Measuring Collaborative Synergies with Advanced Real Options: MNEs’ Sequential Acquisitions of International Ventures

Abstract

1. Introduction

2. Key Literature Review

2.1. Exploring the Antecedents of Collaborative Competence-Based Synergies

2.2. Measuring Collaborative Synergies

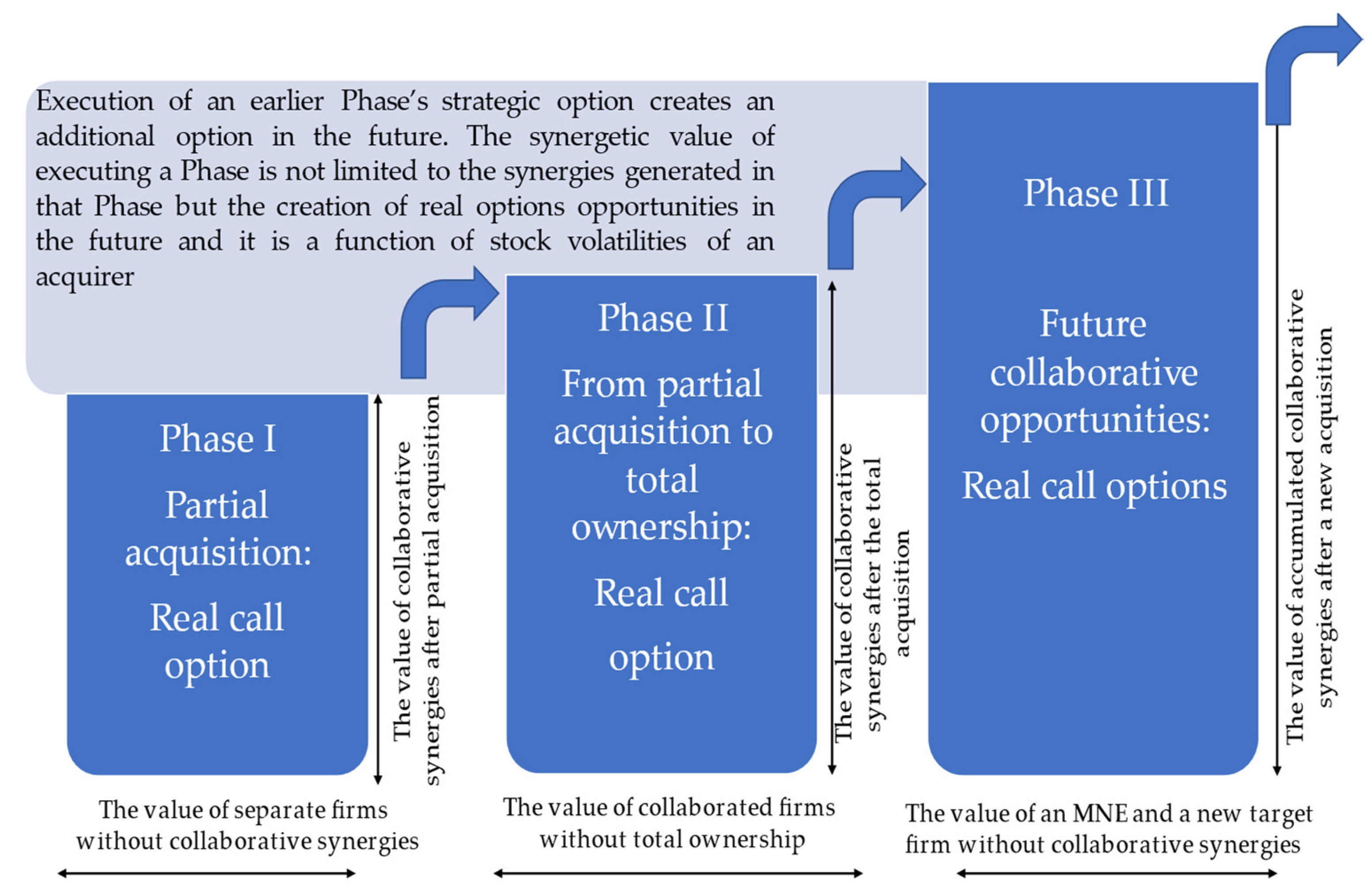

2.3. Measuring Collaborative Synergies with a Real Options Valuation

3. Method

4. Data Analysis and Interpretation: From Partial Acquisition to Total Ownership: Aesop’s Acquisition by Natura Cosméticos S.A.

4.1. Prerequisites of Competence-Based Synergies of Natura Cosméticos S.A.’s Acquisition of the Aesop Brand of Emeis Holdings

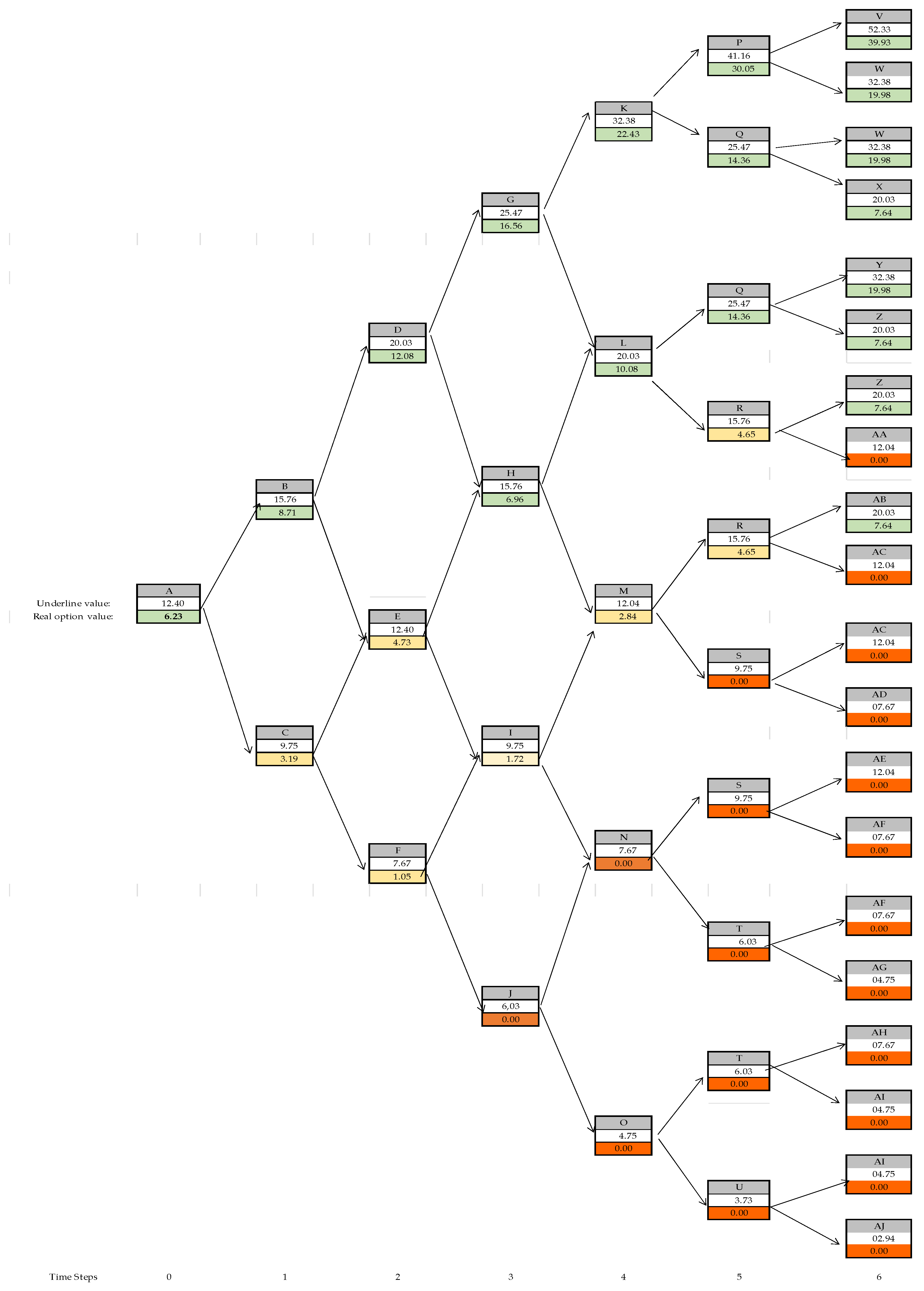

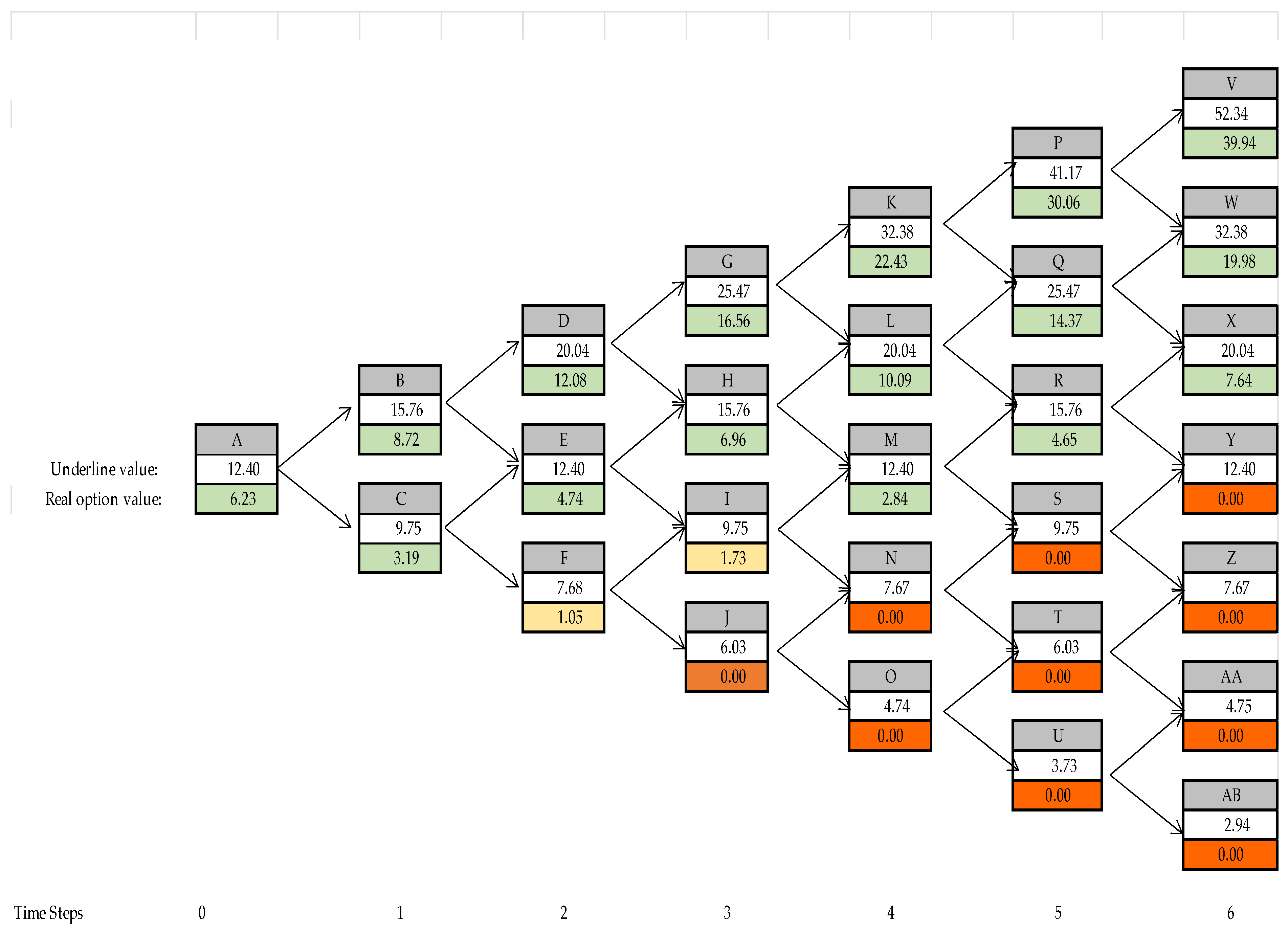

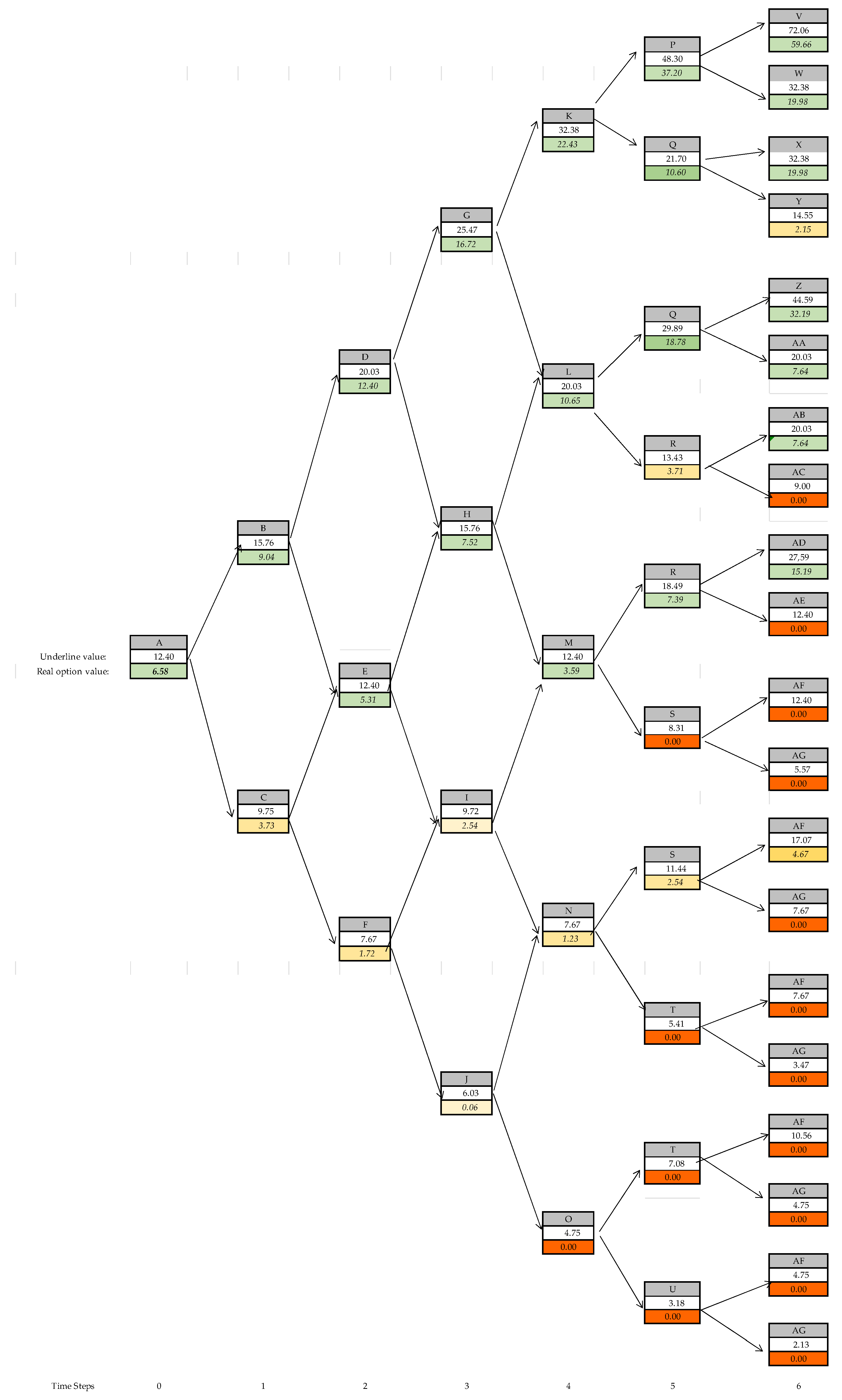

4.2. Measuring Collaborative Synergies with a Non-Recombining Lattice

5. Findings and Discussions

6. Conclusions, Contributions, Limitations, and Future Work

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adner, Ron, and Daniel A. Levinthal. 2004. What is Not a Real Option: Considering Boundaries to Application of Real Options to Business Strategy. Academy of Management Review 29: 74–84. [Google Scholar] [CrossRef]

- Anand, Jaideep, and Shaohua Lu. 2013. Beyond Strategic Factor Market: Competitive Advantage under Imperfect Information. Academy of Management Proceedings. Available online: https://journals.aom.org/doi/abs/10.5465/ambpp.2013.17054abstract (accessed on 24 November 2022).

- Anand, Jaideep, Laurence Capron, and Will Mitchell. 2005. Using acquisitions to access multinational diversity: Thinking beyond the domestic versus cross-border M&A comparison. Industrial and Corporate Change 14: 191–224. [Google Scholar]

- Annual Report Natura Cosméticos S.A. 2012. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwiU2qjykpb8AhXN4DgGHRynB9cQFnoECAsQAQ&url=https%3A%2F%2Fwww.annualreports.com%2FHostedData%2FAnnualReportArchive%2Fn%2FNYSE_NTCO_2012.pdf&usg=AOvVaw1Mp1t8Yl7vcA0HFMxPD429 (accessed on 24 November 2022).

- Bain & Company. 2022. Core Competencies. Available online: https://www.bain.com/insights/management-tools-core-competencies/ (accessed on 23 November 2022).

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Barney, Jay B., and William S. Hesterly. 2018. Strategic Management and Competitive Advantage: Concepts and Cases, 6th ed. Global Edition. London: Pearson. [Google Scholar]

- Bettanti, Alberto, and Antonella Lanati. 2022. A quantitative approach to risk-driven strategy formulation: A case study introducing a real-options framework. Front Manage Bus 3: 238–51. [Google Scholar] [CrossRef]

- Błaszczyk, Marek. 2018. Strategic synergies and perspectives of their evaluation in the process of strategic analysis. Management Sciences. Nauki o Zarządzaniu 23: 9–17. [Google Scholar]

- Borison, Adam. 2005. Real Options Analysis: Where are the Emperor’s Clothes? Journal of Applied Corporate Finance 17: 17–31. [Google Scholar] [CrossRef]

- Brach, Marion. 2003. Real Options in Practice. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Bradley, Michael, Anand Desai, and E. Han Kim. 1988. Synergistic Gains from Corporate Acquisitions and their Division between the Stockholders of Target and Acquiring Firms. Journal of Financial Economics v21: 3–40. [Google Scholar]

- Brandāo, Luiz E., James S. Dyer, and Warren J. Han. 2005. Using Binominal Decision Trees to Solve Real-Option Valuation problems. Decision Analysis 2: 69–88. [Google Scholar] [CrossRef]

- Chang, Sea-Jin, and Philip M. Rosenzweig. 2001. The choice of entry mode in sequential foreign direct investment. Strategic Management Journal 22: 747–76. [Google Scholar] [CrossRef]

- Chi, Tailan, Li Jing, Trigeorgis G Lenos, and Tsekrekos E. Andrianos. 2019. Real options theory in international business. Journal of International Business Studies 50: 525–53. [Google Scholar] [CrossRef]

- Childs, Paul D., Steven H. Ott, and Alexander J. Triantis. 1998. Capital budgeting for Interrelated Projects: A Real Options Approach. Journal of Financial and Quantitative Analysis 33: 305–33. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2017. Acquisition-based dynamic capabilities and reinvention of business models: Bridging two perspectives together. Entrepreneurship and Sustainability Issues 4: 516–25. [Google Scholar] [CrossRef] [PubMed]

- Čirjevskis, Andrejs. 2020a. Valuing Reciprocal Synergies in Merger and Acquisition Deals Using the Real Options Analysis. Administrative Sciences 10: 27. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2020b. Brazilian Natura & Co: Creating cosmetic powerhouse. Empirical evidence of competence-based synergies in M&A processes. Academia Revista Latinoamericana de Administración 34: 18–42. [Google Scholar]

- Čirjevskis, Andrejs. 2021a. Exploring the Link of Real Options Theory with Dynamic Capabilities Framework in Open Innovation-Type Merger and Acquisition Deals. Journal of Risk and Financial Management 14: 168. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2021b. Exploring Critical Success Factors of Competence-Based Synergy in Strategic Alliances: The Renault–Nissan–Mitsubishi Strategic Alliance. Journal of Risk and Financial Management 14: 385. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2022a. Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective. Journal of Risk and Financial Management 15: 281. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2022b. A Discourse on Foresight and the Valuation of Explicit and Tacit Synergies in Strategic Collaborations. Journal of Risk and Financial Management 15: 305. [Google Scholar] [CrossRef]

- Collis, Jill, and Roger Hussy. 2009. Business Research, 3rd ed. London: Palgrave Macmillan, pp. 164–66. [Google Scholar]

- Copeland, Thomas E., and Philip T. Keenan. 1998. Making Real Options Real. McKinsey Quarterly 3: 128–41. [Google Scholar]

- Čulík, Miroslav. 2016. Real options valuation with changing volatility. Perspectives in Science 7: 10–18. [Google Scholar] [CrossRef]

- Damodaran, Aswath. 2002. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, 2nd ed. Hoboken: John Wiley and Sons. [Google Scholar]

- Damodaran, Aswath. 2005. The Value of Synergy. Available online: https://pages.stern.nyu.edu/~adamodar/pdfiles/papers/synergy.pdf (accessed on 22 November 2022).

- Dunis, Christian H., and Til Klein. 2005. Analyzing Mergers and Acquisitions in European Financial Services: An Application of Real Options. European Journal of Finance 11: 339–55. [Google Scholar] [CrossRef]

- Eden, Loraine. 2009. Letter from the Editor-in-Chief: Real options and international business. Journal of International Business Studies 40: 357–60. [Google Scholar] [CrossRef][Green Version]

- Ehrhardt, Michael C., and Eugene F. Brigham. 2006. Corporate Finance: A Focused Approach, 2nd ed. Cincinnati: Southwestern Educational Publishing. [Google Scholar]

- Eisenhardt, Kathleen M., and Melissa E. Graebner. 2007. Theory building from cases: Opportunities and challenges. Academy of Management Journal 50: 25–32. [Google Scholar] [CrossRef]

- Exchange Rates UK. 2022. Brazilian Real to US Dollar Spot Exchange Rates for 2020. Available online: https://www.exchangerates.org.uk/BRL-USD-spot-exchange-rates-history-2020.html (accessed on 22 December 2022).

- Feldman, Emilie R., and Exequiel Hernandez. 2021. Synergy in Mergers and Acquisitions: Typology, Lifecycles, and Value. Academy of Management Review 47: 549–78. [Google Scholar] [CrossRef]

- Ferreira, Manuel Portugal, Nuno Rosa dos Reis, and Cláudia Frias Pinto. 2016. Three decades of strategic management research on M&As: Citations, co-citations, and topics. Global Economics and Management Review 21: 13–24. [Google Scholar]

- Finbox. 2022a. Market Capitalization NTCO. Available online: https://finbox.com/NYSE:NTCO/explorer/marketcap (accessed on 8 October 2022).

- Finbox. 2022b. EV/EBITDA for Natura & Co Holding S.A. Available online: https://finbox.com/NYSE:NTCO/explorer/ev_to_ebitda_ltm (accessed on 9 October 2022).

- Folta, Timothy B., and Jonathan P. O’Brien. 2004. Entry in the presence of duelling options. Strategic Management Journal 25: 121–38. [Google Scholar] [CrossRef]

- Glazer, Emily. 2012. Brazil’s Natura Buys Aesop Majority Stake. The Wall Street Journal. Available online: https://www.wsj.com/articles/BL-DJAUB-2115 (accessed on 23 November 2022).

- Hannah, Douglas P., Ron Tidhar, and Kathleen M. Eisenhardt. 2021. Analytic models in strategy, organizations, and management research: A guide for consumers. Strategic Management Journal 42: 329–60. [Google Scholar] [CrossRef]

- Hull, John. 2022. Options, Futures, and Other Derivatives, 11th ed. Harlow: Pearson Education Limited, Edinburgh Gate Harlow. [Google Scholar]

- Knott, Paul. 2015. Does VRIO help managers evaluate a firm’s resources? Management Decision 53: 1806–22. [Google Scholar] [CrossRef]

- Kodukula, Prasad, and Chandra Papudesu. 2006. Project Valuation Using Real Options: A Practitioner’s Guide. Fort Lauderdale. Richmond: Ross Publishing, Inc. [Google Scholar]

- Kogut, Bruce. 1991. Joint Ventures and the Option to Expand and Acquire. Management Science 37: 19–33. [Google Scholar] [CrossRef]

- KPMG. 2012. Natura Cosmēticos S.A. Valuation Report of Emeis Holding ty Ltd. Available online: https://docplayer.net/4158581-Natura-cosmeticos-s-a.html (accessed on 22 November 2022).

- Leiblein, Michael J., Jeffrey J. Reuer, Marcus M. Larsen, and Torben Pedersen. 2022. When are global decisions strategic? Global Strategy Journal 12: 714–37. [Google Scholar] [CrossRef]

- Li, Jing. 2007. Real Options Theory and International Strategy: A Critical Review. Advances in Strategic Management 24: 67–101. [Google Scholar]

- Lockett, Andy, Steve Thompson, and Uta Morgenstern. 2009. The development of the resource-based view: A critical appraisal. International Journal of Management Reviews 11: 9–28. [Google Scholar] [CrossRef]

- MarketScreener. 2022. NATURA &CO HOLDING S.A. (NTCO3). Available online: https://www.marketscreener.com/quote/stock/NATURA-CO-HOLDING-S-A-6497167/financials/ (accessed on 22 December 2022).

- Mun, Johnathan. 2002. Real Options Analysis, Tools and Techniques for Valuing Strategic Investments and Decisions. Hoboken: John Wiley and Sons. [Google Scholar]

- Mun, Johnathan. 2003. Real Options Analysis Course: Business Cases and Software Applications. Hoboken: John Wiley and Sons. [Google Scholar]

- Myers, Stewart C. 1977. Determinants of corporate borrowing. Journal of Financial Economics 5: 147–75. [Google Scholar] [CrossRef]

- Natura Cosméticos S.A. 2018. Individual and Consolidated Financial Statements for the Year Ended 31 December 2018. Management Report. Available online: https://mz-filemanager.s3.amazonaws.com/9e61d5ff-4641-4ec3-97a5-3595f938bb75/central-de-resultadoscentral-de-downloads/228be03dc888c45517d2f0e6a5ca64218fc8fd8bbe61d42a6ed1013d3fca5c25/4q18_financial_statements_in_international_standards.pdf (accessed on 17 November 2022).

- Pound Sterling Live. 2012. Available online: https://www.poundsterlinglive.com/history/AUD-USD-2012 (accessed on 9 October 2022).

- Prahalad, Coimbatore K., and Gary Hamel. 1990. The Core Competence of the Corporation. Harvard Business Review May–June: 79–91. [Google Scholar]

- Ragozzino, Roberto, Jeffrey J. Reuer, and Lenos Trigeorgis. 2016. Real option in strategy and finance. Current Gaps and Future Linkages. Academy of Management Perspective 30: 428–40. [Google Scholar] [CrossRef]

- Raisch, Sebastian, and Michael L. Tushman. 2016. Growing new corporate businesses: From initiation to graduation. Organization Science 27: 1237–57. [Google Scholar] [CrossRef]

- Teece, David J., Gary Pisano, and Amy Shuen. 1997. Dynamic Capabilities, and Strategic Management. Strategic Management Journal 18: 509–33. [Google Scholar] [CrossRef]

- Teece, David J., Margaret A. Peteraf, and Sohvi Leih. 2016. Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. California Management Review 58: 13–35. [Google Scholar] [CrossRef]

- Tellis, Winston M. 1997. Introduction to Case Study. The Qualitative Report 3: 1–14. [Google Scholar] [CrossRef]

- Tong, Tony W., and Jeffrey J. Reuer. 2007. Real Options in Strategic Management. Advances in Strategic Management 2: 3–24. [Google Scholar]

- Trading Economics. 2022. Brazil Interest Rate. Available online: https://tradingeconomics.com/brazil/interest-rate (accessed on 9 October 2022).

- Trigeorgis, Lenos, and Jeffrey J. Reuer. 2017. Real options theory in strategic management. Strategic Management Journal 38: 42–63. [Google Scholar] [CrossRef]

- V-Lab. 2022. Natura Cosmeticos SA GARCH Volatility Analysis. Available online: https://vlab.stern.nyu.edu/volatility/VOL.NATU3%3ABZ-R.GARCH (accessed on 9 October 2022).

- Wang, Vin, and Joseph Mahoney. 2022. An MNE’s Governance Choice of Acquiring Its International Joint Venture: Extending the Real Options Lens. Available online: https://www.strategicmanagement.net/london/tools/session-details?sessionId=2446 (accessed on 14 October 2022).

- Xu, Dean, Zhou Changhui, and Phan H. Phillip. 2010. A real options perspective on sequential acquisitions in China. Journal of International Business Studies 41: 166–74. [Google Scholar] [CrossRef]

- Yin, Robert K. 2011. Qualitative Research from Start to Finish. New York: The Guilford Press a Division of Guilford Publications, Inc. [Google Scholar]

- Zhu, PengCheng. 2011. Persistent performance and interaction affect sequential cross-border mergers and acquisitions. Journal of Multinational Financial Management 21: 18–39. [Google Scholar] [CrossRef]

| Parameters of Financial Options | Parameters of Real Options with Changing Volatility | Data |

|---|---|---|

| Stock price (So) | The cumulated market value of Aesop and Natura Cosméticos S.A. (four-week average) before the announcement of the deal | The market capitalization of Natura Cosméticos S.A (NTCO) on 31 December 2012, was USD 12.287 bn (Finbox 2022a). The market value of Aesop was AUD 114.690 M (KPMG 2012, p. 28) or USD110.3 M (Pound Sterling Live 2012). Therefore, the cumulated market value of the separated entities before the partial acquisition (So) equals USD 12.397 bn. |

| The strike price (K) | The hypothetical future market value of the separate entities is forecast by the EV/EBITDA multiples of Aesop and Natura Cosméticos S.A. in 2012 | In 2012, Natura Cosméticos S.A. consolidated EBITDA reached BRL 1511 billion (Annual Report Natura Cosméticos S.A. 2012, p. 6) and on 31 December 2012, the EV/EBITDA multiple was 17.4 (Finbox 2022b). Therefore, the hypothetical future market value of Natura Cosméticos S.A. as a separate entity was USD 12.847 bn. According to the KMPG report (KPMG 2012), Aesop’s EBITDA in 2012 was AUD 6.852 M. As shown by KPMG, the median EV/EBITDA market multiples of comparable companies are equal to 12.2. (KPMG 2012, p. 30). Thus, the future value of Aesop without acquisition was AUD 83.5944 M or USD 80.4 M. Therefore, the hypothetical future market value of the separate entities was forecasted as USD 12.927 bn. |

| Stock volatility of an acquirer the during the time of partial ownership of a target’s shares (σ1) | Natura Cosméticos S.A.’s historical volatilities within the first week after the announcement of the partial acquisition of Aesop: 20–27 December 2012. | The stock volatility of Natura Cosméticos S.A on 20–27 December 2012 (one week after the announcement of partial acquisition) was 24.0% (V-Lab 2022). |

| Stock volatility of an acquirer during the time of total ownership of a target’s shares in the next two years (σ2) | Natura Cosméticos S.A.’s historical volatilities within the first week after the announcement of the full acquisition | The sock volatility of Natura Cosméticos S.A on 20–27 December 2016 (one week after the announcement of the total acquisition) was 40% (V-Lab 2022). |

| Risk-free rate (r) | The annualized risk-free interest rate in Brazil in 2012 | The annualized risk-free interest rate in Brazil in 2012 was 11.0% (Trading Economics 2022). |

| Time to maturity (T1 and T2) | Duration of gaining collaborative tacit synergy when Natura Cosméticos S.A. kept 65% of Aesop’s stock was four years (T1). The time to maturity after full acquisition was assumed to be two-years (T2) | Duration (T1) was the period from 2012 to 2016 (four years) when Natura Cosméticos S.A. kept 65% of Aesop’s stock. The time of synergy expectation (T2) by management during the period from 2016 to 2018 is two years after the 100% acquisition of Aesop. |

| Time increment (δt) | One-year time intervals for six years to account for the change in the up and down factors of the lattice-based real options method | 1.0 year |

| Time increment (years) | 1.00 | |

| Up factor (u) | 1.271 | |

| Down factor (d) | 0.787 | |

| Risk-neutral probability (p) | 0.680 |

| Time increment (years) | 1.00 | |

| Up jump factor (u’) | 1.492 | |

| Down jump factor (d’) | 0.670 | |

| Risk-neutral probability (p’) | 0.543 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Čirjevskis, A. Measuring Collaborative Synergies with Advanced Real Options: MNEs’ Sequential Acquisitions of International Ventures. J. Risk Financial Manag. 2023, 16, 11. https://doi.org/10.3390/jrfm16010011

Čirjevskis A. Measuring Collaborative Synergies with Advanced Real Options: MNEs’ Sequential Acquisitions of International Ventures. Journal of Risk and Financial Management. 2023; 16(1):11. https://doi.org/10.3390/jrfm16010011

Chicago/Turabian StyleČirjevskis, Andrejs. 2023. "Measuring Collaborative Synergies with Advanced Real Options: MNEs’ Sequential Acquisitions of International Ventures" Journal of Risk and Financial Management 16, no. 1: 11. https://doi.org/10.3390/jrfm16010011

APA StyleČirjevskis, A. (2023). Measuring Collaborative Synergies with Advanced Real Options: MNEs’ Sequential Acquisitions of International Ventures. Journal of Risk and Financial Management, 16(1), 11. https://doi.org/10.3390/jrfm16010011