1. Introduction

The recent global widespread adoption of financial technology (FinTech) has driven many innovative financial services that ordinary people can access through their affordable smartphones. The success of FinTech is attributed to the integration of artificial intelligence, data utilisation, finance, and real-world needs for better financial services (

Anshari et al. 2021). FinTech is an amalgam of finance and digital technology that creates innovation in financial services, which leads to new business models, applications, processes, products, or services that have a meaningful impact on financial markets and institutions, as well as providing financial services to consumers (

Schindler 2017). It can be considered a disruptive innovation in the financial sector, as it facilitates disintermediation, and it revolutionises how existing firms create and deliver products and services; address privacy, regulatory and law-enforcement challenges; open new doors for entrepreneurship; and create opportunities for inclusive growth (

Dhar and Stein 2017;

Kim et al. 2015;

Hamdan and Anshari 2020).

FinTech plays a leading role in leveraging information and communications technology (ICT) to deliver financial services in market infrastructure, payments, settlements, digital currencies, and data analytics and improves the efficiency of financial services. FinTech solutions and startups have disrupted or enhanced the finance, banking, and insurance industries conducting business (

Méndez-Suárez et al. 2020). They are becoming one of the fastest-growing sectors in the world of finance and technology. In addition, FinTech has invoked the development of financial innovations, including creating inclusive finance. Financial inclusion is a term that refers to the provision of financial services, such as sending and receiving money, peer-to-peer lending, and crowdfunding that enables almost any group of people, including the underprivileged, to access financial services at a very affordable cost (

Anshari et al. 2019;

Anshari et al. 2020).

What is the next step in the progression of FinTech, particularly in terms of contributing to personal financial management or robo-advisory services for individuals? The evolution of artificial intelligence has gained momentum in transforming big data into significant value for both businesses and individuals. Data that originate from structured and unstructured data sources can be extracted, analysed, and presented to the user comprehensively, resulting in new value co-creation. Digital twin is just one aspect of AI advancement that can be applied to FinTech.

The term “digital twin” (DT) refers to a digital representation of an individual that has the capability of integrating any digital data with virtually real-time data and generating advanced analytics for feedback, recommendation, and alternative solutions for users. DT implies the development of new tools, technologies, and methodologies for collecting, storing, and analysing data, which are then used for better decision making and customer management. This study aims to explore the possibilities of DT for use in developing robo-advisor. The exploratory research method was used in conjunction with thematic analysis from recent studies to gather information for this study. Because DT can achieve value co-creation, it has enormous promise for greatly optimising financial services and management. This value co-creation can then be transformed into a robo-advisory for every user. There is a knowledge gap in this area, and the objective of this study is to fill it and present an insight into the research direction on the implications of DT on personal financial services.

This paper addresses the notion of DT robo-advisor and its characteristics and future directions. The rest of paper is organised as follows: the next section examines the idea of FinTech, robo-advisor, and a section of digital twin.

Section 3 and

Section 4 present a methodology and the proposed model, respectively. Finally,

Section 5 provides the conclusion.

3. Financial Technology and Robo Advisory

Initially, the phrase “financial technology” referred to any technology used at the backend of financial institutions that served both customers and traders. The introduction of the automatic teller machine, also known as the ATM, by Barclays Bank in 1967 marked the beginning of one of the most modern advancements in today’s financial technology (

Arner et al. 2015). As it has been used to refer to any technological breakthrough in the financial sector ever since the beginning of the twenty-first century, it has been expanded to cover financial literacy and education, retail banking, investment and even cryptocurrencies, such as Bitcoin (

Wigglesworth 2016).

FinTech has progressed to the point where it is now possible to transfer funds using a smartphone or another smart mobile device with an internet connection (

Razzaq et al. 2018;

Mulyani et al. 2019). FinTech includes any technological advancements in the money-related sector, including monetary proficiency and training, retail account management, payments and even forms of cryptocurrencies, such as Bitcoin (

Dapp et al. 2014). There are six FinTech business models being adopted by the expanding number of FinTech businesses. These include payment, wealth management, crowdfunding, lending, capital markets, and insurance services (

Lee and Shin 2017).

The growth in FinTech as a continuing process has resulted in various incremental and disruptive developments, such as internet banking, mobile payments, crowdfunding, peer-to-peer lending, and online identity robo-advisory, among others (

Arner et al. 2015). Robo-advisors in the FinTech industry can estimate and forecast how users’ portfolio balance would appear if the user invested according to the strategies of the robo-advisor. This is accomplished by analysing investment strategies and potential risks to determine their impact on personal financial well-being in the future (

Joshi 2021). Overall, the financial sector’s growth due to technology can be divided into three separate eras: analogue technologies, the digitalisation of finance, and the FinTech age (

Ahad et al. 2017;

Hasmawati et al. 2020).

Robo-advisors are digital platforms that employ artificial intelligence (AI) to automatically generate and maintain users’ portfolios. They are created as a low-cost substitute for traditional human advisors. Since its emergence as FinTech startups in the wake of the global financial crisis, robo-advisors have gained a foothold in the financial services industry, particularly as more traditional financial institutions have begun to provide their robo-advisory services (

Abraham et al. 2019).

Robo-advisors are becoming increasingly popular worldwide (

Abraham et al. 2019). Data in 2017 indicated that more than 70 robo-advisors were operating in Europe, five of them handling assets worth more than EUR 100 million (

Phoon and Koh 2017). It was also observed that robo-advisors are becoming more popular in emerging markets. Taking Asia as an example, the number of robo-advisors is rapidly increasing, spurred on by a growing middle-class population and widespread technology connectivity (

Forbes 2017). Robo-advisors are already in use in several countries, including China (mainland), Hong Kong, India, Japan, Singapore, Thailand, and Vietnam. The existence of robo-advisors is also present in other emerging economies, but their numbers are limited at this time. For example, there are only six robo-advisors throughout the entire continents of Africa and Latin America, combined (

Phoon and Koh 2017).

Robo-advisors begin by determining the investment strategy for each individual based on their investment objectives and risk tolerance (

Abraham et al. 2019). Robo-advisors inquire about the aim of the investment and the time horizon of users. Retirement, substantial planning, establishing funds and generating an income stream to cover living expenses are all outcomes that robo-advisors may help users achieve through investment strategies. Robo-advisors will ask objective and subjective questions to determine a user’s willingness and ability to tolerate risk in diverse circumstances. Based on these two aspects, robo-advisors employ automated algorithms to suggest distributing funds across different types of assets. These algorithms are based on current portfolio selection (

Bjernes and Vukovic 2017). Since robo-advisors are inexpensive and easily accessible, they can encourage more sophisticated investment practices among people that are not accustomed to having easy and affordable access to the services of professional financial advisors. The following section introduces DT and how it can benefit FinTech. While DT is still in its early stages, it is expected to propel robo-advisors to the next stage of FinTech development.

4. Digital Twin

Many organisations might adopt digital twin in a variety of ways. For example, in health care, cardiovascular experts can utilise digital twin to construct a realistic replica or 3D model of the human heart to aid in cardiovascular education and training. This contributes to the generation of new knowledge in some ways. Additionally, digital twins can help transform how businesses maintain their products and machines. This is accomplished by using sensors embedded in the devices, which transmit performance data to the Digital Twin. This enables businesses to recognise and address any problems in advance, making them far more efficient (

Parrott et al. 2020).

Having a digital twin makes it possible for people to be more productive and efficient because of the rapid development of the internet and the digital technologies that use it. With the internet of things (IoT), artificial intelligence (AI), and machine learning on its side, acceleration is happening in innovations and knowledge generation in many areas, including healthcare and urban planning. For example, digital twins are useful in healthcare for a variety of purposes, including diagnosis, monitoring, surgery, medical equipment, new medication research, and regulation (

Orcajo 2021). Additionally, digital twins enable doctors to evaluate some medicines prior to conducting clinical trials on real patients, ensuring patient safety (

Frearson 2021). To illustrate, Siemens Healthineers, a company that invests heavily in digital technology, such as artificial intelligence, has developed a digital heart twin to assist physicians in making correct diagnoses (

Copley 2018;

Méndez-Suárez et al. 2019). Additionally, the digital heart twin saves money and eliminates the need for unnecessary procedures (

Copley 2018).

In urban planning, DT simulation enables developers to think creatively when considering a smart city. They assist researchers in studying future infrastructure and city planning by recreating a metropolis into a three-dimensional model (

McCall 2021). With the IoT and cloud computing, digital twins supply information that assists city developers, such as engineers and architects, in visualising their cities (

McCall 2021). For instance, a Chinese business called 51World employed digital technology to create 3D city models of Shanghai and Singapore (

Frearson 2021). The 3D digital city model exemplifies the digital revolution of digital twins for smart cities by serving as a platform for exploring ways to improve city infrastructures such as public transportation, skyscrapers, and traffic signals.

Making better and faster decisions that can be executed flawlessly is critical for delivering superior and long-term business value to organisations. DT could perhaps be the key to making intelligent decisions in this new reality. DT is a virtual representation of an object or system that spans its lifecycle. It is updated from real-time data and employs simulation, machine learning, and reasoning to assist decision makers in making decisions about that object or system (

Armstrong 2020). For example, it could include developing a highly complicated virtual model that is the counterpart (or twin) of a physical thing.

The ‘thing’ might be an individual who consistently produces data from any smart mobile device: physical or digital activity connected sensors on the physical being collect data that can be mapped into the virtual model. In a nutshell, a DT can gather pertinent data about how a physical thing is performing in the actual world. By simulating a real-world event in virtual reality, DTs can improve the capabilities of the robo-advisor.

DT would record all of the data, conduct a simulation to determine how the system would work in various real-world settings, and then advise the physical twin on the options. In addition, by constructing DTs, we can simulate and test how the twin might operate in different settings or conditions without putting its real-world twin at risk of failing or crashing (

Mistry 2021). The beauty of DT is that it will learn from us by gathering all of the data created, as well as specific patterns and behaviour, particularly those related to our finance-related activities, and then display individualised recommendations and suggestions.

6. Digital Twin and Robo-Advisor

The bibliographic analysis of relevant work in the domain under investigation consisted of three steps: (a) collecting of relevant work, (b) filtering of relevant work, and (c) in-depth review and analysis of state-of-the-art related work. The first phase was conducting a keyword search for conference papers and articles in the Scopus databases and Google Scholar (

Henninger 2012) from a bibliographic analysis of publications indexed by Scopus using the keyword “Digital Twin”. As presented in

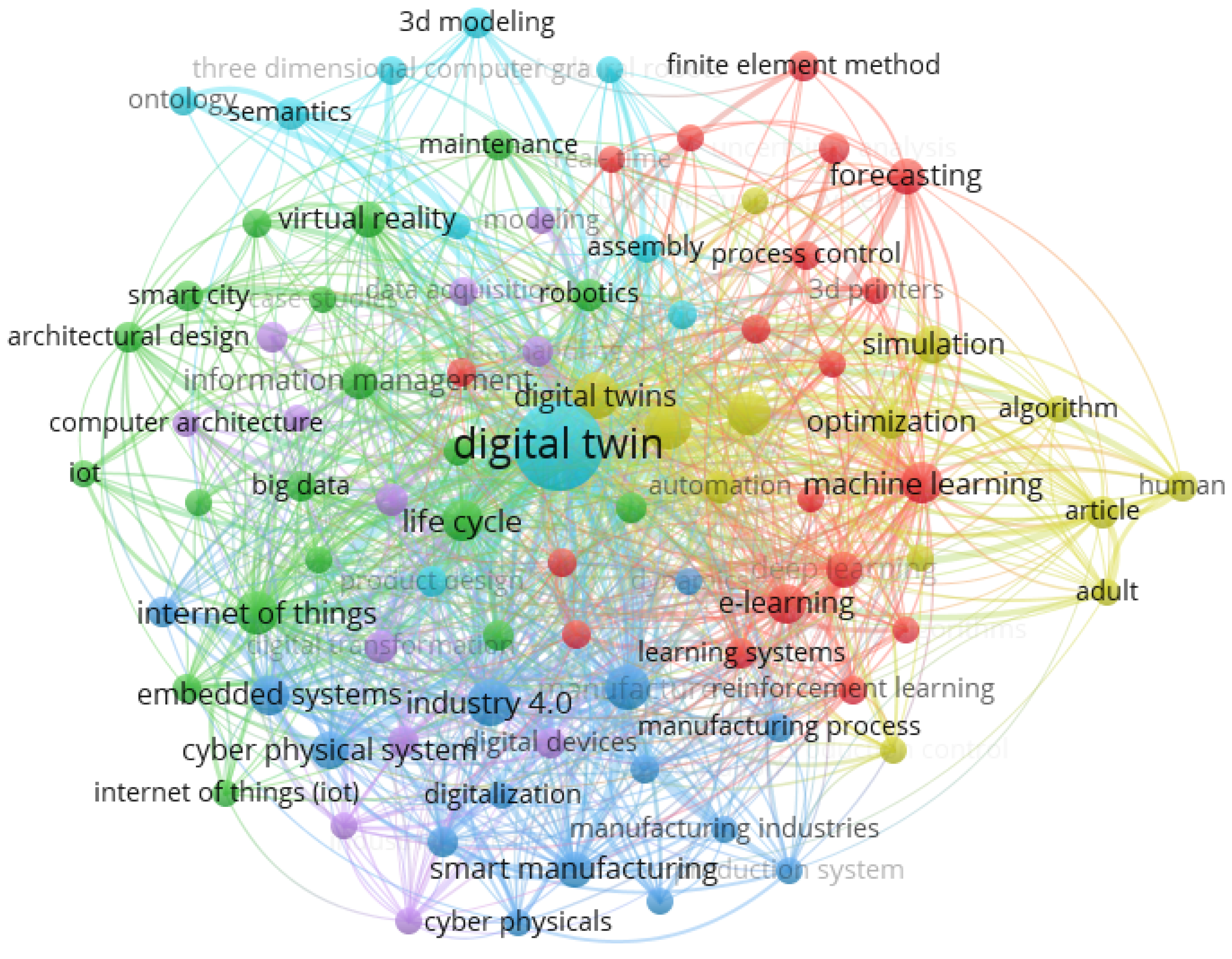

Figure 1, most of the research on a digital twin is related to Industry 4.0, cyber–physical systems, machine learning, IoT, and smart manufacturing. There is very little research done on FinTech with DT enabled. Therefore, this paper assists in developing research on FinTech and robo-advisor trends in the future.

The development of financial robo-advisor with DT enabled is driven by the massive smartphone adoption. Individual activities are identified, tracked, and recorded digitally, which can be digitally extracted and analysed for value creation. The dependency of individuals on smart mobile devices, especially smartphones, is explicit, as evidenced by the rapidly changing smartphone usage as people spend more time online using their smartphones. The digital activities of individuals may include e-commerce, digital transactions, investment, payment or buying online, and social media interactions. Smart mobile devices, such as smartphones and laptops, have become a front-end device of individuals engaging in almost daily financial activities directly or indirectly and are also used as tools to manage finances anytime and anywhere.

In typical robo-advisor services, individual data do not offer much value because they are used in an ad hoc manner. For example, a robo-advisor can be an app, a website, or any other digital platform that makes it possible to recommend an investment portfolio based solely on the investment objectives and risk tolerance level. It does not represent the entire financial pattern and situation but rather the data gathered from the individual digital footprint. Consequently, the data may not provide accurate and complete information that comprise ideas, analysis, diagnosis, predictions or recommendations, which could be transformed into knowledge to develop new things, new business models, and innovative financial solutions for individuals. This is because they are unable to acquire a complete understanding from the digital data that they generate.

In

Figure 1, a digital twin scenario that enhances the capabilities of robo-advisors for personal financial management is shown. The model highlights the interrelated, holistic, and iterative aspects of the physical and digital ecosystems. The core concept of the digital twin allows discourse in knowledge-building individuals beyond the conventional patterns. Robo-advisor shows a future scenario for personal financial management.

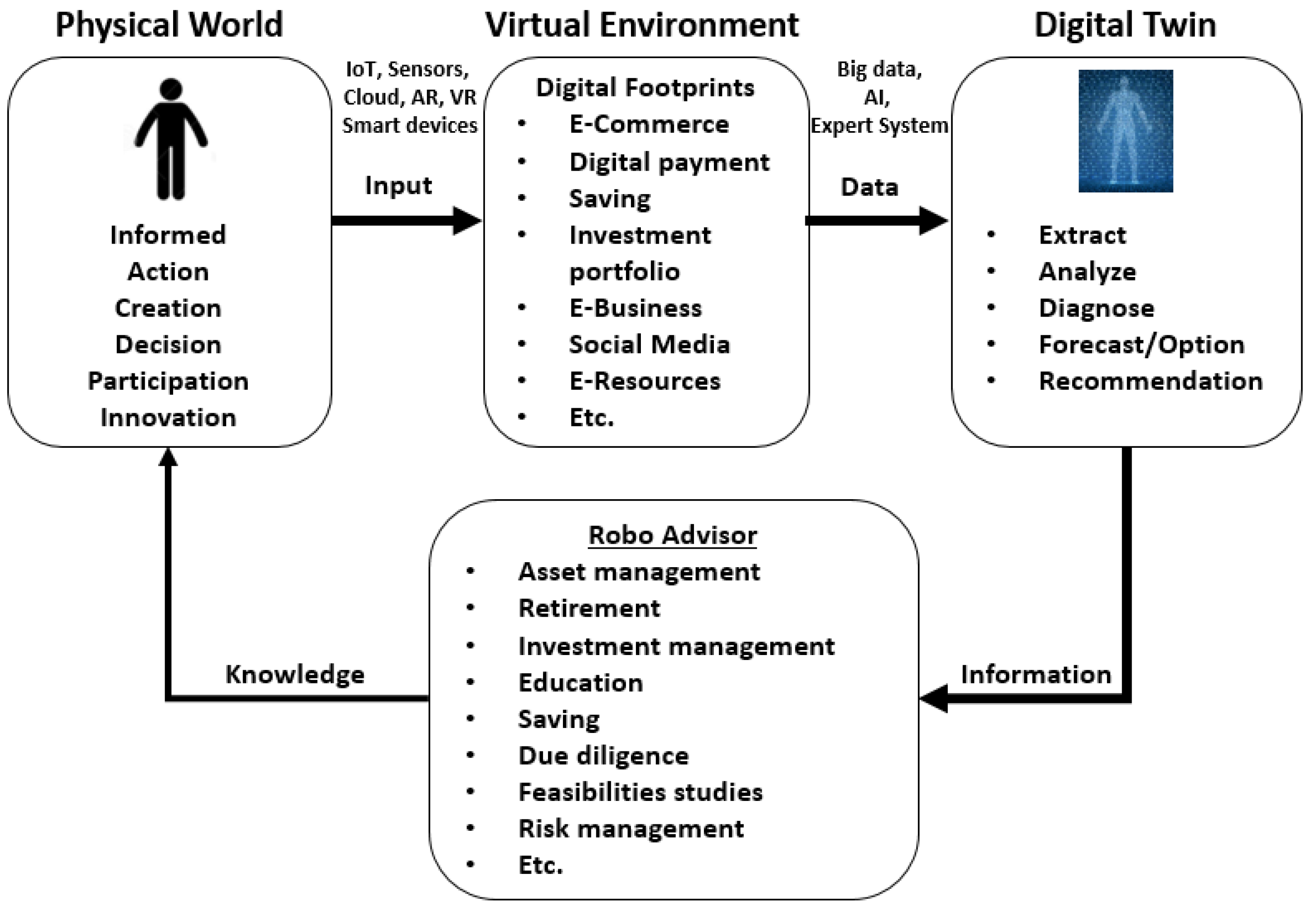

In the case of robo-advisor with DT enabled (see

Figure 2), personal data will be integrated into a platform that will operate as a digital twin. Raw data produced by individuals from numerous data sources, such as IoT, sensors, cloud computing technologies, and smart mobile devices, create a personal digital footprint of their online financial activities, which may be traced back to them. Every digital activity is listened to, recorded, extracted, and diagnosed in order to be translated into forecasts, analyses, and recommendations for the individual. Individuals have the ability to access, update, and interactively engage with their DT in order to acquire various options and recommendations. The outcome of intelligent interaction between individuals and DT improves the DT’s capabilities as a robo-advisor in terms of providing feedback and suggestions for asset management, retirement, investing, education, saving, due diligence, risk management, and other purposes that will offer a significantly greater value for their financial management and well-being.

When combined with a digital twin, robo-advisor will become a core platform from which individuals can expect significantly more value for their well-being. In the future, the robo-advisor’s platform will no longer be static, but will instead convert into a dynamic and comprehensive digital advisor platform with interactivity elements to assist in the difficult financial decision-making process. This is accomplished by extracting all of the digital activity processes associated with a user and then thoroughly analysing them across all of the e-services that the person uses. Once this is accomplished, whenever critical issues or problems arise that must be communicated to the (physical) user, the digital twin will give options, answers, and recommendations that are based on the whole data continuum that has been obtained.

Robo-advisor with DT enabled can become a robust platform that keeps track of an individual’s investment monitoring 24 h a day, 7 days a week. DT has the ability to monitor any movement that may have an impact on an individual’s investment, whether it is beneficial or unfavourable, based on digital resources that are constantly updated in real time. Individuals can be notified in real time if they are about to make a profit or loss on their investment. Furthermore, DT not only sends messages to the user, but also provides solution alternatives based on the analysis findings. Recommended actions for the user include the types of actions that must be taken and the types of tasks that must be completed immediately. The near real-time synchronisation of data between physical and digital systems is the essence of a digital twin for the purposes of problem prevention and response. In summary, the data integration of the digital twin allows users to receive financial and commercial advice based on the extraction of available e-commerce data and e-resources from the DT.

Individuals will be able to visualise how their financial well-being performs in real time and enhance their talents with the help of a digital twin. The information obtained from the digital twin can be used for planning and development purposes. The forecast will track the progress and make decisions based on the latest modelling techniques, starting with the current situation. When financial robo-advisory is ready to embrace DT, individuals can then analyse alternative action options, measure their capabilities, and calculate the resulting cost functions to determine the best course of action.

Finally, why is the development of DT applications so important for the advancement of the next stage of financial technology (FinTech)? Individuals can use the digital twin to keep track of their extensive financial activities that are derived from their own digital footprint, such as e-commerce, digital wallets, e-business, social media activities, and any other digital data that are generated that form patterns and behaviours in an individual’s life. Therefore, having a digital twin integrated inside their FinTech platform as a robo-advisor will allow them to gain a thorough awareness of themselves in near real time, as well as improving their own performance through recommendations presented by DT. People will be able to monitor in real time how their financial well-being is performing with the use of DT, which will allow them to improve their qualities. Information gathered through DT can be used to improve individual planning and growth. Once individuals have evaluated various action choices, assessed their talents, and estimated the ensuing cost functions, they may select the optimal course of action for the next steps, all of which are possible when DT is integrated into FinTech systems.