1. Introduction

1.1. Background of the Study

Risks are virtually present in every circumstance. They are defined as an element of a situation in which they carry uncertainties or unfavorable consequences (

Ennouri 2013). Risks do not only emanate from one’s choices, but also from one’s environment even with the absence of direct relationships (

MacCrimmon et al. 1988). In other words, risks may be external or internal, and the existence of these types depend on a situation (

Noor and Abdalla 2014). Contextualizing it in the business landscape, there are various risks that organizations face, and one of them is financial risk.

Woods and Dowd (

2008) relate financial risk to the financial operations of a business which essentially boils down to the possibilities of experiencing financial gains or losses.

Wani and Dar (

2015) also stipulate that the aforementioned risk is also concerned with the likelihood of an organization collapsing due to the failure of payment commitment associated with loan acceptance. Furthermore, inflation is one of the considerations in financial risks as it influences borrowing costs (

Valverde and Fernández 2022).

Noor and Abdalla (

2014) also place emphasis on this, reporting that financial risks have a role in a firm’s performance.

It then becomes imperative for business owners to manage risks as it increases and reduces the likelihood of success and failure, respectively (

Susanto and Meiryani 2018). However, approaches in managing risks anchors on one’s risk appetite (

Brockman et al. 2006).

Wang et al. (

2015) define risk appetite as a situational-specific variable where it refers to one’s current disposition towards taking or avoiding risks depending on the abundance of information. Relating this to one’s disposition towards loans, it is influenced by a multitude of factors, such as collateral requirements, interest rates, and the availability of different loan systems (

Pozzolo 2002). Such risk dispositions also vary across countries. In a study conducted by

Vieider et al. (

2012), risk attitudes were examined in 30 different countries and results provided that risk tolerance is found to be higher and lower in developed and developing countries, respectively. This was confirmed by

Hung et al. (

2012) that general risk propensities of business professionals from U.S. (developed) and China (developing) were different, citing cultural differences particularly when referring to avoidance from uncertainties. Lastly, in another perspective, the individual’s capacity to take risk is influenced by demographic factors. The financial risk appetite is not constant and is subject to change. Therefore, financial risk tolerance will change as the demographic factors do (

Thanki and Baser 2019).

Focusing the lens on Micro, Small, and Medium Enterprises (MSMEs), formal global discussions about the same only started to coalesce in 2015 when the Philippines presented it to the World Trade Organization (WTO) as a call to start discourse with regards to its involvement in global trade, as well as to put it in the global spotlight. Furthermore, the term SME sans the ‘Micro’ component was previously and commonly used. However, with recent developments towards this field, it became the norm to pursue discussions using the term MSME instead of SME. These terms are often interchangeable and simply refer to the exclusion of large enterprises (

Micro 2017).

Interestingly, while differences in risk behavior were found in terms of country development, differences were also found in the risk appetite of MSMEs and large enterprises.

Carland et al. (

1995) reported that MSMEs are more likely to be risk averse than larger ones. This was echoed by

Danso et al. (

2016), wherein they stated that MSMEs in developing countries have lower risk appetites due to less developed markets and lower access to resources. As such, they had to rely on political, business, and community ties to positively moderate their risk propensities; ultimately, this goes back to the challenges due to financial risks. Since finance barriers have been identified to be the most deterring factor towards MSME growth (

The MSME Sector at a Glance 2012), most of the existing works have only delved into the factors that affect how MSMEs can access finance, but did not link it to the growth and development of MSMEs (

Chowdhury and Alam 2017). Studies around it are limited and, if there are any, the works have only provided qualitative studies on how growth-driven factors influence growth decisions (

Angeles 2022).

Despite the Philippines being dominated by the MSME sector,

Hampel-Milagrosa (

2014) provided that they are still yet to exceed their larger counterparts in terms of economic contribution as MSMEs have only provided around 25% of the country’s total gross value added (GVA). In the same vein, empirical evidence has provided that only a minuscule amount of MSMEs were able to upgrade to a better level of profitability (

Berner et al. 2008, as cited in

Hampel-Milagrosa 2014). The multitude of challenges surrounding financial risks would then mean that these affect MSME growth decision, since perceptions towards such challenges and/or opportunities influence the owner’s degree of motivation (

Angeles 2022).

Considering most of the literature focused solely on access to finance and how it affects financial performance, the proponents intend to contribute in this study by shifting the perspective to the determination of the relationship of financial risk considerations, specifically inflation and access to finance, and growth decision in the context of MSMEs, and then analyzing whether loan-related risk appetite may mediate such a relationship instead of relating it to financial performance.

1.2. Statement of the Problem

Extant literature has frequently delved into factors that affect access to finance, given that it is a recurring problem for MSMEs. However, further studies that relate finance risks to growth decision are lacking.

Asah et al. (

2015) provided that motivations and perceptions of MSME owners towards loan taking may be explored, aside from determining the linkage of access to finance and firm performance.

Chowdhury and Alam (

2017) cited that studies in determining the link of access to finance to MSME growth should be made. While there are some works that have explored this direction, it is scant at best.

Sibanda et al. (

2018) reported in their study and laid out an interesting point that there is a weak positive relationship between access to finance and firm performance that can be attributed to various factors. Hence, they pointed out that future studies may also contemplate other effects. Lastly,

Levie and Autio (

2013) concluded that there is suggestive evidence that intentions to grow have complex interactions with other variables, and they provided an example that one may pursue strategies that are riskier or innovative because of the intention to grow.

Considering these, most of available works have only revolved around factors that affect access to finance, and only few studies have taken this further to determine its relation to performance, more so in the context of MSME growth decision. It is through this cycle, found in both global and local studies, that the researchers have identified a gap, that is, existing literature has barely explained the link of financial risk considerations, particularly inflation and access to finance, to growth decision, especially in the context of MSMEs. From this point, the researchers argue that what should be assessed and isolated first is whether such financial risk considerations give rise to MSME growth decision, since such motivation fundamentally talks about what forces make people act and why they do the things that they do (

Eccles et al. 1998) and whether loan-related risk appetite mediates this relationship. Thus, the researchers aim to explore this within the Philippine context by reflecting the gaps that previous works have pointed out. Consequently, the following research questions are raised:

What is the profile of the respondent as well as their business?

- (a)

Age;

- (b)

Sex;

- (c)

Category in terms of total assets excluding Land;

- (d)

Number of years in operation;

- (e)

Nature of business;

- (f)

Industry/Business sector.

Do financial risk considerations, particularly inflation and access to finance, play a role in loan-related risk appetite?

What degree does loan-related risk appetite influence MSME growth decision?

What percentage of respondents are risk takers or risk averse?

How does loan-related risk appetite mediate the relationship between financial risk considerations, particularly inflation and access to finance, and MSME growth decision?

1.3. Objectives of the Study

This serves as a form of criteria for the researchers to determine whether the research endeavor is on the proper track by matching the objectives to the stated problems in order to accurately present and explain what it intends to achieve. For specificity, this study aims to satisfy the following objectives: (1) To determine and analyze the profile of the respondents and their business by collecting information about them such as the age and sex of the respondent, and the category of their business in terms of total assets excluding Land, number of years in operation, nature of business, and the industry or business sector where the entity operates in; (2) to determine the degree of influence of financial risk considerations, particularly inflation and access to finance, towards loan-related risk appetite, including analyzing which factor has the highest influence; (3) to determine the impact of financial risk considerations, specifically inflation and access to finance, towards MSME growth decision; (4) to determine the percentage of respondents who are risk takers or risk averse; and (5) to determine the role of loan-related risk appetite as a mediator between the relationship of financial risk considerations, namely inflation and access to finance, and MSME growth decision.

1.4. Theoretical Framework

In order to understand how inflation and access to finance influence MSME growth decision, the researchers used the Stimulus-Organism-Response (SOR) Model by

Mehrabian and Russell (

1974).

The SOR Model, as presented in

Figure 1, is simple and generalizable, thus allowing it to be extended on research issues that relate to various states and factors such as intentions and behaviors, among others (

Tan 2020;

Nagoya et al. 2021). Despite its flexibility, most of its applications revolve around consumer behaviors (

Guo et al. 2022) but are yet to address MSME behavior in terms of growth decision. It posits that environmental cues (stimulus) elicit human judgment (organism), consequently triggering positive or negative behavior (response) (

Nagoya et al. 2021).

Stimulus is a factor that prompts an individual by affecting its internal state (

Eroglu et al. 2001), and such factors may be internal or external (

Tan et al. 2019). The latter further adds that internal factors relate to personal perceptions while external factors relate to either tangible or intangible aspects, both of which help facilitate analysis. On the other hand, the organism can be thought of as a bridge that connects stimulus and response.

Buxbaum (

2016) stipulates that organisms are composed of different structures. One of them is psychological structure, being guided by numerous concepts such as learning, thinking, and judgment, among others. In another perspective, the organism is the internal state relating to various thinking and feeling systems, such as perception, experience, and evaluation (

Jayadi et al. 2022). Lastly, the response is the completing factor linked by the organism.

Nunthiphatprueksa (

2017) provides that the former largely influences the latter, and such responses are perceived to either be leading to approach or avoidance. Furthermore, the same researcher describes that positive environments facilitate approach behaviors. These manifest by the willingness to stay, explore, or return to a contemplated environment. Conversely, avoidance behaviors are those opposite to what the approach behaviors evoke, and this may be through the desire to leave the environment or by even having a feeling of restlessness.

It is through this wide applicability that the SOR Model has been frequently used to integrate in numerous research endeavors while including their chosen factors that will be placed under scrutiny (

Jeong et al. 2020). For instance,

Mkedder et al. (

2021) utilized the SOR Model to probe purchase intention towards local dairy products. On the other hand,

Chen et al. (

2019) have used the same approach to understand mobile payment usage intention.

Moe and Tan (

2016) sought to understand consumer behavior in a tourism context by utilizing the same model. Lastly,

Moreno et al. (

2021) also used the SOR Model to investigate the role of atmospheric cues, namely: e-Content, e-Design, e-Reviews, and e-Promotion in impulse buying behavior. In line with this, the researchers used the SOR Model as its foundation in understanding the growth decision of MSMEs. Moreover, it also incorporated specific financial risks, particularly inflation and access to finance, to investigate its influence towards MSME growth decision, including loan-related risk appetite as a mediating variable between the relationship.

1.5. Conceptual Framework

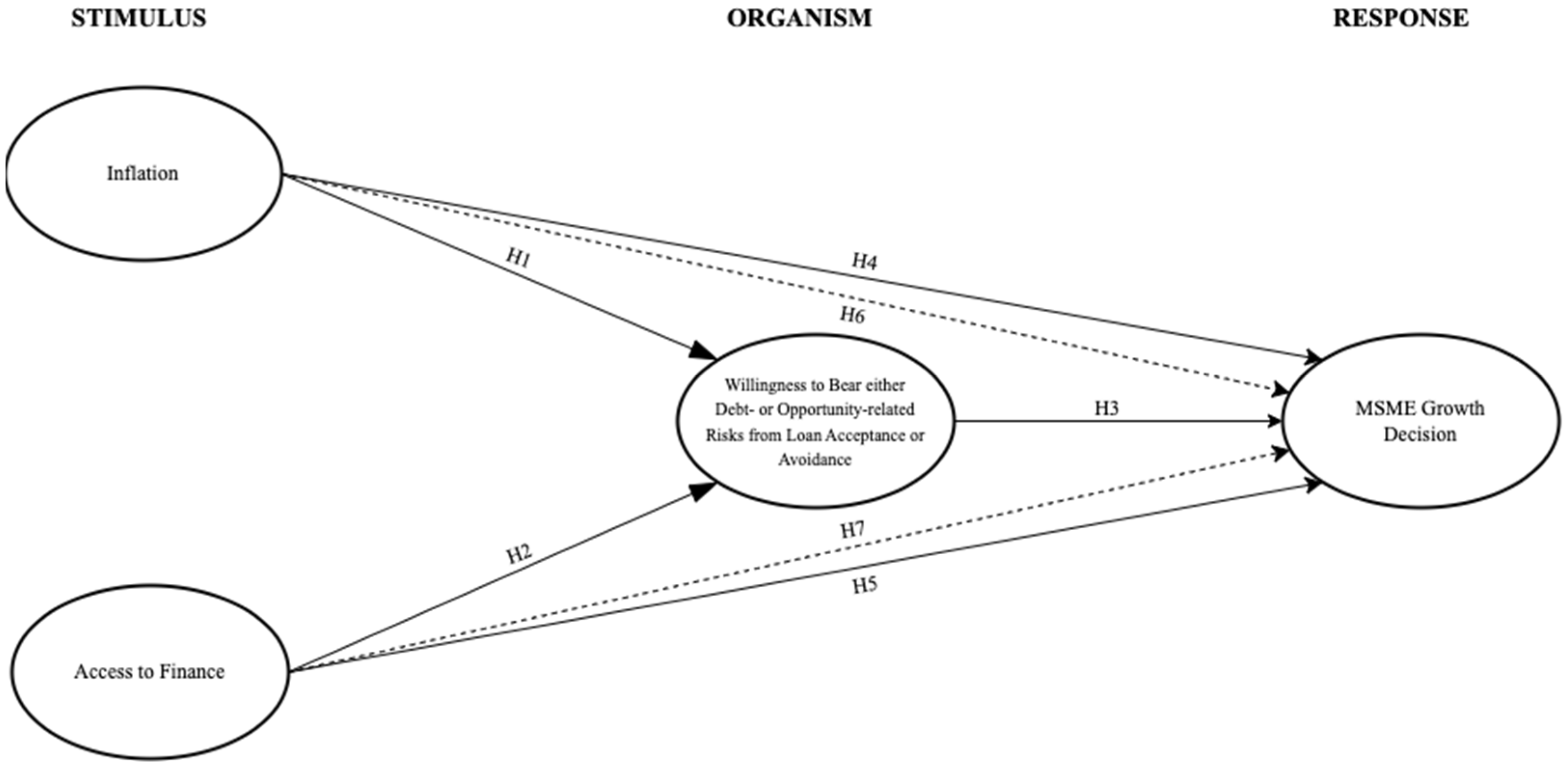

As for the descriptors of the variables presented in

Figure 2,

Table 1 provides the operational definition of the aforementioned.

After considering the factors intended to be scrutinized,

Figure 2 depicts the conceptual framework with the SOR Model as its foundation. Aside from access to finance, inflation was also incorporated, both of which fall under the Stimulus category. Access to finance refers to an MSME’s capability to avail loans either from formal or informal systems of lending. Such formal systems pertain to either state-owned or private commercial banks; on the other hand, informal systems refer to individuals who privately lend their money, revolving credit associations, or even relatives who extend loan agreements (

Pham and Lensink 2007).

Laidler and Parkin (

1977) defines inflation in two ways: (1) continuous process of rising prices or (2) continuous process of money value deterioration. The researchers placed the aforementioned variables under such category to test whether these external intangible factors affect one’s internal state, especially in the context of MSME growth decision.

On the other hand, the willingness to bear debt-related risks from loan acceptance and willingness to bear opportunity-related risks from loan avoidance fall under the Organism category. It refers to the costs of leaving someone with less resources for present acquisitions due to saving for a future endeavor (

Financial Fitness for Life n.d.). As the factor elicits thinking and judgment, the researchers hypothesized this as the Organism that the Stimuli affects.

Lastly, thorough consideration of Stimuli and Organisms would either lead to a certain behavior or thinking, which is depicted by the MSME Growth Decision variable. Given all the considerations, the researchers will also investigate the mediating role of loan-related risk appetite between the relationship of financial risk considerations, specifically inflation and access to finance, and MSME growth decision.

One of the distinctions between this endeavor and existing studies is its approach. In the study of

Adeyoriju and Agbadudu (

2018), they focused on the interactions between environmental factors (i.e., economic, political, socio-cultural, and technological factors) and MSME survival under the theory of system approach. It assumed that entities do not operate independently but rather interact with the aforementioned factors. In terms of assessing MSME growth motivation through growth-driven factors, a similar study was made in the Philippines by

Angeles (

2022). Some of the similarities include the investigation of access to finance as an element to explain growth decision or motivation, as well as being able to pinpoint the problem of access to finance, particularly external financing, as an inhibitor to MSME growth due to information asymmetry. Lastly,

Idris et al. (

2022) similarly a mediation model through the consideration of factors namely: inflation, financial technology, and banking financing.

On the other hand, as compared to

Adeyoriju and Agbadudu’s (

2018) study, this endeavor used the SOR model as its foundation as it emphasized on investigating growth itself, particularly the factors or stimulants, as is the case in such a model, that affect the response of MSMEs in which it was referred to as growth decision. Additionally, the study of

Angeles (

2022) was premised on a qualitative study while the researchers focused on a quantitative approach. Although

Idris et al. (

2022) used a mediation model and also investigated inflation and banking financing, the main difference lies on (1) their inclusion of financial technology and (2) the variable that acts as a mediator. In this study, it only focused on inflation and access to finance. Furthermore, their mediating element is MSME growth itself, with their independent variable being financial inclusion. Contrarily, as this study placed emphasis on growth itself, its independent variable is MSME growth decision while its mediating variable is the loan-related risk appetite, or willingness to bear either debt-related or opportunity-related risks arising from loan acceptance or avoidance, respectively. In another perspective, their study leans towards on the investigation of financial inclusion while this endeavor emphasized on growth itself, instead of using it only as a mediating variable between other variables.

Accordingly, the following hypotheses were developed:

H1: There is no positive relationship between inflation and loan-related risk appetite.

H2: There is no positive relationship between access to finance and loan-related risk appetite.

H3: There is no positive relationship between loan-related risk appetite and MSME growth decision.

H4: There is no positive relationship between inflation and MSME growth decision.

H5: There is no positive relationship between access to finance and MSME growth decision.

H6: The willingness to bear either debt- or opportunity-related risks on loan acceptance and avoidance, respectively, has no mediating role between the relationship of inflation and MSME growth decision.

H7: The willingness to bear either debt- or opportunity-related risks on loan acceptance and avoidance, respectively, has no mediating role between the relationship of access to finance and MSME growth decision.

1.6. Significance of the Study

While this endeavor is not the first to pursue discussions about MSME growth decision, much of the existing literature only places emphasis on the factors that affect access to finance, with some placing calls to bridge it to financial performance, but only few have tried to understand it in a growth decision context. The focus of this research is contextualized in a Philippine setting and is placed towards the determination of the influence of inflation, aside from financial inclusion or access to finance. Its relationship towards MSME growth decision along with the consideration of loan-related risk appetite as its mediator is also contemplated upon which places a new element in the usual dialogues around financial risks.

For clarity, the results of this endeavor may prove to be beneficial to the following:

Government.

2020 MSME Statistics (

2020) stated in their List of Establishments report that, out of 957,620 businesses operating in the country, 952,969 (99.51%) are classified as MSMEs with the remaining 4651 (0.49%) being large enterprises. It is clear that MSMEs dominate the country. By being familiar with what influences the growth decisions of MSMEs, with the help of this research, the knowledge gained from it may be used as a basis to offer various forms of assistance towards MSMEs which ultimately helps in the development of the economy.

Banking Institutions. Having an understanding of the risk appetites of MSMEs may enable it to determine why owners are more risk accepting than others which may resultingly help them to create less stringent loan packages towards the mentioned enterprises. Consequently, the knowledge gained from this research may also contribute in changing their perceptions towards MSMEs to a lighter note and guide them to think of better ways in serving MSMEs.

Current and Prospective Business Owners. The business owners that are leaning towards growth will help them be aware of the factors that may influence their decision to grow their business, thus giving them the proper knowledge to assess its advantages and disadvantages. Furthermore, having an understanding of the financial risks that may influence them will make it easier to accurately anticipate possible changes in the business. Lastly, this will aid prospective business owners by being aware of the issues that MSMEs consider, especially in the context of financial risks, and possessing this knowledge will make them more understanding and cautious towards the aforementioned issues.

Future Researchers. Since this endeavor of investigating growth decision is only the few of its kind, with only a handful being conducted within the context of Philippine MSMEs, this research will provide a new direction for them to explore in terms of the variables that affect MSME growth decision.

1.7. Scope and Limitations

The scope of this research mainly focused on financial risk considerations, particularly inflation and access to finance. Furthermore, the mediating variables, namely their willingness to bear either debt-related or opportunity-related risks arising from their risk appetite is also financial in nature. Thus, other factors that may influence MSME growth decision, such as political relationships and technological capabilities, are not explored but may serve as an opportunity for researchers to look upon.

Its delimitations are primarily premised on the lack of economic resources and temporal constraints. On the other hand, its limitations are attributable to the choice of using a non-probability sampling method, specifically purposive sampling, to gather respondents which may not be indicative of the population it intends to represent. Related to this, the quality of the answers derived from the questionnaires contains the possibility of it being compromised. Another limitation is the distribution of questionnaires was only limited in Laguna. Still, it is worth noting that, out of 81 provinces in the Philippines, Laguna has the third highest urbanization rate at 79.3% (

Urban Population of the Philippines 2022). In line with this, the role of urbanization helps in the accumulation of both people and businesses and it is also viewed to be a key factor of entrepreneurship (

Arouri et al. 2014). Combining with the researchers’ point of contacts of businesses in Laguna, this rationalizes the appropriateness of distributing questionnaires in such locations in spite of imposed limitations.

4. Discussion

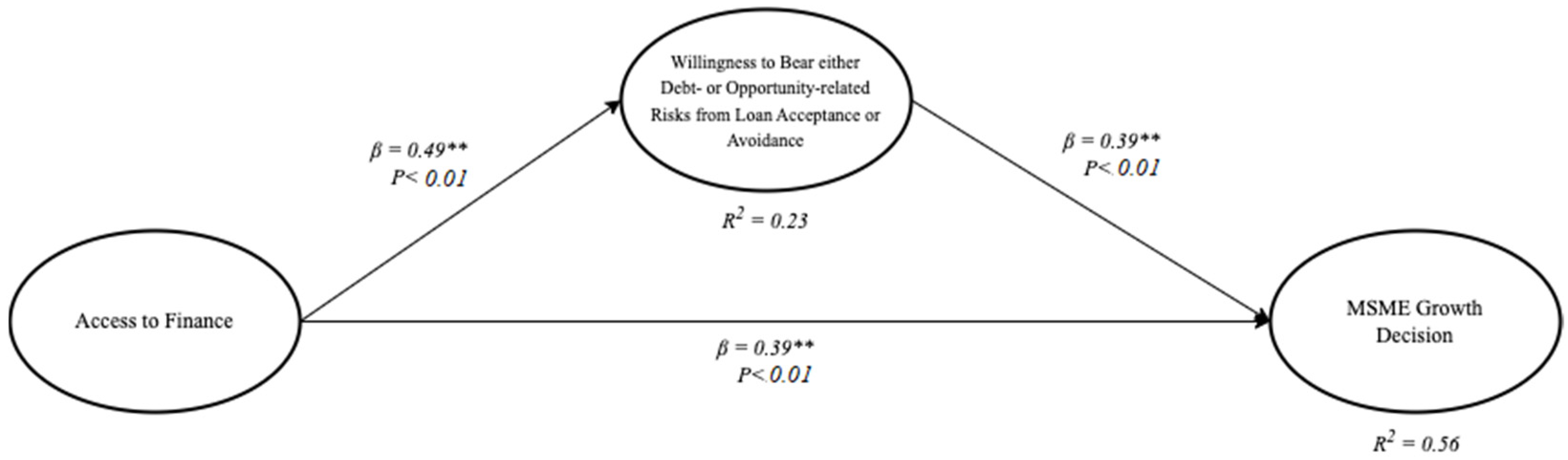

As provided in

Table 8, it depicts a comprehensive analysis of an illustrated initial mediation model with parameter estimates. According to

Cohen (

1988), r-squared values between 0.13 and 0.25 indicate a medium effect size, while values between 0.26 and above indicate a high effect size when reflecting the exogenous variable’s ability to predict endogenous variables. Therefore, the financial risks considered, inflation and access to finance, explained 23% of the variances observed in risk appetite, which indicates a medium effect size. On the other hand, the same variables explained 56% of the variances observed in MSME growth decision, which is considered as high.

Table 8 reveals that the three hypotheses, Access to Finance to Risk Appetite (β = 0.49,

p < 0.01), Risk Appetite to Growth Decision (β = 0.39,

p < 0.01), and Access to Finance to Growth Decision (β = 0.39,

p < 0.01) indicates a relationship. Therefore, H2, H3, and H5 are rejected. This can be supported by the study of

Elston and Audretsch (

2010) that, in the process of choosing financing sources, risk attitudes and the degree of personal wealth are proven to have a significant impact.

Guariglia et al. (

2011) also provided that internal funds of MSMEs, despite generally being discriminated against by the banking sector, presented itself as to have fostered MSME growth instead of constraining it. Furthermore, the financial access to credit enables account holders to start and expand business, which can improve the overall quality of their well-being (

Vo et al. 2019).

The correlations become weaker as estimated coefficients approach zero, and for a relationship to be considered significant, the matching p-value must be lower than 0.01 (

Hair et al. 2017). With that being said, the hypotheses Inflation to Risk Appetite (β = 0.10,

p = 0.175) and Inflation to Growth Decision (β = 0.19,

p = 0.071) do not demonstrate a relationship and, therefore, there is a failure to reject H1 and H4. This can be associated with the study of

Lynch (

2022) that sellers of essential products and services and those who have little competition typically experience fewer problems even as prices climb. This is due to the fact that consumers are frequently prepared to pay more for goods and services they require but cannot easily obtain elsewhere and that inflation may not affect the business growth as much as others.

5. Conclusions

This endeavor aims to determine the influence of inflation and access to finance in the growth decision of MSMEs which is placed in the lens of the SOR model. It assumes the idea that loan-related risk appetite is stimulated by inflation and access to finance and is ultimately led to the decision of growing the business. This follows the suggestion of previously examined literature by

Chowdhury and Alam (

2017) that the link between access to finance and MSME growth must be studied, and it is also grounded on the idea that growth intentions have complex interactions with other variables (

Levie and Autio 2013) which led the proponents to incorporate inflation and loan-related risk appetite in this undertaking.

The findings present that, in terms of direct effects, access to finance has a positive impact towards loan-related risk appetite while the same circumstance cannot be observed for inflation. It was also found that loan-related risk appetite has an impact and influence towards growth decision. Interestingly, inflation as a direct effect to growth decision was not found to be significant while the contrary can be said when it comes to access to finance as a direct effect to growth decision. This would then mean that access to finance, being a financial risk, has a role in loan-related risk appetite. In an indirect context, loan-related risk appetite does not mediate the positive link between inflation and growth decision, but it does so between access to finance and growth decision.

The significance of access to finance and growth decision suggests that having the former incentivizes the business when it comes to growth decision. This means that, between inflation or access to finance, only the latter is considered when it comes to risk behaviors of the respondents, since the latter provided statistically insignificant results. Adding the fact that the respondents have an affinity for risk-taking behavior, it can be interpreted that debt financing carries with it the expectations of benefit through tax shields or deductions from taxable income which ultimately result to lower tax liabilities. Still, due care must be made as there are also numerous factors that may affect the impact of such benefit (e.g., comprehensiveness of tax legislations and business performance). On the other hand, a feasible interpretation for the statistical insignificance of inflation is that it is an all-encompassing concept; it suggests that it cannot be contextualized merely to growth decision. Furthermore, it can also be attributed to the idea that businesses have varied responses towards inflation depending on the nature of their products (i.e., essential or non-essential items). While access to finance can also be thought of as a broad concept, it can still be contextualized in the perspective of MSME growth decision, but it cannot be done so to inflation as it is a macroeconomic phenomenon that seeps through each aspect of the economy where it is not selective of its targets. Contrarily, loan-related risk appetite can be looked only at the perspective of taking or avoiding loans when it comes to growth decision.

While it has been established that access to finance has a direct effect towards growth decision, the found indirect influence confirms that, indicating a small effect, access to finance is positively related to loan-related risk appetite which consequently affects their decision to grow the business. In line with this, the significance found between direct and indirect effects provides a case of partial mediation. The proponents recommend that banking or financing institutions should consider developing more MSME-friendly agreements since having access to finance leads them to the decision of growing the business. On the other hand, MSMEs, particularly the owners or managers, must further understand how their risk appetite drives the management of their business as it is important that they should only make decisions that they are willing to bear once its outcome arrives. Thus, factoring in the results, this study proved that, not only are there links between access to finance and the decision to grow the business, it also proved the existence of loan-related risk appetite as a mediator between the aforementioned variables.

However, as is the case in every study, this undertaking is also subject to certain limitations. In terms of measuring risk appetite, it is only restricted to the dimension of loan-related risk appetite and has only two incorporated factors, namely inflation and access to finance. Lastly, the lack of significance of the relationship the direct and indirect effects related to inflation may be attributed to the high amount of food service-related MSME business owners and/or managers. Lastly, the risks investigated in this study mainly refer to the considerations that influence in acquiring loans, considering that the investigation is focused on what prompts the response of growing the business instead of determining how risks become justified after its acquisition and is already in use. Bearing all these in mind, it is worth noting to exercise care and caution in generalizing and applying these results to different environments.

5.1. Implications for Practice

The findings that were revealed in this undertaking offer several perspectives that will provide guidance for various players in the business landscape. It has been echoed by reviewed literature that the Philippines is primarily dominated by MSMEs. In line with this, starting from a macro perspective, the government will obtain better insights on what drives MSME growth which is a precursor to economic growth as it has been affirmed in this study that having access to finance is positively related to MSME growth decision. In the same vein, this knowledge also provides better assistance for banking or financial institutions in order to develop more MSME-friendly loan agreements, considering that the study presented that the majority of the respondents are leaning towards risk-taking behavior. More than being able to secure such link, the results also provide avenues for establishing better safeguards.

The global health crisis has significantly impacted economies. In line with this, more stringent policies are being employed both by financing institutions and regulators to protect themselves from greater risk. Relating this to the existing information asymmetry between MSMEs and financial institutions, this poses further constraints in the relationship. However, sustaining stringent policies may do more harm than good as it inhibits economic growth, considering MSME owners, as provided by results in this study, are incentivized to grow their business when they have access to finance. It then presents a complex relationship in terms of being able to support MSMEs while balancing risks so as to avoid a ripple effect. Understandably, the risk in the act of providing financing to MSMEs is not only exclusive to the parties involved in the same. Rather, the economy also bears a portion of the risk. Given the existing methods of assessing creditworthiness, much of the criteria is not really applicable to the nature of MSMEs. Thus, our result implicates a shift to more non-traditional methods in order to have the same level of protection from risk while also giving flexibility for MSMEs to grow, considering that, aside from being incentivized, MSMEs also constitute a major portion of economies around the world. In another perspective, the necessity of debt financing becomes further emphasized as a business grows, particularly because solely using earnings from the business may no longer be sufficient to cover the costs of growth. Nevertheless, thorough analysis must still be made as the risk also grows along with the growing need for larger financing. Lastly, the possession of such knowledge also allows current and prospective business owners to understand how their risk propensities affect how they manage or operate their business. In another sense, this also implicates the need for more comprehensive financial literacy among MSMEs. This will ultimately reflect on how they can better anticipate upcoming challenges given the constantly changing nature of the competitive business landscape.

5.2. Future Research Direction

The aforementioned limitations would entail supplementation of further studies to strengthen knowledge regarding MSME growth decision. First, the authors recommend expanding to other cities in order to confirm whether cross-city differences exist, and this may ultimately be expanded to a cross-regional scale. Second, in terms of risk profiles in demographics, future researchers may also consider exploring the differences in risk behaviors of people across various age groups and as well as investigating the differences between sexes. Third, since growth decision was suggestively found by studies to have complex interactions with other variables, it is also recommended to include more variables. In line with this, future researchers may also consider introducing non-financial risks such as political and social factors as a moderating variable. As previously mentioned, while it has been interpreted that there are expectations of benefits arising from debt financing in the form of tax shields, its magnitude still differs depending on various circumstances. A feasible direction for this is the deeper investigation of perceived benefits arising from relevant tax legislations or even laws that provide subsidies, which ultimately is a political factor, so as to allow for a multifaceted approach when it comes to understanding the growth decision of MSMEs. Meanwhile, social factors may further investigate the applicability of the availability of connections with key people in a particular industry to boost one’s presence and possibly facilitate risk behaviors. Lastly, it is also suggested to investigate trust gaps between financial institutions and MSMEs to enable having broader access to finance.