Is Bitcoin a Safe Haven for Indian Investors? A GARCH Volatility Analysis

Abstract

:1. Introduction

2. Literature Review

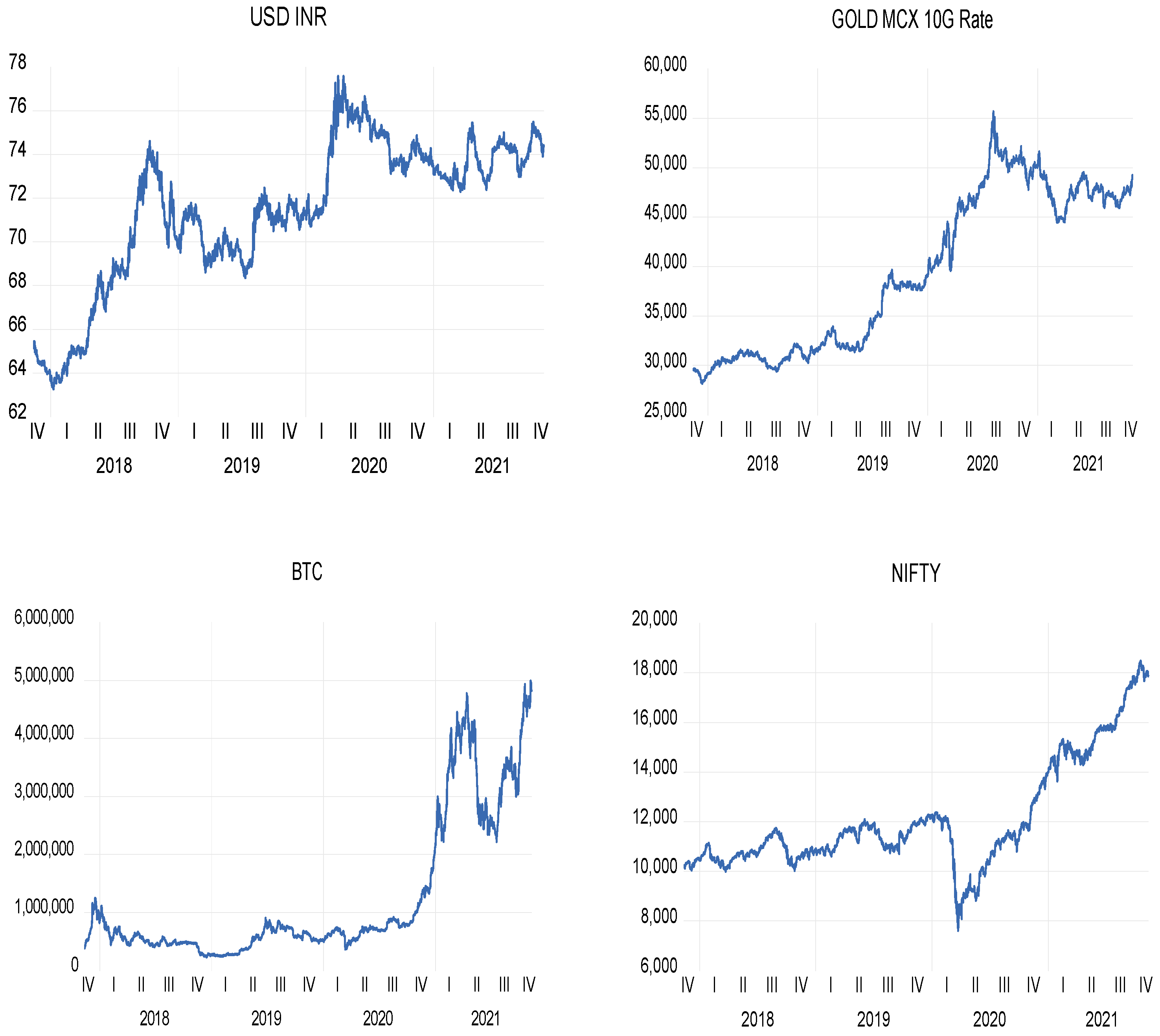

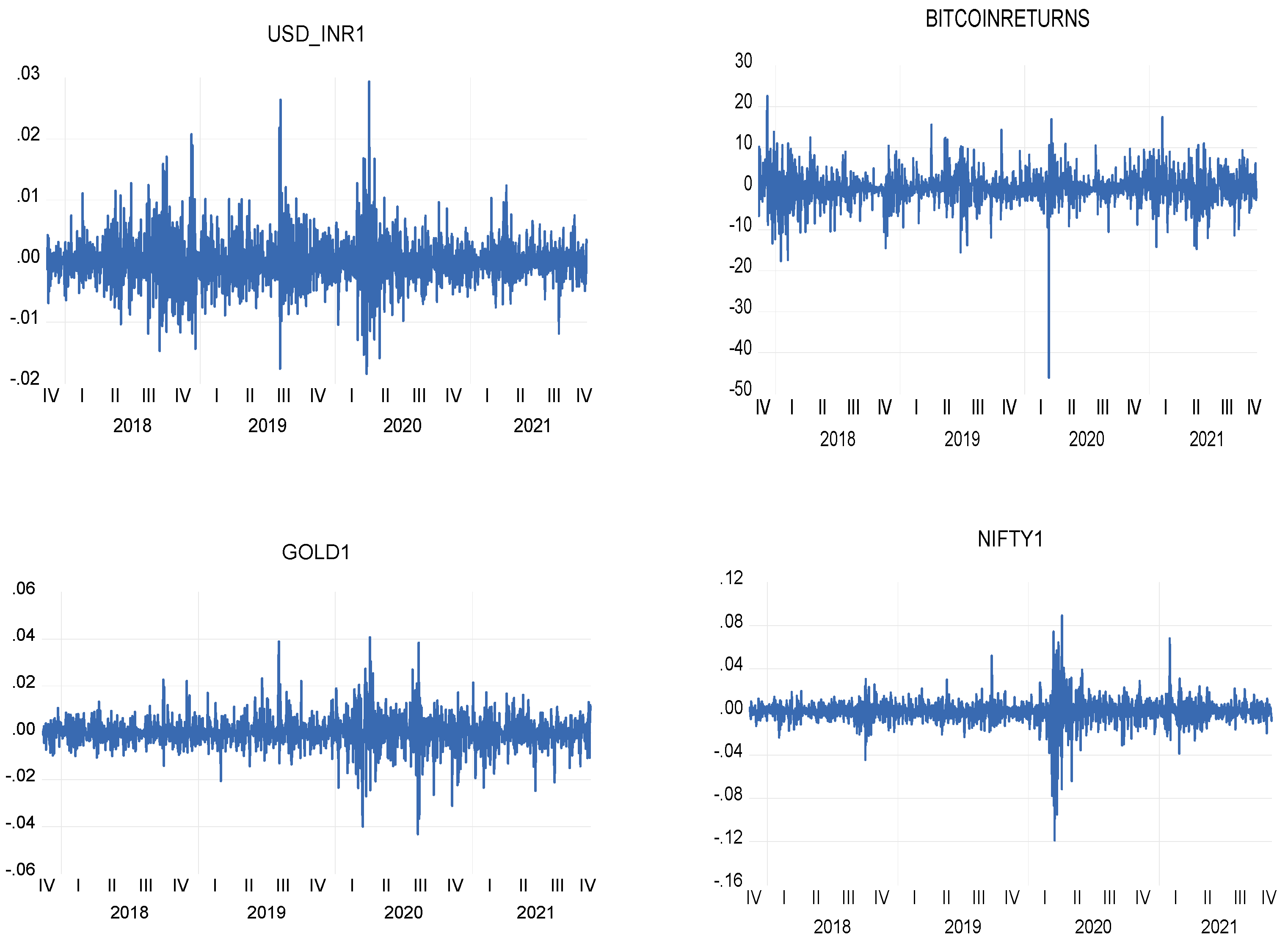

3. Data and Methodology

4. Time Series Properties

5. Results

5.1. GARCH (1,1) Results

5.2. Exponential GARCH (EGARCH)

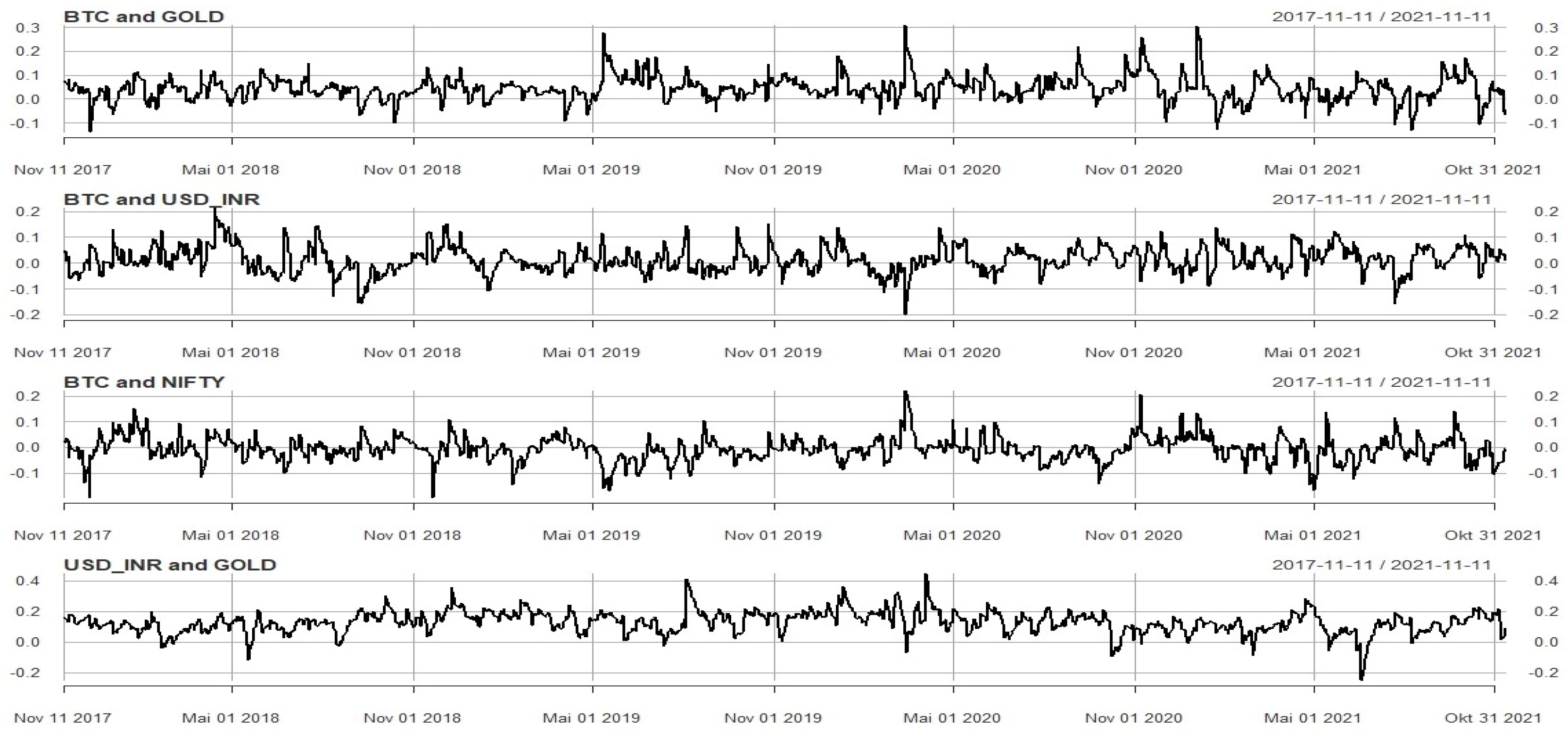

5.3. DCC GARCH Model

6. Limitations and Future Study Directions

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aalborg, Halvor Aarhus, Peter Molnár, and Jon Erik de Vries. 2019. What can explain the price, volatility and trading volume of Bitcoin? Finance Research Letters 29: 255–65. [Google Scholar]

- Afzal, Fahim, Pan Haiying, Farman Afzal, Asif Mahmood, and Amir Ikram. 2021. Value-at-Risk Analysis for Measuring Stochastic Volatility of Stock Returns: Using GARCH-Based Dynamic Conditional Correlation Model. SAGE Open 11: 21582440211005758. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2020. Financial contagion during covid–19 crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef] [PubMed]

- Ali, Fahad, Yuexiang Jiang, and Ahmet Sensoy. 2021. Downside risk in Dow Jones Islamic equity indices: Precious metals and portfolio diversification before and after the COVID-19 bear market. Research in International Business and Finance 58: 101502. [Google Scholar] [CrossRef]

- Ari, Yakup. 2020. Volatility Transmission Model using DCC-GARCH representation. In Studies at the Crossroads of Management & Economics. Edited by Samet Evci and Anshuman Sharma. London: IJOPEC, pp. 237–50. [Google Scholar]

- Aysan, Ahmet Faruk, Ender Demir, Giray Gozgor, and Chi Keung Marco Lau. 2019. Effects of the geopolitical risks on Bitcoin returns and volatility. Research in International Business and Finance 47: 511–18. [Google Scholar] [CrossRef] [Green Version]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas Dimpfl. 2021. The volatility of Bitcoin and its role as a medium of exchange and a store of value. Empirical Economics 61: 2663–83. [Google Scholar] [CrossRef]

- Beneki, Christina, Alexandros Koulis, Nikolaos A. Kyriazis, and Stephanos Papadamou. 2019. Investigating volatility transmission and hedging properties between Bitcoin and Ethereum. Research in International Business and Finance 48: 219–27. [Google Scholar] [CrossRef]

- Bhowmik, Roni, and Shouyang Wang. 2020. Stock Market Volatility and Return Analysis: A Systematic Literature Review. Entropy 22: 522. [Google Scholar] [CrossRef]

- Böhme, Rainer, Nicolas Christin, Benjamin Edelman, and Tyler Moore. 2015. Bitcoin: Economics, Technology, and Governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Rangan Gupta, Aviral Kumar Tiwari, and David Roubaud. 2017. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters 23: 87–95. [Google Scholar] [CrossRef] [Green Version]

- Brière, Marie, Bastien Drut, Valérie Mignon, Kim Oosterlinck, and Ariane Szafarz. 2013. Is the market portfolio efficient? A new test of mean-variance efficiency when all assets are risky. Finance 34: 7–41. [Google Scholar] [CrossRef] [Green Version]

- Briere, Marie, Kim Oosterlinck, and Ariane Szafarz. 2015. Virtual currency, tangible return: Portfolio diversification with bitcoin. Journal of Asset Management 16: 365–73. [Google Scholar] [CrossRef]

- Capie, Forrest, Terence C. Mills, and Geoffrey Wood. 2005. Gold as a hedge against the dollar. Journal of International Financial Markets. Institutions and Money 15: 343–52. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and d’Artis Kancs. 2016. The economics of BitCoin price formation. Applied Economics 48: 1799–815. [Google Scholar] [CrossRef] [Green Version]

- Civelek, Mehmet, Aleksandr Ključnikov, Jitka Kloudová, and Iveta Vozňáková. 2021. Digital local currencies as an alternative digital payment method for businesses to overcome problems of COVID-19 pandemic. Polish Journal of Management Studies 23: 57. [Google Scholar] [CrossRef]

- Colon, Francisco, Chaehyun Kim, Hana Kim, and Wonjoon Kim. 2020. The Effect of Political and Economic Uncertainty on the Cryptocurrency Market. Finance Research Letters 39: 101621. [Google Scholar] [CrossRef]

- Conlon, Thomas, and Richard McGee. 2020. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef]

- Corbet, Shaen, Charles Larkin, and Brian Lucey. 2020. The contagion effects of the COVID-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters 35: 101554. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef] [Green Version]

- Fassas, Athanasios P., Stephanos Papadamou, and Alexandros Koulis. 2020. Price discovery in bitcoin futures. Research in International Business and Finance 52: 101116. [Google Scholar] [CrossRef]

- Glaser, Florian, Kai Zimmermann, Martin Haferkorn, Moritz Christian Weber, and Michael Siering. 2014. Bitcoin-asset or Currency? Revealing Users’ Hidden Intentions. Revealing Users’ Hidden Intentions. April 15 ECIS. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2425247 (accessed on 2 February 2022).

- Guesmi, Khaled, Samir Saadi, Ilyes Abid, and Zied Ftiti. 2019. Portfolio Diversification with Virtual Currency: Evidence from Bitcoin. International Review of Financial Analysis 63: 431–37. [Google Scholar] [CrossRef]

- Haar. 2021. What Is Bitcoin? August 12. Available online: https://time.com/nextadvisor/investing/cryptocurrency/what-is-bitcoin/ (accessed on 9 February 2022).

- Hendrickson, Joshua R., and William J. Luther. 2017. Banning bitcoin. Journal of Economic Behavior & Organization 141: 188–95. [Google Scholar]

- Investing.com. 2022. Bitcoin. Available online: https://in.investing.com/crypto/bitcoin/historical-data (accessed on 13 February 2022).

- Jin, Jingyu, Jiang Yu, Yang Hu, and Yue Shang. 2019. Which one is more informative in determining price movements of hedging assets? Evidence from Bitcoin, gold and crude oil markets. Physica A: Statistical Mechanics and Its Applications 527: 121121. [Google Scholar] [CrossRef]

- Kayal, Parthajit, and Purnima Rohilla. 2021. Bitcoin in the economics and finance literature: A survey. SN Business & Economics 1: 1–21. [Google Scholar]

- Khan, Muhammad Asif, Masood Ahmed, József Popp, and Judit Oláh. 2020. US Policy Uncertainty and Stock Market Nexus Revisited through Dynamic ARDL Simulation and Threshold Modelling. Mathematics 8: 2073. [Google Scholar] [CrossRef]

- Klein, Tony, Hien Pham Thu, and Thomas Walther. 2018. Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis 59: 105–16. [Google Scholar] [CrossRef]

- Kothari. 2022. Crypto Revolution Is Here to Stay. What about India’s India’s Regulatory Stance. Available online: https://www.htsyndication.com/mint/article/crypto-revolution-is-here-to-stay.-what-about-india-s-regulatory-stance/57442497 (accessed on 12 February 2022).

- Likos, Paulina, and Coryanne Hicks. 2022. The History of Bitcoin, the First Cryptocurrency. Available online: https://money.usnews.com/investing/articles/the-history-of-bitcoin (accessed on 4 February 2022).

- Liu, Yukun, and Aleh Tsyvinski. 2021. Risks and returns of cryptocurrency. The Review of Financial Studies 34: 2689–727. [Google Scholar] [CrossRef]

- Lo, Stephanie, and Christina Wang. 2014. Bitcoin as Money. FED Boston, Boston. Available online: https://bitcoinwallets.com/bitcoin-as-money.pdf (accessed on 8 February 2022).

- Luther, William, and Nikhil Sridhar. 2021. On the Origin of Cryptocurrencies (1 December 2021). AIER Sound Money Project Working Paper No. 2022-02. Available online: https://ssrn.com/abstract=3976424 (accessed on 5 February 2022). [CrossRef]

- Madhok. 2022. India Wants to Launch a Digital Rupee and Tax Crypto Profits. Available online: https://edition.cnn.com/2022/02/01/investing/india-budget-digital-rupee/index.html (accessed on 8 February 2022).

- Mandelbrot, B. 1963. New methods in statistical economics. Journal of Political Economy 71: 421–40. [Google Scholar] [CrossRef]

- MCX, India. 2022. Historical Data. Available online: https://www.mcxindia.com/market-data/historical-data (accessed on 18 February 2022).

- Moore, Winston, and Jeremy Stephen. 2016. Should cryptocurrencies be included in the portfolio of international reserves held by central banks? Cogent Economics & Finance 4: 1147119. [Google Scholar]

- NSE. 2022. Historical Index Data. Available online: https://www1.nseindia.com/products/content/equities/indices/historical_index_data.htm (accessed on 4 February 2022).

- RBI, Reserve Bank of India. 2022. Reference Rate Archive. Available online: https://www.rbi.org.in/scripts/referenceratearchive.aspx (accessed on 7 February 2022).

- Rogojanu, Angela, and Liana Badea. 2014. The issue of competing currencies. Case study. Bitcoin Theoretical and Applied Economics 21: 103–14. [Google Scholar]

- Rudolf, Karl Oton, Samer Ajour El Zein, and Nicola Jackman Lansdowne. 2021. Bitcoin as an Investment and Hedge Alternative. A DCC MGARCH Model Analysis. Risks 9: 154. [Google Scholar] [CrossRef]

- Sahoo, Pradipta Kumar. 2017. Bitcoin as digital money: Its growth and future sustainability. Theoretical and Applied Economics 24: 53–64. [Google Scholar]

- Setiawan, Budi, Marwa Ben Abdallah, Maria Fekete-Farkas, Robert Jeyakumar Nathan, and Zoltan Zeman. 2021. GARCH (1, 1) Models and Analysis of Stock Market Turmoil during COVID-19 Outbreak in an Emerging and Developed Economy. Journal of Risk and Financial Management 14: 576. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Elie Bouri, David Roubaud, and Ladislav Kristoufek. 2020. Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling 87: 212–24. [Google Scholar] [CrossRef]

- Symitsi, Efthymia, and Konstantinos J. Chalvatzis. 2019. The economic value of Bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance 48: 97–110. [Google Scholar] [CrossRef] [Green Version]

- Szetela, Beata, Grzegorz Mentel, Urszula Mentel, and Yuriy Bilan. 2020. Directional movement distribution in the bitcoin markets. Engineering Economics 31: 188–96. [Google Scholar] [CrossRef]

- Wei, Wang Chun. 2018. The impact of Tether grants on Bitcoin. Economics Letters 171: 19–22. [Google Scholar] [CrossRef]

- Yahoo Finance. 2022. Bitcoin INR (BTC-INR). Available online: https://finance.yahoo.com/quote/BTC-INR/history?p=BTC-INR&guccounter=1 (accessed on 8 February 2022).

| BITCOIN | GOLD | NIFTY | USD_INR | |

|---|---|---|---|---|

| Mean | 0.245 | 10.56 | 9.38 | 4.26 |

| Median | 0.15 | 10.55 | 9.33 | 4.27 |

| Std. Dev | 5.02 | 0.20 | 0.16 | 0.04 |

| Skewness | −0.78 | 0.016 | 0.81 | −0.85 |

| Kurtosis | 12.231 | 1.36 | 3.09 | 3.00 |

| Jarque Bera | 3595.27 (0.000) | 109.37 (0.000) | 109.60 (0.000) | 120.49 (0.000) |

| Variables | Mean Equation | Variance Equation |

|---|---|---|

| USD-INRt-1 | −39.556 | 505.618 ** |

| (29.580) | (87.57) | |

| NIFTYt-1 | −5.222 | 46.550 |

| (14.044) | (33.624) | |

| GOLDt-1 | 23.201 | 64.131 * |

| (19.044) | (34.098) | |

| α | 0.158 ** | |

| (0.021) | ||

| β | 0.774 ** | |

| (0.023) | ||

| Constant | 0.223 | 1.997 |

| (0.1477) | (0.251) | |

| Observations | 983 | 983 |

| Variables | Mean Equation | Variance Equation |

|---|---|---|

| USD-INRt-1 | −27.436 | 0.5155 |

| (34.605) | (6.427) | |

| NIFTYt-1 | −9.858 | −6.062 |

| (13.37) | (1.734) | |

| GOLDt-1 | 18.248 | 0.3777 |

| (21.41) | (2.011) | |

| L.egarch | −0.0584 ** | |

| (0.0161) | ||

| Constant | 0.650 | |

| (0.1477) | ||

| Observations | 983 | 983 |

| Variable | Coefficient (Standard Error) |

|---|---|

| Distribution and Model | Mvnorm (Multi-Variate Normal Distribution) and DCC (Dynamic Conditional Correlation) (1.1) |

| No. of parameters | 28 |

| No. of Series | 4 |

| No. of Observations | 1462 |

| Log likelihood | 18,988.86 |

| Av. Log likelihood | 12.99 |

| Information Criteria | |

| Akaike | −25.938 |

| Bayes | −25.837 |

| Shibata | −25.939 |

| Hannah Quinn | −25.900 |

| Joint (dccα1) | 0.031634 |

| (0.376823) | |

| Joint (dccβ1) | 0.829733 |

| (0.015282) ** | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Murty, S.; Victor, V.; Fekete-Farkas, M. Is Bitcoin a Safe Haven for Indian Investors? A GARCH Volatility Analysis. J. Risk Financial Manag. 2022, 15, 317. https://doi.org/10.3390/jrfm15070317

Murty S, Victor V, Fekete-Farkas M. Is Bitcoin a Safe Haven for Indian Investors? A GARCH Volatility Analysis. Journal of Risk and Financial Management. 2022; 15(7):317. https://doi.org/10.3390/jrfm15070317

Chicago/Turabian StyleMurty, Sarika, Vijay Victor, and Maria Fekete-Farkas. 2022. "Is Bitcoin a Safe Haven for Indian Investors? A GARCH Volatility Analysis" Journal of Risk and Financial Management 15, no. 7: 317. https://doi.org/10.3390/jrfm15070317

APA StyleMurty, S., Victor, V., & Fekete-Farkas, M. (2022). Is Bitcoin a Safe Haven for Indian Investors? A GARCH Volatility Analysis. Journal of Risk and Financial Management, 15(7), 317. https://doi.org/10.3390/jrfm15070317