Fintech Innovations in the Financial Service Industry

Abstract

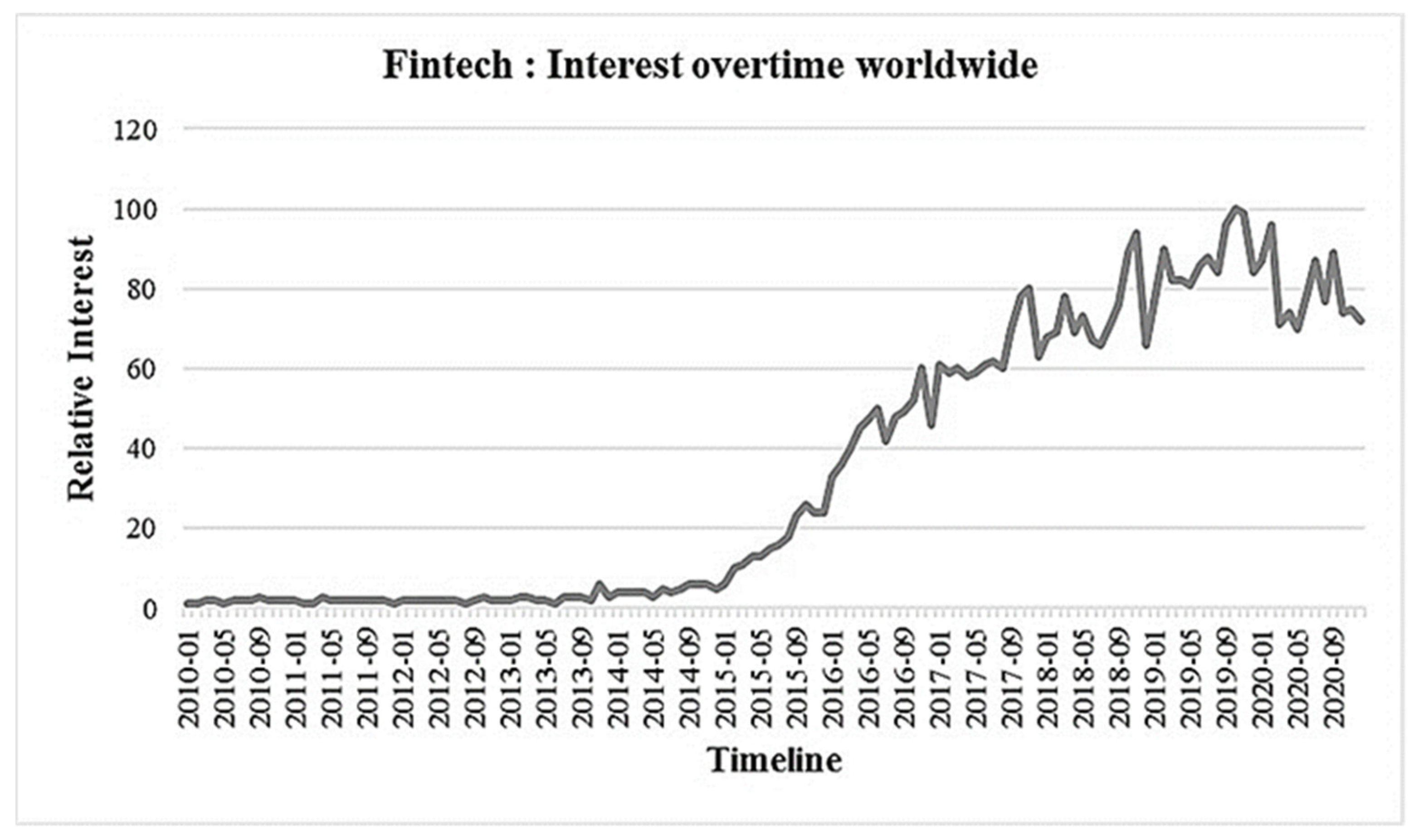

:1. Introduction

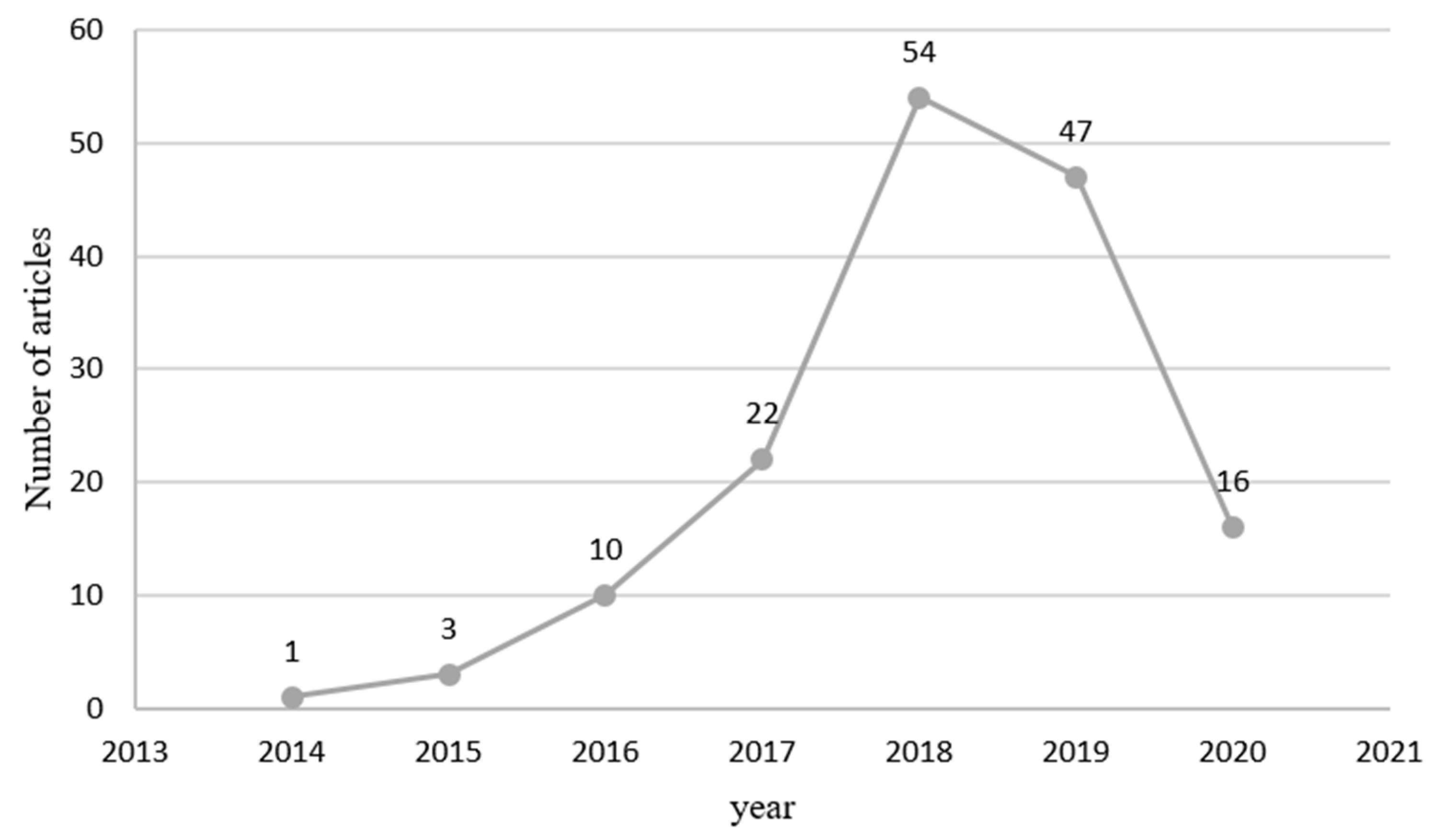

2. Methodology

2.1. Research Philosophy

2.2. Research Questions

2.3. Strategies in Articles Selection

2.4. Research Gap

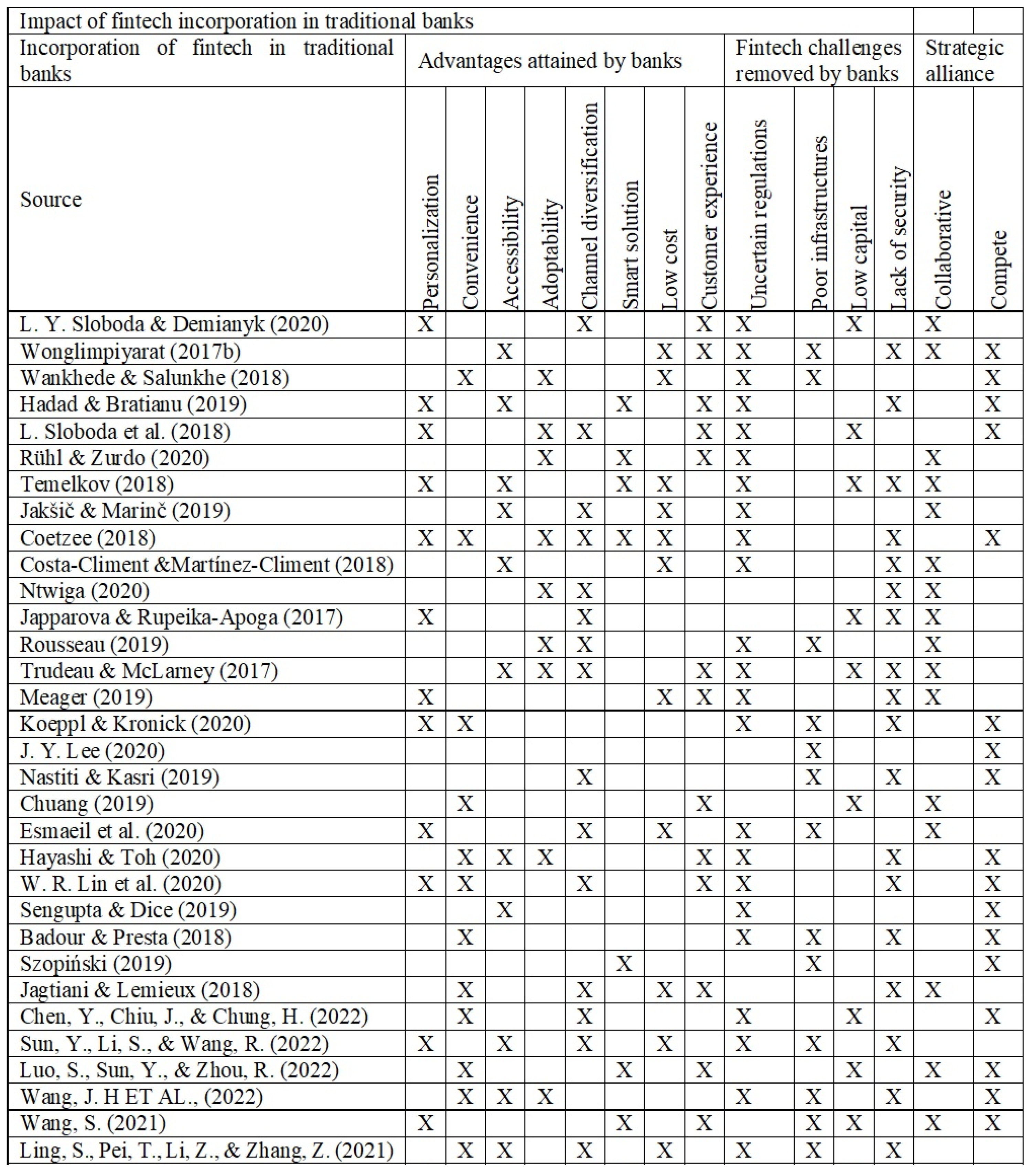

3. Result

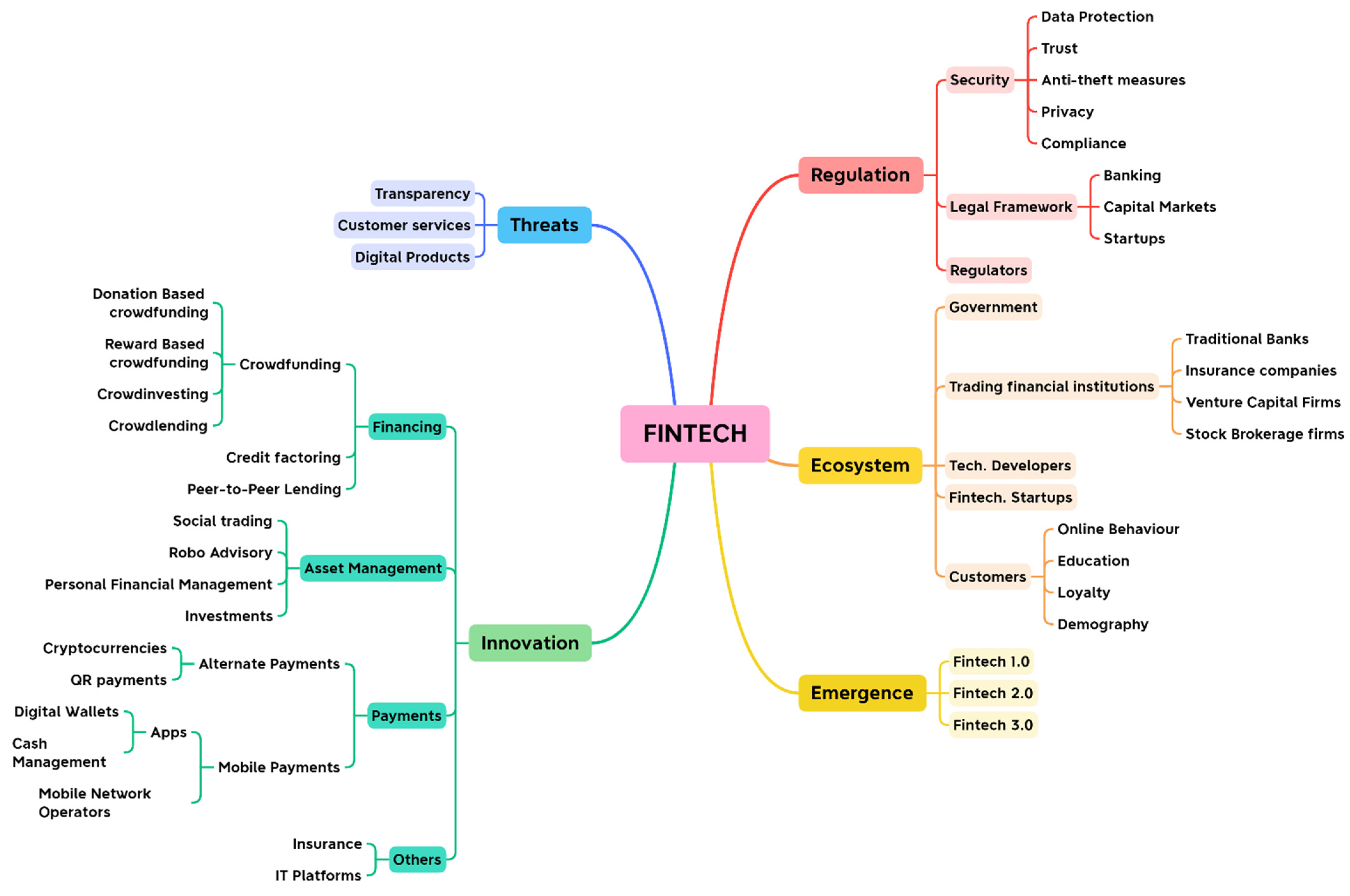

3.1. RQ1: What Are the Fintech Innovations in Financing and Payments in Financial Service Industry?

3.1.1. Financing

3.1.2. Payments

3.2. RQ2: What Is the Significance of Regulation in Fintech Innovation?

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdullah, Syahida, and Umar A. Oseni. 2017. Towards a shari’ah compliant equity-based crowdfunding for the halal industry in Malaysia. International Journal of Business and Society 18: 223–40. [Google Scholar]

- Adriana, Daniel, and Wawan Dhewantoa. 2018. Regulating P2P lending in Indonesia_Lessons learned from the case of China and India. Journal of Internet Banking and Commerce 23: 1–19. [Google Scholar]

- Afzal, Ayesha. 2019. Cryptocurrencies, Blockchain and Regulation: A Review. The Lahore Journal of Economics 24: 103–30. [Google Scholar] [CrossRef]

- Allen, Franklin, Itay Goldstein, and Julapa Jagtiani. 2018. The Interplay among Financial Regulations, Resilience, and Growth. Journal of Financial Services Research 53: 141–62. [Google Scholar] [CrossRef]

- Alt, Rainer, Roman Beck, and Martin T. Smits. 2018. FinTech and the transformation of the financial industry. Electronic Markets 28: 235–43. [Google Scholar] [CrossRef] [Green Version]

- Altamirano, Monica A., and Cees P. V. Beers. 2018. Frugal Innovations in Technological and Institutional Infrastructure: Impact of Mobile Phone Technology on Productivity, Public Service Provision and Inclusiveness. European Journal of Development Research 30: 84–107. [Google Scholar] [CrossRef] [Green Version]

- Andersen, Jonas V., and Claire I. Bogusz. 2019. Self-organizing in blockchain infrastructures: Generativity through shifting objectives and forking. Journal of the Association for Information Systems 20: 1242–73. [Google Scholar] [CrossRef]

- Arner, Douglas W., Janos Barberis, and Ross P. Buckley. 2015. The evolution of Fintech: A new post-crisis paradigm. Georgetown Journal of International Law 47: 1271. [Google Scholar] [CrossRef] [Green Version]

- Arner, Douglas W., Janos Barberis, and Ross P. Buckley. 2016. 150 years of Fintech: An evolutionary analysis. JASSA 3: 22–29. [Google Scholar]

- Arner, Douglas W., Janos Barberis, and Ross P. Buckley. 2017. FinTech, regTech, and the reconceptualization of financial regulation. Northwestern Journal of International Law and Business 37: 373–415. [Google Scholar]

- Aulia, Mahdiah, Aulia F. Yustiardhi, and Reni O. Permatasari. 2020. An overview of Indonesian regulatory framework on Islamic financial technology (fintech). Jurnal Ekonomi & Keuangan Islam 6: 64–75. [Google Scholar] [CrossRef] [Green Version]

- Azali, Kathleen. 2016. Cashless in Indonesia: Gelling Mobile E-frictions? Southeast Asian Economies 33: 364–86. [Google Scholar] [CrossRef]

- Boreiko, Dmitri, and Gioia Vidusso. 2019. New blockchain intermediaries: Do ICO rating websites do their job well? The Journal of Alternative Investments 21: 67–79. [Google Scholar] [CrossRef] [Green Version]

- Borrero-Domínguez, Cinta, Encarnación Cordón-Lagares, and Rocío Hernández-Garrido. 2020. Sustainability and real estate crowdfunding: Success factors. Sustainability 12: 5136. [Google Scholar] [CrossRef]

- Bruckner, William. 2018. Regulating fintech. Vanderbilt Law Review 71: 1167–226. [Google Scholar]

- Cai, Cynthia W. 2018. Disruption of financial intermediation by FinTech: A review on crowdfunding and blockchain. Accounting and Finance 58: 965–92. [Google Scholar] [CrossRef] [Green Version]

- Carnahan, Seth, Rajshree Agarwal, and Benjamin Campbell. 2010. The Effect of Firm Compensation Structures on the Mobility and Entrepreneurship of Extreme Performers. Business 333: 1–43. [Google Scholar] [CrossRef]

- Chanson, Mathieu, Andreas Bogner, Dominik Bilgeri, Elgar Fleisch, and Felix Wortmann. 2019. Blockchain for the IoT: Privacy-preserving protection of sensor data. Journal of the Association for Information Systems 20: 1271–307. [Google Scholar] [CrossRef] [Green Version]

- Chen, Yuxuan, Junmao Chiu, and Huimin Chung. 2022. Givers or Receivers? Return and volatility spillovers between Fintech and the Traditional Financial Industry. Finance Research Letters 46: 102458. [Google Scholar] [CrossRef]

- Choi, Gongpil, and Meeyoung Park. 2019. Reconnecting the Dots for the Payment Service Directive 2—Compatible Asian Financial Network. SSRN Electronic Journal 23: 285–309. [Google Scholar] [CrossRef]

- Clohessy, Trevor, and Thomas Acton. 2019. Investigating the influence of organizational factors on blockchain adoption: An innovation theory perspective. Industrial Management and Data Systems 119: 1457–91. [Google Scholar] [CrossRef]

- Coffie, Cephas P. K., Hongjiang Zhao, and Isaac A. Mensah. 2020. Panel econometric analysis on mobile payment transactions and traditional banks effort toward financial accessibility in sub-Sahara Africa. Sustainability 12: 895. [Google Scholar] [CrossRef] [Green Version]

- Costa-Climent, Ricardo, and Carla Martínez-Climent. 2018. Sustainable profitability of ethical and conventional banking. Contemporary Economics 12: 519–30. [Google Scholar] [CrossRef]

- Currie, Wendy L., Daniel P. Gozman, and Jonathan J. M. Seddon. 2018. Dialectic tensions in the financial markets: A longitudinal study of pre- and post-crisis regulatory technology. Journal of Information Technology 33: 304–25. [Google Scholar] [CrossRef] [Green Version]

- Da Silva Momo, Fernanda, Giovana S. Schiavi, and Ariel Behr. 2018. Business models and blockchain: What can change? Americas Conference on Information Systems 2018: Digital Disruption. AMCIS 2018: 228–48. [Google Scholar] [CrossRef]

- Daj, Alexis. 2018. Beyond cryptocurrencies: Economic and legal facets of the disruptive potential of blockchain technology. Bulletin of the Transilvania University of Brasov. Series V: Economic Sciences 11: 207–16. [Google Scholar]

- Das, Kishore K., and Shahnawaz Ali. 2020. The role of digital technologies on growth of mutual funds industry. International Journal of Research in Business and Social Science 9: 171–76. [Google Scholar] [CrossRef] [Green Version]

- Davis, Jacqueline, Kerrie Mengersen, Sarah Bennett, and Lorraine Mazerolle. 2014. Viewing systematic reviews and meta-analysis in social research through different lenses. SpringerPlus 3: 1–9. [Google Scholar] [CrossRef] [Green Version]

- Deng, Hui, Robin Hui Huang, and Qingran Wu. 2018. The regulation of initial coin offerings in China: Problems, prognoses and prospects. European Business Organization Law Review 19: 465–502. [Google Scholar] [CrossRef]

- Denisova, Valeriia, Alexey Mikhaylov, and Evgeny Lopatin. 2019. Block chain infrastructure and growth of global power consumption. International Journal of Energy Economics and Policy 9: 22–29. [Google Scholar] [CrossRef]

- Dermaku, Kastriot. 2018. Model SAAS on international payment organizations. The Journal of Accounting and Management 8: 3. [Google Scholar]

- Drummer, Daniel, Stefan Feuerriegel, and Dirk Neumann. 2017. Crossing the next frontier: The role of ICT in driving the financialization of credit. Journal of Information Technology 32: 218–33. [Google Scholar] [CrossRef] [Green Version]

- Du, Kui. 2018. Complacency, capabilities, and institutional pressure: Understanding financial institutions’ participation in the nascent mobile payments ecosystem. Electronic Markets 28: 307–19. [Google Scholar] [CrossRef]

- Duma, Florin, and Raluca Gligor. 2018. Study regarding Romanian students’ perception and behaviour concerning the fintech area with a focus on cryptocurrencies and online payments. Online Journal Modelling the New Europe 27: 86–106. [Google Scholar] [CrossRef]

- Eka Putri, Yolli, Sudarso Kaderi Wiryono, Yunieta Anny Nainggolan, and Tomy Dwi Cahyono. 2019. Method of Payment Adoption in Indonesia E-Commerce. The Asian Journal of Technology Management (AJTM) 12: 94–102. [Google Scholar] [CrossRef]

- Fandl, Kevin J. 2020. Can smart contracts enhance firm efficiency in emerging markets? Northwestern Journal of International Law and Business 40: 332–62. [Google Scholar]

- Franklin, Jimmie. 2019. Burdensome regulation makes for burgeoning regtech. International Financial Law Review, October 11. [Google Scholar]

- Funke, Michael, Xiang Li, and Andrew Tsang. 2019. Monetary policy shocks and peer-to-peer lending in China. No. 23/2019. Helsinki: BOFIT Discussion Papers, pp. 4–24. [Google Scholar]

- Gassot, Yves, Jooyong Jun, and Marianne Verdier. 2016. Digital Innovation & Finance Transformation. Digiworld Economic Journal 103: 211. [Google Scholar]

- Gaughan, Michael. 2017. Commentary: FinTech and the liberation of the Community Reinvestment Act marketplace. Cityscape 19: 187–98. [Google Scholar]

- Golubić, Gordana. 2019. Do digital technologies have the power to disrupt commercial banking? InterEULawEast 6: 83–110. [Google Scholar] [CrossRef]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- Gomber, Peter, Robert J. Kauffman, Chris Parker, and Bruce W. Weber. 2018. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. Journal of Management Information Systems 35: 220–65. [Google Scholar] [CrossRef]

- Grover, Purva, Arpan K. Kar, and Marijn Janssen. 2019. Diffusion of blockchain technology: Insights from academic literature and social media analytics. Journal of Enterprise Information Management 32: 735–57. [Google Scholar] [CrossRef]

- Haddad, Christian, and Lars Hornuf. 2019. The emergence of the global fintech market: Economic and technological determinants. Small Business Economics 53: 81–105. [Google Scholar] [CrossRef] [Green Version]

- Haikel-Elsabeh, Marie, Sébastien Nouet, and Maximilien Nayaradou. 2016. How Personal Finance Management Influences Consumers’ Motivations and Behavior Regarding Online Banking Services. Communications & Strategies 103: 15. [Google Scholar]

- Harris, Wesley L., and Jarunee Wonglimpiyarat. 2019. Blockchain platform and future bank competition. Foresight 21: 625–39. [Google Scholar] [CrossRef]

- Hayashi, Fumiko, and Ying L. Toh. 2020. Mobile banking use and consumer readiness to benefit from faster payments. Federal Reserve Bank of Kansas City, Economic Review 105: 21–36. [Google Scholar] [CrossRef]

- Hendriyani, Chandra, and Samun Jaja Raharja ’. 2019. Business Agility Strategy: Peer-to-Peer Lending of Fintech Startup in the Era of Digital Finance in Indonesia. Review of Integrative Business and Economics Research 8: 239. [Google Scholar]

- Henly, Claire, Sam Hartnett, Sam Mardell, Buck Endemann, Ben Tejblum, and Daneil S. Cohen. 2018. Energizing the Future With Blockchain. Energy Law Journal 39: 197–232. [Google Scholar]

- Holden, Mary T., and Patrick Lynch. 2004. Choosing the appropriate methodology: Understanding research philosophy. The Marketing Review 4: 397–409. [Google Scholar] [CrossRef]

- Hua, Xiuping, Yiping Huang, and Yanfeng Zheng. 2019. Current practices, new insights, and emerging trends of financial technologies. Industrial Management and Data Systems 119: 1401–10. [Google Scholar] [CrossRef]

- Huang, Robin H. 2018. Online P2P Lending and Regulatory Responses in China: Opportunities and Challenges. European Business Organization Law Review 19: 63–92. [Google Scholar] [CrossRef]

- Hughes, Thomas M. 2018. The global financial services industry and the blockchain. Journal of Structured Finance 23: 36–40. [Google Scholar] [CrossRef]

- Ibrahim, P. A. 2018. Innovations in Financing SMEs: A Study on the Growth of Crowdfunding in India. Wealth 7: 66–75. [Google Scholar]

- Lu, Lerong. 2018. Promoting SME finance in the context of the fintech revolution: A case study of the UK’s practice and regulation. Banking and Finance Law Review 33: 317–43. [Google Scholar]

- Kang, Jungho. 2018. Mobile payment in Fintech environment: Trends, security challenges, and services. Human-centric Computing and Information Sciences 8: 32. [Google Scholar] [CrossRef] [Green Version]

- Klein, Johannes, Leonard Stuckenborg, and Jens Leker. 2020. Hot or not—Which features make FinTechs attractive for investors? The Journal of Entrepreneurial Finance 22: 27–59. [Google Scholar]

- Kou, Gang. 2020. Introduction to the special issue on Fintech. Financial Innovation 5: 45. [Google Scholar] [CrossRef] [Green Version]

- Kumail Abbas Rizvi, Syed, Bushra Naqvi, and Fatima Tanveer. 2018. Is Pakistan Ready to Embrace Fintech Innovation? The Lahore Journal of Economics 23: 151–82. [Google Scholar] [CrossRef]

- Lazcano, Israel Cedillo. 2019. A New Approach for “Cryptoassets” Regulation. Banking & Finance Law Review 35: 37–61. [Google Scholar]

- Lee, David Kuo Chuen, and Ernie G. S. Teo. 2015. Emergence of FinTech and the LASIC Principles. Journal of Financial Perspectives 3: 3. [Google Scholar] [CrossRef] [Green Version]

- Lee, Jei Y. 2020. Prediction of Default Risk in Peer-to-Peer Lending Using Structured and Unstructured Data. Journal of Financial Counseling and Planning 31: 115–29. [Google Scholar] [CrossRef]

- Lee, Seong-Hoon, and Dong-Woo Lee. 2016. A Study on Fintech Based on Actual Cases. International Journal of U- and e-Service, Science and Technology 9: 439–48. [Google Scholar] [CrossRef]

- Lee, Tae-Heon, and Hee-Woong Kim. 2015. An exploratory study on fintech industry in Korea: Crowdfunding case. Paper presented at 2nd International Conference on Innovative Engineering Technologies (ICIET’2015), Bangkok, Thailand, August 7–8. [Google Scholar]

- Leong, Kelvin, and Anna Sung. 2018. FinTech (Financial Technology): What is It and How to Use Technologies to Create Business Value in Fintech Way? International Journal of Innovation, Management and Technology 9: 74–78. [Google Scholar] [CrossRef]

- Lin, Lin. 2019. Regulating fintech: The case of Singapore. Banking and Finance Law Review, October 30. [Google Scholar]

- Ling, Shixian, Tianyue Pei, Zhaohui Li, and Zhiping Zhang. 2021. Impact of COVID-19 on financial constraints and the moderating effect of financial technology. Emerging Markets Finance and Trade 57: 1675–88. [Google Scholar] [CrossRef]

- Liu, Xinmin, Flora Huang, and Horace Yeung. 2018. The regulation of illegal fundraising in China. Asia Pacific Law Review 26: 77–100. [Google Scholar] [CrossRef]

- Luo, Sumei, Yongkun Sun, and Rui Zhou. 2022. Can fintech innovation promote household consumption? Evidence from China family panel studies. International Review of Financial Analysis 82: 102137. [Google Scholar] [CrossRef]

- Malala, Joy. 2017. Law and Regulation of Mobile Payment Systems: Issues Arising ‘Post’ Financial Inclusion in Kenya. London: Routledge. [Google Scholar]

- Manta, Otilia, and Napoleon Pop. 2017. The virtual currency and financial blockchain technology. Current trends in digital finance. Financial Studies 21: 45–59. [Google Scholar]

- Marot, Emmanuel, Giovanni Fernandez, Jon Carrick, and Justin Hsi. 2017. Investing in Online Peer to Peer Loans: A Platform for Alpha. Journal of Applied Business and Economics 19: 86–92. [Google Scholar]

- Martínez-Climent, Carla, Ana Zorio-Grima, and Domingo Ribeiro-Soriano. 2018. Financial return crowdfunding: Literature review and bibliometric analysis. International Entrepreneurship and Management Journal 14: 527–53. [Google Scholar] [CrossRef]

- Medeiros, Maya, and Brian Chau. 2016. Fintech—Stake a Patent Claim? Intellectual Property Journal 28: 303–14. [Google Scholar]

- Minto, Andrea, Moritz Voelkerling, and Melanie Wulff. 2017. Separating apples from oranges: Identifying threats to financial stability originating from FinTech. Capital Markets law Journal 12: 428–65. [Google Scholar] [CrossRef]

- Mitchell, Alan. 2016. GDPR: Evolutionary or revolutionary? Journal of Direct, Data and Digital Marketing Practice 17: 217–21. [Google Scholar] [CrossRef]

- Naglie, Harvey. 2017. Not Ready for Prime Time: Canada’s Proposed New Securities Regulator. CD Howe Institute Commentary 489. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3041599 (accessed on 21 June 2022). [CrossRef] [Green Version]

- Nahata, Vatsal. 2018. An Analysis of Demonetisation and Digitalisation. Review of Integrative Business and Economics Research 7: 85–115. [Google Scholar]

- Nair, Dakshata, Mounika Veeragandham, Priya Pamnani, Sumit Prasad, and M. Guruprasad. 2021. Impact of COVID-19 On Fintech Industry. International Journal of Research in Engineering, Science and Management 4: 27–34. [Google Scholar] [CrossRef]

- Najaf, Khakan, Ravichandran K. Subramaniam, and Osama F. Atayah. 2022. Understanding the implications of FinTech Peer-to-Peer (P2P) lending during the COVID-19 pandemic. Journal of Sustainable Finance & Investment 12: 87–102. [Google Scholar]

- Nan, Dongyan, Yerin Kim, Min H. Park, and Jang H. Kim. 2020. What motivates users to keep using social mobile payments? Sustainability 12: 6878. [Google Scholar] [CrossRef]

- Nathan, Robert J., Budi Setiawan, and Mac N. Quynh. 2022. Fintech and financial health in Vietnam during the COVID-19 pandemic: In-depth descriptive analysis. Journal of Risk and Financial Management 15: 125. [Google Scholar] [CrossRef]

- Ng, Artie W., and Benny K. B. Kwok. 2017. Emergence of Fintech and cybersecurity in a global financial centre: Strategic approach by a regulator. Journal of Financial Regulation and Compliance 25: 422–34. [Google Scholar] [CrossRef]

- Oliveira, Vitor B., and Clara Raposo. 2019. How did regulation and market discipline influence banking distress in Europe? Lessons from the global financial crisis. Studies in Economics and Finance 37: 160–98. [Google Scholar] [CrossRef]

- Olsen, Richard, Stefano Battiston, Guido Caldarelli, Anton Golub, Mihail Nikulin, and Sergey Ivliev. 2018. Case study of Lykke exchange: Architecture and outlook. Journal of Risk Finance 19: 26–38. [Google Scholar] [CrossRef] [Green Version]

- Omede, Philemon I. 2020. A Tale of Two Markets: How Lower-end Borrowers Are Punished for Bank Regulatory Failures in Nigeria. Journal of Consumer Policy 43: 519–42. [Google Scholar] [CrossRef] [Green Version]

- Palladino, Lenore. 2018. Small Business Fintech Lending: The Need for Comprehensive Regulation. Fordham Journal of Corporate and Financial Law 24: 77. [Google Scholar] [CrossRef] [Green Version]

- Pang, Shoulin, Shiting Dou, and Huan Li. 2020. Synergy effect of science and technology policies on innovation: Evidence from China. PLoS ONE 15: e0240515. [Google Scholar] [CrossRef]

- Paripunyapat, Dachatorn, and Tanpat Kraiwanit. 2018. Financial Technology Acceptance in Bangkok Metropolis and Vicinity. SSRN Electronic Journal 8: 54–61. [Google Scholar] [CrossRef]

- Petrushenko, Yuriy, Liudmyla Kozarezenko, Aldona Glinska-Newes, Maryna Tokarenko, and Maryna But. 2018. The opportunities of engaging FinTech companies into the system of crossborder money transfers in Ukraine. Investment Management and Financial Innovations 15: 332–44. [Google Scholar] [CrossRef]

- Polasik, Michał, and Dariusz Piotrowski. 2016. Payment Innovations in Poland: A New Approach of the Banking Sector To Introducing Payment Solutions. Ekonomia i Prawo 15: 103. [Google Scholar] [CrossRef] [Green Version]

- Pollman, Elizabeth. 2019. Tech, Regulatory Arbitrage, and Limits. European Business Organization Law Review 20: 567–90. [Google Scholar] [CrossRef]

- Popkin, Phillip. 2019. The effect of the Internet era and South Dakota v. Wayfair on the unitary business rule. Boston College Law Review E Supp. II 60: 82. [Google Scholar]

- Puschmann, Thomas. 2017. Fintech. Business and Information Systems Engineering 59: 69–76. [Google Scholar] [CrossRef]

- Rabbani, Mustafa R. 2022. Fintech innovations, scope, challenges, and implications in Islamic Finance: A systematic analysis. International Journal of Computing and Digital Systems 11: 1–28. [Google Scholar]

- Rabbani, Mustafa R., Abu Bashar, Nishad Nawaz, Sitara Karim, Mahmood A. M. Ali, Habeeb U. Rahiman, and Md S. Alam. 2021. Exploring the role of Islamic fintech in combating the aftershocks of COVID-19: The open social innovation of the Islamic financial system. Journal of Open Innovation: Technology, Market, and Complexity 7: 136. [Google Scholar] [CrossRef]

- Raharja, Sam’un J., Sutarjo, Herwan A. Muhyi, and Tetty Herawaty. 2020. Digital Payment as an Enabler for Business Opportunities: A Go-Pay Case Study. Review of Integrative Business and Economics Research 9: 319–30. [Google Scholar]

- Ramsay, Iain, and Toni Williams. 2020. Peering Forward, 10 Years after: International Policy and Consumer Credit Regulation. Journal of Consumer Policy 43: 209–26. [Google Scholar] [CrossRef] [Green Version]

- Rao, Sudna P., and M. R. Anand. 2019. Peer to Peer Lending Platforms in India: Regulations and Response. Prajnan 48: 107–22. [Google Scholar]

- Romanova, Inna, Simon Grima, Jonathan Spiteri, and Marina Kudinska. 2018. The payment services Directive II and competitiveness: The perspective of European fintech companies. European Research Studies Journal 21: 3–22. [Google Scholar] [CrossRef] [Green Version]

- Rosavina, Monica, Raden A. Rahadi, Mandra L. Kitri, Shimaditya Nuraeni, and Lidia Mayangsari. 2019. P2P lending adoption by SMEs in Indonesia. Qualitative Research in Financial Markets 11: 260–79. [Google Scholar] [CrossRef]

- Rossi, Alice, and Silvio Vismara. 2018. What do crowdfunding platforms do? A comparison between investment-based platforms in Europe. Eurasian Business Review 8: 93–118. [Google Scholar] [CrossRef]

- Rühl, Alexander, and Ricardo P. Zurdo. 2020. Contribuye la tecnologia a la democratizacion financiera? La economia colaborativa y las fintech como catalizadoras del cambio. REVESCO. Revista de Estudios Cooperativos 133: 1–12. [Google Scholar]

- Saksonova, Svetlana, and Irina Kuzmina-Merlino. 2017. Fintech as financial innovation—The possibilities and problems of implementation. European Research Studies Journal 20: 961–73. [Google Scholar] [CrossRef] [Green Version]

- Sangwan, Vikas, Puneet Prakash, Harshita, and Shveta Singh. 2019. Financial technology: A review of extant literature. Studies in Economics and Finance 37: 71–88. [Google Scholar] [CrossRef]

- Șcheau, Mircea C., and Ștefan Zaharie. 2018. The Way of Cryptocurrency. Economy Informatics 18: 32–44. [Google Scholar]

- Șcheau, Mircea C., Simona L. Crăciunescu, Iulia Brici, and Monica V. Achim. 2020. A Cryptocurrency Spectrum Short Analysis. Journal of Risk and Financial Management 13: 184. [Google Scholar] [CrossRef]

- Schulte, Paul, and Gavin Liu. 2018. Fintech is merging with iot and AI to challenge banks: How entrenched interests can prepare. Journal of Alternative Investments 20: 41–57. [Google Scholar] [CrossRef]

- Šerėjienė, Svetlana, Nikolaj Goranin, and Inga Tumasonienė. 2019. The application of TOPSIS methodology for identification of national critical infrastructure. Mokslas–Lietuvos ateitis/Science–Future of Lithuania 11. [Google Scholar] [CrossRef]

- Shin, Yong J., and Yongrok Choi. 2019. Feasibility of the fintech industry as an innovation platform for sustainable economic growth in Korea. Sustainability 11: 5351. [Google Scholar] [CrossRef] [Green Version]

- Singh, Harjit, Geetika Jain, Alka Munjal, and Sapna Rakesh. 2019. Blockchain technology in corporate governance: Disrupting chain reaction or not? Corporate Governance 20: 67–86. [Google Scholar] [CrossRef]

- Snyder, Hannah. 2019. Literature review as a research methodology: An overview and guidelines. Journal of Business Research 104: 333–39. [Google Scholar] [CrossRef]

- Son, Insung, and Sihyun Kim. 2018. Mobile payment service and the firm value: Focusing on both up- and down-stream alliance. Sustainability 10: 2583. [Google Scholar] [CrossRef] [Green Version]

- Soulé, Matthieu. 2016. Is Fintech Eating the World of Financial Services, One API After Another? Communications & Strategies 103: 174–84. [Google Scholar]

- Soutter, Leigh, Kenzie Ferguson, and Michael Neubert. 2019. Digital Payments: Impact Factors and Mass Adoption in Sub-Saharan Africa. Technology Innovation Management Review 7: 41–55. [Google Scholar] [CrossRef]

- Stern, Caroline, Mikko Makinen, and Zongxin Qian. 2017. FinTechs in China—With a special focus on peer to peer lending. Journal of Chinese Economic and Foreign Trade Studies 10: 215–28. [Google Scholar] [CrossRef] [Green Version]

- Sun, Yi, Shihui Li, and Rui Wang. 2022. Fintech: From budding to explosion-an overview of the current state of research. Review of Managerial Science, 1–14. [Google Scholar] [CrossRef]

- Surujnath, Ryan. 2017. Off The Chain! A Guide to Blockchain Derivatives Markets and the Implications on Systemic Risk. Fordham Journal of Corporate & Financial Law 22: 257. [Google Scholar]

- Swan, Melanie. 2017. Anticipating the Economic Benefits of Blockchain. Technology Innovation Management Review 7: 6–13. [Google Scholar] [CrossRef]

- Talom, Frank S. G., and Robertson K. Tengeh. 2020. The impact of mobile money on the financial performance of the SMEs in douala, Cameroon. Sustainability 12: 183. [Google Scholar] [CrossRef] [Green Version]

- Tang, Yong, Jason Xiong, Rafael Becerril-Arreola, and Lakshmi Iyer. 2019. Ethics of blockchain: A framework of technology, applications, impacts, and research directions. Information Technology and People 33: 602–32. [Google Scholar] [CrossRef]

- Teja, Adrian. 2017. Indonesian Fintech Business: New Innovations or Foster and Collaborate in Business Ecosystems? 2. Literature Study and Hypothesis Development. The Asian Journal of Technology Management 10: 10–18. [Google Scholar]

- Toderașcu, Carmen, and Otilia R. Oprea. 2021. The impact of financial Innovation in the context of the Covid-19 Crisis in emerging economies. Pandemic Challenges for European Finance, Business and Regulation EUFIRE 2021: 621. [Google Scholar]

- Tönnissen, Stefan, Jan H. Beinke, and Frank Teuteberg. 2020. Understanding token-based ecosystems—A taxonomy of blockchain-based business models of start-ups. Electronic Markets 30: 307–23. [Google Scholar] [CrossRef] [Green Version]

- Tseng, Jen-Hung, Yen-Chih Liao, Bin Chong, and Shih-Wei Liao. 2018. Governance on the drug supply chain via gcoin blockchain. International Journal of Environmental Research and Public Health 15: 1055. [Google Scholar] [CrossRef] [Green Version]

- Tsindeliani, Imeda. 2019. Public Financial Law and digital economy. Media, Culture and Public Relations 10: 48–56. [Google Scholar] [CrossRef]

- Umarovich, Adam A., Natalia V. Gennadyevna, Olga A. Vladimirovna, and Roman S. Alexandrovich. 2017. Block Chain and Financial Controlling in the System of Technological Provision of Large Corporations’ Economic Security. European Research Studies Journal 20: 3–12. [Google Scholar]

- Utami, Ema. 2018. Design Concept Integration Tax Payment System with Implementing Financial Technology. International Journal of Information Engineering and Electronic Business 10: 15–22. [Google Scholar] [CrossRef] [Green Version]

- Van der Elst, Christoph, and Anne Lafarre. 2019. Blockchain and Smart Contracting for the Shareholder Community. European Business Organization Law Review 20: 111–37. [Google Scholar] [CrossRef] [Green Version]

- Vanatta, Sean H. 2018. Charge Account Banking: A Study of Financial Innovation in the 1950s. Enterprise and Society 19: 352–90. [Google Scholar] [CrossRef] [Green Version]

- Venturelli, Valeria, Alessia Pedrazzoli, and Giovanni Gallo. 2020. Birds of a feather flock together: The inclusive effect of similarity patterns in equity crowdfunding. Sustainability 12: 3539. [Google Scholar] [CrossRef]

- Volkov, Artiom, Tomas Balezentis, Mangirdas Morkunas, and Dalia Streimikiene. 2019. In a search for equity: Do direct payments under the common agricultural policy induce convergence in the European Union? Sustainability 11: 3462. [Google Scholar] [CrossRef] [Green Version]

- Wang, Jian-Hang, Yu-Sheng Hsieh, Cheng-Hsin Chiang, and Hsien-Chen Lo. 2022. Assessing the Financial Innovation System within Fintech Development: Technology Innovation System Perspective. Journal of Insurance and Financial Management 6: 1. [Google Scholar]

- Wang, Shiji. 2021. Opportunities of Financial Technology Under the Impact of COVID-19. Paper presented at 6th International Conference on Financial Innovation and Economic Development (ICFIED 2021), Online, January 29–31; pp. 529–32. [Google Scholar]

- Weech-Maldonado, Robert, Ferhat D. Zengul, and Grant T. Savage. 2014. Technological innovations and hospital performance: A systematic review of the literature. Innovation and Entrepreneurship in Health 1: 13–26. [Google Scholar]

- Wilamowicz, Angelica. 2019. The Great FinTech Disruption: InsurTech. Banking & Financial Law Review 34: 215–38. [Google Scholar]

- Wonglimpiyarat, Jarunee. 2017a. FinTech banking industry: A systemic approach. Foresight 19: 590–603. [Google Scholar] [CrossRef]

- Wonglimpiyarat, Jarunee. 2017b. FinTech Crowdfunding of Thailand 4.0 Policy. Journal of Private Equity 21: 55–63. [Google Scholar] [CrossRef]

- Xu, Min, Xingtong Chen, and Gang Kou. 2019. A systematic review of blockchain. Financial Innovation 5: 1–14. [Google Scholar] [CrossRef] [Green Version]

- Yeo, Eunjung, and Jooyong Jun. 2020. Peer-to-peer lending and bank risks: A closer look. Sustainability 12: 6107. [Google Scholar] [CrossRef]

- Yin, Xuluo, Xuan Xu, Qi Chen, and Jiangang Peng. 2019. The sustainable development of financial inclusion: How can monetary policy and economic fundamental interact with it effectively? Sustainability 11: 2524. [Google Scholar] [CrossRef] [Green Version]

- Yoon, Kyoung-Soo, and Jooyong Jun. 2019. Liability and Antifraud Investment in Fintech Retail Payment Services. Contemporary Economic Policy 37: 181–94. [Google Scholar] [CrossRef]

- You, Chuanman. 2018. Recent Development of FinTech Regulation in China: A Focus on the New Regulatory Regime for the P2P Lending (Loan-based Crowdfunding) Market. Capital Markets Law Journal 13: 85–115. [Google Scholar] [CrossRef]

- Zalan, Tatiana. 2018. Born global on blockchain. Review of International Business and Strategy 28: 19–34. [Google Scholar] [CrossRef]

- Zetzsche, Dirk, and Christina Preiner. 2018. Cross-border crowdfunding: Towards a single crowdlending and crowdinvesting market for Europe. European Business Organization Law Review 19: 217–51. [Google Scholar] [CrossRef]

- Zhang, Yuming, Chao Xing, and Xiaohan Guo. 2022. The Shielding Effect of Access to Finance on Small and Medium-Sized Enterprises during the COVID-19 Crisis: Comparing Fintech and Traditional Finance. Emerging Markets Finance and Trade, 1–15. [Google Scholar] [CrossRef]

| Analysis of Fintech Innovation in Payment Service | ||

|---|---|---|

| Source | Key Discussion | Benefits for Customers |

| Kang (2018) | Customized payment service | Convenience |

| Yoon and Jun (2019) | Anti-fraud investments in payment service | Increased safety |

| Du (2018) | Increased participation of financial institution in payment service | New mobile payment service |

| Soutter et al. (2019) | Mobile payment adoption in informal economy | Increased low margin customer participation |

| Polasik and Piotrowski (2016) | Bank involvement in payment innovation | Convenience |

| Duma and Gligor (2018) | Awareness of cybercrime | Increased Gen Z participation |

| Romanova et al. (2018) | Regulation for industry competitiveness | Improves customer satisfaction |

| Utami (2018) | Tax payment system using fintech | Time savings |

| Coffie et al. (2020) | Banks effort toward financial Accessibility | Sustainable growth in finance sector |

| Choi and Park (2019) | Measures taken by Payment service directive | Diverse and decentralized payment networks in markets |

| Nan et al. (2020) | Users’ continuance intentions to utilize social mobile payment | Improves customer satisfaction |

| Hayashi and Toh (2020) | Mobile banking offered by community banks | Faster payments |

| Raharja et al. (2020) | Digital payment solutions | Customers get access to wide market |

| Eka Putri et al. (2019) | More payment options | Customer experience is more productive |

| Son and Kim (2018) | Company alliances with other companies | Wide range of choices |

| Petrushenko et al. (2018) | Technology acceptance by customers | User-friendliness |

| Collaborative Fintech | Products | Competitive Fintech |

|---|---|---|

| low risk | Deposit accounts | relationship loss |

| low risk | Payments | revenue loss |

| low operational cost | Lending | revenue loss |

| new digital model | Asset Management | relevance loss |

| new digital model | Markets | revenue loss |

| customer retention | Insurance | customer loss |

| low operational cost | Back Office functions | neutral |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anifa, M.; Ramakrishnan, S.; Joghee, S.; Kabiraj, S.; Bishnoi, M.M. Fintech Innovations in the Financial Service Industry. J. Risk Financial Manag. 2022, 15, 287. https://doi.org/10.3390/jrfm15070287

Anifa M, Ramakrishnan S, Joghee S, Kabiraj S, Bishnoi MM. Fintech Innovations in the Financial Service Industry. Journal of Risk and Financial Management. 2022; 15(7):287. https://doi.org/10.3390/jrfm15070287

Chicago/Turabian StyleAnifa, Mansurali, Swamynathan Ramakrishnan, Shanmugan Joghee, Sajal Kabiraj, and Malini Mittal Bishnoi. 2022. "Fintech Innovations in the Financial Service Industry" Journal of Risk and Financial Management 15, no. 7: 287. https://doi.org/10.3390/jrfm15070287

APA StyleAnifa, M., Ramakrishnan, S., Joghee, S., Kabiraj, S., & Bishnoi, M. M. (2022). Fintech Innovations in the Financial Service Industry. Journal of Risk and Financial Management, 15(7), 287. https://doi.org/10.3390/jrfm15070287