Character Counts: Psychometric-Based Credit Scoring for Underbanked Consumers

Abstract

1. Introduction

2. Alternative Credit Data

3. Psychometric-Based Credit Data

4. Materials and Methods

4.1. Sample

4.2. Measures

4.2.1. Psychometric Scores

4.2.2. Bank Scores

4.2.3. Loan Defaults

4.3. Procedure

5. Results

6. Discussion

Funding

Data Availability Statement

Conflicts of Interest

References

- Arraiz, Irani, Miriam Bruhn, and Rodolfo Stucchi. 2017. Psychometrics as a tool to improve credit information. The World Bank Economic Review 30 S1: S67–S76. [Google Scholar] [CrossRef]

- Baumeister, Roy F. 2002. Yielding to temptation: Self-control failure, impulsive purchasing, and consumer behavior. Journal of Consumer Research 28: 670–76. [Google Scholar] [CrossRef]

- Bernerth, Jeremy, Shannon Taylor, Jack Walker, and Daniel Whitman. 2012. An empirical investigation of dispositional antecedents and performance-related outcomes of credit scores. Journal of Applied Psychology 97: 469–78. [Google Scholar] [CrossRef] [PubMed]

- Bertrand, Marianne, Dean Karlan, Sendhil Mullainathan, Eldar Shafir, and Jonathan Zinman. 2010. What’s advertising content worth? Evidence from a consumer credit marketing field experiment. The Quarterly Journal of Economics 125: 263–306. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Saniya Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19. Washington, DC: World Bank. [Google Scholar] [CrossRef]

- Djeundje, Viani B., Jonathan Crook, Raffaella Calabrese, and Mona Hamid. 2021. Enhancing credit scoring with alternative data. Expert Systems with Applications 163: 113766. [Google Scholar] [CrossRef]

- Dlugosch, Thorsten J., Bailey Klinger, Michael Frese, and Ute-Chrisine Klehe. 2017. Personality-based selection of entrepreneurial borrowers to reduce credit risk: Two studies on prediction models in low- and high-stakes settings in developing countries. Journal of Organisational Behaviour 39: 612–28. [Google Scholar] [CrossRef]

- Fair Isaac Corporation. 2023. FICO Scores are Used in over 90% of U.S. Lending Decisions. Available online: https://www.ficoscore.com/about (accessed on 11 January 2023).

- Fine, Saul. 2016. Worthy Credit. Technical Report. Tel Aviv: Innovative Assessments International, Ltd. [Google Scholar]

- Fine, Saul. 2021. An empirical look at psychometric-based credit scoring. Paper presented at the 17th Credit Scoring and Credit Control Conference, Virtual, August 25. [Google Scholar]

- Fine, Saul. 2023. Banking on personality: Psychometrics and consumer creditworthiness. Journal of Credit Risk 19: 1–19. [Google Scholar] [CrossRef]

- Gathergood, John. 2012. Self-control, financial literacy and consumer over-indebtedness. Journal of Economic Psychology 33: 590–602. [Google Scholar] [CrossRef]

- Goel, Akanksha, and Shailesh Rastogi. 2023. Understanding the impact of borrowers’ behavioural and psychological traits on credit default: Review and conceptual model. Review of Behavioral Finance 15: 205–23. [Google Scholar] [CrossRef]

- Hogan, Robert, John Johnson, and Stephen Briggs, eds. 1997. Handbook of Personality Psychology. San Diego: Academic Press. [Google Scholar] [CrossRef]

- Janda, Louis H. 1998. Psychological Testing: Theory and Application. Boston: Allyn and Bacon. [Google Scholar]

- Josuweit, Andrew. 2018. Could Personality Tests One Day Replace Credit Scores? Forbes. Available online: https://www.forbes.com/sites/andrewjosuweit/2018/04/25/could-psychometrics-predict-your-financial-behavior/?sh=4e28cd8d6e8b (accessed on 31 January 2023).

- Klinger, Bailey, Asim I. Khwaja, and Joseph LaMonte. 2013. Improving Credit Risk Analysis with Psychometrics in Peru, Inter-American Development Banks. Technical Note No IDB-TN-587. Washington, DC: Inter-American Development Bank. [Google Scholar]

- Letkiewicz, Jodi C., and Jonathan J. Fox. 2014. Conscientiousness, financial literacy, and asset accumulation of young adults. The Journal of Consumer Affairs 48: 274–300. [Google Scholar] [CrossRef]

- Liberati, Caterina, and Furio Camillo. 2018. Personal values and credit scoring: New insights in the financial prediction. Journal of the Operational Research Society 69: 1–12. [Google Scholar] [CrossRef]

- Livingstone, Sonia M., and Peter K. Lunt. 1992. Predicting personal debt and debt repayment: Psychological, social and economic determinants. Journal of Economic Psychology 13: 111–34. [Google Scholar] [CrossRef]

- McIntyre, Allan. 2017. Banks Need to Focus on a New Customer: The Unbanked. Forbes.com. Available online: https://www.forbes.com/sites/alanmcintyre/2017/05/10/banks-need-to-focus-on-a-new-customer-the-unbanked/#3e696f2459c8 (accessed on 31 January 2023).

- Moffitt, Terrie E., Louise Arseneault, Daniel Belsky, Nigel Dickson, Robert J. Hancox, HonaLee Harrington, Renate Houts, Richie Poulton, Brent W. Roberts, Stephen Ross, and et al. 2011. A gradient of childhood self-control predicts health, wealth, and public safety. Proceedings of the National Academy of Sciences of the United States of America 108: 2693–98. [Google Scholar] [CrossRef] [PubMed]

- Perry, Vanessa G. 2008. Giving credit where credit is due: The psychology of credit ratings. Journal of Behavioral Finance 9: 15–21. [Google Scholar] [CrossRef]

- Romal, Jane B., and Barbara J. Kaplan. 1995. Differences in self-control among spenders and savers. Psychology: A Journal of Human Behavior 32: 8–17. [Google Scholar]

- Rustichini, Aldo, Colin G. DeYoung, Jon Anderson, and Stephen V. Burks. 2012. Towards the Integration of Personality Theory and Decision Theory in the Explanation of Economic and Health Behavior. IZA DP No, 6750. Bonn: Institute for the Study of Labor (IZA). [Google Scholar]

- Sadana, Mukesh, Josh Woodard, Vikas Bali, and Himanshu Bansal. 2018. Digitizing Rural Value Chains in India: An Assessment of High Potential Opportunities to Increase Women’s Economic Empowerment. Mumbai: Intellecap Advisory Services Pvt. Ltd. [Google Scholar]

- Stein, Robert M. 2007. Benchmarking default prediction models: Pitfalls and remedies in model validation. Journal of Risk Model Validation 1: 77–113. [Google Scholar] [CrossRef][Green Version]

- Taylor, Allen. 2018. Alternative Credit Scoring—Financial Salvation for Those with Low or No Credit Score. Lending Times. Available online: https://lending-times.com/2018/04/04/alternative-credit-scoring-financial-salvain-for-those-with-low-or-no-credit-score/ (accessed on 10 December 2022).

- United Nations—Department of Economic and Social Affairs. 2021. The 17 Goals. Available online: https://sdgs.un.org/goals (accessed on 10 December 2022).

- Webley, Paul, and Ellen K. Nyhus. 2001. Life-cycle and dispositional routes into problem debt. British Journal of Psychology 92: 423–46. [Google Scholar] [CrossRef] [PubMed]

- Woo, Hyunwoo, and So Y. Sohn. 2022. A credit scoring model based on the Myers–Briggs type indicator in online peer-to-peer lending. Financial Innovation 8: 42. [Google Scholar] [CrossRef] [PubMed]

- World Bank. 2022. World Development Report 2022: Finance for an Equitable Recovery. Washington, DC: World Bank. [Google Scholar] [CrossRef]

- Zest AI. 2020. 2020 Zest/Harris Poll Consumer Credit Survey. The Ethical Financial Consumer Is Here. Available online: https://www.zest.ai/resources/harris-poll-consumer-credit-survey (accessed on 11 January 2023).

- Ziegler, Matthias, Carolyn MacCann, and Richard Roberts. 2012. New Perspectives on Faking in Personality Assessments. Oxford: Oxford University Press. [Google Scholar]

- Zuckerman, Marvin, and David M. Kuhlman. 2000. Personality and risk-taking: Common biosocial factors. Journal of Personality 68: 999–1029. [Google Scholar] [CrossRef] [PubMed]

| Sample 1 | Sample 2 | |

|---|---|---|

| Region | S. S. Africa | W. Europe |

| n | 1113 | 1033 |

| Psychometric scores (mean) | 58.00 (±12.93) | 64.95 (±9.23) |

| Bank scores (mean) | 569.01 (±61.10) | 428.63 (±91.06) |

| Default rates | 7.37% | 40.27% |

| Sample | n | Bank Score—Loan Default | Psychometric—Loan Default | Bank Score—Psychometric |

|---|---|---|---|---|

| 1 | 1113 | −0.26 * | −0.15 * | 0.08 * |

| 2 | 1033 | −0.31 * | −0.25 * | 0.22 * |

| Sample | n | AUC | SE | CI | Gini | K-S |

|---|---|---|---|---|---|---|

| 1 | 1113 | 0.656 | 0.03 | 0.594–0.719 | 0.31 | 0.27 |

| 2 | 1033 | 0.639 | 0.02 | 0.605–0.673 | 0.28 | 0.20 |

| Predictors | B | SE | Exp(B) | Wald | Nagelkerke R2 | X2 | AUC |

|---|---|---|---|---|---|---|---|

| Model 1 | |||||||

| Constant | 3.46 | 0.73 | 31.65 | 22.31 * | |||

| Bank score | −0.01 | 0.00 | 0.99 | 62.92 * | 0.12 | 56.25 * | 0.716 |

| Model 2 | |||||||

| Constant | 5.26 | 0.87 | 191.99 | 36.39 * | |||

| Bank score | −0.01 | 0.00 | 0.99 | 55.13 * | |||

| Psychometric score | −0.04 | 0.01 | 0.96 | 17.20 * | 0.16 | 73.90 * | 0.747 |

| Predictors | B | SE | Exp(B) | Wald | Nagelkerke R2 | X2 | AUC |

|---|---|---|---|---|---|---|---|

| Model 1 | |||||||

| Constant | 3.39 | 0.40 | 29.74 | 73.73 * | |||

| Bank score | −0.01 | 0.00 | 0.99 | 90.27 * | 0.14 | 116.42 * | 0.695 |

| Model 2 | |||||||

| Constant | 5.99 | 0.61 | 400.43 | 96.51 * | |||

| Bank score | −0.01 | 0.00 | 0.99 | 72.29 * | |||

| Psychometric score | −0.05 | 0.01 | 0.96 | 34.55 * | 0.19 | 152.86 * | 0.721 |

| Bank Score | Psychometric Score | |||

|---|---|---|---|---|

| 1–45 | 46–69 | 70–100 | Total | |

| 400–574 | 23.9% (71) | 11.5% (243) | 8.2% (61) | 13.3% (375) |

| 575–594 | 16.1% (56) | 5.5% (235) | 2.7% (75) | 6.6% (366) |

| 595–700 | 2.1% (48) | 2.5% (243) | 1.2% (81) | 2.2% (372) |

| Total | 15.4% (175) | 6.5% (721) | 3.7% (217) | 7.4% (1113) |

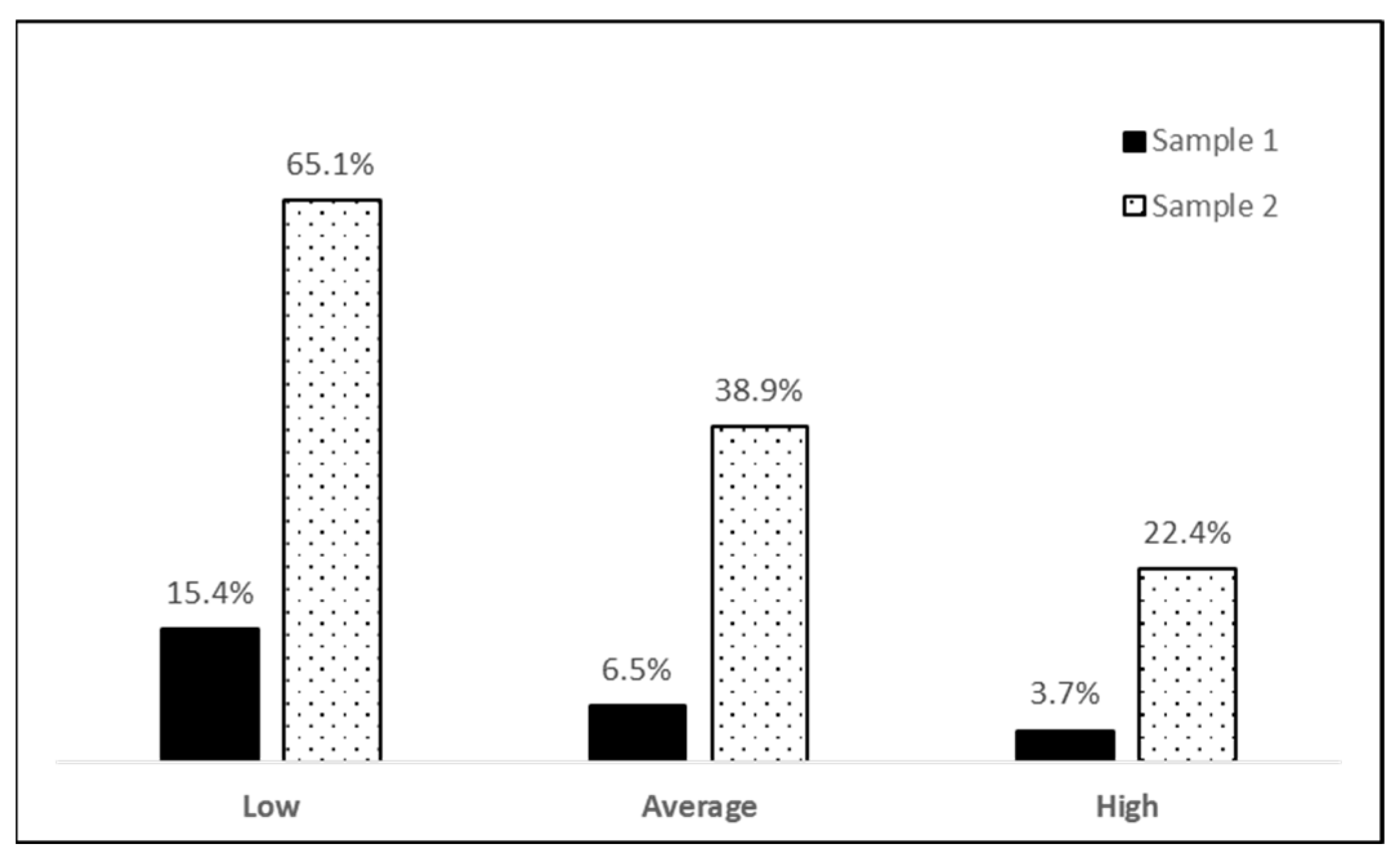

| Bank Score | Psychometric Score | |||

|---|---|---|---|---|

| 1–55 | 56–74 | 75–100 | Total | |

| 300–374 | 74.3% (70) | 55.3% (244) | 30.0% (30) | 57.0% (344) |

| 375–449 | 67.4% (46) | 43.1% (239) | 32.7% (52) | 44.8% (337) |

| 450–900 | 44.4% (36) | 18.2% (242) | 12.2% (74) | 19.6% (352) |

| Total | 65.1% (152) | 38.9% (725) | 22.4% (156) | 40.3% (1033) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fine, S. Character Counts: Psychometric-Based Credit Scoring for Underbanked Consumers. J. Risk Financial Manag. 2024, 17, 423. https://doi.org/10.3390/jrfm17090423

Fine S. Character Counts: Psychometric-Based Credit Scoring for Underbanked Consumers. Journal of Risk and Financial Management. 2024; 17(9):423. https://doi.org/10.3390/jrfm17090423

Chicago/Turabian StyleFine, Saul. 2024. "Character Counts: Psychometric-Based Credit Scoring for Underbanked Consumers" Journal of Risk and Financial Management 17, no. 9: 423. https://doi.org/10.3390/jrfm17090423

APA StyleFine, S. (2024). Character Counts: Psychometric-Based Credit Scoring for Underbanked Consumers. Journal of Risk and Financial Management, 17(9), 423. https://doi.org/10.3390/jrfm17090423