1. Introduction

A sustainable environment and a nation’s growth and development are strongly intertwined (

Muller 2014;

Ward et al. 2016). It is illogical even to try to decouple them. However, how a sustainable environment and economic development are defined is relevant while exploring their mutual association.

Morelli (

2011) postulates that a sustainable environment maintains natural capital, including social and economic sustainability. The definition of a sustainable environment also overlaps with the context of economic sustainability. This study adopts this definition of a sustainable environment. One of the most essential aspects of a sustainable environment is the financial materiality of environmental improvement. The financial materiality of environmental performance concerns the financial viability of environmental improvements. It means that the environmental improvements obviously have some cost associated with them; however, the cost of environmental improvements results in much better financial viability in the economy, like in terms of GDP, and is a matter of concern (

Schiehll and Kolahgar 2021). If a country works on boosting environmental efficiency then it benefits the economy in terms of financial materiality (GDP) (

Baumüller and Sopp 2022;

Chiu 2022). Environmental efficiency is defined as the utilization of available resources to have minimum pollutant emissions. Hence, the resources infused to have a better environmental quality, should also be focused on cost cutting to financially benefit the economy (

Zhang et al. 2021) rather than creating economic burden.

Feldman et al. (

2016) quite explicitly present that economic development is expanding the capacities of societies through realising the full potential of individuals, firms, and communities. In the current study, the words growth and development are both used interchangeably, but they are used in the same context as defined by

Feldman et al. (

2016).

A country’s primary focus area is always good economic development. Such development incorporates the growth of various components of society. In recent decades, it has also raised the concern that such developments are not being gained at the cost of environmental degradation. Therefore, researchers have given due importance to determining the developmental effects on the environment. However, very little attention has been given to finding whether environmental improvements can benefit the economic development of a country. There is an expansive literature on their (the environment and growth of nations) mutual association (

Dinda 2004;

Azevedo et al. 2018). However, the direction of the studies is usually from the nation’s growth to environmental concerns. Studies, on topics ranging from environmental concerns to its impact on the growth of the nations, are pretty scarce. This situation becomes challenging when, in the literature, no association is found between the environment and the growth of the nations from either direction (

Zilio and Recalde 2011).

There is an obvious question about environmental concerns’ financial viability. There is scarcity in the literature regarding the financial materiality of environmental concerns. Studies are either limited to reporting sustainability and financial materiality (

Schiehll and Kolahgar 2021) or the discussion is limited to a firm level (

Albrecht and Greenwald 2014). The sustainable development goals (SDGs) (

Sachs et al. 2019) do not group the two. The SDGs are 17 goals and 169 targets given by the United Nations, mainly focusing on social and environmental targets (

Hák et al. 2016). They also include inclusive growth. However, they are not insufficiently grouped with the growth and development of the nations. This situation is one of the rudimentary questions of whether sustainability is financially viable. Though in a nascent stage, the growing clamour for double materiality is testimony to the fact that both the growth of nations and environmental concerns should be seen in totality (

Baumüller and Sopp 2022;

Chiu 2022). Moreover, the impact of the environment on a nations’ growth also lacks pragmatism.

From the discussion above it is evident that there is a gap in the literature. Double-materiality-based studies do exist. However, they are inadequate in addressing such a large concept. Hence, the current study attempts to bridge the gap and provide a fresh perspective on the impact of environmental concerns on the growth and development of nations.

The identified problem can be studied in several ways, including using cross-sectional and time series data. However, due to their ability to capture more information and the richness of the outcome, we decided to use panel data to analyse the problem (

Hsiao 1985;

Hsiao 2005;

Hsiao 2007). In addition, measuring the primary variables is also an issue of choice. We had several options to measure the environment and economic development of the nations. The use of different determinants of the environment is often seen in the literature (

Del Río González 2009;

Lee and Holden 1999). However, we decided to put a few determinants into estimating environmental efficiency using DEA, believing it to be a more effective (

Song et al. 2012;

Reinhard et al. 2000) measure of the variable (sustainable environment).

Similarly, growth and development are considered two things in the literature (

Young et al. 2019). We decided to use GDP per capita (GDPC) as the proxy for the same, believing it to be a more effective and transparent measurement of the variable. Development is also considered more challenging to measure accurately than growth. Hence, we settle for growth (or GDPC).

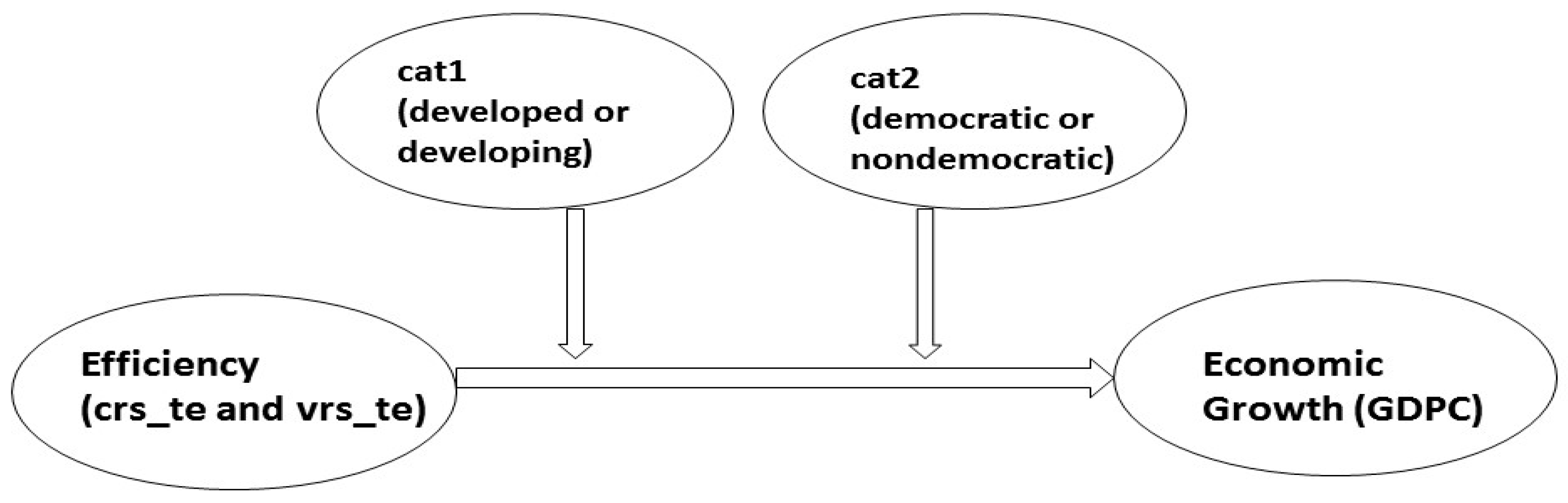

Economic prosperity and the environment should complement, not compete with, each other. This lack of studies on the utility of environmental pursuits and economic prosperity is the current study’s primary motivation, believing the two are well connected. The current study provides a few startling contributions which the authors have not observed in the literature. Environmental efficiency negatively impacts the GDPC when the GDPC is low and moderate. In addition, environmental efficiency does not influence the GDPC when the GDPC is in the highest quantile. In addition, developed economies positively influence (only when GDPC is high), and democracy negatively influences (only when GDPC is low) the already negative impact of the environmental efficiency of nations on the GDPC. The findings of the current study have path-breaking implications for policymakers to consider environmental efficiency critically for a nation’s growth. Hence, they need to put in place some regulations to set it right.

The remaining paper is presented in six sections. The following section discusses a review of the relevant literature and the hypothesis formulation. The data and methodology are discussed in

Section 3. The results are presented in

Section 4. A discussion of the previous research on the topic, contribution, and its implications is presented in

Section 5. The study is concluded in

Section 6.

5. Discussion

5.1. Hypotheses Testing Outcomes

The first hypothesis, that environmental efficiency (EE) positively impacts the GDPC, is rejected. The evidence provided in

Table 6 does not support Hypothesis 1. This result implies that EE’s impact on GDPC significantly differs and depends upon GDPC levels. The EE significantly (negatively) impacts the GDPC when the GDPC is low. Moreover, for moderate levels of GDPC, the impact of EE on the GDPC is partially significant. However, for high GDPC, the EE does not impact GDPC.

The second hypothesis, that developed nations positively moderate the impact of EE on the GDPC, cannot be rejected. The results discussed in

Table 7 highlight that developed nations positively moderate the impact of EE on the GDPC. This positive moderation by developed nations is significant only for high GDPC. The moderating impact of developed nations on the impact of EE on the GDPC is not significant for moderate and low GDPC.

The third hypothesis, that democratic governance positively influences the impact of EE on the GDPC, is rejected (

Table 8). The moderating influence of democratic governance is negatively significant instead of positive (as expected). However, the significantly negative moderation is only valid for low and moderate levels of GDPC. This result implies that democratic governance with low GDPC will negatively impact EE on their already low GDPC.

5.2. Comparison with Earlier Studies on the Topic

The extant literature on the financial materiality of sustainability or ESG usually focuses on corporate and reporting purposes (

Albrecht and Greenwald 2014;

Schiehll and Kolahgar 2021). This situation is consistent even for the European-Union-based discussion on double materiality (

Baumüller and Sopp 2022;

Chiu 2022). The overlapping area in the literature and our findings is significant financial materiality. However, the nature might not be the same or may be unclear in the literature. This situation may exist because of their orientation towards reporting rather than determining EE’s impact on GDPC.

Furthermore, our findings support the positive moderation by developed nations on the EE’s impact on the GDPC. We could not observe any study on this. However,

Fakher and Abedi (

2017) find evidence of EE’s positive impact on developing nations’ GDP growth rate.

Chowdhury and Islam (

2017) report a negative association between the two using BRICS nations. However, none of the studies explores the moderating influence of developed nations on the EE’s impact on the GDPC.

Similarly, we do not find any study where democracy moderates the EE’s impact on the GDPC. However, studies on democracy and the environment are there. Their findings are also mixed. Some studies find that democracy reduces pollution (

Li and Reuveny 2006;

Winslow 2005). A few also report the negative or uncertain status of the impact of democracy on pollution (

Acheampong et al. 2022). The current study reports the negative impact of democracy on the EE’s impact on the GDPC (this is significant only for low or moderate GDPC nations), partially similar to

Acheampong et al. (

2022).

5.3. Contribution

The current study’s findings of the environmental concerns’ financial materiality are not so explicitly found in the literature. Environmental efficiency is rarely assessed in the existing literature and is considered an environmental factor. The current study has looked for this factor to examine its effect on economic development. The negative impact of environmental efficiency on the GDPC when the GDPC is low, and the insignificant impact when the GDPC is high, are novel and the main contributions of the current study. In addition, it is not found in any other study that developed nations reduce the negative association of EE on the GDPC when GDPC is high. Moreover, it is also not observed in the literature that democracy accentuates the negative impact of EE on the GDPC of nations when the GDPC is low. In toto, it is believed by the authors that all the findings are novel and significantly contribute to the extant knowledge on the topic.

5.4. Implications

The current study’s findings debunk a few long-cherished illusions, and therefore carry some path-breaking implications for all the stakeholders. Above all, nations’ long-term environmental policies need a revisit based on the current study’s findings. Firstly, it needs to be realised that environmental concerns hurt the GDPC under certain conditions. This negative impact of EE on GDPC is significant only for low GDPC nations. The same association is not significant for high GDPC nations. This situation implies that, if the policymakers want to protect the environment and simultaneously want the emerging nations to prosper unhindered, the nations with high GDPC should take the maximum burden of EE, not those with low GDPC.

Secondly, the positive moderation of developed nations on the EE’s impact on GDPC for high GDPC nations reinforces the implication discussed in the first point. A developed nation with high GDPC nations would reduce the negative association of EE’s on the GDPC. Thirdly, the negative moderation by democracy on EE’s impact on the GDPC is significant for low GDPC nations. This finding implies that a democratic nation with a low GDPC would further deteriorate the negative impact of EE on the GDPC of such nations. This situation demands a two-pronged explanation. First, this result reinforces the implication discussed in the first point. Second, compared to democracy, a non-democratic nation would not be hurt further by EE’s impact on the GDPC. This situation means a democratic nation with a low GDPC has much to worry about due to the negative implications of environmental concerns on the GDPC. The findings’ practical implication is the financial unviability of environmental efficiency, indicating it is not always beneficial for a nation’s growth. It might be due to the lower financial materiality of environmental quality. Hence, countries with higher GDPC (economic growth) should concentrate more on environmental performance than lower GDPC countries.

6. Conclusions

The current study is aimed at determining the impact of environmental efficiency (EE) on the gross domestic product per capita (GDPC). The study employs quantile regression to address the impact of EEs on GDPC regarding different levels of GDPC.

We find that an EE increase negatively impacts the GDPC for low GDPC nations. In addition, the negative impact of EE on the GDPC for low GDPC countries is further exacerbated if it is a democratic country. On the contrary, if the GDPC is high, EE has no negative impact on the GDPC. Moreover, for a highly GDPC-developed country, an increase in EE positively influences the GDPC of the country.

The current findings are significant as they address the disagreement between developed and emerging economies regarding environmental concerns. The differences between the two are regarding the issue of who will take the considerable burden to protect the environment. The findings are significant as their implications can change the course of action regarding the long-term policies on environmental protection for developed and developing nations.

One of the current study’s limitations is the absence of data from the other counties that were not part of the sample. Additionally, this circumstance will be the focus of further study on the subject. We use GDPC as a measure to assess the growth and development of the nations. Some other tools or proxies can also be employed, such as standard of living, health parameters, and education, to assess the impact of environmental concerns on the nations. Such limitations also provide scope for future research on the topic.

Based on the current study’s findings, the authors recommend rudimentary restructuring in the policy of environmental concerns so that the twin purpose of protecting the environment and the benefits for flora and fauna on the earth can also be ensured. Passing the buck to one another between nations will only attenuate all the excellent work carried out on the issue.