Abstract

Stablecoins are crypto assets designed to maintain stable value by bridging fiat currencies and volatile crypto assets. Our study extends previous research by analyzing the instability and co-movement of major stablecoins (USDT, USDC, DAI, and TUSD) during significant economic events such as the COVID-19 pandemic and the collapses of Iron Finance, Terra-Luna, FTX, and Silicon Valley Bank (SVB). We investigated the temporal volatility and dynamic connections between stablecoins using wavelet techniques. Our results showed that the announcement of USDT’s listing on Coinbase in April 2021 significantly impacted the stability of stablecoins, evidenced by a decline in the power spectrum. This phenomenon has not been explored in the literature. Furthermore, the collapse of SVB was highly relevant to the stablecoin market. We observed high coherence between pairs during the pandemic, the Coinbase listing, and the collapse of SVB. After the collapse of Terra-Luna, USDT, USDC, and DAI became more connected in the medium term, with USDC and DAI extending in the long term despite a negative co-movement between USDT and the others. This study highlights the impact of exchange listings on the volatility of stablecoins, with implications for investors, regulators, and the cryptocurrency community, especially regarding the stability and safe integration of these assets into the financial system.

1. Introduction

The history of stablecoins is the history of their instabilities. It is punctuated by significant economic events that further illustrate their intrinsic instabilities. Various studies have also examined the events’ impacts on crypto asset market dynamics, such as the COVID pandemic (Gadi & Sicilia, 2022; Ghabri et al., 2022; Lamine et al., 2024; Yousaf & Yarovaya, 2022), the outcomes of stablecoin collapses (De Blasis et al., 2023; Esparcia et al., 2024; Saengchote & Samphantharak, 2024), and announcement events (Filezac de l’Etang, 2024; Saggu, 2022), providing insights into behavioural and economic effects on stablecoin. In addition, research, such as that by Hoang and Baur (2021), has detailed how stablecoins, though less volatile than Bitcoin, display greater instability than traditional assets like fiat currencies and gold. This vulnerability is predominantly due to their strong correlations with Bitcoin’s price movements, which Brik et al. (2022) noted as having bidirectional influences, quickly reflecting Bitcoin’s performance in stablecoin prices. Even under normal conditions, the role of stablecoins as diversifiers and safe havens, as identified by Wang et al. (2020), is heavily contingent on these crypto-market dynamics, influencing their ability to serve as stable financial instruments during periods of economic stress.

Recent strands of the literature extend our understanding of stablecoins’ fragility and co-instabilities (Gregory et al., 2024; Thanh et al., 2023). However, these studies analysed different periods. These studies did not consider the listing of USDT on Coinbase. Thanh et al. (2023) addressed the COVID period, but Gregory et al. (2024) did not. Moreover, these studies did not focus on how specific events affect stablecoin volatility over different time horizons and investigate the longer-term connectivity that emerges before and after events like SVB’s collapse. We have jointly analysed the instability and co-movement of these instabilities of the main stablecoins (USDT, USDC, DAI, and TUSD) during the economic events cited in the literature, notably the COVID pandemic and collapses, such as Iron Finance, Terra-Luna, FTX, and Silicon Valley Bank (SVB), and others not yet studied in the literature, such as Coinbase’s USDT listing. To analyse and write the history of the instabilities and co-movement of the instabilities of stablecoins, we used a wavelet-based approach because it extends beyond conventional time-series methods by operating in a joint time-frequency domain. Through wavelet analysis, we applied the wavelet power spectrum (WPS) measure (Abid & Kaffel, 2018; Aguiar-Conraria & Soares, 2014), which allows us to capture localised periods of high volatility in stablecoins, while wavelet coherence (WC) (Abid & Kaffel, 2018; Aguiar-Conraria & Soares, 2014; Jana & Sahu, 2023; Ali et al., 2024) provides a robust measure of how closely two stablecoins move together across different time horizons, and through Wavelet Coherence Phase Difference (WCPD) (Abid & Kaffel, 2018; Ali et al., 2024), we identify the leading and lagging behaviours in this relationship.

Our main empirical results revealed the following. First, we identified that the announcement of the listing of USDT on Coinbase in April 2021 (Listing Coinbase)1 impacted the stability of stablecoins. The visualisation of the scalogram is perceived as a substantial decline in the WPS. We did not find any research in the literature on the impact of this event on the stablecoin market. Second, we found that beyond COVID and Listing Coinbase, the collapse of SVB was more relevant for the stablecoin market. Third, we found a high coherence between all pairs investigated during the COVID pandemic, the Listing Coinbase, and the SVB collapse. Lastly, we identified that after the collapse of Terra-Luna, USDT, USDC, and DAI started to become more connected in the medium term, and USDC and DAI also in the long term. However, we concluded that there was a negative co-movement between USDT and the other stablecoins in the analysis, with USDT lagging the relationship.

Our findings have significant implications for market participants, regulators, and anyone interested in the future of digital currencies. This paper aims to contribute to the existing literature by providing empirical evidence on the impact of exchange (de)listings on stablecoin volatility. The substantial differences in the characteristics of stablecoin’s volatility before and after the listing of USDT in Coinbase suggest that the findings of previous studies (Chen & Chang, 2022; Grobys et al., 2021; Jarno & Kołodziejczyk, 2021; Wang et al., 2020) based on data from the pre-listing period could be quite different if these studies were replicated using data from the post-listing period. In addition, our findings about the impact of the collapse of SVB in the stablecoin market are relevant for policymakers concerned with the stability of stablecoin, especially concerns arising from the existence of reserve funds related to the stablecoin pegged to fiat with goals of 1:1. The regulatory frameworks are being developed to address this problem (AICPA, 2023)2, aiming to ensure their safe integration into the broader financial ecosystem while mitigating risks associated with their use. Lastly, due to the growing integration of cryptocurrencies in mainstream financial services (Jin et al., 2023; Kochergin, 2020; Morgan, 2022; Moura de Carvalho et al., 2022; Sood et al., 2023), understanding these dynamics offers valuable implications for investors, regulatory bodies, and the cryptocurrency community3.

This article is structured as follows: The next section describes the literature review. Following this, we present the data and methodology section. The results are presented and discussed in the subsequent section. Finally, the article concludes by presenting the limitations and suggesting directions for future research.

2. Literature Review

Stablecoins are frequently described as digital assets that merge elements of traditional fiat currency with the volatility of cryptocurrencies, aiming to mitigate price fluctuations and potentially function as both a means of payment and a store of value (ECB, 2020a, 2022). However, despite efforts to remain stable, they remain vulnerable to price volatility and liquidity runs, which can lead to significant deviations from their targeted peg (BIS, 2023). From a financial theory standpoint, asset stability and pricing are shaped by factors such as liquidity, investor confidence, information asymmetry, and governance quality (Elbadry et al., 2015; Kim et al., 2024; Petersen & Plenborg, 2006). Although stablecoins are technologically distinct from conventional financial instruments, these fundamental principles still apply (ECB, 2020a, 2022). In particular, the stability of stablecoins depends on the calibre of their reserve assets, the issuer’s commitment to upholding the peg, and the robustness of the underlying technology (BIS, 2023). Consequently, if market participants fear losing par value, stablecoins can face liquidity runs (ECB, 2020b).

Recent empirical research—spanning our analysis period of January 2020 to June 2024—has shed light on stablecoin stability and its intricate interdependencies with crypto and traditional markets. Smales (2021) and Grobys et al. (2021) found that stablecoins do not independently influence the broader crypto market’s volatility, although they are affected by Bitcoin and Ethereum’s fluctuations. Brik et al. (2022) identified bidirectional influences between Bitcoin and stablecoins, suggesting swift integration of Bitcoin performance data into stablecoin prices, reflecting market efficiency. Hairudin and Mohamad (2023) and Łęt et al. (2023) highlighted that USDT exhibits short-lived volatility responses to market shocks. Fernandez-Mejia (2024) investigated extreme price fluctuations in stablecoins relative to financial and crypto assets indices and found asymmetric reactions in stablecoin pricing. Lastly, Lyons and Viswanath-Natraj (2023) observed that improvements like USDT’s migration to the Ethereum blockchain have enhanced its arbitrage efficiency and reduced peg deviations significantly.

Other studies analysed stablecoin in turbulence time, mainly during COVID-19. Gadi and Sicilia (2022) found that stablecoins like USDT and USDC consistently acted as effective hedges across most markets during the COVID-19 pandemic. Ali et al. (2024) explored the relationship between conventional crypto assets (Bitcoin, Ethereum, and Binance coin) and Islamic gold-backed stablecoins (OGC, X8X token, and HelloGold), discovering weak correlations that offer diversification opportunities. Mzoughi et al. (2023) explored the interdependencies between various markets, including West Texas Intermediate (WTI) crude oil, and crypto assets, during the pandemic, finding that digital gold outperformed stablecoins like Tether regarding return on investment in crisis conditions. Feng et al. (2024) demonstrated that stablecoins pegged to the USD provided robust hedging against global stock markets during the pandemic, outperforming traditional assets like gold, USD, and volatile Bitcoin. Conversely, Lamine et al. (2024) found that stablecoins like USDT and TUSD did not exhibit similar hedging effectiveness during the COVID-19 pandemic crisis for US and Chinese stock markets. Almeida et al. (2024) discovered that stablecoins did not consistently hedge against geopolitical risks or economic uncertainties in BRIC countries. Jana and Sahu (2023) highlighted the effectiveness of stablecoins as hedges and safe havens during stable and turbulent times for global stock markets.

The history of instabilities has also been written in the context of collapse moments. Recent studies have dissected financial collapses, revealing deep vulnerabilities and systemic risks across the cryptocurrency and banking sectors. The collapse of Iron Finance in June 2021 and The Terra-Luna collapse in May 2022 marked a moment in the history of algorithmic stablecoins, highlighting the inherent risks and vulnerabilities of decentralized finance (DeFi) (Adams & Ibert, 2022) and triggering widespread financial repercussions and a wave of regulatory scrutiny4. Iron Finance’s algorithmic stablecoin, IRON, was partially collateralized, relying on a combination of USDC and TITAN tokens to maintain its peg to the U.S. dollar. However, when TITAN’s price plummeted due to a sudden surge in withdrawals and a “bank run” scenario, the mechanism intended to stabilise IRON failed, leading to a complete devaluation of TITAN and a loss of investor funds5. Saengchote and Samphantharak (2024) analysed this collapse, noting the vulnerabilities associated with algorithmic stablecoins that lack fully backed collateralisation. In May 2022, Terra’s UST, an algorithmic stablecoin designed to maintain its peg through a burning mechanism with its token LUNA, lost its peg following a rapid, large-scale sell-off (Liu et al., 2023). According to Cho (2023), the de-pegging was exacerbated by a poorly designed redemption structure, which failed to respond effectively to the shock. The collapse of UST led to significant contagion effects, as highlighted by De Blasis et al. (2023), who observed herding behavior among traders that further destabilized the market. Lee et al. (2023) noted the event’s impact on the overall connectedness of the crypto ecosystem, as UST’s devaluation reverberated across various digital assets, fueling volatility and shaking investor confidence.

The collapse of the FTX cryptocurrency exchange in November 2022 had profound implications for the digital asset ecosystem, particularly in terms of trust and transparency within centralised platforms6. FTX’s rapid downfall was triggered by revelations of financial mismanagement and an insolvency crisis, with significant funds reportedly misappropriated to cover debts for its affiliated trading firm, Alameda Research. Esparcia et al. (2024) examined the aftermath, noting a sharp increase in intraday volatility among cryptocurrencies, with stablecoins experiencing heightened volatility and spillover effects. Bouri et al. (2023) highlighted the risk spillover from FTX Token (FTT) to other crypto markets, although they noted that USDT remained relatively insulated.

The collapse of Silicon Valley Bank (SVB) in March 2023 demonstrated the potential for cross-market contagion in traditional finance7, with notable spillover effects in the digital asset space, particularly stablecoins8. The most direct and immediate impact was on USD Coin (USDC), the second-largest stablecoin by market capitalisation. USDC experienced a significant de-pegging from its USD 1 target value. Circle, the issuer of USDC, revealed that it had USD 3.3 billion (approximately 8% of USDC’s reserves) deposited with SVB (Kakebayashi, 2023). This exposure was the primary cause of USDC’s de-pegging. Galati and Capalbo (2024) observed heightened volatility and a shift towards more stable assets like USDT. Ali et al. (2023) reported a subsequent increase in interconnectedness among major crypto assets, with traditional cryptocurrencies such as Bitcoin and Ethereum transmitting spillovers to stablecoins.

Other studies analysed the interconnected instabilities of stablecoins. Thanh et al. (2023) employ a Vector Autoregression (VAR) model to uncover how shocks in USDT and USDC transmit to other stablecoins, using data from 23 November 2019, to 1 April 2021. Gregory et al. (2024) focus on the May 2021 to December 2023 period, detecting structural breaks in stablecoin pegs via dynamic methods such as Dynamic Time Warping (DTW) and DCC-GARCH; their findings suggest minimal herding effects in the wake of certain collapses (e.g., IRON, TERRA) but observe more pronounced short-lived disruptions around FTX and Silicon Valley Bank (SVB).

Through wavelet methods over a longer horizon (January 2020 to June 2024) than either Thanh et al. (2023) or Gregory et al. (2024), our study offers a broader lens. Notably, we incorporate the overlooked episode of USDT’s Coinbase listing—an event that our results show markedly affected stablecoin volatility in April 2021 and is absent in prior studies. In addition, a global pandemic (COVID), a crypto exchange collapse (FTX), a bank run (SVB), or an algorithmic stablecoin (Terra-Luna and Iron Finance) failure stands out in our wavelet analysis, revealing previously unidentified patterns in short-term turbulence and longer-term co-movement.

3. Methodology

3.1. Data

Based on their market capitalisation and data availability, we used 1642 observations of daily closing prices of significant stablecoins (USDT, USDC, DAI, and TUSD). The sample period starts from 1 January 2020, to 30 June 20249. This period allows us to analyse stablecoin market behaviour (stability and co-movement) in the following events described in the literature and found through empirical analysis: COVID-19 (11 March 2020)10, the Listing of USDT in Coinbase (22 April 2021), the Iron Finance collapse (17 June 2021), the removal of DAI Price Stability Module (PSM) fees (10 November 2021)11, the Terra-Luna collapse (13 May 2022), the FTX collapse (8 November 2022), the SVB collapse (10 March 2023), and the delisting TUSD trading pairs in Binance (15 March 2024)12.

We selected the specific dates of the events based on the established literature and major news announcements. However, it is crucial to recognise that market responses often precede and outlast the dates cited. For example, although we marked 11 March 2020, as the pivotal day for COVID-19, the economic and financial effects of the pandemic began earlier and lasted much longer beyond that date13. Similarly, although 8 November 2022, represents the collapse of FTX, the turbulence surrounding that event manifested itself before the chosen date and continued afterwards. Therefore, we interpreted the results in the broader temporal context, rather than confining them strictly to single, discrete points in time.

3.2. Wavelet Analysis

Wavelet analysis provides a powerful framework to examine how the volatility and co-movement of financial time series evolve over time and across different frequencies (Abid & Kaffel, 2018; Aguiar-Conraria & Soares, 2014; Ali et al., 2024; Haq & Bouri, 2022; Jana & Sahu, 2023). By applying wavelet analysis to stablecoin returns, we can identify how market events—such as the COVID-19 pandemic, major exchange listings, or institutional collapses—impact volatility over different time horizons and how these effects vary over the lifespan of the assets.

We employ three key wavelet-based measures14 to capture these dynamic behaviours fully. The WPS allows us to visualise the intensity of volatility at different frequencies over time, pinpointing periods of heightened instability. WC extends this analysis to pairs of stablecoins, revealing how strongly their returns move together across various frequencies. Finally, by examining the WCPD, we can determine which stablecoin leads or lags the other at specific frequencies, uncovering directional patterns not easily detected through standard time-domain techniques.

In wavelet coherence analysis, identifying lead-lag relationships across different frequencies is instrumental in assessing the interdependence between time series. However, it does not provide definitive evidence of causality (Rodríguez-Murillo & Filella, 2020). To rigorously validate cause-and-effect relationships, one should complement wavelet coherence with specialised causal inference methods—such as Granger causality tests (in both the time and wavelet domains) (Kim Karlsson et al., 2018; Yousfi & Bouzgarrou, 2024)—which specifically examine whether past values of one variable provide additional predictive power for another, beyond what can be explained by the latter’s own history or by common external shocks.

In our study, we strengthen the interpretability of wavelet results by cross-referencing known event dates (COVID-19, Terra-Luna crash, SVB collapse, etc.) with significant wavelet power surges and checking for consistency with relevant literature (previous papers that document similar phenomena using different methodologies). We overlay vertical dashed lines on wavelet plots at the exact dates of known shocks or announcements. Therefore, if wavelet power or coherence significantly increases near those lines, this visually underscores the connection between the shock and market volatility. In addition, if the shock was theoretically more relevant for one stablecoin (e.g., USDC’s reserves at SVB) and the wavelet plot shows a stronger or earlier reaction for that coin, it further solidifies the causal link narrative.

4. Result Analysis

In the following sessions, we present the history of stablecoin instabilities through descriptive statistics of the period before and after the listing of USDT on Coinbase, WPS analysis of daily stablecoin returns, and coherence between stablecoin pairs.

4.1. Descriptive Statistics

This section presents descriptive statistics for the returns of four major stablecoins—USDT, USDC, DAI, and TUSD. Although our analysis references other significant market events, such as the COVID-19 pandemic and the collapses of Terra-Luna, FTX, and Silicon Valley Bank, our primary goal is how the Coinbase listing impacted stablecoin volatility. We focus on stablecoins volatility and distributional characteristics before and after the Tether (USDT) listing on Coinbase on 22 April 2021. We divide our sample into two periods: pre-listing (from the start of our sample up to 21 April 2021) and post-listing (from 22 April 2021, onwards).

Table 1 reports summary statistics for DAI, TUSD, USDC, and USDT returns in both the pre-listing and post-listing periods. Across all four stablecoins, we observe narrower ranges between the maximum and minimum returns, and substantially lower standard deviations (SD) of returns after the listing. For instance, USDT’s SD decreases from 0.495 to 0.0417, indicating a notable stabilisation. To statistically confirm this decline, we ran F-tests for equal variances. The p-values associated with these tests indicated that the reduction in volatility observed after Tether’s listing on Coinbase is statistically significant.

Table 1.

Descriptive statistics.

However, the reduction in overall volatility does not imply that stablecoins have become entirely free from abrupt, extreme fluctuations. The high kurtosis values and the more pronounced negative skewness in USDC and DAI returns after the listing suggest that, while daily volatility diminished, occasionally sharp and potentially destabilising price movements still occur. For this purpose, in the next section, we apply wavelet analysis to investigate these lingering signs of instability more deeply, examining how volatility patterns evolve over time and at various frequencies.

4.2. The History of the (In)Stabilities

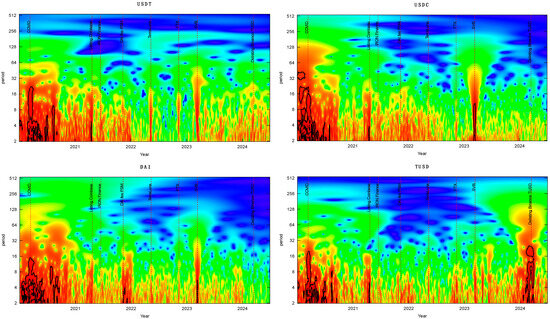

Figure 1 presents a WPS analysis of the daily returns of the USDT, USDC, TUSD, and DAI. Vertically, the period axis measures in days, ranging from shorter periods at the bottom—capturing high-frequency variations—to longer periods at the top that detect lower-frequency trends. Horizontally, the timeline highlights specific years and notable events with vertical dashed lines indicating their occurrences. The colour gradient from blue to red illustrates varying levels of WPS, where cooler colours represent lower energy levels and warmer colours indicate higher levels of volatility or statistical significance. The black contour in the plot signifies regions where the WPS is statistically significant at a 5% level. The cone of influence, shown as a shaded area, indicates the region where edge effects might distort the analysis. Similarly to Jana and Sahu (2023), we have classified holding periods into three categories, such as long periods (128–512 days), mid-period (32–128 days), and short periods (2–32 days).

Figure 1.

Wavelet power spectrum analysis of the USDT, USDC, DAI, and TUSD.

The onset of the COVID-19 pandemic in early 2020 has also tested the resilience and stability of the stablecoin (Feng et al., 2024; Jalan et al., 2021; Mzoughi et al., 2023; Syuhada et al., 2022). As shown in Figure 1, the COVID-19 period is characterised by an almost continuous red blur accompanied by multiple black contours, indicating persistently elevated volatility levels that are statistically significant. At the beginning of COVID-19, all stablecoins demonstrated significant WPS in the short period, with USDC also in the mid-period.

Next, a high WPS was evident around the USDT listing in Coinbase. It is also noted that after this event, there was a reduction in WPS in all stablecoins. This is aligned by analogy with studies that analysed the impact on company shares’ returns when listed in other countries (stock exchange foreigners) (Faff et al., 2002; Howe et al., 1993; Lei & Li, 2010; Zavaleta Vázquez & González Maiz Jiménez, 2016). According to Faff et al. (2002), firms signal to investors about the quality of their future income streams by listing on international exchange and adhering to regulatory disclosure requirements. Therefore, listing Tether in a regulated exchange might imply compliance with stricter financial controls and transparency, reducing systemic risks and speculative trading, which are often sources of high volatility. This instability before listing, as demonstrated visually in the graph and by the statistical results, aligns with previous studies’ findings. Specifically, by employing intra-day data, Duan and Urquhart (2023) found that stablecoins show different extents of deviations from the USD 1 value, indicating clear evidence of instability. The stability found after listing also aligns with previous studies’ findings (Hairudin & Mohamad, 2023; Jana & Sahu, 2023; Sinlapates & Chancharat, 2024). The graph of daily conditional volatilities shown in (Gregory et al., 2024) firmly also demonstrates that, for USDT, USDC and TUSD, after April 2021, the conditional volatility reduced and only increased during the SVB event and returned to reduce after this event.

As the timeline progresses, the graph shows a general trend of stabilisation in stablecoins’ daily returns post-listing, punctuated by occasional spikes during significant global or sector-specific events. Iron Finance collapse was the most minor spectrum for all stablecoins. This lower impact is also revealed in the literature review, in which we find a single study on the subject (Saengchote & Samphantharak, 2024). Next, removing the PSM fees in November 2021 has enabled risk-free arbitrage between DAI and other stablecoins such as USDC. This event only significantly impacted the WPS of DAI without affecting the WPS of USDC. The collapse of Terra-Luna (Briola et al., 2023; Cho, 2023; De Blasis et al., 2023; Lee et al., 2023) and FTX (Esparcia et al., 2024) also affected the WPS of the stablecoins returns. The Terra-Luna and FTX collapses caused a strong spike in the WPS of the USDT.

In March 2023, the SVB collapse underscored the interconnected risks between the cryptocurrency markets and the traditional banking system, challenging stablecoins’ perceived stability and reliability (Ali et al., 2023; Galati & Capalbo, 2024; Oefele et al., 2024). The stablecoins market faced a significant stress test as USDC temporarily lost its peg to the U.S. dollar in response to the collapse of Silicon Valley Bank (SVB). The de-pegging occurred shortly after the revelation that Circle, the issuer of USDC, had USD 3.3 billion, approximately 8% of its reserves, trapped in the now-defunct SVB. This incident was a significant event that increased the WPS of all stablecoins, mainly DAI and USDC. This event affected all stablecoins in the short and mid-period.

Lastly, TUSD’s market capitalisation declined from USD 3.8 billion in November 2023 to USD 0.4 billion by late March 202415. This drop aligns with the WPS, which first shows elevated volatility in November (dark red band), suggesting the initial phase of TUSD’s instability. Early January 2024 marked TUSD’s sharp deviation from its intended 1:1 peg16, and around this point, several significant WPS spikes (black outlines) signal intensified volatility. The peak occurred in March 2024—when Binance, one of the world’s leading cryptocurrency exchanges, announced the delisting of multiple TUSD trading pairs17—corresponding closely with a surge in TUSD’s volatility on the WPS.

Therefore, WPS analysis using a scalogram may be useful for visually and statistically linking significant events with observed data behaviours, as we demonstrated in writing the history of stablecoin instability. This technique allowed us to pinpoint events’ exact timing and impact on stablecoins. We identified significant events not previously covered in the literature, such as the listing of Tether on Coinbase, events for further research (delisting of Binance’s TUSD), events with the most significant systemic impact (COVID-19, listing on Coinbase, and SBV collapse), and the stablecoins that reacted the most to these events (USDC’s reaction to the SVB collapse and TUSD to the Binance delisting).

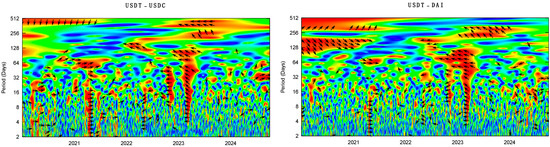

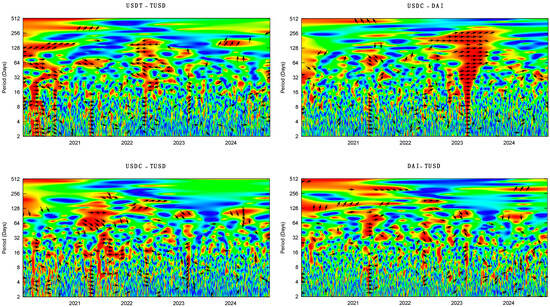

4.3. The History of the Co-Movements of the (In)Stabilities

The co-movement demonstrated by wavelet coherence between stablecoins returns is depicted in Figure 2. The varying colours represent different coherence levels between the two financial instruments across various frequencies and over time. The warmer colours (red, orange) indicate higher coherence, while cooler colours (blue, dark blue) suggest less coherence. The vertical axis indicates the cycle period or frequency of interest, measured in days. Lower values represent shorter cycles (high-frequency components), and higher values represent longer cycles (low-frequency components). The horizontal axis shows the time from January 2020 to June 2024, allowing analysis of how the coherence between stablecoins evolves. The contours, often marked with arrows, indicate statistically significant coherence regions. The direction of the arrows provides additional information. The right-pointing arrows mean that the two stablecoins are in phase (i.e., they move together). The left-pointing arrows mean that the two series are out of phase (i.e., they move in opposite directions). The right–up and left–down arrows (↗, ↙) significate a leading effect of the first stablecoin returns on the second stablecoin returns, while the right–down and left–up arrows (↘, ↖) signify a lagging effect of the first stablecoin returns on the second stablecoin returns. The curved white area at the edges (known as the cone of influence) warns that results close to the edges might be distorted due to edge effects in data processing.

Figure 2.

Wavelet coherence between stablecoins.

During the COVID-19 pandemic, our analysis revealed distinct phase dynamics at different frequency bands. Specifically, at the 128-day frequency, the coherence plot indicated right–down arrows, suggesting that DAI slightly leads USDT by less than a quarter of the cycle. Conversely, at the 512-day frequency, right–up arrows were observed, indicating that USDT leads DAI by a similar phase margin. Furthermore, USDT and TUSD were highly connected across all frequency periods, as shown in the red spot.

During the Listing of Coinbase, all stablecoins were in phase in the short term. Iron Finance did not propose a systemic risk to altering the coherence between stablecoins. This result corroborates those found by (Gregory et al., 2024). Also, despite the withdrawal of fees as per the event DAI fee PSM described above, there was no increase in coherence between USDC-DAI. After the Terra-Luna collapse, the correlation between USDT and the other stablecoins turned negative (out of phase). USDC, DAI, and TUSD lead to the relationship in the long term. This long-term co-movement demonstrates that stablecoin price returns have become more connected in the long term since the Terra-Luna collapse. This relationship was also short and medium term during the SVB collapse.

The positive coherence between the USDC-DAI pair increased in the long and short term during the SVB collapse, demonstrating the structural dependencies and systemic risks because part of the collateralised DAI is in USDC. Finally, the delisting of TUSD trading pairs in Binance did not generate an increase in coherence between stablecoins, which means that the shock of this event did not spread to other stablecoins.

While our findings align with Gregory et al. (2024) in identifying significant market events, our wavelet analysis over a longer time horizon reveals more nuanced dynamics in stablecoin relationships. Gregory et al. (2024) concluded that the Terra-Luna crash led to no significant increase in interdependence between major stablecoins, characterising it as an idiosyncratic shock. In contrast, our results uncover a more complex picture: Following the Terra-Luna collapse, we observed a shift to a negative correlation (out of phase) between USDT and other stablecoins, with USDC, DAI, and TUSD leading the relationship in the long term. This divergence in findings highlights the value of our extended timeframe and the sensitivity of wavelet methods in capturing subtle changes in market dynamics. Furthermore, our analysis detected that this long-term co-movement pattern persisted and extended to short- and medium-term relationships during the SVB collapse, suggesting a more interconnected and evolving stablecoin ecosystem than previously recognised.

In addition, after Terra-Luna’s collapse, the negative co-movement, particularly in crisis events, suggests that exposure to USDT and USDC/DAI could provide a hedging opportunity against the risk of failure or significant devaluation. If one starts to perform poorly due to idiosyncratic or systemic factors, the other might hold its value better, thus providing a hedge. Conversely, USDC and DAI presented an in-phase relationship during all periods during the SVB crisis and medium and long term during the Terra-Luna and FTX collapses, demonstrating the impossibility of the two being in the same investment portfolio.

5. Conclusions

We comprehensively analysed stablecoin stability and interconnectivity employing short storytelling written through the volatility of stablecoin daily returns, the economic facts that occurred during the period, the literature review, and advanced wavelet techniques. The findings underscore a significant decrease in volatility post-listing of USDT on Coinbase on 22 April 2021, evidenced by reduced standard deviations and narrower ranges between the maximum and minimum returns. The WPS analysis using a scalogram also proved to identify significant events not previously covered in the literature. We also identified by this method events for further research (delisting of Binance’s TUSD), events with the most significant systemic impact (COVID-19, listing on Coinbase and SBV collapse), and the stablecoin that reacted the most to these events (USDC’s reaction to the SVB collapse). We also identified medium and high coherence between the stablecoin pairs by wavelet coherence technique. Our results demonstrate that exposure to USDT and USDC in downturns provides a hedging opportunity against the risk of failure or significant devaluation. Conversely, after the listing of Tether, the USDC-DAI pair showed positive co-movement in times of turbulence, which rules out the possibility of the two being in the same portfolio.

Therefore, our findings signal that listing USDT on Coinbase has been fundamental in the history of stablecoin instabilities. We can also affirm that the Terra-Luna collapse was the fundamental event in the history of stablecoin co-instability, in which, in the long term, the stablecoins became more correlated with negative co-movement between the main stablecoin, USDT, and the others.

Our analysis does not fully account for broader market or economic events that could influence stablecoin volatility. This includes changes in regulatory frameworks, macroeconomic shifts, or developments in other cryptocurrencies that could concurrently impact market conditions. In addition, our study focused solely on daily returns and other price frequencies, which can result in different results.

Future research should consider extending this analysis to examine the spillover effects between USDT and other cryptocurrencies before and after the listing. Additionally, it would be valuable to investigate the behaviour of companies utilising stablecoin in their daily operations, spurred by the observed reduction in volatility. Understanding how and why companies integrate stablecoin into their financial practices could offer insights into the broader implications of adopting stablecoin in corporate finance, providing a richer picture of its utility in a real-world business context.

Author Contributions

Conceptualization, R.M.d.C., H.C.I. and R.P.M.; Methodology, R.M.d.C., H.C.I. and R.P.M.; Formal analysis, R.M.d.C., H.C.I. and R.P.M.; Investigation, R.M.d.C., H.C.I. and R.P.M.; Data curation, R.M.d.C.; Writing—original draft, R.M.d.C., H.C.I. and R.P.M.; Writing—review & editing, R.M.d.C., H.C.I. and R.P.M.; Supervision, H.C.I. and R.P.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The stablecoins data are freely available from coinmarketcap.com (accessed on 20 July 2024).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

This appendix provides the mathematical formulations and technical details of the wavelet analysis techniques used in Section 3.2.

For the analysis, we used the daily returns, as described in the following measure:

where is the return of the stablecoin for daily t, is the price of the stablecoin for daily t, and is the price of the stablecoin for daily t − 1.

We specifically utilised the Continuous Wavelet Transform (CWT) to compute the WPS and WC between pairs of stablecoins. Below is the detailed econometric model.

The CWT of a time series x(t) is defined as (Aguiar-Conraria & Soares, 2014; Abid & Kaffel, 2018):

where s is a scale parameter (dilation factor) that determines the wavelet length, and τ represents the time domain (translation parameter), which controls the wavelet’s location (Abid & Kaffel, 2018). The (*) indicates the complex conjugate of the wavelet function and is the mother wavelet function defined as (Abid & Kaffel, 2018):

where is the non-dimensional frequency (Costa et al., 2022).

The WPS measures the local variance of the time series at different scales and times (Abid & Kaffel, 2018). The WPS for a series x(t) is defined as the squared absolute value of the CWT (Abid & Kaffel, 2018):

WC is a robust method for visualising the relationship between two-time series and analysing their co-movements in the joint time/frequency domains (Abid & Kaffel, 2018). The initial step in calculating the WC involves determining the cross-wavelet transform (CRWT) defined as follows (Torrence & Compo, 1998):

where and are the CWT of the original series x(t) and y(t), respectively, and the symbol * indicates the complex conjugate (Abid & Kaffel, 2018; Costa et al., 2022).

The CRWT analyses the shared power and phase variances among pairs of stablecoins. It is defined as (Torrence & Webster, 1999):

where is a smoothing operator in both time and scale (Abid & Kaffel, 2018).

To discern the directional information (positive and negative co-movements) in the relationships between the two stablecoins, we employed the Wavelet Coherence Phase Difference (WCPD) method, created by (Torrence & Webster, 1999). This method allows for the calculation of WPCD as follows:

where and are the imaginary and the real components, respectively.

Notes

| 1 | On 22 April 2021, Coinbase announced it would list USDT (Tether) on its exchange. This was a notable development, as Coinbase is one of the largest and most prominent cryptocurrency exchanges in the United States. Available online: https://www.coinbase.com/pt-pt/blog/tether-usdt-is-launching-on-coinbase-pro (accessed on 20 July 2024). |

| 2 | Government sets out plan to make UK a global cryptoasset technology hub. Available online: https://www.gov.uk/government/news/government-sets-out-plan-to-make-uk-a-global-cryptoasset-technology-hub (accessed on 20 July 2024). |

| 3 | SEC says FTX auditor did not understand the crypto market. Available online: https://www.ft.com/content/ad04330b-4252-45d3-a7f9-b60a9d930081 (accessed on 2 October 2024). |

| 4 | Terraform Labs and Do Kwon found liable for fraud in SEC case. Available online: https://www.ft.com/content/e180b713-21db-49df-ac56-bfb019af920b (accessed on 2 October 2024). |

| 5 | Iron Finance bank run stings investors—A lesson for all stablecoins? Available online: https://cointelegraph.com/news/iron-finance-bank-run-stings-investors-a-lesson-for-all-stablecoins (accessed on 2 October 2024). |

| 6 | The collapse of FTX—Lessons and implications for stakeholders in the crypto industry. Available online: https://assets.kpmg.com/content/dam/kpmg/sg/pdf/2022/12/the-collapse-of-ftx-1.pdf (accessed on 2 October 2024). |

| 7 | California regulator cites social media, digital banking as key factors in Silicon Valley Bank’s failure. Available online: https://www.latimes.com/business/story/2023-05-08/california-regulator-cites-social-media-digital-banking-as-key-factors-in-silicon-valley-banks-failure (accessed on 2 October 2024). |

| 8 | Here’s What On-Chain Data Tells Us About Crypto’s Reaction to the Demise of Silicon Valley Bank And Its Impact on USDC. Available online: https://www.chainalysis.com/blog/crypto-market-usdc-silicon-valley-bank/ (accessed on 2 October 2024). |

| 9 | Data was collected from coinmarketcap.com on 20 July 2024. |

| 10 | WHO Director-General’s opening remarks at the media briefing on COVID-19—11 March 2020. Available online: https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19---11-march-2020 (accessed on 17 December 2024). |

| 11 | The history of a DAI at par value: What can we learn from it? Available online: https://cryptobanking.network/the-history-of-a-dai-at-par-value/ (accessed on 17 December 2024). |

| 12 | Binance to delist several TrueUSD trading pairs. https://cointelegraph.com/news/binance-trueusd-stablecoin-trading-pair-delisting (accessed on 17 December 2024). |

| 13 | Several studies use different time intervals to determine the period of COVID (Costa et al., 2022; Shang et al., 2023). |

| 14 | Full mathematical definitions, derivations, and parameter choices for the Continuous Wavelet Transform (CWT), WPS, WC, and WCPD are provided in Appendix A. |

| 15 | https://coinmarketcap.com/currencies/trueusd/ (accessed on 2 October 2024). |

| 16 | Fifth largest stablecoin TrueUsd extends drop after losing peg. Available online: https://www.bloomberg.com/news/articles/2024-01-18/fifth-largest-stablecoin-trueusd-extends-drop-after-losing-peg?embedded-checkout=true (accessed on 2 October 2024). |

| 17 | “TUSD saw some volatility in its secondary market prices in early 2024 following large redemptions. There is no information about what caused this” (p. 4). Source: S&P Global Ratings—Stablecoin Stability Assessment: TrueUSD (TUSD). Available online: https://www.spglobal.com/_assets/documents/ratings/research/101608839.pdf (accessed on 17 December 2024). |

References

- Abid, F., & Kaffel, B. (2018). Time–frequency wavelet analysis of the interrelationship between the global macro assets and the fear indexes. Physica A: Statistical Mechanics and its Applications, 490, 1028–1045. [Google Scholar] [CrossRef]

- Adams, A., & Ibert, M. (2022). Runs on algorithmic stablecoins: Evidence from iron, titan, and steel. Available online: https://www.federalreserve.gov/econres/notes/feds-notes/runs-on-algorithmic-stablecoins-evidence-from-iron-titan-and-steel-20220602.html (accessed on 2 October 2024).

- Aguiar-Conraria, L., & Soares, M. J. (2014). The Continuous Wavelet Transform: Moving Beyond Uni- and Bivariate Analysis. Journal of Economic Surveys, 28(2), 344–375. [Google Scholar] [CrossRef]

- AICPA. (2023). Proposed criteria for the presentation of the sufficiency of assets for redemption. Available online: https://www.aicpa-cima.com/resources/download/proposed-criteria-for-the-presentation-of-the-sufficiency-of-assets-for (accessed on 17 September 2024).

- Ali, S., Moussa, F., & Youssef, M. (2023). Connectedness between cryptocurrencies using high-frequency data: A novel insight from the Silicon Valley Banks collapse. Finance Research Letters, 58, 104352. [Google Scholar] [CrossRef]

- Ali, S., Yousaf, I., & Vo, X. V. (2024). Comovements and hedging effectiveness between conventional and Islamic cryptocurrencies: Evidence from the COVID-19 pandemic. International Journal of Emerging Markets, 19(12), 4383–4408. [Google Scholar] [CrossRef]

- Almeida, J., Gaio, C., & Gonçalves, T. C. (2024). Crypto market relationships with bric countries’ uncertainty—A wavelet-based approach. Technological Forecasting and Social Change, 200, 123078. [Google Scholar] [CrossRef]

- BIS. (2023). Financial stability risks from cryptoassets in emerging market economies. Available online: https://www.bis.org/publ/bppdf/bispap138.pdf (accessed on 17 December 2024).

- Bouri, E., Kamal, E., & Kinateder, H. (2023). FTX Collapse and systemic risk spillovers from FTX Token to major cryptocurrencies. Finance Research Letters, 56, 104099. [Google Scholar] [CrossRef]

- Brik, H., El Ouakdi, J., & Ftiti, Z. (2022). Roles of stable versus nonstable cryptocurrencies in Bitcoin market dynamics. Research in International Business and Finance, 62, 101720. [Google Scholar] [CrossRef]

- Briola, A., Vidal-Tomás, D., Wang, Y., & Aste, T. (2023). Anatomy of a Stablecoin’s failure: The Terra-Luna case. Em Finance Research Letters, 51, 103358. [Google Scholar] [CrossRef]

- Chen, K.-S., & Chang, S.-H. (2022). Volatility co-movement between Bitcoin and Stablecoins: BEKK–GARCH and Copula–DCC–GARCH approaches. Em Axioms, 11, 259. [Google Scholar] [CrossRef]

- Cho, J. (2023). A token economics explanation for the de-pegging of the algorithmic stablecoin: Analysis of the case of Terra. In Em ledger (Vol. 8, pp. 27–36). University Library System, University of Pittsburgh. [Google Scholar] [CrossRef]

- Costa, A., da Silva, C., & Matos, P. (2022). The Brazilian financial market reaction to COVID-19: A wavelet analysis. International Review of Economics & Finance, 82, 13–29. [Google Scholar] [CrossRef]

- De Blasis, R., Galati, L., Webb, A., & Webb, R. I. (2023). Intelligent design: Stablecoins (in)stability and collateral during market turbulence. In Em financial innovation (Vol. 9, Número 1). Springer Science and Business Media Deutschland GmbH. [Google Scholar] [CrossRef]

- Duan, K., & Urquhart, A. (2023). The instability of stablecoins. Em Finance Research Letters, 52, 103573. [Google Scholar] [CrossRef]

- ECB. (2020a). A regulatory and financial stability perspective on global stablecoins. Available online: https://www.ecb.europa.eu/press/financial-stability-publications/macroprudential-bulletin/html/ecb.mpbu202005_1~3e9ac10eb1.en.html (accessed on 17 December 2024).

- ECB. (2020b). Stablecoins: Implications for monetary policy, financial stability, market infrastructure and payments, and banking supervision in the euro area. Available online: https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op247~fe3df92991.en.pdf (accessed on 17 December 2024).

- ECB. (2022). Stablecoins’ role in crypto and beyond: Functions, risks and policy. Available online: https://www.ecb.europa.eu/press/financial-stability-publications/macroprudential-bulletin/html/ecb.mpbu202207_2~836f682ed7.en.html (accessed on 17 December 2024).

- Elbadry, A., Gounopoulos, D., & Skinner, F. (2015). Governance quality and information asymmetry. Financial Markets, Institutions & Instruments, 24(2–3), 127–157. [Google Scholar] [CrossRef]

- Esparcia, C., Escribano, A., & Jareño, F. (2024). Assessing the crypto market stability after the FTX collapse: A study of high frequency volatility and connectedness. International Review of Financial Analysis, 94, 103287. [Google Scholar] [CrossRef]

- Faff, R. W., Hodgson, A., & Saudagaran, S. (2002). International cross-listings towards more liquid markets: The impact on domestic firms. Journal of Multinational Financial Management, 12(4–5), 365–390. [Google Scholar] [CrossRef]

- Feng, J., Yuan, Y., & Jiang, M. (2024). Are stablecoins better safe havens or hedges against global stock markets than other assets? Comparative analysis during the COVID-19 pandemic. Em International Review of Economics and Finance, 92, 275–301. [Google Scholar] [CrossRef]

- Fernandez-Mejia, J. (2024). Extremely stablecoins. Em Finance Research Letters, 63, 105268. [Google Scholar] [CrossRef]

- Filezac de l’Etang, C. (2024). Dollar’s role in institutional and media impact on stablecoins. Em Finance Research Letters, 61, 104999. [Google Scholar] [CrossRef]

- Gadi, M. F. A., & Sicilia, M.-A. (2022). Analyzing safe haven, hedging and diversifier characteristics of heterogeneous cryptocurrencies against G7 and BRICS market indexes. Journal of Risk and Financial Management, 15(12), 572. [Google Scholar] [CrossRef]

- Galati, L., & Capalbo, F. (2024). Silicon valley bank bankruptcy and stablecoins stability. Em International Review of Financial Analysis, 91, 103001. [Google Scholar] [CrossRef]

- Ghabri, Y., Ben Rhouma, O., Gana, M., Guesmi, K., & Benkraiem, R. (2022). Information transmission among energy markets, cryptocurrencies, and stablecoins under pandemic conditions. Em International Review of Financial Analysis, 82, 102197. [Google Scholar] [CrossRef]

- Gregory, G., Alessio, C., Vito, L., & Patrice, S. (2024). Break a peg! A study of stablecoin co-instability. International Review of Financial Analysis, 96, 103608. [Google Scholar] [CrossRef]

- Grobys, K., Junttila, J., Kolari, J. W., & Sapkota, N. (2021). On the stability of stablecoins. Journal of Empirical Finance, 64, 207–223. [Google Scholar] [CrossRef]

- Hairudin, A., & Mohamad, A. (2023). The isotropy of cryptocurrency volatility. Em International Journal of Finance and Economics, 29(3), 3779–3810. [Google Scholar] [CrossRef]

- Haq, I. U., & Bouri, E. (2022). Sustainable versus conventional cryptocurrencies in the face of cryptocurrency uncertainty indices: An analysis across time and scales. Em Journal of Risk and Financial Management, 15, 442. [Google Scholar] [CrossRef]

- Hoang, L. T., & Baur, D. G. (2021). How stable are stablecoins? Em European Journal of Finance, 30, 1984–2000. [Google Scholar] [CrossRef]

- Howe, J. S., Madura, J., & Tucker, A. L. (1993). International listings and risk. Journal of International Money and Finance, 12(1), 99–110. [Google Scholar] [CrossRef]

- Jalan, A., Matkovskyy, R., & Yarovaya, L. (2021). “Shiny” crypto assets: A systemic look at gold-backed cryptocurrencies during the COVID-19 pandemic. International Review of Financial Analysis, 78, 101958. [Google Scholar] [CrossRef]

- Jana, S., & Sahu, T. N. (2023). Is the cryptocurrency market a hedge against stock market risk? A Wavelet and GARCH approach. Economic Notes, 52(3), e12227. [Google Scholar] [CrossRef]

- Jarno, K., & Kołodziejczyk, H. (2021). Does the design of stablecoins impact their volatility? Em Journal of Risk and Financial Management, 14, 42. [Google Scholar] [CrossRef]

- Jin, F., Li, J., & Xue, Y. (2023). Preferring stablecoin over dollar: Evidence from a survey of Ethereum platform traders. Em Journal of International Money and Finance, 131, 102796. [Google Scholar] [CrossRef]

- Kakebayashi, M. (2023). Potential points of failure for stablecoins—Did the silicon valley bank collapse lead to defi instability?—(SSRN scholarly paper 4533835). Social Science Research Network. Available online: https://papers.ssrn.com/abstract=4533835 (accessed on 2 October 2024).

- Kim, J. C., Su, Q., & Elliott, T. (2024). Political regimes, stock liquidity, and information asymmetry in a global context. Em Journal of Risk and Financial Management, 17, 342. [Google Scholar] [CrossRef]

- Kim Karlsson, H., Li, Y., & Shukur, G. (2018). The causal nexus between oil prices, interest rates, and unemployment in Norway using wavelet methods. Sustainability, 10(8), 2792. [Google Scholar] [CrossRef]

- Kochergin, D. A. (2020). Economic nature and classification of stablecoins. Finance: Theory and Practice, 24(6), 140–160. [Google Scholar] [CrossRef]

- Lamine, A., Jeribi, A., & Fakhfakh, T. (2024). Spillovers between cryptocurrencies, gold and stock markets: Implication for hedging strategies and portfolio diversification under the COVID-19 pandemic. Em Journal of Economics, Finance and Administrative Science, 29, 21–41. [Google Scholar] [CrossRef]

- Lee, S., Lee, J., & Lee, Y. (2023). Dissecting the Terra-LUNA crash: Evidence from the spillover effect and information flow. Em Finance Research Letters, 53, 103590. [Google Scholar] [CrossRef]

- Lei, Z., & Li, H. (2010, August 24–26). Cross listing and price volatility based on time series filter in chinese stock market. 2010 International Conference on Management and Service Science (pp. 1–4), Wuhan, China. [Google Scholar] [CrossRef]

- Liu, J., Makarov, I., & Schoar, A. (2023). Anatomy of a run: The terra luna crash. National Bureau of Economic Research. Available online: https://www.nber.org/papers/w31160 (accessed on 2 October 2024).

- Lyons, R. K., & Viswanath-Natraj, G. (2023). What keeps stablecoins stable? Em Journal of International Money and Finance, 131, 102777. [Google Scholar] [CrossRef]

- Łęt, B., Sobański, K., Świder, W., & Włosik, K. (2023). What drives the popularity of stablecoins? Measuring the frequency dynamics of connectedness between volatile and stable cryptocurrencies. Em Technological Forecasting and Social Change, 189, 122318. [Google Scholar] [CrossRef]

- Morgan, J. (2022). Systemic stablecoin and the defensive case for Central Bank Digital Currency: A critique of the bank of England’s framing. Em Research in International Business and Finance, 62, 101716. [Google Scholar] [CrossRef]

- Moura de Carvalho, R., Inácio, H. C., & Marques, R. P. F. (2022). Ledger to ledger: Off-and on-chain auditing of stablecoin. International Journal of Digital Accounting Research, 22, 129–161. [Google Scholar] [CrossRef]

- Mzoughi, H., Ghabri, Y., & Guesmi, K. (2023). Crude oil, crypto-assets and dependence: The impact of the COVID-19 pandemic. Em International Journal of Energy Sector Management, 17, 552–568. [Google Scholar] [CrossRef]

- Oefele, N., Baur, D. G., & Smales, L. A. (2024). Flight-to-quality—Money market mutual funds and stablecoins during the March 2023 banking crisis. Em Economics Letters, 234, 111464. [Google Scholar] [CrossRef]

- Petersen, C., & Plenborg, T. (2006). Voluntary disclosure and information asymmetry in Denmark. Journal of International Accounting, Auditing and Taxation, 15(2), 127–149. [Google Scholar] [CrossRef]

- Rodríguez-Murillo, J. C., & Filella, M. (2020). Significance and causality in continuous wavelet and wavelet coherence spectra applied to hydrological time series. Hydrology, 7(4), 82. [Google Scholar] [CrossRef]

- Saengchote, K., & Samphantharak, K. (2024). Digital money creation and algorithmic stablecoin run. Em Finance Research Letters, 64, 105435. [Google Scholar] [CrossRef]

- Saggu, A. (2022). The intraday Bitcoin response to Tether minting and burning events: Asymmetry, investor sentiment, and “Whale Alerts” on Twitter. Finance Research Letters, 49, 103096. [Google Scholar] [CrossRef]

- Shang, Y., Qi, P., Chen, H., Yang, Q., & Chen, Y. (2023). COVID-19 and its impact on tourism sectors: Implications for green economic recovery. Economic Change and Restructuring, 56(2), 941–958. [Google Scholar] [CrossRef]

- Sinlapates, P., & Chancharat, S. (2024). Persistence and volatility spillovers of Bitcoin to other leading cryptocurrencies: A BEKK-GARCH analysis. Foresight, 26(1), 84–97. [Google Scholar] [CrossRef]

- Smales, L. A. (2021). Volatility spillovers among cryptocurrencies. Journal of Risk and Financial Management, 14(10), 493. [Google Scholar] [CrossRef]

- Sood, K., Singh, S., Behl, A., Sindhwani, R., Kaur, S., & Pereira, V. (2023). Identification and prioritization of the risks in the mass adoption of artificial intelligence-driven stable coins: The quest for optimal resource utilization. Em Resources Policy, 81, 103235. [Google Scholar] [CrossRef]

- Syuhada, K., Hakim, A., Suprijanto, D., Muchtadi-Alamsyah, I., & Arbi, L. (2022). Is Tether a safe haven of safe haven amid COVID-19? An assessment against Bitcoin and oil using improved measures of risk. Em Resources Policy, 79, 103111. [Google Scholar] [CrossRef]

- Thanh, B. N., Hong, T. N. V., Pham, H., Cong, T. N., & Anh, T. P. T. (2023). Are the stabilities of stablecoins connected? Em Journal of Industrial and Business Economics, 50, 515–525. [Google Scholar] [CrossRef]

- Torrence, C., & Compo, G. P. (1998). A practical guide to wavelet analysis. Available online: https://journals.ametsoc.org/downloadpdf/view/journals/bams/79/1/1520-0477_1998_079_0061_apgtwa_2_0_co_2.pdf (accessed on 1 October 2024).

- Torrence, C., & Webster, P. J. (1999). Interdecadal changes in the ENSO–monsoon system. Journal of Climate, 12, 2679–2690. [Google Scholar] [CrossRef]

- Wang, G.-J., Ma, X., & Wu, H. (2020). Are stablecoins truly diversifiers, hedges, or safe havens against traditional cryptocurrencies as their name suggests? Em Research in International Business and Finance, 54, 101225. [Google Scholar] [CrossRef]

- Yousaf, I., & Yarovaya, L. (2022). Spillovers between the Islamic gold-backed cryptocurrencies and equity markets during the COVID-19: A sectorial analysis. Em Pacific Basin Finance Journal, 71, 101705. [Google Scholar] [CrossRef]

- Yousfi, M., & Bouzgarrou, H. (2024). On the linkage of oil prices and oil uncertainty with US equities: A combination analysis based on the wavelet approach and quantile-on-quantile regression. Frontiers in Physics, 12, 1357366. [Google Scholar] [CrossRef]

- Zavaleta Vázquez, O. H., & González Maiz Jiménez, J. (2016). The implicit impact of cross-listing on stock prices: A market microstructure perspective—The case of Latin American markets. Contaduría y Administración, 61(2), 283–297. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).