Abstract

The purpose of this paper is to conduct a comparative analysis of monetization as a priority of the new monetary growth of the economies using the example of the Russian economy, identifying new trends in global practices of monetary factor management, as well as the search for ways to stimulate economic growth using the best international experience. Our paper tackles the novel research question of whether changing the priorities of monetary policy from targeting (and curbing) inflation to stimulating economic growth might yield more favorable economic results and what best world practices should be appropriately introduced in Russia to improve the effectiveness of monetary policy. The key results of the paper are focused on a comparative analysis of the economies’ development under the influence of monetary factors in comparison with the most progressive economies, the study of the best practices for increasing the monetization of national economies, and the identification of recommendations for determining the most optimal way to increase economic growth through the monetization of the economy. Monetarist views on the decisive role of fiat money in the development of the real sector of the economy, capital markets, payment and settlement systems, the standard of living of the population, and other important aspects of macro- and microeconomics have become the mainstream of government regulation. It seemed that by finding the right indicators of the relationship between interest rates, GDP, and inflation, all problems of economic growth could be solved. By increasing the amount of money faster than the achieved economic growth, it was believed that it was possible to stimulate GDP growth through monetary investments and credit, i.e., more money was issued than the value produced represented by the goods and services. Accordingly, new money that had no value had to create new value. We argue that monetization can be seen as the main factor in providing such incentives. Our results can be useful for central bankers, policymakers, and stakeholders in the banking and financial sector. The conclusions and recommendations of the authors are based on studies conducted using such research methods as content analysis, logical analysis, and statistical analysis.

1. Introduction

The economic policy of any country is aimed at stimulating economic growth and maintaining sustainable development (Doran et al. 2018; Batrancea 2021; Song et al. 2021). The argument that monetization is unlikely to help the economy is not shared by the regulators of the leading financial systems (Kyriazis 2017). For them, the injection of resources (and a large-scale one) during the crisis was critically necessary. That is why the financial systems of developed countries have multiplied their monetary base (the level of monetization) (Arendt et al. 2020). In the United States, for the period 2007–2014, the emission of the dollar increased by more than 350%, the British pound—by more than 400%, and the Swiss franc—by more than 700% (Cook 2014; Zemke 2017). In combination with lower interest rates (often to a level even below inflation) and other measures that increase the demand for money from economic agents, these measures have led to a significant increase in the monetization of the economy. In particular, in Switzerland, monetization increased from 100% in 2005 to 145% by 2016 (McKinsey & Company 2018). Moreover, at critical moments, liquidity injections can be unprecedented in size. Therefore, the growth of monetization, as an increase in the money supply in the economy, is a consequence of a number of reasons and involves an increase in both the supply of money and, at the same time, an increase in demand for them through the active use of levers that increase the availability of financial resources and reduce their price (Palma 2018; Mishchenko et al. 2018; Žukauskas and Hülsmann 2019; Samargandi et al. 2020). This includes a decrease in interest rates, reserve norms, special instruments, etc. The growth of monetization as a stimulus for economic growth does not lend itself to unambiguous interpretation. This conclusion is also refuted by real practice.

In Russia, the dynamics of real GDP and real money supply show a rather rigid connection. An increase or decrease in the money supply with a certain lag usually causes an increase or decrease in GDP (Mikosch and Solanko 2019; Zaitsev 2020; Yang et al. 2021). In other words, this phenomenon is long-term sustainable. Thus, the current level of economic monetization in Russia is lower than in most developed and developing countries of the world (Kalyukov 2016). Hence, in Brazil, the monetization of the economy is 80%, in the USA—90%, in China—195.3%, in Japan—253.2% (Semenova et al. 2017). With such a high monetization of the economy in Japan and China, inflation in 2015 was 0.8% and 1.4%, respectively. The average world level of monetization of the economy is 125% (He and Zou 2016). The experience of China demonstrates the broad possibilities of using targeted monetary emissions for lending to investment and production growth without inflationary consequences. Thus, the 10-fold growth of GDP in China from 1993 to 2016 was accompanied by an increase in investments of 28 times, money supply and bank loans to the manufacturing sector—of 19 and 15 times, respectively (Glazyev 2018, 2020). A unit of GDP growth accounts for almost three units of investment growth and about two units of growth in money supply and volume of credit. This illustrates the operation of the growth mechanism of the Chinese economy; the increase in economic activity, measured by GDP, is provided by the outstripping growth in investment, most of which is financed by expanding the credit of the state banking system (Dieppe et al. 2018). In comparison with the above, one has to remember that the monetization of the Russian economy is still one of the lowest in the world, which constitutes a huge barrier for sustainable economic growth in Russia. In November 2018, the Bank of Russia adopted the main directions of the Unified State Monetary Policy for the period of 2020–2021, providing for an extremely moderate increase in monetization, and the resumption of foreign currency purchases for the Ministry of Finance is not ruled out. At the same time, the economic growth rates are practically stagnating, the inflation rate is growing and approaching the target level, and the ruble exchange rate has become unstable. Moreover, the constant expansion of economic sanctions imposed at the Russian Federation would inevitably lead to an increase in exchange rate volatility and a renewed trend toward the depreciation of Russian currency. Last but not least, the monetization of the Russian economy is still one of the lowest in the world, which according to many economists’ opinion is an obstacle to sustainable economic growth.

Similar ways of using the emission of fiat money to lend to investment growth are also successfully used in other economies, such as Japan, India, Vietnam, South Korea, or Malaysia, Singapore, and other successfully developing countries. Their characteristic feature is the anticipatory increase in targeted credit emissions to finance investments in accordance with the priorities determined by the state (Ngo et al. 2021). Due to this, a sharp increase in the rate of accumulation was achieved with low incomes and savings of the population.

The main novelty and the value-added of this paper are its focus on the targeted emission and monetization of economies in general and in Russia in particular, which, according to our opinion, would be capable of constituting the main source of financing for capital investments in the economic development of this country. Moreover, our paper demonstrates why and how it is necessary to change the priorities of Russian monetary policy from targeting (and curbing) inflation to stimulating economic growth.

The rest of this paper is structured as follows: Section 2 presents the materials and methods used in this study. Section 3 reports on the main results and outcomes. Section 4 offers a discussion of the obtained results. Finally, Section 5 concludes this research by offering overall conclusions and policy implications.

2. Materials and Methods

The methods used in this review include content analysis as well as the description and interpretation of statistical data. Even though the overview of the data, comparison, and some ideas/interpretation of data by the authors might be viewed as a limitation of this study, in our opinion they still provide valuable insights and meaningful results. Our research covers the period from 2012 to 2020 and is based on data analysis from international organizations, analytical centers, mass media, and official data sources. The literature is reviewed for understanding the countries’ monetary policy in relation to GDP. The monetary factors of economic development and the impact of monetization on economic growth were analyzed. We provide an assessment of the relationship between the level of monetization and key macroeconomic indicators of the country’s economic development and the author’s position on their elimination.

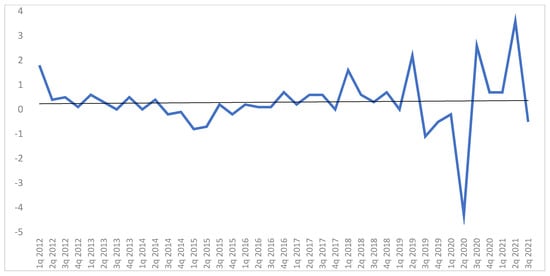

Looking at the example of the Russian economy again, one can see that it has been demonstrating somewhat weak results (Kaneva and Untura 2019; Kholodilin and Netšunajev 2019; Chebotareva et al. 2020). Since the end of 2012, there has been a steady downward trend, and since then the GDP growth rate has not exceeded 4% (see Figure 1).

Figure 1.

Growth dynamics of Russia’s GDP (2012–2020) (Russian GDP growth rates (q/q)). Source: Own visualization based on Trading Economics (2021).

Moreover, over the past five years, quarterly estimates of GDP growth in the Russian economy have rarely exceeded 2%. At the same time, in 2014, 2015, 2019, and 2020, quarterly GDP estimates often recorded a decline (Salnikov et al. 2017; Porfiriev 2020).

Such a trend could be explained by a combination of objective internal and external factors. The main external factors are the Ukrainian crisis and subsequent sanctions by the EU and the United States (mainly concerning individual large Russian companies (and sectors) on investment, trade interaction, and access to certain technologies), counter-sanctions, negative dynamic world prices for several raw materials (mainly oil and gas), and a slowdown in the global economy (Tyll et al. 2018; Krivko et al. 2019; Belin and Hanousek 2021).

Internal factors are mostly associated with a shortage of investment support and, as a consequence, a drop in investment activity (Table 1) and a decrease in consumer demand (Sutyagin and Radyukova 2016).

Table 1.

Investment dynamics in fixed assets in the Russian Federation (2010–2020).

Generally, this situation is quite natural, since due to the sanction pressure on Russia in its tight integration into the world, especially into the European trading and economic space, its economy is inclined to the severing of trade and investment ties (Hufbauer and Jung 2020; Doornich and Raspotnik 2020; Crozet et al. 2021).

3. Main Results

In this section, we provide an overview of statistical information and the scientific literature. All in all, by 2015–2017 it became quite obvious that the sanctions policy toward Russia is a strategic choice of the USA and the EU, and therefore, it would last for quite a long time. This has been double-proved by the community expert and by the most senior Russian officials (Hellquist 2019; Guter-Sandu and Kuznetsova 2020; Ershov and Tanasova 2020). Hence, it is obvious that the Russian economy must undergo some transformational changes. The deficit of foreign investment and the rupture of several inter-economic ties require compensation for these losses.

One can see that it takes time to re-direct the Russian economy to the non-European markets (e.g., China and Central Asia), and the deficit of foreign investment requires compensation from domestic sources. On the other hand, seven years have already passed since 2014, and there has been no significant success in internal investment sources. Moreover, the sanctions can be expanded, both the instruments used (i.e., the disconnection of Russia from SWIFT, still discussed) and the countries involved.

In such a situation, the strategy of the area of monetary and fiscal policy requires transformation. The policy of the Central Bank of the Russian Federation in the 1990s and 2000s was characterized by attempts to contain inflation. Such decisions of the Bank of Russia were more than logical since the transition to a market economy led to hyperinflation in the first half of the 1990s. Despite some success by the end of 1997, the 1998 default made the problem of high inflation urgent again (Table 2). Since 2014, the Bank of Russia has moved to a new stage in the fight against inflation, i.e., inflation targeting.

Table 2.

Comparison of GDP growth rates, inflation rate and key interest rate in Russia (1995–2020).

The inflation targeting regime has been successfully used for almost 30 years by the monetary authorities of many countries. The objective prerequisite for its spread was the processes of globalization, which led to a significant increase in cross-border commodity and financial flows (Mohan and Ray 2019; Frascaroli and Nobrega 2019). An important role was played by the flexibility and adaptability of approaches and tools for inflation targeting. Russia switched to this regime later than most countries—only at the end of 2014, which is due to the radical transformation of the socio-economic and institutional conditions for the development of the national economy in the previous decades (Bekareva et al. 2019; Karlova et al. 2020).

Both of these periods (before 2014 and after) have much in common, although they differ in the use of the toolkit. The first stage aims to simply reduce inflation, and the second (or targeting) is designed to ensure the stability of the national currency, and thereby achieve inflation targets. However, if you do not go into the nuances and tools used, both are aimed at curbing inflation.

Despite the relative youth of inflation targeting, the principles of its application and the tools used have significantly transformed. Increasing the flexibility of approaches was a response to criticism for being excessively rigid in achieving the inflation target, leading, among other things, to an increase in the gap between potential and actual rates of economic growth and an increase in the volatility of exchange rates of national currencies as a result of inaction of the monetary authorities (Krušković 2020; Hayat et al. 2021). Currently, the monetary authorities of six developed countries (Australia, Canada, Japan, Norway, Sweden, and Great Britain) and four developing countries (Chile, Mexico, Poland, and Russia) adhere to inflation targeting in its traditional sense (López-Villavicencio and Pourroy 2019). This presupposes keeping inflation close to the target with a freely floating exchange rate, that is, the regulator does not participate in the exchange rate formation process.

In Russia, at the time of the introduction of inflation targeting, the relative amount of bank debt of non-financial corporations and the population was 55% of GDP. This was slightly inferior to its average level at the time of the introduction of this regime by other countries—59.4% (Altunyan et al. 2020). However, given that the main group of countries switched to inflation targeting of the 2008–2009 world financial crisis, and developed countries even earlier—in the 1990s, the lag has now grown (Kitrar 2021). Thus, in Russia in 2020, the depth of the banking sector decreased to 53% of GDP, while in other inflation-targeting countries it increased on average to 85.5% of GDP (see Table 3).

Table 3.

Selected macroeconomic characteristics of countries targeting inflation (2020, % of GDP).

In Russia, the inflation target is 4% in the same range as in most developing countries, although in many of them, actual inflation is allowed to deviate from the target within plus/minus 1–2 percentage point. Unlike developing countries, in developed countries, the 2% level serves as a benchmark; in some cases, the goal is not set by a point value, but by a 1–3% corridor. During the transition to inflation targeting, the Bank of Russia viewed this regime as one of the mechanisms for ensuring macroeconomic stability and as the most important condition for the formation of balanced and sustainable economic growth. During the transition period, the mechanisms for implementing the monetary policy were transformed in two key directions. First, the Bank of Russia has consistently weakened its participation in the exchange rate setting process. Secondly, they developed a system of interest rate instruments. The purpose of these changes was to create conditions for the transition to a floating ruble exchange rate and increase the effectiveness of the interest rate policy of the monetary regulator (Bank of Russia 2021).

The Guidelines for Monetary Policy in Russia provide a rationale for the inflation target of 4%, summarizing the data of modern research on the optimal level of inflation in the economy. For developing countries, it is from 9 to 17% and for developed countries—from 1 to 3% (Bank of Russia 2021). The choice of an inflation target of 4% for the Russian economy indicates that, according to the Bank of Russia, the Russian economy is very close to the state of developed countries. In terms of economic growth rates of 1.5–2.0% projected for the next three-year outlook, the Russian economy should also be classified as a group of developed countries that are currently in a stage of relative stagnation and have not determined the path of transition to a policy of economic growth.

However, other parameters of the economic development of the Russian Federation and the assessments of the regulator itself indicate that the domestic economy still corresponds only to the level of a developing one, and it still has a long way to go to reach the level and quality of economic systems of a developed market. Other developing economies demonstrate economic growth rates 2–3 times higher, albeit with higher inflation (Ministry of Economic Development of Russia 2021). This contradiction between the goals of the national economy and its subjects (outstripping growth in the volume of goods and income) and the goals of the monetary policy (consistently low level of inflation and GDP growth) seems extremely illogical and is unlikely to turn into a driving force of positive qualitative changes in transmission mechanisms.

In terms of economic growth, tight monetary policy is not conducive to the formation of domestic sources of investment and discourages ‘long’ investment. Paradoxically, the government is partially trying to compensate for the rigidity of monetary policy with budgetary policy (i.e., targeted budget programs, grants, interest subsidies, etc.). This testifies to the absence of an economic strategy and a lack of coordination between the actions of the Bank of Russia and the Government of the Russian Federation (Ministry of Economic Development of Russia 2021).

Since February 2020, the global economy has been actively influenced by the Covid 19 epidemic, which certainly acted as a shock and caused the need to revise the central bank policy in order to stabilize the situation in the monetary sphere and apply unconventional monetary policy. Nevertheless, in 2020 almost all countries, following the US, resorted to “monetary injections” into the economy. The size of general government measures as a percentage of national GDP was 60% in Germany, 44% in Italy, 26% in France, 21% in England, 14% in the USA, 12% in Spain, and 2.1% in the Russian Federation. Many analysts believe that the main limitation for the Russian economy in 2022 may be a further tightening of monetary policy, which will lead to a restraint of consumer demand (Bureau of Economic Analysis 2021).

The tightening of the monetary policy of the U.S. Federal Reserve, which actively used the mechanisms of “forward guidance”, led to an increase in exchange rate volatility and increased tension in the world financial markets. The most vulnerable were developing countries, including Russia, which faced the depreciation of national currencies and a sharp outflow of capital as a result of the decline in the attractiveness of domestic assets in comparison with the risk-free assets of developed countries. In these conditions, in an effort to weaken inflationary pressures generated by the depreciation of national currencies and curb capital outflows, the monetary authorities of developing countries targeting inflation, acting in opposition to the US Federal Reserve, began to tighten the monetary policy.

As world experience shows, in the overwhelming majority of countries during inflation targeting, the cost of money in the economy decreases, as evidenced by the decrease in the nominal interest rates of the monetary authorities. At the same time, in real terms, in a much larger number of countries, primarily developing countries, rates in Kazakhstan, Indonesia, Ghana, Mexico, and Chile increased. Russia is no exception. However, at the same time, the value of the positive real key rate in 2021 was 4.5% after two years of successive reduction of the key rate from 7.75%—it exceeded its average value among inflation-targeting countries. Stable preservation of the key rate of the Bank of Russia—the main operating instrument of interest rate policy—in the positive realm supported the entire system of interest rates in the economy at a relatively high level. Thus, the monetary conditions of reproduction limited the aggregate domestic demand and, as a consequence, reduced the intensity of the use of production factors and slowed down economic growth.

Finally, the non-monetary factors (for example, the rise in tariffs of natural monopolies), which are outside the control of the Russian financial regulator, make a significant contribution to the formation of inflation every year.

4. Discussion of Results

The practice of recent decades shows that in the context of global economic integration, a significant increase in the volume of cross-border flows of foreign exchange and financial resources, inflation targeting is becoming the only acceptable monetary policy regime for both developed and developing countries. The availability of inflation targeting for countries that differ significantly from each other in macroeconomic parameters is due to both a slowdown in growth rates and a decrease in consumer price volatility, and a high adaptability of its approaches and tools to changes in external and internal conditions. At the same time, the dependence of developing economies on transnational capital flows and the resulting increase in exchange rate volatility do not allow their monetary authorities to maintain tolerance in the domestic foreign exchange market.

A few words should be said about the importance of stationarity of the variables used in the financial analysis. Many processes in finance are non-stationary; hence, the values and associations among and between the variables tend to vary over time (Chishti et al. 2020a, 2021; Zhang et al. 2022). This has to be taken into consideration when discussing the implications for any economy, including that of Russia.

For Russia, inflation targeting was the result of a consistent change in approaches, goals, and tools for implementing monetary policy over a long period. This process was determined both by the radical socio-economic transformations of the social structure in the country, and by significant changes in the material, financial, and cost characteristics of reproduction. All these changes, as well as those taking place in global markets and in the economies of the rest of the world, required reflection in the development and implementation of monetary management and regulation.

The implementation of the inflation targeting regime in Russia as one of the elements of macroeconomic policy contributed to:

- Rather quickly overcoming the negative consequences of a double external shock—the fall in oil prices and the introduction of financial and economic sanctions by certain Western countries against Russia;

- Reducing the volatility of the national currency and adapting economic agents to the new exchange rate policy;

- Consistent movement toward price stability, that is, achieving and maintaining consistently low inflation.

Nevertheless, the rapid decline in consumer price dynamics from double-digit levels to close to the target of 4% was largely due to the long-term deep fall in consumer demand, as well as temporary market factors, for example, high harvests, which caused a sharp decline in prices for many types of agricultural products. Therefore, the formation of conditions conducive to the long-term maintenance of persistently low inflation remains an urgent task of monetary policy (Majeed et al. 2021).

However, analyzing only the financial aspect, low rates of economic growth became the payment for such stability. It should be kept in mind that since 2014, the Russian economy has been under the sanction regime. One of the areas of sanctions pressure is prohibitions or obstacles in the investment sphere. The deficit of foreign investment must be compensated for by domestic sources.

The importance of monetary stimulation of economic growth has been discussed many times, including by us (Sutyagin et al. 2017a, 2017b). The link between monetization and economic growth is direct, and it is well illustrated by examples of the world’s leading economies (according to the IMF, GDP at purchasing power parity) (see Table 4).

Table 4.

Comparative analysis of the dynamics of GDP and money supply (1995–2020) (monetary aggregate M2), (fragment).

It is easy to see that those countries that have significantly increased the monetization of the economy, according to the results of the 25 year analysis, were the most successful in terms of economic growth. This is also confirmed by the Russian figures, although they are also largely distorted by the data of the 1990s (periods of hyperinflation). It is necessary to take into account that nominal estimates by themselves are not yet an indicator of economic growth. One should keep inflation in the country in mind. However, the logic is clear that monetization is an effective tool to support economic growth. This is the basis of quantitative easing instruments (the so-called QE), widely used by the US Federal Reserve and the European Central Bank. At the same time, we note that judging by the figures given by the leading countries of the world, the goal of monetary policy is not so much to curb inflation as to monetize the needs of the economy. Thus, developed economies and China have a high monetization coefficient (Ahmad et al. 2021). See Table 5 for more detailed results.

Table 5.

Monetization coefficient dynamics (1995–2020) (fragment).

As a rule, it is considered that the normal level of monetization (or the monetization coefficient) of the economy is from 70 to 100%. Russia has significant potential for economic monetization. We have almost a two-fold monetization reserve for our economy, which can potentially give practically the same two-fold GDP growth.

Apparently, the effectiveness of monetization as a tool also has a limit, no matter how regrettable and how some economists do not like it.

Our analysis of the available data (see Table 4 and Table 5) allows us to make the typological grouping and to draw conclusions about the main factors that determine the level of monetization of the economy, and to visualize the distribution of countries into 4 groups:

- (1)

- Countries that are world financial centers, such as Japan (monetization rate—207%), Switzerland (182%), Luxembourg (378%), Great Britain (133%), Singapore (131%);

- (2)

- Countries with a high level of GDP per capita and a high level of monetization, the so-called advanced economies. This group includes such countries as Germany (103%), France (118%), Italy (90%), Australia (109.77%), the USA (92%), and South Korea (139.87%);

- (3)

- Actively developing countries of the Asia-Pacific region: China (216%), Malaysia (142%), Thailand (138%), and Indonesia (45%). These countries are characterized by a high level of monetization of the economy with a low value of GDP per capita;

- (4)

- BRICS countries. These countries, with low GDP per capita, have an average monetization rate, as a rule, above 20%: Russia (55%), Brazil (52%), South Africa (51%), and India (23%).

The paradox of the absence of inflation with a high level of monetization of the economy and a constant increase in the money supply is explained by the high degree of absorption of the “surplus”, which is re-involved in the economy and generated in the process of credit and investment multiplication of the money supply. The high adsorption capacity of these economies is due to the presence of a number of factors:

- (1)

- A well-developed financial system, including banking. The countries of the first group are countries on whose territory the largest world and regional financial centers operate; that is, they are characterized by highly developed financial markets and a banking system. The financial system should ensure the efficient transfer of financial resources from households to business entities and financial intermediaries. In their absence or underdevelopment, monetary resources would be directly channeled to consumption, thereby creating inflationary pressure in the economy;

- (2)

- Developed countries are characterized by a high level of market capitalization, which determines a high demand for money for financial transactions. In developed countries, the money supply is used, among other things, for servicing transactions with financial assets, which reflects the indicator of market capitalization;

- (3)

- An insignificant share of cash in the structure of the money supply, which is due to the absence of a significant shadow sector of the economy, since settlements in the shadow economy, as a rule, are carried out in cash.

Despite the steady growth of the money supply in the Russian Federation, its level remains insufficient to ensure high rates of economic growth. Today in Russia, the actual amount of money in circulation is more than 2 times less than the total GDP produced and does not even exceed 50%. Thus, an acute shortage of money supply leads to the fact that the economy is actually “bled out”.

Alan Greenspan, the Chairman of the Board of Governors of the U.S. Federal Reserve System, expressed the thesis that “there are no limits to liquidity replenishment”, speaking about the possibilities of stimulating economic growth by monetary means of the economy (Federal Reserve Board 2004). His follower Bernanke tested this thesis in practice during the crisis of 2008–2009. Apparently, this is not the case, and the experience of many countries, especially Japan, confirms this. The efficiency of monetization after overcoming the monetization coefficient of more than 100–130% begins to fall. At the same time, inflationary risks begin to increase, and a significant part of the emission goes not to the real sector, but to the financial market, warming it up and generating financial bubbles. However, this requires a separate analysis.

The success in curbing inflation with purely monetary instruments is rather limited, despite the classic monetary recommendations. In order to determine the optimal level of monetization, we need to recall several basic postulates in economic theory:

- A certain amount of money corresponds to a certain level of total income. The amount of income and the amount of money are interconnected through the interest rate. Therefore, a rational organization of monetary circulation regulation is needed, which would ensure the efficiency of economic processes (Demchuk and Fadeykina 2016);

- According to Keynesian theory, an increase in the money supply causes a fall in the interest rate, and this leads to an increase in investment and, as a result, to an increase in employment and production volumes. That is, the interest rate becomes a lever of influence of monetary circulation on the economy as a whole;

- At a key rate of 4.5%, a business can be lent only at 15–20%, which, with a profitability level of 3–5%, turns any business into a loss-making one. Similarly, an increase in the interest rate affects demand.

Obviously, economic growth depends on the intensity of use of the available money supply, as well as on the speed of its circulation, which follows from the I. Fisher equation, or in other words, on the demand for money from the population and business. It is important that with economic growth and an increase in the monetization coefficient, consumer prices do not grow or grow at a rate that is significantly inferior to the rate of economic growth. Otherwise, it creates the basis for inflation.

In accordance with the theory of monetarism, the main argument in the policy of the regulator in reducing the money supply is the provision that the contraction of the money supply should be accompanied by a decrease in consumer prices, therefore, a decrease in the demand of the population and business for money. In this way, in their opinion, it is possible to regulate consumer prices in the phases of crisis and depression (Saddique et al. 2016). In these phases, there is indeed a decline in consumer prices and a contraction in the money supply. In its monetary policy, the Bank of Russia often does not take into account the nature of another important factor of the financial and credit mechanism of a market economy—the degree of development of the financial market itself. When the financial market is sufficiently developed, it inspires confidence among the population and business, and they trust it with their money, thereby increasing the monetary base of the economy. If the financial market is developed, then the inflationary pressure from additional emissions will decrease due to the reallocation of resources by financial intermediation institutions in the manufacturing sector and investments. That is why the highest monetization coefficient is observed in countries with developed financial markets: Australia, Great Britain, Hong Kong, Singapore, and Switzerland (Kazmin 2015).

It is well known from world practice that not a single country in the world made an economic breakthrough and could not maintain good economic growth rates with a monetization coefficient below 1.0. In the crisis year of 2009, China, with the highest monetization rate of 179%, showed the highest GDP growth of 9.2%. At the same time, it was in this year that the largest increase in the money supply and deflation of 0.4% was observed in China. Russia, having the lowest monetization coefficient of 55%, received the smallest percentage of GDP growth—1.3%—and inflation—7.5%. China, with the level of monetization now at 194%, received the largest GDP growth of 7.3% and inflation of 2.6%. On average, the GDP monetization ratio in OECD countries is 1.50. Sweden has the lowest coefficient—1.0.

First, for effective monetary containment of inflation, the economy must be weakly monopolized and well-diversified. In such a situation, its functioning is largely associated with the laws of supply and demand, and pricing is carried out in standard models of perfect and monopolistic competition. In other words, modern monetary instruments are fighting demand inflation. On the contrary, in a monopolized economy, the link between demand and price is broken, since a monopolist—for that is, they are a monopolist—may not follow (and do not follow) the demand.

The latter is very typical for Russia, where the level of monopolization in several sectors is very high (oil and gas sector, metallurgy, financial sector, retail, etc.). Thus, the Federal Antimonopoly Service of the Russian Federation (FAS) notes that at the end of 2018, the state’s share in the economy exceeded 50%. In addition, it notes that before the 1998 crisis, the share of the state in the Russian economy was estimated at 25%, in 2008—already at 40–45%. By 2013, it exceeded 50% (FAS 2018). In 2017, according to many expert estimates, it may already exceed 60–70%. It should be noted that in 2018, the situation has not changed significantly. All this ultimately creates inflation of costs, and the Bank of Russia does not have any effective instruments.

Secondly, a successful monetary impact on inflation in the context of globalization is possible in a developed economy or an autarchy of the national economy. The latter is very rare in the conditions of recent decades and is rather an exception.

Concerning the development of the economy, we mean not so much the quantitative size of GDP (or some other indicator of the system of national accounts), but the level of diversification of the economy, the possibility and availability of production of the main groups of goods within the country (food, consumer goods, means of production, etc.) The market for such an economy is largely self-sufficient, although it is in constant interaction with the world economy. The main thing is that it is protected from inflation imports and foreign exchange shocks. Some studies even demonstrate that the shocks in technological and financial innovation influence environmental quality (Chishti et al. 2020b; Chishti and Sinha 2022), which might also be an important lesson for the Russian economy. The latter is manifested in the volatility of food prices within the country.

It is no coincidence that there are not so many examples of the long-term effectiveness of anti-inflationary policies in developing countries. Those were largely obtained by small states and with the help of the United States (that is, the creation of greenhouse conditions).

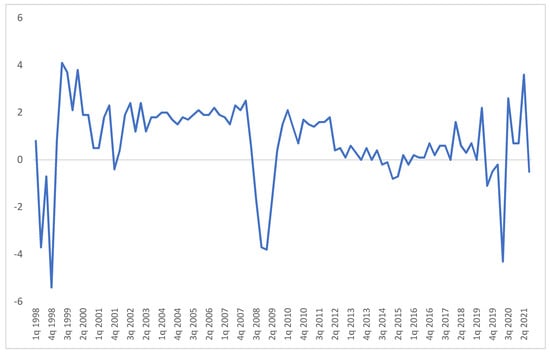

At the same time, the Russian economy is still largely dependent on imports of consumer goods and means of production, and the dynamics of the ruble exchange rate against world currencies are extremely volatile (see Figure 2).

Figure 2.

Dynamics of Russian ruble against the US $ and GDP (1998–2021). Source: Own visualization based on Trading Economics (2021).

It is easy to see that the devaluation of the ruble has always preceded the economic recession (GDP). On the contrary, stable periods of the ruble exchange rate were characterized by stable and high rates of economic growth. The periods from 2003 to 2007 and 2011–2012, when the ruble appreciated against the U.S. dollar, are noteworthy. It is these periods that are characterized by high rates of economic growth, even though this is negative for large Russian exporters.

Moreover, the independence of the Bank of Russia is called into question, since by its actions it actively participates in the fiscal functions of the state. The monetary policy is only a tool for filling the budget. According to the nature of Russian inflation, a floating exchange rate is unacceptable in terms of targeting (or containing) inflation. Apparently, inflation targeting does not stimulate economic growth.

5. Conclusions and Implications

Overall, the analysis conducted in this paper allows us to draw some useful conclusions and policy implications. First of all, the sanctions pressure on Russia is serious and will occur for a long time. This is not so much connected with the Western countries’ rejection of the Russian political regime, as a sign of a systemic world crisis and as a consequence of the aggravation of world competition (including the financial sphere). China faces similar problems (for example, trade wars). Moreover, the United States does not hesitate to push aside the interests of even its traditional allies (for example, Canada and the ban on the construction of the Keystone XL oil pipeline, France and the termination of the contract with Naval Group Australia in the interests of the United States, etc.)

Furthermore, seeing this, it makes no sense to rely on foreign investment. It has to be mentioned that the leadership of the Bank of Russia spoke about this quite diplomatically back in 2016. The latter is an urgent reorientation to internal sources, which requires strategic changes in monetary and fiscal policies and implies joint actions of the Bank of Russia and the Government of the Russian Federation (mainly, the Ministry of Finance of the Russian Federation and the Ministry of Economic Development of the Russian Federation). However, if one analyzes the investment activity since 2014, there are still no significant or obvious successes in the development of the Russian internal investment.

In addition, the development of domestic investment requires a change of priorities in monetary policy, i.e., from targeting and curbing inflation in favor of stimulating economic growth. It is advisable to associate the task of stimulating the economy with any government agency with the empowerment for this. Note that among the available institutions, the most suitable for this is the Bank of Russia, which implements monetary policy. At the same time, it is advisable to consolidate the stimulation of economic growth as the main task (goal) of the Bank of Russia.

Moreover, stimulating economic growth has a significant relationship with the level of monetization of the economy. Russia has a significant reserve of approximately two-fold growth concerning the current levels of monetization, which can lead to a 1.5–2-fold increase in GDP. It should be kept in mind that the very mechanism of monetary stimulation of economic growth has a decreasing efficiency. The latter is a manifestation of a well-known phenomenon—the fall in the marginal efficiency of capital—in the financial sector. Many developed countries have already faced this problem. At the same time, not using monetization (for this reason) in stimulating the Russian economy looks illogical (although this is a temporary measure).

Finally, an increase in the monetization of the Russian economy should be preceded by the development of a strategy for a mechanism for transporting monetary resources to the real sector. The latter is an integral basis, since without this, one will have to face two obvious negative consequences, i.e., first, the flow of a significant part of the emission to the financial market (and, as a consequence, the creation of financial bubbles that threaten the creation of financial crises, sectoral hypertrophy and the dominance of the financial sector over the real one); secondly, the growth of corruption schemes (crimes in the financial sector, capital outflow, etc.). Due to this, we think that the Bank of Russia needs clear interaction with the Government of the Russian Federation and that its monetary policy should be interlinked with fiscal policy.

Therefore, Russia, as always, is a specific case with its national and geopolitical specialties and norms that might not correspond to those applicable in the West and that might not be very clear to foreign observers. Taking into account the general economic state of the economy of the Russian Federation, we can conclude that the most important financial and credit institutions of the state need to smoothly raise the level of monetization through an increase in the money supply and preferential lending to the real sector of the economy. This strategy will make it possible to obtain the maximum multiplier in the long run, significantly influencing the rate of economic growth. However, an increase in the M2 aggregate and additional lending should be combined with a policy aimed at increasing the income of the population, their purchasing power and creating a number of “trade corridors” within the country and aimed at international exports.

The Central Bank can raise the level of monetization in two more ways: by buying foreign currency on the market for rubles or by lowering the key rate, increasing the demand of banks for credit money. Such a strategy has one significant drawback—an increase in the money supply in the economy can increase the inflation rate. This is the so-called “Russian paradox” that is often mentioned in the financial and economic literature.

When it comes to the limitation of this study, we have to acknowledge that it provides mainly an overview, comparison, and interpretation of the statistical data complemented with the analysis and discussion, as well as the authors’ own ideas. Nevertheless, we think that the outcome of the above yields quite an interesting and novel scientific input. Whether this study should be treated as an original research article or review is up to the readers focusing on the topics of monetization, monetary policy, or economics of sanctions.

In addition, we should mention such issues as the lack of comparable financial data on the Russian economy and the economy of the leading developed and developing countries, which makes it difficult to conduct empirical research, model, and adequately forecast the main macroeconomic indicators and to form sound conclusions and recommendations.

As for the pathways for further research in this direction, we think that the most interesting ways to further develop this research would be to compare the monetization of the Russian economy with the economies of the Eurasian Economic Union (EAEU) countries, as well as to conduct a factor analysis that would allow us to identify the main components of the variability in the development of the EAEU economy and scenario risk modeling with the purpose of predicting the development trajectories of a particular economy under the influence of monetary factors.

Author Contributions

Conceptualization, S.Z. and Y.R.; methodology, S.Z., W.S., L.S., T.V., Y.R. and V.S.; software, V.S.; validation, S.Z., W.S., L.S., T.V., Y.R. and V.S.; formal analysis, W.S., L.S., T.V. and V.S.; data curation, S.Z., W.S., L.S., T.V., Y.R. and V.S.; writing—original draft preparation, S.Z., W.S., L.S., T.V., Y.R. and V.S.; writing—review and editing, S.Z., W.S., L.S., T.V., Y.R. and V.S.; supervision, W.S. and S.Z.; project administration, W.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by a grant from the Internal Grant Agency (IGA) of the Faculty of Economics and Management, Czech University of Life Sciences, project 2021B0002 entitled “Post-sovětský region v kontextu mezinárodně-obchodních aktivit: příležitosti a hrozby vyplývající ze vzájemné spolupráce”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmad, Mahmood, Abdul Majeed, Muhammad Asif Khan, Muhammad Sohaib, and Khurram Shehzad. 2021. Digital financial inclusion and economic growth: Provincial data analysis of China. China Economic Journal 14: 291–310. [Google Scholar] [CrossRef]

- Altunyan, Armen, Tatiana Kotcofana, and Viktoria Bazzhina. 2020. The impact of economic policy instruments on the conditions of sustainable economic growth. SHS Web of Conferences 74: 06003. [Google Scholar] [CrossRef][Green Version]

- Arendt, Rosalie, Till M. Bachmann, Masaharu Motoshita, Vanessa Bach, and Matthias Finkbeiner. 2020. Comparison of Different Monetization Methods in LCA: A Review. Sustainability 12: 10493. [Google Scholar] [CrossRef]

- Bank of Russia. 2021. Monetary Policy of the Bank of Russia. Available online: http://www.cbr.ru/dkp/print.aspx?file=dkp.htm&pid=dkp&sid=itm_31087 (accessed on 4 December 2021).

- Batrancea, Larissa. 2021. Empirical Evidence Regarding the Impact of Economic Growth and Inflation on Economic Sentiment and Household Consumption. Journal of Risk and Financial Management 14: 336. [Google Scholar] [CrossRef]

- Bekareva, Svetlana, Ekaterina Meltenisova, and Nataliya Kravchenko. 2019. Central banks’ inflation targeting and real exchange rates: Cointegration with structural breaks. Model Assisted Statistics and Applications 14: 89–102. [Google Scholar] [CrossRef]

- Belin, Matek, and Jan Hanousek. 2021. Which sanctions matter? Analysis of the EU/Russian sanctions of 2014. Journal of Comparative Economics 49: 244–57. [Google Scholar] [CrossRef]

- Bureau of Economic Analysis. 2021. International Data. Available online: https://www.bea.gov/system/files/2021–05/trans418.pdf (accessed on 16 February 2022).

- Chebotareva, Galina, Wadim Strielkowski, and Dalia Streimikiene. 2020. Risk assessment in renewable energy projects: A case of Russia. Journal of Cleaner Production 269: 122110. [Google Scholar] [CrossRef]

- Chishti, Muhammad Zubair, and Avik Sinha. 2022. Do the shocks in technological and financial innovation influence the environmental quality? Evidence from BRICS economies. Technology in Society 68: 101828. [Google Scholar] [CrossRef]

- Chishti, Muhammad Zubair, Javed Iqbal, Farrukh Mahmood, and Hafiz Syed Muhammad Azeem. 2020a. The implication of the oscillations in exchange rate for the commodity-wise trade flows between Pakistan and China: An evidence from ARDL approach. Review of Pacific Basin Financial Markets and Policies 23: 2050030. [Google Scholar] [CrossRef]

- Chishti, Muhammad Zubair, Sana Ullah, Ilhan Ozturk, and Ahmed Usman. 2020b. Examining the asymmetric effects of globalization and tourism on pollution emissions in South Asia. Environmental Science and Pollution Research 27: 27721–37. [Google Scholar] [CrossRef]

- Chishti, Muhammad Zubair, Manzoor Ahmad, Abdul Rehman, and Muhammad Kamran Khan. 2021. Mitigations pathways towards sustainable development: Assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. Journal of Cleaner Production 292: 126035. [Google Scholar] [CrossRef]

- Cook, Haas. 2014. Under the Microscope: The Real Costs of a Dollar. Available online: https://www.coindesk.com/markets/2014/07/05/under-the-microscope-the-real-costs-of-a-dollar (accessed on 30 November 2021).

- Crozet, Matthieu, Julian Hinz, Amrei Stammann, and Joschka Wanner. 2021. Worth the Pain? Firms’ Exporting Behaviour to countries under sanctions. European Economic Review 134: 103683. [Google Scholar] [CrossRef]

- Demchuk Irina, Natalia Fadeykina. 2016. Unlearned lessons of the economic doctrine of John Maynard Keynes. Siberian Financial School 114: 34–41. [Google Scholar]

- 2018. The Transition of China to Sustainable Growth—Implications for the Global Economy and the Euro Area; Frankfurt am Main: European Central Bank. Available online: https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op206.en.pdf (accessed on 9 December 2021).

- Doornich, June Borge, and Andreas Raspotnik. 2020. Economic Sanctions Disruption on International Trade Patterns and Global Trade Dynamics: Analyzing the Effects of the European Union’s Sanctions on Russia. Journal of East-West Business 26: 344–64. [Google Scholar] [CrossRef]

- Doran, Justin, Nóirín McCarthy, and Marie O’Connor. 2018. The role of entrepreneurship in stimulating economic growth in developed and developing countries. Cogent Economics & Finance 6: 1442093. [Google Scholar] [CrossRef]

- Ershov, Mikhail, and Anna Tanasova. 2020. On monetization, interest rates and economic growth. Proceedings of the Free Economic Society of Russia 213: 456–66. [Google Scholar]

- FAS. 2018. Report on Competition Policy in Russian Federation in 2018 to Organisation for Economic Co-Operation and Development. Available online: http://en.fas.gov.ru/upload/other/FAS%20Annual%20Report%202018.pdf (accessed on 12 December 2021).

- Federal Reserve Board. 2004. Risk and Uncertainty in Monetary Policy. Available online: https://www.federalreserve.gov/boarddocs/speeches/2004/20040103/default.htm (accessed on 11 December 2021).

- Frascaroli, Bruno, and Wellington Nobrega. 2019. Inflation targeting and inflation risk in Latin America. Emerging Markets Finance and Trade 55: 2389–408. [Google Scholar] [CrossRef]

- Glazyev, Sergei. 2018. Potential Opportunities for the Growth of the Russian Economy and the Monetary Policy of the Bank of Russia. Economic and Social Changes: Facts, Trends, Forecast 11: 30–48. [Google Scholar] [CrossRef]

- Glazyev, Sergei. 2020. On the incoherence of monetary policy with the task of economic development breakthrough. Proceedings of the Free Economic Society of Russia 214: 71–127. [Google Scholar]

- Guter-Sandu, Andrei, and Elizaveta Kuznetsova. 2020. Theorising resilience: Russia’s reaction to US and EU sanctions. East European Politics 36: 603–21. [Google Scholar] [CrossRef]

- Hayat, Muhammad Azmat, Huma Ghulam, Maryam Batool, Muhammad Zahid Naeem, Abdullah Ejaz, Cristi Spulbar, and Ramona Birau. 2021. Investigating the Causal Linkages among Inflation, Interest Rate, and Economic Growth in Pakistan under the Influence of COVID-19 Pandemic: A Wavelet Transformation Approach. Journal of Risk and Financial Management 14: 277. [Google Scholar] [CrossRef]

- He, Qichun, and Heng-fu Zou. 2016. Does inflation cause growth in the reform-era China? Theory and evidence. International Review of Economics & Finance 45: 470–84. [Google Scholar] [CrossRef][Green Version]

- Hellquist, Elin. 2019. Ostracism and the EU’s contradictory approach to sanctions at home and abroad. Contemporary Politics 25: 393–418. [Google Scholar] [CrossRef]

- Hufbauer, Gary Clyde, and Euijin Jung. 2020. What’s new in economic sanctions? European Economic Review 130: 103572. [Google Scholar] [CrossRef]

- IMF. 2021. World Economic Outlook Database. Available online: https://www.imf.org/en/Publications/WEO (accessed on 11 December 2021).

- Kalyukov, Evgeny. 2016. Nabiullina Told about the Change in the Development Model of the Russian Economy. Available online: http://www.rbc.ru/economics/14/11/2016/5829b9229a7947388373a8f3 (accessed on 30 November 2021).

- Kaneva, Maria, and Galina Untura. 2019. The impact of R&D and knowledge spillovers on the economic growth of Russian regions. Growth and Change 50: 301–34. [Google Scholar] [CrossRef]

- Karlova, Natalia, Elena Puzanova, Irina Bogacheva, and Alexandr Morozov. 2020. How Are Inflation Expectations of Enterprises Formed: Survey Results. Studies on Russian Economic Development 31: 522–32. [Google Scholar] [CrossRef]

- Kazmin, Alexey. 2015. Monetization of the economy as an indicator of the economic development of the state: Concept, methodology, modern trends. Vestnik OrelGIET 1: 119–22. [Google Scholar]

- Kholodilin, Konstantin, and Aleksei Netšunajev. 2019. Crimea and punishment: The impact of sanctions on Russian economy and economies of the euro area. Baltic Journal of Economics 19: 39–51. [Google Scholar] [CrossRef]

- Kitrar, Liudmila. 2021. The relationship of economic sentiment and GDP growth in Russia in light of the Covid-19 crisis. Entrepreneurial Business and Economics Review 9: 7–29. [Google Scholar] [CrossRef]

- Krivko, Mikhail, Luboš Smutka, and Wadim Strielkowski. 2019. Food security and the trade via lenses of sanctions. Journal of Security & Sustainability Issues 8: 813–24. [Google Scholar] [CrossRef]

- Krušković, Borivoj. 2020. Exchange Rate Targeting Versus Inflation Targeting: Empirical Analysis of the Impact on Employment and Economic Growth. Journal of Central Banking Theory and Practice 9: 67–85. [Google Scholar] [CrossRef]

- Kyriazis, Νikolaos. 2017. Eurozone Debt Monetization and Helicopter Money Drops: How Viable can this be? Journal of Central Banking Theory and Practice 6: 5–15. [Google Scholar] [CrossRef][Green Version]

- López-Villavicencio, Antonia, and Marc Pourroy. 2019. Does inflation targeting always matter for the ERPT? A robust approach. Journal of Macroeconomics 60: 360–77. [Google Scholar] [CrossRef]

- Majeed, Abdul, Ping Jiang, Mahmood Ahmad, Muhammad Asif Khan, and Judit Olah. 2021. The Impact of Foreign Direct Investment on Financial Development: New Evidence from Panel Cointegration and Causality Analysis. Journal of Competitiveness 13: 95–112. [Google Scholar] [CrossRef]

- McKinsey & Company. 2018. The Future of Work: Switzerland’s Digital Opportunity. Available online: https://www.mckinsey.com/ch/~/media/mckinsey (accessed on 10 December 2021).

- Mikosch, Heiner, and Laura Solanko. 2019. Forecasting Quarterly Russian GDP growth with mixed-frequency data. Russian Journal of Money and Finance 78: 19–35. [Google Scholar] [CrossRef]

- Ministry of Economic Development of Russia. 2021. On the Current Situation in the Russian Economy. Available online: https://www.economy.gov.ru/material/directions/makroec/ekonomicheskie_obzory/_o_tekushchey_situacii_v_rossiyskoy_ekonomike_dekabr_2021_yanvar_2022_goda.html (accessed on 15 February 2022).

- Mishchenko, Volodymyr, Svitlana Naumenkova, Svitlana Mishchenko, and Viktor Ivanov. 2018. Inflation and economic growth: The search for a compromise for the Central Bank’s monetary policy. Banks & Bank Systems 13: 153–63. [Google Scholar] [CrossRef]

- Mohan, Rakesh, and Partha Ray. 2019. Indian monetary policy in the time of inflation targeting and demonetization. Asian Economic Policy Review 14: 67–92. [Google Scholar] [CrossRef]

- Ngo, Vi Dung, Duc Khuong Nguyen, and Ngoc Thang Nguyen, eds. 2021. Entrepreneurial Finance, Innovation and Development: A Research Companion. London: Routledge. [Google Scholar]

- Palma, Nuno. 2018. Money and modernization in early modern England. Financial History Review 25: 231–61. [Google Scholar] [CrossRef]

- Porfiriev, Boris. 2020. Prospects for economic growth in Russia. Herald of the Russian Academy of Sciences 90: 158–64. [Google Scholar] [CrossRef]

- Rosstat. 2021. Dynamics of Investments in Fixed Assets in the Russian Federation. Available online: https://www.gks.ru/free_doc/new_site/business/invest/Din-inv.xls (accessed on 7 December 2021).

- Saddique, Asima, Mahmood Ahmad, Raheel Mumtaz, and Muhammad Arif. 2016. The Effect of Financial Variables on Bank Performance Pre and Post Financial Crisis. Journal of Finance and Accounting 4: 378–82. [Google Scholar] [CrossRef]

- Salnikov, Vladimir, Dmitry Galimov, Olga Mikheeva, Andrey Gnidchenko, and Alexey Rybalka. 2017. Russian manufacturing production capacity: Primary trends and structural characteristics. Russian Journal of Economics 3: 240–62. [Google Scholar] [CrossRef][Green Version]

- Samargandi, Nahla, Ali M. Kutan, Kazi Sohag, and Faisal Alqahtani. 2020. Equity market and money supply spillovers and economic growth in BRICS economies: A global vector autoregressive approach. The North American Journal of Economics and Finance 51: 101060. [Google Scholar] [CrossRef]

- Semenova, Nadezhda, Busalova Svetlana, Eremina Olga, Makeykina Svetlana, and Filichkina Yulia. 2017. Influence of Monetary Policy on Economic Growth in Russia. Journal of Applied Economic Sciences 12: 1389–98. [Google Scholar]

- Song, Chang-Qing, Chun-Ping Chang, and Qiang Gong. 2021. Economic growth, corruption, and financial development: Global evidence. Economic Modelling 94: 822–30. [Google Scholar] [CrossRef]

- Sutyagin, Vladislav, and Yana Radyukova. 2016. Economic Sanctions: Challenges and Opportunities for Russian Agriculture. Proceedings of the Free Economic Society of Russia 202: 257–76. [Google Scholar]

- Sutyagin, Vladislav, Viktor Zagumennov, Yana Radyukova, and Elena Kolesnichenko. 2017a. The reasons for the monetary nature of the current crisis of the Russian economy. Models, Systems, Networks in Economics, Technology, Nature and Society 2: 22–40. [Google Scholar]

- Sutyagin Vladislav, Yana Radyukova, Elena Kolesnichenko, Mikhail Bespalov, and Nikolai Pakhomov. 2017b. Systemic Crisis of the World Economy or the ‘Bourgeois Mode of Production’. European Research Studies Journal 20: 421–31. [Google Scholar]

- Trading Economics. 2021. Russia—GDP Growth Rate (QoQ). Available online: https://ru.tradingeconomics.com/russia/gdp-growth (accessed on 11 December 2021).

- Tyll, Ladislav, Karel Pernica, and Marketa Arltová. 2018. The impact of economic sanctions on Russian economy and the RUB/USD exchange rate. Journal of International Studies 11: 21–33. [Google Scholar] [CrossRef]

- World Bank. 2021. Inflation in Emerging and Developing Economies. Available online: https://www.worldbank.org/en/research/publication/inflation-in-emerging-and-developing-economies (accessed on 20 February 2022).

- Yang, Jinxuan, Syed Kumail Abbas Rizvi, Zhixiong Tan, Muhammad Umar, and Mansoor Ahmed Koondhar. 2021. The competing role of natural gas and oil as fossil fuel and the non-linear dynamics of resource curse in Russia. Resources Policy 72: 102100. [Google Scholar] [CrossRef]

- Zaitsev, Yuriy. 2020. Monetary and fiscal policy measures during the COVID-19 economic crisis in Russia. Finance: Theory and Practice 24: 6–18. [Google Scholar] [CrossRef]

- Zemke, Jerzy. 2017. The risk of hipothecary credic indexed to Swiss franc. Optimum. Economic Studies 89: 200–9. [Google Scholar] [CrossRef][Green Version]

- Zhang, Jiu, Li-Fu Jin, Bo Zheng, Yan Li, and Xiong-Fei Jiang. 2022. Simplified calculations of time correlation functions in non-stationary complex financial systems. Physica A: Statistical Mechanics and Its Applications 589: 126615. [Google Scholar] [CrossRef]

- Žukauskas, Vytautas, and Jorg Hülsmann. 2019. Financial asset valuations: The total demand approach. The Quarterly Review of Economics and Finance 72: 123–31. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).