1. Introduction

The current financial and economic situation worldwide affects the activities of all sectors of the economy, creating new challenges for banks. In turn, banks provide increasingly universal services: in addition to lending and intermediary functions, banks participate in the international circulation of capital and loans and carry out insurance and consulting activities. Banks are a source of finance and credit for trade and industry, enabling entrepreneurs to innovate and invest, accelerating economic development (

Safiullah and Shamsuddin 2018).

Commercial banks play such an essential role in the country’s economic development that the modern industrial economy cannot exist without them (

Ilmiani and Meliza 2022). They are the center of production, trade, and industry of the country, namely: banks are a source of finance and credit for business and industry; bank loans allow entrepreneurs to innovate and invest, accelerating economic development; banks help promote large-scale production and growth of priority industries such as agriculture, small-scale industry, retail trade, and exports; banks can provide more loans and advances than depositors have cash; banks help trade and industry grow their business; banks optimize the use of resources.

In today’s economic environment, one can consider bank management one of the most challenging management areas, as banks are constantly at the crossroads of many complicated, contradictory, and unpredictable economic, political, and social processes. In modern conditions, it is difficult for banks to achieve the goals of their shareholders, customers, society, employees, and government services following the requirements set by regulators (

Haseeb 2018).

In banking institutions, asset and liability management is the practice of banking risk management arising from the mismatch between the bank assets and liabilities (

Tan and Floros 2018). Banks face various risks, such as assets, interest rate, currency, geographical, operational, and other risks. Asset and liability management is a tool for managing interest rate and liquidity risks faced by all banking institutions and other companies that provide financial services (

Brandao-Marques et al. 2020).

In general, bank asset and liability management are the efforts of the bank management team and senior management to carefully balance the bank’s current and long-term potential profits with the need to maintain adequate liquidity and adequate interest rate risk (

Mpofu and Nikolaidou 2018). Each bank has a different strategy, customer base, product choice, distribution of funds, combination of assets, and risk profile. These differences require adapting risk assessment and risk management practices to specific risks and activities of each bank, rather than using a single approach for all of them. Thus, the urgency of the problem is the need to study the economic aspects of asset and liability management of a commercial bank regarding risk.

This work aims to build a model for assessing banking risks. The authors chose as the model the CAPM currency risk management model, the Basel Committee standardized operational risk management model, and the credit risk management model based on IFRS 9. The aim of the work is also to provide a theoretical generalization of the concept of commercial bank risk and a practical recommendation for its minimization in the economic activities of banks. It will allow the bank to efficiently respond to changes in exogenous factors and prevent losses in the process of banking operations.

The authors set and solved the following problems to achieve the declared purpose of the study: consider the nature and types of activity of banking institutions; analyze the concept of risk management of commercial banks; study the types of risks that arise in the process of activities of a commercial bank; set the problem of optimal management and determination of the optimal distribution of bank assets and liabilities, with maximum bank profit at the end of the period; characterize the purpose, technical, and economic nature of the problem and justify the need to solve it; study models that reflect the activities of commercial banks; build an optimal economic–mathematical model; specify the objects to be guided to solve the problem; describe the purpose and use of output information; describe input information, its purpose, and methods to obtain it.

2. Literature Review

2.1. Specifics of Banking Risk Types

There are various banking risks. We will consider the main risks that correspond to the object of our study.

Risks characterize bank activity. A bank manages its risks through an ongoing process of identification, assessment, and supervision and setting risk limits and other internal controls. The risk management process is essential to maintain the bank’s sustainable profitability. Each bank employee is responsible for the risks related to their functions. The following risks are inherent in a bank: credit, liquidity, market, operational, and other risks (

Namahoot and Laohavichien 2018).

A risk management system is a set of analytical, organizational, and financial measures used to determine, assess, optimize levels, and control risks to reduce or prevent the negative consequences of their occurrence (

Jo et al. 2022).

The primary purpose of risk management is to minimize bank losses, preserve capital and assets, and achieve the best business results by identifying, maintaining, and controlling the level of bank risk (

Trivedi 2019).

Operational risk management aims to minimize the bank losses and preserve its capital and assets while ensuring the best activity results based on determining, maintaining, and controlling the level of operational risk acceptable to the bank (

Chauhan et al. 2019).

Achieving this goal is a necessary condition for maintaining a stable financial position of a bank that protects the interests of its customers and shareholders.

Of all the risks that affect the bank, operational risks are separate due to their specificity, lack of a systematic approach to analysis, and lack of identification criteria that require further study (

Habachi and Haddad 2021). Operational risk is unique in that although it covers almost all areas of a credit institution’s activity, it is difficult to identify and separate it from other banking risks.

One should remember that a credit institution is exposed every year to new operational risk types related to the development of information and computer systems, the growing complexity of stock market instruments, and the improvement of operation methods. As a result, regulators in all countries are constantly striving to improve the legal and regulatory framework for commercial bank operational risk management based on the Basel Committee on Banking Supervision (

Shaikh et al. 2021).

According to the current practices, there are different approaches to risk management and risk management organization. These differences are, to some extent, due to the level of banking development in the country (

Torre Olmo et al. 2021).

According to

Thakor (

2018), the most typical approaches to the organization of a risk management system are as follows: risk management with only back-office functions, no integration with the front office; risk management partially performs the functions of the back and middle offices; the control of the behavioral characteristics of open risk positions is at the basis of the relations with the front office; risk management performs the functions of the middle office and partly those of the front office; the front office activity is part of the bank risk management at all stages of its activity.

In risk management, the bank uses derivatives and other instruments to manage positions arising from changes in interest rates, exchange rates, stock price risk, credit risk, other risks, and positions regarding forecast operations (

Srairi 2019).

The bank assesses risks using a methodology that reflects both the expected losses in the banking sector and inherent in financial institutions as well as unexpected losses, which are estimates of the actual maximum losses calculated using statistical models (

Aboobucker and Bao 2018). These models use the values of events based on firsthand experience adapted to current economic conditions. The bank models the “worst-case scenarios” that may occur in the case of events that are considered exceptional (extreme) but probable.

Currency risk is the current or potential risk to the bank’s income and capital due to adverse exchange rates. The bank constantly monitors open currency positions (

Lu and Boateng 2018).

The main factor in the emergence of currency risks is short- and long-term exchange rate fluctuations, which depend on a currency’s supply and demand in national and international money markets (

Saidane et al. 2021).

In general, currency risk is speculative and can be due to changes in the direction of the exchange rate and the bank having a long or short net position in foreign currency. For example, suppose a bank has a long currency position. In that case, the depreciation of the national currency will give it a net profit, and the increase of this currency will cause losses (

Kulińska-Sadłocha et al. 2020). These exchange rate changes will have the opposite effect on a short currency position.

Banks are qualified investors, and according to international practice, they operate in the market without state insurance. From a practical point of view and for practical management purposes, it is necessary to consider the specifics of currency risk (

Ojeniyi et al. 2019).

The operational risk or operational currency risk is related to adverse changes in exchange rates that affect the actual value of the bank’s open currency position. It causes losses from specific foreign exchange transactions (for example, market transactions, bidding, and so on) (

de Mendonça and da Silva 2018).

Therefore, it would be fair to include them in the so-called currency provisions in contracts.

The risk of transfer from one currency to another (conversion or accounting) arises when the value of the equivalent of a foreign currency position in the reports changes due to changes in exchange rates used in the revaluation of foreign currency assets and liabilities in national currency (base), or when a parent bank with foreign currency branches consolidates financial statements (

Finger et al. 2018).

Economic (commercial) currency risk is a change in the long-term position of the state or the competitive value of a financial enterprise, or in its structures in the international market due to significant changes in exchange rates. A decrease in the national currency value may reduce imports and increase exports (

Chavali and Kumar 2018).

There may be other risks related to international foreign exchange transactions to which banks that make such settlements are exposed. For example, one of such risks is a form of credit risk related to the counterparty’s failure to perform a foreign currency contract, leading to an unsecured currency position (

Ali et al. 2021).

Interest rate risk arises from the possibility that changes in interest rates will affect future cash flows and the fair value of financial instruments. The sensitivity of income and other revenue statements reflects the effect of allowable interest rate fluctuations on the bank’s net income for one year calculated based on floating interest rates and non-commercial financial liabilities and assets (

Coimbra 2020).

Liquidity risk is the risk that the company will face difficulties paying its liabilities and financial obligations. Banks face this risk daily due to requirements for repayment of cash deposits, current accounts, short-term deposits, credit extension, and other derivative off-balance sheet liabilities such as guarantees and avals, and other requirements for derivative instruments settled in cash (

Alawattegama 2018).

A bank seeks to maintain a stable financing base consisting primarily of bank funds, corporate and retail deposits, and debt securities. A bank invests in various liquid asset portfolios to respond quickly and efficiently to unforeseen liquidity needs (

Bunea and Dinu 2020).

Bank liquidity management requires an analysis of the level of liquid assets needed for repayment of liabilities over time to provide access to various funding sources for preparing the need for funding and control over compliance with liquidity ratios (

He et al. 2020).

Compliance and controlled non-compliance with retirement periods and interest rates on assets and liabilities are significant factors in bank management (

Abadi and Yoshanloey 2019). The wrong position can potentially increase profitability and increase the risk of loss. The retirement period of assets and liabilities and the possibility of replacement (at a reasonable price) for calculating interest-bearing liabilities are essential factors in assessing the liquidity of a bank and its response to changes in interest rates and exchange rates.

Having studied the risks inherent in a commercial bank, one obtains an optimal combination of models for the management of operational, currency, and credit risks.

2.2. Overview of Banking Risk Management Methods

Overview of individual procedures in the context of banking business using the task of optimizing certain types of operations to avoid specific risks. In this case, the description of currency risks will be limited to the mechanisms analyzed in the model. An example is the two-factor model of monetary impact assessment (

Robatto 2019).

The problem is that national banks have not directly examined most of these previous studies on the impact of banks on foreign exchange. Still, their results suggest that domestic banks should be susceptible to the least risk and possible reduction of interest rates and low exchange rates.

These studies identify deviations from parity conditions, forecast future cash flow errors, the level of competition, and the substitutability of production factors as crucial factors in the bank currency impact.

Karkowska (

2019) shows that the industry’s competitive structure can also be the main factor in the impact of currencies. However, these theoretical studies pose many practical problems.

In previous studies,

Thusi and Maduku (

2020) begin to define risk assessment using a two-factor model, which later became the norm for assessing the currency risk in market activity.

However,

Gupta and Sardana (

2021) found that revenues are also sensitive to factors other than the market index. The third approach to assessing the currency risk of companies is that the market risk premium (market profit less risk-free rate) replaces the market index used in the two previous models.

Another practical problem faced in these studies and other areas of financial studies is the relevant market index for use. Although the impact of the market index is not a priority here or in other currency studies, the choice of the market index was considered essential for assessing the currency risk.

The next problem discussed in this literature is the appropriate time interval for assessing the impact of currencies. As a whole, in practice, this issue has two aspects.

The first issue is whether the risk appetite is current or whether there is a mismatch between exchange rate changes and the resulting impact on firm size. The second issue is the assessment horizon for measuring currency risk (

Hirata and Ojima 2020).

Esposito et al. (

2019) use a sample of companies that play a significant role in determining financial statements and do not find simultaneous links between the operating characteristics of a firm and changes in the dollar exchange rate. However, they still find a stronger relationship with firms and late changes in the dollar exchange rate. These results indicate the need for time to adjust commercial and other hedging transactions in response to changes in exchange rates.

Some scientific studies have used generalized models of autoregressive conditional heteroskedasticity (GARCH) to assess currency exchange. Previous studies have used monthly and simultaneous time horizons to measure exposure. However, if the impact of these exchange rate changes is more prolonged or more consistent, longer temporal horizons for estimating time are likely to be best. Estimating the temporal horizon was considered in these studies of Teply and Klinger studies (2019). Although, in general, these studies show that the expected number of companies with significant currency risks is higher over a more extended period,

Teply and Klinger (

2019) are cautious about recommendations for very long-term circumstances, which can lead to limited periods that are not overlapping.

The most common methods of measuring currency risk are VaR (Value-at-Risk), stress tests, reverse tests, gap analysis, and other widely used methods.

The gap analysis determines the size and characteristics of the foreign currency position. According to

Maghyereh and Yamani (

2022), the foreign currency position is the ratio of claims (assets) to liabilities (on-balance sheet and off-balance sheet) by bonds (on-balance sheet and off-balance sheet) in each currency and each bank metal. In the case of inequality, the position is considered open, and in the case of equality, it is considered closed.

One uses valuation-based assessment methods based on the VaR concept to calculate expected maximum portfolio losses maintaining current market trends in the future (

Rahman 2018). Currency risk assessment using the VaR method is carried out by all open currency positions of the bank. Data used for risk assessment are daily data on the official hryvnia exchange rate for a certain period (quarter) and the sum of the bank currency positions.

One can use the bank’s currency risk management model developed as a more realistic description in the applied model of the intertemporal equilibrium of the economy (

Huynh and Dang 2020). It explains the large amount of external data used. Exchange rate statistics is the source of all external data; they interact with other blocks in the model and are responsible for describing economic agents. However, a study of the bank’s currency risk management model showed that one could also use it in simpler business models.

The capital asset pricing model (CAPM) assesses a conversion risk, i.e., the risk arising from the revaluation of the bank assets and liabilities (

Argimón and Rodríguez-Moreno 2022).

The model is used to determine the required level of return on an asset taking into account market risk. The model sets the following limitations (

Bidabad and Allahyarifard 2019): the market is efficient; assets are liquid and divisible; there are no taxes, transaction costs, or bankruptcies; all investors have similar expectations and can borrow and provide funds at a risk-free rate and act rationally, seeking to maximize their utility; profitability is only a function of risk; asset price changes do not depend on past price levels; one time period is under consideration.

One can answer how individual assets should be valued using the Security Market Line (SML). SML is the main result of CAPM. It indicates that, in equilibrium, the expected return on an asset is equal to the risk-free rate plus the reward for market risk, for which measurement we use β (beta) (

Erwin et al. 2018). In the state of market equilibrium, the expected return of an asset and portfolio, whether it is efficient or not, should be located on SML.

The CAPM model is quite widespread, however, like any other model, it has its advantages and disadvantages. Its main advantage is a visual description of the relationship between profitability and risk. The main disadvantages include that the model is single-factor and cannot consider all the factors affecting profitability. Additionally, the model is conditional enough since some unrealistic preconditions limit it.

Thus, it is necessary to use a modified model (CAPM) in current economic conditions. We use such a model in the author’s study, and we consider the model in more detail in the next section.

3. Materials and Methods

The model developed by Shapiro and Cornell, which is used to study exchange rates, deviations from parity conditions, forecast errors in future cash flows, i.e., important indicators for currency risk management that will allow you to assess exchange rate dynamics precisely and accurately, and assess operational risks directly related to business transactions and currency fluctuations, as well as related economic risks and future contractual arrangements (

Maier-Paape and Zhu 2018).

The level of operational risk of each industry is calculated as the product of the gross income of the industry by the corresponding coefficient (denoted by the letter

) (

Maier-Paape and Zhu 2018). The coefficient

indicates the total ratio of losses from operational risk to total gross income of the industry.

The indicator allows the authors to assess capital adequacy, taking into account not only credit, currency, and liquidity risks, but also operational risks.

As a result, the sum required to cover operational risk is calculated as a simple three-year average simple sum of operational risk sums for each business line and is calculated by the following formula (

Global Liquidity Indicators 2022):

where

—sum required to cover operational risk;

—sum of gross income for each activity sector calculated with the increase of the total sum from the beginning of the year;

—coefficient for each activity sector.

To assess the level of operational risk, the bank capital adequacy ratio is calculated, adjusted to the need to cover operational risk.

Regarding currency risk assessment, theoretical modules of financial activity are mainly devoted to the study of these problems: exchange rates alone, separate procedures, and portfolio size.

Building the model, the authors accept purchasing power parity as true, stating that the exchange rate between the national currency and any foreign currency will be adjusted to calibrate the price level of both countries. Formally, with increasing prices (inflation) for both countries, the value of foreign currencies at the beginning of the period, the spot rate of the period

, we obtain:

where

—spot period

;

—value of foreign currencies at the beginning of the period;

—price level increase (inflation rate) for the country

;

—rise in prices (inflation rate) for the country

.

The obtained value is known as the purchasing power parity ratio.

Usually, they present the purchasing power parity using the following approximation of the latter function (the authors divide both sides of the equation by

, then subtract 1 from both sides, since

is small):

In other words, the change in the exchange rate for the period should be equal to the dynamics of inflation for the same period.

The authors formalize the concept of the real exchange rate.

It is pointless to study the real rate, provided that its fluctuations may be due to inflation and have no real consequences for the company and the nation. This model is used to study the real exchange rate, which is adjusted for changes in the relative purchasing power of each currency for a given base period:

where

—level of foreign prices;

—level of housing prices now

;

—differential.

, are indexed from 100 to 0.

An alternative and equivalent way of presenting the real exchange rate is to directly reflect the change in the relative purchasing power of these currencies by adjusting the nominal exchange rate for inflation in both countries by 0:

To provide a simple basis for market behavior modeling, the authors have created a framework for asset trading. Suppose a bank has independent assets. Specify the total value of each basic asset indicated at the time/as for all .

The basis covers the entire market, and one can express it by any linear combination of basic assets. Then, the total market value is as follows:

The market includes all currencies, stocks, bonds, commodities, real estate assets, and economic factors of production available in exchange for other assets. Everything concerning the exchange rate is included.

This base is orthogonal; no basic asset is related to one another. Thus, the authors can divide into components all basic assets, market, or orthogonal components. They consider the probability space , where is the state space, and is the probability measure. The authors choose the following .

The main risk tools are under the control of a set of independent Brownian motions

. One can determine the dynamics of the basic asset by the following Brownian motion:

where

—risky substrates;

—variance of market profitability.

Now for each basic asset the authors determine its number

value

, where

. Since the number of assets in this case is constant, the authors have the following equation:

where

—price of each basic asset.

The authors formalize the bank net profit. They define the process of achieving net income as follows: for each basic asset, the owner of the basic asset receives a profit in the time interval depending on the net result: .

As a result, the portfolio

that contains

-th as an asset and reinvest net income in the base

i is increased as follows:

where

—variance of market profitability.

Then, Equation (6) takes the following form:

Therefore, to find operational risks, it is necessary to solve this system of equations:

where

utility function, the return on all assets, which is maximized by the bank, defined as the sum of the return on risk-free assets and risk premium–risk premium can be considered positive and negative;

—risk-free rate of return, profitability of sales;

—asset price in foreign currency for a certain period of time;

—level of profitability, return on assets;

—exchange rate per hour

—rate at which the owner of an asset makes a profit;

—alpha coefficient of

-th asset—variance of market profitability;

—profitability ratio—average profitability.

Thus, having studied the risks inherent in a commercial bank, the authors obtained a model that is the optimal combination of models for management of operational, currency, and credit risks. The authors will solve the model as a multi-criterion problem maximizing the profits of a commercial bank and minimizing operational and credit risks.

The authors selected Bank Credit Agricole (Poland) to test the implementation of the suggested modified model for assessment of banking risks. They selected a commercial bank rather than a central bank for several reasons. Firstly, due to the opportunity to consider the model balance sheet account 110 Cash, due from Narodowy Bank Polski. Secondly, due to the specific goals of the bank’s operation.

The main goals of the bank under study: increase the bank margins and return on assets through the development of retail lending; continue to expand services provided to small and medium-sized enterprises and micro-enterprises.

In 2022, Bank Credit Agricole (Poland) is taking the lead in the implementation of the humanitarian policy of Poland in connection with the arrival of more than 2.5 million Ukrainian refugees. Thus, it is necessary to assess the stability of the bank before 2021 in order to be able to withstand new risks.

To solve the problem of multi-criterion optimization, the authors use the method of successive concessions. The essence of the method is that the original multi-criterion problem is replaced by a sequence of single criteria; the number of useful solutions from one problem to another is reduced by additional constraints that take into account the requirements of the criteria. When formulating each problem in relation to the most important criterion, the authors make a concession, the value of which depends on the requirements of the problem and the optimal solution of this criterion.

The basis of calculations will be the financial statements, namely the turnover balance sheet of the bank assets and liabilities (

Table 2).

For their model the authors introduce the following indicators: AssetMean—average values by items of bank assets and liabilities; ssetCovar—matrix of covariances by items; CashMean—profitability of sales—risk-free rate; MarketMean—market profitability; CashVar—standard deviation (variance) of sales profitability; MarketVar—standard deviation (variance) of market profitability.

4. Results

In today’s economic environment, one can consider bank management one of the most challenging management areas since banks are constantly at the crossroads of many complicated, contradictory, and unpredictable economic, political, and social processes. In current conditions, it is difficult for banks to achieve the goals of their shareholders, customers, society, employees, and government services according to the requirements set by regulators.

Banks must make management decisions that may reduce liquidity risks, currency risks, and interest rate risks every day. It is necessary to automate these processes to maximize bank profits.

A problem with the development of an economic–mathematical model arises. The model will help reduce operational, currency, and credit risks. Additionally, it will make it possible for a bank to respond efficiently to changes in external factors, prevent losses related to banking operations, maximize bank profits at the end of the period, and comply with the requirements set by the state regulator. The model will also help solve the problem of the complexity of accounting for risk management models with a significant number of external factors.

The authors’ task is to maximize the Sharpe ratio. They recalculate the distribution of economic activity according to the Sharpe ratio and build the bank’s structure by dividing operations into those for which one needs to have a short position and those for which it is advisable to have a long position (

Table 3).

In addition, the authors will build an alternative portfolio that does not maximize the Sharpe ratio but presents the bank assets as those for which it is advisable to have a long position (

Table 4).

Since the used portfolio is not risky, the authors use formula 7 for forecasting. Calculating the data for the previous period with the new coefficients, the authors see that income indeed increased in

Table 5.

Dividing the bank’s activities into eight areas, according to the classification proposed by the Basel Committee, and taking into account the values obtained by the first criterion, we form

Table 6 for calculation.

After calculating the

forecast and actual data, the authors see that operational risks are higher for the forecast data. This is because riskier deposits correspond to higher income, and vice versa. Having established the permissible error for the first criterion–

$2.6 mln–the authors minimize the

and obtain a new income for the bank (

Table 7).

To minimize this criterion, the authors divide the bank loan portfolio into the one evaluated on an individual basis, i.e., the one that will fall under the third criterion of the equation system, and the one evaluated on a group basis, i.e., the one that will fall under the criterion based on the following indicators: signs of a significant increase in credit risk: number of days in arrears (maximum value per client); significant reduction in the interest rate compared to the date of recognition of the financial instrument; absence of financial statements; signs of default: maximum number of days in arrears (maximum value per client); debt restructuring; lowering the interest rate below the critical level; bankruptcy.

The authors also rely on the materiality criterion—the debt amount to the debtor must be more than 5% of regulatory capital.

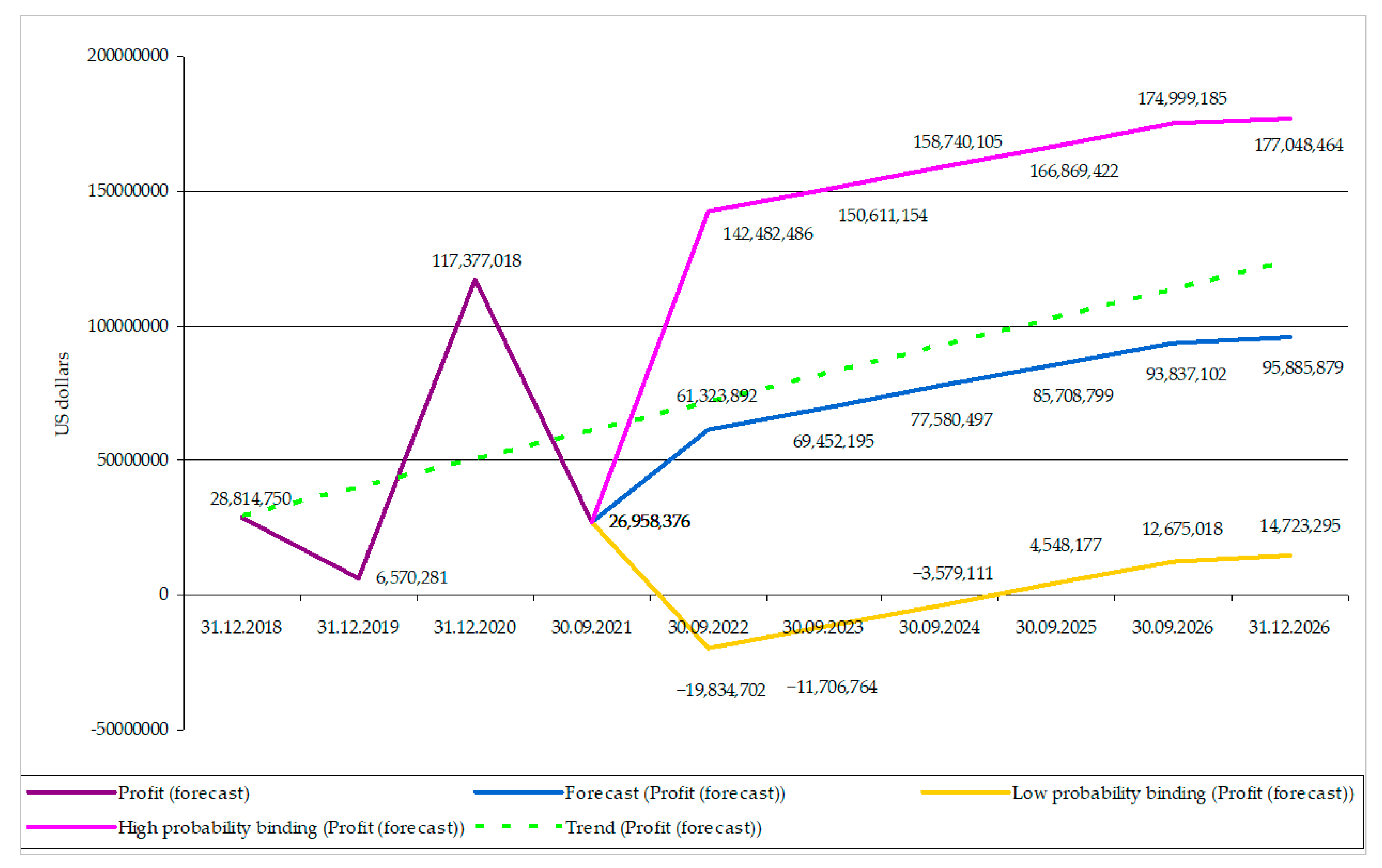

According to the calculated model, the bank profit will be as follows (

Figure 1).

Thus, one can see that the bank profit increased by $3.6 mln, providing a slight redistribution of assets and liabilities of the bank.

In the business world, change is the only constant. Banks managing change successfully and efficiently operate successfully, constantly adapting their services, strategies, systems, and culture to overcome and take advantage of circumstances that may undermine their competitiveness. Today, the issues of formation of bank resources, optimization of their structure, and, considering this, the quality of management of own and borrowed funds, which make up the bank’s resource base, are of particular importance. Passive operations are the basis of active operations, and banking resources, in turn, form the bank portfolio. Banks inevitably face various interrelated risks when actively carrying out passive operations to place investments with high returns.

Thus, the high interest rate risk and the resulting financial instability of economic agents can, as a chain reaction, lead to high credit risk, i.e., the high probability of loan default and reduced liquidity. Based on these considerations, the main aim of the bank is to achieve the highest possible level of profitability according to the requirements of the bank’s operating activities.

Modeling as a tool to study the relationships in the phenomena and economic processes of the banking system aims to analyze them and describe the flow mechanisms. It also aims to identify alternatives to management decisions when setting interest rates on loans and deposits, considering the value of interest payments, terms of deposits and loans, inflation, and exchange rates.

5. Discussion

In the current economic environment, one can consider bank management one of the most challenging management areas, as banks are constantly at the crossroads of many complicated, contradictory, and unpredictable processes taking place in the economic, political, and social spheres. In modern conditions, it is difficult for banks to achieve the goals of their shareholders, customers, society, employees, and government services following the requirements set by regulators (

Driouchi et al. 2020).

Every day, banks have to make management decisions to reduce liquidity risks, currency risks, and interest rate risks. It is necessary to automate these processes to maximize the bank profits (

Pérez-Martín et al. 2018).

IT systems are at the basis of almost every significant banking process. Bank IT infrastructure connects services and information with bank branches/offices and customers. IT systems manage the daily operations of banks and are constantly updated to improve the security of customer information and operating efficiency (

Lassoued 2018).

The world banking sector is based on digital communications and information infrastructure (

Leo et al. 2019). According to many experts, distrust of citizens of various electronic platforms is one of the main reasons for the slowdown in the development of the banking sector. Despite the distrust, large banks began to invest actively in new business methods a few years ago.

The digitalization of the economy is facilitated by active state participation and support for technology development. However, despite this, the state must also regulate the security and stability of the banking system. It requires tailored state actions for prompt and timely monitoring, as well as identifying threats and taking measures to eliminate or minimize the consequences of these threats (

Zhu 2022).

Modern crisis phenomena raise the problem of the formation of qualitatively new methodological foundations for bank management. Naturally, this results in the actualization of the problem of improving the efficiency of the financial risk management of a credit institution (

Musthaq 2021). A variety of financial risks and methods for assessment and management indicates the need for constant modernization of the bank risk management system.

In this paper, the standardized model of the Basel Committee for Operational Risk Management, the modified CAPM model, the model developed by Shapiro and Cornell for currency risk management, and the model that meets the IFRS 9 for credit risk management were used for modeling.

The advantages of the obtained model are as follows.

The model uses parameters that commercial banks must calculate with a specific frequency and based on which management decisions are made, such as attracting or placing funds on interbank markets or the need to decrease/increase the customer base. In other words, one can use this model in practice in regular bank operating activities without additional studies.

This model calculates the optimal values of the balance sheet items of a commercial bank, which allows for making the right management decision.

This model solves its economic problem of determining effective management decisions about the need for changes in the bank assets and liabilities, which would maximize profits and minimize risks. The disadvantage of this model is the complexity of the calculations, which requires additional software and qualified personnel.

The labor content of implementing the operational risk management system requirements depends both on the volume of assets and the complexity of the business, and on the level of development of the risk management of a credit institution.

The necessary conditions (

Ahamed 2021): the implementation usually takes more than eight months; the level of necessary investments for full implementation depends on the scale of the bank and the level of development of the operational risk management system; banks with assets of more than

$500 million require investments of more than

$30 million.

Main difficulties (for all groups of banks) (

Shanko et al. 2019): the change in the procedure for collecting data on operational risk events, meeting the requirements for the loss base for five years; ensuring the quality and availability of data; identification of accounting entries for losses from operational risk.

The following are the top three initiatives by the level of expenses and labor intensity (

Nocoń and Pyka 2019): the implementation of software to automate the database of losses and operational risk events (noted by 50% of banks); data quality improvement; development of methodology and implementation of operational risk management procedures.

The cost of software (SW) remains high for medium-sized and small banks, which, in turn, creates the need for banks to independently develop solutions with a low level of automation for maintaining a database.

The competitiveness of software of Polish vendors, customization, and updating of solutions of foreign software providers leads to a trend towards import substitution of software for operational risk management.

High labor costs for improving the quality of the database of operational risk events are due to the expenses for large-scale changes in the organization of collection and record of events, including the development, implementation, and automation of standardized algorithms for identification of events and operational risk losses, as well as long periods of training employees in new processes (

Novickytė and Droždz 2018).

The primary data quality issues in the in-house operational risk loss database are:

Lack of necessary information in data source systems for automated identification of losses and the need to use several sources of information (

Vives 2019).

Impossibility of complete identification of losses from operational risk in accounting due to the lack of complete and sufficient information in the names of accounting entries and allocated accounts for certain types of direct losses (

Sun 2020).

Impossibility of full completion of the historical base of events due to the lack of necessary details in the primary sources of information, the change of responsible personnel, which significantly complicates reconciliation, and the possibility of identifying signs of operational risk (

Aljughaiman and Salama 2019).

6. Conclusions

Effective risk management is crucial for banks to ensure their profitability and reliability and maximize shareholder value. In recent decades, the banking business has developed by introducing advanced trading technologies and sophisticated financial products. Although these advances improve the bank intermediation role, increase profitability, and diversify banking risk, they pose significant challenges for banking risk management.

For successful modeling of banking processes, one needs to choose the most appropriate method, or even a group of methods with a weighted average effect, to find the optimal value of the required parameters, which will minimize error. To obtain the most accurate model possible, one should consider the maximum possible number of factors and processes that affect exchange rates, interest rates, credit, and operational risks of the bank. It should be considered that the modeling must meet the goals and objectives of its implementation; it must bear the consequences and conclusions drawn from its results.

The authors’ novelty is the improvement of the methodology for assessment of banking risks, especially operational ones, based on the modification of CAPM–Shapiro models for effective formation of risk management. It will allow the bank to efficiently respond to changes in exogenous factors and prevent losses in the process of banking operations.

Among the limitations of the suggested authors’ model, one can distinguish the following. There are also pitfalls in assessing credit risks based on internal ratings. The probability of default (PD) calculated within the framework of this approach significantly affects both the number of reserves that the bank must create for loans and the risk factor with which one includes the loan in the calculation of capital adequacy. The idea is that the PD point in time should fluctuate around the PD value through the cycle, depending on the phase of the economic cycle. The actual risks at the current moment may be an order of magnitude higher than the average ones published by rating agencies, and one must take this into account. Two factors cause such rapid growth of the PD point in time. The first factor is a sharp increase in the debt burden of borrowers due to a significant depreciation of their assets. Nominally, loan obligations may not have increased, but the primary indicator of the debt burden–how much the companies’ assets provide for their debt–is growing. The burden has increased since the assets have depreciated, and credit risks have grown with it. The second factor is the unprecedented increase in volatility. The volatility in the value of company assets has increased significantly, which means that soon, they may depreciate even more. When assets begin to cost less than liabilities, this is a default situation.

The results of calculations based on test data demonstrated the ability to use the results effectively. Prospects for further studies are to develop a strategy for bank development, taking into account the obtained results of banking risk modeling.