A Singular Stochastic Control Approach for Optimal Pairs Trading with Proportional Transaction Costs

Abstract

1. Introduction

2. A Pairs Trading Problem with Proportional Transaction Costs

2.1. Model Specification

2.2. The Hamilton-Jacobi-Bellman Equations and Free Boundary Problems

- (i)

- buying stock P and sell stock Q at the same rate (i.e., ) when

- (ii)

- selling stock P and buy stock Q at rate (i.e., ) when

- (iii)

- doing nothing (i.e., ) when

2.3. Optimal Trading with Exponential Utility Functions

3. Discretization and a Numerical Algorithm

4. Simulation Studies

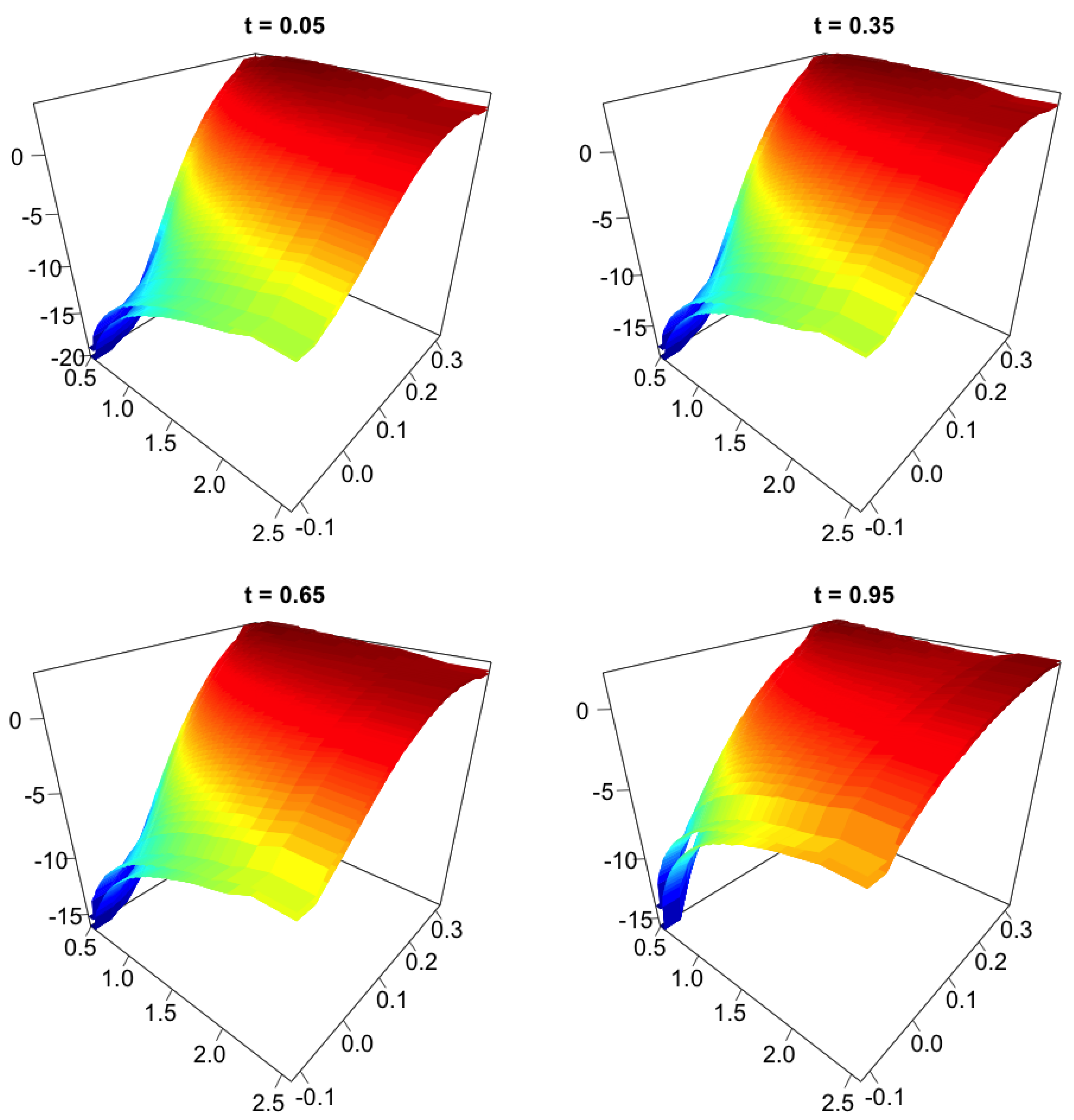

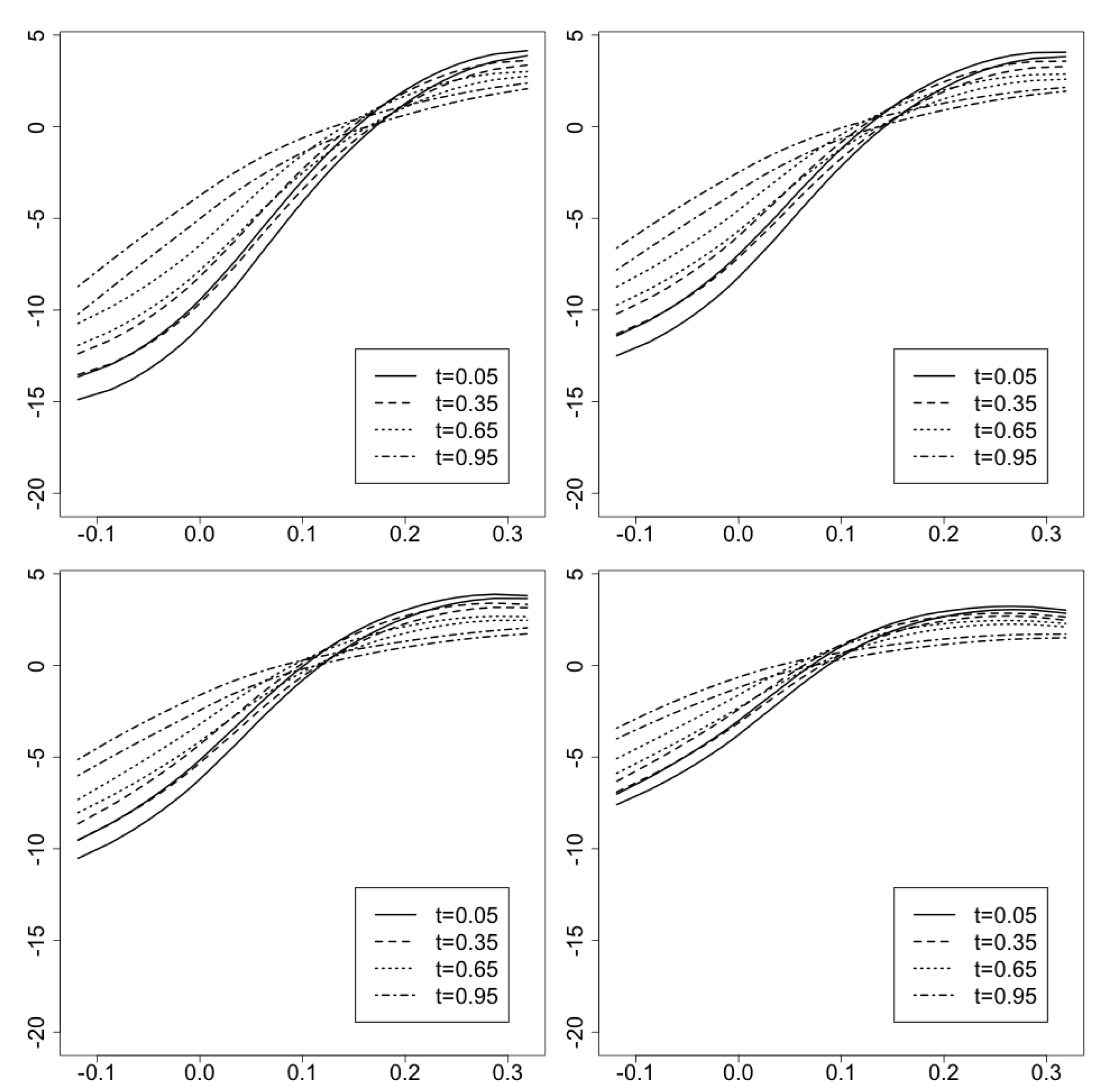

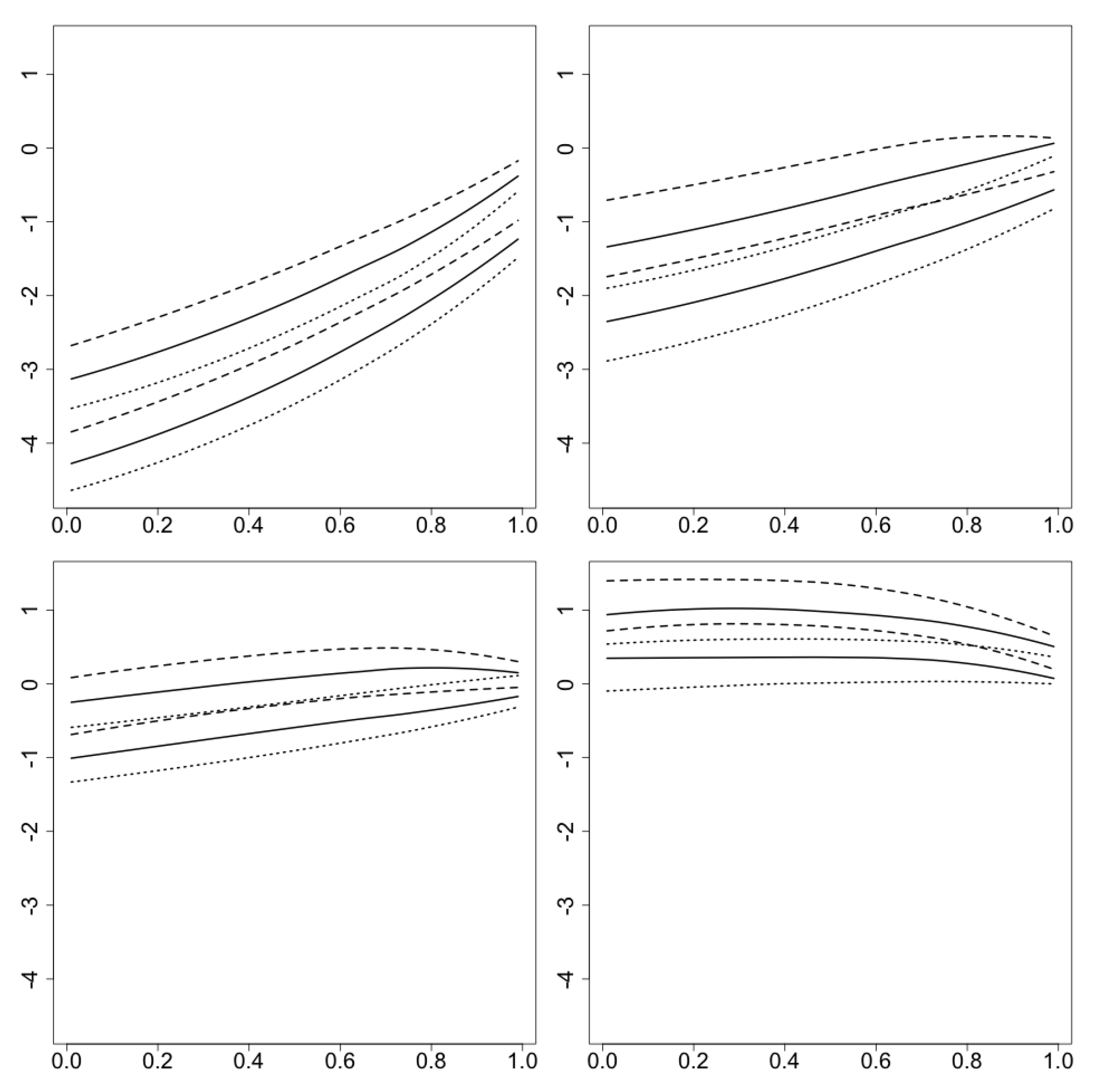

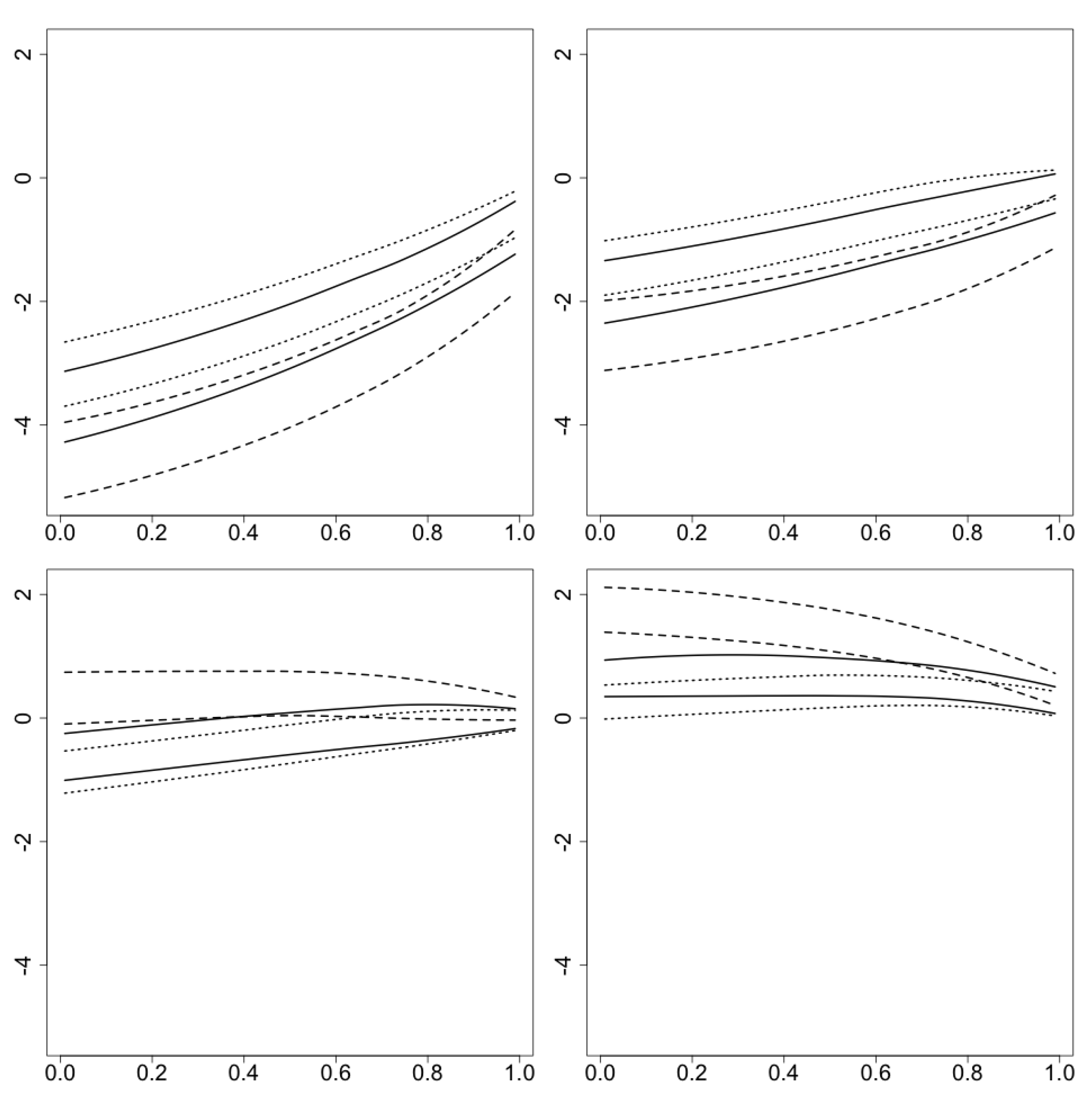

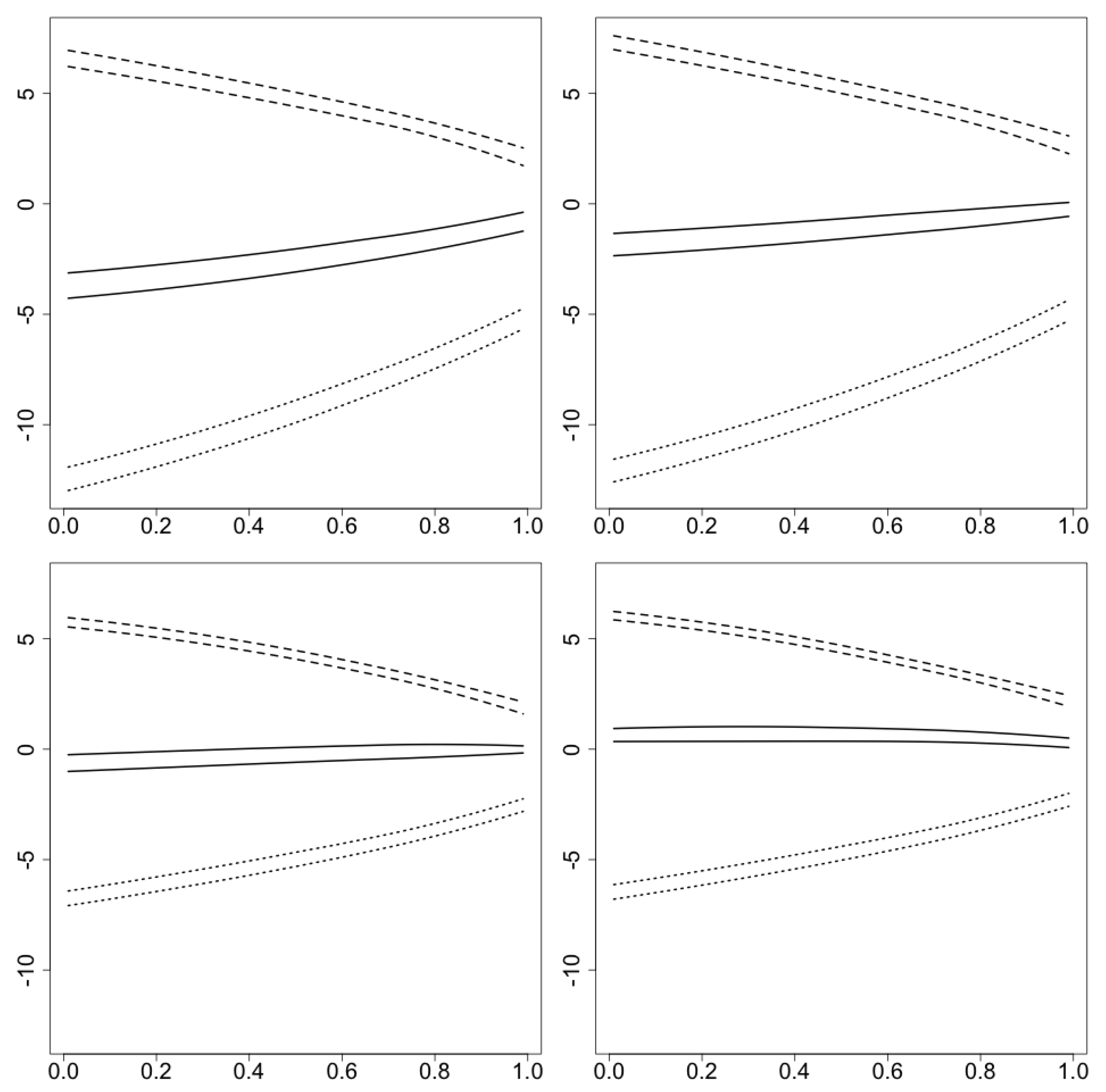

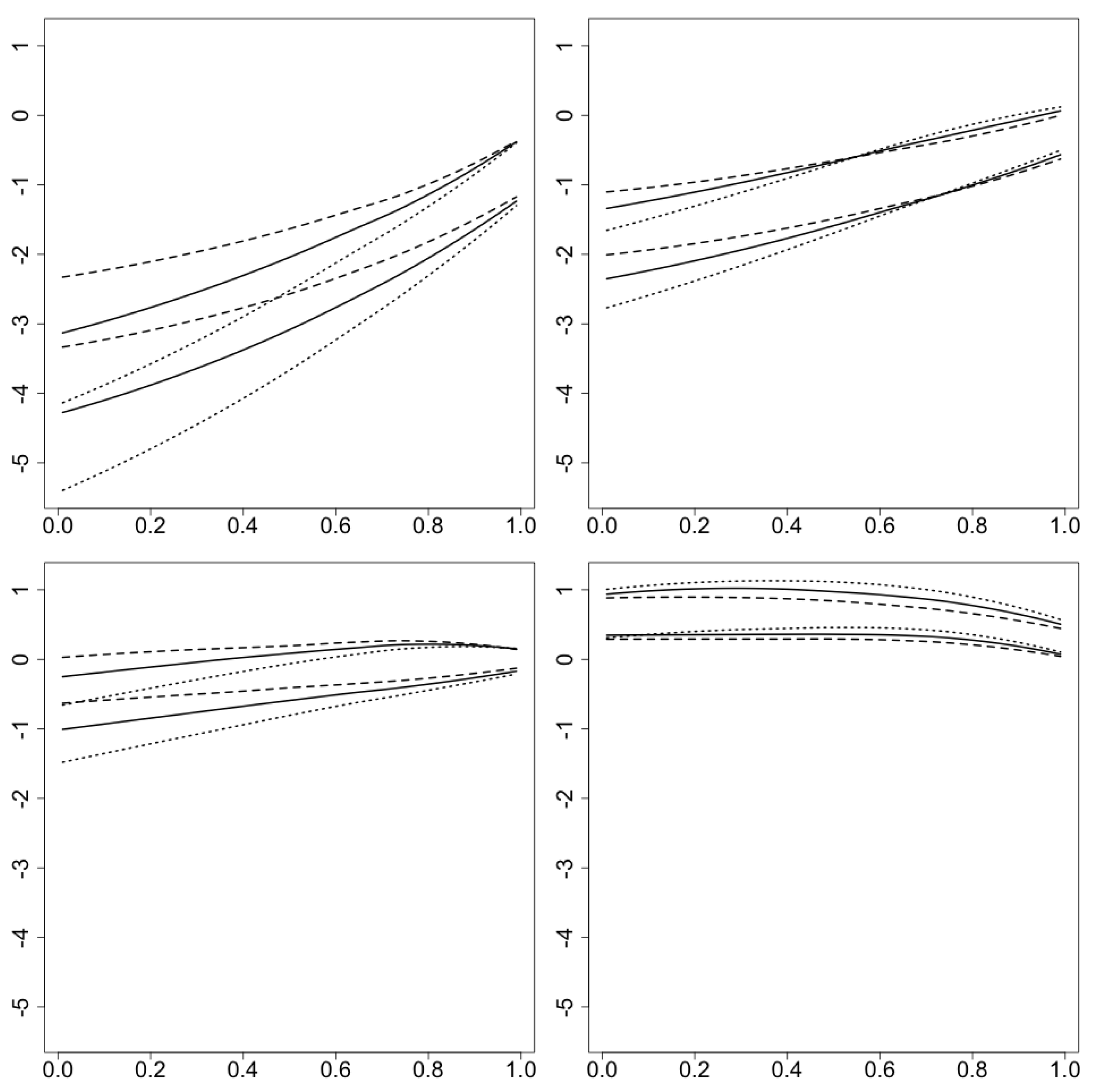

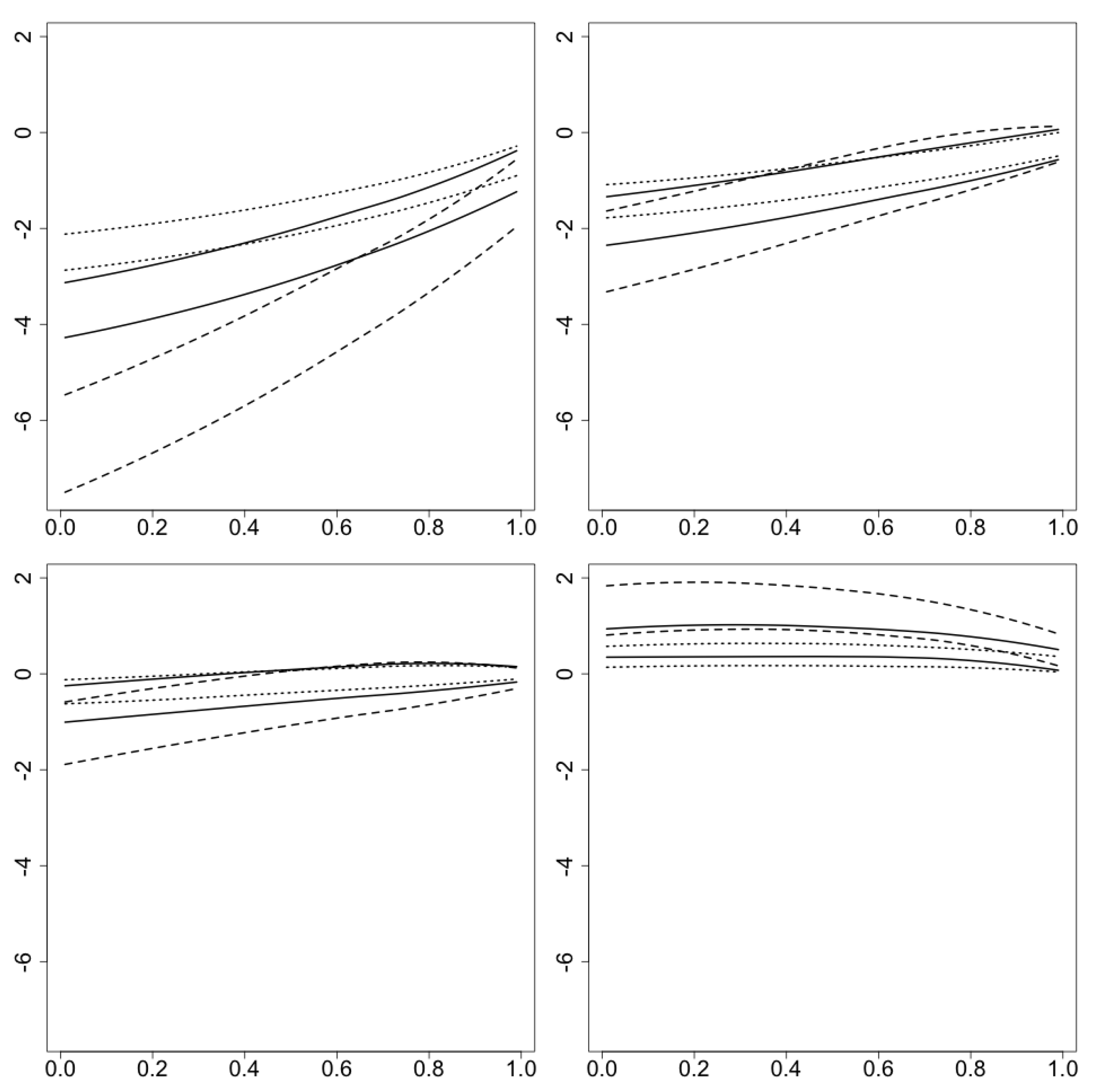

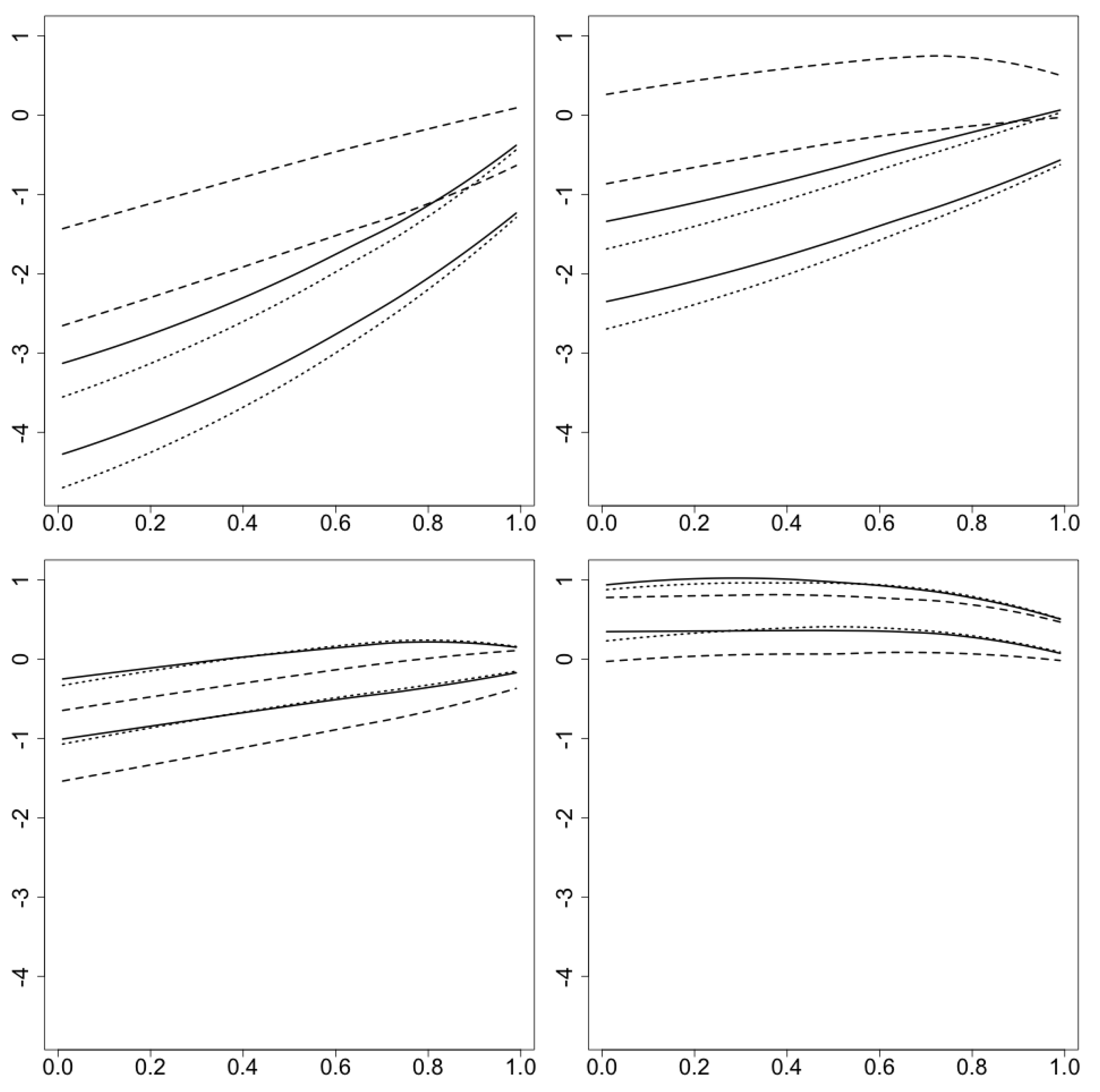

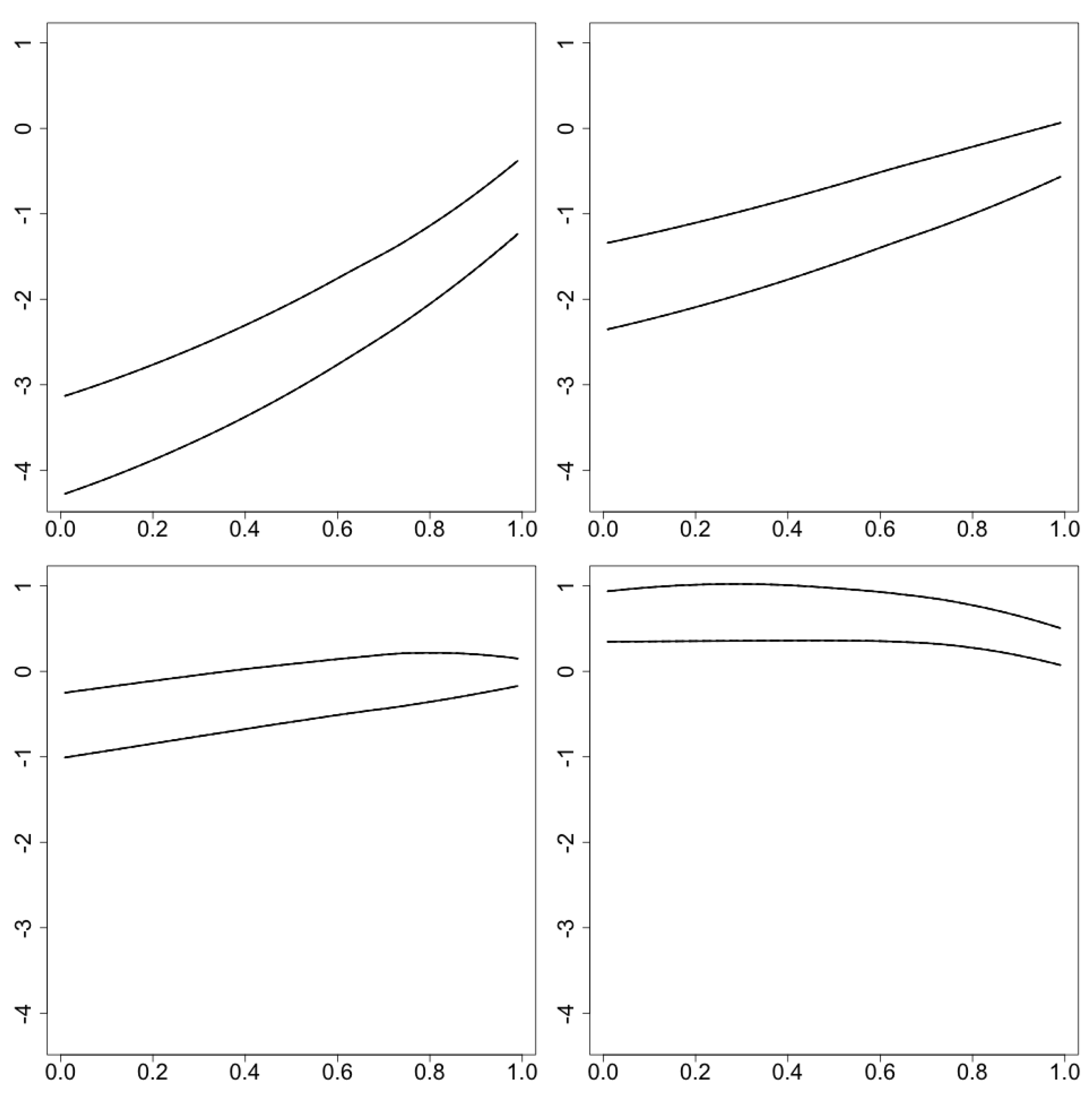

4.1. Buy and Sell Regions

4.2. Performance of the Strategy

5. Real Data Studies

6. Concluding Remark

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Theorems

References

- Davis, Mark H. A., Vassilios G. Panas, and Thaleia Zariphopoulou. 1993. European option pricing with transaction costs. SIAM Journal on Control and Optimization 31: 470–93. [Google Scholar] [CrossRef]

- Ehrman, Douglas S. 2006. The Handbook of Pairs Trading: Strategies Using Equities, Options, and Futures. Hoboken: John Wiley and Sons. [Google Scholar]

- Elliott, Robert J., John Van Der Hoek, and William P. Malcolm. 2005. Pairs Trading. Quantitative Finance 5: 271–76. [Google Scholar] [CrossRef]

- Gatev, Evan, William N. Goetzmann, and K. Geert Rouwenhorst. 2006. Pairs trading: Performance of a relative-value arbitrage rule. The Review of Financial Studies 19: 797–827. [Google Scholar] [CrossRef]

- Lai, Tze Leung, and Haipeng Xing. 2008. Statistical Models and Methods for Financial Markets. New York: Springer. [Google Scholar]

- Lei, Yaoting, and Jing Xu. 2015. Costly arbitrage through pairs trading. Journal of Economic Dynamics and Control 56: 1–19. [Google Scholar] [CrossRef]

- Leung, Tim, and Xin Li. 2015. Optimal mean reversion trading with transaction costs and stop-loss exit. International Journal of Theoretical and Applied Finance 18: 1550020. [Google Scholar] [CrossRef]

- Mudchanatongsuk, Supakorn, James A. Primbs, and Wilfred Wong. 2008. Optimal pairs trading: A stochastic approach. Paper presented at 2008 American Control Conference, Seattle, WA, USA, June 11–13. [Google Scholar]

- Ngo, Minh-Man, and Huyen Pham. 2016. Optimal switching for the pairs trading rule: A viscosity solutions approach. Journal of Mathematical Analysis and Applications 441: 403–25. [Google Scholar] [CrossRef][Green Version]

- Song, Qingshuo, and Qing Zhang. 2013. An optimal pairs-trading rule. Automatica 49: 3007–14. [Google Scholar] [CrossRef]

- Tourin, Agnès, and Raphael Yan. 2013. Dynamic pairs trading using the stochastic control approach. Journal of Economic Dynamics and Control 37: 1972–81. [Google Scholar] [CrossRef]

- Vidyamurthy, Ganapathy. 2004. Pairs Trading—Quantitative Methods and Analysis. New York: John Wiley and Sons. [Google Scholar]

- Whistler, Mark. 2004. Trading Pairs—Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies. New York: John Wiley and Sons. [Google Scholar]

- Xing, Haipeng, Yang Yu, and Tiong Wee Lim. 2017. European option pricing under geometric levy processes with proportional transaction costs. Journal of Computational Finance 21: 101–27. [Google Scholar]

- Zhang, Hanqin, and Qing Zhang. 2008. Trading a mean-reverting asset: Buy low and sell high. Automatica 44: 1511–18. [Google Scholar] [CrossRef]

| (S1) , | ||

| and . | ||

| (S2) | (S8) | (S14) |

| (S3) | (S9) | (S15) |

| (S4) | (S10) | (S16) |

| (S5) | (S11) | (S17) |

| (S6) | (S12) | (S18) |

| (S7) | (S13) | (S19) |

| (S1) | 52.289 (0.247) | 0.349 (0.019) | 0.048 (0.004) | 1.094 (0.084) | 0.005 (0.002) | 0.005 (0.002) |

| (S2) | 53.218 (0.241) | 0.389 (0.020) | 0.051 (0.004) | 1.094 (0.084) | 0.006 (0.002) | 0.006 (0.002) |

| (S3) | 51.348 (0.253) | 0.318 (0.019) | 0.046 (0.004) | 1.094 (0.084) | 0.004 (0.002) | 0.004 (0.002) |

| (S4) | 52.999 (0.208) | 0.378 (0.019) | 0.054 (0.003) | 1.094 (0.084) | 0.007 (0.002) | 0.007 (0.002) |

| (S5) | 51.896 (0.275) | 0.326 (0.019) | 0.040 (0.005) | 1.094 (0.084) | 0.003 (0.004) | 0.003 (0.004) |

| (S6) | 49.299 (0.235) | 0.357 (0.020) | 0.032 (0.003) | 1.094 (0.084) | 0.003 (0.002) | 0.003 (0.002) |

| (S7) | 54.233 (0.262) | 0.344 (0.019) | 0.064 (0.005) | 1.094 (0.084) | 0.008 (0.003) | 0.008 (0.003) |

| (S8) | 55.821 (0.304) | 0.359 (0.021) | 0.062 (0.006) | 1.094 (0.084) | 0.005 (0.003) | 0.005 (0.003) |

| (S9) | 45.736 (0.254) | 0.266 (0.016) | 0.046 (0.003) | 1.094 (0.084) | 0.005 (0.002) | 0.005 (0.002) |

| (S10) | 46.347 (0.292) | 0.228 (0.016) | 0.042 (0.005) | 1.052 (0.083) | 0.004 (0.002) | 0.004 (0.002) |

| (S11) | 57.689 (0.212) | 0.489 (0.022) | 0.053 (0.003) | 1.206 (0.084) | 0.007 (0.002) | 0.007 (0.002) |

| (S12) | 46.774 (0.248) | 0.325 (0.015) | 0.065 (0.003) | 1.140 (0.086) | 0.008 (0.001) | 0.008 (0.001) |

| (S13) | 53.516 (0.245) | 0.361 (0.020) | 0.045 (0.004) | 1.140 (0.087) | 0.006 (0.002) | 0.006 (0.002) |

| (S14) | 54.027 (0.232) | 0.579 (0.032) | 0.048 (0.004) | 1.094 (0.084) | 0.005 (0.002) | 0.005 (0.002) |

| (S15) | 50.031 (0.266) | 0.219 (0.012) | 0.049 (0.004) | 1.094 (0.084) | 0.005 (0.002) | 0.005 (0.002) |

| (S16) | 52.300 (0.247) | 0.347 (0.019) | 0.048 (0.004) | 1.094 (0.084) | 0.005 (0.002) | 0.005 (0.002) |

| (S17) | 52.261 (0.247) | 0.357 (0.019) | 0.050 (0.004) | 1.094 (0.084) | 0.006 (0.002) | 0.006 (0.002) |

| (S18) | 73.801 (0.286) | 0.339 (0.019) | 0.045 (0.004) | 1.094 (0.084) | 0.006 (0.002) | 0.006 (0.002) |

| (S19) | 42.996 (0.222) | 0.339 (0.019) | 0.049 (0.004) | 1.094 (0.084) | 0.004 (0.002) | 0.004 (0.002) |

| Sector | Stock Q | Stock P |

|---|---|---|

| Consumer goods | Apple Inc. (AAPL) | Procter & Gamble Co. (PG) |

| Consumer goods | Coca-Cola Co. (KO) | PepsiCo, Inc. (PEP) |

| Technology | Alphabet Inc Class A (GOOGL) | Microsoft Corporation (MSFT) |

| Technology | AT&T Inc. (T) | Verizon Communications Inc. (VZ) |

| Industrial goods | Boeing Corporation (BA) | General Electric Company (GE) |

| Financial | Goldman Sachs Group Inc. (GS) | JPMorgan Chase & Co. (JPM) |

| Pairs | Year | ||||||

|---|---|---|---|---|---|---|---|

| (AAPL, PG) | 2014 | 58 | 8.56 | 2.173 | 0 | 0 | 0 |

| 2015 | 70 | 25.439 | 3.91 | 0 | 0 | 0 | |

| (BA, GE) | 2014 | 97 | 27.866 | 1.292 | 0 | 0 | 0 |

| 2015 | 165 | 168.543 | 1.982 | 20 | 0.455 | 0.455 | |

| (T, VZ) | 2014 | 127 | 77.908 | 2.158 | 2 | 0.603 | 0.603 |

| 2015 | 131 | 115.587 | 2.883 | 0 | 0 | 0 | |

| (GOOGL, MSFT) | 2015 | 103 | 94.271 | 6.734 | 8 | 1.623 | 1.623 |

| 2016 | 135 | 65.957 | 6.296 | 0 | 0 | 0 | |

| (GS, JPM) | 2015 | 100 | 7.654 | 0.195 | 6 | −2.54 | −2.54 |

| 2016 | 200 | 94.542 | 2.375 | 8 | −1.66 | −1.66 | |

| (KO, PEP) | 2015 | 142 | 37.51 | 0.675 | 22 | 10.154 | 10.154 |

| 2016 | 165 | 217.878 | 4.059 | 4 | 5.983 | 5.983 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xing, H. A Singular Stochastic Control Approach for Optimal Pairs Trading with Proportional Transaction Costs. J. Risk Financial Manag. 2022, 15, 147. https://doi.org/10.3390/jrfm15040147

Xing H. A Singular Stochastic Control Approach for Optimal Pairs Trading with Proportional Transaction Costs. Journal of Risk and Financial Management. 2022; 15(4):147. https://doi.org/10.3390/jrfm15040147

Chicago/Turabian StyleXing, Haipeng. 2022. "A Singular Stochastic Control Approach for Optimal Pairs Trading with Proportional Transaction Costs" Journal of Risk and Financial Management 15, no. 4: 147. https://doi.org/10.3390/jrfm15040147

APA StyleXing, H. (2022). A Singular Stochastic Control Approach for Optimal Pairs Trading with Proportional Transaction Costs. Journal of Risk and Financial Management, 15(4), 147. https://doi.org/10.3390/jrfm15040147