1. Introduction

The regulation of environmental, social, and governance (ESG) factors is rapidly evolving and is a major financial compliance concern worldwide. The European Union (EU) has been making steady progress in implementing Sustainable Finance Disclosure Regulations (SFDRs), which specify sustainability disclosure requirements for investment advisors and managers across all asset types (

European Parliament 2021). Similar requirements are also being implemented in the Asia Pacific region, such as the Monetary Authority of Singapore’s Green Finance Action Plan (

MAS 2023), the Taiwan Government’s Green Finance Action Plan 2.0 (

FSC 2020), the Kingdom of Thailand’s Sustainable Financing Framework (

KOT 2020), and the Australian Sustainable Finance Initiative (

ASFI 2020). The main goal of SFDR and these other initiatives is to improve the transparency and quality of ESG-related information provided by financial-market participants and make it easier to compare their disclosures.

While the implementation of regulations and definition of related standards are well underway, the technology infrastructure required to fully address ESG disclosure requirements is still being developed. “Green” Fintech solutions, which support the generation of environmental disclosure reports and ESG data management, were some of the first technology platforms to appear (

Macchiavello and Siri 2022). Software applications that make use of machine learning and artificial intelligence also have great potential to help reduce the effort and cost associated with ESG disclosure compliance (

Lee et al. 2022). However, these technology solutions are predicated on the assumption that underlying ESG data are both fully available and trustworthy, or, in some cases, they ignore incomplete information (

Lanza et al. 2020). However, the current availability and quality of the data used for ESG disclosures varies widely and is, in many cases, deficient (

NGFS 2021). Currently, much of the underlying information that is used is obtained from companies’ reports, which have limited depth and uncertain quality, as well as questionnaires, which may vary in their scope and interpretation. Furthermore, there is often little consistency regarding the type, quality, and format of the data that are available.

Consequently, financial institutions face substantial challenges with ESG information disclosure. Many of the processes involved with sourcing and managing sustainability

1 data are manual, making them costly and prone to error. Greenwashing—the practice of providing misleading or false information about the environmental impact of a product, project, or company—is also a potential concern to both the entities making disclosures and those receiving them. Firms making disclosures can face punitive action by market participants and regulators for misrepresentation, as highlighted by the recent civil penalty proceedings initiated by the Australian Securities and Investments Commission (ASIC) against a large asset manager (

ASIC 2023). For financial institutions receiving ESG disclosures, the current lack of data infrastructure makes verification of sustainability claims difficult to verify, and, thus, in many cases, greenwashing may go undetected (

Chueca Vergara and Ferruz Agudo 2021).

With the short timelines and rapid change necessary to meet COP26 sustainability targets, existing knowledge and technology should be leveraged whenever possible (

United Nations 2023). There is an opportunity for participants in the ESG disclosure value chain to learn from their experiences and take advantage of technologies developed by the financial services industry over the past thirty years and to provide an environment for the introduction and growth of new services (

Alonso and Marqués 2019). Three Fintech infrastructure areas are particularly relevant: (1) data collection and distribution, (2) regulatory reporting and disclosure, and (3) communication standards. By applying preexisting technology architectures and principles from these areas, Fintech can help accelerate the availability and use of sustainability data, providing the depth and integrity necessary to support the growth and scalability of ESG disclosure compliance.

Fintech can address data governance concerns, such as improving the completeness and quality of ESG data, to reduce the burden of ESG reporting compliance for market participants. This is important for small- and medium-sized firms, which bear a disproportionately large cost of compliance given the fixed overhead costs required for disclosure. Fintech can also reduce the cost of maintaining compliance as standards evolve and regulations change (

Siri and Zhu 2019). New technology solutions have emerged to address ESG reporting challenges; however, for the most part, these initiatives have been specific to a particular industry vertical, such as private equity (

Novata 2023). They also have limited scope within ESG, such as focusing on the disclosure of greenhouse gas (GHG) emissions (

Carbon Disclosure Project 2023). While the availability of manifold technology solutions provides benefits, it can also lead to a fragmented environment that is difficult for users of data to navigate and source consolidated information.

To meet compliance timelines and address the complexities that ESG disclosure presents, proven solutions must be applied. This paper uses a comparative case study approach to analyze Fintech infrastructure that can support ESG disclosure. The following sections analyze how established Fintech architecture models and principles can address ESG data challenges on a large scale. Additionally, new capabilities that are required for ESG-specific data governance and reporting are considered. To help provide empirical analysis and verification a brief case study is presented. Finally, key considerations and recommendations for policymakers are outlined. Prior research has focused primarily on identifying problems associated with ESG reporting and proposing technology solutions that have limited scope. The significance of this paper is that it presents a holistic technology approach that addresses existing ESG-data-reporting needs and can adapt to a changing regulatory environment.

2. Literature Review

Kotsantonis and Serafeim (

2019) question whether a firm’s ESG performance can be accurately assessed due to concerns about the quality of the underlying ESG data. They identify four major concerns: inconsistency of reported data, distortions caused by benchmarking, challenges with imputing missing data, and inconsistencies with data provided by different ESG data providers. The inconsistency of reported data is mainly caused by the use of different reporting metrics. Distortions related to benchmarking arise from difficulties in selecting appropriate peer groups for ESG comparisons, especially for diversified businesses. When there are gaps in ESG data, imputed values are commonly used to fill them. The choice of imputation methods can lead to wide variations in the data, potentially skewing the results of downstream analysis. Lastly, they highlight the lack of agreement in third-party ESG ratings, expressing concern that as the number of underlying ESG data increases, the ratings tend to diverge rather than converge.

On the topic of ESG data availability and quality,

Ferreira et al. (

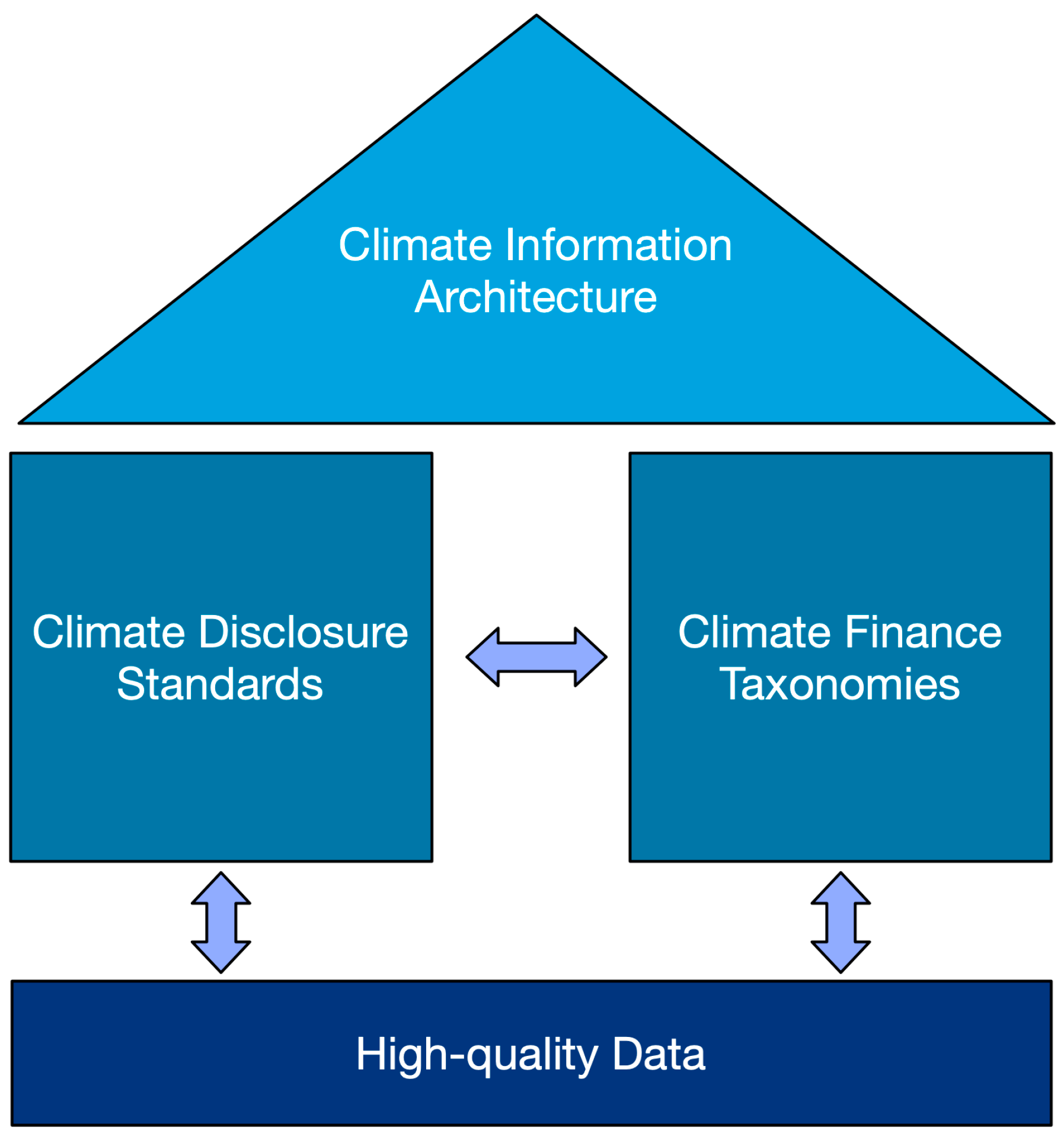

2021) proposed a conceptual Climate Information Architecture, which includes climate disclosure standards and principles for climate finance taxonomies which are both layered upon a foundation of high-quality, reliable, and comparable data (

Figure 1). They identify concerns regarding the lack of relevant ESG data and limitations related to the quality, comparability, and consistency of available data. Specifically, the granularity of information is often insufficient to assess environmental risk. They also highlight the significant cost for SMEs to collect and report ESG data, especially when data need to be gathered from extended and complex supply chains. In this regard, disclosure of climate-related metrics and targets drops significantly as the reporting firm’s size decreases. Ferreira et al. emphasize the need for verification and audit mechanisms to ensure data integrity. Likewise, technology-based solutions are necessary to support the collection and distribution of ESG data and make data analytics available on an industry-wide scale.

The Financial Stability Board (

FSB 2021) analyzed the limitations regarding the availability of environmental data for monitoring and assessing climate-related risk. It concluded that the accuracy of calculations of climate risk exposure is limited by the lack of detailed information on firms’ exposures to these risks. Specifically, emerging markets and developing economies are highlighted for lacking granular data, such as GHG emissions for individual firms, which are necessary for Scope 3 emissions

2 calculations.

In its final report on bridging data gaps related to environmental data, the Network of Central Banks and Supervisors for Greening the Financial System (

NGFS 2021) identified lack of data availability, insufficient granularity of available data, and uncertainties related to evolving climate-related models as key challenges. It raised concerns about data fragmentation, e.g., across nations and asset classes. Likewise, estimates are often used due to data unavailability, which brings into question the accuracy of Scope 3 GHG emission disclosures. To help identify data gaps, NGFS created a directory of available climate-related data sources that support use cases in financial services and provide relevant metrics. It determined that close to a quarter of the mapped data points were either unavailable or had accessibility concerns. Around half the data items were based on estimated or modeled information. It also observed that much of the available data had potential issues with availability, reliability, and comparability. It concluded that key challenges for climate-related data include the availability of high-quality data and the overuse of estimated data. One of NGFS’s policy recommendations was to take advantage of existing data sources, approaches, and tools.

The

Climate Data Steering Committee (

2022) identified the limited availability of Scope 3 emissions data and the inconsistency of emission reduction target information as key challenges for GHG emission disclosures. Financial institutions commonly use models to estimate Scope 3 emissions. However, the accuracy of these models varies depending on the granularity of the data they use. The committee highlighted that most firms do not report Scope 3 emissions. Additionally, SMEs and companies in emerging markets and developing economies do not report any emissions data. They also made recommendations regarding the capabilities and product functionality to be supported by a Net Zero Data Public Utility (NZDPU), including capturing the quality of data used for reporting disclosure. Additionally, requirements for data authentication, data integrity, and metadata

3 management were identified.

With regard to Fintech, its underlying technology sources include blockchain, artificial intelligence, security, Internet of Things (IoT), and cloud services (

Deloitte 2018). Of these,

Werth et al. (

2022) found evidence that security, privacy, and transparency were most relevant to the success of Fintech, and the

FSB (

2017) identified transparency and efficiency as key benefits that Fintech provides. Furthermore,

Correia et al. (

2022) found evidence that the transparency provided by Fintech for loans improves the efficiency of the credit market, providing better access to finance, while also reducing risk to lenders.

Wu et al. (

2023) also concluded that, based on evidence in China, Fintech can improve financial efficiency. These characteristics directly apply to ESG with regard to the privacy of sustainability data, avoidance of Greenwashing, and access to capital for transition finance.

While the nature of Fintech and concerns related to ESG data have been identified and examined, the research on technology solutions that can address these problems is quite limited. As summarized by

Saxena et al. (

2023), there have been several research studies that have attempted to address ESG reporting and data-related challenges (

Cerchiaro et al. 2021;

Golding et al. 2022;

Schulz and Feist 2021) using blockchain technology. There have also been several studies investigating how AI and machine learning can be applied to ESG data (

D’Amato et al. 2021;

Wu et al. 2022). These assume that the necessary data for analysis are available and accurate.

Cruz and Matos (

2023) describe a software solution that supports automated ESG assessment and reporting based on questionnaire data. However, to date, most of the research focus has been on the use of new technologies, rather than applying existing technologies, to address ESG data challenges.

3. Methodology

This paper uses a case-oriented comparative analysis approach to analyze existing Fintech data infrastructures and assess their potential for reuse to support ESG data distribution and management for sustainability disclosure and reporting. This approach was chosen due to its capacity to analyze historical processes and examine a complex unity by taking context into account (

Ragin and Zaret 1983;

Della Porta and Keating 2008). By comparing a small number of cases, it is possible to distil the unique features relevant to the topic being investigated (

Skocpol and Somers 1980). More specifically, process tracing and historical explanation support the analysis of causal mechanisms based on a small number of cases (

George and Bennett 2005).

A contextualized explanation approach is used to trace the development of Fintech data infrastructure for financial services (

Welch et al. 2011). The evolution of existing Fintech models that apply to current challenges with ESG data is analyzed. The drivers that led to their development are identified, and the successes and shortcomings that arose from their development are considered. The aspects of existing Fintech platforms that can be leveraged to support current ESG disclosure requirements are pinpointed, as well as additional considerations that need to be addressed.

The comparison of market data infrastructure, regulatory trade reporting, and clearing and settlement communication infrastructure was chosen for several reasons. The development and evolution of market data distribution infrastructure was chosen because it is most similar to the current task at hand, i.e., distribution of information for use by financial institutions and other stakeholders. However, the core market data technology was developed more than two decades ago, based on market needs at the time, making it less relevant in the immediate context of ESG data. The case of OTC derivative reporting was chosen because it is more recent, involved less-standardized data, and was driven by regulatory changes that had short timelines for compliance, as is the case with ESG data. Finally, the case of financial services’ communication infrastructure was chosen because it includes aspects related to the development of data standards, which were not addressed and remain pain points for the other two cases.

4. Evolving ESG Data Initiatives

This section provides an overview of current initiatives related to developing relevant data standards for ESG data. It explores the progress that has been made and is currently underway for defining, measuring, and managing ESG data.

Since the 1990s, the demand for publicly listed companies to report sustainability factors alongside traditional financial metrics has been growing steadily. Corporate Social Responsibility (CSR) disclosures began appearing in annual reports in the early 2000s and evolved into more specific environmental, social, and governance disclosures. Proactive public companies led a voluntary disclosure movement, followed by “disclose or explain” mandates by specific stock exchanges and, finally, full mandatory reporting requirements. Organizations such as the Global Reporting Initiative (GRI) and the Carbon Disclosure Project (CDP) emerged as these mandates matured. Along with the shift toward mandatory reporting requirements, there was a move away from the use of broad qualitative statements in companies’ annual reports to more standardized, industry-specific, quantifiable, and science-based metrics.

In parallel with the evolution of disclosures, there was increasing public demand for sustainable and impact investing. Fund managers created investment products that promoted environmental, social, and/or governance characteristics and objectives. Global regulators introduced regulations to govern the correct labeling and marketing of these products. The major financial data aggregators

4 developed sustainability rating products. Early rating offerings had flaws, partly due to overlapping ESG factors and rating inconsistencies. However, pressure from regulators and industry demand has led to the ongoing improvement of these products. Nevertheless, the lack of clarity and transparency regarding the formulations of ratings, as well as limited geographical coverage, have limited their use (

IOSCO 2021).

As an alternative to using third-party ratings, some data consumers, particularly large asset managers, have chosen to calculate their own proprietary ESG scores by using underlying data. This approach enables them to assess the ESG characteristics of potential investments in a way that is better aligned with their sustainable investment philosophies. This approach is less practical for smaller asset managers due to the effort and cost associated with sourcing and managing the raw data. The lack of standardization for reporting and distributing ESG information may require asset managers to parse companies’ annual reports and ESG disclosures to collect sustainability metrics, tasks that are time-intensive and costly. In cases where the reported information lacks sufficient granularity or coverage, asset managers may also contact companies directly and ask them to complete detailed questionnaires. This can result in extensive duplication of effort for both sides, as an asset manager may need to engage with dozens of companies and a company may need to respond to dozens of asset managers. Additionally, some companies may have extensive, granular, and distinctive data available that are too voluminous to include in published disclosures, but they lack a straightforward means to provide them to data consumers.

There have been various public and private initiatives aimed at supporting the collection and distribution of ESG data. For example, the Net Zero Public Data Utility (

Climate Data Steering Committee 2022) plans to be a centralized global source of standardized GHG emissions data. NZPDU intends to provide captured and stored data to the public for free. So far, it has focused on defining requirements and has engaged third-party vendors to implement a pilot system. Another initiative is ESGenome, a disclosure platform provided by the Singapore Exchange (SGX). It offers support to SGX-listed companies for the collection, tracking, and reporting of ESG-related data. In both cases, the captured data are what firms voluntarily or are obliged to report.

Beyond the information disclosed by companies, there are initiatives to capture and make available raw data, often from suppliers, required to support or validate companies’ disclosure calculations. The Green Button Initiative is a voluntary program in North America governing the disclosure of consumer utility usage for analysis and management (

Green Button Data 2023). Its members include 11 utility companies (e.g., water, electricity, and gas) and 22 service providers in the US and Canada. In the EU, data portability regulations put in place to support Open Banking are now being expanded to require other types of businesses, with the customer’s consent, to share usage data with third parties (

European Parliament 2023).

There has been an acceleration in the definition of ESG data standards, such as taxonomies. This has culminated in the convergence of multiple overlapping standards initiatives

5 into the newly formed IFRS Foundation and the International Sustainability Standards Board (ISSB). This initiative has brought together disparate efforts to create a single set of standards for general and theme-specific disclosure frameworks, such as GHG emissions. The ISSB has adopted the Sustainable Accounting Standards Board (SASB)’s mature industry classification system. This system documents material quantitative and qualitative topics for 77 industries across 11 sectors (

SASB 2023). Progress has also been made regarding definitions related to data quality. The Partnership for Carbon Accounting Financials (PCAF) Standard (

PCAF 2022) includes a data quality score ranging from 1 to 5, highest to lowest, with low scores indicating that estimates were used to fill in data gaps.

In summary, requirements, technology solutions, and data standards for ESG disclosure reporting are rapidly evolving and still in flux. ESG reporting is in its early stages, so requirement changes can be expected for many years to come. Currently, the quality of the disclosed data is lacking, and the availability of raw data is limited. However, technology solutions are being developed to support ESG data producers and consumers. Data requirements and conventions are maturing, but the overall technology strategy for ESG data infrastructure is loosely defined and uncoordinated. The trajectory of ESG reporting is similar to the early stages of financial market data propagation and regulatory reporting for financial transactions. The current standardized vocabulary for describing common stock, company shareholding, debt, profits, dividends, and trading venues evolved from a myriad of national standards and conventions. In many cases, divergent technology solutions developed for financial services were consolidated and harmonized over time.

5. Fintech Data Infrastructure

For many years, the financial service industry struggled with business and technology challenges as it grew and matured. Over the course of four decades, Fintech companies helped address these challenges and allowed financial institutions to focus on their core businesses. This section examines the development of Fintech data infrastructure for market data distribution, regulatory trade reporting, and clearing and settlement communication. These platforms enabled an ecosystem of Fintech solution providers, many of them start-ups, to build layered solutions and accelerate industry growth. This development is consistent with evidence that access to the latest technology and supporting infrastructure positively impacts the formation of Fintech start-ups (

Haddad and Hornuf 2019). The subsections below provide context for comparing and analyzing how these models and architectures can address current ESG data challenges.

5.1. Market Data Distribution Infrastructure

Market data collection and distribution were some of the earliest challenges in the financial markets. Various technologies were developed for data communication, including carrier pigeons, telegraph, video screens, and digitized market data delivered over computer networks. Stock exchanges generated most of the market price information, but there was also a need to capture price information from smaller broker-dealers for financial instruments such as bonds. In this environment, the first data “utilities” emerged, offering standardized services for common functions such as market data distribution. A small number of firms, such as Reuters and Bloomberg, rose to become quasi-monopolies, dominating market data collection and distribution.

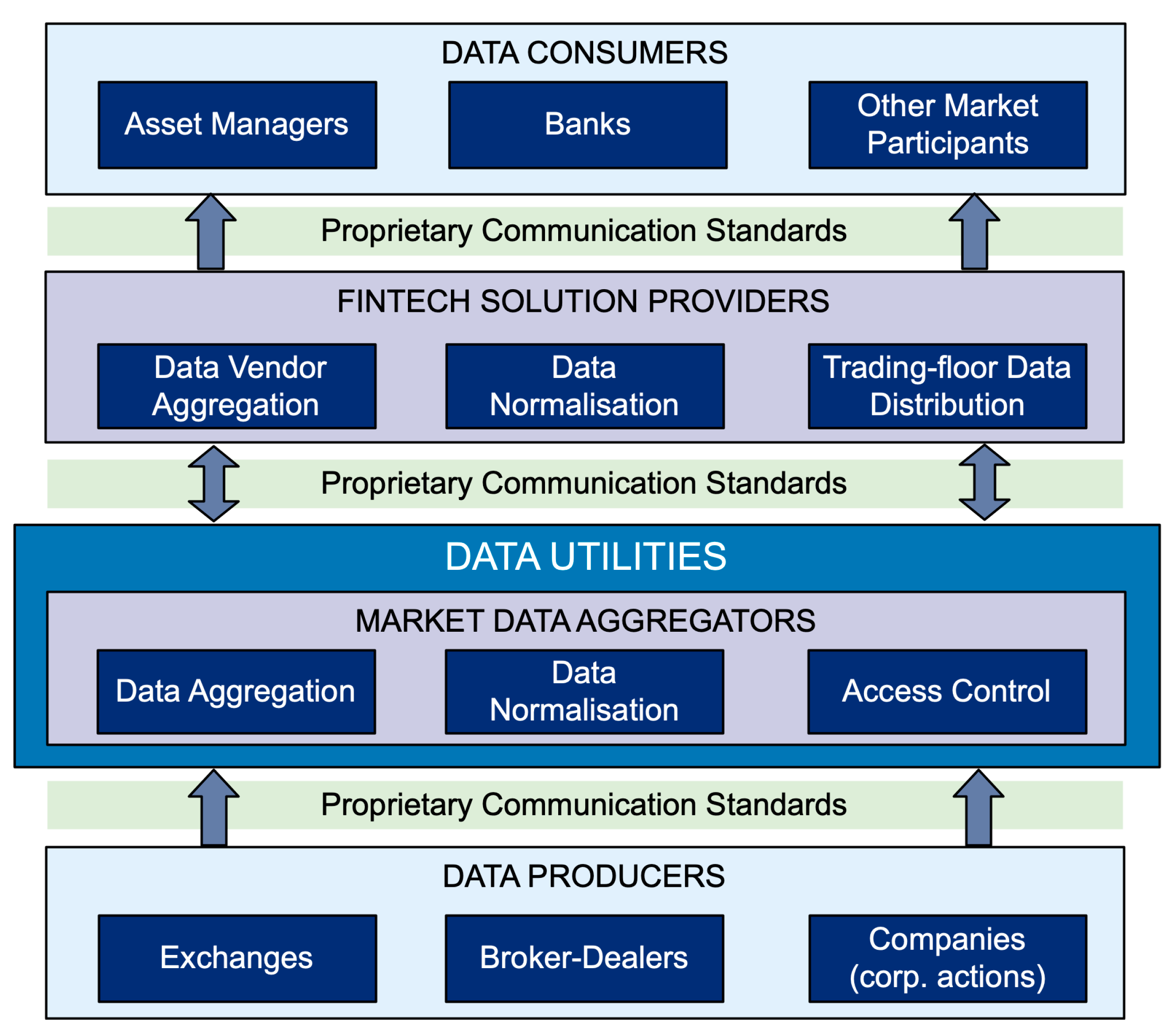

The Fintech infrastructure that emerged from the market data environment was mostly proprietary, with few open standards. A common technology architecture was developed to support real-time price data dissemination and provide access to reference and historical data. This architecture was designed to collect and distribute data originating from a limited number of sources, such as stock exchanges (

Figure 2). Raw data were received in the native formats of data producers and delivered using source-specific proprietary communication protocols (

Duran 2017). Market data aggregators would then transform the data into a common, normalized format for storage and distribution, implementing access control mechanisms to restrict which information is accessible to data consumers. Aggregator-specific proprietary communication protocols were used to deliver the aggregated data to consumers.

There were several drawbacks to this model. Firstly, as independent profit-driven entities, the objectives of the data aggregators were not aligned with the data producers and consumers. Secondly, not all data sources were available from a single aggregator, thus resulting in a fragmented market-data universe. As a result, data consumers had to source market data from multiple aggregators. Lastly, the absence of common data communication standards increased software integration and data management costs. Fintech companies provided solutions that combined and normalized data from different data aggregators and disseminated market prices within financial institutions.

Data aggregators faced difficulties in cases where there were many different contributors of information and no standard format for sharing information. Corporate-action data, such as dividend and stock split information, exemplified this challenge. Companies issued this information through their websites or other ad hoc communications, and the way the information was presented varied across domestic markets and companies. Data consumers often had to screen-scrape, manually parse information, and then extract the relevant data, making the process inefficient and costly.

Unlike data aggregators, which were separate and standalone commercial entities from the financial institutions to which they provided services, more cooperative market utilities emerged over time to address other types of industry needs. For example, stock exchanges were formed to support the needs of buyers and sellers of securities and clearing houses, and central security depositories were set up to facilitate the clearing and settlement of securities. In most cases, these utilities were jointly owned by key stakeholders and given the mandate to efficiently serve the market, provide robust service, and enable industry growth. These market utilities were usually monopolies, but they were regulated and industry owned. In many cases, these utilities’ roles expanded as new challenges and requirements arose. One example was the creation of trade repositories to support new regulatory reporting requirements for OTC derivatives.

5.2. Regulatory Reporting Infrastructure

Regulatory reporting for stock and listed derivatives trading, such as futures and options, has been in place for several decades. This reporting aims to ensure price transparency and supports index calculations, benchmarking, and risk management activities. Common entities, such as stock exchanges or clearing houses, provide standardized, industry-wide reporting facilities. They act as conduits for the transactions on behalf of their clients. However, this model did not apply to uncleared OTC derivative trades.

Some OTC derivatives are traded bilaterally between banks and customers, as well as between banks themselves. No intermediating entities are involved in these trades or their clearing and settlement. The parties involved in OTC derivatives’ transactions often operate in different countries and are subject to oversight from different regulators. Transaction agreements are negotiated between the parties, and the trade details are digitally recorded on each party’s internal system of record. Due to the lack of central recordkeeping of these transactions for many years, the extent of systemic risk presented by OTC derivatives held by institutions such as AIG and Lehman Brothers was not readily apparent during the Global Financial Crisis.

Post-crisis, G20 nations commissioned the Financial Stability Board (FSB) to design and coordinate the implementation of reforms of the global financial system to address these deficiencies in the derivatives markets. The reforms focused heavily on data and transparency and led to the urgent implementation of laws, such as Title VII of the Dodd-Frank Act in the US (

U.S. Congress 2010), and supporting regulations across major financial markets such as the European Market Infrastructure Regulation (

European Parliament 2012), updates to Singapore’s Securities and Futures Regulations (

MAS 2013), and Australia’s Derivative Transaction Rules (

ASIC 2013). Regional regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) in the US, the European Securities and Markets Authority, the Monetary Authority of Singapore, the Financial Services Agency in Japan, and ASIC in Australia, began implementing these reforms between 2012 and 2015. While their principles were consistent with the FSB reforms, there was substantial variation in the reporting requirements across jurisdictions. For example, Japan’s FSA required large banks to report daily and other financial participants to report monthly. On the other hand, the CFTC required real-time reporting, but only by dealers of OTC derivatives. Most other jurisdictions required both dealers and their counterparties to report on an end-of-day basis.

Under the new mandated reporting processes, the counterparties to the trade were responsible for providing transaction details to relevant authorities. The reporting process involved three main activities:

Collection and aggregation of the underlying transaction and position information;

Data conversion, reporting determination, and reporting submission;

Reporting data collection, validation, and management.

This section further discusses the Fintech data infrastructure developed to address the latter two activities.

A key problem that had to be resolved as part of the reporting process was standardizing the collection of underlying transaction data and its subsequent validation and management. Financial regulators were not prepared to perform this function, nor were there existing market utilities that provided this service. A foundation for data collection needed to be implemented quickly to enable the upstream reporting activities to be set up and tested.

Voluntary transaction disclosures for credit default swaps (CDSs) preceded mandated OTC trade reporting. A US-based clearinghouse operated a centralized reporting service that captured over 90% of CDS trading volume. This service enabled the orderly resolution of financial exposures in CDS during the crisis and served as a model for the mandated reporting facilities that followed. To minimize the time required to build reporting infrastructure, industry participants and regulators directed existing market utilities, such as clearinghouses and exchanges, to create OTC derivative trade repositories.

Typically, there would be one approved trade repository per jurisdiction, and possibly two or more in larger jurisdictions, such as the EU and the US. Centralizing this responsibility streamlined decision-making and enabled faster resource mobilization. Most regulatory jurisdictions chose to replicate the initial reporting structure, which was implemented in the US, but each jurisdiction added regional variations to the US reporting requirements. The differences mainly related to the types of information and the specific fields that had to be reported. Some jurisdictions, such as Hong Kong and Korea, chose to implement customized, local interpretations of the G20 objectives. Note that in the very early planning stages, having a single global repository was considered. However, it was deemed impractical given the coordination that would be required and the short timeframes required for implementation.

The global OTC derivatives market covered five major asset classes, each with its unique data requirements. Trading volume was concentrated in a few large entities, such as multinational banks, while smaller firms, such as asset managers, were responsible for much less of the total volume. Mandatory OTC derivative reporting requirements were introduced gradually over several years, with the timing and scope of the phases based on firms’ trading volumes and the types of assets traded. This phased approach aimed to quickly establish baseline transparency for the highest concentrations of risk and then extend coverage gradually over a longer period to achieve full visibility.

Once the problem of where to report was solved, the second major concern of how to report became the focus and responsibility of the financial institutions involved in OTC derivative transactions. In certain instances, large banks opted to develop and operate their own solutions. However, for smaller banks and asset managers, this approach was not feasible, due to the high cost and extensive effort required. For these firms, Fintech regulatory solutions providers swiftly developed solutions that enabled them to meet regulatory deadlines.

Fintech platforms accepted both transaction and position data from the financial institutions’ internal information technology (IT) systems. Often, there were different IT systems for different asset classes, so data from each system had to be converted to a standard format that could be used for further processing (

Duran 2017). Reporting determination was also required to establish if a transaction was reportable and, if so, to which jurisdictions. Some cross-border transactions were reportable in multiple jurisdictions. Reportable transactions were then translated and submitted to the relevant trade repository(s). Fintech firms were able to implement these solutions quickly, sometimes taking advantage of preexisting capabilities for other types of financial reporting.

The remaining effort was in the hands of financial institutions, gathering and preparing data for processing. This work was more onerous than expected for several reasons. In some cases, data sourcing and aggregation involved coordination between different parts of the organization, depending on the asset classes involved. Additionally, the data could potentially reside in a number of different IT systems. Hence, identifying the data sources, extracting the data from them, and consolidating them for further processing were major undertakings. Most institutions were fortunate, though, as all the data were available internally, and there was no reliance on communication with other parties for the underlying data required for reporting.

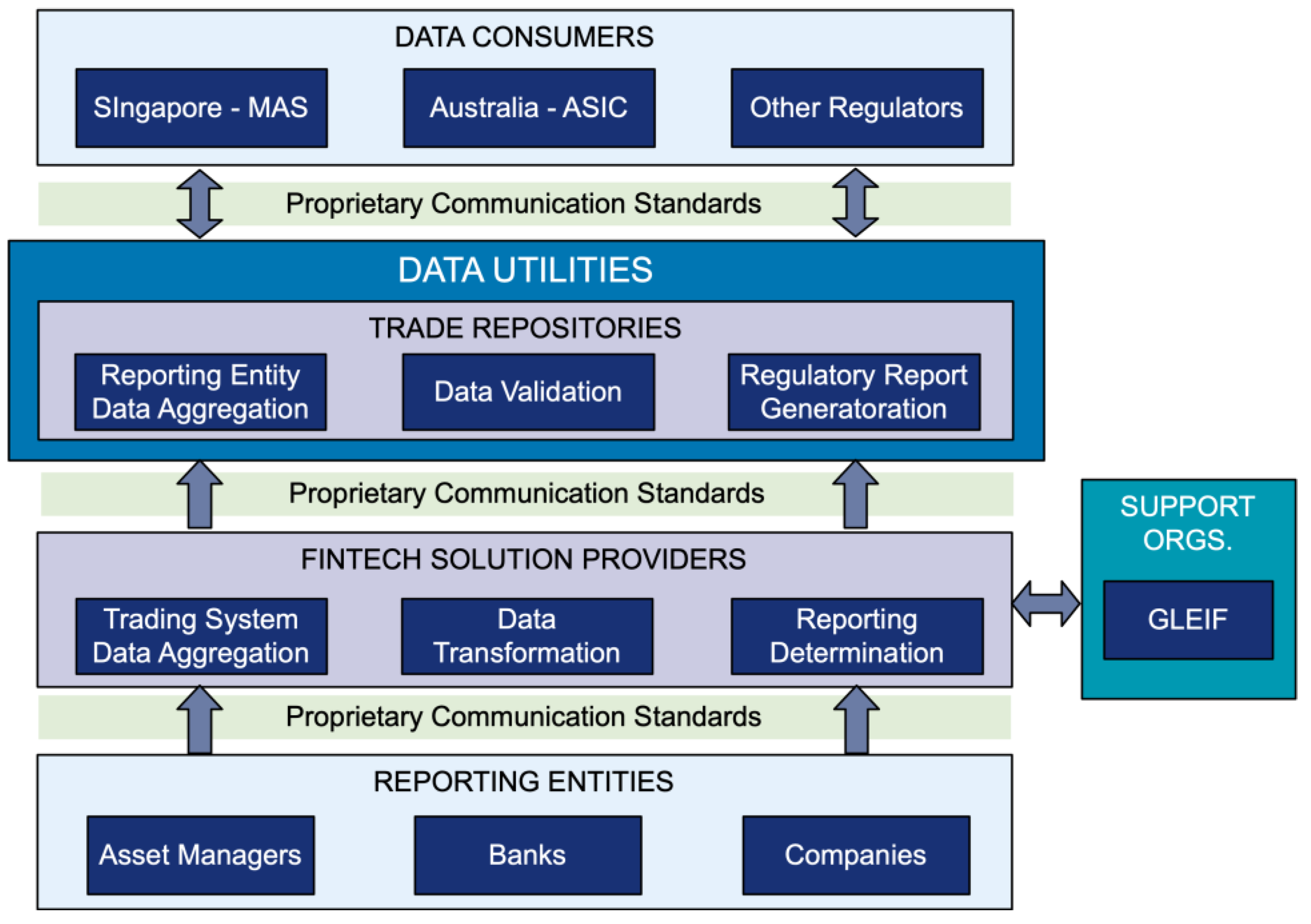

The Fintech infrastructure that supported the OTC derivative trade reporting consisted of two main processing stages. Fintech regulatory solution providers would aggregate the raw data provided by reporting entities from their IT systems. They would then check the completeness and validity of the data and transform it into the proprietary data formats required by the trade repositories (see

Figure 3). These solutions also identified the jurisdictions to which the data had to be reported and ensured that all necessary information was included in the data.

Trade repositories would then aggregate data from all reporting entities, analyze them, and distribute the results to the national regulators. In this model, the role of the market utilities, i.e., the trade repositories, was limited. A Fintech ecosystem grew up around them to help unburden data producers and shield them from the impact of major changes required by regulators and trade repositories. These changes spanned more than ten years from when OTC derivative trade reporting requirements first went into effect, and they will continue into the future.

As reporting processes matured, the need for the standardization of reference data also arose. For instance, conventions for unique trade identification (UTI), unique (financial) product identification (UPI), and legal entity identification (LEI) were established and put into practice. These standards determined how certain types of information would be represented, not just communicated. Supporting organizations, such as the Global Legal Entity Identifier Foundation (GLEIF), became part of the ecosystem offering services related to these identifiers.

One of the challenges and pain points for OTC derivative trade reporting was the absence of a standard for communication with trade repositories. Each repository operator required data producers to submit data using its own proprietary standard. This resulted in complexity and increased effort for data producers that had to report to multiple trade repositories. More than ten years after reporting commenced, regulators started to address this issue by mandating that trade repositories support the ISO 20022 communications standard. Likewise, regulators across different jurisdictions began harmonizing their reporting requirements. This late-stage migration to standardized and harmonized reporting requirements created additional migration work for reporting entities. Fortunately, the Fintech regulatory solution providers addressed these changes directly, buffering reporting entities from much of the impact.

5.3. Financial Services Communication Infrastructure

A third type of technology infrastructure evolved in the financial markets to address the needs of standardized interparty communication. One of the first infrastructures that emerged was the SWIFT platform, which was developed as a bank-owned Fintech utility service in the 1970s to provide secure interbank payment messaging for clearing and settlement. SWIFT hosts a private, secure network and defined the structure and format of the messages used for communication (

SWIFT 2023). The SWIFT platform was robust and secure, but also quite static. It changed very little until the past decade, when it finally shifted to use an Internet-based format, XML, for message encoding

6. The SWIFT platform provided a consistent way for banks to communicate settlement instructions with other banks. This common standard eliminated confusion and debate regarding the communication protocol to be used and reduced integration support costs.

In the equity trading world, another more open and flexible standard, Financial Information Exchange (FIX), emerged. FIX was initially developed and used by a large fund manager and broker in the 1990s and quickly gained popularity and was adopted across the financial markets industry. FIX defined the structure, format, and interaction sequence of messages, but unlike SWIFT, it did not provide a communication network (

FIX 2023). The ownership of the FIX protocol was transferred to a non-profit organization that oversees its development, maintenance, and governance. FIX quickly evolved to support many asset classes and support three encoding formats: text, binary, and XML. New versions of the FIX protocol standard were regularly released, while older versions remained in use and continued to receive support. Its usage significantly expanded, serving as a common language between counterparties and some of the IT systems within organizations. Due to its open nature and design, FIX was readily adopted, particularly as free, open-source platforms that enabled communication using FIX became available.

These three types of technology infrastructure took decades to develop but have survived the test of time and served the industry well. The rapid speed at which the financial services industry can change today is largely due to the infrastructure that supports it. Fintech service providers have played an important role in providing utility services in various forms and for different purposes. These technology infrastructures can provide useful models for accelerating the collection, management, and dissemination of sustainability-related information to support ESG disclosure reporting.

6. Comparative Analysis Results

A number of considerations related to the Fintech data infrastructure apply to ESG disclosure reporting. This section analyzes how the models and architectures of Fintech infrastructure can be applied to address current ESG data challenges. It also discusses how ESG-specific requirements that are not addressed by existing Fintech implementations also need to be taken into consideration.

Several considerations related to market data infrastructure are relevant to ESG data. Firstly, having a data utility that normalizes data structures and formats provides major benefits for data consumers. It centralizes the transformation of exchange-specific formats and reduces the effort required for data consumers to assimilate data from multiple sources. At the same time, the absence of a common, open communication standard for consuming data from data aggregators increases the effort required to consume data from more than one of them. Furthermore, because data aggregators are fully independent quasi-monopolies, data consumers have little pricing leverage. The most relevant challenge that market data aggregators face is diverse data sources, such as corporate actions, which present a similar scenario to ESG data. The type of information provided and the format in which it is provided varies by industry and company.

The relevant considerations that can be drawn from the experience of OTC derivatives trade reporting are as follows. Leveraging existing market utilities to provide trade repository services helped expedite their implementation. Moreover, the clearinghouses and exchanges that provided the services were already familiar with the industry’s needs and expectations, so they were ready to provide the required levels of operational service. Fragmentation of reporting requirements and data repository services was also a significant aspect of OTC derivative trade reporting. In the beginning, the G20 nations could not agree on reporting regulations, leading to greater complexity and compliance effort for larger banks. They had to comply with the requirements of multiple jurisdictions. Regulatory changes also presented ongoing challenges. Due to the newness of the regulations and reporting technology environment, improvements and refinements were gradually introduced. Given the immaturity of sustainability regulations and reporting solutions, similar challenges are likely to be encountered with ESG disclosure compliance.

With regard to financial services communication infrastructure considerations, one of the key factors is the benefit provided by open and flexible data representation standards. Common, open standards reduce the cost and complexity for data providers, data aggregators, and data consumers to integrate with each other. It is also important that the organization responsible for managing the standard can quickly make changes to adapt to new business requirements. Maintaining compatibility of new versions of the communication standard with older versions is also important to minimize the impact of change on users. While standards for the taxonomies for ESG data have emerged, standards that define how the information will be represented in elementized, machine-readable forms are still lacking.

Looking beyond the similarities of Fintech data infrastructure, we can see that there are also significant differences with ESG data that need to be considered. One major difference is the wide range of sources and varying levels of data refinement. Granular raw ESG data can come from suppliers (e.g., power utilities), IoT sensors, and companies’ internal IT systems. Corporate disclosures are a form of partially refined data that is derived from this raw ESG data. Further refinement occurs when data analysis is applied to corporate disclosure data to generate ratings or other comparative information. Different types of data consumers prefer different levels of data refinement. For example, small asset managers may choose to only consume fully refined ESG data. Larger asset managers may prefer to consume partially refined ESG data and perform a customized analysis of that information. Alternatively, ESG-focused asset managers may also want to access the raw data to obtain additional data points for their analysis and potentially use the raw data for cross-check validation of the ESG information that companies disclose.

Another important difference is the need to track data quality and provenance. The quality level of ESG data, such as accuracy and completeness, needs to be quantified and labeled by the original source. It needs to be reassessed as new data are synthesized using that data and other data, possibly of different quality. The quantification of data quality needs to consider the scale and effects of missing data and imputed data. Data provenance, which involves tracing the origins of data and determining how they were derived, is also important for providing transparency and validating the integrity of refined ESG data. For instance, by tracking data provenance, it would be possible to determine exactly which suppliers’ data had been incorporated into a company’s Scope 3 emissions disclosure.

Moreover, the need for access control to be applied to raw and partially refined sustainability data is more substantial than for financial-market data. Providers of raw data, such as power utilities, will need mechanisms to manage customers’ authorization to make data available. In this regard, customers may want to control which entities can access their data and place other types of restrictions on their availability. It is important to note that concerns related to access control go beyond basic privacy concerns. Non-public raw ESG information related to a company could be used by its competitors to their advantage.

The availability of accurate and comparable sustainability data underpins legislation related to sustainability disclosure across multiple jurisdictions. Fintech’s advantage in this context is that it provides data infrastructure that supports these requirements. Fintech is also dynamic, enabling it to adapt to legislative and regulatory changes over time. At the same time, Fintech’s novelty presents disadvantages. Uncertainty about its regulatory status and lack of understanding about Fintech’s potential for addressing compliance requirements can hinder its adoption. Endorsement and promotion of Green Fintech by regulators and governments can help address the former concern. Leveraging a framework that defines how stakeholders and technology solutions interrelate can help address the latter.

7. A Fintech-Based Framework for ESG Data

This section describes an architectural framework based on previously discussed Fintech-data-infrastructure concepts. It supports ESG compliance on a large scale and provides a high-level blueprint for fulfilling ESG-specific data requirements. The framework shows how existing and new technology solutions can be combined to effectively support ESG disclosure reporting. It deconstructs key functions and relates them in the form of a value chain that supports the data needs of data consumers and producers. The framework supports the acquisition of ESG data for financial-product-sustainability disclosure by asset managers, as well as companies’ public ESG disclosures and reporting required for Green Finance

7.

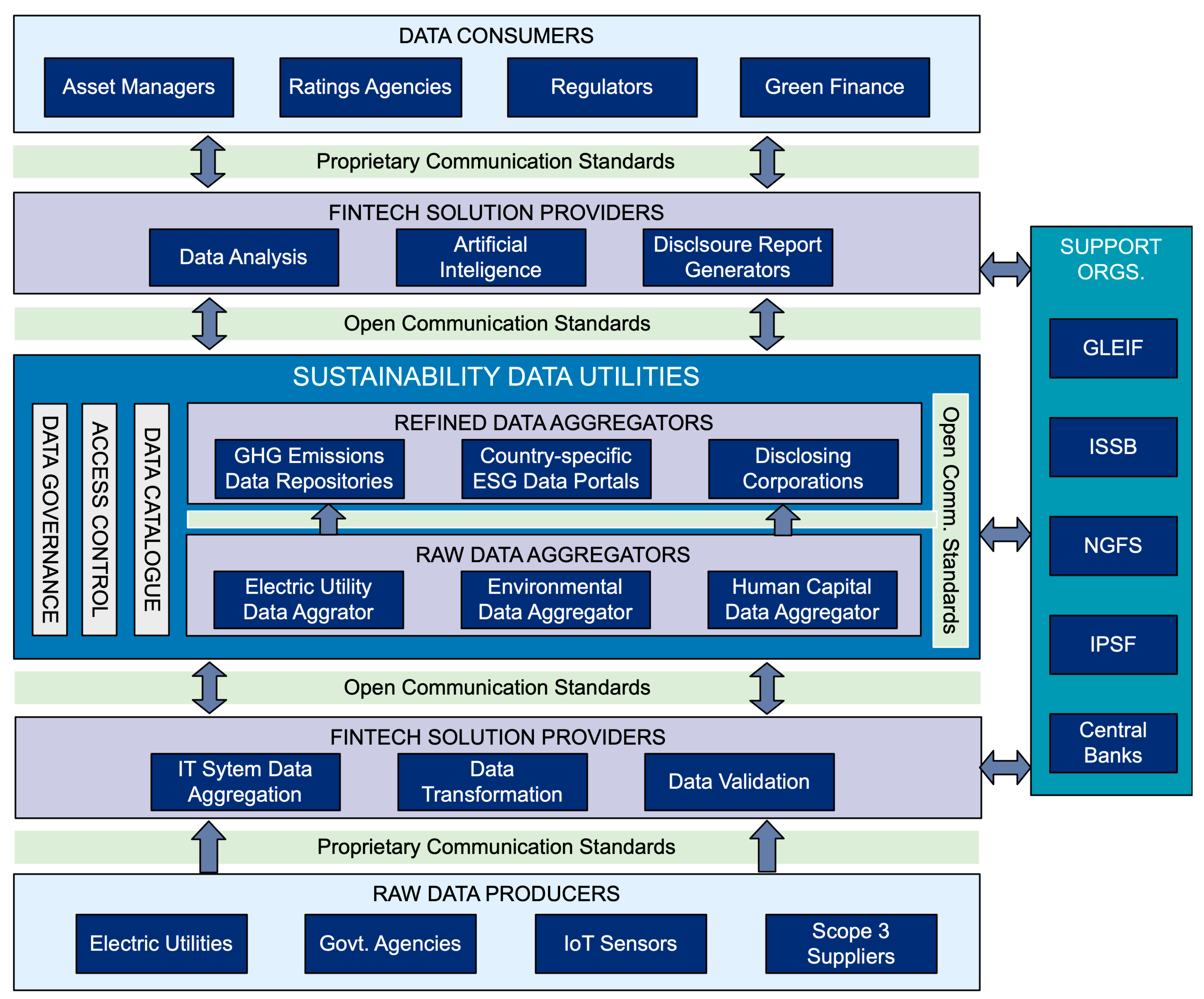

As shown in

Figure 4, the framework has a layered, or stack, model through which an ecosystem of service providers transforms raw ESG data into refined ESG data

8. Data producers can use Fintech solutions to aggregate and validate data from their IT systems. Source system formats will be converted to open communication standards used by data aggregators. Companies making ESG disclosures can source raw ESG data from data utilities that aggregate and normalize the information. Companies can also utilize Fintech solution providers to support their ESG disclosures. For instance, Fintech solution providers could provide services to produce disclosure reports that include the details required by different regulatory jurisdictions. Asset managers and other data consumers can access various types of raw and refined data. They can also employ Fintech solution providers for customized data analysis and to leverage artificial-intelligence technologies.

Figure 4 shows the roles of different entities from the perspective of company-level ESG disclosures. Alternatively, for financial-product-level disclosures, the entity at the refined-data-aggregator level would be an asset manager, and investors would be at the data-consumer level. This highlights that data consumers, such as rating agencies, can also be data producers. The entities shown are just a few examples; many more would be included in practice. As shown on the left side of the diagram, functions at all layers need access control and data governance capabilities. Additionally, due to the fragmented nature of data across the ecosystem, a data catalogue is needed to help data consumers easily locate the data that they require.

Support organizations, as shown on the right-hand side, will also be an important part of the ecosystem. There are already projects underway to use LEIs to identify small- and medium-sized enterprises for ESG reporting

9. Other standards bodies, such as the ISSB, will also have an ongoing role in defining data-reporting specifications. Central banks and regulators will also define requirements and set guidelines for ESG-data-disclosure compliance.

Given the number of potential interactions and flows of sustainability information between different ecosystem participants, it is crucial that common, open communication standards are used. Otherwise, obtaining data from multiple sources will be a significant time and cost burden for data consumers. Common communication standards will streamline interactions between the various parties involved in the chain of ESG data processing. It is essential that the standard used is open so that it can be more easily adapted to meet the needs of a wide range of participants. Already, some progress is being made in this area. The National Consortium for the Business Reporting Standard, XBRL US, created recommendations for developing a common, machine-readable standard for communicating ESG data (

XBRL US 2023). The XBRL data standard, which is already used for financial reporting data, could be a good candidate as a common standard if it can be extended to support the reporting of ESG data as well.

Fintech firms will be well-positioned to provide solutions to problems such as the following:

Facilitating the contribution of raw ESG data from data sources, such as Scope 3 suppliers;

Aggregating, normalizing, and enriching raw source information;

Transforming refined data into destination-specific forms, such as regulatory reporting;

Managing historical data and providing filtering and querying capabilities.

By offering these as common services, Fintech companies can offload generic, redundant, and non-differentiating tasks from data consumers.

The framework described is applicable across jurisdictions and is designed to serve several purposes. First, it provides a model for identifying and describing how participants fit into the overall ecosystem, i.e., what functions they fulfil. Second, it can be used to help identify gaps in the existing ecosystem and which areas require further development, which could potentially be achieved through public or private investment. Third, it identifies functional boundaries and relationships that may be relevant to legislation and regulatory considerations. Formally defining the functions and interactions between them will make it easier to assess how changes to laws and regulations may affect various participants and the ecosystem as a whole. In an ideal world, the ESG solutions developed might all map cleanly to the framework presented, but it is rarely the case that organic growth matches the structure of predefined models. Nevertheless, this model can be useful for describing, analyzing, and tracking the development of the sustainability data infrastructure environment.

8. Case Study

This section presents a short case study to highlight the complexity of sustainability data acquisition and reporting and illustrate how the Fintech framework described could be applied in practice. It outlines the sustainability information that a commercial real estate management firm would require for regulatory and commercial disclosure purposes and assesses its availability. It then goes on to briefly explain how the Fintech framework would provide benefits in this context.

Majulah ICAV is an Irish collective asset-management vehicle that manages two property investment funds that are registered with and subject to the regulations of the Central Bank of Ireland. In aggregate, the funds raised have raised over EUR 100 million in private equity from qualified investors, and they own and operate 15 suburban office park properties that have a total space of nearly one million square feet. Majulah has proactively incorporated sustainability factors into its investment approach and operational decision-making. It has encountered a growing demand for sustainability data from its tenants and investors and recognizes that the effective use of this information will increase the value of its property assets. Furthermore, Majulah anticipates that the ability to provide sustainability data will facilitate access to preferential financing via Green Finance arrangements. It has appointed a sustainability manager for the fund portfolios and communicates the funds’ ESG strategy and progress to their tenants and investors.

Majulah’s sustainability efforts follow ISSB’s recommended framework, which focuses on governance, strategy, risk management, and metrics. Its focus areas also align with the SASB material disclosure topics for their industry, specifically energy, water, tenant management, and climate-change adaptation. Furthermore, Majulah adheres to the UN goals for sustainable development and has set a goal of a 51% reduction, over 2022 levels, in GHG emissions from their property investment portfolio by 2030. Majulah also engaged a Big 4 accounting firm to perform a gap analysis of its SFDR disclosure readiness.

The ESG disclosure requirements relevant to Majulah’s investments include:

Based on an analysis, it was determined that Majulah was missing information for a third of the twenty-one applicable SASB and SFDR quantitative disclosure metrics. Furthermore, for available data points, underlying data were only readily available for seven of them, and five of the data points were derived. Of most relevance, the lack of availability of water-management data lowered the quality of the overall disclosure.

Material topics related to a property asset often involve a combination of landlord- and tenant-managed resources. The collection of data required for disclosure, such as electricity supply information for a landlord by each tenant and for each tenant by a landlord, is very manual and time-consuming. The information is typically stored and managed using a relatively low-tech approach, i.e., through spreadsheets.

Majulah, and other firms like it, could leverage sustainability data infrastructure to substantially reduce the effort required for ESG disclosure and improve the quality of its reporting. For example, if tenants’ electricity- and water-usage information was made available directly by the raw-data producers, i.e., public utilities, through electronic data interfaces, Majulah would not need to engage with the tenants to obtain or provide this information. Fintech solution providers could further reduce Majulah’s effort by aggregating the data from different public utilities and converting them into a standard format. Fintech solution providers could also automate the generation of reporting information in both the SASB- and SFDR-compliant formats, helping to avoid potential mistakes that could arise through manual processing. Moreover, cloud-based Fintech infrastructure would eliminate the need for Majulah to manage the IT infrastructure required to perform ESG data management and disclosure functions.

So far, the lack of sustainability data infrastructure has not been a major impediment for Majulah. However, it anticipates that its asset portfolio will grow, and the scope of disclosure reporting requirements will expand. If sustainability data infrastructure is not available, the effort required for it to source additional ESG data and prepare disclosures could quickly multiply.

9. Conclusions

From their outset, both OTC derivative reporting and ESG disclosure compliance have had to support global, multi-jurisdictional requirements. In each case, reporting has evolved from voluntary efforts involving a narrow sample of participants and shifted to mandatory reporting requirements across a wide range of firms and financial products. Given the similarity of requirements, lessons learnt from the evolution of Fintech data infrastructure can benefit the development of sustainability data infrastructure.

There is an important role for policymakers, regulators, and industry bodies to play in the development of Fintech infrastructure for sustainability data. Specifically, they can help drive initiatives that address functional gaps, such as maintaining a catalogue of available ESG data. Policymakers can also help tackle challenges that are beyond the scope of individual ecosystem participants, such as defining rules and providing common mechanisms. For example, access control and data-governance capabilities will be required by many participants. Ideally, they would provide the common services for these, rather than each developing different versions on their own.

Policymakers can help drive the development of common data standards that will provide a common means of sharing information between entities. This is crucial so that the fragmented ecosystem does not become a virtual Tower of Babel, where little progress can be made due to the difficulty and overhead involved in sharing information. Defining a comprehensive ESG data standard will be a time-consuming and burdensome task, given the various types of data involved in ESG reporting. However, as highlighted by the example provided of the FIX protocol, simple standards can be put in place to start with, offering benefits and providing a base for further development. To make progress towards sustainability goals quickly, it is important to ensure that the perfect is not the enemy of the good. Policymakers are positioned to help kickstart an initiative that brings together stakeholders to define and adopt a common standard for sharing ESG data.

Moreover, policymakers should consider whether repurposing existing data utilities to support ESG data would accelerate the rate at which sustainability information can be made available on a large scale. This approach aligns with the NGFS policy recommendation to utilize “existing global initiatives and platforms”. The alternative, creating completely new facilities, will be time-consuming, and they may not be fully operational for many years. The EU has taken steps to create a new facility with its plan for the European Single Access Point (ESAP), which will consolidate ESG company information and offer access in a standardized, machine-readable format. However, ESAP is not projected to be available in its most basic form until 2027 (

Council of the EU 2023).

This research builds on Haddad and Hornuf’s theory that the availability of supporting infrastructure benefits Fintech start-ups, helping to spur innovation. By establishing a sustainability data infrastructure ecosystem, stakeholders involved in ESG disclosure compliance can help drive the change and growth required to meet near-term deadlines for achieving sustainability targets. Furthermore,

Sulkowski and Jebe (

2022) predicted, based on a regime theory analysis, that the fragmentation of ESG reporting governance across jurisdictions will continue, as individual nations will choose strategies that protect their own interests. Under these circumstances, the harmonization of reporting requirements appears to be a distant goal, and the consolidation of standards is the more practical near-term target. Accordingly, ongoing change and varying requirements will persist for sustainability data producers and consumers. The proposed framework can help address challenges brought about by fragmentation and dislocation. A federated approach that combines sustainability data utilities with Fintech solutions will provide the flexibility required to meet the needs of this environment.

Following on from this study, additional research would be beneficial in several areas. First, a detailed analysis of the architecture components required to implement the framework would help identify areas that call for further exploration both in a research context and commercially. In particular, data access control, reporting entity relationship mapping, data communication standards, and data quality benchmarking for ESG data are areas that would benefit from further research. Second, it would be useful to perform a market analysis to map existing and planned ESG data solution offerings, both commercial and government-sponsored, to the framework to determine which functions are overrepresented and which are underdeveloped. Lastly, a case study that analyzes the ESG data integration and processing challenges which are encountered during the sustainability disclosure process of a fund manager would help establish which challenges are most relevant and also form a basis for evaluating the efficacy of key architectural components.