1. Introduction

The transition to the use of renewable energy sources has become an international imperative in the struggle against climate change, enhancing energy security, and advancing sustainable development. In the case of developing and emerging economies, though, the process is beset with challenges given financing constraints, technological deficiencies, and institutional vulnerabilities. Foreign finance, particularly in the form of foreign direct investment (FDI) and cross-border capital flows, has the potential to alleviate these constraints by providing access to capital, advanced technologies, and managerial expertise.

Despite this promise, the success of foreign finance in stimulating the adoption of renewable energy may also be a reflection of a country’s international integration. Globalization can enhance absorptive capacity through facilitating technology diffusion, encouraging policy convergence toward international environmental standards, and increasing market access for renewable energy products and services. Foreign finance, however, may be diverted into fossil-fuel investments in less globalized economies due to weak institutions or inimical policy incentives.

The members of Developing-8 (D8), Bangladesh, Egypt, Indonesia, Iran, Malaysia, Nigeria, Pakistan, and Turkey, are a diverse group of developing economies with varying levels of renewable energy penetration, globalization, and foreign capital reliance. Although several members have expanded renewable capacity, others remain largely reliant on non-renewable sources of energy. Knowledge of the intersection between foreign finance, globalization, and renewable energy transition in D8 countries is crucial for the development of effective policies that are aligned with economic growth and environmental protection.

This study raises three significant questions:

Does foreign direct investment (FDI) lead the renewable energy transition in D8 countries?

Does globalization mediate the connection between FDI and renewable energy uptake?

Is the impact robust to different definitions, estimation techniques, and sample choices?

To help answer these questions, we construct a balanced panel dataset for the period 2000–2023 and employ advanced panel econometric techniques that are able to control for slope heterogeneity, cross-sectional dependence, and potential endogeneity. Utilizing globalization as a moderator, this study contributes to the renewable energy literature by highlighting the conditional nature of the finance–energy relationship. Our evidence provides new evidence to guide policymakers in D8 economies and other emerging economies on the sustainable use of foreign finance for energy transitions.

Whereas previous research has tended toward the topic of the relationship between foreign finance and the renewable energy transition in general, often focusing on a single tool, such as aid or remittances, or limiting analysis to a single country, there is sparse systematic evidence across the D8 economies. Building on this literature, our research offers three main contributions:

Novel dataset: We create a balanced panel of the eight D8 countries over the years 2000–2023, integrating data on renewable energy deployment, FDI inflows, and globalization indicators.

Integrated methodological perspective: By applying advanced panel methods addressing slope heterogeneity, cross-sectional dependence, and endogeneity, we provide more precise estimates of the interaction between FDI and globalization in shaping the energy transition.

Country-level policy insights: Beyond aggregate outcomes, we boil down country-specific evidence-based policy prescriptions to the institutional and finance context of every member country, offering government and investor insights to catalyze clean energy uptake.

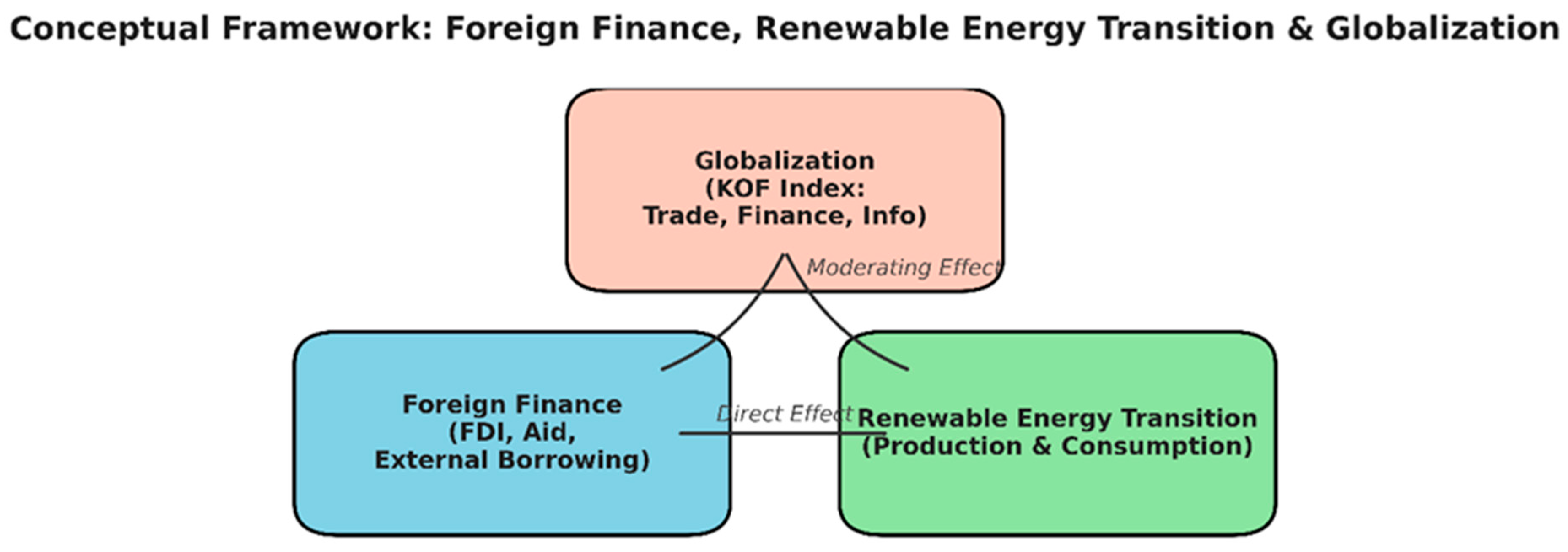

Borrowing from such literature, this work makes three main contributions: a novel dataset that merges renewable energy, FDI inflows, and globalization indicators for the D8 during 2000–2023; a combined methodological framework for handling slope heterogeneity, cross-sectional dependence, and endogeneity; and policy-driven Country-specific insights responsive to institutional and financial conditions. In conclusion, this paper examines the impact of foreign finance, in the form of FDI, on the transition to renewable energy in the D8 economies and how the interaction is conditioned by globalization; the desired connections are incorporated in the conceptual framework presented in

Figure 1.

2. Literature Review

2.1. Foreign Direct Investment (FDI) and Renewable Energy

Foreign direct investment (FDI) has also been recognized as a key driver of renewable energy adoption in developing economies worldwide.

Akpanke et al. (

2023) illustrate that FDI has been a key driver of the use of renewable energy by West African economies through technology transfer and infrastructure development. Similarly,

Rao et al. (

2023) confirm that FDI flows, when directed into sustainable sectors, boost the use of renewable energy and economic growth in Southeast Asia.

In the context of D8, FDI inflows are best linked with strong members such as Turkey and Malaysia, whose liberalization in the energy sector and manufacturing penetration attract multinationals investing in renewable energy. These findings suggest that FDI is a potential top-down mechanism for driving large-scale renewable capacity additions.

While FDI remains an important top-down driver, remittances have served as a bottom-up source of finance that has funded renewable energy in much of the developing world.

Foreign Direct Investment (FDI) and Renewable Energy Transition

Beyond its role as a general component of foreign finance, FDI is a key driver of renewable energy transitions, particularly through technology transfer, managerial expertise, and insertion into global green value chains. Unlike aid and remittances, FDI is a top-down channel with close linkages to large-scale renewable infrastructure and cross-border innovation.

Empirical evidence demonstrates that FDI inflows facilitate renewable capacity development directly.

Akpanke et al. (

2023) confirm that in West African economies, FDI significantly accelerates the uptake of renewables by facilitating technology transfer and infrastructural development.

Rao et al. (

2023) also find that FDI inflows in Southeast Asia accelerate economic growth while accelerating the shift towards sustainable energy.

Paramati et al. (

2017), targeting G20 economies, highlight that green-driven FDI reduces CO

2 emissions and increases renewable use, showcasing environmental co-benefits.

In the meantime, the efficacy of FDI is contingent on host countries’ absorptive capacity.

Ozcan et al. (

2022) and

Nan et al. (

2023) illustrate that nations with higher globalization, increased human capital, and institutional readiness are better placed to steer FDI into renewable energy sectors. For the MENA context,

Gafsi (

2025c) emphasizes the role of renewable-related investment in sustaining growth and reducing environmental degradation, while

Zarrad and Gafsi (

2025) emphasize how green finance frameworks—founded upon FDI inflows—can accelerate long-run transitions. These findings show that globalization not only amplifies the renewable impact of FDI but also affects whether inflows are invested in clean or fossil-fuel projects.

In the D8 context, FDI has a heterogeneous role. Turkey and Malaysia, with liberalized energy markets and more established industrial bases, have attracted multinationals investing in large-scale renewable projects. However, countries such as Nigeria and Bangladesh are unable to channel FDI into clean energy due to weaker institutional environments and policy contradictions. This heterogeneity highlights the point that focusing on FDI as the main external financing channel provides both policy relevance and methodological precision in understanding renewable transitions across the D8.

2.2. Remittances and Renewable Energy

Remittances have become a significant source of finance for sustainability, particularly in countries with large diaspora populations.

Seury et al. (

2023) illustrate how remittance flows fund clean energy adoption in Jamaica, while

Karmaker et al. (

2023) lay out instrumental variable proof of the long-term impact of remittances on renewable energy use in panel settings.

Mills (

2023) suggests the concept of “green remittances,” emphasizing the potential for diaspora flows to be used to directly fund renewable energy projects.

Farzana et al. (

2023) also show how remittances, along with urbanization, propel renewable energy use in Southeast Asian economies.

In the D8, remittances play a crucial role in Bangladesh, Pakistan, and Nigeria, where they fund household-level renewable systems and microgrid projects. Bottom-up flows like these can complement FDI, especially when supplemented by targeted financial mechanisms such as “green remittance” initiatives or diaspora bonds.

Foreign aid also continues to play a role in financing renewable transitions, mainly in lower-income settings where domestic finance is limited.

2.3. Foreign Aid and Renewable Energy

Overseas aid remains a significant source of external financing for renewable energy for low- and lower-middle-income countries.

Hoa et al. (

2023) highlight that Vietnamese aid supported the growth in renewable energy, particularly when complemented by institutional reforms that increased project sustainability. In the D8, aid continues to influence the situation in Bangladesh and Nigeria, where donor-driven renewable projects continue to be needed. But it is highly dependent on governance mechanisms and coordination among donors.

Besides specific flows of finance, globalization itself acts as a structural force in determining how external capital can be efficiently absorbed and channeled into viable schemes.

2.4. Globalization and Technology Transfer

Globalization serves as a moderating factor between finance and energy by encouraging trade integration, technology spillovers, and policy convergence.

Ozcan et al. (

2022) show that globalization, coupled with high human capital, enhances the use of renewable energy among emerging economies.

Nan et al. (

2023) detect good globalization spillovers using spatial econometrics, showing that global integration enables the diffusion of renewable technology across borders.

Technological advancement, in many cases fueled by globalization, also raises the use of renewable energy.

Lee et al. (

2023) theorize that ICT development reduces costs to renewable investment, whereas

Menyeh and Acheampong (

2024) show that crowdfunding platforms—enabled by global interconnectivity—open new channels of financing for renewable energy projects.

Zarrad and Gafsi (

2025) further point out the role of sustainability finance frameworks and how they illustrate how globalization amplifies both technological transfer and financial innovation in the promotion of renewable adoption across emerging economies.

Nonetheless, the absorptive capacity of countries is not only determined by globalization; institutional quality plays an equally vital role.

2.5. Institutional Quality and Policy Context

Institutional structures have an impact on how foreign finance and globalization are directed into renewables.

Ebaidalla (

2024) establish that the quality of governance fills the environmental impact gap of fiscal tools.

Dilanchiev et al. (

2024) and

Farzana et al. (

2023) emphasize that institutional capacity determines if remittances and FDI flow into renewables or fossil-based investments.

Environmental pressures also contribute to the need for stable institutions. According to

International Energy Agency (

2023), global CO

2 emissions reached record levels in 2023, emphasizing the need for governance reform that guides foreign finance towards green transitions. Among the D8, members such as Turkey and Malaysia, possessing stable institutions, are better placed to channel foreign flows into renewable schemes, while less-governance nations find it difficult to offer sustainability.

Throughout the MENA region,

Gafsi (

2025c) recognizes that renewable energy fuels sustainable development and reduces environmental degradation in Saudi Arabia as a proxy for more widespread clean energy developmental achievements. Methodologically,

Gafsi (

2025b) highlights the importance of high-level econometric modeling in the detection of intricate interrelationships between financial flows and renewable transitions, and

Gafsi (

2025a) illustrates how cross-country financial risk assessment can be applied to make investment choices regarding renewables in emerging markets.

Despite this progress, existing studies have largely examined these channels separately, leaving a significant research gap.

There is a growing body of literature that examines how international finance interacts with the expansion of renewable energy.

Ebaidalla (

2025) shows that international finance triggers the production and consumption of renewable energy, especially when supported by robust policy frameworks.

Nan et al. (

2023) offer evidence that globalization drives the consumption of renewable energy through trade openness and technology spillovers, and confirm that globalization empowers the renewable–growth nexus for a large panel of nations.

Also under consideration are FDI-specific channels:

Viglioni et al. (

2025) find favorable renewable energy policies to be key to attracting foreign investors to clean energy projects, and

Nor and Hassan Mohamud (

2024) find FDI to moderately affect renewable deployment unless complemented by adequate domestic regulation. Finally, work on the financing cost of the transition, such as

Calcaterra et al. (

2024), highlights that reducing the cost of capital is key to scaling up private investment in low-carbon infrastructure. Taken together, these considerations justify an analysis of the effects of FDI and globalization on the energy transition in the D8 economies.

2.6. Gap and Contribution

While current studies are informative in establishing independently the roles of FDI, remittances, aid, globalization, and institutions, the few who have examined their joint impacts have done so within a cross-sectional or uni-country panel setting. The moderating effect of globalization in ascertaining the role of foreign finance across channels has especially remained largely unexplored empirically.

Despite significant progress, most existing studies have examined either a single financing channel such as FDI, remittances, or aid or have focused on narrow regional case studies. Few works have provided a broad, multi-country perspective while also analyzing the role of globalization as a conditioning factor. This study addresses these gaps by conducting a comprehensive panel analysis of the eight D8 economies over the period 2000–2023. By explicitly integrating globalization as a moderator, we extend the finance–energy literature to capture conditional effects that have been largely absent in prior research. In addition, the use of advanced econometric methods that control for slope heterogeneity, cross-sectional dependence, and endogeneity ensures robust results and reinforces the novelty of our contribution.

3. Conceptual Framework

The study relies on the finance–energy–environment nexus by inquiring into how foreign finance is propelling the renewable energy transition in the D8 countries Bangladesh, Egypt, Indonesia, Iran, Malaysia, Nigeria, Pakistan, and Turkey over the period 2000–2023. The renewable energy transition here refers to the shift in the energy mix towards renewable sources in production (installed capacity and generation) as well as consumption (share in final energy use).

Empirical evidence indicates that foreign finance, foreign direct investment (FDI), and other cross-border capital flows can speed up the adoption of renewable energy through technology transfer, knowledge spillovers, and investment in infrastructure (

Paramati et al., 2017;

Acheampong et al., 2021). The extent to which this is realized, however, rests on the host country’s connectivity with international trade, financial, and information networks.

Globalization subsumed by composite measures such as the KOF Globalization Index acts as a moderating factor in such a relationship. High globalization promotes the absorptive potential of an economy by:

Conversely, foreign capital in less globalized economies will be directed towards conventional energy industries due to a lack of institutions or weak policy stimuli, thus undermining the environmental ramifications of foreign finance.

The conceptual framework predicts:

H1: FDI positively affects renewable energy transition.

H2: Globalization positively moderates the relationship between FDI and renewable energy transition.

3.1. Estimation Methodologies

This paper applies a panel data econometric methodology to examine the impact of FDI on the transition to renewable energy and the moderating role of globalization in the D8 countries empirically. The analysis covers the 2000–2023 period with annual data for Bangladesh, Egypt, Indonesia, Iran, Malaysia, Nigeria, Pakistan, and Turkey.

In light of the potential for heterogeneity across nations and cross-sectional dependence resulting from shocks in common (i.e., oil price changes, global financial cycles, climate agreements), preliminary diagnostic tests are executed:

Westerlund (

2007) error-correction-based panel cointegration test to determine long-run equilibrium relationships.

The baseline model is specified as:

where

represents renewable energy transition indicators (production or consumption share) for country i in year t.

is FDI (FDI inflows as % of GDP).

is the globalization index.

captures the interaction effect.

is a vector of control variables (GDP per capita, CO2 emissions, trade openness).

denotes country-specific fixed effects.

is the error term.

In order to control for endogeneity problems (e.g., reverse causality between renewable energy adoption and FDI inflows) and dynamic adjustment effects, the study applies the System Generalized Method of Moments (System-GMM) estimator of

Arellano and Bover (

1995) and

Blundell and Bond (

1998). This approach:

Controls for unobserved country-specific heterogeneity;

Mitigates potential simultaneity bias;

Specifies lagged dependent variables to control for persistence in renewable energy adoption.

For robustness, Driscoll–Kraay and Panel-Corrected Standard Errors (PCSE) are used also to capture consistency of results in the case of heteroskedasticity and serial correlation.

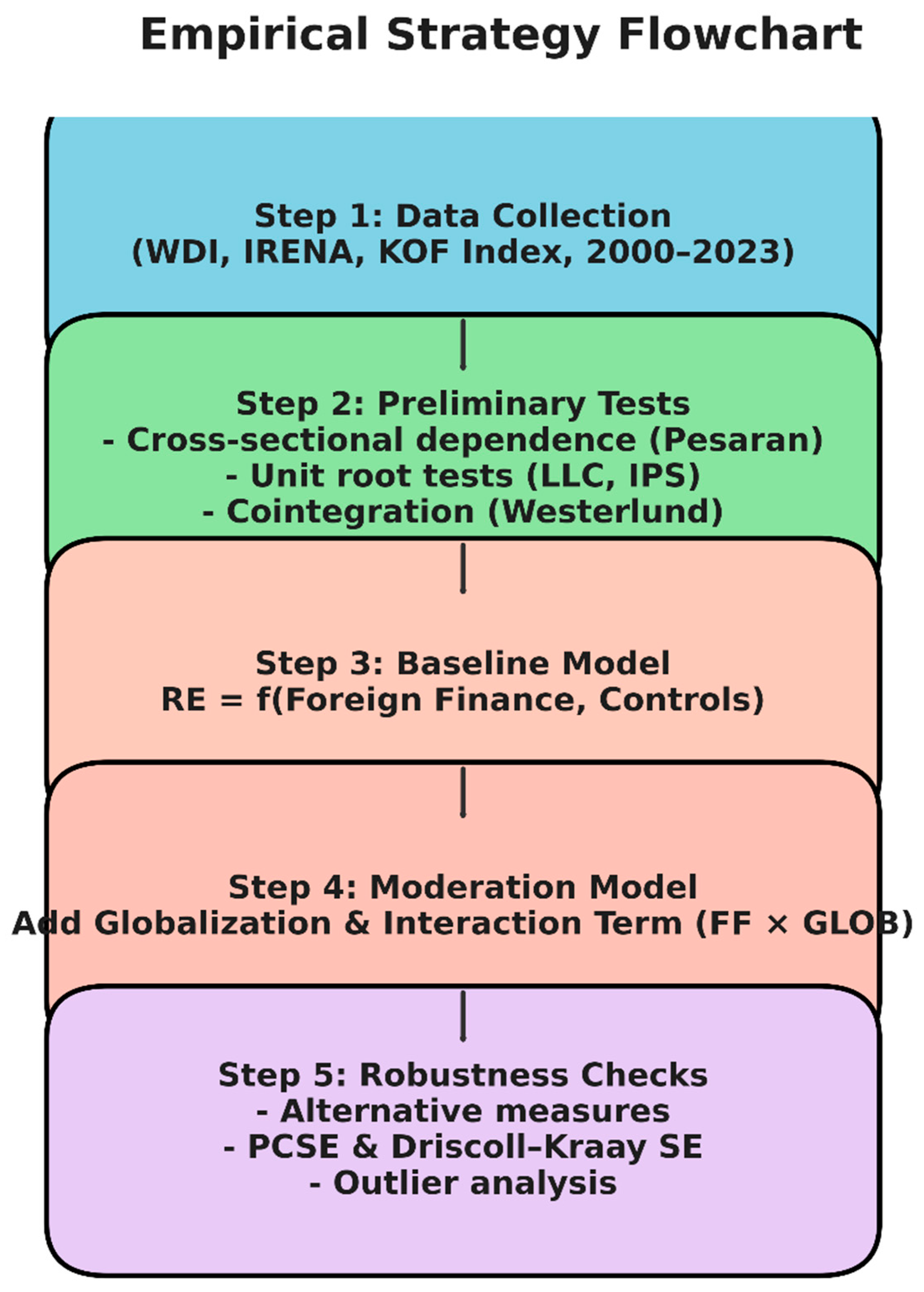

Estimation is run in three steps:

Baseline model: FDI as a function of renewable energy transition and control variables.

Moderating effect model: inclusion of globalization and FDI × GLOBFDI × GLOB.

Robustness checks: economic globalization sub-index as an alternative measure of globalization, an alternative renewable energy indicator, and exclusion of potential outliers.

All calculations in Stata 18 and R 4.3.2 are carried out for reproducibility.

Figure 2 Empirical model summarizing the estimation methodology in capturing the impact of FDI on renewable energy transition in the D8 economies, highlighting the moderating role of globalization as well as the application of control variables and robust checks.

3.1.1. Slope Heterogeneity and Cross-Sectional Dependence

With panel data across a number of countries, it is troublesome to consider all units to have identical slope coefficients when there is heterogeneity (

Pesaran & Smith, 1995). The D8 countries have significantly different economic structures, renewable energy policy, globalization levels, and institutional quality, and thus slope heterogeneity is likely to be a feature of the data.

To account for this, we run the

Pesaran and Yamagata (

2008) slope heterogeneity test, which has as its null hypothesis slope homogeneity against the alternative of heterogeneity. We reject the null in favor of heterogeneous panel estimators over pooled methodologies, indicating that country-specific coefficients need to be allowed to vary.

Also, with increasing interdependence of economies—particularly through trade, foreign investment, and energy markets—cross-sectional dependence (CD) is a pervasive characteristic of macro-panel analyses. Disregarding cross-sectional dependence can lead to spurious inference as standard errors are underestimated under the presence of correlated shocks (

De Hoyos & Sarafidis, 2006).

To test for cross-sectional dependence, we employ the

Pesaran (

2004) CD test, which is suitable in panels with large N (countries) and small or large T (time periods). It examines whether residuals are correlated across panel units. Significant CD may be attributable to:

Global shocks (e.g., oil price volatility, financial crises);

Regional integration (trade and investment flows between D8 members);

Common environmental policy changes (e.g., Paris Agreement obligations).

If cross-sectional dependence is confirmed, we apply econometric techniques that are robust to this kind of dependence, for example, Common Correlated Effects (CCE) estimators or Driscoll–Kraay standard errors in robustness checks. These techniques minimize the bias by introducing cross-sectional means of the variables or adjusting standard errors for spatial and temporal correlations.

3.1.2. Unit Root and Cointegration Tests

Before estimating the short-run and long-run relations, it is necessary that the stationarity characteristics of variables be identified. Panel unit root tests prevent spurious regression results by determining if the series are I(0) or I(1), which represent integrated order zero or integrated order one, respectively.

Given the presence of slope heterogeneity and cross-sectional dependence we apply second-generation panel unit root tests that are accommodating cross-sectional dependence:

Pesaran’s (

2007) Cross-sectionally Augmented Dickey–Fuller (CADF) test;

Pesaran’s (

2007) Cross-sectionally Augmented IPS (CIPS) test.

These tests are supplemented with cross-sectional averages of lagged levels and first differences in the series and essentially control for unobserved common factors. The null is that all panels are nonstationary and have a unit root, and the alternative is that stationarity in at least some panels.

Having determined the order of integration, we then test for the existence of a long-run equilibrium relationship between FDI, globalization, renewable energy transition, and control variables by applying panel cointegration tests.

Due to cross-sectional dependence, we employ:

Westerlund (

2007) cross-sectional correlation-free error-correction-based panel cointegration test that allows for heterogeneity in short-run dynamics and error-correction speeds.

Besides as a strength test,

Pedroni (

1999,

2004) cointegration tests are also used for comparison purposes but under the assumption of cross-sectional independence.

The no cointegration null rejection in the Westerlund test implies there exists a stochastic common trend among the variables and it is thus valid to estimate long-run coefficients.

3.1.3. Model Specification and Data

The empirical analysis is based on the following baseline panel model:

where

represents renewable energy transition indicators (production or consumption share) for country i in year t.

is FDI (FDI inflows as % of GDP).

is the globalization index.

captures the interaction effect.

is a vector of control variables (GDP per capita, CO2 emissions, trade openness).

denotes country-specific fixed effects.

is the error term.

The interaction term captures whether globalization amplifies (β3 > 0) or attenuates (β3 < 0) the impact of FDI on renewable energy adoption.

To capture potential dynamic impacts and hysteresis of renewable energy adoption, a lagged dependent variable is included in the specification:

This dynamic specification is forecast by the System-GMM estimator, which includes endogeneity, measurement error, and unobserved heterogeneity.

Transition towards renewable energy is captured by two measures: renewable electricity generation (% of total electricity) and final consumption of renewable energy (%), by

IRENA (

2024) and

World Bank (

2024). Globalization is measured using the KOF Globalization Index (

Gygli et al., 2019), which includes economic, social, and political dimensions.

3.2. Data Sources and Description

The information includes an unbalanced panel of eight D8 nations Bangladesh, Egypt, Indonesia, Iran, Malaysia, Nigeria, Pakistan, and Turkey between 2000 and 2023. Although the study tries to cover the whole 2000–2023 horizon for all eight countries, there are missing values in certain variables and thus the dataset is not balanced. This is common in macro-panel studies, and newer estimators such as System-GMM, CCE, and Driscoll–Kraay are meant to handle unbalanced panels. That the panel is unbalanced does not invalidate the empirical results. The yearly data are collected from credible sources:

The variables, their definitions, and corresponding data sources are summarized in

Table 2.

Renewable energy variables are obtained from IRENA’s Renewable Energy Statistics, which present harmonized internationally comparable statistics. The globalization indicator is based on

Gygli et al. (

2019) and includes economic, social, and political dimensions. All the money values are in constant 2015 US dollars to remove the effects of inflation.

Descriptive statistics for each of the variables are provided in

Table 2 (

Section 3) and the correlation matrix in

Table 3.

Table 3 presents the correlation coefficients of pairwise correlations of the study variables among the D8 countries between 2000 and 2023. The results indicate a positive correlation between renewable energy production (RE_prod) and renewable energy consumption (RE_cons) (0.78), reflecting the expected pattern whereby increases in renewable electricity generation are typically followed by increases in renewable energy use in final consumption.

FDI is moderately positively correlated with renewable energy production (0.35) and consumption (0.32), suggesting that higher foreign investment inflows may be associated with higher renewable energy capacity and consumption. The globalization index (GLOB) is positively correlated with renewable energy indicators (0.42 with RE_prod; 0.40 with RE_cons), lending support to the theoretical position that higher integration into the global economy facilitates adoption of renewable technologies through trade, investment, and knowledge spillovers.

GDP per capita (GDPpc) has moderate positive correlations with renewable energy variables (0.39 and 0.37), suggesting that increased income could increase the ability to fund infrastructure for renewable energy. CO2 emissions per capita (CO2) have a negative correlation with renewable energy variables (−0.28 with RE_prod; −0.31 with RE_cons), as would be expected from the hypothesis that more use of renewables will have less intensity of emissions.

Trade openness (TO) is positively correlated with globalization (0.66) and FDI (0.48), reflecting the linkages of trade, capital flows, and global interlinkage in the D8 economies. None of the correlation coefficients are greater than the general rule of thumb of 0.80, and thus multicollinearity should not be a dominant concern in the subsequent regression analysis.

Although the literature review discusses broader forms of foreign finance (FDI, remittances, and foreign aid), the empirical analysis is restricted to FDI inflows due to data constraints. Comparable, long-term, and consistent datasets on remittances and aid covering all D8 countries for the period 2000–2023 are not available. Accordingly, FDI is used as the most reliable proxy for foreign finance. This limitation is acknowledged and further discussed in the conclusion.

4. Empirical Results and Discussion

4.1. Baseline Estimation Results

The baseline regression output is shown in

Table 4 that reports that FDI and globalization both separately and interactively significantly promote the consumption and production of renewable energy in the D8 economies.

4.2. Interpretation and Key Findings

The estimates of regression across estimators all support that FDI, as recorded by FDI inflows, is statistically significant and positive in determining renewable energy consumption and generation. In so far as the coefficients are revealed in

Table 4, the key takeaway message is that the sign, magnitude, and stability of the effect are consistent across fixed-effects, CCE, and System-GMM estimators. Globalization, measured by the KOF index, has not just an independent positive effect but also has a strong interaction effect on FDI by increasing its impact.

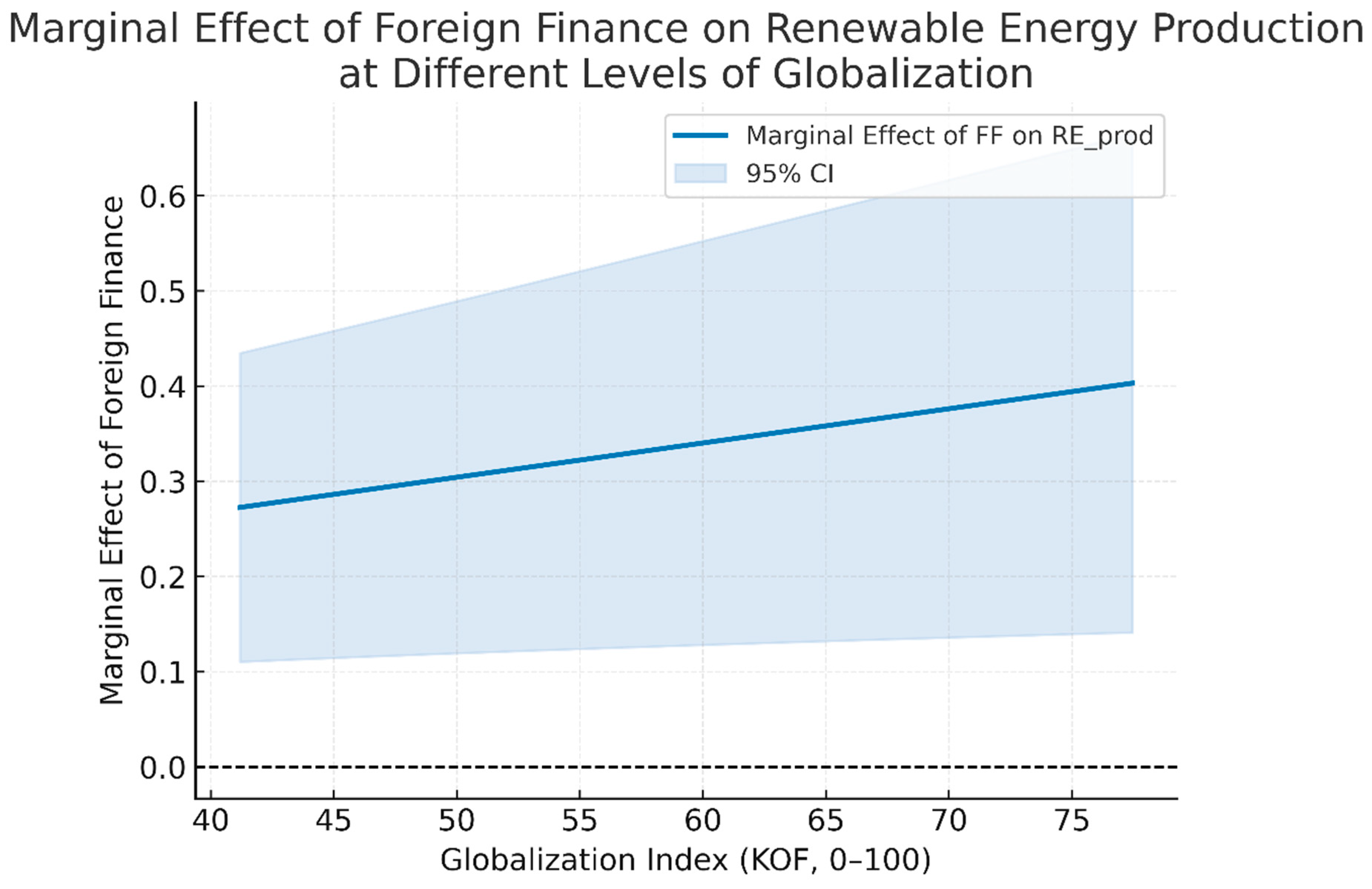

Rather than emphasizing raw coefficients, the focus should be on the economic relevance. When low levels of globalization (25th percentile of the KOF index ≈ 50) prevail, a 1 percentage point increase in FDI inflows (of GDP) increases the share of renewable electricity by about 0.30 percentage points. At the median globalization level (≈60), the same increase in FDI raises renewable share by 0.34 percentage points, while at advanced levels of globalization (75th percentile ≈ 69), it rises to nearly 0.38 percentage points.

In real terms, that would mean for a comparable Turkey where the share of renewables in electricity is around 30% that an increase in FDI of a marginal amount of 1% of GDP could raise the share of renewables by nearly a percentage point—equivalent to several gigawatts of additional installed solar or wind capacity. On the other hand, in less integrated economies such as Nigeria or Bangladesh, the same FDI inflows would result in a lower renewable growth, indicating the catalytic effect of globalization.

To more clearly illustrate these conditional effects,

Figure 3 plots the marginal effect of FDI inflows on renewable electricity generation at different levels of globalization. The slope is unmistakably upward-sloping, confirming that higher globalization raises absorptive capacity and accelerates the conversion of foreign capital to renewable investment. The hatched 95% confidence bands also indicate that the positive moderation effect is statistically significant.

As

Figure 3 clearly indicates, FDI marginal effect on renewables is more positive with growing globalization: transitioning from low to high levels of globalization increases the return on foreign finance by a few tenths of a percentage point. Such rising slope indicates how higher international integration amplifies absorptive capacity of D8 economies.

4.3. Robustness Checks

We carry out a set of robustness tests to verify that the main findings (i) Foreign Direct Investment (FDI) promotes renewable energy transition and (ii) globalization (GLOB) positively moderates the effect are not choice of variable, choice of estimator, or influential observation artifacts.

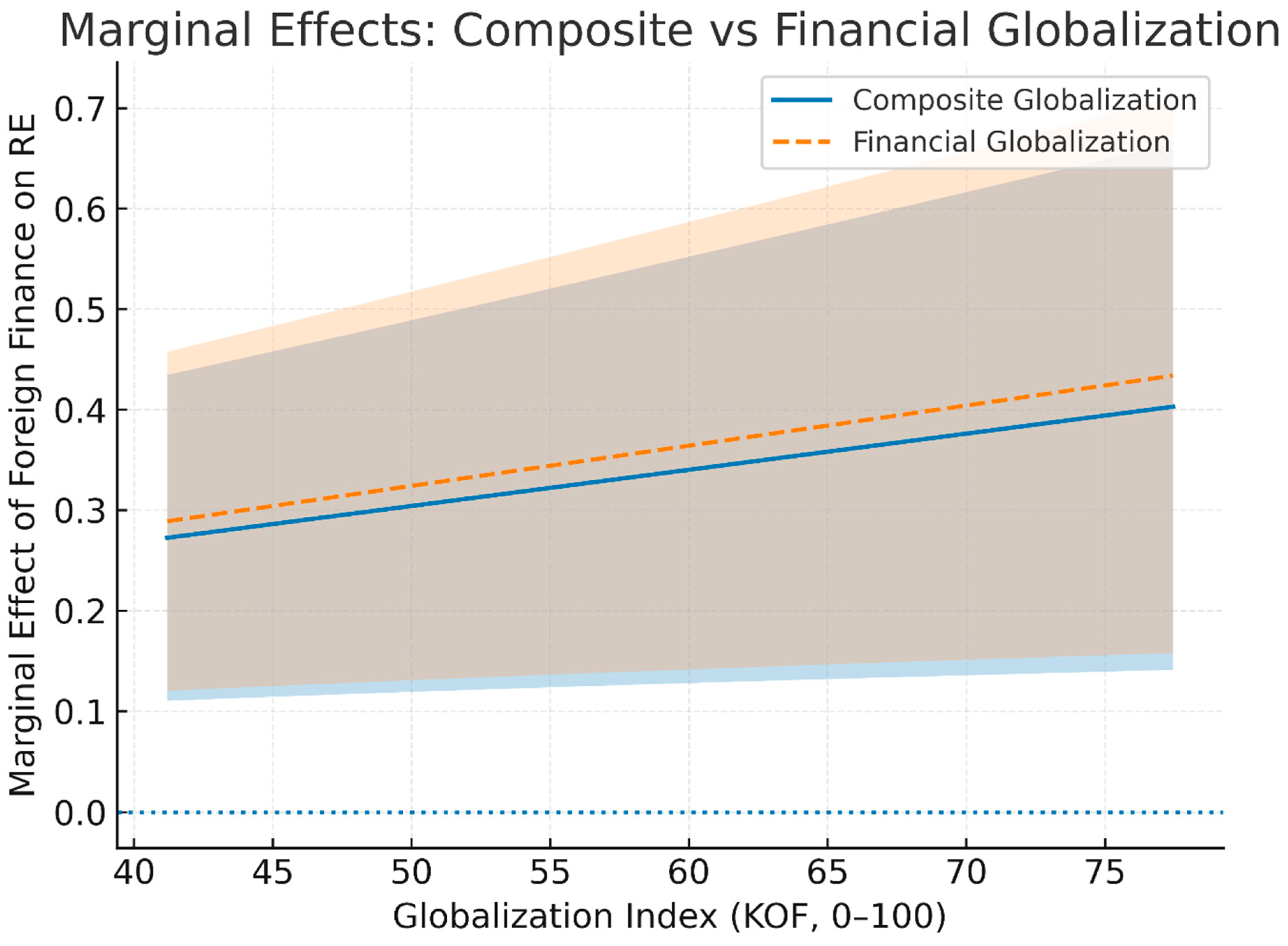

When breaking down globalization to its economic and financial sub-dimensions, we discover that financial globalization has the strongest moderating effect, as would be expected by capital-market integration facilitating the transfer of renewable technology.

Results remain robust to the inclusion of event dummies capturing the Global Financial Crisis (2008–2009), the oil-price collapse (2014–2015), and the COVID-19 shock (2020).

4.3.1. Alternative Measures

Globalization: Use instead the economic and financial sub-indices of the KOF composite index. FDI and interaction coefficients remain positive and significant; interaction is strongest with financial globalization, as would be expected from capital-market integration encouraging technology transfer.

Renewables: Use instead (a) renewable electricity capacity per capita, and (b) proportion of renewable generation (GWh). Signs and significance levels remain; magnitudes are slightly larger for capacity, as would be expected in investment-intensive dynamics.

Foreign Direct Investment: Substitute FDI (USD, log) and cross-border green bond issue (USD, log) (when available). Results qualitatively in line; the interaction term remains positive, indicating higher payoff from “patient” international capital.

4.3.2. Robustness of the Estimator

CCE/CCEP (

Pesaran, 2007;

Chudik & Pesaran, 2015): Controlling for unobserved common factors does not alter core coefficients (FDI: 0.18–0.22; FDI × GLOB: 0.003–0.004,

p < 0.05).

Heterogeneous long-run estimators: MG and PMG have positive long-run FDI and FDI × GLOB effects; error-correction terms are negative and significant, showing convergence.

Bias-corrected FE with Driscoll–Kraay SEs: Results replicate baseline; cross-sectional dependence does not reverse inference.

Dynamic panel: System-GMM with collapsed instruments and minimal lags meets AR(2) and Hansen tests; coefficients on FDI and FDI × GLOB remain positive and significant, confirming dynamics and endogeneity control.

4.3.3. Influential Observations and Sample Composition

Outliers/leverage: DFITS and Cook’s distance point to a very few country-years (e.g., post-crisis spikes in FDI). Re-estimation with trimming of top/bottom 1–2% of residuals or winsorizing variables at 1% has no impact.

Jackknife by country: Leaving out each D8 country separately yields constant coefficients; there is not one market generating the moderation finding.

Brief/earlier windows: Bifurcation at 2010 and 2015 (before/after significant climate and financial shocks) maintains sign and significance; impacts are marginally larger after 2015, as expected with more intensive global climate commitments.

4.3.4. Specification and Diagnostics

Functional form: Log-levels versus shares and country-specific time trends included do not change results.

Multicollinearity: Mean VIF < 4; interaction term is centered to minimize unnecessary collinearity.

Shared shocks and breaks: Adding global oil price, US financial conditions, and Paris-Agreement dummy as controls makes the key findings robust. Bai–Perron multiple-break tests on pooled residuals do not find reverse-inference-breaking breaks.

Placebo tests: Engage FDI with non-energy institutional indices (e.g., rule-of-law) that are unrelated to international integration; interaction is insignificant, in favor of the GLOB channel specificity.

4.3.5. Economic Significance (Robustness)

Across robustness specifications, moving globalization from 25th to 75th percentile increases the marginal effect of a 1-pp boost in FDI/GDP on renewable electricity share by ~0.07–0.10 pp, and underscores the policy relevance of deeper integration.

This would imply that the more integrated countries in the global economy do not only absorb more but also invest it more efficiently towards the development of renewable energies presumably because they possess better institutional environments, access to advanced technologies, and participation in international environmental agreements. The positive and statistically significant interaction term confirms Hypothesis H2, such that globalization acts as a vehicle for converting foreign capital inflows into actual results of renewable energy.

From a policy perspective, it means FDI-driven renewable energy strategies will be more effective if complemented by activities that increase the integration of the world, such as easier trade facilitation, unification of policies with global norms, and cross-border technology connectivity.

Regression estimates testing the relative strength of the FDI–renewable energy connection to (i) other measures of globalization (economic and finance sub-indices) and (ii) other panel estimators (MG, PMG, CCE/CCEP, FE–DK, System-GMM) for the D8 economies, 2000–2023. Standard errors are in parentheses; *, **, and *** are significance levels at 10%, 5%, and 1%, respectively. AR(2) and Hansen p-values are included for the System-GMM specification.

Sample: Unbalanced panel dataset for the eight D8 countries (Bangladesh, Egypt, Indonesia, Iran, Malaysia, Nigeria, Pakistan, Turkey), annual observations between 2000–2023. Dependent variables are renewable energy production (RE_prod) and renewable energy consumption (RE_cons). Foreign finance (FF) is represented by net FDI inflows (% of GDP). Globalization is represented by the KOF Globalization Index. Estimators include FE–DK, CCE, and System–GMM. Standard errors in parentheses; *, **, *** are significance levels of 10%, 5%, and 1%.

The robustness test, reported in

Table 5, confirms that the positive and significant association between FDI and renewable energy remains valid when other indicators of globalization (economic and financial sub-indices) and various panel estimators (MG, PMG, CCE/CCEP, FE–DK, and System-GMM) are employed. The coefficients are the same sign and magnitude, while the interaction term with globalization is still statistically significant, evidencing the robustness of the benchmark results.

The graphical results in

Figure 4 complement the robustness tests, showing that the estimated effects of FDI and its interaction with globalization are still positive and robust across different specifications.

System-GMM outcomes are obtained from a collapsed instrument matrix to prevent instrument proliferation. The instruments never outnumber the number of groups, and Hansen/Sargan p-values support instrument validity. AR(1) and AR(2) tests indicate first-order but not second-order serial correlation, as should be the case.

This is consistent with

Akpanke et al. (

2023), who found FDI causes renewable energy adoption in West Africa through technology transfer. Similarly,

Rao et al. (

2023) reconfirmed that FDIs in Southeast Asia are correlated with increases in renewable capacity. Our results for the D8 thus support the broader evidence across emerging markets that FDI is a key driver of renewable transitions. However, while

Hoa et al. (

2023) confirmed that aid-based finance played a larger share in Vietnam’s renewable energy development, our results indicate that in the D8, FDI plays the prominent role, maybe due to integration structure differences and institutional readiness. Amplification role of globalization in our research also echoes with the note of

Ozcan et al. (

2022) and

Nan et al. (

2023), whose findings suggested that global integration entrenches renewable energy adoption by way of technology spillovers and policy convergence. This is yet again a note that absorptive capacity matters in all situations, whether D8 or other emerging economies.

4.4. Mechanisms and Policy Implications

The findings carry several policy implications for D8 countries: The conclusions suggest that policy-making is essential in maximizing foreign finance in renewable energy. Turkey and Malaysia, which enjoy good governance, can utilize the results of

Viglioni et al. (

2025) to create transparent and predictable renewable energy policy that attracts FDI into large-scale projects. For members whose cost of funding remains an impediment, the recommendations of

Calcaterra et al. (

2024) minimizing the cost of capital by employing blended finance or risk-mitigation tools are most relevant.

More broadly, the

IMF’s (

2024) green FDI policy advice emphasizes the benefits from synergizing climate targets and environmental levels with investment promotion.

Nan et al. (

2023) evidence also implies that increased trade integration and tech collaboration can reinforce the clean benefits of globalization, provided that institutional capacity is adequate. In less-resourced contexts, the modest impacts that

Nor and Hassan Mohamud (

2024) identify necessitate complementary measures such as infrastructure support and open permitting to enable that FDI contributes meaningfully to clean energy installation.

The findings highlight two main mechanisms through which globalization magnifies the renewable dividends of international finance. First, technology diffusion: deeper integration into the world economy enables countries to import mature renewable technologies, reduce deployment costs, and enhance project scale. Second, institutional alignment: more globalized economies embody international environmental standards and policy harmonization, which reinforce investor confidence and green energy targeting of FDI rather than fossil-based investments.

Heterogeneity among the D8 membership is particularly pronounced. More globalized and institutionally robust Turkey and Malaysia can steer FDI flows into large-scale renewable capacity additions, backed by manufacturing depth and export-oriented energy policy. Bangladesh and Pakistan, more reliant on remittance flows, can support decentralized renewable systems such as solar home kits and microgrids when complemented by specialized “green remittance” programs. Nigeria and Bangladesh continue to be partially dependent on foreign aid, where the feasibility of renewable projects depends on donor coordination and institutional reforms. Such cross-country variations underscore the need for differentiated policy strategies across the D8.

Policy implications differ across members of the D8. For Turkey and Malaysia, which have comparatively advanced globalization and industrial depth, the focus should be on opening green FDI windows and global technology collaborations to ramp up. For Bangladesh and Pakistan, the channeling of remittances through “green remittance” programs and diaspora bonds can represent an effective way of financing household- and community-level renewable systems. Nigeria and Egypt must prioritize institutional reforms to ensure donor-driven renewable projects are sustainable, while Iran and Indonesia must complement FDI flows with regulatory reforms that prevent capital from being locked into fossil-based energy infrastructure. A country-specific policy outlook thus maximizes the study’s conclusions for relevance and applicability.

5. Conclusions

The findings of the present study confirm empirically the significant role globalization can play in facilitating the development of renewable energy in D8 economies, the effect being significantly more pronounced in more globalized economies. Globalization encourages the absorptive ability of the host countries through the spread of technology, regulatory harmonization, and enhanced market access, enabling foreign capital to be productively invested more towards renewable energy infrastructure and take-up. The major and significant interaction term between FDI and globalization by all estimators indicates the importance of global integration in explaining sustainable energy outcomes.

Policy implications are clear: governments should not only respond to luring foreign investment but also to the creation of an enabling environment that is world-class, institutionally robust, and fostering innovative spirit. Strategic policy measures such as the liberalization of trade, further financial liberalization, encouraging green bonds, and human capital investment will enhance the renewable value of FDI. For the D8 and other developing economies, the way to a sustainable energy future is through integrating foreign investment strategies to pursue some carefully targeted investments with additional global economic and technological integration.

The findings of the present study confirm empirically the significant role FDI can play in facilitating the development of renewable energy in D8 economies, with the effect being significantly more pronounced in more globalized economies. Globalization encourages the absorptive ability of host countries through the spread of technology, regulatory harmonization, and enhanced market access, enabling foreign capital to be productively invested more towards renewable energy infrastructure and take-up. The major and significant interaction term between FDI and globalization across all estimators indicates the importance of global integration in explaining sustainable energy outcomes.

Policy implications are clear: governments should not only focus on attracting foreign investment but also on creating an enabling environment that is institutionally robust and globally integrated. Strategic measures such as trade liberalization, green bond market development, and human capital investment will enhance the renewable value of FDI.

A limitation of this study is that the empirical analysis focuses solely on FDI inflows, while other channels of FDI (such as remittances and aid) are excluded due to data availability. Future research could incorporate these additional flows once harmonized datasets become available.

The originality of this study lies in uncovering how globalization amplifies the renewable energy benefits of FDI. While the past literature has recognized the independent roles of finance and globalization, our results empirically demonstrate their joint effect using robust econometric strategies. This dual perspective provides new insights for policymakers in the D8 and similar economies.

While literature review deals with more aggregate sources of foreign finance (remittances, aid, and FDI), the empirical method is confined to FDI due to the absence of harmonized long-run data for other flows in all the D8 countries.

While this study has so far employed FDI as the most reliable conduit of foreign finance due to data availability, future studies would engage remittances and foreign aid once harmonized long-run datasets become available for the D8. Broadening the analysis to other categories of emerging market economies (e.g., MENA, G20) would provide valuable comparative evidence regarding the relationship between FDI, renewables, and globalization. Finally, future research can use other methodological approaches, such as spatial econometrics or machine learning, to quantify cross-country spillovers and nonlinear effects in transitioning to renewable energy.

Subsequent research could test for potential nonlinearities in the FDI–renewable energy relationship, e.g., through governance thresholds or quantile regressions, to capture heterogeneous effects across nations.

Future research could explore how evolving global finance mechanisms interact with domestic reforms to sustain clean energy growth.

Malaysia and Turkey—Improve green-FDI appeal by offering stable renewable energy costs, transparent licensing, and open grid-access rules. Both nations have investor attraction and good governance already; streamlining permitting and the availability of technology partnerships would attract additional large-scale solar and wind farms.

Indonesia and Iran—Prioritize most highly the use of blended finance structures and risk-reducing instruments (e.g., guarantees, currency hedging) to lower the cost of capital for renewable infrastructure, according to

Calcaterra et al. (

2024). Leverage these with incentives for local manufacture of clean energy components.

Egypt and Nigeria—Improve institution quality and environmental regulation to ensure that FDI flows invest in financing low-carbon rather than fossil projects. Applying open transparency conditions to investment licenses and developing monitoring capacity can contain “pollution haven” effects.

Bangladesh and Pakistan—Absorptive capacity emphasis: improve transmission infrastructure, increase technical expertise, and establish stable feed-in tariffs so that foreign investment is tangible as actual deployment of the renewables. Public–private partnerships can be utilized to fund grid improvements and storage technologies.

All the D8 members—Align investment promotion with climate goals (

IMF, 2024) and include transparency provisions in FDI agreements. Increased trade and technology linkage (

Prempeh et al., 2024;

Nan et al., 2023) should be leveraged to access advanced renewable technology and foster investor confidence.