Abstract

Australian housing prices are reported to be overvalued and unaffordable for the past two decades. Many researchers and practitioners have attributed the persistent growth in housing prices to the prolonged period of low borrowing costs. However, due to inflationary pressure, the Central Bank has raised its cash rate consecutively in recent months. This paper aims to examine whether interest rate rises affect housing price in different parts of Australia. Evidence generated from the analysis reported bipolar results between the large and smaller cities, whereby housing prices in Sydney and Melbourne show a significant negative relationship with interest rate changes while Brisbane and the Gold Coast and Perth and Adelaide, respectively, are showing negative but insignificant results during the study period. Short-run trend projections on housing prices indicate that Sydney, Melbourne, Brisbane and the Gold Coast are on a downward trend while Adelaide and Perth will maintain its current momentum before plateauing out later next year. Likewise, control variables, such as oil prices, inflation rate and stock market performance, are found to be related to housing prices in larger cities only. These findings have implications on housing policy, house purchase decisions and investment portfolio management strategy.

1. Introduction

According to the OECD Report (2004) and Cox (2021) in Demographia International Housing Affordability 2021, Australian housing prices are overvalued and unaffordable. These reports indicated a 51.8 percent and 40 percent overvaluation in 2004 and 2021, respectively. The ratios of house prices to incomes and rents are also at the highest quantile of the OECD countries since 2003. In terms of affordability, Cox (2021) indicated that the median multiple of national house prices to household income was 6.4 times in Australia compared to the US’s 3.7 and UK’s 4.6 times in 2016. In the third quarter of 2021, the national house price to household income ratio deteriorated to 12.1 times to become severely unaffordable comparing to 5.1 times in UK and 5.0 times in the US (Cox 2022). In Sydney, it was 15.3 times, Melbourne 9.7 times, Adelaide 8 times, Perth 7.1 times and Brisbane 7.4 times, respectively. Generally, all five Australian major cities are in the severely unaffordable category. Sydney has become the second least affordable metropolitan in the world after Hong Kong. This overvaluation and severe unaffordability concur with increases in debt-to-income ratio, place Australia’s housing at the top quantile of the OECD countries. A recent study on the Australian housing market by Cho et al. (2021) asserts that the steadily increasing housing prices have attributed to a steady decline of home ownership. Additionally, they also found that the fundamental housing prices of all Australian cities are significantly overvalued. Melbourne and Sydney had their housing prices overvalued for the last two decades. The authors content that the near zero interest rate was one of the variables that affects the fundamental prices of the housing in Australia.

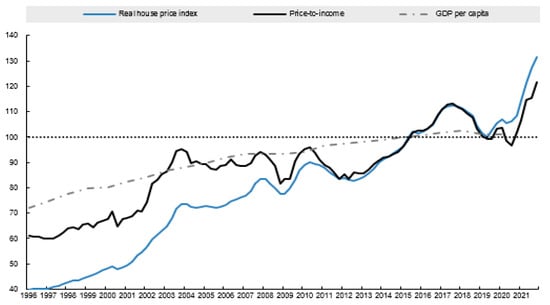

Figure 1 presents the development of Australia housing prices from 1996 to 2021. As can be seen from this figure, housing prices have surpassed the performance of GDP per capital in the past few years. Since the Global Financial Crisis (GFC) in 2008, researchers and industry analysts have been predicting an imminent housing market meltdown. Nonetheless, in the absence of a prominent trigger, the housing market crash predictions remains a common subject of talk until recently. In the past decade, despite being overvalued and coupled with high debt-to-income ratio, mortgage stress remains insignificant due to record low interest rates. An easing of monetary policy offers liquidity to the market whilst a contracting monetary policy works in the opposite direction. The historical low interest rate was one of the key factors that drove housing prices to greater heights (Cho et al. 2021). However, the recent surge in inflation rate has prompted the Reserve Bank of Australia to increase its cash rate each month since May 2022. These moves drive mortgage rates higher. The current high inflation and growing mortgage rates environment has put homeowners and investors into a new and uncertain situation. With that in mind, the main objectives of this study are:

Figure 1.

Development of Australia Housing Price, 1996–2021. Source: https://www.oecd.org/housing/data/affordable-housing-database/housing-market.htm; accessed on 3 September 2022.

- (i)

- To assess whether the increase in mortgage rate, as a result of the increases in cash rate implemented by the Central Bank, has a significant impact on the persistently rising housing prices in the different cities in Australia.

- (ii)

- To examine whether the increase in mortgage rates affects housing prices in different cities differently.

- (iii)

- To examine whether other factors, such as oil price, which influences inflation and economic growth and stock prices which represent an alternative investment, influence housing prices.

2. Background

Information gathered from OECD and Demographia indicates that Australia’s housing market has been overheated and overpriced the past twenty years. Strong demand on housing was not only generated by those who are buying a home but also from investors. Furthermore, investors’ willingness to pay beyond the fundamental value can be another factor that has driven housing prices high. Bubbles are usually formed when asset prices are rapidly increase beyond fundamental values and become unsustainable. The rise in property prices is driven by the market’s expectations or average beliefs about future price trends (Keynes 1936; Dovman et al. 2012). Information made available, particularly macroeconomic variables and policy changes related to the housing industry can influence market expectations as well.

Researchers and practitioners posit that factors that could attribute to a property crash are recession, a surge in interest rates or oversupply. By definition, when a crash happen, housing value would fall at least 20 percent market wide. In a recession, higher unemployment rate leads to high default rates and this debt servicing stress causes housing market plunges, similar to the one that happened in the previous GFC. The unemployment rate at the time of this study is low at 3.4%; therefore, it is unlikely that Australia is going into a recession soon. Housing oversupply could be another factor but the constant insufficient supply of land and the lack of builders in Australia have ruled out this possibility.

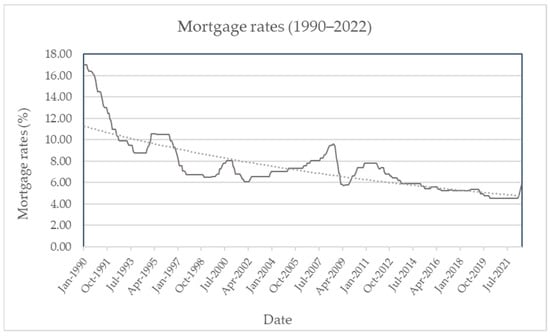

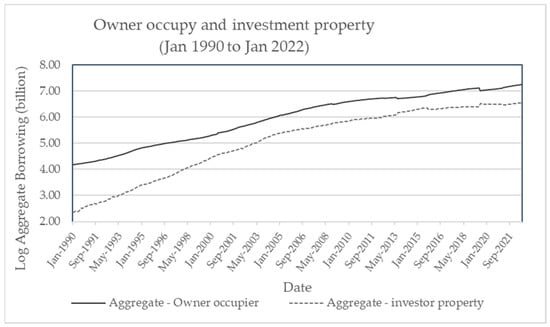

In Australia, the mortgage rate refers to the 3-year bank lending rate for house buyers. As can be seen from the graph (Figure 2), mortgage rates have been on a downward trend from its highest at 17 percent in 1990 to below 6 percent from 2013 until mid-2022. The lowest mortgage rate was 2.07 percent per annum offered by Bankwest in November 2020. In 2016, the cash rate in Australia was reduced to 1.5 percent and maintained at historical low between 0.10 percent to 1.5 percent from August 2016 until July 2022. This is beneficial to mortgage borrowers as it keeps the borrowing cost low. However, this more conducive borrowing environment has resulted in a steady growth of the aggregate borrowing from AUD 64.9 billion to 1413.6 billion for owner occupied home and an increase from 10.5 billion to 696.9 billion for investor housing from 1990 to 2022, respectively (see Figure 3).

Figure 2.

Mortgage rates (1990–2022). (Data Source: Reserve Bank of Australia, accessed on 3 September 2022). Note: Dashed line indicates that mortgage rate is on a downward trend.

Figure 3.

Aggregate borrowing (in log) (1990–2022).

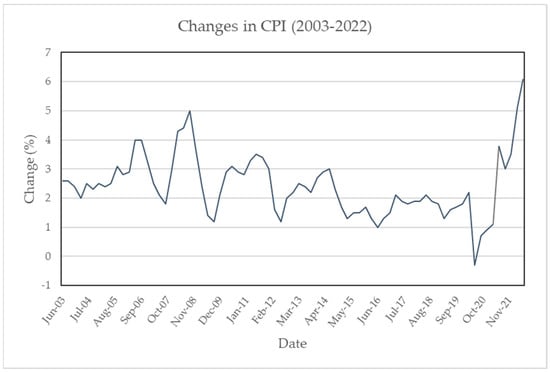

Nevertheless, the Central bank had reversed from its expansionary monetary policy due to the escalating inflation happening worldwide, including Australia (see Figure 4). In responding to the sudden surge of the inflation rate, the Reserve Bank of Australia has increased cash rate for 25 basis point in May 2022, followed by another four 50 basis point in June, July, August and September 2022.

Figure 4.

Changes in CPI (Quarterly, 2003–2022). (Data source: https://www.abs.gov.au; accessed on 3 September 2022).

Ambrose et al. (2013), in their study on Amsterdam’s housing prices, provided evidence that an overheated housing market does not necessarily readjust or end with a crash. A soft landing is possible with a fitting government policy. It would be interesting to see how the Australian housing market flares in a high inflation and rising interest rate environment.

3. Literature Review

Australia’s total housing value was estimated at AUD10.1 trillion in March 2022 (Australia Bureau of Statistics 2022), more than its total GDP at AUD 14,147 million as at June 2022. This informs the significance of the housing market in determining the financial stability of the economy. Numerous researchers have documented the importance of influencing housing prices through different government measures to maintain a healthy economy. Monetary policies and fiscal policies are the popular channels used to achieve this objective. Generally, it is accepted that a tightening monetary policy would help to curb an overheating housing market to prevent a housing crush (Williams 2016; Torre 2016). This is supported by Xu and Tang’s (2014) study which found that interest rate is negatively related to housing price in the UK 1971–2012. Chong and Liew (2020) studied the New Zealand housing market from 2009 and 2019 assert that mortgage rate is negatively related to housing prices, both in the short and long run. Studies by Upadhyaya et al. (2017) confirm the influential power of interest rates on housing price in the U.S whilst Zhang et al. (2018) report that, under a high money supply setting, there is a tendency for investors to bid, offer and trade significantly higher for houses than in a low money supply environment. Cho et al. (2021) studied the housing affordability in Australia and postulate that the deteriorating housing affordability and the deviation of housing prices from fundamental value in the past two decades are driven by low interest rates. As housing supply can be inelastic in the short to medium terms, lower interest rates lead to higher housing prices due to a higher demand.

Conversely, some studies contend that changes in monetary policy were not transmitted to housing prices. Dreger and Wolters (2011) posit that the association between expansionary monetary policy and housing prices are not significant while Cohen and Karpaviciute (2017) posit that interest rates are not a determinant of housing prices in Lithuania for 2005–2015. Tsai’s (2013) study on the UK market asserts that housing price increases under an expansionary monetary policy but market failed to react to a contracting monetary policy. A recent study by Yin et al. (2020) examines the impact of money supply (M2) and interest rate on housing prices in China. They contend that money supply affects housing prices positively in the medium run. On the other hand, monetary policy transmission via interest rate is not effective in China’s housing market.

In addition to interest rates, many researchers argue that housing prices and stock prices are interrelated as they are investment alternatives. An increase in stock prices might motivates investors to rebalance their portfolio by holding more houses while an increase in housing price will encourage investments in stocks (Bayer et al. 2013). Upadhyaya et al. (2017) contend that there is a bilateral relationship between stock prices and housing prices. Nonetheless, an earlier study by Fereidouni (2010) posits that there is no significant relationship between stock market performance and housing prices.

Oil price is another macroeconomic variable that could explain house price movements. In economies that rely on oil revenue (oil exporting countries), an increase in oil price will inject more investment into the housing market and lead to an increase in housing prices (Fereidouni 2010). Grossman et al. (2019) studied the effect of oil price shocks on housing prices in Texas (a major oil production centre) and contend that an oil price shock has the highest pass-through among oil-dependent cities. Australia is an oil importing country. An increase in oil prices will trigger higher logistic cost and lead to increases in the price of products and services. A high CPI induces rate hikes. Under this scenario, family expenditure increases, savings are reduced, and this can put pressure on the housing industry. If the growth in salary is slower than inflation, consumers will suffer from a loss in purchasing power. This could impact housing prices negatively. However, there are opposite forces at work as well. As oil prices are determined by the supply and demand forces, the easing of COVID-19 led to higher mobility and, therefore, higher demand. The Ukraine war also caused oil supply disruption shock. All these factors instigated higher oil price which were passed on to industry and consumers. In the context of housing industry, a higher oil price leads to higher building material costs which will bring about higher housing prices. Nonetheless, if wages are not keeping up, housing affordability will deteriorate and this would affect housing prices negatively. Hence, based on the discussions above, the impact of oil prices on housing price is mixed and inconclusive.

4. Methodology

In this study, intraday data spanning from September 2021 to September 2022 on housing index are sourced from CoreLogic, Australia. The data covers the five cities Sydney, Melbourne, Brisbane and Gold Coast, Adelaide and Perth. Data for mortgage rates, crude oil WTI and ASX 200 index were collected from Yahoo Finance, Reserve Bank of Australia and Australia Bureau of Statistics (2022). This data range was chosen as more dynamics in borrowing rates were exhibited during this period. Prior to this study period, mortgage rates had been unchanged for many years at an historical low (see Figure 2).

Based on the background information of the Australian housing market and the literature review discussed earlier, the research questions of this study are:

- (i)

- Do increases in mortgage rate as a result of the increases in cash rate implemented by the Central Bank have significant impact on housing prices in different cities in Australia?

- (ii)

- Do increases in mortgage rates affect housing price in different cities differently?

- (iii)

- Are there any associations between factors, such as oil price and stock market performance, and housing prices?

As the time series data for housing indexes are not normally distributed after log transformation, nonparametric statistical tests including Spearman’s correlation and Bootstrap regression are used to analyse and provide answers for the above questions. These statistical tests are discussed below.

4.1. Spearman’s Rank Correlation

Spearman correlation coefficient is a nonparametric rank statistic designed to measure the strength of association between two variables. This testing statistic assesses the extent of an arbitrary monotonic function which depicts the relationship between two variables with no further assumption being made about the frequency distribution (Zhang 2021). As the dataset for this study meets all the key assumptions required for the Spearman correlation test, it was used to gauge the association between variables in this study. The Spearman correlation coefficient can be defined as follows:

- ρ = Spearman’s rank correlation coefficient;

- di = difference between the two ranks of each observation;

- n = number of observations.

Whereby, ρ equals to +1 implies a perfect correlation between ranks and −1 indicates perfect negative correlation between ranks, while 0 means no correlation between ranks.

4.2. Bootstrap Regression

Bootstrapping regression model is another nonparametric approach used in this study as it does not require distributional assumptions. According to Cline (2019), bootstrapping analysis is asymptotically consistent and more accurate than using the standard intervals obtained using sample variance and the assumption of normality. Applying this analysis method, the daily data collected from September 2021 to September 2022 were resampled to perform the regression models stated below with 2000 bootstrap samples.

where Y = Sydney or Melbourne, Brisbane and Gold Coast, Perth, Adelaide housing price index

HPI (Y) = α + βX1 + βX2 + βX3 + ε

- X1 = Mortgage rate;

- X2 = WTI Crude Oil Index;

- X3 = ASX 200 index performance;

- ε = Error term.

5. Analysis and Findings

5.1. Descriptive Statistics

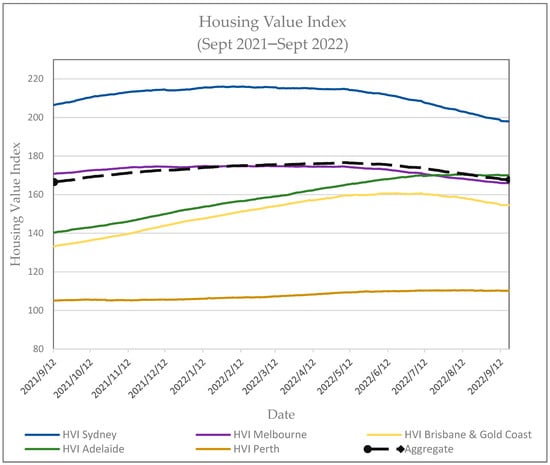

Line graphs of the housing value index for the five major cities under study and the national aggregate are depicted in Figure 5. From the figure, Sydney is outperforming all other cities and the national aggregate. It shows a decline after reaching its peak at 215 on May 2022. Melbourne being the second largest city has the second highest housing value after Sydney and displays a similar trend to that of Sydney during the study period. Adelaide ranked third in terms of housing price and displays strong growth with no sign of decline during the study period. Brisbane and Gold Coast ranked fourth in the chart with a steep growth until mid-August 2022. On the other hand, Perth’s housing was rather stable and represents the most affordable of the five major cities under study.

Figure 5.

Housing Value Index for the national aggregate, Sydney, Melbourne, Brisbane and Gold Coast, Adelaide and Perth.

5.2. Spearman’s Rho Correlation Analysis

Results of the correlation analysis performed using Spearman’s rho rank correlation are as shown in Table 1 below.

Table 1.

Spearman’s rho correlation matrix.

Based on the Spearman’s rho results shown in Table 1, among the five cities under study, housing values of Sydney and Melbourne are positively associated and this relationship is significant. However, housing prices in these two cities are negatively associated with those of Adelaide, Brisbane and Gold Coast and Perth. Results also indicated that Adelaide, Brisbane and Gold Coast and Perth are positively associated with each other.

On the other hand, analysis of the relationship between mortgage rate with variables included in this study indicate that there is an inverse relationship between mortgage rate with housing price of all cities, but this relationship is only significant for Sydney and Melbourne. A plausible reason is a higher mortgage rate in a stagnant wage growth and a high inflation environment has deteriorated borrowing power. With that, a house price correction is inevitable for the top two severely unaffordable cities. In addition, the mortgage rate was found to have a significant positive relationship with inflation rate and WTI crude, but it reported a significant negative relationship with ASX 200 performance.

The increasing CPI over the past twelve months shows a negative relationship with housing prices in all five cities, but only Sydney and Melbourne are significantly affected. CPI is also showing a significant positive relationship with WTI crude and mortgage rate. In addition, result of the analysis also indicates a significant inverse relationship between CPI and ASX200 performance.

A rise in WTI crude has two effects on housing. First, it brings about diminishing of spending power on other goods and services for individuals together with a lower demand of housing (Fereidouni 2010; Grossman et al. 2019). Second, it increases logistic cost which escalates building material and labour costs. Both forces are contradictory as the first one leads to more supply than demand, hence, a decrease in housing price whilst the latter push up housing prices due to higher construction cost. Spearman’s rho correlation analysis indicates a mild significant positive impact of WTI crude on Sydney’s housing price. Other cities however are displaying insignificant relationship with WTI crude movements.

The literature generally indicates a negative relationship between the performance of the share market and interest rates (Bayer et al. 2013). A higher interest rate discourages investment and promotes savings. In addition, as investment in housing represents a substitution of share investment, a negative relationship is expected. Nonetheless, only Brisbane and Gold Coast, Perth and Adelaide are displaying the expected sign in the Spearman’s rho test analysis but insignificant. On the contrary, for the more affluent cities, such as Sydney and Melbourne, stock market performance is positively related to housing price movement. Possible explanations for this phenomenon are (i) investors are more affluent in these two cities and, therefore, are financially capable of forming a more diversified investment portfolio, (ii) investors from these two larger cities have better financial literacy and hence, value portfolio diversification more and do not view property and stock investment as substitutes. Bootstrap regression analysis was conducted on the variables under study and the findings are discussed in the next section.

5.3. Bootstrap Regression Analysis and Results

As can been seen from Table 2, regressions are performed on five models to gauge the relations of housing performance across five cities with independent variables including mortgage rates, WTI crude index and ASX200 index. Results of R2 obtained from the analyses indicate that independent variables included in the model are able to explain variations of the housing performance in Sydney by 84.4 percent and Melbourne 87.5 percent, whereas the other three cities are in the range of 0.1 to 5 percent. The findings in Panel 1 (Sydney) and 2 (Melbourne) reveal that there is a significant negative relationship between mortgage rate and housing performance of Sydney and Melbourne. These findings are consistent with Chong (2020), Xu and Tang (2014) and Chong and Liew 2020). However, housing prices in smaller cities including Perth, Adelaide and Brisbane and Gold Coast are unaffected by interest rate during the study period. Indeed, larger cities, such as Sydney and Melbourne, display different characteristics comparing to other cities in Australia (Cho et al. 2021).

Table 2.

Results of Bootstrap regression.

These results have policy implications indicating that tightening the monetary policy through rising interest rates to ease inflationary pressure will produce different results for different city’s housing prices. For Sydney and Melbourne, both with extremely high-medium housing price at $1,601,467 and $1,101,612, respectively, as of January 2022, house owners are required to take on a much higher loan-to-income ratio comparing to those in Brisbane, Adelaide and Perth with medium housing prices of $792,065, $731,547 and $612,348, respectively (Lutton 2022). Under a low wage growth and inflationary environment, borrowing capability and repayment capability deteriorates, therefore, a housing correction is inevitable for cities with high housing prices. Under this scenario, homeowners would also sell their houses in Melbourne and Sydney and emigrate to more affordable cities to ease the burden of increasing mortgage rate. The availability of flexible work arrangements, such as working from home after the pandemic, have also provided opportunity for homeowners to move to cities with better housing affordability.

5.4. Trend Analysis

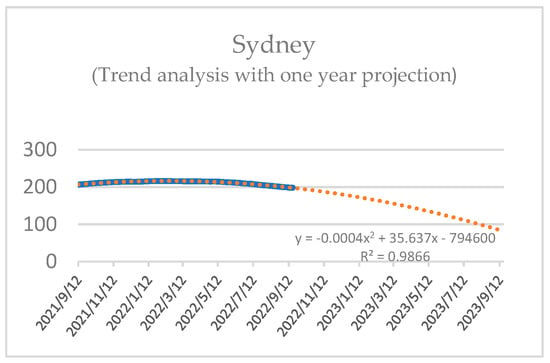

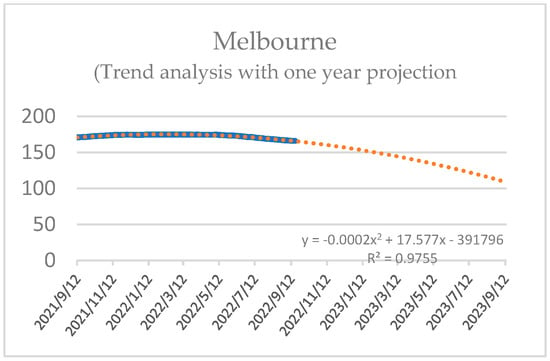

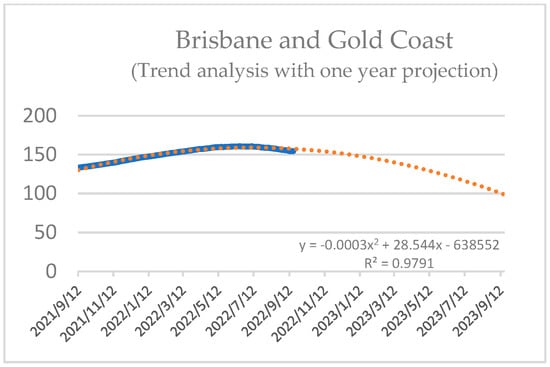

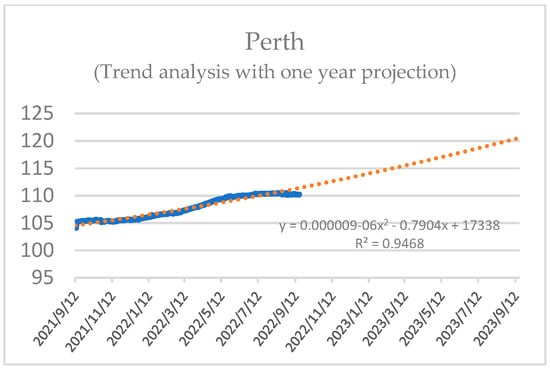

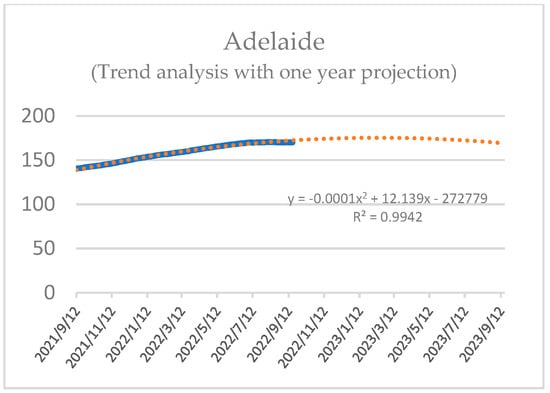

After completing the regression tests, using the data collected, trend analyses were performed on the five major cities. A one year projection was conducted, and the results are as shown in Figure 6, Figure 7, Figure 8, Figure 9 and Figure 10. From the figures below, we can see that Sydney, Melbourne, Brisbane and Gold Coast are on the downward trend, while Perth and Adelaide are trending upwards before slowing down in the second half of next year

Figure 6.

Trend analysis and one year prediction on housing prices for Sydney.

Figure 7.

Trend analysis and one year prediction on housing prices for Melbourne.

Figure 8.

Trend analysis and one year prediction on housing prices for Brisbane and Gold Coast.

Figure 9.

Trend analysis and one year prediction on housing prices for Perth.

Figure 10.

Trend analysis and one year prediction on housing prices for Adelaide.

6. Conclusions

The aim of this paper is to examine whether consecutive monthly mortgage rate hikes in Australia from May until September 2022 have affected housing prices in its five major cities. Correlation analyses indicated that mortgage rate has a significant inverse relationship with housing performance for cities with higher medium housing prices, such as Melbourne and Sydney. Positive significant relationships are also reported between WTI crude, inflation rate with mortgage rate and Sydney housing prices. Bootstrap regression results using independent variables including mortgage rate, WTI crude and ASX200 performance were also performed. Findings indicate that the proposed models are able to explain variations of the housing performance by 84.4 percent and 87.5 percent for Sydney and Melbourne, respectively but are insignificant for the smaller cities. As 49.86 percent of the total number of dwellings in Australia are in Sydney and Melbourne, this finding will contribute heavily to the overall national housing performance following the mortgage rate hikes. Based on the analysis discussed above, this study concludes that: (1) An increase in mortgage rate has a significant negative impact on the housing prices in Sydney and Melbourne. Other cities’ housing prices are negatively associated with interest rates, but were insignificant during the study period, (2) The increases in mortgage rate have affected housing prices in different cities differently and (3) The influence of oil price and stock price on housing prices are found to be insignificant for all cities except Sydney and Melbourne. As the evidence reported bipolar results between the large cites comparing to their smaller counterparts and low explanatory power for models of smaller cities, more factors need to be taken into consideration when analysing housing prices of the smaller cities. Among others, the availability of flexible work arrangement which motivates homeowners with higher debt-to-income ratio to liquidate properties situated in cities with higher housing prices to avoid rising mortgage payment and emigrate to a more affordable city are worth looking into. In addition, borrowing power, repayment capability and the level of financial literacy of existing and potential homeowners between different cities could also offer some explanations to housing price performance in Australia.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

References

- Ambrose, Brent, Piet Eichholtz, and Thies Lindenthal. 2013. House prices and fundamentals: 355 years of evidence. Journal of Money, Credit and Banking 45: 477–91. [Google Scholar] [CrossRef]

- Australia Bureau of Statistics. 2022. Total Value of Dwellings. Available online: https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/total-value-dwellings (accessed on 1 September 2022).

- Bayer, Patrick, Alvin Murphy, Robert McMillan, and Christopher Timmins. 2013. A Dynamic Model of Demand for Houses and Neighborhoods. ERID Working Paper No. 107. Durham: Duke University. [Google Scholar]

- Cho, Yunho, May Shuyun Li, and Lawrence Uren. 2021. Understanding housing affordability in Australia. The Australian Economic Review 54: 375–86. [Google Scholar] [CrossRef]

- Chong, Fennee. 2020. Housing price, mortgage interest rate and immigration. Real Estate Management and Evaluation 28: 36–44. [Google Scholar] [CrossRef]

- Chong, Fennee, and Venus K. Liew. 2020. New Zealand’s residential price dynamics: Do capability to consume and government policies matter? Economics Bulletin 40: 2262–74. [Google Scholar]

- Cline, Graysen. 2019. Nonparametric Statistical Methods Using R. London: Edtech Press. [Google Scholar]

- Cohen, Viktorija, and Lina Karpaviciute. 2017. The analysis of the determinants of housing prices. Independent Journal of Management and Production 8: 49–63. [Google Scholar] [CrossRef]

- Cox, Wendell. 2021. Demographia International Housing Affordability-2021. Frontier Centre for Public Policy. Available online: http://www.demographia.com/dhi.pdf (accessed on 20 September 2022).

- Cox, Wendell. 2022. Demographia International Housing Affordability-2022. Frontier Centre for Public Policy CID: 20.500.12592/2s4fmz. Available online: https://policycommons.net/artifacts/2273181/demographia-international-housing-affordability/3032994/ (accessed on 25 September 2022).

- Dovman, Polina, Sigal Ribon, and Yakhin Yakhin. 2012. The housing market in Israel 2008–2010: Are house prices a “bubble”? Israel Economic Review 10: 1–38. [Google Scholar]

- Dreger, Christian, and Jrgen Wolters. 2011. Liquidity and asset prices: How strong are the linkages? Review of Economics & Finance 1: 43–52. [Google Scholar]

- Fereidouni, Hassan. 2010. Analysis of fluctuation in housing prices in Iran. Housing Finance International 25: 19–22. [Google Scholar]

- Grossman, Valerie, Enrique Martinez-Garcia, Bernardo Torres, and Yongzhi Sun. 2019. Drilling down: The impact of oil price shocks on housing prices. The Energy Journal 40: 59–84. [Google Scholar] [CrossRef]

- Keynes, John. 1936. The General Theory of Employment, Interest and Money. London: Macmillan. [Google Scholar]

- Lutton, Ellen. 2022. Australia’s Median House Price Hits a Record $1.066 Million. Available online: https://www.domain.com.au/news/australias-median-house-price-hits-1-066-million-but-have-prices-peaked-1114685 (accessed on 10 September 2022).

- OECD Report. 2004. OECD Annual Report 2004. OECD. Available online: https://www.oecd-ilibrary.org/economics/oecd-annual-report-2004_annrep-2004-en (accessed on 10 September 2022).

- Torre, Juan. 2016. Asymmetric Effects of Monetary Policy on the Colombian House Prices. Vniversitas Economica 015124. Bogota: Universidad Javeriana. [Google Scholar]

- Tsai, I-Chun. 2013. The asymmetric impacts of monetary policy on housing prices: A viewpoint of housing price rigidity. Economic Modelling 31: 405–13. [Google Scholar] [CrossRef]

- Upadhyaya, Kamal, Dharmendra Dhakal, and Franklin Mixon. 2017. Housing prices, stock prices and the US economy. Applied Economics 49: 5916–22. [Google Scholar] [CrossRef]

- Williams, John. 2016. Measuring the effects of monetary policy on house prices and the economy. BIS Papers Chapters 88: 7–16. [Google Scholar]

- Xu, Lu, and Bo Tang. 2014. On the determinants of UK house prices. International Journal of Economics and Research 5: 57–64. [Google Scholar]

- Yin, Xiao-Cui, Chi-Wei Su, and Ran Tao. 2020. Has monetary policy caused housing prices to rise or fall in China? The Singapore Economic Review 6: 1601–18. [Google Scholar] [CrossRef]

- Zhang, Qingqi. 2021. Housing price prediction based on Multiple Linear regression. Hindawi Scientific Programming 2021: 7678931. [Google Scholar] [CrossRef]

- Zhang, Yang, Dongyue Mao, Baoyi Shi, and Michael Seiler. 2018. Money supply and housing price bubbles: Evidence from micro-experiments. Real Estate Finance 34: 139–46. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).