Investor Perception, Market Reaction, and Post-Issue Performance in Bank Seasoned Equity Offerings

Abstract

:1. Introduction

2. Literature Review

3. Data, Variables, and Descriptive Statistics

3.1. Data

3.2. Variables

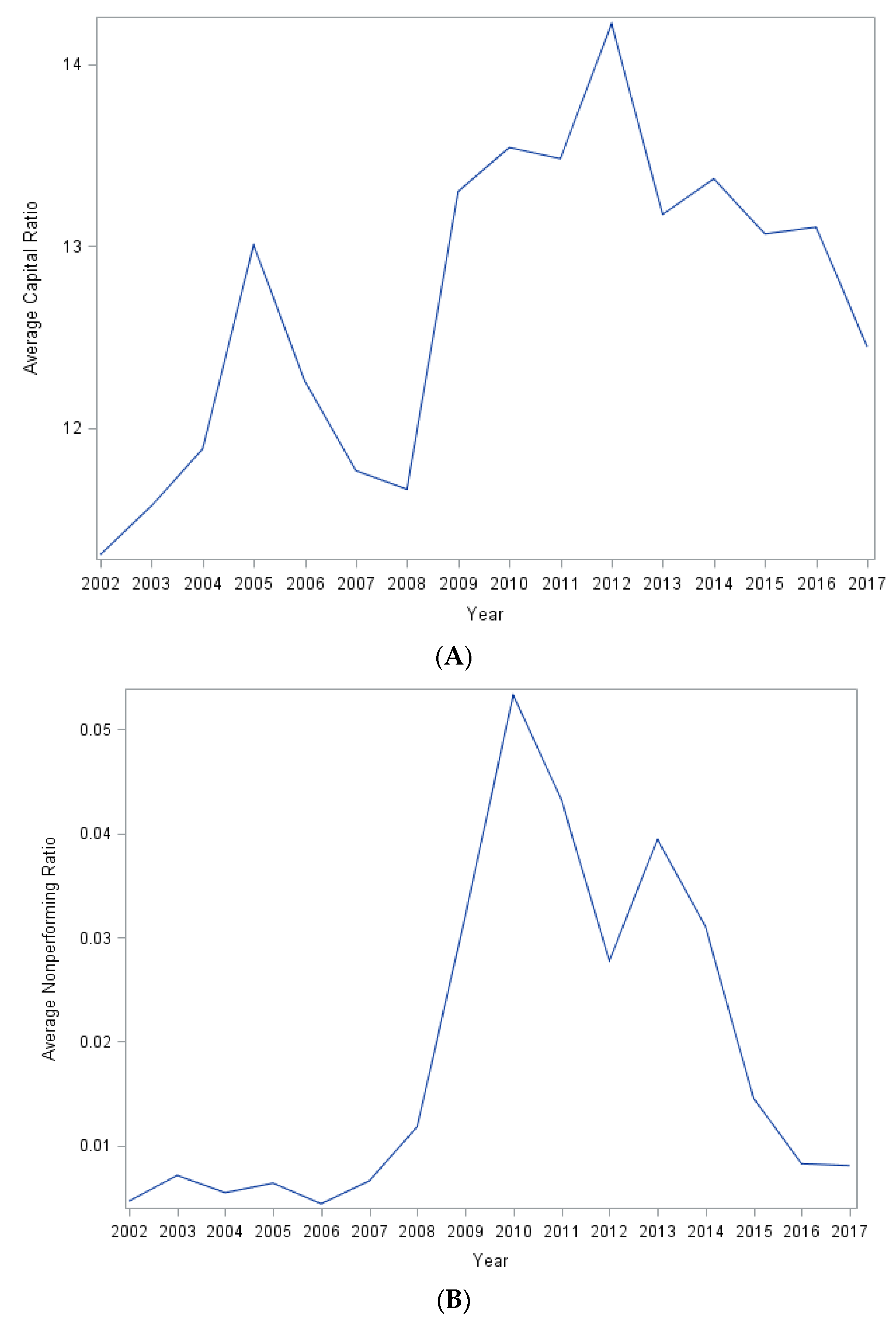

3.3. Descriptive Statistics

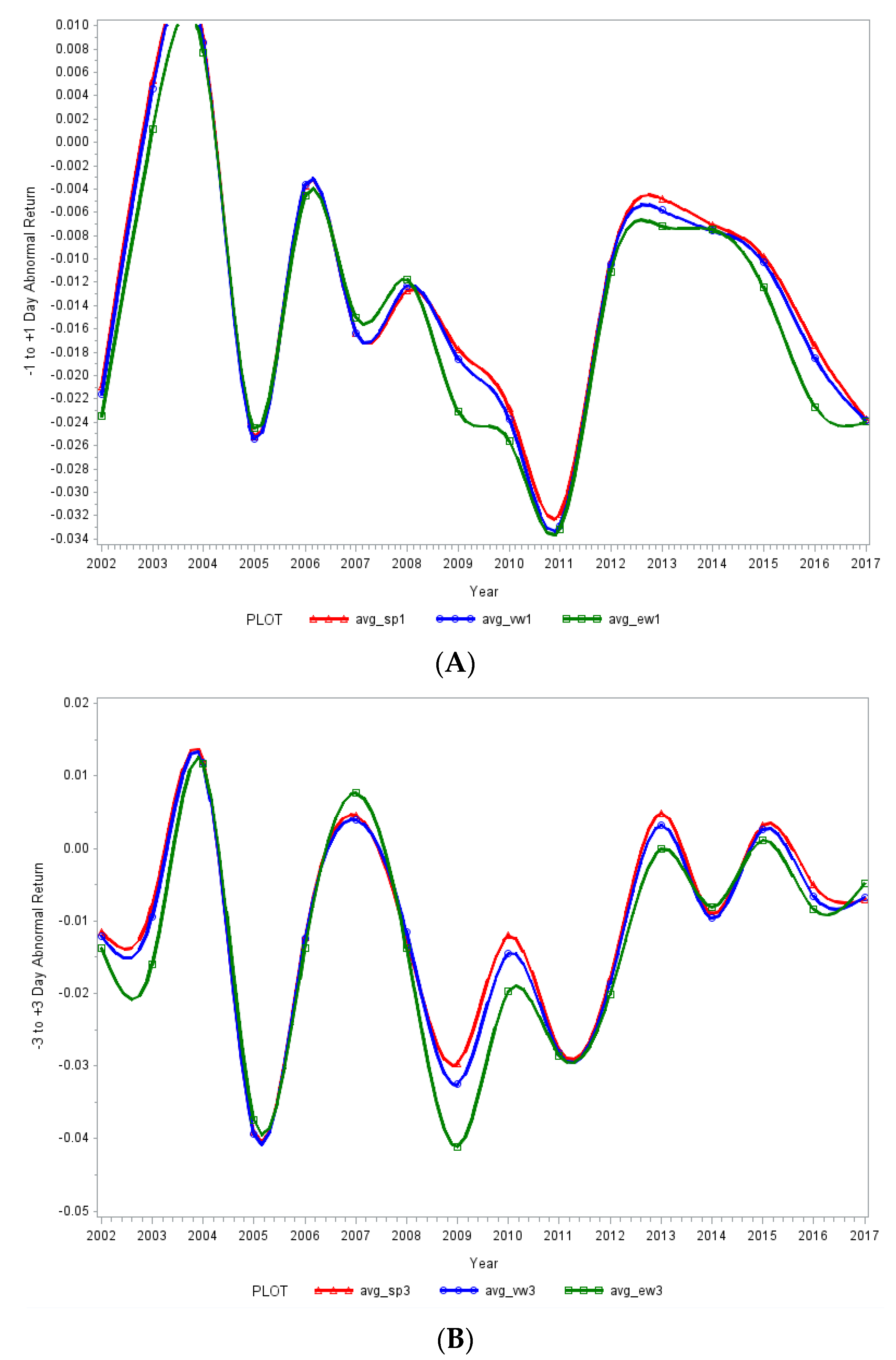

4. Univariate Results

5. Multivariate Results

5.1. Determinants of Announcement Period Abnormal Returns

5.2. Determinants of Longer-Term Post-SEO Abnormal Return

6. Conclusions, Limitations, and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Definition of Variables

| Variables | Description |

| APAR | Announcement period abnormal stock return around bank seasoned equity offering (SEO) announcements: from −1 to +1 day, or from −3 to +3 days around the SEO announcement date, computed as stock return minus equity-beta times S&P 500 Index return, or Equal-weighted (EW) Index return, or the Value-weighted (VW) Index return of the same period, where the beta is computed by regressing the past 36 months of stock returns on S&P 500 index returns before the announcement date. (Source: daily stock price, daily market return from CRSP) |

| LRAR | Cumulative abnormal return of 6 months post-SEO, over and above equity-beta times S&P 500 index return, EW Index return, or VW Index return, given by: or Buy and hold abnormal return of 6 months post-SEO, over and above equity-beta times S&P 500 index return, EW Index return, or VW Index return, given by: where AR is monthly stock return minus beta times a market index return, where the beta is computed by regressing the past 36 months of stock returns on S&P 500 index returns before the announcement date. (Source: monthly stock price, monthly market return from CRSP) |

| Market Value of Equity (MVE) | MVE (market value of equity) is calculated by multiplying CSHOQ and PRC, where CSHOQ (Shares Outstanding Quarterly) represents the net number of all common shares outstanding at quarter-end, excluding treasury shares and scrip, and PRC directly comes from CRSP. PRC (price) is the closing price of the same day as the report date of CSHOQ. (Source: COMPUSTAT and CRSP) |

| Market-to-book Ratio (MB Ratio) | MB Ratio (Market-to-book ratio, calculated by dividing MVE by stock holder equity (SEQQ). SEQQ (Stockholders Equity Quarterly) directly comes from COMPUSTAT Bank Fundamentals, and represents the common and preferred shareholders’ interest in the company. (Source: market stock price from CRSP, book value per share from COMPUSTAT) |

| Return on Assets (ROA), ROA6, ROA12 | ROA (return on assets), for the quarter ending immediately before the SEO announcement, is calculated by dividing NIQ by ATQ, where NIQ and ATQ directly come from COMPUSTAT Bank Fundamentals Quarterly. NIQ (net income) represents the income or loss reported by a bank after expenses and losses have been subtracted from all revenues and gains, including extraordinary items and discontinued operations. This item, for banks, includes securities gains and losses, and ATQ (Assets–Total) represents the total value of assets reported on the Balance Sheet. ROA is also computed 6 months or 12 months after SEO: ROA6 and ROA12. (Source: COMPUSTAT) |

| Capital Ratio (CR), CR6, CR12 | CR is Tier 3 capital ratio (CAPR3Q) as of the quarter ending immediately before the SEO announcement, from COMPUSTAT Bank Fundamentals Quarterly. This item represents the combined core and supplementary capital ratio calculated by adding up tier 1 capital ratio (CAPR1Q) and tier 2 capital ratio (CAPR2Q). Tier 1 capital ratio is Common Shareholders’ Equity plus Noncumulative Preferred Stock plus Minority Interest minus Goodwill minus 50 percent investment in certain subsidiaries as a percent of adjusted risk-weighted assets. Tier 2 capital ratio is Cumulative preferred stock plus qualifying debt plus qualifying allowance for credit losses minus 50 percent investment in certain subsidiaries as a percent of adjusted risk-weighted assets. CR6 and CR12 are the capital ratios (CR), 6 months and 12 months postissue. (Source: COMPUSTAT Bank Fundamentals Quarterly) |

| Nonperforming Assets Ratio (NR), NR6, NR12 | Nonperforming assets ratio is calculated, as at the end of the quarter immediately before SEO announcement, by dividing NPATQ by LGQ. NPATQ and LGQ directly comes from COMPUSTAT Bank Fundamentals Quarterly, where NPATQ (Nonperforming Assets–Total) presents the reported amount of assets that are considered nonperforming. This item includes: loans and leases carried on a nonaccrual basis; loans which are 90 days past due both accruing and non-accruing; renegotiated loans; real estate acquired through foreclosure; and repossessed movable property. LGQ (Loans—Net of Unearned Income Loans—Gross) represents the aggregate face value of all outstanding loans before the deduction of reserves for bad debt losses on loans. In some cases (most frequently after 1975), this item is reported net of Unearned Discount/Income and the Valuation Portion of Reserve for Loan Losses. Nonperforming Assets Ratio (NR) is also computed 6 months or 12 months after SEO: NR6 and NR12. (Source: COMPUSTAT Bank Fundamentals Quarterly) |

| Loan to Assets Ratio (LTA), LTA6, LTA12 | Loan to assets ratio is calculated as total loan divided by total assets. This ratio is calculated one quarter before SEO issuance, and 6 months or 12 months after SEO issuance. (Source: total assets and total loan from COMPUSTAT) |

| Net Interest Margin | Net Interest Margin, NIMQ, from COMPUSTAT Bank Fundamentals Quarterly, is computed by dividing net tax equivalent interest income by average interest earning assets. (Source: COMPUSTAT) |

| Net charge-off Ratio (NCO), NCO6, NCO12 | Net charge-off ratio is computed by dividing net charge-off NCOQ (net charge-offs) that represent the reported amount of asset write-downs minus recoveries of previous write-downs by total loan assets, by LGQ (Loans—Net of Unearned Income Loans—Gross) that represents the aggregate face value of all outstanding loans before the deduction of reserves for bad debt losses on loans. This ratio is calculated one quarter before SEO announcement and 6 months or 12 months after SEO issuance, NCO6 and NCO12. (Source: net charge-off and total loan from COMPUSTAT) |

| CR*NR | The interaction term for capital ratio and nonperforming assets ratio one quarter before SEO announcement. |

References

- Aebi, Vincent, Gabriele Sabato, and Markus Schmid. 2012. Risk Management, Corporate Governance, and Bank Performance in the Financial Crisis. Journal of Banking & Finance 36: 3213–26. [Google Scholar]

- Alam, Md Shabbir, Mustafa Raza Rabbani, Mohammad Rumzi Tausif, and Joji Abey. 2021. Banks’ Performance and Economic Growth in India: A Panel Cointegration Analysis. Economies 9: 38. [Google Scholar] [CrossRef]

- Balasubramnian, Bhanu, and Ken B. Cyree. 2011. Market Discipline of Banks: Why Are Yield Spreads on Bank-Issued Subordinated Notes and Debentures Not Sensitive to Bank Risks? Journal of Banking & Finance 35: 21–35. [Google Scholar]

- Ball, Ray, and Stephen P. Kothari. 1991. Security Returns around Earnings Announcements. The Accounting Review 66: 718–38. [Google Scholar]

- Barber, Brad M., and John D. Lyon. 1997. Detecting Long-Run Abnormal Stock Returns: The Empirical Power and Specification of Test Statistics. Journal of Financial Economics 43: 341–47. [Google Scholar] [CrossRef] [Green Version]

- Barth, James R., and Stephen Matteo Miller. 2018a. Benefits and Costs of a Higher Bank ‘Leverage Ratio’. Journal of Financial Stability 38: 37–52. [Google Scholar] [CrossRef]

- Barth, James R., and Stephen Matteo Miller. 2018b. On the Rising Complexity of Bank Regulatory Capital Requirements: From Global Guidelines to Their United States (US) Implementation. Journal of Risk and Financial Management 11: 77. [Google Scholar] [CrossRef] [Green Version]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Ross Levine. 2006. Bank Concentration, Competition, and Crises: First Results. Journal of Banking & Finance 30: 1581–603. [Google Scholar]

- Berger, Allen N., and Christa H. S. Bouwman. 2013. How Does Capital Affect Bank Performance during Financial Crises? Journal of Financial Economics 109: 146–76. [Google Scholar] [CrossRef]

- Birn, Martin, Olivier de Bandt, Simon Firestone, Matías Gutiérrez Girault, Diana Hancock, Tord Krogh, Hitoshi Mio, Donald Morgan, Ajay Palvia, Valerio Scalone, and et al. 2020. The Costs and Benefits of Bank Capital—A Review of the Literature. Journal of Risk and Financial Management 13: 74. [Google Scholar] [CrossRef] [Green Version]

- Carletti, Elena, Robert Marquez, and Silvio Petriconi. 2020. The Redistributive Effects of Bank Capital Regulation. Journal of Financial Economics 136: 743–59. [Google Scholar] [CrossRef]

- Chishti, Muhammad Zubair, Manzoor Ahmad, Abdul Rehman, and Muhammad Kamran Khan. 2021. Mitigations Pathways towards Sustainable Development: Assessing the Influence of Fiscal and Monetary Policies on Carbon Emissions in BRICS Economies. Journal of Cleaner Production 292: 126035. [Google Scholar] [CrossRef]

- Clarke, Jonathan, Hailiang Chen, Ding Du, and Yu Jeffrey Hu. 2021. Fake News, Investor Attention, and Market Reaction. Information Systems Research 32: 35–52. [Google Scholar] [CrossRef]

- Cohen, Daniel A., Aiyesha Dey, Thomas Z. Lys, and Shyam V. Sunder. 2007. Earnings Announcement Premia and the Limits to Arbitrage. Journal of Accounting and Economics 43: 153–80. [Google Scholar] [CrossRef] [Green Version]

- Ҫolak, Gönül, and Özde Öztekin. 2021. The Impact of COVID-19 Pandemic on Bank Lending around the World. Journal of Banking & Finance 133: 106207. [Google Scholar]

- Cooper, Michael J., Huseyin Gulen, and Michael J. Schill. 2008. Asset Growth and the Cross-Section of Stock Returns. The Journal of Finance 63: 1609–51. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Asli, Enrica Detragiache, and Ouarda Merrouche. 2013. Bank Capital: Lessons from the Financial Crisis. Journal of Money, Credit and Banking 45: 1147–64. [Google Scholar] [CrossRef] [Green Version]

- Diamond, Douglas W., and Raghuram G. Rajan. 2000. A Theory of Bank Capital. The Journal of Finance 55: 2431–65. [Google Scholar] [CrossRef]

- Dinger, Valeriya, and Francesco Vallascas. 2016. Do Banks Issue Equity When They Are Poorly Capitalized? Journal of Financial and Quantitative Analysis 51: 1575–609. [Google Scholar] [CrossRef] [Green Version]

- Echandi, Roberto, Jana Krajcovicova, and Christine Zhen-Wei Qiang. 2015. The Impact of Investment Policy in a Changing Global Economy: A Review of the Literature. SSRN Scholarly Paper 2673878. Rochester: Social Science Research Network. [Google Scholar]

- Elekdag, Selim, Sheheryar Malik, and Srobona Mitra. 2020. Breaking the Bank? A Probabilistic Assessment of Euro Area Bank Profitability. Journal of Banking & Finance 120: 105949. [Google Scholar]

- Elyasiani, Elyas, Loretta J. Mester, and Michael S. Pagano. 2014. Large Capital Infusions, Investor Reactions, and the Return and Risk-Performance of Financial Institutions over the Business Cycle. Journal of Financial Stability 11: 62–81. [Google Scholar] [CrossRef]

- Estrella, Arturo. 2004. The Cyclical Behavior of Optimal Bank Capital. Journal of Banking & Finance 28: 1469–98. [Google Scholar]

- Fahlenbrach, Rüdiger, Robert Prilmeier, and René M. Stulz. 2018. Why Does Fast Loan Growth Predict Poor Performance for Banks? The Review of Financial Studies 31: 1014–63. [Google Scholar] [CrossRef]

- Flannery, Mark J., Simon H. Kwan, and Mahendrarajah Nimalendran. 2013. The 2007–2009 Financial Crisis and Bank Opaqueness. Journal of Financial Intermediation 22: 55–84. [Google Scholar] [CrossRef]

- Gropp, Reint, and Florian Heider. 2010. The Determinants of Bank Capital Structure. Review of Finance 14: 587–622. [Google Scholar] [CrossRef] [Green Version]

- Haselmann, Rainer, and Paul Wachtel. 2010. Institutions and Bank Behavior: Legal Environment, Legal Perception, and the Composition of Bank Lending. Journal of Money, Credit and Banking 42: 965–84. [Google Scholar] [CrossRef]

- Haubrich, Joseph G. 2020. A Brief History of Bank Capital Requirements in the United States. Economic Commentary 5: 1–6. [Google Scholar] [CrossRef]

- Honohan, Patrick, and Luc Laeven. 2005. Systemic Financial Crises: Containment and Resolution. Cambridge: Cambridge University Press. [Google Scholar]

- Ivashina, Victoria, and David Scharfstein. 2010. Bank Lending during the Financial Crisis of 2008. Journal of Financial Economics 97: 319–38. [Google Scholar] [CrossRef]

- Kindleberger, Charles P. 2000. Manias, Panics, and Crashes: A History of Financial Crises, 4th ed. Wiley Investment Classics. New York: Wiley. [Google Scholar]

- Krishnan, CNV, and Yu He. 2022. IPO Performance: A Cross-Country Comparison of the Effect of Regulations. Journal of Accounting and Finance 22: 59–78. [Google Scholar] [CrossRef]

- Krishnan, CNV, O. Emre Ergungor, Paul A. Laux, Ajai K. Singh, and Allan A. Zebedee. 2010. Examining Bank SEOs: Are Offers Made by Undercapitalized Banks Different? Journal of Financial Intermediation 19: 207–34. [Google Scholar] [CrossRef]

- Laeven, Luc, and Fabian Valencia. 2018. Systemic Banking Crises Revisited. Washington, DC: IMF. [Google Scholar]

- Leung, Woon Sau, Nicholas Taylor, and Kevin Evans. 2015. The determinants of bank risks: Evidence from the recent financial crisis. Journal of International Financial Markets Institutions and Money 34: 277–93. [Google Scholar] [CrossRef]

- Li, Hui, Hong Liu, Antonios Siganos, and Mingming Zhou. 2016. Bank Regulation, Financial Crisis, and the Announcement Effects of Seasoned Equity Offerings of US Commercial Banks. Journal of Financial Stability 25: 37–46. [Google Scholar] [CrossRef] [Green Version]

- Liang, Qi, Pisun Xu, and Pornsit Jiraporn. 2013. Board Characteristics and Chinese Bank Performance. Journal of Banking & Finance 37: 2953–68. [Google Scholar]

- Liu, Hong. 2018. Why Do Banks Issue Equity? SSRN Scholarly Paper ID 3288633. Rochester: Social Science Research Network. [Google Scholar]

- Loughran, Tim, and Jay R. Ritter. 1995. The New Issues Puzzle. The Journal of Finance 50: 23–51. [Google Scholar] [CrossRef]

- Martinez Peria, Maria Soledad, and Sergio L. Schmukler. 2001. Do Depositors Punish Banks for Bad Behavior? Market Discipline, Deposit Insurance, and Banking Crises. The Journal of Finance 56: 1029–51. [Google Scholar] [CrossRef] [Green Version]

- Meeker, Larry G., and Laura Gray. 1987. A Note on Non-Performing Loans as an Indicator of Asset Quality. Journal of Banking & Finance 11: 161–68. [Google Scholar]

- Mehran, Hamid, and Anjan Thakor. 2011. Bank Capital and Value in the Cross-Section. The Review of Financial Studies 24: 1019–67. [Google Scholar] [CrossRef]

- Mourouzidou-Damtsa, Stella, Andreas Milidonis, and Konstantinos Stathopoulos. 2019. National Culture and Bank Risk-Taking. Journal of Financial Stability 40: 132–43. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, James. 2012. The Relationship between Net Interest Margin and Noninterest Income Using a System Estimation Approach. Journal of Banking & Finance 36: 2429–37. [Google Scholar]

- Nier, Erlend, and Ursel Baumann. 2006. Market Discipline, Disclosure and Moral Hazard in Banking. Journal of Financial Intermediation 15: 332–61. [Google Scholar] [CrossRef]

- Polonchek, John, Myron B. Slovin, and Marie E. Sushka. 1989. Valuation Effects of Commercial Bank Securities Offerings: A Test of the Information Hypothesis. Journal of Banking & Finance 13: 443–61. [Google Scholar]

- Qian, Jun, and Philip E. Strahan. 2007. How Laws and Institutions Shape Financial Contracts: The Case of Bank Loans. The Journal of Finance 62: 2803–34. [Google Scholar] [CrossRef]

- Raskovich, Alexander. 2008. Should Banking Be Kept Separate from Commerce. SSRN Scholarly Paper 1263406. Rochester: Social Science Research Network. [Google Scholar]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2011. From Financial Crash to Debt Crisis. The American Economic Review 101: 64. [Google Scholar] [CrossRef] [Green Version]

- Tetlock, Paul C., Maytal Saar-Tsechansky, and Sofus Macskassy. 2008. More Than Words: Quantifying Language to Measure Firms’ Fundamentals. The Journal of Finance 63: 1437–67. [Google Scholar] [CrossRef]

- Wansley, James W., and Upinder S. Dhillon. 1989. Determinants of Valuation Effects for Security Offerings of Commercial Bank Holding Companies. Journal of Financial Research 12: 217–33. [Google Scholar] [CrossRef]

- Weimin, Zhu, Muhammad Zubair Chishti, Abdul Rehman, and Manzoor Ahmad. 2022. A Pathway toward Future Sustainability: Assessing the Influence of Innovation Shocks on CO2 Emissions in Developing Economies. Environment, Development and Sustainability 24: 4786–809. [Google Scholar] [CrossRef]

- Yue, Heng, Liandong Zhang, and Qinlin Zhong. 2022. The Politics of Bank Opacity. Journal of Accounting and Economics 73: 101452. [Google Scholar] [CrossRef]

- Zhang, Dayong, Jing Cai, David G. Dickinson, and Ali M. Kutan. 2016. Non-Performing Loans, Moral Hazard and Regulation of the Chinese Commercial Banking System. Journal of Banking & Finance 63: 48–60. [Google Scholar]

| Year | Number of SEOs | Year | Number of SEOs |

|---|---|---|---|

| 2002 | 10 | 2010 | 39 |

| 2003 | 10 | 2011 | 16 |

| 2004 | 9 | 2012 | 23 |

| 2005 | 11 | 2013 | 21 |

| 2006 | 12 | 2014 | 21 |

| 2007 | 2 | 2015 | 10 |

| 2008 | 24 | 2016 | 11 |

| 2009 | 72 | 2017 | 20 |

| Total | 311 |

| (A) | ||||||||

| Year | Nonperforming Assets Ratio | Capital Ratio | Loan to Assets Ratio | Market to Book Ratio | ROA | Net Interest Margin | Net Charge-Off Ratio | MVE |

| 2002 | 0.005 | 10.851 | 0.657 | 2.473 | 0.019 | 3.561 | −0.0004 | 3238 |

| 2003 | 0.007 | 11.384 | 0.585 | 2.118 | 0.015 | 3.575 | 0.0014 | 2803 |

| 2004 | 0.006 | 11.883 | 0.756 | 2.231 | 0.016 | 3.987 | 0.0002 | 1406 |

| 2005 | 0.006 | 13.006 | 0.634 | 1.299 | 0.015 | 3.576 | 0.0005 | 672 |

| 2006 | 0.004 | 12.258 | 0.667 | 2.171 | 0.018 | 3.657 | 0.0003 | 22,060 |

| 2007 | 0.007 | 11.765 | 0.691 | 1.476 | 0.020 | 3.885 | 0.0004 | 12,573 |

| 2008 | 0.012 | 11.659 | 0.675 | 1.250 | 0.017 | 3.338 | 0.0012 | 4512 |

| 2009 | 0.033 | 13.416 | 0.695 | 0.761 | 0.015 | 3.562 | 0.0037 | 1593 |

| 2010 | 0.063 | 13.226 | 0.701 | 1.278 | 0.014 | 3.545 | 0.0051 | 1726 |

| 2011 | 0.047 | 13.414 | 0.664 | 0.933 | 0.013 | 3.594 | 0.0050 | 606 |

| 2012 | 0.028 | 14.585 | 0.669 | 0.849 | 0.013 | 3.862 | 0.0014 | 358 |

| 2013 | 0.045 | 12.993 | 0.643 | 0.864 | 0.012 | 3.304 | 0.0023 | 687 |

| 2014 | 0.031 | 13.371 | 0.675 | 1.439 | 0.012 | 3.461 | 0.0014 | 1005 |

| 2015 | 0.015 | 13.067 | 0.749 | 1.313 | 0.012 | 3.867 | 0.0003 | 2029 |

| 2016 | 0.008 | 13.142 | 0.685 | 1.230 | 0.010 | 3.415 | 0.0003 | 1734 |

| 2017 | 0.008 | 12.446 | 0.765 | 1.570 | 0.012 | 3.574 | 0.0004 | 1916 |

| (B) | ||||||||

| Year | Nonperforming Assets Ratio | Capital Ratio | Loan to Assets Ratio | Market to Book Ratio | ROA | Net Interest Margin | Net Charge-Off Ratio | MVE |

| 2002 | 0.004 | 10.910 | 0.685 | 2.228 | 0.019 | 3.580 | 0.0000 | 290 |

| 2003 | 0.006 | 11.220 | 0.602 | 2.036 | 0.015 | 3.485 | 0.0005 | 509 |

| 2004 | 0.005 | 11.590 | 0.764 | 2.038 | 0.015 | 4.130 | 0.0002 | 230 |

| 2005 | 0.003 | 12.800 | 0.664 | 1.931 | 0.015 | 3.610 | 0.0001 | 237 |

| 2006 | 0.004 | 12.020 | 0.727 | 1.922 | 0.018 | 3.860 | 0.0002 | 663 |

| 2007 | 0.007 | 11.765 | 0.691 | 1.476 | 0.020 | 3.885 | 0.0004 | 1257 |

| 2008 | 0.010 | 11.365 | 0.676 | 1.191 | 0.017 | 3.470 | 0.0007 | 1080 |

| 2009 | 0.029 | 13.075 | 0.726 | 0.775 | 0.015 | 3.535 | 0.0026 | 279 |

| 2010 | 0.049 | 13.380 | 0.688 | 0.683 | 0.014 | 3.600 | 0.0037 | 160 |

| 2011 | 0.045 | 14.035 | 0.656 | 0.838 | 0.013 | 3.585 | 0.0036 | 225 |

| 2012 | 0.020 | 14.120 | 0.677 | 0.879 | 0.012 | 3.860 | 0.0007 | 131 |

| 2013 | 0.028 | 13.080 | 0.676 | 0.804 | 0.011 | 3.370 | 0.0011 | 93 |

| 2014 | 0.024 | 13.800 | 0.690 | 1.061 | 0.012 | 3.410 | 0.0005 | 135 |

| 2015 | 0.009 | 13.410 | 0.770 | 1.327 | 0.013 | 3.965 | 0.0002 | 840 |

| 2016 | 0.006 | 12.800 | 0.728 | 1.312 | 0.010 | 3.270 | 0.0002 | 864 |

| 2017 | 0.008 | 12.435 | 0.761 | 1.560 | 0.012 | 3.640 | 0.0001 | 208 |

| (A) | ||||

| Year | SP AR1 | SP AR3 | SP CAR6 | SP BHAR6 |

| 2002 | −0.018 | −0.011 | 0.074 | 0.082 |

| 2003 | 0.005 | −0.008 | 0.181 | 0.194 |

| 2004 | 0.009 | 0.012 | 0.095 | 0.098 |

| 2005 | −0.025 | −0.039 | 0.059 | 0.056 |

| 2006 | −0.004 | −0.012 | −0.045 | −0.044 |

| 2007 | −0.016 | 0.005 | −0.217 | −0.206 |

| 2008 | −0.028 | −0.018 | −0.125 | −0.159 |

| 2009 | −0.020 | −0.025 | −0.018 | −0.021 |

| 2010 | −0.002 | −0.009 | −0.166 | −0.145 |

| 2011 | −0.011 | −0.017 | −0.043 | −0.048 |

| 2012 | −0.016 | −0.021 | 0.073 | 0.066 |

| 2013 | −0.005 | 0.005 | 0.034 | 0.022 |

| 2014 | −0.005 | −0.009 | −0.048 | −0.052 |

| 2015 | −0.010 | 0.003 | −0.022 | −0.011 |

| 2016 | −0.017 | 0.004 | 0.125 | 0.142 |

| 2017 | −0.024 | −0.007 | 0.041 | 0.039 |

| (B) | ||||

| Year | SP AR1 | SP AR3 | SP CAR6 | SP BHAR6 |

| 2002 | −0.022 | −0.034 | 0.017 | 0.006 |

| 2003 | 0.014 | −0.003 | 0.172 | 0.178 |

| 2004 | 0.014 | −0.002 | 0.100 | 0.103 |

| 2005 | −0.017 | −0.038 | −0.003 | −0.004 |

| 2006 | −0.007 | −0.006 | −0.006 | −0.009 |

| 2007 | −0.016 | 0.005 | −0.217 | −0.206 |

| 2008 | −0.006 | 0.000 | −0.160 | −0.191 |

| 2009 | −0.011 | −0.032 | 0.063 | 0.024 |

| 2010 | −0.017 | −0.014 | −0.099 | −0.114 |

| 2011 | −0.032 | −0.029 | −0.039 | −0.066 |

| 2012 | −0.009 | −0.007 | 0.109 | 0.075 |

| 2013 | −0.002 | 0.018 | 0.053 | 0.051 |

| 2014 | −0.004 | −0.002 | −0.047 | −0.055 |

| 2015 | −0.008 | 0.002 | 0.001 | −0.004 |

| 2016 | −0.018 | −0.015 | −0.019 | −0.029 |

| 2017 | −0.015 | −0.012 | 0.048 | 0.045 |

| (A) | ||||

| Difference of Means Test | Difference of Median Test | |||

| High Capital Ratio | Low Capital Ratio | High Capital Ratio | Low Capital Ratio | |

| SP AR1 | −0.010 | −0.018 ** | 0.544 | 0.455 *** |

| VW AR1 | −0.010 | −0.018 ** | 0.540 | 0.459 *** |

| EW AR1 | −0.012 | −0.020 ** | 0.531 | 0.468 *** |

| SP AR3 | −0.011 | −0.021 ** | 0.541 | 0.462 *** |

| VW AR3 | −0.012 | −0.022 ** | 0.523 | 0.478 |

| EW AR3 | −0.015 | −0.025 ** | 0.537 | 0.466 *** |

| SP CAR6 | −0.017 | −0.018 | 0.512 | 0.487 |

| VW CAR6 | −0.009 | −0.029 | 0.507 | 0.493 |

| EW CAR6 | −0.000 | −0.053 | 0.550 | 0.438 |

| SP BHAR6 | −0.020 | −0.026 | 0.520 | 0.479 |

| VW BHAR6 | −0.032 | −0.035 | 0.504 | 0.496 |

| EW BHAR6 | −0.055 | −0.048 | 0.520 | 0.479 |

| CR6 | 15.933 | 13.579 *** | 0.723 | 0.267 *** |

| CR12 | 15.718 | 13.763 *** | 0.669 | 0.322 *** |

| NR6 | 0.031 | 0.026 | 0.565 | 0.433 |

| NR12 | 0.031 | 0.025 | 0.464 | 0.528 |

| LTA6 | 0.069 | 0.067 | 0.551 | 0.448 |

| LTA12 | 0.677 | 0.668 | 0.529 | 0.463 |

| ROA6 | 0.013 | 0.014 | 0.464 | 0.537 |

| ROA12 | 0.013 | 0.014 | 0.478 | 0.514 |

| NCO6 | 0.002 | 0.002 | 0.532 | 0.467 |

| NCO12 | 0.002 | 0.002 | 0.526 | 0.471 |

| (B) | ||||

| Difference of Means Test | Difference of Median Test | |||

| High Nonperforming Assets Ratio | Low Nonperforming Assets Ratio | High Nonperforming Assets Ratio | Low Nonperforming Assets Ratio | |

| SP AR1 | −0.018 | −0.016 | 0.516 | 0.485 |

| VW AR1 | −0.018 | −0.017 | 0.529 | 0.473 |

| EW AR1 | −0.020 | −0.019 | 0.534 | 0.468 |

| SP AR3 | −0.019 | −0.014 | 0.508 | 0.493 |

| VW AR3 | −0.021 | −0.015 | 0.510 | 0.490 |

| EW AR3 | −0.025 | −0.016 * | 0.513 | 0.488 |

| SP CAR6 | −0.039 | 0.016 *** | 0.474 | 0.525 |

| VW CAR6 | −0.051 | 0.007 *** | 0.461 | 0.537 ** |

| EW CAR6 | −0.076 | −0.011 *** | 0.471 | 0.527 |

| SP BHAR6 | −0.046 | 0.013 *** | 0.463 | 0.535 ** |

| VW BHAR6 | −0.057 | 0.004 *** | 0.458 | 0.540 ** |

| EW BHAR6 | −0.081 | −0.013 *** | 0.458 | 0.540 ** |

| CR6 | 15.457 | 13.858 *** | 0.651 | 0.356 *** |

| CR12 | 15.757 | 13.951 *** | 0.649 | 0.349 *** |

| NR6 | 0.045 | 0.009 *** | 0.909 | 0.110 *** |

| NR12 | 0.043 | 0.009 *** | 0.871 | 0.123 *** |

| LTA6 | 0.667 | 0.677 | 0.481 | 0.518 |

| LTA12 | 0.659 | 0.673 ** | 0.470 | 0.531 ** |

| ROA6 | 0.013 | 0.014 * | 0.478 | 0.520 |

| ROA12 | 0.013 | 0.014 * | 0.495 | 0.506 |

| NCO6 | 0.004 | 0.001 *** | 0.743 | 0.270 *** |

| NCO12 | 0.003 | 0.001 *** | 0.741 | 0.272 *** |

| Dependent Variable: | SP AR1 | VW AR1 | EW AR1 | SP AR3 | VW AR3 | EW AR3 |

|---|---|---|---|---|---|---|

| Capital Ratio | 0.004 *** | 0.004 *** | 0.004 *** | 0.005 ** | 0.004 ** | 0.005 ** |

| (2.79) | (2.72) | (2.71) | (2.13) | (2.07) | (2.38) | |

| Nonperforming Assets Ratio | 0.316 | 0.286 | 0.365 | 0.066 | 0.059 | 0.232 |

| (0.74) | (0.67) | (0.83) | (0.11) | (0.10) | (0.37) | |

| Loan to Assets Ratio | 0.015 | 0.013 | 0.019 | −0.035 | −0.034 | −0.020 |

| (0.77) | (0.71) | (0.94) | (−1.22) | (−1.20) | (−0.69) | |

| ROA | −0.878 | −0.939 | −1.251 | −0.555 | −0.652 | −0.855 |

| (−0.94) | (−1.01) | (−1.31) | (−0.38) | (−0.45) | (−0.57) | |

| Net Interest Margin | 0.008 ** | 0.008 ** | 0.009 ** | 0.007 | 0.007 | 0.003 |

| (2.29) | (2.32) | (2.34) | (1.27) | (1.29) | (0.63) | |

| MB Ratio | 0.015 *** | 0.015 *** | 0.015 *** | 0.011 ** | 0.011 ** | 0.014 *** |

| (5.09) | (5.14) | (5.18) | (2.45) | (2.53) | (2.97) | |

| Net Charge-off Ratio | −1.499 ** | −1.449 ** | −1.483 ** | −4.20 *** | −4.364 *** | −4.902 *** |

| (−2.09) | (−2.02) | (−2.01) | (−3.88) | (−4.03) | (−4.40) | |

| CR*NR | 0.0000 | 0.001 | −0.004 | 0.021 | 0.022 | 0.013 |

| (−0.01) | (0.03) | (−0.13) | (0.46) | (0.48) | (0.27) | |

| Time-Fixed Effects | YES | YES | YES | YES | YES | YES |

| Dependent Variable: | SP CAR6 | VW CAR6 | EW CAR6 | SP BHAR6 | VW BHAR6 | EW BHAR6 |

|---|---|---|---|---|---|---|

| Nonperforming Assets Ratio | −8.139 *** | −8.080 *** | −8.3805 *** | −7.645 *** | −7.4830 *** | −8.156 *** |

| (−4.57) | (−4.52) | (−4.49) | (−4.44) | (−4.36) | (−4.61) | |

| Capital Ratio | 0.008 | 0.008 | 0.008 | 0.009 | 0.009 | 0.007 |

| (1.46) | (1.40) | (1.27) | (1.64) | (1.57) | (1.27) | |

| Loan to Assets Ratio | −0.082 | −0.083 | −0.043 | −0.086 | −0.082 | −0.045 |

| (−1.04) | (−1.04) | (−0.53) | (−1.13) | (−1.09) | (−0.58) | |

| ROA | 5.586 | 4.897 | 2.167 | 5.534 | 4.838 | 2.388 |

| (1.39) | (1.21) | (0.51) | (1.42) | (1.25) | (0.60) | |

| Net Interest Margin | −0.004 | −0.002 | 0.008 | −0.001 | 0.001 | 0.010 |

| (−0.29) | (−0.12) | (0.49) | (−0.07) | (0.07) | (0.70) | |

| MB Ratio | −0.006 | −0.003 | 0.010 | 0.001 | 0.003 | 0.015 |

| (−0.46) | (−0.28) | (0.75) | (0.06) | (0.25) | (1.23) | |

| Net Charge-off Ratio | −12.159 *** | −12.172 *** | −13.718 *** | −11.950 *** | −11.795 *** | −13.038 *** |

| (−4.15) | (−4.13) | (−4.47) | (−4.22) | (−4.18) | (−4.48) | |

| CR*NR | 0.6612 *** | 0.656 *** | 0.702 *** | 0.619 *** | 0.605*** | 0.673 *** |

| (4.95) | (4.88) | (5.02) | (4.72) | (4.70) | (5.07) | |

| Time-Fixed Effects | YES | YES | YES | YES | YES | YES |

| Dependent Variable: | ROA6 | ROA12 | NR6 | NR12 | NCO6 | NCO12 |

|---|---|---|---|---|---|---|

| Nonperforming Assets Ratio | −0.020 * | −0.027 ** | 1.011 *** | 0.731 *** | 0.041 ** | 0.054 *** |

| (−1.83) | (−2.15) | (9.68) | (6.83) | (2.33) | (2.97) | |

| Capital Ratio | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (−1.62) | (−1.63) | (0.35) | (−1.00) | (−0.79) | (0.52) | |

| Loan to Assets Ratio | 0.000 | −0.002 | 0.012 ** | 0.007 | 0.000 | 0.001 |

| (−0.35) | (−3.63) | (2.49) | (1.45) | (−0.18) | (1.03) | |

| ROA | 0.7473 *** | 0.794 *** | 0.724 *** | 0.553 ** | 0.091 ** | 0.062 |

| (30.26) | (26.35) | (2.95) | (2.18) | (2.16) | (1.49) | |

| Net Interest Margin | 0.000 ** | 0.000 | 0.000 | 0.0000 | −0.001 *** | 0.000 |

| (−2.10) | (−1.04) | (−0.38) | (0.38) | (−3.93) | (−0.37) | |

| MB Ratio | 0.000 | 0.000 ** | −0.001 | −0.002 *** | 0.000 *** | 0.000 *** |

| (0.84) | (−2.27) | (−1.95) | (−2.81) | (−3.05) | (−1.66) | |

| Net Charge-off Ratio | −0.008 | 0.032 | 0.155 | −0.0941 | 0.453 *** | 0.257 *** |

| (−0.40) | (1.55) | (0.90) | (−0.54) | (14.01) | (8.52) | |

| CR*NR | 0.001 * | 0.002 * | −0.016 ** | 0.000 | −0.001 | −0.002 |

| (1.66) | (1.79) | (−2.10) | (0.06) | (−0.40) | (−1.61) | |

| Time-Fixed Effects | YES | YES | YES | YES | YES | YES |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Krishnan, C.; He, Y. Investor Perception, Market Reaction, and Post-Issue Performance in Bank Seasoned Equity Offerings. J. Risk Financial Manag. 2022, 15, 275. https://doi.org/10.3390/jrfm15070275

Krishnan C, He Y. Investor Perception, Market Reaction, and Post-Issue Performance in Bank Seasoned Equity Offerings. Journal of Risk and Financial Management. 2022; 15(7):275. https://doi.org/10.3390/jrfm15070275

Chicago/Turabian StyleKrishnan, CNV, and Yu He. 2022. "Investor Perception, Market Reaction, and Post-Issue Performance in Bank Seasoned Equity Offerings" Journal of Risk and Financial Management 15, no. 7: 275. https://doi.org/10.3390/jrfm15070275

APA StyleKrishnan, C., & He, Y. (2022). Investor Perception, Market Reaction, and Post-Issue Performance in Bank Seasoned Equity Offerings. Journal of Risk and Financial Management, 15(7), 275. https://doi.org/10.3390/jrfm15070275