1. Introduction

A unique feature of the independent director market is multiple directorships. According to Institutional Shareholder Services (RiskMetrics), more than half of all independent directors hold numerous directorships (

Brown et al. 2019). Prior literature has focused on whether multiple directorships result in overcommitted (or “overboarded”) directors, whose time and attention are stretched too thinly to properly complete their duties on any given board, and thus multiple directorships can destroy shareholder value and be detrimental to monitoring and corporate governance (

Fich and Shivdasani 2006;

Ahn et al. 2010;

Andres et al. 2013;

Falato et al. 2014;

Hauser 2018;

Al Lawati and Hussainey 2021). On the other hand, serving on multiple boards allows directors to gain access to valuable skills and industry information that can help their performance in advising managers on strategy (

Field et al. 2013;

Kuang and Sharma 2014;

Brown et al. 2019;

Liu et al. forthcoming). This study develops an analytical model of directors holding multiple board seats in order to examine another important, and heretofore unexplored, aspect of multiple directorships: optimal contracting for directors’ compensation.

The academic literature has exhaustively studied executive compensation (e.g.,

see Holstrom 1979;

Grossman and Hart 1983;

Jensen and Murphy 1990;

Core et al. 1999;

Becht et al. 2003;

Masulis 2020;

Choi et al. 2021;

Wang et al. forthcoming). However, research on director compensation is relatively underexplored (

Brick et al. 2006;

Adams et al. 2010;

Chen et al. 2019;

Donelson et al. forthcoming;

Melis and Rombi 2021). In particular, theoretical analysis on the board of directors is scarce in two key areas: (1) analytical models of multiple directorships, and (2) director compensation. To the best of our knowledge, this paper is the first to analytically model the optimal contracting for directors with multiple directorships. More specifically, we model multiple directorships and optimal contracting in order to explore several research questions: (1) are multiple directorships associated with more or less incentive-based pay? (2) is this affected by whether director efforts on multiple boards are complementary or substitutive? and (3) what are the determinants of the optimal number of board seats and optimal compensation structure for an outside director? These questions are interesting and important because they may shed light on the interaction between different companies’ boards. In addition, investigating these issues deepens our understanding of the trade-offs between risk sharing and incentive provisions. Last, the answers to these questions may yield important policy implications, especially with respect to the public policy debate on whether directors’ multiple board seats should be limited.

In our model, multiple companies compete for a director’s efforts. An outside director can determine the number of boards they will serve on before the companies offer compensation contracts including performance payments (pay–performance sensitivity, hereafter, PPS, and fixed salary). Next, the director chooses efforts for each company. In the end, the output for each company is realized, and the companies make payments to the outside director.

Our model yields a number of new results. First, when the number of directorships is exogenous, there are two effects regarding the relationship between the number of directorships N and incentives (or PPS): the competition effect and the task interaction effect. As the number of directorships increases, the competition effect means that more companies compete for the same directors to serve on their board. Thus, companies offer more significant incentives, leading to a positive relationship between the number of directorships and the level of incentive-based pay. This means that, empirically, we should observe a positive association between multiple directorships and incentive-based pay; thus, this opens the door for future empirical studies to test this theoretical prediction.

Next, for the task interaction effect, directors’ efforts may be complementary or substitutive across tasks. When efforts are substitutive, as directorships increase, it is more costly to induce the director to work hard; this means that firms face a higher marginal cost of incentivizing the director to work harder, leading to a negative relationship between the number of directorships and incentives. In practice, substitutive efforts could exist in multiple scenarios: for example, when board members serve on the boards of firms in different industries (which is possible, due to non-compete agreements limiting directors’ service on competitor boards), and thus knowledge synergies are scarce, or if they serve on difference committees on different boards.

On the contrary, when efforts are complementary, as directorships increase, it is less costly to induce the director to work hard; this leads to a positive relationship between the number of directorships and the incentives, as the marginal cost of incentivizing the director to work harder is lower. In practice, complementary efforts for board members with multiple directorships are likely quite common, as directors frequently specialize in a given industry, and thus knowledge gained on one board may be useful to another board.

However, overall, our model concludes that multiple directorships are positively associated with incentive-based pay whether director efforts are substitutive or complementary: (1) when efforts are complementary, the association between incentives and the number of directorships is positive, since both the competition and task interaction effects are positive; (2) when efforts are substitutive, the relationship is still positive, because the competition effect dominates the task interaction effect. This yields some interesting and novel predictions, paving the way for future empirical research on interlocked board synergies, director pay structure, and firm performance.

Further, we examine how the optimal number of directorships is determined endogenously and the optimal incentives. We numerically conduct comparative static analyses, as the closed-form solutions are not available. The numerical analyses yield a number of findings on the optimal number of directorships and substitutive efforts: (1) outside directors with greater abilities serve on more boards, (2) less risk-averse directors also serve on more boards, (3) the riskier the firms are, the fewer directorships the outside director holds, and (4) the optimal number of directorships decreases with the degree of substitution. Moreover, after endogenizing the optimal number of directorships, we find some results on optimal incentives with substitutive efforts: (1) companies provide more muted incentives for more risk-averse directors, (2) the optimal incentives decrease with companies’ riskiness, (3) directors with greater abilities are offered stronger incentives, and (4) the optimal incentives increase with the degree of substitution.

This paper may help inform the policy debate on potential restrictions on the number of board seats that outside directors of public firms may hold. Although there are currently no broad policy restrictions in the US, there exists investor pressure toward such regulation, as investors are increasingly resistant to “overboarded” or busy directors (

Papadopoulos 2019). In fact, many companies have their own policies limiting director board seats (about 44% of Russell 3000 companies have such policies), although the limits tend to be high, at a maximum of four or more board seats (

Tonello 2020). In contrast, the maximum number of directorships an independent director can hold in China is five. Further, the Professional Organization for Non-Executive Directors recommends devoting 1.5 days per week to each board seat; therefore, one can easily imagine that directors holding multiple appointments might be “too busy” to successfully fulfill their role at each board. The primary board policy restrictions in the U.S. relate to majority board independence requirements under the Sarbanes–Oxley Act (SOX): in the era immediately preceding SOX, circa 1998–2002, there were many prominent accounting frauds and scandals due to the breakdown in corporate governance at public U.S. firms. Under SOX, adopted in 2002, public company boards are required to have a majority of independent directors. Our study lends evidence to this general policy debate by offering evidence of another drawback to overboarded directors: the cost to shareholders and firms from offering excessive incentive-based pay in order to attract directors with multiple board seats, leading to high-risk premia and welfare losses.

This paper is also relevant to the empirical literature on busy boards and their effect on firm value, which tends to be mixed. Several studies find that busy directors (or directors with multiple board seats) are detrimental to find value (

Fich and Shivdasani 2006;

Ahn et al. 2010;

Falato et al. 2014;

Hauser 2018), or associated with aggressive firm practices (

Andres et al. 2013;

Al Lawati and Hussainey 2021), presumably because they are too busy to monitor firm and executive activity. Others document a positive effect of multiple directorships on advising activity (

Field et al. 2013), and/or operating activity, especially when directors serve on board seats with strong connections (

Brown et al. 2019). Finally, several studies document that directors with multiple board seats may excel at allocating time and monitoring efforts toward the audit committee and firm audit monitoring, perhaps due to concerns about their reputation (

Kuang and Sharma 2014;

Liu et al. forthcoming).

Our paper contributes to this literature on the benefits and costs of multiple directorships in several ways. First, we propose a heretofore unexplored cost of director busyness: the incentive pay required to attract these directors, which can be detrimental to shareholder welfare. In fact, we find that, due to the competition effect, the relationship between multiple directorships and incentive-based pay is positive, whether director efforts on multiple boards are complementary or substitutive. We also offer many testable hypotheses for empirical studies, including cross-sectional predictions on the optimal number of directorships and optimal incentives. For example, our findings on director effort complementarity and substitutability speak more broadly to studies on firm strategy and operations (

Adamides and Karacapilidis 2020). In summary,

Table 1 displays a SWOT analysis of the current literature and policy debate on multiple directorships, including our findings.

This paper is also associated with the literature on common agency (e.g.,

see Martimort 1996;

Dixit et al. 1997;

Martimort and Stole 2002;

Bergemann and Valimaki 2003).

Bernheim and Whinston (

1986) show that a noncooperative menu auction has an efficient equilibrium among the principals. There have been some applications. For example,

Grossman and Helpman (

1994) apply the model to the setting of tariffs lobbying, and

Dixit (

1996) applies it to producer taxes and subsidies. This line of literature on common agency focuses on whether the efficient outcome can be achieved. However, our paper focuses on the relationship between incentives, the number of principals, and their determinants. This relationship has not heretofore been explored in the existing literature.

Finally, this paper builds on the Linear–Exponential–Neutral (LEN) framework. According to

Lambert (

2001), the model in this paper belongs to the class of multi-action models using the LEN framework (e.g.,

Bushman and Indjejikian 1993;

Feltham and Xie 1994;

Hemmer 1995;

and Rajan and Reichelstein 2004). In particular, it is related to the optimal number of partnerships (

Huddart and Liang 2005;

and Liang et al. 2008).

Huddart and Liang (

2005) investigate optimal partnership size, profit shares, and inventive payments when every partner performs the same tasks and find that smaller or larger partnerships dominate medium-sized partnerships.

Liang et al. (

2008) explore the optimal team size and monitoring in organizations and document complementarities between team size and monitoring and between worker talent and managerial monitoring ability. The distinguishing feature of our model is that multiple principals offer incentive contracts simultaneously to compete for the same agent’s costly efforts. Thus, the interplay between principals plays a key role, and the externality one principal imposes on others needs to be considered.

2. Literature Review

There is a broad body of literature on multiple directorships, with mixed findings on the effects of multiple directorships on firm outcomes. First,

Ferris et al. (

2003) find no evidence that directors with multiple directorships shirk their responsibilities to serve on board committees or are associated with more securities fraud litigation. These findings are consistent with

Fama and Jensen’s (

1983) reputation hypothesis. However, a number of studies find that multiple directorships harm firm value because directors are too busy to devote sufficient time and attention to each board seat.

Fich and Shivdasani (

2006) find that companies with busy boards are less profitable and have lower sensitivity of CEO turnover to financial performance.

Ahn et al. (

2010) find that firms where independent directors hold more outside board seats have more negative abnormal returns.

Falato et al. (

2014) find that an exogenous increase in board busyness (due to sudden director deaths at another board the director serves on) negatively impacts firm value.

Hauser (

2018) finds that an exogenous decrease in board busyness (due to M&A terminating another board that the director serves on) is associated with increases in firm value. Still others find that directors with multiple board seats and audit committee membership engage in aggressive practices:

Andres et al. (

2013) find that firms with busier boards (defined using the degree of board connections) are associated with poorer firm performance and higher executive pay, while

Al Lawati and Hussainey (

2021) report that overlapped audit committee members and chairs are associated with more aggressive tax avoidance.

On the other hand, multiple directorships can lead to synergies, or complementarities, across different companies the same director serves on (i.e., “interlocked boards”). For example, if a director serves on the boards of two companies in the same industry simultaneously, the more effort she invests in one company, the more familiar she will be with the industry. Thus, her marginal cost of effort will be lower. Directors serving on well-connected boards also gain access to contacts and knowledge that can benefit each additional board they serve on. Consistent with this idea,

Field et al. (

2013) find that busy boards are associated with higher firm value for IPO firms.

Brown et al. (

2019) find that an exogenous decrease in director busyness (due to M&A terminating a board) is associated with null or negative effects to operating performance and advising when directors lose access to a very well-connected board, which suggests that connections gained from multiple appointments can be beneficial to director performance. Further,

Liu et al. (

forthcoming) find that directors who serve on multiple audit committees allocate their time and effort to each committee based on firm risk, which implies that directors may be able to successfully allocate their time and energy to where it is most needed. Indeed,

Kuang and Sharma (

2014) find that they are associated with less aggressive earnings management, presumably due to the potential adverse effects of restatements on their reputation.

A relatively smaller body of literature examines director compensation.

Brick et al. (

2006) document that director pay displays characteristics of cronyism: director pay is positively associated with CEO pay, and negatively associated with firm performance.

Chen et al. (

2019) similarly find that excess director compensation is symptomatic of cronyism and agency problems.

Melis and Rombi (

2021) find that country-level institutional characteristics as well as firm- and director-level characteristics drive observed variation in the compensation of independent directors. Finally,

Donelson et al. (

forthcoming) examine how changes in director litigation risk affect director compensation.

We know of no previous studies connecting multiple directorships with the structure of director compensation and incentive-based pay. Our study combines these two literatures—the literature on the benefits and costs of multiple directorships, and the literature on director compensation—by modeling the association between multiple directorships and director compensation structure in order to reach important and novel findings on director busyness and director pay.

3. Model and Method

3.1. Model

In the initial model, an outside director works for N companies simultaneously. Within the LEN (Linear–Exponential–Normal) framework, we assume the outside director’s effort can improve the companies’ outputs. However, efforts are unobservable, and payments can only be based on the actual output, which equals the effort plus a random noise, i.e., where and is independently and identically distributed across For simplicity, we assume for all in the initial model and consider the case of different variances in the extension. The outside director is risk-averse with exponential utility, and the risk-aversion coefficient is γ. Therefore, her utility maximization problem is equivalent to maximizing the certainty equivalence

where . When p ≥ 2, the substitution among efforts is so strong that the outside director exerts all effort on a single company, which is unrealistic. Thus, we assume that p < 2 in the following analysis. We allow the parameter p to be negative, which means there is complementarity (synergy) among the effort spent in different companies. However, when p is negative, we assume it is not so negative that the total cost would be negative, suggesting that . Generally, the cost function’s parameter p captures the degree of substitution and complementarity among the effort spent on different companies. On the one hand, a director has limited time and energy, and works for several companies simultaneously. If she exerts more effort in firm , her marginal cost for firm is higher, which is the case when efforts are substitutive. On the other hand, there could also be synergy among efforts spent on different companies. For example, if an outside director works for several companies in the same industry, she gains valuable knowledge and connections within the industry. Thus, if she exerts more effort at firm , her marginal cost for firm , , can be lower. Aside from the assumption that the director is risk-averse, the companies’ shareholders can hold a diversified portfolio. Thus, it is assumed that the companies are risk-neutral, and their objectives are to maximize the expected profits.

At the beginning of the game, the outside director can choose the number of directorships N, becoming common knowledge. N is exogenously given in the initial model. The compensation scheme for outside directors is modeled as a fixed payment plus some share of the company’s output . Following the literature on CEO compensation, we call PPS. In this model, the outside director has bargained with the N companies. The companies pick incentives and the director chooses a fixed payment and efforts to spend in each company subject to the director’s incentive compatibility (IC) constraint and the companies’ rationality (IR) constraint that companies’ profit is greater than or equal to the outside option. The justification for this assumption is that there is not enough supply of directors. The director has more bargaining power and can set the fixed salary to extract the surplus. The outside options for all the N companies are assumed to be . For simplicity, the outside option is normalized to be zero in the following analyses.

To summarize, the timeline of the model is as follows:

At t = 0, the director chooses the number of companies (N) that she will serve on, and this information is common knowledge afterward.

At t = 1, in the negotiation, the N companies simultaneously offer a bonus or incentive rate and fixed salary to the director.

At t = 2, the director decides whether to accept the contracts or not. If she accepts, she exerts effort for each company, i.e., . These efforts are unobservable.

At t = 3, given efforts the output of the N companies are realized, and the payments to the director are made to the director.

The backward induction approach is employed to solve the game, and the solution concept is SPNE (Subgame-Perfect Nash Equilibrium). At t = 2, given the choice of N and the incentive contracts the director chooses efforts to maximize her utility. Lemma 1 gives the director’s optimal effort as the best response to the incentive contracts.

Lemma 1. Given the number of directorships, N, and incentive contractsoffered by companies, the outside director chooses effortsto maximize her utility, and the optimal efforts arefor all

This result is intuitive and straightforward. If firm offers stronger incentives, the director will exert more effort for firm . If p is positive, the efforts are substitutive. The lower the incentives other companies provide, the more efforts the director will exert on firm . If is negative, the efforts are complementary, so the stronger the incentives firm offers, the more effort the director exerts for firm i. If the effort is less costly (the parameter c is smaller), the levels of effort for all companies are higher.

Then, given the outside director’s optimal effort choice, the optimal linear contract is summarized in Proposition 1.

Proposition 1. The optimal contract offered by each company is, and the corresponding fixed payments are. For the solution to exist, the restriction on parameters should be such thatand the outside option should not be too large,. The outside optionis normalized to be zero.

The interior solution only exists if the value function is still positive, so the outside option cannot be too large. For simplicity, the outside option is normalized to be zero in the following analyses.

3.2. Comparative Static Analysis When the Number of Directorships N Is Treated as Exogenous

From the above proposition in

Section 3.1, we know that the incentive (PPS)

depends on the riskiness of companies

, the coefficient of risk-aversion of the director

γ, the cost of efforts

c (or equivalently, the ability of the director), the number of directorships

, and the parameter

In this subsection, some comparative static analyses are conducted.

First, the following proposition summarizes the comparative static analyses of incentive (PPS) , considering parameters c, γ, p, and .

Proposition 2. The comparative static analyses suggest that,and. Concerning, the results show thatwhenandwhen.

The standard trade-off between risk-sharing and incentive provisions still applies here. Companies provide lower incentives for more risk-averse directors, since it is more costly to expose them to risk. Risk-sharing is more critical for riskier companies, leading to lower incentives in equilibrium. If a director has greater ability (i.e., the coefficient c in the cost function is smaller), the director’s efforts are more valuable. Thus, companies offer stronger incentives to induce the director to work hard. Regarding the comparative static analyses on

p, when

, suggesting that when efforts become more substitutive, the optimal incentives are greater because companies face fiercer competition. On the other hand, when

p < 0,

, suggesting that when efforts become more complementary (

p < 0 and

p becomes more negative), the optimal incentives are greater due to companies’ strategic behavior. Specifically, company

would like to offer greater incentives, attracting more effort for firm

which in turn reduces the marginal cost for other companies, and induces them to provide more significant incentives and attract more efforts for other firms. This is beneficial to firm

itself due to the reduced marginal cost. This phenomenon is similar to strategic complements in industrial organizations (

Bulow et al. 1985;

Fudenberg and Tirole 1989).

Next, we summarize the relationship between incentives and the number of directorships N in the following proposition:

Proposition 3. The marginal effect of the number of directorships N on the optimal incentive b∗is positive, i.e.,.

When the number of directorships is exogenously given, when exploring the relationship between the number of directorships N and incentives (or PPS), there are two effects: the competition effect and the task interaction effect. As the number of directorships increases, the competition effect suggests that more companies compete for the same director’s effort. Thus, companies will offer more significant incentives, leading to a positive relationship between the number of directorships and incentives. The task interaction effect depends on whether efforts are complementary or substitutive across tasks. When efforts are substitutive with more directorships, it becomes more costly to induce the director to work hard, leading to a negative relationship between the number of directorships and incentives. However, when efforts are complementary, with more directorships, it is less costly to induce the director to work hard, leading to a positive relationship between the number of directorships and the incentives. However, overall, the model finds that: (1) when efforts are complementary, the association between incentives and the number of directorships is positive, since both the competition and task interaction effects are positive, and (2) when substituting efforts, the relationship is still positive because the competition effect dominates the task interaction effect.

In summary, when the number of directorships is exogenous, whether efforts are substitutive or complementary, the relationship between the number of directorships and incentives is always positive, i.e., with more multiple directorships, companies offer more significant incentives.

3.3. Special Case: p = 0

After solving the model, it is interesting to consider a special case and compare the results to those from other classical models. Corollary 1 provides the results when p = 0.

Corollary 1. When p = 0, the optimal contract is, the same as the classical one-principal-one-agent Linear–Exponential–Neutral (LEN) framework.

Proof . Plugging in p = 0 into the expression for gives us □

When p = 0, this model is equivalent to the one-principal-one-agent Linear–Exponential–Neutral (LEN) framework. The intuition for the equivalence is straightforward. Unlike the one-principal-one-agent framework, multiple principals compete for a director’s efforts. The interaction occurs through the non-separability in the cost function, and depending on whether p is positive or negative, if the director exerts more effort for company , the marginal cost for effort at other companies may increase or decrease. When p = 0, the efforts are neither substitutive nor complementary, and thus there is no interaction between contracts offered by different companies. So, the result restores the one-principal-one-agent framework.

3.4. Determining the Optimal Number of Directorships

After solving the optimal contracts given the director’s choice of the number of companies to work for N, we turn to the outside director’s optimal decision of this number at the beginning of the game. The following proposition implicitly specifies the optimal number of directorships the outside director chooses and its determinants.

Proposition 4. The optimal number of directorships N is determined by the director to maximize the following objective function: In the above proposition, the companies’ outside options are normalized to zero. To maximize her payoff, the director decides the optimal number of directorships (N). The function Payoff (.) is complicated, and it is impossible to get a closed-form solution from the first-order condition. We then conduct some numerical analyses on the optimal number of directorships N.

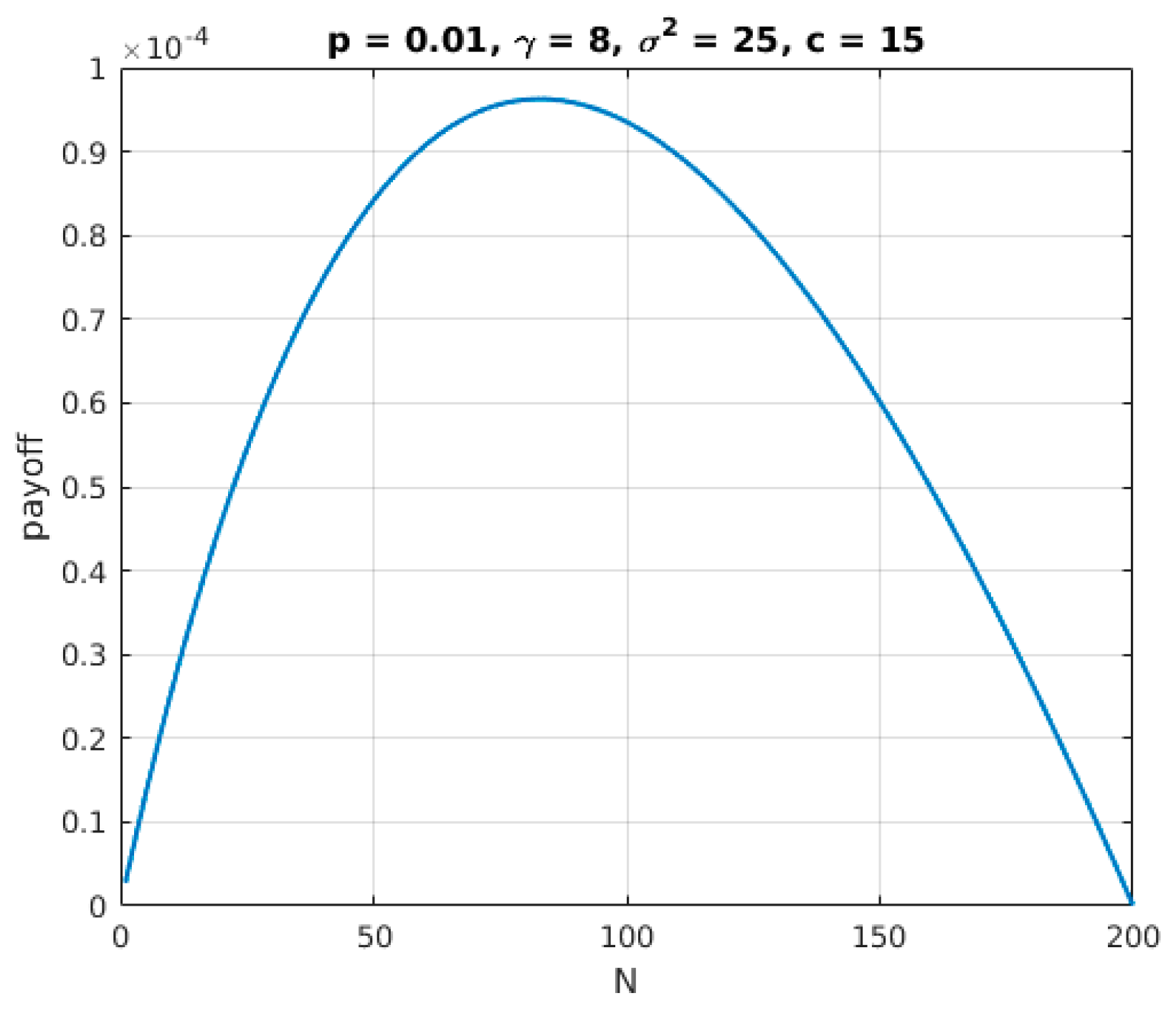

When

p < 0, the efforts are complementary. The more directorships the director holds, the lower the “equivalent” cost, and thus, the director would like to hold as many directorships as possible. The boundary condition in Proposition 1 determines the optimal number of directorships. This case is less interesting. Thus, we only focus on the cases with substitutive efforts in the following numerical analysis. When

p > 0, efforts are substitutive. Following

Figure 1, the payoff first increases and then decreases with the number of directorships. The number of directorships that generate the highest payoff for the director is denoted as the optimal number of directorships. We also try other parameter values and find similar patterns. However, as we cannot get a closed-form solution, this conclusion may not hold with some parameter values.

3.5. Comparative Static Analyses on the Optimal Number of Directorships and the Optimal Incentives

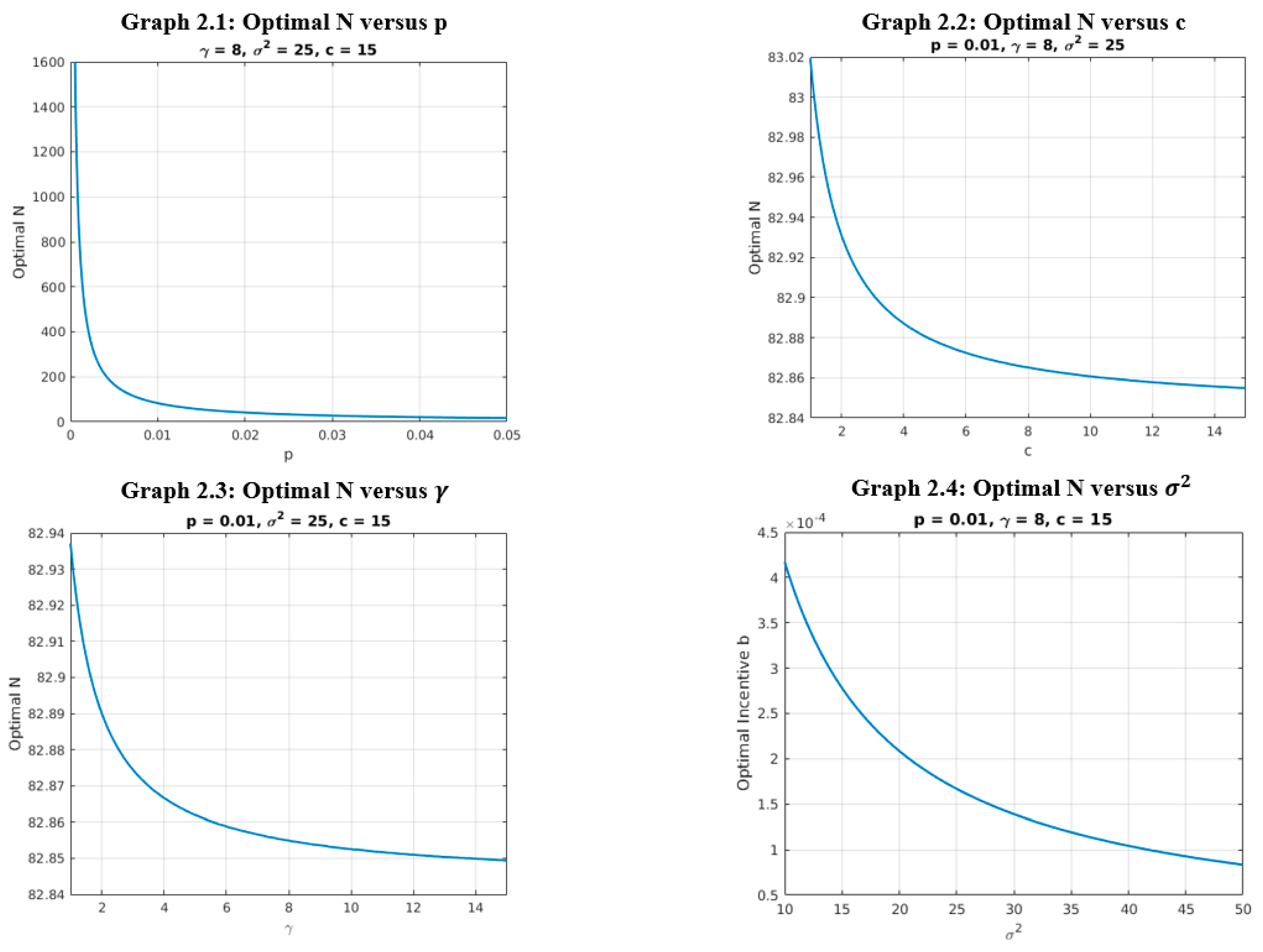

Some comparative static analyses on the optimal number of directorships considering parameters are available using numerical calculations.

First, in Graph 2.1 of

Figure 2, the relationship between the optimal number of directorships and

p is negative. Intuitively, when efforts become more substitutive, serving on more boards will increase the “equivalent” cost of efforts, and thus, the director serves on a few boards.

Second, in

Figure 2, from the graphs, we can see that the relationships between the optimal number of directorships and c (the cost of effort),

γ, and

are all negative. Intuitively, these three graphs can be explained as: (1) the outside director with greater ability (whose parameter

c in the cost function is smaller) serves on more boards, (2) the less risk-averse director serves on more boards, and (3) the riskier the firms, the smaller the number of directorships the outside director holds, i.e.,

,

,

Again, there is a caveat that these results may not hold with other parameter values.

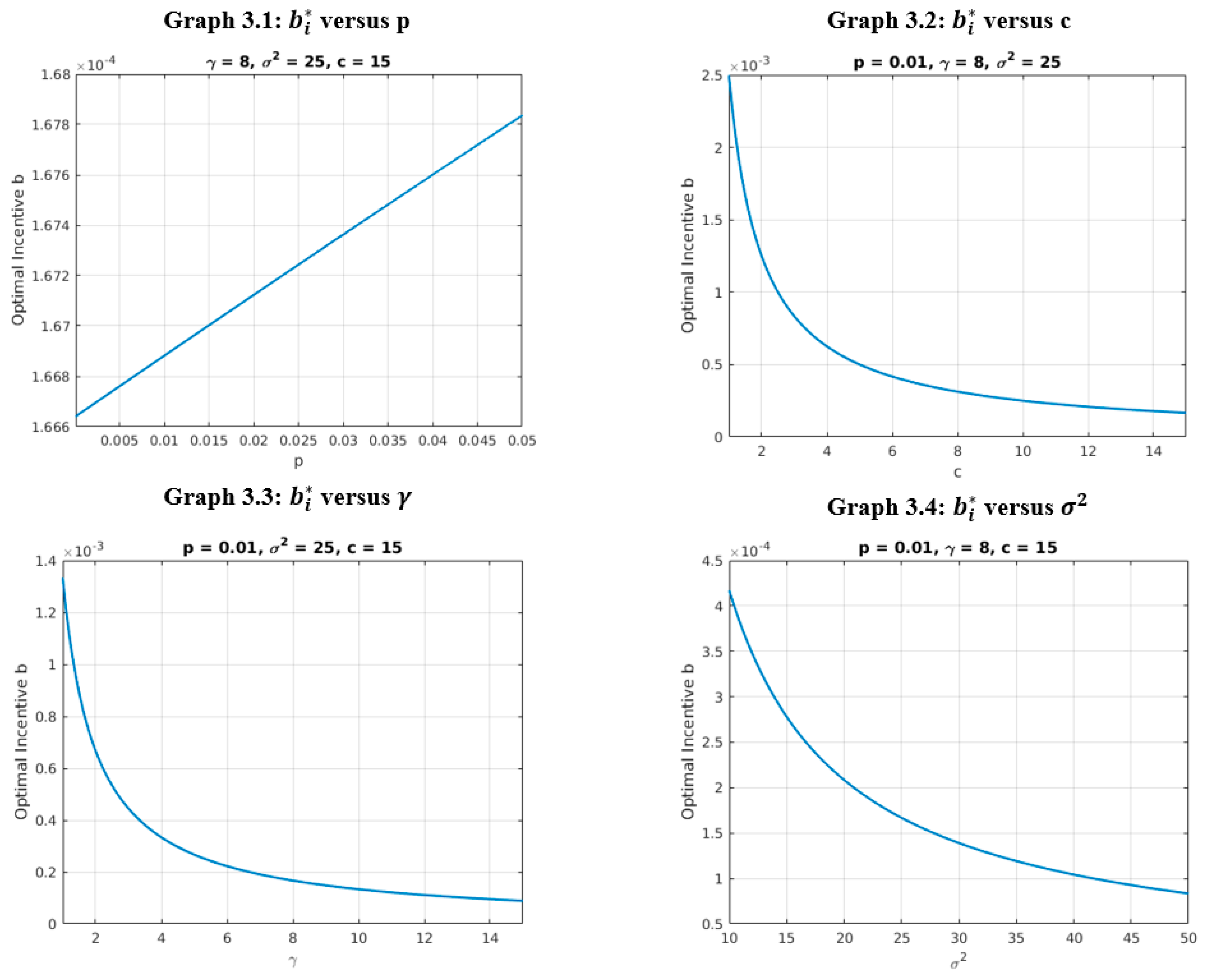

After determining the optimal number of directorships, using numerical analyses, we can recalculate the comparative static analyses for the optimal incentive at the optimal number of directorships .

From the graphs of

Figure 3, when

p > 0, the optimal incentive (PPS)

is increasing with the degree of substitution. Intuitively, the optimal incentives are greater because companies face fiercer competition.

From

Figure 3, we find that the standard trade-off between risk-sharing and incentive provisions still applies even after endogenizing the optimal number of directorships. Companies provide lower incentives for more risk-averse directors, since it is more costly to incentivize them to be exposed to risk. Risk-sharing is more critical for riskier companies, leading to lower incentives. Directors with greater ability are offered stronger incentives. Of course, these results may not hold with other parameter values.

4. Conclusions

Outside directors are crucial to a company’s corporate governance. A unique phenomenon in the outside director market is that outside directors frequently hold multiple board seats, and so they work for multiple firms simultaneously. To our knowledge, this paper is the first to analytically model the relationship between the number of directorships and incentive contracts. We find that when the number of directorships is exogenous, the relationship between the number of directorships N and incentive-based pay (PPS) is always positive, i.e., with more directorships, companies should offer more incentive-based pay. More specifically, the model finds that: (1) when efforts are complementary across boards, the association between incentive pay and the number of directorships is positive, since both the competition and task interaction effects are positive; and (2) when efforts are substitutive, the overall relationship is still positive, because the competition effect dominates the task interaction effect.

Next, we find some results on the determinants of the optimal number of directorships an outside director chooses, as well as optimal incentive contracting. Using comparative static analyses, we find that within some parameter values, with substitutive efforts, outside directors with greater ability serve on more boards, less risk-averse directors serve on more boards, and riskier firms have fewer multiple directorships. Moreover, when efforts across companies are more substitutive, outside directors serve on fewer boards. Numerical comparative static analyses on optimal incentives, after endogenizing the number of directorships, N, find that companies provide more muted incentives for more risk-averse directors, optimal incentives decrease with the companies’ riskiness, directors with a greater ability are offered stronger incentives, and optimal incentives increase with the degree of substitution.

All of our findings may be applied to empirical research, and offer avenues for researchers to test new predictions on the associations between multiple directorships, director pay, and complementarities or interlocks across boards of directors. For example, future empirical research based on our models may examine whether multiple directorships are associated with incentive-based pay, and whether director effort complementarity or substitutability (which may be measured by board interlocks, or the degree of firm similarity among interlocked boards) affect this association. Further, our findings contribute to the policy discussion on proposed limits to the number of board seats that outside directors may serve on by offering evidence of a previously unexplored consequence of multiple directorships: in order to attract directors with multiple board seats, firms must offer high incentive-based pay, leading to higher risk premia and welfare losses than the socially optimal level.