Abstract

Financial technology (FinTech) has significantly changed access to financial services, particularly benefiting historically marginalized communities. While it offers many advantages, FinTech also brings substantial risks associated with this digital transformation. Recent studies highlight the significant impact of FinTech on financial inclusion, especially for marginalized populations. To investigate the benefits and drawbacks of FinTech and identify specific risks affecting users, particularly vulnerable groups, we employed the PRISMA method. A systematic literature review was conducted using the Web of Science database to explore recent research on FinTech and its relationship with financial inclusion, focusing on associated risks. The search covered 2010–2025; however, after applying inclusion criteria, the final dataset comprised publications from 2012 to 2025. Unlike previous bibliometric studies broadly addressing FinTech innovations, this review identifies and categorizes key risks affecting financial inclusion, emphasizing regulatory barriers, digital literacy, and socio-cultural challenges. The review is limited by the exclusive use of Web of Science and the English language, suggesting future research avenues using additional databases and multilingual sources. Findings reveal a notable increase in research activity surrounding FinTech and financial inclusion. This highlights challenges such as data privacy, regulation, and financial literacy. By mapping FinTech-related risks, this study aims to inform policymakers and stakeholders about effective strategies to mitigate these challenges and promote safe, inclusive financial ecosystems.

1. Introduction

Financial technology (FinTech) has emerged as a revolutionary force in the financial industry, transforming access to financial services, particularly for traditionally excluded groups. This rapid growth is driven by FinTech’s potential to overcome traditional barriers, reduce the cost of transactions, and enhance accessibility for unbanked and underbanked communities around the world. Innovations such as mobile banking, digital payment, and peer-to-peer lending have proven significantly effective in augmenting financial access. This can be demonstrated using case studies in countries like Kenya and India, where mobile money services and Aadhaar-based payment systems have been able to propel financial inclusion forward. Although previous studies have explored various facets of FinTech in financial inclusion, there is still a gap regarding the systematic identification and categorization of specific risks associated with its adoption, especially concerning regulatory and privacy issues. This study addresses this gap by providing an in-depth analysis of recent literature, emphasizing these risks and their implications for policymakers.

Yet, the rapid evolution and mass popularity of FinTech come with inherent risks and possible adverse effects on inclusive finance. Key challenges include regulatory uncertainty, cybersecurity threats, digital literacy disparities, and burdensome compliance requirements such as AML and KYC regulations. Lack of clear regulatory guidelines in most risk-susceptible countries generates uncertainty among both providers and consumers of FinTech products. Further, insufficient digital literacy skills and infrastructural constraints, including poor internet connectivity and low smartphone penetration, can inhibit the use of digital financial services, thereby reinforcing the existing digital divide. The adoption of FinTech products, especially by marginalized communities, is mostly influenced by socio-cultural aspects and trust concerns.

According to data from the World Bank, about 1.4 billion adults still lack access to formal financial services (documents.worldbank.org), highlighting the importance and scope of the issue of financial exclusion. This fact is a motivation for our research.

Whereas previous bibliometric studies pointed to growing scholarly attention to FinTech and financial inclusion between 2016 and 2024, this present study aims to determine knowledge gaps in relation to the need for further studies on digital lending and financial literacy’s role in FinTech adoption. In this research, a systematic review of the literature following the PRISMA (Preferred Reporting Items for Systematic Reviews and Me-ta-Analyses) template is used to delineate significant studies pertinent to FinTech and its association with financial inclusion, with a particular emphasis on the corresponding risks. As part of mapping the risk landscape of FinTech, this research endeavors to enlighten policymakers and stakeholders on developing effective measures to address these issues and foster secure, inclusive financial systems.

Unlike previous bibliometric analyses (Dhaya & Sundaram, 2024), which dealt with a general overview of FinTech innovations, this study analyzes in detail the specific risks associated with financial inclusion, particularly focusing on regulatory barriers and privacy issues. The original contribution of this work lies in the systematic identification and categorization of specific risks associated with the application of FinTech technologies in financial inclusion through the analysis of the recent scientific literature, which was not sufficiently explored in the previous literature reviews.

The study aims to address the following inquiries:

- RQ1: What are the recent publication trends on the risks of FinTech use in the financial inclusion of the population?

- RQ2: Which journals and sources are considered most relevant, and what is the most common study type published in this area?

- RQ3: What are the major subjects and trends of this field of research?

The article is structured as follows: The theoretical background section provides a foundation by reviewing earlier research on the intersection of FinTech and financial inclusion, both pointing to opportunities and risks. The methodology section describes the systematic literature review process. The discussion section explores the identified risks. The conclusion sections recapitulate the findings, offer recommendations for risk mitigation, and propose directions for future research.

2. FinTech and Financial Inclusion

2.1. The Concept of FinTech

Financial technology (FinTech), otherwise referred to as such, is a revolutionary means of delivering financial services through sophisticated technologies that simplify access to a broader range of financial products (Zetzsche et al., 2019). Through the utilization of sophisticated technologies, FinTech aims to simplify and make the provision and consumption of financial services, thereby enhancing the range of financial products that can be accessed by consumers. As it evolves, FinTech offers a mix of opportunities and challenges, therefore requiring prudent risk management in a bid to tap into its benefits while protecting consumers (Zetzsche et al., 2019).

2.2. Understanding Financial Inclusion

Financial inclusion is also recognized to be a significant catalyst for economic growth, especially in less wealthy nations with limited access to traditional financial services.

It involves providing financial services and products that are affordable and within reach to every part of the population and business, regardless of their respective firm size or net worth. It is necessary for fostering marginalized groups and economic resilience (Sahay et al., 2020).

2.3. The Role of FinTech in Promoting Financial Inclusion

FinTech has provided new channels to reach unbanked populations, particularly in low-income regions. Innovations like mobile money have bypassed traditional infrastructure, fostering inclusion. Specifically, mobile money in Africa has facilitated such inclusion by enabling financial transactions through mobile phones, bypassing traditional banking infrastructure (Gupta, 2024; Yinka James Ololade, 2024).

2.4. Innovations in Financial Technology

Blockchain technology delivers secure and transparent financial transaction platforms, widening the possibilities for financial inclusion through financial services such as cross-border remittances and micro-lending. These technologies are particularly vital to people who do not have formal identification (Blakstad & Amars, 2020; Ebirim & Odonkor, 2024). Digital banking platforms have also widened access, while alternative credit scoring models using non-traditional data provide new methods of determining creditworthiness, thereby supporting small and medium-sized enterprises (SMEs) and informal economies (Girma & Huseynov, 2023).

2.5. Risks and Barriers to FinTech Adoption

2.5.1. Regulatory Challenges and Consumer Protection

A key barrier to advancing financial inclusion through FinTech is the prevailing regulatory landscape. Most vulnerable nations tend to lack a well-established regulatory framework, hence bringing uncertainty to both consumers and service providers. Regulators find it challenging to keep up with the fast-paced development of FinTech, potentially exposing consumers to exploitation (Arner et al., 2016). Additionally, the necessity to obtain licenses and adherence to anti-money laundering (AML) and know-your-customer (KYC) concepts can be cumbersome for start-up FinTech firms (Ediagbonya & Tioluwani, 2023; Yinka James Ololade, 2024). In 2016, the UK was the first country to adopt a regulatory sandbox for FinTech (Cornelli et al., 2024; Fahy, 2022). Over 50 countries (including Australia, Canada, Hong Kong, Switzerland, Singapore, and Taiwan) have since established their own FinTech regulatory sandboxes (Ahern, 2019; Fahy, 2022). Lithuania has positioned itself as a regional FinTech hub through its sandbox program. With accelerated registration and regulatory support, many European FinTech companies are using the Lithuanian model to enter the EU market (Raudla et al., 2024). The regulatory sandbox program implemented by the Monetary Authority of Singapore (MAS) is a good example of successful and innovative regulation. This program allows innovative financial solutions to be tested in a controlled environment with limited regulatory obligations, but with safeguards in place for consumers and market stability. This reduces the risks associated with new technologies, while at the same time encouraging the development and uptake of innovations. The MAS sandbox shows how smartly designed regulation can effectively balance between fostering innovation and preserving regulatory certainty, which is directly relevant to the topic of the paper (Fuda, 2025).

2.5.2. Digital Literacy and Infrastructure Barriers

Digital literacy significantly influences the adoption of FinTech, especially in developing and underserved regions. A substantial portion of the population in these regions lacks sufficient knowledge and skills to effectively utilize digital financial services, hindering the overall effectiveness of FinTech solutions (Ahamadou & Agada, 2023; Al Rifai & AlBaker, 2025). Infrastructure limitations, including inadequate internet connectivity and low smartphone penetration, further exacerbate the digital divide. Such infrastructure barriers significantly constrain the accessibility and usability of digital financial products, reinforcing financial exclusion among vulnerable populations. Without targeted improvements in digital literacy and substantial investment in telecommunications infrastructure, these barriers will continue to impede the potential of FinTech to expand financial inclusion.

2.5.3. Socio-Cultural Barriers and Trust Issues

The successful adoption of FinTech services among marginalized communities is significantly influenced by socio-cultural factors, including societal attitudes, cultural norms, and trust in digital financial products. In many communities, especially those with limited prior exposure to formal financial systems, there is prevalent skepticism and distrust towards digital financial services. Additionally, cultural factors such as gender norms and religious beliefs may restrict or discourage the use of certain financial products, particularly among women or specific ethnic groups (Kouam, 2024). Concerns related to algorithmic bias in credit scoring, potential over-indebtedness, and perceived threats to privacy further contribute to these trust issues (Fuster et al., 2022; Gabor & Brooks, 2020). Therefore, culturally sensitive approaches, coupled with transparent and inclusive communication strategies, are essential to overcoming these socio-cultural barriers and enhancing trust in digital financial services.

2.6. Addressing Challenges

For the maximum effect of FinTech on financial inclusion, regulatory challenges must be surmounted, digital literacy promoted, and infrastructure boosted. Policymakers and FinTech stakeholders need to engage with local people to develop culturally sensitive and inclusive financial services. Gender equality policies and empowerment of women must be a priority, along with designing Sharia-compliant products for some cultural needs (Kouam, 2024). FinTech holds the potential to significantly enhance financial inclusion by offering innovative solutions to traditional barriers. To maximize the following advantages, there is a necessity to establish enabling regulatory frameworks, invest in digital infrastructure and literacy, develop trust and security, and break socio-cultural barriers. These can assist in the development of an inclusive financial system that stimulates economic development and lowers inequality.

3. Methodology

This study employs a systematic literature review in accordance with the PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) 2020 guidelines. The goal was to identify and synthesize existing academic research on the risks of using FinTech in financial inclusion, focusing on relevant studies published within the defined time span.

The search was limited to English-language articles indexed in Web of Science and subject categories related to business, finance, economics, and management.

The search strategy involved a three-stage keyword-based process, combining the following search terms in article titles, abstracts, and topics:

- “Financial Inclusion” AND “FinTech” → 516 hits

- “Financial Inclusion” AND “Risks” → 213 hits

- “Financial Inclusion” AND “Risks” AND “FinTech” → 58 hits

The search covered the full period from 2010 to 2025 to ensure the inclusion of both early and recent scholarly contributions. However, after applying the predefined inclusion and exclusion criteria—such as peer-reviewed status, language, and subject relevance—the earliest publication that met all requirements dated from 2012. As such, while the search window was 2010–2025, the final dataset for analysis spans from 2012 to 2025.

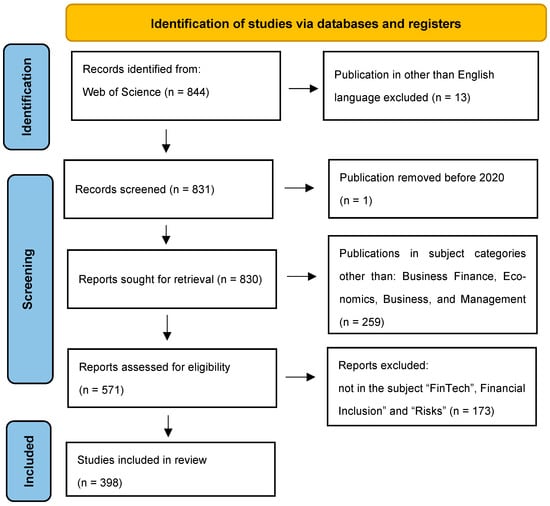

The selection process is illustrated in Figure 1 (PRISMA Flow Diagram). During the screening stage, publications prior to 2010 and those not matching the subject and language criteria were excluded. The final dataset includes 398 peer-reviewed papers, which were then analyzed using the Bibliometrix R-package (Aria & Cuccurullo, 2017) for quantitative bibliometric analysis and VOSviewer 1.6.19 (Van Eck & Waltman, 2010) for keyword co-occurrence mapping and visualization.

Figure 1.

PRISMA 2020 flow diagram.

This combined methodological approach enables an in-depth examination of publication trends, risk themes, and geographical and thematic patterns in the literature concerning FinTech and financial inclusion.

In this study, the literature search was conducted exclusively within the Web of Science database, focusing on papers published in English. This is a significant methodological limitation. Relevant papers published outside of the Web of Science may be missed, and this is a direction for some new research. In addition, the restriction to English further narrows the scope of the search, which can affect the comprehensiveness of the results and conclusions displayed. Therefore, it is crucial to take these aspects into account when interpreting the results, as they can significantly affect the overall impression of the research topic. Data were generated on 18 April 2025.

Figure 1 was created for a literature review using the PRISMA model (Page et al., 2021).

Although the initial search scope included documents from 2010 onward, publications before 2012 did not meet all inclusion criteria. As a result, the dataset used for analysis spans from 2012 to 2025.

This PRISMA flow diagram illustrates the systematic process of selecting studies for review. Initially, 844 records were identified from the Web of Science. During this stage, 13 records were excluded because they were in languages other than English. Screening: A total of 831 records were screened. One publication was removed because it was published before 2010, leaving 830 reports sought for retrieval. While the initial search covered publications from 2010 to 2025, the final dataset includes studies published between 2012 and 2025, reflecting the period when FinTech initiatives in financial inclusion gained greater momentum (e.g., in Kenya and India) (Aduda & Kalunda, 2012; Barik & Sharma, 2019). Eligibility: Out of the 571 reports, 173 were assessed for eligibility. A total of 173 reports were excluded because they did not fit the subject criteria. Subject criteria include studies that are thematically related to the niche of analysis addressed by this paper.

The Prisma diagram provides a structured overview of how studies were methodically filtered and selected for inclusion in the review. Descriptive analysis was performed using the Bibliometrix web application based on R studio (Aria & Cuccurullo, 2017). The tool allows identifying keywords, annual production, citations, and countries in which specific topics are written. VOSviewer 1.6.19 software was used to visualize keywords (Van Eck & Waltman, 2010). This dataset summarizes publication metrics related to financial inclusion and FinTech research from 2012 to 2025, highlighting significant growth and engagement in this area.

The dataset’s time span covers 15 years, revealing an annual growth rate of 37.19%, which indicates a rising interest among researchers in understanding financial inclusion and the impact of FinTech innovations. A total of 398 documents have been published across 206 sources, including journals and books, which shows diverse contributions to the field.

The average age of documents is 2.45 years, underscoring that most research draws from current data and recent trends. Each document has received 19.65 citations, reflecting the influence and relevance of these works in academic discourse. A total of 19,469 references were used across these documents.

The dataset also reveals 557 unique keywords categorized under Keywords Plus (ID), and 1211 unique authors’ keywords (DE), which shows the broad spectrum of topics and subfields. This variety points to the complexity and multifaceted nature of research in financial inclusion, including technology-driven solutions to enhance access to financial services. Collaboration among researchers is also very common, with 953 authors contributing to the publications. Among these, 68 documents were single-authored, and the international co-authorship percentage stands at 38.69%, illustrating the global interest in financial inclusion and the cross-border exchange of ideas and practices.

The 289 articles are the predominant form of publication, complemented by 22 book chapters, 40 early access articles, 14 proceedings papers, 22 reviews, and various other formats, highlighting a diverse approach to disseminating financial inclusion and FinTech knowledge.

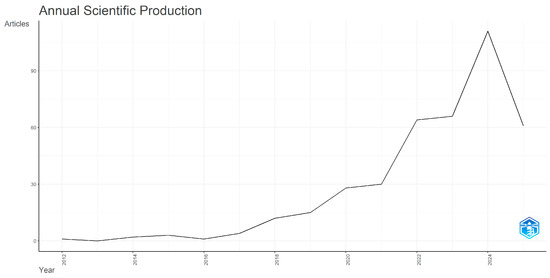

The increasing annual growth rate and diversity of publication types reflect these topics’ ongoing importance and relevance in academic and practical contexts. As the landscape evolves, understanding these trends will be vital for shaping future research and policy initiatives to enhance financial accessibility and inclusion globally. The annual increase in scientific output related to FinTech and financial inclusion is presented in Figure 2, highlighting a notable rise after 2018.

Figure 2.

Annual scientific production (Source: Authors’ work with Bibliometrix R-package).

As previously mentioned, the search covered the literature published between 2010 and 2025; the oldest publication meeting all inclusion criteria was published in 2012. Thus, the data shown in this figure represent the time span from 2012 to 2025.

Since 2018, significant digitalization and innovation within the financial sector have existed. The development of new technologies such as blockchain, artificial intelligence, and mobile banking has spurred research into their impact on access to financial services. Khatib et al. (2025) emphasize the role of digital transformation in increasing awareness of financial inclusion. Global initiatives, such as the United Nations Sustainable Development Goals, have put financial inclusion in focus. States, NGOs, and international institutions have begun to invest more in strategies to integrate marginalized communities into the financial system (Kansiime et al., 2021).

The COVID-19 pandemic began to manifest itself in earnest at the end of 2019. Its effects became apparent in 2020 and beyond, prompting research into the resilience of financial systems (Naz et al., 2024). Many researchers have become interested in how FinTech can help maintain financial stability during crises. Increased investment in the FinTech sector. Investment in FinTech startups has increased drastically, creating a need to explore their impact and potential (Mittal & Singh, 2024). Investing in FinTech has encouraged the growth of professional literature on this topic.

Many countries have reformed their regulatory frameworks to encourage innovation in the financial sector (Freij, 2018). These changes have led to new opportunities for research and analysis, challenging the academic community to explore the impact of regulation on FinTech and financial inclusion. In short, the increased growth of papers on the topic of financial inclusion and FinTech since 2018 can be explained by a combination of technological innovations, global initiatives, investments, and changes in regulations, all of which together provide a rich ground for research and analysis.

4. Results

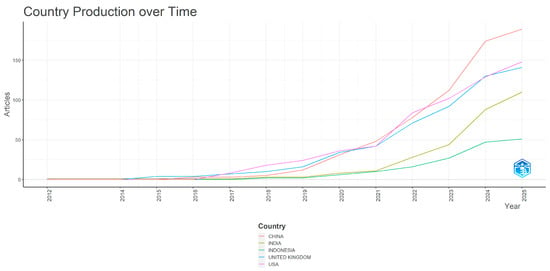

Already from Figure 3, which shows the production of papers by country, it is possible to draw conclusions and monitor the development of financial inclusion and systematically connect with trends in research focus.

Figure 3.

Country production over time (Source: Authors’ work with Bibliometrix software Version 4.3.2).

The analyzed data show that the number of articles increased significantly from 2018 onwards. While in 2012 some countries had only a symbolic number of publications (or none), by 2025 the number of articles will reach triple digits in all observed developed and larger emerging markets. This growth is responding to the rapid development of digital infrastructure, incentives for financial inclusion, and the emergence of increasingly sophisticated FinTech solutions.

China leads the way with a total of 685 articles by 2025, with a sharp increase from 2016 onwards. The development of platforms such as Alipay and WeChat Pay (Tinmaz & Doan, 2023), as well as early experiments with digital currencies (CBDCs), has made China a global leader in the practical application of FinTech solutions. However, the pace of innovation has also raised significant regulatory challenges, especially in the context of systemic risk management, privacy protection, and control of digital credit markets.

The United States has achieved a total of 591 articles by 2025, with a sharp jump since 2017. As the home of the most famous FinTech companies (Stripe, Square, PayPal) and a growing interest in cryptocurrencies, the US has positioned itself as an innovation hub (Mikhaylov, 2020). Despite this, the lack of uniform federal regulation has opened space for market fragmentation, unregulated practices, and the growth of cyber threats. In particular, the need to strengthen safety protocols and consumer protection is emphasized.

The United Kingdom published 557 articles by 2025, steadily increasing since 2015. London’s FinTech sector, one of the most advanced in Europe, has been strengthened by open banking legislation that has allowed for greater competition and transparency (Pereira, 2025). However, the technological complexity and ethical issues related to the application of artificial intelligence in finance remain a challenge. The UK shows how smart regulation can encourage innovation, but also requires constant adaptation.

India produced 320 articles during the period analyzed, and its production has grown explosively since 2018. Government initiatives like Aadhaar (digital identity), UPI (real-time payment system), and Jan Dhan Yojana (opening bank accounts for the poor) have significantly increased financial inclusion (Sharma et al., 2022). However, technological development also brings new challenges: data security, digital literacy, and the regulation of non-banking financial institutions.

Although Indonesia entered the analysis later, it has shown a steady increase in interest since 2018, reaching 161 articles by 2025. Given the large number of non-banked citizens and the high penetration of mobile phones, FinTech in Indonesia offers practical solutions for financial access in remote and rural areas (Anisa, 2021). The main challenges include weak financial literacy and the need to strengthen the regulatory infrastructure.

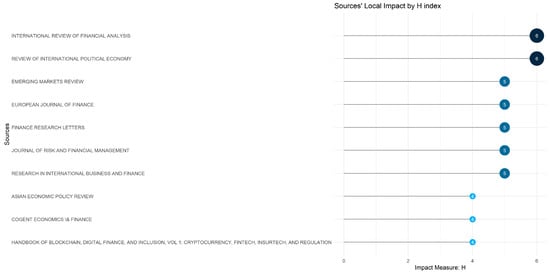

This analysis shows that FinTech and financial inclusion are no longer just trends but key drivers of economic development and social change in the 21st century. Although countries are at different stages of development, the common denominator is the need to balance innovation with responsible risk management. The future of finance is clearly digital—but only with smart policies, regulatory innovation, and an inclusive approach. Figure 4 illustrates the relative impact of key publication sources based on their H index, highlighting the most influential journals in the field of FinTech and financial inclusion.

Figure 4.

Sources local impact by H index (Source: Author’s work with Bibliometrix software Version 4.3.2).

Among the most represented countries in terms of the number of published papers are Nigeria, India, the USA, and the UK, which indicates significant interest in countries with a greater need for financial inclusion.

Data analysis has led to ten of the most important publications with the greatest reach. The degree of measurability of the most influential journals is according to the H-index of publications. The H index is often considered a better criterion than just the number of citations for several reasons. The H index considers both the number of publications and the number of citations per publication, providing a more balanced representation of the impact. A publication must have at least an “H” citation to contribute. At the top of the list with an H index of 6 are the “International Review of Financial Analysis”, “Review of International Political Economy”, “Emerging Markets Review”, and “European Journal of Finance”. These journals have a significant impact in the field of finance and economics.

They are followed by sources with an H index of five, including “Finance Research Letters”, “Journal of Risk and Financial Management”, “Research in International Business and Finance”, “Asian Economic Policy Review”, and “Cogent Economics & Finance”. These journals also contribute to important research in relevant fields.

Finally, the “Handbook of Blockchain, Digital Finance, and Inclusion, Vol. 1” has an H index of 3, indicating a more specialized but still essential contribution to specific topics such as blockchain technology and digital finance.

This distribution of the H index helps in assessing the relative importance and impact of individual publications within the research framework of the paper related to this topic.

The top five most relevant sources in the field of risk of using FinTech in financial inclusion are as follows:

Journal of Financial Stability—This journal often covers topics related to financial systems and stability concerns that can arise with the adoption of new technologies like FinTech.

Journal of Banking & Finance—Known for comprehensive research on banking, financial markets, and their interfaces with emerging technologies, including FinTech.

Finance Research Letters—A source for quick dissemination of significant research findings, often featuring studies on the implications of FinTech innovations.

Journal of Financial Services Research—Publishes research on the management and regulation of financial services, including the risks and benefits of new technologies.

Electronic Commerce Research and Applications—Focuses on technological developments in banking and finance, including emerging risks related to financial inclusion through digital means.

In recent years, there has been a sharp increase in the number of articles with themes of digital financing and innovation dominating.

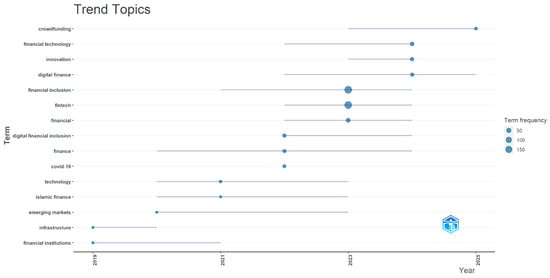

Figure 5 indicates the clear thematic difference between developed and emerging countries. For example, developed countries primarily focus on cybersecurity and data privacy, while emerging economies highlight mobile banking and digital literacy challenges. This distinction underscored the need for region-specific policy strategies.

Figure 5.

Thematic trends by frequency and temporal distribution (Source: Author’s work with Bibliometrix software Version 4.3.2).

By analyzing the topics that have appeared in publications over the past 15 years, we can draw numerous conclusions, which confirm the development of research interests in this topic. Basic central terms such as “Financial Inclusion” and “FinTech” are present throughout the observed period. The large presence of these terms (financial inclusion: 188 impressions), especially in 2023, when an increase is recorded, suggests that technological and financial modernization and inclusiveness are terms that follow economic and political circumstances and are the focus of research interest. Topics such as FinTech, innovation, digital finance, and crowdfunding stand out as newer but increasingly significant trends, with the most recent developments recorded in 2024 and 2025. Such patterns indicate a strong shift towards digital and disruptive solutions in finance. In contrast, topics such as financial institutions, infrastructure, and emerging markets reached their peak a little earlier, with medians concentrated between 2019 and 2020. Such development may indicate their key role in the earlier stages of development of the area, but also their gradual integration into the wider context of contemporary trends. The case of the term COVID-19 is also interesting, as it shows an extremely limited but intense temporal interest—all three quartiles of incidence are placed in 2022. This concentration reflects the specific and temporary character of the pandemic as a dominant topic in the scientific and professional literature of the time. Ultimately, the analysis points to an increasingly pronounced shift towards digitalization, innovation, and financial inclusivity. New trends such as digital financial inclusion, digital finance, and crowdfunding are increasingly defining the contemporary thematic focus, while traditional themes are giving way to the transformation of the financial landscape. This evolution reflects the sector’s dynamic adaptation to global technological and societal changes.

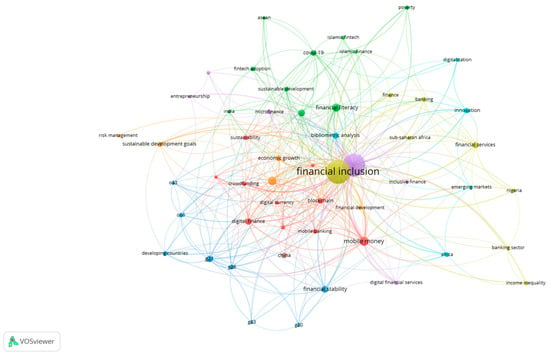

Figure 6 visualizes the co-occurrence of keywords across publications from 2010 to 2025, revealing the thematic structure and evolution of research in FinTech and financial inclusion.

Figure 6.

Scientific map of keywords co-occurrence 2010–2025 (Source: Author, using VOSviewer software version 1.6.19).

Thematic network created using the VOSviewer analysis software tool version 1.6.19.

Visualization shows how concepts and thematic sets develop over time, pointing to new trends, technologies, and approaches in financial inclusion. The term “Financial Inclusion” occupies a central place in the network, which indicates its key role as the main topic in all the analyzed works. This post confirms that financial inclusion remains the dominant research area in scientific literature, with great interest in the period from 2010 to 2025. Although the term is fundamental, its application and context evolve over time, especially in the context of technology and innovation.

Since 2010, with the rise in digitalization, clusters related to digital financial services have become dominant. Technologies such as mobile banking, blockchain, cryptocurrencies, and digital payment systems (such as PayPal, M-Pesa, etc.) are key aspects that enable greater availability of financial services. Given the increasing importance of digital solutions in financial inclusion, the scholarly output on this topic has steadily increased in the lead-up to 2025. It is an important topic in financial education, exploring access to financial knowledge and training, and papers appearing since 2010 show a steady growth in interest in education that enables individuals to better understand financial products and services. The cluster has been expanding over the years, with an emphasis on the role of financial literacy in achieving wider inclusion.

Research shows a growing correlation between financial inclusion, social entrepreneurship, and sustainable development. Given the growing focus on sustainability, clusters linked to environmental and social goals have become increasingly present since 2015, and by 2025, many papers will explore the synergy between financial inclusion and sustainable business models.

The beginning of the decade shows that terms such as “microfinance” or “banking” were more dominant, while in recent years, with the growth of digitalization, “digital financial services” and “blockchain” have become dominant.

Between 2010 and 2025, we can see the lines between terms like “financial inclusion” and “technology” thickening, reflecting a stronger interaction between technology and financial inclusion. Also, there is a growing connection between terms such as “financial literacy” and “economic empowerment” to point out the importance of education in the inclusion process.

Since 2010, the emphasis in the literature has been on traditional financial services, microfinance, and access to banking services. However, since 2015, with rapid technological advancements, there has been a significant shift towards digital services, with a particular focus on mobile apps, digital wallets, and cryptocurrencies. By 2025, research is increasingly focused on how digital solutions can help expand access to financial services, especially in underdeveloped and rural areas. Also, with the growing interest in sustainable development, more and more papers are exploring the synergy between financial inclusion and social responsibility, which forms an important segment of the network from 2020 onwards.

The visualization of scientific papers on financial inclusion between 2010 and 2025 clearly shows the evolution of this field. The beginning of the decade was marked by research that focused on access to traditional financial services, while later work shows an increasing emphasis on digitalization, technology, financial education, sustainability, and entrepreneurship. Through this network, it is possible to track how financial inclusion is becoming more widely associated with new technologies and global sustainable development goals.

Mapping the articles, various innovations and impacts on financial inclusion are detected; Table 1 presents various financial sector innovations crucial in enhancing financial inclusion, especially among marginalized groups.

Table 1.

Innovation and impact on financial inclusion.

This review systematically addressed the research questions posed.

Regarding RQ1, the bibliometric analysis revealed a sharp increase in publications on FinTech-related risks in financial inclusion, particularly after 2018, driven by digitalization and global financial initiatives.

Regarding RQ2, the most influential sources were identified, notably Journal of Financial Stability, Journal of Banking & Finance, and Finance Research Letters, with original research articles prevailing.

Regarding RQ3, the major thematic trends include the prominence of mobile money, digital literacy barriers, regulatory uncertainty, and emerging technologies like blockchain, with clear distinctions between developed and emerging markets.

These findings provide a comprehensive overview of the evolution and key challenges at the intersection of FinTech and financial inclusion.

5. Discussion

The regulatory sandbox models implemented in the UK and Singapore serve as successful examples of how flexible regulation can support FinTech innovation while ensuring consumer protection. Conversely, challenges faced by less structured regulatory frameworks, such as those in parts of Africa, underline the necessity of a balanced regulatory approach. Furthermore, real-world cases like Aadhaar in India highlight the critical role of digital identity systems but also expose significant privacy concerns and implementation risks.

After conducting the analysis, potential research gaps and trends can be identified. The identified themes highlight the connection between digital financial services, FinTech, mobile payments, and economic growth, emphasizing the vital role of digitalization in modern finance. The key role of FinTech in promoting financial inclusion is also highlighted, especially as this trend has been recorded in countries with lower wealth status. The connection between COVID-19 and the increased number of works dealing with digital finance emphasizes that it is the pandemic that has brought about transformative change in financial systems and accelerated the whole process.

This suggests an opportunity for deeper exploration into their integration within traditional FinTech frameworks such as mobile payments and microfinance. The lack of prominent connections between FinTech innovation and regulatory considerations, indicated by the low prevalence of terms like “financial regulation” and “policy,“points to an underexplored area that warrants attention within the literature. Regions like Africa and Nigeria are well represented, but key FinTech hubs such as Europe and Latin America seem underexplored, which may reflect a deficit in data availability or investigative focus in these areas. FinTech and mobile payments dominate research discourse; FinTech’s pivotal role in facilitating financial inclusion and driving economic development is evident. By mapping the landscape of FinTech-related risks, the study aims to inform policymakers and stakeholders about effective strategies to mitigate these challenges. This contribution is crucial for promoting safe and inclusive financial ecosystems that benefit marginalized populations.

The trends presented in this paper not only confirm some of the findings of previous research but also indicate certain differences. For example, while earlier research, such as that conducted by Dhaya and Sundaram (2024), indicates a growing interest in FinTech innovations as a means of improving financial inclusion, our findings further highlight the specific risks associated with these technologies that previous work has not sufficiently addressed. Furthermore, differences in the distribution of published papers by country were observed, suggesting that certain regions focus more on research on these topics than others. Therefore, these trends provide additional insights that enrich the existing literature, while at the same time, demonstrating the need for further research into the specific challenges faced by FinTech in the context of financial inclusion.

Although previous studies provided a general overview, this review explicitly focuses on nuanced risk categorization, providing clearer implications for policy development.

6. Conclusions

This study successfully addressed the research questions by mapping publication trends, identifying key sources, and analyzing major thematic risks related to FinTech and financial inclusion.

It highlights critical challenges, notably data privacy breaches, insufficient financial literacy, and regulatory uncertainty.

Policymakers should prioritize the development of robust, adaptive regulatory frameworks to effectively mitigate these risks.

Strengthening digital literacy programs for vulnerable populations and strategically investing in digital infrastructure are equally crucial.

Future research should further explore the integration of AI-driven lending solutions and blockchain technologies to promote a more inclusive and resilient financial ecosystem.

7. Limitations and Future Research

The paper significantly contributes to the understanding of FinTech’s impact on financial inclusion by systematically reviewing the existing literature, identifying risks, and providing actionable insights for stakeholders and researchers alike. In future research, it would be useful to explore in greater depth the interconnections between FinTech and legislative issues, particularly how regulatory changes can be adapted to the rapid innovations in the FinTech sector. Additionally, the role of socio-cultural factors in vulnerable groups’ adoption of FinTech solutions could be further investigated. In the future, it would be beneficial to focus more on other regions, such as Latin America or Europe, and their inclusion could enrich the discussion and understanding of global challenges.

Future research should further investigate regional differences, especially in underrepresented areas such as Europe and Latin America.

Additional empirical research is needed that will examine the long-term consequences of using AI-driven lending models for reducing or increasing the financial exclusion of vulnerable groups. Also, a more detailed analysis of the potential of blockchain technology in creating more transparent and inclusive financial systems in regions with a low level of trust in financial institutions is recommended.

This review is limited to articles published in English within the Web of Science database, potentially omitting relevant studies from other sources. Future research could expand the review scope to include additional databases and non-English publications. Moreover, empirical studies focusing on AI-driven credit scoring and blockchain technology in regions with low institutional trust would significantly enrich the literature.

Author Contributions

Conceptualization, A.M., B.M. and I.R.Ž.; methodology, A.M. and B.M.; validation, B.M. and I.R.Ž.; formal analysis, A.M.; writing—original draft preparation, A.M.; writing—review and editing, B.M. and I.R.Ž.; visualization, A.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the University North Grant for Research UNIN-HUM-25-1-1.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. The bibliometric data were extracted from the Web of Science database. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Adesola Oluwatosin, A., Stanley Chidozie, U., Bibitayo Ebunlomo, A., & Michelle Chibogu, N. (2024). Advancing financial inclusion through fintech: Solutions for unbanked and underbanked populations. World Journal of Advanced Research and Reviews, 23(2), 427–438. [Google Scholar] [CrossRef]

- Aduda, J., & Kalunda, E. (2012). Financial inclusion and financial sector stability with reference to Kenya: A review of literature. Journal of Applied Finance and Banking, 2(6), 95. [Google Scholar]

- Ahamadou, M., & Agada, D. B. (2023). Adopting FinTech to promote financial inclusion: Evidence from western African economic and monetary union. International Journal of Applied Economics, Finance and Accounting, 17(1), 135–145. [Google Scholar] [CrossRef]

- Ahern, D. (2019). Regulators nurturing fntech innovation: Global evolution of the regulatory sandbox as opportunity-based regulation. Indian Journal of Law & Technology, 15, 345–378. [Google Scholar] [CrossRef]

- Al Rifai, M., & AlBaker, Y. (2025). The role of financial technology in enhancing financial inclusion: A regulatory perspective on current industry trends. Corporate and Business Strategy Review, 6(1), 43–52. [Google Scholar] [CrossRef]

- Anisa, N. (2021). FinTech peer to peer lending as approach to encourage economic inclusion for rural communities in Indonesia. In ADB-IGF special working paper series “FinTech to enable development, investment, financial inclusion, and sustainability. Institute of Global Finance Research Paper Series, Institute of Global Finance. [Google Scholar] [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Arner, D. W., Barberis, J., & Buckey, R. P. (2016). FinTech, RegTech, and the reconceptualization of financial regulation. Journal of International Law and Business, 37, 371. [Google Scholar]

- Barik, R., & Sharma, P. (2019). Analyzing the progress and prospects of financial inclusion in India. Journal of Public Affairs, 19(4), e1948. [Google Scholar] [CrossRef]

- Blakstad, S., & Amars, L. (2020). FinTech at the frontier: Technology developments supporting financial inclusion in Niger. Journal of Digital Banking, 4(4), 318. [Google Scholar] [CrossRef]

- Cornelli, G., Doerr, S., Gambacorta, L., & Merrouche, O. (2024). Regulatory sandboxes and fntech funding: Evidence from the UK. Review of Finance, 28(1), 203–233. [Google Scholar] [CrossRef]

- Dhaya, M., & Sundaram, N. (2024). FinTech innovations in financial inclusion: A bibliometric and systematic review. International Research Journal of Multidisciplinary Scope (IRJMS), 5(4), 501–518. [Google Scholar] [CrossRef]

- Ebirim, G. U., & Odonkor, B. (2024). Enhancing global economic inclusion with fintech innovations and accessibility. Finance & Accounting Research Journal, 6(4), 648–673. [Google Scholar] [CrossRef]

- Ediagbonya, V., & Tioluwani, C. (2023). The role of fintech in driving financial inclusion in developing and emerging markets: Issues, challenges and prospects. Technological Sustainability, 2(1), 100–119. [Google Scholar] [CrossRef]

- Fahy, L. (2022). Regulator reputation and stakeholder participation: A case study of the UK’s regulatory sandbox for fntech. European Journal of Risk Regulation, 13(1), 138–157. [Google Scholar] [CrossRef]

- Freij, Å. (2018). A regulatory innovation framework: How regulatory change leads to innovation outcomes for FinTechs. In The rise and development of FinTech (pp. 21–42). Routledge. [Google Scholar]

- Fuda, K. (2025). The evolution of financial regulation and the role of the monetary authority of Singapore: A historical analysis based on organizational knowledge creation theory. Management & Organizational History, 20(1), 130–152. [Google Scholar] [CrossRef]

- Fuster, A., Goldsmith-Pinkham, P., Ramadorai, T., & Walther, A. (2022). Predictably unequal? The effects of machine learning on credit markets. The Journal of Finance, 77(1), 1. [Google Scholar] [CrossRef]

- Gabor, D., & Brooks, S. (2020). The digital revolution in financial inclusion: International development in the fintech era. In Material cultures of financialisation (pp. 69–82). Routledge. [Google Scholar] [CrossRef]

- Girma, A. G., & Huseynov, F. (2023). The causal relationship between FinTech, financial inclusion, and income inequality in African economies. Journal of Risk and Financial Management, 17(1), 2. [Google Scholar] [CrossRef]

- Guo, Z. (2024). The application of fintech in emerging markets and its impact on financial inclusion. Scientific Journal of Economics and Management Research, 6(11), 102–109. [Google Scholar] [CrossRef]

- Gupta, V. (2024). What role do fintech companies play in enhancing financial inclusion in emerging markets? EPH-International Journal of Business & Management Science, 10(1), 189–202. [Google Scholar] [CrossRef]

- Ingale, A. (2025). Financial inclusion through mobile banking in emerging economies. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Kansiime, M. K., Tambo, J. A., Mugambi, I., Bundi, M., Kara, A., & Owuor, C. (2021). COVID-19 implications on household income and food security in Kenya and Uganda: Findings from a rapid assessment. World Development, 137, 105199. [Google Scholar] [CrossRef]

- Khatib, S. F., Mustafa, Z., & Abbas, A. F. (2025). Digital transformation and financial sustainability. In Algorithmic training, future markets, and big data for finance digitalization (pp. 33–74). IGI Global Scientific Publishing. [Google Scholar] [CrossRef]

- Kouam, A. W. F. (2024). Steering the digital shift: The role of fintech in transforming banking in emerging markets. Preprints. [Google Scholar] [CrossRef]

- Liu, Y. (2024). Research on fintech promoting financial innovation and growth in emerging markets. SHS Web of Conferences, 200, 01006. [Google Scholar] [CrossRef]

- Mikhaylov, A. (2020). Cryptocurrency market analysis from the open innovation perspective. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 197. [Google Scholar] [CrossRef]

- Mittal, P., & Singh, R. I. (2024). Changing landscape of financial inclusion through fintech: A systematic literature review. Paradigm, 09718907241286957. [Google Scholar] [CrossRef]

- Naz, F., Karim, S., Houcine, A., & Naeem, M. A. (2024). FinTech growth during COVID-19 in MENA region: Current challenges and future prospects. Electronic Commerce Research, 24(1), 371–392. [Google Scholar] [CrossRef]

- Ocharive, A., & Iworiso, J. (2024). The impact of digital financial services on financial inclusion: A panel data regression method. International Journal of Data Science and Analysis, 10(2), 20–32. [Google Scholar] [CrossRef]

- Ololade, Y. J. (2024). Conceptualizing fintech innovations and financial inclusion: Comparative analysis of African and U.S. Initiatives. Finance & Accounting Research Journal, 6(4), 546–555. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., & Brennan, S. E. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ, 372, n71. [Google Scholar] [CrossRef]

- Patel, A., & Satapathy, S. K. (2023, July 14–16). Empowering digital banking services and enhancing financial inclusion using smart and robust fintech software solutions. 2023 World Conference on Communication & Computing (WCONF) (pp. 1–9), Raipur, India. [Google Scholar] [CrossRef]

- Pereira, C. M. (2025). The uncertain path towards open finance: Mutual lessons from the United Kingdom and European Union regulatory approaches. In A research agenda for financial law and regulation (pp. 83–112). Edward Elgar Publishing. [Google Scholar] [CrossRef]

- Raudla, R., Juuse, E., Kuokstis, V., Cepilovs, A., & Douglas, J. W. (2024). Regulatory sandboxes and innovation hubs for FinTech: Experiences of the Baltic states. European Journal of Law and Economics, 1–21. [Google Scholar] [CrossRef]

- Sahay, M. R., von Allmen, M. U. E., Lahreche, M. A., Khera, P., Ogawa, M. S., Bazarbash, M., & Beaton, M. K. (2020). The promise of FinTech: Financial inclusion in the post COVID-19 era. International Monetary Fund. [Google Scholar]

- Sharma, A., Bhimavarapu, V. M., Kanoujiya, J., Barge, P., & Rastogi, S. (2022). Financial inclusion-an impetus to the digitalization of payment services (UPI) in India. The Journal of Asian Finance, Economics and Business, 9(9), 191–203. [Google Scholar] [CrossRef]

- Tinmaz, H., & Doan, V. P. (2023). User perceptions of WeChat and WeChat pay in China. Global Knowledge, Memory and Communication, 72(8/9), 797–812. [Google Scholar] [CrossRef]

- Umar, M., Abbas, R., & Sheharyar, M. (2023). FinTech and financial inclusion in sub-saharan Africa: A comparative analysis. Review of Applied Management and Social Sciences, 6(4), 669–680. [Google Scholar] [CrossRef]

- Van Eck, N., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. [Google Scholar] [CrossRef] [PubMed]

- Zetzsche, D. A., Buckley, R. P., & Arner, D. W. (2019). FinTech for financial inclusion: Driving sustainable growth. In Sustainable development goals: Harnessing business to achieve the SDGs through Finance, technology, and law reform (pp. 177–203). Wiley. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).