Abstract

This study analyzes the wealth impact on M&A deals when the acquirers in the financial industry utilize external versus in-house advising services. A quasi-natural observatory setting is applied to investigate the costs and benefits of retaining a financial advisor. Based on agency theory, information asymmetry and conflict of interest both exist in the setting of M&A deals when acquirers use advisory services. We first find that almost 40% of financial acquirers are more likely to use in-house advising services, the frequency of which is significantly higher than that of non-financial acquisitions previously documented. Further, we find that in certain complex deals of greater information asymmetry, the frequency of retaining advisory services in-house is even higher. This finding suggests that for financial acquirers who possess expertise in the M&A market, the concern of conflict of interests (i.e., misaligned incentives) between the acquirers and their advisors are more salient than the concern of information asymmetry. More importantly, using the two-stage regressions method controlling the endogeneity of the choice between in-house versus external advisory services, this study finds that the three-day abnormal returns around the acquisition announcements are 4.5% higher for the acquirers retaining in-house advisory services, 18.7% higher for the corresponding target, and the combined merger gains are 2.2% higher. Overall, our findings provide direct evidence of the agency cost when an external advisor is hired and document the incremental values that the financial acquirers’ in-house advisory services may create.

Keywords:

external advisors; in-house advisors; agency costs; information asymmetry; financial industry JEL Classification Codes:

G14; G24; G34

1. Introduction

Mergers and acquisitions (M&A) smashed records in 2021. According to the Refinitiv review of 2021 global M&As, the M&A activities around the world reached an all-time record of USD 5.9 trillion in value, up by 64 percent compared to 2020 (). The M&A market in the United States was particularly hot and contributed nearly 50 percent of global completed M&A values in 2021. The financial service industry, as the second-largest component of the M&A market globally and in the United States, becomes an important factor in the M&A market. Players in the financial service industry are expected to continue their influence in 2022. “Based on recently raised funds, the amount of dry powder and new funds available, we believe that the growth in acquisitions by private equity firms will continue to play a big role in 2022”, says Philip J. Isom, Global Head of M&A at KPMG (). Christopher Sur, Global Financial Services Deals Leader at PwC Germany, also says that “Strong interest from investors of all kinds will continue to push the financial services M&A market upwards in 2022. In particular, I see potential for distressed assets from the banking and insurance sectors to produce a wave of deals ()”. As the influence of the financial players in the heated M&A market continues, it is important to study how firms in the financial services industry participate in M&A transactions. In this study, we investigate the choices of advisory services by financial acquirers in M&A transactions, e.g., whether they tend to hire external advisors or retain the advisory services in-house.1 More importantly, financial acquirers’ choices of advisory services provide a unique quasi-natural observatory setting to examine the agency costs of external advisory services in M&A transactions.

Financial advisors are important information intermediaries in the M&A process to reduce the information asymmetry between the acquirer and the target (for example, ; ; ; ; ; and ). () show that, among 5337 merger deals between January 1995 and June 2000, 4547 (85.2%) used external advisors and 790 (14.8%) kept the service in-house. () report that, among 1709 mergers by non-financial companies, 1455 acquirers (85.14%) hired external advisors and 254 (14.86%) retained in-house advisors. Financial acquirers are specialists in the M&A market and often serve as advisors to other firms, and therefore, compared to non-financial acquirers, the cost of information asymmetry in the M&A processes is lower for financial acquirers. Accordingly, the likelihood of retaining the advisory services in-house may be higher among acquirers in the financial industry. Our first research question is to investigate the in-house advisory service usage among financial acquirers.

As well as the information asymmetry, another consideration for the choice of advisory services are the conflicts of interest. Just like the existence of conflicts of interest in most principal-agent relationships, external advisors may not always fully represent the interests of the acquirers. First, the advisory fee is contingent on the outcome of the M&A transactions, and therefore, the external advisors have an incentive to promote the completion of deals with a higher transaction value (; , ; ; ). Second, conflicts of interest are more likely to arise at larger financial institutions and commercial banks due to various other services they provide to the acquirer or target firms, such as lending, trading, underwriting, etc. (; ). The extant literature provided evidence that, due to conflicts of interests, it is not always beneficial for the acquirers to hire external advisors, despite that the advisors may effectively reduce information asymmetry in M&A transactions. (See , for example). Although they have argued and inferred the presence of conflicts of interests, prior studies have not yet directly measured the conflict of interests in acquirer external advisory services. The second research question in this study is to test and provide direct evidence on how much conflict of interests reduces the market returns to the acquirers in M&A transactions. The advisory choices of financial acquirers provide a quasi-natural laboratory to investigate our second research question.

When financial acquirers retain advisory services in-house, the interests of the acquirer and the “in-house” advisor are aligned, and therefore, conflict of interests is eliminated in the M&A transactions. Levitt and Dubner, in one of their bestseller books Freakonomics, suggest that one way to find out the misalignment between the incentives of a real estate agent and their client is to “measure the difference between the sales data for houses that belong to real-estate agents themselves and the houses they sold on behalf of clients” (), and their findings, based on 100,000 Chicago homes sold, provide evidence that real-estate agents sell their own homes for an extra three-plus percent. Similarly, we examine the agency costs of hiring an external acquirer advisor by measuring the difference in the cumulative abnormal returns of financial deals between the hired advisor group and the in-house group.

We control for the sample self-selection bias of financial advisors using the two-stage procedure of the treatment model. Among financial acquirers, 39.4% retain the advisory services in-house, which is over two and half times the percentage of in-house acquirer advisory services among all M&A transactions. Compared to the hired advisor group, when the financial acquirers retain the advisory services in-house, the abnormal returns are 4.5% higher for the acquirers, 18.7% higher for the target, and the combined merger gains are 2.2% higher. The higher abnormal returns for the acquirers indicate the benefit of eliminating conflicts of interest. In other words, it represents how much conflict-of-interest costs acquirers to use external financial advisors in M&A transactions. Furthermore, we find that financial acquirers are more likely to retain advisory services in-house in cross-state transactions than in in-state transactions. Since information asymmetry and conflict of interests both are higher in cross-state transactions than in-state deals, our findings suggest that conflict of interests is the primary concern for financial acquirers, and they tend to rely more on themselves to reduce potential agency issues.

This study makes contributions to the M&A literature. This study examines financial institutions in the role of acquirers in the M&A market. Prior studies investigate financial firms extensively as advisors in industrial M&A transactions. As the influence of financial acquirers increases, it is important to investigate the behavior of financial players as acquirers in the M&A market. Our findings provide insight into what and how financial acquirers choose advisory services. In an imperfect market where acquirers face the risk of information asymmetry if they choose not to use an advisor but suffer the cost of conflict of interests if they hire an advisor, the primary concern for financial acquirers is the conflict of interests.

Further, our findings shed light on the presence and the magnitude of agency cost of hiring an advisor. By eliminating the agency cost, the cumulative abnormal returns are significantly higher when the financial acquirers retain the advisory services in-house. The findings contribute to the financial intermediation literature regarding agency costs. For studies on financial advisors, if it is beneficial to disentangle the agency cost of financial advisors from other costs or factors, the financial acquirers in the sample who retain advisory services in-house can be examined and the data of this group of acquirers used as the “baseline” to investigate other investment groups.

2. Literature Review

Two branches of the literature are most relevant to our study. The first one is the literature concerning the role of financial advisors in M&A transactions. This branch of the literature includes the characteristics of the transactions and the advisors that affect the merging firms’ choices of advisors, and the value that the advisors create or add to the transactions. The second branch is the literature documenting the characteristics of financial acquirers, and the regulation and policy issues that apply to financial investors.

2.1. The Role of Financial Advisors

Financial advisors are information intermediaries between merging firms. () find that, in more complex transactions where the information asymmetry between the acquirer and the target is significant, the merging companies are more likely to retain investment bank advisors. Compared to investment banks, commercial banks have comparative advantages as advisors and can provide more certification value to the merging companies because the private information they obtained about the merging companies in the course of long-term customer relationship is reusable and transferrable (). Due to the significance of information in the success of M&A transactions, merging companies often pursue assistance and services from financial advisors. () show that, among 5337 merger deals between January 1995 and June 2000, 4547 (85.2%) used financial advisors. Similarly, () report that 1455 acquirers (85.14%), among 1709 non-financial companies, hired financial advisors in M&A transactions.

The deal outcomes of using financial advisors have also received a fair amount of attention in the extant literature. () argue that merger advisors are emerging as the principal architects of the M&A deals and determine the wealth gains to the acquirer and the target. They found that wealth gains are larger when either the acquirer or the target uses a tier-one investment bank advisor. () and (), on the other hand, find an insignificant relationship between advisor reputation and acquirer gains. () construct a measure of the relative reputation of the advisors, which is the ratio of the acquirer advisor’s reputation to that of the target advisor, and document that the total wealth gains and the wealth gains accruing to the acquirer increases as the relative reputation of the acquirer advisor increases. () provide similar evidence that acquirer returns are positively related to top-tier advisors retained by acquirers but negatively related to top-tier advisors retained by targets. () revisits the relationship between advisor tiers and wealth gains in M&A deals. This study finds that acquirers advised by tier-one advisors turn out to experience significant losses, which is mainly driven by the large loss deals advised by tier-one advisors. () contend that bank fixed effect, which is a measure of the advisor reputation based on their past performance, has a significant impact on acquirer return. Recent studies further examine whether the relationship between financial advisors and the wealth gains in M&A deals may depend on other factors. () provide evidence that acquirers receive higher returns when they hire top-tier advisors rather than non-top-tier advisors, but only in public M&A transactions where the advisor reputational exposure and required skills are relatively large. () find that the effects of top-tier advisors are dependent on the financial conditions of the acquirers. They divide M&A deals into three groups based on acquirer financial constraints—constrained, neutral, and unconstrained. Top-tier advisors have a significant impact on acquirer returns only for constrained acquirers, but not for neutral or unconstrained acquirers.

Overall, the empirical evidence has not reached a conclusive congruence on the mechanism between the role of advisors and deal outcomes. Researchers have attributed this inconsistent evidence to the presence of conflicts of interest. The extant literature has mainly discussed the conflicts of interest between the financial advisors and the merging firms from three perspectives.

First, the incentives of the advisors and merging firms may be misaligned due to the compensation schemes in the merger fee contracts. () examine various merger fee contracts and find that the most common contract used in merger transactions is contingent on the successful completion of the merger. Further, the amount of the contract fee includes both a fixed fee and a variable amount based on the transaction price. Similarly, (, ) examine the advisory fee structure and the role of fee contracts in tender offers and argue that the fee contracts may influence the deal outcomes. () examines the relationship between the advisor’s market share, contract fee structure, and the acquirer’s deal outcomes. The findings suggest that the advisor’s market share is determined only by the advisor’s completion rate, not by the acquirer’s abnormal returns post the M&A deal. The advisor’s market share, in turn, determines the future contract fee structure charged by the advisor. () also find that the contingent contract fee plays a significant role in expediting the completion of M&A deals. Overall, because of the fee mechanisms in the merger contract, the advisor may be more motivated to push the deal to completion while less motivated to negotiate a lower offer price for the acquirer.

Second, conflicts of interest may arise when the advisor institutions provide a variety of services to the merging companies in addition to advisory services. () provide some examples of such situations. For example, when the advisor bank is also the lender to the acquirer or the target, they may push the completion of the M&A deal if the deal can enhance the financial conditions of their client. The banks are also motivated to provide conditioned advice if there is a potential for them to finance the merger and earn large fees through financing services. () also argue and provide evidence that when acquirers hire boutique advisors who, compared to full-service banks, are more independent and only focus on advisory services, the premiums paid for the target are significantly lower due to the reduced conflicts of interest.

Third, information leakage is another big concern when the banks serve different customers. For example, Goldman Sachs was forced to resign from its role as the advisor to Mirant Corp. (the acquirer) after being accused of leaking confidential information in its previous engagement with the target firm, NRG ().

Although the extant literature has discussed agency cost in M&A transactions from various perspectives, there has not been any direct measurement of the presence and the magnitude of agency cost. () provide a measure of agency cost in real-estate sales, that is, to measure the difference between the sales data for houses belonging to real-estate agents themselves and the houses belonging to their clients. They use sales data of 100,000 Chicago homes and control for variables such as locations, age, and quality of the houses. They find that real-estate agents hold out their own homes on the market an average of 10 days longer and wait for the best offer while encouraging their clients to take the first decent offer. Their own homes are sold for an extra three-plus percent compared to homes they sold for their clients.

To measure the agency cost in M&A transactions, we will compare the difference in the wealth gains for acquirers when the financial institutions are the acquirers themselves and when the financial institutions serve as the advisors for the acquirers.

2.2. Financial Acquirers in the M&A Market

M&A activities in the financial sector began to increase in the U.S. in the early 1980s and took off in Europe about 10 years later (). Compared to non-financial industries, the financial industry is heavily regulated. Some financial institutions that are perceived “too-big-to-fail” may enjoy advantageous treatment from regulators (). Therefore, being “big” is of particular importance to financial institutions, which may be achieved through M&A transactions. M&A activities in the banking sector expanded dramatically after the Riegle–Neal Interstate Banking and Branching Efficiency Act of 1994, which removed the restrictions on nationwide branching in the U.S. As financial M&A activities increase in the global and U.S. market, these activities have attracted extensive academic attention. In this section, instead of providing an exhaustive review of the ample empirical literature, we will only focus on some studies post-2000 that are relevant to the issue in this study.

A series of studies examine market reactions to merging banks and yield mixed results. () examine a sample of the largest bank mergers between 1985 and 1996 and provide evidence that the acquirer banks experience significant negative abnormal returns post-merger while the returns to the targets and the combined returns increase slightly. () study large merger deals between bank holding companies from 1987 to 1998, and show negative market returns to the merging banks. The mergers also experience reductions in profit and credit quality in the post-merger period. () examine a different sample period of 1991–2004 and find that, after controlling for risk factors and economic environments, the combined abnormal returns to the target and the acquirer banks are significantly positive when the mergers allow the banks to attain the status of “too-big-to-fail”, i.e., to cross the perceived size threshold of USD 100 billion in assets. In addition, they estimate that, in eight merger deals that brought the organizations to over USD 100 billion in assets, the financial institutions paid at least USD 15 billion in added acquisition premiums. () examine, during the similar period of 1990–2004, M&A deals between banks in European Union, and provide evidence that the targets benefit from positive and significant abnormal returns, while the acquirers earn negative but statistically insignificant abnormal returns. () show that the market may misreact to bank M&As based on the acquirer’s leverage, i.e., capital ratio, at the time of announcement. Specifically, when the acquirer bank has a lower capital ratio, the abnormal returns at the M&A announcement are significantly negative. However, the longer-run abnormal returns and operating performance are positive, indicating that the market misreacts based on the acquirer leverage in the short run, which tends to be corrected in the long run.

Non-bank financial M&As attracted relatively less academic attention. () find that, among U.S. mutual fund M&A transactions between 1994 and 1997, target funds have positive abnormal gains while acquirer funds have negative abnormal returns. For credit union mergers from 1994 to 2004, () also provide evidence of abnormal gains to target credit unions, but not to the acquirer credit unions.

Although the empirical evidence is not conclusive on the market reactions to financial M&As, the returns to the acquirer institution have been consistently documented. The acquirers experience either insignificant or significantly negative abnormal returns post-merger. Researchers have investigated the motives for financial M&As from non-profit perspectives. The most salient motive for acquirers is to expand the institution. From the management perspective, a larger size grants greater market power and reduced hassles of competition, which may result in a “quiet life” for managers (). From the regulation perspective, as discussed earlier in this section, financial institutions may seek the “too-big-to-fail” status to benefit from advantageous regulatory treatment.

The prior literature has provided ample empirical evidence for our understanding of why financial institutions acquire. In this study, we are interested in how they acquire. Because the financial institutions are “insiders” in the M&A market, and often serve as financial advisors to industrial mergers, we are interested in whether they use external advisory services when they acquire. Further, what are their major concerns when they choose advisory services? And lastly, the choices of advisory services by financial acquirers provide a setting of a quasi-natural laboratory for us to examine the conflict of interests between financial advisors (i.e., the agent) and acquirers (i.e., the principal).

3. Sample and Variables

3.1. Data Sources and Sample Selection

The data collection process begins with the SDC M&A database. The initial data include all M&A transactions announced from 1994 to 2010 by financial institutions.2 We identify financial institutions by the acquirer’s primary SIC code that equals 6000. Both the acquirer and the target firms in the M&A transactions are publicly listed in the U.S. In addition, we impose these filters: (i) the acquirer must hold less than 50% toehold of the target shares before the takeover; (ii) if the deal is completed, the transaction must result in the acquirer owning 100% of the target; (iii) the transaction value and the offer price of the deal must be disclosed in the SDC database; (iv) following the traditional M&A literature, we exclude deals of self-tender or repurchase, bankrupt target, or failed bank mergers; (v) we also exclude tender offers without financial advisors’ identity information disclosed by SDC;3 (vi) both the target and the acquirer must have stock return information available in the CRSP database; (vii) deals with targets’ stock prices of five dollars or less are not included, effectively excluding highly distressed target firms; and (viii) we delete transactions involving REIT firms or HMO firms, since they are not considered traditional financial firms. This sample selection process results in a final sample of 731 financial takeovers.

Next, we extract the following deal characteristics from the SDC database: (i) the announcement, withdrawal, and completion dates of a takeover; (ii) the names and CUSIP numbers of the target and the acquirer; (iii) the outcome of the transaction; (iv) names of financial advisors to the acquirer; (v) the method of payment; (vi) the deal value and the offer price of the transaction; (vii) the geographic locations (state and city) of the target and the acquirer; (viii) the toehold portion held by the acquirer at the announcement; (ix) the number of competing bidders; and x) the takeover-related transactions completed by the acquirer 10 years prior to the current transaction. Finally, we collect stock price data from CRSP and firm-level accounting information from Compustat. Table 1 lists and defines the variables used in this study.

Table 1.

Description of variables used in the models.

3.2. Variables

3.2.1. Advisory Services: External vs. In-House

The main explanatory variable is whether the financial acquirer hires an external M&A advisor or completes the transaction with in-house advisory services. We use a dummy variable: ADV, which equals zero for external advisory services and equals one for in-house advisory services. To identify the advisory services in the M&A transactions, we manually compare the advisor’s name (or the name of the advisor’s parent company) with the acquirer’s name (or the name of the parent of the acquirer firm). If one of the advisors’ names matches the name of the acquirer (e.g., Wachovia Securities, St. Louis, MO, USA, advises Wachovia Corp, Charlotte, NC, USA) or the subsidiary of the acquirer (e.g., Salomon Smith Barney, New York, NY, USA, advised Citigroup, New York, NY, USA, after the year 1998), or if the acquirer does not use any financial advisor, we identify the transaction as in-house. Otherwise, the transaction is labeled as external.

Table 2, Panel A presents the sample summary of the external versus in-house group. 288 out of 731 (39.6%) acquirers retain advisory services in-house. The ratio of the in-house group is significantly higher than that documented in prior studies on advisory services. For example, the ratio of in-house advisory services is 14.8% in () and 14.86% in (). The result is reasonable because () examine all M&A deals, which include financial and non-financial M&As, and () investigate only non-financial M&As. This study focuses on the choices of advisory services by financial acquirers who are experienced and specialized in the M&A market. In addition to their expertise, the higher ratio of the in-house group also motivates us to investigate other potential reasons for financial acquirers to retain advisory services in-house, such as the concern of agency costs.

Table 2.

External vs. in-house advisory services.

Table 2, Panels B provides detailed information on the merging firms and deal values of the top 10 transactions in both the external advisor group and the in-house group, ranked by the size of the deal. () provide that the choice of external vs. in-house advisory services depends highly on the size and complexity of the transaction. As the size and complexity of the transaction increase, the problem of information asymmetry becomes more significant, and therefore, merging companies are more likely to hire external advisors. This argument is supported by the empirical evidence in various studies (See , etc.) However, we find different evidence in financial transactions. The larger the size of the transaction, the more likely the financial acquirers to retain the advisory services in-house. The evidence suggests that, compared to information asymmetry, financial firms have greater concerns about the agency cost of using external advisors.

3.2.2. Control Variables

In the regression analysis, we control for various deal characteristics extracted from the SDC database and firm accounting information from the Compustat database. Table 3 reports the summary statistics of deal characteristics and firm accounting information that we control in this study.

Table 3.

Summary statistics of deal characteristics and financial information.

As the size and complexity of the transaction increase, the problem of information asymmetry becomes more significant, and therefore, merging companies are more likely to hire external advisors (). We use, ln(Val), which is the log of the dollar value of the transaction4 as a proxy measure of deal size and deal complexity, since a bigger transaction usually involves a larger target, indicating that the merger requires more time and involves more resources. The number of bidders, #Bidder, is another measure of deal complexity. () and () find that the number of bidders affects the relative market power of the bidding firms in the negotiation process. When more bidders participate in the transaction, the wealth gain for the target increases, and the return to the acquirer goes down.

The payment method is an important determinant of the merger gain. The market return to the acquirer is higher when the deal is announced if the acquirer offers cash payments than it would be with stock payments (; ). Furthermore, a stock deal may increase the complexity of the deal since more finance arrangements are needed (). We use a dummy variable, StockPay, which equals one if the transaction is financed at least 50% by stock payment and zero otherwise.

We also control for the acquirer toehold position. The toehold ownership, Toehold, is the percentage of shares of the target firm owned by the acquirer before the takeover. A large toehold represents an advantageous bargaining position for the acquirer, increases the possibility of deal completion, and is associated with higher acquirer wealth gains (; ).

We measure the acquirer’s prior experience in M&As, Prior, based on the number of M&A transactions that the acquirer completed during the past ten years. () argue that acquirers are more experienced if they have more exposure to the M&A market. Experienced acquirers are more likely to retain the advisory services in-house. Consistent with this argument, acquirers in the in-house group are significantly more experienced than those in the external group.

Relative equity size, RelEquity, is defined as the ratio of the target market capitalization over that of the acquirer’s, measured 31 days before the announcement. () suggest that the abnormal returns are larger for relatively smaller acquirers, whereas for the target firms, the abnormal returns are smaller for relatively smaller firms. Accordingly, the variable, relative equity size catches the difference between the magnitudes of the acquirer and the target abnormal returns. Further, because financial institutions are highly leveraged, we construct a second measure of the relative size, RelAsset, which is based on the total assets of the target over the total assets of the acquirer. The values of total assets are extracted from the annual financial statements that the firms filed with SEC before the merger announcement, which are available in Compustat. Table 3 shows that the relative size of the in-house group is, on average, smaller than that of the external group.

We use two variables to measure the geography focus and activity focus of the takeover. First, () and () find that the more diversified the merger, the lower the synergy gains. Following (), we set a dummy variable, SameIND, which equals one if the first three-digit primary SIC codes of the target and the acquirer are the same, indicating that the merger is more likely to be activity-focused. Otherwise, the variable equals zero, meaning that the takeover is activity diversified. Moreover, () finds that the market favors activity/geography-focused mergers over those with activity/geography-diversified takeovers. Thus, we use another variable, SameST, which equals one if the target and the acquirer are headquartered in the same state, i.e., the takeover is geographically focused; otherwise, the merger is geographically diversified and the variable equals zero. A geographically diversified merger allows the acquirer to obtain a greater market share and increase the market power of the existing business (), and to operate in a more diversified regulatory environment (); however, it also increases the level of information asymmetry ().

In addition to the deal characteristics, we also control for the firm-level accounting information of the acquirer and the target obtained from Compustat. We control for the acquirer and target market-to-book values, ACQ_M/B and TGT_M/B, to relate the merger outcome to the likelihood of stock overvaluation.5 Target (acquirer) M/B is defined as the target (acquirer) market capitalization 30 days before the announcement over the book value of the target (acquirer). Recent studies on bank M&As provide that leverage () and profitability () are important characteristics to impact M&A outcomes. We control for the target profitability measures (including TGT_ROE and TGT_ROA), the target equity ratio (TGT_EQU), and the target growth rate (including sales growth, TGT_SGR, and net income growth, TGT_IGR), which are obtained from the annual financial reports before the merger announcement. Finally, since the sample period in this study includes both the financial deregulation and the dot-com bubble periods, we include the year dummies in the regression to control the year-fixed effects.

3.2.3. Regression Methodology and Wealth Gains in M&As

We use the Heckman 2-stage regressions to investigate the wealth effects of the in-house deals versus the independently advised deals. () show that the decision of hiring an advisor depends on many factors that are common to those used in the wealth gain analysis, such as deal complexity, deal size, payment option, prior M&A experiences, etc. Thus, we first control this endogeneity issue in the first stage analysis of advisor choice using a probit model. In the first stage regression, the dependent variable equals one for an in-house advised takeover and equals zero otherwise. In addition to the common factors of the deal characteristics, we employ the explanatory variables that describe the activity and geographic focus in the bank merger literature discussed above. The probit regression also reports a hazard ratio as an instrument variable used in the second-stage OLS regression of wealth gains.

In the second stage, we use the wealth gain of M&As as the dependent variables to test how the advisor choice (in-house vs. external) impacts the merger gains along with the deal characteristics, as well as the hazard ratios produced in the first-stage regression. We measure the wealth gains in M&A deals based on short-term market reactions, i.e., the cumulative abnormal returns (CARs) around takeover announcements for both targets (TCAR) and acquirers (ACAR). The daily abnormal return is the difference between the firm’s daily raw return and the expected return. We use the market risk-adjusted model estimated over the [−250, −31] trading days before the announcement day to measure the expected returns. We then sum up the abnormal returns over multiple event-day windows to measure the cumulative market reaction. The combined cumulative abnormal return (CCAR) is a weighted sum of the target and the acquirer abnormal returns based on their market sizes 31 days before the announcement day.

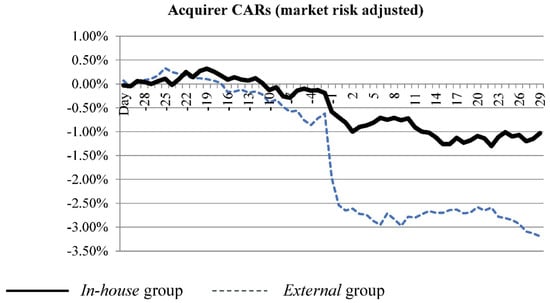

Figure 1 illustrates the acquirer CARs from 30 days before the merger announcement to 30 days after. Consistent with the extant literature on bank and non-bank financial takeovers (see, for example, ; ; ; and ), the market reaction to acquirers is non-positive on average. More importantly, the two plots of acquirer CARs show that, compared to the in-house group, the market is more skeptical about merger gains when external advisors are used: a persistent 1.5% to 3% difference in abnormal returns between the in-house group and the external group lasts from zero to 30 days after the announcement. This finding suggests that the conflict of interests between the external advisor and the acquirer hurts the value of mergers.

Figure 1.

Dynamic plots of acquirer cumulative abnormal returns. The figure presents cumulative average abnormal returns to acquiring firms from trading day −30 to +30 relative to the takeover announcements. Market model parameters used to define abnormal returns are estimated using the CRSP value-weighted portfolio for days −250 to −31. The cumulative abnormal returns of the in-house group are shown in a solid line, and the cumulative abnormal returns of the external group are shown in a dotted line.

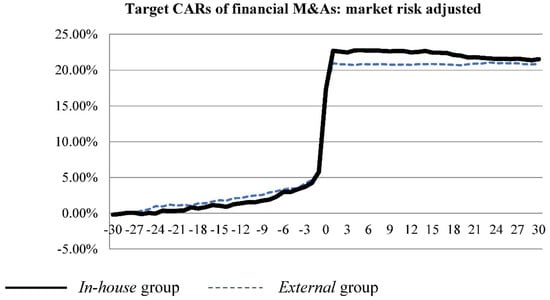

We then plot the target cumulative abnormal returns in Figure 2. The average target CARs are 20% to 25%. Unlike acquirer abnormal returns, there is no persistent difference in target abnormal returns between the in-house and the external groups.

Figure 2.

Dynamic plots of target cumulative abnormal returns. The figure presents cumulative average abnormal returns to target firms from trading day −30 to +30 relative to the takeover announcements. Market model parameters used to define abnormal returns are estimated using the CRSP value-weighted portfolio for days −250 to −31. The cumulative abnormal returns of the in-house group are shown in a solid line, and the cumulative abnormal returns of the external group are shown in a dotted line.

4. Empirical Results

4.1. The Choice of External vs. In-House Advisory Services

In this section, we follow the approach of () to estimate the determinants of retaining the advisory services in-house using probit models. The dependent variable is ADV, which equals one for in-house advisory services and zero for external advisory services. We report both the probit coefficients and the marginal effects in Table 4. Model I reports the estimation of the full sample without the accounting variables and Model II tests the reduced sample with the accounting information controlled.

Table 4.

Determinants of in-house advising.

The acquirers are more likely to retain the advisory services in-house when the size of the transaction is smaller or when the relative size of the target is smaller, indicating that the choice of in-house advisory services is associated with less complicated deals and lower transaction costs. Our results also show a positive relationship between the likelihood of in-house advising and the acquirer’s prior experience in M&A transactions (i.e., Prior), suggesting that acquirers that have more acquisition experience are more likely to rely on themselves.

A shred of interesting evidence is that when the acquirer and the target are in the same state (SameST = 1), the coefficient is significantly negative, suggesting that acquirers are less likely to retain the advisory services in-house when the transaction is in-state. In other words, financial acquirers are more likely to rely on themselves if the transaction is geographically diversified. In model II when firm accounting information is controlled, the results indicate that a geographic-diversifying merger is 14% more likely to be advised by in-house group. One explanation is that financial acquirers are aware of the fact that geographic-diversifying mergers potentially incur higher agency costs. Thus, they rely more on their own experience and expertise in evaluating the deal quality rather than trusting an external advisor.6

Further, target sales growth (TGT_SGR) is negatively associated with the likelihood of in-house advising, suggesting that financial acquirers prefer to use in-house advisors when targets are experiencing a decline in sales.

4.2. Deal Outcomes—Market Returns and Completion Rate

The examination of deal outcomes is the key test to distinguish the benefit and the cost of advisory services. The results of the regression models are presented in Table 5. Panel A and Panel B present the analysis of the cumulative abnormal returns (−1, +1) around the merger announcement to the acquirer and to the target, respectively. Panel C reports the combined cumulative abnormal returns (−1, +1) around the merger announcement. Panel D reports the results on the probability that a merger deal is successfully completed. We employ the OLS regression as well as the two-stage treatment procedure that controls for the potential self-selection bias of the merger sample. In the treatment procedure, the first-stage probit regression controls for the endogenous choice of retaining the advisory services in-house, with the hazard ratio reported as an indicator of the significance of the self-selection bias. The second-stage regression reports the net impact of the advisor identity on the merger gain.

Table 5.

The impact of acquirer’s choice of advisory services on deal outcomes.

4.3. Market Returns to the Acquirers

When acquirers retain the advisory services in-house, the acquirer’s CARs are 0.9% higher than when external advisory services are used, and the difference is statistically significant. Measuring at the sample mean of −1.5% acquirer CARs, in-house advisory services lead to a 60% higher acquirer merger gain (or 60% lower loss), which is both economically and statistically significant. This finding is robust in the two-stage treatment procedure, with a coefficient of 4.5% during the three-day window. The hazard ratio is significant at 2.5%, showing that the self-selection bias is significant. Consistent with the prior literature, we also find that transactions financed primarily by stock payments have lower CAR to the acquirers. As the relative asset size of the acquirer compared to the target is smaller (i.e., RelAsset increases), the acquirer receives higher CARs. Furthermore, deals with higher acquirer toeholds give more negotiation power and advantages to the acquirers, and lead to a higher acquirer return. We do not find that the acquirer wealth gain is related to the target performances prior to the transaction, except for the target’s net income growth prior to the deal.

Overall, from the acquirer’s market return perspective, our findings show that financial acquirers who retain advisory services in-house outperform those who use external advisory services. Being insiders of the M&A market, financial acquirers are capable of completing the deals themselves, and external advisory services may become costly to financial acquirers, although external advisors may provide valuable services to the financial acquirers, just as the services they provide to nonfinancial acquirers. For example, they may play a certification role in financial mergers, provide managers with legal protection from criticism and lawsuit from the board or shareholders in case of bad deals,7 and provide some other common advisory services. As we have shown earlier in this study, over 60% of financial acquirers use external advisory services. However, our results suggest that overall, for financial acquirers, the costs of using external advisory services outweigh the benefits.

4.4. Wealth Redistribution and Allocation Efficiency

We further explore how the acquirer’s choice of advisory services impacts the target and the combined wealth gains in M&A transactions. Acquirer advisors may affect the wealth gains through two effects. The first effect is the wealth redistribution effect, that is, the advisory services may result in a shift of wealth from the acquirer to the target, and vice versa. Some types of advisory services, such as deal suggestions, valuation, or financing arrangements influence wealth redistribution between the acquirer and the target; however, such services have no impact on the combined wealth gains of the acquirer and the target in the transaction. For example, if the acquirer’s advisor is to seek greater market share and therefore suggests a higher offer price, it will lead to a lower acquirer gain and a higher target gain. The total synergy produced by the newly merged entity is unchanged.

A second effect is the allocation efficiency effect, which is more commonly claimed by financial advisors. The allocation efficiency effect argues that M&A advisory services may help the merging firms achieve higher synergistic gains by bringing better business combinations. Since the advisors are extrinsically driven by advising fees and their future advising fees are largely impacted by their market share or the number of deals they have completed, they have great motivation to promote new businesses. This motivation of promoting new businesses is a double-edged sword for merging companies. On one hand, it may mean a new and better growth opportunity. On the other hand, they may advise the acquirers to conduct value-destroying, pre-emptive mergers before their competitors could make a move, which happened during the merger wave in the 1990s ().

We perform regressions of target CARs and combined CARs, reported in Table 5, Panels B, and C, to decompose the wealth redistribution and allocation efficiency effects. Panel B shows the regression results of target CARs. Acquisitions with in-house advisory services yield significantly higher CARs for targets, which are 4% higher in the OLS regression, and 18.7% higher in the two-stage procedure. This finding indicates that, when the acquirer relies on themselves and retains the advisory services in-house, both the acquirer and the target may receive a higher market return.

Among the control variables, we first find that higher target CARs are significantly associated with less experienced acquirers, lower acquirer toeholds, and more bidders. When the acquirers are less experienced in M&A or have a lower toehold over the target, or when there are more bidders in the transaction, the acquirers have lower negotiation power and therefore, more wealth gains may be shifted to the target. In addition, targets may gain higher CARs when their market-to-book ratio is lower, which is not surprising because a target with a lower M/B ratio is less overvalued or even undervalued in the market. Finally, we also find that target CARs are higher in in-state mergers and for relatively smaller targets.

Panel C in Table 5 reports the regression estimation of the combined CARs. We find that in-house advisory services to the acquirers lead to higher total synergies for the merging firms. However, the positive coefficients are only marginally significant in the treatment model.

Collectively, we find significant evidence that the acquirer and the target gains are all significantly higher if the financial acquirers retain the advisory services in-house than when they use external advisory services. The combined CARs are also higher with marginal significance. The findings suggest that in-house advisory services improve the overall quality of deals, consistent with the view that better allocation efficiency is achieved when the conflict of interests is reduced or eliminated.

4.5. Deal Completion Rate

In addition to wealth gain, another important factor to measure the outcome of M&A deals is the completion rate. Based on the descriptive statistics provided in Table 3, the completion rate of financial M&As is high, which is 95.3% among the 288 deals using in-house advisory services and 94% among the 443 deals. The difference, as reported in Table 5, Panel D, is insignificant, which is not surprising because financial M&As usually require complex regulatory approvals (), financial firms would estimate the likelihood of approval before taking action in the corporate control market. Thus, no matter whether the financial institutions rely on themselves or use external advisory assistance, deals with the low possibility of completion will not be announced or even initiated.

Two variables that have a significant effect on the completion rate are StockPay and #Bidder. This suggests that stock swap transactions are associated with higher completion rates than cash, consistent with (). Furthermore, more firms bidding for the target means that more firms and competitors view the target as a good and worthy investment, and therefore, the M&A transaction is more likely to be completed.

5. Conclusions

As the participation of financial institutions as acquirers in the M&A market rises, we investigate one important factor in the financial acquirer’s decision-making process in this study, i.e., their choice of advisory services. Our findings suggest that, compared to nonfinancial acquirers, financial acquirers are more likely to rely on themselves, instead of external advisors, in M&A transactions. When they face more complex transactions, e.g., the target is in a different state, the likelihood that they retain the advisory services in-house is even higher.

From the market-return perspective, the financial acquirers’ decision to rely on their own advisory skills seems to be wise. Controlling for the self-selection bias of the advisory choices, deals in which the financial acquirers rely on themselves yield significant higher market returns to the acquirer and the target and marginally significant combined market returns than those advised by external advisors. The comparison of the market returns between the in-house and the external advisory service groups provides a quasi-natural laboratory setting to examine the agency cost between acquirers, i.e., the principal, and their financial advisors, i.e., the agent. Our finding of a higher market return generated by in-house advisory services to the financial acquirers suggests that financial institutions have superior skills to create values in M&A transactions; however, when they participate in the M&A transactions as external advisors to the acquirers, the conflict of interests may outweigh the values created by their superior skills.

The findings in this study contribute to our understanding of what and why financial acquirers choose for advisory services. It also provides direct measurement of conflicts of interest between acquirers and their financial advisors in M&A transactions. However, it must be noted that the findings are based on M&A transactions announced from 1994 to 2010. As explained in footnote 3, we limit the sample period to 2010 when the Dodd–Frank Act was enacted. A major impact of the Dodd–Frank Act on the M&A market is the change in the size threshold for regulatory standard changes for bank holding companies. Therefore, extending the sample period post-2010 may create a sample selection bias for the study, that is, large or complicated M&As where financial advisors provide the most benefits are less likely to occur. The selection bias will lead to a confounding issue affecting our analysis of the impact of financial advisors on deals valuation. A possible extension of the study would investigate whether the conflicts of interest of using an external acquirer advisor become stronger or of less concern in the post-2010 period. Furthermore, this study compares the benefits of in-house vs. external advisors based on the abnormal market returns at the announcement of financial M&A transactions, which is the immediate or short-run wealth gains of the M&A transactions. Future studies may investigate the conflicts of interest between acquirers and their financial advisors based on the long-run benefits of using in-house vs. external advisory services, such as long-term abnormal returns or post-M&A operating performance.

Author Contributions

Conceptualization, H.Y. and J.H.; data curation, H.Y.; methodology, H.Y.; formal analysis, H.Y.; investigation, H.Y. and J.H. and Z.Z.; writing—original draft preparation, J.H. and H.Y. and Z.Z.; writing—review and editing, J.H. and H.Y. and Z.Z.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interests.

Notes

| 1 | This study is different from the prior literature on choices of advisory services in two ways. First, we focus on the players in the financial services industry only, who are “insiders” in the financial market and may be more experienced and professional in the M&A process. Therefore, it is uncertain whether external advisors may offer incremental benefits to the financial players, such as improving the completion rate, increasing market abnormal returns, etc. Second, this study focuses on the choices of acquirer advisors, not target advisors. The conflict of interests between the acquirer and their advisor is more pronounced than that between the target firm and the advisor. Usually, the advisory fee is contingent on deal completion and the magnitude of the advisory fee is largely tied to the transaction value (, ). Therefore, the acquirer’s advisor prefers a higher offer price to lock the deal whereas the acquirer would benefit by paying less in the acquisition. The situation is simpler on the target side because the incentives of the target firm and their advisor are aligned—both are willing to accept a higher offer price. Overall, the acquirers in the financial service industry provide a unique setting to investigate the cost and benefits of external vs. in-house advisory services in the M&A process. |

| 2 | The volume of the financial M&A market post financial crisis was low partially due to the Dodd–Frank Act which was enacted in 2010, and our sample ends in 2010 as well. In response to the financial crisis, the US enacted the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd–Frank Act). A major impact of the Dodd–Frank Act on the M&A market is the size threshold. It requires the Federal Reserve to establish regulatory standards based on individualized risk analysis for bank holding companies with assets greater than USD 50 billion. In other words, large banks with a size above USD 50 billion are facing more strict regulation and monitoring compared to smaller financial companies. Therefore, the incentive of the scale of economics is dampened with the threshold. In fact, bank or financial holding companies were reluctant to size up or merge, since doing so will move them up to the “above 50 billion thresholds” category. Thus, while extending the sample period into the post-crisis period provides the limited benefit of increased sample size, it will create a sample selection bias for the post-crisis deals. Large or complicated M&As where financial advisors provide the most benefits are less likely to occur in the first place. Such selection bias will be a confounding issue affecting our analysis of the impact of financial advisors on deals valuation. |

| 3 | () mention that the acquirer-side advisor information is sometimes unobservable in tender-offer deals even if an advisor is retained. Also see regulation M-A, Section 1012(b) for detailed requirements of information disclosure in tender offers. |

| 4 | The distribution of transaction values is highly skewed. Therefore, we convert the transaction value into log format in the regressions to eliminate biases. |

| 5 | The market timing theory in the M&A market is explained in (), and (). The acquirer uses its overvalued stock to purchase the target, driving poor long-run acquirer stock performance due to the correction of misvaluation. |

| 6 | It is also possible that over-confident managers go out of state and believe they can handle the deal themselves. However, our regression result (Table 5) shows that in-house deals of financial firms, overall, have higher quality. |

| 7 | () argue that managers of the acquirers obtain fairness opinions from financial advisors to protect themselves against potential lawsuit triggers by the outcome or performance of the M&As. Thus, investors are skeptical of such transactions and the acquirer’s announcement return is 2.3% lower. |

References

- Allen, Linda, Julapa Jagtiani, Stavros Peristiani, and Anthony Saunders. 2004. The role of bank advisors in mergers and acquisition. Journal of Money, Credit, and Banking 36: 197–224. [Google Scholar] [CrossRef]

- Amihud, Yakov, Baruch Lev, and Nickolaos G. Travlos. 1990. Corporate control and the choice of investment financing: The case of corporate acquisitions. The Journal of Finance 45: 603–16. [Google Scholar] [CrossRef]

- Andries, Alin Marius, Sabina Cazan, and Nicu Sprincean. 2021. Determinants of Bank M&As in Central and Eastern Europe. Journal of Risk and Financial Management 14: 621. [Google Scholar] [CrossRef]

- Asimakopoulos, Ioannis, and Panayiotis Athanasoglou. 2013. Revisiting the merger and acquisition performance of European banks. International Review of Financial Analysis 29: 237–49. [Google Scholar] [CrossRef]

- Asquith, Paul, Robert F. Bruner, and David W. Mullins, Jr. 1983. The gains to bidding firms from merger. Journal of Financial Economics 11: 121–39. [Google Scholar] [CrossRef]

- Bao, Jack, and Alex Edmans. 2011. Do investment banks matter for M&A returns? Review of Financial Studies 24: 2286–315. [Google Scholar]

- Bauer, Keldon J., Linda L. Miles, and Takeshi Nishikawa. 2009. The effect of mergers on credit union performance. Journal of Banking & Finance 33: 2267–74. [Google Scholar] [CrossRef]

- Berger, Allen N., and Timothy H. Hannan. 1998. The Efficiency Cost of Market Power in the Banking Industry: A Test of the “Quiet Life” and Related Hypotheses. The Review of Economics and Statistics 80: 454–65. [Google Scholar] [CrossRef]

- Berger, Philip G., and Eli Ofek. 1995. Diversification’s effect on firm value. Journal of Financial Economics 37: 39–66. [Google Scholar] [CrossRef]

- Boone, Audra L., and J. Harold Mulherin. 2008. Do auctions induce a winner’s curse? New evidence from the corporate takeover market. Journal of Financial Economics 89: 1–19. [Google Scholar] [CrossRef]

- Bowers, Helen M., and Robert E. Miller. 1990. Choice of investment banker and shareholders wealth of firms involved in acquisitions. Financial Management 19: 34–44. [Google Scholar] [CrossRef]

- Bradley, Michael, Anand Desai, and E. Han Kim. 1988. Synergistic gains from corporate acquisitions and their division between the stockholders of target and acquiring firms. Journal of Financial Economics 21: 3–40. [Google Scholar] [CrossRef]

- Brewer, Elijah, III, and Julapa Jagtiani. 2013. How Much Did Banks Pay to Become Too-Big-To-Fail and to Become Systemically Important? Journal of Financial Services Research 43: 1–35. [Google Scholar] [CrossRef]

- Cain, Matthew, and David J. Denis. 2013. Information Production by Investment Banks: Evidence from Fairness Opinions? The Journal of Law and Economics 56: 245–80. [Google Scholar] [CrossRef]

- Chang, Xin, Chander Shekhar, Lewis H. K. Tam, and Jiaquan Yao. 2016. The information role of advisors in mergers and acquisitions: Evidence from acquirers hiring targets’ ex-advisors. Journal of Banking & Finance 70: 247–64. [Google Scholar] [CrossRef]

- Chen, Fang, Jian Huang, Minghui Ma, and Han Yu. 2021. In-house deals: Agency and information asymmetry perspectives. Corporate Ownership & Control 18: 8–19. [Google Scholar] [CrossRef]

- DeLong, Gayle L. 2001. Stockholder gains from focusing versus diversifying bank mergers. Journal of Financial Economics 59: 221–52. [Google Scholar] [CrossRef]

- DeYoung, Robert, Douglas D. Evanoff, and Philip Molyneux. 2009. Mergers and acquisitions of financial institutions: A review of the literature. Journal of Financial Services Research 36: 87–110. [Google Scholar] [CrossRef]

- Du, Lijing, and Jian Huang. 2015. What determines M&A advisory fees? Southern Business & Economic Journal 38: 37–68. [Google Scholar]

- Golubov, Andrey, Dimitris Petmezas, and Nickolaos G. Travlos. 2012. When It Pays to Pay Your Investment Banker: New Evidence on the Role of Financial Advisors in M&As. The Journal of Finance 67: 271–311. [Google Scholar] [CrossRef]

- Guo, Jie (Michael), Yichen Li, Changyun Wang, and Xiaofei Xing. 2020. The role of investment bankers in M&As: New evidence on Acquirers’ financial conditions. Journal of Banking & Finance 119: 105298. [Google Scholar] [CrossRef]

- Hankir, Yassin, Christian Rauch, and Marc Umber. 2011. Bank M&A: A market power story? Journal of Banking & Finance 35: 2341–54. [Google Scholar] [CrossRef]

- Houston, Joel F., Christopher M. James, and Michael D. Ryngaert. 2001. Where do merger gains come from? Bank mergers from the perspective of insiders and outsiders. Journal of Financial Economics 60: 285–331. [Google Scholar] [CrossRef]

- Hunter, William C., and Julapa Jagtiani. 2003. An analysis of advisor choice, fees, and efforts in mergers and acquisitions. Review of Financial Economics 12: 65–81. [Google Scholar] [CrossRef]

- Hunter, William C., and Mary Beth Walker. 1990. An empirical examination of investment banking merger fee contracts. Southern Economic Journal 56: 1117–30. [Google Scholar] [CrossRef]

- Ismail, Ahmad. 2010. Are good financial advisors really good? The performance of investment banks in the M&A market. Review of Quantitative Finance and Accounting 35: 411–29. [Google Scholar] [CrossRef]

- Jayaraman, Narayanan, Ajay Khorana, and Edward Nelling. 2002. An Analysis of the Determinants and Shareholder Wealth Effects of Mutual Fund Mergers. The Journal of Finance 57: 1521–51. [Google Scholar] [CrossRef]

- Kale, Jayant R., Omesh Kini, and Harley E. Ryan. 2003. Financial Advisors and Shareholder Wealth Gains in Corporate Takeovers. The Journal of Financial and Quantitative Analysis 38: 475–501. [Google Scholar] [CrossRef]

- Kisgen, Darren J., Jun “QJ” Qian, and Weihong Song. 2009. Are fairness opinions fair? The case of mergers and acquisitions. Journal of Financial Economics 91: 179–207. [Google Scholar] [CrossRef]

- Knapp, Morris, Alan Gart, and David Becher. 2005. Post-Merger Performance of Bank Holding Companies, 1987–1998. The Financial Review 40: 549–74. [Google Scholar] [CrossRef]

- KPMG. 2021. 2021 Was a Blowout Year for M&A—2022 Could Be Even Bigger. Available online: https://advisory.kpmg.us/articles/2021/blowout-year-global-ma.html (accessed on 15 June 2022).

- Krishnan, C. N. V., and Jialun Wu. 2022. Market Misreaction? Evidence from Cross-Border Acquisitions. Journal of Risk and Financial Management 15: 93. [Google Scholar] [CrossRef]

- Krishnan, C. N. V., and Vasiliy Yakimenko. 2022. Market Misreaction? Leverage and Mergers and Acquisitions. Journal of Risk and Financial Management 15: 144. [Google Scholar] [CrossRef]

- Levitt, Steven D., and Stephen J. Dubner. 2009. Freakonomics: A Rogue Economist Explores the Hidden Side of Everything. New York: William Morrow. [Google Scholar]

- Malmendier, Ulrike, Marcus M. Opp, and Farzad Saidi. 2016. Target revaluation after failed takeover attempts: Cash versus stock. Journal of Financial Economics 119: 92–106. [Google Scholar] [CrossRef]

- McLaughlin, Robyn M. 1990. Investment-banking contracts in tender offers: An empirical analysis. Journal of Financial Economics 28: 209–32. [Google Scholar] [CrossRef]

- McLaughlin, Robyn M. 1992. Does the form of compensation matter? Investment banker fee contracts in tender offers. Journal of Financial Economics 32: 223–60. [Google Scholar] [CrossRef]

- Michel, Allen, Israel Shaked, and You-Tay Lee. 1991. An evaluation of investment banker acquisition advice: The shareholders’ perspective. Financial Management 20: 40–49. [Google Scholar] [CrossRef]

- Morck, Randall, Andrei Shleifer, and Robert W. Vishny. 1990. Do managerial objectives drive bad acquisitions? The Journal of Finance 45: 31–48. [Google Scholar] [CrossRef]

- PwC. 2021. Global M&A Trends in Financial Services: 2022 Outlook. Available online: https://www.pwc.com/gx/en/services/deals/trends/financial-services.html (accessed on 15 June 2022).

- Rau, P. Raghavendra. 2000. Investment bank market share, contingent fee payments, and the performance of acquiring firms. Journal of Financial Economics 56: 293–324. [Google Scholar] [CrossRef]

- Refinitiv. 2021. Global Mergers & Acquisitions Review; Full Year 2021. Available online: https://thesource.refinitiv.com/TheSource/getfile/download/eacef8be-ef5d-4335-b807-5db0db1cf6bc (accessed on 10 June 2022).

- Rhodes-Kropf, Matthew, David T. Robinson, and S. Viswanathan. 2005. Valuation waves and merger activity: The empirical evidence. Journal of Financial Economics 77: 561–603. [Google Scholar] [CrossRef]

- Servaes, Henri, and Marc Zenner. 1996. The role of investment banks in acquisitions. The Review of Financial Studies 9: 787–815. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1986. Large shareholders and corporate control. The Journal of Political Economy 94: 461–88. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 2003. Stock market driven acquisitions. Journal of Financial Economics 70: 295–311. [Google Scholar] [CrossRef]

- Smith, Brian W., and Laura R. Biddle. 2005. Is the Bank Merger Regulatory Review Process Ripe for Change? Bank Accounting and Finance 18: 9–14. [Google Scholar]

- Song, Weihong, Jie (Diana) Wei, and Lei Zhou. 2013. The value of “boutique” financial advisors in mergers and acquisitions. Journal of Corporate Finance 20: 94–114. [Google Scholar] [CrossRef]

- Stuart, Alix N. 2006. Are Your Secrets Safe? CFO Magazine. October 1. Available online: https://www.cfo.com/banking-capital-markets/2006/10/are-your-secrets-safe/ (accessed on 5 September 2021).

- Stulz, Rene M., Ralph A. Walkling, and Moon H. Song. 1990. The distribution of target ownership and the division of gains in successful takeovers. The Journal of Finance 45: 817–33. [Google Scholar] [CrossRef]

- Travlos, Nicholaos G. 1987. Corporate takeover bids, methods of payment, and bidding firms’ stock returns. The Journal of Finance 42: 943–63. [Google Scholar] [CrossRef]

- Zámborský, Peter, Zheng Joseph Yan, Erwann Sbaï, and Matthew Larsen. 2021. Cross-Border M&A Motives and Home Country Institutions: Role of Regulatory Quality and Dynamics in the Asia-Pacific Region. Journal of Risk and Financial Management 14: 468. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).