Abstract

This paper examines the impact of multi-layer corporate governance (MCG) on banks’ performance under the global financial crisis (GFC) and COVID-19. Using a random and fixed effects method, we regressed the impact of MCG variables on return on assets (ROA), return on equity (ROE), and non-performing loans (NPL) of a panel data of 44 conventional banks (CBs) and 40 Islamic banks (IBs), across 17 countries, and over the period from 2006 to 2020. The results show that board of directors (BoD)’ structure has no association with CBs performance whereas the chief executive officer (CEO) duality is strongly negatively impacting CBs performance, especially during the GFC. In addition, supervision framework proxies have a strong positive influence on CBs performance, especially in the period after the GFC. Furthermore, cross-membership and the size of the Shariah board (SB) have a significant negative influence on IBs’ performance, but SB qualification has a positive non-significant impact overall—with the exception of NPLs, which had a positive significant impact during the GFC. The supervision position has a favorable impact on IBs performance except during crises.

1. Introduction

In the span of barely a decade, two major crises have hit the global economy: the global financial crisis 2008–2009 (GFC) and the ongoing COVID-19 as a global pandemic. Despite similarities in the economic and financial repercussions of these two crises on the global economy, they differ in terms of the underlying nature of the causes. Generally, risk can be exogenous or endogenous to the economic system. The former reflects factors that emanate from outside the economy, while the latter emanates from within the system (Bouchaud 2016). The GFC is a clear example of an endogenous risk that emerged from the actions of market participants, bankers, and speculators. These actions led to excessive risk-taking and debt accumulation which resulted in the “largest credit bubble in history” in the words of Nobel laureate Paul Krugman (2009). The current global COVID-19 pandemic, on the other hand, is due to exogenous factors that directly affect the real economy. However, the financial sector in general and banks in particular are expected to play a capital role in absorbing the crisis shock caused by the pandemic (Borio 2020; Acharya and Steffen 2020).

Furthermore, assessing the performance of the financial system and the banking industry has been an attention-grabbing area for policymakers, central banks, and researchers of all time. The soundness of the banking sector is very important and its stability is considered the backbone of the national and global economy (Thalassinos et al. 2015). The GFC had a negative impact on the banking sector (Erkens et al. 2012; Nersisyan and Wray 2010). However, several studies concur in asserting that the Islamic banking sector was not affected by the GFC and that Islamic banks (IBs) have shown more resilience than conventional banks (CBs) (Setyawati et al. 2017; Baber 2018; Hussien et al. 2019). Daly and Frikha (2016), Trad et al. (2017), Majeed and Zainab (2021), and Haddad and Bouri (2022) demonstrated that IBs, thanks to their Shariah-based business model, withstood the subprime crisis better than their CBs counterparts.

However, there are other empirical research studies that are not in line with previous results. Parashar and Venkatesh (2010), Bourkhis and Nabi (2013), Alandejani et al. (2017), and Salman and Nawaz (2018) have found that Islamic and conventional banking systems are both vulnerable since IBs, too, have been impacted by the effects of the financial crisis due to their higher exposure to real estate and equity based-transactions. Thus, the conflict is not resolved yet as to what causes their non-performance during a crisis period.

The recent growth of the Islamic financial system propelled it to be one of the most dynamic segments of the international financial services industry (Safiullah and Shamsuddin 2018). Despite the magnitude of the challenges in 2020 related to COVID-19, the Islamic finance industry posted double-digit growth for the second year in a row, albeit at a slower pace of 14% versus 15% in 2019, to reach USD 3.4 trillion at the end of 2020 (IFDR 2021). Furthermore, the Islamic banking sector continues to hold the most assets in the entire Shariah compliant finance industry, (70%) in 2020, with double-digit year-on-year growth of 14%, albeit down slightly from 15% in 2019. Although industry growth was moderate in early 2020 and several IBs recorded losses, the trend reversed towards the second half of 2020 and early 2021. As a result, Islamic banking emerged relatively unscathed from the pandemic in 2020, with expected growth to over USD 3.3 trillion in assets by 2025 (IFDR 2021).

Crises in the banking industry are not only the result of the external dimension of governance (prudential regulation) but also of the internal dimension (board of directors, ownership structure, leverage) (Richard and Masmoudi 2010; Compaoré et al. 2020). Indeed, the institutional environment and, more specifically, bank governance play a remarkable role in the emergence of banking crises. Therefore, in the aftermath of the GFC, banking governance, under its different angles, is a topical theme to both practitioners and researchers. It has broadened the enthusiasm of researchers about the interaction between corporate governance and the financial performance of banks (Pathan and Faff 2013). Several studies have examined the performance of CBs during the GFC and attributed their failure to the weak governance system in place (Kirkpatrick 2009; Erkens et al. 2012; Berger et al. 2016; Marie et al. 2021). However, empirical studies on multi-layer corporate governance (MCG) of banks, including both internal and external factors, are limited and those investigating the impact of Shariah compliant governance mechanisms on IBs are even more limited (Nomran et al. 2017; Hakimi et al. 2018; Khan and Zahid 2020; Nomran and Haron 2020a; Alam et al. 2021). Most previous studies have focused solely on either CBs or IBs, and few of them have compared the financial performance of the two categories of banks (Mollah and Zaman 2015). Moreover, studies using the latest data to examine the impact of CG mechanisms on banks’ performance are missing.

Therefore, given the different shortcomings of the previous studies, this research aims to examine the relationship between MCG and banks’ performance over 17 macroeconomic contexts around the world. It differs from previous studies on this topic and contributes to the existing literature in three main ways. First, this paper is one of the limited studies in this area and it is the first, to the best of our knowledge, that analyzes the impact of MCG on both CBs and IBs during the GFC and COVID-19 crisis. Several studies have examined the impact of the GFC on the performance of banks; however, the ongoing global crisis caused by COVID-19 in 2020 is not yet sufficiently explored by researchers in this field. More so, our study attempts to highlight the impact of these two crises on the performance of both Islamic and conventional banks. Second, this study uses a large panel of endogenous and exogenous explanatory variables at the micro and macro levels to discern those among them that underpin the banking performance. Third, the paper undertakes cross-country comparative analysis of the performance of CBs and IBs using a large dataset covering 15 years, from 2006 to 2020, and using the latest data provided by one of the most recognized financial databases (Bloomberg database). To be able to compare the performance of the two types of banks, Islamic and conventional, we have chosen to include a variety of jurisdictions in our analysis, notably those having a dual banking system. We also want to test our model in different macroeconomic and political settings. As a result, and based on the availability and accuracy of the necessary data, our study includes 44 CBs and 40 IBs operating in 17 different countries.

Therefore, this paper falls within the scope of bank corporate governance, which is of particular interest due to the unique characteristics of the banking industry and its critical position in the global economy. It aims to make noteworthy contributions to the empirical studies on assessing bank performance as a result of the MCG mechanisms. The study may also serve as an immunity evaluation of banks’ performance for the ongoing global crisis of COVID-19. It provides important information that concerns executive managers of banks and regulators. An effective MCG could improve the performance of banks in the future, especially in times of crisis and pandemics. Thus, the results of the study can help regulators, central banks, and policymakers analyze MCG mechanisms of banks. In the case of IBs, policymakers will be able to adapt the regulation framework to take into account the governmental specificities required by the Shariah compliance of IBs. The ultimate objective is to increase the resilience of the global financial system and bank performance by developing an efficient MCG framework.

The remaining parts of this paper are organized as follows. The next section presents a review of previous studies, a theoretical framework for MCG of banks, and the development of research hypotheses. The sample, model specifications, and variable descriptions are presented in Section 3. The empirical findings are detailed in Section 4, which includes descriptive statistics, regression analysis, paper contributions and limitations, and future research directions. Section 5 summarizes the main findings of the research.

2. Literature Review

2.1. Previous Studies Review

In this section, we present a selected literature review of the most relevant studies that have been conducted in recent years to examine the influence of internal and external CG mechanisms on bank performance. Studies of banking performance fall into two general categories. The first comprises studies which examine the impact of CG determinants on IBs and CBs performance. The second category contains studies that are more focused on the performance of IBs given the rapid growth of this banking activity around the world. We will go over each of these one by one and in order.

Abdel Baki and Sciabolazza (2014) examined the impact of CG on a sample of 72 IBs efficiently operating in 14 Middle East and Asian countries and they found that poor CG leads to higher risk exposures. However, they used a general CG index without examining the impact of each separate CG mechanism on IBs performance. On the other hand, Grassa and Matoussi (2014) were interested in studying the impact of governance mechanisms, including SB characteristics, on performance of 77 IBs and 85 CBs operating in GCC and Southeast Asian countries from 2000 to 2009. They found that board of directors (BoD) fees, CEO age, and duality have a positive impact on banks’ performance. The results related to IBs indicated that SB size and cross-membership negatively influence the performance, whereas there is no impact of the SB members’ gender. The study, however, made no attempt to account for endogeneity, including macroeconomic factors, which can have unintended implications.

Similarly, in their study, Mollah and Zaman (2015) looked at how the performance of banks was affected by three aspects of governance: CEO power, BoD structure, and Shariah compliance supervision. For the years 2005–2011, the sample included 86 IBs and 86 CBs from 25 different countries. The findings showed that the CEO’s influence has a generally negative impact on IBs performance and a good impact on CBs performance. Regarding the role of the SB, the research revealed that when the SB has a supervisory position, it positively affects the performance of the IBs; however, when it merely has an advisory role, the influence is little. Although the study examined many important issues related to the rule of the SB in IBs, it only used a single proxy, namely the SB size, to examine the SB influence on performance, ignoring other important characteristics such as independence and cross-membership.

Another study of Mollah et al. (2017) focused on the differences in CG structures of 52 IBs and 104 CBs from 14 countries in the period 2005–2013. The authors combined the BoD and CEO characteristics and developed a CG index, assuming IBs reflect the power of Shariah governance. The results found that IBs have better performance compared to CBs due to the structure of IBs based on different financial contracts and different CG mechanisms. Nevertheless, the paper did not measure the direct SB impact on IBs performance by investigating each SB mechanism.

Given the rapid development of the Islamic finance industry around the world, several authors recently focused only on IBs characteristics and examined their effects on performance. Ajili and Bouri (2018) focused only on IBs and studied the impact of CG characteristics on performance. They used a sample of 44 IBs from GCC countries for the period 2010–2014. The findings indicated that CG had no effect on IBs’ performance and concluded that the SB’s role in GCC is largely advising. Similarly, Farag et al. (2018) examined the impact of BoD and SB structures on the performance of 90 IBs selected from 13 countries. Using a fixed effects model and generalized method of moments (GMM) estimation, the study demonstrated a strong positive link between the SB size and IBs performance, whereas BoD size has a weak positive influence on performance. In contrast, a similar study by Hakimi et al. (2018) on 13 IBs in Bahrain found that BoD size and SB size both have a significant positive impact on bank performance. Nomran and Haron (2020b) conducted research on the importance of Shariah governance in influencing IBs performance during the GFC period using panel data analysis and GMM estimate. The authors used system GMM estimation to analyze the selected data from 66 IBs over 18 countries covering the period of 2007–2015. The findings indicated that an increase in SB effectiveness positively influences the IBs performance even during crisis times.

More recently, Muhammad et al. (2021) examined the influence of SB’s characteristics toward Shariah compliance of 15 IBs operating in Indonesia, Malaysia, and Bahrain for the period 2010–2018. The study employed panel regression software and revealed that while cross-membership, remuneration, and rotation of SB members have no effect on the compliance with Shariah, SB’s size negatively affects IBs’ adherence to Shariah rules. However, the study disregarded the fact that those nations have varying laws and policies, which might alter SB’s characteristics. Additionally, examining the influence of Shariah compliance on IBs will improve the empirical research in this field. Likewise, Alam et al. (2021) examined the quality of the Shariah governance system and its influence on the performance of IBs in Bangladesh. The study found that the composition, background, and quality of SB positively influence the Shariah compliance and the financial performance of IBs.

A recent study conducted by El-Chaarani (2022) compared the financial evolution of the Islamic and conventional banking sector in the Gulf Cooperative Council (GCC) countries before and during the COVID-19 pandemic. They found that CBs have revealed higher capacity to manage their financial risk during the crisis period, with a high level of non-performing loan, high inflation rate, and high percentage of non-important cost which have a negative impact on the financial performance of Islamic banks mainly during the pandemic period of COVID-19.

Despite the importance of those previous studies providing empirical evidence on the impact of CG mechanisms on banks’ performance, they are suffering from some limitations as previously mentioned. Thus, this study aims to address some of these limitations. Regarding IBs, there is a great need for empirical evidence as to how SB position and its characteristics can impact IBs’ performance. Moreover, further studies are needed to investigate whether the influence of BoD and SB structure is the same in times of crisis as in times of stability. In fact, there is a lack in studies conducted during the COVID-19 crisis to examine the immunity and performance of banks, whether CBs or IBs, during this specific global crisis time.

2.2. Multi-Layer Corporate Governance Framework

The purpose of CG theories is not to study the way in which managers govern (the management of the firm) but rather to study the mechanisms of regulation of managers, Given that the latter play a crucial role in the performance of firms. CG aims to imply a relationship between management, BoD, shareholders, and stakeholders of a company (Nomran and Haron 2020b). It includes means and procedures to be followed, through which objectives for a firm, in this instance a bank, are set and monitoring performance is determined (Munisi and Randøy 2013). CG mechanisms can be defined as a set of tools influencing management decisions and determining the power limits of managers within a bank (Hopt 2021). Moreover, the shareholder approach to governance emphasizes the combination of disciplinary control mechanisms internal and external to the banking firm. The internal mechanisms concern mainly the BoD (Charreaux 2011), while the external control mechanisms result from the regulation and functioning of the financial market (Schäuble 2018). Therefore, a good and strong relationship between the firm and its various stakeholders is supposed to promote the improvement of the firm’s performance.

Banks, as major financial institutions, manage the relationship between management and the various shareholders and depositors. The literature states that the performance of the banking industry depends on several factors including the mode of governance, internal and external management mechanisms, the regulations in force, the strength and completeness of the economic-financial system, but also the socio-economic environment at the country level (Hopt 2021).

For IBs, determining the compatibility between the adoption of Shariah principles within the bank and its performance amounts to defining the variables of Shariah compliance and evaluating their impact on the profitability of the banking institution. Several authors such as Hakimi et al. (2018), Nomran and Haron (2020a), and Alam et al. (2021) argue that there is a lack in empirical studies which examine the influence of this dual CG system on the performance of IBs, especially during crisis and shock periods. Therefore, it is paramount to provide insights on how CG and SB characteristics influence the IBs performance in times of the current pandemic crisis of COVID-19.

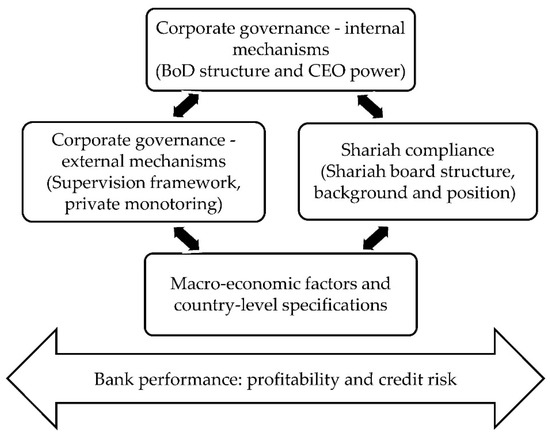

However, the diversity of governance practices around the world seems inconsistent with a common global CG model. The models of CG and supervision vary considerably from one jurisdiction to another due to national differences in the composition of corporate boards and due to the banking supervision framework (Marie et al. 2021; Hopt 2021). In this study, we attempt to account for international differences through a variety of country-level variables commonly used in international CG studies to measure differences in the economic, legal, and institutional environment of each country. Overall, our theorical framework is based on four areas of focus, namely the mechanisms of CG, the characteristics of SB, the bank’s specifications, and the external environment with its macroeconomic factors. The purpose is to define a comprehensive multi-layer corporate governance (MCG) framework to empirically examine its impact on banks’ performance. The following figure (Figure 1) presents the suggested model to investigate how MCG factors affect banks’ performance:

Figure 1.

Bank multi-layer corporate governance framework (proposed by authors).

The BoD is thought to be an important institutional body that promotes the efficiency of the bank’s resources, reduces operational costs, and protects businesses from environmental concerns. (Adams and Mehran 2012). Furthermore, numerous studies have examined how gender diversity on the BoD affects the company’s performance (Amrani et al. 2022). Because of their cognitive traits, qualities, and attitudes, they demonstrate that there is a positive and significant influence related to the presence of women and imply that they make a valuable contribution to companies (Mahadeo et al. 2012). Therefore, it is suggested that a strong and equitable BoD structure enhances bank’s performance. Our first hypothesis in null form is:

H01.

There is no relationship between BoD structure and bank’s performance.

The fast rise of women in senior roles on management boards highlights the crucial role that female executives play in corporate governance (Fan et al. 2019). Women’s presence on boards is typically a more accurate indicator of board gender diversity and has a greater impact on company success (Green and Homroy 2018). CEO women are outperforming CEO men as they break past the glass ceiling. In addition, successful female CEOs are less conventional and more self-reliant than their peers (Ting 2021). Female directors are more likely to monitor more closely than male directors, which could improve performance for companies with poor governance processes (Adams and Ferreira 2009). Thus, female leaders are more able to utilize their skills and behaviors that can benefit and improve company performance (Xing et al. 2020). The second hypothesis is set as follows:

H02.

There is no relationship between CEO gender and bank’s performance.

Another aspect of internal CG and CEO authority that influences the success of the banking organization is the CEO-chair position (Humphery-Jenner et al. 2022; Awais et al. 2022). The CEO performs critical work in a bank and is responsible for the overall bank performance to ensure the interest of the shareholders and stakeholders (Khan et al. 2021). However, agency theory claims that having many tasks and functions raises agency expenses and reduces the BoD’s efficacy, which has a negative influence on performance (Al-Gamrh et al. 2020). Thus, scholars argue that a single person serving as both the BoD chair and CEO could have a negative effect on the performance of banks by limiting the independence and flexibility of the board. The third hypothesis in null form is as follows:

H03.

There is no relationship between CEO duality and bank’s performance.

Furthermore, the overarching objective of supervision is to identify and remediate conditions that could threaten banks’ immediate health or long-term viability. There are normally two types of supervision frameworks in jurisdictions where IBs and CBs are overseen by the same regulator. In the first situation, all banks are subject to a common supervisory framework, and the supervisory authority does not apply a specialized supervisory framework to IBs, while in the second case, the regulatory authority uses a separate supervisory framework for each bank category (Song et al. 2014). With regards to the relationship between regulation, supervision, and bank performance of a bank, the theory suggests a strong and positive relationship (Rachdi and Ben Bouheni 2016). Therefore, the null form of the fourth hypothesis is as follows:

H04.

There is no relationship between regulatory supervision framework and bank’s performance.

On the other hand, the BoD is barred from employing interest in all of the bank’s transactions under the MCG of IBs. Directors are also obligated to avoid hazardous product investments, as this is prohibited by Islamic law (Shariah). These criteria are supposed to promote social justice by preventing low-quality lending and credit risk. Consequently, the CG aspects of IBs and Shariah board as an extra governance body indicate that those banks are unlikely to face the same financial challenges as their conventional counterparts. Therefore, a reasonable number of board members is recommended from an Islamic perspective since their expertise in Shariah and banking issues might lessen communication issues (Bukair and Rahman 2015). The performance of Islamic banks globally exhibits a favorable correlation with SB size, according to Almutairi and Quttainah (2017). Thus, the fifth hypothesis in null form is:

H05.

There is no relationship between Shariah board size and Islamic bank’s performance.

Understanding the SB position, the duties of the advisers, and the impact for monitoring Shariah compliance are now essential concerns. SBs typically have the following roles and responsibilities: advising the boards of directors, giving advice to Islamic financial institutions on Shariah-related issues to help businesses adhere to Shariah principles, establishing Shariah-related rules and principles, and monitoring compliance to make sure that policies and procedures created by Islamic financial institutions are in accordance with Shariah principles (Safieddine 2009). DeLorenzo (2007) stated that IBs have an additional layer of oversight in the shape of religious boards in addition to the best standards of corporate governance. The religious boards serve in both a consultative and a supervisory capacity. According to the findings of the study conducted by Mollah and Zaman (2015), Shariah supervision boards positively impact Islamic banks’ performance when they perform a supervisory role, but the impact is non-significant when they have only an advisory role. Additionally, in its ongoing supervisory role, the SB is committed to complying with disclosures to continuously inform stakeholders of the bank’s performance situation (Neifar et al. 2020). Thus, the sixth null hypothesis is:

H06.

There is no relationship between SB position and Islamic bank’s performance.

According to some scholars, the knowledge and experience of SB members contribute to provide significant Shariah guidelines in decision making and improve the performance of IBs (Nomran et al. 2017). Additionally, according to Almutairi and Quttainah (2017), a SB member with double qualification is competent in case analysis and can propose creative policies, which is consistent with the claim made by Johnson et al. (2013) that education level is thought to affect cognition in decision making. Hassan et al. (2010) conducted research on the demand for SB expertise outside of fiqh Muamalat and discovered that respondents needed SB with legal expertise (83%), business expertise (80%), economic expertise (90%), and accounting expertise (83%), as well as the ability to master English (63%), Arabic (74%), and networking skills (85%). Because banks are intricate commercial entities, SB is valued for both its experience and Shariah education (Ginena and Hamid 2015; Khan and Zahid 2020). The seventh hypothesis in null form is:

H07.

There is no relationship between SB qualification and Islamic bank’s performance.

Cross-membership is a situation in which an SB member concurrently becomes an SB member at another IB or Islamic financial institution. Cross-membership will improve the quality of discussion, perspective, and experience in the application of Shariah principles. The quality of interviews, perspectives, and expertise in managing Shariah compliance of Islamic bank products will be enhanced by cross-membership (Farook et al. 2011). However, multiple functions decrease the board’s independence, flexibility, and therefore the likelihood that it will be able to effectively perform its supervisory work (Alman 2012). Additionally, Grais and Pellegrini (2006) are concerned about conflicts of interest and confidentiality difficulties because it is so simple to obtain sensitive and confidential information, which might harm the IBs if it is revealed to rival IBs. In contrast, AAOIFI does not have a strong opinion on cross-membership. The eighth hypothesis in null form is:

H08.

There is no relationship between SB cross-memberships and Islamic bank’s performance.

With regard to macroeconomic factors, Obiora et al. (2022) argued that economic growth promotes bank lending by raising lending rates and reducing the number of nonperforming loans. On the other hand, the increase in interest rates that typically comes along with rapid inflation has a negative impact on the earnings and balance sheet of a bank (Batayneh et al. 2021). Chan and Karim (2016) looked into the connection between bank’s efficiency—both in terms of profit and cost efficiency—and governance indicators using the Worldwide Governance Indicators (WGI) and found that reducing corruption, enhancing government effectiveness, and adopting less onerous regulatory framework all have a positive effect on bank efficiency. Furthermore, bank incentives are determined by the governing structures of a country and reflect the underlying risk management and economic performance (Ball et al. 2003; Burgstahler et al. 2006). Under the oversight of effective country-level governance, bank managers are expected to use the inherent flexibility provided by CG codes and accounting standards to communicate higher levels of risk information in order to reduce information asymmetry that can help them attract more external resources (Beyer et al. 2010). In line with these studies, the ninth null hypothesis is:

H09.

There is no relationship between macroeconomic factors and bank’s performance.

Furthermore, the GFC had a negative impact on the banking sector (Erkens et al. 2012; Nersisyan and Wray 2010). However, numerous studies agree that the Islamic banking sector was not affected by the GFC and IBs have shown more resilience than CBs (Setyawati et al. 2017; Baber 2018; Hussien et al. 2019). However, Parashar and Venkatesh (2010), Bourkhis and Nabi (2013), Alandejani et al. (2017), and Salman and Nawaz (2018) argued that Islamic and conventional banking systems are both vulnerable in time of crisis and IBs have been impacted by the effects of the GFC because of their higher exposure to real estate and equity-based transactions but also because of their weak governance system in place (Kirkpatrick 2009; Erkens et al. 2012; Berger et al. 2016; Marie et al. 2021). With regard to the impact of the current pandemic crisis of COVID-19, important bank performance metrics, such as profitability and asset quality, have been impacted globally (Kozak 2021). Grassa et al. (2022) showed that IBs are not as resilient in the COVID-19 pandemic as in the GFC. Accordingly, the tenth null hypothesis is:

H10.

The GFC and the COVID-19 crisis have no impact on banks’ performance.

3. Materials and Methods

3.1. Sample and Data Collection

In this study, cross-country bank-level data are employed. Our sample contains 84 banks (44 CBs and 40 IBs) operating in 17 countries, over the period of 15 years. We selected the period (2006–2020) particularly to span both the GFC (2007–2009) and the ongoing COVID-19 crisis (2020). Additionally, we increased the time study to 15 years, based on the availability of both quantitative and qualitative data, in order to improve modeling and analysis. We merged financial data from the Bloomberg database with hand-collected data on MCG from banks’ annual reports. In the case of IBs, we used a purposive sampling technique that is adjusted with predetermined criteria. The prescribed criteria are banks exclusively engaged in Islamic banking and that consistently published annual reports for the period 2006 to 2020, which are available on the bank’s website and include Shariah compliant governance data related to this study. As a result, we excluded a number of IBs in several counties (such as Malaysia, Indonesia, Jordan, and Morocco). With regard to macroeconomic indicators and Worldwide Governance Indicators (WGI), they were extracted from the World Bank database. The final sample consists of 1 320 bank-year observations and the data are processed using EViews’12 software.

The sample construction and distribution are presented in Table 1.

Table 1.

Sample distribution.

3.2. Model Specifications

This study uses panel data models as research data have both individual and temporal variability. There are numerous benefits to using panel data models, according to several authors (Baltagi 2021; Gujarati and Porter 2009; Wooldridge 2010): increasing the sample size; capturing the heterogeneity involved in both cross-section units and time dimensions; testing hypotheses about the presence of heteroscedasticity or autocorrelation or both; and, finally, they are ideally adapted to study the dynamics of change and complex behavioral models.

Bank performance is related to profitability and measured using a combined ratios from previous studies, namely return on assets ratio (ROA), return on equity ratio (ROE), and non-performing loans ratio (NPL), to highlight the eventual impact of GFC and COVID-19 crisis. Additionally, the size, age, leverage, and equity of the banks are used as controlling factors in the study’s regression model. Furthermore, macroeconomic factors, namely the country’s growth and inflation rate, as well as Worldwide Governance Indicators (WGI), are also considered.

We set the following model to test the research’s hypotheses:

represents the proxy for bank i’s performance variable at time t. is the proxy of internal CG mechanisms of bank i at time t, while is the proxy of external CG mechanisms. is the proxy corresponding to Shariah compliance within bank i at time t. Furthermore, is the proxy for the characteristics of bank i at time t and corresponds to the control variables relating to macroeconomic factors and country-level specifications. is the error term, is the constant, and ∝, β, and γ are the vectors of coefficient estimates.

Table 2 presents the description, measurement, and coding of the study’s variables.

Table 2.

Variable descriptions.

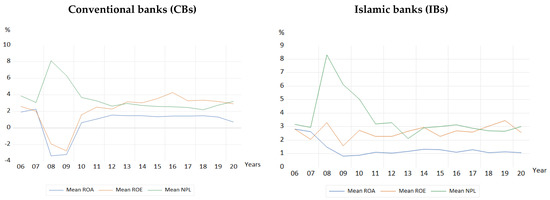

In order to visualize the temporal evolution of bank performance variables over the entire study period, we plotted the data related to the performance indicators (ROA, ROE, and NPL) of CBs and IBs. The evolution of banks’ performance from 2006 to 2020 is represented in Figure 2.

Figure 2.

Evolution of average ROA, ROE, and NPL over 2006–2020 (%).

The graphical representation of the data allows us to highlight the metrics often in a more striking way than a table and much better than long explanatory sentences would do. We can therefore observe, in both graphs, that the two metrics representing banks’ performance—ROA and ROE—fell sharply between 2008 and 2009, then increased from 2010 before tending to decline again passing 2019. The two major fluctuations over the study period are primarily linked to the impact of the GFC and COVID-19 crisis on banking systems throughout the world.

For NPLs, we notice a remarkable increase between 2008 and 2009, reflecting the higher level of outstanding receivables as a result of the subprime crisis. Additionally, the NPL rates peak in 2020, which may be related to the cessation of activity caused by the COVID-19 crisis.

These variations in our data sample are in line with the literature that argues that both IBs and BCs are vulnerable to financial shocks. For Doumpos et al. (2017), the difference in financial efficiency between CBs and IBs is statistically insignificant. Additionally, Izzeldin et al. (2021) argued that the efficiency and speed of convergence of IBs and CBs during crises are equal. In the GCC, IBs performance during the GFC was influenced by a number of factors, including credit risk, capital sufficiency, financial risk, gross domestic product, and inflation (Hussien et al. 2019).

Focusing on the impact of the current pandemic crisis of COVID-19, the findings of a recent study conducted by Grassa et al. (2022) demonstrated that IBs are less resistant to the COVID-19 crisis than they were to the GFC. However, with time, IBs in the GCC countries gain experience, improve their effectiveness, and stabilize. Therefore, the present study aims to further enrich the debate around the performance issue by comparing the impacts of both GFC and the COVID-19 crisis on the performance of CBs and IBs in different countries of the world, especially since the studies related to this subject and conducted in the recent context of COVID-19 are not yet sufficiently developed.

3.3. Diagnostic Tests

The primary multiple regression analysis assumptions, including normality, multicollinearity, and heteroskedasticity were examined before the analysis.

Shapiro–Wilk normality test of continuous independent and control variables revealed that the data were normally distributed as the results were insignificant for all models (see Table 3).

Table 3.

Diagnostic tests.

In addition, heteroskedasticity is a crucial assumption to verify using the Modified Wald test for group-wise heteroskedasticity. All of the models’ results were insignificant, for both IBs and CBs, which suggest no severe heteroskedasticity issue.

Regarding multicollinearity check, all independent variables in Table A1’s correlation matrix of CBs and in Table A2’s correlation matrix of IBs have weak pairwise correlations with one another. Table A1 and Table A2 in Appendix A further demonstrate that, on average, there is little association between the independent variables and the dependent variables. In addition, we examined multicollinearity of the research variables for model 1, 2, and 3 using the variance inflation factor (VIF test). The results are reported in Table A3. The VIFs suggest that multicollinearity does not exist in the sample as all variables were associated with VIF < 10 (Gujarati and Porter 2009); (Hair et al. 2010).

Furthermore, (Patrick 2019) suggested an augmented regression test which is the Durbin–Wu–Hausman test to discern endogeneity issues. The test was carried out by adding the residuals of each endogenous right-hand-side variable as a function of all exogenous variables in the original model’s regression. The results of the test show that we cannot reject the null hypothesis because the p-value is more than 0.05 for all models. Hence, there is no endogeneity issue in our models.

3.4. Specification Test

The Hausman test was used to assess whether the estimating approach should be based on fixed or random effects (Hausman 1978); (Hausman and Taylor 1981). Table A4 and Table A5 in Appendix B present the findings. For both CBs and IBs panels, the results suggest that the factors related to regression model 1 (ROA) are subject to fixed effects while the variables in model 2 (ROE) and model 3 (NPL) are subject to random effects. The ability to create sophisticated data structures is the foremost advantage of the multilevel random effects framework (Bell et al. 2019). Additionally, with a relatively parsimonious specification, the multilevel model allows alternative explanations to be considered, precisely at which level in a hierarchy matters the most. Therefore, appropriate estimation techniques were used.

4. Results and Discussion

4.1. Descriptive Statistics

To provide an overview of the sample data, we reported the descriptive statistics of the independent and dependent variables in Table 4 over the entire study period and on a total of 84 banks. The following are the maximum, minimum, and average values of the research.

Table 4.

Description of variables.

With regard to the dependent variables, the profitability measured by ROA presents an average of 1.042% with a minimum value of −9.221% and a maximum of 16.430%. At the same time, the profitability measured by ROE has a minimum value of −9.510% and a maximum value of 9.998%, with an average of 2.399%. On the other hand, the average value of the NPL is 3.562%, with a maximum rate of 35.474% and a minimum rate of 0.101%. This reflects variability in banks’ profitability. For the independent variables, the BOD_Z mean is 9, while BOD_NEM is 65.644% and BOD_GD average is 3.930% which indicates a low level of representation of women on boards of directors. Bank_Z, BANK_L, and Bank_E show a relatively close average with values of 9.596%, 8.257%, and 6.068%, respectively. GDP, INR, and WGI rates range from a minimum of −21.464%, −10.067%, and −1.889% to a maximum of 26.170%, 84.864%, and 1.434%, respectively. The large degree of variation may reflect the differences in country-level growth, governance, and institutions’ quality and show the diversification of the economic contexts involved in our study.

Splitting our sample by bank activity, we find, for example, that the average ROA, ROE, and NPL do not vary much across bank categories. Particularly, for the NPL, we notice that, for both categories of banks, it shows a significant individual variation ranging from a minimum of 0.101% (for both IBs and CBs) to a maximum of 27.555% (IBs) and 35.474% (CBs). This large variation may be due to the crisis phases, in particular the GFC, which generated a large increase in outstanding receivables for banks.

In the case of IBs, independent variables related to Shariah compliant governance, namely SB_Z, SB_GD, SB_DQ, and SB_CROSS, show quite revealing statistics. The SB_Z average does not exceed two members. Moreover, these members are on average specialized only in Shariah since SB_DQ average is very low and does not exceed 7%. As for SB_CROSS, the latter has a remarkably high average rate of 64% on an average SB size of only two scholars. These statistics support the importance of studying and empirically examining the impact of Shariah compliant variables on the performance of Islamic banks in different countries and economic contexts.

4.2. Panel Data Regression Results

First, we examined how MCG variables affected CBs and IBs performance over the entire study period. Models 1–3 are for CBs (Panel A) whereas models 4–6 are for IBs (Panel B). According to the specification test described in Section 3.4 of the Material and Methods, the variables in regression models 2, 3, 5, and 6 are subject to random effects while the variables related to regression models 1 and 4 are susceptible to fixed effects. Results of the regression analysis are reported in Table 4.

In accordance with the literature, the findings show that BoD size (BOD_Z) has a negative non-significant association with CBs performance (Panel A). Adams and Mehran (2012) suggested that the effectiveness of the BoD is more likely to be influenced by quality than by numbers alone. For IBs, the impact is negatively significant, which is not consistent with prior research (Mollah and Zaman 2015). This negative impact may be linked to the fact that these banks have a much larger board of directors than the size of their business, which could further affect their performance level. The board non-executive members variable (Bod_NEM) has a positive significant impact on CBs performance (Panel A) and positive non-significant effect on IBs performance (Panel B). For CBs, the result is consistent with the extant literature, suggesting that independent non-executive directors are beneficial for complicated firms, whereas for IBs, the insignificant effect may be related to the prevalence of other governance factors specific to Islamic banking, namely the Shariah compliance.

Moreover, the presence of women in the BoD and CEO_G have a positive but non-significant impact on banks’ performance (Panel A and B). This may be due to the low level of representation of women on boards of directors in our sample. However, we suggest that the insignificance of the impact needs to be further investigated by introducing the seniority of women on the board and as a CEO as well as the weight of their contribution to decision making. Therefore, the relationship between board structure and performance for CBs and IBs is positive but non-significant (H01 accepted) and CEO gender does not significantly impact the bank’s performance (H02 accepted).

On the other hand, the CEO and chairman duality is strongly negatively impacting banks’ performance (Panel A and B). The result confirms that performance is enhanced by the separation of powers and duties as suggested by agency theory (Al-Gamrh et al. 2020). Therefore, H03 cannot be accepted.

Then, the coefficients of supervision framework (Sup_Fram and BIG4) have a positive and significant association with banks’ performance (Panel A and B). Particularly, the control exercised by the BIG4 is highly connected to CBs performance, which proves these banks’ systemic significance for the stability of the domestic and global banking sector. Thus, we reject H04.

With respect to Shariah board proxies (Panel B), the findings show that SB_Z has a negative and strongly significant impact on IBs performance. This result contrasts with the conclusions of Grassa and Matoussi (2014), Farag et al. (2018), and Hakimi et al. (2018). However, they go with the findings of the recent study conducted by Muhammad et al. (2021) which suggest that the SB size negatively influence IBs performance and increases the salaries and other employment charges, which further reduces the profitability of those banks. Thus, H05 cannot be accepted.

On the other hand, according to the empirical results reported in Table 5, the performance of the IBs is positively and significantly impacted by the SB’s position. The SB supervision is entrusted with the duty of directing, reviewing, and supervising the activities of the Islamic financial institution (Bukhari et al. 2020); (N. Nomran et al. 2017), which enhances the performance of the bank. The effect of SB_DQ is positive but non-significant, which may be related to the weak level of technical expertise of SB’s members in our sample (7% as an average). Therefore, we reject H06 and accept H07.

Table 5.

Multi-layer corporate governance and bank performance—Full period (2006–2020).

In the case of cross-membership of the SB’s members, the impact is negative and significant on IBs’ performance which confirms that the duality of roles reduces SB independence and consequently reduces the likelihood that the board can properly carry out their oversight role (Alman 2012), especially since the average of SB_CROSS is remarkably very high (64%). Therefore, we reject H08.

With regard to macroeconomic factors at national scales, GDP proxy has a non-significant positive impact on CBs and IBs performance. However, the insignificant effect may be due to the low growth rate of the countries considered in the study. In contrast, the effect of INR on banks’ performance is positive in the case of NPLs, which means that inflation increases the number of non-performing loans, and negative for ROA and ROE. According to the theory, the increase in interest rates that typically comes along with rapid inflation has a negative impact on the earnings and balance sheet of a bank. Banks have expensive resources on the one hand and a portfolio of low-interest loans on the other hand when the yield curve rises (Batayneh et al. 2021). The WGI coefficients have a favorable non-significant impact on all banks’ performance. Therefore, we accept H09.

According to the results reported in Table 5, the GFC and the ongoing COVID-19 crisis strongly and negatively impact CBs performance by increasing NPLs and reducing ROA and ROE. However, in the case of IBs, the impact of the GFC is negative but non-significant on all dependent variables, whereas the COVID-19 effect is strongly increasing the NPLs. This result may be related to the cessation of activity caused by the COVID-19 pandemic crisis. Therefore, it confirms that IBs are not as resilient in the COVID-19 pandemic as in the GFC (Grassa et al. 2022), particularly in terms of NPLs. Trad et al. (2017), Majeed and Zainab (2021), and Haddad and Bouri (2022) demonstrated that IBs have a competent business model based on Shariah that allowed them to be more stable than conventional banks during the subprime crisis. Consequently, H010 is rejected for CBs and IBs regarding the COVID-19 effect and accepted for IBs with respect to the GFC impact. Overall, banks’ performance cannot be isolated from macroeconomic indicators.

4.3. Robustness Check and Discussion

For robustness checking and further analysis purposes, we also investigated the impact of multi-layer corporate governance variables on banks’ performance by dividing our sample by bank activity and by time periods into pre-global financial crisis (2006–2007), GFC period (2008–2009), between crises (2010–2019), and COVID-19 time (2020). We report the results of our panel regression analysis in Table 6. To examine the correlations between the dependent and independent variables in each of the three models during the COVID-19 period, we used multivariate linear regression.

Table 6.

Multi-layer corporate governance and bank performance: pre-GFC, GFC, post-GFC, and COVID-19 time.

As Panel A shows, BOD_Z and BOD_Nem have a negative non-significant impact on pre-GFC, post-GFC, and COVID-19 time, but the negative impact is significant under the GFC. BOD_GD has a negative non-significant effect on CBs performance (ROA, ROE, and NPL), regardless of the study period. The findings support the statement that greater independence and non-executability of board’s members might be counterproductive in more complex and opaque situations (Adams and Mehran 2012). CEO_G has no effect on CBs performance whatever the period is.

With respect to the power of CBs’ CEOs, CEO_D proxy has a strong negative impact on normal times as well as on crisis time, and the influence is even very significant during the GFC period. However, for the NPLs, the impact is not significant before and after the GFC.

On the other hand, supervision framework proxies (Sup_Fram and Big4) have globally a strong positive influence on CBs performance, especially in the period after the GFC. In general, CBs are known to have a systemic importance in the stability and soundness of the national and global banking sector (Thalassinos et al. 2015). Therefore, in the aftermath of the GFC, assessing the performance of the financial system, and in particular the banking sector, has captured the attention of policymakers, central banks, and even BIG4 companies in order to help banks overcome the flaws experienced during this violent crisis. The strong sign of the proxies after the GFC may be attributed to the efforts deployed by the regulators in assisting the banks to implement governance guidelines suggested by Basel 3, which aim to strengthen the governance system of banks and make it more resilient to financial crises.

In Panel B, we reported the findings of the regression analysis of IBs. While the coefficients of BOD_Z are negative with a strong significant impact during the GFC and COVID-19 in the different models, the coefficients of BOD_GD and BOD_NEM are positive and non-significant. This insignificant effect may be related to the prevalence of other governance factors specific to Islamic banking, namely the Shariah compliance. On the other hand, regardless of the period, the combined role of CEO and chairman of IBs generally has a strong negative effect on bank’s performance, except during the GFC where the effect becomes non-significant. These results prove that the classic internal governance indicators of IBs have not been affected by the GFC.

With respect to SB characteristics, SB_Z has a significant negative impact on IB performance, especially during the GFC and COVID-19 for ROA and ROE. The SB_CROSS proxy has a strong negative coefficient, particularly during the GFC and COVID-19 time. The fact that there are many scholars who are board members at the same time in several banks or Islamic financial institutions may keep them overly busy and overworked especially under crises time, especially considering the small size of the SB. Therefore, the regulatory authorities ought to be interested in such a matter.

Furthermore, the double qualification of SB members has a favorable but non-significant effect on the performance of banks, except for NPLs, which had a significant impact during the GFC. In addition, the coefficient related to the SB_P proxy became negative during the GFC and COVID-19, especially for ROA and ROE. This indicates that synergy between the advisory and monitoring functions of the SB is crucial under crises time to support the bank in overcoming the effects of the crisis in compliance with Shariah rules.

4.4. Study Contributions, Limitations, and Future Research Directions

The paper falls under the umbrella of bank’s corporate governance which has special relevance due to the specificities of the banking sector and its important role in the global economy. However, it differs from previous studies on this topic and contributes to the existing literature in three main ways. First, this paper is one of the limited studies in this area and it is the first, to the best of our knowledge, that analyzes the impact of MCG on both CBs and IBs during the GFC and COVID-19 crisis. Several studies have examined the impact of the GFC on the performance of banks; however, the ongoing global crisis caused by COVID-19 in 2020 is not yet sufficiently explored by researchers in this field. More so, our study attempts to highlight the impact of these two crises on the performance of both Islamic and conventional banks. Second, this study uses a large panel of endogenous and exogenous explanatory variables at the micro and macro levels. The purpose is to include as many variables as possible to avoid problems of omitted variables in our model but also to be as exhaustive as possible in terms of explanatory factors of the banking performance. Third, the paper undertakes cross-country comparative analysis of the performance of CBs and IBs using a large dataset covering 15 years, from 2006 to 2020, and using the latest data provided by one of the most recognized financial databases (Bloomberg database).

Therefore, the paper aims to make noteworthy contributions to the empirical studies on assessing bank performance as a result of the MCG mechanisms impact. The study may also serve as an immunity evaluation of banks’ performance for the ongoing global crisis of COVID-19. It provides important information that concerns investors, executive managers of banks, and regulators. Moreover, an effective MCG could improve the performance of banks in the future, especially in times of crisis and pandemics. Thus, the results of the study can help regulators, central banks, and policymakers analyze MCG mechanisms in different banks and countries to improve the regulatory framework and enhance the performance of the global banking system.

Nevertheless, we acknowledge the limitations of our work, which provide opportunities for further research. First, a number of internal and external CG variables are included in the panel model; nevertheless, some variables might have been left out. Additionally, as market data for the unlisted IBs was unavailable, we were forced to settle for the three primary performance indicators for banks: ROA, ROE, and NPL. Second, it would be interesting to increase the research sample to include other jurisdictions and banks, particularly with regard to IBs, whose activity is becoming increasingly worldwide. Third, the COVID-19 time has been limited to 2020, the year in which the disease began to spread over the globe. Therefore, future research should examine this subject in light of these limitations while extending the time period to cover the years following 2020, which are expected to be marked by the pandemic.

5. Conclusions

The main purpose of this paper is to examine the relationship between MCG and banks’ performance of both IBs and CBs under the GFC and COVID-19 crisis. We investigated the impact of BoD structure, CEO power, supervision framework power, SB structure, SB position, SB qualification, cross-memberships, GDP, INR, and WGI among 84 banks (44 CBs and 40 IBs) and over 15 years (2006–2020). Using panel data regression analysis with random and fixed effects, we found the following results:

(a) BOD structure: BoD size has a positive non-significant association with CBs whereas the impact is negative for IBs. The board non-executive members variable has a positive and significant impact on IBs and CBs performance. Similarly, the presence of women in the BoD has a positive non-significant impact on banks’ performance even during the GFC and COVID-19 period.

(b) CEO power: The CEO and chairman duality is strongly negatively impacting banks’ performance. The result confirms that, for CBs, performance is enhanced by the separation of powers and duties as suggested by agency theory, including during the GFC and COVID-19 time. For IBs, the effect is non-significant during the GFC.

(c) Supervision framework power: Supervision framework proxies (Sup_Fram and Big4) have globally a strong positive influence on CBs performance, especially in the period after the GFC. Particularly, the control exercised by the BIG4 is highly connected to CBs performance, which proves these banks’ systemic significance for the stability of the domestic and global banking sector.

(d) SB structure and characteristics: SB_Z has a significant negative impact on IB performance, especially during the GFC and COVID-19 time. Furthermore, IB performance is positively and significantly influenced by SB position. However, SB_P proxy is negative during the GFC and COVID-19 time, particularly for ROA and ROE. This indicates that synergy between the advisory and monitoring functions of the SB are crucial during crises time. The double qualification of SB members has a favorable but non-significant effect on the performance of banks, except for NPLs, which has a significant impact during the GFC. Regarding cross-membership of the SB’s members, the impact is negative and significant, especially during the GFC and COVID-19 time.

(e) Macroeconomic factors: GDP proxy positively impacts CBs and IBs performance; however, the impact is not significant. The effect of INR on banks’ performance is significantly positive in the case of NPLs, which means that inflation increases the number of non-performing loans, and significantly negative for ROA and ROE, especially during crises time. The WGI coefficients have a favorable non-significant impact on banks’ performance, regardless of the time period.

According to the outcomes of our study, we can state that the GFC and the ongoing COVID-19 crisis have significant and undesirable consequences on CBs’ performance by raising NPLs and lowering ROA and ROE globally. However, in the case of IBs, the GFC has a negative but non-significant influence on all dependent variables, whereas the COVID-19 effect is significantly increasing the NPLs.

Author Contributions

Conceptualization, O.A.; Data curation, O.A.; Formal analysis, O.A.; Methodology, O.A.; Project administration, A.N.; Supervision, A.N.; Writing—original draft, O.A.; Writing—review & editing, O.A and A.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available at Bloomberg database upon subscription.

Acknowledgments

Sincere gratitude goes to Mohamed Jalal Maaouni for his help and unconditional support. Thanks also to the anonymous reviewers for their constructive comments.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Correlation matrix—Conventional banks.

Table A1.

Correlation matrix—Conventional banks.

| ROA | ROE | NPL | BOD_Z | BOD_NEM | BOD_GD | CEO_G | CEO_D | SUP_FRAM | BIG4 | BANK_Z | BANK_L | BANK_E | BANK_A | GDP | INR | WGI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1 | 0.308 | −0.302 | −0.044 | 0.019 | 0.105 | −0.043 | −0.053 | 0.029 | 0.094 | 0.018 | −0.018 | −0.089 | 0.031 | 0.090 | −0.049 | −0.037 |

| ROE | 1 | −0.212 | −0.022 | −0.026 | 0.058 | 0.085 | −0.048 | 0.078 | 0.052 | −0.004 | 0.046 | −0.020 | 0.049 | −0.077 | −0.181 | −0.016 | |

| NPL | 1 | 0.142 | −0.098 | −0.107 | −0.039 | −0.111 | 0.053 | −0.013 | −0.286 | 0.114 | 0.005 | −0.018 | −0.059 | −0.081 | 0.216 | ||

| BOD_Z | 1 | −0.075 | 0.000 | 0.020 | 0.133 | −0.205 | 0.018 | 0.045 | −0.039 | 0.093 | 0.018 | −0.062 | −0.002 | 0.048 | |||

| BOD_NEM | 1 | −0.029 | −0.050 | 0.285 | −0.091 | 0.110 | 0.039 | −0.154 | 0.015 | −0.013 | 0.068 | 0.161 | −0.189 | ||||

| BOD_GD | 1 | 0.116 | −0.057 | 0.045 | −0.013 | 0.000 | −0.053 | −0.060 | 0.078 | −0.086 | 0.008 | −0.033 | |||||

| CEO_G | 1 | −0.049 | 0.110 | −0.016 | −0.036 | 0.040 | 0.040 | −0.008 | −0.055 | −0.053 | 0.060 | ||||||

| CEO_D | 1 | 0.150 | 0.271 | 0.189 | 0.072 | 0.128 | −0.032 | −0.081 | 0.095 | −0.238 | |||||||

| SUP_FRAM | 1 | 0.143 | 0.076 | 0.243 | −0.057 | −0.032 | −0.141 | 0.004 | −0.208 | ||||||||

| BIG4 | 1 | −0.079 | 0.027 | −0.011 | 0.023 | −0.060 | 0.060 | −0.092 | |||||||||

| BANK_Z | 1 | −0.155 | 0.012 | −0.006 | −0.108 | 0.114 | −0.200 | ||||||||||

| BANK_L | 1 | 0.006 | −0.172 | −0.059 | −0.185 | 0.066 | |||||||||||

| BANK_E | 1 | 0.183 | −0.048 | 0.053 | −0.051 | ||||||||||||

| BANK_A | 1 | 0.025 | 0.029 | −0.039 | |||||||||||||

| GDP | 1 | −0.098 | 0.133 | ||||||||||||||

| INR | 1 | −0.292 | |||||||||||||||

| WGI | 1 |

Source: Authors’ computational results.

Table A2.

Correlation matrix—Islamic banks.

Table A2.

Correlation matrix—Islamic banks.

| ROA | ROE | NPL | BOD_Z | BOD_NEM | BOD_GD | CEO_G | CEO_D | SUP_FRAM | BIG4 | SB_Z | SB_GD | SB_P | SB_DQ | SB_CROSS | BANK_Z | BANK_L | BANK_E | BANK_A | GDP | INR | WGI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1 | 0.136 | −0.116 | 0.062 | 0.069 | −0.195 | −0.286 | −0.201 | −0.188 | 0.045 | −0.048 | −0.002 | 0.002 | −0.083 | 0.110 | 0.095 | −0.086 | −0.069 | 0.066 | 0.289 | 0.044 | 0.056 |

| ROE | 1 | 0.020 | 0.024 | 0.076 | 0.001 | −0.133 | −0.136 | 0.029 | 0.067 | −0.004 | −0.023 | 0.010 | −0.051 | −0.008 | 0.136 | −0.050 | −0.047 | 0.036 | −0.048 | −0.017 | 0.003 | |

| NPL | 1 | −0.046 | 0.099 | 0.021 | 0.060 | 0.103 | 0.197 | 0.006 | −0.016 | −0.032 | −0.089 | 0.033 | −0.079 | −0.262 | 0.159 | −0.072 | −0.003 | −0.001 | 0.163 | −0.133 | ||

| BOD_Z | 1 | 0.022 | −0.053 | −0.135 | -0.126 | 0.037 | 0.119 | 0.231 | −0.055 | 0.122 | 0.089 | 0.111 | −0.100 | 0.021 | −0.090 | 0.058 | 0.016 | −0.004 | 0.008 | |||

| BOD_NEM | 1 | 0.054 | 0.051 | 0.089 | 0.180 | −0.040 | −0.139 | 0.031 | −0.187 | 0.060 | 0.011 | 0.047 | 0.245 | −0.031 | 0.010 | −0.042 | 0.199 | −0.354 | ||||

| BOD_GD | 1 | 0.349 | 0.343 | 0.201 | −0.037 | 0.103 | −0.016 | 0.071 | 0.100 | −0.038 | 0.055 | 0.117 | −0.055 | −0.102 | −0.072 | 0.126 | −0.135 | |||||

| CEO_G | 1 | 0.523 | 0.117 | 0.004 | 0.065 | −0.006 | 0.071 | 0.087 | 0.018 | −0.149 | 0.131 | −0.045 | −0.181 | −0.020 | 0.094 | −0.088 | ||||||

| CEO_D | 1 | 0.184 | −0.101 | −0.061 | −0.009 | −0.023 | 0.274 | −0.110 | −0.036 | 0.102 | 0.014 | −0.114 | −0.049 | 0.177 | −0.242 | |||||||

| SUP_FRAM | 1 | −0.177 | −0.110 | 0.033 | −0.153 | 0.075 | −0.222 | −0.269 | 0.222 | −0.040 | 0.052 | −0.085 | 0.219 | −0.243 | ||||||||

| BIG4 | 1 | 0.220 | −0.013 | 0.213 | 0.189 | 0.185 | 0.126 | 0.155 | −0.022 | 0.001 | −0.171 | −0.233 | 0.195 | |||||||||

| SB_Z | 1 | −0.007 | 0.495 | 0.108 | 0.092 | 0.073 | 0.118 | −0.055 | −0.119 | −0.088 | −0.206 | 0.331 | ||||||||||

| SB_GD | 1 | 0.020 | −0.031 | 0.042 | 0.042 | 0.004 | −0.048 | 0.053 | −0.082 | −0.043 | 0.026 | |||||||||||

| SB_P | 1 | 0.065 | 0.226 | −0.001 | −0.047 | −0.063 | −0.104 | −0.084 | −0.215 | 0.369 | ||||||||||||

| SB_DQ | 1 | 0.095 | 0.047 | 0.458 | 0.216 | −0.036 | −0.132 | 0.049 | −0.192 | |||||||||||||

| SB_CROSS | 1 | 0.181 | 0.101 | −0.071 | −0.019 | −0.001 | −0.156 | 0.322 | ||||||||||||||

| BANK_Z | 1 | 0.049 | 0.022 | −0.078 | −0.270 | −0.230 | 0.249 | |||||||||||||||

| BANK_L | 1 | −0.018 | −0.023 | −0.061 | 0.002 | −0.223 | ||||||||||||||||

| BANK_E | 1 | 0.090 | −0.077 | −0.001 | 0.001 | |||||||||||||||||

| BANK_A | 1 | 0.069 | −0.019 | −0.098 | ||||||||||||||||||

| GDP | 1 | 0.053 | 0.080 | |||||||||||||||||||

| INR | 1 | −0.235 | ||||||||||||||||||||

| WGI | 1 | |||||||||||||||||||||

Source: Authors’ computational results.

Table A3.

Test of Multicollinearity.

Table A3.

Test of Multicollinearity.

| Variables | VIF—Islamic Banks | VIF—Conventional Banks | ||||

|---|---|---|---|---|---|---|

| Model (1) ROA | Model (2) ROE | Model (3) NPL | Model (1) ROA | Model (2) ROE | Model (3) NPL | |

| BOD_Z | 1.331 | 1.099 | 1.103 | 1.083 | 1.082 | 1.067 |

| BOD_NEM | 1.062 | 1.130 | 1.096 | 1.098 | 1.158 | 1.129 |

| BOD_GD | 1.503 | 1.209 | 1.242 | 1.067 | 1.041 | 1.043 |

| CEO_G | 1.872 | 1.512 | 1.543 | 1.045 | 1.037 | 1.035 |

| CEO_D | 2.457 | 1.798 | 1.840 | 1.137 | 1.413 | 1.319 |

| SUP_FRAM | 2.213 | 1.311 | 1.734 | 1.108 | 1.231 | 1.170 |

| BIG4 | 1.149 | 1.138 | 1.133 | 1.073 | 1.075 | 1.049 |

| SB_Z | 1.628 | 1.320 | 1.283 | - | - | - |

| SB_GD | 1.091 | 1.020 | 1.030 | - | - | - |

| SB_P | 1.593 | 1.249 | 1.237 | - | - | - |

| SB_DQ | 1.052 | 1.341 | 1.266 | - | - | - |

| SB_CROSS | 1.175 | 1.124 | 1.085 | - | - | - |

| BANK_Z | 1.107 | 1.201 | 1.357 | 1.049 | 1.099 | 1.081 |

| BANK_L | 1.070 | 1.359 | 1.303 | 1.019 | 1.140 | 1.103 |

| BANK_E | 1.054 | 1.054 | 1.041 | 1.070 | 1.072 | 1.069 |

| BANK_A | 1.060 | 1.034 | 1.035 | 1.051 | 1.065 | 1.059 |

| GDP | 1.351 | 1.074 | 1.207 | 1.083 | 1.058 | 1.057 |

| INR | 1.198 | 1.164 | 1.155 | 1.097 | 1.124 | 1.106 |

| WGI | 1.306 | 1.764 | 2.020 | 1.094 | 1.387 | 1.303 |

Source: Authors’ computational results.

Appendix B

Table A4.

Hausman test—Conventional banks.

Table A4.

Hausman test—Conventional banks.

| ROA | ROE | NPL | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | Fixed | Random | Prob. | Fixed | Random | Prob. | Fixed | Random | Prob. |

| BOD_Z | −0.014 | −0.013 | 0.983 | −0.055 | −0.031 | 0.773 | 0.191 | 0.288 | 0.217 |

| BOD_NEM | 0.010 | 0.002 | 0.208 | −0.019 | −0.004 | 0.058 | 0.002 | 0.002 | 0.959 |

| BOD_GD | 0.018 | 0.026 | 0.414 | −0.003 | −0.009 | 0.595 | −0.008 | −0.014 | 0.541 |

| CEO_G | −0.779 | −0.612 | 0.666 | 0.627 | 0.993 | 0.356 | −0.907 | −1.285 | 0.290 |

| CEO_D | −0.817 | −0.555 | 0.655 | −1.708 | −0.464 | 0.105 | −0.600 | −0.624 | 0.976 |

| SUP_FRAM | −0.062 | 0.026 | 0.880 | 1.521 | 0.460 | 0.187 | −0.087 | 1.352 | 0.075 |

| BIG4 | 0.101 | 0.587 | 0.211 | −0.457 | 0.245 | 0.144 | 0.066 | −0.056 | 0.799 |

| BANK_Z | 0.868 | 0.052 | 0.000 | −0.332 | −0.082 | 0.601 | −0.532 | −0.418 | 0.822 |

| BANK_L | 0.065 | 0.010 | 0.619 | −0.188 | −0.070 | 0.377 | 0.114 | 0.117 | 0.981 |

| BANK_E | −0.038 | −0.036 | 0.825 | 0.006 | 0.001 | 0.548 | −0.018 | −0.013 | 0.541 |

| BANK_A | 0.177 | 0.106 | 0.404 | −0.210 | 0.039 | 0.003 | 0.268 | 0.198 | 0.339 |

| GDP | 0.084 | 0.041 | 0.000 | −0.031 | −0.030 | 0.964 | −0.088 | −0.106 | 0.102 |

| INR | −0.017 | −0.020 | 0.503 | −0.055 | −0.064 | 0.079 | −0.050 | −0.049 | 0.823 |

| WGI | −2.302 | −0.297 | 0.000 | −0.611 | −0.125 | 0.514 | 0.864 | 0.791 | 0.925 |

| Chi−Sq. Statistic | 56.993 | 14.679 | 16.607 | ||||||

| Hausman test | 0.000 | 0.259 | 0.278 | ||||||

Source: Authors’ computational results.

Table A5.

Hausman test—Islamic banks.

Table A5.

Hausman test—Islamic banks.

| ROA | ROE | NPL | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | Fixed | Random | Prob. | Fixed | Random | Prob. | Fixed | Random | Prob. |

| BOD_Z | −0.055 | 0.000 | 0.213 | 0.051 | 0.058 | 0.936 | 0.143 | −0.048 | 0.046 |

| BOD_NEM | −0.002 | 0.002 | 0.216 | 0.003 | 0.007 | 0.662 | 0.026 | 0.017 | 0.330 |

| BOD_GD | 0.012 | −0.011 | 0.062 | 0.009 | 0.028 | 0.575 | −0.035 | −0.045 | 0.776 |

| CEO_G | −1.152 | −1.413 | 0.427 | 0.235 | −0.551 | 0.459 | −0.088 | −0.674 | 0.608 |

| CEO_D | −1.603 | −0.583 | 0.029 | −2.228 | −1.912 | 0.808 | −0.474 | 0.793 | 0.365 |

| BIG4 | −0.721 | 0.039 | 0.091 | −0.160 | 0.374 | 0.381 | −1.188 | 0.053 | 0.063 |

| SUP_FRAM | −0.591 | 0.332 | 0.076 | 1.032 | 2.192 | 0.617 | 1.091 | 0.972 | 0.195 |

| SB_Z | −0.066 | 0.040 | 0.110 | −0.304 | −0.084 | 0.062 | 0.123 | 0.091 | 0.782 |

| SB_GD | 0.000 | 0.018 | 0.015 | −0.054 | −0.048 | 0.740 | 0.002 | −0.031 | 0.041 |

| SB_P | 0.027 | 0.038 | 0.953 | −0.149 | −0.004 | 0.421 | −0.886 | −0.759 | 0.496 |

| SB_DQ | −0.007 | −0.004 | 0.411 | 0.008 | 0.003 | 0.700 | 0.023 | 0.007 | 0.230 |

| SB_CROSS | −0.006 | 0.001 | 0.008 | −0.012 | −0.006 | 0.187 | −0.006 | −0.006 | 0.013 |

| BANK_Z | −0.547 | 0.214 | 0.000 | 0.268 | 0.289 | 0.949 | −0.247 | −0.559 | 0.169 |

| BANK_L | 1.862 | −0.027 | 0.218 | −2.996 | −0.145 | 0.295 | 3.618 | 0.369 | 0.302 |

| BANK_E | 0.010 | 0.001 | 0.004 | −0.010 | −0.022 | 0.097 | −0.068 | −0.062 | 0.410 |

| BANK_A | −0.057 | −0.077 | 0.408 | 0.120 | 0.139 | 0.761 | 0.203 | 0.072 | 0.045 |

| GDP | 0.078 | 0.074 | 0.741 | 0.073 | 0.014 | 0.000 | −0.003 | −0.012 | 0.533 |

| INR | 0.001 | 0.010 | 0.002 | 0.003 | −0.002 | 0.578 | 0.063 | 0.058 | 0.580 |

| WGI | −0.739 | −0.571 | 0.760 | −1.200 | −0.206 | 0.236 | 2.238 | 0.989 | 0.152 |

| Chi−Sq. Statistic | 38.129 | 28.809 | 20.828 | ||||||

| Hausman test | 0.003 | 0.158 | 0.288 | ||||||

Source: Authors’ computational results.

References

- Abdel Baki, Monal, and Valerio Sciabolazza. 2014. A Consensus−based corporate governance paradigm for Islamic banks. Qualitative Research in Financial Markets 6: 93–108. [Google Scholar] [CrossRef]

- Acharya, Viral V., and Sascha Steffen. 2020. The Risk of Being a Fallen Angel and the Corporate Dash for Cash in the Midst of COVID. The Review of Corporate Finance Studies 9: 430–71. [Google Scholar] [CrossRef]

- Adams, Renée B., and Daniel Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94: 291–309. [Google Scholar] [CrossRef]

- Adams, Renee, and Hamid Mehran. 2012. Bank board structure and performance: Evidence for large bank holding companies. Journal of Financial Intermediation 21: 243–67. [Google Scholar] [CrossRef]

- Ajili, Hana, and Abdelfettah Bouri. 2018. Corporate governance quality of Islamic banks: Measurement and effect on financial performance. International Journal of Islamic and Middle Eastern Finance and Management 11: 470–87. [Google Scholar] [CrossRef]

- Alam, Md Kausar, Mohammad Mizanur Rahman, Mahfuza Kamal Runy, Babatunji Samuel Adedeji, and Md Farjin Hassan. 2021. The influences of Shariah governance mechanisms on Islamic banks performance and Shariah compliance quality. Asian Journal of Accounting Research 7: 2–16. [Google Scholar] [CrossRef]

- Alandejani, Maha, Ali M. Kutan, and Nahla Samargandi. 2017. Do Islamic banks fail more than conventional banks? Journal of International Financial Markets, Institutions and Money 50: 135–55. [Google Scholar] [CrossRef]

- Al-Gamrh, Bakr, Redhwan Al–Dhamari, Akanksha Jalan, and Asghar Afshar Jahanshahi. 2020. The impact of board independence and foreign ownership on financial and social performance of firms: Evidence from the UAE. Journal of Applied Accounting Research 21: 201–29. [Google Scholar] [CrossRef]

- Alman, Mahir. 2012. Shari’ah Supervisory Board Composition Effects on Islamic Banks’ Risk−Taking Behavior. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Almutairi, Ali R., and Majdi Anwar Quttainah. 2017. Corporate governance: Evidence from Islamic banks. Social Responsibility Journal 13: 601–24. [Google Scholar] [CrossRef]

- Amrani, Oumniya, Amal Najab, and Mohamed Azmi. 2022. The impact of governance structure on bank performance: A cross-country panel analysis using statistical learning algorithms. Procedia Computer Science 203: 520–24. [Google Scholar] [CrossRef]

- Awais, Muhammad, Naeem Ullah, Numair Ahmad Sulehri, Mohamed Asmy bin Mohd Thas Thaker, and Muhammad Mohsin. 2022. Monitoring and Efficiency in Governance: A Measure for Sustainability in the Islamic Banking Industry. Frontiers in Psychology 13: 884532. [Google Scholar] [CrossRef] [PubMed]

- Baber, Hasnan. 2018. How crisis-proof is Islamic finance?: A comparative study of Islamic finance and conventional finance during and post financial crisis. Qualitative Research in Financial Markets 10: 415–26. [Google Scholar] [CrossRef]

- Ball, Ray, Ashok Robin, and Joanna Shuang Wu. 2003. Incentives versus standards: Properties of accounting income in four East Asian countries. Journal of Accounting and Economics 36: 235–70. [Google Scholar] [CrossRef]

- Baltagi, Badi H. 2021. Econometric Analysis of Panel Data. Springer Texts in Business and Economics. Cham: Springer International Publishing. [Google Scholar] [CrossRef]

- Batayneh, Khaled, Wasfi Al Salamat, and Mohammad Q. M. Momani. 2021. The impact of inflation on the financial sector development: Empirical evidence from Jordan. Cogent Economics & Finance 9: 1970869. [Google Scholar] [CrossRef]

- Bell, Andrew, Malcolm Fairbrother, and Kelvyn Jones. 2019. Fixed and random effects models: Making an informed choice. Quality & Quantity 53: 1051–74. [Google Scholar] [CrossRef]

- Berger, Allen N., Björn Imbierowicz, and Christian Rauch. 2016. The Roles of Corporate Governance in Bank Failures during the Recent Financial Crisis. Journal of Money, Credit and Banking 48: 729–70. [Google Scholar] [CrossRef]

- Beyer, Anne, Daniel A. Cohen, Thomas Z. Lys, and Beverly R. Walther. 2010. The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics 50: 296–343. [Google Scholar] [CrossRef]

- Borio, Claudio. 2020. The COVID-19 economic crisis: Dangerously unique. Business Economics 55: 181–90. [Google Scholar] [CrossRef]

- Bouchaud, Jean–Philippe. 2016. Crises économiques: Hasard exogène ou endogène? Raison Presente 198: 49–56. [Google Scholar] [CrossRef]

- Bourkhis, Khawla, and Mahmoud Nabi. 2013. Islamic and conventional banks’ soundness during the 2007–2008 financial crisis. Review of Financial Economics 22: 68–77. [Google Scholar] [CrossRef]

- Bukair, Abdullah Awadh, and Azhar Abdul Rahman. 2015. Bank performance and board of directors attributes by Islamic banks. International Journal of Islamic and Middle Eastern Finance and Management 8: 291–309. [Google Scholar] [CrossRef]

- Bukhari, Syed Asim Ali, Fathyah Hashim, and Azlan Bin Amran. 2020. Determinants and outcome of Islamic corporate social responsibility (ICSR) adoption in Islamic banking industry of Pakistan. Journal of Islamic Marketing 12: 730–62. [Google Scholar] [CrossRef]

- Burgstahler, David, Luzi Hail, and Christian Leuz. 2006. The Importance of Reporting Incentives: Earnings Management in European Private and Public Firms. The Wharton Financial Institutions Center 04-07. SSRN Scholarly Paper No 484682. Available online: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=0bd4c1490893d8b703084fa2ff2d4b7569df027f (accessed on 7 June 2022).

- Chan, Sok–Gee, and Mohd Zaini Abd Karim. 2016. Financial Market Regulation, Country Governance, and Bank Efficiency: Evidence from East Asian Countries. Contemporary Economics 10: 39–54. Available online: https://ideas.repec.org/a/wyz/journl/id433.html (accessed on 8 September 2022). [CrossRef]

- Charreaux, Gérard. 2011. Quelle Théorie Pour La Gouvernance? De La Gouvernance Actionnariale à La Gouvernance Cognitive et Comportementale; Working Papers CREGO. No 1110402. Université de Bourgogne—CREGO EA7317 Centre de Recherches en Gestion des Organisations. Available online: https://ideas.repec.org/p/dij/wpfarg/1110402.html (accessed on 7 June 2022).

- Compaoré, Ali, Montfort Mlachila, Rasmané Ouedraogo, and Sandrine Sourouema. 2020. The Impact of Conflict and Political Instability on Banking Crises in Developing Countries. IMF Working Papers 2020 (41). Available online: https://www.elibrary.imf.org/view/journals/001/2020/041/001.2020.issue-041-en.xml (accessed on 12 June 2022).

- Daly, Saida, and Mohamed Frikha. 2016. Banks and economic growth in developing countries: What about Islamic banks? Cogent Economics & Finance 4: 1168728. [Google Scholar] [CrossRef]

- DeLorenzo, Yusuf Talal. 2007. Shariah compliance risk. Journal of International Law 7: 1–12. [Google Scholar]

- Doumpos, Michael, Iftekhar Hasan, and Fotios Pasiouras. 2017. Bank overall financial strength: Islamic versus conventional banks. Economic Modelling 64: 513–23. [Google Scholar] [CrossRef]

- El-Chaarani, Hani. 2022. The Impact of Corporate Governance and Political Connectedness on the Financial Performance of Lebanese Banks during the Financial Crisis of 2019–2021. SSRN Scholarly Paper No 4096766. Rochester: Social Science Research Network. Available online: https://papers.ssrn.com/abstract=4096766 (accessed on 10 December 2022).

- Erkens, David H., Mingyi Hung, and Pedro Matos. 2012. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance 18: 389–411. [Google Scholar] [CrossRef]

- Fan, Yaoyao, Yuxiang Jiang, Xuezhi Zhang, and Yue Zhou. 2019. Women on boards and bank earnings management: From zero to hero. Journal of Banking & Finance 107: 105607. [Google Scholar] [CrossRef]

- Farag, Hisham, Chris Mallin, and Kean Ow-Yong. 2018. Corporate governance in Islamic banks: New insights for dual board structure and agency relationships. Journal of International Financial Markets, Institutions and Money 54: 59–77. [Google Scholar] [CrossRef]

- Farook, Sayd, M. Kabir Hassan, and Roman Lanis. 2011. Determinants of corporate social responsibility disclosure: The case of Islamic banks. Journal of Islamic Accounting and Business Research 2: 114–41. [Google Scholar] [CrossRef]

- Ginena, Karim, and Azhar Hamid. 2015. Foundations of Shari’ah Governance of Islamic Banks. Chichester: Wiley. Available online: http://site.ebrary.com/id/11027501 (accessed on 10 December 2022).