Assessing the Early Impact of Industry 4.0 Technologies on the Activity, Efficiency, and Profitability of Croatian Micro-, Small-, and Medium-Sized Enterprises

Abstract

1. Introduction

- C—Manufacturing;

- G—Wholesale and Retail Trade;

- J—Information and Communication;

- M—Professional, Scientific and Technical Activities.

1.1. Research Problem

- Big data and analytics;

- Autonomous robots;

- Simulation;

- Horizontal and vertical system integration;

- The Internet of Things (IoT);

- Cybersecurity;

- Cloud computing;

- Additive manufacturing (3D printing);

- Augmented reality.

1.2. Objectives, Hypotheses, and Research Methodology

- To develop a conceptual understanding of I4.0, its key components, and technological foundations.

- To analyze the core technological elements of I4.0—such as IoT, AI, big data analytics, and autonomous robotics—in the context of digital transformation.

- To establish a theoretical link between the implementation of I4.0 technologies and business performance, drawing from conventional microeconomic and neoclassical production theories (Kovačević, n.d.).

- To identify and classify Croatian enterprises according to their level of I4.0 adoption, based on BCG criteria.

- To measure and compare the financial performance of I4.0 adopters and non-adopters across three key dimensions: activity, efficiency, and profitability.

- To test whether the adoption of I4.0 technologies has a statistically significant impact on selected financial indicators using ANOVA and linear regression models.

- To provide empirical insights into how digital maturity influences business performance in a small and open economy during early-stage I4.0 implementation.

1.3. Scientific and Research Contribution

- 1.

- Empirical Evidence:

- 2.

- Methodological Originality:

- 3.

- Theoretical Contribution:

1.4. Structure of the Paper

2. Fundamental Concepts of Industry 4.0 Through the Lens of Advanced Technologies and Artificial Intelligence: Status and Challenges in Croatia

2.1. Theoretical Background: The Evolution of Industrial Revolutions and the Foundations of Industry 4.0

2.2. Conceptual Definition of Industry 4.0

2.3. Fundamental Components of Industry 4.0

- Big data involves large datasets analyzed for decision-making insights, requiring new storage and processing methods (Kocijan, 2014).

- Autonomous robots operate in industries such as agriculture and healthcare, enabling human–machine collaboration and increasing adaptability (Schwab, 2016).

- Simulations optimize decision-making, risk assessment, and planning of complex manufacturing systems (De Paula Ferreira et al., 2020).

- Horizontal and vertical system integration provides a holistic business approach, improving process efficiency and sustainability.

- IoT connects devices into networks that communicate, linking physical and digital worlds (Piccarozzi et al., 2018).

- Cybersecurity protects data and systems in digital environments.

- Cloud computing allows remote data storage and processing, used by 39% of Croatian businesses (Croatian Bureau of Statistics, 2021).

- 3D printing produces objects layer-by-layer from digital models, enhancing manufacturing flexibility (Schwab, 2016).

2.4. Structure and Key Characteristics of the Business Sector in Croatia and Technological Transformation of Enterprises

3. Empirical Research on the Impact of Industry 4.0 Implementation on Business Performance in the Early Stages of Adoption

3.1. Research Methodology, Sample Definition, and Measurement of Business Performance

3.1.1. Sample Definition and Scope of the Study

3.1.2. Defining and Measuring Business Performance Indicators

3.2. Analysis of the Research Results on the Impact of Industry 4.0 Technology Implementation on Selected Financial Indicators

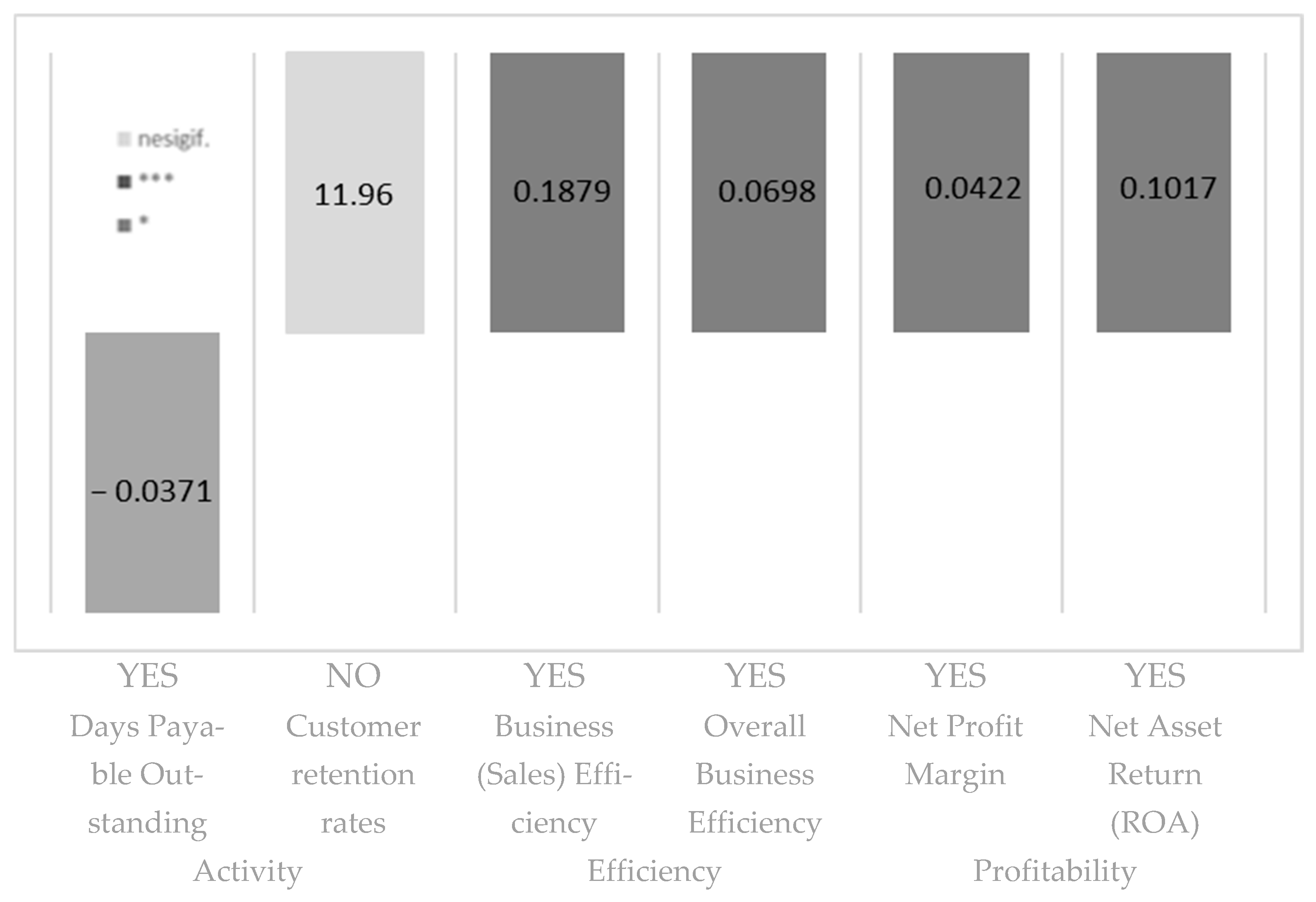

Results of Analysis of Variance (ANOVA) and Simple Linear Regression

4. Discussion

5. Conclusions

- The average profitability indicators (net profit margin and net return on assets (ROA)) are better, with higher indicators for I4.0 companies compared to traditional ones.

- The average efficiency indicators (overall business efficiency and business efficiency (sales)) are better (higher) for I4.0 companies compared to traditional ones.

- The average days sales outstanding indicator is not significantly different for I4.0 companies compared to traditional companies, meaning their days sales outstanding are on average the same.

- The average activity indicator, supplier bonding days, is better (lower) for I4.0 companies compared to traditional companies.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AOP 049 | Receivables from customers |

| AOP 065 | Total assets |

| AOP 115 | Payables to suppliers |

| AOP 125 | Operating income |

| AOP 126 | Sales revenue from group companies |

| AOP 127 | Sales revenue (outside the group) |

| AOP 133 | Material costs |

| AOP 137 | Personnel costs |

| AOP 177 | Total income |

| AOP 178 | Total expenses |

| AOP 184 | Profit for the period |

References

- Arroyabe, M. F., Arranz, C. F., & De Arroyabe, I. F. (2024). The effect of IT security issues on the implementation of I4.0 in SMEs: Barriers and challenges. Technological Forecasting and Social Change, 199, 123051. [Google Scholar] [CrossRef]

- Bahovec, V., Dumičić, K., Erjavec, N., Čizmešija, M., Kurnoga, N., Arnerić, J., Čeh Časni, A., & Lolić, I. (2015). Statistika. Element. [Google Scholar]

- Bahovec, V., & Erjavec, N. (2009). Uvod u ekonometrijsku analizu (1st ed.). Element. [Google Scholar]

- Bartik, A. W., Bertrand, M., Cullen, Z., Glaeser, E. L., Luca, M., & Stanton, C. (2020). The impact of COVID-19 on small business outcomes and expectations. Proceedings of the National Academy of Sciences, 117(30), 17656–17666. [Google Scholar] [CrossRef] [PubMed]

- Boston Consulting Group. (2020). Embracing I4.0 and rediscovering growth. Available online: https://www.my-mooc.com/en/article/embracing-industry-40-and-rediscovering-growth-87ba0246-fff7-439b-85a0-ec298bf384eb (accessed on 8 March 2020).

- Brettel, M., Friederichsen, N., Keller, M., & Rosenberg, M. (2014). How virtualization, decentralization and network building change the manufacturing landscape: An Industry 4.0 perspective. International Journal of Mechanical, Industrial Science and Engineering, 8(1), 37–44. [Google Scholar]

- Croatian Bureau of Statistics. (2021). Primjena informacijskih i komunikacijskih tehnologija (IKT) u poduzećima u 2021 [dataset]. Available online: https://podaci.dzs.hr/media/2jzcr2tq/2-3-1_primjena-ikt-u-poduzecima-u-2021.pdf (accessed on 24 April 2025).

- Dalenogare, L. S., Benitez, G. B., Ayala, N. F., & Frank, A. G. (2018). The expected contribution of Industry 4.0 technologies for industrial performance. International Journal of Production Economics, 204, 383–394. [Google Scholar] [CrossRef]

- Davis, F. D., Jr. (1980). A technology acceptance model for empirically testing new end-user information systems: Theory and results [Doctoral dissertation, Sloan School of Management, Massachusetts Institute of Technology]. [Google Scholar]

- De Paula Ferreira, W., Armellini, F., & Santa-Eulalia, L. A. (2020). Simulation in I4.0: A state-of-the-art review. Computers & Industrial Engineering, 149(11), 106868. [Google Scholar] [CrossRef]

- De Sousa Jabbour, A. B. L., Jabbour, C. J. C., Godinho Filho, M., & Roubaud, D. (2018). Industry 4.0 and the circular economy: A proposed research agenda and original roadmap for sustainable operations. Annals of Operations Research, 270(1–2), 273–286. [Google Scholar] [CrossRef]

- Fitzgerald, M., Kruschwitz, N., Bonnet, D., & Welch, M. (2014). Embracing digital technology: A new strategic imperative. MIT Sloan Management Review, 55, 1–12. [Google Scholar]

- Frank, A. G., Dalenogare, L. S., & Ayala, N. F. (2019). Industry 4.0 technologies: Implementation patterns in manufacturing companies. International Journal of Production Economics, 210, 15–26. [Google Scholar] [CrossRef]

- Hess, T., Matt, C., Benlian, A., & Wiesböck, F. (2016). Options for formulating a digital transformation strategy. MIS Quarterly Executive, 15, 6. [Google Scholar]

- Hrbić, R. (2024). Acceptance of I4.0 in Croatian companies as a determinant of their business success [Doctoral dissertation, University of Zagreb]. [Google Scholar]

- Hrbić, R., & Grebenar, T. (2021). Procjena spremnosti hrvatskih poduzeća na uvođenje tehnologija I4.0 [e-publication]. Croatian National Bank. Available online: https://www.hnb.hr/-/i-062 (accessed on 24 April 2025).

- Kagermann, H., Wahlster, W., & Helbig, J. (2013). Recommendations for implementing the strategic initiative INDUSTRIE 4.0: Securing the future of German manufacturing industry. Final report of the industrie 4.0 working group. Acatech. Available online: https://en.acatech.de/publication/recommendations-for-implementing-the-strategic-initiative-industrie-4-0-final-report-of-the-industrie-4-0-working-group/ (accessed on 24 April 2025).

- Kocijan, K. (2014). Big Data: Kako smo došli do Velikih podataka i kamo nas oni vode. In V. Radovan, & P. Đilda (Eds.), Komunikacijski obrasci i informacijska znanost (pp. 37–62). Zavod za informacijske studije. [Google Scholar]

- Kovačević, Z. (n.d.). Teorija poduzeća [e-publication]. Available online: https://www.efzg.unizg.hr/UserDocsImages/MGR/zkovacevic/industrijska%20politika/Teorije%20poduze%C4%87a%20FULL%20TEKST.pdf (accessed on 24 April 2025).

- Lasi, H., Fettke, P., Kemper, H.-G., Feld, T., & Hoffmann, M. (2014). Industry 4.0. Business & Information Systems Engineering, 6(4), 239–242. [Google Scholar] [CrossRef]

- Lu, Y. (2017). Industry 4.0: A survey on technologies, applications and open research issues. Journal of Industrial Information Integration, 6, 1–10. [Google Scholar] [CrossRef]

- Manyika, J., Chui, M., Bughin, J., Dobbs, R., Bisson, P., & Marrs, A. (2013). Disruptive technologies: Advances that will transform life, business, and the global economy (Vol. 180, pp. 17–21). McKinsey Global Institute. [Google Scholar]

- Maravić, D., Redek, T., & Čater, T. (2022). Implementation of I4.0 technologies in Croatia: Proactive motives and a long-term perspective. Društvena Istraživanja, 31(1), 39–61. [Google Scholar] [CrossRef]

- McKinsey. (2018). Croatia—Emerging digital challenger: Digitization as the new growth engine for Croatia [e-publication]. Available online: https://digitalchallengers.mckinsey.com/files/Digital-Challengers-Perspective-on-Croatia.pdf (accessed on 19 January 2020).

- Mittal, S., Khan, M. A., Romero, D., & Wuest, T. (2018). A critical review of smart manufacturing & Industry 4.0 maturity models: Implications for small and medium-sized enterprises (SMEs). Journal of Manufacturing Systems, 49, 194–214. [Google Scholar] [CrossRef]

- Müller, J. M., Kiel, D., & Voigt, K.-I. (2018). What drives the implementation of Industry 4.0? The role of opportunities and challenges in the context of sustainability. Sustainability, 10(1), 247. [Google Scholar] [CrossRef]

- National Classification of Activities. (2007a). Nacionalna klasifikacija djelatnosti 2007. NKD 2007 [e-publication]. Available online: https://www.dzs.hr/App/NKD_Browser/assets/docs/NKD_2007_struktura.pdf (accessed on 19 January 2020).

- National Classification of Activities. (2007b). NKD 2007. s objašnjenjima [e-publication]. Available online: https://web.dzs.hr/App/NKD_Browser/assets/docs/NKD_2007_objasnjenja.pdf (accessed on 19 January 2020).

- Oztemel, E., & Gursev, S. (2020). Literature review of I4.0 and related technologies. Journal of Intelligent Manufacturing, 31(1), 127–182. [Google Scholar] [CrossRef]

- Piccarozzi, M., Aquilani, B., & Gatti, C. (2018). I4.0 in management studies: A systematic literature review. Sustainability, 10(10), 3821. [Google Scholar] [CrossRef]

- Schwab, K. (2016). The fourth industrial revolution. World Economic Forum. [Google Scholar]

- Szalavetz, A. (2019). Industry 4.0 and capability development in manufacturing subsidiaries. Technological Forecasting and Social Change, 145, 384–395. [Google Scholar] [CrossRef]

- Veža, I., Gjeldum, N., & Mladineo, M. (2018). Inovativno pametno poduzeće (innovative smart company). Faculty of Mechanical Engineering and Naval Architecture. Available online: https://www.croris.hr/crosbi/publikacija/knjiga/16629 (accessed on 19 January 2020).

- Westerman, G., Bonnet, D., & McAfee, A. (2014). Leading digital: Turning technology into business transformation. Harvard Business Review Press. [Google Scholar]

- Žager, K., Mamić Sačer, I., Sever Mališ, S., Ježovita, A., & Žager, L. (2020). Analiza financijskih izvještaja. Masmedia. [Google Scholar]

| Categorization of Companies | Number of Companies According to the Annual Financial Reports of Entrepreneurs in the Early Stages of Implementation | |||||

|---|---|---|---|---|---|---|

| Assumed/surveyed/confirmed by the survey | 2016 | 2017 | 2018 | 2019 | 2020 | Total |

| Assumed I4.0 companies | 75 | 83 | 92 | 95 | 95 | 440 |

| I4.0 company | 20 | 23 | 26 | 27 | 27 | 123 |

| Traditional | 55 | 60 | 66 | 68 | 68 | 317 |

| Not an I4.0 company | 4 | 5 | 6 | 7 | 7 | 29 |

| Did not respond to the survey | 51 | 55 | 60 | 61 | 61 | 288 |

| Traditional | 15.237 | 15.974 | 16.823 | 17.421 | 17.615 | 83.070 |

| Total number of companies | 15.312 | 16.057 | 16.915 | 17.516 | 17.710 | 83.510 |

| Variable Name | Variable Definition | Variable Measurement Method |

|---|---|---|

| COMPANY CHARACTERISTICS (I4.0 or not I4.0) | Based on the survey questionnaire sent to companies and the respondents’ assessment, it is determined whether the company belongs to I4.0. | Survey questionnaire—binary |

| FINANCIAL INDICATORS | Indicators from the categories of profitability, efficiency, and activity, showing the impact of I4.0 elements on the company’s financial indicators. | Use of secondary data sources (annual financial statements). |

| Net Profit Margin | The net profit margin shows the profit after taxation divided by total revenue. | Annual financial statements of the entrepreneur: Income Statement (P&L), balance sheet. Formula: P_P_3 = AOP184/AOP177 (higher is better) |

| Return on Assets (ROA) | Return on assets (ROA) shows the profit after taxation divided by total assets. | Annual financial statements of the entrepreneur: Income Statement (P&L), balance sheet. Formula: P_P_4 = AOP184/AOP065 (higher is better) |

| Overall Business Efficiency | Business efficiency is the ratio of total revenue to total expenses. | Annual financial statements of the entrepreneur: Income Statement (P&L), balance sheet. Formula: P_E_1 = AOP177/AOP178 (higher is better) |

| Sales Efficiency | Sales efficiency is the ratio of sales revenue to sales expenses. | Annual financial statements of the entrepreneur: Income Statement (P&L), balance sheet. Formula: P_E_2 = (AOP126 + AOP127)/(AOP133 + AOP137) (higher is better) |

| Days of Customer Receivables | Days of customer receivables refer to the number of days in the year multiplied by receivables from customers, divided by regular business income. | Annual financial statements of the entrepreneur: Income Statement (P&L), balance sheet. Formula: P_A_2 = (365 * AOP049)/AOP125 (lower is better) |

| Indicator Group | Indicator Name | Numerator | Denominator |

|---|---|---|---|

| Activity | Days of Customer Receivables | Number of days in the year (365) × Short-term receivables from customers | Revenue from regular operations |

| Activity | Days of Supplier Payables | 365 × Short-term payables to suppliers | Revenue from regular operations |

| Efficiency | Overall Business Efficiency | Total revenue | Total expenses |

| Efficiency | Sales Efficiency | Sales revenue | Sales expenses |

| Profitability | Net Profit Margin | Profit after taxation | Total revenue |

| Profitability | Net Asset Return (ROA) | Profit after taxation | Total assets |

| Dependent Variable/ Significance Level | Source of Variation | Simple Linear Regression | One-Way ANOVA | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Indicator Value | Estimate β | Std. Error | t-Value | Pr(>|t|) | Degrees of Freedom | Sum of Squares | Mean Square | F-Ratio | p-Value | ||

| Net Profit Margin *** | Between Groups | 0.0944 | 0.0422 | 0.0083 | 5.0971 | 0.0000 | 1 | 0.0407 | 0.0407 | 25.9804 | 0.0000 |

| Net Profit Margin | Within Groups | 0.0522 | 0.0522 | 0.0006 | 82.0056 | 0.0000 | 3899 | 6.1153 | 0.0016 | ||

| Net Profit Margin | Total | 3900 | 6.1561 | ||||||||

| Dependent Variable/ Significance Level | Source of Variation | Simple Linear Regression | One-Way ANOVA | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Indicator Value | Estimate β | Std. Error | t-Value | Pr(>|t|) | Degrees of Freedom | Sum of Squares | Mean Square | F-Ratio | p-Value | ||

| Net Asset Return (ROA) *** | Between Groups | 0.1888 | 0.1017 | 0.0143 | 7.1133 | 0.0000 | 1 | 0.2367 | 0.2367 | 50.5989 | 0.0000 |

| Net Asset Return (ROA) | Within Groups | 0.0870 | 0.0870 | 0.0011 | 79.1498 | 0.0000 | 3889 | 18.1914 | 0.0047 | ||

| Net Asset Return (ROA) | Total | 3890 | 18.4280 | ||||||||

| Dependent Variable/ Significance Level | Source of Variation | Simple Linear Regression | One-Way ANOVA | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Indicator Value | Estimate β | Std. Error | t-Value | Pr(>|t|) | Degrees of Freedom | Sum of Squares | Mean Square | F-Ratio | p-Value | ||

| Overall business efficiency *** | Between Groups | 1.1398 | 0.0698 | 0.0120 | 5.8335 | 0.0000 | 1 | 0.1114 | 0.1114 | 34.0294 | 0.0000 |

| Overall business efficiency | Within Groups | 1.0700 | 1.0700 | 0.0009 | 1162.8925 | 0.0000 | 3887 | 12.7223 | 0.0033 | ||

| Overall business efficiency | Total | 3888 | 12.8337 | ||||||||

| Dependent Variable/ Significance Level | Source of Variation | Simple Linear Regression | One-Way ANOVA | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Indicator Value | Estimate β | Std. Error | t-Value | Pr(>|t|) | Degrees of Freedom | Sum of Squares | Mean Square | F-Ratio | p-Value | ||

| Business (sales) efficiency *** | Between Groups | 1.3753 | 0.1879 | 0.0319 | 5.90000 | 0.0000 | 1 | 0.8074 | 0.8074 | 34.8095 | 0.0000 |

| Business (sales) efficiency | Within Groups | 1.1874 | 1.1874 | 0.0024 | 484.9448 | 0.0000 | 3890 | 90.2290 | 0.0232 | ||

| Business (sales) efficiency | Total | 3891 | 91.0364 | ||||||||

| Dependent Variable/ Significance Level | Source of Variation | Simple Linear Regression | One-Way ANOVA | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Indicator Value | Estimate β | Std. Error | t-Value | Pr(>|t|) | Degrees of Freedom | Sum of Squares | Mean Square | F-Ratio | p-Value | ||

| Customer retention rates *** | Between Groups | 66.6235 | 11.9561 | 7.7994 | 1.5329 | 0.1254 | 1 | 3268.4437 | 3268.4337 | 2.3499 | 0.1254 |

| Customer retention rates | Within Groups | 54.6674 | 54.6674 | 0.5985 | 91.3418 | 0.0000 | 3904 | 5,429,933.3730 | 1390.8641 | ||

| Customer retention rates | Total | 3905 | 5,433,201.8067 | ||||||||

| Dependent Variable/ Significance Level | Source of Variation | Simple Linear Regression | One-Way ANOVA | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Indicator Value | Estimate β | Std. Error | t-Value | Pr(>|t|) | Degrees of Freedom | Sum of Squares | Mean Square | F-Ratio | p-Value | ||

| Days payable outstanding *** | Between Groups | 0.0764 | −0.0371 | 0.0182 | −2.0351 | 0.0419 | 1 | 0.0315 | 0.0315 | 4.1414 | 0.0419 |

| Days payable outstanding | Within Groups | 0.1135 | 0.1135 | 0.0014 | 80.8808 | 0.0000 | 3886 | 29.5828 | 0.0076 | ||

| Days payable outstanding | Total | 3887 | 29.6143 | ||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hrbić, R. Assessing the Early Impact of Industry 4.0 Technologies on the Activity, Efficiency, and Profitability of Croatian Micro-, Small-, and Medium-Sized Enterprises. J. Risk Financial Manag. 2025, 18, 590. https://doi.org/10.3390/jrfm18100590

Hrbić R. Assessing the Early Impact of Industry 4.0 Technologies on the Activity, Efficiency, and Profitability of Croatian Micro-, Small-, and Medium-Sized Enterprises. Journal of Risk and Financial Management. 2025; 18(10):590. https://doi.org/10.3390/jrfm18100590

Chicago/Turabian StyleHrbić, Rajka. 2025. "Assessing the Early Impact of Industry 4.0 Technologies on the Activity, Efficiency, and Profitability of Croatian Micro-, Small-, and Medium-Sized Enterprises" Journal of Risk and Financial Management 18, no. 10: 590. https://doi.org/10.3390/jrfm18100590

APA StyleHrbić, R. (2025). Assessing the Early Impact of Industry 4.0 Technologies on the Activity, Efficiency, and Profitability of Croatian Micro-, Small-, and Medium-Sized Enterprises. Journal of Risk and Financial Management, 18(10), 590. https://doi.org/10.3390/jrfm18100590