ECB Monetary Policy and the Term Structure of Bank Default Risk

Abstract

:1. Introduction

2. Literature and Hypotheses

3. Data and Sample Selection

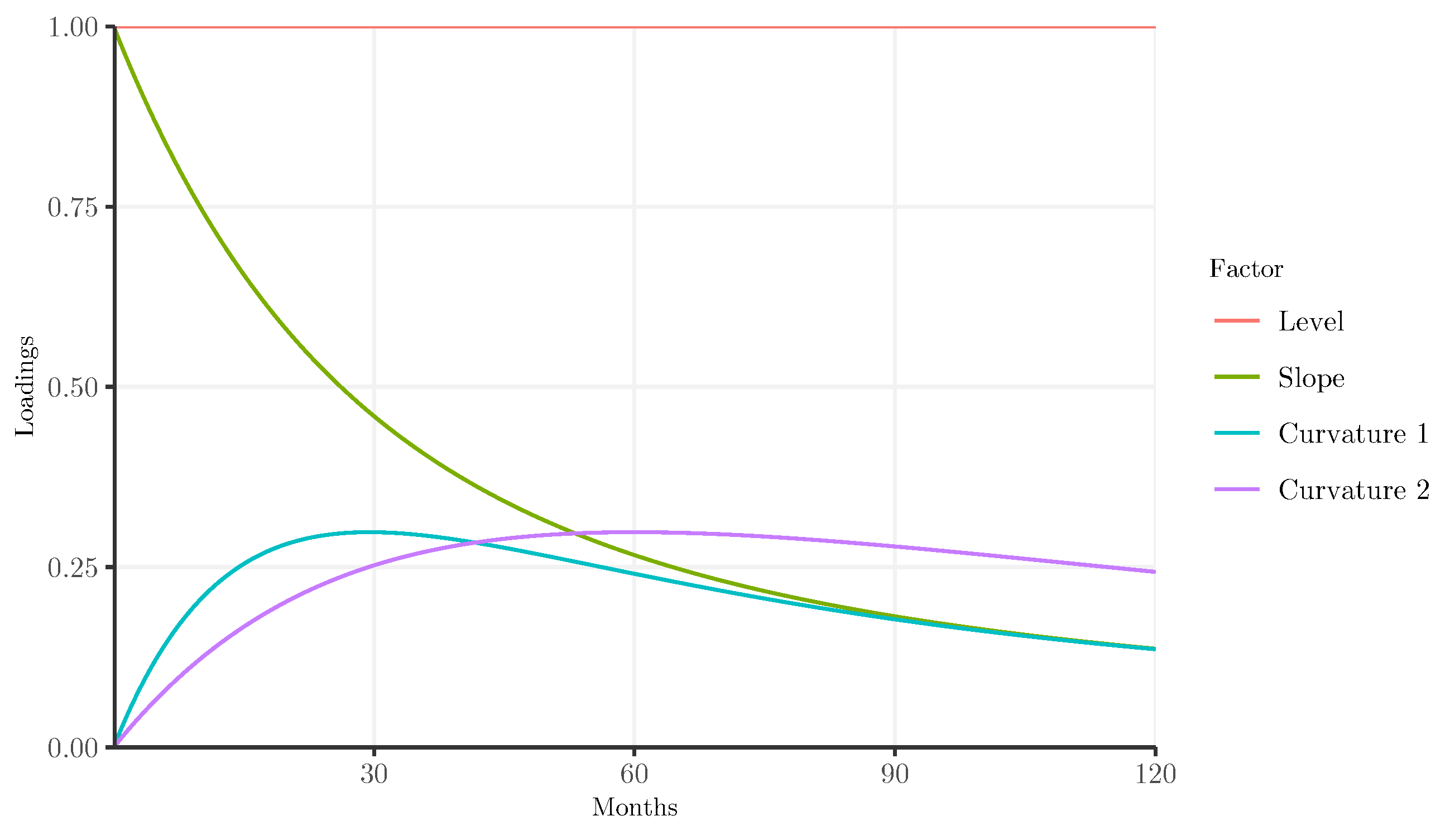

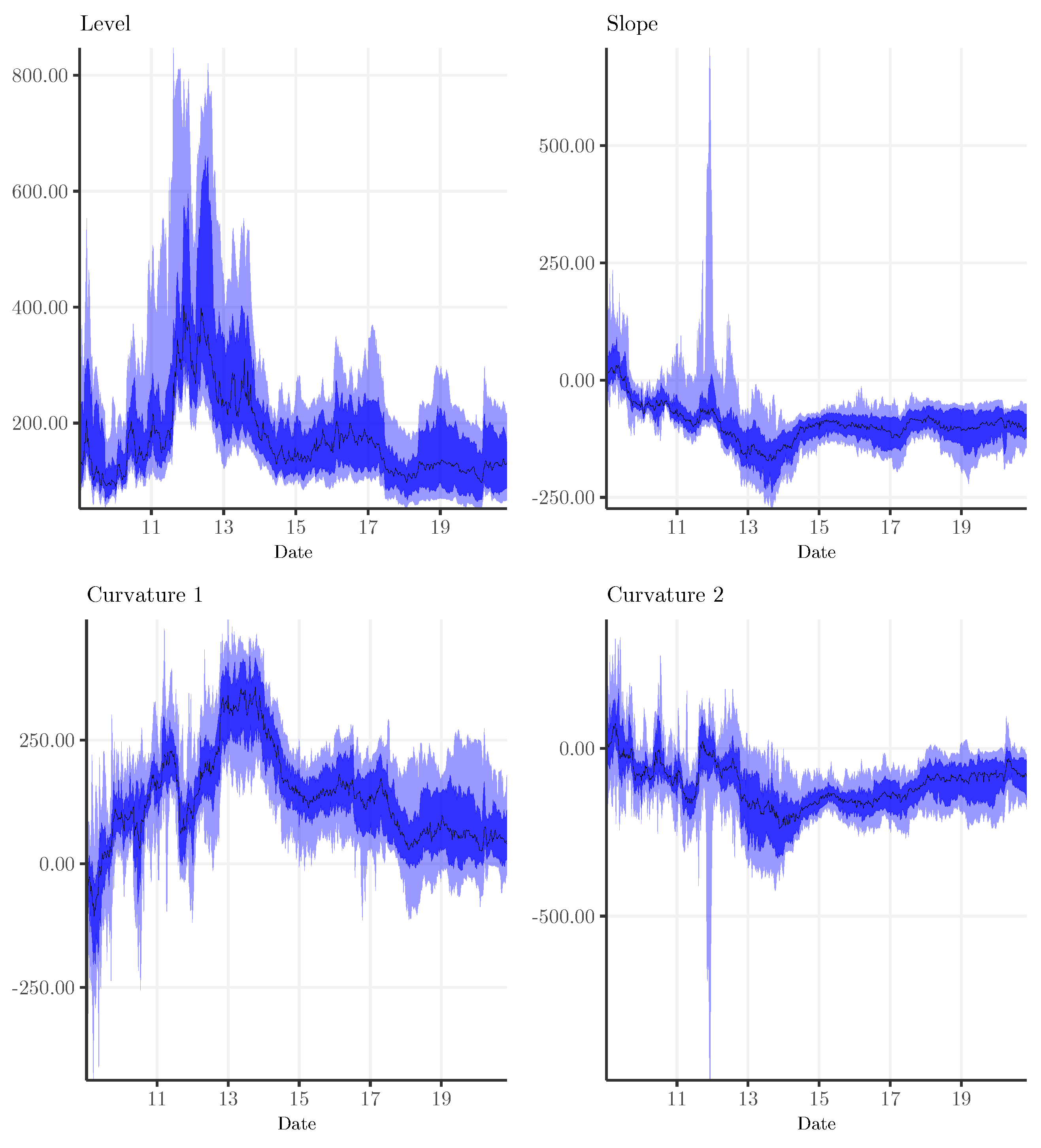

3.1. Term Structure of Bank Default Risk

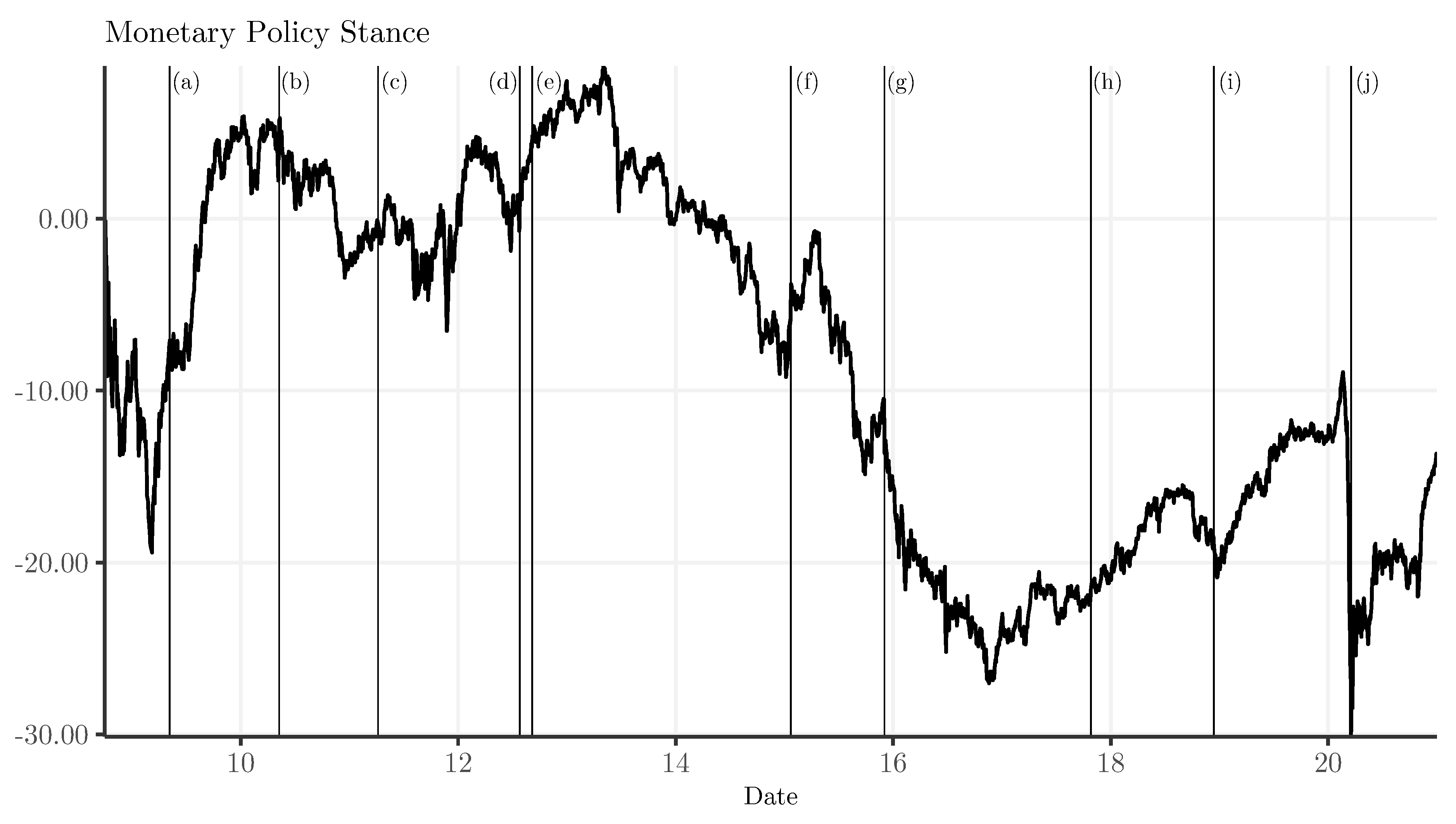

3.2. Identifying Monetary Policy

3.3. Control Variables: Bank-Specific and Market Variables

4. Methodology

5. Results

5.1. ECB Monetary Policy and Bank Credit Risk

5.2. Core versus Periphery: Euro Area Banks

5.3. Time Variation of the Effect of Monetary Policy on Bank Credit Risk

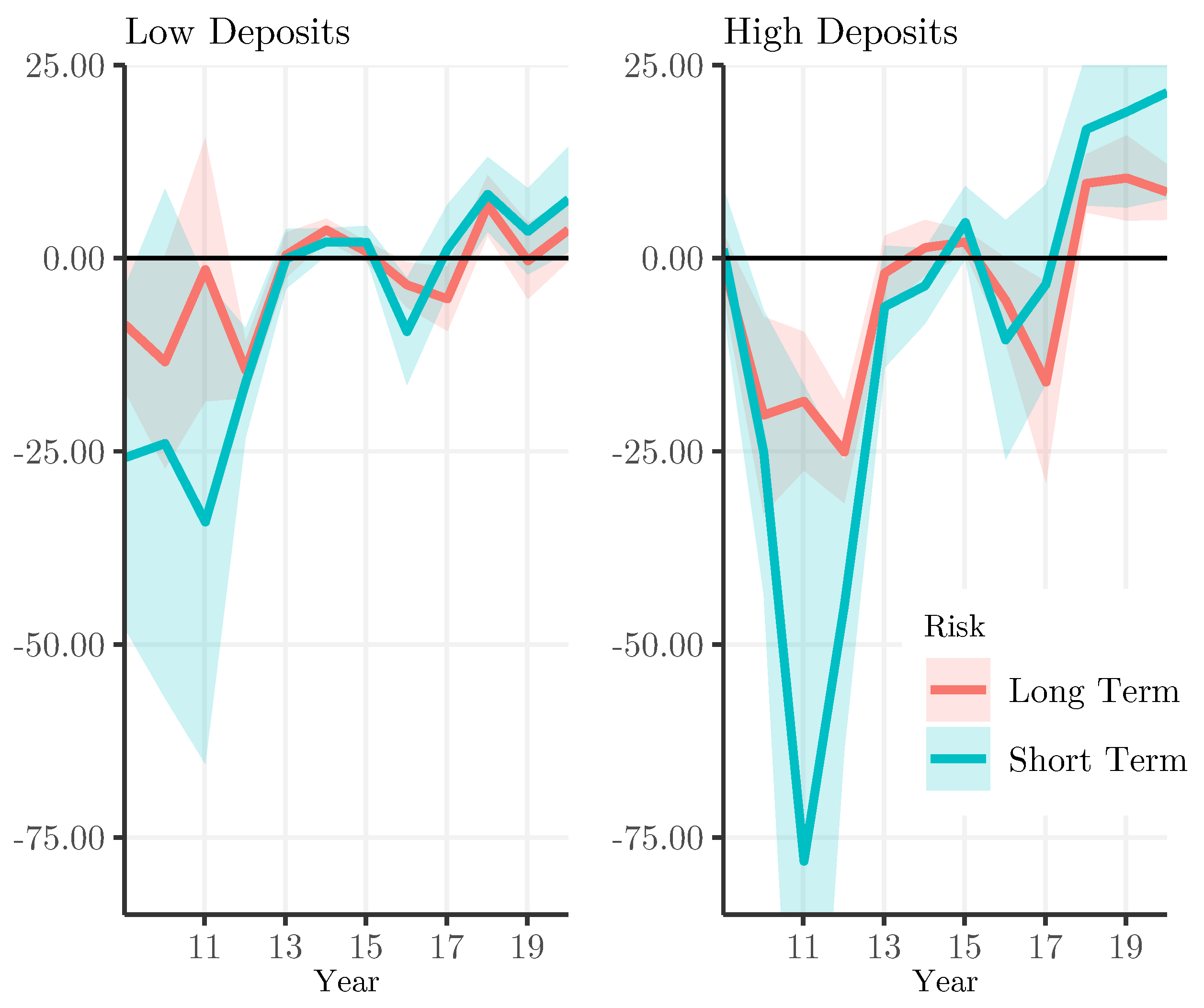

5.4. High versus Low Deposits

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | If the frequency of the CDS spread quotes was less than 25% over the sample period of 2008–2018, the bank was omitted from the sample. |

| 2 | We included only those banks with loans/assets or deposits/liabilities ratios above 20% to ensure that we focused on banks engaged in financial intermediation. The combination of the selection criteria with regard to CDS spreads and bank-specific variables implies that our sample is limited to large and predominantly listed banks. |

| 3 | We aggregated daily CDS spreads in order to have a sufficient number of observations. |

| 4 | The results with alternative decay rates are qualitatively similar. |

| 5 | For details on the estimation procedure, we refer to Lamers et al. (2019). |

| 6 | Using other variables to identify a unit shock and using the CDS spread of, e.g., Italy, to calibrate an accommodative shock yielded an almost identical shock series. |

| 7 | The differences in banks’ short- and long-term credit risk may be partly explained by a difference in their underlying liquidity. To check that this does not partly explain our results, we estimated the same model directly on the 1-year and 5-year CDS spreads, which have a more comparable liquidity. We interpreted the 1-year CDS as short-term credit risk and the 5-year as long-term credit risk. The results remained qualitatively similar, so we assumed that our results were not affected by possible differences in liquidity. |

| 8 | We ran a series of robustness checks to verify whether or not the baseline results hold under different assumptions. When we winsorized the data more (5–95%, in order to avoid potential outliers), left out the CDS spreads with a maturity of 6 months (to take into account potential liquidity concerns for these short CDS contracts), or left out inverted term structures (typically in 2011), the findings were robust: expansionary monetary policy shocks were associated with a significant lowering of short-term CDS spreads and a significant steepening of the slope of the term structure. |

| 9 | In a similar vein, banks credit risk may be affected differently by monetary policy based on the level of capitalization of banks. However, including the banks’ capital ratios with interaction terms yields no significant coefficients. |

References

- Acharya, Viral V., Rahul S. Chauhan, Raghuram Rajan, and Sascha Steffen. 2023. Liquidity Dependence and the Waxing and Waning of Central Bank Balance Sheets. NBER Working Paper Series, No. 31050. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Adrian, Tobias, and Hyun Song Shin. 2009. Money, Liquidity, and Monetary Policy. American Economic Review: Papers and Proceedings 99: 600–5. [Google Scholar] [CrossRef]

- Albertazzi, Ugo, Francesca Barbiero, David Marques-Ibanez, Alexander Popov, Costanza Rodriguez D’Acri, and Thomas Vlassopoulos. 2020. Monetary Policy and Bank Stability: The Analytical Toolbox Reviewed. ECB Working Paper Series, No. 2377. Frankfurt: European Central Bank. [Google Scholar] [CrossRef]

- Altavilla, Carlo, Desislava Andreeva, Miguel Boucinha, and Sarah Holton. 2019. Monetary Policy, Credit Institutions and the Bank Lending Channel in the Euro Area. ECB Occasional Paper No. 222. Frankfurt: European Central Bank. [Google Scholar] [CrossRef]

- Altavilla, Carlo, Luca Brugnolini, Refet S. Gürkaynak, Roberto Motto, and Giuseppe Ragusa. 2019. Measuring Euro Area Monetary Policy. Journal of Monetary Economics 108: 162–79. [Google Scholar] [CrossRef]

- Altavilla, Carlo, Miguel Boucinha, and José-Luis Peydró. 2018. Monetary Policy and Bank Profitability in a Low Interest Rate Environment. Economic Policy 33: 531–86. [Google Scholar] [CrossRef]

- Altunbas, Yener, Leonardo Gambacorta, and David Marques-Ibanez. 2012. Do Bank Characteristics Influence the Effect of Monetary Policy on Bank Risk? Economics Letters 117: 220–22. [Google Scholar] [CrossRef]

- Ampudia, Miguel, and Skander Van den Heuvel. 2018. Monetary Policy and Bank Equity Values in a Time of Low Interest Rates. ECB Working Paper Series, No. 2199. Frankfurt: European Central Bank. [Google Scholar] [CrossRef]

- Arai, Natsuki. 2017. The Effects of Monetary Policy Announcements at the Zero Lower Bound. International Journal of Central Banking 13: 159–96. [Google Scholar]

- Baele, Lieven, Geert Bekaert, Koen Inghelbrecht, and Min Wei. 2020. Flights to Safety. Review of Financial Studies 33: 689–746. [Google Scholar] [CrossRef]

- Baele, Lieven, Olivier De Jonghe, and Rudi Vander Vennet. 2007. Does the Stock Market Value Bank Diversification? Journal of Banking and Finance 31: 1999–2023. [Google Scholar] [CrossRef]

- Berger, Allen N., and Christa H. S. Bouwman. 2013. How Does Capital Affect Bank Performance During Financial Crises. Journal of Financial Economics 109: 146–76. [Google Scholar] [CrossRef]

- Bonfim, Diana, and Carla Soares. 2018. The Risk-Taking Channel of Monetary Policy: Exploring All Avenues. Journal of Money, Credit and Banking 50: 1507–41. [Google Scholar] [CrossRef]

- Borio, Claudio, and Haibin Zhu. 2012. Capital Regulation, Risk-Taking and Monetary Policy: A Missing Link in the Transmission Mechanism? Journal of Financial Stability 8: 236–51. [Google Scholar] [CrossRef]

- Borio, Claudio, and Leonardo Gambacorta. 2017. Monetary Policy and Bank Lending in a Low Interest Rate Environment: Diminishing Effectiveness? Journal of Macroeconomics 54: 217–31. [Google Scholar] [CrossRef]

- Brei, Michael, Claudio Borio, and Leonardo Gambacorta. 2020. Bank Intermediation Activity in a Low-Interest-Rate Environment. Economic Notes 49: e12164. [Google Scholar] [CrossRef]

- Bubeck, Johannes, Angela Maddaloni, and José-Luis Peydró. 2020. Negative Monetary Policy Rates and Systemic Banks’ Risk-Taking: Evidence from the Euro Area Securities Register. Journal of Money, Credit and Banking 52: 197–231. [Google Scholar] [CrossRef]

- Carpinelli, Luisa, and Matteo Crosignani. 2021. The Design and Transmission of Central Bank Liquidity Provisions. Journal of Financial Economics 141: 27–47. [Google Scholar] [CrossRef]

- Christensen, Jens H. E., Francis X. Diebold, and Glenn D. Rudebusch. 2009. An arbitrage-free generalized Nelson–Siegel term structure model. Econometrics Journal 12: 33–64. [Google Scholar] [CrossRef]

- Claessens, Stijn, Nicholas Coleman, and Michael Donnelly. 2018. “Low-For-Long” Interest Rates and Banks’ Interest Margins and Profitability: Cross-Country Evidence. Journal of Financial Intermediation 35: 1–16. [Google Scholar] [CrossRef]

- Coroneo, Laura, Ken Nyholm, and Rositsa Vidova-Koleva. 2011. How arbitrage-free is the Nelson–Siegel model? Journal of Empirical Finance 18: 393–407. [Google Scholar] [CrossRef]

- Crosignani, Matteo, Miguel Faria-e-Castro, and Luís Fonseca. 2020. The (Unintended?) Consequences of the Largest Liquidity Injection Ever. Journal of Monetary Economics 112: 97–112. [Google Scholar] [CrossRef]

- Demiralp, Selva, Jens Eisenschmidt, and Thomas Vlassopoulos. 2021. Negative interest rates, excess liquidity and retail deposits: Banks’ reaction to unconventional monetary policy in the euro area. European Economic Review 136: 103745. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Canlin Li. 2006. Forecasting the Term Structure of Government Bond Yields. Journal of Econometrics 130: 337–64. [Google Scholar] [CrossRef]

- Falagiarda, Matteo, and Stefan Reitz. 2015. Announcements of ECB Unconventional Programs: Implications for the Sovereign Spreads of Stressed Euro Area Countries. Journal of International Money and Finance 53: 276–95. [Google Scholar] [CrossRef]

- Fratzscher, Marcel, and Malte Rieth. 2019. Monetary Policy, Bank Bailouts and the Sovereign-Bank Risk Nexus in the Euro Area. Review of Finance 23: 745–75. [Google Scholar] [CrossRef]

- Gambacorta, Leonardo, and Hyun Song Shin. 2018. Why bank capital matters for monetary policy. Journal of Financial Intermediation 35: 17–29. [Google Scholar] [CrossRef]

- Heider, Florian, Farzad Saidi, and Glenn Schepens. 2019. Life below Zero: Bank Lending under Negative Policy Rates. Review of Financial Studies 32: 3728–61. [Google Scholar] [CrossRef]

- Huang, Rocco, and Lev Ratnovski. 2011. The Dark Side of Bank Wholesale Funding. Journal of Financial Intermediation 20: 248–63. [Google Scholar] [CrossRef]

- Jäger, Jannik, and Theocharis Grigoriadis. 2017. The Effectiveness of the ECB’s Unconventional Monetary Policy: Comparative Evidence from Crisis and Non-Crisis Euro-area Countries. Journal of International Money and Finance 78: 21–43. [Google Scholar] [CrossRef]

- Jiménez, Gabriel, Steven Ongena, José-Luis Peydró, and Jésus Saurina. 2014. Hazardous Times for Monetary Policy: What Do Twenty-Three Million Bank Loans Say About the Effects of Monetary Policy on Credit Risk-Taking? Econometrica 82: 463–505. [Google Scholar] [CrossRef]

- Krishnamurthy, Arvind, Stefan Nagel, and Annette Vissing-Jorgensen. 2018. ECB Policies Involving Government Bond Purchases: Impact and Channels. Review of Finance 22: 1–44. [Google Scholar] [CrossRef]

- Laeven, Luc, Lev Ratnovski, and Hui Tong. 2016. Bank size, capital, and systemic risk: Some international evidence. Journal of Banking and Finance 69: S25–S34. [Google Scholar] [CrossRef]

- Lamers, Martien, Frederik Mergaerts, Elien Meuleman, and Rudi Vander Vennet. 2019. The Tradeoff between Monetary Policy and Bank Stability. International Journal of Central Banking 15: 1–42. [Google Scholar]

- Lamers, Martien, Thomas Present, Nicolas Soenen, and Rudi Vander Vennet. 2022. BRRD Credibility and the Bank-Sovereign Nexus. Applied Economics Letters 30: 1308–13. [Google Scholar] [CrossRef]

- Lanne, Markku, and Helmut Lütkepohl. 2008. Identifying Monetary Policy Shocks via Changes in Volatility. Journal of Money, Credit and Banking 40: 1131–49. [Google Scholar] [CrossRef]

- Lopez, Jose A., Andrew K. Rose, and Mark M. Spiegel. 2020. Why Have Negative Nominal Interest Rates Had Such a Small Effect on Bank Performance? Cross Country Evidence. European Economic Review 124: 103402. [Google Scholar] [CrossRef]

- Molyneux, Philip, Alessio Reghezza, and Ru Xie. 2019. Bank Margins and Profits in a World of Negative Rates. Journal of Banking and Finance 107: 105613. [Google Scholar] [CrossRef]

- Nave, Juan M., and Javier Ruiz. 2015. Risk Aversion and Monetary Policy in a Global Context. Journal of Financial Stability 20: 14–35. [Google Scholar] [CrossRef]

- Nelson, Charles R., and Andrew F. Siegel. 1987. Parsimonious Modeling of Yield Curves. The Journal of Business 60: 473. [Google Scholar] [CrossRef]

- Paligorova, Teodora, and João A. C. Santos. 2017. Monetary Policy and Bank Risk-Taking: Evidence from the Corporate Loan Market. Journal of Financial Intermediation 30: 35–49. [Google Scholar] [CrossRef]

- Peersman, Gert. 2004. The Transmission of Monetary Policy in the Euro Area: Are the Effects Different Across Countries? Oxford Bulletin of Economics and Statistics 66: 285–308. [Google Scholar] [CrossRef]

- Rajan, Raghuram G. 2006. Has Finance Made the World Riskier? European Financial Management 12: 499–533. [Google Scholar] [CrossRef]

- Rigobon, Roberto, and Brian Sack. 2004. The Impact of Monetary Policy on Asset Prices. Journal of Monetary Economics 51: 1553–75. [Google Scholar] [CrossRef]

- Rogers, John H., Chiara Scotti, and Jonathan H. Wright. 2014. Evaluating Asset-Market Effects of Unconventional Monetary Policy: A Multi-Country Review. Economic Policy 29: 749–99. [Google Scholar] [CrossRef]

- Rossi, Barbara. 2021. Identifying and Estimating the Effects of Unconventional Monetary Policy in the Data: How to Do It And What Have We Learned? The Econometrics Journal 24: C1–C32. [Google Scholar] [CrossRef]

- Rostagno, Massimo, Carlo Altavilla, Giacomo Carboni, Wolfgang Lemke, Roberto Motto, Arthur Saint Guilhem, and Jonathan Yiangou. 2019. A Tale of Two Decades: The ECB’s Monetary Policy at 20. ECB Working Paper Series, No. 2346. Frankfurt: European Central Bank. [Google Scholar]

- Saunders, Anthony, and Marcia Millon Cornett. 2018. Financial Institutions Management: A Risk Management Approach. New York: McGraw-Hill. [Google Scholar] [CrossRef]

- Schelling, Tan, and Pascal Towbin. 2022. What lies beneath—Negative interest rates and bank lending. Journal of Financial Intermediation 51: 100969. [Google Scholar] [CrossRef]

- Soenen, Nicolas, and Rudi Vander Vennet. 2022. ECB Monetary Policy and Bank Default Risk. Journal of International Money and Finance 122: 102571. [Google Scholar] [CrossRef]

- Svensson, Lars E. O. 1994. Estimating and Interpreting Forward Interest Rates: Sweden 1992–1994. Discussion Paper Nr. 1051. London: Centre for Economic Policy Research. [Google Scholar]

- Szczerbowicz, Urszula. 2015. The ECB Unconventional Monetary Policies: Have They Lowered Market Borrowing Costs for Banks and Governments? International Journal of Central Banking 11: 91–127. [Google Scholar]

- Vazquez, Francisco, and Pablo Federico. 2015. Bank Funding Structures and Risk: Evidence from the Global Financial Crisis. Journal of Banking and Finance 61: 1–14. [Google Scholar] [CrossRef]

- Wright, Jonathan H. 2012. What does Monetary Policy do to Long-term Interest Rates at the Zero Lower Bound? The Economic Journal 122: F447–F466. [Google Scholar] [CrossRef]

| Name | Country |

|---|---|

| Erste Group Bank | Austria |

| Raiffeisen Bank International | Austria |

| Raiffeisen Zentralbank osterreich | Austria |

| UniCredit Bank Austria | Austria |

| BNP Paribas Fortis | Belgium |

| KBC Bank | Belgium |

| Banque Federative du Credit Mutuel | France |

| BNP Paribas | France |

| Credit Agricole | France |

| Credit Lyonnais | France |

| Natixis | France |

| Societe Generale | France |

| Bayerische Landesbank | Germany |

| Commerzbank | Germany |

| Deutsche Bank | Germany |

| Hamburg Commercial Bank | Germany |

| IKB Deutsche Industriebank | Germany |

| Landesbank Baden-Wurttemberg | Germany |

| UniCredit Bank | Germany |

| Governor and Company of the Bank of Ireland | Ireland |

| Permanent TSB Group Holdings | Ireland |

| Banca Italease | Italy |

| Banca Monte dei Paschi di Siena | Italy |

| Banca Nazionale del Lavoro | Italy |

| Banca Popolare di Milano Societa per Azioni | Italy |

| Banco BPM | Italy |

| Banco Popolare Societa Cooperativa | Italy |

| Intesa Sanpaolo | Italy |

| Mediobanca-Banca di Credito Finanziario | Italy |

| UniCredit | Italy |

| Unione di Banche Italiane | Italy |

| ABN AMRO Group | Netherlands |

| Cooperatieve Rabobank | Netherlands |

| ING Bank | Netherlands |

| NIBC Bank | Netherlands |

| Banco Comercial Portugues | Portugal |

| Caixa Geral de Depositos | Portugal |

| Novo Banco | Portugal |

| Banco Bilbao Vizcaya Argentaria | Spain |

| Banco de Sabadell | Spain |

| Banco Popular Espanol | Spain |

| Banco Santander | Spain |

| Bankia | Spain |

| Bankinter | Spain |

| CaixaBank | Spain |

| Variables | MEAN | SD | P1 | P50 | P99 |

|---|---|---|---|---|---|

| Level | 203.49 | 151.72 | 50.24 | 165.05 | 811.48 |

| Slope | −65.22 | 296.26 | −265.01 | −92.41 | 955.14 |

| Curvature 1 | 150.81 | 302.71 | −299.67 | 135.68 | 686.45 |

| Curvature 2 | −150.18 | 505.31 | −1059.96 | −118.01 | 301.84 |

| Monetary Policy Stance | −8.36 | 10.34 | −26.01 | −6.89 | 7.83 |

| Euro Stoxx 50 | 1066.09 | 252.61 | 585.43 | 1090.25 | 1553.88 |

| VSTOXX | 22.42 | 8.11 | 11.64 | 20.82 | 48.59 |

| CAP | 6.35 | 2.06 | 2.52 | 6.33 | 12.84 |

| Size | 19.26 | 1.19 | 16.62 | 19.22 | 21.45 |

| LTA | 57.51 | 16.72 | 15.32 | 60.79 | 88.87 |

| NPL | 7.80 | 8.22 | 1.13 | 5.48 | 36.91 |

| ROA | 0.09 | 0.73 | −2.68 | 0.25 | 1.05 |

| DEP | 47.31 | 16.83 | 5.84 | 48.55 | 85.19 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Short-Term | Long-Term | Slope | |

| Monetary Policy | −4.44 *** | −0.14 | 4.30 *** |

| (1.58) | (0.38) | (1.31) | |

| CAP | 21.60 | −9.97 | −31.57 |

| (27.29) | (10.01) | (21.77) | |

| NPL | −4.13 | 0.85 | 4.98 |

| (3.34) | (0.77) | (3.28) | |

| SIZE | 146.26 | −66.69 | −212.95 ** |

| (112.23) | (43.69) | (88.16) | |

| DEP | −11.79 *** | −1.24 | 10.55 *** |

| (3.26) | (0.90) | (2.74) | |

| ROA | −107.14 *** | −50.02 *** | 57.12 * |

| (34.05) | (9.58) | (29.46) | |

| LTA | 4.81 | 2.09 ** | −2.72 |

| (4.46) | (0.98) | (4.08) | |

| Euro Stoxx | −0.18 *** | −0.17 *** | 0.01 |

| (0.06) | (0.02) | (0.06) | |

| VSTOXX | 1.46 | −0.29 | −1.76 * |

| (1.17) | (0.35) | (1.03) | |

| Bank fixed effects | Yes | Yes | Yes |

| Time fixed effects | No | No | No |

| R | 0.18 | 0.27 | 0.11 |

| No. Obs. | 23,505 | 23,505 | 23,505 |

| No. Banks | 45 | 45 | 45 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Short-Term | Long-Term | Slope | |

| Monetary Policy | −2.95 *** | −0.81 * | 2.14 *** |

| (1.06) | (0.46) | (0.77) | |

| Monetary Policy × Periphery | −2.82 | 1.58 | 4.40 * |

| (3.19) | (1.01) | (2.59) | |

| Bank fixed effects | Yes | Yes | Yes |

| Time fixed effects | No | No | No |

| Bank control variables | Yes | Yes | Yes |

| Macro control variables | Yes | Yes | Yes |

| R | 0.2 | 0.29 | 0.13 |

| No. Obs. | 23,505 | 23,505 | 23,505 |

| No. Banks | 45 | 45 | 45 |

| (1) | (2) | |

|---|---|---|

| Short-Term | Long-Term | |

| Monetary Policy × 2009 | −8.05 * | −1.83 |

| (4.25) | (1.75) | |

| Monetary Policy × 2010 | −21.37 ** | −13.40 *** |

| (8.61) | (3.54) | |

| Monetary Policy × 2011 | −37.50 *** | −11.44 *** |

| (11.50) | (3.17) | |

| Monetary Policy × 2012 | −28.26 *** | −18.85 *** |

| (5.09) | (2.16) | |

| Monetary Policy × 2013 | 2.88 | 1.04 |

| (3.64) | (1.97) | |

| Monetary Policy × 2014 | −0.74 | 3.02 *** |

| (1.04) | (0.74) | |

| Monetary Policy × 2015 | 2.01 * | 1.15 |

| (1.10) | (0.78) | |

| Monetary Policy × 2016 | −4.61 | −8.20 ** |

| (2.82) | (3.60) | |

| Monetary Policy × 2017 | −9.40 | −12.82 ** |

| (8.20) | (5.79) | |

| Monetary Policy × 2018 | 6.73 | 8.38 *** |

| (4.36) | (2.16) | |

| Monetary Policy × 2019 | 9.50 *** | 5.24 *** |

| (2.96) | (1.65) | |

| Monetary Policy × 2020 | 10.60 *** | 6.08 *** |

| (2.40) | (0.95) | |

| Bank fixed effects | Yes | Yes |

| Time fixed effects | No | No |

| Bank control variables | Yes | Yes |

| Macro control variables | Yes | Yes |

| R | 0.24 | 0.46 |

| No. Obs. | 23,505 | 23,505 |

| No. Banks | 45 | 45 |

| (1) | (2) | |

|---|---|---|

| Short-Term | Long-Term | |

| Monetary Policy | −6.84 ** | −2.29 * |

| (2.78) | (1.36) | |

| Monetary Policy × Deposits | 0.05 | 0.04 * |

| (0.05) | (0.03) | |

| Bank fixed effects | Yes | Yes |

| Time fixed effects | No | No |

| R | 0.18 | 0.27 |

| No. Obs. | 23,505 | 23,505 |

| No. Banks | 45 | 45 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Beernaert, T.; Soenen, N.; Vander Vennet, R. ECB Monetary Policy and the Term Structure of Bank Default Risk. J. Risk Financial Manag. 2023, 16, 507. https://doi.org/10.3390/jrfm16120507

Beernaert T, Soenen N, Vander Vennet R. ECB Monetary Policy and the Term Structure of Bank Default Risk. Journal of Risk and Financial Management. 2023; 16(12):507. https://doi.org/10.3390/jrfm16120507

Chicago/Turabian StyleBeernaert, Tom, Nicolas Soenen, and Rudi Vander Vennet. 2023. "ECB Monetary Policy and the Term Structure of Bank Default Risk" Journal of Risk and Financial Management 16, no. 12: 507. https://doi.org/10.3390/jrfm16120507

APA StyleBeernaert, T., Soenen, N., & Vander Vennet, R. (2023). ECB Monetary Policy and the Term Structure of Bank Default Risk. Journal of Risk and Financial Management, 16(12), 507. https://doi.org/10.3390/jrfm16120507