Using Fuzzy Analytic Hierarchy Process and Technique for Order of Preference by Similarity to the Ideal Solution in Performance Evaluation in the Albanian Banking Sector

Abstract

1. Introduction

- The research applies a relatively new methodology that, unlike traditional methods for assessing and ranking bank performance, offers an innovative and contemporary approach.

- The integration of the fuzzy approach with financial data provides a comprehensive and innovative framework for assessing the performance of the Albanian banking system.

- Previous research has focused on the performance of individual banks using traditional financial indicators. Moreover, the lack of fuzzy logic integration and the absence of comprehensive frameworks in performance studies represent a gap in this body of research.

2. Literature Review

3. Research Methodology

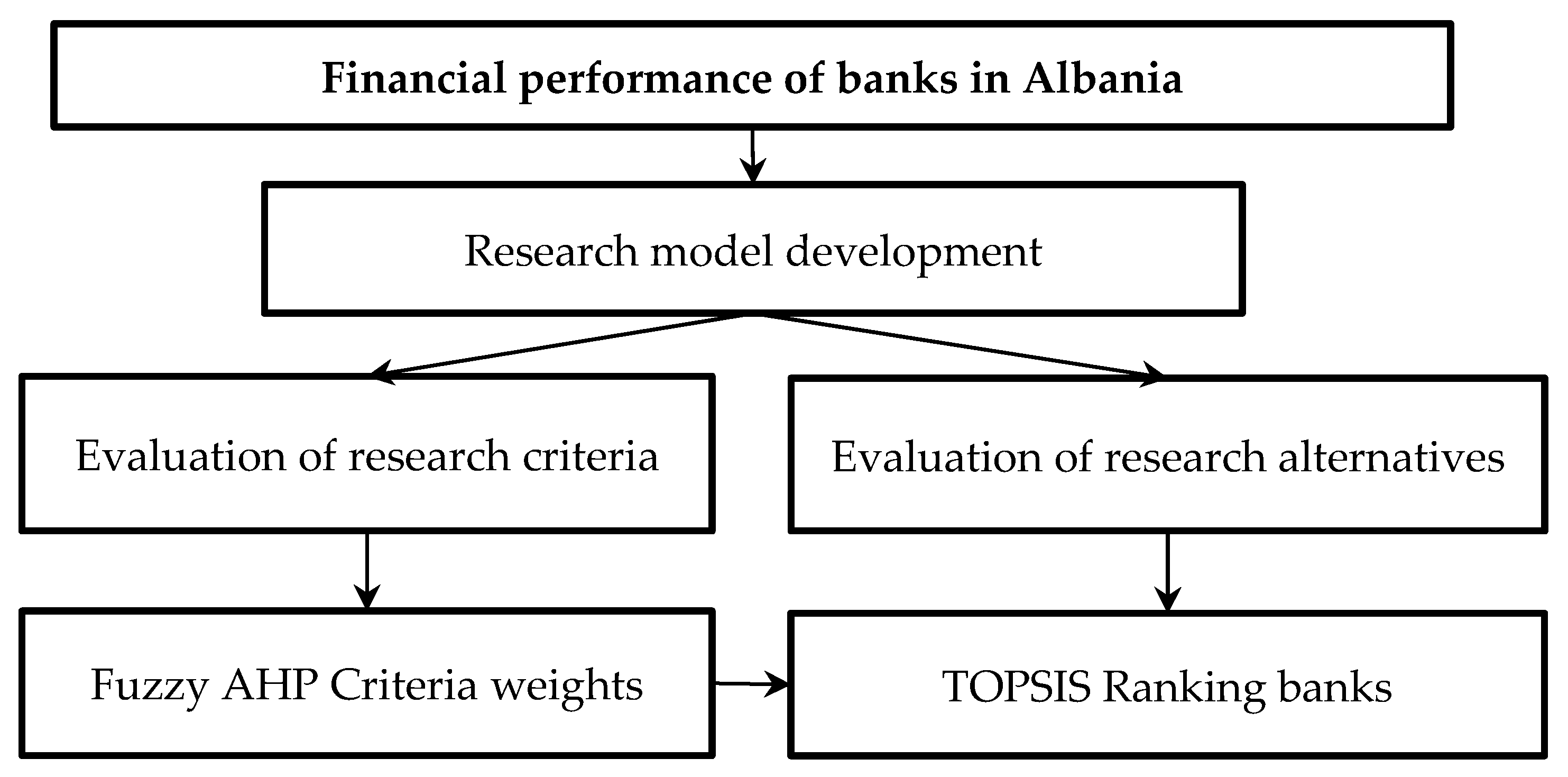

3.1. Research Model

- To enrich the financial offerings, various additional services are provided, including financial services (Breidbach et al., 2020). However, in some cases, these services are not only complementary but essential to the banking experience. Understanding how these financial services are delivered is crucial, leading to the development of a research model. This model is designed with sustainability in mind, aiming to meet current demands while preserving the environment for future generations. Drawing from previous studies and financial experts, the eight most important financial criteria/parameters selected for this research to measure the financial performance of banks are the following: Equity, Portfolio, Sources, Liquid Assets, Cash, Net Interest Income (NII+), Core Business Net Income (CBNI+), and Earnings Before Tax (EBT) (Mastilo et al., 2024; Mandic et al., 2014; Akkoc & Vatansever, 2013; Amile et al., 2012; Ozbek, 2015; Rezaei & Ketabi, 2016). The selection of these criteria is organized in this way because in the financial services provided by banks the relationship with the client comes first. Brief descriptions of the eight criteria are as follows:

- Equity: In evaluating bank performance, capital is considered a fundamental criterion. Often, capital in a business refers to the ownership interest of shareholders or the owner. Net capital also refers to the combination of liabilities and the owner’s capital (Mastilo et al., 2024; Mandic et al., 2014; Akkoc & Vatansever, 2013; Amile et al., 2012; Ozbek, 2015; Rezaei & Ketabi, 2016).

- Portfolio: The Portfolio criterion includes deposits and loans, stocks, bonds, cash equivalents, interests and fees, securities, and other investments. In this case study, the Portfolio is considered one of the parameters and is significant because Net Interest Income is generated from its use (Mastilo et al., 2024; Mandic et al., 2014; Rezaei & Ketabi, 2016; Yang et al., 2024).

- Sources: The Sources criterion includes average Sources such as transaction deposits, deposits, and other loans, liabilities under securities, interest liabilities, fees, and the valuation of derivatives. Proper management of these Sources of financing directly impacts the profitability of banks (Mandic et al., 2014; Rezaei & Ketabi, 2016; Batta et al., 2022).

- Liquid Assets: Assets are considered liquid if they can be easily converted into cash without a loss in value. Liquid Assets typically include banknotes and current accounts. Given that banks often take risks in their business transactions, considering Liquid Assets is important when analyzing the efficiency of banks (Mastilo et al., 2024; Mandic et al., 2014; Akkoc & Vatansever, 2013; Rezaei & Ketabi, 2016).

- Cash: Cash and its equivalents, also known as Cash in banks, are the most Liquid Assets a bank holds. Cash is also a reflection of the bank’s business activities and impacts the Cash flow statement (Mastilo et al., 2024; Mandic et al., 2014; Rezaei & Ketabi, 2016; Tan et al., 2024).

- Net Interest Income (NII+): Net Interest Income is one of the most critical criteria for evaluating bank performance (Mandic et al., 2014; Akkoc & Vatansever, 2013; Amile et al., 2012; Ozbek, 2015; Rezaei & Ketabi, 2016).

- Core Business Net Income (CBNI+): Core Business Net Income is an essential criterion, encompassing Net Interest Income and income from fees and commissions, excluding indirect write-offs (Mandic et al., 2014; Rezaei & Ketabi, 2016).

- Earnings Before Tax (EBT): EBT is an important criterion for assessing bank performance and serves as a key indicator for measuring productivity (Mandic et al., 2014; Rezaei & Ketabi, 2016).

3.2. Research Conduction

3.3. Research Methods

3.3.1. Fuzzy AHP Method

3.3.2. TOPSIS Method

- The decision matrix R, which is normalized, is constructed in this initial step for alternative and criterion j:

- The weighted matrix, which is normalized, is constructed in this second step of the method using the weights of the criterion :

- As a third step, the ideal positive solution A+ and the negative one A− are determined:where and are the set of benefit and cost criteria, respectively.

4. Results

5. Discussions

5.1. Research Limitations

5.2. Directions for Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AHP | Analytic Hierarchy Process |

| ARAS | Additive Ratio Assessment |

| BKT | Banka Kombëtare Tregtare |

| BWM | Best–Worst Method |

| CBNI+ | Core Business Net Income |

| CoCoSo | Combined Compromise Solution |

| COPRAS | complex proportional assessment |

| CRITIC | CRiteria Importance Through Intercriteria Correlation |

| DEA | Data envelopment analysis |

| DEMATEL | Decision-Making Trial and Evaluation Laboratory |

| DER | debt-to-equity ratio |

| EBT | Earnings Before Tax |

| HDI | Human Development Index |

| MCDM | multi-criteria decision-making |

| MOORA | Multi-objective Optimization with Ratio Analysis |

| MOOSRA | Multi-objective Optimization on the Basis of Simple Ratio Analysis |

| NBC | National Business Center |

| NII+ | Net Interest Income |

| ROA | return on assets |

| SADC | Southern African Development Community |

| SAW | Simple Additive Weighting |

| SMEs | small- and medium-sized enterprises |

| SWARA | Stepwise Weight Assessment Ratio Analysis |

| TEA-IS | Trigonometric Envelopment Analysis for Ideal Solutions |

| TOPSIS | Technique for Order of Preference by Similarity to the Ideal Solution |

| WASPAS | Weighted Aggregated Sum Product Assessment |

References

- Abdel-Basset, M., Ding, W., Mohamed, R., & Metawa, N. (2020). An integrated plithogenic MCDM approach for financial performance evaluation of manufacturing industries. Risk Management, 22(3), 192–218. [Google Scholar] [CrossRef]

- Abdel-Basset, M., Mohamed, R., Elhoseny, M., Abouhawash, M., Nam, Y., & AbdelAziz, N. M. (2021). Effcient mcdm model for evaluating the performance of commercial banks: A case study. Computers, Materials and Continua, 67(3), 2729–2746. [Google Scholar] [CrossRef]

- Agrawal, V., Seth, N., & Dixit, J. K. (2022). A combined AHP–TOPSIS–DEMATEL approach for evaluating success factors of e-service quality: An experience from Indian banking industry. Electronic Commerce Research, 22, 1–33. [Google Scholar] [CrossRef]

- Ahmed, A.-B., Badi, I., & Bouraima, M. B. (2024). Combined location set covering model and multi-criteria decision analysis for emergency medical service assessment. Spectrum of Engineering and Management Sciences, 2(1), 110–121. [Google Scholar] [CrossRef]

- Akkoc, S., & Vatansever, K. (2013). Fuzzy performance evaluation with AHP and topsis methods: Evidence from turkish banking sector after the global financial crisis. Eurasian Journal of Business and Economics, 6(11), 53–74. [Google Scholar]

- Alaoui, M. E., Yassini, K. E., & Azza, H. B. (2019). Type 2 fuzzy TOPSIS for agriculture MCDM problems. International Journal of Sustainable Agricultural Management and Informatics, 5(2/3), 112. [Google Scholar] [CrossRef]

- Aldalou, E., & Perçin, S. (2020). Financial performance evaluation of food and drink index using fuzzy MCDM approach. Uluslararası Ekonomi Ve Yenilik Dergisi, 6(1), 1–19. [Google Scholar] [CrossRef]

- Alimohammadlou, M., & Bonyani, A. (2017). A novel hybrid MCDM model for financial performance evaluation in Iran’’s food industry. Accounting and Financial Control, 1(2), 38–45. [Google Scholar] [CrossRef][Green Version]

- Alsanousi, A. T., Alqahtani, A. Y., Makki, A. A., & Baghdadi, M. A. (2024). A hybrid MCDM approach using the BWM and the TOPSIS for a financial performance-based evaluation of saudi stocks. Information, 15(5), 258. [Google Scholar] [CrossRef]

- Amile, M., Sedaghat, M., & Pourhossein, M. (2012). Performance evaluation of banks using fuzzy AHP and TOPSIS, case study: State-owned banks, partially private and private banks in Iran. Caspian Journal of Applied Sciences Research, 2(3), 128–138. [Google Scholar]

- Amiri, A. R., Haghighi, M., Pirzad, A., & Gholimi Chenarestan Oulia, A. (2023). Identification and ranking of factors affecting the growth and development of the market share of refah kargaran bank. Journal of Management and Sustainable Development Studies, 3(3), 169–190. [Google Scholar] [CrossRef]

- Angilella, S., Doumpos, M., Pappalardo, M. R., & Zopounidis, C. (2024). Assessing the performance of banks through an improved sigma-mu multicriteria analysis approach. Omega, 127, 103099. [Google Scholar] [CrossRef]

- Antunes, J., Wanke, P., Azad, M. A. K., Tan, Y., Faria, J. R., & Mamede, A. (2024). Estimating Japanese bank performance: Stochastic entropic analysis on the basis of ideal solutions. Expert Systems with Applications, 242, 122762. [Google Scholar] [CrossRef]

- Anwar, S., Kamran Jamil, M., Azeem, M., Deveci, M., & Antucheviciene, J. (2025). Fuzzy soft topological numbers with an operation of vertex deletion: A comparative study with TOPSIS method and its application in car import decision-making. Cognitive Computation, 17(1), 1–25. [Google Scholar] [CrossRef]

- Arsu, T., & Aytaç, M. B. (2023). Evaluating Turkish banks’ complaint management performance using multi-criteria decision analysis. In Data analytics for management, banking and finance (pp. 197–220). Springer Nature Switzerland. [Google Scholar] [CrossRef]

- Asutay, M., & Ubaidillah. (2024). Examining the impact of intellectual capital performance on financial performance in islamic banks. Journal of the Knowledge Economy, 15(1), 1231–1263. [Google Scholar] [CrossRef]

- Avşarlıgil, N., Doğru, E., & Ciğer, A. (2023). The bank performance ranking in the emerging markets: A case of Turkey. Sosyoekonomi, 31(55), 69–84. [Google Scholar] [CrossRef]

- Aydın, Y. (2020). A hybrid multi-criteria decision making (MCDM) model consisting of SD and COPRAS methods in performance evaluation of foreign deposit banks. Ekinoks Ekonomi İşletme Ve Siyasal Çalışmalar Dergisi, 7(2), 160–176. [Google Scholar]

- Aytekin, A. (2020). Evaluation of the financial performance of tourism companies traded in BIST via a hybrid MCDM model. International Journal of Applied Research in Management and Economics, 2(4), 20–32. [Google Scholar] [CrossRef]

- Ballouk, H., Ben Jabeur, S., Boubaker, S., & Mefteh-Wali, S. (2024). The effect of social media on bank performance: An fsQCA approach. Electronic Commerce Research, 24(1), 477–495. [Google Scholar] [CrossRef]

- Batta, K., Arora, S., & Pandey, A. (2022). Financial inclusion in India through micro units schemes-sustainable development for the five year (2015-20) study. Opportunities and Challenges in Sustainability, 1(2), 116–127. [Google Scholar] [CrossRef]

- Baydaş, M., & Elma, O. E. (2021). An objectıve criteria proposal for the comparison of MCDM and weighting methods in financial performance measurement: An application in Borsa Istanbul. Decision Making: Applications in Management and Engineering, 4(2), 257–279. [Google Scholar] [CrossRef]

- Baydaş, M., & Pamučar, D. (2022). Determining objective characteristics of MCDM methods under uncertainty: An exploration study with financial data. Mathematics, 10(7), 1115. [Google Scholar] [CrossRef]

- Baydaş, M., Eren, T., Stević, Ž., Starčević, V., & Parlakkaya, R. (2023). Proposal for an objective binary benchmarking framework that validates each other for comparing MCDM methods through data analytics. PeerJ Computer Science, 9, e1350. [Google Scholar] [CrossRef] [PubMed]

- Benítez, J. M., Martín, J. C., & Román, C. (2007). Using fuzzy number for measuring quality of service in the hotel industry. Tourism Management, 28(2), 544–555. [Google Scholar] [CrossRef]

- Bobar, Z., Božanić, D., Đurić-Atanasievski, K., & Pamučar, D. (2020). Ranking and assessment of the efficiency of social media using the fuzzy AHP-Z number model—Fuzzy MABAC. Acta Polytechnica Hungarica, 17(3), 43–70. [Google Scholar] [CrossRef]

- Boubaker, S., Le, T. D., & Ngo, T. (2023). Managing bank performance under COVID-19: A novel inverse DEA efficiency approach. International Transactions in Operational Research, 30(5), 2436–2452. [Google Scholar] [CrossRef] [PubMed]

- Bouraima, M., Badi, I., Stević, Ž., Kiptum, C. K., Pamucar, D., & Marinkovic, D. (2024). A novel vehicle routing algorithm for route optimization using best-worst method and ranking alternatives for similarity to ideal solution. Engineering Review, 44(4), 57–76. [Google Scholar] [CrossRef]

- Božanić, D., Pamučar, D., Milić, A., Marinković, D., & Komazec, N. (2022). Modification of the logarithm methodology of additive weights (LMAW) by a triangular fuzzy number and its application in multi-criteria decision making. Axioms, 11(3), 89. [Google Scholar] [CrossRef]

- Breidbach, C. F., Keating, B. W., & Lim, C. (2020). Fintech: Research directions to explore the digital transformation of financial service systems. Journal of Service Theory and Practice, 30(1), 79–102. [Google Scholar] [CrossRef]

- Büyüközkan, G., Feyzioğlu, O., & Nebol, E. (2008). Selection of the strategic alliance partner in logistics value chain. International Journal of Production Economics, 113(1), 148–158. [Google Scholar] [CrossRef]

- Chang, D.-Y. (1996). Applications of the extent analysis method on fuzzy AHP. European Journal of Operational Research, 95(3), 649–655. [Google Scholar] [CrossRef]

- Çalikoğlu, C., & Łuczak, A. (2024). Multidimensional assessment of SDI and HDI using TOPSIS and bilinear ordering. International Journal of Economic Sciences, 13(2), 116–128. [Google Scholar] [CrossRef]

- Đukić, Đ., Petrović, I., Božanić, D., & Delibašić, B. (2022). Selection of unployed aircraft for training of small-range aircraft defense system AHP—TOPSIS optimization methods. Yugoslav Journal of Operations Research, 32(3), 389–406. [Google Scholar] [CrossRef]

- Ecer, F., Gunes, E., & Zavadskas, E. K. (2024). Focusing on identifying the digital transformation performance of banks in the technology age through a multi-criteria methodology. Transformations in Business & Economics, 23(1), 127–153. [Google Scholar]

- Ecer, F., & Pamucar, D. (2022). A novel LOPCOW-DOBI multi-criteria sustainability performance assessment methodology: An application in developing country banking sector. Omega, 112, 102690. [Google Scholar] [CrossRef]

- Eftekhari Aliabadi, A., & Momen, M. (2024). Evaluating the performance of private sector banks in Iran based on financial ability indicators using the fuzzy multi-criteria decision making method. Journal of Investment Knowledge, 13(52), 507–525. [Google Scholar] [CrossRef]

- El Alaoui, M. (2021). Fuzzy TOPSIS: Logic, approaches, and case studies (1st ed.). CRC Press. [Google Scholar]

- Erdoğan, B. (2023). Financial performance analysis of development and investment banks: TOPSIS method. Dicle Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 34, 1–15. [Google Scholar] [CrossRef]

- Erdoğan, H. H. (2022). A multicriteria decision framework for bank performance evaluation in Turkey. Süleyman Demirel Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 27(1), 98–109. [Google Scholar]

- Farahbakhsh, K., Kheradyar, S., Shahroodi, K., & Farahbod, F. (2024). Prioritizing the key factors for performance evaluation of Iran’s banking system based on the balanced scorecard (BSC) approach and the fuzzy analytic network process (FANP). International Journal of Nonlinear Analysis and Applications, 15(1), 151–160. [Google Scholar] [CrossRef]

- Farrokh, M., Heydari, H., & Janani, H. (2016). Two comparative MCDM approaches for evaluating the financial performance of Iranian basic metals companies. Interdisciplinary Journal of Management Studies, 9(2), 359–382. [Google Scholar] [CrossRef]

- Fazeli, Z., Bikzadeh Abbasi, F., & Sardar, S. (2023). Identifying and ranking indicators affecting the evaluation of financial performance in private banks using the fuzzy AHP method. Fuzzy Optimization and Modeling Journal, 4(3), 40–53. [Google Scholar] [CrossRef]

- Foglia, M., Addi, A., & Angelini, E. (2022). The Eurozone banking sector in the time of COVID-19: Measuring volatility connectedness. Global Finance Journal, 51, 100677. [Google Scholar] [CrossRef]

- Gavalas, D., Syriopoulos, T., & Tsatsaronis, M. (2021). Assessing key performance indicators in the shipbuilding industry; an MCDM approach. Maritime Policy & Management, 49(4), 463–491. [Google Scholar] [CrossRef]

- Genç, E., Keleş, M. K., & Özdağoğlu, A. (2024). A hybrid MCDM model for personnel selection based on a novel Gray AHP, Gray MOORA and Gray MAUT methods in terms of business management: An application in the tourism sector. Journal of Decision Analytics and Intelligent Computing, 4(1), 263–284. [Google Scholar] [CrossRef]

- Ghosh, R., & Saima, F. N. (2021). Resilience of commercial banks of Bangladesh to the shocks caused by COVID-19 pandemic: An application of MCDM-based approaches. Asian Journal of Accounting Research, 6(3), 281–295. [Google Scholar] [CrossRef]

- Gupta, S., Mathew, M., Gupta, S., & Dawar, V. (2021a). Benchmarking the private sector banks in India using MCDM approach. Journal of Public Affairs, 21(2), e2409. [Google Scholar] [CrossRef]

- Gupta, S., Mathew, M., Syal, G., & Jain, J. (2021b). A hybrid MCDM approach for evaluating the financial performance of public sector banks in India. International Journal of Business Excellence, 24(4), 481–501. [Google Scholar] [CrossRef]

- Gupta, S., Singh, S., Garg, A., & Goel, P. (2023). Examining adoption drivers of payments bank using fuzzy analytic hierarchy process approach. FIIB Business Review. online first. [Google Scholar] [CrossRef]

- Guru, S., & Mahalik, D. K. (2021). Ranking the performance of Indian public sector bank using analytic hierarchy process and technique for order preference by similarity to an ideal solution. International Journal of Process Management and Benchmarking, 11(1), 28–43. [Google Scholar] [CrossRef]

- Hassanzadeh, M. R., & Valmohammadi, C. (2021). Evaluation and ranking of the banks and financial institutes using fuzzy AHP and TOPSIS techniques. International journal of operational research, 40(3), 297–317. [Google Scholar] [CrossRef]

- Heralová, O. (2024). Merger spin-off project and its effect on financial health of post-transformation companies. International Journal of Economic Sciences, 13(1), 1–12. [Google Scholar] [CrossRef]

- Hwang, C. L., & Masud, A. S. M. (2012). Multiple objective decision making—Methods and applications: A state-of-the-art survey (Vol. 164). Springer Science & Business Media. [Google Scholar]

- Hwang, C. L., & Yoon, K. (1981). Multiple attributes decision making methods and applications. Springer. [Google Scholar]

- Iç, Y. T., Celik, B., Kavak, S., & Baki, B. (2021). Development of a multi-criteria decision-making model for comparing the performance of Turkish commercial banks. Journal of Advances in Management Research, 18(2), 250–272. [Google Scholar] [CrossRef]

- Igbudu, N., Garanti, Z., & Popoola, T. (2018). Enhancing bank loyalty through sustainable banking practices: The mediating effect of corporate image. Sustainability, 10, 4050. [Google Scholar] [CrossRef]

- Işık, Ö., Shabir, M., Demir, G., Puska, A., & Pamucar, D. (2025). A hybrid framework for assessing Pakistani commercial bank performance using multi-criteria decision-making. Financial Innovation, 11(1), 38. [Google Scholar] [CrossRef]

- İç, Y. T., Yurdakul, M., & Pehlivan, E. (2022). Development of a hybrid financial performance measurement model using AHP and DOE methods for Turkish commercial banks. Soft Computing, 26(6), 2959–2979. [Google Scholar] [CrossRef]

- Jakšić, M., Moljević, S., Aleksić, A., Misita, M., Arsovski, S., Tadić, D., & Mimović, P. (2016). Fuzzy approach in ranking of banks according to financial performances. Mathematical Problems in Engineering, 2016(1), 6169586. [Google Scholar] [CrossRef]

- Kahraman, C., Gülbay, M., & Kabak, Ö. (2006). Applications of fuzzy sets in industrial engineering: A topical classification. In Fuzzy Applications in Industrial Engineering (pp. 1–55). Springer. [Google Scholar] [CrossRef]

- Kantharaju, G., Shubha, A., & KS, N. B. (2024). Comparative performance evaluation of selected public and private sector banks: CAMELS model approach in Indian context-a longitudinal study. Educational Administration: Theory and Practice, 30(5), 7232–7244. [Google Scholar] [CrossRef]

- Karbassi Yazdi, A., Spulbar, C., Hanne, T., & Birau, R. (2022). Ranking performance indicators related to banking by using hybrid multicriteria methods in an uncertain environment: A case study for Iran under COVID-19 conditions. Systems Science & Control Engineering, 10(1), 166–180. [Google Scholar] [CrossRef]

- Kilincci, O., & Onal, S. A. (2011). Fuzzy AHP approach for supplier selection in a washing machine company. Expert Systems with Applications, 38(8), 9656–9664. [Google Scholar] [CrossRef]

- Kizielewicz, B., & Sałabun, W. (2024). SITW method: A new approach to re-identifying multi-criteria weights in complex decision analysis. Spectrum of Mechanical Engineering and Operational Research, 1(1), 215–226. [Google Scholar] [CrossRef]

- Kola, F., Gjipali, A., & Sula, E. (2019). Commercial bank performance and credit risk in Albania. Journal of Central Banking Theory and Practice, 8(3), 161–177. [Google Scholar] [CrossRef]

- Komazec, N., Janković, K., Mladenović, M., Mijatović, M., & Lapčević, Z. (2024). Ranking of risk using the application of the AHP method in the risk assessment process on the Piraeus-Belgrade-Budapest railway corridor. Journal of Decision Analytics and Intelligent Computing, 4(1), 176–186. [Google Scholar] [CrossRef]

- Kousar, S., Ansar, A., Kausar, N., & Freen, G. (2025). Multi-criteria decision-making for smog mitigation: A comprehensive analysis of health, economic, and ecological impacts. Spectrum of Decision Making and Applications, 2(1), 53–67. [Google Scholar] [CrossRef]

- Koziuk, V., Ivashuk, Y., & Hayda, Y. (2024). CBDC, trust in the central bank and the privacy paradox. Economics-Innovative and Economics Research Journal, 12(2), 219–242. [Google Scholar] [CrossRef]

- Kumar, K., & Prakash, A. (2019). Developing a framework for assessing sustainable banking performance of the Indian banking sector. Social Responsibility Journal, 15(5), 689–709. [Google Scholar] [CrossRef]

- Kumar, P., & Sharma, D. (2023). Benchmarking the financial performance of Indian commercial banks by a hybrid MCDM approach. International Journal of Process Management and Benchmarking, 15(3), 285–309. [Google Scholar] [CrossRef]

- Kumar, P., & Sharma, D. (2024). Prioritising the financial performance of Indian private sector banks by a hybrid MCDM approach. International Journal of Process Management and Benchmarking, 16(4), 490–511. [Google Scholar] [CrossRef]

- Lan, P. M., Minh, N. K., Khanh, P. V., & Luan, N. T. (2024). The efficiency and the stability of efficiency rankings of Vietnamese commercial banks through mergers and acquisitions from 2008 to 2018. Afro-Asian Journal of Finance and Accounting, 14(4), 581–604. [Google Scholar] [CrossRef]

- Liu, Y., Eckert, C. M., & Earl, C. (2020). A review of fuzzy AHP methods for decision-making with subjective judgements. Expert Systems with Applications, 161, 113738. [Google Scholar] [CrossRef]

- Makki, A. A., & Alqahtani, A. Y. (2023). Capturing the effect of the COVID-19 pandemic outbreak on the financial performance disparities in the energy sector: A hybrid MCDM-based evaluation approach. Economies, 11(2), 61. [Google Scholar] [CrossRef]

- Mandic, K., Delibasic, B., Knezevic, S., & Benkovic, S. (2014). Analysis of the financial parameters of Serbian banks through the application of the fuzzy AHP and TOPSIS methods. Economic Modelling, 43, 30–37. [Google Scholar] [CrossRef]

- Marjanović, I., & Popović, Ž. (2020). MCDM approach for assessment of financial performance of Serbian banks. In Contributions to economics (pp. 71–90). Springer International Publishing. [Google Scholar] [CrossRef]

- Mastilo, Z., Štilić, A., Gligović, D., & Puška, A. (2024). Assessing the banking sector of bosnia and herzegovina: An analysis of financial indicators through the MEREC and MARCOS methods. Journal of Central Banking Theory and Practice, 13(1), 167–197. [Google Scholar] [CrossRef]

- Mehdiabadi, A., Sadeghi, A., Karbassi Yazdi, A., & Tan, Y. (2025). Sustainability service chain capabilities in the oil and gas industry: A Fuzzy hybrid approach SWARA-MABAC. Spectrum of Operational Research, 2(1), 92–112. [Google Scholar] [CrossRef]

- Mishra, A. R., & Rani, P. (2025). Evaluating and prioritizing blockchain networks using intuitionistic fuzzy multi-criteria decision-making method. Spectrum of Mechanical Engineering and Operational Research, 2(1), 78–92. [Google Scholar] [CrossRef]

- Mistrean, L. (2023). Factors influencing customer loyalty in the retail banking sector: A study of financial-banking services in the republic of moldova. Opportunities and Challenges in Sustainability, 2(2), 81–92. [Google Scholar] [CrossRef]

- Moghimi, R., & Anvari, A. (2014). An integrated fuzzy MCDM approach and analysis to evaluate the financial performance of Iranian cement companies. The International Journal of Advanced Manufacturing Technology, 71, 685–698. [Google Scholar] [CrossRef]

- Muhammad Ghazali, W. N. I. (2022). Modelling the performance of commercial banks in Malaysia before and during COVID-19 using MCDM approaches. International Journal of Academic Research in Accounting, Finance and Management Sciences, 12(4), 290–301. [Google Scholar] [CrossRef]

- Muniz, R. D. F., Cornelio, O. M., & Abdolmaleki, E. (2024). Hierarchical efficiency in banking: Decentralized bi-level programming with stackelberg dynamics. Journal of Operational and Strategic Analytics, 2(4), 225–234. [Google Scholar] [CrossRef]

- Nguyen, P.-H., Tsai, J.-F., Hu, Y.-C., & Ajay Kumar, G. V. (2022). A hybrid method of MCDM for evaluating financial performance of Vietnamese commercial banks under COVID-19 impacts. In Studies in systems, decision and control (pp. 23–45). Springer International Publishing. [Google Scholar] [CrossRef]

- No, R. K. G., Niroomand, S., Didehkhani, H., & Mahmoodirad, A. (2021). Modified interval EDAS approach for the multi-criteria ranking problem in banking sector of Iran. Journal of Ambient Intelligence and Humanized Computing, 12, 8129–8148. [Google Scholar] [CrossRef]

- Nosratabadi, S., Pinter, G., Mosavi, A., & Semperger, S. (2020). Sustainable banking; Evaluation of the European business models. Sustainability, 12(6), 2314. [Google Scholar] [CrossRef]

- Osmanovic, N., Puska, A., Thomas, S. S., & Stojanovic, I. (2022). Sustainable economic performances of Islamic banks in gulf countries: Bahrain, Oman, Saudi Arabia and the United Arab Emirates. Journal of Sustainable Finance & Investment. online first. [Google Scholar] [CrossRef]

- Othman, M., Nagina, R., & Samdrup, D. (2024). Assessing banking sector performance: A comparative camel study between public and private banks. Revista De Gestão Social E Ambiental, 18(8), e05584. [Google Scholar] [CrossRef]

- Ozbek, A. (2015). Efficiency analysis of foreign-capital banks in Turkey by OCRA and MOORA. Research Journal of Finance and Accounting, 6(13), 21–31. [Google Scholar]

- Özçalıcı, M., Kaya, A., & Gürler, H. E. (2022). Long-term performance evaluation of deposit banks with multi-criteria decision making tools: The case of Turkey. Pamukkale Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 50, 87–114. [Google Scholar] [CrossRef]

- Palmieri, E., & Ferilli, G. B. (2024). Innovating the bank-firm relationship: A spherical fuzzy approach to SME funding. European Journal of Innovation Management, 27(9), 487–515. [Google Scholar] [CrossRef]

- Pineda, P. J. G., Liou, J. J., Hsu, C. C., & Chuang, Y. C. (2018). An integrated MCDM model for improving airline operational and financial performance. Journal of Air Transport Management, 68, 103–117. [Google Scholar] [CrossRef]

- Quynh, V. T. N. (2024). An extension of fuzzy TOPSIS approach using integral values for banking performance evaluation. Multidisciplinary Science Journal, 6(8), 2024155. [Google Scholar] [CrossRef]

- Radovanović, M., Jovčić, S., Petrovski, A., & Cirkin, E. (2025). Evaluation of university professors using the spherical fuzzy AHP and grey MARCOS multi-criteria decision-making model: A case study. Spectrum of Decision Making and Applications, 2(1), 198–218. [Google Scholar] [CrossRef]

- Raju, V. K., & Kesava Rao, V. V. S. (2020). Financial performance ranking of nationalized banks through integrated AHM-GRA-DEA method. International Journal of Management, 10(3), 15–35. [Google Scholar]

- Rao, S. H., Kalvakolanu, S., & Chakraborty, C. (2021). Integration of ARAS and MOORA MCDM techniques for measuring the performance of private sector banks in India. International Journal of Uncertainty, Fuzziness and Knowledge-Based Systems, 29(Suppl. 2), 279–295. [Google Scholar] [CrossRef]

- Reig-Mullor, J., & Brotons-Martinez, J. M. (2021). The evaluation performance for commercial banks by intuitionistic fuzzy numbers: The case of Spain. Soft Computing, 25(14), 9061–9075. [Google Scholar] [CrossRef]

- Reyes, M. L. A., & Young, M. N. (2024). Portfolio selection on bank corporations in the philippines using fuzzy-analytic network process. Library Progress International, 44(3), 26635–26647. [Google Scholar]

- Rezaei, M., & Ketabi, S. (2016). Ranking the banks through performance evaluation by integrating fuzzy AHP and TOPSIS methods: A study of Iranian private banks. International Journal of Academic Research in Accounting, Finance and Management Sciences, 6(3), 19–30. [Google Scholar] [CrossRef]

- Saaty, T. L. (1980). Analytic hierarchy process. John Wiley & Sons, Ltd. [Google Scholar]

- Safaei Ghadikolaei, A., Khalili Esbouei, S., & Antucheviciene, J. (2014). Applying fuzzy MCDM for financial performance evaluation of Iranian companies. Technological and Economic Development of Economy, 20(2), 274–291. [Google Scholar] [CrossRef]

- Salur, M. N., & Cıhan, Y. (2020). Comparison of financial performances of banks by multi criteria decision making methods: The case of Turkey. The Eurasia Proceedings of Educational and Social Sciences, 19, 41–49. [Google Scholar]

- Sangaré-Oumar, M. M., Qian, S., Qiu, Y., Bouraima, M. B., Badi, I., & Tengecha, N. A. (2025). Evaluation of factors influencing university graduates’ unemployment in developing country: A multi-criteria decision-making perspective. Spectrum of Operational Research, 2(1), 151–160. [Google Scholar] [CrossRef]

- Saraçlı, S., Tunca, B., Gül, I., Arı, E., Villi, B., Berk, B. I., Berk, I., & Boca, G. D. (2023). Modeling the influences on sustainable attitudes of students towards environmental challenges: A partial least squares-structural equation modelling approach. Opportunities and Challenges in Sustainability, 2(3), 161–171. [Google Scholar] [CrossRef]

- Sharma, D., & Kumar, P. (2023). Ranking the performance of public sector banks using fuzzy AHP and fuzzy TOPSIS in balanced scorecard framework: An evidence from India. International Journal of Productivity and Quality Management, 40(1), 1–27. [Google Scholar] [CrossRef]

- Sharma, D., & Kumar, P. (2024). Prioritizing the attributes of sustainable banking performance. International Journal of Productivity and Performance Management, 73(6), 1797–1825. [Google Scholar] [CrossRef]

- Siagian, P. (2023). Determinants of banking operational efficiency and the relationship between the factors to market price: Evidence from indonesia. Economics-Innovative and Economics Research Journal, 11(2), 153–168. [Google Scholar] [CrossRef]

- Tan, D. Y. S., Woo, S. W., & Wong, Y. C. (2024). Enhancing economic, social, and ecological resilience through sustainable waterfront development in penang. Journal of Urban Development and Management, 3(3), 176–187. [Google Scholar] [CrossRef]

- Todorova, V., Moraliyska, M., & Raycheva, I. (2024). De-dollarisation in international payments: Trend or fiction. Economics-Innovative and Economics Research Journal, 12(2), 129–144. [Google Scholar] [CrossRef]

- Trung, D. D., Dudić, B., Dung, H. T., & Truong, N. X. (2024). Innovation in financial health assessment: Applying MCDM techniques to banks in Vietnam. Economics-Innovative and Economics Research Journal, 12(2), 21–33. [Google Scholar] [CrossRef]

- Türegün, N. (2022). Financial performance evaluation by multi-criteria decision-making techniques. Heliyon, 8(5), e09361. [Google Scholar] [CrossRef]

- Ünlü, U., Yalçın, N., & Avşarlıgil, N. (2022). Analysis of efficiency and productivity of commercial banks in turkey pre-and during COVID-19 with an integrated MCDM approach. Mathematics, 10(13), 2300. [Google Scholar] [CrossRef]

- Ünvan, Y. A. (2020). Financial performance analysis of banks with topsis and fuzzy topsis approaches. Gazi University Journal of Science, 33(4), 904–923. [Google Scholar] [CrossRef]

- Ünvan, Y. A., & Ergenç, C. (2022). Financial performance analysis with the fuzzy COPRAS and entropy-COPRAS approaches. Computational Economics, 59(4), 1577–1605. [Google Scholar] [CrossRef]

- Yakymchuk, A., Valyukh, A., Poliakova, N., Skorohod, I., & Sak, T. (2023). Intellectual economic development: Cost and efficiency indicators. Economics-Innovative and Economics Research Journal, 11(1), 107–126. [Google Scholar] [CrossRef]

- Yang, Z. Y., Zhang, Y., & Yu, L. N. (2024). Predicting bank users’ time deposits based on LSTM-stacked modeling. Acadlore Transactions on AI and Machine Learning, 3(3), 172–182. [Google Scholar] [CrossRef]

- Yazdi, A. K., Okereke, P., Wanke, P. F., Aeini, S. A. S., & Mehdiabadi, A. (2024). Credit rating ranking of Iranian banks based on CAMELS and hybrid multi-criteria decision analysis methods in uncertain environments. International Journal of Operational Research, 49(3), 358–384. [Google Scholar] [CrossRef]

- Yeşildağ, E., Özen, E., & Baykut, E. (2020). An assessment for financial performance of banks listed in Borsa Istanbul by multiple criteria decision making. In Uncertainty and challenges in contemporary economic behaviour (pp. 159–183). Emerald Publishing Limited. [Google Scholar] [CrossRef]

- Yu, W., Gan, Y., Zhou, B., & Dai, J. (2024). Revisiting the economic policy uncertainty and resource rents nexus: Moderating impact of financial sector development in BRICS. International Review of Financial Analysis, 94, 103324. [Google Scholar] [CrossRef]

- Zadeh, L. A. (1965). Fuzzy sets. Information and Control, 8(3), 338–353. [Google Scholar] [CrossRef]

- Zanaj, B., Peci, A., & Zanaj, E. (2023, June 21–23). Reviewing of different algorithms application with qualitative variables for the different financial indicators. 10th International Conference on Modern Power Systems (MPS) (pp. 1–4), Cluj-Napoca, Romania. [Google Scholar]

- Zeneli, B., & Bara, Ż. (2015). Evolution of banking system in Albania. Finanse i Prawo Finansowe, 2(4), 83–98. [Google Scholar] [CrossRef]

- Zhao, B., Tian, Y., Kenjegalieva, K., & Wood, J. (2024). Measuring the productivity of urban commercial banks in China. International Review of Economics & Finance, 93, 477–489. [Google Scholar] [CrossRef]

| Authors | Applied Model | Field of Application | Description |

|---|---|---|---|

| Fazeli et al. (2023) | FAHP | Bank | Identified and ranked eight indicators that are effective in assessing the financial performance of private banks. |

| Sharma and Kumar (2023) | FAHP and FTOPSIS | Bank | Performance assessment of ten public sector banks in India. They used 17 performance indicators. |

| Gupta et al. (2023) | FAHP | Bank | Explored the key factors responsible for the adoption of Payments Bank in the northern region of India. |

| Arsu and Aytaç (2023) | FAHP and TOPSIS | Bank | They assessed the performance of 19 banks operating in Turkey in terms of customer complaint management. |

| Reig-Mullor and Brotons-Martinez (2021) | FAHP and TOPSIS | Bank | They assessed the performance of Spanish commercial banks with intuitive fuzzy numbers. |

| Abdel-Basset et al. (2020) | AHP, VIKOR, and TOPSIS | Manufacturing industry | Evaluated the financial performance of the 10 main steel companies in Egypt. |

| Safaei Ghadikolaei et al. (2014) | Fuzzy AHP, Fuzzy VIKOR, Fuzzy ARAS, and Fuzzy COPRAS | Automobile company | They assessed the financial performance of automotive companies on the Tehran Stock Exchange. |

| Moghimi and Anvari (2014) | FAHP and TOPSIS | Manufacturing industry | Analyzed financial reports of Iranian cement production companies. |

| Farrokh et al. (2016) | FAHP, VIKOR, and TOPSIS | Manufacturing industry | Analyzed financial reports of eight base metal-producing companies in Iran. |

| Aytekin (2020) | TOPSIS | Tourism | They studied the financial performance of publicly traded tourism companies on BIST for the period 2014–2018. |

| Türegün (2022) | TOPSIS and VIKOR | Tourism | Evaluated the financial performance of companies operating in the tourism industry in Turkey. |

| Linguistic Scale of Importance | TFN | TFN Reciprocal Value |

|---|---|---|

| Equal | (1, 1, 1) | (1, 1, 1) |

| Weakly | (1/2, 1, 3/2) | (2/3, 1, 2) |

| Fairly strongly | (3/2, 2, 5/2) | (1/2, 1, 3/2) |

| Very strongly | (5/2, 3, 7/2) | (2/7, 1/3, 2/5) |

| Absolutely | (7/2, 4, 9/2) | (2/9, 1/4, 2/7) |

| Criteria | Equity | Portfolio | Sources | Liquid Assets | Cash | NII+ | CBNI+ | EBT |

|---|---|---|---|---|---|---|---|---|

| Equity | Equal | Very strong | Fairly strong | Very strong | Fairly strong | Absolute | Fairly strong | Equal |

| Portfolio | Equal | 1/Fairly strong | Equal | 1/Fairly strong | Absolute | Equal | 1/Very strong | |

| Sources | Equal | Fairly strong | Equal | Absolute | Fairly strong | 1/Fairly strong | ||

| Liquid Assets | Equal | 1/Fairly strong | Absolute | Equal | 1/Very strong | |||

| Cash | Equal | Absolute | Fairly strong | 1/Fairly strong | ||||

| NII+ | Equal | 1/Very strong | 1/Very strong | |||||

| CBNI+ | Equal | 1/Fairly strong | ||||||

| EBT | Equal |

| Criteria | Weights |

|---|---|

| Equity | 0.2300 |

| Portfolio | 0.0864 |

| Sources | 0.1482 |

| Liquid Assets | 0.0864 |

| Cash | 0.1482 |

| NII+ | 0.0430 |

| CBNI+ | 0.0961 |

| EBT | 0.2300 |

| Equity (0.23) | Portfolio (0.086) | Sources (0.148) | Liquid Assets (0.086) | Cash (0.148) | NII+ (0.043) | CBNI+ (0.096) | EBT (0.23) | |

|---|---|---|---|---|---|---|---|---|

| American Bank of Investments SH.A. (ABI Bank) | 10,312,413 | 35,496,321 | 76,752,316 | 14,599,110 | 11,098,410 | 2,500,592 | 3,112,658 | 1,266,289 |

| Credins Bank (Credins) | 18,535,243 | 105,695,118 | 228,438,723 | 29,859,112 | 27,073,989 | 6,632,352 | 9,413,481 | 1,086,515 |

| The United Bank of Albania (UBA Bank) | 1,164,834 | 5,904,902 | 8,581,867 | 2,138,574 | 3,214,129 | 43,372 | 322,456 | 356,654 |

| First Investment Bank Albania Sha (FiBank) | 3,646,590 | 19,520,932 | 30,597,248 | 2,089,676 | 931,524 | 997,704 | 1,392,877 | 447,315 |

| Intesa Sanpaolo Bank Albania (Intesa) | 23,198,471 | 149,544,971 | 164,308,146 | 861,767 | 32,432,194 | 3,231,565 | 8,142,434 | 1,508,990 |

| Banka Kombëtare Tregtare (BKT) | 543,258,884 | 1,619,998,506 | 4,408,288,939 | 1,021,966,079 | 465,266,853 | 133,660,998 | 154,612,644 | 88,474,283 |

| OTP Bank Albania (OTP Bank) | 9,456,255 | 58,849,505 | 87,024,528 | 5,535,926 | 12,771,021 | 3,796,468 | 3,852,886 | 830,199 |

| ProCredit Bank Albania (ProCredit) | 3,187,389 | 28,355,158 | 32,259,457 | 4,515,050 | 4,515,050 | 1,086,984 | 481,256 | −398,452 |

| Raiffeisen Bank Albania (Raiffeisen) | 30,426,372 | 115,538,754 | 207,128,002 | 56,327,181 | 42,269,288 | 6,583,069 | 8,565,978 | 2,076,356 |

| Tirana Bank | 9,984,782 | 37,991,132 | 74,406,112 | 12,789,996 | 6,972,818 | 2,604,232 | 3,325,088 | 824,889 |

| Union Bank | 5,809,574 | 31,661,639 | 66,046,962 | 12,635,500 | 8,421,761 | 2,230,838 | 2,490,530 | 573,590 |

| Banks | d+ | d− | Rank | |

|---|---|---|---|---|

| American Bank of Investments SH.A. (ABI Bank) | 0.4117 | 0.0075 | 0.0180 | 6 |

| Credins Bank (Credins) | 0.4045 | 0.0162 | 0.0386 | 4 |

| The United Bank of Albania (UBA Bank) | 0.4179 | 0.0021 | 0.0050 | 10 |

| First Investment Bank Albania Sha (FiBank) | 0.4168 | 0.0028 | 0.0066 | 9 |

| Intesa Sanpaolo Bank Albania (Intesa) | 0.4033 | 0.0180 | 0.0427 | 3 |

| Banka Kombëtare Tregtare (BKT) | 0.0000 | 0.4192 | 1.0000 | 1 |

| OTP Bank Albania (OTP Bank) | 0.4120 | 0.0076 | 0.0182 | 5 |

| ProCredit Bank Albania (ProCredit) | 0.4177 | 0.0021 | 0.0050 | 11 |

| Raiffeisen Bank Albania (Raiffeisen) | 0.3984 | 0.0224 | 0.0531 | 2 |

| Tirana Bank | 0.4129 | 0.0064 | 0.0152 | 7 |

| Union Bank | 0.4143 | 0.0050 | 0.0119 | 8 |

| Year | 2020 | 2021 | 2022 | |||

|---|---|---|---|---|---|---|

| Name of Banks | Q | Rank | Q | Rank | Q | Rank |

| American Bank of Investments SH.A. (ABI Bank) | 0.0180 | 6 | 0.0175 | 6 | 0.0186 | 6 |

| Credins Bank (Credins) | 0.0386 | 4 | 0.0420 | 3 | 0.0452 | 3 |

| The United Bank of Albania (UBA Bank) | 0.0050 | 10 | 0.0022 | 11 | 0.0007 | 11 |

| First Investment Bank Albania Sha (FiBank) | 0.0066 | 9 | 0.0083 | 9 | 0.0090 | 9 |

| Intesa Sanpaolo Bank Albania (Intesa) | 0.0427 | 3 | 0.0392 | 4 | 0.0375 | 4 |

| Banka Kombëtare Tregtare (BKT) | 1.0000 | 1 | 1.0000 | 1 | 1.0000 | 1 |

| OTP Bank Albania (OTP Bank) | 0.0182 | 5 | 0.0239 | 5 | 0.0361 | 5 |

| ProCredit Bank Albania (ProCredit) | 0.0050 | 11 | 0.0060 | 10 | 0.0061 | 10 |

| Raiffeisen Bank Albania (Raiffeisen) | 0.0531 | 2 | 0.0631 | 2 | 0.0600 | 2 |

| Tirana Bank | 0.0152 | 7 | 0.0163 | 7 | 0.0176 | 7 |

| Union Bank | 0.0119 | 8 | 0.0141 | 8 | 0.0142 | 8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peci, A.; Dervishaj, B.; Puška, A. Using Fuzzy Analytic Hierarchy Process and Technique for Order of Preference by Similarity to the Ideal Solution in Performance Evaluation in the Albanian Banking Sector. J. Risk Financial Manag. 2025, 18, 116. https://doi.org/10.3390/jrfm18030116

Peci A, Dervishaj B, Puška A. Using Fuzzy Analytic Hierarchy Process and Technique for Order of Preference by Similarity to the Ideal Solution in Performance Evaluation in the Albanian Banking Sector. Journal of Risk and Financial Management. 2025; 18(3):116. https://doi.org/10.3390/jrfm18030116

Chicago/Turabian StylePeci, Arianit, Blerina Dervishaj, and Adis Puška. 2025. "Using Fuzzy Analytic Hierarchy Process and Technique for Order of Preference by Similarity to the Ideal Solution in Performance Evaluation in the Albanian Banking Sector" Journal of Risk and Financial Management 18, no. 3: 116. https://doi.org/10.3390/jrfm18030116

APA StylePeci, A., Dervishaj, B., & Puška, A. (2025). Using Fuzzy Analytic Hierarchy Process and Technique for Order of Preference by Similarity to the Ideal Solution in Performance Evaluation in the Albanian Banking Sector. Journal of Risk and Financial Management, 18(3), 116. https://doi.org/10.3390/jrfm18030116