The Association between Audit Quality and Corporate Tax Avoidance. A Bibliometric Review of Literature and Early Evidence on the European Union, from the Perspective of Tax-Related Key Audit Matters Disclosure

Abstract

1. Introduction

2. Theoretical Background

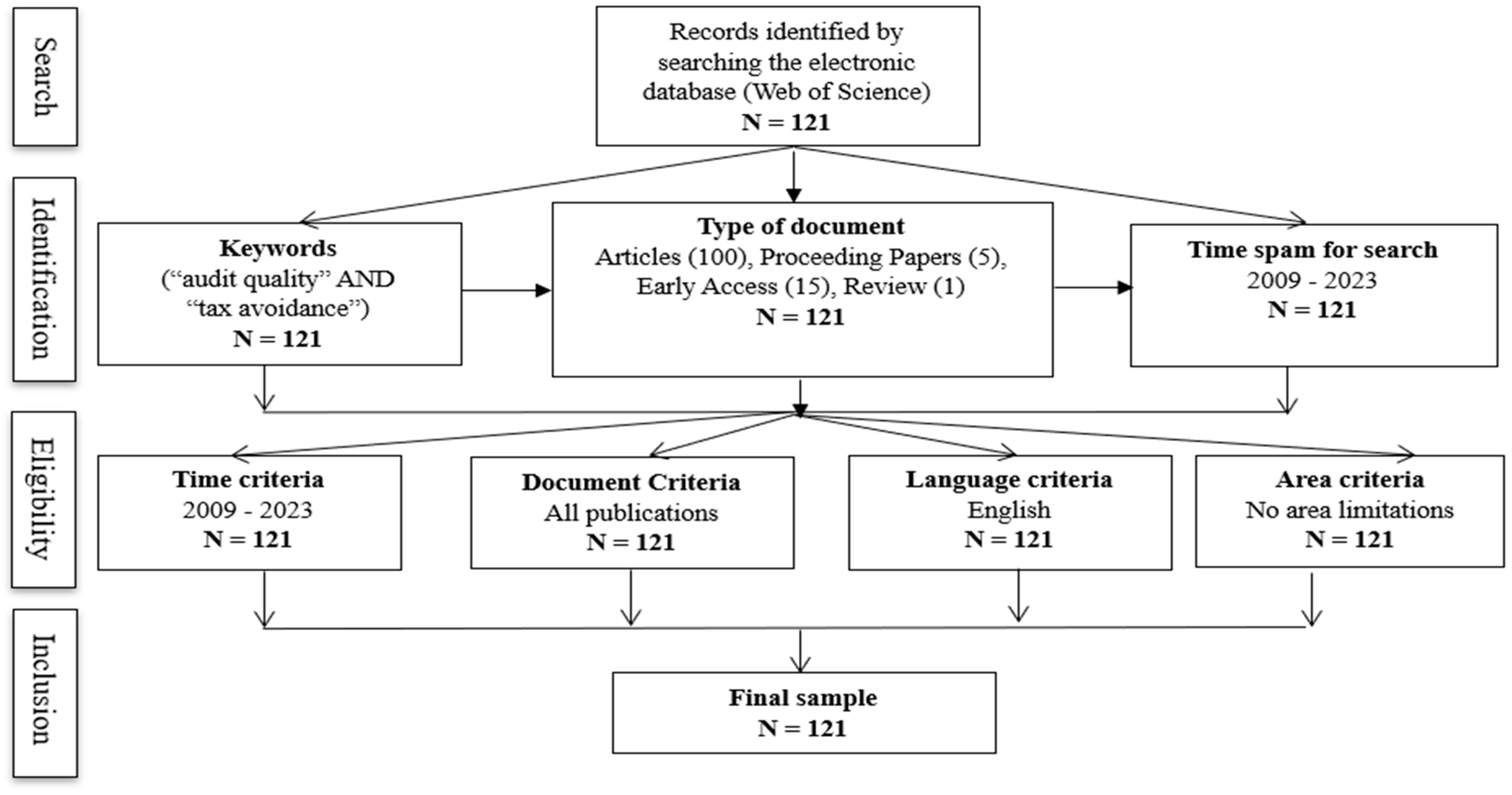

3. Research Methodology

4. Results and Discussions

4.1. Bibliometric Analysis

4.1.1. Keyword Analysis

- Avoidance—with 30 appearances;

- Earnings management—with 30 appearances;

- Quality—with 27 appearances;

- Aggressiveness—with 19 appearances;

- Independence—with 14 appearances;

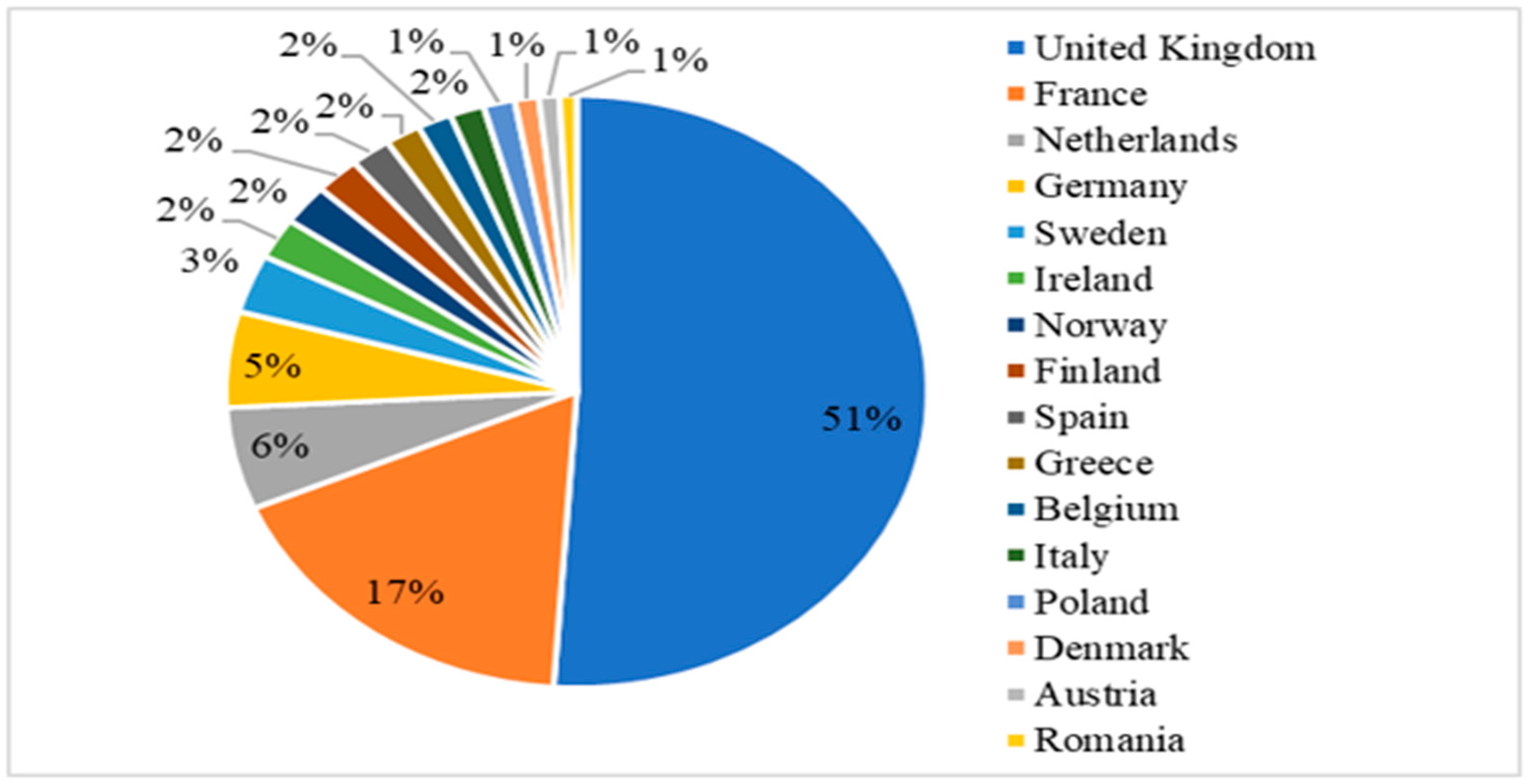

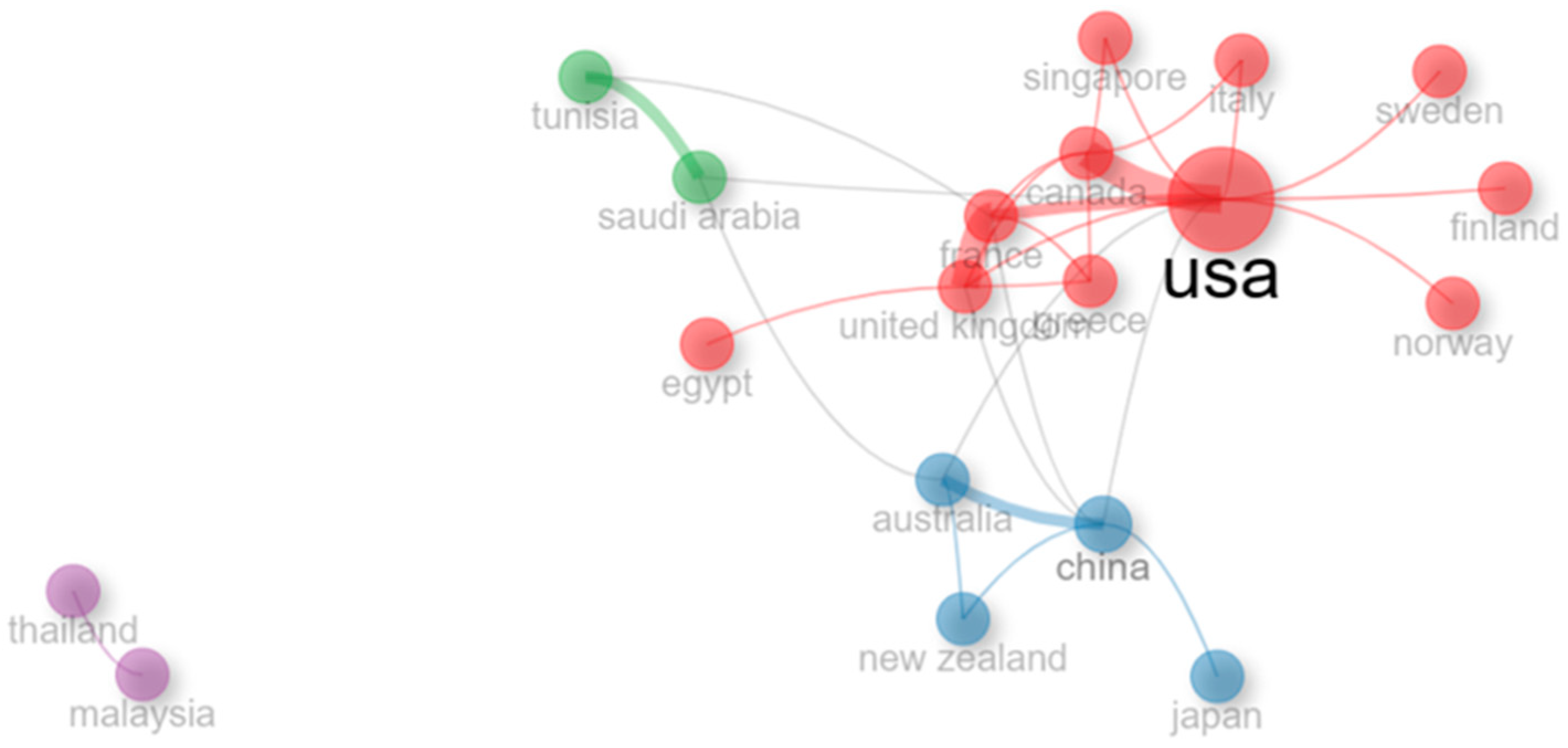

4.1.2. Analysis of Authors, Affiliations, and Countries

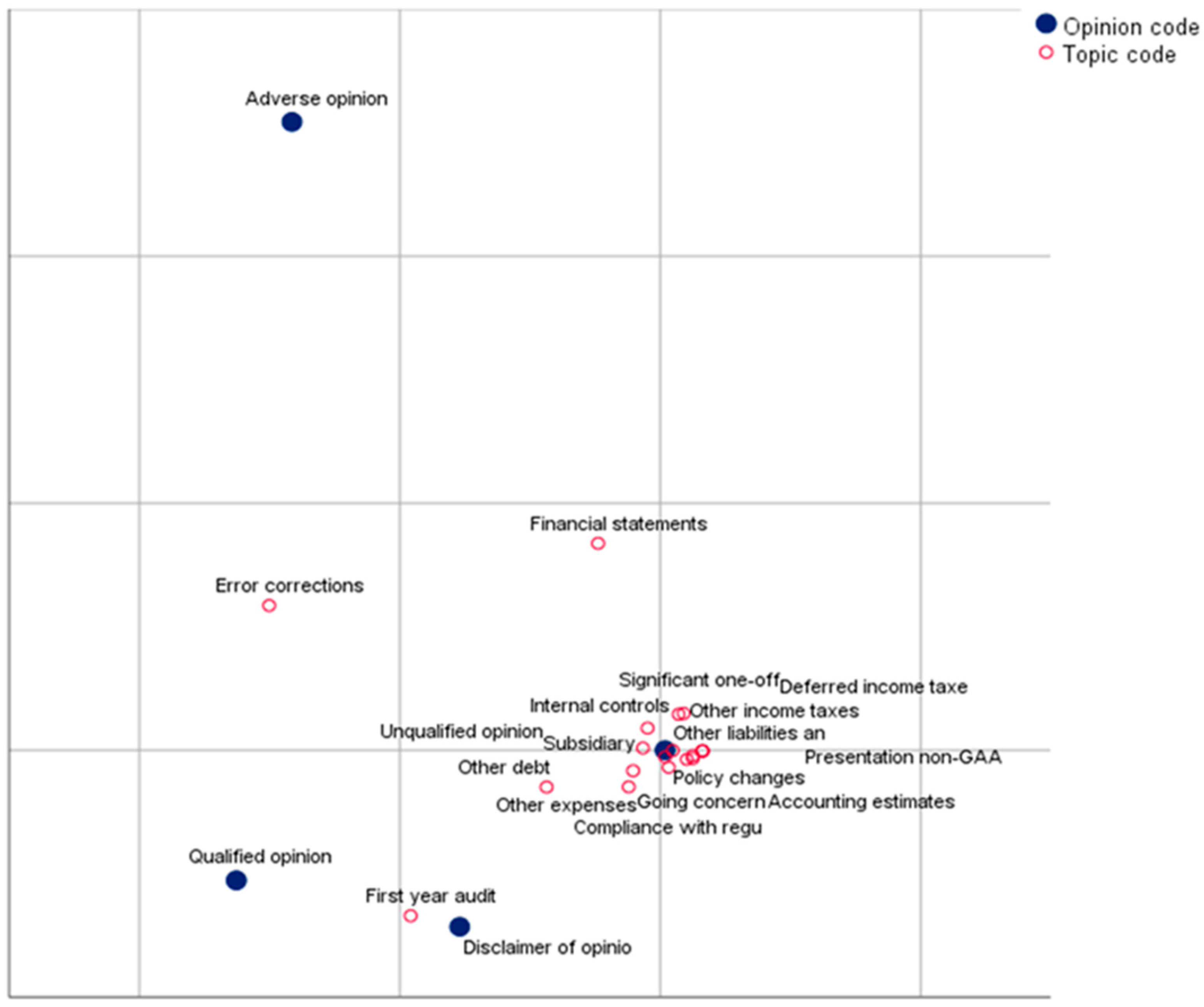

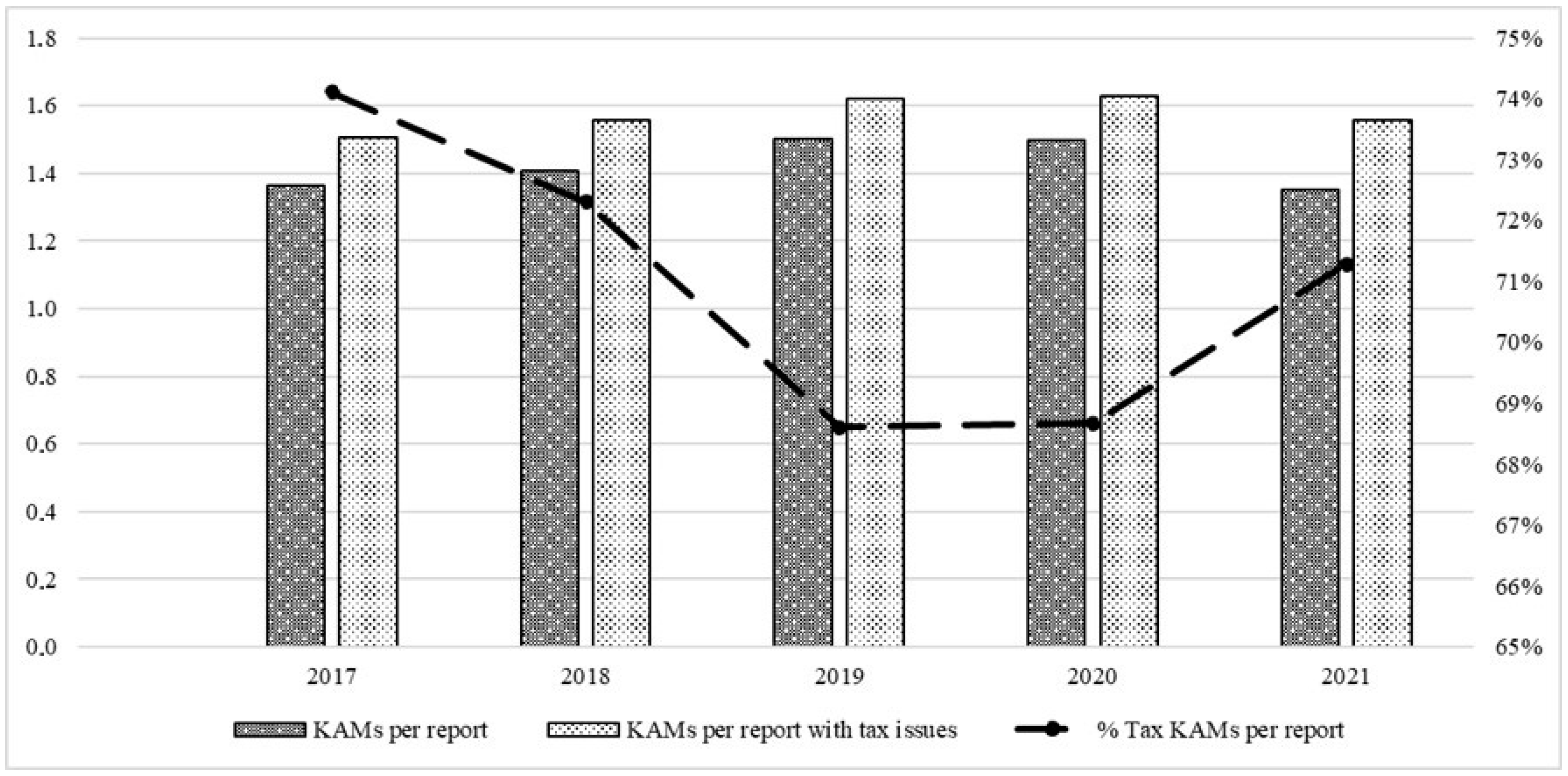

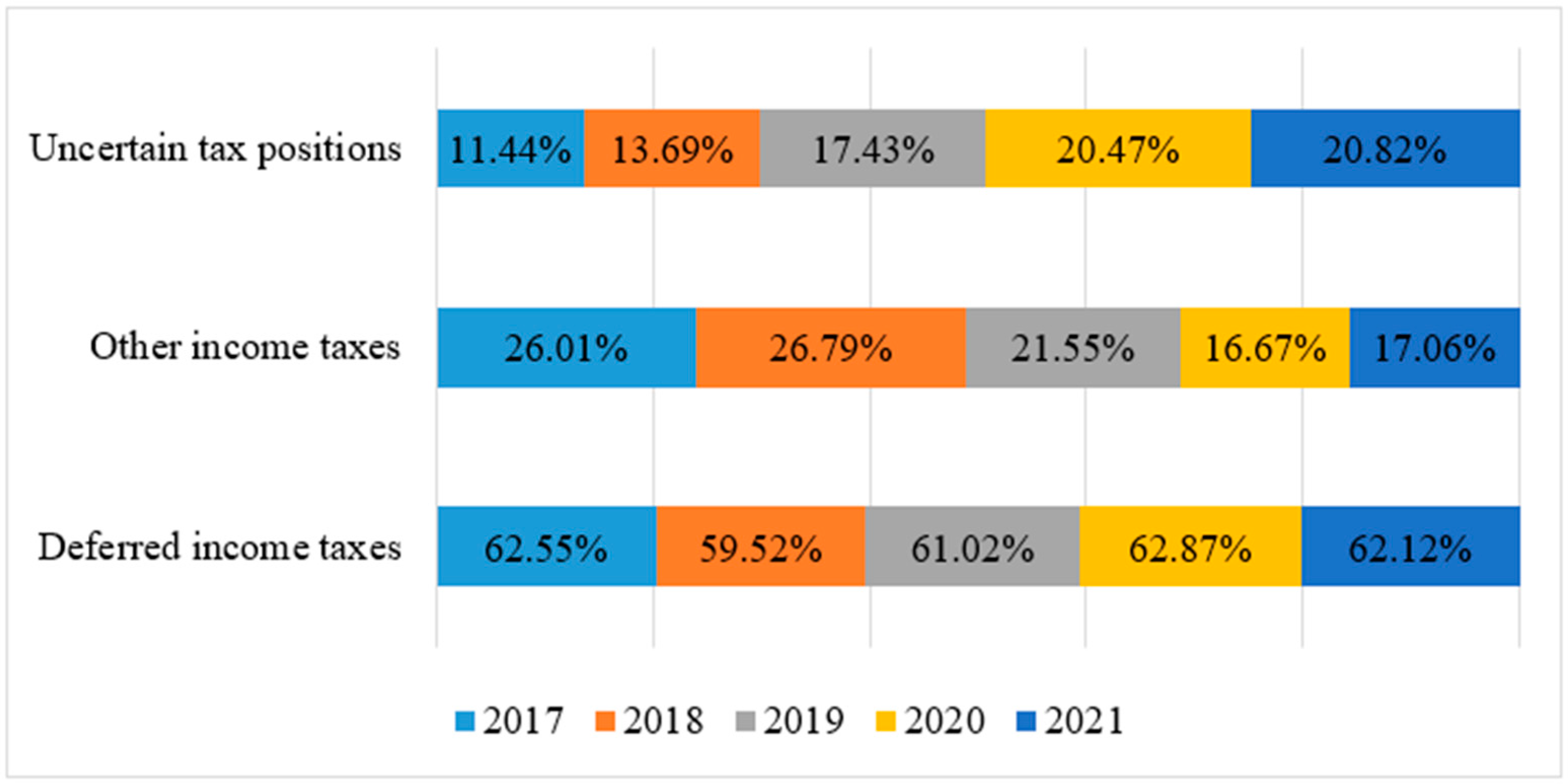

4.2. View on the Most Frequent Issues Disclosed by KAMs

- did not have any experience related to similar tax treatments;

- did not obtain any legal advice or case law related to other entities;

- did not receive any guidance from tax authorities on the specific case;

- obtained already a pre-clearance from the tax authorities on an uncertain tax treatment (EY 2021).

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abernathy, John L., Andrew R. Finley, Eric T. Rapley, and James Stekelberg. 2021. External auditor responses to tax risk. Journal of Accounting, Auditing & Finance 36: 489–516. [Google Scholar]

- Alareeni, Bahaaeddin Ahmed. 2019. The associations between audit firm attributes and audit quality-specific indicators: A meta-analysis. Managerial Auditing Journal 34: 6–43. [Google Scholar] [CrossRef]

- Beyer, Anne, Daniel A. Cohen, Thomas Z. Lys, and Beverly R. Walther. 2010. The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics 50: 296–343. [Google Scholar] [CrossRef]

- Birkle, Caroline, David A. Pendlebury, Joshua Schnell, and Jonathan Adams. 2020. Web of Science as a data source for research on scientific and scholarly activity. Quantitative Science Studies 1: 363–76. [Google Scholar] [CrossRef]

- Blaufus, Kay, Jakob Reineke, and Ilko Trenn. 2023. Perceived tax audit aggressiveness, tax control frameworks and tax planning: An empirical analysis. Journal of Business Economics 93: 509–57. [Google Scholar] [CrossRef]

- Camacho-Miñano, Maria del Mar, Muñoz Izquierdo Nora, Morton Pincus, and Patricia Wellmeyer. 2023. Are Key Audit Matter Disclosures Useful in Assessing the Financial Distress Level of a Client Firm? Available online: https://ssrn.com/abstract=3744282 (accessed on 5 May 2023).

- Christensen, Hans B., Luzi Hail, and Christian Leuz. 2021. Mandatory CSR and sustainability reporting: Economic analysis and literature review. Review of Accounting Studies 26: 1176–248. [Google Scholar] [CrossRef]

- Chyz, James A., Ronen Gal-Or, and Vic Naiker. 2023. Separating Auditor-Provided Tax Planning and Tax Compliance Services: Audit Quality Implications. Auditing: A Journal of Practice and Theory 42: 101–31. [Google Scholar] [CrossRef]

- Coram, Paul J., and Leiyu Wang. 2021. The effect of disclosing key audit matters and accounting standard precision on the audit expectation gap. International Journal of Auditing 25: 270–82. [Google Scholar] [CrossRef]

- Dee, Carol Callaway, Bing Luo, and Jing Zhang. 2021. Internal control quality: The role of critical audit matters reporting. SSRN, 3882399. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3882399 (accessed on 1 June 2023).

- Deepal, Aluthgama Guruge, and Ariyarathna Jayamaha. 2022. Audit expectation gap: A comprehensive literature review. Asian Journal of Accounting Research 7: 308–19. [Google Scholar] [CrossRef]

- Dechow, Patricia, Weili Ge, and Catherine Schrand. 2010. Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50: 344–401. [Google Scholar] [CrossRef]

- Detzen, Dominic, and Anna Gold. 2021. The different shades of audit quality: A review of the academic literature. Maandblad voor Accountancy en Bedrijfseconomie 95: 5–15. [Google Scholar] [CrossRef]

- dos Santos, Luis Paulo Guimaraes, Paula Araújo Soares, Sheizi Calheira de Freitas, and José Maria Dias. 2021. The influence of tax services provided by auditors on tax avoidance: Evidence from Brazil. Revista de Contabilidade e Organizações 15: 1–14. [Google Scholar]

- Drake, Katherine D., Nathan C. Goldman, Stephen J. Lusch, and Jaime J. Schmidt. 2021a. Do Firms Reduce Earnings Management after a Critical Audit Matter Disclosure? Evidence from Tax Accounts. Working Paper, University of Arizona, North Carolina State University, Texas Christian University, and University of Texas at Austin. American Accounting Association. Available online: https://aaahq.org/portals/0/documents/meetings/2021/ata/4.02%20do%20firms%20reduce%20_drake,%20goldman,%20lusch,%20schmidt.pdf (accessed on 1 June 2023).

- Drake, Katherine D., Nathan C. Goldman, Stephen J. Lusch, and Jaime J. Schmidt. 2021b. Is the Disclosure of Tax-Related Critical Audit Matters Associated with Tax-Related Audit and Financial Reporting Quality, Tax Avoidance, or Tax-Related Earnings Management? SSRN, 3606701. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3606701 (accessed on 1 June 2023).

- Ernst & Young. 2021. IFRS Accounting Considerations of the Coronavirus Pandemic. Available online: https://www.ey.com/en_gl/ifrs-technical-resources/accounting-considerations-of-the-coronavirus-pandemic-updated-april-2021 (accessed on 1 June 2023).

- Francis, Jere R. 2023. Going big, going small: A perspective on strategies for researching audit quality. The British Accounting Review 55: 101167. [Google Scholar] [CrossRef]

- Gaaya, Safa, Nadia Lakhal, and Faten Lakhal. 2017. Does family ownership reduce corporate tax avoidance? Managerial Auditing Journal 32: 731–44. [Google Scholar] [CrossRef]

- Gimbar, Christine, Bowe Hansen, and Michael E. Ozlanski. 2016. Early evidence on the effects of critical audit matters on auditor liability. Current Issues in Auditing 10: 24–33. [Google Scholar] [CrossRef]

- Görlitz, Anna, and Michael Dobler. 2021. Financial accounting for deferred taxes: A systematic review of empirical evidence. Management Review Quarterly 73: 113–65. [Google Scholar] [CrossRef]

- Gul, Ferdinand, Mehdi Khedmati, and Syed M. M. Shams. 2020. Managerial acquisitiveness and corporate tax avoidance. Pacific-Basin Finance Journal 64: 25–46. [Google Scholar] [CrossRef]

- Hoang, Hien, Robyn Moroney, Soon-Yeow Phang, and Xinning Xiao. 2022. Investor reactions to key audit matters: Financial and non-financial contexts. Accounting & Finance 1: 1–21. [Google Scholar]

- IASB. 2021. Applying IFRS Standards in 2020—Impact of COVID-19. Paper presented at the VI Internacional Symposium on Accounting and Finance ISAF, Bursa, Turkey, April 23–25.

- IFAC. 2020. Highlighting Areas of Focus in an Evolving Audit Environment Due to the Impact of COVID-19. New York: IFAC. [Google Scholar]

- Kanagaretnam, Kiridaran, Jimmy Lee, Chee Yeow Lim, and Gerald J. Lobo. 2016. Relation between auditor quality and tax aggressiveness: Implications of cross-country institutional differences. Auditing: A Journal of Practice & Theory 35: 105–35. [Google Scholar]

- Klueber, Johanna, Gold Anna, and Pott Christiane. 2018. Do Key Audit Matters Impact Financial Reporting Behavior? Available online: https://ssrn.com/abstract=3210475 (accessed on 27 April 2023).

- Knechel Warren Robert, Gopal V. Krishnan, Mikhail Pevzner, Lori B. Shefchik, and Uma K. Velury. 2012. Audit quality: Insights from the academic literature. Auditing: A Journal of Practice & Theory 32: 385–421. [Google Scholar]

- Leuz, Christian, and Peter D. Wysocki. 2016. The Economics of Disclosure and Financial Reporting Regulation: Evidence and Suggestions for Future Research. Journal of Accounting Research 54: 525–622. [Google Scholar] [CrossRef]

- Lynch, Dan, Aaron Mandell, and Linette M. Rousseau. 2021. The Importance of Topical Content in Understanding Expanded Audit Reporting: Evidence from Tax-Related Key Audit Matters. Available online: https://aaahq.org/portals/0/documents/meetings/2021/ata/2.01b%20the%20important%20of%20topical.pdf (accessed on 27 April 2023).

- Ma, Jin, Paul Coram, and Indrit Troshani. 2020. The Effect of Key Audit Matters and Uncertainty Disclosures on Auditors’ Accountability Perceptions and Fair Value Decisions. Available online: https://ssrn.com/abstract=3718508 (accessed on 27 April 2023).

- Maydew, Edward L., and Douglas A. Shackelford. 2005. The Changing Role of Auditors in Corporate Tax Planning. Available online: https://www.nber.org/system/files/working_papers/w11504/w11504.pdf (accessed on 3 May 2023).

- Nguyen, Lan Anh, and Michael Kend. 2021. The perceived impact of the KAM reforms on audit reports, audit quality and auditor work practices: Stakeholders’ perspectives. Managerial Auditing Journal 36: 437–62. [Google Scholar] [CrossRef]

- Parker, Lee D., and Indrit Troshani. 2022. Pursuing big issues in COVID-world accounting research. Accounting and Management Review = Revista de Contabilidade e Gestão 26: 13–48. [Google Scholar] [CrossRef]

- Pinto, Ines, and Ana Isabel Morais. 2019. What matters in disclosures of key audit matters: Evidence from Europe. Journal of International Financial Management & Accounting 30: 145–62. [Google Scholar]

- Ratzinger-Sakel, Nicole V., and Jochen Theis. 2019. Does considering key audit matters affect auditor judgment performance? Corporate Ownership & Control 17: 196–210. [Google Scholar]

- Rautiainen, Antti, Jani Saastamoinen, and Kati Pajunen. 2021. Do key audit matters (KAMs) matter? Auditors’ perceptions of KAMs and audit quality in Finland. Managerial Auditing Journal 36: 386–404. [Google Scholar] [CrossRef]

- Saragih, Arfah Habib, and Syaiful Ali. 2021. Corporate tax risk: A literature review and future research directions. Management Review Quarterly 73: 527–77. [Google Scholar] [CrossRef]

- Sulcaj, Valbona. 2020. Litigation Risk, Financial Reporting Quality, and Critical Audit Matters in the Audit Report: Early US Evidence. Financial Reporting Quality, and Critical Audit Matters in the Audit Report: Early US Evidence (October 2020). Available online: https://ssrn.com/abstract=3771081 (accessed on 26 May 2023).

- Szekely, Nadine, and Jan vom Brocke. 2017. What can we learn from corporate sustainability reporting? Deriving propositions for research and practice from over 9,500 corporate sustainability reports published between 1999 and 2015 using topic modelling technique. PLoS ONE 12: e0174807. [Google Scholar] [CrossRef]

- Wang, Fangjun, Shuolei Xu, Junqin Sun, and Charles P. Cullinan. 2020. Corporate tax avoidance: A literature review and research agenda. Journal of Economic Surveys 34: 793–811. [Google Scholar] [CrossRef]

- Willekens, Marleen, Simon Dekeyser, Liesbeth Bruynseels, and Wieteke Numan. 2023. Auditor market power and audit quality revisited: Effects of market concentration, market share distance, and leadership. Journal of Accounting, Auditing & Finance 38: 161–81. [Google Scholar]

- Zeng, Yamin, Joseph H. Zhang, Junsheng Zhang, and Mengyu Zhang. 2021. Key audit matters reports in China: Their descriptions and implications of audit quality. Accounting Horizons 35: 167–92. [Google Scholar] [CrossRef]

| Ranking | Affiliation | Number of Articles |

|---|---|---|

| 1 | Université de Sfax | 9 |

| 2 | North Carolina State University | 5 |

| 3 | University of Arizona | 4 |

| 4 | Université de Sousse | 4 |

| 5 | University of Waterloo | 4 |

| Ranking | Country | Number of Articles | Average Article Citations |

|---|---|---|---|

| 1 | USA | 11 | 23.2 |

| 2 | Canada | 7 | 27.6 |

| 3 | UK | 7 | 24 |

| 4 | Tunisia | 6 | 4.6 |

| 5 | China | 4 | 3.2 |

| KAM Topic | % Per Period before COVID-19 | % Per Period before COVID-19 |

|---|---|---|

| Deferred income taxes | 46.31 | 46.27 |

| Other income taxes | 18.99 | 12.47 |

| Uncertain tax positions | 10.56 | 15.27 |

| Other liabilities and provisions | 4.37 | 1.52 |

| Going concern | 2.65 | 7.81 |

| Subsidiary/affiliate | 5.05 | 7.81 |

| Presentation—Exceptional items and non-GAAP measures | 3.17 | 3.38 |

| Information technology | 3.12 | 3.38 |

| Internal controls | 1.51 | 0.93 |

| Policy changes | 4.27 | 1.17 |

| Country | Total KAMs Disclosed | Number of Firms | KAMs Per Audit Report | Total Tax-Related KAMs Per Audit Report | % Tax-Related KAMs Per Audit Report |

|---|---|---|---|---|---|

| UK | 1.740 | 996 | 1.747 | 1.033 | 59.37 |

| France | 1.040 | 367 | 2.834 | 763 | 73.37 |

| Germany | 353 | 291 | 1.213 | 295 | 83.57 |

| Netherlands | 382 | 242 | 1.579 | 243 | 63.61 |

| Sweden | 193 | 156 | 1.237 | 161 | 83.42 |

| Spain | 148 | 106 | 1.396 | 116 | 78.38 |

| Belgium | 118 | 100 | 1.180 | 107 | 90.68 |

| Denmark | 94 | 92 | 1.022 | 92 | 97.87 |

| Ireland | 149 | 80 | 1.863 | 81 | 54.36 |

| Finland | 86 | 75 | 1.147 | 75 | 87.21 |

| Before COVID-19 Pandemic | During COVID-19 Pandemic | |||||

|---|---|---|---|---|---|---|

| KAM Category | Deferred Income Taxes | Other Income Taxes | Uncertain Tax Positions | Deferred Income Taxes | Other Income Taxes | Uncertain Tax Positions |

| Valuation | 51.49% | 42.11% | 41.19% | 50.54% | 45.24% | 44.89% |

| Recognition | 25.47% | 38.82% | 38.00% | 25.50% | 39.05% | 38.32% |

| Recoverability | 21.49% | 0.69% | 0.42% | 23.49% | 1.90% | 0.00% |

| Provisions | 0.88% | 11.52% | 16.77% | 0.00% | 7.14% | 13.14% |

| Transfer pricing | 0.00% | 1.65% | 3.18% | 0.00% | 2.86% | 2.55% |

| Adjustments | 0.00% | 2.88% | 0.00% | 0.00% | 1.90% | 0.73% |

| Disclosures | 0.41% | 1.37% | 0.00% | 0.31% | 0.95% | 0.36% |

| Complexity | 0.27% | 0.96% | 0.42% | 0.15% | 0.95% | 0.00% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lungu, C.; Burcă, V.; Bunget, O.-C.; Dumitrescu, A.-C. The Association between Audit Quality and Corporate Tax Avoidance. A Bibliometric Review of Literature and Early Evidence on the European Union, from the Perspective of Tax-Related Key Audit Matters Disclosure. J. Risk Financial Manag. 2023, 16, 345. https://doi.org/10.3390/jrfm16080345

Lungu C, Burcă V, Bunget O-C, Dumitrescu A-C. The Association between Audit Quality and Corporate Tax Avoidance. A Bibliometric Review of Literature and Early Evidence on the European Union, from the Perspective of Tax-Related Key Audit Matters Disclosure. Journal of Risk and Financial Management. 2023; 16(8):345. https://doi.org/10.3390/jrfm16080345

Chicago/Turabian StyleLungu, Cristian, Valentin Burcă, Ovidiu-Constantin Bunget, and Alin-Constantin Dumitrescu. 2023. "The Association between Audit Quality and Corporate Tax Avoidance. A Bibliometric Review of Literature and Early Evidence on the European Union, from the Perspective of Tax-Related Key Audit Matters Disclosure" Journal of Risk and Financial Management 16, no. 8: 345. https://doi.org/10.3390/jrfm16080345

APA StyleLungu, C., Burcă, V., Bunget, O.-C., & Dumitrescu, A.-C. (2023). The Association between Audit Quality and Corporate Tax Avoidance. A Bibliometric Review of Literature and Early Evidence on the European Union, from the Perspective of Tax-Related Key Audit Matters Disclosure. Journal of Risk and Financial Management, 16(8), 345. https://doi.org/10.3390/jrfm16080345