Abstract

Due to inadequate studies, our knowledge of the effect of female directors and national culture on the corporate response to climate change is still limited. To address this gap, the purpose of this paper is to investigate the dynamic relationship between gender diversity on the board of directors and corporate carbon proactivity and how two dimensions of national culture (individualism and indulgence) moderate this relationship. This study focuses on large companies that disclosed carbon-related information via the CDP survey in 2011–2017. Our findings show that gender diversity promotes corporate carbon proactivity. Furthermore, the positive effect of gender diversity on carbon proactivity is weaker when firms are in countries marked by a higher level of individualism and indulgence. As far as we know, this study is the first to explore and document the empirical evidence on the dynamic impact of gender diversity in the corporate governance body and national culture on managers’ climate change behaviors in terms of green proactivity.

1. Introduction

Over the past two decades, the academic literature has paid increasing attention to corporate carbon emissions and carbon accounting. Many studies have considered the consequences of corporate carbon decisions and issues (e.g., carbon disclosure, carbon emissions, and carbon risks) on financial markets. Some studies investigated how the enforcement of climate change regulations impacts market reactions and shareholder returns (Chapple et al. 2013; Jiang and Luo 2018; Luo and Tang 2014; Wang et al. 2021, 2022). Other studies explored the value relevance of carbon emissions or emissions allowances in different countries or regions, such as the United States, the European Union, the United Kingdom, Japan, and Australia (Baboukardos 2017; Choi et al. 2021; Clarkson et al. 2015; Griffin et al. 2017; Matsumura et al. 2014). Furthermore, Nguyen (2018) studied the relationship between carbon risk and firm performance. In contrast, Jung et al. (2018) and Herbohn et al. (2017) examined the effect of a firm’s carbon-related risk on lending decisions.

With the development of carbon emissions practices and the proposal of carbon-peak and carbon-neutral targets in all countries around the world, enterprises should respond to and manage climate change from the perspective of corporate governance mechanisms and carbon accounting practices. Several studies investigate whether and how corporate governance affects a firm’s carbon disclosures, assurance, and performance. For example, Prado-Lorenzo and Garcia-Sanchez (2010), Liao et al. (2015), Peters and Romi (2014), and Hollindale et al. (2019) examined the effects of characteristics of corporate boards, such as gender diversity, board independence, and the presence of an environmental committee and a chief sustainability officer on promoting information related to greenhouse gases (GHGs).1 In addition, Datt et al. (2018) found that firms with an environmental committee and carbon reduction incentives tend to adopt external carbon assurance. Furthermore, Haque (2017) documented that when companies have greater gender diversity on the board, they are inclined to undertake more carbon reduction initiatives. Luo and Tang (2021) reveal that the overall quality of corporate governance mechanisms is positively associated with corporate carbon performance. This positive effect is stronger when firms exhibit greater awareness of carbon risks and adopt a more proactive carbon strategy.

However, few studies have examined how firms’ governance mechanisms affect carbon proactivity. Corporate carbon proactivity includes a high level of awareness of climate change, transparent carbon disclosure, advanced carbon management activities, innovative carbon reduction initiatives, and leadership in response to climate change. Our study attempts to fill this gap in the literature by investigating how board gender diversity can play into firms’ proactive responses to addressing climate change. Previous literature finds that the presence of female directors on the board is an important corporate governance mechanism that plays a critical role in decision making in the corporate environmental, social, and governance domain (e.g., Bear et al. 2010; Ben-Amar et al. 2017; Liao et al. 2015; McGuinness et al. 2017; Post et al. 2011; Rao and Tilt 2016). Therefore, our study examines the impact of gender diversity on firms’ carbon proactivity. In addition, an extensive stream of prior studies documents that national institutions and culture may impact corporate social responsibility (CSR) codes, practices, and performance across firms (e.g., Ioannou and Serafeim 2012; Luo and Tang 2016a; Peng and Lin 2009). As a soft and implicit institution, national culture likely influences the perceptions of management concerning the severity and prominence of climate change and thus determines firms’ carbon strategy and proactivity. We also investigate whether and how national culture affects the association between gender diversity on the board and carbon proactivity.

Our research sample includes large companies from 16 countries that participated in the CDP (previously known as the Carbon Disclosure Project) survey from 2011 to 2017. Corporate carbon proactivity is measured based on the rank score developed by the CDP, which considers firms’ carbon disclosure, awareness, management, and leadership. Eight ordinal values (1–8) are assigned to represent the ranks of D–, D, C–, C, B–, B, A–, and A (the highest rank), respectively. The higher the value, the greater the carbon proactivity. We provide consistent empirical evidence that corporate carbon proactivity is positively affected by board gender diversity. We use Hofstede’s framework of national culture and focus on the dimensions of individualism and indulgence (Hofstede et al. 2010). Our results show that the positive effect of board gender diversity on carbon proactivity is weakened by the cultural dimensions of individualism and indulgence.

We make a few contributions to the current literature. First, our study fills a void in the literature on gender diversity on the board and carbon proactivity. Previous studies investigated the link between board gender diversity and CSR reporting (e.g., Bear et al. 2010; Ben-Amar et al. 2017; Liao et al. 2015; McGuinness et al. 2017; Post et al. 2011; Rao and Tilt 2016). In the carbon context, most early literature studied the relationship between gender diversity and the disclosure of carbon information (Hollindale et al. 2019; Liao et al. 2015; Peters and Romi 2014; Prado-Lorenzo and Garcia-Sanchez 2010). However, a measure of carbon disclosure only reveals how transparent a firm’s carbon information is; it does not reveal what the firm has performed to manage climate change. The carbon proactivity measure in our study is more comprehensive, as it combines green investment with carbon management and assurance. The previous higher disclosure score is different from greater proactivity and represents superior underlying performance a firm has conducted or achieved. Thus, disclosure does not fully reflect the various proactive activities a firm has undertaken to reduce carbon emissions. Our study sheds extra light on the role of gender diversity in promoting firms’ overall proactivity in addressing climate change.

Second, previous studies show the direct impact of national culture on firms’ environmental, social, and governance decisions (e.g., Luo and Tang 2016a; Peng and Lin 2009; Vitolla et al. 2019). To the best of our knowledge, no studies have examined the moderating effect of national culture on the relationship between board gender diversity and carbon proactivity. Our research tests two dimensions of national culture—individualism and indulgence—and suggests that the positive relationship between board gender diversity and carbon proactivity is weaker for companies domiciled in countries marked by more individualism and indulgence.

Third, our measure of corporate carbon proactivity is innovative. We use the CDP rank score (2016), which considers four aspects of corporate carbon strategy: Awareness, disclosure, management, and leadership. To the best of our knowledge, the current study is the first to investigate the interactive relationship between board gender diversity, national culture, and corporate carbon proactivity using the CDP carbon rank score approach.

Finally, we consider the influence of natural factors on corporate carbon proactivity. We argue that carbon activity is linked to geographic and climate-related factors that are not at the discretion of corporate directors. For example, in regions with higher temperatures, governments are more likely to adopt a stringent climate policy that will motivate companies to enhance carbon proactivity. Moreover, rising sea levels due to global warming may force businesses to move from lower-lying land to higher ground. Thus, businesses that are situated closer to sea level may be more prone to carbon proactivity. These effects of natural factors have been neglected in prior studies. As we use appropriate proxies to control for these effects, our empirical results are robust and convincing.

The remainder of the paper is structured as follows. Section 2 presents the theoretical background and literature review, and the hypotheses are developed in Section 3. We describe our research design in Section 4, including sample selection, the measurement of variables, and empirical models. In Section 5, we provide the empirical results. Section 6 presents our conclusions and the limitations of the study.

2. Literature Review

2.1. Board Gender Diversity and CSR

Resource dependency theory holds that an organization is an open system that needs to exchange resources from the outside; at the same time, it indicates that board diversity influences CSR (Bear et al. 2010). Thus, gender synergy on the corporate board is believed to be a valuable source of competitive advantage. Board diversity can expand board members’ networks and linkages to other firms as a result of the human capital provided by board members (Hillman et al. 2000; Hillman and Dalziel 2003), which may improve the environmental performance of the firm (Ben-Amar et al. 2017; Mallin and Michelon 2011).

Female directors may pay more attention to CSR reports and environmental, social, and governance disclosures (Griffin et al. 2021; Hafsi and Turgut 2013; Hillman et al. 2007). Females have the unique characteristics of being cooperative, polite, sympathetic, and empathetic (Griffin et al. 2021; Kramer et al. 2006); thus, female directors tend to care about the natural environment (Stevens 2010). Furthermore, empirical evidence suggests that boards with greater female representation are more stakeholder oriented (Al-Shaer and Zaman 2016; Katmon et al. 2019). When corporations include women directors on their boards, it sends a signal to society that they are oriented toward stakeholders (Ibrahim and Angelidis 1994). They may enhance environmental and social objectives more democratically (Hillman et al. 2002; Hussain et al. 2018) because female directors not only comply better with environmental regulations and policies but also are more prone to participate in CSR and charity (Bear et al. 2010; Boyd 1990; Glass et al. 2016; Manita et al. 2018; Post et al. 2011).

Women appear better able to tolerate different opinions, and conflict around carbon-related issues may be mitigated through open discussion and transparent information sharing (Nielsen and Huse 2010). The community-oriented characteristics of female directors not only strengthen a board’s understanding of communities’ social demands (Hollindale et al. 2019) but also lead to successful corporate environmental practices (Glass et al. 2016; Mun and Jung 2018) because of greater sensitivity to stakeholders’ concerns (Horbach and Jacob 2018; Isidro and Sobral 2015). Compared to male directors, female directors appear more participative, cooperative, and democratic (Eagly et al. 2003), and women’s leadership style is markedly different from men’s (Al-Shaer and Zaman 2016; Bear et al. 2010; Manita et al. 2018). Women leaders pay more attention to stakeholders and are more effective in corporate social and environmental matters (He and Jiang 2019; Husted 2005).

Critical mass theory as it relates to gender politics states that if women want to make a substantial change to corporate policy, they need to make up 30% of personnel. Galbreath (2010) provides empirical evidence supporting this theory and argues that if the percentage of female directors on the board is too low, they may not determine or change policy. Post et al. (2011) find a positive relationship between female directors and the quality of CSR information only when the number of female directors is no less than three. Empirical studies also show that female directors are more likely to support CSR activities from ethical initiatives, more effectively helping the company become a good corporate citizen than their male counterparts (Bear et al. 2010; Hafsi and Turgut 2013; Isidro and Sobral 2015; Liao et al. 2015; Rao and Tilt 2016).

Surveys and experiments in the fields of psychology and economics indicate that women tend to score lower on personal achievement and higher on community and public welfare relative to men, who are keener to exercise power and self-direction (Adams and Funk 2012; Schwartz and Rubel 2005). Meanwhile, by enhancing the transparency of information disclosure, female directors can play an essential role on the board (Gul et al. 2011). This is supported by empirical results of a positive relationship between the number of female directors and CSR practices (Ben-Amar et al. 2017; Prado-Lorenzo and Garcia-Sanchez 2010). Some studies also show that having more females on the board can decrease the risk of impression management and stimulate sustainable corporate practices and carbon reduction initiatives (Chams and García-Blandón 2019; Nadeem et al. 2017).

2.2. National Culture and CSR

Researchers have offered many definitions of national culture, which generally refers to the beliefs, values, codes of conduct, and artifacts shared by the members of a society (Peterson and Barreto 2018). The dimensions of culture are generally quantified in attempts to characterize national culture (e.g., Hofstede 1980; House et al. 2004). Cultural values are typically associated with firms’ strategic financial decisions (Chui et al. 2002), economic systems (Kwok and Solomon 2006), and stock price and trading (An et al. 2018; Grinblatt and Keloharju 2001).

Increasingly, studies focus on the relationship between national culture and nonfinancial decisions, such as CSR and environmental protection activities (e.g., Gallego-Álvarez and Ortas 2017; Luo et al. 2018; Luo and Tang 2016a; Vitolla et al. 2019; Wagner 2009). In particular, previous studies suggest that CSR is an outcome of cultural values and managerial discretion, which may influence the perception of management related to CSR matters (e.g., Finkelstein and Hambrick 1996; Wood 1991). Waldman et al. (2006) report that the individualism and power distance dimensions of national culture influence executives’ decisions around CSR. Husted (2005) indicates that power distance, individualism, and masculinity positively influence a nation’s sustainability. Williams (1999) shows that voluntary environmental disclosure correlates with uncertainty avoidance and masculinity.

Similarly, feminine societies tend to focus on social goals, such as protecting the physical environment (Van der Laan Smith et al. 2005). A “feminine” society refers to the overlapping of gender roles between men and women in society and believes that both men and women should be modest, gentle, and concerned about the quality of life. People will see “income, praise, ambition, and challenge” written on the masculinity pole; on the femininity side, it says “peace, cooperation, routine, and security”. Buhr and Freedman (2001) find that Canada tends to have higher environmental disclosure than America; the former is collectivist and the latter is individualist from the viewpoint of national culture. Individualism arises from a society in which individuals are rather loosely connected, and each person in the society tends to focus only on himself or his immediate family; as its opposite, Collectivism comes from a strong cohesive society, in which people are integrated from birth into a close-knit group that continuously protects in exchange for the absolute loyalty of each member. Furthermore, literature on the incentives behind corporate carbon reduction is emerging. Luo and Tang (2016a) find that national culture has a significant direct effect on corporate disclosure of carbon information. Yet there is still limited knowledge of how national culture interacts with corporate governance to jointly affect firms’ carbon decisions.

3. Hypothesis Development

3.1. Board Gender Diversity and Carbon Proactivity

We argue that greater gender diversity can enhance firms’ carbon proactivity. According to resource dependency theory, the unique experiences and skills of female directors help companies access various external resources and strengthen corporate carbon proactivity (Ben-Amar and McIlkenny 2015; Mallin et al. 2013) through the sharing of essential information and open communication. For example, Hollindale et al. (2019) argue that women directors can increase a board’s communication of community issues through value attunement. In this way, female representation on the board ensures that alternative considerations of climate change are offered (Bear et al. 2010).

Moreover, female directors, who are more democratic and participative, tend to care more about the natural environment than male directors (Eagly et al. 2003; Luo and Tang 2016a; Orij 2010). This encourages more open conversations and information sharing among board members (Eagly et al. 2003; Eagly and Johnson 1990) and increases board effectiveness around climate-related actions (Nielsen and Huse 2010). Owing to their community orientation, female directors are more sensitive to societal stakeholders’ interests, including climate change (Glass et al. 2016; Mallin and Michelon 2011). The prior literature provides empirical evidence that female directors are more proactive concerning sustainability initiatives, such as corporate low-carbon strategies (Bear et al. 2010; Glass et al. 2016; Liao et al. 2015; Mallin and Michelon 2011; Rao and Tilt 2016).

Thus, having greater female representation on the board promotes a company’s awareness of climate change and stimulates the use of low-carbon technologies to mitigate GHG emissions. Furthermore, a higher percentage of female directors reflects effective consideration of stakeholders’ demands (Ben-Amar et al. 2017; Liao et al. 2015). Moreover, Srinidhi et al. (2011) argue that female board members can improve board monitoring and oversight, ensuring that carbon strategies are implemented properly with genuine activities and adequate resources instead of just superficial slogans (Nielsen and Huse 2010). Therefore, we propose the following hypothesis:

H1.

Ceteris paribus, there is a positive association between board gender diversity and carbon proactivity.

3.2. The Moderating Effect of National Individualism

According to Matten and Moon (2008), the hypothesis about society and business may derive from different cultural systems. Crossland and Hambrick (2011) show that several cultural characteristics directly influence the decisions of management, which they conceptualize as executive action latitude (Hambrick and Finkelstein 1987). Thus, we would expect gender diversity to influence the ways in which firms respond to climate change differently across distinct societies with different cultures. Because climate change is highly uncertain, there is significant variation in corporate carbon proactivity across countries (Luo et al. 2012; Luo and Tang 2016a). Corporate carbon proactivity is influenced by national culture, and different dimensions may have different effects.

National culture has obvious effects on various organizational practices (Hofstede 1980), especially when formal institutions are weak or absent (Nakpodia et al. 2018). Prior empirical results show that moderating effects exist between national culture and firm innovation (Van Everdingen and Waarts 2003; Wu et al. 2019), corporate entrepreneurship (Turró et al. 2014), and corporate finance and governance outcomes (Hooghiemstra et al. 2015; Lewellyn and Muller-Kahle 2020). As an important part of the CSR strategy, carbon proactivity is a complex business decision related to environmental accountability (Hambrick and Finkelstein 1987; Smith et al. 2002). We focus here on the moderating effects of two dimensions of national culture (individualism and indulgence) on the relationship between board gender diversity and corporate carbon proactivity. We consider the moderating effect of individualism first.

In individualist cultures, individuals focus on their own interests and objectives over those of the group (Hofstede 1980). The philosophy behind individualism focuses on self-interest. The higher the individualism, the looser the society. In contrast, in collectivist groups, people care more about public welfare.

In a business environment, the accomplishment of corporate objectives can affect stakeholder judgment (Freeman 1984). Thus, corporate managers deal with CSR by participating in stakeholder activities. In individualist societies, the linkages between individuals are weaker and need driven (Hofstede 2001). People prioritize self-actualization over social concerns. In collectivist societies, individuals who desire lifelong relationships are loyal to in-groups. Organizations in collectivist cultures are more cooperative, participatory, and consultative (Buhr and Freedman 2001). The prior literature shows a negative link between individualism and CSR performance (Halkos and Polemis 2017; Ho et al. 2012), because collectivist cultures are more sensitive to stakeholder interests. Companies are more prone to disclose social responsibility information in collectivist societies than in individualist societies. Hence, the positive effect of board gender diversity on carbon proactivity may be reduced for firms in societies characterized by more individualism. We thus expect that the influence of board gender diversity on carbon proactivity will be weaker when firms operate in more individualist societies. Therefore, we propose the following hypothesis:

H2.

Higher levels of the cultural dimension of individualism weaken the positive relationship between board gender diversity and carbon proactivity.

3.3. The Moderating Effect of National Indulgence

The cultural dimension of indulgence (vs. restraint) refers to the degree to which a society is free to satisfy its desires instead of controlling its impulses through strict societal norms (Hofstede et al. 2010). Indulgence reflects the ability to control personal desires and wishes. Indulgent societies emphasize the importance of freedom of speech and personal life and allow individuals to enjoy life and have fun (Hofstede et al. 2010). In indulgent cultures, individuals tend to spend money and enjoy leisure, and they pay more attention to everyday enjoyment. In contrast, in restrained cultures, individuals try to control their impulses and desires. Until now, few studies have empirically shown the effects of indulgence on corporate carbon proactivity. Indulgent societies are more wasteful and extravagant, which increases environmental pollution. Whereas Halkos and Polemis (2017) find a positive relationship between indulgence and the disclosure of CSR information, Gallego-Álvarez and Ortas (2017) show a negative relationship between indulgence and CSR practices.

Climate change is marked by high uncertainty but has many negative outcomes for the environment, such as extreme weather, glacial melting, and rising sea levels (Stern 2006). Carbon proactivity is a long-term consideration in that people must control their current wasteful behavior although it may satisfy their current desires and wishes. Simultaneously, the willingness of society to seek out long-term results will influence the adoption of proactive carbon decisions and the innovation of green technologies. Individuals’ behavior is inevitably influenced by national culture. Corporate directors in more indulgent societies are prone to be more indulgent. They tend to spend money to satisfy stakeholders’ present desires and ignore social welfare, such as investment in CSR. A proactive carbon strategy to mitigate the effects of climate change seems more compatible with a national culture characterized by less indulgence. This is because directors, particularly female directors, in less indulgent societies may opt to save money for more proactive carbon reduction initiatives, providing additional assurances and promising more stable future weather. In this way, the positive effect of board gender diversity on carbon proactivity may be mitigated for firms in more indulgent societies. We thus expect that the positive effect of board gender diversity on carbon proactivity will be weaker when firms operate in more indulgent societies. According to the analysis, we propose our final hypothesis as follows:

H3.

Higher levels of the cultural dimension of indulgence weaken the positive relationship between board gender diversity and carbon proactivity.

4. Research Design

4.1. Sample Selection

Our sample comes from the CDP database. As a leading nongovernmental organization headquartered in the United Kingdom, the CDP collects comprehensive carbon information from the largest companies worldwide. The use of CDP data has two main advantages. First, the CDP uses standardized questionnaires and guidelines for all participating firms. This uniformity ensures consistency in companies’ carbon reports over time and means that data are more comparable spatially (Luo et al. 2012). Second, the CDP collects different types of carbon information relevant to different stakeholders’ decision making, including information on carbon initiatives and assurance, carbon emissions and reduction, carbon risk and opportunity, and carbon strategy and performance. It is one of the most comprehensive and credible sources of carbon data in the world. The CDP database has been widely used not only for academic study by scholars worldwide but also for commercial purposes by institutional investors (e.g., Bui et al. 2020; Griffin et al. 2017; Ioannou et al. 2016; Kolk et al. 2008; Matsumura et al. 2014; Qian and Schaltegger 2017; Reid and Toffel 2009).

Our initial sample includes the largest companies that respond to the CDP survey from 2011 to 2017. We first deleted companies with missing carbon rank scores, missing scores for dimensions of national culture, and missing financial data. Next, we excluded countries with fewer than 30 observations. Ultimately, we obtained a total of 2731 observations across 16 countries or regions covering 11 Global Industry Classification Standard sectors with firm level and year time. The sample selection process is presented in Table 1.

Table 1.

Sample Selection Process.

4.2. Measurement of Carbon Proactivity

We measured corporate carbon proactivity using the carbon rank score assigned to the firm by the CDP based on its responses to the annual CDP questionnaire. This rank score ranges from D to A (Guo et al. 2020), where a higher rank indicates greater carbon proactivity. Specifically, a grade of D means the company only discloses carbon information. A grade of C means the company not only discloses its GHG emissions and activities but is also aware of climate-related opportunities and risks. A grade of B indicates that the company has undertaken carbon reduction activities to manage its carbon emissions and risks and maximize its carbon opportunities. Finally, a grade of A shows that the company demonstrates leadership in carbon awareness, higher-quality disclosure of carbon information, and superior carbon governance and management (CDP Scoring Methodology 2018).

The CDP scoring methodology consists of three steps. In the first step, the CDP calculates points for carbon disclosure and awareness based on the company’s responses to the questionnaire. Next, the total points the company has been awarded out of the maximum available points is multiplied by 100. Finally, this score is rounded to the nearest whole number. Points for the management and leadership levels are weighted. Because the four levels are sequential, companies must achieve a score of at least 80% in the previous level to move to the next level and earn a higher ranking (CDP Scoring Methodology 2018, p. 6).

Here we converted the CDP’s carbon rank score (D– to A) to an ordinal scale (1–8), where 1 = D– and 8 = A. These values are used to measure carbon proactivity (the primary dependent variable in this study). A higher value represents greater carbon proactivity. In 2016, the CDP adopted a new carbon ranking system. Therefore, we transformed disclosure scores to rank scores for 2011 to 2015. The method used for this transformation is shown in Table 2. For example, if a company’s disclosure score for 2012 is 82, it is transformed to rank B, and the corresponding rank score is 6.

Table 2.

Process for converting the four consecutive levels from fractions to ranks.

4.3. Empirical Model

We used ordered multivariate logistic (OML) regression to estimate coefficients as specified in Equation (1) to test H1. We then introduced two interaction variables to test H2 and H3, respectively.

Firm-level data with year and industry fixed effect.

Firm-level data with year and industry fixed effect.

Firm-level data with year and industry fixed effect.

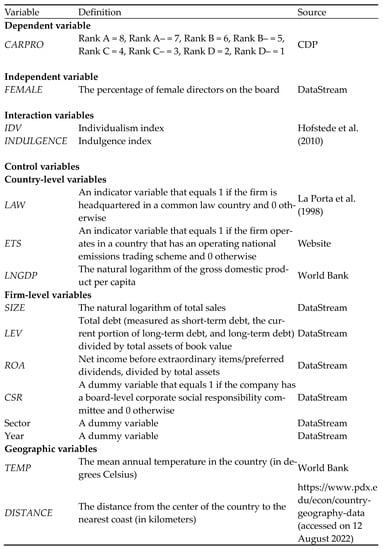

CARPRO is the dependent variable (carbon proactivity). FEMALE, which is the percentage of female board members, represents the firm’s board gender diversity. The individualism index (IDV) and indulgence index (INDULGENCE) identified and developed by Hofstede et al. (2010) are used as the primary test variables. FEMALE×IDV represents the interaction between individualism and board gender diversity, and FEMALE×INDULGENCE represents the interaction between indulgence and board gender diversity.

We considered three types of control variables. First, we controlled for firm-level factors that may influence carbon proactivity. Because large companies have the capability to do better CSR and are under greater social pressure (e.g., Ioannou et al. 2016), we controlled for firm size (SIZE), which is measured as the natural logarithm of total sales. Firm leverage (LEV) may restrict funding for carbon abatement projects, and thus it was controlled as well. The effect of financial resources on ethical activities and carbon decisions was represented by return on assets (ROA; Luo et al. 2013). Furthermore, a corporate board’s CSR orientation (CSR) may influence carbon proactivity practices; CSR was a dummy variable that equals 1 if the company has a CSR committee and 0 otherwise.

Second, we considered the impact of different institutional factors on corporate carbon behavior at the national level. The previous literature shows that the type of legal system in a country is related to the stakeholder or shareholder orientation of the society and thus affects CSR. Therefore, we controlled for the legal system (LAW) at the national level (Simnett et al. 2009). LAW equals 1 if the firm is headquartered in a region with a civil law system and 0 otherwise. In addition, as a major instrument for regulating climate change policy, the emissions trading scheme (ETS) is crucial to the impact of corporate carbon policy. Finally, the level of economic development in a region is closely related to its environmental policies, so we used the gross domestic product per capita (LNGDP) to control for the influence of the country’s economic development on carbon proactivity (Luo et al. 2013).

Third, we considered the impact of natural conditions on corporate carbon policies. Geographic factors are outside of managers’ control, but nevertheless, they have an impact on corporate carbon strategy that should not be ignored. Regions with higher temperatures, for example, may be more committed to reducing carbon emissions. As global warming melts glaciers and sea levels rise, regions closer to the sea will pay more attention to climate issues and resulting corporate carbon strategies. Thus, we included two geographic control variables: The mean annual temperature of the country (TEMP) and the distance from the center of the country to the nearest coastline (DISTANCE). Finally, the effects of sector and year were considered (e.g., Choi and Luo 2021; Choi et al. 2021; Luo et al. 2012). Figure 1 provides the definitions of variables.

Figure 1.

Definitions and Sources of Variables. Note: Hofstede et al. (2010); La Porta et al. (1998).

5. Empirical Results

5.1. Descriptive Analysis

Descriptive statistics for the variables are shown in Table 3. The mean CARPRO is 5.955, which implies that our sample firms’ average corporate carbon proactivity is 5.96 out of 8. The mean FEMALE is 20.008, which suggests the average percentage of female board members in our study sample. Concerning the independent variables, the mean IDV and INDULGENCE are 77.074 and 60.488, respectively. Regarding country-level variables, approximately 56% of the sample companies are from common-law countries that are shareholder oriented, 34.7% of countries participate in a national emissions trading scheme, and the mean LNGDP is 10.791. Furthermore, the mean SIZE is 16.18, which suggests our sample firms are among the world’s largest companies, comparable to prior empirical results (e.g., Guo et al. 2020; Lemma et al. 2019; Luo and Tang 2021). ROA is 6.131% and LEV is 26.028% in our sample. Regarding geographic factors that may affect corporate carbon proactivity, the mean TEMP is 8.713 and DISTANCE is 512.696. The descriptive statistics for the primary variables indicate that our sample is representative.

Table 3.

Descriptive Statistics (N = 2731).

Table 4 shows the distribution of the sample by sector (Panel A), year (Panel B), and country (Panel C). Panel A shows that of the 11 sectors represented by sample firms, industrials (17.87%), financials (15.82%), and consumer discretionary (12.78%) account for the most firms. Energy (3.37%), telecommunications (3.41%), and real estate (4.03) account for the least. Panel B reveals the sample size by year. The number of firms responding to the CDP increases from 355 (in 2011) to 473 (in 2016), then drops to 297 in 2017. This shows that overall, corporate awareness of carbon proactivity is increasing. Meanwhile, the year-by-year data show that the mean carbon proactivity trends upward over the study period, increasing from 4.721 in 2011 to 6.141 in 2017. Panel C shows the distribution of sample firms by country. Of the 16 countries represented, the United States (34.05%), the United Kingdom (14.87%), and Japan (13.15%) have the highest proportion of firms. Compared to the other countries, these three countries are more industrialized and pay more attention to low-carbon environmental protection.

Table 4.

Distribution of the Sample by Sector, Year, and Country.

Table 5 shows the correlations between the major independent variables and the dependent variable of the rank score. Regarding the independent variables of cultural dimension, individualism and indulgence are significantly correlated. The correlations between the other variables indicate that multicollinearity is not a problem in the sample.

Table 5.

Correlations (N = 2731).

5.2. Multivariate Regression Analysis

Table 6 reports our main regression results based on Equations (1)–(3). For all specifications, we use OML regression and control for year and industry fixed effects. Column (1) contains only our independent variable board gender diversity (FEMALE) and the control variables. Columns (2) and (3) add the interaction variables FEMALE×IDV and FEMALE×INDULGENCE to the main model to test the moderating effects of the cultural dimensions of individualism and indulgence on the association between gender diversity and carbon proactivity.

Table 6.

Results of OML Regression Based on Board Gender Diversity.

In Column (1), we see that the coefficient of FEMALE is positive and significant at the 1% level, which confirms H1 that companies with a higher percentage of female directors have better carbon proactivity. This result is compatible with Liao et al. (2015), who documented that companies are prone to voluntarily disclose carbon information when there is more gender diversity on the board. Regarding the control variables, SIZE and ROA are positively linked to carbon proactivity, which indicates that larger firms and more profitable firms are more likely to engage in carbon proactivity. However, the relationship between LEV and carbon proactivity is not significant in our sample. The coefficient of CSR is positive and significant at the 1% level, which suggests that boards with a stakeholder orientation have greater carbon proactivity. Consistent with our expectations, carbon regulations such as emissions trading schemes (ETS) have a positive effect on carbon proactivity. The coefficients of LAW, LNGDP, and TEMP are negative but not significant. One possible reason for this is that cultural factors may have a more substantial effect on carbon proactivity than economic factors. The coefficient of DISTANCE is negative and significant at the 5% level, which indicates that the shorter distance from the center of the country to the nearest coast, the greater the climate change proactivity, which suggests that geographic factors influence carbon proactivity.

The empirical results in Column (2) show that the interaction effect of FEMALE×IDV is negative and significant at the 5% level, which strongly supports H2 that the positive effect of board gender diversity on carbon proactivity decreases as individualism increases. Previous empirical literature shows that in collectivist societies, citizens value social responsibilities (e.g., in waste recycling) over self-actualization, and collectivist cultures are more cooperative, participatory, and consultative (Buhr and Freedman 2001). In regions with less individualism, corporate managers may feel more responsible for the broader social welfare and thus take on more corporate social responsibilities related to stakeholders.

In Column (3), we see that the interaction effect of FEMALE×INDULGENCE is negative and significant at the 10% level, which provides empirical evidence for H3. This indicates that female directors’ positive impact on carbon proactivity is weaker for firms in countries high in indulgence. Regions with higher scores for indulgence adopt relatively little carbon proactivity in response to climate change, which may be because low-carbon behaviors consume many social and economic resources (restructuring the local industrial chain, etc.), which is not in line with the ideals of a local culture that values current consumption and enjoys life in the present.

5.3. Robustness Tests

We ran a series of robustness tests to check our main findings. First, our sample only contains firms that voluntarily disclose carbon information to the CDP (Matsumura et al. 2014). To address this self-selection bias, we use Heckman’s (1979) two-stage estimation. In the first stage, we use maximum likelihood to design a Probit model to estimate a company’s likelihood of disclosing carbon emissions information. The Probit model is also a generalized linear model. When the dependent variable is a categorical variable, there are four commonly used analysis models: The Linear probability model (LPM), Logistic Model, Probit Model, and Log-linear model. In the same way as Logistic regression, Probit regression is also divided into binary Probit regression, ordered multiclassification Probit regression, and unordered multi-classification Probit regression.

Firm-level data with year and industry fixed effect.

In Equation (4), DIS equals 1 if the firm participates in the CDP and 0 otherwise. In the second stage, we perform OML regression controlling for year and industry effects. The empirical results (not shown) support our findings.

Second, U.S. firms account for as much as 34.05% of our sample. To address bias due to the uneven distribution among countries, we remove U.S. companies from the research sample and repeat the regression. Again, the results are not significantly different from our baseline findings. Third, instead of using OML regression in Model (1), we use Tobit regression to test our hypotheses, as the dependent variable ranges from 1 to 8. In the process of regression, sometimes continuous explained variables can only select a certain range of values because they are truncated or censored, which will lead to inconsistent estimators. Davidson and MacKinnon (2004) defined that if some observed values are systematically removed from the sample, it is called truncation. When no observations are eliminated, but some are limited to a certain point, this is called blocking. The Tobit regression results show that our main inferences remain unchanged. Fourth, because firms’ growth may influence carbon proactivity, we replace ROA with an alternative measure of profitability, TOBINQ, which equals the total market value at the end of the year. TOBINQ represents firms’ growth opportunities and is a longer-term index than ROA. Our results are still valid. Finally, we add Scope 1 and Scope 2, which are measured as the logarithm of total absolute Scope 1 and Scope 2 emissions, as control variables in our model. Scope 1 and Scope 2 emissions are significant GHG emissions that may affect corporate carbon proactivity. The results suggest that our main inferences are still qualitatively the same.

5.4. Further Analyses

Finally, we perform further analyses of subsamples of firms based on membership in a carbon-intensive sector, government policies, and legal system. First, we test whether our main results vary according to firms’ membership in a carbon-intensive sector (INTENSIVE). INTENSIVE equals 1 if the firm operates in a carbon-intensive sector (such as energy, materials, or utilities) and 0 otherwise (e.g., Choi and Luo 2021; Choi et al. 2021; Luo et al. 2012). Table 7 shows the results for gender diversity, the two cultural dimensions of individualism and indulgence, and carbon proactivity based on membership in a carbon-intensive sector. Our main inferences only hold for firms in carbon-intensive sectors, which suggests that board gender diversity plays a more prominent role in promoting carbon proactivity in carbon-intensive sectors than in non-carbon-intensive sectors. The moderating effects of individualism and indulgence also only exist for firms in carbon-intensive sectors, which implies that the relative effects of these cultural dimensions on carbon proactivity depend on firms’ membership in a carbon-intensive sector.

Table 7.

Results of subsample analyses based on membership in a carbon-intensive sector.

Second, we test whether the direct effect of board gender diversity varies between subsamples in countries with and without an emissions trading scheme. An emissions trading scheme is a government mechanism that establishes a market so firms can trade emissions allowances or rights. It sets a price for carbon that internalizes the cost of emissions for participating firms. ETS equals 1 if the country in which the firm is located has a national emissions trading scheme and 0 otherwise. An emissions trading scheme may amplify or diminish the effect of culture on carbon proactivity. The coefficients of the main variables in Table 8 are all significant and the same as our main results for both subsamples, except for the FEMALE×IDV coefficient in the subsample in countries without an emissions trading scheme.

Table 8.

Results of subsample analyses based on participation in a national emissions trading scheme.

Finally, there is a consensus among researchers that firms in countries with a common-law system tend to be under less pressure from shareholders to engage in carbon proactivity than firms in countries with a code-law system (and a stakeholder orientation; Hope 2003; Jaggi and Low 2000; Luo 2018; Luo and Tang 2016b; Zhou et al. 2016). The variable LAW equals 1 if the company is in a country with a common-law system and 0 otherwise. The empirical results in Table 9 show that the coefficient of FEMALE is positive and significant at the 1% level for firms in countries with a common-law system; we do not find any significant results for firms in countries with a code-law system. Concerning the interaction effect, FEMALE×IDV is positively related to carbon proactivity at the 5% level. This means that the effect of gender diversity on corporate carbon proactivity is sensitive to the country’s legal system.

Table 9.

Results of subsample analyses based on legal system.

6. Conclusions and Limitations

Our study shows that female board members play an essential role in firms’ carbon proactivity and exogenous informal institutions, such as national culture, when it comes to their influence on carbon productivity. After we control for factors such as the legal system, carbon regulations, and the natural environment, our empirical findings reveal the extent to which management’s proactive response to climate change depends on gender diversity on the corporate board. More specifically, we find that the cultural dimensions of individualism and indulgence have a significant conditioning influence on board gender diversity and corporate carbon proactivity. This study enhances the understanding of female directors’ role in corporate response to climate change under different cultural environments.

Our findings have a range of implications for policymakers, managers, and other stakeholders. Policymakers should consider cultural factors when advocating climate policies and regulations. Our results also suggest that corporations should pay more attention to the unique cultural backgrounds of local managers to ensure a more environmentally friendly board of directors. Such a team can help companies adopt a net-zero business model. Furthermore, the satisfaction of various stakeholders may bring many advantages to companies, such as reputation, low cost of debt, market share, and others.

It is true that our study has some limitations. First, our research sample includes the largest companies in each country that responded to the CDP survey. Future researchers need to study whether these conclusions hold for small and medium-sized companies. Second, we only tested the cultural dimensions of individualism and indulgence. Follow-up research can use our method to examine Hofstede’s other four dimensions (power distance, masculinity, long-term orientation, and uncertainty avoidance). In addition, future research can use alternative measures of national culture, for example, Global Leadership and Organizational Behavior Effectiveness, to investigate the effect of national culture on corporate carbon strategy.

Author Contributions

Methodology, H.W.; Formal analysis, H.W.; Investigation, T.G.; Resources, Q.T.; Data curation, T.G.; Writing—original draft, H.W.; Writing—review & editing, Q.T.; Visualization, T.G.; Supervision, Q.T.; Funding acquisition, H.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Humanities and Social Sciences Project of Ministry of Education [grant numbers 22YJA790063].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | The terms emissions, carbon emissions and equivalent, and GHG emissions are used interchangeably in this paper. |

References

- Adams, Renée B., and Patricia Funk. 2012. Beyond the glass ceiling: Does gender matter? Management Science 58: 219–35. [Google Scholar] [CrossRef]

- Al-Shaer, Habiba, and Mahbub Zaman. 2016. Board gender diversity and sustainability reporting quality. Journal of Contemporary Accounting & Economics 12: 210–22. [Google Scholar] [CrossRef]

- An, Zhe, Zhian Chen, Donghui Li, and Lu Xing. 2018. Individualism and stock price crash risk. Journal of International Business Studies 49: 1208–36. [Google Scholar] [CrossRef]

- Baboukardos, Diogenis. 2017. Market valuation of greenhouse gas emissions under a mandatory reporting regime: Evidence from the UK. Accounting Forum 41: 221–33. [Google Scholar] [CrossRef]

- Bear, Stephen, Noushi Rahman, and Corinne Post. 2010. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics 97: 207–21. [Google Scholar] [CrossRef]

- Ben-Amar, Walid, and Philip McIlkenny. 2015. Board effectiveness and the voluntary disclosure of climate change information. Business Strategy and the Environment 24: 704–19. [Google Scholar] [CrossRef]

- Ben-Amar, Walid, Millicent Chang, and Philip McIlkenny. 2017. Board gender diversity and corporate response to sustainability initiatives: Evidence from the Carbon Disclosure Project. Journal of Business Ethics 142: 369–83. [Google Scholar] [CrossRef]

- Boyd, Brian. 1990. Corporate linkages and organizational environment: A test of the resource dependence model. Strategic Management Journal 11: 419–30. [Google Scholar] [CrossRef]

- Buhr, Nola, and Martin Freedman. 2001. Culture, institutional factors and differences in environmental disclosure between Canada and the United States. Critical Perspectives on Accounting 12: 293–322. [Google Scholar] [CrossRef]

- Bui, Binh, Olayinka Moses, and Muhammad N. Houqe. 2020. Carbon disclosure, emission intensity and cost of equity capital: Multi-country evidence. Accounting & Finance 60: 47–71. [Google Scholar] [CrossRef]

- CDP Scoring Methodology. 2018. CDP Climate Change 2018 Scoring Methodology. Carbon Disclosure Project. Available online: https://guidance.cdp.net/en/guidance?cid=2&ctype=theme&idtype=ThemeID&incchild=1µsite=0&otype=ScoringMethodology&tags=TAG-599%2CTAG-605%2CTAG-646 (accessed on 16 July 2022).

- Chams, Nour, and Josep García-Blandón. 2019. Sustainable or not sustainable? The role of the board of directors. Journal of Cleaner Production 226: 1067–81. [Google Scholar] [CrossRef]

- Chapple, Larelle, Peter M. Clarkson, and Daniel L. Gold. 2013. The cost of carbon: Capital market effects of the proposed emission trading scheme. Abacus 49: 1–33. [Google Scholar] [CrossRef]

- Choi, Bobae, and Le Luo. 2021. Does the market value greenhouse gas emissions? Evidence from multi-country firm data. The British Accounting Review 53: 100909. [Google Scholar] [CrossRef]

- Choi, Bobae, Le Luo, and Pramila Shrestha. 2021. The value relevance of carbon emissions information from Australian-listed companies. Australian Journal of Management 46: 3–23. [Google Scholar] [CrossRef]

- Chui, Andy C. W., E. Lloyd Alison, and Chuck C. Y. Kwok. 2002. The determination of capital structure: Is national culture a missing piece to the puzzle? Journal of International Business Studies 33: 99–127. [Google Scholar] [CrossRef]

- Clarkson, Peter M., Yue Li, Matthew Pinnuck, and Gordon D. Richardson. 2015. The valuation relevance of greenhouse gas emissions under the European Union carbon emissions trading scheme. European Accounting Review 24: 551–80. [Google Scholar] [CrossRef]

- Crossland, Craig, and Donald C. Hambrick. 2011. Differences in managerial discretion across countries: How nation-level institutions affect the degree to which CEOs matter. Strategic Management Journal 32: 797–819. [Google Scholar] [CrossRef]

- Datt, Rina, Le Luo, Qingliang Tang, and Girijasankar Mallik. 2018. An international study of determinants of voluntary carbon assurance. Journal of International Accounting Research 17: 1–20. [Google Scholar] [CrossRef]

- Davidson, Russell, and James G. MacKinnon. 2004. Econometric Theory and Methods. New York: Oxford University Press. [Google Scholar]

- Eagly, Alice H., and Blair T. Johnson. 1990. Gender and leadership style: A meta-analysis. Psychological Bulletin 108: 233. [Google Scholar] [CrossRef]

- Eagly, Alice H., Mary C. Johannesen-Schmidt, and Marloes L. van Engen. 2003. Transformational, transactional, and laissez-faire leadership styles: A meta-analysis comparing women and men. Psychological Bulletin 129: 569–91. [Google Scholar] [CrossRef]

- Finkelstein, Sydney, and Donald C. Hambrick. 1996. Strategic Leadership: Top Executives and Their Effects on Organizations. Minneapolis and St. Paul: West Publishing. [Google Scholar]

- Freeman, R. Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Pitman. [Google Scholar]

- Galbreath, Jeremy. 2010. Corporate governance practices that address climate change: An exploratory study. Business Strategy and the Environment 19: 335–50. [Google Scholar] [CrossRef]

- Gallego-Álvarez, Isabel, and Eduardo Ortas. 2017. Corporate environmental sustainability reporting in the context of national cultures: A quantile regression approach. International Business Review 26: 337–53. [Google Scholar] [CrossRef]

- Glass, Christy, Alison Cook, and Alicia R. Ingersoll. 2016. Do women leaders promote sustainability? Analyzing the effect of corporate governance composition on environmental performance. Business Strategy and the Environment 25: 495–511. [Google Scholar] [CrossRef]

- Griffin, Dale, Kai Li, and Ting Xu. 2021. Board gender diversity and corporate innovation: International evidence. Journal of Financial and Quantitative Analysis 56: 123–54. [Google Scholar] [CrossRef]

- Griffin, Paul A., David H. Lont, and Estelle Y. Sun. 2017. The relevance to investors of greenhouse gas emission disclosures. Contemporary Accounting Research 34: 1265–97. [Google Scholar] [CrossRef]

- Grinblatt, Mark, and Matti Keloharju. 2001. How distance, language, and culture influence stockholdings and trades. The Journal of Finance 56: 1053–73. [Google Scholar] [CrossRef]

- Gul, Ferdinand A., Bin Srinidhi, and Anthony C. Ng. 2011. Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics 51: 314–38. [Google Scholar] [CrossRef]

- Guo, Ting, Guiliang Zha, Chyilin Lee, and Qingliang Tang. 2020. Does corporate green ranking reflect carbon-mitigation performance? Journal of Cleaner Production 277: 123601. [Google Scholar] [CrossRef]

- Hafsi, Taïeb, and Gokhan Turgut. 2013. Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. Journal of Business Ethics 112: 463–79. [Google Scholar] [CrossRef]

- Halkos, George E., and Michael L. Polemis. 2017. Does financial development affect environmental degradation? Evidence from the OECD countries. Business Strategy and the Environment 26: 1162–80. [Google Scholar] [CrossRef]

- Hambrick, Donald C., and Sydney Finkelstein. 1987. Managerial discretion: A bridge between polar views of organizational outcomes. Research in Organizational Behavior 9: 369–406. [Google Scholar]

- Haque, Faizul. 2017. The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. The British Accounting Review 49: 347–64. [Google Scholar] [CrossRef]

- Heckman, James J. 1979. Sample selection bias as a specification error. Econometrica 47: 153–61. [Google Scholar] [CrossRef]

- Herbohn, Kathleen, Ru Gao, and Peter Clarkson. 2017. Evidence on whether banks consider carbon risk in their lending decisions. Journal of Business Ethics 158: 155–75. [Google Scholar] [CrossRef]

- He, Xiaoping, and Shuo Jiang. 2019. Does gender diversity matter for green innovation? Business Strategy and the Environment 28: 1341–56. [Google Scholar] [CrossRef]

- Hillman, Amy J., Albert A. Cannella, and Ramona L. Paetzold. 2000. The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. Journal of Management Studies 37: 235–56. [Google Scholar] [CrossRef]

- Hillman, Amy J., Albert A. Cannella, Jr., and Ira C. Harris. 2002. Women and racial minorities in the boardroom: How do directors differ? Journal of Management 28: 747–63. [Google Scholar] [CrossRef]

- Hillman, Amy J., and Thomas Dalziel. 2003. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review 28: 383–96. [Google Scholar] [CrossRef]

- Hillman, Amy J., Christine Shropshire, and Albert A. Cannella, Jr. 2007. Organizational predictors of women on corporate boards. Academy of Management Journal 50: 941–52. [Google Scholar] [CrossRef]

- Ho, Foo Nin, Hui-Ming Deanna Wang, and Scott J. Vitell. 2012. A global analysis of corporate social performance: The effects of cultural and geographic environments. Journal of Business Ethics 107: 423–33. [Google Scholar] [CrossRef]

- Hofstede, Geert H. 1980. Culture’s Consequences: International Differences in Work-Related Values, 1st ed. London and Beverly Hils: Sage Publications, Inc. [Google Scholar]

- Hofstede, Geert H. 2001. Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organizations across Nations. London and Beverly Hils: Sage Publications. [Google Scholar]

- Hofstede, Geert H., Gert Jan Hofstede, and Michael Minkov. 2010. Cultures and Organisations: SOFTWARE of the Mind: Intercultural Operation and Its Importance for Survival, 3rd ed. New York: McGraw-Hill. [Google Scholar]

- Hollindale, Janice, Pamela Kent, James Routledge, and Larelle Chapple. 2019. Women on boards and greenhouse gas emission disclosures. Accounting & Finance 59: 277–308. [Google Scholar] [CrossRef]

- Hooghiemstra, Reggy, Niels Hermes, and Jim Emanuels. 2015. National culture and internal control disclosures: A cross-country analysis. Corporate Governance: An International Review 23: 357–77. [Google Scholar] [CrossRef]

- Hope, Ole-Kristian. 2003. Firm-level disclosures and the relative roles of culture and legal origin. Journal of International Financial Management & Accounting 14: 218–48. [Google Scholar] [CrossRef]

- Horbach, Jens, and Jojo Jacob. 2018. The relevance of personal characteristics and gender diversity for (eco-)innovation activities at the firm-level: Results from a linked employer-employee database in Germany. Business Strategy and the Environment 27: 924–34. [Google Scholar] [CrossRef]

- House, Robert J., Paul John Hanges, Mansour Javidan, Peter W. Dorfman, and Vipin Gupta. 2004. Culture, Leadership, and Organizations: The GLOBE Study of 62 Societies. Thousand Oaks: SAGE Publications, Inc. [Google Scholar]

- Hussain, Nazim, Ugo Rigoni, and René P. Orij. 2018. Corporate governance and sustainability performance: Analysis of triple bottom line performance. Journal of Business Ethics 149: 411–32. [Google Scholar] [CrossRef]

- Husted, Bryan W. 2005. Culture and ecology: A cross-national study of the determinants of environmental sustainability. MIR: Management International Review, 349–71. [Google Scholar]

- Ibrahim, Nabil A., and John P. Angelidis. 1994. Effect of board members gender on corporate social responsiveness orientation. Journal of Applied Business Research 10: 35–40. [Google Scholar] [CrossRef]

- Ioannou, Ioannis, and George Serafeim. 2012. What drives corporate social performance? The role of nation-level institutions. Journal of International Business Studies 43: 834–64. [Google Scholar] [CrossRef]

- Ioannou, Ioannis, Shelley Xin Li, and George Serafeim. 2016. The effect of target difficulty on target completion: The case of reducing carbon emissions. Accounting Review 91: 1467–92. [Google Scholar] [CrossRef]

- Isidro, Helena, and Márcia Sobral. 2015. The effects of women on corporate boards on firm value, financial performance, and ethical and social compliance. Journal of Business Ethics 132: 1–19. [Google Scholar] [CrossRef]

- Jaggi, Bikki, and Pek Yee Low. 2000. Impact of culture, market forces, and legal system on financial disclosures. The International Journal of Accounting 35: 495–519. [Google Scholar] [CrossRef]

- Jiang, Yan, and Le Luo. 2018. Market reactions to environmental policies: Evidence from China. Corporate Social Responsibility and Environmental Management 25: 889–903. [Google Scholar] [CrossRef]

- Jung, Juhyun, Kathleen Herbohn, and Peter Clarkson. 2018. Carbon risk, carbon risk awareness and the cost of debt financing. Journal of Business Ethics 150: 1151–71. [Google Scholar] [CrossRef]

- Katmon, Nooraisah, Zam Zuriyati Mohamad, Norlia Mat Norwani, and Omar Al Farooque. 2019. Comprehensive board diversity and quality of corporate social responsibility disclosure: Evidence from an emerging market. Journal of Business Ethics 157: 447–81. [Google Scholar] [CrossRef]

- Kolk, Ans, David Levy, and Jonatan Pinkse. 2008. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. European Accounting Review 17: 719–45. [Google Scholar] [CrossRef]

- Kramer, Vicki W., Alison M. Konrad, Sumru Erkut, and Michele J. Hooper. 2006. Critical Mass on Corporate Boards: Why Three or More Women Enhance Governance. Wellesley: Wellesley Centers for Women. [Google Scholar]

- Kwok, Chuck C. Y., and Tadesse Solomon. 2006. National culture and financial systems. Journal of International Business Studies 37: 227–47. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez de Silanes, Andrei Shleifer, and Robert W. Vishny. 1998. Law and Finance. Journal of Political Economy 106: 1113–55. [Google Scholar] [CrossRef]

- Lemma, Tesfaye T., Martin Feedman, Mthokozisi Mlilo, and Jin Dong Park. 2019. Corporate carbon risk, voluntary disclosure, and cost of capital: South African evidence. Business Strategy and the Environment 28: 111–26. [Google Scholar] [CrossRef]

- Lewellyn, Krista B., and Maureen I. Muller-Kahle. 2020. The corporate board glass ceiling: The role of empowerment and culture in shaping board gender diversity. Journal of Business Ethics 165: 329–46. [Google Scholar] [CrossRef]

- Liao, Lin, Le Luo, and Qingliang Tang. 2015. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47: 409–24. [Google Scholar] [CrossRef]

- Luo, Laura Le, and Qingliang Tang. 2016a. Does national culture influence corporate carbon disclosure propensity? Journal of International Accounting Research 15: 17–47. [Google Scholar] [CrossRef]

- Luo, Le, and Qingliang Tang. 2014. Carbon tax, corporate carbon profile and financial return. Pacific Accounting Review 26: 351–73. [Google Scholar] [CrossRef]

- Luo, Le, and Qingliang Tang. 2016b. The determinants of the quality of corporate carbon management systems: An international study. The International Journal of Accounting 51: 275–305. [Google Scholar] [CrossRef]

- Luo, Le, and Qingliang Tang. 2021. Corporate governance and carbon performance: Role of carbon strategy and awareness of climate risk. Accounting and Finance 61: 2891–934. [Google Scholar] [CrossRef]

- Luo, Le, Qingliang Tang, and Juan Peng. 2018. The direct and moderating effects of power distance on carbon transparency: An international investigation of cultural value and corporate social responsibility. Business Strategy and the Environment 27: 1546–57. [Google Scholar] [CrossRef]

- Luo, Le, Qingliang Tang, and Yi-Chen Lan. 2013. Comparison of propensity for carbon disclosure between developing and developed countries: A resource constraint perspective. Accounting Research Journal 26: 6–34. [Google Scholar] [CrossRef]

- Luo, Le, Yi-Chen Lan, and Qingliang Tang. 2012. Corporate incentives to disclose carbon information: Evidence from the CDP Global 500 report. Journal of International Financial Management & Accounting 23: 93–120. [Google Scholar] [CrossRef]

- Mallin, Christine A., and Giovanna Michelon. 2011. Board reputation attributes and corporate social performance: An empirical investigation of the US best corporate citizens. Accounting and Business Research 41: 119–44. [Google Scholar] [CrossRef]

- Mallin, Christine, Giovanna Michelon, and Davide Raggi. 2013. Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure? Journal of Business Ethics 114: 29–43. [Google Scholar] [CrossRef]

- Manita, Riadh, Giuseppina Bruna Maria, Rey Dang, and L’Hocine Houanti. 2018. Board gender diversity and ESG disclosure: Evidence from the USA. Journal of Applied Accounting Research 19: 206–24. [Google Scholar] [CrossRef]

- Matsumura, Ella Mae, Rachna Prakash, and Sandra C. Vera-Muñoz. 2014. Firm-value effects of carbon emissions and carbon disclosures. The Accounting Review 89: 695–724. [Google Scholar] [CrossRef]

- Matten, Dirk, and Jeremy Moon. 2008. “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. The Academy of Management Review 33: 404–24. [Google Scholar] [CrossRef]

- McGuinness, Paul B., João Paulo Vieito, and Mingzhu Wang. 2017. The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. Journal of Corporate Finance 42: 75–99. [Google Scholar] [CrossRef]

- Mun, Eunmi, and Jiwook Jung. 2018. Change above the glass ceiling: Corporate social responsibility and gender diversity in Japanese firms. Administrative Science Quarterly 63: 409–40. [Google Scholar] [CrossRef]

- Nadeem, Muhammd, Rashid Zaman, and Irfan Saleem. 2017. Boardroom gender diversity and corporate sustainability practices: Evidence from Australian Securities Exchange listed firms. Journal of Cleaner Production 149: 874–85. [Google Scholar] [CrossRef]

- Nakpodia, Franklin, Emmanuel Adegbite, Kenneth Amaeshi, and Akintola Owolabi. 2018. Neither principles nor rules: Making corporate governance work in Sub-Saharan Africa. Journal of Business Ethics 151: 391–408. [Google Scholar] [CrossRef]

- Nguyen, Justin Hung. 2018. Carbon risk and firm performance: Evidence from a quasi-natural experiment. Australian Journal of Management 43: 65–90. [Google Scholar] [CrossRef]

- Nielsen, Sabina, and Morten Huse. 2010. The contribution of women on boards of directors: Going beyond the surface. Corporate Governance: An International Review 18: 136–48. [Google Scholar] [CrossRef]

- Orij, René. 2010. Corporate social disclosures in the context of national cultures and stakeholder theory. Accounting, Auditing & Accountability Journal 23: 868–89. [Google Scholar]

- Peng, Yu-Shu, and Shing-Shiuan Lin. 2009. National culture, economic development, population growth and environmental performance: The mediating role of education. Journal of Business Ethics 90: 203–19. [Google Scholar] [CrossRef]

- Peters, Gary F., and Andrea M. Romi. 2014. Does the voluntary adoption of corporate governance mechanisms improve environmental risk disclosures? Evidence from greenhouse gas emission accounting. Journal of Business Ethics 125: 637–66. [Google Scholar] [CrossRef]

- Peterson, Mark F., and Tais S. Barreto. 2018. Interpreting societal culture value dimensions. Journal of International Business Studies 49: 1190–207. [Google Scholar] [CrossRef]

- Post, Corinne, Noushi Rahman, and Emily Rubow. 2011. Green governance: Boards of directors’ composition and environmental corporate social responsibility. Business & Society 50: 189–223. [Google Scholar]

- Prado-Lorenzo, Jose-Manuel, and Isabel-Maria Garcia-Sanchez. 2010. The role of the board of directors in disseminating relevant information on greenhouse gases. Journal of Business Ethics 97: 391–424. [Google Scholar] [CrossRef]

- Qian, Wei, and Stefan Schaltegger. 2017. Revisiting carbon disclosure and performance: Legitimacy and management views. The British Accounting Review 49: 365–79. [Google Scholar] [CrossRef]

- Rao, Kathyayini, and Carol Tilt. 2016. Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. Journal of Business Ethics 138: 327–47. [Google Scholar] [CrossRef]

- Reid, Erin M., and Michael W. Toffel. 2009. Responding to public and private politics: Corporate disclosure of climate change strategies. Strategic Management Journal 30: 1157–78. [Google Scholar] [CrossRef]

- Schwartz, Shalom H., and Tammy Rubel. 2005. Sex differences in value priorities: Cross-cultural and multimethod studies. Journal of Personality and Social Psychology 89: 1010. [Google Scholar] [CrossRef]

- Simnett, Roger, Ann Vanstraelen, and Wai Fong Chua. 2009. Assurance on sustainability reports: An international comparison. The Accounting Review 84: 937–67. [Google Scholar] [CrossRef]

- Smith, Peter B., Mark F. Peterson, and Shalom H. Schwartz. 2002. Cultural values, sources of guidance, and their relevance to managerial behavior: A 47-nation study. Journal of Cross-Cultural Psychology 33: 188–208. [Google Scholar] [CrossRef]

- Srinidhi, Bin, Ferdinand A. Gul, and Judy Tsui. 2011. Female directors and earnings quality. Contemporary Accounting Research 28: 1610–44. [Google Scholar] [CrossRef]

- Stern, Nicholas. 2006. The Stern Review on the Economics of Climate Change. Cambridge: Cambridge University Press. [Google Scholar]

- Stevens, Candice. 2010. Are women the key to sustainable development. Sustainable Development Insights 3: 1–8. [Google Scholar]

- Turró, Andreu, David Urbano, and Marta Peris-Ortiz. 2014. Culture and innovation: The moderating effect of cultural values on corporate entrepreneurship. Technological Forecasting and Social Change 88: 360–69. [Google Scholar] [CrossRef]

- Van der Laan Smith, Joyce, Ajay Adhikari, and Rasoul H. Tondkar. 2005. Exploring differences in social disclosures internationally: A stakeholder perspective. Journal of Accounting and Public Policy 24: 123–51. [Google Scholar] [CrossRef]

- Van Everdingen, Yvonne M., and Eric Waarts. 2003. The effect of national culture on the adoption of innovations. Marketing Letters 14: 217–32. [Google Scholar] [CrossRef]

- Vitolla, Filippo, Nicola Raimo, Michele Rubino, and Antonello Garzoni. 2019. The impact of national culture on integrated reporting quality. A stakeholder theory approach. Business Strategy and the Environment 28: 1558–71. [Google Scholar] [CrossRef]

- Wagner, Marcus. 2009. National culture, regulation and country interaction effects on the association of environmental management systems with environmentally beneficial innovation. Business Strategy and the Environment 18: 122–36. [Google Scholar] [CrossRef]

- Waldman, David A., Mary Sully de Luque, Nathan Washburn, Robert J. House, Bolanle Adetoun, Angel Barrasa, Mariya Bobina, Muzaffer Bodur, Yi-Jung Chen, Sukhendu Debbarma, and et al. 2006. Cultural and leadership predictors of corporate social responsibility values of top management: A GLOBE study of 15 countries. Journal of International Business Studies 37: 823–37. [Google Scholar] [CrossRef]

- Wang, Haifei, Hongjun Wu, and Peter Humphreys. 2022. Chinese Merchant Group Culture, Corporate Social Responsibility, and Cost of Debt: Evidence from Private Listed Firms in China. Sustainability 14: 2630. [Google Scholar] [CrossRef]

- Wang, Haifei, Ting Guo, and Qingliang Tang. 2021. The effect of national culture on corporate green proactivity. Journal of Business Research 131: 140–150. [Google Scholar] [CrossRef]

- Williams, S. Mitchell. 1999. Voluntary environmental and social accounting disclosure practices in the Asia-Pacific region: An international empirical test of political economy theory. The International Journal of Accounting 34: 209–38. [Google Scholar] [CrossRef]

- Wood, Donna J. 1991. Corporate social performance revisited. The Academy of Management Review 16: 691–718. [Google Scholar] [CrossRef]

- Wu, Jie, Zhenzhong Ma, and Zhiyang Liu. 2019. The moderated mediating effect of international diversification, technological capability, and market orientation on emerging market firms’ new product performance. Journal of Business Research 99: 524–33. [Google Scholar] [CrossRef]

- Zhou, Shan, Roger Simnett, and Wendy J. Green. 2016. Assuring a new market: The interplay between country-level and company-level factors on the demand for greenhouse gas (GHG) information assurance and the choice of assurance provider. Auditing: A Journal of Practice & Theory 35: 141–68. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).