Abstract

The study investigated the threshold effects of economic-policy uncertainty on food security in Nigeria, covering the period from 1970 to 2021. Summary statistics and unit root tests were employed for preliminary analysis, while the threshold regression model was used to realize the key objective of the study. The results revealed that adult population (ADULTPOP), environmental degradation (ENVT), exchange rate uncertainty (EXRU), financial deepening (FINDEEP), food security (FS), government expenditure in agriculture uncertainty (GEAU), global economic uncertainty (GEU), inflation (INF), and interest rate uncertainty (INRU) showed positive mean, maximum, and minimum values over the study period. Most variables exhibited low volatility, except for inflation (SD = 15.619) and interest rate uncertainty (SD = 8.435), which had relatively higher volatility. ADF and PP unit root tests indicated that ADULTPOP, FINDEEP, and FS had unit roots in levels, but became stationary after first differencing (integrated of order one). ENVT, EXRU, GEAU, GEU, INF, and INRU were stationary in level, indicating they were integrated of order zero. The result showed a threshold value of 0.077 for global economic uncertainty (GEU). Above this threshold, exchange rate uncertainty (EXRU) had a statistically significant effect on food security (p = 0.031). Non-threshold variables such as adult population (p = 0.000) and environmental degradation (p = 0.000) also had significant effects on food security. The study thus provided evidence of threshold effects of economic-policy uncertainty on food security. The study recommends that policymakers incorporate threshold values in policy implementation to mitigate risks linked to high economic-policy uncertainty. The Government is also advised to establish strategies for stabilizing exchange rates or alleviating their harmful effects on food supply, which may be crucial for achieving food security.

1. Introduction

The agricultural sector in Nigeria has been a strong pillar of the economy, providing food, creating jobs, and generating income. The sector has struggled to perform the above stated functions since the 1980s (Oluwaseyi, 2017). The devastating effects of declining agricultural output prompted the inclusion of food security in the 2008 G8 Summits in Hokkaido, Japan. Agriculture remains a linchpin of Nigeria’s economy, contributing nearly 25% to GDP and employing 70% of the country’s workforce. Despite the contribution to the economy, Nigeria’s agricultural sector faces many challenges that affect its productivity (FAO, 2023; NAN, 2022).

Food is essential to life, making it a powerful tool of national influence. (Kotur et al., 2024a). Any system where food demand is not sufficiently matched by supply is no doubt one with a looming food crisis (Ojo & Adebayo, 2012). Pangaribowo et al. (2013) emphasized that food-related issues are shaped by the underlying structure and processes governing entire economies and policy.

Food security is widely regarded as one of the most pressing global challenges (Kotur et al., 2024a; Shoaib et al., 2021). Food security is defined as a condition in which all individuals, at all times, have physical and economic access to adequate, safe, and nutritious food that satisfies their dietary requirements and preferences for an active and healthy life (Sadati et al., 2021; FAO, 1996). Food security is a complex and multidimensional concept that encompasses the availability, access, utilization, and stability of food supplies. It extends beyond the mere quantity of food to include its equitable distribution and the ability of individuals to access it. Food security involves ensuring that sufficient quantities of food are produced or imported to meet the dietary needs of the population at national, regional, and local levels. This also entails the capacity to store, distribute, and process food effectively, minimizing losses (FAO, 1996; World Bank, 2000). Access to food means that individuals and households can acquire enough food, either through purchasing power, social safety nets, or food assistance programs, with factors such as income, poverty, and social inequality influencing access (Sen, 1981; FAO, 2013). Food security also requires the proper utilization of food, which includes the ability to prepare and consume nutritious food, along with the knowledge and skills for healthy diets. The health status of individuals plays a significant role in this dimension, as poor health can limit the body’s ability to absorb nutrients.

Additionally, food safety and dietary diversity are crucial for ensuring food meets the nutritional needs of society (Hoddinott, 1999; FAO, 2010). Stability in food security ensures that food availability and access remain consistent over time, even in the face of shocks like economic instability, natural disasters, or political upheaval. It implies that fluctuations in food supply do not undermine the nutritional status of the population (FAO, 2008; Haddad et al., 2003). Therefore, food security is not just about physical availability, but also about affordability, nutritional quality, and the resilience of food systems to external shocks such as economic-policy uncertainty, global trade disruptions, and the impacts of climate change (FAO, 2009; UN, 2018). Food insecurity is particularly critical, as it is linked to the consumption of unhealthy food choices among the most vulnerable households. As such, food security is interconnected with food consumption, production, and marketing, the operation of labor markets, social safety nets, the role of governmental and nongovernmental agencies, and the distribution of initial assets and incomes, among many other factors across various disciplines. Despite Nigeria’s vast agricultural potential, poverty, hunger, and food insecurity remain on the rise, fostering widespread apprehension among its citizens. As noted by Aluko (2020), resolving Nigeria’s agricultural challenges could have far-reaching impacts on other sectors and significantly address Africa’s food-insecurity issues. However, Ojo and Adebayo (2012) highlighted that Nigeria is still far from achieving full food security, and the challenges posed by global warming are compounded by uncertainty and ambiguity. Current trends suggest that agriculture is among the most vulnerable sectors, making the pursuit of food security an urgent priority for any nation. Food security could be influenced by a myriad of factors, including climate change, policy uncertainty, demographic factors and other micro- and macroeconomic variables. This study focuses on the effect of economic-policy uncertainty (EPU) on food security. EPU refers to the unpredictability in the economic environment due to government policies, regulations, or changes in governance.

The Protection Motivation Theory (PMT) serves as a widely adopted framework for understanding how individuals respond to potential threats, such as insecurity (Kotur et al., 2024a). EPU may generate fear regarding food security, motivating individuals to adopt protective behaviors or avoid actions that could harm themselves or others. PMT, categorized within expectancy-value theories, asserts that attitudes and beliefs shape subsequent behaviors. According to PMT, individuals assess threats through two appraisal processes: threat appraisal and coping appraisal. Threat appraisal involves evaluating the seriousness of a potential threat and the probability (vulnerability) of its occurrence (Shillair, 2020; Kjelberg, 2022). EPU could impact agricultural production, food prices, distribution systems, and, ultimately, the affordability and accessibility of food for households. Nigeria, being a country reliant on agriculture, has experienced significant food insecurity due to frequent shifts in fiscal and monetary policies. These shifts create an uncertain investment climate, affect agricultural input costs, and disrupt food supply chains.

The body of research examining the influence of economic policy and its associated uncertainty on broader economic activities is expanding rapidly. For instance, Dejuan-Bitria et al. (2021) explored the implications of policy-related uncertainty by analyzing its effects on firms’ investment decisions. Similarly, Chen et al. (2019) investigated how fluctuations in economic-policy uncertainty impact capital investment at the firm level. Kang et al. (2014) focused on the Chinese context, studying how corporate investment decisions are influenced by economic-policy uncertainty. Lesame (2021), utilizing firm-level data alongside a news-based metric for measuring policy uncertainty, provided empirical evidence that such uncertainty negatively affects firm-level investment in South Africa. Additionally, Aye (2018) examined the relationship between economic-policy uncertainty and real housing returns in eight emerging economies, uncovering a detrimental effect of policy uncertainty on housing markets. Few studies have also been identified regarding the focus of this study. For instance, Kotur et al. (2020) analyzed the influence of economic-policy uncertainty on poverty in Nigeria, revealing a negative impact through the application of the ARDL model. Aye et al. (2019) investigated how monetary- and fiscal-policy uncertainty asymmetrically affects economic activity in the United States over both short- and long-term horizons. Similarly, Olarinde and Abdullahi (2014) examined the effects of macroeconomic policies on agricultural output, with a particular focus on crop production in Nigeria.

The majority of these studies focused on the aggregate economic variables, and even studies on agriculture and/or food ignored the uncertainty surrounding economic policies, and, rather, focused on economic policies themselves. The limited studies addressing food-related variables (e.g., Kotur et al., 2024a, 2024b) tend to overlook critical aspects such as the threshold effects of economic-policy uncertainty on food security. Consequently, this research seeks to address these gaps by analyzing the threshold effects of economic-policy uncertainty on food security in Nigeria, which constitutes the primary objective of the study.

2. Literature Review

Understanding the long-term drivers of food security and their interconnections is crucial for guiding policymakers in formulating strategies to ensure future food security and promote sustainable development.

Food security is vulnerable to macroeconomic fluctuations driven by EPU. One of the key mechanisms through which EPU affects food security is through food prices. Several studies in Nigeria and globally have explored the relationship between EPU and agriculture-sector variables. Understanding the long-term factors influencing food security and their interconnections is crucial for policymakers to develop strategies that ensure future food security and sustainable development.

Focusing on the effect of EPU on food security and/or agriculture-sector variables, various studies have been conducted. For instance, Abbas and Alnafrah (2024) examined how the Russia–Ukraine conflict influenced wheat prices in Pakistan through channels such as oil prices, exchange-rate depreciation, and economic-policy uncertainty (EPU). Their findings, based on cross-quantilogram and rolling-window correlation analysis, revealed significant spillover effects from the conflict. Similarly, Cao et al. (2023) investigated the impacts of policy uncertainties—including economic, fiscal, monetary, and trade—on spillovers between crude oil, corn, and soybeans, finding that fiscal and economic uncertainties exert significant long-term effects, while trade uncertainty intensifies food–oil spillovers.

Frimpong et al. (2021) provided evidence that EPU increases the interconnectedness of agricultural commodity markets, consistent with Zhu et al. (2019), who found that Chinese EPU significantly influences the correlation between crude oil and agricultural markets, especially over longer time scales. Alnour et al. (2023) uncovered asymmetric responses of food prices to energy price shocks and EPU, with medium- and long-term impacts being more pronounced. Tsongo et al. (2024) assessed the role of financial inclusion in enhancing food security across 38 African countries. Their results indicated that financial inclusion significantly improves kilocalorie availability per capita and reduces undernourishment, even after conducting sensitivity analyses. Arshad (2022) similarly argued that financial inclusion supports food security by enabling low-income households to withstand economic challenges.

Kotur et al. (2024a, 2024b), employing the Nonlinear Autoregressive Distributed Lag (NARDL) model, revealed that EPU impacts food security and agricultural growth in Nigeria, asymmetrically. Positive and negative components of government expenditure and exchange-rate uncertainty were found to have significant short- and long-term effects on agricultural growth. Chen et al. (2024) investigated the link between oil prices, EPU, and food prices in developing countries, concluding that oil prices are a primary driver of food price fluctuations in oil-importing countries over the long term. Mittenzwei et al. (2017) examined the combined effects of climate and policy uncertainties on agriculture in Norway. Their results revealed that, while farm incomes increased under uncertainty, land use and labor were negatively affected, underscoring the complex relationship between policy and environmental uncertainties.

Zhang et al. (2022) evaluated the effects of uncertainty resulting from global and domestic economic-policy changes on the stability component of food security in China. The results indicate that global economic-policy uncertainty has a greater impact on the stability of agricultural imports than Chinese economic-policy uncertainty. They concluded that stabilizing domestic food prices and improving domestic agricultural productivity would significantly enhance the stability of these imports. Thomas and Turk (2023) investigated the drivers of food security in Nigeria in a cross-country setting, and assessed the role of policies. They findings revealed that high per capita consumption, high yields and low food inflation support food security. They also show that the Central Bank policies for funding agriculture and import bans have not managed to stimulate agricultural output, nor moderated the impact of international food prices.

Based on a heterogeneous framework, Su et al. (2023) empirically investigates the impact of EPU on food security by utilizing panel data of 25 countries for the period of 1995–2019. This article combines the FAO’s definition of food security and improves the food-security evaluation system based on the existing data, further establishing secondary indicators of food supply, food access, food utilization, and food stability. The finding revealed that the uncertainty of economic policy has a significant negative impact on food security. Su et al. (2023) argued that EPU poses a substantial threat to food security by influencing food prices, trade policies, household purchasing power, and supply-chain stability.

Ling et al. (2024) used a vector autoregression model to explore the evolving and nonlinear relationships between global economic-policy uncertainty (GEPU), food prices, and maritime transport. They employed both bivariate and multivariate wavelet techniques to assess and validate the lead–lag relationships, co-movements, and dynamic interactions among these factors over different time and frequency scales. Their analysis found notable covariance between the variables, with medium- and long-term shifts being primarily influenced by short-term disturbances. Additionally, the study identified both positive and negative interdependencies between the variables, in the long run. Algifahri and Heriqbaldi (2023) investigated the impact of economic uncertainty on food security in 58 developing countries between 2012 and 2021, with a focus on how trade openness moderates this relationship. They employed dynamic panel data analysis using the two-step System GMM methodology. The findings indicated that economic uncertainty had little-to-no significant impact on food security in developing countries.

Iorember et al. (2024) investigated how exchange rates, energy costs, and sector-specific expenditures influenced agriculture value-added and other indicators in Nigeria, over the period 1981–2020. Employing the Kernel Regularized Least Squares method, their findings revealed that exchange rates and agricultural expenditures had a positive average-pointwise marginal effect, whereas energy prices exhibited a significantly negative average-pointwise marginal effect on agriculture value-added. Sun et al. (2024) analyzed the nonlinear relationships among global economic-policy uncertainty, food prices, and maritime transport, using the VAR model. They found that short-term shocks significantly influence medium- and long-term trends, with both positive and negative interdependence strengthening over time.

As far as other drivers of food security are concerned, Osabohien et al. (2020) emphasized that access to low-interest agricultural financing positively impacts food security by enhancing agricultural productivity. In Sub-Saharan Africa (SSA), Beyene (2023) noted that population growth and urbanization adversely affect food security, a finding reinforced by Theodore et al. (2023), who linked population increases in SSA to declining agricultural productivity, due to unfavorable economic and political policies. Similarly, Iwu (2020) observed that in southwestern Nigeria, rising populations and inadequate access to farm inputs have exacerbated food insecurity. Metu et al. (2016) highlighted the fact that Nigeria’s food production is not proportional to its rapid population growth, resulting in widespread food insecurity.

Oguntegbe et al. (2018) and Ogunlesi and Bokana (2018) explored the relationship between population growth and food production in Nigeria and SSA. They identified that, while population growth has the potential to enhance food production through increased labor, socioeconomic challenges such as inflation and unfavorable macroeconomic policies exacerbate food insecurity. Using Quantile Autoregressive Distributed Lag (QARDL) and Wavelet Coherence (WTC) models with data spanning 1980–2022, Onwe et al. (2024) revealed that population growth negatively impacts the Food Production Index (FPI) across various quantiles in Nigeria.

The relationship between economic-policy uncertainty (EPU) and food security could also be influenced by indirect factors such as oil price volatility. Fluctuating oil prices increase agricultural input costs, disrupt food production, and escalate retail prices (Nwoko et al., 2016; Hebebrand & Laborde, 2022). Furthermore, reliance on oil revenue heightens vulnerability to macroeconomic shocks, as observed in Angola and Algeria, where oil price instability has affected food imports (Cantore et al., 2012). Oil price-induced exchange-rate volatility also impacts food affordability and access, with evidence from South Africa and Kenya showing its role in raising imported food costs (Okou et al., 2022). Additionally, oil price fluctuations asymmetrically affect Nigeria’s agricultural growth. Positive changes in oil prices significantly impact agricultural growth in the long run (1.038), and show mixed effects in the short run, while negative changes demonstrate a unique short-run positive impact (Ugwuh et al., 2023).

In conclusion, the existing literature highlights the multifaceted factors influencing food security, ranging from population dynamics and economic policies to environmental uncertainties and international conflicts. These findings underscore the need for integrated policy interventions to address the interconnected challenges of food insecurity effectively. While the literature highlights various ways in which EPU influences food security, a critical gap exists in understanding the threshold effects of EPU—specifically, how the intensity of its impact on food security might differ when EPU surpasses certain critical levels. Several studies have explored the relationship between EPU and food prices, but they do not provide insights into whether a threshold level exists beyond which the impact of EPU intensifies or changes in nature. In Nigeria, economic-policy uncertainty is particularly pronounced, due to factors like political instability, exchange-rate fluctuations, and volatile oil prices, which heavily influence food security. A deeper understanding of how EPU interacts with some of these variables and whether it triggers threshold effects is essential for formulating targeted policy interventions. Some studies have also examined EPU’s relationship with agricultural growth and food security, but there is limited research addressing the threshold effects of EPU. This gap presents an opportunity for the current study, which aims to examine the threshold effects of EPU on food security in Nigeria. The study will assess whether there are specific thresholds of EPU beyond which food-security outcomes worsen significantly. This will contribute to a better understanding of the impact of EPU and provide policy recommendations tailored to different levels of economic uncertainty, helping to mitigate food insecurity during periods of heightened policy volatility.

3. Methodology

3.1. Method of Data Collection

The study utilized secondary data in the form of annual time-series spanning 51 years (1970–2021). Specifically, data on interest rates, exchange rates, and government expenditure on agriculture were sourced from the Central Bank of Nigeria and the World Development Indicators. Food-security data was obtained from the Food and Agriculture Organization Statistical Database. Additionally, control variables such as inflation (measured by the percentage change in the consumer price index), environmental degradation, financial deepening, and adult population were drawn from the World Development Indicators. The World Uncertainty Index data were taken from Ahir et al. (2022).

The variables are measured as follows:

- Economic-policy uncertainty (including monetary, fiscal, and trade policies) was assessed by measuring the volatility in interest rates, exchange rates, and government expenditure on agriculture.

- Volatility was calculated as the three-year moving standard deviation for each economic-policy variable.

- Food security was represented by dietary energy supply, measured in kcal per capita per day.

- Environmental degradation was quantified by CO2 emissions from manufacturing and construction industries, as a percentage of total fuel combustion.

- Financial deepening was measured using domestic credit to the private sector as a percentage of GDP.

- The adult population was defined as the total number of adults (both male and female) within the country.

- Inflation was represented by the percentage change in the consumer price index.

- Global economic uncertainty is proxied by the world uncertainty index, which is a composite measure of global political and economic uncertainty.

3.2. Threshold Regression

A threshold regression with two regions (regimes) defined by a threshold , can be written as

The two equations can be written compactly, as follows:

where is the dependent variable, is a vector of covariates which may include the lagged values of to capture the dynamics in the model, is a vector of region-invariant parameters, is a vector of exogenous variables with region-specific coefficient vectors and , is a threshold variable that may also be one of the variables in or , and is an IID error with mean 0 and variance . is an indicator function which takes the value of 1 if , and 0 otherwise (Chen et al., 2012; Chong & Yan, 2014). The value of threshold parameter, , used in this study, is not arbitrarily chosen, but is endogenously estimated from the model, as proposed by Hansen (1999). This approach ensures that the threshold is statistically determined based on the data, allowing for an objective identification of the critical point at which the relationship between economic uncertainty and food security shifts.

The empirical threshold model for Food Security (FS) can be specified as

where

INF = Inflation

FINDEEP = Financial Deepening

ADULTPOP = Adult Population

ENVT = Environmental Degradation

INRU = Interest-rate uncertainty

EXRU = Exchange-rate uncertainty

GEAU = Government expenditure on agriculture uncertainty

GEU is the global economic uncertainty, which is the threshold variable used to split the sample into two regimes, namely low-economic-uncertainty and high-economic-uncertainty regimes. The selection of this GEU as the threshold variable follows Che and Jiang (2021) and Lagos and Wang (2022). The parameters are as previously defined.

The two-regime threshold regression model is particularly suited for this analysis, as it allows for the identification and estimation of non-linear effects that vary across different levels of global economic uncertainty. The endogenously determined threshold provides a robust framework for capturing the dynamics of these effects, offering deeper insights into their implications for food security.

Theoretical Justification for Choice of Variables:

Each variable included in the model has been carefully selected, based on both theoretical foundations and empirical evidence from the literature. Specifically: inflation (INF) has been widely recognized as a significant factor influencing food security, through its effects on purchasing power and food prices. Moges et al. (2020) found a negative relationship between inflation and food security in Ethiopia, emphasizing its critical role in food affordability. Zhang et al. (2022) indicated that rising inflation leads to increased food prices, negatively impacting household food security in China.

Financial Deepening (FINDEEP) captures the role of financial systems in enhancing access to resources for agricultural investment, a key aspect of food security. Adeyemo et al. (2020) demonstrated that financial deepening positively impacts agricultural productivity and food security in Nigeria. Umar et al. (2020) also highlighted the importance of financial inclusion in improving food security by facilitating access to credit for farmers.

The Adult Population (ADULTPOP) variable represents demographic factors that directly impact labor availability and consumption patterns. Research by Zhang et al. (2022) supports this, indicating that population structure significantly influences food demand and security. Mamo et al. (2019) found that the adult population’s labor participation directly affects agricultural productivity and food-security outcomes in Ethiopia.

Environmental Degradation (ENVT) is crucial, as it relates to the sustainability of agricultural practices and overall food-production capacity. Schmidt et al. (2020) highlight the fact that environmental degradation negatively affects food-security outcomes, through reduced agricultural productivity. Tadesse et al. (2019) indicated that land degradation significantly impacts food security, by reducing arable land and crop yields in developing countries.

Global Economic Uncertainty (GEU) implies global economic disruptions, such as those from the COVID-19 pandemic, amplifying uncertainties in food supply chains, and leading to price surges and increased volatility in agricultural markets. These conditions often reduce food availability and affordability for vulnerable populations worldwide. The inclusion of Global Economic Uncertainty (GEU) as the threshold variable is grounded in the hypothesis that the effects of other variables (such as inflation and financial deepening) on food security are contingent upon the level of economic uncertainty. The use of threshold effects allows us to investigate these dynamics more thoroughly. This approach was supported by the findings of Hao and Ki-Seong (2024), whose findings indicate that that increased EPU leads to significant volatility in agricultural prices, with notable effects observed during periods of major economic events, such as the 2008 global financial crisis. Hence, they conclude that heightened economic-policy uncertainty can disrupt agricultural markets, leading to price instability.

Economic Policy Uncertainty is the key variable in this study. The effects of economic policy uncertainty (EPU) on food security have been widely studied, highlighting several mechanisms through which uncertainty impacts both access to, and availability of, food. The study used four EPU variables: volatilities in exchange rate, interest rate and government spending. Key findings across the empirical literature suggest that fluctuations in EPU, global economic uncertainty, and specific volatilities in interest and exchange rates have direct and indirect effects on food security. EPU can increase food prices by creating instability in trade relationships, affecting import and export flows of food products. For instance, Zhang et al. (2022) show that policy uncertainty can disrupt agricultural trade flows and push up domestic food prices, thereby constraining food access, especially in import-dependent regions. High EPU from large economies, such as the U.S. and China, indirectly affects global food security, due to their roles in international supply chains and trade. Volatile interest rates and fluctuating exchange rates can significantly impact food prices by affecting the cost of imports, debt servicing, and investment in agriculture. Exchange-rate volatility, for example, raises the cost of imported food items, reducing affordability in countries reliant on food imports. In China, exchange-rate uncertainty has been shown to affect the stability of agricultural imports, thereby impacting the country’s food-security landscape (Zhang et al., 2022). Inconsistent government spending on food programs and agricultural support can also destabilize food security. Studies indicate that unpredictable changes in public investment in agriculture reduce the resilience of food systems, particularly in low-income regions where government support is essential for food stability. This volatility not only affects domestic food production, but also alters rural employment and income levels, further reducing food access (Algifahri & Heriqbaldi, 2023; Kotur et al., 2024a, 2024b).

4. Results and Discussion

4.1. Preliminary Analysis

4.1.1. Summary Statistics

Table 1 presents the descriptive statistics, including the mean, median, minimum, maximum, standard deviation, skewness, kurtosis, and Jarque–Bera test results for the variables used in the analysis. From 1970 to 2021, the mean values for the variables are as follows: 18.534 for Adult Population (ADULTPOP), 0.052 for Environmental Degradation (ENVT), 2.39 for Exchange Rate Uncertainty (EXRU), 0.150 for Financial Deepening (FINDEEP), 2.156 for Food Security (FS), 7.643 for Government Expenditure Uncertainty (GEAU), 0.319 for Global Economic Uncertainty (GEU), 0.072 for Inflation (INF), and 18.304 for Interest Rate Uncertainty (INRU). The median values, which provide insights into the central tendency, show that ADULTPOP has a median of 18.535, while the medians for ENVT, EXRU, FINDEEP, FS, GEAU, GEU, INF, and INRU are approximately 2.499, 0.076, 2.104, 7.630, 0.199, 0.051, 12.775, and 6.163, respectively.

Table 1.

Descriptive statistics of the variables used.

The minimum value for ADULTPOP is 17.887, and the maximum is 19.169, indicating that the values for adult population are relatively close to one another. For GEAU, GEU, and EXRU, the minimum values are 0.000, with the maximum values for GEAU, GEU, and EXRU reaching 1.850, 0.234, and 0.860, respectively. The difference between the maximum and minimum values for ENVT and FINDEEP is relatively small, with the maximum values for both variables being similar (2.914 and 2.977, respectively) and the minimum values (1.447 and 1.547) also quite close.

The highest recorded values for INF and INRU are 72.836 and 36.135, while their respective minimum values are 3.458 and 0.460. For FS, the maximum and minimum values are 7.692 and 7.611, respectively. In terms of volatility, variables like ADULTPOP, ENVT, EXRU, FINDEEP, FS, GEAU, and GEU show low variability, with standard deviations of 0.378, 0.316, 0.211, 0.348, 0.026, 0.399, and 0.062, respectively. However, INF and INRU exhibit significantly higher volatility, with standard deviations of 15.619 and 8.435, respectively.

A skewness value of 0 signifies perfect symmetry in the distribution, whereas a skewness value close to zero indicates a nearly symmetrical distribution. In this scenario, the data are evenly spread around the mean, with both tails being approximately equal in length. For the variables ADULTPOP (−0.015) and ENVT (−1.177), the negative skewness values suggest that the distributions are left-skewed. This implies that the left tail is longer, and the majority of the data points are clustered toward the right side of the distribution. FS (0.821), FINDEEP (0.347), GEU (0.846), (0.690) and INF (1.936) have a positive skewness value, indicating a right-skewness. A positive skewness indicates that the right tail of the distribution is longer, with most of the data clustered on the left. The higher the positive skewness value, the more pronounced the rightward skew. For example, EXRU (2.109), INRU (2.120), and GEAU (2.145) exhibit significant positive skewness, suggesting a highly asymmetrical distribution with a pronounced right skew.

Kurtosis, which gauges the concentration of data around the mean, has a normal distribution value of 3. A high kurtosis value indicates that the data are heavily concentrated in the tails, leading to fatter tails and more-extreme values. The kurtosis of ADULTPOP (1.836), FS (2.175), FINDEEP (2.359), and GEU (2.798), suggests a distribution that is less concentrated in the tails compared to a normal distribution, indicating a relatively moderate presence of extreme values. The kurtosis value for ENVT (4.229) indicates a distribution with a higher concentration of data points in the tails, leading to more extreme values. Similarly, the kurtosis values for INF (5.949), EXRU (6.811), GEAU (7.665), and INRU (7.316) reflect distributions with greater concentration in the tails, resulting in fatter tails and more extreme values. The Jarque–Bera test statistics for GEAU (83.699), EXRU (67.316), INF (49.350), and INRU (76.239), with p-values of 0.000, as well as for ENVT (14.697) with a p-value of 0.001, all indicate that these distributions significantly deviate from normality. GEU (6.044) and FS (7.041), and the probability values of 0.049 and 0.030, respectively, suggests that the distribution deviates from a normal distribution at a significance level of 0.05. The kurtosis values for ADULTPOP (2.823) and FINDEEP (1.857), with corresponding probability values of 0.244 and 0.395, respectively, suggest that the distributions for ADULTPOP and FINDEEP do not significantly deviate from normality.

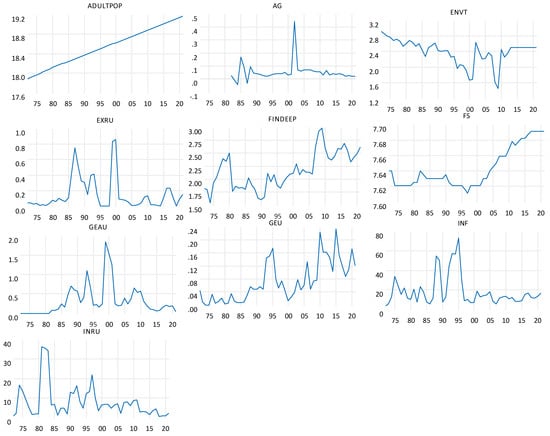

Figure 1 presents the graphical representation of the variables used in the analysis. With the exception of adult population and food-supply quantity, with a clear positive trend, the remaining variables showed variability throughout the period under study. Within this construction, the economic-uncertainty series and all variables in growth rates such as agricultural growth, inflation and interest rates, revert to the mean, as expected.

Figure 1.

Graphical representation of the variables used.

4.1.2. Unit Root Tests

The results of the Augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) unit root tests are presented in Table 2. The ADF unit root test for ADULTPOP indicate a test statistic of −2.490 and a p-value of 0.125. Similarly, the Phillips–Perron (PP) test produced a t-statistic of −1.140 and a p-value of 0.693. Since both p-values exceed the typical significance levels (1%, 5%, or 10%), the null hypothesis of a unit root cannot be rejected at the level. However, upon differencing the data, the ADF and PP tests show evidence that D(ADULTPOP) is stationary, with t-statistics of −4.077 and −2.595, and p-values of 0.003 and 0.101, respectively. Consequently, it can be concluded that ADULTPOP is integrated of order (1), as it becomes stationary after first differencing.

Table 2.

Unit Root Test.

The unit root test results for GEAU show ADF and PP test statistics of −3.131 and −2.924, respectively, with p-values of 0.031 and 0.050. Both p-values are below the 0.05 significance level, providing sufficient evidence to reject the null hypothesis at the 5% significance level. This indicates that GEAU is stationary, and does not exhibit a unit root. For GEU, the ADF statistic is −2.746 with a p-value of 0.074, which exceeds the 0.05 threshold but is below 0.1, suggesting rejection of the null hypothesis only at the 10% significance level. This indicates that GEU is stationary at the 10% level. Similarly, the PP test for GEU gives a p-value of 0.10, reinforcing the conclusion that GEU is stationary at the 10% level.

Regarding INFU, the ADF statistic is −4.106 with a p-value of 0.002, and for INRU, the statistic is −4.517 with a p-value of 0.001. Both p-values are well below the 0.05 threshold, providing strong evidence to reject the null hypothesis of a unit root. The highest statistics and low p-values confirm that both INFU and INRU are stationary.

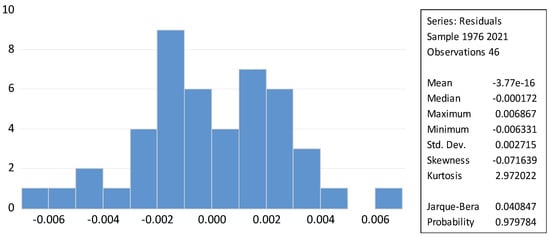

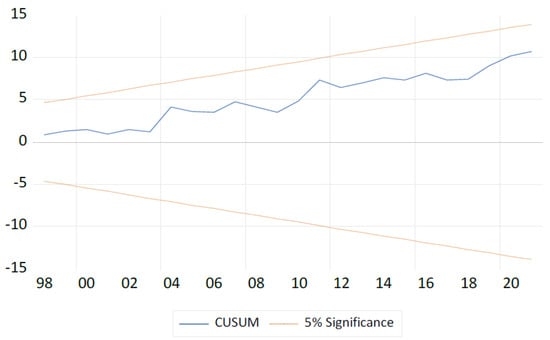

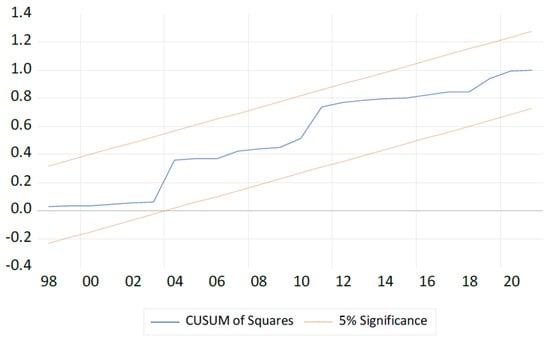

4.1.3. Diagnostic Tests

To ensure the reliability of the model results, several diagnostic tests were conducted. These tests include the Jarque–Bera test for normality, the serial correlation test, the heteroskedasticity test, as well as the CUSUM and CUSUM of squares stability tests, which are detailed in Appendix A. The Jarque–Bera test has high p-value (0.998) suggesting that there is no significant evidence to reject the null hypothesis that the residuals are normally distributed. Serial correlation results revealed that the F-statistic did not provide strong evidence of serial correlation (p-value = 0.146), while the Chi-square statistic suggests some evidence of serial correlation (p-value = 0.012). This indicates that serial correlation may be present in the model, particularly when considering the Chi-square statistics. Heteroskedasticity test in the relationship between Economic-Policy Uncertainty (EPU) and food security has a high p-value (0.613) suggesting that there is no evidence of heteroskedasticity. The CUSUM and CUSUM of square plots for the EPU and food-security nexus shows that the recursive residuals did not move outside the two critical lines, indicating structural stability in the relationship over time.

4.2. Threshold Effects of Economic-Policy Uncertainty on Food Security

The result of threshold regression model examining the threshold effects of Economic Policy Uncertainty (EPU) on food security using the global economic uncertainty (GEU) as a threshold variable is shown in Table 3. The model’s goodness-of-fit statistics suggests a high degree of explanatory power (R-squared = 0.918). The adjusted R-squared value accounts for the number of variables and observations in the model (adjusted R-squared = 0.895). The endogenously estimated threshold value from the model is 0.077. The threshold regression model divided and estimated the coefficients of observations for economic uncertainty (GEU) into two groups, which is less than 0.077 or greater than or equal to 0.077, separately. Below the GEU threshold value, none of the EPU variables have significant effect on food security. This implies that in periods of lower global economic uncertainty, fluctuations in exchange rates or inflation do not significantly disrupt food security. This finding aligns with the hypothesis that during more stable economic times, food security may be influenced by other structural factors, rather than immediate economic policy uncertainties.

Table 3.

Threshold effects of economic-policy uncertainty on food security.

However, when GEU is greater than or equal to the threshold, the coefficient for EXRU is −0.584, and it is statistically significant at 5% level (p-value = 0.031). This suggests that an increase in EXRU has a negative effect on food security when GEU is above the threshold value of 0.077, affirming the analysis of (WFP, 2020) and (Zhao, 2020) who affirmed that exchange rate affects productivity. When economic uncertainty (GEU) exceeds or equals the threshold value of 0.077, indicating a relatively high level of economic uncertainty or specific economic conditions, an increase in exchange-rate uncertainty (EXRU) has a negative impact on food security. Further, the negative sign on EXRU which implies a decrease in food security, may be likely due to increased costs of imports, reduced access to food, or disruptions in the agricultural sector that depend on imported goods or inputs. This agreed with the finding of Olowoyo (2023). This implies that during such periods of economic uncertainty, currency exchange-rate fluctuations can adversely affect food security by potentially influencing the availability and affordability of food. For instance, a depreciating currency can raise the cost of food imports, making food less accessible, particularly in countries that rely on imports for staple foods.

The findings from Nigeria align with trends observed in other developing regions. For instance, studies from Ghana highlight how inconsistent agricultural subsidies have disrupted food production and market stability (Agyemang et al., 2022). Similarly, research in Kenya shows that trade-policy volatility significantly increases food price instability, undermining food security efforts (Meni & Kimunio, 2024). In South Asia, India’s abrupt tariff changes have disrupted food supply chains, while political instability in Pakistan has hindered long-term agricultural planning and productivity (Kumar, 2022; Rogers & Kumar, 2023). These examples underscore the universal need for stable economic policies to mitigate food insecurity in contexts of high uncertainty. While the thresholds identified in Nigeria are context-specific, these parallels suggest broader implications for countries facing similar challenges, reinforcing the role of predictable policy frameworks in safe-guarding food security globally.

The result for the non-threshold variables revealed that ADULTPOP has a coefficient of 0.381 and is statistically significant with a p-value of 0.0000. ENVT has a coefficient of 0.254 and is statistically significant with a p-value of 0.000, implying that adult population and environmental degradation have a positive effect on food security. Adults can provide the necessary labor for agricultural activities. Their experience and knowledge in agricultural practices can contribute to the efficient production of food, leading to increased yields and enhanced food availability. Adults can contribute to household income, which can be used to purchase food or invest in agricultural production. Higher household income can lead to improved access to food and better nutrition for the family, as agreed by Edohen and Ikelegbe (2018). The conversion of natural habitats to agricultural land due to environmental degradation might temporarily increase the land available for cultivation, leading to gains in food production. Pressures from environmental degradation can spur the development of innovative agricultural practices and technologies that promote sustainability and increase food productivity, mitigating some of the negative effects on food security, agreeing with Subramanian and Masron (2021) that the level of environmental degradation tends to be higher with a higher level of food security. While this short-term effect might be positive, the long-term impact of environmental degradation, such as soil erosion, loss of fertility, and climate instability, can significantly reduce agricultural productivity. Therefore, the positive relationship observed here might reflect short-term compensations, but future studies could explore the more nuanced long-term effects of environmental degradation on food security. This finding contrasts with studies such as Robert (2020), which argue that environmental degradation can lead to negative outcomes, including reduced agricultural yields and higher food insecurity.

5. Conclusions and Policy Implications

The threshold regression model employed in this study divides observations of global economic uncertainty (GEU) into two regimes, and estimates the coefficients separately. The findings reveal that when GEU remains below the threshold value, none of the economic-policy uncertainty (EPU) variables exert a significant influence on food security. However, when GEU is greater than or equal to the threshold, EXRU has a negative effect on food security, indicating a relatively high level of economic uncertainty or specific economic conditions; an increase in exchange-rate uncertainty (EXRU) has a negative impact on food security. This implies that during such periods of economic uncertainty, currency exchange-rate fluctuations can adversely affect food security by potentially influencing the availability and affordability of food. The non-threshold variables revealed that adult population (ADULTPOP) and environmental degradation (ENVT) have a positive effect on food security.

This study recommends that policy makers should put into consideration the threshold line in implementation of policy to reduce the risk of economic-policy uncertainty, since the effect is more pronounced at higher-uncertainty levels. Uncertainty about economic policies should be reduced by the government to lower potential risks in the agricultural industry and to secure food security. The government should develop strategies to stabilize exchange rates or mitigate their negative effects on food supply, to ensure food security. Specifically, given the significant impact of exchange-rate uncertainty during periods of high global economic uncertainty, policymakers should prioritize stabilizing exchange rates, especially in economies heavily reliant on food imports. This could involve implementing foreign exchange reserves, hedging mechanisms, and targeted subsidy programs to shield food prices from currency fluctuations. These approaches are feasible through institutional collaboration among government agencies, private-sector stakeholders, and international organizations, to ensure effective policy implementation. The findings on the adult population underscore the importance of investing in human capital. Policies that enhance the productivity and income of adults, particularly in rural areas, could improve household food security. This might include training programs, access to financial services, and support for agricultural innovations, which align with broader developmental goals such as the United Nations Sustainable Development Goals (SDGs), including Goal 2 (Zero Hunger), Goal 8 (Decent Work and Economic Growth), and Goal 13 (Climate Action). While environmental degradation might lead to short-term gains in food production, sustainable agricultural practices are needed to ensure long-term food security. Governments should focus on promoting environmentally sustainable agricultural methods to avoid the negative long-term consequences of environmental degradation. By adopting practices such as agroforestry, crop diversification, and soil conservation, policymakers can address environmental challenges while safeguarding food systems for future generations.

This study was limited by the unavailability of existing databases on economic-policy uncertainty variables for Nigeria. To address this, a three-year moving standard deviation was constructed for each policy variable (monetary, fiscal, and trade policies), capturing the volatility in the threshold effect of economic-policy uncertainty in Nigeria. While the two-regime threshold regression model effectively captures the non-linear relationship between economic uncertainty and food security, the analysis does not incorporate oil price volatility, a critical factor in Nigeria’s economy. Additionally, the limited set of control variables, such as agricultural infrastructure development and institutional quality, may affect the comprehensiveness of the findings. Future research should explore these factors to provide a more holistic understanding of the determinants of food security. Furthermore, comparative analyses with alternative modeling approaches could validate the findings.

Author Contributions

Conceptualization, G.C.A. and L.N.K.; methodology, G.C.A. and L.N.K.; software, G.C.A.; validation, G.C.A. and P.I.A.; formal analysis, G.C.A. and L.N.K.; investigation, L.N.K.; resources, G.C.A., L.N.K. and P.I.A.; data curation, L.N.K.; writing—original draft preparation, L.N.K. writing—review and editing, G.C.A.; visualization, G.C.A. and L.N.K.; supervision, G.C.A. and P.I.A.; project administration, G.C.A. and P.I.A.; funding acquisition, G.C.A. and L.N.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data is available from authors upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Normality test for EPU and food security.

Table A1.

Serial Correlation LM Test for EPU and food security.

Table A1.

Serial Correlation LM Test for EPU and food security.

| Breusch–Godfrey Serial Correlation LM Test: | |||

| Null hypothesis: No serial correlation at up to 4 lags | |||

| F-statistic | 1.922 | Prob. F(4,20) | 0.146 |

| Obs*R-squared | 12.773 | Prob. -Square(4) | 0.012 |

Table A2.

Heteroskedasticity Test for EPU and food security.

Table A2.

Heteroskedasticity Test for EPU and food security.

| Heteroskedasticity Test: Breusch–Pagan–Godfrey | |||

| Null hypothesis: Homoskedasticity | |||

| F-statistic | 0.886 | Prob. F(23,23) | 0.613 |

| Obs*R-squared | 22.075 | Prob. Chi-Square(23) | 0.516 |

| Scaled-explained SS | 8.193 | Prob. Chi-Square(23) | 0.998 |

Figure A2.

CUSUM Stability Test for EPU and Dietary Energy Supply.

Figure A3.

CUSUM of Squares Stability Test for EPU and food security.

Table A3.

BDS test for food security.

Table A3.

BDS test for food security.

| Dimension | BDS Statistic | Std. Error | z-Statistic | Prob. |

|---|---|---|---|---|

| 2 | 0.165 | 0.01 | 16.018 | 0.000 |

| 3 | 0.264 | 0.017 | 15.996 | 0.000 |

| 4 | 0.327 | 0.02 | 16.45 | 0.000 |

| 5 | 0.361 | 0.021 | 17.18 | 0.000 |

| 6 | 0.371 | 0.02 | 18.126 | 0.000 |

References

- Abbas, S., & Alnafrah, I. (2024). Food security in Pakistan: Investigating the spillover effect of Russia-Ukraine conflict. Sustainable Futures, 8, 1–11. [Google Scholar] [CrossRef]

- Adeyemo, R., Alabi, R., & Ogunleye, O. (2020). Financial deepening and food security in Nigeria. African Journal of Agricultural Research, 15(4), 585–594. [Google Scholar]

- Agyemang, S. A., Ratinger, T., & Bavorová, M. (2022). The impact of agricultural input subsidy on productivity: The case of Ghana. European Journal of Development Research, 34(3), 1460–1485. [Google Scholar] [CrossRef]

- Ahir, H., Bloom, N., & Furceri, D. (2022). The world uncertainty index. (No. 29763). National Bureau of Economic Research. [Google Scholar]

- Algifahri, A., & Heriqbaldi, U. (2023). The Influence of economic uncertainty on food security and the moderating role of trade openness in developing countries. JDE (Journal of Developing Economies), 8(2), 271–284. [Google Scholar] [CrossRef]

- Alnour, M., Altintaş, H., & Rahmane, M. N. (2023). Unveiling the asymmetric response of global food prices to the energy price shocks and economic policy uncertainty. Resources Policy, 86, 1–13. [Google Scholar] [CrossRef]

- Aluko, O. I. (2020). Agricultural policy and food security in Nigeria: A rational choice analysis. In The palgrave handbook of agricultural and rural development in Africa (pp. 475–491). Springer. [Google Scholar] [CrossRef]

- Arshad, A. (2022). Impact of financial inclusion on food security: Evidence from developing countries. International Journal of Social Economics, 49(3), 1–15. [Google Scholar] [CrossRef]

- Aye, G. C. (2018). Causality between economic policy uncertainty and real housing returns in emerging economies: A cross-sample validation approach. Cogent Economics and Finance, 6(1), 1473708. [Google Scholar] [CrossRef]

- Aye, G. C., Clance, M. W., & Gupta, R. (2019). The effectiveness of monetary and fiscal policy shocks on U.S. inequality: The role of uncertainty. Quality and Quantity, 53(1), 283–295. [Google Scholar] [CrossRef]

- Beyene, S. D. (2023). The impact of food insecurity on health outcomes: Empirical evidence from sub-Saharan African countries. BMC Public Health, 23, 338. [Google Scholar] [CrossRef] [PubMed]

- Cantore, N., Antimiani, A., & Anciaes, P. R. (2012). Energy price shocks: Sweet and sour consequences for developing countries. (Overseas development institute working papers series 335). Overseas Development Institute. [Google Scholar]

- Cao, Y., Cheng, S., & Xinran, L. (2023). How economic policy uncertainty affects asymmetric spillovers in food and oil prices: Evidence from wavelet analysis. Resources Policy, 86, 1–13. [Google Scholar] [CrossRef]

- Che, X., & Jiang, M. (2021). Economic policy uncertainty, financial expenditure and energy poverty: Evidence based on a panel threshold model. Sustainability, 13(21), 11594. [Google Scholar] [CrossRef]

- Chen, D., Gummi, U. M., Lu, S., & Hassan, A. (2024). Oil price, economic policy uncertainty, and food prices in oil-exporting and oil-importing developing economies. Economic Change and Restructuring, 57(4), 1–22. [Google Scholar] [CrossRef]

- Chen, H., Chong, T. T. L., & Bai, J. (2012). Theory and applications of TAR model with two threshold variables. Econometric Reviews, 31(2), 142–170. [Google Scholar] [CrossRef]

- Chen, H., Zhang, J., Tao, Y., & Tan, F. (2019). Asymmetric GARCH type models for asymmetric volatility characteristics analysis and wind power forecasting. Protection and Control of Modern Power Systems, 4(1), 1–11. [Google Scholar] [CrossRef]

- Chong, T. T. L., & Yan, I. K. (2014). Estimating and testing threshold regression models with multiple threshold variables. University Library of Munich. [Google Scholar]

- Dejuan-Bitria, D., Ghirelli, C., Blanco, R., Coricelli, F., Carrascal, C. M., Moral, E., Urtasun, A., & Wagner, M. (2021). Economic policy uncertainty and investment in Spain. SERIEs: Journal of the Spanish Economic Association, 12, 351–388. [Google Scholar] [CrossRef]

- Edohen, O. P., & Ikelegbe, O. O. (2018). Labour use types, agricultural income of farm household in Nigeria: An evidence from rural benin. Knowledge Review, 37(1), 1–9. [Google Scholar]

- FAO. (1996). Rome declaration on world food security and world food summit plan of action. Food and Agriculture Organization of the United Nations. [Google Scholar]

- FAO. (2008). An introduction to the basic concepts of food security. FAO. [Google Scholar]

- FAO. (2009). The state of food insecurity in the world. FAO. [Google Scholar]

- FAO. (2010). Guidelines for the integrated food security phase classification (IPC). FAO. [Google Scholar]

- FAO. (2013). The state of food and agriculture. FAO. [Google Scholar]

- FAO. (2023). Nigeria at a glance | FAO in Nigeria | Food and Agriculture Organization of the United Nations. Available online: https://www.fao.org/nigeria/fao-in-nigeria/nigeria-at-a-glance/en/ (accessed on 4 February 2024).

- Frimpong, S., Gyamfi, E. N., Ishaq, Z., Kwaku Agyei, S., Agyapong, D., & Adam, A. M. (2021). Can global economic policy uncertainty drive the interdependence of agricultural commodity prices? Evidence from partial wavelet coherence analysis. Complexity, 2021, 8848424. [Google Scholar] [CrossRef]

- Haddad, L., Alderman, H., Appleton, S., Song, L., & Yohannes, Y. (2003). Reducing child malnutrition: How far does income growth take us? The World Bank Economic Review, 17, 107–131. [Google Scholar] [CrossRef]

- Hansen, B. E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics, 93(2), 345–368. [Google Scholar] [CrossRef]

- Hao, L., & Ki-Seong, L. (2024). The impact of economic policy uncertainty on agricultural prices: Evidence from China. Asia and the Global Economy, 4, 100100. [Google Scholar] [CrossRef]

- Hebebrand, C., & Laborde, D. (2022). High fertilizer prices contribute to rising global food security concerns. Available online: https://www.ifpri.org/blog/high-fertilizer-prices-contribute-rising-global-food-security-concerns/ (accessed on 5 April 2024).

- Hoddinott, J. F. (1999). Choosing outcome indicators of household food security; Technical guide: Strengthening the household food security and nutritional aspects of IFAD poverty alleviation projects: Developing operational methodologies for project design and monitoring. Available online: https://hdl.handle.net/10568/161284 (accessed on 5 April 2024).

- Iorember, P. T., Yusoff, N. Y. M., Abachi, P. T., Usman, O., & Alola, A. A. (2024). Effect of exchange rate uncertainty, energy prices and sectoral spending on agriculture value added, household consumption, and domestic investment. Heliyon, 10, 1–15. [Google Scholar] [CrossRef]

- Iwu, N. H. (2020). Food security and population growth in Nigeria. IJRDO-Journal of Social Science and Humanities Research, 5(4), 93–113. [Google Scholar]

- Kang, W., Lee, K., & Ratti, R. A. (2014). Economic policy uncertainty and firm-level investment. Journal of Macroeconomics, 39, 42–53. [Google Scholar] [CrossRef]

- Kjelberg, C. (2022). Protection motivation theory. Available online: https://www.communicationtheory.org/protection-motivation-theory/ (accessed on 14 March 2023).

- Kotur, L. N., Aye, G. C., & Ater, P. I. (2024b). Asymmetric effects of economic policy uncertainty on agricultural growth in Nigeria. In Reference module in social sciences. Elsevier BV. [Google Scholar] [CrossRef]

- Kotur, L. N., Aye, G. C., & Ayoola, J. B. (2024a). Asymmetric effects of economic policy uncertainty on food security in Nigeria. Journal of Risk and Financial Management, 17(3), 114. [Google Scholar] [CrossRef]

- Kotur, L. N., Aye, G. C., & Biam, C. K. (2020). Effect of economic policy uncertainty on poverty. Journal of Agricultural Economics, Extension and Science, 6, 75–89. [Google Scholar]

- Kumar, B. N. (2022). Food insecurity in South Asia: A national security implication for India. Available online: https://chintan.indiafoundation.in/ (accessed on 15 March 2023).

- Lagos, K., & Wang, Y. (2022). The threshold effects of global economic uncertainty on foreign direct investment. Transnational Corporations, 29(1), 75–105. [Google Scholar] [CrossRef]

- Lesame, K. (2021). WIDER working paper 2021/52—The asymmetric impact of economic policy uncertainty on firm-level investment in South Africa: Firm-level evidence from administrative tax data. WIDER. [Google Scholar]

- Ling, L., Zhang, J., & Zhou, H. (2024). Time-varying nonlinear connections among global economic policy uncertainty, food prices, and maritime transport. Maritime Economics and Logistics, 26(3), 414–435. [Google Scholar] [CrossRef]

- Mamo, S., Tegegne, G., & Gashaw, T. (2019). The effect of demographic factors on food security in Ethiopia: Evidence from household survey data. Sustainability, 11(7), 1972. [Google Scholar]

- Meni, F., & Kimunio, I. (2024). Inflation targeting and its effect on food price volatility in Kenya. African Journal of Emerging Issues, 6(10), 93–110. [Google Scholar]

- Metu, A. G., Okeyika, K. O., & Maduka, O. D. (2016, May 9–11). Achieving sustainable food security in Nigeria: Challenges and the way forward. 3rd International Conference on African Development Issues (CU-ICADI) (pp. 182–187), Ota, Nigeria. [Google Scholar]

- Mittenzwei, K., Persson, T., Höglind, M., & Kværnø, S. (2017). Combined effects of climate change and policy uncertainty on the agricultural sector in Norway. Agricultural Systems, 153, 118–126. [Google Scholar] [CrossRef]

- Moges, A., Bogale, A., & Haile, M. (2020). Inflation and food security in Ethiopia: Evidence from the consumer price index. Journal of Food Security, 8(3), 85–92. [Google Scholar]

- NAN. (2022, September 15). Agriculture contributes 23% to GDP in 2022—Minister—Nigeria—The Guardian Nigeria News—Nigeria and World News. The Guardian. Available online: https://guardian.ng/news/agriculture-contributes-23-to-gdp-in-2022-minister/ (accessed on 20 February 2024).

- Nwoko, I. C., Aye, G. C., & Asogwa, B. C. (2016). Effect of oil price on Nigeria’s food price volatility. Cogent Food & Agriculture, 2, 1146057. [Google Scholar] [CrossRef]

- Ogunlesi, A. O., & Bokana, K. G. (2018). Dynamics of agricultural productivity in Sub Saharan Africa: A P-ARDL model approach. Acta Universitatis Danubius Oeconomica, 14(3), 148–172. [Google Scholar]

- Oguntegbe, K., Okoruwa, V., Obi-Egbedi, O., & Olagunju, K. (2018). Population growth problems and food security in Nigeria. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3330999 (accessed on 7 October 2024).

- Ojo, E. O., & Adebayo, P. F. (2012). Food security in Nigeria: An overview. European Journal of Sustainable Development, 1(2), 199–222. [Google Scholar]

- Okou, C., Spray, J. A., & Unsal, F. D. (2022). Staple food prices in sub-saharan Africa: An empirical assessment. Available online: https://www.elibrary.imf.org/ (accessed on 18 June 2024).

- Olarinde, M., & Abdullahi, H. (2014). Macroeconomic policy and agricultural output in Nigeria: Implications for food security. American Journal of Economics, 2014(2), 99–113. [Google Scholar] [CrossRef]

- Olowoyo, O. J. (2023). Global economic uncertainty and exchange rate in Nigeria: A toda-yamamoto approach top rated economist, researcher, and data analyst at upwork global Inc. Global Scientific Journals, 11(2), 1291–1305. Available online: https://www.researchgate.net/publication/368575829 (accessed on 2 April 2024).

- Oluwaseyi, A. (2017). The prospects of agriculture in Nigeria: How our fathers lost their way—A review. Asian Journal of Economics, Business and Accounting, 4(2), 1–30. [Google Scholar] [CrossRef]

- Onwe, J. C., Ojide, M. G., Subhan, M., & Forgenie, D. (2024). Food security in Nigeria amidst globalization, economic expansion, and population growth: A wavelet coherence and QARDL analysis. Journal of Agriculture and Food Research, 18, 1–10. [Google Scholar]

- Osabohien, R., Adeleye, N., & De Alwis, T. (2020). Agro-financing and food production in Nigeria. Heliyon, 6(5), e04001. [Google Scholar] [CrossRef]

- Pangaribowo, E. H., Nicolas, G., & Maximo, T. (2013). Food and nutrition security indicators: A review. ZEF Working Paper No. 108. Available online: https://ssrn.com/abstract=2237992 (accessed on 7 October 2024).

- Robert, B. (2020). Environmental degradation and impacts on biodiversity. In Nature-based solutions to 21st century challenges. Routledge. Available online: https://www.researchgate.net/publication/340328 (accessed on 13 March 2024). [CrossRef]

- Rogers, C., & Kumar, D. (2023). India’s food supply chain intervention. Available online: https://www.spglobal.com/market-intelligence/en/news-insights/research/indias-food-supply-chain-intervention (accessed on 15 March 2024).

- Sadati, A. K., Nayedar, M., Zartash, L., & Falakodin, Z. (2021). Challenges for food security and safety: A qualitative study in an agriculture supply chain company in Iran. Agriculture and Food Security, 10(1), 41. [Google Scholar] [CrossRef]

- Schmidt, J., Dannenberg, P., & Henniges, W. (2020). Environmental degradation and food security: An empirical analysis. Ecological Economics, 169, 106508. [Google Scholar]

- Sen, A. (1981). Poverty and famines: An essay on entitlement and deprivation. Oxford University Press. [Google Scholar]

- Shillair, R. (2020). Protection motivation theory. The International Encyclopedia of Media Psychology, 3, 70–106. [Google Scholar] [CrossRef]

- Shoaib, S. A., Khan, M. Z. K., Sultana, N., & Mahmood, T. H. (2021). Quantifying uncertainty in food security modeling. Agriculture, 11(1), 33. [Google Scholar] [CrossRef]

- Su, F., Liu, Y., Chen, S.-H., & Fahad, S. (2023). Towards the impact of economic policy uncertainty on food security: Introducing a comprehensive heterogeneous framework for assessment. Journal of Cleaner Production, 386, 135792. [Google Scholar] [CrossRef]

- Subramanian, Y., & Masron, T. A. (2021). Food security and environmental degradation: Evidence from development countries. Geojournal, 86, 1141–1153. [Google Scholar] [CrossRef]

- Sun, L., Zheng, W., Hu, Z., & Ning, Z. (2024). Food security under global economic policy uncertainty: Fresh insights from the ocean transportation of food. In Maritime economics and logistics. Springer. Available online: https://link.springer.com/article/10.1057/s41278-023-00282-w (accessed on 14 August 2024).

- Tadesse, T., Ayele, G., & Mohammed, A. (2019). Land degradation and food security in the highlands of Ethiopia: A review. Food Security, 11(2), 273–290. [Google Scholar]

- Theodore, A. I., Sunday, E. O., Olusuyi, A. E., & Lawrence, I. (2023). Agricultural productivity, population growth and food security in sub-Saharan Africa. Innovations, 72, 235–247. [Google Scholar]

- Thomas, A., & Turk, R. (2023). Food insecurity in Nigeria: Food supply matters Nigeria. Selected issues paper No. 2023/018. International Monetary Fund. [Google Scholar]

- Tsongo, G. M., Wirajing, M. A. K., Ningaye, P., & Nchofoung, N. N. (2024). Food security and financial inclusion in Africa: Exploring the role of educational development. International Review of Applied Economics, 1–26. [Google Scholar] [CrossRef]

- Ugwuh, M. G., Aye, G. C., & Abu, G. A. (2023). Asymmetric effect of world oil price on agricultural growth in Nigeria: A nonlinear ARDL analysis (1970–2020). Journal of Agricultural Economics, Extension and Science (JAEES), 9(1), 135–152. [Google Scholar]

- Umar, M., Hossain, M., & Ameen, A. (2020). Financial inclusion and food security in Nigeria: Evidence from the recent survey. International Journal of Development Issues, 19(1), 18–30. [Google Scholar]

- UN. (2018). Transforming our world: The 2030 agenda for sustainable development. United Nations. [Google Scholar]

- WFP. (2020). World Food Programme annual performance report for 2019. Agenda item 4 WFP/EB.A/2020/4-A, Annual reports. Executive Board Annual session Rome, 29 June–3 July 2020. Available online: https://executiveboard.wfp.org/document_download/WFP-0000115522 (accessed on 14 August 2024).

- World Bank. (2000). World development report 2000/2001: Attacking poverty. World Bank. [Google Scholar]

- Zhang, Y., Tam, J., & Wang, J. (2022). Does economic policy uncertainty undermine the stability of agricultural imports? Evidence from China. PLoS ONE, 17(3), e0265279. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Y. (2020). The influence and impact of the exchange rate on the economy. E3S Web of Conferences, 214, 03007. [Google Scholar] [CrossRef]

- Zhu, H., Huang, R., Wang, N., & Hau, L. (2019). Does economic policy uncertainty matter for commodity market in China? Evidence from quantile regression. Applied Economics, 52(21), 1–17. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).