4.3. Results of Model Estimation by Bayesian Method

Based on the model estimates in

Table 4, we identified prior distributions of the coefficients in the models assessing the impact of non-interest income on the performance of commercial banks in the ASEAN region as determined by the normal distribution as follows:

The model with the dependent variable ROE will have the following prior distributions of the coefficients: , , , , , and .

The model with the dependent variable SD_ROE will have the following prior distributions of the coefficients: , , , , , and .

The model with the dependent variable ROA will have the following prior distributions of the coefficients: , , , , , and .

The model with the dependent variable SD_ROA will have the following prior distributions of the coefficients: , , , , , and .

The results of estimating the impact of non-interest income on the performance of commercial banks in the ASEAN region with dependent variables ROE and SD_ROE are presented in

Table 5.

In this study, we created posterior distributions using the Metropolis–Hastings sampling technique. Our preferred MCMC size is 12,500, with a burn-in stage of 2500. In the model with the ROE-dependent variable,

Table 5 shows the posterior mean of the coefficients corresponding to L.ROE, NII, NPL, ETA, and SIZE of 0.533, −0.009, −0.017, −0.338, and −0.001, respectively. Unlike frequency analysis using the 95% confidence interval, Bayesian analysis uses the 95% credible interval.

Table 5 shows that the 95% credible interval of the coefficients corresponding to NII and ETA has an upper bound of less than 0, so NII and ETA have a negative impact on ROE. Meanwhile, the 95% credible interval of the coefficient corresponding to L.ROE has a lower bound greater than 0, so L.ROE has a positive effect on ROE. In addition, the 95% credible interval of the coefficients corresponding to NPL and SIZE vary from the negative domain to the positive domain, so NPL and SIZE have an unclear impact on ROE.

In the model with SD_ROE as a dependent variable,

Table 5 shows the posterior mean of the coefficients corresponding to L.SD_ROE, NII, NPL, ETA, and SIZE are 0.555, −0.222, −0.342, −6.796, and −0.122, respectively.

Table 5 also shows that the 95% credible interval of the coefficients corresponding to NII has an upper bound of less than 0, so NII has a negative impact on SD_ROE. We also found the negative impact of ETA and SIZE on SD_ROE. Additionally, L.SD_ROE has a positive effect on SD_ROE. Finally, NPL has an unclear impact on SD_ROE.

To better determine the likelihood of a positive or negative impact of variables on ROE and SD_ROE, we calculated the probability of each coefficient. The results are presented in

Table 6.

In the model with ROE as the dependent variable, the results in

Table 6 show that the probability that the coefficient corresponding to NII has a negative value is 100%, so non-interest income has a negative impact on banks’ performance. This means that the probability of hypothesis H1 occurring is 100%.

Furthermore, the result shows that the probability that the coefficient corresponding to L.ROE has a positive value is 100%, so the previous profitability has a positive impact on the current profitability. With a 100% probability of occurrence, equity-to-assets has a negative impact on the current profitability. Non-performing loan ratios and bank size both have a negative impact on the current profitability, with 63% and 62.5% probabilities, respectively. These results are in line with the results obtained by

Lee et al. (

2014),

Sun et al. (

2017),

Jaffar et al. (

2014), and

Senyo et al. (

2015). The results in

Table 6 also show that the probability that the coefficient corresponding to NII has a negative value is 100% in the model with the dependent variable SD_ROE, indicating that non-interest income has a negative impact on commercial bank performance as reflected in SD_ROE. This also implies that the H1 hypothesis has a 100% chance of being correct. This result is also the same as a result from the model with ROE as the dependent variable. Thus, the results show that when banks depend more on non-interest income, the performance of these banks decreases. This result is consistent with the actual operation of banks in the region. Specifically, banks in the ASEAN region often have relatively high lending rates and a high proportion of interest income in total income. Therefore, the conversion of operations to non-interest income will reduce income and create higher costs for banks in this area.

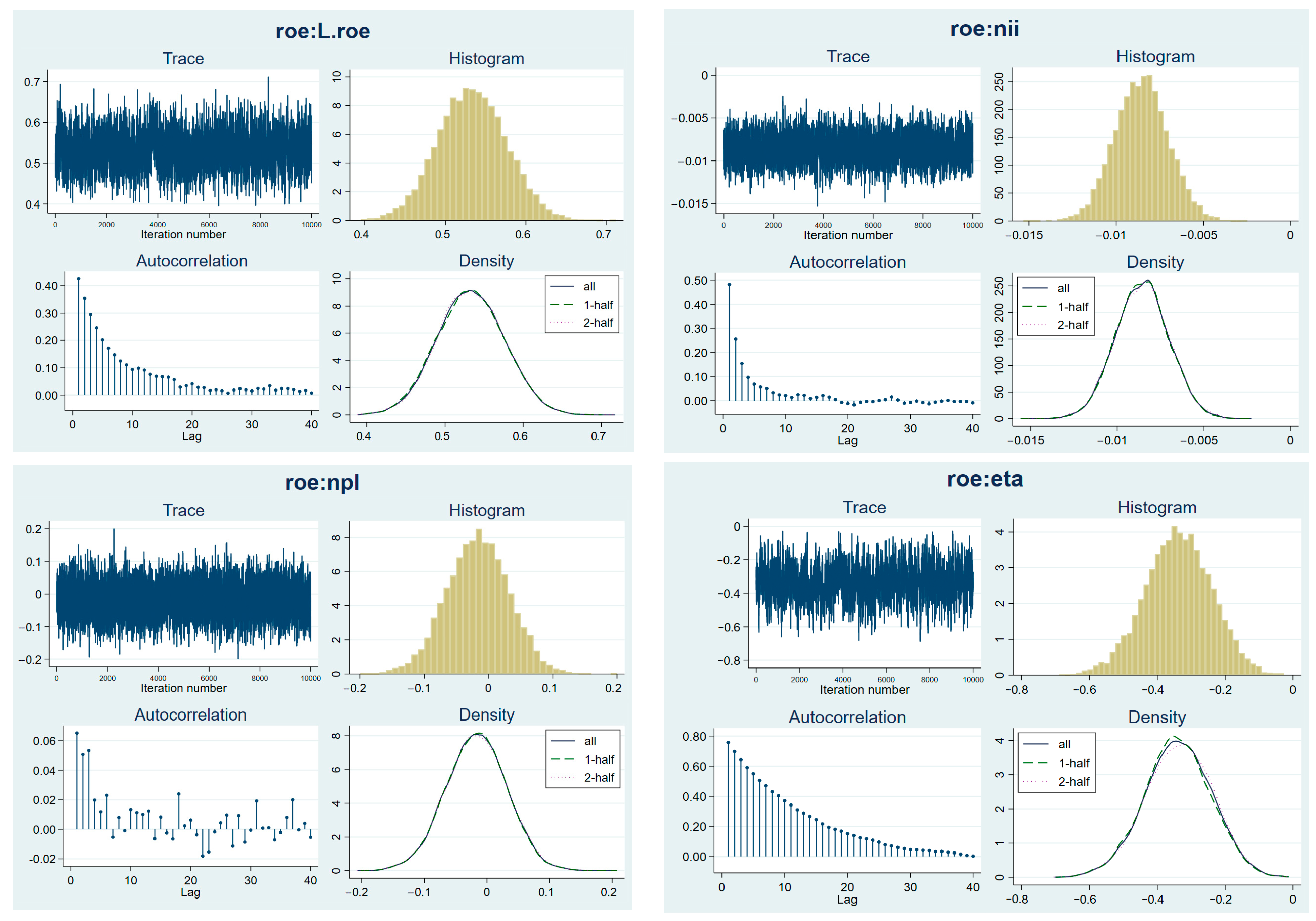

The results of the convergence test of MCMCs are performed for each coefficient in the model.

Figure 1 shows that the MCMCs corresponding to the coefficients in the model all show convergence. Specifically, the Trace plots demonstrate that the MCMC is not trending, with estimates of the values thickly distributed into a horizontal line oscillating around the mean of the regression coefficients. The Autocorrelation plots illustrate that the correlation is approaching zero. The Histograms of MCMCs follow the normal distribution. The Density plots of 1 half, 2 halves, and all MCMC are the same shape.

The results of estimating the impact of non-interest income on the performance of commercial banks in the ASEAN region with dependent variable SD_ROA are presented in

Table 7.

Table 7 shows the posterior mean of the coefficients corresponding to L.SD_ROA, NII, NPL, ETA, and SIZE, which are 0.932, −0.124, −0.067, −0.439, and 0.000, respectively.

Table 7 also shows that the 95% credible interval of the coefficient corresponding to NII has an upper bound of less than 0, so NII negatively impacts SD_ROA. Additionally, L.SD_ROA has a positive impact on SD_ROA. NPL, ETA, and SIZE all have an unclear impact on SD_ROA.

The probability that the coefficient corresponding to the variables in the model is positive or negative is presented in the table below.

The results in

Table 8 also show that the probability of the coefficient corresponding to NII has a negative value is 100%, so that non-interest income negatively impacts commercial banks’ performance is reflected in SD_ROA. This also implies that the probability of the H1 hypothesis occurring is 100%. This result also converges with the results obtained from models with dependent variables ROE and SD_ROE.

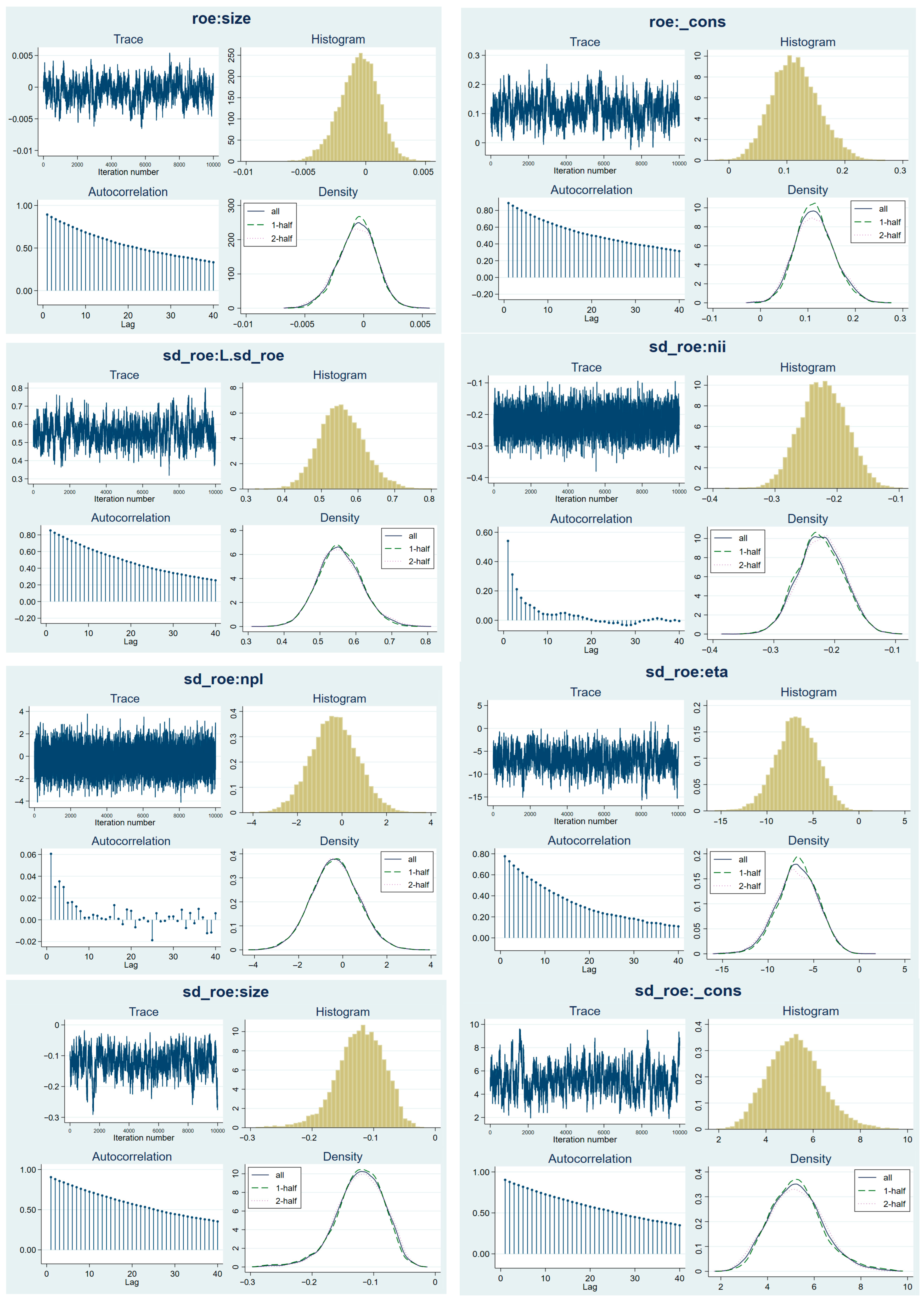

The results of the convergence test of MCMCs are performed for each coefficient in the model with SD_ROA as a dependent variable.

Figure 2 shows that the MCMCs corresponding to the coefficients in the model all show convergence. Specifically, the Trace plots demonstrate that the MCMC is not trending, with estimates of the values thickly distributed into a horizontal line oscillating around the mean of the regression coefficients. The Autocorrelation plots illustrate that the correlation is approaching zero. The Histograms of MCMCs follow the normal distribution. The Density plots of 1 half, 2 halves, and all MCMC are the same shape.

To ensure the study results are convergent, we continue to use the quantile regression to assess the impact of non-interest income on the performance of commercial banks according to the 25th, 50th, and 75th percentiles. We perform the quantile regression with models whose dependent variables are ROE and SD_ROE. The results are presented in the table below.

Table 9 shows that in the model with the dependent variable ROE, at all 25th, 50th, and 75th percentiles, the coefficients corresponding to NII are valued negatively and statistically significant at 1%. Thus, NII has a negative impact on ROE. Similarly, in the model with the dependent variable SD_ROE, at all 25th, 50th, and 75th percentiles, the coefficients corresponding to NII have negative values and are statistically significant at 1%. Thus, NII has a negative impact on SD_ROE. In summary, the quantile regression result is convergent with the results obtained earlier.