An Evolving Risk Landscape: Insights from a Decade of Surveys of Executives and Risk Professionals

Abstract

1. Introduction

2. Methodology

3. Results

- Macroeconomic risks that may affect growth opportunities

- Strategic risks that may affect the efficacy of particular strategies designed for maximizing growth opportunities

- Operational risks that may affect operational capabilities with respect to strategic execution6

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Correction Statement

| 1 | A 10-point scale was chosen to allow a broad range of choices to survey participants. Responses have included all options (i.e., assessments have ranged from one to ten). |

| 2 | As the risk landscape has evolved, the number of specific risk issues included in the surveys has expanded over the decade we focus on in this research. Thus, not all risks have a full ten-year history of responses. |

| 3 | A response of “Not Applicable” was also available. These responses were not included in the data analysis. |

| 4 | This decrease in the full sample mean responses from 2013 to 2022 is statistically significant at the p < 0.01 level. |

| 5 | This increase from 5.8 in 2013 to 6.4 in 2022 is also statistically significant (p < 0.01). |

| 6 | The risks provided in the table are abridged to enhance readability and reduce word-count. For the specific wording of each risk, please see the surveys at erm.ncsu.edu. |

References

- Aebi, Vincent, Gabriele Sabato, and Markus Schmid. 2012. Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking and Finance 36: 3213–26. [Google Scholar] [CrossRef]

- AON. 2021. Global Risk Management Survey. Available online: http://www.aon.com/attachments/risk-services/2013-GRMS-Executive-Summary.pdf (accessed on 7 September 2022).

- Association for Financial Professionals. 2021. 2021 AFP RISK SURVEY: Post Crisis and Preparation for the Future. Available online: https://www.marshmclennan.com/insights/publications/2021/september/2021-afp-risk-survey.html (accessed on 7 September 2022).

- Baxter, Ryan, Jean C. Bedard, Rani Hoitash, and Ari Yezegel. 2013. Enterprise risk management program quality: Determinants, value relevance, and the financial crisis. Contemporary Accounting Research 30: 1264–95. [Google Scholar] [CrossRef]

- Beasley, Mark S., and Bruce C. Branson. 2022. 2022 State of Risk Oversight, 13th ed. Available online: https://erm.ncsu.edu/library/article/2022-risk-oversight-report-erm-ncstate-lp (accessed on 7 September 2022).

- Beasley, Mark S., Bruce C. Branson, and Donald P. Pagach. 2015. An Analysis of the Maturity and Strategic Impact of Investments in ERM. Journal of Accounting & Public Policy 34: 219–43. [Google Scholar] [CrossRef]

- Beasley, Mark S., Donald P. Pagach, and Richard S. Warr. 2008. Information conveyed in hiring announcements of senior executives overseeing enterprise-wide risk management processes. Journal of Accounting, Auditing, and Finance 23: 311–32. [Google Scholar] [CrossRef]

- Beasley, Mark S., Richard Clune, and Dana R. Hermanson. 2005. Enterprise risk management: An empirical analysis of factors associated with the extent of implementation. Journal of Accounting and Public Policy 24: 521–31. [Google Scholar] [CrossRef]

- Bromiley, Philip, Michael McShane, Anil Nair, and Elzotbek Rustambekov. 2015. Enterprise risk management: Review, critique, and research directions. Long Range Planning 48: 265–76. [Google Scholar] [CrossRef]

- Camfferman, Kees, and Jacco L. Wielhouwer. 2019. 21st century scandals: Towards a risk approach to financial reporting scandals. Accounting and Business Research 49: 503–35. [Google Scholar] [CrossRef]

- Carmichael, Douglas. 2020. Financial Statement Fraud by External Parties. The CPA Journal 90: 28–34. [Google Scholar]

- COSO. 2004. Enterprise Risk Management: Integrated Framework. Committee of Sponsoring Organizations of the Treadway Commission. Available online: www.coso.org (accessed on 7 September 2022).

- COSO. 2017. Enterprise Risk Management: Aligning Risk with Strategy and Performance: Committee of Sponsoring Organizations of the Treadway Commission. Available online: www.coso.org (accessed on 7 September 2022).

- Deloitte. 2021. Global Risk Management Survey. Available online: https://www2.deloitte.com/us/en/insights/industry/financial-services/global-risk-management-survey-financial-services.html (accessed on 7 September 2022).

- Fraser, Ian, and William Henry. 2007. Embedding risk management: Structures and approaches. Managerial Auditing Journal 22: 392–409. [Google Scholar] [CrossRef]

- Gatzert, Nadine, and Michael Martin. 2015. Determinants and value of enterprise risk management: Empirical evidence from the literature. Risk Management and Insurance Review 18: 29–53. [Google Scholar] [CrossRef]

- Gordon, Lawrence A., Martin P. Loeb, and Chih-Yang Tseng. 2009. Enterprise risk management and firm performance: A contingency perspective. Journal of Accounting & Public Policy 28: 301–27. [Google Scholar]

- Hoyt, Robert E., and Andre P. Liebenberg. 2011. The value of enterprise risk management. Journal of Risk and Insurance 78: 795–822. [Google Scholar] [CrossRef]

- Jemaa, Fatma. 2022. Recoupling work beyond COSO: A longitudinal case study of enterprise-wide risk management. Accounting, Organizations and Society, 103, 101369. [Google Scholar]

- Liebenberg, Andre P., and Robert E. Hoyt. 2003. The determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Management & Insurance Review 6: 37–52. [Google Scholar]

- Lundqvist, Sara A. 2015. Why firms implement risk governance: Stepping beyond traditional risk management to enterprise risk management. Journal of Accounting and Public Policy 34: 441–66. [Google Scholar] [CrossRef]

- McShane, Michael K., Anil Nair, and Elzotbek Rustambekov. 2011. Does enterprise risk management increase firm value? Journal of Accounting, Auditing, and Finance 26: 641–58. [Google Scholar] [CrossRef]

- Nocco, Brian W., and René M. Stulz. 2006. Enterprise risk management: Theory and practice. Journal of Applied Corporate Finance 18: 8–20. [Google Scholar] [CrossRef]

- Paape, Leen, and Roland F. Speklé. 2012. The Adoption and Design of Enterprise Risk Management Practices: An Empirical Study. European Accounting Review 21: 533–64. [Google Scholar] [CrossRef]

- Pagach, Don, and Heather Pascanik. 2021. A Review of Academic Research on Enterprise Risk Management. In Enterprise Risk Management: Today’s Leading Research and Best Practices for Tomorrow’s Executives. Edited by John R. S. Fraser, Rob Quail and Betty Simkin. Hoboken: John Wiley and Sons, Inc., chp. 39. [Google Scholar]

- Protiviti/NC State. 2013–2022. Executive Perspectives on Top Risks. Available online: https://erm.ncsu.edu/library/article/top-risks-report-2013-executive-perspectives-on-top-risks-for-2013 (accessed on 7 September 2022).

- Sheedy, Elizabeth, and Barbara Griffin. 2018. Risk governance, structures, culture, and behavior: A view from the inside. Corporate Governance: An International Review 26: 4–22. [Google Scholar] [CrossRef]

- Society of Actuaries. 2021. 15th Emerging Risk Survey|SOA. Available online: https://www.soa.org/resources/research-reports/2022/15th-survey-emerging-risks/ (accessed on 7 September 2022).

- U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1]. 2022. Retrieved from FRED, Federal Reserve Bank of St. Louis. Available online: https://fred.stlouisfed.org/series/GDPC1 (accessed on 20 September 2022).

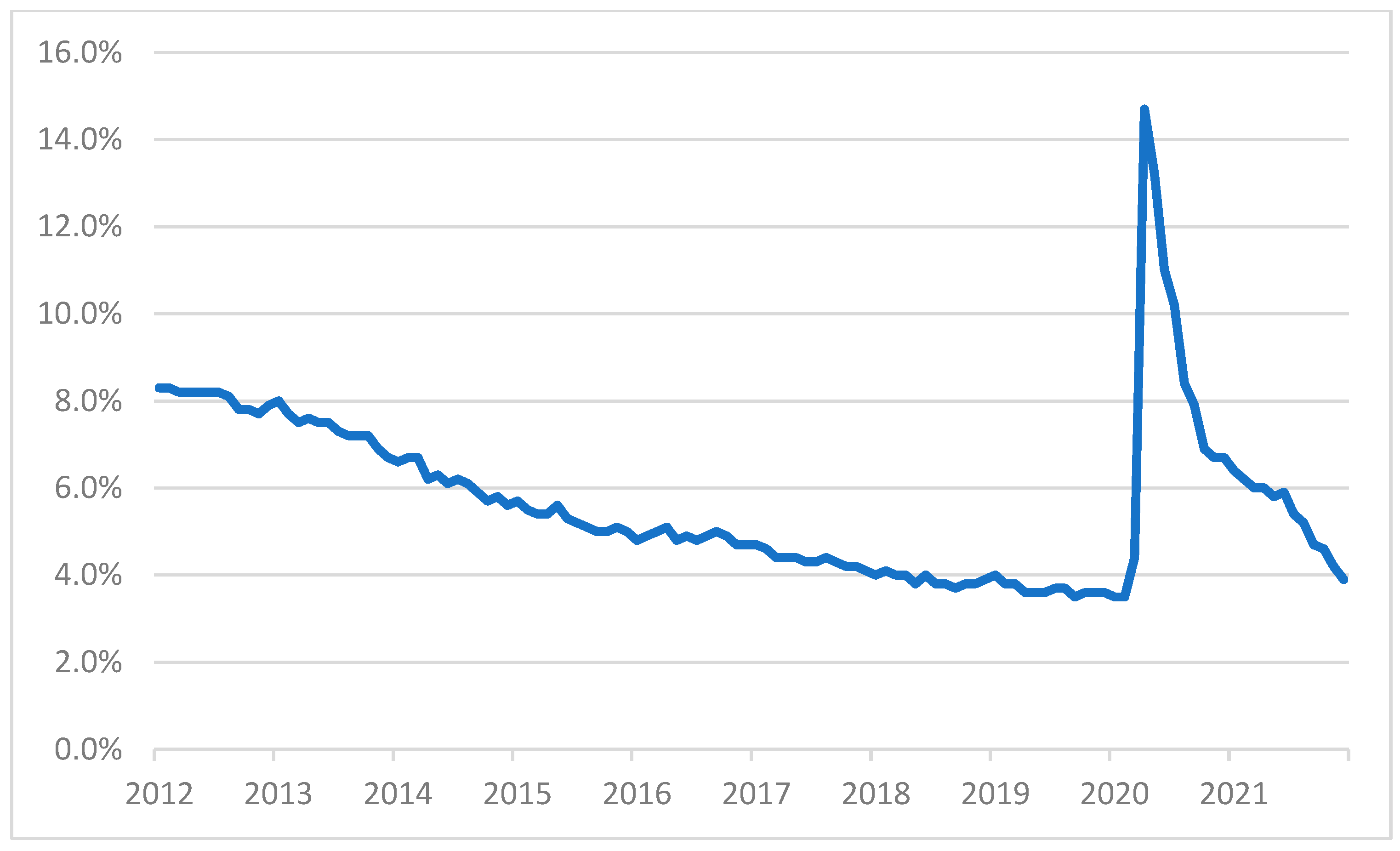

- U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE]. 2022. Retrieved from FRED, Federal Reserve Bank of St. Louis. Available online: https://fred.stlouisfed.org/series/UNRATE (accessed on 20 September 2022).

- Viscelli, Therese R., Mark Beasley, and Dana R. Hermanson. 2016. Research Insights About Risk Governance: Implications from a Review of ERM Research. SAGE Open 6: 2158244016680230. [Google Scholar] [CrossRef]

- World Bank, Inflation, Consumer Prices for the United States [FPCPITOTLZGUSA]. 2022. Retrieved from FRED, Federal Reserve Bank of St. Louis. Available online: https://fred.stlouisfed.org/series/FPCPITOTLZGUSA (accessed on 20 September 2022).

- World Economic Forum. 2022. The Global Risks Report 2022, 17th ed. Available online: https://www.weforum.org/global-risks/reports (accessed on 7 September 2022).

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| North America | 205 | 374 | 277 | 257 | 413 | 333 | 371 | 418 | 424 | 632 |

| Europe | NA | NA | NA | 114 | 136 | 198 | 120 | 233 | 207 | 292 |

| Asia | NA | NA | NA | 128 | 151 | 133 | 82 | 111 | 105 | 207 |

| Australia/New Zealand | NA | NA | NA | NA | NA | NA | 86 | 79 | 82 | 88 |

| Latin America | NA | NA | NA | NA | NA | NA | 72 | 74 | 108 | 113 |

| India | NA | NA | NA | NA | NA | NA | 33 | 52 | 62 | 43 |

| Africa | NA | NA | NA | NA | NA | 18 | 21 | 21 | 15 | 24 |

| Middle East | NA | NA | NA | NA | NA | NA | 40 | 75 | 78 | 54 |

| Other | NA | NA | NA | 36 | 35 | 46 | 0 | 0 | 0 | 0 |

| Totals | 205 | 374 | 277 | 535 | 735 | 728 | 825 | 1063 | 1081 | 1453 |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Total | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | |

| Financial Services | 57 | 28% | 86 | 23% | 92 | 33% | 168 | 31% | 198 | 27% | 243 | 33% | 230 | 28% | 320 | 30% | 305 | 28% | 319 | 22% | 2018 | 28% |

| Consumer Products and Services | 39 | 19% | 84 | 22% | 66 | 24% | 117 | 22% | 185 | 25% | 173 | 24% | 185 | 22% | 221 | 21% | 210 | 19% | 319 | 22% | 1599 | 22% |

| Manufacturing and Distribution | 27 | 13% | 74 | 20% | 30 | 11% | 83 | 16% | 129 | 18% | 112 | 15% | 129 | 16% | 227 | 21% | 206 | 19% | 288 | 20% | 1305 | 18% |

| Technology, Media and Telecommunications | 25 | 12% | 39 | 10% | 21 | 8% | 42 | 8% | 46 | 6% | 69 | 9% | 63 | 8% | 79 | 7% | 118 | 11% | 173 | 12% | 675 | 9% |

| Energy and Utilities | 19 | 9% | 28 | 7% | 30 | 11% | 47 | 9% | 58 | 8% | 37 | 5% | 72 | 9% | 105 | 10% | 119 | 11% | 131 | 9% | 646 | 9% |

| Healthcare | 23 | 11% | 31 | 8% | 14 | 5% | 37 | 7% | 62 | 8% | 50 | 7% | 93 | 11% | 60 | 6% | 45 | 4% | 88 | 6% | 503 | 7% |

| Other | 15 | 7% | 32 | 9% | 24 | 9% | 41 | 8% | 57 | 8% | 44 | 6% | 53 | 6% | 51 | 5% | 78 | 7% | 135 | 9% | 530 | 7% |

| Totals | 205 | 374 | 277 | 535 | 735 | 728 | 825 | 1063 | 1081 | 1453 | 7276 | |||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Total | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | N | % | |

| Greater than USD 10 Bn | 31 | 15% | 50 | 13% | 42 | 15% | 64 | 12% | 75 | 10% | 65 | 9% | 150 | 18% | 163 | 15% | 143 | 13% | 196 | 13% | 979 | 13% |

| Between USD 1 Billion and USD 9.99 Bn | 69 | 34% | 88 | 24% | 84 | 30% | 258 | 48% | 371 | 50% | 235 | 32% | 348 | 42% | 381 | 36% | 378 | 35% | 464 | 32% | 2676 | 37% |

| Between USD 100 Million and USD 999 Mn | 74 | 36% | 132 | 35% | 80 | 29% | 143 | 27% | 204 | 28% | 318 | 44% | 226 | 27% | 337 | 32% | 347 | 32% | 452 | 31% | 2313 | 32% |

| Less than USD 100 Mn | 24 | 12% | 98 | 26% | 69 | 25% | 70 | 13% | 85 | 12% | 110 | 15% | 101 | 12% | 182 | 17% | 213 | 20% | 341 | 23% | 1293 | 18% |

| Did not report | 7 | 3% | 6 | 2% | 2 | 1% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% | 15 | 0% |

| Totals | 205 | 374 | 277 | 535 | 735 | 728 | 825 | 1063 | 1081 | 1453 | 7276 | |||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Services | 6.5 | 6.1 | 5.7 | 6.0 | 6.5 | 5.8 | 6.1 | 6.2 | 6.5 | 6.3 |

| Consumer Products and Services | 6.5 | 6.2 | 6.2 | 5.9 | 5.9 | 5.8 | 6.1 | 5.8 | 6.5 | 6.4 |

| Manufacturing and Distribution | 7.0 | 6.3 | 6.2 | 6.5 | 6.1 | 6.2 | 6.4 | 6.3 | 6.4 | 6.1 |

| Technology, Media and Telecommunications | 7.0 | 6.9 | 5.8 | 6.6 | 6.5 | 6.5 | 6.2 | 6.1 | 6.0 | 6.0 |

| Energy and Utilities | 6.0 | 6.6 | 6.4 | 5.9 | 6.5 | 5.7 | 6.1 | 6.0 | 6.4 | 5.9 |

| Healthcare | 7.1 | 7.3 | 5.5 | 6.6 | 6.2 | 6.2 | 6.8 | 6.5 | 6.8 | 6.3 |

| Combined Sample | 6.7 | 6.4 | 6.0 | 6.1 | 6.2 | 6.0 | 6.2 | 6.1 | 6.4 | 6.2 |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Services | 7.0 | 5.9 | 6.9 | 6.4 | 6.3 | 6.4 | 6.7 | 6.6 | 6.1 | 6.9 |

| Consumer Products and Services | 5.7 | 5.5 | 6.0 | 6.2 | 5.8 | 6.0 | 6.1 | 5.7 | 6.2 | 6.3 |

| Manufacturing and Distribution | 5.4 | 5.3 | 5.4 | 6.0 | 6.3 | 6.3 | 6.4 | 6.2 | 5.9 | 6.3 |

| Technology, Media and Telecommunications | 5.5 | 5.5 | 5.6 | 5.8 | 5.9 | 6.3 | 6.4 | 6.0 | 6.0 | 6.3 |

| Energy and Utilities | 4.5 | 5.7 | 5.8 | 5.5 | 5.9 | 5.2 | 6.1 | 6.1 | 6.4 | 6.2 |

| Healthcare | 5.5 | 6.1 | 6.2 | 6.2 | 5.5 | 5.9 | 6.1 | 6.0 | 6.4 | 5.9 |

| Combined Sample | 5.8 | 5.7 | 6.2 | 6.1 | 6.0 | 6.1 | 6.4 | 6.2 | 6.1 | 6.4 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

| Number of Observations | 205 | 374 | 277 | 535 | 735 | 728 | 825 | 1063 | 1081 | 1453 |

| Macroeconomic Risks (abridged) | ||||||||||

| M1: Increasing volatility in global financial markets and in foreign currency exchange rates | 5.4 | 5.0 | 4.7 | 5.3 | 5.7 | 5.4 | 5.3 | 5.1 | 5.2 | 5.1 |

| M2: Political uncertainty and political extremism may impact the stability of national and international markets | 5.6 | 6.0 | 5.2 | 5.0 | 5.5 | 5.5 | 5.1 | 5.1 | 5.1 | 4.9 |

| M3: Global trade policies may adjust and affect our ability to operate in an effective and efficient manner in international markets | 4.3 | 4.4 | 3.7 | 4.5 | 5.2 | 4.8 | 5.1 | 4.9 | 4.6 | 4.6 |

| M4: Insufficient capital/liquidity may restrict growth opportunities | 4.1 | 4.6 | 4.3 | 4.8 | 4.8 | 5.0 | 5.2 | 4.8 | 5.0 | 5.0 |

| M5: Economic conditions may significantly restrict growth opportunities or negatively affect profit margins | 5.7 | 6.5 | 5.7 | 5.8 | 6.6 | 5.7 | 5.9 | 6.3 | 5.8 | 5.7 |

| M6: Uncertainty surrounding compliance costs associated with healthcare reform legislation (added for the 2014 survey and dropped for the 2019 survey) | NA | 5.1 | 4.0 | 4.5 | 4.5 | 4.6 | NA | NA | NA | NA |

| M7: Regional conflicts, geopolitical shifts, expansion of global terrorism, and/or instability in governmental regimes may impact our global growth and profitability objectives (added for the 2015 survey) | NA | NA | 4.2 | 4.4 | 4.7 | 5.1 | 5.3 | 4.7 | 4.8 | 4.8 |

| M8: Increases in labor costs may affect profitability targets (added for the 2017 survey) | NA | NA | NA | NA | 5.5 | 5.2 | 5.5 | 5.1 | 5.1 | 5.6 |

| M9: Interest rates may affect operations and profitability (added for the 2017 survey) | NA | NA | NA | NA | 5.4 | 5.3 | 5.5 | 5.2 | 5.1 | 5.0 |

| M10: New digital technologies may require skills that are in short supply or require significant resources to upskill our current employees (added for the 2020 survey) | NA | NA | NA | NA | NA | NA | NA | 5.7 | 5.7 | 5.7 |

| M11: Government policies surrounding public health practices and other pandemic-related regulations may significantly impact performance (added for the 2021 survey) | NA | NA | NA | NA | NA | NA | NA | NA | 6.5 | 5.9 |

| M12: Increasing expectations concerning social issues and diversity, equity and inclusion goals may affect our ability to attract and retain talent and compete effectively (added for the 2021 survey) | NA | NA | NA | NA | NA | NA | NA | NA | 5.3 | 5.5 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

| Number of Observations | 205 | 374 | 277 | 535 | 735 | 728 | 825 | 1063 | 1081 | 1453 |

| Strategic Risks (abridged) | ||||||||||

| S1: Disruptive innovations enabled by advanced technologies may outpace our organization’s ability to compete | 4.6 | 4.8 | 5.2 | 5.5 | 5.9 | 6.1 | 6.1 | 5.6 | 5.2 | 5.4 |

| S2: Regulatory scrutiny may increase, affecting our processes and our products | 6.8 | 6.4 | 6.4 | 6.1 | 6.5 | 5.9 | 6.2 | 6.4 | 5.6 | 5.5 |

| S3: Enhanced expectations associated with climate change policies, regulations, and expanded disclosure requirements may demand changes in our strategy and business model | 4.6 | 4.7 | 5.0 | 5.1 | 5.3 | 5.6 | 5.2 | 4.7 | 4.7 | 5.1 |

| S4: New competitors entering the industry may threaten our market share | 3.9 | 4.3 | 4.5 | 4.9 | 5.1 | 5.2 | 5.6 | 5.2 | 5.0 | 5.2 |

| S5: We may not be sufficiently resilient and/or agile to effectively manage an unexpected crisis that threatens our reputation | 4.8 | 4.8 | 5.3 | 5.2 | 5.4 | 5.5 | 5.8 | 5.6 | 5.3 | 5.4 |

| S6: Growth opportunities may be difficult to identify and implement | 4.3 | 4.6 | 4.6 | 4.9 | 5.2 | 5.3 | 5.4 | 5.1 | 5.1 | 5.2 |

| S7: We may experience limitations on our ability to grow organically through customer acquisition | 5.5 | 5.3 | 4.9 | 5.0 | 5.3 | 5.6 | 5.7 | 5.3 | 5.2 | 5.3 |

| S8: Our competitors may develop substitute products and services that impacts the success of our current business model | 4.4 | 4.7 | 4.3 | 4.9 | 5.2 | 5.4 | 5.6 | 5.1 | 5.0 | 5.2 |

| S9: Rapidly expanding social media developments may affect how we conduct business, interact with our customer base, ensure compliance with applicable regulations, and/or manage our image/brand (added for the 2015 survey) | NA | NA | 5.2 | 5.1 | 5.4 | 5.6 | 5.8 | 5.1 | 4.4 | 4.9 |

| S10: Changes in customer preferences and/or demographic shifts may challenge our ability to sustain customer loyalty (added for the 2015 survey) | NA | NA | 5.2 | 5.3 | 5.6 | 5.63 | 6.0 | 5.8 | 5.3 | 5.2 |

| S11: Activist shareholders who seek changes to our organization’s strategic plan and vision may be triggered by performance shortfalls (added for the 2017 survey) | NA | NA | NA | NA | 5.1 | 5.0 | 5.1 | 4.6 | 4.7 | 4.8 |

| S12: Shifts in consumer behavior caused by the COVID-19 pandemic may continue to impact customer demand (added for the 2021 survey) | NA | NA | NA | NA | NA | NA | NA | NA | 5.8 | 5.8 |

| S13: The evolving “new normal” resulting from the ongoing pandemic and emerging social change may impact our business model and our ability to adapt in a timely fashion (added for the 2021 survey) | NA | NA | NA | NA | NA | NA | NA | NA | 5.2 | 5.4 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

| Number of Observations | 205 | 374 | 277 | 535 | 735 | 728 | 825 | 1063 | 1081 | 1453 |

| Operational Risks (abridged) | ||||||||||

| O1: Uncertainty in our supply chain, including the viability of key suppliers and/or scarcity of materials, may make it difficult to deliver products and/or services to our customer base | 3.8 | 4 | 3.6 | 4.5 | 5 | 5.1 | 5.2 | 4.7 | 4.9 | 5.5 |

| O2: Our ability to attract and retain top talent in a tightening labor market and manage succession challenges may make it difficult to achieve operational targets | 5.5 | 5.5 | 5.7 | 5.6 | 5.8 | 5.9 | 6.3 | 6.3 | 5.6 | 5.8 |

| O3: Cyber threats that have the potential to disrupt core operations may present significant management challenges | 5.4 | 5.3 | 5.7 | 5.8 | 5.9 | 6.0 | 6.2 | 6.1 | 5.6 | 5.5 |

| O4: Compliance with growing identity protection expectations and ensuring data privacy may require adjustments that consume significant resources | 5.4 | 5.2 | 5.4 | 5.6 | 5.9 | 5.8 | 6.1 | 6.1 | 5.6 | 5.3 |

| O5: Legacy IT infrastructure, our lack of digital expertise in the workforce and our existing operating model(s) may damage our ability to meet performance expectations | 4.9 | 4.8 | 5.2 | 5.1 | 5.4 | 5.7 | 6.4 | 6.2 | 5.4 | 5.5 |

| O6: Inability to utilize data analytics to achieve information advantages may affect our management of core operations and strategic plans | 4.7 | 4.5 | 5.0 | 5.2 | 5.5 | 5.7 | 6.1 | 5.6 | 5.4 | 5.5 |

| O7: Our organization’s resistance to change our culture may restrict us from making necessary adjustments to our core operations and business model | 5.2 | 5.2 | 5.4 | 5.4 | 5.6 | 6.0 | 6.2 | 6.2 | 5.6 | 5.6 |

| O8: Organizational targets may be affected by third-party risks arising from outsourcing and strategic sourcing arrangements (added for the 2014 survey) | NA | 4.3 | 4.3 | 4.9 | 5.3 | 5.3 | 5.7 | 5.5 | 5.4 | 5.5 |

| O9: Our culture may prevent the timely identification and escalation of risk issues and opportunities that may affect our operations and ability to achieve our strategic objectives (added for the 2015 survey) | NA | NA | 5.5 | 5.3 | 5.7 | 5.9 | 6.0 | 5.8 | 5.3 | 5.5 |

| O10: We may experience difficulty in obtaining affordable insurance coverages for certain risks that have been covered in the past (added for the 2015 survey and dropped for the 2018 survey) | NA | NA | 3.2 | 4.1 | 4.7 | NA | NA | NA | NA | NA |

| O11: The conduct of the organization’s management team and other key representatives may not conform to internal or external expectations (added for the 2019 survey and dropped for the 2021 survey) | NA | NA | NA | NA | NA | NA | 5.4 | 4.3 | NA | NA |

| O12: Our ability to protect the health and safety of our employees may be insufficient to operate effectively or encourage people to work for or do business with us (added for the 2021 survey) | NA | NA | NA | NA | NA | NA | NA | NA | 4.9 | 5.1 |

| O13Expectations from a significant portion of our workforce to “work remotely” may impact our ability to retain talent (added for the 2021 survey) | NA | NA | NA | NA | NA | NA | NA | NA | 5.4 | 5.5 |

| O14: Shifts to hybrid work environments, expansion of digital labor, and evolving talent and labor shortages, may lead to challenges in sustaining our organization’s culture and the way we conduct business (added for the 2022 survey) | NA | NA | NA | NA | NA | NA | NA | NA | NA | 5.5 |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

| Macroeconomic Risks | 3 | 4 | 1 | 2 | 2 | 1 | 0 | 2 | 3 | 5 |

| Strategic Risks | 2 | 2 | 3 | 3 | 3 | 2 | 3 | 2 | 2 | 1 |

| Operational Risks | 5 | 4 | 6 | 5 | 5 | 7 | 7 | 6 | 5 | 4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Beasley, M.; Branson, B.; Pagach, D. An Evolving Risk Landscape: Insights from a Decade of Surveys of Executives and Risk Professionals. J. Risk Financial Manag. 2023, 16, 29. https://doi.org/10.3390/jrfm16010029

Beasley M, Branson B, Pagach D. An Evolving Risk Landscape: Insights from a Decade of Surveys of Executives and Risk Professionals. Journal of Risk and Financial Management. 2023; 16(1):29. https://doi.org/10.3390/jrfm16010029

Chicago/Turabian StyleBeasley, Mark, Bruce Branson, and Don Pagach. 2023. "An Evolving Risk Landscape: Insights from a Decade of Surveys of Executives and Risk Professionals" Journal of Risk and Financial Management 16, no. 1: 29. https://doi.org/10.3390/jrfm16010029

APA StyleBeasley, M., Branson, B., & Pagach, D. (2023). An Evolving Risk Landscape: Insights from a Decade of Surveys of Executives and Risk Professionals. Journal of Risk and Financial Management, 16(1), 29. https://doi.org/10.3390/jrfm16010029