Imperfect Competition, Real Estate Prices and New Stylized Facts

Abstract

1. Introduction

The Kaldor’s facts are:KF1: Per capita output grows over time.KF2: Capital per capita grows over time.KF3: The rate of return to capital is constant.KF4: Capital to output ratio is constant.KF5: Factor shares are constant.KF6: Per capita growth rates differ among countries.Kaldor (1961, p. 178) argued that:Since facts, as recorded by statisticians, are always subject to numerous snags and qualifications, and for that reason are incapable of being accurately summarized, the theorist, in my view, should be free to start off with a “stylized” view of the facts—i.e., concentrate on broad tendencies, ignoring individual detail, and proceed on the “as if” method, i.e., construct a hypothesis that could account for these “stylized” facts, without necessarily committing himself on the historical accuracy, or sufficiency, of the facts or tendencies thus summarized.

2. Background of Increasing Market Power

3. The Model

3.1. The Households

3.2. The Production

3.3. The Allocation of Land

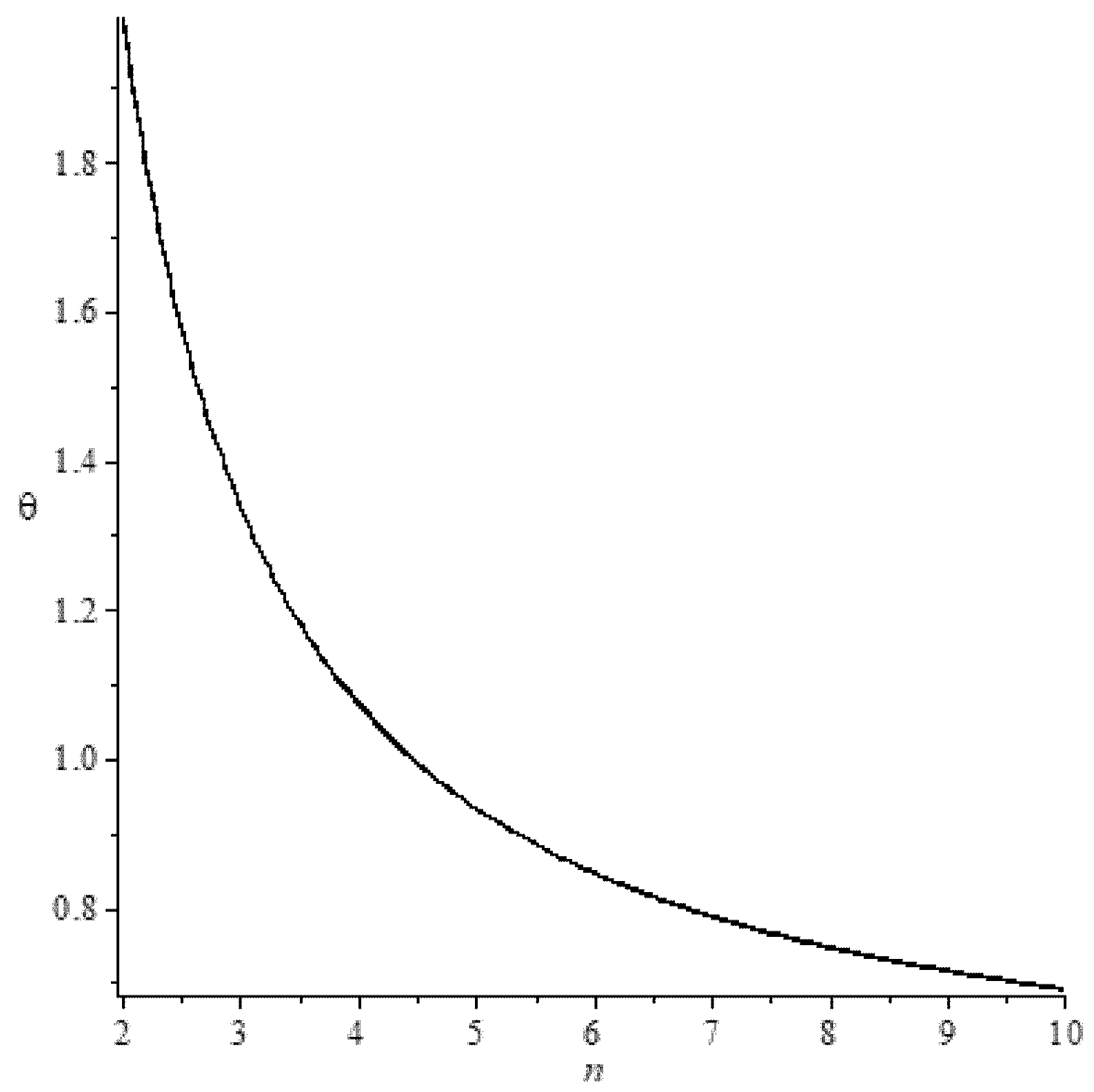

3.4. Comparative Statics

3.5. The Dynamics

4. The Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Autor, David, Laurence F. Katz, Chris Patterson, and John Van Reenen. 2017. Concentrating on the Fall of the Labor Share. American Economic Review: Papers & Proceedings 107: 180–85. [Google Scholar] [CrossRef]

- Autor, David, David Dorn, Laurence F. Katz, Chris Patterson, and John Van Reenen. 2020. The Fall of the Labor Share and the Rise of Superstar Firms. Quarterly Journal of Economics 135: 645–709. [Google Scholar] [CrossRef]

- Azar, Jose, Iona Marinescu, and Marshall I. Steinbaum. 2019. Labor Market Concentration, National Bureau Economic Research. Working Paper 24147. Available online: https://www.nber.org/paper/w24147 (accessed on 22 January 2022).

- Bajgar, Matej, Giuseppe Berlingieri, Sara Calligaris, Chiara Criscuolo, and Jonathan Timmis. 2019. Industry Concentration in Europe and North America. OECD Productivity Working Papers 2019–18. Paris: OECD Publishing. [Google Scholar]

- Barkai, Simcha. 2016. Declining Labor and Capital Shares. Mimeo: University of Chicago. [Google Scholar]

- Barkai, Simcha. 2018. 70 Years of US Corporate Profits. Mimeo: University of Chicago. [Google Scholar]

- Barkai, Simcha. 2020. Declining labor and capital shares. The Journal of Finance 75: 2421–63. [Google Scholar] [CrossRef]

- Barkai, Simcha, and Seth G. Benzell. 2018. 70 Years of US Corporate Profits, Stigler Center for the Study of the Economy and the State University of Chicago. New Working Paper Series No. 22. Chicago: Booth School of Business, University of Chicago. [Google Scholar]

- Basu, Susanto. 2019. Are Price-Cost Markups Rising in the United States? A Discussion of the Evidence. Journal of Economic Perspectives 33: 3–22. [Google Scholar] [CrossRef]

- Baumol, William J., John C. Panzar, and Robert D. Willig. 1982. Contestable Markets and the Theory of Industry Structure. New York: Harcourt Brace Jovanovich. [Google Scholar]

- Berry, Steven, Marvin Gaynor, and Fiona Scott Morton. 2019. Do Increasing Markups Matter? Lessons from Empirical Industrial Organization. Journal of Economic Perspectives 33: 44–68. [Google Scholar] [CrossRef]

- Cavalleri, Maria C., Alice Eliet, Peter McAdam, Filippos Petroulakis, Ana Soares, and Isabel Vansteenkiste. 2019. Concentration, Market Power and Dynamism in the Euro Area, European Central Bank, ECB Working Paper Series No. 2253. Available online: https://www.ecb.europa.eu//pub/pdf/scpwps/ecb.wp2253~cf7b9d7539.en.pdf (accessed on 22 January 2022).

- Che, Shulu, Ronald R. Kumar, and Peter J. Stauvermann. 2021. Taxation of Land and Economic Growth. Economies 9: 61. [Google Scholar] [CrossRef]

- Chen, Peter, Loukas Karabarbounis, and Brent Neiman. 2017. The global rise of corporate saving. Journal of Monetary Economics 89: 1–19. [Google Scholar] [CrossRef]

- De Loecker, Jan, and Jan Eeckhout. 2017. The Rise of Market Power and the Macroeconomic Implications. NBER Working Paper No. 23687. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- De Loecker, Jan, Jan Eeckhout, and Gabriel Unger. 2020. The Rise of Market Power and the Macroeconomic Implications. Quarterly Journal of Economics 135: 561–644. [Google Scholar] [CrossRef]

- Deaton, Angus, and Guy Laroque. 2001. Housing, Land Prices, and Growth. Journal of Economic Growth 6: 87–105. [Google Scholar] [CrossRef]

- Diamond, Peter A. 1965. National Debt in a Neoclassical Growth Model. American Economic Review 55: 1126–50. [Google Scholar]

- Díez, Federico J., Jiayue Fan, and Carolina Villegas-Sánchez. 2019. Global Declining Competition. IMF Working Paper WP/19/82. Geneva: International Monetary Fund. [Google Scholar] [CrossRef]

- Djankov, Simeon. 2009. The regulation of entry: A survey. The World Bank Research Observer 24: 183–203. [Google Scholar] [CrossRef]

- Djankov, Simeon, Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2002. The regulation of entry. Quarterly Journal of Economics 117: 1–37. [Google Scholar] [CrossRef]

- Eggertsson, Gauti B., Jacob A. Robbins, and Ella Getz Wold. 2021. Kaldor and Piketty’s facts: The rise of monopoly power in the United States. Journal of Monetary Economics 124: S19–S38. [Google Scholar] [CrossRef]

- Elsby, Michael W., Bart Hobijn, and Aysegul Şahin. 2013. The decline of the US labor share. Brookings Papers on Economic Activity 2013: 1–63. [Google Scholar] [CrossRef]

- Foldvary, Fred E. 2007. The Depression of 2008. Berkeley: The Gutenberg Press. [Google Scholar]

- Frankel, Marvin. 1962. The Production Function in Allocation and Growth: A Synthesis. American Economic Review 52: 995–1022. [Google Scholar]

- Ge, Jinfeng, Jie Luo, and Yangzhou Yuan. 2019. Misallocation in Chinese Manufacturing and Services: A Variable Markup Approach. China & World Economy 27: 74–103. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Noriyuki Yanagawa. 1993. Asset bubbles and endogenous growth. Journal of Monetary Economics 31: 3–19. [Google Scholar] [CrossRef]

- Grullon, Gustavo, Yelena Larkin, and Roni Michaely. 2018. Are U.S. Industries Becoming More Concentrated? Review of Finance 23: 697–743. [Google Scholar] [CrossRef]

- Guinea, Oscar, and Frederik Erixon. 2019. Standing up for Competition: Market Concentration, Regulation, and Europe’s Quest for a New Industrial Policy. ECIPE Occasional Paper 01/2019. Brussels: European Centre on the International Political Economy. [Google Scholar]

- Hahn, Frank H. 1966. Equilibrium Dynamics with Heterogeneous Capital Goods. Quarterly Journal of Economics 80: 633–46. [Google Scholar] [CrossRef]

- Hall, Robert E. 2018. New Evidence on the Markup of Prices over Marginal Costs and the Role of Mega-Firms in the US Economy. NBER Working Paper No. 24574. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Holston, Kathryn, Thomas Laubach, and John C. Williams. 2017. Measuring the natural rate of interest: International trends and determinants. Journal of International Economics 108: 59–75. [Google Scholar] [CrossRef]

- Kaldor, Nicolas. 1961. Capital Accumulation and Economic Growth. In Theory of Capital. Edited by Friederich Lutz and Douglas. C. Hague. London: Macmillan, pp. 177–223. [Google Scholar]

- Karabarbounis, Loukas, and Brent Neiman. 2014. The global decline of the labor share. Quarterly Journal of Economics 129: 61–103. [Google Scholar] [CrossRef]

- Karabarbounis, Loukas, and Brent Neiman. 2018. Accounting for Factor-Less Income. NBER Working Paper 24404. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Karakaya, Fahri. 2002. Barriers to entry in industrial markets. Journal of Business & Industrial Marketing 17: 379–88. [Google Scholar] [CrossRef]

- Knoll, Katharina, Moritz Schularick, and Thomas Steger. 2017. No Price Like Home: Global House Prices, 1870–2012. American Economic Review 107: 331–53. [Google Scholar] [CrossRef]

- Krugman, Paul. 2016. Robber Baron Recessions. New York Times. April 18. Available online: https://www.nytimes.com/2016/04/18/opinion/robber-baron-recessions.html (accessed on 22 January 2022).

- Kuhn, Moritz, Moritz Schularick, and Ulrike I. Steins. 2020. Income and Wealth Inequality in America, 1949–2016. Journal of Political Economy 128: 3469–519. [Google Scholar] [CrossRef]

- Kumar, Ronald R., and Peter J. Stauvermann. 2021. Revisited: Monopoly and Long-Run Capital Accumulation in Two-sector Overlapping Generation Model. Journal of Risk and Financial Management 14: 304. [Google Scholar] [CrossRef]

- Kumar, Ronald R., Peter J. Stauvermann, and Frank Wernitz. 2021. Capitalists’ Spirit and Endogenous Growth. Journal of Risk and Financial Management 15: 27. [Google Scholar] [CrossRef]

- Kumar, Ronald R., and Peter J. Stauvermann. 2020. Economic and Social Sustainability: The Influence of Oligopolies on Inequality and Growth. Sustainability 12: 9378. [Google Scholar] [CrossRef]

- Kwoka, John E. 2013. Does Merger Control Work? A Retrospective on U.S. Enforcement Actions and Merger Outcomes. Antitrust Law Journal 78: 619–50. [Google Scholar] [CrossRef]

- Lamoreaux, Naomi R. 2019. The Problem of Bigness: From Standard Oil to Google. Journal of Economic Perspectives 33: 94–117. [Google Scholar] [CrossRef]

- Laubach, Thomas, and John C. Williams. 2003. Measuring the Natural Rate of Interest. Review of Economics and Statistics 85: 1063–70. [Google Scholar] [CrossRef]

- Li, Bo, Rita Yi Man Li, and Thitinant Wareewanich. 2021. Factors Influencing Large Real Estate Companies’ Competitiveness: A Sustainable Development Perspective. Land 10: 1239. [Google Scholar] [CrossRef]

- Melitz, Marc J., and Gianmarco I. P. Ottaviano. 2008. Market size, trade and productivity. Review of Economic Studies 75: 295–316. [Google Scholar] [CrossRef]

- Mian, Atif, Ludwig Straub, and Amir Sufi. 2021. What Explains the Decline in r∗? Rising Income Inequality versus Demographic Shifts, University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2021–104. Available online: https://ssrn.com/abstract=3916345 (accessed on 22 January 2022).

- Ogilvie, Sheilagh. 2014. The economics of guilds. Journal of Economic Perspectives 28: 169–92. [Google Scholar] [CrossRef]

- Ogilvie, Sheilagh, and Andre W. Carus. 2014. Institutions and economic growth in historical perspective. In Handbook of Economic Growth 2. Edited by Steven Durlauf and Peter Aghion. Amsterdam: Elsevier, pp. 405–514. [Google Scholar] [CrossRef]

- Philippon, Thomas. 2019. The Great Reversal: How America Gave Up on Free Markets. Cambridge: Harvard University. [Google Scholar] [CrossRef]

- Pigou, Arthur C. 1938. The Economics of Welfare, 4th ed. London: Macmillan. [Google Scholar]

- Piketty, Thomas. 2014. Capital in the Twenty-First Century. Cambridge: Harvard University Press. [Google Scholar] [CrossRef]

- Piketty, Thomas, and Gabriel Zucman. 2014. Capital is back: Wealth-Income ratios in rich countries 1700–2010. Quarterly Journal of Economics 129: 1255–310. [Google Scholar] [CrossRef]

- Poschke, Markus. 2018. The Firm Size Distribution across Countries and Skill-Biased Change in Entrepreneurial Technology. American Economic Journal: Macroeconomics 10: 1–41. [Google Scholar] [CrossRef]

- Rebelo, Sergio. 1991. Long-run policy analysis and long-run growth. Journal of political Economy 99: 500–21. [Google Scholar] [CrossRef]

- Romer, Paul M. 1986. Increasing returns and long-run growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Romer, Paul M. 1989. Capital Accumulation in the Theory of Long-Run Growth. In Modem Business Cycle Theory. Edited by R. J. Barro. Boston: Harvard University Press, pp. 51–127. [Google Scholar]

- Shapiro, Carl. 2019. Protecting Competition in the American Economy: Merger Control, Tech Titans, Labor Markets. Journal of Economic Perspectives 33: 69–93. [Google Scholar] [CrossRef]

- Shell, Karl, and Joseph E. Stiglitz. 1967. Allocation of Investment in a Dynamic Economy. Quarterly Journal of Economics 81: 592–609. [Google Scholar] [CrossRef][Green Version]

- Shleifer, Andrei, and Robert W. Vishny. 1993. Corruption. Quarterly Journal of Economics 108: 599–617. [Google Scholar] [CrossRef]

- Skinner, John. 1996. The Dynamic Efficiency Cost of Not Taxing Housing. Journal of Public Economics 59: 397–417. [Google Scholar] [CrossRef]

- Solow, Robert M. 1956. A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics 70: 65–94. [Google Scholar] [CrossRef]

- Solow, Robert M. 1957. Technical Change and the Aggregate Production Function. Review of Economics and Statistics 39: 312–20. [Google Scholar] [CrossRef]

- Stauvermann, Peter J. 1997. Endogenous Growth in OLG-Models. Wiesbaden: Springer. [Google Scholar]

- Stauvermann, Peter J. 2002. Endogenous growth, land and intertemporal efficiency. History of Economic Ideas 10: 63–77. [Google Scholar]

- Stauvermann, Peter J., and Ronald R. Kumar. 2021. Does more market competition lead to higher income and utility in the long run? Bulletin of Economic Research, 1–22. [Google Scholar] [CrossRef]

- Stigler, George J. 1971. The theory of economic regulation. Bell Journal of Economics and Management Science 2: 3–21. [Google Scholar] [CrossRef]

- Stiglitz, Joseph. E. 2019. Market Concentration Is Threatening the U.S. Economy. Chazen Global Insights. March 12. Available online: https://www8.gsb.columbia.edu/articles/chazen-global-insights/market-concentration-threatening-us-economy (accessed on 22 January 2022).

- Syverson, Chad. 2019. Macroeconomics and Market Power: Context, Implications, and Open Questions. Journal of Economic Perspectives 33: 23–43. [Google Scholar] [CrossRef]

- Van Reenen, John. 2018. Increasing Differences between Firms: Market Power and the Macro-Economy, Centre of European Policy. CEP Discussion Paper No. 1576. London: Centre for Economic Performance, London School of Economics. [Google Scholar]

- Zingales, Luigi. 2012. A Capitalism for the People. New York: Basic Books. [Google Scholar]

- Zingales, Luigi. 2017. Towards a political theory of the firm. Journal of Economic Perspectives 31: 113–30. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, R.R.; Stauvermann, P.J. Imperfect Competition, Real Estate Prices and New Stylized Facts. J. Risk Financial Manag. 2022, 15, 99. https://doi.org/10.3390/jrfm15030099

Kumar RR, Stauvermann PJ. Imperfect Competition, Real Estate Prices and New Stylized Facts. Journal of Risk and Financial Management. 2022; 15(3):99. https://doi.org/10.3390/jrfm15030099

Chicago/Turabian StyleKumar, Ronald R., and Peter J. Stauvermann. 2022. "Imperfect Competition, Real Estate Prices and New Stylized Facts" Journal of Risk and Financial Management 15, no. 3: 99. https://doi.org/10.3390/jrfm15030099

APA StyleKumar, R. R., & Stauvermann, P. J. (2022). Imperfect Competition, Real Estate Prices and New Stylized Facts. Journal of Risk and Financial Management, 15(3), 99. https://doi.org/10.3390/jrfm15030099