Assessment of Attractiveness of the Baltic States for Foreign Direct Investment: The TOPSIS Approach

Abstract

1. Introduction

2. The Concept of Foreign Direct Investment

The Factors Affecting FDI

3. Methodology

- w1 … wn—weight coefficients;

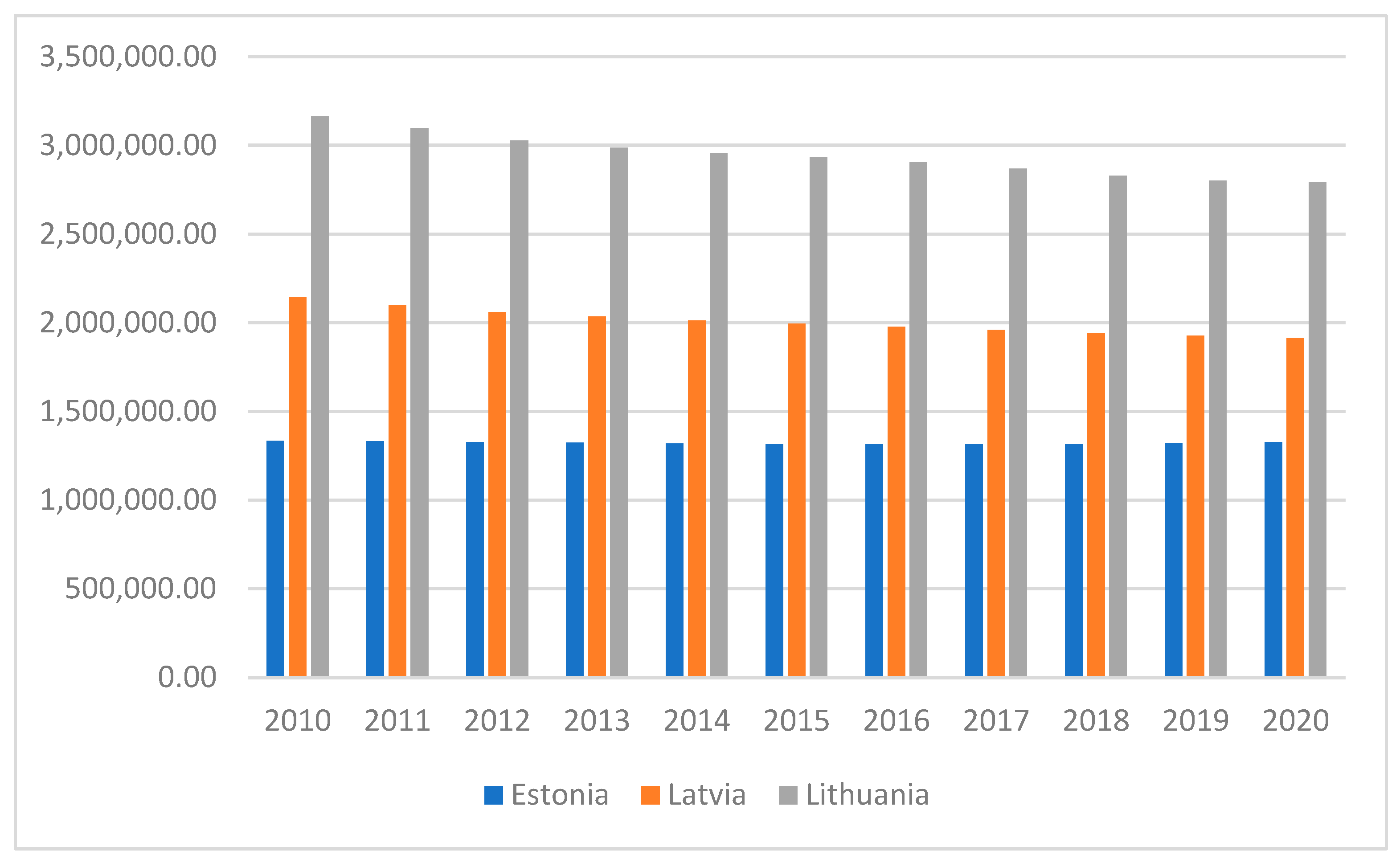

- R1—factor of population;

- R2—factor of market size;

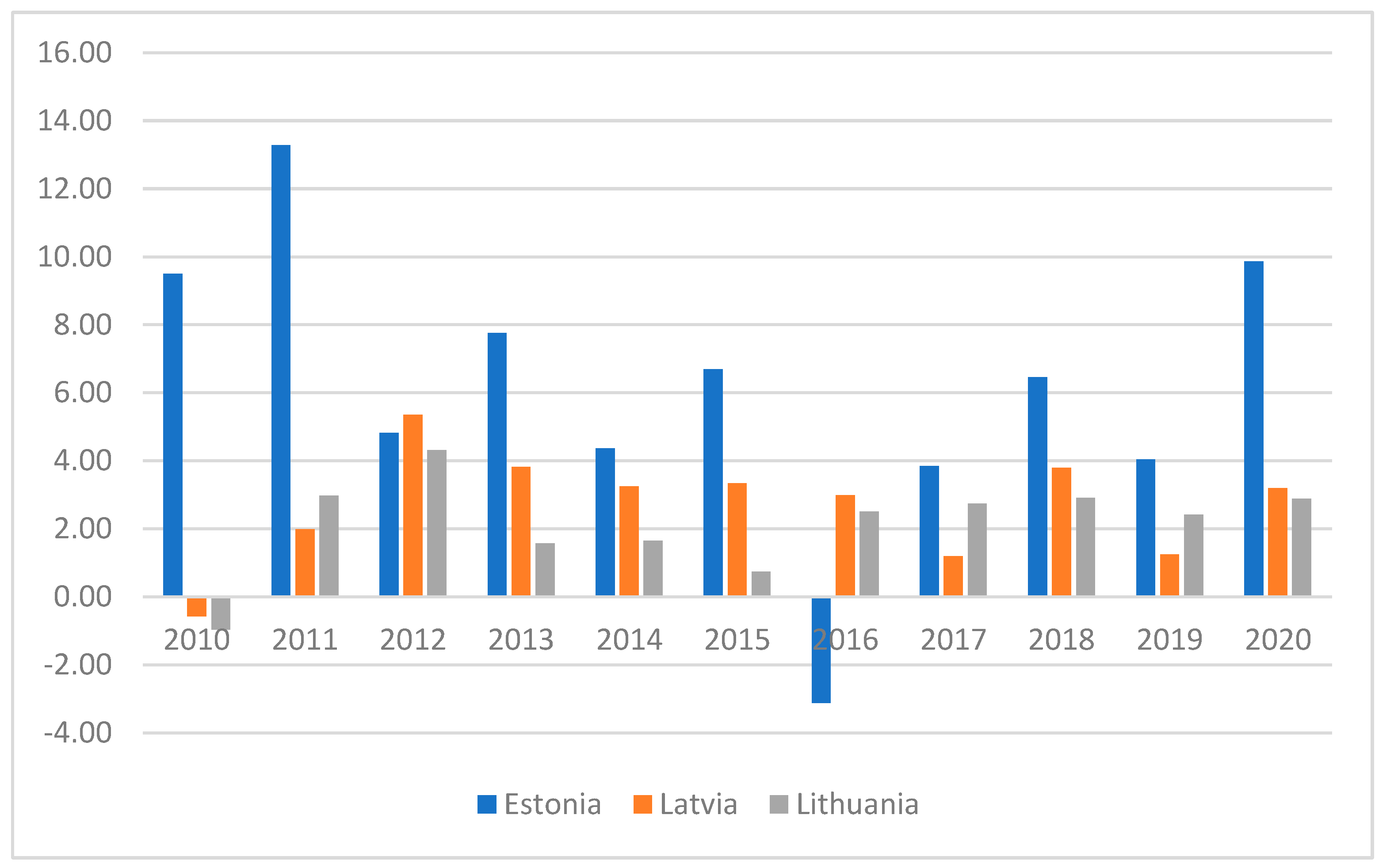

- R3—factor of GDP per capita;

- R4—factor of unemployment;

- R5—factor of education;

- R6—factor of energy consumption;

- R7—factor of transport infrastructure;

- R8—factor of communication infrastructure;

- R9—factor of ease of doing business;

- R10—factor of FDI inflows;

- R11—factor of trade openness;

- R12—factor of inflation;

- R13—factor of bribery and corruption;

- R14—factor of political stability;

- R15—factor of property rights;

- R16—factor of regulatory quality;

- R17—factor of government efficiency;

- R18—factor of the rule of law;

- R19—factor of income tax rates;

- R20—factor of research and development costs;

- R21—factor of labor costs.

- —the row sum of the normalized matrix;

- N—the number of criteria;

- wj—the weight of a single criterion.

- n—the number of indicators;

- C.I.—compatibility index;

- R.I.—the value of T. Saaty’s coefficients.

- rij—a standardized matrix with criteria weights wj = w1, w2, w3, …, wn;

- wj—the criterion weight for all js and ∑j = 1 wj = 1.

- I′ is related to the benefit criteria;

- I″ is related to the cost criteria;

- v—denotes normalization of the weight matrix, vij = wj*rij;

- A+—a positive ideal solution matrix;

- A−—a negative ideal solution matrix.

- si+—an alternative distance from the positive ideal solution, where i = 1, 2, 3, …, m;

- v—normalization of the weight matrix.

- si−—an alternative distance from the negative ideal solution, where i = 1, 2, 3, …, m;

- v—normalization of the weight matrix.

- CCi+—the positive ideal solution;

- si+—an alternative distance from the positive ideal solution;

- si−—an alternative distance from the negative ideal solution.

4. Research Results

5. Conclusions and Discussion of the Findings

- Based on the results of the scientific research, the concept of investment is defined as the allocation of monetary funds for material assets or the provision of services, with the expectation that this decision will become profitable in the future.

- Investment attractiveness is not a completely static concept. Most of the authors analyzed perceive investment attractiveness as an indicator that shows the accessibility of the region, the resources, and the infrastructure, the advantage over competitors, and the specific benefits related to the area.

- There is no unified investment attractiveness instrument; considering that investment attractiveness is influenced by many different factors, the author of the article sought to comprehensively assess the investment attractiveness of the Baltic states by using multi-criteria methods, including the following factors: population, market size, GDP per capita, unemployment, education, energy consumption, transport infrastructure, communication infrastructure, ease of doing business, trade openness, FDI inflows, inflation, bribery and corruption, political stability, property rights, quality regulation, government efficiency, the rule of law, income tax rates, research and development costs, and labor costs.

- After evaluating the attractiveness of the Baltic countries for FDI, Estonia can be said to remain the most attractive for FDI throughout the considered period (2010–2020). The evaluated results for Latvia and Lithuania changed only in 2011, when Lithuania was in the third position and Latvia in the second position.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agnihotri, Anurag. 2019. Study of Linkages between Outward Foreign Direct Investment (OFDI) and Domestic Economic Growth: An Indian Perspective. Financial Markets, Institutions and Risks 3: 43–49. Available online: http://armgpublishing.sumdu.edu.ua/journals/fmir/volume-3-issue-1/article-4/ (accessed on 20 April 2021). [CrossRef]

- Alina, Nitescu. 2018. Aspects of Foreign Direct Investment in the Romanian Economy. Annals-Economy Series, Constantin Brancusi University, Faculty of Economics 0: 125–30. [Google Scholar]

- Antonello, Michele, Luca Cipani, and Wolfgang J. Runggaldier. 2018. Minimizing Capital Injections by Investment and Reinsurance for a Piecewise Deterministic Reserve Process Model. Scandinavian Actuarial Journal 2018: 907–32. Available online: https://www.tandfonline.com/doi/full/10.1080/03461238.2018.1471001 (accessed on 20 April 2021). [CrossRef]

- Avetisyan, Ani. 2020. Country Attractiveness: Analysis of the Main Factors. Finance: Theory and Practice 24: 58–74. Available online: https://financetp.fa.ru/jour/article/view/1043 (accessed on 15 May 2021). [CrossRef]

- Baiashvili, Tamar, and Luca Gattini. 2020. Impact of FDI on Economic Growth: The Role of Country Income Levels and Institutional Strength. EIB Working Papers 2020/02, European Investment Bank (EIB). Available online: https://www.econstor.eu/bitstream/10419/214165/1/1690460822.pdf (accessed on 1 January 2020).

- Bayar, Yilmaz, Rita Remeikiene, Armenia Androniceanu, Ligita Gaspareniene, and Ramunas Jucevicius. 2020. The Shadow Economy, Human Development and Foreign Direct Investment Inflows. Journal of Competitiveness 12: 5–21. Available online: https://www.cjournal.cz/index.php?hid=clanek&bid=archiv&cid=352&cp= (accessed on 17 May 2021). [CrossRef]

- Bojnec, Štefan, and Imre Fertő. 2018. Globalization and Outward Foreign Direct Investment. Emerging Markets Finance and Trade 54: 88–99. Available online: https://www.tandfonline.com/doi/full/10.1080/1540496X.2016.1234372 (accessed on 5 January 2021). [CrossRef]

- Bruneckienė, Jurgita. 2010. Šalies Regionų Konkurencingumo Vertinimas Įvairiais Metodais: Rezultatų Analizė Ir Vertinimas. Economics & Management 15: 25–31. Available online: http://web.b.ebscohost.com/ehost/detail/detail?vid=5&sid=46d29dc4-d367-454e-a17f-0384733d0561%40pdc-v-sessmgr06&bdata=JnNpdGU9ZWhvc3QtbGl2ZQ%3D%3D#AN=53172840&db=bsu (accessed on 17 March 2020).

- Buchanan, Bonnie G., Quan V. Le, and Meenakshi Rishi. 2012. Foreign Direct Investment and Institutional Quality: Some Empirical Evidence. International Review of Financial Analysis 21: 81–89. Available online: https://linkinghub.elsevier.com/retrieve/pii/S1057521911000871 (accessed on 17 March 2020). [CrossRef]

- Burns, Darren K., Andrew P. Jones, Yevgeniy Goryakin, and Marc Suhrcke. 2017. Is Foreign Direct Investment Good for Health in Low and Middle Income Countries? An Instrumental Variable Approach. Social Science & Medicine 181: 74–82. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0277953617302083 (accessed on 20 April 2021).

- Černius, Gintaras. 2011. Namų Ūkio Finansų Valdymas. Available online: https://repository.mruni.eu/bitstream/handle/007/16837/9789955194057.pdf?sequence=1&isAllowed=y (accessed on 20 April 2021).

- Cicea, Claudiu, and Corina Marinescu. 2020. Bibliometric analysis of foreign direct investment and economic growth relationship. A research agenda. Journal of Business Economics and Management 22: 445–66. Available online: https://journals.vilniustech.lt/index.php/JBEM/article/view/14018 (accessed on 17 May 2021). [CrossRef]

- Cleeve, Emmanuel A., Yaw Debrah, and Zelealem Yiheyis. 2015. Human Capital and FDI Inflow: An Assessment of the African Case. World Development 74: 1–14. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0305750X1500087X (accessed on 7 September 2021). [CrossRef]

- Danilevičienė, Irena, and Vilma Lukšytė. 2017. The Assessment of Foreign Direct Investment Influence on The Country’s Economic Competitiveness. Mokslas-Lietuvos Ateitis 9: 183–96. Available online: https://journals.vilniustech.lt/index.php/MLA/article/view/549 (accessed on 7 September 2021).

- Donaubauer, Julian, Birgit Meyer, and Peter Nunnenkamp. 2016. Aid, Infrastructure, and FDI: Assessing the Transmission Channel with a New Index of Infrastructure. World Development 78: 230–45. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0305750X15002375 (accessed on 23 November 2021). [CrossRef]

- European Commission. 2010. Towards a Comprehensive European International Investment Policy. Brussels: European Commission, vol. 13, Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2010:0343:FIN:EN:PDF (accessed on 23 November 2021).

- Golubeva, Olga. 2020. Maximising International Returns: Impact of IFRS on Foreign Direct Investments. Journal of Contemporary Accounting & Economics 16: 100200. Available online: https://linkinghub.elsevier.com/retrieve/pii/S1815566918301401 (accessed on 23 November 2021).

- Grundy, Bruce D., and Patrick Verwijmeren. 2020. The External Financing of Investment. Journal of Corporate Finance 65: 101745. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0929119920301899 (accessed on 7 October 2021). [CrossRef]

- Hlaváček, Petr, and Beata Bal-Domańska. 2016. Impact of Foreign Direct Investment on Economic Growth in Central European Countries. Engineering Economics 27: 294–303. Available online: http://www.inzeko.ktu.lt/index.php/EE/article/view/3914 (accessed on 12 September 2021).

- Hnatenko, Iryna, Ihor Kuksa, Iryna Shtuler, Olga Orlova-Kurilova, and Viktoriia Rubezhanska. 2020. Innovation cluster as a mechanism for ensuring the enterprises interaction in the innovation sphere. Management Theory and Studies for Rural Business and Infrastructure Development 41: 487–500. Available online: https://ejournals.vdu.lt/index.php/mtsrbid/article/view/418 (accessed on 7 October 2021). [CrossRef]

- Iloie, Raluca Elena. 2015. Connections between FDI, Corruption Index and Country Risk Assessments in Central and Eastern Europe. Procedia Economics and Finance 32: 626–33. Available online: https://linkinghub.elsevier.com/retrieve/pii/S2212567115014422 (accessed on 11 May 2022). [CrossRef]

- Iwasaki, Ichiro, and Keiko Suganuma. 2015. Foreign Direct Investment and Regional Economic Development in Russia: An Econometric Assessment. Economic Change and Restructuring 48: 209–55. Available online: http://link.springer.com/10.1007/s10644-015-9161-y (accessed on 3 July 2022). [CrossRef]

- Jungmann, Hendrik, and Simon Loretz. 2019. On the Measurement of Investment Types: Heterogeneity in Corporate Tax Elasticities. The World Economy 42: 478–508. Available online: https://onlinelibrary.wiley.com/doi/10.1111/twec.12672 (accessed on 5 May 2022). [CrossRef]

- Kanapienytė, Laura, and Renata Činčikaitė. 2022. Evaluation of attractiveness of the EU member states for foreign direct investment. Business and Management 12: 114–23. [Google Scholar]

- Kearney, Andrew Thomas. 2021. On Shaky Ground. Available online: https://www.kearney.com/foreign-direct-investment-confidence-index (accessed on 20 July 2022).

- Kersan-Skabic, Ines. 2015. The Importance of Corporate Taxation for FDI Attractiveness of Southeast European Countries. Panoeconomicus 62: 105–22. Available online: http://www.doiserbia.nb.rs/Article.aspx?ID=1452-595X1501105K (accessed on 24 March 2022). [CrossRef]

- Kurul, Zühal, and A. Yasemin Yalta. 2017. Relationship between Institutional Factors and FDI Flows in Developing Countries: New Evidence from Dynamic Panel Estimation. Economies 5: 17. Available online: https://www.mdpi.com/2227-7099/5/2/17 (accessed on 27 March 2022). [CrossRef]

- Lahrech, Abdelmounaim, Sami Zaki Alabdulwahab, and Safaâ Bouayach. 2020. Nation branding and how it is related to foreign direct investment inflows. International Journal of Economics and Financial Issues 10: 248–55. Available online: https://www.econjournals.com/index.php/ijefi/article/view/9345 (accessed on 3 July 2022). [CrossRef]

- Łatuszyńska, Anna. 2014. Multiple-criteria decision analysis using Topsis method for interval data in research into the level of information society development. Folia Oeconomica Stetinensia 13: 63–76. [Google Scholar] [CrossRef]

- Lenaerts, Karolien, and Bruno Merlevede. 2018. Indirect Productivity Effects from Foreign Direct Investment and Multinational Firm Heterogeneity. Review of World Economics 154: 377–400. Available online: http://link.springer.com/10.1007/s10290-017-0298-9 (accessed on 17 October 2021). [CrossRef]

- Ly, Amadú, José Esperança, and Nebojsa S. Davcik. 2018. What Drives Foreign Direct Investment: The Role of Language, Geographical Distance, Information Flows and Technological Similarity. Journal of Business Research 88: 111–22. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0148296318301334 (accessed on 17 October 2021). [CrossRef]

- Maza, Adolfo, and José Villaverde. 2015. A New FDI Potential Index: Design and Application to the EU Regions. European Planning Studies 23: 2535–65. Available online: https://www.tandfonline.com/doi/full/10.1080/09654313.2015.1020771 (accessed on 5 May 2022). [CrossRef]

- Milesi-Ferretti, Gian-Maria, and Cédric Tille. 2011. The Great Retrenchment: International Capital Flows during the Global Financial Crisis. Economic Policy 26: 289–346. Available online: https://academic.oup.com/economicpolicy/article-lookup/doi/10.1111/j.1468-0327.2011.00263.x (accessed on 23 January 2022). [CrossRef]

- Mirza, Afrasiab, and Eric Stephens. 2020. Securitization and Aggregate Investment Efficiency. Journal of Financial Intermediation 52: 100894. Available online: https://linkinghub.elsevier.com/retrieve/pii/S1042957320300486 (accessed on 23 January 2022). [CrossRef]

- Oh, Hyun, and Woo Kim. 2018. The Effect of Analyst Coverage on the Relationship between Seasoned Equity Offerings and Investment Efficiency From Korea. Sustainability 10: 2704. Available online: https://www.mdpi.com/2071-1050/10/8/2704 (accessed on 17 December 2021). [CrossRef]

- Okada, Keisuke. 2013. The Interaction Effects of Financial Openness and Institutions on International Capital Flows. Journal of Macroeconomics 35: 131–43. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0164070412001103 (accessed on 17 December 2021). [CrossRef]

- Ortiz-de-Mandojana, Natalia, Pratima Bansal, and J. Alberto Aragón-Correa. 2019. Older and Wiser: ‘How CEOs’ Time Perspective Influences Long-Term Investments in Environmentally Responsible Technologies. British Journal of Management 30: 134–50. Available online: https://onlinelibrary.wiley.com/doi/10.1111/1467-8551.12287 (accessed on 5 December 2021). [CrossRef]

- Pantelidis, Pantelis, and Efthymios Nikolopoulos. 2008. FDI Attractiveness in Greece. International Advances in Economic Research 14: 90–100. Available online: http://link.springer.com/10.1007/s11294-007-9106-y (accessed on 3 February 2022). [CrossRef]

- Paul, Andreea, Oana Cristina Popovici, and Cantemir Adrian Cǎlin. 2014. The Attractiveness of CEE Countries for FDI. A Public Policy Approach Using the Topsis Method. Transylvanian Review of Administrative Sciences 10: 156–80. [Google Scholar]

- Podvezko, Valentinas. 2006. Neapibrėžtumo Įtaka Daugiakriteriniams Vertinimams. Verslas: Teorija ir Praktika 7: 81–88. [Google Scholar] [CrossRef]

- Rahim, Robbi, S. Supiyandi, A. P. U. Siahaan, Tri Listyorini, Andy Prasetyo Utomo, Wiwit Agus Triyanto, Yudie Irawan, Siti Aisyah, Mufida Khairani, Siti Sundari, and et al. 2018. TOPSIS method application for decision support system in internal control for selecting best employees. Journal of Physics: Conference Series 1028: 012052. [Google Scholar] [CrossRef]

- Sadeghi, Pegah, Hamid Shahrestani, Kambiz Hojabr Kiani, and Taghi Torabi. 2020. Economic Complexity, Human Capital, and FDI Attraction: A Cross Country Analysis. International Economics 164: 168–82. Available online: https://linkinghub.elsevier.com/retrieve/pii/S211070172030264X (accessed on 3 February 2022). [CrossRef]

- Samborskyi, Oleksandr, Oksana Isai, Iryna Hnatenko, Olga Parkhomenko, Viktoriia Rubezhanska, and Olena Yershova. 2020. Modeling of Foreign Direct Investment Impact on Economic Growth in a Free Market. Accounting 6: 705–12. Available online: http://www.growingscience.com/ac/Vol6/ac_2020_65.pdf (accessed on 5 December 2022). [CrossRef]

- Sarkodie, Samuel Asumadu, and Vladimir Strezov. 2019. Effect of Foreign Direct Investments, Economic Development and Energy Consumption on Greenhouse Gas Emissions in Developing Countries. Science of The Total Environment 646: 862–71. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0048969718328602 (accessed on 14 March 2022). [CrossRef]

- Shang, Xuesong, Hebing Duan, and Jingyi Lu. 2021. Gambling versus Investment: Lay Theory and Loss Aversion. Journal of Economic Psychology 84: 102367. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0167487021000076 (accessed on 14 March 2022). [CrossRef]

- Simelyte, Agne, Gitana Dudzeviciute, and Aušra Liucvaitiene. 2017. Scandinavian foreign direct investment and economic growth of the baltic states. European Journal of Sustainable Development 6: 105. Available online: https://ecsdev.org/ojs/index.php/ejsd/article/view/505/502 (accessed on 21 April 2022). [CrossRef]

- Valentinavičius, Stasys. 2012. Investicijos. Available online: https://www.vle.lt/straipsnis/investicijos/ (accessed on 20 July 2022).

- Wang, Jinhuan, Liyin Shen, Yitian Ren, J. Jorge Ochoa, Zhenhua Guo, Hang Yan, and Zezhou Wu. 2019. A Lessons Mining System for Searching References to Support Decision Making towards Sustainable Urbanization. Journal of Cleaner Production 209: 451–60. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0959652618332700 (accessed on 12 April 2022). [CrossRef]

- Younsi, Moheddine, and Marwa Bechtini. 2019. Does Good Governance Matter for FDI? New Evidence from Emerging Countries Using a Static and Dynamic Panel Gravity Model Approach. Economics of Transition and Institutional Change 27: 841–60. Available online: https://onlinelibrary.wiley.com/doi/10.1111/ecot.12224 (accessed on 20 July 2022). [CrossRef]

| Author | Concept Explanation |

|---|---|

| (Bayar et al. 2020) | FDI is a means for countries to gain new experience and management skills and to adjust to new production methods and thus raise competitiveness and promote economic growth. |

| (European Commission 2010) | FDI refers to the establishment of an investor’s company or the acquisition of a company (or a controlling stake in a company) in another country. |

| (Burns et al. 2017) | FDI is a widely recognized economic tool for promoting economic growth, higher wages, and generally better working conditions in low- and middle-income countries. |

| (Sadeghi et al. 2020) | FDI is a key element of globalization and the combination of capital, technology, management, and entrepreneurship that allows investors in a source country to produce goods and services elsewhere. |

| (Bojnec and Fertő 2018) | FDI is one of the processes through which the economy is internationalized. |

| (Alina 2018) | FDI is a long-term economic relationship related to an investor’s long-term interests in an economic entity located in a country other than the investor’s country. |

| (Kearney 2021) | FDI is a type of investment that involves a long-term relationship and represents the long-term interest and control of a resident in one economy over an enterprise (a FDI recipient, a subsidiary, or a foreign subsidiary) in another economy. |

| (Hlaváček and Bal-Domańska 2016) | FDI refers to investment where the largest part of the resources transferred is real capital, allowing an investing company to obtain full or partial control, respectively, as well as the right to participate in decision making when its share exceeds 10 percent of the total property. |

| (Lenaerts and Merlevede 2018) | FDI refers to investment providing long-term economic benefits, on the basis of which the relationships and interests between a direct investor and a direct investee are formed. |

| w1 | w2 | w3 | w4 | w5 | w6 | w7 | w8 | w9 | w10 | w11 | w12 | w13 | w14 | w15 | w16 | w17 | w18 | w19 | w20 | w21 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.08 | 0.08 | 0.08 | 0.04 | 0.04 | 0.04 | 0.04 | 0.08 | 0.025 | 0.025 | 0.025 | 0.025 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.08 | 0.08 | 0.08 |

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Estonia | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Lithuania | 2 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| Latvia | 3 | 2 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Estonia | 1 | 3 | 1 | 1 | 3 | 2 | 1 | 1 | 1 | 1 | 2 |

| Lithuania | 2 | 1 | 3 | 3 | 1 | 3 | 2 | 2 | 3 | 3 | 3 |

| Latvia | 3 | 2 | 2 | 2 | 2 | 1 | 3 | 3 | 2 | 2 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Činčikaitė, R.; Meidute-Kavaliauskiene, I. Assessment of Attractiveness of the Baltic States for Foreign Direct Investment: The TOPSIS Approach. J. Risk Financial Manag. 2023, 16, 63. https://doi.org/10.3390/jrfm16020063

Činčikaitė R, Meidute-Kavaliauskiene I. Assessment of Attractiveness of the Baltic States for Foreign Direct Investment: The TOPSIS Approach. Journal of Risk and Financial Management. 2023; 16(2):63. https://doi.org/10.3390/jrfm16020063

Chicago/Turabian StyleČinčikaitė, Renata, and Ieva Meidute-Kavaliauskiene. 2023. "Assessment of Attractiveness of the Baltic States for Foreign Direct Investment: The TOPSIS Approach" Journal of Risk and Financial Management 16, no. 2: 63. https://doi.org/10.3390/jrfm16020063

APA StyleČinčikaitė, R., & Meidute-Kavaliauskiene, I. (2023). Assessment of Attractiveness of the Baltic States for Foreign Direct Investment: The TOPSIS Approach. Journal of Risk and Financial Management, 16(2), 63. https://doi.org/10.3390/jrfm16020063