PCA-Based Investor Attention Index and Its Impact on the KSE-100 Excess Returns

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Discussion

2.2. The Measurement of Investor Attention

2.3. The Impact of Investor Attention on Stock Markets

3. Methodology

3.1. Data Sources and Variables

3.2. Aggregate Attention Index and Principal Component Analysis (PCA)

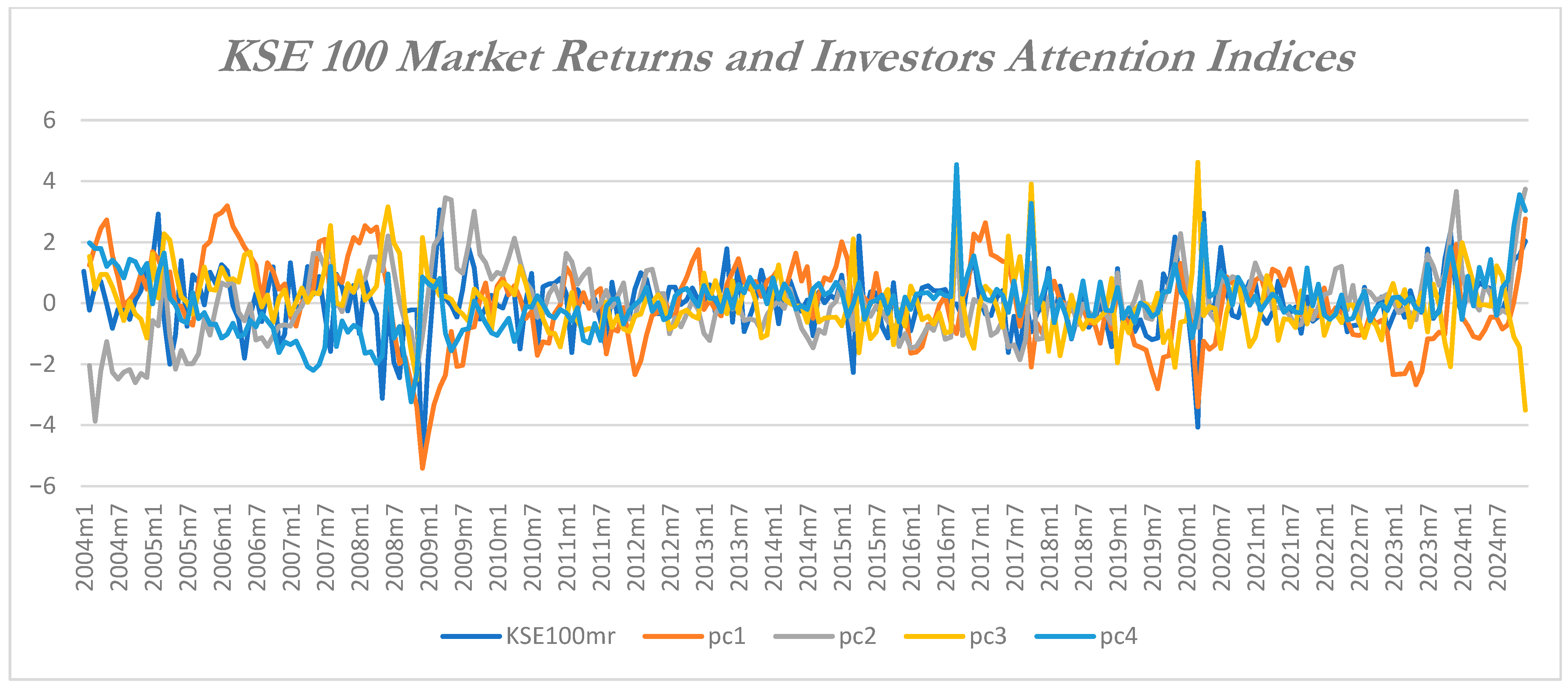

4. Results and Discussion

4.1. Descriptive and Correlation Analysis

4.2. Attention Index Construction Through PCA and Its Impact on Stock Market Returns of KSE-100 Index

5. Discussion

6. Conclusions, Limitations, Implications, and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Descriptive Statistics of Standardized Variables

| Variables | Obs | Mean | Std. Dev. | Min | Max | p1 | p99 | Skew. | Kurt. |

| 252 | 0 | 1 | −4.856 | 3.132 | −2.566 | 2.394 | −0.504 | 5.309 | |

| 252 | 0 | 1 | −4.046 | 1.203 | −2.687 | 1.203 | −0.974 | 3.628 | |

| 252 | 0 | 1 | −1.211 | 4.616 | −1.198 | 3.228 | 1.061 | 4.872 | |

| 252 | 0 | 1 | −2.718 | 3.743 | −2.149 | 2.788 | 0.58 | 3.707 | |

| 252 | 0 | 1 | −3.169 | 3.175 | −2.792 | 2.658 | −0.22 | 3.967 | |

| 252 | 0 | 1 | −3.688 | 7.115 | −1.81 | 3.574 | 2.585 | 18.498 | |

| 252 | 0 | 1 | −2.31 | 3.351 | −2.22 | 2.752 | 0.269 | 2.965 | |

| 252 | 0 | 1 | −1.739 | 3.432 | −1.667 | 2.668 | 1.257 | 4.088 |

Appendix B. Matrix of Correlations of Standardized Variables

| Variables | ||||||||

| 1.000 | ||||||||

| 0.387 | 1.000 | |||||||

| −0.077 | 0.007 | 1.000 | ||||||

| 0.112 | 0.382 | 0.094 | 1.000 | |||||

| −0.288 | −0.051 | 0.007 | 0.117 | 1.000 | ||||

| −0.176 | −0.160 | 0.157 | 0.094 | 0.143 | 1.000 | |||

| 0.271 | 0.187 | −0.063 | 0.229 | −0.335 | −0.095 | 1.000 | ||

| 0.163 | 0.131 | −0.255 | 0.264 | 0.043 | −0.089 | 0.327 | 1.000 |

Appendix C. Augmented Dickey–Fuller Test Results of Standardized Index Variables

| Variable | ADF p-Value |

| 0.0000 | |

| 1.0000 | |

| 0.0000 | |

| 0.0000 | |

| 0.0207 | |

| 0.0000 | |

| 0.0140 | |

| 0.0138 | |

| 0.0000 |

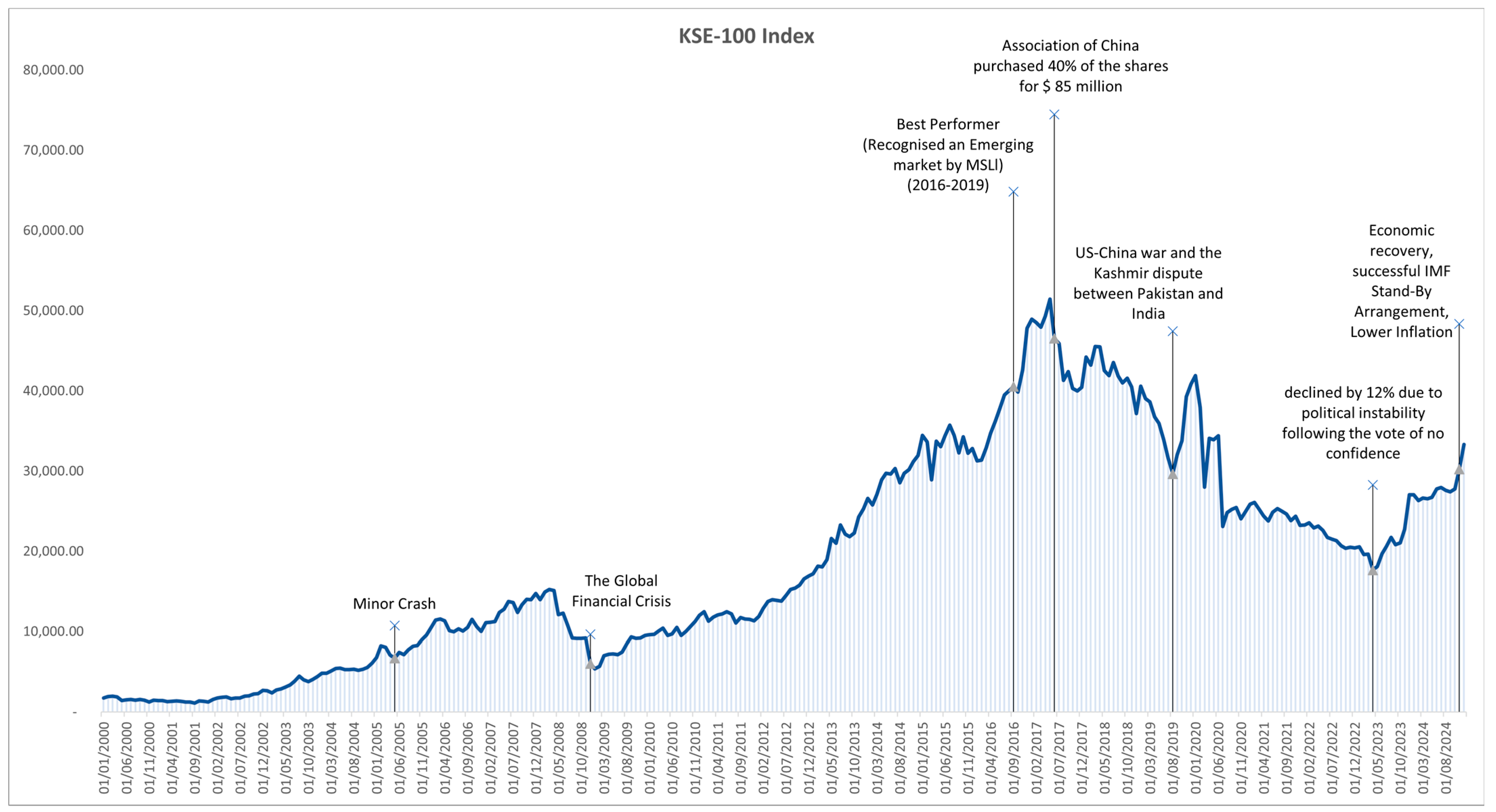

Appendix D. Graphical Analysis

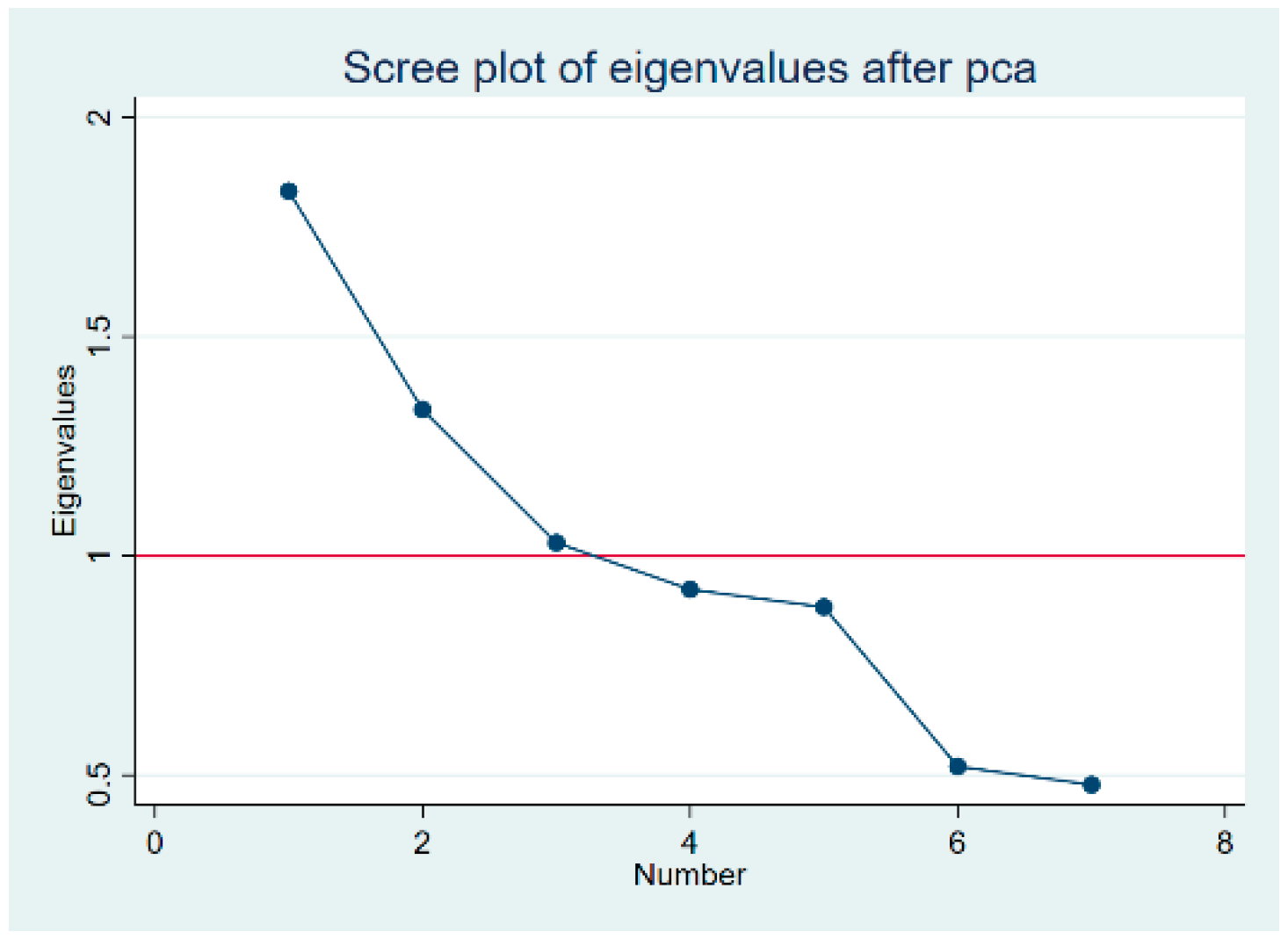

Appendix E. Screeplot

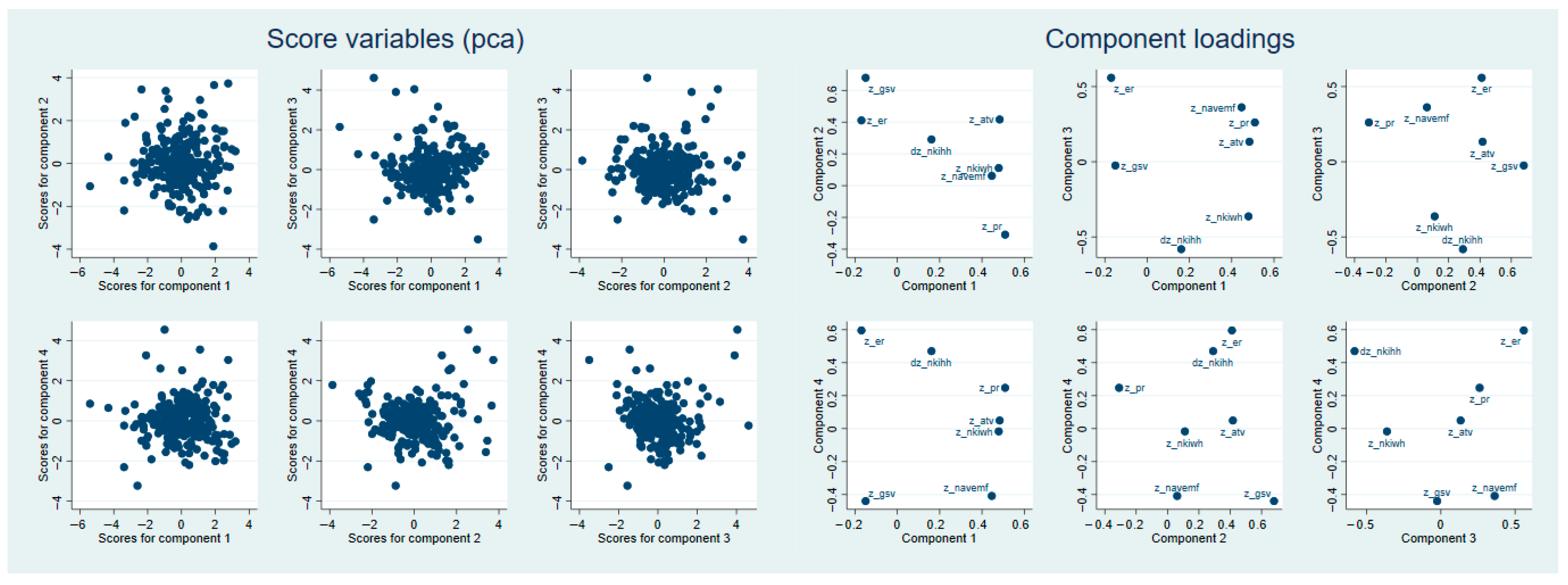

Appendix F. Score and Loading Plots

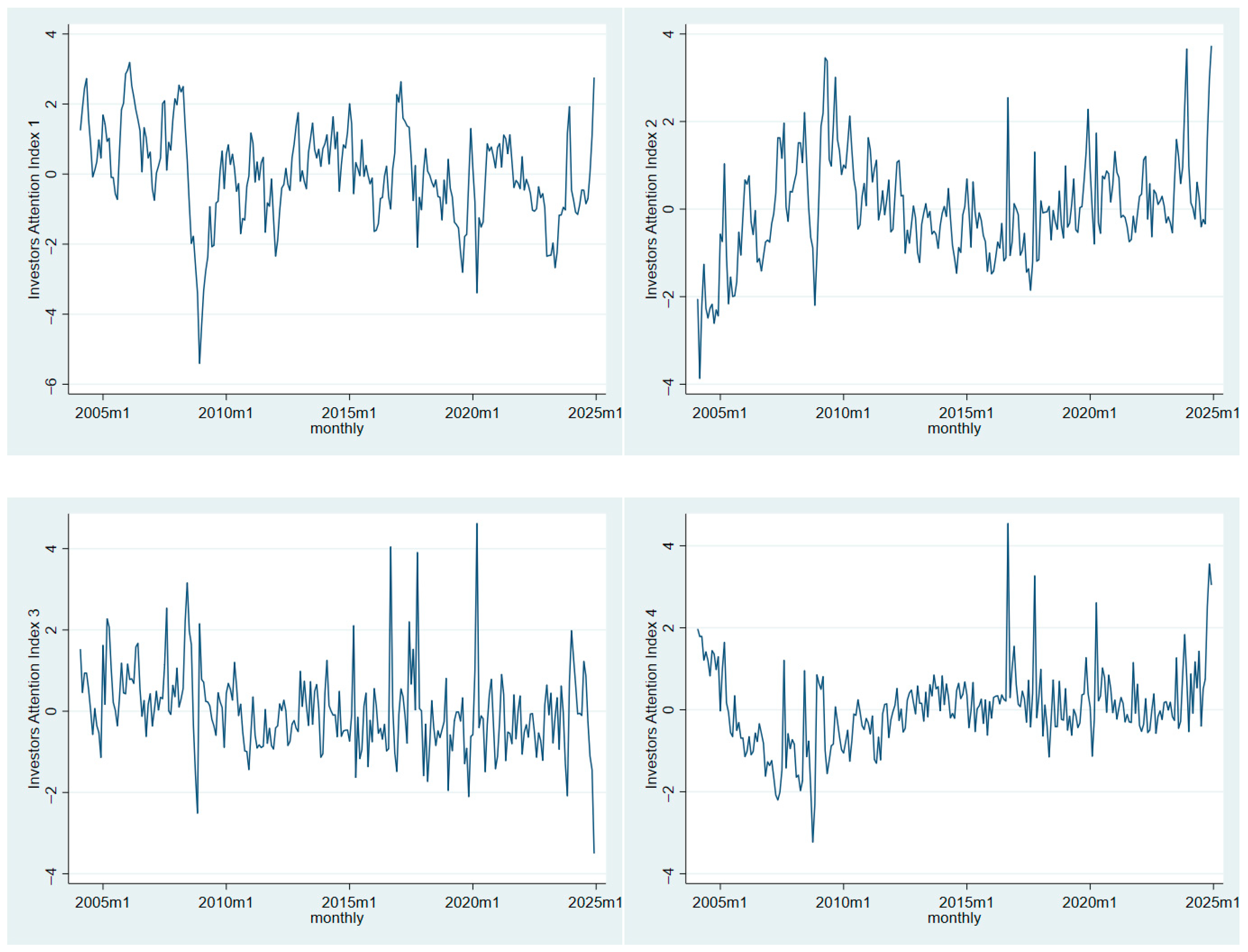

Appendix G. Indices Line Graphs and Augmented Dickey–Fuller Test Results of Indices

| Variable | ADF p-Value |

| 0.0001 | |

| 0.0000 | |

| 0.0000 | |

| 0.0000 |

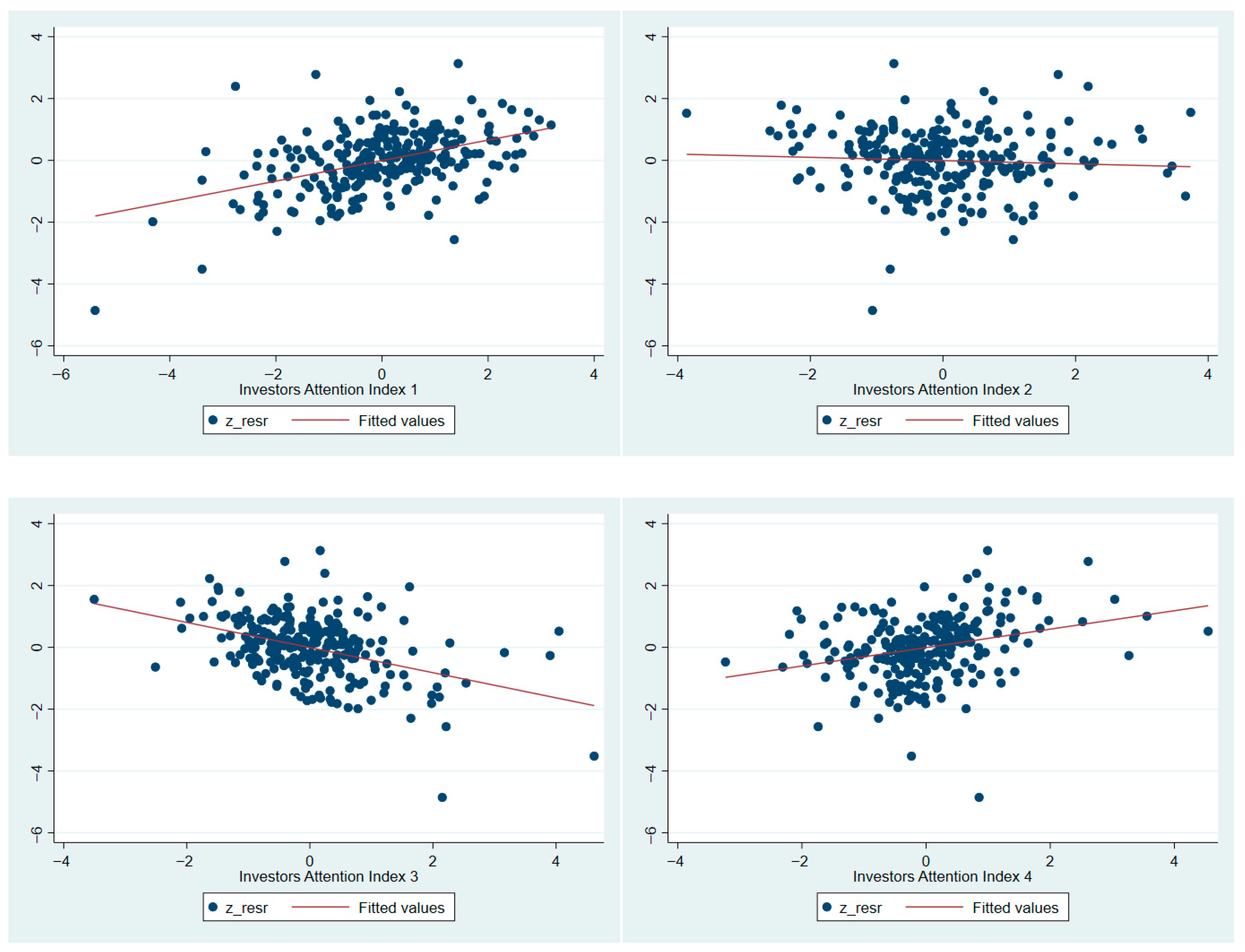

Appendix H. Scatterplots-Linearity

Appendix I. OLS Regression Estimation and Assumptions Results

| OLS Regression Estimation and Assumptions Results | |||||||||||||

| Regress | Dependent Variable | Investor Attention Index | Beta Coefficients | p-Value | Alpha Coefficients | p-Value | F-Stats | F-Test p-Value | Adj R2 | Durbin-Watson | Jarque–Bera | Hettest | VIF |

| 1 | 0.332 | 0.000 | −0.008 | −0.890 | 63.75 | 0.000 | 0.200 | 1.424 | 0.000 | 0.000 | 1.000 | ||

| 2 | −0.052 | 0.335 | −0.008 | 0.902 | 0.93 | 0.3346 | −0.000 | 1.313 | 0.000 | 0.912 | 1.000 | ||

| 3 | −0.406 | 0.000 | −0.008 | 0.892 | 51.72 | 0.000 | 0.169 | 0.916 | 0.000 | 0.000 | 1.000 | ||

| 4 | 0.298 | 0.000 | −0.008 | 0.898 | 22.53 | 0.000 | 0.079 | 1.29 | 0.000 | 0.207 | 1.000 | ||

Appendix J. Orthogonalized Rotation Results

| Component | Variance | Difference | Proportion | Cumulative |

| Comp1 | 1.675 | 0.401 | 0.239 | 0.239 |

| Comp2 | 1.274 | 0.180 | 0.182 | 0.421 |

| Comp3 | 1.094 | 0.078 | 0.156 | 0.577 |

| Comp4 | 1.076 | . | 0.154 | 0.731 |

| Variable | Comp1 | Comp2 | Comp3 | Comp4 | Unexplained |

| 0.346 | 0.4189 | 0.427 | |||

| 0.8159 | 0.287 | ||||

| 0.577 | 0.320 | ||||

| 0.810 | 0.164 | ||||

| 0.930 | 0.073 | ||||

| 0.390 | −0.57 | 0.271 | |||

| 0.609 | −0.339 | 0.341 |

| Comp1 | Comp2 | Comp3 | Comp4 | |

| Comp1 | 0.883 | −0.332 | 0.264 | −0.200 |

| Comp2 | 0.285 | 0.779 | 0.354 | 0.432 |

| Comp3 | 0.308 | −0.122 | −0.721 | 0.609 |

| Comp4 | −0.210 | −0.520 | 0.534 | 0.635 |

References

- Abdi, H., & Williams, L. J. (2010). Principal component analysis. Wiley Interdisciplinary Reviews: Computational Statistics, 2(4), 433–459. [Google Scholar] [CrossRef]

- Abideen, Z. U., Ahmed, Z., Qiu, H., & Zhao, Y. (2023). Do behavioral biases affect investors’ investment decision making? Evidence from the Pakistani equity market. Risks, 11(6), 109. [Google Scholar] [CrossRef]

- Aboody, D., Lehavy, R., & Trueman, B. (2010). Limited attention and the earnings announcement returns of past stock market winners. Review of Accounting Studies, 15(2), 317–344. [Google Scholar] [CrossRef]

- Ali, A., & Sharif, S. (2022). Stock market efficiency: The Pakistan stock exchange merger. Afro-Asian Journal of Finance and Accounting, 12(4), 455–478. [Google Scholar] [CrossRef]

- Aouadi, A., Arouri, M., & Teulon, F. (2013). Investor attention and stock market activity: Evidence from France. Economic Modelling, 35, 674–681. [Google Scholar] [CrossRef]

- Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. The Journal of Finance, 61(4), 1645–1680. [Google Scholar] [CrossRef]

- Baker, M., & Wurgler, J. (2007). Investor sentiment in the stock market. Journal of Economic Perspectives, 21(2), 129–151. [Google Scholar] [CrossRef]

- Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. (2020). COVID-induced economic uncertainty (No. w26983). National Bureau of Economic Research. Available online: https://www.nber.org/system/files/working_papers/w26983/w26983.pdf (accessed on 20 May 2024).

- Banerjee, A. V. (1992). A simple model of herd behavior. The Quarterly Journal of Economics, 107(3), 797–817. [Google Scholar] [CrossRef]

- Barber, B. M., & Odean, T. (2008). All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Review of Financial Studies, 21(2), 785–818. [Google Scholar] [CrossRef]

- Barberis, N., & Huang, M. (2001). Mental accounting, loss aversion, and individual stock returns. The Journal of Finance, 56(4), 1247–1292. [Google Scholar] [CrossRef]

- Ben-Rephael, A., Da, Z., & Israelsen, R. D. (2017). It depends on where you search: Institutional investor attention and underreaction to news. The Review of Financial Studies, 30(9), 3009–3047. [Google Scholar] [CrossRef]

- Bikhchandani, S., Hirshleifer, D., & Welch, I. (1992). A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy, 100(5), 992–1026. [Google Scholar] [CrossRef]

- Cattell, R. B. (1966). The scree test for the number of factors. Multivariate Behavioral Research, 1(2), 245–276. [Google Scholar] [CrossRef]

- Chang, S. L., Chien, C. Y., Lee, H. C., & Lin, C. (2018). Historical high and stock index returns: Application of the regression kink model. Journal of International Financial Markets, Institutions and Money, 52, 48–63. [Google Scholar] [CrossRef]

- Chemmanur, T. J., & Yan, A. (2019). Advertising, attention, and stock returns. Quarterly Journal of Finance, 9(3). [Google Scholar] [CrossRef]

- Chen, J., Tang, G., Yao, J., & Zhou, G. (2022). Investor attention and stock returns. Journal of Financial and Quantitative Analysis, 57(2), 455–484. [Google Scholar] [CrossRef]

- Chen, T. (2017). Investor attention and global stock returns. Journal of Behavioral Finance, 18(3), 358–372. [Google Scholar] [CrossRef]

- Choi, S., & Choi, W. Y. (2019). Effects of limited attention on investors’ trading behavior: Evidence from online ranking data. Pacific Basin Finance Journal, 56, 273–289. [Google Scholar] [CrossRef]

- Chu, G., Goodell, J. W., Shen, D., & Zhang, Y. (2022). Machine learning to establish proxies for investor attention: Evidence of improved stock-return prediction. Annals of Operations Research, 318(1), 103–128. [Google Scholar] [CrossRef]

- Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461–1499. [Google Scholar] [CrossRef]

- Ding, R., & Hou, W. (2015). Retail investor attention and stock liquidity. Journal of International Financial Markets, Institutions and Money, 37, 12–26. [Google Scholar] [CrossRef]

- Düz Tan, S., & Taş, O. (2019). Investor attention and stock returns: Evidence from Borsa Istanbul. Borsa Istanbul Review, 19(2), 106–116. [Google Scholar] [CrossRef]

- Fama, E. F. (1970). Efficient capital markets. Journal of Finance, 25(2), 383–417. [Google Scholar] [CrossRef]

- Field, A. (2024). Discovering statistics using IBM SPSS statistics. Sage publications limited. [Google Scholar]

- Ghani, M., Guo, Q., Ma, F., & Li, T. (2022). Forecasting Pakistan stock market volatility: Evidence from economic variables and the uncertainty index. International Review of Economics & Finance, 80, 1180–1189. [Google Scholar] [CrossRef]

- Gill, R. K., & Bajwa, R. (2018). Study on behavioral finance, behavioral biases, and investment decisions. International Journal of Accounting and Financial Management Research, 8(3), 1–14. [Google Scholar] [CrossRef]

- Guan, C., Yu, B., & Bi, S. (2021). A novel profit cutting mechanism for Chinese banks: Theory and multi-dimensional evidence. The North American Journal of Economics and Finance, 58, 101541. [Google Scholar] [CrossRef]

- Hair, J. F. (2009). Multivariate data analysis. Pearson. [Google Scholar]

- He, M., Zhang, Y., Wen, D., & Wang, Y. (2021). Forecasting crude oil prices: A scaled PCA approach. Energy Economics, 97, 105189. [Google Scholar] [CrossRef]

- Hillert, A., & Ungeheuer, M. (2015). Ninety years of media coverage and the cross-section of stock returns. SSRN Electronic Journal, March. 1–2. [Google Scholar] [CrossRef]

- Hirshleifer, D., Hsu, P. H., & Li, D. (2013). Innovative efficiency and stock returns. Journal of Financial Economics, 107(3), 632–654. [Google Scholar] [CrossRef]

- Hirshleifer, D., & Teoh, S. H. (2003). Limited attention, information disclosure, and financial reporting. Journal of Accounting and Economics, 36, 337–386. [Google Scholar] [CrossRef]

- Hong, H., & Stein, J. C. (1999). A unified theory of underreaction, momentum trading, and overreaction in asset markets. The Journal of Finance, 54(6), 2143–2184. [Google Scholar] [CrossRef]

- Huang, L., & Liu, H. (2007). Rational inattention and portfolio selection. The Journal of Finance, 62(4), 1999–2040. [Google Scholar] [CrossRef]

- Ibikunle, G., McGroarty, F., & Rzayev, K. (2020). More heat than light: Investor attention and bitcoin price discovery. International Review of Financial Analysis, 69, 101459. [Google Scholar] [CrossRef]

- Jaffri, A., Shirvani, A., Jha, A., Rachev, S. T., & Fabozzi, F. J. (2025). Optimizing portfolios with Pakistan-exposed exchange-traded funds: Risk and performance insight. Journal of Risk and Financial Management, 18(3), 158. [Google Scholar] [CrossRef]

- Jamal, A. H., & Ashraf, A. (2024). How demutualization of Pakistan stock exchange affected determinants of foreign portfolio investment in Pakistan? International Journal of Management Research and Emerging Sciences, 14(2), 87–101. [Google Scholar] [CrossRef]

- Jolliffe, I. T., & Cadima, J. (2016). Principal component analysis: A review and recent developments. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 374(2065), 20150202. [Google Scholar] [CrossRef]

- Joyo, A. S., & Lefen, L. (2019). Stock market integration of Pakistan with its trading partners: A multivariate DCC-GARCH model approach. Sustainability, 11(2), 303. [Google Scholar] [CrossRef]

- Kahneman, D. (1973). Attention and effort (Vol. 1063, pp. 218–226). Prentice-Hall. [Google Scholar]

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–292. [Google Scholar] [CrossRef]

- Li, J., & Yu, J. (2012). Investor attention, psychological anchors, and stock return predictability. Journal of Financial Economics, 104(2), 401–419. [Google Scholar] [CrossRef]

- Li, Z., Liu, J., Liu, J., Liu, X., & Wu, C. (2025). Investor attention and stock price manipulation: Evidence from daily quasi-natural experiments. Journal of Banking & Finance, 179, 107528. [Google Scholar] [CrossRef]

- Li, Z., Liu, J., Liu, X., & Wu, C. (2024). Investor attention and stock price efficiency: Evidence from quasi-natural experiments in China. Financial Management, 53(1), 175–225. [Google Scholar] [CrossRef]

- Lou, D. (2014). Attracting investor attention through advertising. Review of Financial Studies, 27(6), 1797–1829. [Google Scholar] [CrossRef]

- Ludvigson, S. C., & Ng, S. (2007). The empirical risk–return relation: A factor analysis approach. Journal of Financial Economics, 83(1), 171–222. [Google Scholar] [CrossRef]

- Mangi, F. (2016). Pakistan stocks jump most in a year as MSCI seen luring Cash, bloomberg. Available online: https://www.bloomberg.com/news/articles/2016-06-15/pakistani-stocks-jump-most-this-year-after-upgrade-from-msci (accessed on 10 March 2025).

- Merton, R. C. (1987). A simple model of capital market equilibrium with incomplete information. The Journal of Finance, 42, 483–510. [Google Scholar] [CrossRef]

- Miller, E. M. (1977). Risk, uncertainty, and divergence of opinion. The Journal of Finance, 32(4), 1151–1168. [Google Scholar] [CrossRef]

- Mooi, E., Sarstedt, M., & Mooi-Reci, I. (2018). Principal component and factor analysis. In Market research (Springer Texts in Business and Economics). Springer. [Google Scholar] [CrossRef]

- Neely, C. J., Rapach, D. E., Tu, J., & Zhou, G. (2014). Forecasting the equity risk premium: The role of technical indicators. Management Science, 60(7), 1772–1791. [Google Scholar] [CrossRef]

- Oprea, A. (2022). The use of principal component analysis (PCA) in building yield curve scenarios and identifying relative-value trading opportunities on the Romanian government bond market. Journal of Risk and Financial Management, 15(6), 247. [Google Scholar] [CrossRef]

- Pakistan Stock Exchange. (2024, April 1). PSX—A historical perspective. Available online: https://www.psx.com.pk/psx/psx-blog-articles/psx-a-historical-perspective (accessed on 9 August 2025).

- Pakistan Stock Exchange. (2025, June). KSE100 index. Available online: https://www.psx.com.pk/psx/themes/psx/uploads/KSE-100-and-KSE100-PR-Brochure-Jun-2025-Updated.pdf (accessed on 9 August 2025).

- Pakistan Stock Exchange Annual Report. (2024). Available online: https://www.psx.com.pk/psx/themes/psx/uploads/Annual-Report-2024.pdf (accessed on 9 August 2025).

- Pashler, H., Johnston, J. C., & Ruthruff, E. (2001). Attention and performance. Annual Review of Psychology, 52(1), 629–651. [Google Scholar] [CrossRef]

- Peng, L., & Xiong, W. (2006). Investor attention, overconfidence and category learning. Journal of Financial Economics, 80(3), 563–602. [Google Scholar] [CrossRef]

- Resta, M. (2016). Enhancing self-organizing map capabilities with graph clustering: An application to financial markets. Intelligent Systems in Accounting, Finance and Management, 23(1–2), 21–46. [Google Scholar] [CrossRef]

- Seasholes, M. S., & Wu, G. (2007). Predictable behavior, profits, and attention. Journal of Empirical Finance, 14(5), 590–610. [Google Scholar] [CrossRef]

- Shah, S. Z. A., Ahmad, M., & Mahmood, F. (2018). Heuristic biases in investment decision-making and perceived market efficiency: A survey at the Pakistan stock exchange. Qualitative Research in Financial Markets, 10(1), 85–110. [Google Scholar] [CrossRef]

- Sharif, S. (2018). From mutualized exchange to investor-owned demutualized entity: The case of Pakistan stock exchange. International Journal of Experiential Learning & Case Studies, 3(2), 1–8. [Google Scholar] [CrossRef]

- Simon, H. A. (1955). A behavioral model of rational choice. The Quarterly Journal of Economics, 69(1), 99–118. [Google Scholar] [CrossRef]

- Smales, L. A. (2021). Investor attention and global market returns during the COVID-19 crisis. International Review of Financial Analysis, 73, 101616. [Google Scholar] [CrossRef]

- Song, Z., Gong, X., Zhang, C., & Yu, C. (2023). Investor sentiment based on scaled PCA method: A powerful predictor of realized volatility in the Chinese stock market. International Review of Economics & Finance, 83, 528–545. [Google Scholar] [CrossRef]

- Subramaniam, S., & Chakraborty, M. (2020). Investor attention and cryptocurrency returns: Evidence from quantile causality approach. Journal of Behavioral Finance, 21(1), 103–115. [Google Scholar] [CrossRef]

- Tversky, A., & Kahneman, D. (1973). Availability: A heuristic for judging frequency and probability. Cognitive Psychology, 5(2), 207–232. [Google Scholar] [CrossRef]

- Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases: Biases in judgments reveal some heuristics of thinking under uncertainty. Science, 185(4157), 1124–1131. [Google Scholar] [CrossRef]

- Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323. [Google Scholar] [CrossRef]

- Wang, B., Long, W., & Wei, X. (2018). Investor attention, market liquidity and stock return: A new perspective. Asian Economic and Financial Review, 8(3), 341. [Google Scholar] [CrossRef]

- Wang, X. (2006). On the effects of dimension reduction techniques on some high-dimensional problems in finance. Operations Research, 54(6), 1063–1078. [Google Scholar] [CrossRef]

- Wold, S., Esbensen, K., & Geladi, P. (1987). Principal component analysis. Chemometrics and Intelligent Laboratory Systems, 2(1–3), 37–52. [Google Scholar] [CrossRef]

- Yahya, F., Shaohua, Z., Abbas, U., & Waqas, M. (2021). COVID-19-induced returns, attention, sentiments and social isolation: Evidence from dynamic panel model. Global Business Review. [Google Scholar] [CrossRef]

- Yao, T., Zhang, Y. J., & Ma, C. Q. (2017). How does investor attention affect international crude oil prices? Applied Energy, 205, 336–344. [Google Scholar] [CrossRef]

- Yuan, Y. (2015). Market-wide attention, trading, and stock returns. Journal of Financial Economics, 116(3), 548–564. [Google Scholar] [CrossRef]

- Zahid, S., & Saleem, H. M. N. (2025). A comparison of machine learning algorithms to predict stock price during COVID-19 outbreaks: An empirical investigation of Pakistan stock exchange. Global Business Review, 09721509251316121. [Google Scholar] [CrossRef]

- Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 36, 101528. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W., Shen, D., Zhang, Y., & Xiong, X. (2013). Open source information, investor attention, and asset pricing. Economic Modelling, 33, 613–619. [Google Scholar] [CrossRef]

- Zou, L., Cao, K. D., & Wang, Y. (2019). Media coverage and the cross-section of stock returns: The Chinese evidence. International Review of Finance, 19(4), 707–729. [Google Scholar] [CrossRef]

| Variables | Symbol and Operationalization | Definition | |

|---|---|---|---|

| Abnormal Trading Volume | (1) | In Equation (1), is the equal-weighted abnormal trading volume () at time across all stocks. It is calculated as a ratio of the stock’s trading volume () at time to its average trading volume () over the previous year. According to Barber and Odean (2008), when abnormally heavy trading volumes are observed in the stock market, investors are more attracted to these shares than usual. Hence, it is a measure of the market-level attention index. | |

| Extreme Returns | (2) | According to Barber and Odean (2008), investors notice extreme one-day returns, positive or negative, mostly when news about the company occurs. Hence, extreme returns play a significant role in measuring investors’ attention. In Equation (2), is ratio of extreme returns () at the end of each month to the average of extreme returns over the previous one year for each stock (). Hence, it is the equal-weighted extreme returns at time across all stocks. | |

| Past Returns | Aboody et al. (2010) highlighted that stocks with sharp past returns attract investors’ attention. Also, the company’s earnings announcements grab attention; hence, there is a need to include a past returns proxy in the investors’ attention index. is the cumulative monthly returns for the past twelve months for each stock at time is calculated which is the equally weighted past return across all stocks (J. Chen et al., 2022). | ||

| Nearness to the KSE-100 Index 52-Week High | (3) | To empirically test psychological anchoring and limited investor attention, J. Li and Yu (2012) used Nearness to the Index 52-week high () and historical high proxies. Furthermore, the authors stated that helps in measuring the extent of underreaction and in predicting the aggregate market returns. In Equation (3), is the ratio of the current level of KSE-100 index () at the end of month to its 52-week high () at month . | |

| Nearness to the KSE-100 Index Historical High | (4) | J. Li and Yu (2012) used Nearness to the KSE-100 index historical high () specifically to examine when the current price is far from the historical high price, which is the time when investors react to the bad news. The authors stated that investors overreact because there has been a series of bad news in the past, and prolonged news has a negative impact on future market returns. In Equation (4), is the ratio of the current KSE-100 index () at the end of the month to its historical high () at the end of month . The is the maximum index value of KSE-100 price index dataset from January 2004 to December 2024. | |

| Google Search Volume | Da et al. (2011) proposed Google aggregate search frequency as a direct measure of investors’ attention. is the monthly aggregate search frequency of companies listed on KSE-100 index from Google Trends using their stock ticker. The data is available from January 2004 onwards. | ||

| Equity Mutual Funds Inflow | denotes the net asset value of mutual fund inflow for each equity mutual fund at the end of the month . Like J. Chen et al. (2022), we computed the equal-weighted mutual funds inflow as a proxy for the market level. | ||

| KSE 100 Index Returns | (5) | is the index returns, is the KSE-100 index price at time and is the index price at time . | |

| KSE 100 Index Excess Returns | (6) | is the KSE-100 index excess market returns. It is the difference of and (three-month treasury bill rate) | |

| Variables | Obs | Mean | SD | Min | Max | P1 | P99 | Skew | Kurt |

|---|---|---|---|---|---|---|---|---|---|

| 252 | 0.861 | 0.115 | 0.395 | 1 | 0.552 | 1 | −0.974 | 3.628 | |

| 252 | 0.241 | 0.164 | 0.041 | 1 | 0.044 | 0.772 | 1.061 | 4.872 | |

| 252 | 0.996 | 0.365 | 0.004 | 2.361 | 0.212 | 2.013 | 0.58 | 3.707 | |

| 252 | 10.442 | 2.862 | 1.373 | 19.529 | 2.451 | 18.049 | −0.22 | 3.967 | |

| 252 | 0.08 | 0.021 | 0.001 | 0.233 | 0.041 | 0.157 | 2.585 | 18.498 | |

| 252 | 0.238 | 0.346 | −0.56 | 1.397 | −0.529 | 1.19 | 0.269 | 2.965 | |

| 252 | 2404.885 | 659.002 | 1258.838 | 4666.711 | 1306.07 | 4163.147 | 1.257 | 4.088 | |

| 252 | −0.088 | 0.081 | −0.483 | 0.167 | −0.297 | 0.107 | −0.504 | 5.309 |

| Variables | ||||||||

|---|---|---|---|---|---|---|---|---|

| 1.000 | ||||||||

| 0.387 *** | 1.000 | |||||||

| (0.000) | ||||||||

| 0.566 *** | 0.123 * | 1.000 | ||||||

| (0.000) | (0.052) | |||||||

| 0.112 * | 0.382 *** | 0.107 * | 1.000 | |||||

| (0.077) | (0.000) | (0.091) | ||||||

| −0.288 *** | −0.051 | 0.083 | 0.117 * | 1.000 | ||||

| (0.000) | (0.420) | (0.188) | (0.065) | |||||

| −0.176 *** | −0.160 ** | −0.010 | 0.094 | 0.143 ** | 1.000 | |||

| (0.005) | (0.011) | (0.877) | (0.137) | (0.023) | ||||

| 0.271 *** | 0.187 *** | 0.049 | 0.229 *** | −0.335 *** | −0.095 | 1.000 | ||

| (0.000) | (0.003) | (0.442) | (0.000) | (0.000) | (0.131) | |||

| 0.163 *** | 0.131 ** | 0.021 | 0.264 *** | 0.043 | −0.089 | 0.327 *** | 1.000 | |

| (0.009) | (0.038) | (0.737) | (0.000) | (0.497) | (0.160) | (0.000) |

| Component | Eigenvalue | Difference | Proportion | Cumulative |

|---|---|---|---|---|

| Comp1 | 1.831 | 0.498 | 0.262 | 0.262 |

| Comp2 | 1.334 | 0.303 | 0.191 | 0.452 |

| Comp3 | 1.030 | 0.107 | 0.147 | 0.599 |

| Comp4 | 0.924 | 0.040 | 0.132 | 0.731 |

| Comp5 | 0.883 | 0.363 | 0.126 | 0.857 |

| Comp6 | 0.520 | 0.042 | 0.074 | 0.932 |

| Comp7 | 0.478 | 0.000 | 0.068 | 1.000 |

| Variable | Comp1 | Comp2 | Comp3 | Comp4 | Unexplained |

|---|---|---|---|---|---|

| 0.479 | 0.111 | −0.363 | −0.017 | 0.427 | |

| 0.161 | 0.291 | −0.582 | 0.470 | 0.287 | |

| 0.484 | 0.417 | 0.133 | 0.049 | 0.320 | |

| −0.170 | 0.411 | 0.559 | 0.596 | 0.073 | |

| 0.510 | −0.309 | 0.261 | 0.248 | 0.271 | |

| −0.150 | 0.679 | −0.025 | −0.440 | 0.164 | |

| 0.447 | 0.062 | 0.362 | −0.408 | 0.341 |

| Variable | Comp 1 (PCA1) | Comp 2 (PCA2) | Comp 3 (PCA3) | Comp 4 (PCA4) | Unexplained |

|---|---|---|---|---|---|

| 0.4792 | −0.3634 | 0.4267 | |||

| −0.5816 | 0.4700 | 0.287 | |||

| 0.4836 | 0.4168 | 0.3195 | |||

| 0.4108 | 0.5585 | 0.5958 | 0.0728 | ||

| 0.5095 | −0.3087 | 0.2707 | |||

| 0.6793 | −0.4397 | 0.1642 | |||

| 0.4465 | 0.3621 | −0.4084 | 0.3407 |

| Variable | KMO |

|---|---|

| 0.5595 | |

| 0.6101 | |

| 0.5368 | |

| 0.4403 | |

| 0.5400 | |

| 0.4170 | |

| 0.5693 | |

| Overall | 0.5248 |

| Variables | Obs | Mean | Std. Dev. | Min | Max | p1 | p99 | Skew. | Kurt. |

|---|---|---|---|---|---|---|---|---|---|

| 251 | 0 | 1.353 | −5.408 | 3.188 | −3.393 | 2.859 | −0.388 | 3.797 | |

| 251 | 0 | 1.155 | −3.866 | 3.736 | −2.487 | 3.454 | 0.336 | 4.042 | |

| 251 | 0 | 1.015 | −3.505 | 4.62 | −2.102 | 3.904 | 0.919 | 6.316 | |

| 251 | 0 | 0.961 | −3.232 | 4.544 | −2.201 | 3.267 | 0.683 | 6.118 |

| Variables | |||||

|---|---|---|---|---|---|

| 1.000 | |||||

| 0.451 *** | 1.000 | ||||

| (0.000) | |||||

| −0.061 | 0.000 | 1.000 | |||

| (0.335) | (1.000) | ||||

| −0.415 *** | 0.000 | 0.000 | 1.000 | ||

| (0.000) | (1.000) | (1.000) | |||

| 0.288 *** | 0.000 | 0.000 | 0.000 | 1.000 | |

| (0.000) | (1.000) | (1.000) | (1.000) |

| Variables | Coef. | St. Er. | t-Value | p-Value | R2 | F-Test | Prob > F | Transformed DW |

|---|---|---|---|---|---|---|---|---|

| Model 1: | ||||||||

| 0.361 | 0.051 | 7.06 | 0.000 *** | 0.167 | 49.85 | 0.000 *** | 2.01 | |

| Constant | −0.009 | 0.076 | −0.12 | 0.904 | ||||

| Model 2: | ||||||||

| 0.089 | 0.066 | 1.36 | 0.176 | 0.007 | 1.85 | 0.176 | 2.10 | |

| Constant | −0.012 | 0.096 | −0.12 | 0.904 | ||||

| Model 3: | ||||||||

| −0.632 | 0.046 | −13.69 | 0.000 *** | 0.430 | 187.33 | 0.000 *** | 2.22 | |

| Constant | −0.031 | 0.120 | −0.26 | 0.796 | ||||

| Model 4: | ||||||||

| 0.320 | 0.069 | 4.65 | 0.000 *** | 0.080 | 21.67 | 0.000 *** | 2.05 | |

| Constant | −0.008 | 0.088 | −12.38 | 0.928 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thalassinos, E.; Parveen, S.; Mughal, R.; Zada, H.; Ahmed, S. PCA-Based Investor Attention Index and Its Impact on the KSE-100 Excess Returns. J. Risk Financial Manag. 2025, 18, 670. https://doi.org/10.3390/jrfm18120670

Thalassinos E, Parveen S, Mughal R, Zada H, Ahmed S. PCA-Based Investor Attention Index and Its Impact on the KSE-100 Excess Returns. Journal of Risk and Financial Management. 2025; 18(12):670. https://doi.org/10.3390/jrfm18120670

Chicago/Turabian StyleThalassinos, Eleftherios, Samina Parveen, Riffat Mughal, Hassan Zada, and Shakeel Ahmed. 2025. "PCA-Based Investor Attention Index and Its Impact on the KSE-100 Excess Returns" Journal of Risk and Financial Management 18, no. 12: 670. https://doi.org/10.3390/jrfm18120670

APA StyleThalassinos, E., Parveen, S., Mughal, R., Zada, H., & Ahmed, S. (2025). PCA-Based Investor Attention Index and Its Impact on the KSE-100 Excess Returns. Journal of Risk and Financial Management, 18(12), 670. https://doi.org/10.3390/jrfm18120670