1. Introduction

The purpose of this paper is to encourage reframing the discussion of transforming the provision and use of electricity. The concept we describe is based on market exchange for claims on electricity, assuming all agents in the system have some ability to generate or direct the generation of kilowatt-hours, thus allocating kilowatt-hours for immediate or postponed use. Acknowledging the uncertainty of electricity need, on the one hand, and the costs of adapting means for its provision, on the other hand, we explore an institutional adjustment that incorporates insurance as a design feature in the electricity system. The fundamental requirement for inducing the institutional transformation that could dismantle much of the existing infrastructure of centralized generation and high voltage transmission is to introduce the incentive for all agents in the system to engage in market exchange that is denominated in kilowatt-hours. That is, we present a concept of electricity as money.

At present, there is robust discussion and debate about reconfiguring the electricity grid, assuring that the provision of electricity is affordable for the masses, that it is reliable and resilient, and that it incorporates environmentally benign sources of energy for generation. These objectives of the energy transition may be as commendable as they are often difficult to pursue consistently, as trade-offs abound in assuring each. The trade-offs span capital investment requirements, operational complexity, and variable levels of performance on universal dimensions of energy sources and systems. We suggest that it may be fruitful to reframe the problem in terms of the principal objective, subject to constraints that producers, States, and users can accept. This requires a re-institutionalization of electricity supply and demand that replaces the institution of the electricity grid as we know it.

The paper is organized as follows. We briefly summarize the evolution of electricity in modern economies, noting key consequences of choices made by decisionmakers in the institutionalization of the electricity grid, especially in industrialized economies.

En passant, we invoke the concept of the imaginary from the French and Italian social philosophy literature, and we use it to establish how electricity and money contribute to the perceptions of realities in modern economies. In

Section 3, we present a concept of electricity as money that adds financial intermediation as an economic function of the electricity grid, introduces market intermediaries to supply highly geographically delimited service areas, and endows the end user with the means to speculate on future consumption. In

Section 4, we address several issues that arise with the re-institutionalization of electricity that we propose. We conclude in

Section 5 with a brief summary that welcomes future study of certain speculations.

2. Origins of Electricity as an Institution

For much of the 19th century, inventors, scientists, and entrepreneurs struggled to establish a commercially viable application of electricity.

Nye (

1990,

1992,

1999) and

Koerth-Baker (

2012) have chronicled the fits and starts that began, arguably, around 1800 when Humphry Davy, a British chemist, produced the first electric arc light and culminated in Edison’s successful commercialization of his long-burning incandescent light bulb in 1878. Finding applications that could support investment in an infrastructure deemed necessary for generation of electricity presented formidable challenges. The electricity grid, as we now know it, was not planned in a systematic manner to serve everyone who would demand electricity for an expanding array of applications. Critically, the grid evolved without any systematic plan to store electrons that would find no immediate use

1 (

Nye 1990,

1992).

Yet, perhaps ironically, industrialized economies now depend fundamentally on well-developed, extensive central electricity generation, long-distance transmission, and distribution into local service areas that distinguish these economies from almost all of the least developed economies. Some have argued that technology advance presents less industrialized countries the opportunity to avoid emulating the complex grid system designs of the industrialized world (cf.

Sebitosi and Okou 2010, p. 1452, for example).

We acknowledge that electricity, as a technology, is subject to evolving interpretations of its place in any society. Similarly, the interpretation of money is linked to the development of modern, industrialized economies. Especially since the collapse of the Bretton Woods Agreement in the early 1970s when the U.S. unilaterally transformed the international monetary system by basing it on the U.S. dollar as a fiat currency, the institution of money and banking has become US dollar-centric (

Eichengreen 2011). We seek to describe the transformative concept of electricity as money by applying the concept of the socio-technical

imaginary from the French and Italian literatures (

Fabiani 2009;

Bachelard 1934;

Flichy 1995;

Catoriadis 1999). In some respects, our argument reflects earlier arguments (

Soddy 1934;

Lietaer 2002), although our argument incorporates incentives for incumbents at all levels of the conventional vertical market system of electricity to adapt to a new institutional configuration.

2.1. Defining the Concept of a Socio-Technical Imaginary

A socio-technical imaginary (

Durand 1963), in the context of this paper, is a means of building a collective understanding of an innovation that becomes an institution, in the sense defined by

North (

1990).

2 The concept of

the imaginary seeks a balance between an imagined utopia projected by certain actors and frequently induced by an innovation to break with the current status quo and the dominant ideology that would maintain and control the status quo, such as the social norms governing energy consumption (

Flichy 1995). Thus, the imaginary has been described as the mediator between order and disorder; between creativity and reason; between wisdom and folly (

Thomas 1998). Whereas the imaginary is always in flux, always being negotiated, it remains a means of constructing a collective identity (

Flichy 1995,

2001); and in the case of an institutional innovation, it is a collective acceptance of the new artifact and associated behaviors (

Gautschi 2009).

3 In the context of this paper, we have attempted, among other things, to construct a new imaginary that renegotiates the structure and function of the electricity grid, as well as the role of electricity consumption and production. In effect, we are proposing an imagined utopia in the hopes that our vision will be adopted by innovators, policy makers and other interested parties. We recognize that the current imaginaries for electricity and money would need to be renegotiated, and this is just one of many possible roadblocks that would prevent our proposal from coming to fruition.

2.1.1. The Imaginary of Money

Money can be defined as what people motivated to engage in economic exchange agree it to be. That means that if there is disagreement, then there is no money. If there is no money, then there is no money and banking system—at least not the sophisticated system that we have accepted as an institution.

A significant advantage of money is that it enables impersonal exchange that abets economic development. Three essential requirements for something to serve as money are commonly (e.g.,

Cremer 2000;

Ferguson 2008;

Gogerty 2014) described as

4:

it must be a relatively stable representation of value to those who would engage in exchange

it must be a fairly stable informational unit of account for those who would engage in exchange

it must be a medium of exchange that those who would engage in exchange would believe to be shareable across an economic network of other money believers.

This means that money is, in some respects, a figment of collective human imagination. Since the collapse of the Bretton Woods Agreement, fiat currency has become the institution of money and banking.

5 On a global level, we have negotiated a collective imaginary around money that so many of us share an

imaginary of money that has been founded on a belief in a promise, especially of one modern state, that the state will honor its obligations to compensate those to whom it is indebted. Fiat currencies vary in terms of the collective belief in the promises of their state sponsors. Not all currencies enjoy widespread belief that the states that issue them can be trusted to honor their promises. All the while, we maintain powerful imaginaries on the individual level that vary and sometimes even clash. Who has not had the uncomfortable realization that a loved one may hold very different views on money related matters?

2.1.2. The Imaginary of Electricity

It may be difficult to imagine the initial challenge to convince the public of the benefits of electricity. In the second half of the nineteenth century, public demonstrations of electrical phenomena gained in popularity. Much like the magic lantern (

Perriault 1981), these demonstrations served to entertain and educate the public. Even as these demonstrations became pervasive and frequent, electricity remained mysterious for the general public. For the nineteenth century public, electricity was closely associated with mesmerism and spiritualism, uses far removed from its contemporary applications. Due to the fact that this association was problematic for innovators and promoters of electrical applications,

the imaginary associated with electricity needed to be renegotiated.

Reflecting on how those of us who live in an industrialized economy conceive of electricity, it may be difficult to formulate anything substantive (

Coutard 2001). Why? Very likely since the introduction of the earliest society-wide applications of electricity, this specific lower entropy form of energy has become such an integral part of the lives of the past few generations that it has become quasi-invisible. This is the definitive indication that a given technological innovation has been accepted by a society and, thus, the negotiations between innovators, promoters and users have been and continue to be successful. The collective

imaginary in this case is strong. This also means that modifying the currently agreed upon

imaginary may be especially difficult, since it is so widely accepted.

6 From describing indications of human intelligence, surprise, speed, and vitality with idioms evoked by electricity, we should now anticipate electricity to evoke new idioms of wealth generation and wealth distribution. To appreciate how ingrained our

electric imaginary has become, we would need only to visit an economy that is not industrialized to appreciate navigating reality with little or no reference of electricity to human experience.

As electricity is recognized not only as a low entropy form of energy but as a potentially clean source of energy, as well, its place in contemporary societies worldwide is being renegotiated.

7 Policy makers, clean energy advocates, and industries alike are now pushing to electrify just about everything.

8 Table 1 presents some evidence of the aggregate implications for selected countries as aggregate production and per capita electricity consumption, with few exceptions, continues to grow faster than population.

2.2. History of the Electricity “Grid” Concept in the Industrialized World

What seems to be a consistent characteristic of both American and European grid systems is that the initial applications of electricity were not sufficiently intense to support the systematic construction of an integrated grid that would enable seamless and reliable service over time and place. Ironically, perhaps, Edison attempted to sell neighborhood electricity generation stations, a forerunner of the microgrids of today.

9 The architecture of the grids in the late 19th and early 20th centuries would seem to have been inspired by the existing town gas systems that were established decades earlier in the 19th century and that supplied virtually every city in the U.S. and Europe with centrally produced coal gas. For purposes of illumination, especially, electric arc lighting was a vast improvement over the yellow and noxious lighting of coal gas (

Nye 1992,

1999). As electricity was applied to illumination, it was perceived to be a “clean” form of energy relative to energy sources that preceded its use (

Möllers and Zachmann 2012), a perception that would seem to have endured.

More than two decades after Samuel Insull demonstrated the economic benefits of centralized generation in serving the Chicago mass market, the Roosevelt Administration pursued an ambitious plan to electrify America.

10 Notwithstanding its rather narrowly construed title, the Rural Electrification Act (REA) of 1936 had two justifications that enabled its passage: to modernize the American economy and to reduce unemployment (

Nye 1992). To achieve its aims, the Administration launched a public service campaign to educate the American public of the benefits of the modern electric home. Although launched a decade before the REA, the face of this campaign, Reddy Kilowatt, became an American icon and was used in encouraging electricity demand development around the world.

11The campaign bolstered by the marketing programs of an array of such industrial companies as GE, Westinghouse, RCA, Philips, Siemens, Motorola, and more very likely exceeded the expectations of the original sponsors of the initiative. Although the initial problem was to stoke demand to achieve scale economies, thus, to justify the significant capital investment in building large-scale, centralized power plants and transmission systems, the problem for the past several decades has been to manage excessive and variable demand to avoid diseconomies of scale. From generating too much demand, there is risk of incurring mounting capital investment requirements and high costs of operating a complex fixed plant to assure reliable provision of electricity to end users. There is also the risk of disappointing the users of the system by performing provision at levels below users’ expectations that have been cultivated by the demand generation campaigns.

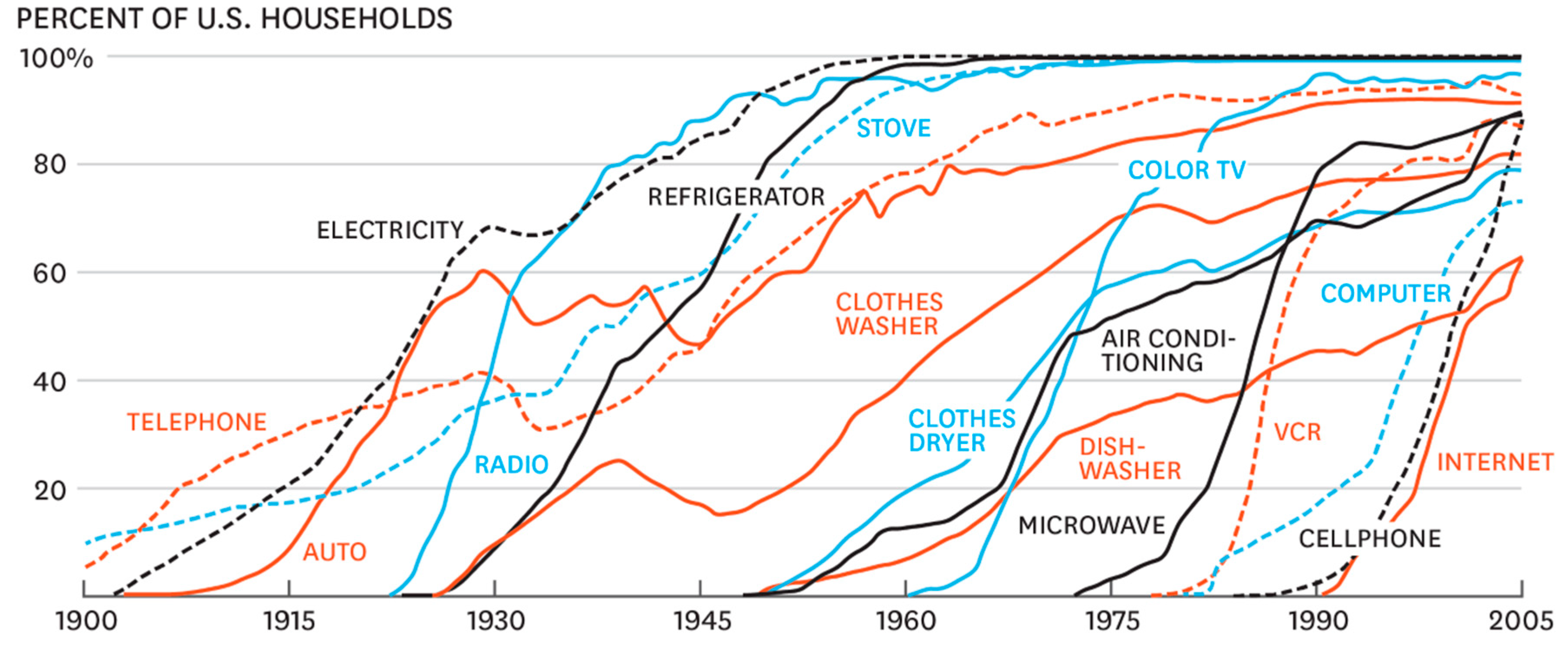

Figure 1 illustrates how consumers of electricity have become progressively more dependent on electricity by the growth of the variety of electricity-dependent new products for American households from 1900 to 2005. What is perhaps most significant about the figure is that as the world has become progressively more electrified, a growing variety and number of electrical appliances have become standard artifacts of lifestyles of people all over the world.

The pattern in

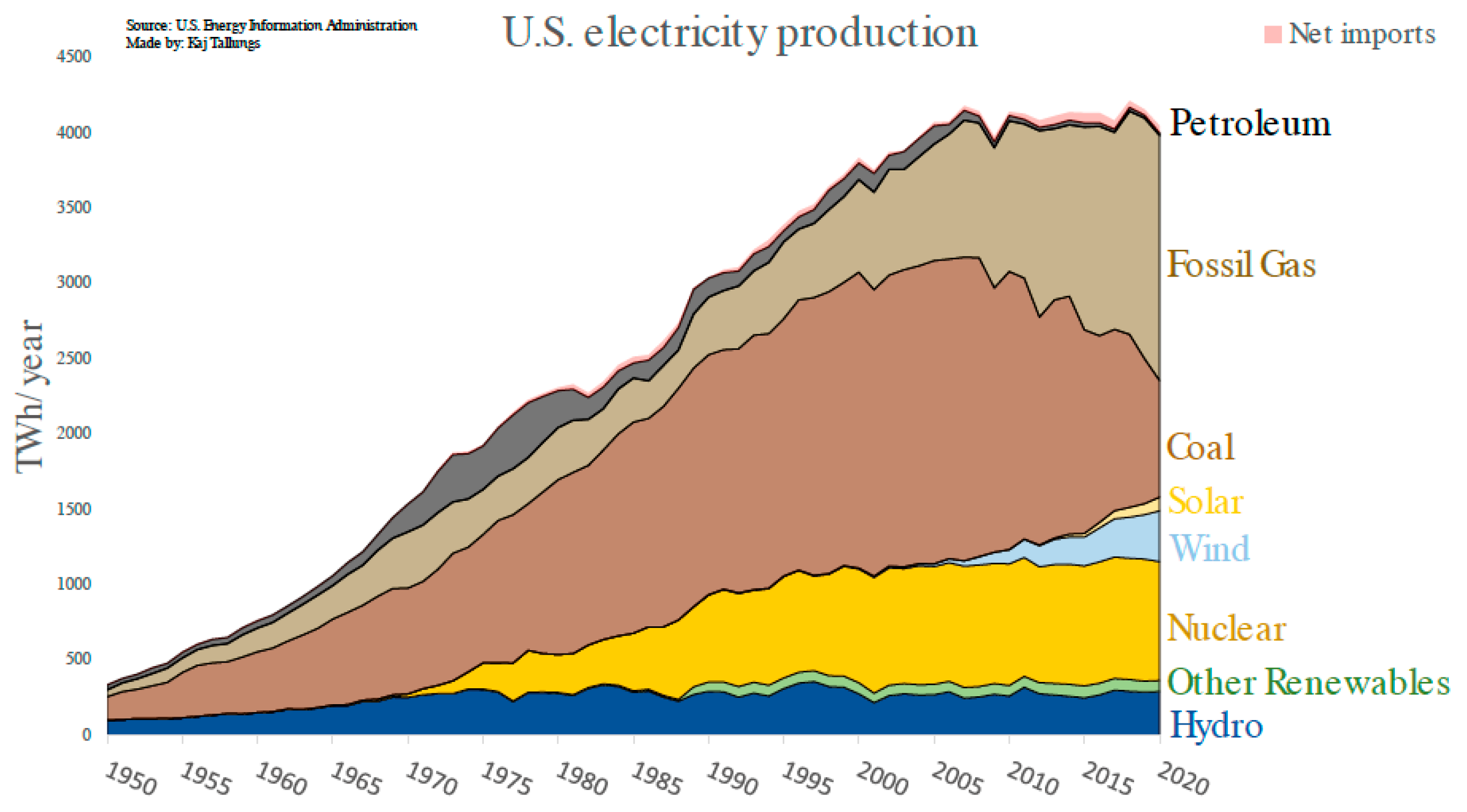

Figure 2 reveals the growth of electricity generation in the US from 1950 to 2020. Between 1950 and 2005, the U.S. population grew almost 86%, whereas U.S. electricity production grew more than 742%.

12 Between 1990 and 2020, world population grew more than 46% and electricity production grew 117% (see note 12 above). Hence, even with downward trending energy intensity worldwide, efficiency gains are not keeping up with per capita growth in electricity demand.

13 2.3. Electrification and Capacity of the Grid

The increasing dependence on electricity is very likely to continue for the foreseeable future in industrialized and industrializing economies alike. For example, Juniper Research estimates that at the end of 2021 there were 48 billion connected devices, each requiring recharging using the grid at intervals according to intensity of use.

14 We often forget that digital devices require electricity to function and access the internet. The “magical” characteristics of the smartphone reinforced by Steve Job’s launch speech

15, for example, harken back to the “magical” electrical displays at World Fairs in the 19th century (

Marvin 1988). Moreover, each connected digital device is connected to the internet and draws information from data centers that use significant amounts of energy.

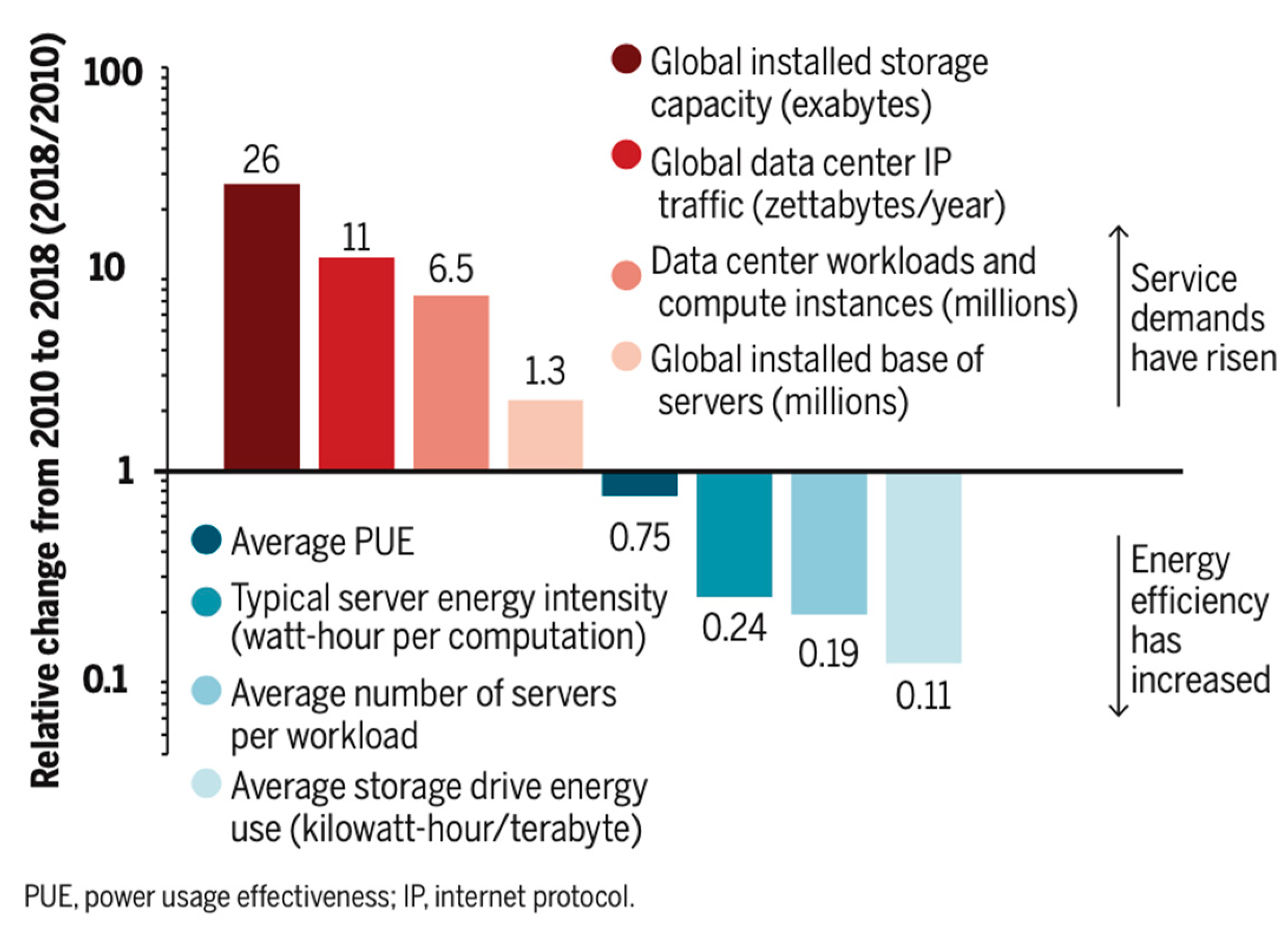

Masanet et al. (

2020) have estimated the growth in energy use of data centers between 2010 and 2018 (See

Figure 3 below). Even with advancing technologies and energy efficiency gains, aggregate electricity use continues to increase. The U.S. Department of Energy reports that data centers in the U.S. account for approximately 2% of total electricity use.

16A prominent example of the current tendency to ‘electrify everything’ is the emergence of the electric vehicle (EV) as the standard product of the vehicle manufacturing industry’s future.

17 In the aggregate, were all households with vehicles to substitute EVs for internal combustion engine vehicles (ICEVs), there would be a rather significant need to increase capacity of the electricity infrastructure. What additional load would all those EVs impose on the electricity grid? For perspective, the average household use of electricity in the U.S. is 11,000 kWh per year.

18 This would mean that, on average, charging the family Tesla S would entail an increase in electricity use for the household annually of about 23%.

19 (

Gautschi 2022).

The electricity grid is critical to supporting economic activity and high living standards, although the relationship between living standards

20 and electricity consumption also depends on the availability of relevant resources, such as primary energy sources (especially, primary fuels)

21 that are not uniformly present around the world. Given the rate of energy consumption in the industrialized world the electricity grid requires redundant sub-systems to assure its reliability. The high capital investment required to operate the grid presents an incentive for the agents that operate the grid to seek scale economies. Although the grid is an exceptionally impressive engineering achievement, its ponderous scale introduces operational complexity in adapting to variability of environmental conditions (such as weather and climate) under which the grid must assure reliable and affordable service.

Indeed, it would seem that the objectives of the extended campaigns to generate sufficient demand for electricity to permit the realization of scale economies in the centralization of the grids were met decades ago. The challenge now facing the agents who manage the electricity grids—private interests and public policymakers alike—is to avoid experiencing diseconomies of scale, revealed especially when unanticipated events occur, such as heat waves, cold snaps, and wildfires.

2.4. Sustained Consequences of Demand Generation Campaigns

One major strategic choice for the generator in the grid is whether to orient capital investments to generate loads that follow demand or to manage demand to avoid exceeding generation capacity, or both. As the construction of generation plants and transmission systems is very expensive, takes many years, and produces returns that achieve breakeven only over long horizons, it is understandable that the electricity industry is riddled with path dependencies that influence supply.

From the sustained marketing campaigns over the past several decades to build demand for electricity, there are now at least three possibilities for re-designing conventional electricity systems to reduce the need to consider high capital investment choices. Indeed, each of these possibilities is becoming a reality.

(1) Demand response (DR) refers to the collection of techniques and policies to induce customers to shift their demands for electricity over the hours of the day and over days of the month to enhance efficiencies in electricity generation and distribution (cf.

Wellinghoff and Morenoff 2007;

Fox-Penner 2014, for example). DR is accomplished primarily through pricing incentives, and although early attempts merely shifted peaks, more recent DR programs have been more successful in smoothing profiles of demand. One of the more extreme pricing mechanisms is that of ERCOT, the operator of the wholesale electricity pool in the State of Texas. After a near miss of a wide-ranging blackout in February 2021 caused by a sudden cold snap, ERCOT has implemented a revised scarcity pricing mechanism by introducing a cap of

$5000 per MWH on the wholesale price of electricity.

22(2) Smart Grid (SG) is a collection of digital technologies that permit decentralized control of the generation, distribution, and use of electricity that enable efficiency gains in generation, distribution, and use (

Fox-Penner 2014). The adoption of smart grid technology also opens the energy market to companies with expertise in digital technologies that are not traditionally associated with energy, such as Google, Microsoft, and Apple.

(3) Distributed energy resources (DER) are resources that are connected to the distribution system in service areas of the grid. These systems constitute a variety of resources that are deployed close to points of use, such as power generation resources (generators, combined heat and power systems), as well as smart metering, storage, and microgrids. For purposes of the discussion, we shall be particularly interested in microgrids, which are islands of generation and distribution for a relatively small number of users who are located in a contained area and that are connected to the grid (

Woo et al. 2014). One of the design features of a centralized grid is that electricity must be transmitted over relatively long distances producing on average 8–15% of energy loss, whereas microgrids covering much smaller areas are subject to significantly less energy loss.

23 Growth of microgrids has been significant over the past decade and estimates of growth through 2026 range from 11–24% reaching estimated global sales of more than

$40 billion.

24Considering the massive scales of conventional electricity grid systems that now define human enterprise, it should give one pause to entertain the prospect of incurring the costs of switching from a system that has enabled significant economic development in various regions around the world since the late nineteenth century to an alternative system with untested consequences. However, there are vocal proponents of shifting from a dependence on central electricity generation and transmission to distributed power generation.

Lovins (

1976,

2003,

2009) and (

Lovins and Rocky Mountain Institute 2011), for example, has been a consistent critic of central power generation, arguing that big economies do not need big power plants.

Burger and Weinmann (

2013) document the move to community-based systems of generation and distribution in Germany.

25 Matsumoto and Yanabu (

2005) proposed a novel electric power system architecture using electric clusters that is a reference case for the system that we describe in this paper.

Carver (

2013) presents a balanced analysis of the opportunities and challenges for such distributed energy systems.

Clearly, the technology to shift to a predominantly decentralized system of generation exists. The most significant impediments to accomplishing such a shift would not be technological, per se, but most likely a collection of inconsistent and restrictive state policies applying regulations that assume centralized generation and the capital investment risk that incumbents would face, coupled with a well-established electricity imaginary that has been accepted by societies around the world. Additionally, considering the lengthy operational lifetimes of physical assets of grids, such as power plants and transmission lines, incumbents in the conventional centralized grid may be reluctant to decommission these assets before they have operated long enough to deliver favorable economic returns. Hence, a transition from centralized grid systems to a predominantly distributed electricity system would need to provide incentives for incumbents to adjust, including a realistic plan to relieve themselves of the burden of stranded assets.

3. Renegotiating the Relationship between Electricity and Money

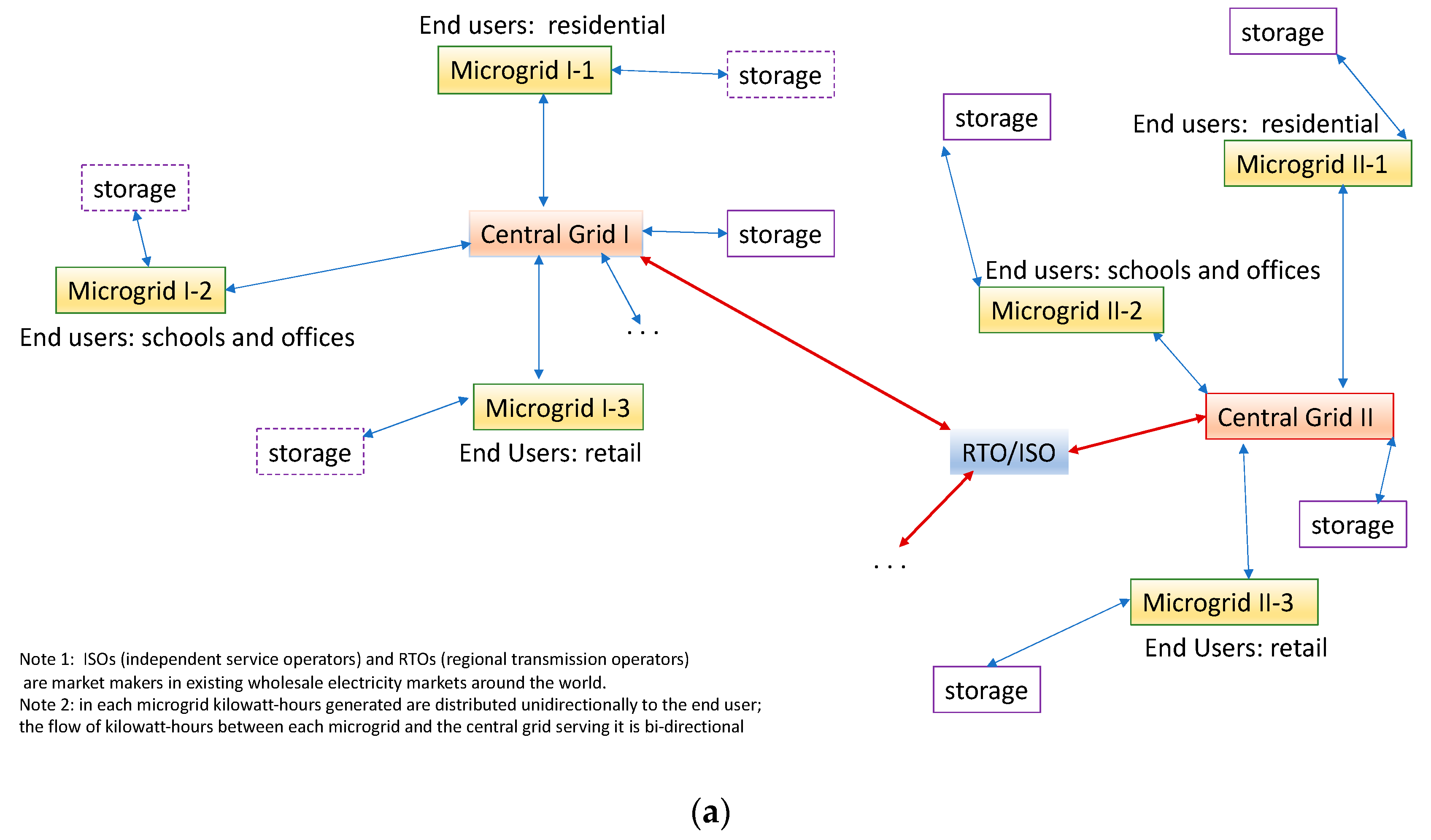

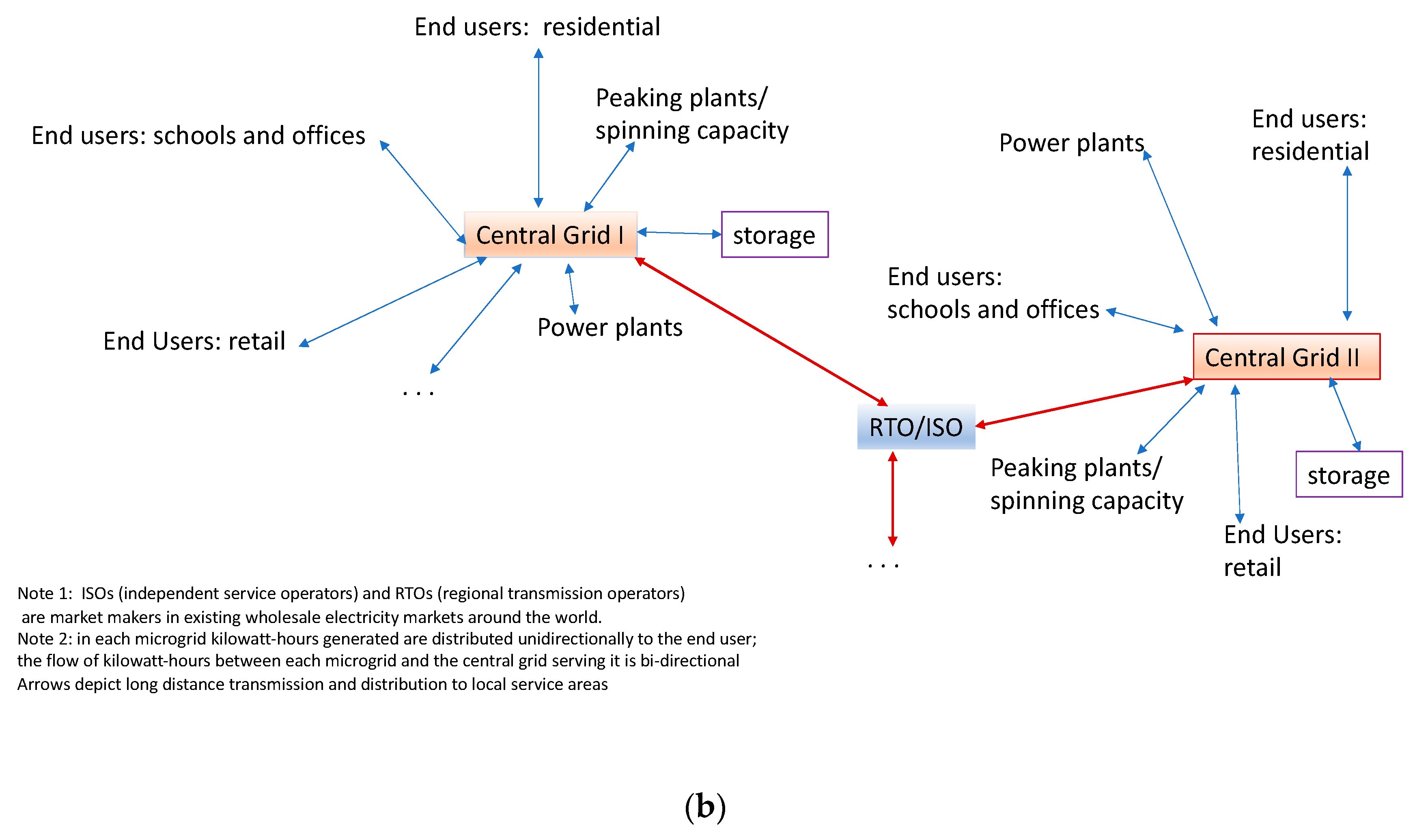

As we have seen, historically, electricity is provided to the end user via a centralized grid. Most end users are passive consumers. Electricity generation and delivery is the purview of large companies or public utilities subject to a complex system of regulations and policies. In what follows, we present a concept to encourage considering the grid as a resource or platform for transformation, and we attempt to identify a range of incentives for incumbents, especially, to align their businesses with a new system design. An abstraction of the transformed system may be depicted as a vertical market system corresponding to

Figure 4a as contrasted from an abstraction of the conventional system in

Figure 4b. We describe the market system of

Figure 4a as follows.

The upstream market comprises agents who collectively define the current system that generates, transmits, and distributes kilowatt-hours to end users. Let us call these agents central grid systems or central grids that are interconnected through a wholesale electricity market mediated by special-purpose agents (e.g., regional transmission operators (RTOs) and independent service operators (ISOs)).

The downstream market is composed of clusters of microgrids, a collection of specialized market intermediaries that generate and deliver kilowatt-hours to end users such that each cluster is connected to a specific central grid in the upstream market.

26The end market comprises end users, who are organized into catchments, each served by a distinct microgrid (e.g., residential neighborhoods, retail stores, schools, office buildings).

As the incumbents remain in the transformed system, there is an infrastructure much of which could survive a systems reconfiguration that could enable each end user to engage in market exchange in the market system. Microgrids and central grids could also use the infrastructure to engage in market exchange in the market system following the general principles of

Bucklin (

1972).

Three key issues that appear to determine the design and functioning of conventional electricity systems are geography, synchronization of supply and demand, and storage. Geography and the distribution of population influence the extent to which high voltage transmission must be a design feature of the system, especially in the upstream market.

27 The second issue, the synchronizing of supply and demand, is a key contributor to the complexity of electricity systems. That is, whenever a kilowatt-hour is generated, it must be delivered to some end use or wasted. Energy storage to produce kilowatt-hours to achieve synchronization whenever generation capacity is exceeded is a deficiency in most electricity systems that is only recently receiving serious attention. The transformed system would need to adopt storage as a design feature at each level of the vertical market system.

28In addition to these three issues, as users have begun to adopt limited generation capabilities, grid operators now face pressure to consider building the capacity for bi-directional flows of kilowatt-hours. Solutions to synchronization in the original design of the electricity grids have been predicated on exclusively unidirectional flows of kilowatt-hours from the central grid to the user. Although not universal, there are initiatives to introduce bi-directional flows in electricity systems, but these features do not necessarily solve the synchronization problem, and, in some cases, they exacerbate the challenge of achieving synchronization.

29 In the proposed transformed system, bi-directional flows would be needed only between the upstream and downstream levels of the market, thus reducing the number of nodes from the universe of end users to the universe of microgrids. If a typical microgrid were to serve, say, 1000 end users, then for a city with a population of 50,000 end users there would only be need for 50 bi-directional links rather than 50 thousand to support market exchange.

The transformed system re-positions the operator of the central grid and positions microgrids as financial intermediaries who happen to supply electricity. In economic terms, this re-configuration shifts costs and functions across the market, thereby changing the optimization decisions of agents on both sides of the market for electricity and by introducing new functions in the electricity value chain. Endowing the user, though, with the means to direct the generation of electricity would satisfy a necessary condition for wealth generation.

3.1. Basic Elements

We describe six basic elements of the transformed system.

Element 1: Each end user buys a forward contract for a quantity of kilowatt-hours to be delivered by a market intermediary, the local microgrid, within a given accounting period, (e.g., a month). During the accounting period, the end user may exercise claims on the generation of the microgrid subject to the quantity specified in the forward contract. If the end user’s demands for kilowatt-hours exceed the quantity of kilowatt-hours specified in the forward contract, the end user may either purchase kilowatt-hours at the prevailing spot price set by the microgrid or acquire unexercised kilowatt-hour claims from other end users.

30 The main responsibility of the end user is to contract with the microgrid each period in anticipation of the end user’s intended demand for kilowatt-hours. Considering the uncertainty of the end user’s future demand, the end user may acquire energy storage capacity to supply kilowatt-hours whenever the user’s demand exceeds the quantity specified in the forward contract. Although this may diminish the end user’s exposure to deprivation of kilowatt-hours at any time during the accounting period, it is unlikely to eliminate the risk.

31 Element 2: Microgrids are established as the downstream suppliers of kilowatt-hours to end users in their respective service areas. Guided by the aggregation of forward contracts from end users in its service area, the microgrid serving a collection of end users would plan generation levels for each accounting period. As demands of individual end users may deviate from the quantities specified in their forward contracts, a service provided by the microgrid would be to allocate kilowatt-hours within its collection of end users from those end users in surplus (i.e., whose demands fall short of their quantities specified in their forward contracts) to those end users in deficit (i.e., whose demands exceed the quantities specified in their forward contracts). As each microgrid operator maintains a connection to the central grid, the microgrid purchases kilowatt-hours from the central grid, as needed, to assure synchronization for its collection of end users whenever total demand of its end users exceeds the total quantity of kilowatt-hours specified in their forward contracts. The main business of the microgrid is to assure delivery of kilowatt-hours to its collection of end users as they plan.

Additionally, if the consumption of the collection of end users is in surplus, the microgrid has the opportunity either to sell surplus kilowatt-hours to the central grid for re-allocation to other microgrids or to allocate the surplus to its own energy storage capacity to satisfy postponed electricity demand of its collection of end users.

Element 3: The incumbent central grid generates a continuous, low base load that is allocated to energy storage, to the microgrids connected to its infrastructure, and to other central grids as mediated by a market maker (e.g., an ISO or an RTO). Each microgrid operator maintains a bi-directional connection with the central grid that permits the central grid to allocate surplus kilowatt-hours to those microgrids in deficit from those in surplus to assure synchronization in all downstream markets that the microgrids supply. The main business of the central grid is to ensure the continuous supply of kilowatt-hours, especially under conditions that present exceptional, unanticipated demands.

Element 4: Insurance. In addition to purchasing forward contracts from the microgrid in anticipation of quantities demanded during each accounting period, the end user also purchases an insurance policy from the microgrid operator for a guarantee of assurance of delivery of a minimum quantity of kilowatt-hours the end user would require during each accounting period. The premium that the end user pays is a fixed price during the accounting periods in which the policy is in force.

32 To assure delivery of kilowatt-hours under exceptional conditions (e.g., unforeseeable severe weather events), the microgrid purchases an insurance policy from the central grid. The premium that the microgrid pays is a fixed price for a guarantee of assurance of delivery of a minimum quantity of kilowatt-hours the microgrid requires to be delivered to the microgrid at any time during the accounting period.

33Element 5. Effectively, the unexercised kilowatt-hour claims of end users constitute a currency, an electricity currency. Any end user with unexercised claims for kilowatt-hours may trade such claims for other goods and services with any other agent in the market system, either upstream or downstream. The electricity currency is denominated in a standard unit of account, namely, a kilowatt-hour. Comparisons of electricity currency with such alternate forms of near money as fiat currency and scrip are summarized in

Table 2. Moreover, considering the pervasive coverage of digital systems that complement the electricity system, the unexercised claims may be exchanged electronically in any number of kilowatt-hours.

34 A necessary condition for the market system based on the electricity currency is that the kilowatt-hour backed currency would be fungible. That is, an unexercised claim on a kilowatt-hour would be honored in exchange for goods and services at any level of the market system (upstream, downstream, or in the end market) irrespective of the source of its intended generation.

Consider an abstract illustration of fungibility among agents served by microgrids connected to the same central grid. In reference to

Figure 4a, imagine a resident who is served by Microgrid I-1 and who has a surplus of unexercised kilowatt-hours claims. The resident patronizes a retailer served by Microgrid I-3. The retailer has a deficit of claims for kilowatt-hours. As Microgrids I-1 and I-3 are both connected to (served by) Central Grid I, claims would be mediated and settled by Central Grid I. In this respect, Central Grid I functions as a merchant bank and Microgrids I-1 and I-3 function as retail banks. All end users of each microgrid have kilowatt-hour accounts with the microgrid that serves them; all microgrids connected with the central grid have kilowatt-hour accounts with the central grid to which they are connected.

Assume the resident served by Microgrid I-1 were to patronize a retailer served by Microgrid II-3 and that this retailer also has a deficit of claims for kilowatt-hours. As Microgrid II-3 is connected to Central Grid II, and as Central Grid II is connected to the same wholesale electricity market mediated by the same RTO/ISO, then claims may pass from Central Grid II to Central Grid I and vice versa. As claims pass through the upstream merchant banks (i.e., the central grids) to the downstream retail banks (i.e., the microgrids), a system of clearing and settling of claims can function very much like a system supporting credit cards.

At present variations in electricity prices among the states and countries are a function of such factors as the capacity of the infrastructure and its utilization, the climate, the mix of economic activities, the resources available for generation, as well as the decisions of regulators in setting prices or ranges in which prices may vary that are intended to respond to the welfare of users and suppliers. If unexercised kilowatt-hour claims were to be accepted as money, how could prices for other commodities in the economy respond?

We return to the definition of money, namely that all agents attribute value to the claims. The intermediaries in the transformed market system that we have presented are active in both the market for the supply and demand of electricity (measured in kilowatt-hours), and the agents in the upstream and downstream markets are active in providing financial intermediation services.

Let us use the case of market exchange for fresh whole milk using electricity money. As fresh milk is a perishable commodity, it would require refrigeration at points of sale. U.S. supermarkets consume on average 50 kWh of electricity per square foot per year, where refrigeration and illumination constitute 50% of electricity consumption.

35 Consider a food retailer who is or anticipates being in deficit of kilowatt-hours to support the refrigeration requirements of store operations. In seeking kilowatt-hours, the food retailer could adjust the price in kilowatt-hour equivalents of any perishable item in the assortment, such as fresh milk.

Assume that the retailer is in Texas, where the average price of milk in fiat currency is

$3.48 per gallon.

36 As a baseline, we use the average price per kilowatt-hour (

$0.1281) for a household in Texas. Hence, without acknowledging the retailer’s demand for kilowatt-hours, the household could purchase a gallon of fresh milk by exchanging with the retail store 27.17 unexercised kilowatt-hour claims. However, since the retailer needs kilowatt-hours to support the refrigeration in store operations, the retailer could choose to offer the milk to the household at a discounted number of kilowatt-hours, say, at a 50% reduction from the baseline price. The average daily kilowatt-hour consumption of a Texas household is 42.66 kWh. Hence, at baseline pricing, if a Texas household were to consistently achieve 10% efficiency gains in electricity use, then it would take the household 6.4 days to acquire sufficient kilowatt-hour claims and 3.2 days at the discounted price to purchase the fresh milk from the Texas food retailer.

37 An analogous adjustment occurs in the market for any perishable item in the assortment of the retailer and for the store operations.

This example illustrates what the end user and the food retailer gain from exchange denominated in electricity money. Electricity money is accumulated by the end user’s efficient use of electricity, i.e., by accumulating surpluses of kilowatt hour claims. Thus, even an end user who may be unable to earn cash in exchange for his or her labor services or from the sale of an asset could still generate wealth through efficient electricity consumption. The demand for electricity is universal, thus any end user who happens to have a stock of kilowatt hour claims can use those claims in exchange for goods and services in the economy (milk at the grocery store), and vendors could accept cash or kilowatt hour claims in exchange for the goods and services for sale. As the spot price for electricity in fiat currency may vary significantly over time, forcing the food retailer to accept only fiat currency from the end user could require the food retailer to engage in some degree of hedging in order to acquire electricity service. With the kilowatt hour claims the food retailer receives from its patrons in exchange for items in its assortment, the food retailer would be able to acquire the face value of the claims it saves that are denominated in kilowatt-hours at any point in time irrespective of the variation in the spot price of kilowatt-hours denominated in fiat currency. Finally, the end user avoids incurring transaction costs were transactions with the food retailer to be exclusively in kilowatt hour claims. Basically, we are permitting end users who find it easier to accumulate kilowatt hour claims than to accumulate cash to engage in the market economy.

Considering the possibilities for demand-induced electricity price adjustments for non-electricity commodities offered for sale by any supplier, recall the scarcity pricing of ERCOT during and after the February 2021 cold snap. If kilowatt-hours become so dear to support a critical production activity, ERCOT scarcity pricing as a guide would impose a price cap of either 70 times (assuming a $9000/MWh price cap) or 39 times (assuming a $5000/MWh price cap) of the baseline price. One seventieth of the baseline for milk becomes 0.39 kilowatt-hours and one-thirty-ninth of the baseline becomes 0.7 kilowatt-hours. Thus, prices could vary significantly depending on the variability in the demand for electricity that specific agents in the economy would have.

Effectively, the electricity market system that we have described would associate the exchange of commodities between any two agents in the system, where one of the commodities would always be a claim on the provision of electricity. The payment system that supports the transformed electricity market system we describe is analogous to a system associated with credit cards. To organize the market exchange requires agreement among all agents to conditions that would govern the exchange. The pervasive energy storage designed into the transformed system helps to make agreement technically feasible. We consider now selected consequences that help identify, ultimately, incentives for agreement among agents in the transformed system.

3.2. Criteria for Institutional Innovation in the Market System for Electricity

The transformed electricity market system based on electricity money that we describe would constitute a new institution. The willingness of agents to accept the new market system would require consumers of electricity to enjoy a net welfare benefit and for suppliers to enjoy a net economic gain compared to its absence. We express these criteria following an adaptation of the criteria proposed by

Betancourt and Gautschi (

2001) for institutional innovation applying the argument of

North (

1990).

We express the net benefit of the consumer as the cost difference in attaining a given level of utility assuming the institution of the transformed electricity market system exists against its not existing. This may be measured as an expenditure function differential as follows:

where p* represents the price of electricity and complementary market services (e.g., insurance and information services) the electricity supplier provides, p represents a vector of other prices facing the consumer, S represents a vector of ancillary services provided by agents in the system, and Z

0 the levels of consumption activities that yield utility and that require electricity as an input. E(•) is a classical expenditure function that is nondecreasing, linear homogeneous and concave in all prices and nonincreasing in the services that complement electricity supply.

The first function on the right-hand side of (1) represents the costs of attaining a given level of utility conditioned on the existence of the institution (I) and the implied levels of prices, implicit services, and consumption activities. The second function represents the costs of attaining the same level of utility, given that the institution does not exist (NI), and that the consumer faces the corresponding implied levels of prices and services while adjusting on consumption activities. For an efficient institution to arise or to persist, E0, should be nonpositive since the second function represents optimization subject to an additional constraint (namely, that the institution cannot exist) relative to the first one.

On the production side, the gains from the existence of the institution can be measured as a profit differential associated with the aggregate profits of all agents consuming resources to permit the ultimate fulfilment of some consumption aim, that is,

where C is a cost function for the electricity supplier, X is a quantity vector of market goods and services produced or provided, and v are the input prices faced by the retailer. All other terms have been defined already. For an efficient institution to arise or persist, π

0 should be non-negative since the second function entails optimization subject to an additional constraint (namely, that the institution cannot exist) relative to the first one.

Assuming the process of entry and exit to lead to zero profits given that the institution exists or not, then (1) also measures the (negative of the) benefits to society from the existence of the institution. If we allow for nonzero profits, then the benefits to society will be measured by π0 − E0. If the institution is the transformed electricity system and π0 − E0 > 0, then, generally, there is an advantage for agents to participate in the transformed system. The question is, however, whether these advantages are greater than the advantages associated with the persistence of the centralized grid system versus its not existing. That is, is π0 − E0 > 0 for the transformed system greater than π0 − E0 > 0 for the conventional grid system?

3.3. Discussion

What would suggest that π0 − E0 > 0 for the transformed electricity market system? Generally, the protocols of choice on the part of agents at each level of the market system reduce uncertainty by shifting some costs across the market that either does not happen or is not encouraged in the conventional grid system.

Cost shifting. The transformed system shifts certain responsibilities for planning across the market to the end user. This is not something that all end users do now. Nevertheless, by inducing end users to anticipate their demands for electricity, they would be alleviating pressure on the providers of the electricity service. Organizing the provision of electricity using forward contracts would require some end users to acquire some new skills such as paying attention to weather forecasts and preparing to adjust their consumption behavior accordingly (putting on a sweater rather than turning up the thermostat when a cold snap arrives, for example). This would seem considerably simpler and less expensive than how the conventional system requires the centralized electricity generator to prepare to adjust generation capacity to serve thousands or millions of diverse end users as they respond to a weather event that they may have no incentive to anticipate.

38 The planning responsibility also presents an incentive for end users to be efficient in the use of electricity, as end users who are in surplus have a store of unexercised claims. As all agents in the economy attribute value to electricity, such claims can be offered either to other end users who are in deficit in exchange for non-electricity goods and services (e.g., for purchases at a retail store that needs to keep the lights on) or to any other agent in the market system in exchange for fiat currency.

Product Development. As some end users may be more competent in planning than others, the microgrid operator may provide a service that informs the end user of imminent conditions that may influence significant changes in aggregate demands that end users may have at points in time (e.g., weather events, events such as the World Cup or Super Bowl that attract use of electronic devices and electric appliances). The microgrid operator could offer such information services at a price denominated in kilowatt-hours to reduce implicit information acquisition costs as effort expended by the end user, as well as to diminish the prospect of deleterious consequences the end user could suffer from being otherwise uninformed. Accepting unexercised claims reduces obligation of the microgrid, ceteris paribus, to generate the quantity of kilowatt-hours corresponding to the price of the information services it offers to the end user.

Distributed Capital Investment. In the transformed system, the central grid delivers only a low base load and shifts investments downstream. That is, the central grid is relieved of the need to invest in and operate contingent generation capacity (e.g., peaking plants) and could conceivably reduce its investment and avoid many of the operating expenses associated with its existing long distance high voltage transmission infrastructure. As responsibilities for managing the demand and supply of kilowatt-hours is shifted downstream, the central grid is unlikely to suffer the cost and reputational risks associated with brownouts and blackouts that arise from either mismanagement of contingent generation resources or inadequate response to unanticipated surges in demand that induce exorbitant market clearing prices. In effect, because the microgrid is the primary sources of generation for the end user and maintains its own storage capacity, the microgrid serves as a buffer in the load variation that the central grid would otherwise need to manage.

Energy Storage as a Design Feature. Throughout the transformed electricity system, agents seek to store kilowatt-hours and save claims on kilowatt-hours. The central grid would likely invest in energy storage assets that are suitable for large scale operations, such as gravity systems, liquid air energy storage, or pumped hydro. Downstream microgrids would more likely invest in smaller scale technologies such as batteries. End users could either invest in energy storage capacity at their premises or contract for a provisional claim on kilowatt-hours stored by the microgrid or a third party. As storage becomes a design feature of the electricity system, the investment burden to produce a reserve of kilowatt-hours available on demand is distributed among all agents in the system and the price of energy storage is made explicit ex ante.

Synchronizing Payment and Consumption. At present in most electricity systems, end users are billed only at the end of an accounting period for their electricity use during the accounting period. Hence end users may struggle to associate their consumption behavior with the cost of their consumption. This means that end users currently may be sufficiently uninformed to modulate the intensity of their electricity use as conditions that influence the costs of the provision of electricity through the system vary during the accounting period. The transformed electricity system imposes a burden on the end user to anticipate use through the purchase of a forward contract. Hence the price of consumption is known or approximated ex ante, thereby alerting the end user of the cost consequences of electricity use.

Price Stability. By introducing, formally, intermediate markets in the transformed system and by endowing the end user with some discretion in planning electricity consumption, price stability would be enhanced.

(1) The end user. The end user whose kilowatt-hour claims account is in deficit or who anticipates it being in deficit may receive unexercised kilowatt-hour claims in exchange with any other agent for goods and services or for fiat currency that the end user would offer. Such exchange promotes price stability by preempting exchange at spot prices (e.g., scarcity prices) that could vary significantly with supply and demand imbalances in the market system. The end user also has the option to purchase at a fixed price an insurance policy assuring continuous delivery of a minimum required quantity of kilowatt-hours from the microgrid if the end user experiences a spontaneous, pronounced need produced by exceptional conditions (e.g., a weather event) that the end user does not anticipate during the accounting period.

Not all end users would have the same capacity to conserve. For example, a hospital would require low variation in its use of thermal energy, and some end users would either seek out sources other than electricity to produce the thermal energy they need or would develop protocols for conservation of thermal energy (e.g., blankets and sweaters). As end users manage a store of kilowatt-hour claims under the forward contracts that they purchase in addition to the unexercised claims they store (save), they would likely be cognizant of the consequences of their consumption choices throughout each accounting period. Accordingly, end users in the aggregate could be expected to be alert in making adjustments that dampen their demand surges for electricity. That is, price variability would be low compared to price variability in conventional systems.

(2) The microgrid. The purchase of an insurance policy from the central grid substitutes a fixed price for a speculative price that responds to unanticipated, exceptional conditions that impose adjustment costs on the central grid in generating kilowatt-hours responding to surges in demand. The fixed price dictates what the microgrid would pay for kilowatt-hours up to some limit even under exceptional conditions. The combination of insurance and the existence of energy storage under the control of the microgrid promotes price stability in the end market.

(3) The central grid. By offering an insurance policy, the central grid assesses the microgrids that it serves risk premia for expected losses that it could incur in the event exceptional conditions arise during the accounting period. The central grid adjusts the price of insurance depending on actuarial evidence of events and conditions that would cause it to incur losses as it adjusts its generation and draws from its energy storage to satisfy exceptional episodic demand surges downstream. In general, the insurance policies inform all agents in the downstream and end markets of the maximum quantity of kilowatt-hours that the agents would be able to acquire from the upstream market irrespective of conditions that arise.

39 The combination of the revenues the central grid receives from issuing insurance and the existence of energy storage under its control promotes stability in the downstream market.

3.4. Incentives for Agents to Re-Organize the Market System for Electricity

Although the transformed electricity market system that we have elaborated preserves incumbents of the conventional grid systems, it does modify their economic functions and would require renegotiating the socio-technical imaginary of electricity and money. In brief, the microgrid assumes a role analogous to the financial institutions that offer a credit card to their accounts, in our case, the end users that they serve. The ISO is the agent that authorizes transactions among end users, some who are consumers and some who are vendors of one kind or another. The ISO also performs market clearing and settlement services for any exchange that takes place between a vendor in one microgrid served by one central grid and an end user served by a microgrid that is served by another central grid. The central grid performs a role analogous to a settlement bank. Perhaps, the potential benefits of this transformed system would induce the agents to adhere to our conceptual proposal.

3.4.1. Prospective Benefits

For the end user (qua consumer), the set of benefits that are distinct features of the transformed system compared to the conventional system include:

price stability

assured delivery of minimum required electricity as provided under an insurance contract

price discounting through efficient production of consumption activities that use electricity as an input which the end user controls to some degree

financial inclusion. As kilowatt-hour claims are convertible in fiat currency, the end user’s status as banked in the financial services system for electricity money integrates with the fiat currency system. Although kilowatt-hour claims are not legal tender, because of the universal value for electricity the kilowatt-hour claims are instruments of payment that would be honored by a range of agents in the vertical market system who are engaged in exchanging goods and services that are not exclusively electricity.

40

For the electricity suppliers, the transformed system would induce them to develop business models that deviate from their conventional ways of doing business

41. For the central grid in the upstream market, the set of benefits that are distinct features of the transformed system compared to the conventional system include:

reduced capital investment requirement from the shifting of conventional functions of significant generation and distribution to downstream markets

new revenue streams and hedges against loss from unanticipated demand (insurance)

reduced uncertainty in downstream demand from the shifting of conventional functions of generation across the market

reduced complexity from streamlined infrastructure and concomitantly lower operational cost of generating low, continuous baseload

greater assurance of the delivery of electricity levels that end users desire as a hedge against reputational loss, especially in the event of conditions that would otherwise threaten the performance of the conventional system (e.g., brownouts, blackouts, episodic power outages)

For the microgrid in the downstream market the set of benefits that are distinct features of the transformed system compared to the conventional system include:

new revenue streams from generation and distribution, insurance, information services, and financial intermediation (banking services that use savings from end users with surplus claims on kilowatt-hours to provide loans to end users in deficit)

assurance of electricity delivery from upstream suppliers

The transformed electricity market system would present distinct incremental costs that incumbent agents of the conventional grid system would incur.

3.4.2. Prospective Costs for the Agents

In the transformed system, the central grid would operate with a certain, continuous, low base load. That is, the central grid would generate a constant level of kilowatt-hours irrespective of demand fluctuations in the end market. The variability in demand would be buffered for the central grid by the generation performed by the microgrid and by the distribution of energy storage capacity at all levels of the market system. Thus, the intermediation provided by the microgrid should reduce operational and capital costs otherwise borne by the central grid, in so doing shifting operational and capital costs of generation to the collection of microgrids the central grid supplies.

Additionally, the institutionalization of energy storage as a design feature of the system would reduce the adjustment costs the central grid commonly incurs in the conventional system whenever short-term exceptional demand variability in end markets induces the central grid to operate contingent generation resources that far exceed normal conditions that determine planned electricity load.

42 The new costs that the central grid would incur would be associated with its new functions, principally relating to insurance and financial services akin to merchant banking. These costs would entail hiring people with new skills and training existing staff in the performance of new functions. Thus, the net cost of the central grid would be the algebraic sum of reduced capital and operational costs associated with its conventional economic function (power generation and transmission) and new human capital costs and operational costs associated with financial intermediation.

The microgrid is the market intermediary that bears the cost of adjusting to demand variability in the end market. Assuming the microgrid endeavors to assure reliable and affordable delivery of electricity to its end users irrespective of the conditions that may induce significant demand variability, the microgrid would likely bear higher capital costs in integrating energy storage into its infrastructure.

The microgrid would also incur a range of accounting costs that it would not incur under DER set-ups in conventional electricity market systems. For example, the microgrid would assume new responsibilities akin to functions of a retail bank in allocating kilowatt-hour claims from end users in surplus to end users in deficit. These new responsibilities would most likely present human capital costs that the microgrid would not incur in conventional systems. However, the question is whether there would be a net economic return to the microgrid that is the algebraic sum of its new revenue sources (insurance and financial intermediation services) plus its new human capital costs.

The most significant distinction of the transformed system is the shifting of planning costs across the market to the end user. The end user must purchase a forward contract of a quantity of kilowatt-hours to be delivered during each accounting period, and the end user directly bears the costs of inaccurate planning. This feature relieves the upstream and downstream agents of significant adjustment costs, but it imposes these costs on the end user. For those end users who are in surplus, the adjustment cost is negative and denominated in unexercised kilowatt-hour claims. For those end users who are in deficit, the adjustment cost is positive and may be incurred either as an out-of-pocket cost for a loan of kilowatt-hours denominated in increments of kilowatt-hour claims or as an implicit cost in the form of some degree of abstinence from consuming electricity.

4. Efficiency of Institutions, Energy Efficiency, and the Role of the State

Three significant issues arise in considering how to implement the transformed system that we have described. We take each in turn.

4.1. Efficiency of Institutions

For considering institutional change, the question in the aggregate is whether the costs borne by each end user in the transformed system would exceed the adjustment costs from demand variability that upstream and downstream agents face in conventional grid systems. Generally, the answer to the question would devolve to conjecture as to whether distributing adjustments in responsibilities and choices through all levels of the vertical market system would establish that π0 − E0 > 0 for an institutionalized, transformed electricity market system to exceed π0 − E0 > 0 for the persistence of the conventional grid system.

The transformed system makes explicit for end users their optimization of electricity use, as responsibility for planning is shifted from the upstream to the end market. For such systemic suboptimization, the risk-averse end user would have an incentive to plan to realize a surplus of kilowatt-hour claims at the end of any given accounting period. The surplus is essentially money that may be either saved or used in exchange for other goods and services. Reduction in the psychic cost of the end user’s assuming some control in directing levels of generation may be a key in determining the net cost to the end user. The transformed system, though, would be constructed on the proposition that end users would willingly assume this responsibility as they would enjoy the benefits of their ability to accumulate savings denominated in kilowatt-hour claims from managing their electricity consumption efficiently. There are long run and short run aspects to achieving such energy efficiency.

4.2. Energy Efficiency in the End Market

If an unexpected event, such as a cold snap, were to occur that would cause the end user to consider increasing consumption of electricity, the adjustment costs of so doing may deter the end user. Indeed, end users may factor the possibility of such events into their planning in various ways: (a) inform themselves of weather events that would likely influence the performance of the microgrid, (b) don warmer clothes than they would otherwise have been accustomed to wearing, and (c) resist the temptation to turn up their thermostats. These adjustments would not prevent the cold weather, but they would prevent or reduce the risk of adverse health consequences that they would otherwise suffer, as well as preserve their respective wealth positions as denominated in kilowatt-hours.

If end users associate surpluses of unexercised claims for kilowatt-hours with their wealth positions, then it would seem likely that they would prepare their living or working conditions to be energy efficient. For example, the architecture of the structures where they reside or work could be insulated or modified (e.g., passive solar and heat exchange systems could replace or complement conventional thermal systems). It may even be wealth enhancing if they were to change conventions of their energy use such as turning off lights and appliances when they are not needed.

In general, giving end users wealth enhancing incentives to be energy efficient in their consumption in the short term and in the long term could be an expedient means of avoiding Jevon’s Paradox

43 (

Jevons 1866). As efficiency is a source of wealth in the market system in which electricity is money, agents in the downstream (microgrids) and upstream (central grids) markets have incentives to be efficient, as well. Their choices to assure efficiency span resources and technologies for generation, transmission, and distribution.

4.3. Role of the State

Adam Smith (

1776) began his treatise,

The Wealth of Nations, with an example of how labor can be divided in the production of pins. Our concept of a transformed electricity market system could be construed as an application of Smith’s thesis, as the provision of electricity is divided among a system of all interconnected agents.

Whereas Smith’s treatise, generally, was offered as an alternative to the centralized power of the monarch, our concept is offered as an alternative to the centralized power of the central grid, as supported by the state in most instances. Smith may have been remiss in anticipating the need for the state to intervene by introducing all the constraints and incentives to assure efficient distribution of wealth that we debate in contemporary economies. We would be remiss if we were to ignore the need for the state to intervene in the transformed electricity market system we have described.

At present, states tend to intervene in electricity markets by imposing on incumbents regulated prices, restrictions on budgetary processes, requirements and approvals of construction of new facilities, approval of business lines that may be offered, and requirements of assorted energy efficiency programs.

44 The complexity of the state’s involvement in electricity markets is justified by its pursuit of welfare protection or welfare enhancement of members of the polity. Could the pursuit of welfare protection or welfare enhancement be achieved by simpler means? Indeed, a proof of how embedded electricity has become, especially in the most industrialized economies of the world, is the confusion regulators face for its provision. De facto, electricity has become an essential design element of these economies. This is evident as regulators have the responsibility to monitor grid operators from generation to distribution and enforce business operations that are intended to assure reliable and affordable electricity service to customers, thus reinforcing the sense among end users that electricity is ubiquitous, making it essentially invisible. The regulatory regimes persist, notwithstanding the extraordinary complexity in establishing socially optimal prices for it (cf.

Borenstein and Bushnell 2021).

We note that one design feature of the transformed system we have described is that all end users participate in the financial system of electricity. Financial inclusion is a universal goal of states, and the requirement for any end user in this financial system to be included is to have an account with a microgrid qua retail bank. For those members of the polity who are impoverished, subsidizing the cost of an account would seem to be a reasonable role for the state. The benefit of so doing extends beyond the provision of electricity, as each end user would learn rudiments of planning and financial management that would prepare them to participate broadly in the money economy.

Other means of state intervention in the transformed system could follow the tradition of regulating markets generally, such as setting and enforcing standards of performance of agents at all levels of the market system (including the end market), imposing constraints to forestall actions on any agent in the system to corner the market, and to monitor market exchanges to prevent the emergence of black markets and gray markets. However, the need for the state to regulate prices would likely be significantly diminished, if not eliminated, in the transformed system.

Perhaps the most important role for the state to influence the conduct of the agents in the transformed electricity market system would be to establish and enforce licensing criteria for operators at all levels of the market system. Collectively, agents who become licensed participants in a system that honors a kilowatt-hour as money irrespective of its source would need to subscribe to a common set of rules approved by and enforced by the state.

45