Abstract

This study explores the relationship between social media usage for investment advice and financial satisfaction across different generations. Ten ordered logit models were estimated using Stata to explore this relationship. Ordered logit analyses using data from the 2021 National Financial Capability Study State-by-State and Investor survey reveal that Generation X and millennials are less financially satisfied than baby boomers. While general social media use shows no statistically significant association, platform-specific analysis finds that Instagram and TikTok users report higher financial satisfaction, whereas YouTube users report lower satisfaction. Notably, millennials who use social media for investment advice are more financially satisfied than their peers. Detailed analyses reveal that Instagram, TikTok, and Twitter positively influence financial satisfaction across Gen Z, millennials, and Gen X, with more platform-specific associations observed for Facebook, LinkedIn, and Reddit among millennials and Gen X, respectively. These findings provide valuable insights for policymakers, financial professionals, and researchers, highlighting the need for targeted strategies to enhance financial well-being through social media.

Keywords:

social media; financial satisfaction; investment advice; Gen Z; millennial; Gen X; baby boomers 1. Introduction

One specific domain of overall life fulfillment is financial satisfaction (Vera-Toscano et al. 2006), an indicator of subjective financial well-being (Diener and Biswas-Diener 2002). According to the report from the Federal Reserve (2023), the financial well-being of American adults dropped by five percentage points between 2021 and 2023, reaching one of its lowest levels since 2016. Additionally, the 2021 Teachers Insurance and Annuity Association of America (TIAA) Institute- Global Financial Literacy Excellence Center GFLEC Personal Finance Index survey, which examined financial well-being across generations, shows that baby boomers, millennials, and Generation Z have varying degrees of financial satisfaction, with Gen X being the generation with the worst financial challenges (Yakoboski et al. 2021). Money management is one of the challenges that each generation faces with their finances. The framework of Joo and Grable (2004) shows financial management behavior, or how one manages money in terms of savings, debt, cash flow, and others, is one of the determinants of financial satisfaction.

Individual investment behavior is a fundamental aspect of financial management behavior. Every investor is unique, and so are their financial situations and obstacles. Because of this, earlier research has attempted to learn more about investors’ investing behavior and to delve even further into their behavior based on their generation; research has divided them into distinct generations, such as baby boomers, Gen X, millennials, and Gen Z (Ilyas and Djawahir 2021; Schooley and Worden 2003). Generation Z is beginning to invest earlier than boomers (Barrons 2024). Additionally, the study shows that 51% of the respondents expressed confidence in their investments due to easy access to financial advice and knowledge. Technological advancements and the internet have made financial advice widely available, with social media now emerging as a major information source.

According to DataReportal (2024), 239 million Americans use social media actively. The most widely used internet platforms are Facebook and YouTube, with over 50% of American adults using Instagram. TikTok, LinkedIn, Twitter, and Reddit are used by smaller numbers, primarily younger generations (Pew Research Center 2024). Earlier research shows that individuals use social media not just for networking purposes but also to acquire additional information (Yeo 2014). Many studies demonstrate individuals rely on social media to obtain information for decision making (Cooley and Parks-Yancy 2019; Gupta 2019). Also, research indicates that social media increasingly influences individuals’ financial decisions (Florendo and Estelami 2019; Jha 2019). Remarkably, social media has been a source of financial advice for 79% of Americans in the millennial or Gen Z age groups (Forbes 2023).

Social media influences investment decisions, among other financial decisions. The cryptocurrency bubble and the “meme stock” frenzy are recent examples of social media’s impact on investment decision making (Pandey and Guillemette 2024; Tandon et al. 2021). According to a Forbes Advisor survey (2023), YouTube, Reddit, TikTok, Instagram, Twitter, Facebook, and LinkedIn are the most popular social media platforms for financial information. The survey asked what kinds of advice young adults most frequently see on social media. Fifty-seven percent of millennials and Gen Z ranked advice on stock and bond investing as the most encountered topic. While it is undeniable that social media can offer helpful information, users should be aware that not all of it is accurate. User awareness of information available on social media is crucial for younger users, as research indicates that they rely more on social media for information (Reiter et al. 2023; Rue 2018).

Using social media excessively influences not just one’s decision to invest but also their financial satisfaction. 47% of Gen Z, 46% of millennials, 31% of Gen X, and 22% of baby boomers expressed adverse feelings about their financial status after reading other people’s posts related to finances on social media (Bankrate 2023). The influence on each generation was varied, with baby boomers experiencing the least amount of this. Thus, this exemplifies how social media can intensify a sense of financial insecurity, perhaps resulting in a decline in financial satisfaction.

Research on how generation classification is associated with using social media as a source of investment advice is a topic worth looking into, especially in light of the aforementioned context and the growing prevalence of social media usage across generations. Additionally, although an increasing number of individual investors are turning to social media for investment guidance, little is known about the relationship between this dependence and overall financial satisfaction. The current study offers a valuable contribution to the literature. Firstly, this study examines financial satisfaction across different generations, which, to the authors’ knowledge, has not been studied before. Secondly, it explores the association between reliance on social media for investment advice and financial satisfaction, which is also an addition to the literature that has not been explored yet. Finally, this study examines how the association varies across different generations.

The remainder of this paper is structured as follows. Section 2 presents a conceptual review and hypothesis development. Section 3 covers methodology. Section 4 reports the results of the empirical analysis. Section 5 discusses the relevance of the results of the empirical analysis, and finally, Section 6 details the theoretical and practical contributions based on the empirical findings.

2. Conceptual Review and Hypothesis Development

Financial satisfaction is a crucial element of perceived financial well-being (Normawati et al. 2022). It encompasses an individual’s feelings about their entire financial situation, including income, ability to meet primary needs, and capacity to handle financial emergencies (Saurabh and Nandan 2018). Some researchers define it as a state of financial health and happiness (Fan and Babiarz 2019), and it is often viewed as a subjective measure of financial well-being (Joo and Grable 2004). Consequently, financial satisfaction is linked to overall life satisfaction (Michalos and Orlando 2006; Xiao et al. 2009). In the literature, financial satisfaction and financial well-being are frequently used interchangeably (Xiao and O’Neill 2018). Some studies show that it is closely related to subjective well-being (Diener and Chan 2011; Kahneman and Deaton 2010; Ng and Diener 2014) and other studies explain financial satisfaction as a vital component of general well-being (Diener and Biswas-Diener 2002).

The literature extensively explores financial satisfaction and its determinants (Saurabh and Nandan 2018; Arifin 2017; Riitsalu and Murakas 2019). Various studies have investigated different income effects to understand what influences financial satisfaction, including income sources (Hsieh 2004; Ahn et al. 2014), the adequacy of income (Grable et al. 2013), and accumulated wealth (Hansen et al. 2008). Other financial aspects, such as financial behavior (Xiao et al. 2014) and demographic factors like age (Hansen et al. 2008), have also been examined (Plagnol 2011; Vera-Toscano et al. 2006).

Prior research consistently shows that older adults are more financially satisfied than younger adults, despite having lower incomes (Hansen et al. 2008). This phenomenon, sometimes referred to as the satisfaction paradox by Hansen et al. (2008), suggests that older individuals, who typically earn less than those in midlife, should theoretically be less financially satisfied. However, the literature indicates a positive correlation between age and financial satisfaction (Seghieri et al. 2006; Stoller and Stoller 2003). Hansen et al. (2008) support the cohort explanation in their study, indicating that recent generations are less financially satisfied.

Millennials generally find it challenging to achieve financial satisfaction (Nurtati et al. 2024), and Gen Z often struggle to manage their financial circumstances (Nabila et al. 2023). Similarly, a 2021 report by the Society of Actuaries (Greenwald Researcher 2021b) shows that as people age, they tend to feel more financially satisfied when reviewing their financial situation. Consequently, retirement concerns also diminish with age, leading to more significant financial stress among younger generations. The same report shows that baby boomers are more likely to feel financially satisfied compared to younger generations. Millennials, on the other hand, are more likely to feel overwhelmed and depressed about their financial situation, often planning paycheck to paycheck and juggling multiple financial issues at once. Thus, financial concerns weigh more heavily on the younger population. Another 2021 report by the SOA exploring financial fragility across generations confirms that millennials are more likely to be financially fragile than older generations, and those with high fragility have shorter planning horizons (Greenwald Researcher 2021a).

The discussions thus far build a case that financial satisfaction is influenced by the financial decisions individuals make, which are, in turn, affected by their information sources. Technological advancements, particularly social media, have significantly changed how people obtain investment information (Xu et al. 2021). Consumers increasingly use social media for financial and investment-related decisions (Reiter et al. 2023; Guo et al. 2015; Guégan and Renault 2021; Ante 2023). Recent research has focused on how social media is used to gather personal finance information for making financial decisions (Cao et al. 2020). Although social media can provide valuable information, it is well documented that it can also mislead consumers. Information from social media can vary in quality, being both high-quality (Tu et al. 2018) and low-quality (Kadous et al. 2022). For example, social media has also impacted the trading of meme stocks, such as GameStop (Costola et al. 2021; Nobanee and Ellili 2023).

A study by Cao et al. (2020) found that individuals using social media for personal finance experienced positive financial outcomes and increased satisfaction. This satisfaction is typically higher among younger individuals (Cao and Liu 2017; Subramanian 2021), as they are more likely to use social media as an information source for financial decision making (Reiter et al. 2023). Younger generations are more open to modern technologies, hold fewer investable assets, and feel more intimidated when engaging with human financial advisers compared to older generations (Cao and Liu 2017; Reiter et al. 2023; Carlin et al. 2019; Silinskas et al. 2021). Furthermore, Maditinos et al. (2007) discovered that professional investors rely more on technical and fundamental analysis, whereas nonprofessional investors depend more on media and market noise. Younger individuals with less investing experience are more likely to be influenced by social media when considering investments (Gosal et al. 2021). The additional literature has examined cognitive style, age, gender, and income as factors influencing one’s reliance on social media for financial advice (Florendo and Estelami 2019). Despite the growing use of social media for financial decisions, there is limited knowledge about the relationship between financial satisfaction and social media use as an investment information source across generations.

Social Influence Theory

In exploring the relationship between the reliance on social media for investment information and financial satisfaction, this study is motivated by the social influence theory, as explained by Deutsch and Gerard (1955). According to Deutsch and Gerard (1955), individuals’ thoughts, emotions, and behaviors are impacted by other individuals around them and their social networks in two different ways: normative social influence and informational social influence. With normative social influence, individuals’ behaviors are influenced by others in a bid to be liked and to seek social approval. These individuals then alter their behavior to fit into what is popular and what is the norm, even if these changes do not accurately reflect their personal beliefs. Informational social influence, on the other hand, explains a situation where others influence individuals’ behaviors because they do not want to make mistakes and believe their social network knows better than they do, especially in uncertain situations. So, when they are confused or uncertain about a choice, decision, or topic, they seek validation from their social network to make informed decisions. Since this study focuses on the reliance on social media for information and advice, informational social influence will be the focus.

With the advent of social media, individuals of all ages can learn, collaborate, and share ideas and information about various topics ranging from culture to politics to business and even personal finance topics like savings, investing, and debt (Cao et al. 2020). Regarding personal finance and specifically investing, social media provides a plethora of information from different sources like peers, financial experts, and “finfluencers” (Place 2022), which might help individuals make investing decisions. Finfluencers are financial influencers or social media influencers who provide personal finance advice on social media (Place 2022).

On the one hand, because this information shared on social media by these financial experts and finfluencers can be compelling, individuals trust the accuracy of the information, and follow this information and advice, leading to greater confidence in their financial decisions and increased financial satisfaction. On the other hand, relying on just information on social media could lead to “FOMO”, the fear of missing out, causing these individuals to make hasty and impulsive decisions driven by social media trends, which is not always optimal and can lead to stress and financial dissatisfaction.

Based on the social influence theory of Deutsch and Gerard (1955) and the existing literature review (Cao et al. 2020; Hansen et al. 2008; Subramanian 2021), which has shown that financial satisfaction differs across generations and ages, and the reliance on social media for investing information influences financial satisfaction, this present study also hypothesizes the following:

H1.

Financial satisfaction will differ across the different generations.

H2.

Relying on social media for investment information and advice will be related to financial satisfaction.

H3.

The relationship between reliance on social media for investment advice and financial satisfaction will differ across generations.

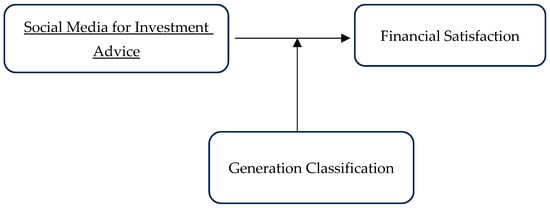

A visual representation of the proposed framework is presented below (See Figure 1):

Figure 1.

Proposed research framework.

3. Methods

3.1. Data and Sample

In this study, analysis is performed using data from the 2021 National Financial Capability Study (NFCS) provided by the Financial Institution Regulatory Authority (FINRA). The NFCS State-by-State survey is merged with the NFCS Investor survey. Although both surveys are commissioned by the Financial Institution Regulatory Authority (FINRA) Investor Education Foundation, and are self-administered surveys collected every three years, the Investor survey is a follow-up to the State-by-State. While the State-by-State survey provides a general view of the financial capability indicators and their variation with demographic, attitudinal, and knowledge factors, the Investor survey builds on the State-by-State survey by focusing on factors that affect investors who own non-retirement investment assets. The NFCS State-by-State surveys over 25,000 American adults aged 18 and older from the 50 states in the Unites States including Puerto Rico, and the Investor survey is completed by 2824 individuals who have non-retirement investment assets. These two surveys were merged based on their NFCSID (NFCS identification numbers) because the dependent variable, moderator, and some control variables are present in the State-by-State, while the main explanatory variable and other control variables are in the Investor survey. Responses such as “I don’t know” and “prefer not to say” were mostly treated as missing data, causing the final analysis sample to be 2111 respondents made up of 546 respondents who used social media for investment information and 1565 respondents who did not.

3.2. Measurement

3.2.1. Outcome Variable

The outcome variable in this analysis is financial satisfaction. The 2021 NFCS contains a Likert-type measure of financial satisfaction. Respondents were asked the following question: “Overall, thinking of your assets, debts, and savings, how satisfied are you with your current financial condition?” Possible responses ranged from 1 (not at all satisfied) to 10 (extremely satisfied). Based on this, this present study measures financial satisfaction as an ordered variable in this study with not at all satisfied as the reference category.

3.2.2. Explanatory Variables

The use of social media for investment information and advice is the main explanatory variable in this analysis. This variable was operationalized based on responses to the question, “Which, if any, of the following do you use for information about investing?” There were 11 options of social media platforms the respondents could select, namely YouTube, Instagram, Facebook, TikTok, Twitter, LinkedIn, Reddit, Stocktwits, Discord, Twitch, and Clubhouse. Respondents who reported using any of the social media platforms outlined were coded as “1”, while those who reported not using any were coded as “0”. Furthermore, based on the findings of Forbes (2023) and Reiter et al. (2023) that found that YouTube, Facebook, Twitter, Instagram, TikTok, LinkedIn, and Reddit were the most popular social media platforms used for investment information and advice, each of these social media platforms were examined separately to see if this relationship between specific social media platforms and financial satisfaction was different for the full sample, and across generations.

Generation classification is another main explanatory variable in this analysis. Also, to test the relationship between financial satisfaction and use of social media for advice across generations, it serves as the moderator. According to Dimock (2022), baby boomers are people born between 1946 and 1964, Gen X are people born between 1965 and 1980, millennials are born between 1981 and 1996, and Gen Z are born after 1997. Given this premise and based on the response to the age question in the survey, generation classifications are created. Since the NFCS data set was collected in 2021, respondents aged 18–24 years are classified as Gen Z, those aged 25–44 years are classified as millennials, Gen X are defined as those aged 45–54 years old, and baby boomers are defined as those aged 55 and older. Given that social media use is more prevalent among younger generations (Watson 2024), the baby boomer generation is the reference category.

The covariates included in the model are objective investment knowledge, subjective investment knowledge (7-point Likert-scale), willingness to take risks (4 categories), income (9 categories), portfolio account balance (9 categories), race/ethnicity (white, non-white), marital status (5 categories), and gender (men, women).

3.3. Data Analysis

This study estimates ten ordered logit models based on the ordinal nature of the outcome variable financial satisfaction. Odds ratios are calculated to determine the magnitude of the effects. The first two models answer the first two research questions asked in this study—does financial satisfaction differ across generations, and does reliance on social media for investment information and advice relate to financial satisfaction? In model 1, the use of any of the eleven social platforms captured in the 2021 NFCS and generation classification are the main explanatory variables while controlling for objective investment knowledge, subjective investment knowledge, willingness to take risks, income, portfolio account balance, race/ethnicity, marital status, and gender. In model 2, each of the seven most common social media platforms for investment advice (YouTube, Facebook, Twitter, Instagram, TikTok, LinkedIn, and Reddit), according to Forbes (2023) and Reiter et al. (2023), are the main explanatory variables, alongside generation classification, while controlling for the same covariates in model 1.

The last eight models are the interaction models answering the third research question—whether the relationship between reliance on social media for investment advice and financial satisfaction will differ across generations. The interaction of generation classification and the use of any social media platform is added as an explanatory variable to the first model to form model 3. Models 4 to 10 examine each of the seven social media platforms alongside their interactions with generation classification as the main explanatory variables in separate models. In all eight of the interaction models, objective investment knowledge, subjective investment knowledge, willingness to take risks, income, portfolio account balance, race/ethnicity, marital status, and gender are the covariates.

4. Results

4.1. Sample Descriptive Statistics

Table 1 provides the descriptive statistics for the entire analytic sample and subsets of the sample—those who use any form of social media for investment information (column 2) and those who do not (column 3). Of the total sample, 25.89% report using social media for investment information. As reported in Table 1, a larger percentage of the full sample are men (66.28%), white (71.65%), married (67.28%), and baby boomers (63.26%). Furthermore, more than 50% of the sample report having incomes over $75,000, portfolio account values of at least $100,000, and willingness to take average financial risks with a willingness to earn average returns. Concerning objective investment knowledge, the average score was 5.63 out of 10 questions, with perceived financial knowledge having an average of 4.95 on a 7-point scale. Overall, the majority of the full sample report was somewhat financially satisfied, with an average rating of 7.73 on a 10-point scale.

Table 1.

Descriptive statistics: full sample, social media users vs. non-social media users.

When comparing those who use social media for investment advice to those who do not, large differences are observed. For instance, while the most social media users for investment advice are millennials (49.93%), the most non-social media users are baby boomers (76.51%). Interestingly, while social media users had a lower average score (4.71/10) on objective investment knowledge in comparison to non-social media users, more of these social media users ranked their perceived investment knowledge to be high (average score of 5.3 on a 7-point scale), hinting at possible overconfidence among social media users. Similarly, while a higher proportion of non-social media users report having portfolio values of $100,000 or more (63.64%) relative to social media users (39.53%), a lower proportion of these non-social media users are willing to take above-average to substantial financial risks (30.14%) relative to social media users (62.14%). More non-social media users report being financially satisfied (7.80/10). Finally, YouTube and Facebook are the two most-used social media platforms for investment information among social media users.

The descriptive statistics for the social media user sample across the generations examined (baby boomers, Gen X, millennials, and Gen Z) are also reported in Table 2. Among social media users, YouTube is the most-used form of social media for investment information across all generations, with a higher percentage of usage observed for millennials (68.41%) and Gen Z (82.24%). However, while Instagram and TikTok have the second- and third-highest percentages of usage for Gen Z social media users, Facebook and Twitter are the next highest for millennials, and Facebook and Reddit for Gen X social media users. In contrast, LinkedIn and Facebook had the subsequent highest use for investment information for baby boomer social media users. The average score among social media users on the objective investment knowledge questions declined with the generations, with baby boomers having the highest (5.58/10). However, while Gen Z had the lowest average objective investment knowledge score (3.92/10), they had the second-highest average ranking of their perceived investment knowledge (5.48/10). The value of investments in non-retirement accounts increased across generations, and risk tolerance mostly decreased across generations. Specifically, a higher proportion (63.24%) of baby boomers who use social media for investment information report portfolio values in non-retirement accounts of above $100,000 (compared to about 15% of Gen Z, 33% of millennials, and 34% of Gen X), and a lower proportion of baby boomers were willing to take substantial financial risks with their investment (10.84%), compared to about 32% of Gen Z’s and 35% of millennial social media users. This statistic is not surprising as most baby boomers are pre-retirees or retirees and have accumulated over their lifetime assets that would be decumulated. Also, given their life stage, these baby boomers are less willing to take risks since they are (or very close to) decumulating their assets. Regarding financial satisfaction, baby boomers report the highest social media users who report being financially satisfied on average (7.9/10), with Gen X having the lowest (6.74/10).

Table 2.

Descriptive statistics: social media users by generation.

4.2. Model Results

4.2.1. Is Reliance on Social Media for Investment Information and Generation Classification Related to Financial Satisfaction?

A total of ten models were examined in this study. Table 3 shows the odds ratios from two (out of the total 10) ordered logistic models analyzed in this study that answer the question of whether or not the reliance on social media for investment advice or information and generation classification is related to financial satisfaction. For the first model, the explanatory variable is using any of the eleven social media platforms outlined in the survey—YouTube, Instagram, Facebook, TikTok, Twitter, Reddit, LinkedIn, Stocktwits, Discord, Twitch, and Clubhouse. Subsequently, the following second model answers these questions by focusing on each of the seven most commonly used social media platforms for investment information as highlighted by Forbes (2023) and Reiter et al. (2023)—YouTube, Facebook, Twitter, Instagram, TikTok, LinkedIn, and Reddit.

Table 3.

Ordered logistic regression of financial satisfaction, general social media use, and specific social media use without interactions.

The results showed that using at least one of the social media platforms for investment advice or information is not statistically associated with financial satisfaction. However, different results are found when specific social media platforms are modeled. For instance, while respondents who use Instagram (OR = 1.78) or TikTok (OR = 2.17) for investment information have higher odds of being financially satisfied compared to those who do not, respondents who used YouTube (OR = 0.64) for investment advice had lower odds of being financially satisfied. Meanwhile, no statistically significant association was found for Facebook, Twitter, LinkedIn, and Reddit. For the association between generation classification and financial satisfaction, a similar result observed across all eight models is that Gen X and millennials have lower odds of being financially satisfied compared to baby boomers, while no statistically significant result was found for the relationship between being Gen Z and financial satisfaction.

Regarding the covariates, respondents with higher incomes, higher values in their non-retirement accounts, and widowed were more likely to be financially satisfied across all two models. Meanwhile, respondents who report being separated from their spouses and those who are more willing to take above-average financial risks are less likely to be financially satisfied. Interestingly, while objective investment knowledge was largely not statistically significant, perceived investment knowledge was positively associated with financial satisfaction.

4.2.2. Does the Relationship between Use of Social Media for Investment Information Change with Generation Classification?

The last eight models depicted in Table 4, Table 5, Table 6 and Table 7 analyzed the moderating role of generation classification in the relationship between the use of social media for investment advice and information and financial satisfaction. This analysis first looks at the use of any form of social media highlighted in the survey and then looks specifically at seven highlighted social media platforms as previously mentioned (YouTube, Facebook, Twitter, Instagram, TikTok, LinkedIn, and Reddit).

Table 4.

Ordered logistic regression of financial satisfaction and general social media use with interactions.

Table 5.

Ordered logistic regression of financial satisfaction, Instagram, TikTok, and YouTube with interactions.

Table 6.

Ordered logistic regression of financial satisfaction, Facebook, Twitter, and LinkedIn with interactions.

Table 7.

Ordered logistic regression of financial satisfaction and Reddit with interactions.

Examining whether this relationship between reliance on social media platforms in general for investment information and financial satisfaction varies across generations, but this current study finds a statistically significant relationship only for millennials. Specifically, this study finds that millennials who use social media for investment information are more likely to be financially satisfied compared to their counterparts who do not (OR = 2.77).

Turning to the moderating effects of generation on the relationship between the use of social media for investment advice and financial satisfaction across the seven different social media platforms focused on, some similar and varying results are also observed. For example, in Table 5 and Table 6 with Instagram, TikTok, and Twitter (in separate models), the results show that the relationship between using Instagram, TikTok, and Twitter for investment information and financial satisfaction held true for Gen Z, millennials, and Gen X, indicating that Gen Z, millennials, and Gen X who use Instagram, TikTok, or Twitter for investment information are more likely to be financially satisfied compared to their counterparts who do not.

Also, the moderating role of generation classification in explaining the association between the use of Facebook and LinkedIn for investment information and financial satisfaction yielded similar results; millennials who use Facebook or LinkedIn for investment information have higher odds of being financially satisfied compared to their counterparts who do not use Facebook or LinkedIn for investment information. The results are not statistically significant for Gen X and Gen Z. Gen X who use Reddit for investment information have higher odds of being financially satisfied compared to their counterparts who do not. However, these results are not significant for millennials and Gen Z. Lastly, the relationship between using YouTube for investment information and financial satisfaction was not significant for Gen Z, millennials, and Gen X.

5. Discussion

This study examined the relationship between the use of social media for investment advice and financial satisfaction across different generations, using a combination of the 2021 National Financial Capability Study (NFCS) State-by-State survey and Investor survey. The combined descriptive and regression analyses support the hypotheses that (i) financial satisfaction differs across generations, (ii) using social media for investment advice is linked to financial satisfaction, and (iii) this relationship varies across generations. This study finds that millennials and Gen X are less financially satisfied than baby boomers. Likewise, the descriptive statistics reveal that millennials are the largest group relying on social media for information, while baby boomers are more likely to use non-social media sources. This aligns with previous findings (Reiter et al. 2023) showing that younger generations are more inclined to use social media for financial decision making. Additionally, this study confirms prior research by Reiter et al. (2023), indicating that those who rely on social media for investment advice tend to have lower objective investment knowledge and smaller investment portfolios compared to non-social media users.

A further notable finding is that the accuracy of responses to objective investment knowledge questions declined with each younger generation, with baby boomers achieving the highest percentage of correct answers. Despite this, social media users rated their perceived investment knowledge as high, hinting at a potential overconfidence among this group. This study also revealed that financial satisfaction varies across generations for those who use social media for investment advice. For instance, compared to other generations, baby boomers appear to be more satisfied (7.79/10), and Gen X (6.74) appear to be less financially satisfied. Regression analysis further indicates that millennials who use social media (any type) for investment advice have higher odds of financial satisfaction compared to those who do not use social media for this purpose. Since from the descriptive statistics it is evident that millennials are the largest group utilizing social media for investment information, this finding is consistent with the 2021 report by the Society of Actuaries (SOA), which highlights that millennials often feel overwhelmed, are managing finances paycheck to paycheck, and dealing with multiple financial issues simultaneously. This could explain why social media, being a more cost-effective or free source of investment information, might be particularly appealing to millennials, as hiring a financial professional could add an additional financial burden.

This study also presents a model examining the relationship between different commonly used social media platforms and financial satisfaction and finds support for the third hypothesis: the relationship between reliance on social media for investment advice and financial satisfaction will differ across generations. It finds that individuals who frequently use Instagram and TikTok are more likely to report being financially satisfied, while those who seek investment advice on YouTube are less likely to feel financially satisfied compared to non-YouTube users. This finding may be due to the nature of these social media platforms. Instagram and TikTok often provide information and advice that may make investing seem very accessible and glamorous due to its short-form content and focus on inspirational, motivational, and entertaining stories. The short video instantly wins over viewers of all ages (Du et al. 2022), and a user-friendly algorithm on TikTok and Instagram makes it simple for users to record and share brief videos. Previous studies have demonstrated that the quality of the TikTok information system is good and that short videos posted on the network can affect viewers’ internal enjoyment and focus (Qin et al. 2022). So, TikTok and Instagram’s focus on motivating their users creates a sense of instant gratification, which could give their users a higher sense of satisfaction with their financial situation. With YouTube, on the other hand, while there are informative videos, most of them are longer. The study by Qin et al. (2022) does offer evidence that social media system quality influences individual experiences more strongly than informational quality. Therefore, the financial satisfaction of TikTok and Instagram users might have differed from that of YouTube users.

Moreover, this study’s findings further reveal generational differences in social media preferences for investment information, which in turn influence financial satisfaction. For instance, Gen Z users of Instagram, TikTok, and Twitter report higher financial satisfaction than those who do not use these platforms. Gen X individuals who use Instagram, TikTok, Twitter, and Reddit for investment advice also show greater financial satisfaction compared to non-users. Similarly, millennials engaging with a broad range of platforms, including Instagram, TikTok, Twitter, Facebook, and LinkedIn, are more financially satisfied than their peers who do not use social media for investment purposes. These results also highlight that some social media platforms, such as Instagram, TikTok, and Twitter, are associated with higher financial satisfaction across all generations, suggesting their widespread appeal and influence on financial satisfaction.

This study underscores the importance of targeting the appropriate social media platforms for different population groups, as not all information on social media is high quality and some can create issues similar to those seen with cryptocurrency bubbles and meme stock frenzies (Pandey and Guillemette 2024). Additionally, despite the increasing trend of individual investors seeking investment advice through social media, there is limited understanding of the regulations governing these financial posts, which is becoming an emerging concern.

A limitation of this study is the demographic composition of the sample due to the secondary nature of the data set. The majority of the sample are baby boomers and white respondents, and a small percentage of the sample are Gen Z and non-white. Future research may benefit from gathering inclusive primary data with a more balanced and diverse sample that includes a more significant proportion of Gen Z and non-white respondents. Furthermore, another limitation is the cross-sectional nature of this data set. Future research could consider longitudinal studies to assess the long-term impact of social media on financial satisfaction and investment behavior.

6. Theoretical and Practical Contributions

This study contributes to the growing body of work in financial behavior, financial technology use, and financial well-being, particularly regarding the reliance on social media for investment guidance across generations, especially as an increasing number of individual investors are turning to social media for investment guidance.

From a theoretical standpoint, this study adds to the literature by including reliance on social media for advice as an explanatory variable, emphasizing how technology and digital media platforms influence financial outcomes and well-being. This study builds on the existing literature like that of Reiter et al. (2023) by showing that millennials and Gen X rely more on social media for investment guidance compared to baby boomers, and this reliance is related to their financial satisfaction.

Furthermore, this study sheds light on how the use of various social media platforms influences financial satisfaction. It reveals that platforms such as Instagram and TikTok, which prioritize short-form, motivational content, are linked to higher financial satisfaction. In contrast, longer-form content provided by YouTube might negatively influence financial satisfaction. This finding challenges the notion that having greater access to information automatically improves satisfaction and instead emphasizes users’ experience with the learning platform, which is based on the quality of the social media system, as supported by Qin et al. (2022).

Findings from this study could benefit policymakers, financial professionals, and scholars. Financial professionals highly value clients’ involvement and satisfaction. By using this social media platform’s widespread popularity, they may produce material that appeals to different generations and expand their audience reach. While millennials were found to have a favorable relationship with using most platforms covered in this study except YouTube, other generations showed somewhat different findings. Thus, financial professionals should exercise caution while using the platforms for each generation. Younger generations, like millennials, may benefit from a more critical approach and openness to social media-based advice, while baby boomers might prefer other sources of information that align more with their traditional preferences. Nonetheless, the current research discovered that users of any generation favor Instagram, TikTok, and Twitter, suggesting that financial professionals can benefit from these platforms. To gain a deeper understanding of the long-term impacts of various social media platforms, researchers may benefit from longitudinal data sets to better examine changes in investment behavior and financial satisfaction over time.

The present study demonstrates how different social media platforms influence individuals’ financial satisfaction differently depending on their generation. Because using social media platforms for investment advice is linked to financial satisfaction, the accuracy and reliability of the information shared on these networks are crucial when making financial decisions. Hence, the results of this study support the policy regulating investment advice on social media platforms (Arrowood 2024). Research from the past indicates that social media may promote financial literacy (Yanto et al. 2021). As this study’s findings demonstrate, policymakers should consider suitable social media platforms for integrating these websites into national financial literacy campaigns.

Author Contributions

Conceptualization, O.O.; Methodology, O.O.; Validation, S.P. and I.P.; Resources, S.P. and I.P.; Writing—original draft, O.O.; Writing—review & editing, S.P. and I.P.; Supervision, O.O.; Project administration, O.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data available on the database mentioned in the text. The data can be found here: https://finrafoundation.org/knowledge-we-gain-share/nfcs/using-the-data (accessed on 4 September 2024).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Ahn, Namkee, Victoria Ateca-Amestoy, and Arantza Ugidos. 2014. Financial satisfaction from an intra-household perspective. Journal of Happiness Studies 15: 1109–23. [Google Scholar] [CrossRef]

- Ante, Lennart. 2023. How Elon Musk’s twitter activity moves cryptocurrency markets. Technological Forecasting and Social Change 186: 122112. [Google Scholar] [CrossRef]

- Arifin, Agus Zainul. 2017. The influence of financial knowledge, control and income on individual financial behavior. European Research Studies Journal 20: 635–48. [Google Scholar]

- Arrowood, Spencer B. 2024. TikTok: Is it Time to Regulate” Finfluencer” Investment Advice on Social Media? North Carolina Banking Institute 28: 429. [Google Scholar]

- Bankrate. 2023. How Social Media Skews Expectations on Achieving Financial Freedom and Stability. Available online: https://datareportal.com/reports/digital-2024-united-states-of-america (accessed on 28 July 2024).

- Barrons. 2024. Gen Zers Are Investing Earlier Than Boomers Ever Did. 2 Big Reasons Why. Available online: https://www.barrons.com/articles/gen-z-boomers-stock-bond-market-investing-508082c1 (accessed on 28 July 2024).

- Cao, Yingxia, and Jeanny Liu. 2017. Financial executive orientation, information source, and financial satisfaction of young adults. Journal of Financial Counseling and Planning 28: 5–19. [Google Scholar] [CrossRef]

- Cao, Yingxia, Fengmei Gong, and Tong Zeng. 2020. Antecedents and consequences of using social media for personal finance. Financial Counseling and Planning 31: 162–76. [Google Scholar] [CrossRef]

- Carlin, Bruce, Arna Olafsson, and Michaela Pagel. 2019. Generational differences in managing personal finances. In AEA Papers and Proceedings. Nashville: American Economic Association, vol. 109, pp. 54–59. [Google Scholar]

- Cooley, Delonia, and Rochelle Parks-Yancy. 2019. The effect of social media on perceived information credibility and decision making. Journal of Internet Commerce 18: 249–69. [Google Scholar] [CrossRef]

- Costola, Michele, Matteo Iacopini, and Carlo R. M. A. Santagiustina. 2021. On the “mementum” of meme stocks. Economics Letters 207: 110021. [Google Scholar] [CrossRef]

- DataReportal. 2024. Digital 2024: United States of America. Available online: https://datareportal.com/reports/digital-2024-united-states-of-america (accessed on 28 July 2024).

- Deutsch, Morton, and Harold B. Gerard. 1955. A study of normative and informational social influences upon individual judgment. The Journal of Abnormal and Social Psychology 3: 629–51. [Google Scholar] [CrossRef]

- Diener, Ed, and Micaela Y. Chan. 2011. Happy people live longer: Subjective well-being contributes to health and longevity. Applied Psychology: Health and Well-Being 3: 1–43. [Google Scholar]

- Diener, Ed, and Robert Biswas-Diener. 2002. Will money increase subjective well-being? Social Indicators Research 57: 119–69. [Google Scholar] [CrossRef]

- Dimock, Michael. 2022. Defining Generations: Where Millennials end and Generation Z Begins. Pew Research Center. Available online: https://www.pewresearch.org/short-reads/2019/01/17/where-millennials-end-and-generation-z-begins/ (accessed on 25 July 2024).

- Du, Xin, Toni Liechty, Carla A. Santos, and Jeongeun Park. 2022. ‘I want to record and share my wonderful journey’: Chinese Millennials’ production and sharing of short-form travel videos on TikTok or Douyin. Current Issues in Tourism 25: 3412–24. [Google Scholar] [CrossRef]

- Fan, Lu, and Patryk Babiarz. 2019. The determinants of subjective financial satisfaction and the moderating roles of gender and marital status. Family and Consumer Sciences Research Journal 47: 237–59. [Google Scholar] [CrossRef]

- Federal Reserve. 2023. Economic Well-Being of U.S. Households in 2022. Available online: https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households-in-2022-overall-financial-well-being.htm (accessed on 28 July 2024).

- Florendo, Jenna, and Hooman Estelami. 2019. The role of cognitive style, gullibility, and demographics on the use of social media for financial decision making. Journal of Financial Services Marketing 24: 1–10. [Google Scholar] [CrossRef]

- Forbes. 2023. Adults Are Turning to Social Media for Financial Advice. Available online: https://www.forbes.com/advisor/investing/financial-advisor/adults-financial-advice-social-media/ (accessed on 28 July 2024).

- Gosal, Rex, Dewi Astuti, and Evelyn Evelyn. 2021. Influence of self-esteem and objective knowledge financial of the financial behavior in young adults with subjective financial knowledge mediation as variable. International Journal of Financial and Investment Studies (IJFIS) 2: 56–64. [Google Scholar] [CrossRef]

- Grable, John E., Sam Cupples, Fred Fernatt, and NaRita Anderson. 2013. Evaluating the link between perceived income adequacy and financial satisfaction: A resource deficit hypothesis approach. Social Indicators Research 114: 1109–24. [Google Scholar] [CrossRef]

- Greenwald Researcher. 2021a. Exploring Financial Fragility Across Generations, Race and Ethnicity. Society of Actuaries Research Institute. Available online: https://www.soa.org/resources/research-reports/2021/generations-survey/ (accessed on 31 July 2024).

- Greenwald Researcher. 2021b. Financial Perspectives on Aging and Retirement across the Generations. Society of Actuaries Research Institute. Available online: https://www.soa.org/resources/research-reports/2021/generations-survey/ (accessed on 31 July 2024).

- Guégan, Dominique, and Thomas Renault. 2021. Does investor sentiment on social media provide robust information for Bitcoin returns predictability? Finance Research Letters 38: 101494. [Google Scholar] [CrossRef]

- Guo, Tao, Michael Finke, and Barry Mulholland. 2015. Investor attention and advisor social media interaction. Applied Economics Letters 22: 261–65. [Google Scholar] [CrossRef]

- Gupta, Vikas. 2019. The influencing role of social media in the consumer’s hotel decision-making process. Worldwide Hospitality and Tourism Themes 11: 378–91. [Google Scholar] [CrossRef]

- Hansen, Thomas, Britt Slagsvold, and Torbjørn Moum. 2008. Financial satisfaction in old age: A satisfaction paradox or a result of accumulated wealth? Social Indicators Research 89: 323–47. [Google Scholar] [CrossRef]

- Hsieh, Chang-Ming. 2004. Income and financial satisfaction among older adults in the United States. Social Indicators Research 66: 249–66. [Google Scholar] [CrossRef]

- Ilyas, Muhammad, and Achmad Helmy Djawahir. 2021. The effect of financial knowledge and financial well-being on investment intention mediated by financial attitude: A study on millennial generation and Gen Z in Malang City. International Journal of Research in Business and Social Science (2147–4478) 10: 175–88. [Google Scholar] [CrossRef]

- Jha, Bidyanand. 2019. The role of social media communication: Empirical study of online purchase intention of financial products. Global Business Review 20: 1445–61. [Google Scholar] [CrossRef]

- Joo, So-hyun, and John E. Grable. 2004. An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues 25: 25–50. [Google Scholar] [CrossRef]

- Kadous, Kathryn, Molly Mercer, and Yuepin Zhou. 2022. Why do investors rely on low-quality investment advice? Experimental evidence from social media platforms. Behavioral Research in Accounting, 1–19. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Angus Deaton. 2010. High income improves evaluation of life but not emotional well-being. Proceedings of the National Academy of Sciences of the United States of America 107: 16489–93. [Google Scholar] [CrossRef]

- Maditinos, Dimitrios I., Željko Šević, and Nikolaos G. Theriou. 2007. Investors’ behaviour in the Athens Stock Exchange (ASE). Studies in Economics and Finance 24: 32–50. [Google Scholar] [CrossRef]

- Michalos, Alex C., and Julie Anne Orlando. 2006. A note on student quality of life. Social Indicators Research 79: 51–59. [Google Scholar] [CrossRef]

- Nabila, Farizka Shafa, Mahendra Fakhri, Mahir Pradana, Budi Rustandi Kartawinata, and Anita Silvianita. 2023. Measuring financial satisfaction of Indonesian young adults: A SEM-PLS analysis. Journal of Innovation and Entrepreneurship 12: 16. [Google Scholar] [CrossRef]

- Ng, Weiting, and Ed Diener. 2014. What matters to the rich and the poor? Subjective well-being, financial satisfaction, and postmaterialist needs across the world. Journal of Personality and Social Psychology 107: 326. [Google Scholar] [CrossRef]

- Nobanee, Haitham, and Nejla Ould Daoud Ellili. 2023. What do we know about meme stocks? A bibliometric and systematic review, current streams, developments, and directions for future research. International Review of Economics & Finance 85: 589–602. [Google Scholar]

- Normawati, Rani Arifah, Sri Mangesti Rahayu, and Saparila Worokinasih. 2022. Financial satisfaction on millennials: Examining the relationship between financial knowledge, digital financial knowledge, financial attitude, and financial behavior. Jurnal Aplikasi Manajemen 20: 354–65. [Google Scholar]

- Nurtati, Nurtati, Patria Nagara, Dorris Yadewani, and Nisrina Nazar. 2024. Analysis of factors affecting the improvement of financial satisfaction of the millennial generation. Target: Jurnal Manajemen Bisnis 6: 29–40. [Google Scholar] [CrossRef]

- Pandey, Ichchha, and Michael Guillemette. 2024. Social media, investment knowledge, and meme stock trading. Journal of Behavioral Finance, 1–17. [Google Scholar] [CrossRef]

- Pew Research Center. 2024. Social Media Fact Sheet. Available online: https://www.pewresearch.org/internet/fact-sheet/social-media/ (accessed on 28 July 2024).

- Place, Nathan. 2022. Social Media’ Finfluencers’ Are Misleading Investors: Young Investors Are Increasingly Turning to TikTokers and Youtubers for Stock Tips, Often with Bad Results. Financial Planning. Available online: www.financial-planning.com/news/beware-the-finfluencer-how-social-media-stars-are-misinforming-young-investors (accessed on 26 June 2024).

- Plagnol, Anke C. 2011. Financial satisfaction over the life course: The influence of assets and liabilities. Journal of Economic Psychology 32: 45–64. [Google Scholar] [CrossRef]

- Qin, Yao, Bahiyah Omar, and Alessandro Musetti. 2022. The addiction behavior of short-form video app TikTok: The information quality and system quality perspective. Frontiers in Psychology 13: 932805. [Google Scholar] [CrossRef]

- Reiter, Miranda, Di Qing, and Morgen Nations. 2023. Who Uses Social Media for Investment Advice. Journal of Financial Planning 37: 78–99. [Google Scholar]

- Riitsalu, Leonore, and Rein Murakas. 2019. Subjective financial knowledge, prudent behavior and income: The predictors of financial well-being in Estonia. International Journal of Bank Marketing 37: 934–50. [Google Scholar] [CrossRef]

- Rue, Penny. 2018. Make way, millennials, here comes Gen Z. About Campus 23: 5–12. [Google Scholar] [CrossRef]

- Saurabh, Kumar, and Tanuj Nandan. 2018. Role of financial risk attitude and financial behavior as mediators in financial satisfaction: Empirical evidence from India. South Asian Journal of Business Studies 7: 207–24. [Google Scholar] [CrossRef]

- Schooley, Diane K., and Debra Drecnik Worden. 2003. Generation X: Understanding Their Risk Tolerance and Investment Behavior. Journal of Financial Planning 16: 58. [Google Scholar]

- Seghieri, Chiara, Gustavo Desantis, and Maria Letizia Tanturri. 2006. The richer, the happier? An empirical investigation in selected European countries. Social Indicators Research 79: 455–76. [Google Scholar] [CrossRef]

- Silinskas, Gintautas, Mette Ranta, and T.-A. Wilska. 2021. Financial behaviour under economic strain in different age groups: Predictors and change across 20 years. Journal of Consumer Policy 44: 235–57. [Google Scholar] [CrossRef] [PubMed]

- Stoller, Michael Alan, and Eleanor Palo Stoller. 2003. Perceived income adequacy among elderly retirees. Journal of Applied Gerontology 22: 230–51. [Google Scholar] [CrossRef]

- Subramanian, Yavana Rani. 2021. Social-Media Influence on the Investment Decisions Among the Young Adults in India. Advancement in Management and Technology (AMT) 2: 17–26. [Google Scholar]

- Tandon, Chahat, Sanjana Revankar, and Sidharth Singh Parihar. 2021. How can we predict the impact of the social media messages on the value of cryptocurrency? Insights from big data analytics. International Journal of Information Management Data Insights 1: 100035. [Google Scholar] [CrossRef]

- Tu, Wenting, Min Yang, David W. Cheung, and Nikos Mamoulis. 2018. Investment recommendation by discovering high-quality opinions in investor based social networks. Information Systems 78: 189–98. [Google Scholar] [CrossRef]

- Vera-Toscano, Esperanza, Victoria Ateca-Amestoy, and Rafael Serrano-Del-Rosal. 2006. Building financial satisfaction. Social Indicators Research 77: 211–43. [Google Scholar] [CrossRef]

- Watson, Amy. 2024. Consumption Frequency of News from Social Media in the U.S. 2022, by Generation. Statista. Available online: https://www.statista.com/statistics/1124159/us-generational-social-media-news/ (accessed on 25 July 2024).

- Xiao, Jing Jian, and Barbara O’Neill. 2018. Propensity to plan, financial capability, and financial satisfaction. International Journal of Consumer Studies 42: 501–12. [Google Scholar] [CrossRef]

- Xiao, Jing Jian, Cheng Chen, and Fuzhong Chen. 2014. Consumer financial capability and financial satisfaction. Social Indicators Research 118: 415–32. [Google Scholar] [CrossRef]

- Xiao, Jing Jian, Chuanyi Tang, and Soyeon Shim. 2009. Acting for happiness: Financial behavior and life satisfaction of college students. Social Indicators Research 92: 53–68. [Google Scholar] [CrossRef]

- Xu, Yongxin, Yuhao Xuan, and Gaoping Zheng. 2021. Internet searching and stock price crash risk: Evidence from a quasi-natural experiment. Journal of Financial Economics 141: 255–75. [Google Scholar] [CrossRef]

- Yakoboski, Paul J., Annamaria Lusardi, and Andrea Hasler. 2021. Financial literacy and well-being in a five generation America. In TIAA Institute-GFLEC Report. Amherst: TIAA Institute. [Google Scholar]

- Yanto, Heri, Norashikin Ismail, Kiswanto Kiswanto, Nurhazrina Mat Rahim, and Niswah Baroroh. 2021. The roles of peers and social media in building financial literacy among the millennial generation: A case of indonesian economics and business students. Cogent Social Sciences 7: 1947579. [Google Scholar] [CrossRef]

- Yeo, Michelle Mei Ling. 2014. Social media and social networking applications for teaching and learning. European Journal of Science and Mathematics Education 2: 53–62. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).