Do Syndicated Loan Borrowers Trade-Off Real Activities Manipulation with Accrual-Based Earnings Management?

Abstract

1. Introduction

2. Background Study and Hypotheses Development

2.1. Syndicated Loans and the Alternative Earnings Management Mechanisms

2.2. Lenders’ Monitoring Mechanisms

2.3. Number of Syndications

2.4. Loan Size

2.5. Loan Maturity

2.6. Lenders’ Reputation

3. Research Methodology

3.1. Data and Sample Selection

3.2. Empirical Models

+ β8 LOSSit + β9 ATit + β10 BUSYit + Σβi IND_CATit + Σβt YEARit

β8 ROAit + β9 FINLit + β10 Zit + β11 MTBit + β12 BIG4it + β13 ATit + β14 ΔGDPit + β15 MFit +

β16 LITit + β17 MATURit + β18 SIZEit + Σβi IND_CATit + Σβt YEARit

β6 EXTRAit + β7 FORit + Β8 ROAit + β9 FINLit + β10 Zit + β11 MTBit + β12 BIG4it + β13 ATit +

β14 ΔGDPit + β15 MFit + β16 LITit + Σβi IND_catit + Σβt YEARit

Σβ5 LOAN_CHit + β6 SOXit + β7 LOSSit + β8 NOAit + β9 EXTRAit + β10 FORit +

β11 ROAit + β12 FINLit + β13 Zit + β14 MTBit + β15 BIG4it + β16 ATit + β17 ΔGDPit +

β18 LITit + Σβi IND_CATit + Σβt YEARit

3.3. Descriptive Statistics

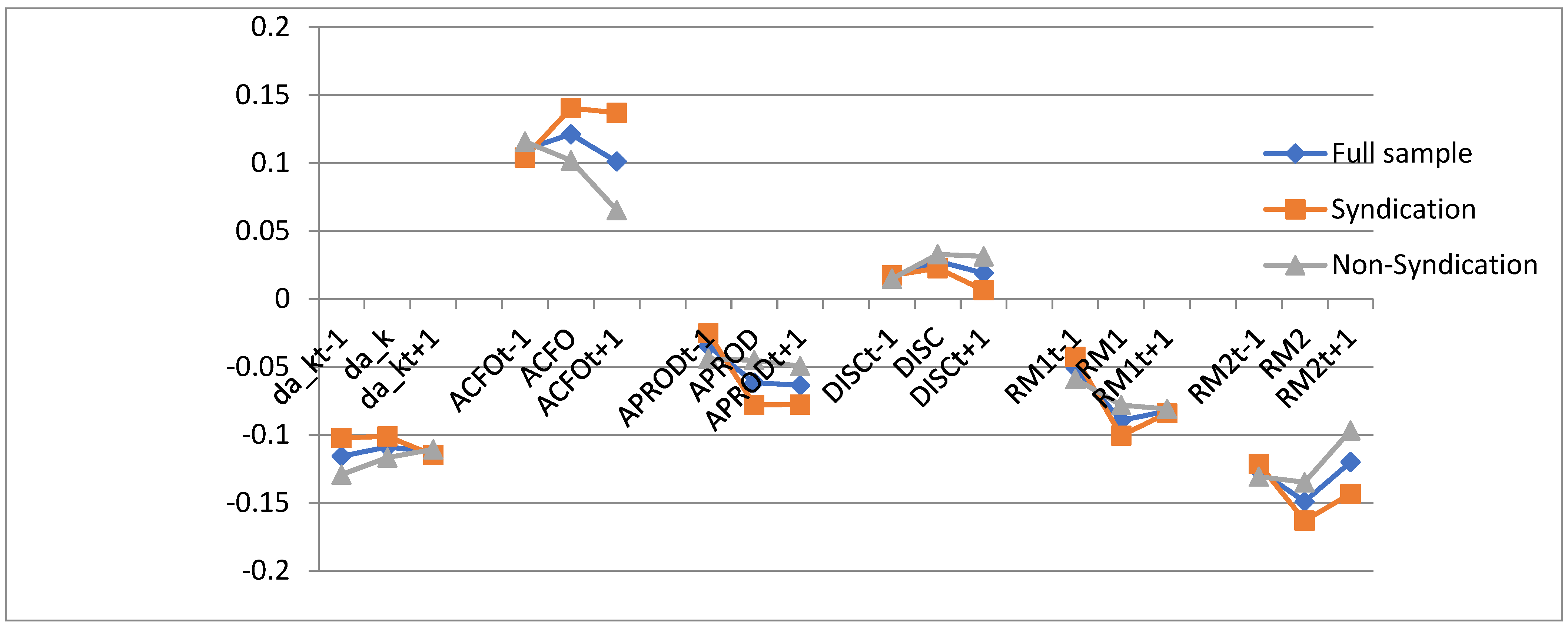

3.4. Univariate Analysis

4. Results and Conclusions

4.1. Earnings Management Around Syndicated Lending

4.2. The Association Between Earnings Management and Lender’s Monitoring Mechanisms

4.3. Additional Analysis

4.3.1. The Association Between RAM and Cost of Debt

4.3.2. The Association Between RAM and Cash Flow from Operations

5. Conclusions and Recommendations for Future Research

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Definition and Measurement |

|---|---|

| Accruals-based earnings management (DA): | |

| DA_Kit−1 | Signed discretionary accruals according to Kothari et al. (2005). |

| DA_Dit−1 | Signed discretionary accruals according to Dechow et al. (1995). |

| DAK_INCit−1 | Income-increasing DA_Kt−1 and it is a continuous number = DA_Kt−1 if it is a positive number, zero otherwise. |

| DAD_INCit−1 | Income-increasing DA_Dt−1 and it is a continuous number = DA_Dt−1 if it is a positive number, zero otherwise. |

| FC_DAK | The difference between DA_K in year t + 1 and year t divided by DA_K in year t. |

| FC_DAD | The difference between DA_D in year t + 1 and year t divided by DA_D in year t. |

| Real-activity manipulation (RAM): | |

| ACFOit−1 | Abnormal cash flow from operations as in Roychowdhury (2006). |

| ADISCit−1 | Abnormal discretionary expenses as in Roychowdhury (2006). |

| APRODit−1 | Abnormal production costs as in Roychowdhury (2006). |

| RM1it−1 | First aggregate measure of real earnings management according to Cohen and Zarowin (2010) as (ADISC* − 1) + APROD. |

| RM2it−1 | Second aggregate measure of real earnings management according to Cohen and Zarowin (2010) as (ACFO* − 1) + (ADISC* − 1). |

| FC_ACFO | The difference between ACFO in year t + 1 and year t divided by ACFO in year t. |

| FC_ADISC | The difference between ADISC in year t + 1 and year t divided by DISC in year t. |

| FC_APROD | The difference between APROD in year t + 1 and year t divided by APROD in year t. |

| FC_RM1 | The difference between RM1 in year t + 1 and year t divided by RM1 in year t. |

| FC_RM2 | The difference between RM2 in year t + 1 and year t divided by RM2 in year t. |

| Variables of interest: | |

| SYND | A dummy variable that equals 1 if the firm engaged in syndicate lending, zero otherwise. |

| SIZE | Loan size, measured in millions. |

| SYNDICATES | Number of syndicate lenders. |

| MATUR | Loan tenor/maturity measured in years. |

| HHI | Lender’s Herfindahl–Hirschman Index, measured as the lender’s concentration of market share per two-digit SIC code. |

| COD | All-in-Spread Drawn and measured as the annual spread paid over LIBOR for each dollar drawn down from the loan. |

| Loan Characteristics (LOAN_CH): | |

| SPREAD | Natural log of the difference between the average annual bid and ask spread of traded facilities. |

| COVEN | A dummy variable that equals 1 if syndicate loans are subject to financial debt covenants, zero otherwise. |

| DRATINGS | A dummy variable that equals 1 if syndicate loans are rated, zero otherwise. |

| Control Variables: | |

| ΔGDP | The change in Gross Domestic Product. |

| MF | A dummy variable that equals 1 if a firm issues a management earnings forecast in a given year, and zero otherwise. |

| SUB | Substitute effect = DA_K if the dependent variable is RAM, and RM1 if the dependent variable is DA. |

| SOX | A dummy variable that equals 1 for post Sarbanes–Oxley Act and zero otherwise. |

| LOSS | A dummy variable that equals 1 if the net income at the beginning of the year is negative and zero otherwise. |

| EXTRA | A dummy variable that equals 1 if the firm reports extraordinary transactions at the beginning of the year, zero otherwise. |

| REG | A dummy variable that equals 1 if the firm is in regulated industry such as financial or utility industry (SIC codes 6000–6999 and 4900–4999), zero otherwise. |

| FOR | A dummy variable that equals 1 if firm engages in foreign transactions as reported at the beginning of the year, 0 otherwise. |

| ROA | Income before Extraordinary items divided by total assets at the beginning of the year. |

| FINL | Financial leverage is debt/total assets at the beginning of the year. |

| Z | Altman Z-score calculated as in Zmijewski (1984). |

| MTB | Market-to-Book ratio at the beginning of the year. |

| BIG4 | A dummy variable that equals 1 if the firm is audited by BIG_N, 0 otherwise. |

| AT | Natural log of total assets at the beginning of the year. |

| REST | A dummy variable that equals 1 if the firm restated financial statements, 0 otherwise. |

| LIQ | Current assets/current liabilities. |

| BUSY | A dummy variable that equals 1 if the fiscal year-end of the firm is December, zero otherwise. |

| NOA | Net operating assets as in Barton and Simko (2002). |

| LIT | A dummy variable that equals 1 if the firm is in litigious industry, zero otherwise. |

| CFOit | Current year’s cash flow from operations. |

| CFOit+1 | Cash flow from operations at year t + 1. |

| IND_CAT | Dummy variables to proxy for industry categories. |

| YEAR | Dummy variables to proxy for year-fixed effects. |

Appendix B

- (1)

- (2)

- (1)

- Individual RAM measures following Roychowdhury (2006):

- (2)

- Aggregate measures following Cohen and Zarowin (2010):

| 1 | Prior research has also documented that firms manipulate accounting earnings around specific corporate events, such as initial public offering (Teoh et al., 1998a), seasoned equity offering (Teoh et al., 1998b; Cohen & Zarowin, 2010; Chang et al., 2010; Kothari et al., 2016), bond issuance (Liu et al., 2010) and debt covenants near violation (Watts & Zimmerman, 1986; DeFond & Jiambalvo, 1994; Dichev & Skinner, 2002; Bradley & Roberts, 2015). |

| 2 | According to Thomson Reuters LPC (Hall, 2015), frequency and relative size of syndicated loan originations have significantly increased over time, growing from around USD 8 billion in 1991 to around USD 2.2 trillion in 2015. |

| 3 | The level of analysis in this study is per “loan facility”, consistent with other studies that use syndicated loans (e.g., Ball et al., 2008; Gaul & Uysal, 2009; Wittenberg-Moerman, 2008). |

| 4 | Several studies conclude that RAM jeopardizes a firm’s competitive advantage in the long run and increases information asymmetry between the borrowers and the lenders (Roychowdhury, 2006; Cohen & Zarowin, 2010; Zang, 2012; Ge & Kim, 2014). |

| 5 | Bereskin et al. (2014) find that RAM carried out through cutting R&D leads to negative implications to the firm’s innovation as measured by a less productive patent portfolio. They argue that a change in innovation activity is value-relevant information that negatively affects stock prices. Greiner et al. (2013) and Sohn (2011) document that auditors see through RAM and consequently request high audit fees. Crabtree et al. (2014) argue that firms engaging in RAM pay a higher cost for debt capital as evidenced by higher yield spreads at issuance. |

| 6 | |

| 7 | The Loanware database is available until only 2005. Additionally, the global financial crisis by the onset of 2007 significantly impacted the debt market and cost of debt was markedly low. Therefore, we prefer to have our sample period up to 2005. |

| 8 | Propensity score matching (PSM) is used to control for self-selection bias due to observable characteristics following (Rosenbaum & Rubin, 1983). The treatment group is matched to the control group based on the propensity score probabilities of observations rather than individual covariates (Fraeman, 2010). |

| 9 | We increased the range of propensity-score matching gradually from 0.10 to 0.20 and the resulting final sample was not significantly larger than our final matched sample, so we opted to use a more conservative matching range (0.10) to increase the reliability of our results. |

| 10 | |

| 11 | Appendix B summarizes the models used to calculate earnings management variables. |

| 12 | In the primary loan market, between the borrowers and the primary lenders, syndicated loans are private debts; information regarding the underlying loan is disclosed to the primary lender via private communication. The private communications result in a different information asymmetry environment when compared with traditional corporate bonds (Allen & Gottesman, 2006; Sufi, 2007; Wittenberg-Moerman, 2008). It is documented that “closeness”, and therefore information symmetry, between the borrower and the primary lender plays an important role in the structure of the syndication (Sufi, 2007). When the primary lender has previous lending relationships with the borrower, it is easier to form a larger syndicate. When information asymmetry between the borrower and the primary lender is higher, participant lenders are more limited and concentrated to those with a previous lending relationship with the borrower (Sufi, 2007). Therefore, structure of the syndication subsequently determines the marketability of the loans in the secondary market, but most importantly, it determines the cost to the borrower (Sufi, 2007; Wittenberg-Moerman, 2008; Allen et al., 2008). |

| 13 | Using 0.80 as a cut-off point of high correlation, we find a significant high correlation between MTB and Z and between SOX and RM1. We repeated the statistical analysis for models that include and exclude these variables together and we did not find any differences in the results or any indication that our results are affected by multicollinearity among our independent variables. |

| 14 | Furthermore, to rule out that our results are driven by voluntary disclosure, we created a dummy variable equal to one if a firm issued a management earnings forecast in a given year, and zero otherwise. Including this variable as a control in all main specifications does not affect the primary results. |

| 15 | Empirical evidence on the consequences of RAM versus AEM on the debt market are both scant and inconclusive. While some researchers (Liu et al., 2010; Jung et al., 2013) find that creditors are unable to price AEM, others (Crabtree et al., 2014; Alissa et al., 2013) find that creditors do incorporate AEM into their credit decisions and increase the yield spread or credit ratings accordingly. For example, Crabtree et al. (2014) find that RAM is associated with lower bond ratings and higher market yield of the firm’s debt at issuance, evidence that bond rating analysts’ and bond investors’ perceived credit risk are changing as a result of RAM. |

References

- Adam, T. R., Burg, V., Scheinert, T., & Streitz, D. (2020). Managerial biases and debt contract design: The case of syndicated loans. Management Science, 66(1), 352–375. [Google Scholar] [CrossRef]

- Ahn, S., & Choi, W. (2009). The role of bank monitoring in corporate governance: Evidence from borrowers’ earnings management behavior. Journal of Banking and Finance, 33(2), 425–434. [Google Scholar] [CrossRef]

- Alissa, W., Bonsall, S. B., Koharki, K., & Penn, M. W. (2013). Firms’ use of accounting discretion to influence their credit ratings. Journal of Accounting and Economics, 55(1), 129–147. [Google Scholar] [CrossRef]

- Allen, L., & Gottesman, A. (2006). The informational efficiency of the equity market as compared to the syndicated bank loan market. Journal of Financial Services Research, 30(1), 5–42. [Google Scholar] [CrossRef]

- Allen, L., Guo, H., & Weintrop, J. (2008). The information content of quarterly earnings in syndicated bank loan prices. Asia-Pacific Journal of Accounting and Economics, 15(2), 91–121. [Google Scholar] [CrossRef][Green Version]

- Ball, R., Bushman, R., & Vasvari, F. (2008). The debt-contracting value of accounting information and loan syndicate structure. Journal of Accounting Research, 46(2), 247–287. [Google Scholar] [CrossRef]

- Barton, J., & Simko, P. (2002). The balance sheet as an earnings management constraint. The Accounting Review, 77, 1–27. [Google Scholar] [CrossRef]

- Becker, C., DeFond, M., Jiambalvo, J., & Subramanyam, K. (1998). The effect of audit quality on earnings management. Contemporary Accounting Research, 15(1), 1–24. [Google Scholar] [CrossRef]

- Bereskin, F., Hsu, P.-H., & Rotenberg, W. (2014). The real effects of real earnings management: Evidence from innovation. Working paper. University of Delaware. [Google Scholar]

- Bharath, S., Pasquariello, P., & Wu, G. (2008a). Does asymmetric information drive capital structure decisions? Review of Financial Studies, 22(8), 3211–3243. [Google Scholar] [CrossRef]

- Bharath, S., Sunder, J., & Sunder, S. (2008b). Accounting quality and debt contracting. The Accounting Review, 83(1), 1–28. [Google Scholar] [CrossRef]

- Billett, M., Flannery, M., & Garfinkel, J. (1995). The effect of lender identity on a borrowing firm’s equity return. Journal of Finance, 50(2), 699–718. [Google Scholar] [CrossRef]

- Bradley, M., & Roberts, M. (2015). The structure and pricing of corporate debt covenants. The Quarterly Journal of Finance, 5(2), 1550001. [Google Scholar] [CrossRef]

- Bushman, B., & Wittenberg-Moerman, R. (2012). The role of bank reputation in “certifying” future performance implications of borrowers’ accounting numbers. Journal of Accounting Research, 50(4), 883–930. [Google Scholar] [CrossRef]

- Chang, R., Tseng, Y., & Chang, C. (2010). The issuance of convertible bonds and earnings management: Evidence from Taiwan. Review of Accounting and Finance, 9(1), 65–87. [Google Scholar] [CrossRef]

- Chi, W., Lisic, L. L., & Pevzner, M. (2011). Is enhanced audit quality associated with greater real earnings management? Accounting Horizons, 25(2), 315–335. [Google Scholar] [CrossRef]

- Chung, R., Firth, M., & Kim, J. B. (2005). Earnings management, surplus free cash flow, and external monitoring. Journal of Business Research, 58(6), 766–776. [Google Scholar] [CrossRef]

- Cohen, D., Dey, A., & Lys, T. (2008). Real and accrual-based earnings management in the pre- and post-sarbanes-oxley periods. The Accounting Review, 83(3), 757–787. [Google Scholar] [CrossRef]

- Cohen, D., & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics, 50(1), 2–19. [Google Scholar] [CrossRef]

- Costello, A., & Wittenberg-Moerman, R. (2011). The impact of financial reporting quality on debt contracting: Evidence from internal control weakness reports. Journal of Accounting Research, 49(1), 97–136. [Google Scholar] [CrossRef]

- Crabtree, A., Maher, J., & Wan, H. (2014). New debt issues and earnings management. Advances in Accounting, Incorporating Advances in International Accounting, 30, 116–127. [Google Scholar] [CrossRef]

- Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting earnings management. The Accounting Review, 70(2), 193–225. [Google Scholar]

- DeFond, M., & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17(1–2), 145–176. [Google Scholar] [CrossRef]

- Denis, D., & Mihov, V. (2003). The choice among bank debt, non-bank private debt, and public debt: Evidence from new corporate borrowings. Journal of Financial Economics, 70(1), 3–28. [Google Scholar] [CrossRef]

- Dennis, S., & Mullineaux, D. (2000). Syndicated loans. Journal of Financial Intermediation, 9, 404–426. [Google Scholar] [CrossRef]

- Dhaliwal, D., Hogan, C., Trezevant, R., & Wilkins, M. (2011). Internal control disclosures, monitoring, and the cost of debt. The Accounting Review, 86(4), 1131–1156. [Google Scholar] [CrossRef]

- Dichev, I., & Skinner, D. (2002). Large-sample evidence on the debt covenant hypothesis. Journal of Accounting Research, 40(4), 1091–1123. [Google Scholar] [CrossRef]

- El Mahdy, D., & Park, M. (2014). Internal control quality and information asymmetry in the secondary loan market. Review of Quantitative Finance and Accounting, 43(4), 683–720. [Google Scholar] [CrossRef]

- Ertan, A. (2022). Real earnings management through syndicated lending. Review of Accounting Studies, 27(4), 1157–1198. [Google Scholar] [CrossRef]

- Fraeman, K. (2010, November 14–17). An introduction to implementing propensity score matching with SAS. Applications Development Presentation (AD05) at the Northeast SAS Users Group 2010 Conference, Baltimore, MD, USA. [Google Scholar]

- Francis, J., LaFond, J., Olsson, P., & Schipper, K. (2005). The market pricing of earnings quality. Journal of Accounting and Economics, 39, 295–327. [Google Scholar] [CrossRef]

- Gadanecz, B. (2004). The syndicated loan market: Structure, development and implications. BIS Quarterly Review, 75–89. [Google Scholar]

- Gao, X., Jia, Y., Krupa, N. R., & Tucker, J. W. (2024). The corroboration role of management earnings forecasts in private loan markets. Journal of Accounting, Auditing & Finance, 39(3), 903–930. [Google Scholar]

- García Osma, B., Guillamón Saorín, E., & Mercado, F. (2023). Quarterly earnings guidance and real earnings management. Journal of Business Finance & Accounting, 50(5–6), 1029–1059. [Google Scholar]

- Gaul, L., & Uysal, P. (2009). Do audit fees influence credit risk and asymmetric information problems? Evidence from the syndicated loan market. Working paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1404126 (accessed on 1 February 2019).

- Ge, W., & Kim, J.-B. (2014). Real earnings management and the cost of new corporate bonds. Journal of Business Research, 67(4), 641–647. [Google Scholar] [CrossRef]

- Graham, J., Harvey, C., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40(1–3), 3–73. [Google Scholar] [CrossRef]

- Greiner, A., Kohlbeck, M., & Smith, T. S. (2013). Do auditors perceive real earnings management as a business risk? Working paper. University of Denver. [Google Scholar]

- Gunny, K. (2010). The relationship between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research, 27(3), 855–888. [Google Scholar] [CrossRef]

- Gupta, M., Pevzner, M., & Seethamraju, C. (2010). The implications of absorption cost accounting and production decisions for future firm performance and valuation. Contemporary Accounting Research, 27(3), 889–922. [Google Scholar] [CrossRef]

- Hall, N. (2015). Global syndicated loans review: Managing underwriters. Thomson Reuters. Available online: http://share.thomsonreuters.com/general/PR/Loan-4Q15-(E).pdf (accessed on 1 February 2019).

- Jones, J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–228. [Google Scholar] [CrossRef]

- Jung, B., Soderstrom, N., & Yang, Y. S. (2013). Earnings smoothing activities of firms to manage credit ratings. Contemporary Accounting Research, 30(2), 645–676. [Google Scholar] [CrossRef]

- Kang, J., Shivdasani, A., & Yamada, T. (2000). The effect of bank relations on investment decisions: An investigation of Japanese takeover bids. Journal of Finance, 55, 2197–2218. [Google Scholar] [CrossRef]

- Khalil, F., & Parigi, B. (1998). Loan size as a commitment device. International Economic Review, 39, 135–150. [Google Scholar] [CrossRef]

- Kothari, S., Leone, A., & Wasley, C. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197. [Google Scholar] [CrossRef]

- Kothari, S., Mizik, N., & Roychowdhury, S. (2016). Managing for the moment: The role of real activity versus accruals earnings management in SEO valuation. The Accounting Review, 91(2), 559–586. [Google Scholar] [CrossRef]

- Lee, S., & Mullineaux, D. (2004). Monitoring, financial distress, and the structure of commercial lending syndicates. Financial Management, 33, 107–130. [Google Scholar]

- Liu, Y., Ning, Y., & Davidson, W., III. (2010). Earnings management surrounding new debt issues. Financial Review, 45(3), 659–681. [Google Scholar] [CrossRef]

- Mafrolla, E., & D’Amico, E. (2017). Borrowing capacity and earnings management: An analysis of private loans in private firms. Journal of Accounting and Public Policy, 36(4), 284–301. [Google Scholar] [CrossRef]

- Manso, G. (2008). Investment reversibility and agency cost of debt. Econometrica, 76(2), 437–442. [Google Scholar] [CrossRef]

- Matsumoto, D. (2002). Management’s incentives to avoid negative earnings surprises. The Accounting Review, 77(3), 483–514. [Google Scholar] [CrossRef]

- Ongena, S., & Smith, D. (1998). Bank relationships: A review. Working paper, Forthcoming in the Performance of Financial Institutions. Cambridge University Press. [Google Scholar]

- Rajan, R., & Winton, A. (1995). Covenants and collateral as incentives to monitor. Journal of Finance, 50, 1113–1146. [Google Scholar] [CrossRef]

- Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55. [Google Scholar] [CrossRef]

- Roychowdhury, S. (2006). Earnings Management through real operation manipulation. Journal of Accounting and Economics, 42(3), 335–370. [Google Scholar] [CrossRef]

- Sohn, B. (2011). Do auditors care about real earnings management in their audit fee decisions? Working paper. University of Macau. [Google Scholar]

- Sufi, A. (2007). Information asymmetry and financing arrangements: Evidence from syndicated loans. The Journal of Finance, 62(2), 629–668. [Google Scholar] [CrossRef]

- Taylor, G., & Xu, R. (2010). Consequences of real earnings management on subsequent operating performance. Research in Accounting Regulation, 22(2), 128–132. [Google Scholar] [CrossRef]

- Teoh, S., Welch, I., & Wong, T. (1998a). Earnings management and the long-run performance of initial public offerings. The Journal of Finance LIII, 53(6), 1935–1974. [Google Scholar] [CrossRef]

- Teoh, S., Welch, I., & Wong, T. (1998b). Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics, 50(1), 63–99. [Google Scholar] [CrossRef]

- Watts, R., & Zimmerman, J. (1986). Positive accounting theory. Prentice-Hall. [Google Scholar]

- Wittenberg-Moerman, R. (2008). The role of information asymmetry and financial reporting quality in debt trading: Evidence from the secondary loan market. Journal of Accounting and Economics, 46(2–3), 240–260. [Google Scholar] [CrossRef]

- Zamri, N., Rahman, R., & Isa, N. (2013). The impact of leverage on real earnings management. Procedia Economics and Finance, 7, 86–95. [Google Scholar] [CrossRef]

- Zang, A. (2012). Evidence on the trade-off between real operation manipulation and accrual-based earnings management. The Accounting Review, 87(2), 675–703. [Google Scholar] [CrossRef]

- Zmijewski, M. (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research, 22, 59–82. [Google Scholar] [CrossRef]

| Variable | Mean | STD | 25th | 50th | 75th |

|---|---|---|---|---|---|

| ACFOt−1 | 0.1099 | 0.4102 | −0.0165 | 0.0547 | 0.1695 |

| ADISCt−1 | 0.0161 | 0.3150 | −0.1966 | −0.0246 | 0.1463 |

| APRODt−1 | −0.0346 | 0.3170 | −0.1722 | −0.0489 | 0.0865 |

| DA_Kt−1 | −0.1157 | 0.4095 | −0.1361 | −0.0430 | 0.0184 |

| DA_Dt−1 | 0.0031 | 1.2122 | −0.0598 | 0.0192 | 0.1395 |

| RM1t−1 | −0.0507 | 0.4721 | −0.2984 | −0.0293 | 0.2104 |

| RM2t−1 | −0.1260 | 0.5084 | −0.2352 | −0.0290 | 0.1054 |

| SOX | 0.4701 | 0.4992 | 0.0000 | 0.0000 | 1.0000 |

| LOSS | 0.1914 | 0.3934 | 0.0000 | 0.0000 | 0.0000 |

| EXTRA | 0.3141 | 0.4642 | 0.0000 | 0.0000 | 1.0000 |

| FOR | 0.6202 | 0.4854 | 0.0000 | 1.0000 | 1.0000 |

| ROA | 0.0519 | 0.1011 | 0.0127 | 0.0511 | 0.0964 |

| NOA | 0.7013 | 0.6363 | 0.3325 | 0.5750 | 0.8605 |

| FINL | 0.6016 | 0.2480 | 0.4514 | 0.5816 | 0.7247 |

| Z | −1.1449 | 1.5785 | −2.0797 | −1.2849 | −0.3544 |

| MTB | 2.7522 | 4.0155 | 1.1869 | 1.9763 | 3.4130 |

| BIG4 | 0.7005 | 0.4581 | 0.0000 | 1.0000 | 1.0000 |

| AT | 6.7155 | 1.8321 | 5.4407 | 6.6690 | 7.9939 |

| ΔGDP | 5.3812 | 1.2647 | 4.9000 | 5.7000 | 6.5000 |

| MF | 0.0417 | 0.2000 | 0.0000 | 0.0000 | 0.0000 |

| LIT | 0.1620 | 0.3684 | 0.0000 | 0.0000 | 0.0000 |

| MATUR | 1.4855 | 0.5008 | 1.0977 | 1.6094 | 1.8986 |

| SIZE | 18.5059 | 1.6257 | 17.5044 | 18.6438 | 19.5993 |

| HHI | 0.3539 | 0.3479 | 0.1111 | 0.2500 | 0.5000 |

| SYND | ACFOt−1 | ADISCt−1 | APRODt−1 | DA_Kt−1 | DA_Dt−1 | RM1t−1 | RM2t−1 | SOX | LOSS | EXTRA | FOR | ROA | NOA | FINL | Z | MTB | BIG4 | AT | ΔGDP | MF | LIT | MATUR | SIZE | HHI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | −0.03 b | 0.02 | 0.01 | 0.04 b | −0.03 b | 0.00 | 0.04 b | 0.01 | −0.02 | −0.03 b | 0.00 | −0.01 | −0.02 | −0.06 a | −0.05 a | −0.05 a | −0.07 a | −0.03 b | −0.05 a | 0.21 a | −0.02 | 0.14 a | −0.49 a | - | |

| 2 | −0.01 | −0.12 a | −0.23 a | −0.53 a | −0.16 a | −0.06 a | −0.47 a | −0.30 a | 0.13 a | −0.16 a | −0.02 | 0.17 a | 0.26 a | 0.08 a | −0.19 a | −0.23 a | 0.27 a | 0.06 a | 0.10 a | 0.01 | 0.07 a | 0.16 a | −0.01 | −0.10 a | |

| 3 | 0.00 | −0.04 b | −0.31 a | 0.00 | −0.11 a | −0.81 a | −0.70 a | −0.74 a | 0.02 | −0.02 | −0.07 a | 0.00 | 0.04 b | 0.11 a | −0.06 a | −0.06 a | 0.14 a | 0.02 | 0.00 | 0.04 a | −0.04 a | 0.05 a | −0.03 c | −0.03 | |

| 4 | 0.03 | −0.04 b | −0.12 a | 0.11 a | 0.03 c | 0.73 a | 0.46 a | 0.73 a | −0.01 | 0.05 a | 0.03 b | 0.00 | −0.17 a | −0.23 a | 0.16 a | 0.18 a | −0.18 a | −0.02 | 0.01 | −0.01 | 0.03 b | 0.02 | −0.05 a | 0.10 a | |

| 5 | 0.03 b | −0.37 a | −0.03 c | −0.01 | 0.38 a | 0.10 a | 0.35 a | 0.24 a | −0.16 a | 0.04 a | −0.05 a | −0.08 a | −0.07 a | −0.01 | 0.05 a | 0.06 a | −0.16 a | −0.03 c | −0.02 | 0.03 b | 0.05 a | −0.16 a | 0.04 b | 0.03 | |

| 6 | −0.01 | −0.23 a | −0.04 b | 0.09 a | 0.24 a | 0.12 a | 0.19 a | 0.17 a | −0.01 | 0.03 c | −0.05 a | 0.05 a | 0.03 b | 0.01 | −0.08 a | −0.08 a | −0.02 | −0.06 a | −0.06 a | 0.04 b | −0.10 a | 0.02 | 0.01 | 0.00 | |

| 7 | 0.02 | 0.00 | −0.75 a | 0.75 a | 0.01 | 0.09 a | 0.73 a | 0.93 a | −0.06 a | 0.02 | 0.05 a | 0.00 | −0.10 a | −0.20 a | 0.12 a | 0.13 a | −0.20 a | −0.03 c | 0.00 | −0.02 | 0.05 a | −0.05 a | 0.01 | 0.09 a | |

| 8 | 0.01 | −0.79 a | −0.59 a | 0.10 a | 0.32 a | 0.21 a | 0.46 a | 0.86 a | −0.11 a | 0.11 a | 0.08 a | −0.08 a | −0.17 a | −0.11 a | 0.15 a | 0.17 a | −0.27 a | −0.06 a | −0.04 b | −0.01 | −0.04 b | −0.13 a | −0.01 | 0.07 a | |

| 9 | 0.02 | −0.40 a | −0.67 a | 0.70 a | 0.16 a | 0.17 a | 0.92 a | 0.74 a | −0.10 a | 0.06 a | 0.05 a | −0.05 a | −0.14 a | −0.20 a | 0.15 a | 0.16 a | −0.25 a | −0.04 a | −0.03 b | −0.10 a | 0.00 | −0.08 a | 0.00 | 0.00 | |

| 10 | −0.02 | 0.13 a | 0.04 b | −0.01 | −0.19 a | −0.10 a | −0.04 b | −0.13 a | −0.08 a | 0.00 | 0.13 a | 0.17 a | 0.04 b | −0.01 | −0.06 a | −0.06 a | 0.10 a | 0.40 a | 0.26 a | −0.03 c | 0.06 a | −0.01 | 0.03 b | 0.01 | |

| 11 | −0.03 b | −0.10 a | −0.03 b | 0.02 | −0.04 b | 0.02 | 0.04 | 0.10 a | 0.08 a | 0.00 | 0.17 a | −0.05 | −0.64 a | 0.05 a | 0.15 a | 0.30 a | −0.22 a | −0.11 a | −0.06 a | −0.06 a | −0.20 a | 0.02 | 0.00 | −0.02 | |

| 12 | 0.00 | 0.01 | −0.06 a | 0.03 c | −0.05 a | −0.05 a | 0.06 a | 0.03 b | 0.05 a | 0.13 a | 0.17 a | 0.05 a | −0.20 a | 0.07 a | 0.19 a | 0.21 a | −0.11 a | −0.02 | 0.15 a | 0.04 b | 0.03 c | −0.05 a | 0.01 | −0.05 a | |

| 13 | −0.01 | 0.10 a | 0.03 c | 0.04 b | −0.09 a | 0.01 | 0.01 | −0.09 a | −0.03 b | 0.17 a | −0.05 a | 0.05 a | 0.02 | 0.05 a | 0.02 | 0.02 | 0.13 a | 0.10 a | 0.33 a | 0.12 a | 0.03 b | 0.09 a | −0.05 a | −0.04 b | |

| 14 | 0.02 | 0.14 a | 0.02 | −0.12 a | 0.05 a | 0.00 | −0.10 a | −0.12 a | −0.14 a | 0.01 | −0.58 a | −0.13 a | 0.02 | −0.10 a | −0.33 a | −0.55 a | 0.48 a | 0.12 a | 0.01 | −0.03 b | 0.14 a | 0.00 | 0.04 b | −0.10 a | |

| 15 | −0.07 a | 0.00 | 0.00 | −0.17 a | −0.01 | −0.01 | −0.11 a | 0.00 | −0.10 a | 0.00 | 0.08 a | 0.06 a | 0.02 | −0.09 a | −0.05 a | −0.02 | −0.04 b | 0.02 | 0.05 a | −0.10 a | 0.03 c | −0.06 a | 0.10 a | 0.01 | |

| 16 | −0.02 | −0.10 a | −0.08 a | 0.10 a | −0.05 a | −0.02 | 0.12 a | 0.13 a | 0.15 a | −0.05 a | 0.17 a | 0.23 a | −0.01 | −0.24 a | −0.07 a | 0.95 a | −0.09 a | −0.01 | 0.20 a | −0.12 a | 0.06 a | −0.13 a | 0.07 a | 0.01 | |

| 17 | −0.02 | −0.13 a | −0.08 a | 0.12 a | −0.06 a | −0.02 | 0.13 a | 0.15 a | 0.17 a | −0.04 a | 0.32 a | 0.24 a | −0.01 | −0.50 a | −0.04 b | 0.96 a | −0.20 a | −0.03 b | 0.18 a | 0.10 a | 0.02 | −0.11 a | 0.05 a | −0.14 a | |

| 18 | −0.03 c | 0.10 a | 0.13 a | −0.09 a | −0.03 c | −0.01 | −0.15 a | −0.16 a | −0.18 a | 0.03 b | −0.08 a | −0.07 a | 0.07 a | 0.21 a | −0.07 a | −0.07 a | −0.12 a | 0.19 a | 0.24 a | −0.02 | 0.08 a | 0.18 a | 0.00 | 0.00 | |

| 19 | −0.03 b | 0.06 a | 0.01 | 0.00 | −0.03 b | −0.07 a | −0.01 | −0.05 a | −0.03 c | 0.40 a | −0.11 a | −0.02 | 0.10 a | 0.09 a | 0.01 | −0.03 b | −0.06 a | 0.09 a | 0.29 a | 0.03 c | 0.10 a | 0.03 c | 0.08 a | −0.19 a | |

| 20 | −0.05 a | 0.09 a | 0.00 | 0.06 a | −0.04 a | −0.06 a | 0.04 a | −0.07 a | 0.00 | 0.26 a | −0.06 a | 0.16 a | 0.33 a | 0.00 | 0.00 | 0.13 a | 0.11 a | 0.09 a | 0.29 a | −0.08 a | 0.12 a | −0.04 a | −0.06 a | 0.00 | |

| 21 | 0.21 a | −0.03 c | 0.04 b | −0.01 | 0.04 b | 0.01 | −0.03 c | 0.00 | −0.10 a | −0.03 b | −0.06 a | 0.04 b | 0.10 a | −0.05 a | −0.09 a | −0.11a | 0.08 a | −0.02 | 0.02 | −0.08 a | 0.06 a | −0.17 a | −0.01 | - | |

| 22 | −0.01 | 0.13 a | −0.02 | 0.05 a | 0.06 a | −0.10 a | 0.04 a | −0.09 a | −0.01 | −0.09 a | −0.20 a | −0.02 | −0.02 | 0.13 a | 0.01 | 0.07 a | 0.02 | 0.02 | 0.07 a | 0.07 a | 0.06 a | −0.02 | 0.17 a | −0.04 b | |

| 23 | 0.14 a | 0.11 a | 0.11 a | 0.02 | −0.14 a | −0.05 a | −0.06 a | −0.15 a | −0.10 a | −0.01 | 0.02 | −0.05 a | 0.09 a | −0.02 | −0.06 a | −0.11 a | −0.09 a | 0.15 a | 0.03 c | −0.03 b | −0.17 a | −0.02 | −0.15 a | 0.07 a | |

| 24 | −0.48 a | −0.02 | −0.05 a | −0.05 a | 0.03 b | 0.01 | 0.00 | 0.05 a | 0.01 | 0.05 a | 0.01 | 0.02 | −0.05 a | 0.02 | 0.09 a | 0.07 a | 0.06 a | −0.02 | 0.07 a | −0.08 a | 0.01 | 0.15 a | −0.15 a | 0.18 a | |

| 25 | - | −0.02 | −0.04 b | 0.10 a | 0.00 | −0.01 | 0.08 a | 0.04 b | 0.02 | 0.01 | −0.02 | −0.02 | 0.00 | −0.09 c | 0.00 | 0.00 | −0.09 a | 0.03 c | −0.11 a | 0.01 | - | −0.04 c | 0.07 a | −0.09 a | - |

| Full Sample | SYND = 1 | SYND = 0 | Difference Tests | |||||

|---|---|---|---|---|---|---|---|---|

| n = 4384 | n = 2192 | n = 2192 | t Test | Wilcox. | ||||

| Mean | Median | Mean | Median | Mean | Median | t Value | z Value | |

| ACFOt−1 | 0.1099 | 0.0547 | 0.1041 | 0.0425 | 0.1158 | 0.0652 | 0.95 | −2.059 ** |

| ADISCt−1 | 0.0161 | −0.0246 | 0.0174 | −0.0195 | 0.0148 | −0.0293 | −0.26 | 1.37 * |

| APRODt−1 | −0.0346 | −0.0489 | −0.0253 | −0.0542 | −0.0440 | −0.0411 | −1.96 * | 0.88 |

| DA_Kt−1 | −0.1157 | −0.0430 | −0.1022 | −0.0357 | −0.1292 | −0.0487 | −2.19 ** | 2.33 ** |

| DA_Dt−1 | 0.0031 | 0.0192 | −0.0071 | 0.0190 | 0.0134 | 0.0204 | 0.56 | −2.24 ** |

| RM1t−1 | −0.0507 | −0.0293 | −0.0426 | −0.0306 | −0.0589 | −0.0244 | −1.14 | 0.08 |

| RM2t−1 | −0.1260 | −0.0290 | −0.1214 | −0.0175 | −0.1307 | −0.0473 | −0.60 | 2.44 *** |

| SOX | 0.4701 | 0.0000 | 0.4599 | 0.0000 | 0.4804 | 0.0000 | 1.36 | −1.36 * |

| LOSS | 0.1914 | 0.0000 | 0.1793 | 0.0000 | 0.2035 | 0.0000 | 2.04 ** | −2.03 ** |

| EXTRA | 0.3141 | 0.0000 | 0.3139 | 0.0000 | 0.3143 | 0.0000 | 0.03 | −0.03 |

| FOR | 0.6202 | 1.0000 | 0.6145 | 1.0000 | 0.6259 | 1.0000 | 0.78 | −0.78 |

| ROA | 0.0519 | 0.0511 | 0.0535 | 0.0470 | 0.0503 | 0.0550 | −1.05 | −1.13 |

| NOA | 0.7013 | 0.5750 | 0.6541 | 0.5622 | 0.7484 | 0.5827 | 4.92 *** | −4.15 *** |

| FINL | 0.6016 | 0.5816 | 0.5979 | 0.5684 | 0.6054 | 0.5884 | 1.41 *** | −3.21 *** |

| Z | −1.1449 | −1.2849 | −1.1740 | −1.3960 | −1.1158 | −1.2091 | 1.22 | −3.23 *** |

| MTB | 2.7522 | 1.9763 | 2.6472 | 1.8982 | 2.8573 | 2.0961 | 1.73 * | −4.95 *** |

| BIG4 | 0.7005 | 1.0000 | 0.6848 | 1.0000 | 0.7162 | 1.0000 | 2.28 ** | −2.27 ** |

| AT | 6.7155 | 6.6690 | 6.6211 | 6.5637 | 6.8098 | 6.7481 | 3.41 *** | −3.61 *** |

| ΔGDP | 5.3812 | 5.7000 | 5.3719 | 5.7000 | 5.3905 | 5.7000 | 0.49 | −1.44 * |

| MF | 0.0417 | 0.0000 | 0.0835 | 0.0000 | 0.0000 | 0.0000 | −14.13 *** | 13.82 *** |

| LIT | 0.1620 | 0.0000 | 0.2135 | 0.0000 | 0.1104 | 0.0000 | −9.35 | 9.26 *** |

| MATUR | 1.4855 | 1.6094 | 1.2462 | 1.3863 | 1.7247 | 1.7938 | 36.01 *** | −32.32 *** |

| SIZE | 18.5059 | 18.6438 | 18.3911 | 18.5160 | 18.6208 | 18.8261 | 4.69 *** | −4.90 *** |

| HHI | - | - | 0.2601 | 0.3539 | - | - | - | - |

| Parameter | Predicted Sign | Coeff. |

|---|---|---|

| Intercept | ? | 1.0084 |

| SYNDt−1 | + | 4.8234 *** |

| BIG4t | + | 0.3236 *** |

| RESTt | − | −0.3020 *** |

| FORt | + | −0.0182 |

| ROAt | + | −2.3127 *** |

| FINLt | + | −0.1570 |

| LIQt | + | 0.0124 |

| LOSSt | + | 0.7406 *** |

| ATt | + | −0.3801 *** |

| BUSYt | + | 0.3244 |

| IND_CAT | Included | |

| YAER | Included | |

| #Obs. | 11,743 | |

| Likelihood Ratio χ2 | 3609.08 *** |

| Parameter | Predicted Sign | DA_Dit−1 | DAD_INCit−1 | DA_Kit−1 | DAK_INCit−1 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | ||

| Intercept | ? | −13.0870 | −1.56 | −10.6457 | −4.33 *** | −14.7374 | −5.66 *** | 1.0357 | 1.26 |

| Variable of interest: | |||||||||

| SYNDt | + | −0.0037 | −0.09 | 0.0559 | 5.27 *** | 0.0462 | 3.60 *** | −0.0107 | −2.97 *** |

| Control variables: | |||||||||

| SOX | − | 2.3879 | 2.12 ** | 1.3363 | 4.26 *** | 1.8067 | 5.59 *** | −0.2016 | −2.03 ** |

| ACFOt−1 | − | −0.6025 | −3.91 *** | −0.1794 | −6.18 *** | −0.3595 | −10.19 *** | −0.0682 | −4.54 *** |

| ADISCt−1 | − | −0.0955 | −0.96 | 0.0828 | 5.45 *** | −0.0260 | −1.31 | 0.0353 | 4.54 *** |

| APRODt−1 | + | 0.3941 | 2.80 *** | 0.0425 | 2.65 *** | 0.0117 | 0.59 | −0.0086 | −1.09 |

| LOSS | + | 0.0685 | 1.05 | 0.0251 | 1.33 | 0.0135 | 0.61 | 0.0167 | 2.38 ** |

| NOA | − | −0.0619 | −1.91 * | −0.0193 | −2.21 ** | −0.0209 | −2.14 ** | −0.0107 | −3.39 *** |

| EXTRA | + | −0.1016 | −2.24 ** | 0.0092 | 0.83 | 0.0035 | 0.27 | 0.0022 | 0.59 |

| FOR | + | 0.1393 | 3.56 *** | −0.0223 | −2.77 *** | −0.0164 | −1.53 | 0.0034 | 0.87 |

| ROA | + | −0.1930 | −0.21 | 0.4710 | 0.95 | 0.3177 | 0.44 | −0.1240 | −0.54 |

| FINL | + | 0.6474 | 0.48 | −0.3595 | −0.53 | −0.2621 | −0.27 | 0.2013 | 0.63 |

| Z | + | −0.1589 | −0.67 | 0.0538 | 0.45 | 0.0125 | 0.07 | −0.0369 | −0.66 |

| MTB | + | 0.0056 | 0.96 | 0.0036 | 2.03 ** | 0.0007 | 0.29 | 0.0022 | 1.41 |

| BIG4 | − | −0.0127 | −0.22 | 0.0172 | 1.24 | 0.0531 | 2.90 *** | 0.0061 | 0.96 |

| AT | + | −0.0603 | −2.88 ** | 0.0098 | 1.67 * | 0.0025 | 0.40 | −0.0050 | −2.06 ** |

| ΔGDP | + | 1.3764 | 1.29 | 1.4471 | 4.67 *** | 1.9588 | 6.15 *** | −0.1454 | −1.51 |

| MF | +/− | −0.1234 | −1.94 * | −0.0010 | −0.06 | 0.0084 | 0.46 | 0.0278 | 2.60 *** |

| LIT | − | −0.1030 | −1.69 * | −0.0193 | −1.14 | −0.1003 | −4.82 *** | 0.0208 | 3.43 *** |

| MATUR | + | 0.0510 | 1.25 | 0.0175 | 1.41 | 0.0218 | 1.54 | 0.0015 | 0.31 |

| SIZE | + | 0.0517 | 2.59 *** | −0.0042 | −0.84 | 0.0067 | 1.15 | 0.0005 | 0.24 |

| IND_CAT | ? | Included | Included | Included | Included | ||||

| YEAR | ? | Included | Included | Included | Included | ||||

| #Obs. | 4384 | 4384 | 4384 | 4384 | |||||

| F Value | 13.48 | 14.31 | 31.25 | 15.49 | |||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | <0.0001 | |||||

| Adjusted R2 | 10.45% | 11.07% | 22.05% | 11.94% | |||||

| Parameter | Predicted Sign | ACFOit−1 | ADISCit−1 | APRODit−1 | |||

|---|---|---|---|---|---|---|---|

| Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | ||

| Intercept | ? | 5.0390 | 1.93 * | 12.0803 | 5.86 *** | 15.2477 | 5.97 *** |

| Variable of interest: | |||||||

| SYNDt−1 | −/+ | −0.0146 | −1.15 | −0.0188 | −1.77 * | −0.0028 | −0.27 |

| Control variables: | |||||||

| SOX | −/+ | −0.6208 | −2.26 ** | −1.4454 | −5.31 *** | 0.24944 | −6.80 *** |

| DA_Kt−1 | −/+ | −0.3430 | −9.66 *** | −0.0180 | −1.30 | 0.01246 | 0.60 |

| ADISCt−1 | −/+ | −0.0886 | −2.79 *** | −0.0645 | −2.78 *** | 0.01483 | −5.32 *** |

| APRODt−1 | + | −0.0353 | −0.86 | −0.1312 | −5.10 *** | 0.01275 | −0.84 * |

| LOSS | + | −0.0105 | −0.58 | −0.0341 | −2.43 ** | 0.01471 | −2.58 ** |

| NOA | −/+ | −0.0160 | −1.39 | 0.0353 | 3.49 *** | 0.0083 | −6.70 *** |

| EXTRA | + | 0.0022 | 0.18 | −0.0215 | −2.00 ** | 0.01044 | 0.89 |

| FOR | + | 0.0246 | 2.03 ** | 0.0016 | 0.16 | 0.01042 | 0.86 |

| ROA | + | 0.7551 | 0.55 | 1.2749 | 3.13 *** | 0.6836 | −1.16 |

| FINL | + | −0.6375 | −0.37 | −1.7833 | −3.42 ** | 0.86801 | 0.85 |

| Z | + | 0.0809 | 0.27 | 0.3081 | 3.35 *** | 0.15304 | −0.80 |

| MTB | + | 0.0043 | 2.77 *** | 0.0089 | 5.87 *** | 0.0012 | −2.74 *** |

| BIG4 | + | −0.0143 | −0.72 | −0.0136 | −1.00 | 0.01378 | 0.63 |

| AT | + | 0.0011 | 0.17 | 0.0045 | 0.86 | 0.00502 | 3.47 *** |

| ΔGDP | + | −0.6166 | −2.30 ** | −1.3443 | −5.12 *** | 0.21449 | −6.86 *** |

| MF | −/+ | −0.0223 | −0.74 | 0.0244 | 0.95 | 0.024 | −0.70 |

| LIT | −/+ | 0.0547 | 2.63 *** | 0.0695 | 4.06 *** | 0.0135 | 1.64 |

| MATUR | −/+ | −0.0314 | −2.48 ** | −0.0272 | −2.38 ** | 0.01148 | −1.28 |

| SIZE | −/+ | 0.0183 | 3.00 *** | −0.0084 | −1.63 | 0.0053 | −2.91 *** |

| IND_CAT | ? | Included | Included | Included | |||

| YEAR | ? | Included | Included | Included | |||

| #Obs. | 4384 | 4384 | 4384 | ||||

| F Value | 38.38 | 11.03 | 16.01 | ||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | ||||

| Adjusted R2 | 25.91% | 8.58% | 12.31% | ||||

| Parameter | Pred. | FC_DADt+1 | FC_DAKt+1 | FC_ACFOt+1 | FC_ADISCt+1 | FC_APRODt+1 | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | |||||||

| Sign | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | |

| Panel A: Lender’s Reputation | |||||||||||

| Intercept | ? | 124.7424 | 2.49 ** | 4.2312 | 0.18 | −9.5022 | −0.64 | −0.9167 | −0.06 | 7.4641 | 0.96 |

| HHI | −/+ | 0.4094 | −0.19 | −3.6881 | −2.06 ** | 0.6516 | 0.40 | −3.4732 | −1.38 | −1.9895 | −4.13 *** |

| Control variables | Included | Included | Included | Included | Included | ||||||

| IND_CAT | ? | Included | Included | Included | Included | Included | |||||

| YEAR | ? | Included | Included | Included | Included | Included | |||||

| F Value | 2.09 | 6.90 | 3.17 | 2.46 | 1.71 | ||||||

| Pr > F | 0.0013 | <0.0001 | <0.0001 | <0.0001 | 0.0049 | ||||||

| Adjusted R2 | 1.04% | 7.15% | 2.75% | 1.87% | 0.09% | ||||||

| Panel B: Loan Size | |||||||||||

| Intercept | ? | 152.0350 | 2.61 ** | −8.8007 | −0.37 | −14.4740 | −1.02 | −17.2976 | −1.22 | −7.5403 | −1.14 |

| SIZE | −/+ | −1.7862 | −2.30 ** | 1.3414 | 3.04 *** | 0.6064 | 3.53 *** | 1.7953 | 0.96 | 1.6183 | 3.79 *** |

| Control variables: | Included | Included | Included | Included | Included | ||||||

| IND_CAT | ? | Included | Included | Included | Included | Included | |||||

| YEAR | ? | Included | Included | Included | Included | Included | |||||

| F Value | 2.38 | 6.90 | 3.21 | 2.58 | 1.81 | ||||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | <0.0001 | 0.0016 | ||||||

| Adjusted R2 | 1.76% | 7.15% | 2.80% | 2.03% | 1.05% | ||||||

| Panel C: Number of Syndicates | |||||||||||

| Intercept | ? | 127.3685 | 2.45 ** | 3.1015 | 0.14 | −10.8457 | 0.69 | −5.2653 | 0.7107 | 6.4917 | 0.81 |

| SYNDICATES | −/+ | −1.0509 | −1.15 | −0.1702 | −0.31 | 0.6761 | 0.96 | 1.3137 | 1.84 * | 0.1166 | 0.39 |

| Control variables: | Included | Included | Included | Included | Included | ||||||

| IND_CAT | ? | Included | Included | Included | Included | Included | |||||

| YEAR | ? | Included | Included | Included | Included | Included | |||||

| F Value | 2.11 | 6.80 | 3.19 | 2.42 | 1.69 | ||||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | <0.0001 | 0.0048 | ||||||

| Adjusted R2 | 1.43% | 7.03% | 2.78% | 1.82% | 0.90% | ||||||

| Panel D: Maturity | |||||||||||

| Intercept | ? | 125.6745 | 2.47 ** | 1.4207 | 0.06 | −9.1926 | −0.64 | −3.8937 | −0.25 | 9.4401 | 0.29 |

| MATUR | −/+ | 0.9577 | 0.57 | −2.1588 | −2.19 ** | 0.0768 | 0.15 | −2.2068 | −2.24 ** | 5.0135 | 1.77 * |

| Control variables: | Included | Included | Included | Included | Included | ||||||

| IND_CAT | ? | Included | Included | Included | Included | Included | |||||

| YEAR | ? | Included | Included | Included | Included | Included | |||||

| F Value | 2.10 | 6.86 | 3.16 | 2.44 | 1.96 | ||||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | <0.0001 | 0.0551 | ||||||

| Adjusted R2 | 1.41% | 7.10% | 2.74% | 1.84% | 1.24% | ||||||

| Parameter | Pred. | COD | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | |||||||

| Sign | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | Coeff. | t-Value | |

| Intercept | ? | −25.314 | −3.67 *** | −25.758 | −3.75 *** | −24.776 | −3.56 *** | −25.208 | −3.75 *** | −23.917 | −3.53 *** |

| DA_kit−1*HHI | − | −0.333 | −1.60 * | ||||||||

| DAK_INCit−1*HHI | − | −0.763 | −1.05 | ||||||||

| ACFOit−1*HHI | + | 0.924 | 2.73 *** | ||||||||

| ADISCit−1*HHI | + | 0.435 | 1.94 ** | ||||||||

| APRODit−1*HHI | + | −1.105 | −4.30 *** | ||||||||

| LENDER_MONITOR | −/+ | Included | Included | Included | Included | Included | |||||

| LOAN_CH | −/+ | Included | Included | Included | Included | Included | |||||

| CONTROL VARIABLES | −/+ | Included | Included | Included | Included | Included | |||||

| IND_CAT | −/+ | Included | Included | Included | Included | Included | |||||

| YEAR | ? | Included | Included | Included | Included | Included | |||||

| F Value | 24.05 | 23.98 | 24.51 | 24.11 | 25.04 | ||||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | <0.0001 | <0.0001 | ||||||

| Adjusted R2 | 28.79% | 24.74% | 25.16% | 24.84% | 25.59% | ||||||

| Panel A: Regression of Current Cash Flow from Operations on RAM: | |||||||

| CFOit | |||||||

| Pred. Sign | Coeff. | t-value | Coeff. | t-value | Coeff. | t-value | |

| Panel A: Regression of Current Cash Flow from Operations on RAM: | |||||||

| Intercept | ? | 25.7710 | 3.16 *** | 27.9180 | 3.45 *** | 24.9950 | 3.15 *** |

| ACFOit−1 | + | 0.0020 | 0.06 | ||||

| ADISCit−1 | + | −0.1199 | −3.38 *** | ||||

| APRODit−1 | − | 0.1673 | 4.74 *** | ||||

| CONTROL VARIABLES | Included | Included | Included | ||||

| IND_CAT | ? | Included | Included | Included | |||

| YEAR | ? | Included | Included | Included | |||

| F Value | 69.22 | 69.94 | 70.37 | ||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | ||||

| Adjusted R2 | 54.26% | 54.52% | 54.68% | ||||

| Panel B: Regression of Future Cash Flow from Operations on RAM: | |||||||

| CFOit+1 | |||||||

| Parameter | Pred. Sign | Coeff. | t-value | Coeff. | t-value | Coeff. | t-value |

| Intercept | ? | −19.2800 | −3.68 *** | −14.3510 | −2.78 *** | −17.7450 | −3.43 *** |

| ACFOit−1 | + | 0.1077 | 2.94 *** | ||||

| ADISCit−1 | + | −0.1868 | −5.06 *** | ||||

| APRODit−1 | − | 0.0202 | 0.06 | ||||

| CONTROL VARIABLES | +/− | Included | Included | Included | |||

| IND_CAT | Included | Included | Included | ||||

| YEAR | ? | Included | Included | Included | |||

| F Value | 158.30 | 160.31 | 157.33 | ||||

| Pr > F | <0.0001 | <0.0001 | <0.0001 | ||||

| Adjusted R2 | 73.23% | 73.48% | 73.11% | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

El Mahdy, D. Do Syndicated Loan Borrowers Trade-Off Real Activities Manipulation with Accrual-Based Earnings Management? J. Risk Financial Manag. 2025, 18, 327. https://doi.org/10.3390/jrfm18060327

El Mahdy D. Do Syndicated Loan Borrowers Trade-Off Real Activities Manipulation with Accrual-Based Earnings Management? Journal of Risk and Financial Management. 2025; 18(6):327. https://doi.org/10.3390/jrfm18060327

Chicago/Turabian StyleEl Mahdy, Dina. 2025. "Do Syndicated Loan Borrowers Trade-Off Real Activities Manipulation with Accrual-Based Earnings Management?" Journal of Risk and Financial Management 18, no. 6: 327. https://doi.org/10.3390/jrfm18060327

APA StyleEl Mahdy, D. (2025). Do Syndicated Loan Borrowers Trade-Off Real Activities Manipulation with Accrual-Based Earnings Management? Journal of Risk and Financial Management, 18(6), 327. https://doi.org/10.3390/jrfm18060327