Examining the Research Taxonomy of Credit Default Swaps Literature Through Bibliographic Network Mapping

Abstract

1. Introduction

- RQ1:

- How has the global CDS market developed?

- RQ2:

- How has the research on CDSs evolved over time?

- RQ3:

- Which keywords appear more frequently in the publications and which topics receive less attention?

- RQ4:

- What is the publication and citation pattern in the CDS literature?

- RQ5:

- Who is the most influential author in terms of publications and citations in the field of credit derivatives?

2. Literature Review

3. Research Methodology and Data Collection

3.1. Methodology

3.2. Data Collection

4. Data Analysis

4.1. Bibliometric Analysis

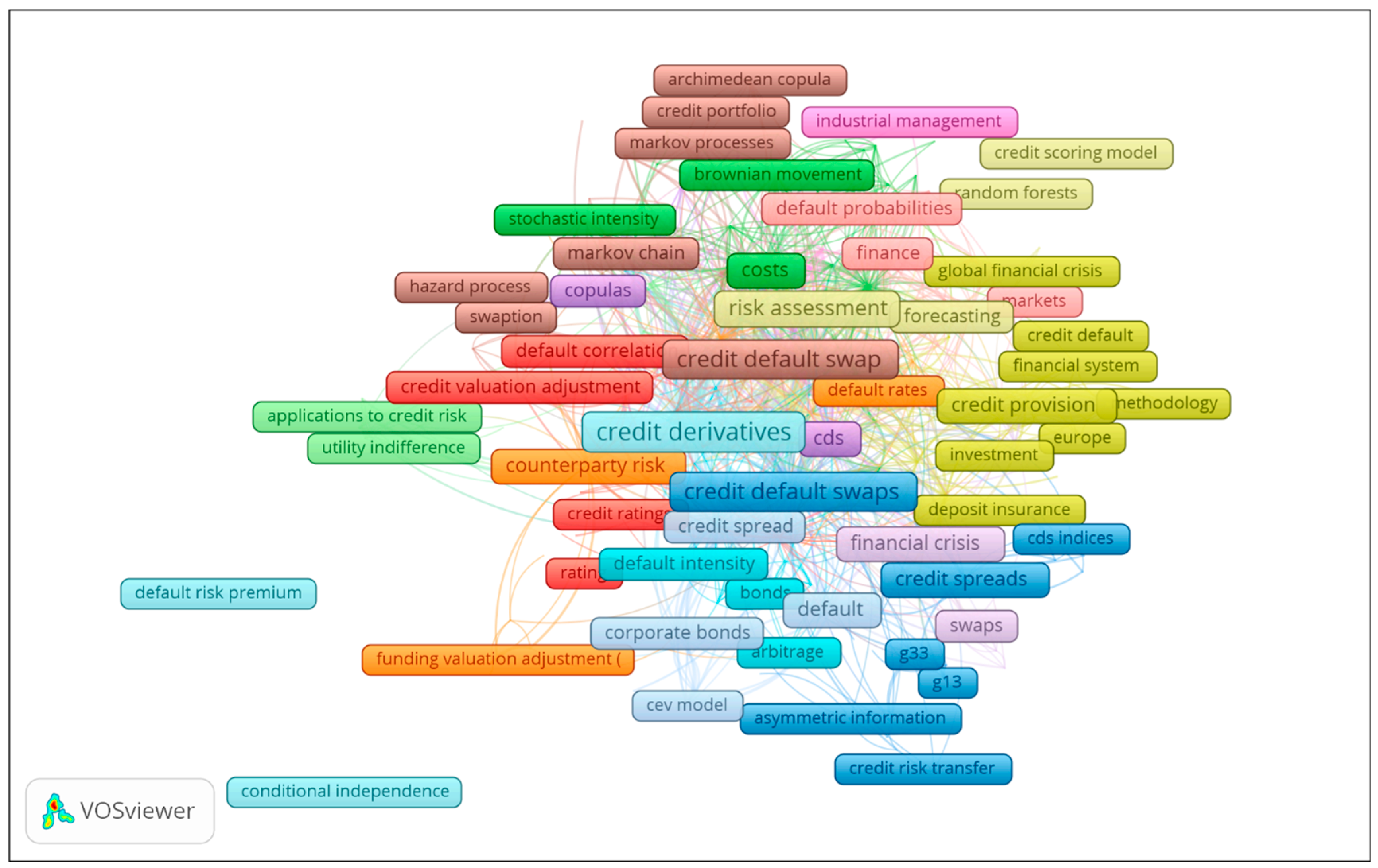

4.1.1. Keywords Co-Occurrence Analysis

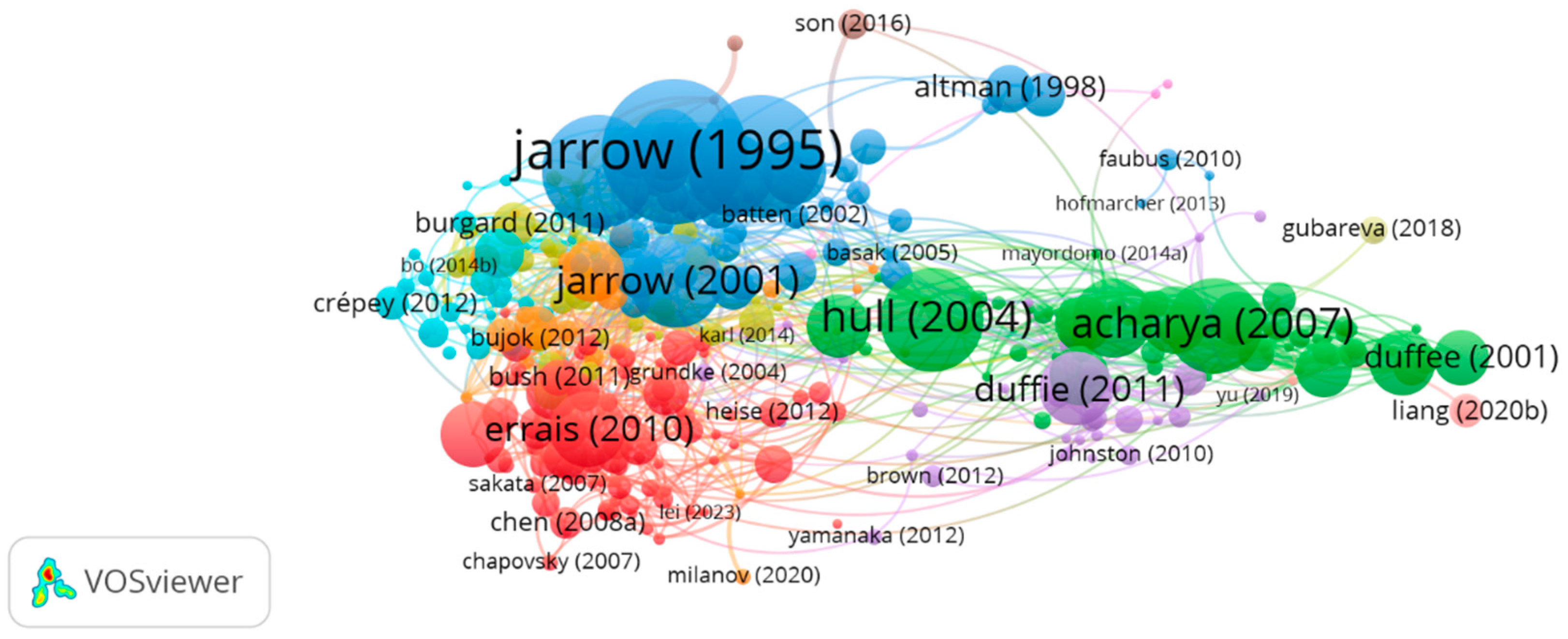

4.1.2. Citation Analysis

Country-Wise Citation Analysis

Author-Wise Citation Analysis

Document-Wise Citation Analysis

4.1.3. Bibliographic Coupling

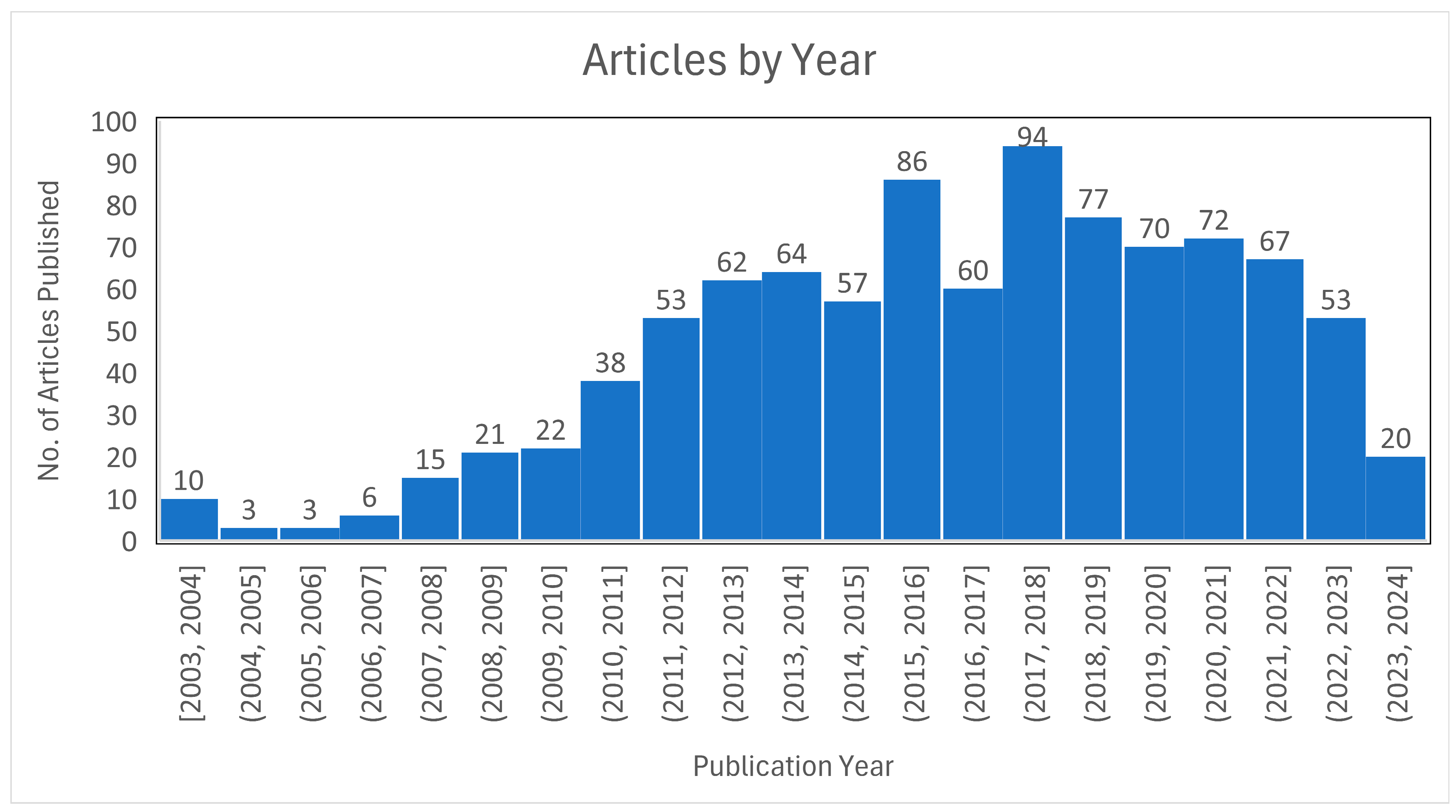

4.1.4. Evolution of CDS Research

4.2. Insights from Literature Review

4.2.1. Credit Default Swaps (CDSs): A Mechanism for Credit Risk Management

4.2.2. CDS Spread: The Cost of Insuring Against a Credit Event

4.2.3. Risk Management Challenges Under CDS Contracts

Counterparty Risk

Systemic Risk

5. Findings and Implications

Policy Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alnassar, W. I., & Chin, O. B. (2015). Why banks use credit derivatives? Review paper. Procedia Economics and Finance, 26, 566–574. [Google Scholar] [CrossRef]

- Al-shakrchy, E., & Almsafir, M. K. (2014). Credit derivatives: Did they exacerbate the 2007 global financial crisis? AIG: Case study. Procedia-Social and Behavioral Sciences, 109, 1026–1034. [Google Scholar]

- Angelini, E. (2012). Credit Default Swaps (CDS) and their role in the credit risk market. International Journal of Academic Research in Business and Social Sciences, 2(1), 584–593. [Google Scholar]

- Appio, F. P., Cesaroni, F., & Di Minin, A. (2014). Visualizing the structure and bridges of the intellectual property management and strategy literature: A document co-citation analysis. Scientometrics, 101(1), 623–661. [Google Scholar] [CrossRef]

- Arora, N., Gandhi, P., & Longstaff, F. A. (2012). Counterparty credit risk and the credit default swap market. Journal of Financial Economics, 103(2), 280–293. [Google Scholar] [CrossRef]

- Ashraf, D., Altunbas, Y., & Goddard, J. (2007). Who transfers credit risk? Determinants of the use of credit derivatives by large US banks. The European Journal of Finance, 13(5), 483–500. [Google Scholar] [CrossRef]

- Augustin, P., Subrahmanyam, M. G., Tang, D. Y., & Wang, S. Q. (2016). Credit default swaps: Past, present, and future. Annual Review of Financial Economics, 8(1), 175–196. [Google Scholar] [CrossRef]

- Baker, C. M. (2015). When regulators collide: Financial market stability, systemic risk, clearinghouses, and CDS. Virginia Law & Business Review, 10, 343. [Google Scholar]

- Baker, H. K., Kumar, S., & Pandey, N. (2021). Thirty years of the global finance journal: A bibliometric analysis. Global Finance Journal, 47, 100492. [Google Scholar] [CrossRef]

- Baker, H. K., Kumar, S., & Pattnaik, D. (2020). Twenty-five years of review of financial economics: A bibliometric overview. Review of Financial Economics, 38(1), 3–23. [Google Scholar] [CrossRef]

- Batten, J., & Hogan, W. (1999). Credit derivatives: An appraisal for Australian financial institutions. Economic Papers: A Journal of Applied Economics and Policy, 18(2), 19–41. [Google Scholar] [CrossRef]

- Batten, J., & Hogan, W. (2002). A perspective on credit derivatives. International Review of Financial Analysis, 11(3), 251–278. [Google Scholar] [CrossRef]

- Bedendo, M., & Bruno, B. (2012). Credit risk transfer in U.S. commercial banks: What changed during the 2007–2009 crisis? Journal of Banking & Finance, 36(12), 3260–3273. [Google Scholar] [CrossRef]

- Bellia, M., Girardi, G., Panzica, R., Pelizzon, L., & Peltonen, T. (2024). The demand for central clearing: To clear or not to clear, that is the question! Journal of Financial Stability, 72, 101247. [Google Scholar] [CrossRef]

- Berndsen, R. (2021). Fundamental questions on central counterparties: A review of the literature. Journal of Futures Markets, 41(12), 2009–2022. [Google Scholar] [CrossRef]

- Beyhaghi, M., Massoud, N., & Saunders, A. (2017). Why and how do banks lay off credit risk? The choice between retention, loan sales and credit default swaps. Journal of Corporate Finance, 42, 335–355. [Google Scholar] [CrossRef]

- Bhaskar, R., & Bansal, S. (2022). Nineteen years of emerging markets finance and trade: A bibliometric analysis. Emerging Markets Finance and Trade, 58(14), 4120–4135. [Google Scholar] [CrossRef]

- Biju, A. K. V. N., Thomas, A. S., & Thasneem, J. (2024). Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—A bibliometric analysis. Quality & Quantity, 58(1), 849–878. [Google Scholar]

- Bo, L., & Capponi, A. (2015). Counterparty risk for CDS: Default clustering effects. Journal of Banking & Finance, 52, 29–42. [Google Scholar]

- Boissel, C., Derrien, F., Ors, E., & Thesmar, D. (2017). Systemic risk in clearing houses: Evidence from the European repo market. Journal of Financial Economics, 125(3), 511–536. [Google Scholar] [CrossRef]

- Broadus, R. N. (1987). Toward a definition of “bibliometrics”. Scientometrics, 12(5–6), 373–379. [Google Scholar] [CrossRef]

- Burton, B., Kumar, S., & Pandey, N. (2020). Twenty-five years of the European Journal of Finance (EJF): A retrospective analysis. The European Journal of Finance, 26(18), 1817–1841. [Google Scholar] [CrossRef]

- Byström, H. (2008). Credit risk management in greater China. Journal of Futures Markets: Futures, Options, and Other Derivative Products, 28(6), 582–597. [Google Scholar] [CrossRef]

- Caglio, C., Darst, R. M., & Parolin, E. (2019). Half-full or half-empty? Financial institutions, CDS use, and corporate credit risk. Journal of Financial Intermediation, 40, 100812. [Google Scholar] [CrossRef]

- Calistru, R. A. (2012). The credit derivatives market—A threat to financial stability? Procedia Social and Behavioral Sciences, 58, 552–559. [Google Scholar] [CrossRef]

- Callon, M., Courtial, J., Turner, W., & Bauin, S. (1983). From translations to problematic networks: An introduction to co-word analysis. Social Science Information, 22(2), 191–235. [Google Scholar] [CrossRef]

- Cont, R., & Minca, A. (2016). Credit default swaps and systemic risk. Annals of Operations Research, 247(2), 523–547. [Google Scholar] [CrossRef]

- Coughlan, J., Richard, H., Lau, M., & Tuckman, B. (2019). Recent trends in CDS markets. OCE staff papers and reports, number 2019–015. Available online: https://cftc.gov/sites/default/files/2019-11/Trends%20in%20CDS_11252019_ada.pdf (accessed on 15 March 2025).

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Dufey, G., & Rehm, F. (2002). An introduction to credit derivatives. The Journal of Risk Finance, 3(3), 65–71. [Google Scholar] [CrossRef]

- Duffee, G. R., & Zhou, C. (2001). Credit derivatives in banking: Useful tools for managing risk? Journal of Monetary Economics, 48(1), 25–54. [Google Scholar] [CrossRef]

- Ellegaard, O., & Wallin, J. A. (2015). The bibliometric analysis of scholarly production: How great is the impact? Scientometrics, 105, 1809–1831. [Google Scholar] [CrossRef] [PubMed]

- Falagas, M. E., Pitsouni, E. I., Malietzis, G. A., & Pappas, G. (2008). Comparison of PubMed, Scopus, web of science, and Google scholar: Strengths and weaknesses. The FASEB Journal, 22(2), 338–342. [Google Scholar] [CrossRef] [PubMed]

- Fitch Ratings. (2010). Global credit derivatives survey: Respondents opine on public perceptions, regulations, sovereigns and more. Credit Policy, Fitch Ratings. Available online: https://asianbondsonline.adb.org/publications/external/2010/global_credit_derivatives_survey_FR_Sep2010.pdf (accessed on 28 March 2022).

- Flostrand, A., Pitt, L., & Bridson, S. (2020). The Delphi technique in forecasting–A 42-year bibliographic analysis (1975–2017). Technological Forecasting and Social Change, 150, 119773. [Google Scholar] [CrossRef]

- Freeman, M. C., Cox, P. R., & Wright, B. (2006). Credit risk management The use of credit derivatives by non-financial corporations. Managerial Finance, 32(9), 761–773. [Google Scholar] [CrossRef]

- Frei, C., Capponi, A., & Brunetti, C. (2022). Counterparty risk in over-the-counter markets. Journal of Financial and Quantitative Analysis, 57(3), 1058–1082. [Google Scholar] [CrossRef]

- Galil, K., Shapir, O. M., Amiram, D., & Ben-Zion, U. (2014). The determinants of CDS spreads. Journal of Banking & Finance, 41, 271–282. [Google Scholar]

- Gazni, A., & Didegah, F. (2016). The relationship between authors’ bibliographic coupling and citation exchange: Analyzing disciplinary differences. Scientometrics, 107, 609–626. [Google Scholar] [CrossRef]

- Ghosh, A. (2017). How do derivative securities affect bank risk and profitability? Evidence from the US commercial banking industry. The Journal of Risk Finance, 18(2), 186–213. [Google Scholar] [CrossRef]

- González, O. L., Rodriguez Gil, L. I., Fernandez Lopez, S., & Vivel Búa, M. (2012). Determinants of credit risk derivatives use by the European banking industry. Journal of Money, Investment and Banking, (25), 36–58. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2578516 (accessed on 25 February 2025).

- Gündüz, Y. (2021). Mitigating counterparty risk. SSRN 2654591. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2654591 (accessed on 17 March 2025).

- Hirtle, B. (2009). Credit derivatives and bank credit supply. Journal of Financial Intermediation, 18(2), 125–150. [Google Scholar] [CrossRef]

- Hu, X., & Zhong, Z. (2024). Developments in CDS markets: A review on recent CDS studies. In Handbook of investment analysis, portfolio management, and financial derivatives: In 4 volumes (pp. 2643–2681). World Scientific. [Google Scholar]

- Hull, J., Predescu, M., & White, A. (2004). The relationship between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking & Finance, 28(11), 2789–2811. [Google Scholar] [CrossRef]

- ISDA. (2021). SwapsInfo full year 2020 and the fourth quarter of 2020 review. ISDA. [Google Scholar]

- Jarrow, R. A., & Turnbull, S. M. (1995). Pricing derivatives on financial securities subject to credit risk. The Journal of Finance, 50(1), 53–85. [Google Scholar] [CrossRef]

- Keshari, A., & Gautam, A. (2023). Asset pricing in global scenario: A bibliometric analysis. IIM Ranchi Journal of Management Studies, 2(1), 48–69. [Google Scholar] [CrossRef]

- Khan, A., Goodell, J. W., Hassan, M. K., & Paltrinieri, A. (2022). A bibliometric review of finance bibliometric papers. Finance Research Letters, 47, 102520. [Google Scholar] [CrossRef]

- Kijima, M., & Muromachi, Y. (2000). Credit events and the valuation of credit derivatives of basket type. Review of Derivatives Research, 4, 55–79. [Google Scholar] [CrossRef]

- Kim, J. S., & Kim, S. (2021). Thirty years of the journal of derivatives and quantitative studies: A bibliometric analysis. Journal of Derivatives and Quantitative Studies, 29(4), 258–279. [Google Scholar] [CrossRef]

- Klieber, D. S. (2012). Credit default swaps–weapon of mass destruction or reliable indicator? Economic Affairs, 32(1), 72–74. [Google Scholar] [CrossRef]

- Konjore, M. J. (2024). Two decades of evaluating evaluation capacity building: A bibliographic coupling review. New Directions for Evaluation, 2024(183), 11–28. [Google Scholar] [CrossRef]

- Kumar, A., Sharma, S., Vashistha, R., Srivastava, V., Tabash, M. I., Munim, Z. H., & Paltrinieri, A. (2024). International Journal of Emerging Markets: A bibliometric review 2006–2020. International Journal of Emerging Markets, 19(4), 1051–1089. [Google Scholar] [CrossRef]

- Lai, S., Liu, S., Pu, X., & Zhang, J. (2025). The real effect of CDS trading: Evidence from corporate employment. International Review of Finance, 25(1), e12464. [Google Scholar] [CrossRef]

- Lardo, A., Corsi, K., Varma, A., & Mancini, D. (2022). Exploring blockchain in the accounting domain: A bibliometric analysis. Accounting, Auditing & Accountability Journal, 35(9), 204–233. [Google Scholar]

- Levovnik, D., Aleksić, D., & Gerbec, M. (2025). Exploring the research on managers’ safety commitment through the prism of leadership. Part 1: A bibliometric analysis. Journal of Loss Prevention in the Process Industries, 94, 105527. [Google Scholar] [CrossRef]

- Lin, Y. C., Padliansyah, R., & Lin, T. C. (2020). The relationship and development trend of corporate social responsibility (CSR) literature: Utilizing bibliographic coupling analysis and social network analysis. Management Decision, 58(4), 601–624. [Google Scholar] [CrossRef]

- Liu, Y., Mai, F., & MacDonald, C. (2019). A big-data approach to understanding the thematic landscape of the field of business ethics, 1982–2016. Journal of Business Ethics, 160(1), 127–150. [Google Scholar] [CrossRef]

- Maseda, A., Iturralde, T., Cooper, S., & Aparicio, G. (2022). Mapping women’s involvement in family firms: A review based on bibliographic coupling analysis. International Journal of Management Reviews, 24(2), 279–305. [Google Scholar] [CrossRef]

- McNally, D. (2009). From financial crisis to world-slump: Accumulation, financialisation, and the global slowdown. Historical Materialism, 17(2), 35–83. [Google Scholar] [CrossRef]

- Meng, L., & Ap Gwilym, O. (2007). The characteristics and evolution of credit default swap trading. Journal of Derivatives & Hedge Funds, 13(3), 186–198. [Google Scholar]

- Mohamad, A. H. H., Zainuddin, M. R. K., Esa, M. S. M., & AB-Rahim, R. (2024). The COVID-19 and malaysia economy: A bibliometric analysis. Universiti Malaysia Terengganu Journal of Undergraduate Research, 6(1), 23–46. [Google Scholar] [CrossRef]

- Mongeon, P., & Paul-Hus, A. (2016). The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics, 106(1), 213–228. [Google Scholar] [CrossRef]

- Nijskens, R., & Wagner, W. (2011). Credit risk transfer activities and systemic risk: How banks became less risky individually but posed greater risks to the financial system at the same time. Journal of Banking & Finance, 35(6), 1391–1398. [Google Scholar]

- Padilla-Ospina, A. M., Medina-Vásquez, J. E., & Rivera-Godoy, J. A. (2018). Financing innovation: A bibliometric analysis of the field. Journal of Business & Finance Librarianship, 23(1), 63–102. [Google Scholar]

- Pandey, D. K., Hassan, M. K., Kumari, V., Zaied, Y. B., & Rai, V. K. (2024). Mapping the landscape of FinTech in banking and finance: A bibliometric review. Research in International Business and Finance, 67, 102116. [Google Scholar] [CrossRef]

- Parker, E., & Brown, M. (2003). The 2003 ISDA credit derivatives definitions. PLC Finance. [Google Scholar]

- Parlour, C. A., & Winton, A. (2013). Laying off credit risk: Loan sales versus credit default swaps. Journal of Financial Economics, 107(1), 25–45. [Google Scholar] [CrossRef]

- Pečiulis, T., Ahmad, N., Menegaki, A. N., & Bibi, A. (2024). Forecasting of cryptocurrencies: Mapping trends, influential sources, and research themes. Journal of Forecasting, 43(6), 1880–1901. [Google Scholar] [CrossRef]

- Phan Tan, L. (2022). Bibliometrics of social entrepreneurship research: Cocitation and bibliographic coupling analyses. Cogent Business & Management, 9(1), 2124594. [Google Scholar]

- Podsakoff, P. M., MacKenzie, S. B., Bachrach, D. G., & Podsakoff, N. P. (2005). The influence of management journals in the 1980s and 1990s. Strategic Management Journal, 26(5), 473–488. [Google Scholar] [CrossRef]

- Rahman, S. M., Saif, A. N. M., Kabir, S., Bari, M. F., Alom, M. M., Rayhan, M. J., Zan, F., Chu, M., & Talukder, A. (2025). Blockchain in the banking industry: Unravelling thematic drivers and proposing a technological framework through systematic review with bibliographic network mapping. IET Blockchain, 5(1), e12093. [Google Scholar] [CrossRef]

- Shadab, H. B. (2009). Counterparty regulation and its limits: The evolution of the credit default swaps market. New York Law School Law Review, 54, 689. [Google Scholar]

- Tabassum, & Yameen, M. (2024). Why do banks use credit default swaps (CDS)? A systematic review. Journal of Economic Surveys, 38(1), 201–231. [Google Scholar] [CrossRef]

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207–222. [Google Scholar] [CrossRef]

- van Eck, N. J., & Waltman, L. (2011). Text mining and visualization using VOSviewer. arXiv, arXiv:1109.2058. [Google Scholar] [CrossRef]

- van Nunen, K., Li, J., Reniers, G., & Ponnet, K. (2018). Bibliometric analysis of safety culture research. Safety Science, 108, 248–258. [Google Scholar] [CrossRef]

- Wang, M., & Chai, L. (2018). Three new bibliometric indicators/approaches derived from keyword analysis. Scientometrics, 116, 721–750. [Google Scholar] [CrossRef]

- Wang, Y., Fang, R., Hu, N., & Huang, R. (2025). Credit default swaps and borrowers’ real earnings management: Evidence from credit default swap initiation. Journal of Accounting, Auditing & Finance, 40(1), 3–36. [Google Scholar]

- Web of Science. (2022). Web of Science: Limit on exporting. Clarivate. Available online: https://support.clarivate.com/ScientificandAcademicResearch/s/article/Web-of-Science-Limit-on-exporting?language=en_US (accessed on 17 March 2025).

- Weistroffe, C. (2009). Credit default swaps. Deutsche Bank Research. [Google Scholar]

- Wengner, A., Burghof, H. P., & Schneider, J. (2015). The impact of credit rating announcements on corporate CDS markets—Are intra-industry effects observable? Journal of Economics and Business, 78, 79–91. [Google Scholar] [CrossRef]

- Young, T., McCord, L., & Crawford, P. J. (2010). Credit default swaps: The good, the bad and the ugly. Journal of Business & Economics Research (JBER), 8(4). Available online: https://core.ac.uk/download/pdf/268111348.pdf (accessed on 17 March 2025).

- Zhao, R., & Zhu, L. (2024). Credit default swaps and corporate ESG performance. Journal of Banking & Finance, 159, 107079. [Google Scholar]

- Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429–472. [Google Scholar] [CrossRef]

| Keyword | Occurrences | Total Link Strength |

|---|---|---|

| Credit Derivatives | 111 | 445 |

| Risk Assessment | 37 | 305 |

| Credit Risk | 69 | 244 |

| Credit Default Swap | 50 | 222 |

| Credit Default Swaps | 69 | 209 |

| Costs | 22 | 206 |

| Credit Risks | 17 | 147 |

| Stochastic Systems | 13 | 126 |

| Stochastic Models | 12 | 119 |

| Commerce | 13 | 103 |

| Default Risk | 23 | 89 |

| Finance | 11 | 88 |

| Derivatives | 25 | 79 |

| Investments | 10 | 77 |

| Risk Management | 18 | 77 |

| Counterparty Risk | 22 | 75 |

| Economics | 7 | 75 |

| Credit Provision | 14 | 73 |

| Default | 17 | 71 |

| CDS | 16 | 70 |

| Country | Documents | Citations |

|---|---|---|

| United States | 141 | 4196 |

| United Kingdom | 60 | 1360 |

| China | 54 | 940 |

| Germany | 49 | 811 |

| Trance | 42 | 519 |

| Canada | 38 | 1317 |

| Italy | 29 | 417 |

| Australia | 19 | 124 |

| South Korea | 14 | 101 |

| Japan | 22 | 193 |

| Netherlands | 22 | 601 |

| Hong Kong | 16 | 131 |

| Spain | 15 | 234 |

| Switzerland | 15 | 277 |

| Belgium | 10 | 62 |

| India | 7 | 7 |

| Taiwan | 12 | 78 |

| Austria | 6 | 11 |

| Tunisia | 4 | 33 |

| Author | Documents | Citations |

|---|---|---|

| Jarrow, Robert | 3 | 2145 |

| Turnbull | 2 | 1780 |

| Lando | 5 | 1322 |

| Hull, John | 3 | 688 |

| White, Alan | 3 | 688 |

| Yu, Fan | 4 | 563 |

| Zhou, Chunsheng | 3 | 532 |

| Presdescu, Mirela | 1 | 477 |

| Acharya, Viral V. | 3 | 407 |

| Johnson, Timothy C. | 3 | 384 |

| Document | Citations |

|---|---|

| Jarrow (2001) | 365 |

| Norden (2009) | 252 |

| Hull (2004) | 477 |

| Lando (1998) | 594 |

| Duffie (2011) | 210 |

| Emus (2010) | 213 |

| Acharya (2007) | 380 |

| Zhou (2001) | 280 |

| Jarrow and Turnbull (1995) | 1072 |

| Jarrow (1997) | 708 |

| Documents | Citations | Total Link Strength |

|---|---|---|

| Duffee and Zhou (2001) | 77 | 77.00 |

| Giesecke (2010) | 13 | 44.00 |

| Mendoza-Arriaga (2010) | 61 | 42.00 |

| Tabassum (2024) | 2 | 40.00 |

| Bias (2016) | 1 | 37.00 |

| Mendoza-Arriaga (2014) | 30 | 34.00 |

| Le (2015) | 14 | 33.00 |

| Bemdt (2010) | 12 | 33.00 |

| Mai (2014) | 2 | 33.00 |

| Cooper (1996) | 26 | 33.00 |

| Kijima (2014) | 1 | 33.00 |

| Belanger (2004) | 45 | 32.00 |

| Choulli (2020) | 10 | 32.00 |

| Gunduz (2011) | 14 | 31.00 |

| Ye (2022) | 2 | 31.00 |

| Loon (2016) | 37 | 31.00 |

| Gouritroux (2014) | 7 | 31.00 |

| Bosh (2011) | 37 | 30.00 |

| Ackerer (2020) | 11 | 30.00 |

| Beyghahi (2017) | 11 | 30.00 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tabassum; Sidhu, J.; Laskar, N. Examining the Research Taxonomy of Credit Default Swaps Literature Through Bibliographic Network Mapping. J. Risk Financial Manag. 2025, 18, 303. https://doi.org/10.3390/jrfm18060303

Tabassum, Sidhu J, Laskar N. Examining the Research Taxonomy of Credit Default Swaps Literature Through Bibliographic Network Mapping. Journal of Risk and Financial Management. 2025; 18(6):303. https://doi.org/10.3390/jrfm18060303

Chicago/Turabian StyleTabassum, Jasvinder Sidhu, and Najul Laskar. 2025. "Examining the Research Taxonomy of Credit Default Swaps Literature Through Bibliographic Network Mapping" Journal of Risk and Financial Management 18, no. 6: 303. https://doi.org/10.3390/jrfm18060303

APA StyleTabassum, Sidhu, J., & Laskar, N. (2025). Examining the Research Taxonomy of Credit Default Swaps Literature Through Bibliographic Network Mapping. Journal of Risk and Financial Management, 18(6), 303. https://doi.org/10.3390/jrfm18060303