses topics related to corporate governance, ESG reporting, and accountability frameworks. Prominent keywords include integrated reporting, corporate social responsibility, stakeholder engagement, and sustainability accounting, pointing to the increasing importance of transparency and standardized disclosure in sustainability practices.

Cluster 3 (blue) captures the intersection of industrial innovation, digital transformation, and supply chain management. Keywords such as Industry 4.0, big data, blockchain, and reverse logistics demonstrate the relevance of advanced technologies in reshaping production and distribution processes within the circular economy.

Cluster 4 (yellow) emphasizes agrifood systems, bioeconomy, and resource efficiency. Terms like food waste, biodiversity, bioeconomy, and renewable resources illustrate the systemic focus on sustainable food production and natural resource management.

Cluster 5 (purple) concentrates on technological solutions for waste valorization and environmental engineering. Frequent terms such as waste treatment, biogas, anaerobic digestion, and bioenergy indicate applied research in energy recovery and waste-to-resource technologies.

Cluster 6 (light blue) covers themes related to urban sustainability, participatory governance, and social impacts. Keywords like urban planning, sustainable building, tourism development, and policy implementation reflect multi-level strategies integrating sustainability principles in cities and regions.

Cluster 7 (orange) highlights circular business models and the textile and fashion industries. Key concepts such as sustainable fashion, fast fashion, value chain, and resource scarcity point to sector-specific challenges and innovations.

Cluster 8 (brown) is centered around eco-design, product development, and production efficiency, with keywords including sustainable production, eco-design, resource efficiency, and qualitative analysis.

Finally, Cluster 9 (pink) represents local implementation and repair-oriented practices, combining terms like repair, reuse, recycle, and local government, underscoring the role of grassroots initiatives in advancing circularity.

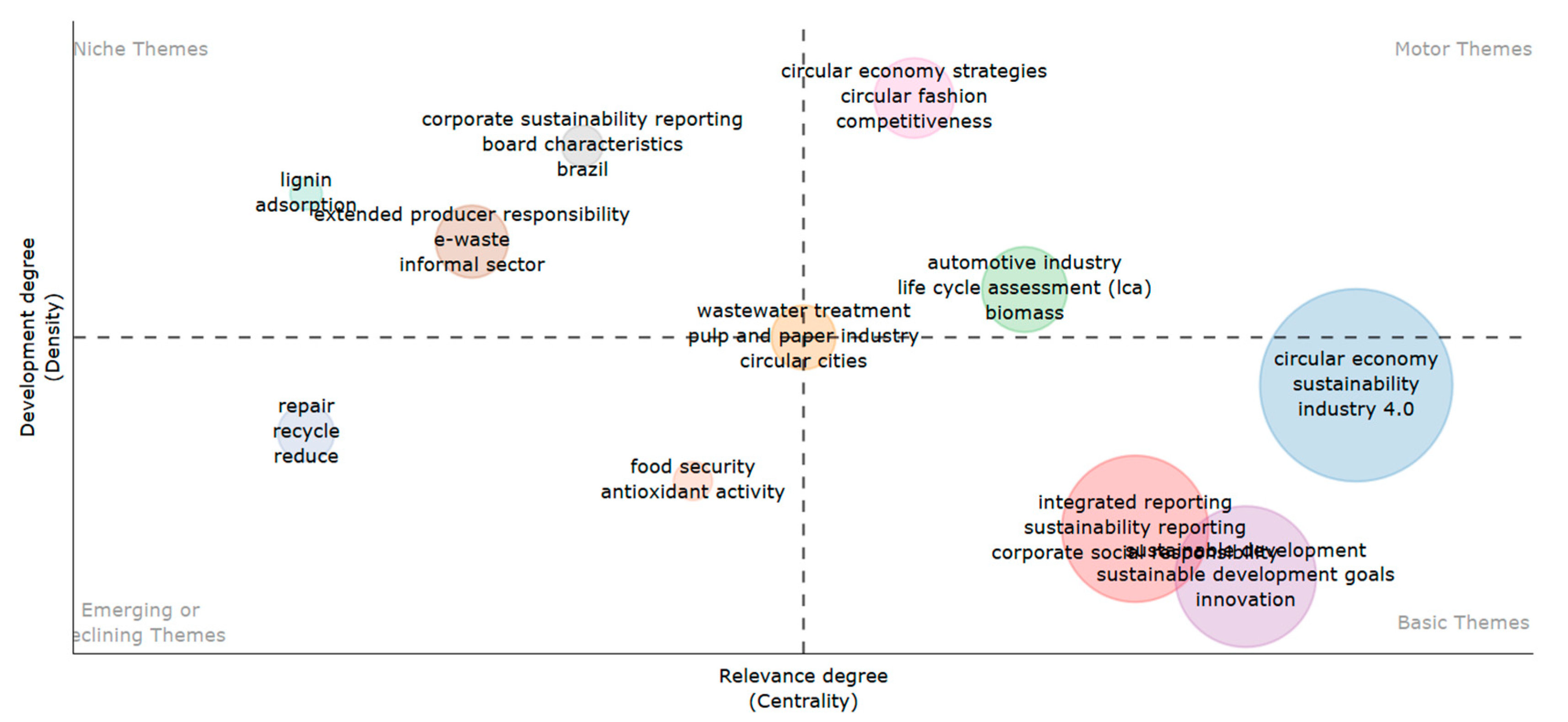

The thematic mapping was conducted using Biblioshiny, resulting in a two-dimensional visualization that positions clusters of keywords according to their

centrality (relevance degree) and

density (development degree). As shown in

Figure 5, this strategic diagram classifies themes into four quadrants: Motor Themes, Basic Themes, Niche Themes, and Emerging or Declining Themes. Each circle represents a thematic cluster, with its size reflecting the number of occurrences and its position indicating its structural significance within the field.

In the Motor Themes quadrant (upper-right), there are well-developed and highly central topics such as circular economy strategies, circular fashion, and competitiveness. These themes are characterized by a high degree of maturity and strong interconnections, suggesting their key role in driving scholarly discussions.

The Basic Themes quadrant (lower-right) includes dominant and transversal topics that are fundamental to the research domain, notably circular economy, sustainability, Industry 4.0, and integrated reporting. These concepts have high centrality but relatively moderate development, reflecting their established relevance and potential for further in-depth exploration.

The Niche Themes quadrant (upper-left) contains specialized but less central clusters such as corporate sustainability reporting, extended producer responsibility, and e-waste. Although these themes exhibit advanced internal development, their external links to other topics remain limited.

Finally, the Emerging or Declining Themes quadrant (lower-left) includes clusters with low centrality and density, such as repair, recycle, and reduce. These themes could represent either nascent areas of inquiry or topics losing traction in the recent literature.

Overall, the thematic map underscores a multidimensional landscape where well-established frameworks (e.g., sustainability reporting and circular economy) coexist with more focused domains (e.g., e-waste management and circular fashion), revealing opportunities for both consolidation and innovation.

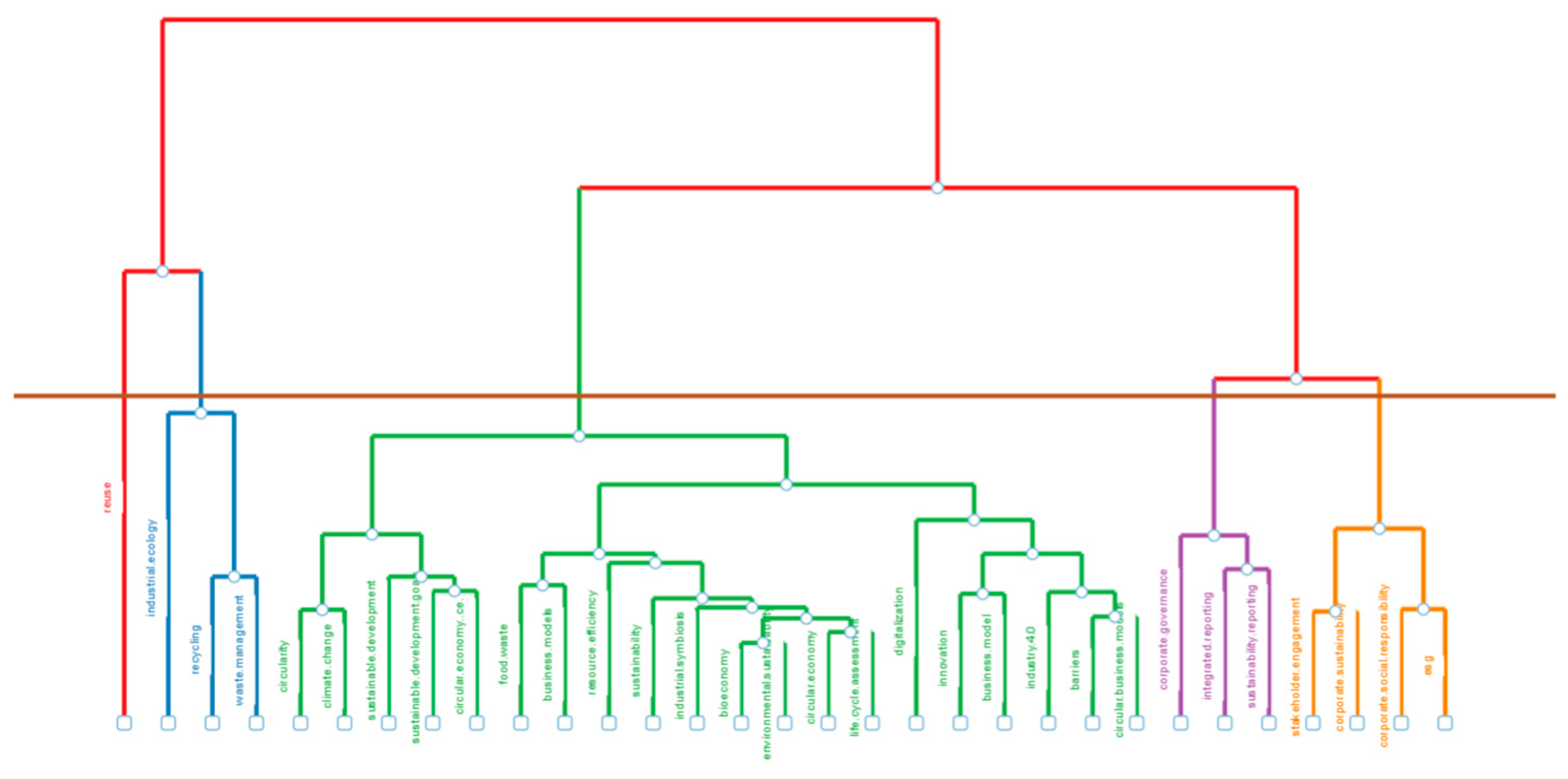

Finally, a conceptual structure dendrogram was generated to explore the hierarchical relationships among the most frequent author keywords, and to cluster them into coherent thematic groups (

Figure 6). This dendrogram visualizes the proximity and interconnections of concepts, offering an in-depth understanding of how research topics in sustainability reporting and the circular economy are structured.

3.3. Framework Interconnection Analysis

This section examines the intellectual and citation-based connections among the three core frameworks of this study—Environmental, Social, and Governance (ESG), integrated reporting (IR), and the circular economy (CE). By analyzing co-citation patterns and bibliographic coupling, the analysis elucidates how these frameworks have evolved in parallel, converged conceptually, and shaped the broader sustainability discourse.

3.3.1. Co-Citation Patterns

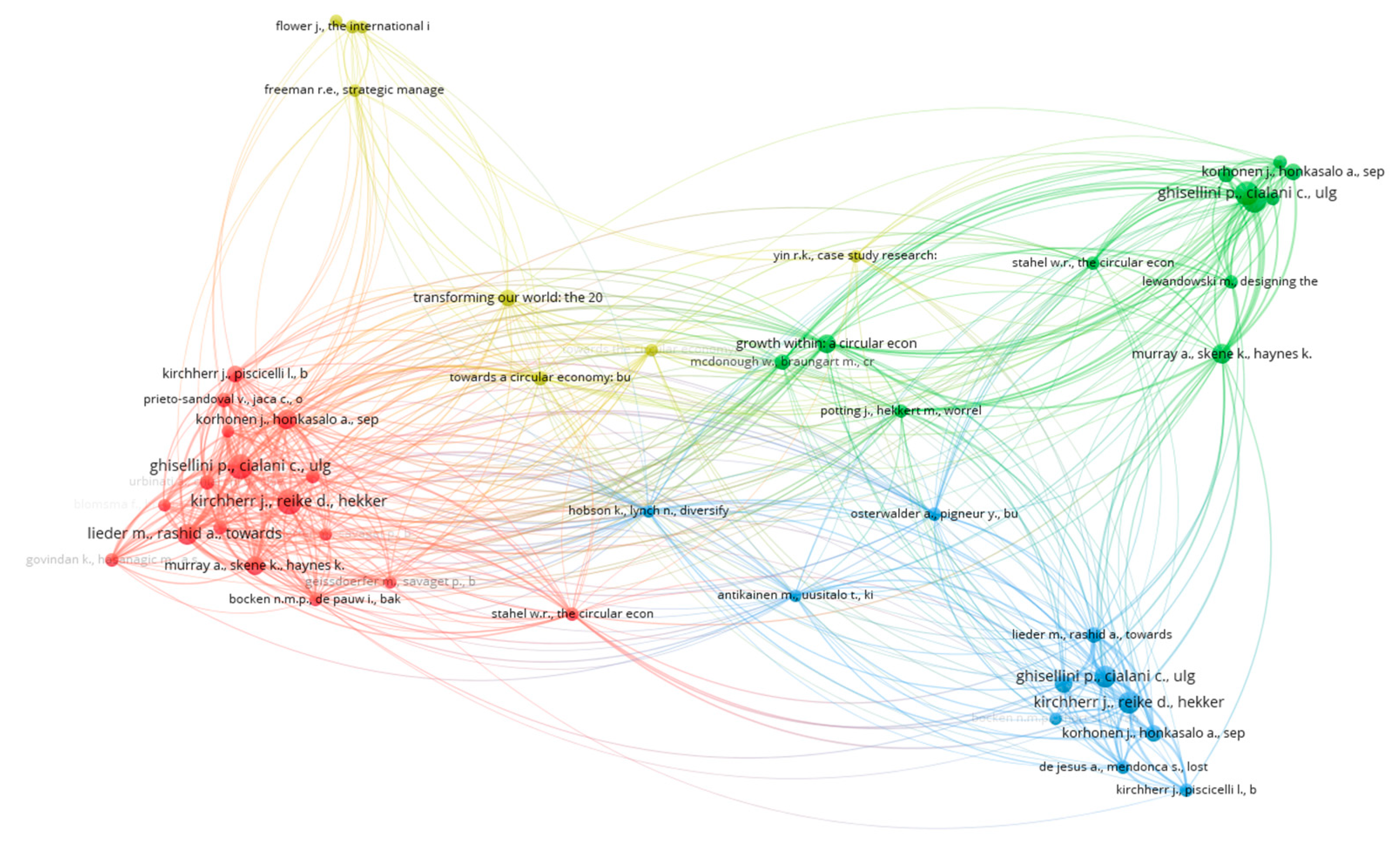

The co-citation analysis reveals how influential publications and foundational theories are jointly referenced, thereby reflecting their intellectual affinity.

Figure 7 presents the co-citation network of authors, visualized with VOSviewer and configured using a threshold of 20 citations per author to ensure the inclusion of both core and peripheral contributions.

The network consists of four main clusters that illustrate the intellectual architecture of sustainability research integrating ESG, integrated reporting, and circular economy frameworks:

Cluster 1 (Red): This dense group centers on seminal works by J. Kirchherr, D. Reike, and P. Ghisellini, whose contributions have shaped the conceptualization and critique of circular economy adoption (

Ghisellini et al., 2016, p. 114;

Kirchherr et al., 2017). The prominence of these nodes underscores their centrality to the field’s theoretical development.

Cluster 2 (Green): Dominated by authors such as J. Korhonen, A. Murray, and K. Skene, this cluster emphasizes systemic models of circularity and sustainability transitions. Publications here often connect environmental management with macro-level policy frameworks (

Korhonen et al., 2018;

Murray et al., 2017).

Cluster 3 (Blue): This segment includes W. Stahel, and M. Antikainen, representing research at the intersection of business model innovation, reverse logistics, and industrial applications (

Antikainen & Valkokari, 2016;

Stahel, 2016). The bridging connections between Clusters 2 and 3 reflect the operationalization of circular economy strategies within corporate practice.

Cluster 4 (Yellow): A smaller but conceptually significant cluster that comprises Freeman and Flower, pointing to the foundational role of stakeholder theory, strategic management, and early conceptual debates on sustainability disclosure (

Flower, 2015;

Freeman, 2013).

The co-citation map further shows a high density of inter-cluster links, highlighting the interdisciplinarity of the field. Notably, publications such as Towards the Circular Economy and McDonough and Braungart’s Cradle to Cradle act as conceptual bridges, frequently cited across clusters.

Another important observation is the visible proximity between the ESG and integrated reporting literature and the more environmentally focused circular economy contributions. This suggests that over the past decade, research in these domains has increasingly converged around common theoretical and managerial paradigms, particularly in relation to corporate accountability, non-financial reporting, and innovation for sustainability.

Overall, the co-citation patterns point to the emergence of a shared conceptual foundation supporting the integration of ESG disclosure, integrated reporting, and circular economy strategies into coherent sustainability frameworks. This convergence not only reflects the maturation of the field but also indicates fertile ground for further cross-disciplinary research.

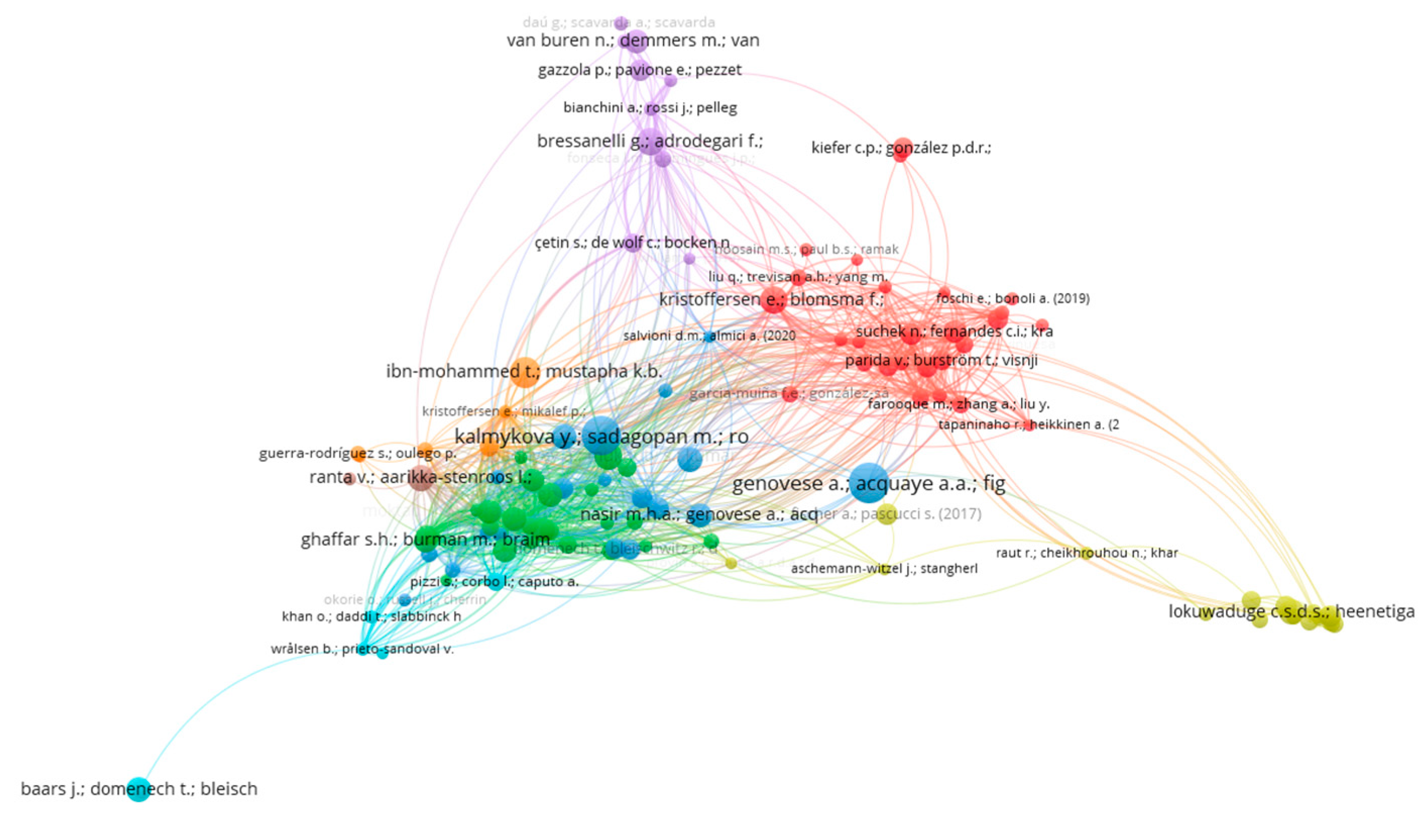

3.3.2. Bibliographic Coupling

Bibliographic coupling complements co-citation analysis by revealing how more recent publications simultaneously cite the same references, thereby mapping contemporary research interconnections.

Figure 8 depicts the bibliographic coupling network (threshold: 100 shared references), showing clusters of studies that are united by common bibliographies.

The coupling analysis identified several prominent thematic clusters:

A corporate governance cluster linking ESG disclosure practices with studies on integrated reporting, corporate accountability, and non-financial performance metrics;

A circular economy cluster emphasizing operational strategies, such as resource efficiency, closed-loop supply chains, and life-cycle assessment, frequently connected to discussions of reporting transparency;

A technology-enabled sustainability cluster where Industry 4.0, digitalization, and blockchain are examined as enablers of integrated reporting and traceability in circular business models.

Interestingly, many publications bridging ESG and CE explicitly focus on performance measurement frameworks (e.g., GRI Standards, SASB indicators) and the institutional pressures driving the adoption of circular practices. This suggests that bibliographic coupling reflects not only conceptual overlaps but also a shared reliance on methodological tools for measurement, assurance, and reporting.

The combined insights from the co-citation and bibliographic coupling analyses demonstrate that, while ESG, IR, and CE have historically developed as distinct research domains, they are increasingly interconnected through shared theoretical references and methodological approaches. This integration underscores the field’s progression toward a more unified understanding of sustainability reporting and performance.

Overall, the results of the co-citation and bibliographic coupling analyses highlight the emergence of a shared conceptual and methodological foundation underpinning ESG reporting, integrated reporting, and circular economy scholarship. This convergence signals a gradual transition toward a more unified understanding of sustainability disclosure and performance measurement. To complement this perspective, the following section focuses on the sectoral dimension of the literature, mapping how research priorities and thematic emphases differ across economic domains.

3.4. Sectoral Focus

This section addresses sector-specific patterns of sustainability reporting and circular economy research, offering a comparative view of how thematic priorities, keyword frequencies, and disclosure practices differ across industries. The analysis was conducted by classifying publications into three primary sectors—the real economy, banking and finance, and the public sector—and extracting sectoral clusters and frequently occurring keywords within each domain.

In the real economy, which dominates the dataset in terms of publication volume and keyword density, the research clusters primarily around operational strategies and performance measurement. Keywords such as life-cycle assessment, resource efficiency, supply chain management, and Industry 4.0 consistently emerge among the most frequent terms. This reflects a strong focus on optimizing production systems and integrating circular practices with standardized reporting frameworks like GRI and SASB. The prevalence of concepts such as eco-design, carbon footprint, and reverse logistics underscores the sector’s emphasis on quantifiable environmental impacts and technological enablers of transparency.

In contrast, the banking and finance sector exhibits a more selective engagement with circular economy concepts but demonstrates growing interest in ESG performance measurement and non-financial disclosure. Publications in this area frequently highlight keywords including financial materiality, ESG ratings, responsible investment, and sustainability disclosure. As noted by prior studies, non-financial reporting has evolved into a critical component of banks’ annual reports, articulating how financial profitability is balanced with environmental and social performance. For example, the recent literature emphasizes that the scope and clarity of such disclosures can materially impact credit ratings, as agencies such as Moody’s, S&P, and Fitch increasingly integrate ESG criteria into their methodologies. Additionally, the link between banking and the circular economy is reflected both directly (through digitization initiatives that reduce resource consumption) and indirectly (through lending to circular projects across industries). However, keyword frequencies indicate that terms such as circular economy and life-cycle assessment remain relatively underrepresented in banking compared to the real economy, suggesting opportunities for further research and more granular reporting frameworks. Regulatory changes (e.g., Directive 2014/95/EU and its successor, Directive (EU) 2022/2464) have institutionalized the requirement for sustainability disclosures in the banking sector, but practical implementation challenges persist, particularly regarding consistency and comparability.

The public sector accounts for a smaller yet conceptually significant share of publications. Sector-specific clusters in this domain revolve around public procurement, policy implementation, transparency, and accountability. Keywords such as public sector reporting, institutional pressures, and green procurement highlight the unique dynamics that distinguish public entities from private corporations. Unlike profit-driven enterprises, public sector organizations primarily deliver public goods and services, requiring sustainability disclosures tailored to budget oversight, non-exchange transactions, and citizen accountability. Professional organizations such as the CIPFA and ACCA have emphasized that reporting standards must be adapted to reflect these sector-specific characteristics. Furthermore, the International Public Sector Accounting Standards Board (IPSASB) has initiated consultations to develop dedicated sustainability disclosure frameworks for public institutions. While public procurement and infrastructure investment are increasingly leveraged to promote circular economy principles, bibliometric mapping reveals that keyword frequencies related to circularity and life-cycle costing remain limited compared to the real economy. This indicates an empirical gap and highlights the need for harmonized standards and further comparative studies.

Overall, the sectoral keyword frequencies and thematic clusters illustrate that although the ESG, integrated reporting, and circular economy concepts are gaining traction across industries, their operationalization varies significantly:

In the real economy, the focus remains on operational optimization, measurement frameworks, and supply chain transparency, supported by a dense network of studies and standardized metrics;

In the banking sector, sustainability reporting increasingly integrates ESG criteria into credit risk assessments and investment decisions but lacks consistent frameworks for capturing the “circular risks” of financing sustainable projects;

In the public sector, transparency and accountability remain the dominant narratives, yet research and reporting practices are comparatively less mature, especially in terms of operationalizing circular principles.

These findings underscore the importance of context-sensitive approaches to sustainability reporting and suggest that cross-sectoral lessons—particularly regarding standardized metrics and methodological tools—could support more consistent and credible disclosures. They also reveal a clear need for further empirical research into the implementation of circular economy strategies beyond the manufacturing sector.

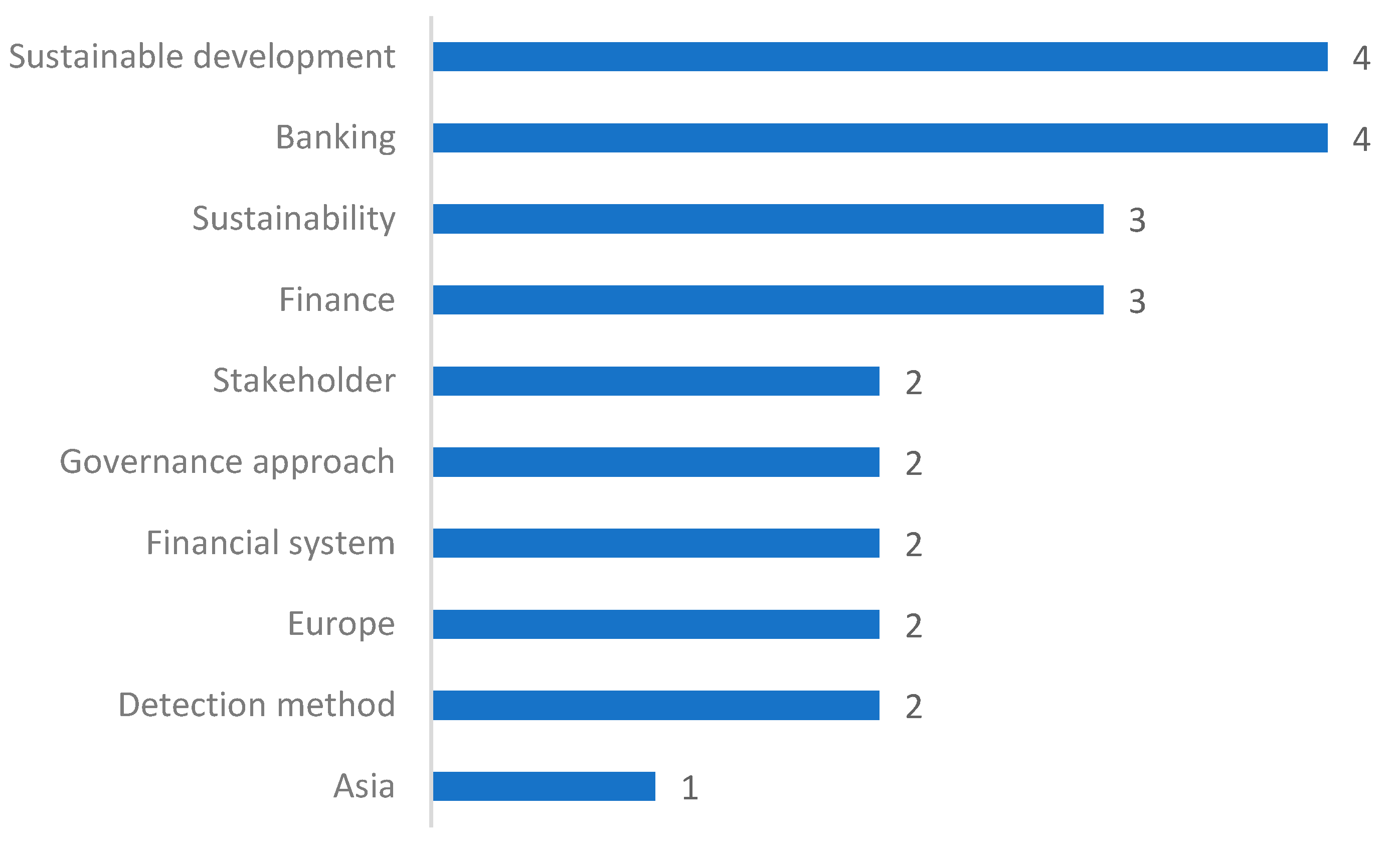

The figures bellow illustrate sector-specific keyword frequencies, further highlighting thematic priorities and underexplored areas in banking and public sector research.

Figure 9 illustrates the frequency distribution of the most recurrent keywords in publications focusing on the banking sector. The analysis shows that terms such as “sustainable development,” “banking,” “sustainability,” and “finance” appear with the highest frequency, reflecting the dominant emphasis on ESG disclosure and the integration of sustainability principles within financial institutions. Other relevant keywords, including “stakeholder,” “governance approach,” and “financial system,” highlight the attention to regulatory frameworks and accountability mechanisms specific to the banking industry. The comparatively lower occurrence of terms like “Asia” and “detection method” suggests more localized or specialized research streams that have yet to gain broader traction in the literature.

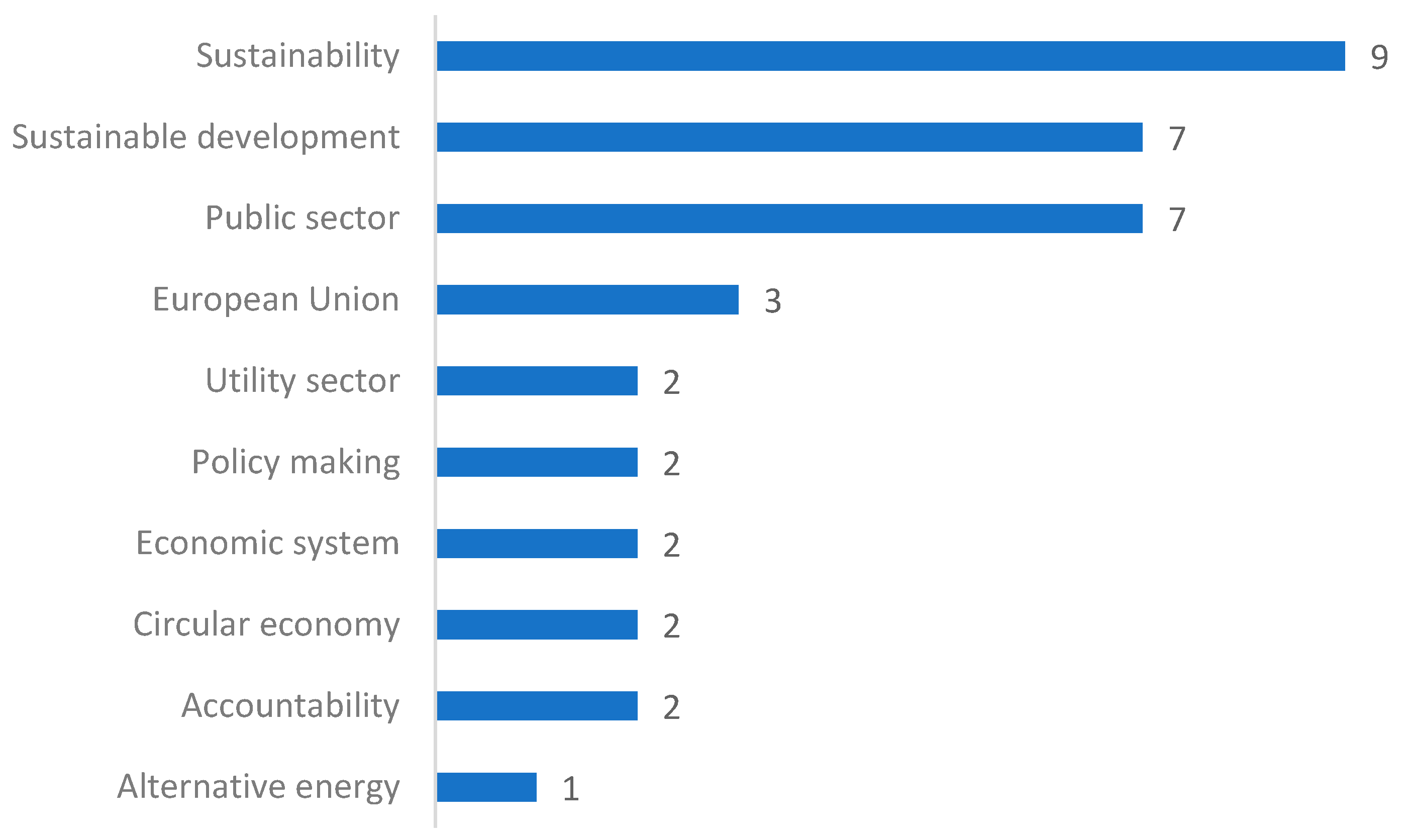

Figure 10 presents the frequency of keywords in publications related to the public sector. Notably, “sustainability,” “sustainable development,” and “public sector” are the most frequently used terms, underscoring the central role of transparency and the delivery of public value as core themes in the research. Keywords such as “European Union,” “policy making,” and “accountability” indicate the influence of supranational regulations and institutional pressures driving sustainability reporting practices. In contrast, keywords like “alternative energy,” “utility sector,” and “circular economy” appear less frequently, reflecting emerging but still underdeveloped areas of inquiry in the public sector context.

Taken together, these visualizations show that although ESG and sustainability reporting are present in all sectors, their practical application and level of development still differ noticeably.

4. Discussion

4.1. Thematic Structure and Keyword Analysis

The keyword co-occurrence analysis highlights the multidimensional nature of sustainability reporting and circular economy research. The results confirm that scholarly attention is distributed across diverse thematic domains, ranging from technological innovations and industrial strategies to policy frameworks and behavioral dimensions.

Notably, the prominence of Cluster 1 underscores the sustained interest in measuring environmental and economic impacts through tools such as life-cycle assessment and material flow analysis. This suggests that the field maintains a strong orientation toward evidence-based decision-making.

Cluster 2 emphasizes governance and accountability, while Cluster 3 highlights digital transformation. They show how advanced technologies are increasingly integrated into ESG disclosure and operational practices. However, despite this convergence, there appears to be a relative underrepresentation of studies explicitly addressing cybersecurity, data privacy, and the ethical implications of digital reporting systems, indicating opportunities for future research.

Similarly, Clusters 4 and 5 confirm the critical importance of resource efficiency in agrifood and waste management systems but reveal limited focus on social innovation and behavioral change, which could enhance the adoption and effectiveness of circular strategies.

The thematic clusters related to urban development (Cluster 6) and circular business models (Cluster 7) reflect a growing interest in sector-specific applications. However, few studies have systematically assessed consumer acceptance, market readiness, and cross-sectoral policy coherence, highlighting another area where further empirical work would be beneficial.

Overall, this analysis demonstrates that while the research field has matured considerably, important knowledge gaps remain in the following areas:

The integration of digital technologies into governance and reporting;

The social dimensions of circular consumption;

The scaling-up of local repair and reuse practices.

Future studies may benefit from interdisciplinary approaches combining environmental science, digital innovation, and behavioral economics to address these gaps and enhance the effectiveness of sustainability reporting frameworks.

To address these gaps more concretely, we propose several empirically actionable directions for future research:

Empirical studies on how digital innovations (e.g., AI, blockchain, automated assurance) transform sustainability reporting;

Research on behavioral and social acceptance aspects of circular practices;

Case-based investigations comparing ESG reporting practices across sectors;

The development of robust metrics linking ESG/CE/IR disclosure with measurable sustainability outcomes.

4.2. Thematic Map and Conceptual Clusters

The thematic map presented in this study highlights a clear stratification of research interests and their evolution across the sustainability reporting and circular economy literature. The prominence of circular economy, sustainability, and integrated reporting as Basic Themes underscores their foundational role and widespread adoption as analytical frameworks. The clustering of circular fashion and competitiveness among Motor Themes points to the growing strategic importance of sector-specific innovations and performance-related considerations.

Importantly, the presence of themes such as repair, recycle, and reduce in the Emerging or Declining Themes quadrant suggests either the underexplored nature of grassroots circular practices or a shift in focus towards more technologically integrated solutions. Likewise, the positioning of extended producer responsibility and e-waste as Niche Themes signals that while these areas are conceptually mature, they remain somewhat peripheral to the dominant discourse.

These findings suggest several research opportunities: (1) deepening the integration between corporate disclosure frameworks and sectoral circular economy practices; (2) exploring the socioeconomic implications of emerging circular strategies, such as circular fashion and collaborative consumption; and (3) examining why certain established concepts appear to have limited centrality despite their policy relevance.

This thematic structure supports the need for interdisciplinary approaches that bridge technological, managerial, and social dimensions in advancing sustainable development goals, reflecting recent findings by

Pavlova and Petrova (

2023,

2024) on the evolving role of accounting professionals in the context of digital transformation (

Pavlova & Petrova, 2023,

2024).

4.3. Conceptual Hierarchies and Dendrogram Insights

The dendrogram underscores the multidimensional nature of sustainability research, revealing how closely interrelated clusters of themes have emerged. For instance, the clear distinction between the clusters focused on circular economy and those emphasizing corporate governance and reporting suggests that the field remains partially compartmentalized, despite the growing calls for integrated approaches. Notably, concepts such as bioeconomy, life-cycle assessment, and digitalization act as bridges between the environmental and managerial research streams.

This hierarchical clustering also highlights potential research gaps and opportunities:

The relative separation of ESG and CSR themes from life cycle and industrial ecology suggests a need for more integrative studies linking reporting frameworks with operational sustainability practices;

The distinct grouping of reuse, recycling, and waste management indicates that circular strategies at the production stage are still conceptually separated from broader corporate sustainability discourses;

The emergence of digitalization and Industry 4.0 within the main sustainability cluster reflects their growing relevance but also signals an opportunity to further explore their role as enablers of transparency and circularity.

Overall, the conceptual structure supports the view that while significant progress has been made in bridging different research domains, future studies could benefit from connecting these currently segmented clusters into more holistic frameworks.

4.4. Citation-Based Interconnections

The co-citation and bibliographic coupling analyses further demonstrate the progressive convergence of ESG reporting, integrated reporting practices, and circular economy research into a cohesive intellectual domain. The identification of frequently co-cited authors—such as Kirchherr, Ghisellini, and Porter—highlights the dual influence of managerial theories (e.g., stakeholder and legitimacy theory) and environmental scholarship (e.g., industrial ecology, life-cycle assessment). This overlap underscores that while each framework initially developed along distinct disciplinary trajectories, the recent scholarship increasingly treats them as complementary pillars of corporate sustainability strategy. In particular, the central positioning of circular economy concepts alongside integrated reporting references suggests that the disclosure of circular practices is becoming an embedded component of broader ESG narratives.

These findings point to an emergent, cross-disciplinary research agenda that prioritizes the interconnections among sustainability performance measurement, transparent reporting mechanisms, and circular business model innovation. However, the observed patterns also reveal potential research gaps, such as limited empirical exploration of how integrated reporting frameworks concretely facilitate circular transitions, and underdeveloped comparative analyses of disclosure practices across sectors and regions. Addressing these gaps would enrich the understanding of how ESG and IR instruments operationally reinforce the shift towards a regenerative and circular economy.

The bibliographic coupling analysis reinforces the evidence of an increasingly integrated scholarly field in which ESG, integrated reporting, and circular economy are no longer treated as isolated domains but as mutually reinforcing components of sustainability discourse. The identified clusters reflect both thematic specialization and conceptual convergence. For instance, the coupling of circular economy practices with ESG disclosure frameworks suggests that performance measurement tools, such as GRI Standards and SASB indicators, have become the common language bridging operational sustainability strategies with financial and non-financial reporting obligations.

Moreover, the presence of technology-focused clusters highlights that digitalization, blockchain, and Industry 4.0 are perceived not only as enablers of efficiency but also as mechanisms for enhancing transparency and accountability in sustainability reporting. This finding aligns with broader trends in the literature emphasizing digital transformation as a catalyst for more integrated and verifiable disclosures.

Finally, the strong bibliographic ties among recent studies illustrate that researchers increasingly draw on overlapping methodological foundations and shared conceptual frameworks. This indicates the maturation of an interdisciplinary field, where the adoption of circular economy principles and ESG reporting is supported by a robust body of empirical evidence, standardized metrics, and policy-relevant insights. These observations point to fertile ground for future research exploring how emerging technologies and regulatory pressures further align sustainability practices and reporting processes across sectors and regions.

4.5. Sectoral Perspectives

The sectoral analysis highlights how the integration of ESG reporting, integrated reporting principles, and circular economy practices manifests unevenly across industries. In the real economy, the dense concentration of research around operational performance and standardized disclosure frameworks suggests a comparatively mature field with established methodologies and well-documented case studies. The frequent co-occurrence of keywords such as life-cycle assessment, resource efficiency, and supply chain transparency indicates a shared understanding of how circular practices can be operationalized and communicated to stakeholders.

In contrast, the banking sector occupies a more emergent position, where sustainability disclosures are primarily driven by regulatory mandates and the expectations of credit rating agencies. While non-financial reporting has become increasingly prominent in banks’ annual reports, the bibliometric evidence and keyword frequencies show that explicit treatment of circular economy considerations remains underdeveloped. This gap underscores the need for clearer definitions, standardized reporting formats, and empirical studies examining how financial institutions assess and disclose the “circular risks” associated with their lending portfolios.

In the public sector, sustainability reporting practices are shaped by unique accountability structures and public service mandates. Although there is growing recognition of the public sector’s potential to catalyze circular economy transitions—particularly through public procurement and infrastructure investment—the comparatively sparse presence of keywords relating to operational circularity reflects an early stage of research maturity. Professional guidance, such as consultations initiated by the IPSASB, represents an important step toward developing consistent frameworks. However, further investigation is needed to understand how sustainability disclosures in public institutions can be standardized and made comparable across jurisdictions.

Taken together, these observations illustrate both the thematic diversity and the asymmetries in empirical maturity that characterize sustainability reporting research. While the real economy has developed a robust evidence base for integrating circular strategies with ESG disclosure, the banking and public sectors lag behind in both conceptual clarity and practical implementation. This reinforces the need for comparative, sector-specific research that documents not only reporting practices but also the operational realities of adopting circular economy principles.

Finally, the convergence observed in co-citation and bibliographic coupling analyses suggests that an interdisciplinary research agenda is emerging—one that bridges environmental management, corporate accountability, and financial disclosure. To build on this foundation, future studies should do the following:

Investigate how sectoral constraints and incentives shape the uptake of standardized reporting frameworks (e.g., GRI, SASB, IPSASB);

Analyze the role of digital technologies in facilitating comparable and verifiable disclosures across industries;

Explore how regulatory developments can drive more consistent integration of circular economy considerations into ESG reporting.

These recommendations will help advance the maturity of the field and promote more transparent, credible, and decision-useful sustainability disclosures across sectors.

4.6. Synthesis of Findings and Research Agenda

This study set out to map the intellectual and thematic landscape of sustainability reporting research across the ESG, integrated reporting (IR), and circular economy (CE) frameworks, with a special emphasis on sectoral differentiation. The findings reveal a field that has grown rapidly over the past decade, both in volume and in complexity, yet still faces persistent fragmentation and conceptual silos.

One of the clearest patterns to emerge is the progressive convergence of ESG, IR, and CE discourses, driven by regulatory pressures, stakeholder expectations, and the increasing sophistication of corporate reporting practices. Bibliometric mapping demonstrated that while these frameworks originated from distinct theoretical backgrounds—such as stakeholder theory for ESG, integrated thinking for IR, and industrial ecology for CE—they now share a common intellectual infrastructure, as evidenced by overlapping citation patterns and frequent co-occurrence of keywords. Nevertheless, the sectoral analysis underscores that the degree of integration remains uneven across industries.

In the real economy, sustainability reporting has matured considerably. The high frequency of keywords such as life-cycle assessment, resource efficiency, and Industry 4.0 points to a strong operational focus and the widespread adoption of standardized reporting frameworks (e.g., GRI, SASB). This sector benefits from a dense network of empirical case studies, methodological innovations, and relatively high comparability of disclosures. However, even here, integration challenges persist—particularly in aligning CE metrics with financial performance indicators and translating technical measures into decision-useful narratives for investors and other stakeholders.

In contrast, the banking and finance sector exhibits a more nascent stage of integration. The predominance of ESG-related terms reflects the sector’s focus on risk assessment, regulatory compliance, and green finance, while the relative absence of CE-related keywords suggests that circularity considerations have not yet been systematically embedded into banking disclosure practices. This fragmentation points to important opportunities for future research exploring how financial institutions can better assess and communicate their exposure to circular risks and the sustainability performance of financed activities.

The public sector represents an even earlier stage of development. While the bibliometric evidence confirms a growing interest in sustainability reporting within public institutions—driven in part by the alignment with sustainable development goals and supranational policy frameworks—operationalization of circular economy principles remains limited. The low frequency of keywords related to circular economy and life-cycle costing indicates that public entities still face significant conceptual and practical barriers in moving beyond high-level sustainability narratives towards robust, comparable disclosures. Given the public sector’s role as both regulator and exemplar, research into mechanisms that can facilitate this transition—such as capacity-building, standard-setting, and inter-sectoral learning—is essential.

Beyond sectoral differences, the thematic analysis reveals several persistent knowledge gaps:

The integration of digital technologies—e.g., blockchain, IoT, and AI—into sustainability reporting remains underexplored, despite frequent references to Industry 4.0 in the literature. Few studies have empirically tested whether these technologies improve data reliability, comparability, or stakeholder trust. This gap aligns with concerns outlined by

Atanasov (

2023) regarding the technological barriers and the risk of data fragmentation in digital sustainability reporting (

Atanasov, 2023).

The social dimensions of circularity, such as consumer acceptance, behavioral change, and equitable distribution of benefits, are only intermittently addressed. The predominance of environmental and economic performance metrics risks sidelining critical social considerations.

The intersections between sustainability reporting and performance measurement remain fragmented. While the ESG and IR frameworks often focus on transparency and accountability, the extent to which disclosures translate into concrete sustainability outcomes (e.g., emissions reductions, resource savings) is insufficiently evidenced. As highlighted in recent Bulgarian studies, integrated reporting practices have evolved significantly to meet the demands of stakeholders for more transparent and holistic disclosures (

Blagoeva et al., 2023;

Filipova et al., 2021).

The bibliographic coupling and co-citation analyses further reinforce the observation that research on sustainability reporting is moving toward a more integrated, interdisciplinary model. Scholars increasingly draw on shared theoretical foundations—particularly stakeholder and legitimacy theories—and rely on common methodological tools such as life-cycle assessment and materiality analysis. However, the literature remains skewed towards large firms in developed economies, with limited representation of SMEs, emerging markets, and non-corporate actors.

Overall, these findings highlight both the significant progress and the limitations of the current research landscape. While the ESG, IR, and CE frameworks are now more frequently studied in combination, conceptual and empirical gaps remain in demonstrating how their integration can drive systemic change across sectors. Addressing these gaps will require the following:

Comparative studies examining sector-specific barriers and enablers of integrated reporting practices;

More research on the spillover effects between sectors, such as how banking disclosures and investment practices shape sustainability performance in the real economy;

Greater focus on the role of the accounting profession and the development of assurance standards that can strengthen the credibility of non-financial disclosures;

Empirical investigation into digital innovations that could enable real-time, verifiable sustainability reporting;

Development of holistic indicators of impact that move beyond financial proxies to capture the true sustainability contribution of organizations.

Most of the existing research in this field comes from Europe and North America. However, it is important to include more studies from regions like Africa, Southeast Asia, and Latin America. These areas have different economic and regulatory contexts, which can offer valuable insights for sustainability reporting. Including research from a wider range of countries would make future studies more balanced and globally relevant. It would also help develop reporting standards that are better suited to different local conditions and challenges.

In sum, this study confirms that sustainability reporting has evolved from a niche concern to a mainstream research field characterized by dynamic growth, interdisciplinary dialogue, and sectoral diversification. However, the path toward a unified and effective reporting landscape remains incomplete. Future research should focus on bridging conceptual divides, fostering cross-sectoral learning, and exploring innovative methodologies that align reporting practices with the urgent imperatives of sustainable development.

5. Conclusions and Policy Implications

This study set out to map the intellectual, thematic, and sectoral landscape of sustainability reporting research, with a particular focus on the intersections between Environmental, Social, and Governance (ESG) disclosure, integrated reporting (IR), and circular economy (CE) frameworks. Using a bibliometric and co-word analysis of 1,611 publications indexed in Scopus, it provides several important insights and directions for future practice and scholarship.

First, regarding RQ1, the results confirm an accelerating growth trajectory in the volume and complexity of publications over the past decade. Sustainability reporting has clearly transitioned from a niche topic to a mainstream field, supported by regulatory developments such as the EU Non-Financial Reporting Directive and the Corporate Sustainability Reporting Directive.

Second, addressing RQ2, the co-citation and bibliographic coupling analyses revealed that the most influential authors and institutions predominantly originate from Europe and the UK, reflecting the region’s regulatory leadership. The most cited journals—including The Journal of Cleaner Production, Sustainability, and Corporate Social Responsibility and Environmental Management—demonstrate the interdisciplinary nature of the field.

Third, RQ3 was explored through the identification of nine thematic clusters. These included core themes of life-cycle assessment, ESG disclosure frameworks, digital transformation, and resource efficiency, underscoring the multidimensional character of sustainability reporting research. Clusters such as circular business models and urban sustainability point to emerging areas of interest that merit further exploration.

Fourth, RQ4 highlighted the progressive convergence of ESG, IR, and CE frameworks. Despite their distinct origins, these paradigms are increasingly treated as complementary components of corporate sustainability strategies. However, this integration remains uneven across sectors and regions.

Finally, RQ5 illuminated sector-specific differences. In the real economy, sustainability reporting practices are relatively mature and operationalized through standardized metrics. The banking sector shows a stronger emphasis on ESG risks and green finance but limited engagement with circular economy principles. The public sector, while increasingly recognizing the importance of transparent reporting, still faces conceptual and practical barriers to implementation.

The findings of this bibliometric and thematic analysis provide several important insights for policymakers, regulators, and standard-setting bodies engaged in shaping the future of sustainability reporting:

Need for Greater Standardization and Harmonization: The observed fragmentation across ESG, integrated reporting, and circular economy frameworks highlights the urgency of aligning reporting standards to enhance comparability and credibility. Policymakers should promote convergence among existing standards—such as GRI, ISSB, and ESRS—and provide clear guidance on integrating circularity indicators into sustainability disclosures.

Supporting Sector-Specific Adaptation: Sectoral disparities in research maturity suggest that regulatory efforts should be tailored to the unique needs and capacities of different industries. While manufacturing sectors benefit from mature methodologies and case studies, the banking and public sectors require targeted capacity-building, dedicated templates, and simplified reporting protocols to accelerate adoption. This perspective aligns with prior research (

Krastev et al., 2023), which highlights that project financing mechanisms can effectively support the implementation of green and energy-efficient projects, thereby operationalizing sustainability strategies.

Promoting Digital Innovation: Despite frequent references to Industry 4.0, the integration of digital tools—such as blockchain, IoT, and real-time reporting platforms—remains limited. Policymakers should incentivize the development and use of secure digital infrastructure to improve the traceability and assurance of ESG and circular economy data.

Addressing Social Dimensions and Greenwashing Risks: The relative neglect of social indicators and the continued risk of symbolic reporting highlight the importance of regulatory safeguards. Clear definitions of materiality, mandatory assurance mechanisms, and stakeholder engagement processes can strengthen accountability and reduce the prevalence of greenwashing.

Fostering Cross-Sectoral Learning and Spillover Effects: The findings suggest that sectors such as banking could act as catalysts for improved sustainability practices across value chains. Policymakers may consider measures that encourage inter-organizational collaboration, knowledge sharing, and the diffusion of reporting best practices from leading industries to lagging sectors.

Global Representation and Inclusiveness: The dominance of European and Anglo-American scholarship implies a potential geographic skew in policy discourse. Regulatory initiatives should support participation from emerging and developing economies to ensure that frameworks are adaptable to diverse contexts and development stages.

The policymakers have a central role to play in bridging the conceptual and operational divides between ESG, IR, and CE frameworks. A coherent, inclusive, and innovation-oriented policy agenda is essential to accelerate the transformation toward credible, decision-useful, and impactful sustainability reporting.

Despite this study’s comprehensive scope, several limitations should be acknowledged. First, the analysis is based solely on publications indexed in the Scopus database, which may exclude relevant contributions from other repositories. Second, the exclusive focus on English-language articles limits the inclusion of regional and non-English perspectives. Third, while bibliometric methods allow for broad and systematic mapping, they cannot fully capture the contextual depth or practitioner insights available through qualitative approaches. These limitations may affect the generalizability of the findings and highlight the need for complementary empirical research.

Overall, this study demonstrates that sustainability reporting has evolved into a vibrant interdisciplinary field characterized by dynamic growth, sectoral diversification, and increasing methodological sophistication. However, persistent fragmentation, knowledge gaps, and uneven integration remain. Addressing these challenges requires the following:

Comparative, cross-sectoral studies to identify and disseminate best practices in integrated reporting;

Further research on the role of digital technologies in facilitating real-time and verifiable disclosures;

Development of holistic indicators that capture not only financial impacts but also social and environmental outcomes;

Closer engagement between scholars, policymakers, and practitioners to ensure that sustainability reporting frameworks are both rigorous and decision-useful.

In conclusion, bridging the conceptual divides and fostering more integrated reporting practices will be essential for supporting the broader transition toward sustainable, regenerative economic systems.