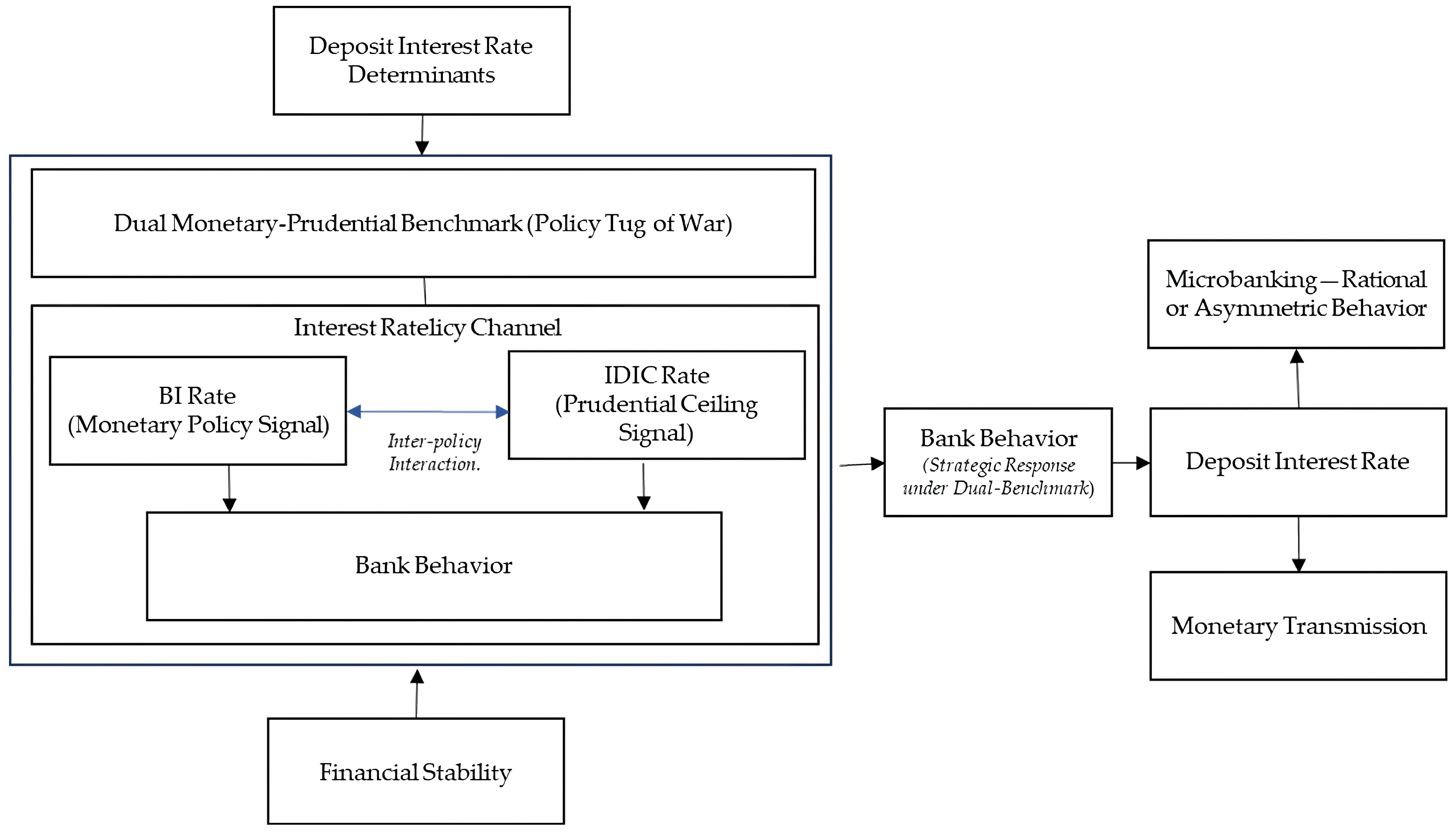

The Missing Link in Bank Behavior: Deposit Interest Rate Setting Under a Dual-Benchmark Framework—A Literature Review

Abstract

1. Introduction

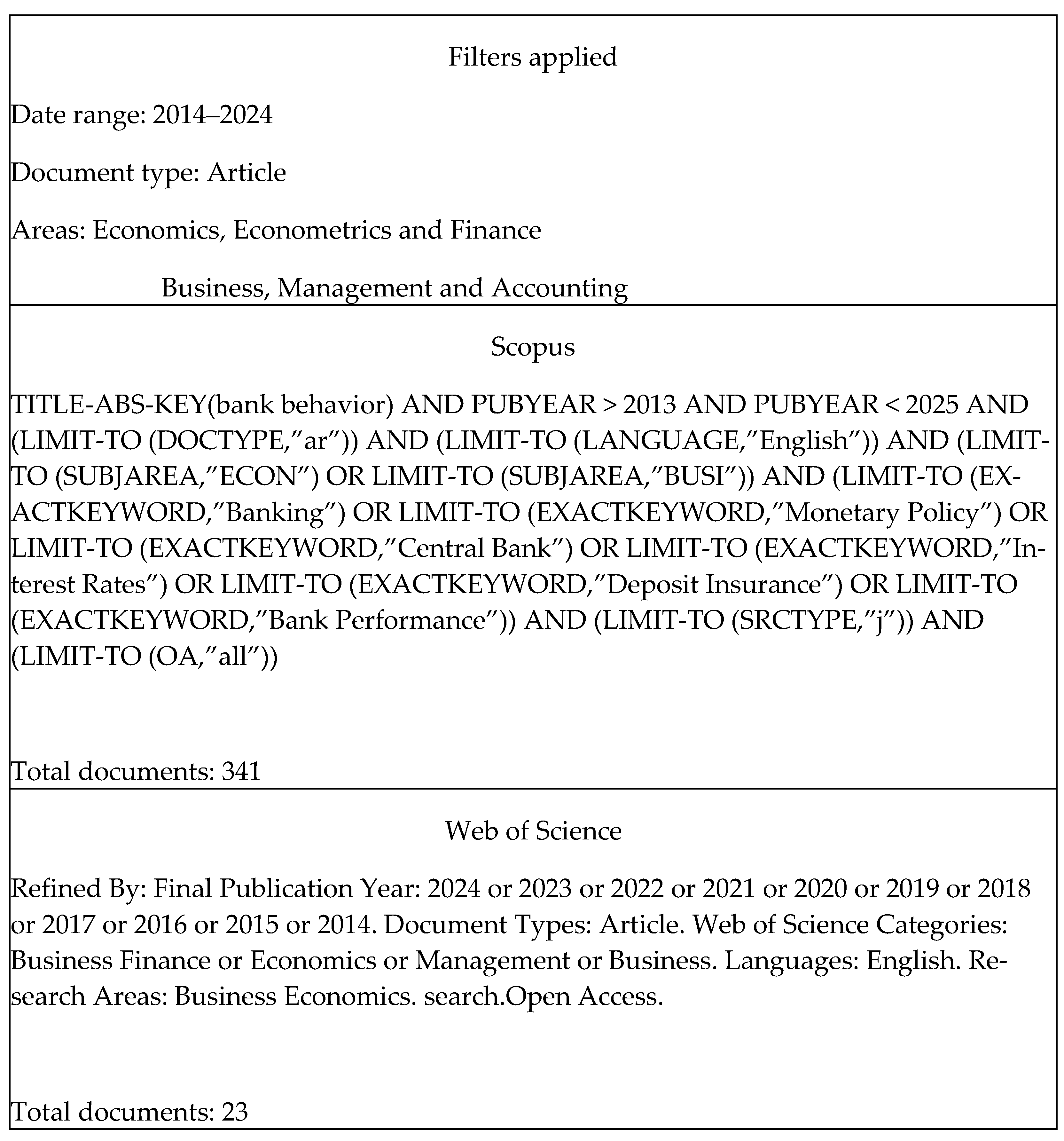

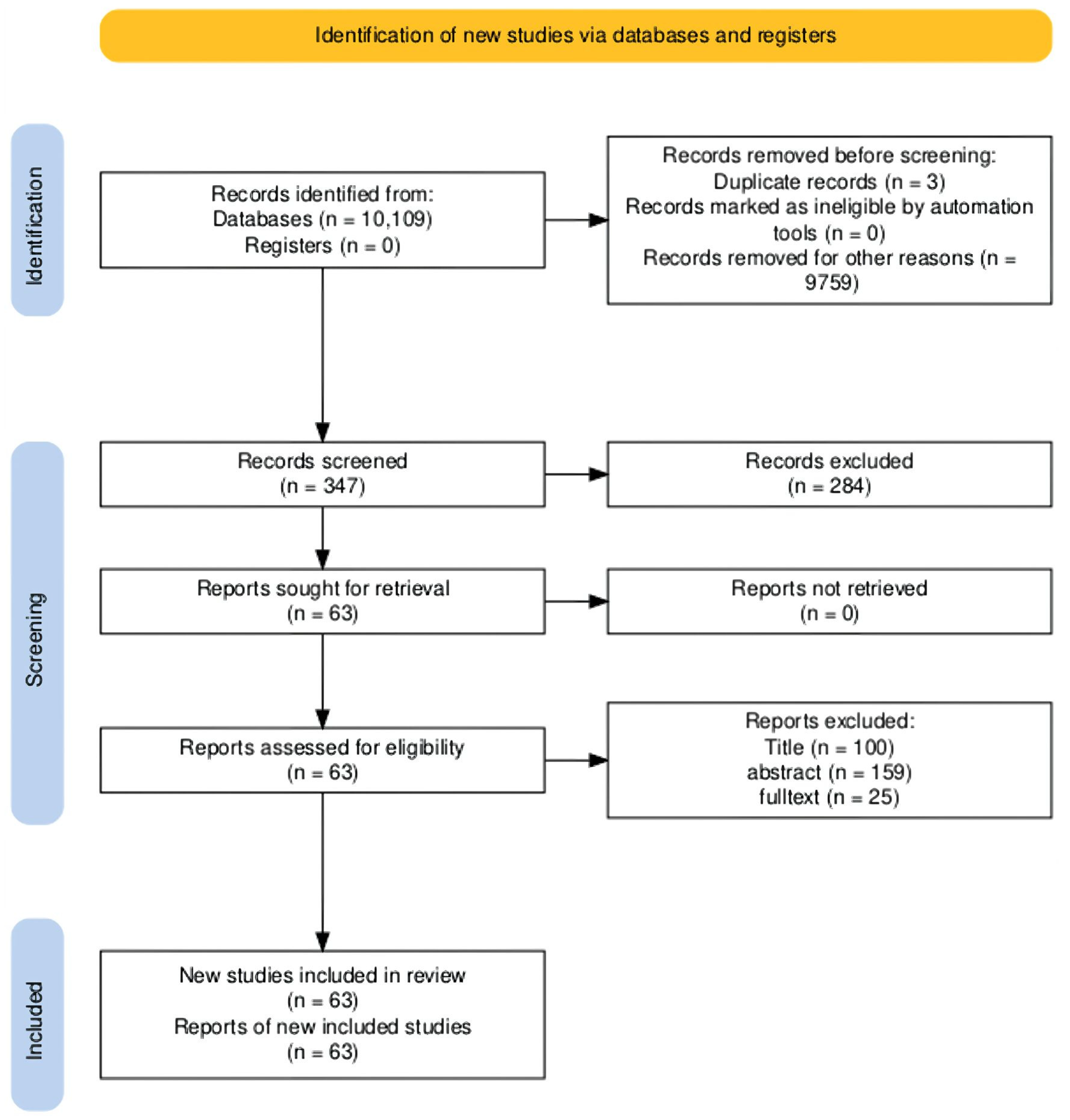

2. Methodological Approach

2.1. Methodology

2.2. Search Equation

2.3. Study Selection and Eligibility Criteria

3. Results and Discussion

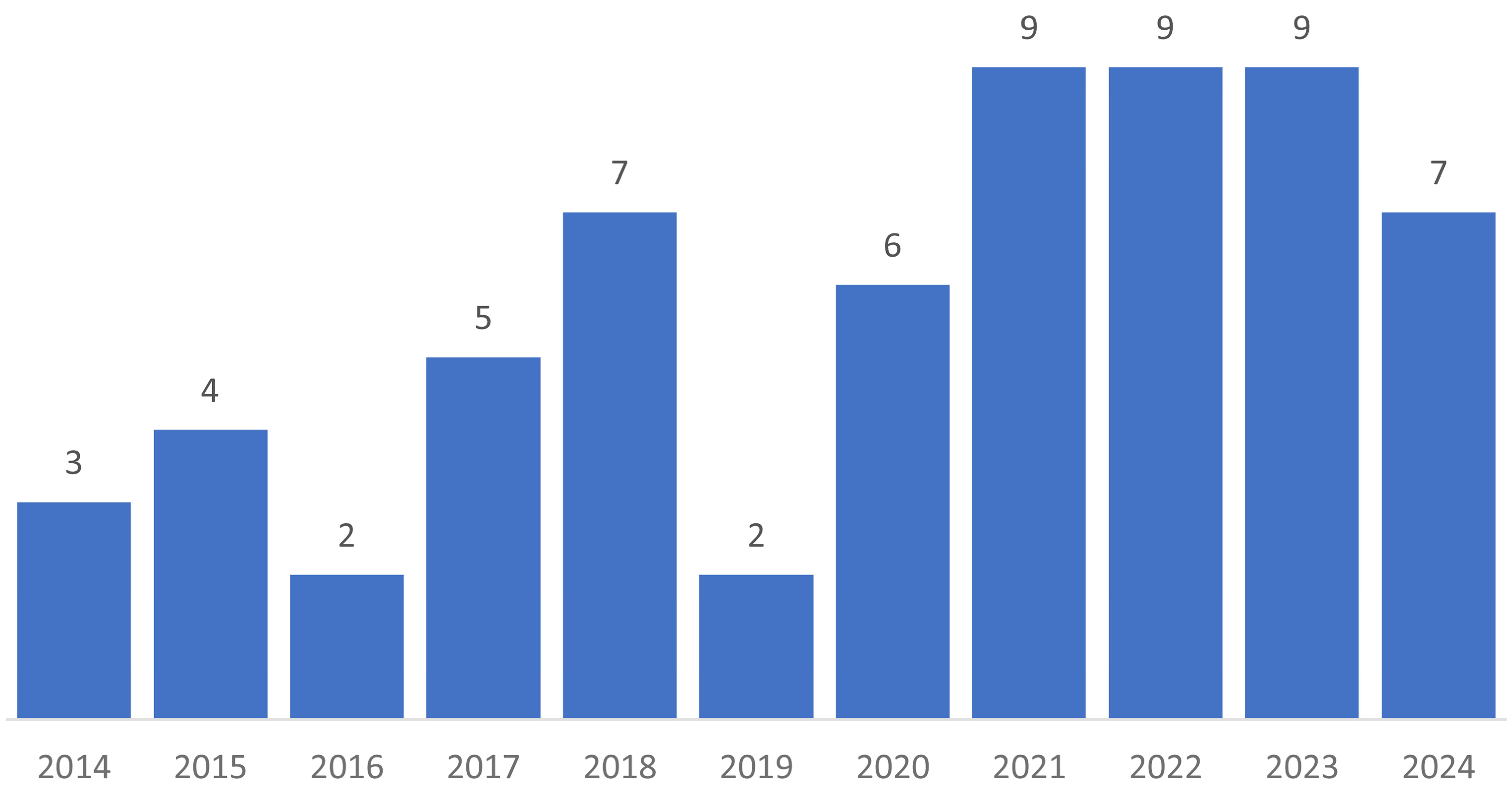

3.1. Descriptive Analysis of Included Studies

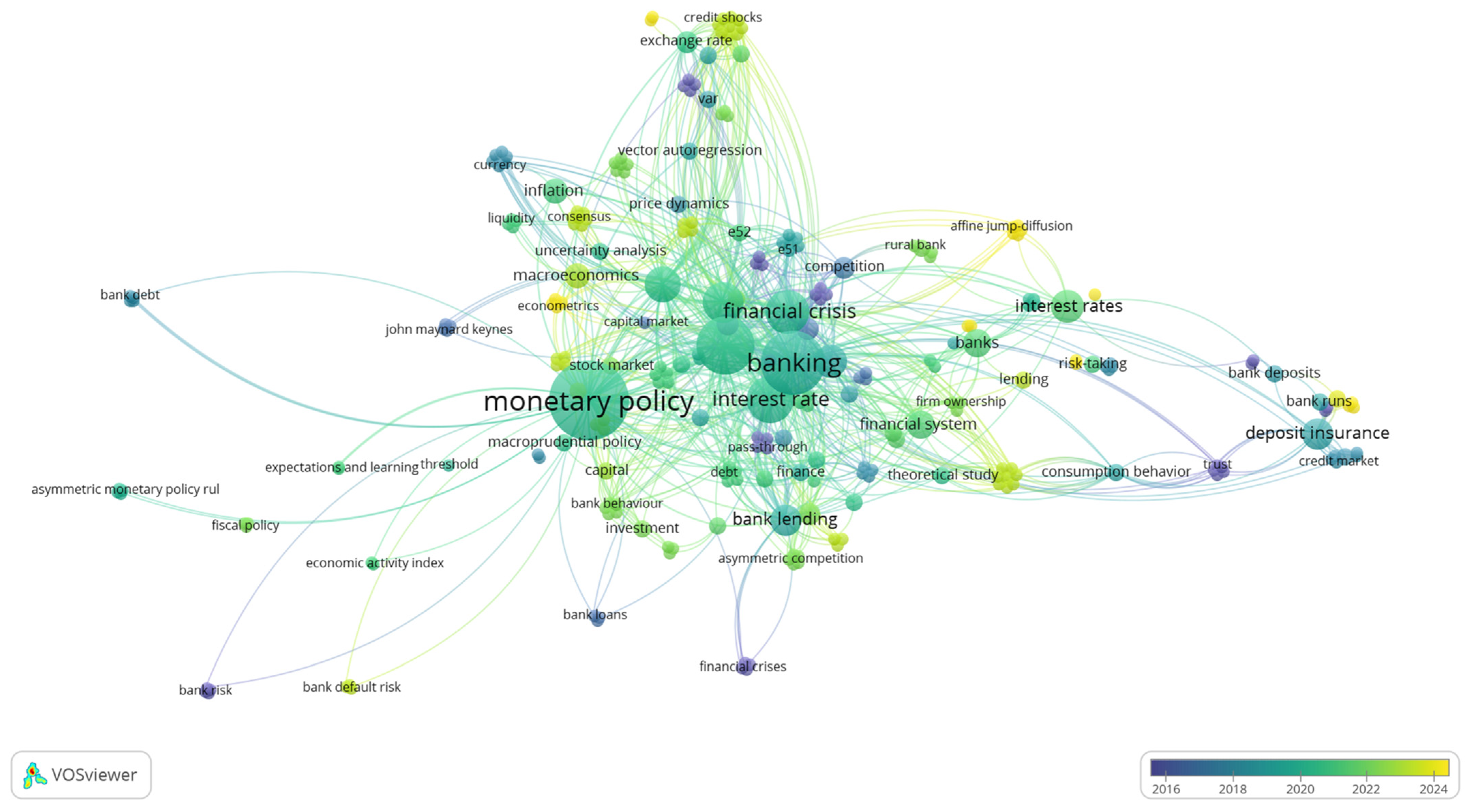

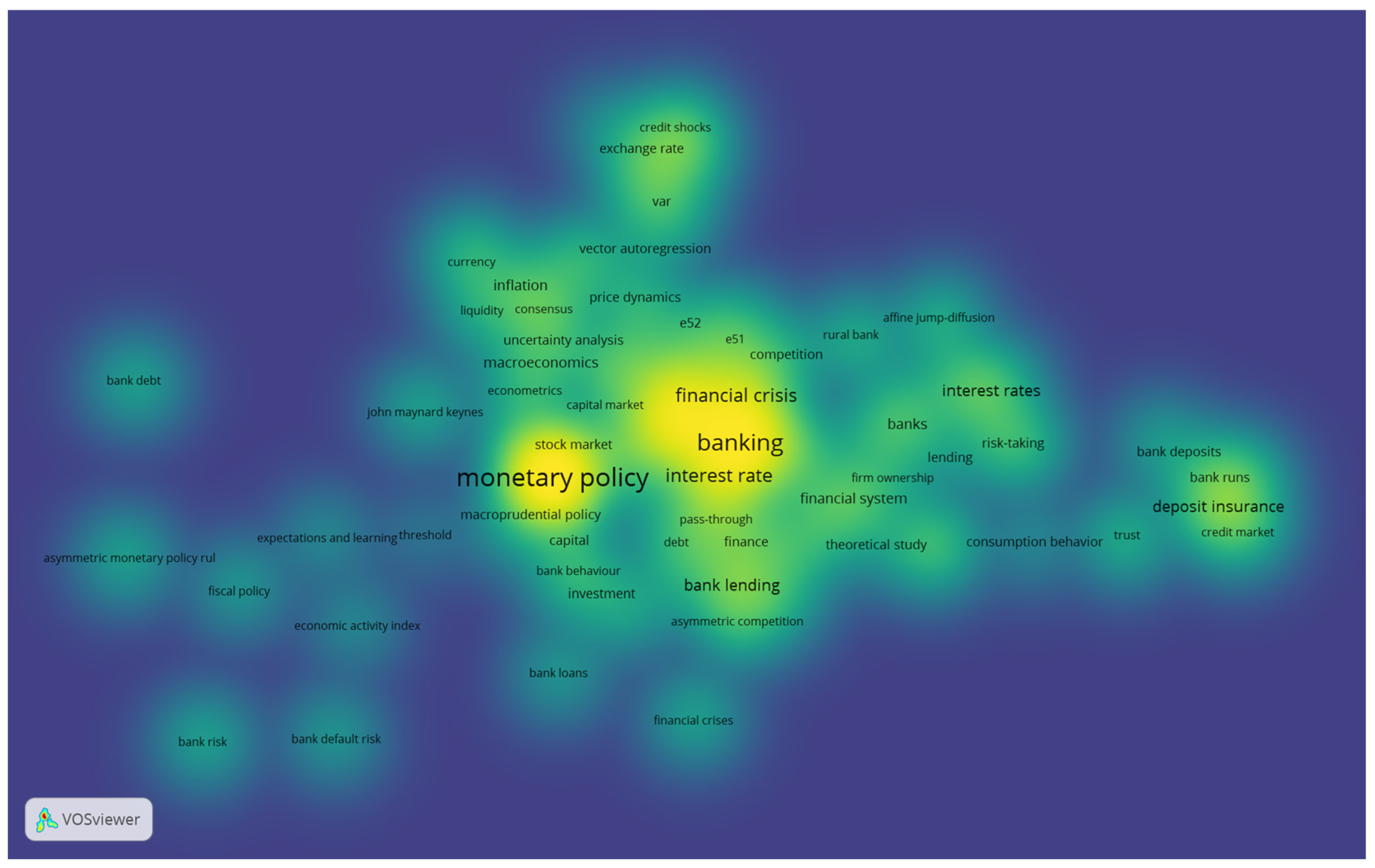

3.2. Vos Viewer Result

3.3. Thematic Study Cluster Analysis

3.4. Discussion

3.4.1. The Intellectual Structure of Bank Behavior Research

3.4.2. The Root of Fragmentation: How a Missing Focus on Deposit Rates Complicates Transmission

3.4.3. The Battle for the Benchmark: How Deposit Insurance Creates a Competing Anchor for the Deposit Rate

3.4.4. The Missing Link: The Omission of Deposit Rates in Explaining Asymmetric Bank Behavior

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Akram, T., & Li, H. (2017). What keeps long-term US interest rates so low? Economic Modelling, 60, 380–390. [Google Scholar] [CrossRef]

- Aldasoro, I., Beltrán, P., Grinberg, F., & Mancini-Griffoli, T. (2023). The macro-financial effects of international bank lending on emerging markets. Journal of International Economics, 142, 103733. [Google Scholar] [CrossRef]

- Allen, F., & Gale, D. (2004). Financial intermediaries and markets. Econometrica, 72, 1023–1061. [Google Scholar] [CrossRef]

- Altavilla, C., Burlon, L., Giannetti, M., & Holton, S. (2022). Is there a zero lower bound? The effects of negative policy rates on banks and firms. Journal of Financial Economics, 144(3), 885–907. [Google Scholar] [CrossRef]

- Anginer, D., & Demirguc-Kunt, A. (2018). Bank runs and moral hazard: A review of deposit insurance (Policy research working paper WPS 8589). World Bank. (In English) [Google Scholar]

- Aydemir, R. (2014). Empirical analysis of collusive behavior in the Turkish deposits market. Economic Research-Ekonomska Istraživanja, 27(1), 527–538. [Google Scholar] [CrossRef]

- Aysan, A. F., Disli, M., & Ozturk, H. (2017). Financial crisis, macroprudential policies and depositor discipline. The Singapore Economic Review, 62(1), 5–25. [Google Scholar] [CrossRef]

- Aysan, A. F., Disli, M., & Ozturk, H. (2018). Bank lending channel in a dual banking system: Why are Islamic banks so responsive? The World Economy, 41(3), 674–698. [Google Scholar] [CrossRef]

- Beatriz, M., Coffinet, J., & Nicolas, T. (2022). Relationship lending and SMEs’ funding costs over the cycle: Why diversification of borrowing matters. Journal of Banking & Finance, 138, 105471. [Google Scholar] [CrossRef]

- Bediako, E. A., Takawira, O., Choga, I., Otchere, I., & Siaw-Asamoah, D. (2024). Asymmetric impact of climate change on banking system stability in selected sub-Saharan economies. The Economics and Finance Letters, 11(4), 3956. [Google Scholar] [CrossRef]

- Beernaert, T., Soenen, N., & Vennet, R. V. (2023). ECB Monetary policy and the term structure of bank default risk. Journal of Risk and Financial Management, 16(12), 507. [Google Scholar] [CrossRef]

- Bernanke, B. S., & Gertler, M. (1995). Inside the black box: The credit channel of monetary policy transmission. Journal of Economic Perspectives, 9(4), 27–48. [Google Scholar] [CrossRef]

- Bhaumik, S. K., Kutan, A. M., & Majumdar, S. (2018). How successful are banking sector reforms in emerging market economies? Evidence from impact of monetary policy on levels and structures of firm debt in India. The European Journal of Finance, 24(12), 1047–1062. [Google Scholar] [CrossRef]

- Boeckx, J., de Sola Perea, M., & Peersman, G. (2020). The transmission mechanism of credit support policies in the euro area. European Economic Review, 124, 103403. [Google Scholar] [CrossRef]

- Bonfim, D., & Santos, J. A. (2023). The importance of deposit insurance credibility. Journal of Banking & Finance, 154, 106916. [Google Scholar] [CrossRef]

- Borio, C. (2011). Central banking post-crisis: What compass for uncharted waters? (BIS working papers, No. 353). Bank for International Settlements. [Google Scholar]

- Borio, C., & Zhu, H. (2012). Capital regulation, risk-taking and monetary policy: A missing link in the transmission mechanism. Journal of Financial Stability, 8(4), 236–251. [Google Scholar] [CrossRef]

- Boyle, G., Stover, R., Tiwana, A., & Zhylyevskyy, O. (2015). The impact of deposit insurance on depositor behavior during a crisis: A conjoint analysis approach. Journal of Financial Intermediation, 24(4), 590–601. [Google Scholar] [CrossRef]

- Brei, M., Borio, C., & Gambacorta, L. (2020). Bank intermediation activity in a low-interest-rate environment. Economic Notes, 49(2), e12164. [Google Scholar] [CrossRef]

- Breitenlechner, M., & Nuutilainen, R. (2023). China’s monetary policy and the loan market: How strong is the credit channel in China? Open Economies Review, 34(3), 555–577. [Google Scholar] [CrossRef]

- Buch, C. M., Eickmeier, S., & Prieto, E. (2014). Macroeconomic factors and microlevel bank behavior. Journal of Money, Credit and Banking, 46(4), 715–751. [Google Scholar] [CrossRef]

- Bui, T. T., & Kiss, G. D. (2020). Asymmetry in the reaction function of monetary policy in emerging economies. Public Finance Quarterly = Pénzügyi Szemle, 65(2), 210–224. [Google Scholar] [CrossRef]

- Bulíř, A., & Vlček, J. (2015). Monetary transmission: Are emerging market and low-income countries different? Journal of Policy Modeling, 43(1), 95–108. [Google Scholar] [CrossRef]

- Bürgi, C., & Jiang, B. (2023). Monetary policy, funding cost and banks’ risk-taking: Evidence from the USA. Empirical Economics, 65(3), 1129–1148. [Google Scholar] [CrossRef]

- Cafiso, G., & Rivolta, G. (2024). Conventional monetary interventions through the credit channel and the rise of non-bank institutions. Economic Systems, 52(2), 101150. [Google Scholar] [CrossRef]

- Chow, H. K., & Choy, K. M. (2023). Economic forecasting in a pandemic: Some evidence from Singapore. Empirical Economics, 64(5), 2105–2124. [Google Scholar] [CrossRef]

- Chun, B. J. (2024). Identifying interest rate transmission mechanism under a Bayesian network. Sustainability, 16(14), 5840. [Google Scholar] [CrossRef]

- Cotler, P., & Carrillo, R. (2024). The interest rate pass-through by loan size: Evidence for Mexico, 2011–2019. Revista Mexicana de Economía y Finanzas, 19(2), 1–21. [Google Scholar] [CrossRef]

- Creel, J., Hubert, P., & Viennot, M. (2016). The effect of ECB monetary policies on interest rates and volumes. Applied Economics, 48(47), 4477–4501. [Google Scholar] [CrossRef]

- Cucciniello, M. C., Deleidi, M., & Levrero, E. S. (2022). The cost channel of monetary policy: The case of the United States in the period 1959–2018. Structural Change and Economic Dynamics, 61, 409–433. [Google Scholar] [CrossRef]

- Da Silva, A. J., & Baczynski, J. (2024). Discretely distributed scheduled jumps and interest rate derivatives: Pricing in the context of central bank actions. Economies, 12(3), 73. [Google Scholar] [CrossRef]

- De la Horra, L. P., Perote, J., & De la Fuente, G. (2024). Beneath the surface: The asymmetric effects of unconventional monetary policy on corporate investment. Finance Research Letters, 61, 105050. [Google Scholar] [CrossRef]

- Demiralp, S., Eisenschmidt, J., & Vlassopoulos, T. (2021). Negative interest rates, excess liquidity and retail deposits: Banks’ reaction to unconventional monetary policy in the euro area. European Economic Review, 136, 103745. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., & Huizinga, H. (2004). Market discipline and deposit insurance. Journal of Monetary Economics, 51(2), 375–399. [Google Scholar] [CrossRef]

- De Roure, C., Furnagiev, S., & Reitz, S. (2015). The microstructure of exchange rate management: FX intervention and capital controls in Brazil. Applied Economics, 47(34–35), 3617–3632. [Google Scholar] [CrossRef][Green Version]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Dotsis, G. (2020). Investment under uncertainty with a zero lower bound on interest rates. Economics Letters, 188, 108954. [Google Scholar] [CrossRef]

- Drechsler, I., Savov, A., & Schnabl, P. (2017). The deposits channel of monetary policy. The Quarterly Journal of Economics, 132(4), 1819–1876. [Google Scholar] [CrossRef]

- Echchakoui, S. (2020). Why and how to merge Scopus and Web of Science during bibliometric analysis: The case of sales force literature from 1912 to 2019. Journal of Marketing Analytics, 8(3), 165–184. [Google Scholar] [CrossRef]

- Evgenidis, A., & Malliaris, A. G. (2022). Monetary policy, financial shocks and economic activity. Review of Quantitative Finance and Accounting, 59(2), 429–456. [Google Scholar] [CrossRef]

- Felici, M., Kenny, G., & Friz, R. (2023). Consumer savings behavior at low and negative interest rates. European Economic Review, 157, 104503. [Google Scholar] [CrossRef]

- Fernández, J. A. F. (2024). Banking systems in the euro zone and transmission of monetary policy. Central Bank Review, 24(1), 100148. [Google Scholar] [CrossRef]

- Frenkel, M., Jung, J. K., & Rülke, J. C. (2022). Testing for the rationality of central bank interest rate forecasts. Empirical Economics, 62(3), 1037–1078. [Google Scholar] [CrossRef]

- Fuster, A., Schelling, T., & Towbin, P. (2024). Tiers of joy? Reserve tiering and bank behavior in a negative-rate environment. Journal of Monetary Economics, 148, 103614. [Google Scholar] [CrossRef]

- Gambacorta, L. (2004). How do banks set interest rates? (NBER working paper series no. 10295). National Bureau of Economic Research. Available online: http://www.nber.org/papers/w10295 (accessed on 30 April 2025).

- Gebauer, S., & Mazelis, F. (2023). Macroprudential regulation and leakage to the shadow banking sector. European Economic Review, 154, 104404. [Google Scholar] [CrossRef]

- Gerritsen, D. F., & Bikker, J. A. (2018). Bank switching and interest rates: Examining annual transfers between savings accounts. Journal of Financial Services Research, 57(1), 29–49. [Google Scholar] [CrossRef]

- Girotti, M. (2019). How monetary policy changes bank liability structure and funding cost. Oxford Economic Papers, 73(1), 49–75. [Google Scholar] [CrossRef]

- Glindro, E., Armas, J. C., Tolentino, V. B., & Cruz-Sombe, L. D. (2022). Heterogenous impact of monetary policy on the Philippine rural banking system. Philippine Review of Economics, 59(2), 111–134. [Google Scholar] [CrossRef]

- Gregor, J., Melecký, A., & Melecký, M. (2020). Interest rate pass-through: A meta-analysis of the literature. Journal of Economic Surveys, 35(1), 141–191. [Google Scholar] [CrossRef]

- Ha, N. T. T., & Quyen, P. G. (2018). Monetary policy, bank competitiveness and bank risk-taking: Empirical evidence from Vietnam. Asian Academy of Management Journal of Accounting & Finance, 14(2), 137–156. [Google Scholar] [CrossRef]

- Haldarov, Z., Asteriou, D., & Trachanas, E. (2020). The impact of bank ownership on lending behavior: Evidence from the 2008–2009 financial crisis. International Journal of Finance & Economics, 27(2), 2006–2025. [Google Scholar] [CrossRef]

- Haubrich, J., Pennacchi, G., & Ritchken, P. (2012). Inflation expectations, real rates, and risk premia: Evidence from inflation swaps. The Review of Financial Studies, 25(5), 1588–1629. [Google Scholar] [CrossRef]

- Heinzelmann, L., & Missong, M. (2019). Nonlinear interest rate-setting behavior of German commercial banks. Studies in Nonlinear Dynamics & Econometrics, 24(3), 20170103. [Google Scholar] [CrossRef]

- Holm-Hadulla, F., & Thürwächter, C. (2021). Heterogeneity in corporate debt structures and the transmission of monetary policy. European Economic Review, 136, 103743. [Google Scholar] [CrossRef]

- Hommes, C., & Makarewicz, T. (2021). Price level versus inflation targeting under heterogeneous expectations: A laboratory experiment. Journal of Economic Behavior & Organization, 182, 39–82. [Google Scholar] [CrossRef]

- Jameaba, M. S. (2018). Deposit insurance and financial intermediation: The case of Indonesia Deposit Insurance Corporation. Cogent Economics & Finance, 6(1), 1468231. [Google Scholar] [CrossRef]

- Jiang, B., & Fu, L. (2025). Corporate investment and shadow banking channel of monetary policy. Emerging Markets Review, 67, 101291. [Google Scholar] [CrossRef]

- Jones, L., Alsakka, R., Gwilym, O., & Mantovan, N. (2022). The impact of regulatory reforms on European bank behavior: A dynamic structural estimation. European Economic Review, 150, 104280. [Google Scholar] [CrossRef]

- Kim, S. T., & Marchesiani, A. (2024). Market intelligence gathering, asymmetric information, and the instability of money demand. Economic Inquiry, 62(3), 1216–1245. [Google Scholar] [CrossRef]

- Kotb, N., & Proaño, C. R. (2022). Capital-constrained loan creation, household stock market participation monetary policy in a behavioral new Keynesian model. International Journal of Finance & Economics, 28(4), 3789–3807. [Google Scholar] [CrossRef]

- Kurowski, L., & Smaga, P. (2018). Monetary policy and cyclical systemic risk—Friends or foes? Prague Economic Papers, 27(5), 522–540. [Google Scholar] [CrossRef]

- Kwizera, P. A. (2024). Monetary policy reaction function in emerging economies: An empirical analysis. Cogent Economics & Finance, 12(1), 2411768. [Google Scholar] [CrossRef]

- Lahav, Y., & Benzion, U. (2022). What happens to investment choices when interest rates change? An experimental study. The Quarterly Review of Economics and Finance, 86, 471–481. [Google Scholar] [CrossRef]

- Li, C., Zhang, Y., & Yu, H. (2024). Digitalization and the “too big to fail” dilemma: Mechanisms and asymmetric effects of banks’ fintech innovation on total factor productivity. Technological and Economic Development of Economy, 30(2), 464–488. [Google Scholar] [CrossRef]

- Lozano-Espitia, I., & Arias-Rodríguez, F. (2022). The relationship between fiscal and monetary policies in Colombia: An empirical exploration of the credit channel. Latin American Journal of Central Banking, 3(4), 100072. [Google Scholar] [CrossRef]

- Mahrous, S. N., Samak, N., & Abdelsalam, M. A. M. (2020). The effect of monetary policy on credit risk: Evidence from the MENA region countries. Review of Economics and Political Science, 5(4), 289–304. [Google Scholar] [CrossRef]

- Memmel, C., Seymen, A., & Teichert, M. (2016). Banks’ interest rate risk and search for yield: A theoretical rationale and some empirical evidence. German Economic Review, 19(3), 330–350. [Google Scholar] [CrossRef]

- Michail, N. A., Savva, C. S., & Koursaros, D. (2021). Are central banks to blame? Monetary policy and bank lending behavior. Bulletin of Economic Research, 73(4), 762–779. [Google Scholar] [CrossRef]

- Mishkin, F. S. (1995). Symposium on the monetary transmission mechanism. Journal of Economic Perspectives, 9(4), 3–10. [Google Scholar] [CrossRef]

- Mishkin, F. S. (2007). Inflation dynamics. International Finance, 10(3), 317–334. [Google Scholar] [CrossRef]

- Mishkin, F. S. (2011). Monetary policy strategy: Lessons from the crisis (Working paper no. 16755). National Bureau of Economic Research (NBER). [Google Scholar] [CrossRef]

- Moyo, C., & Phiri, A. (2024). The effects of interest rates on bank risk-taking in South Africa: Do cyclical and location asymmetries matter? International Journal of Financial Studies, 12(2), 49. [Google Scholar] [CrossRef]

- Mukherjee, D., Lim, W. M., Kumar, S., & Donthu, N. (2022). Guidelines for advancing theory and practice through bibliometric research. Journal of Business Research, 148, 101–115. [Google Scholar] [CrossRef]

- Ojeaga, P., & Odejimi, D. (2014). The impact of interest rates on bank deposits evidence from the Nigerian banking sector and a regional overview. Mediterranean Journal of Social Sciences, 5(16), 232. [Google Scholar] [CrossRef]

- Oyadeyi, O. O. (2024). Financial development, monetary policy, and the monetary transmission mechanism—An asymmetric ardl analysis. Economies, 12(8), 191. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., & Mulrow, C. D. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ, 372, n71. [Google Scholar] [CrossRef]

- Raunig, B., Scharler, J., & Sindermann, F. (2016). Do banks lend less in uncertain times? Economica, 84(336), 682–711. [Google Scholar] [CrossRef]

- Ritz, R. A., & Walther, A. (2015). How do banks respond to increased funding uncertainty? Journal of Financial Intermediation, 24(3), 386–410. [Google Scholar] [CrossRef]

- Sahin, A., & Berument, M. H. (2019). Asymmetric effects of central bank funding on commercial banking sector behavior. Economic Research-Ekonomska Istraživanja, 32(1), 128–147. [Google Scholar] [CrossRef]

- Sahuc, J. G., & Levieuge, G. (2020). Monetary policy transmission with downward interest rate rigidity (EconomiX-UMR7235). University of Paris Nanterre. Available online: https://hal.science/hal-04159706v1 (accessed on 20 February 2025).

- Sarkar, S., & Sensarma, R. (2019). Risk-taking channel of monetary policy: Evidence from Indian banking. Margin: The Journal of Applied Economic Research, 13(1), 1–20. [Google Scholar] [CrossRef]

- Sekmen, T. (2024). Asymmetric interest rate pass-through in Türkiye: The role of global financial crisis. Eskişehir Osmangazi Üniversitesi İİBF Dergisi, 19(3), 726–751. [Google Scholar] [CrossRef]

- Sibande, X. (2024). Herding behavior and monetary policy: Evidence from the ZAR market. Journal of Behavioral and Experimental Finance, 42, 100920. [Google Scholar] [CrossRef]

- Singh, A., Singh, A., Sharma, H. K., & Majumder, S. (2023). Criteria selection of housing loan based on dominance-based rough set theory: An Indian case. Journal of Risk and Financial Management, 16, 309. [Google Scholar] [CrossRef]

- Siregar, H., & Ward, B. D. (2002). Were aggregate demand shocks important in explaining indonesian macroeconomic fluctuations? Journal of the Asia Pacific Economy, 7(1), 35–60. [Google Scholar] [CrossRef]

- Tran, D. V., Hussain, N., Nguyen, D. K., & Nguyen, T. D. (2024). How do depositors respond to banks’ discretionary behaviors? Evidence from market discipline, deposit insurance, and scale effects. International Review of Financial Analysis, 93, 103205. [Google Scholar] [CrossRef]

- Van den Heuvel, S. (2002). Does bank capital matter for monetary transmission? Economic Policy Review, 260–266. [Google Scholar]

- Van Eck, N. J., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. [Google Scholar] [CrossRef] [PubMed]

- Varga, J. Z. (2021). Effects of the financial crisis and low-interest rate environment on interest rate pass-through in Czech Republic, Hungary and Romania. Acta Oeconomica, 71(4), 551–567. [Google Scholar] [CrossRef]

- Vithessonthi, C., Schwaninger, M., & Müller, M. O. (2017). Monetary policy, bank lending and corporate investment. International Review of Financial Analysis, 50, 129–142. [Google Scholar] [CrossRef]

- Vuong, G. T. H., Nguyen, Y. D. H., Nguyen, M. H., & Wong, W. (2024). Assessing the impact of macroeconomic uncertainties on bankstability: Insights from ASEAN-8 countries. Heliyon, 10(11), e31711. [Google Scholar] [CrossRef]

- Xu, B., Van Rixtel, A., & Van Leuvensteijn, M. (2016). Measuring bank competition under binding interest rate regulation: The case of China. Applied Economics, 48(49), 4699–4718. [Google Scholar] [CrossRef]

- Yahyaei, H., Singh, A., & Smith, T. (2024). International transmission of monetary policy shocks and the bank lendingchannel: Evidence from Australia. Journal of Financial Stability, 75, 101343. [Google Scholar] [CrossRef]

- Ysmailov, B. (2021). Interest rates, cash and short-term investments. Journal of Banking & Finance, 132, 106225. [Google Scholar] [CrossRef]

- Zhang, L., Li, D., & Lai, Y. (2020). Equilibrium investment strategy for a defined contribution pension plan under stochastic interest rate and stochastic volatility. Journal of Computational and Applied Mathematics, 368, 112536. [Google Scholar] [CrossRef]

- Zhong, H., Feng, Z., Wang, Z., & Wang, Y. (2024). Revisiting the monetary transmission mechanism via banking from the perspective of credit creation. National Accounting Review, 6(1), 116–147. [Google Scholar] [CrossRef]

- Zhu, S., Kavanagh, E., & O’Sullivan, N. (2021). Inflation targeting and financial conditions: UK monetary policy during the great moderation and financial crisis. Journal of Financial Stability, 53, 100834. [Google Scholar] [CrossRef]

| Criteria | Inclusion Criteria (Included) | Exclusion Criteria (Excluded) |

|---|---|---|

| Time Range | Articles published between 2014–2024 | Articles published before 2014 or after 2024 |

| Document Type | Journal Articles | Books, book chapters |

| Language | Articles written in English | Articles in languages other than English |

| Subject Area | Focus on core fields: Economics, Econometrics, and Finance (54%), and Business, Management, and Accounting | Articles from irrelevant fields (e.g., computer science, medicine) |

| Thematic Focus (Title/Abstract) | Directly discusses “bank behavior” | Studies primarily focused on non-banking (e.g., insurance), pure digital transformation, or general macroeconomics without a direct link to bank behavior |

| Thematic Focus (Full Text) | Confirmation of alignment with study focus: role of deposit interest rates in bank behavior models | Studies that passed abstract screening but whose full text deviated from the core focus (e.g., only discussing digital transformation) |

| Accessibility | Full text available and open access | Abstracts only or subscription-locked articles |

| Journal | Numbers of Studies |

|---|---|

| European Economic Review | 7 |

| Applied Economics | 4 |

| Empirical Economics | 3 |

| Cogent Economics and Finance | 2 |

| Economic Research-Ekonomska Istrazivanja | 2 |

| International Journal of Finance and Economics | 2 |

| International Review of Financial Analysis | 2 |

| Journal of Banking and Finance | 2 |

| Journal of Financial Intermediation | 2 |

| Acta Oeconomica | 1 |

| Asian Academy of Management Journal of Accounting and Finance | 1 |

| Economic Modelling | 1 |

| Economic Notes | 1 |

| Economica | 1 |

| Economies | 1 |

| European Journal of Finance | 1 |

| Gadjah Mada International Journal of Business | 1 |

| German Economic Review | 1 |

| International Journal of Financial Studies | 1 |

| Journal of Behavioral and Experimental Finance | 1 |

| Journal of Economic Behavior and Organization | 1 |

| Journal of Economic Surveys | 1 |

| Journal of Financial Economics | 1 |

| Journal of Financial Services Research | 1 |

| Journal of Financial Stability | 1 |

| Journal of International Economics | 1 |

| Journal of Monetary Economics | 1 |

| Journal of Money, Credit and Banking | 1 |

| Journal of Risk and Financial Management | 1 |

| Latin American Journal of Central Banking | 1 |

| Margin | 1 |

| Mediterranean Journal of Social Sciences | 1 |

| Open Economies Review | 1 |

| Oxford Economic Papers | 1 |

| Philippine Review of Economics | 1 |

| Prague Economic Papers | 1 |

| Public Finance Quarterly | 1 |

| Quarterly Journal of Economics | 1 |

| Review of Economics and Political Science | 1 |

| Review of Quantitative Finance and Accounting | 1 |

| Revista Mexicana de Economia y Finanzas Nueva Epoca | 1 |

| Singapore Economic Review | 1 |

| Structural Change and Economic Dynamics | 1 |

| Studies in Nonlinear Dynamics and Econometrics | 1 |

| Bulletin Of Economic Research | 1 |

| Country | Number of Studies (N) | % Number of Studies |

|---|---|---|

| Cross country | 15 | 24% |

| Euro Area | 11 | 17% |

| US | 8 | 13% |

| Turkey | 4 | 6% |

| Brazil | 3 | 5% |

| China | 2 | 3% |

| German | 2 | 3% |

| India | 2 | 3% |

| Indonesia | 2 | 3% |

| Netherlands | 2 | 3% |

| UK | 2 | 3% |

| Colombia | 1 | 2% |

| Czech Republic | 1 | 2% |

| France | 1 | 2% |

| Mexico | 1 | 2% |

| Nigeria | 1 | 2% |

| Philippines | 1 | 2% |

| Singapore | 1 | 2% |

| South Africa | 1 | 2% |

| Switzerland | 1 | 2% |

| Vietnam | 1 | 2% |

| Total | 63 | 100% |

| Description Paper | Total Citation |

|---|---|

| Drechsler et al. (2017). This study identifies deposit channels as a new mechanism for monetary policy transmission, showing that increases in the Fed funds rate widen deposit spreads and trigger outflows, particularly in concentrated markets, thereby affecting bank lending contraction through market forces in the deposit market. | 311 |

| Buch et al. (2014). This study develops an expanded macroeconomic VAR model incorporating condition factors from approximately 1500 US commercial banks, finding that expansionary monetary shocks increase credit supply and raise prospective risk, with varying transmission depending on bank size, capitalization, liquidity, risk, and exposure to property and consumption credit. | 60 |

| Altavilla et al. (2022). This study shows that healthy banks pass on negative interest rates to corporate depositors without reducing deposit volumes, and this policy encourages liquid companies to invest more, challenging the view that conventional monetary policy becomes ineffective at the zero lower bound. | 48 |

| Aysan et al. (2017). This study found that implementing macroprudential policies in the Turkish banking sector after the 2008 crisis strengthened depositor discipline and encouraged banks to offer higher interest rates, thereby preventing withdrawals and enhancing financial stability through synergies between regulatory oversight and market mechanisms. | 45 |

| Ritz and Walther (2015). This study shows that funding uncertainty in the money market during the 2007–2009 financial crisis explains various bank behaviors, including a decline in lending, increased competition in retail deposits, weak pass-through of policy interest rates, and the need for unconventional monetary policy. | 39 |

| Akram and Li (2017). This study found that short-term interest rates are the primary determinant of long-term interest rates in the US. At the same time, higher government debt lowers long-term interest rates in the long run but raises them in the short term, which aligns with Keynes’ view of the central role of central banks. | 34 |

| Demiralp et al. (2021). This study demonstrates that the negative interest rate policy (NIRP) in the euro area is expansionary, particularly for banks with high dependence on retail deposits and excess liquidity holdings. Its effectiveness increases when combined with central bank liquidity injections, such as asset purchases. | 34 |

| Boyle et al. (2015). This study found that the implementation of deposit insurance during banking crises was only partially effective in preventing bank runs, especially in countries without prior explicit schemes, as withdrawal risk remained high and depositors demanded higher interest premiums. In contrast, long-term relationships with banks and the absence of co-insurance could reduce such risks. | 30 |

| Brei et al. (2020). This study shows that prolonged periods of low interest rates have prompted large international banks to shift their activities from interest income to fee-based income and trading, with a more substantial shift among low-capital banks, accompanied by adjustments in funding structures toward deposits, a decline in risk-weighted asset ratios, and a reduction in loan loss provisions consistent with indications of evergreening practices. | 27 |

| Node | Weighted Degree | Closeness Centrality | Betweenness Centrality | Page Ranks |

|---|---|---|---|---|

| Monetary Policy | 458 | 0.949153 | 0.091567 | 0.054491 |

| Lending Behavior | 370 | 0.692308 | 0.034958 | 0.021028 |

| Interest Rate | 238 | 0.610390 | 0.029781 | 0.013728 |

| Interest Rates | 70 | 0.529032 | 0.01369 | 0.007994 |

| Deposit Insurance | 50 | 1.000000 | 0.002552 | 0.005993 |

| Macroeconomics | 64 | 0.531532 | 0.004543 | 0.005838 |

| Financial Market | 130 | 0.536842 | 0.006492 | 0.005172 |

| Financial Crisis | 190 | 0.639344 | 0.016391 | 0.004096 |

| Financial System | 92 | 0.513089 | 0.004116 | 0.003844 |

| Empirical Analysis | 56 | 0.516807 | 0.007126 | 0.003617 |

| Credit Provision | 148 | 0.527473 | 0.008141 | 0.003224 |

| Inflation | 70 | 0.576642 | 0.005744 | 0.002921 |

| Exchange Rate | 54 | 0.502488 | 0.002707 | 0.002714 |

| Central Bank | 176 | 0.600694 | 0.009586 | 0.002367 |

| Banking | 398 | 0.662338 | 0.009606 | 0.002246 |

| Cost Analysis | 50 | 0.410658 | 0.001029 | 0.002048 |

| Competition (Economics) | 54 | 0.516529 | 0.000687 | 0.001956 |

| Banks | 60 | 0.533632 | 0.000379 | 0.001865 |

| Bank Lending | 104 | 0.537468 | 0.000517 | 0.001677 |

| Capital Controls | 48 | 0.465000 | 0.001451 | 0.001549 |

| Category | Content | References |

|---|---|---|

| Monetary Policy | Cluster 1—Deposit Channel | Drechsler et al. (2017); Girotti (2019); Bürgi and Jiang (2023); Gregor et al. (2020) |

| Cluster 2—Credit Channel & Bank Lending | Sahin and Berument (2019); Breitenlechner and Nuutilainen (2023); Glindro et al. (2022); Vithessonthi et al. (2017); Michail et al. (2021) | |

| Cluster 3—Monetary Policy Response | Bui and Kiss (2020); Holm-Hadulla and Thürwächter (2021); Lozano-Espitia and Arias-Rodríguez (2022); Hommes and Makarewicz (2021); Frenkel et al. (2022); Bhaumik et al. (2018); Kwizera (2024) | |

| Cluster 4—Risk & Financial Stability | Sarkar and Sensarma (2019); Beernaert et al. (2023); Moyo and Phiri (2024); Kurowski and Smaga (2018); Gebauer and Mazelis (2023); Evgenidis and Malliaris (2022) | |

| Cluster 5—Crisis Conditions | Zhu et al. (2021); Chow and Choy (2023); De Roure et al. (2015) | |

| Cluster 6—Global Monetary Policy | Aldasoro et al. (2023); Sibande (2024) | |

| Bank Behavior | Cluster 1—Risk, Capital, and Bank Heterogeneity | Buch et al. (2014); Raunig et al. (2016); Boeckx et al. (2020); Jones et al. (2022); Memmel et al. (2016) |

| Cluster 2—Competition, Regulation, and Market Structure | Xu et al. (2016); Aydemir (2014); Aysan et al. (2018) | |

| Cluster 3—Deposits, Transfers, and Customer Responses | Gerritsen and Bikker (2018); Ojeaga and Odejimi (2014); Fuster et al. (2024); Felici et al. (2023) | |

| Cluster 4—Bank Structure, MSMEs, and Lending Behavior | Aysan et al. (2017) | |

| Cluster 5—Bank Behavior During Crises and Uncertainty | Ritz and Walther (2015); Raunig et al. (2016); Haldarov et al. (2020) | |

| Interest Rate | Cluster 1—Monetary Policy Transmission and Macroeconomic Effects | Kotb and Proaño (2022); Haubrich et al. (2012); Ha and Quyen (2018); Cotler and Carrillo (2024); Mahrous et al. (2020) |

| Cluster 2—Market Structure, Competition, and Risk Perceptions in Interest Rate Setting | Varga (2021); Heinzelmann and Missong (2019); Moyo and Phiri (2024); Da Silva and Baczynski (2024) | |

| Cluster 3—Low and Negative Interest Rate Environment | Demiralp et al. (2021); Altavilla et al. (2022); Felici et al. (2023); Creel et al. (2016) | |

| Cluster 4—Banking Behavior, Depositors, and Distributional Impacts | Brei et al. (2020); Beatriz et al. (2022); Cucciniello et al. (2022) | |

| Deposit Insurance | Cluster 1—Depositor Behavior and Risk Preference Shifts | Jameaba (2018); Tran et al. (2024) |

| Cluster 2—Deposit Insurance Credibility and Financial Stability | Bonfim and Santos (2023); Boyle et al. (2015) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Widiyanti, S.; Siregar, H.; Ratnawati, A.; Suwandi, S. The Missing Link in Bank Behavior: Deposit Interest Rate Setting Under a Dual-Benchmark Framework—A Literature Review. J. Risk Financial Manag. 2025, 18, 638. https://doi.org/10.3390/jrfm18110638

Widiyanti S, Siregar H, Ratnawati A, Suwandi S. The Missing Link in Bank Behavior: Deposit Interest Rate Setting Under a Dual-Benchmark Framework—A Literature Review. Journal of Risk and Financial Management. 2025; 18(11):638. https://doi.org/10.3390/jrfm18110638

Chicago/Turabian StyleWidiyanti, Shandra, Hermanto Siregar, Anny Ratnawati, and Suwandi Suwandi. 2025. "The Missing Link in Bank Behavior: Deposit Interest Rate Setting Under a Dual-Benchmark Framework—A Literature Review" Journal of Risk and Financial Management 18, no. 11: 638. https://doi.org/10.3390/jrfm18110638

APA StyleWidiyanti, S., Siregar, H., Ratnawati, A., & Suwandi, S. (2025). The Missing Link in Bank Behavior: Deposit Interest Rate Setting Under a Dual-Benchmark Framework—A Literature Review. Journal of Risk and Financial Management, 18(11), 638. https://doi.org/10.3390/jrfm18110638