Electronic Payment Behaviors of Consumers under Digital Transformation in Finance—A Case Study of Third-Party Payments

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Electronic Payment Behavior in the Context of Digital Transformation in Finance

2.2. Innovation Diffusion Theory

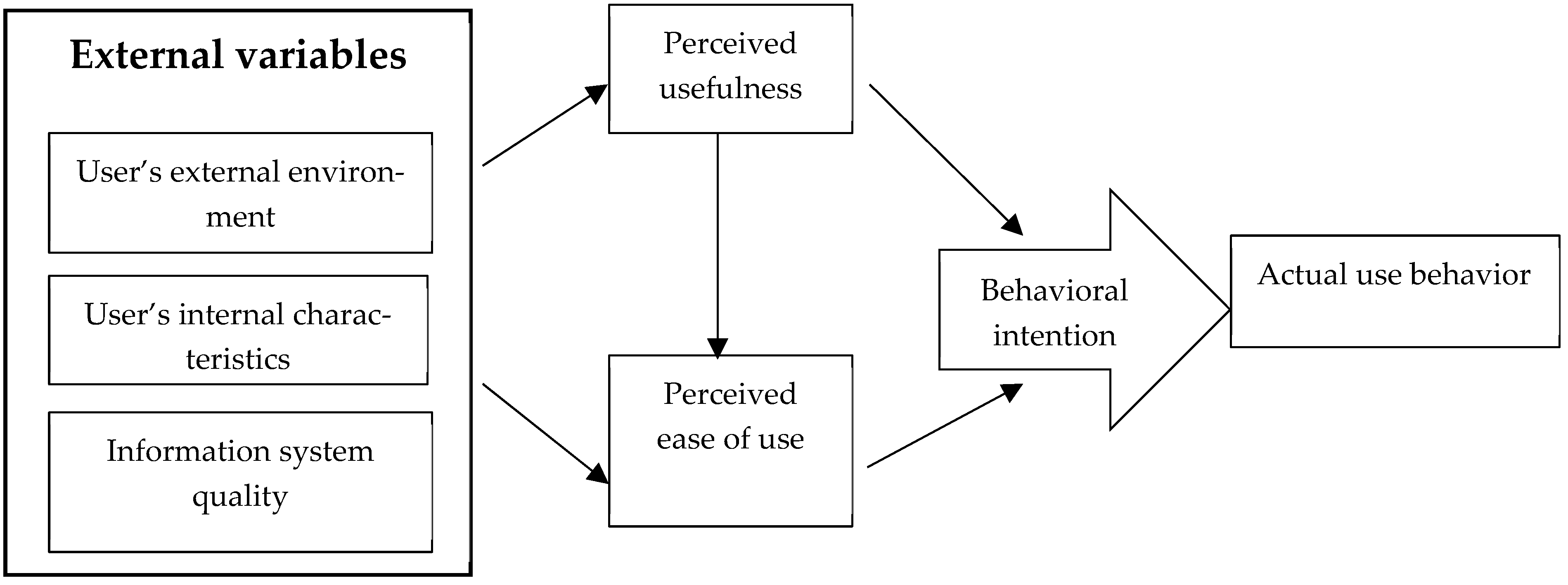

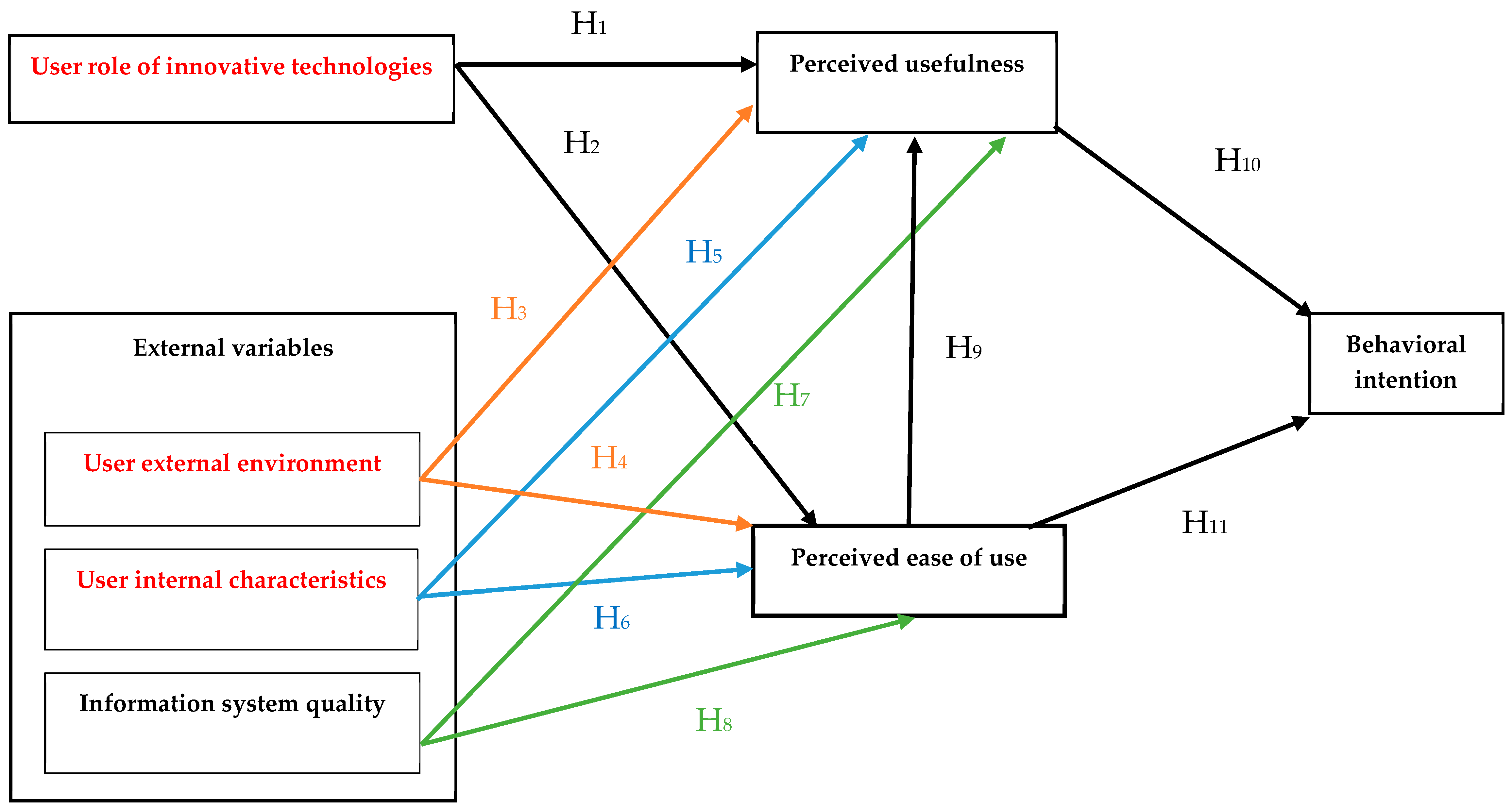

2.3. Modified Technology Acceptance Model

2.4. Relational Inference and Hypothesis Derivation of the Modified Technology Acceptance Model

3. Research Method

3.1. Research Framework

3.2. Questionnaire Design

3.2.1. Research Subjects and Data Sources

3.2.2. Definition and Measurement of Variables

- User’s role in using innovative technologies

- 2.

- External variables

- 3.

- Perceived usefulness

- 4.

- Perceived ease of use

- 5.

- Behavioral intention

3.3. Data Analysis Method

4. Research Results Analysis

4.1. Sample Description

4.2. Reliability and Validity Analysis of the Research Variables

4.2.1. Reliability Analysis

4.2.2. Validity Analysis

4.2.3. Question Groups Reliability Analysis/Validity Analysis

4.3. Correlation Matrix of Variables

4.4. Path Analysis and Results

5. Conclusions and Suggestions

5.1. Conclusions

- Users’ external environment was significantly and positively related to both perceived usefulness and perceived ease of use. When a third-party electronic payment system provides better organizational support and more convenient operating interfaces, consumers perceive usefulness and ease of use when using electronic payment and have a higher level of acceptance.

- Users’ internal characteristics were significantly and positively correlated with perceived usefulness. In other words, when users have higher self-efficacy, they become more confident in using third-party electronic payment. Furthermore, users are influenced by their learning styles, learning preferences, and tendencies. Consumers who often think about replacing an approach with a new method and are willing to try new approaches have a higher level of perceived usefulness and acceptance in using third-party electronic payment.

- User internal characteristics were significantly and positively correlated with perceived ease of use; i.e., when users are more concerned about the learning process, including how to absorb, think, and ultimately assess the result, they will have a weaker sense of distrust with third-party electronic payment and will make more transactions. Therefore, these consumers have a higher level of perceived ease of use and acceptance in using third-party electronic payment.

- Information system quality was significantly and positively correlated with perceived usefulness. In other words, when conducting financial transactions, users would have a higher level of perceived usefulness and acceptance in using third-party electronic payment if the information security is guaranteed, the quality of the financial services is good, and the transaction time is not limited by the fixed business hours of the bank.

- Information system quality was significantly and positively correlated with perceived ease of use. When conducting financial transactions, users would have a higher level of perceived ease of use, convenience, and risk-free operation in using third-party electronic payment if the information security can be controlled easily and the financial service transactions can be made quickly. In this way, users would feel more confident about transactions and further have a higher level of trust in and acceptance of the system security.

- Perceived ease of use was significantly and positively correlated with perceived usefulness of third-party electronic payment. When consumers perceive that a third-party electronic payment system is easy to learn and use, they perceive that they can complete financial transactions more quickly and conveniently in the third-party electronic payment system.

- Perceived usefulness was significantly and positively correlated with consumer behavioral intention to use electronic payments. Consumers believe that, if the industry can actively make attempts to establish more and well-functioned financial transaction mechanisms and make users perceive the usefulness of an electronic payment system, they would have a higher level of behavioral intention to accept third-party electronic payment.

- Perceived ease of use was significantly and positively correlated with consumer behavioral intention to use electronic payments. Consumers believe that, if the industry can make a continuous effort to put forth new ideas in innovation and R&D and make users perceive that an electronic payment system is easy to learn and use, they would have a higher level of behavioral intention to accept third-party electronic payment.

5.2. Management Implications

5.3. Limitations and Recommendations for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adams, Dennis A., R. Ryan Nelson, and Peter A. Todd. 1992. Perceived usefulness, ease of use, and usage of information technology: A replication. MIS Quarterly 16: 227–47. [Google Scholar] [CrossRef]

- Bagozzi, Richard P. 2007. The legacy of the technology acceptance model and a proposal for a paradigm shift. Journal of the Association for Information Systems 8: 244–54. [Google Scholar] [CrossRef]

- Bellman, Steven, Gerald L. Lohse, and Eric J. Johnson. 1999. Predictors of online buying behavior. Communications of the ACM 42: 32–38. [Google Scholar] [CrossRef]

- Chau, Patrick Y. K., and Vincent S. K. Lai. 2003. An empirical investigation of the determinants of user acceptance of internet banking. Journal of Organizational Computing and Electronic Commerce 13: 123–45. [Google Scholar] [CrossRef]

- Chen, Lei-Da, and Justin Tan. 2004. Technology adaptation in e-commerce: Key determinants of virtual stores acceptance. European Management Journal 22: 74–86. [Google Scholar] [CrossRef]

- Citrin, Alka Varma, David E. Sprott, Steven N. Silverman, and Donald E. Stem. 2000. Adoption of Internet shopping: The role of consumer innovativeness. Industrial Management and Data Systems 100: 294–300. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1992. Quantitative methods in psychology: A power primer. Psychological Bulletin 112: 155–59. [Google Scholar] [CrossRef]

- Davis, Fred D. 1986. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Ph.D. thesis, Massachusetts Institute of Technology, Cambridge, MA, USA. [Google Scholar]

- Davis, Fred D., Richard P. Bagozzi, and Paul R. Warshaw. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science 35: 982–1003. [Google Scholar] [CrossRef]

- DeLone, William H., and Ephraim R. McLean. 1992. Information systems success: The quest for the dependent variable. Information Systems Research 3: 60–95. [Google Scholar] [CrossRef]

- DeVellis, Robert F. 1991. Scale development: Theory and applications. In Applied Social Research Methods Series. Newbury Park: Sage Publications. [Google Scholar]

- Featherman, Mauricio S., and John D. Wells. 2004. The Intangibility of E-Services: Effects on Artificiality, Perceived Risk, and Adoption. Paper presented at the 37th Hawaii International Conference on System Sciences, Big Island, HI, USA, January 5–8. [Google Scholar]

- Featherman, Mauricio S., and Paul A. Pavlou. 2003. Predicting e-services adoption: A perceived risk perspective. International Journal of Human-Computer Study 59: 451–74. [Google Scholar] [CrossRef]

- Fishbein, Martin, and Icek Ajzen. 1975. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. Reading: Addison-Wesley. [Google Scholar]

- Fisher, Sandra L., and Ann W. Howell. 2004. Beyond user acceptance: An examination of employee reactions to information technology systems. Human Resource Management 43: 243–258. [Google Scholar] [CrossRef]

- Gefen, David. 2003. TAM or just plain habit: A look at experienced online shoppers. Journal of End User Computing 15: 1–13. [Google Scholar] [CrossRef]

- Hair, Joseph F., William C. Black, Barry J. Babin, and Rolph E. Anderson. 1998. Multivariate Data Analysis, 5th ed. Hoboken: Prentice-Hall. [Google Scholar]

- Heavin, Ciara, and Daniel J. Power. 2018. Challenges for digital transformation—Towards a conceptual decision support guide for managers. Journal of Decision Systems 27: 38–45. [Google Scholar] [CrossRef]

- Hu, Paul J., Patrick Y. K. Chau, Olivia R. Liu Sheng, and Kar Yan Tam. 1999. Examining the acceptance model using physician acceptance of telemedicine technology. Journal of Management Information Systems 16: 91–112. [Google Scholar] [CrossRef]

- Huang, Tseng-Lung, and Shuling Liao. 2015. A model of acceptance of augmented-reality interactive technology: The moderating role of cognitive innovativeness. Electronic Commerce Research 15: 269–95. [Google Scholar] [CrossRef]

- Jarvenpaa, Sirkka L., Noam Tractinsky, and Michael Vitale. 2000. Consumer trust in an internet store. Information Technology and Management 1: 45–71. [Google Scholar] [CrossRef]

- Larose, Daniel T. 2006. Data Mining Methods and Models. Hoboken: John Wiley & Sons. [Google Scholar]

- Lee, Younghwa, Kenneth A. Kozar, and Kai R. T. Larsen. 2003. The technology acceptance model: Past, present, and future. Communications of the Association for Information Systems 12: 752–80. [Google Scholar] [CrossRef]

- Legris, Paul, John Ingham, and Pierre Collerette. 2003. Why do people use information technology? A critical review of the technology acceptance model. Information and Management 40: 191–204. [Google Scholar] [CrossRef]

- Liao, Ziqi, and Michael Tow Cheung. 2002. Internet-based e-banking and consumer attitudes: An empirical study. Information and Management 39: 283–95. [Google Scholar] [CrossRef]

- Lim, Joon Soo, and Jun Zhang. 2022. Adoption of AI-driven personalization in digital news platforms: An integrative model of technology acceptance and perceived contingency. Technology in Society 69: 101965. [Google Scholar] [CrossRef]

- Lin, Judy Chuan-Chuan, and Hsipeng Lu. 2000. Toward an understanding of the behavioral intention to use a web site. International Journal of Information Management 20: 197–208. [Google Scholar]

- Lunney, Abbey, Nicole R. Cunningham, and Matthew S. Eastin. 2016. Wearable fitness technology: A structural investigation into acceptance and perceived fitness outcomes. Computers in Human Behavior 65: 114–20. [Google Scholar] [CrossRef]

- Mathieson, Kieran, Eileen Peacock, and Wynne W. Chin. 2001. Extending the technology acceptance model: The influence of perceived user resources. Data Base for Advances in Information Systems 32: 86–112. [Google Scholar] [CrossRef]

- McKnight, D. Harrison, Vivek Choudhury, and Charles Kacmar. 2002. The impact of initial consumer trust on intentions to transact with a web site: A trust building model. Journal of Strategic Information Systems 11: 297–323. [Google Scholar] [CrossRef]

- Moon, Ji Won, and Young Gui Kim. 2001. Extending the TAM for a world-wide-web context. Information and Management 38: 217–30. [Google Scholar] [CrossRef]

- Moore, Gary C., and Izak Benbasat. 1991. Development of an instrument to measure the perceptions of adopting an information technology innovation. Information Systems Research 2: 192–222. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1978. Psychometric Theory. New York: McGraw-Hill. [Google Scholar]

- Oh, Sangjo, Joongho Ahn, and Beomsoo Kim. 2003. Adoption of broadband internet in Korea: The role of experience in building attitudes. Journal of Information Technology 18: 267–80. [Google Scholar] [CrossRef]

- Parasuraman, Ananthanarayanan. 2000. Technology readiness index (TRI): A multiple-item scale to measure readiness to embrace new technologies. Journal of Service Research 2: 307–20. [Google Scholar] [CrossRef]

- Pavlou, Paul A. 2003. Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. International Journal of Electronic Commerce 7: 101–34. [Google Scholar]

- Rogers, Everett M. 1983. Diffusion of Innovation, 3rd ed. New York: The Free Press. [Google Scholar]

- Shih, Hung-Pin. 2004. An empirical study on predicting user acceptance of e-shopping on the web. Information and Management 41: 351–68. [Google Scholar] [CrossRef]

- Song, HakJun, Wenjia Jasmine Ruan, and Yu Jung Jennifer Jeon. 2021. An integrated approach to the purchase decision making process of food-delivery apps: Focusing on the TAM and AIDA models. International Journal of Hospitality Management 95: 102943. [Google Scholar] [CrossRef]

- Szajna, Bernadette. 1996. Empirical evaluation of the revised technology acceptance model. Management Science 42: 85–92. [Google Scholar] [CrossRef]

- Taylor, Shirley, and Peter Todd. 1995. Assessing IT usage: The role of prior experience. MIS Quarterly 19: 561–70. [Google Scholar] [CrossRef]

- Tsikriktsis, Nikos. 2004. A technology readiness-based taxonomy of customers: A replication and extension. Journal of Service Research 7: 42–52. [Google Scholar] [CrossRef]

- Turban, Efraim, R. Kelly Rainer, and Richard E. Potter. 2000. Introduction to Information Technology. New York: John Wiley & Sons. [Google Scholar]

- Venkatesh, Viswanath. 2000. Determinants of perceived ease of use: Integrating control, intrinsic motivation, and emotion into the technology acceptance model. Information System Research 11: 342–65. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, and Fred D. Davis. 1996. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science 46: 186–204. [Google Scholar] [CrossRef]

- Vijayasarathy, Leo R. 2004. Predicting consumer intentions to use on-line shopping: The case for an augmented technology acceptance model. Information and Management 41: 747–62. [Google Scholar] [CrossRef]

- Wang, Yi-Shun, Yu-Min Wang, Hsin-Hui Lin, and Tzung-I Tang. 2003. Determinants of user acceptance of Internet banking: An empirical study. International Journal of Service Industry Management 14: 501–19. [Google Scholar] [CrossRef]

- Wu, Ing-Long, and Jian-Liang Chen. 2005. An extension of trust and TAM model with TPB in the initial adoption of on-line tax: An empirical study. International Journal Human-Computer Studies 62: 784–808. [Google Scholar] [CrossRef]

- Wu, Runhan, Kamran Ishfaq, Siraj Hussain, Fahad Asmi, Ahmad Nabeel Siddiquei, and Muhammad Azfar Anwar. 2022. Investigating e-retailers’ intentions to adopt cryptocurrency considering the mediation of technostress and technology involvement. Sustainability 14: 641. [Google Scholar] [CrossRef]

| Background Variable | Category | Number of Respondents | Percentage (%) |

|---|---|---|---|

| Gender | Male | 149 | 44.9 |

| Female | 183 | 55.1 | |

| Age | 20 years old and below | 5 | 1.5 |

| 21 to 30 years old | 48 | 14.5 | |

| 31 to 40 years old | 28 | 8.4 | |

| 41 to 50 years old | 69 | 20.8 | |

| 51 to 60 years old | 156 | 47.0 | |

| 61 years old and above | 26 | 7.8 | |

| Educational level | Junior high school diploma and below | 1 | 0.3 |

| Senior (vocational) high school diploma | 37 | 11.1 | |

| Bachelor’s degree | 148 | 44.6 | |

| Master’s degree | 128 | 38.6 | |

| Doctoral degree | 18 | 5.4 | |

| Industry | Student | 35 | 10.5 |

| Steward | 8 | 2.4 | |

| Military, police, civil servant, and teacher | 28 | 8.4 | |

| Catering | 4 | 1.2 | |

| Service | 49 | 14.8 | |

| Manufacturing | 60 | 18.1 | |

| Transportation and storage | 4 | 1.2 | |

| Construction | 14 | 4.2 | |

| Business/finance/insurance | 64 | 19.3 | |

| Information/communication | 9 | 2.7 | |

| Wholesale and retail | 19 | 5.7 | |

| Other | 38 | 11.4 | |

| Average monthly income | NTD 25,000 and below | 40 | 12.0 |

| NTD 25,001–35,000 | 39 | 11.7 | |

| NTD 35,001–45,000 | 39 | 11.7 | |

| NTD 45,001–55,000 | 43 | 13.0 | |

| NTD 55,001–65,000 | 27 | 8.1 | |

| NTD 65,001 and above | 144 | 43.4 |

| Dimensions | Question Item No. | Question Content | Factor Loading | Communality | Cronbach’s α |

|---|---|---|---|---|---|

| User acceptance of innovative technologies | (1) Acceptance | ||||

| 1 | Generally, I can clearly know how to use new technical products/services without others’ help. | 0.794 | 0.701 | 0.842 | |

| 2 | Generally, I am the first one among my friends to search for new technical products/services. | 0.778 | 0.800 | ||

| 3 | I already know how to use a new technical product/service even when others do not know about it. | 0.806 | 0.803 | ||

| (2) Challenge | |||||

| 4 | I will still try to use a new technical product/service even if I do not know it. | 0.781 | 0.746 | 0.833 | |

| 5 | I enjoy the challenge brought by using a new technical product/service. | 0.767 | 0.806 | ||

| (3) Simplicity | |||||

| 6 | I do not think that a new technical product/service is designed for the general public. | 0.707 | 0.610 | 0.539 | |

| 8 | I would rather buy a basic type of new technical product/service than buy a multi-functional and intelligent one. | 0.875 | 0.841 | ||

| External variables | (1) User external environment | ||||

| 9 | I think that personal data will not be leaked when I use a third-party electronic payment system. | 0.826 | 0.725 | 0.915 | |

| 10 | I think that a third-party payment electronic system is stable and trustworthy. | 0.842 | 0.821 | ||

| 11 | I think that I can feel free to use a third-party electronic payment system. | 0.793 | 0.775 | ||

| (2) User internal characteristic | |||||

| 12 | I am willing to try new things. | 0.627 | 0.591 | 0.614 | |

| 14 | I like to think about whether there are new ways of doing things. | 0.537 | 0.498 | ||

| 15 | It is convenient to use a third-party electronic payment system. However, I am still not fond of it. | 0.814 | 0.757 | ||

| 16 | I am used to shopping in physical stores and I am unwilling to try a third-party electronic payment system. | 0.730 | 0.712 | ||

| (3) Information system quality | |||||

| 17 | I believe that a third-party electronic payment system has a robust protection mechanism so that users can feel free to make transactions. | 0.761 | 0.752 | 0.924 | |

| 18 | I believe that laws and the rules of network security systems will protect the transactions in a third-party electronic payment system. | 0.841 | 0.809 | ||

| 19 | I believe that encryption and other technologies will allow users to make transactions safely using a third-party electronic payment system. | 0.706 | 0.710 | ||

| 21 | I think that the accounts in a third-party electronic payment system are not secure. | 0.775 | 0.747 | ||

| 22 | I can query useful transaction records in a third-party electronic payment system. | 0.515 | 0.416 | ||

| 23 | I believe that a third-party electronic payment system can resist external attacks (such as hacker attacks). | 0.795 | 0.690 | ||

| 24 | Overall, I think that a third-party electronic payment system is a robust and secure transaction environment. | 0.767 | 0.753 | ||

| Perceived usefulness | 25 | I think that it is quite useful for me to use electronic payments. | 0.711 | 0.719 | 0.926 |

| 26 | I think using electronic payments can improve the efficiency of financial transactions or related transactions. | 0.775 | 0.672 | ||

| 27 | I think that by using electronic payments, I can better control my time and get rid of the restriction of fixed business hours. | 0.824 | 0.713 | ||

| 28 | I think electronic payments allow me to make financial transactions more conveniently. | 0.847 | 0.763 | ||

| 29 | I think that electronic payments can improve the service quality of online shopping. | 0.726 | 0.632 | ||

| Perceived ease of use | 30 | I think it is easy to use third-party electronic payment to make a payment for a transaction. | 0.772 | 0.727 | 0.801 |

| 31 | I think that it is effortless to use third-party electronic payment. | 0.793 | 0.737 | ||

| 32 | I think that others can also clearly and easily use third-party electronic payment after I tell them how to use it. | 0.686 | 0.586 | ||

| 33 | Third-party electronic payment cannot be used as easily as cash transactions. I will spend a lot of time to learn to use it correctly. | 0.944 | 0.928 | ||

| 34 | Overall, I think that it is easy to use third-party electronic payment. | 0.703 | 0.676 | ||

| Behavior intention | 35 | I think that it is worthy to use third-party electronic payment. | 0.756 | 0.759 | 0.953 |

| 36 | I am willing to spend more time to learn to effectively use third-party electronic payment. | 0.755 | 0.743 | ||

| 37 | I will consider using third-party electronic payment when making financial transactions. | 0.755 | 0.792 | ||

| 38 | When third-party electronic payment service providers provide favorable incentives (redeeming bonus points), I am willing to make some transactions with them. | 0.679 | 0.613 | ||

| 39 | I will recommend others to use third-party electronic payment services. | 0.713 | 0.736 | ||

| 40 | In the future, I will be willing to continue to use third-party electronic payment services. | 0.737 | 0.766 | ||

| a. User Acceptance of Innovative Technologies | b. External Variable (User External Environment) | c. External Variable (User Internal Characteristic) | d. External Variable (Information System Quality) | e. Perceived Usefulness | f. Perceived Ease of Use | g. Behavior Intention | |

|---|---|---|---|---|---|---|---|

| a. User acceptance of innovative technologies | 1 | ||||||

| b. External variable (user external environment) | 0.391 ** | 1 | |||||

| c. External variable (user internal characteristic) | 0.207 ** | 0.206 ** | 1 | ||||

| d. External variable (information system quality) | 0.451 ** | 0.793 ** | 0.300 ** | 1 | |||

| e. Perceived usefulness | 0.370 ** | 0.452 ** | 0.424 ** | 0.584 ** | 1 | ||

| f. Perceived ease of use | 0.407 ** | 0.463 ** | 0.393 ** | 0.600 ** | 0.738 ** | 1 | |

| g. Behavior intention | 0.380 ** | 0.564 ** | 0.462 ** | 0.649 ** | 0.796 ** | 0.726 ** | 1 |

| Independent Variable | Dependent Variable | Estimated Path Coefficient β | F Value | T Value | Adjusted R² | p Value |

|---|---|---|---|---|---|---|

| User acceptance of innovative technologies | H1: perceived usefulness | 0.370 *** | 52.333 | 7.234 | 0.134 | <0.001 |

| H2: perceived ease of use | 0.407 *** | 65.661 | 8.103 | 0.163 | <0.001 | |

| External variable (user external environment) | H3: perceived usefulness | 0.452 *** | 84.625 | 9.199 | 0.202 | <0.001 |

| H4: perceived ease of use | 0.463 *** | 90.166 | 9.496 | 0.212 | <0.001 | |

| External variable (user internal characteristic) | H5: perceived usefulness | 0.424 *** | 72.508 | 8.515 | 0.178 | <0.001 |

| H6: perceived ease of use | 0.393 *** | 60.330 | 7.767 | 0.152 | <0.001 | |

| External variable (information system quality) | H7: perceived usefulness | 0.584 *** | 171.097 | 13.080 | 0.339 | <0.001 |

| H8: perceived ease of use | 0.600 *** | 185.337 | 13.614 | 0.358 | <0.001 | |

| Perceived ease of use | H9: perceived usefulness | 0.738 *** | 393.738 | 19.843 | 0.543 | <0.001 |

| Perceived usefulness | H10: behavior intention | 0.796 *** | 570.818 | 23.892 | 0.633 | <0.001 |

| Perceived ease of use | H11: behavior intention | 0.726 *** | 468.493 | 19.196 | 0.526 | <0.001 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, L.-H.; Lin, F.-C.; Lien, C.-K.; Yang, T.-C.; Chuang, Y.-K.; Hsu, Y.-W. Electronic Payment Behaviors of Consumers under Digital Transformation in Finance—A Case Study of Third-Party Payments. J. Risk Financial Manag. 2023, 16, 346. https://doi.org/10.3390/jrfm16080346

Lin L-H, Lin F-C, Lien C-K, Yang T-C, Chuang Y-K, Hsu Y-W. Electronic Payment Behaviors of Consumers under Digital Transformation in Finance—A Case Study of Third-Party Payments. Journal of Risk and Financial Management. 2023; 16(8):346. https://doi.org/10.3390/jrfm16080346

Chicago/Turabian StyleLin, Lan-Hui, Feng-Chen Lin, Chih-Kang Lien, Tung-Chin Yang, Yao-Kai Chuang, and Yi-Wen Hsu. 2023. "Electronic Payment Behaviors of Consumers under Digital Transformation in Finance—A Case Study of Third-Party Payments" Journal of Risk and Financial Management 16, no. 8: 346. https://doi.org/10.3390/jrfm16080346

APA StyleLin, L.-H., Lin, F.-C., Lien, C.-K., Yang, T.-C., Chuang, Y.-K., & Hsu, Y.-W. (2023). Electronic Payment Behaviors of Consumers under Digital Transformation in Finance—A Case Study of Third-Party Payments. Journal of Risk and Financial Management, 16(8), 346. https://doi.org/10.3390/jrfm16080346