The Influence of Transparency and Disclosure on the Valuation of Banks in India: The Moderating Effect of Environmental, Social, and Governance Variables, Shareholder Activism, and Market Power

Abstract

1. Introduction

2. Review of Literature

2.1. Investment Efficiency as a Predictor of Firm Value

2.2. Managerial Entrenchment, Social Responsibility, Firm Risk-Taking, and Shareholders’ Activity

2.3. Board Compensation and Disclosure Quality: Interference in Corporate Governance

2.4. Capital Market Response to Exploration and Exploitation Disclosure

3. An Elaboration of Empirical Results Obtained by Diverse Researchers and Hypotheses Development

3.1. Conceptual Model of the Study

3.2. Empirical Evidence on Disclosures

3.3. Researchers Take on Disclosures and Valuation

4. Data, Research Methodology, and Results

4.1. Data

4.2. Methodology

4.3. Descriptive Statistics

4.4. Multicollinearity and Endogeneity

4.5. Presenting the Empirical Results of the Study

4.6. Robustness Test of Results

5. Discussion of Results Obtained

5.1. Conversation over Hypotheses Testing

5.2. Comparison of the Findings with the Previous Work

5.3. Contributions and Practical Implications of the Study

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. TD Index (TD)

Appendix B. ESG Index (esgi)

Appendix C. Shareholder Activism Index (shai)

Appendix D. Lerner Index (li)

References

- Ahmed, Sheraz. 2015. Determinants of the quality of disclosed earnings and value relevance across transitional Europe. Journal of Accounting in Emerging Economies 5: 325–49. [Google Scholar] [CrossRef]

- Aksu, Mine, and Arman Kosedag. 2006. Transparency and disclosure scores and their determinants in the Istanbul Stock Exchange. Corporate Governance: An International Review 14: 277–96. [Google Scholar] [CrossRef]

- Alencar, Roberta. 2005. Cost of equity capital and disclosure level in Brazilian companies. Brazilian Business Review 2: 1–12. [Google Scholar] [CrossRef]

- Anam, Ousama Abdulrahman, Abdul Hamid Fatima, and Abdul Rashid Hafiz Majdi. 2011. Effects of intellectual capital information disclosed in annual reports on market capitalisation: Evidence from Bursa Malaysia. Journal of Human Resource Costing & Accounting 15: 85–101. [Google Scholar]

- Ariss, Rima Turk. 2010. On the implications of market power in banking: Evidence from developing countries. Journal of Banking and Finance 34: 765–75. [Google Scholar] [CrossRef]

- Arsov, Sasho, and Vesna Bucevska. 2017. Determinants of transparency and disclosure–evidence from post-transition economies. Economic Research-Ekonomska Istraživanja 30: 745–60. [Google Scholar] [CrossRef]

- Azrak, Tawfik, Buerhan Saiti, Ali Kutan, and Engku Rabiah Adawiah Engku Ali. 2020. Does information disclosure reduce stock price volatility? A comparison of Islamic and conventional banks in Gulf countries. International Journal of Emerging Markets 16: 1769–92. [Google Scholar] [CrossRef]

- Bajic, Stevan, and Burcin Yurtoglu. 2018. Which aspects of CSR predict firm market value? Journal of Capital Markets Studies 2: 50–69. [Google Scholar] [CrossRef]

- Baltagi, Badi H. 2008. Forecasting with panel data. Journal of Forecasting 27: 153–73. [Google Scholar] [CrossRef]

- Banghøj, Jesper, and Thomas Plenborg. 2008. Value relevance of voluntary disclosure in the annual report. Accounting & Finance 48: 159–80. [Google Scholar]

- Barslund, Mikkel. 2018. CHECKROB: Stata Module to Perform Robustness Check of Alternative Specifications. Copenhagen: University of Copenhagen Press. [Google Scholar]

- Baumann, Ursel, and Erlend Nier. 2004. Disclosure, volatility, and transparency: An empirical investigation into the value of bank disclosure. Economic Policy Review 10: 31–45. [Google Scholar]

- Berglof, Erik, and Anete Pajuste. 2005. What do firms disclose and why ? Enforcing corporate governance and transparency in central and eastern Europe. Oxford Review of Economic Policy 21: 178–97. [Google Scholar] [CrossRef]

- Bhimavarapu, Venkata M., Shailesh Rastogi, and Jagjeevan Kanoujiya. 2022. Ownership concentration and its influence on transparency and disclosures of banks in India. Corporate Governance. [Google Scholar] [CrossRef]

- Casu, Barbara, and Claudia Girardone. 2009. Testing the relationship between competition and efficiency in banking: A panel data analysis. Economics Letters 105: 134–37. [Google Scholar] [CrossRef]

- Chakroun, Raidi, Hamadi Matoussi, and Sara Mbirki. 2017. Determinants of CSR disclosure of Tunisian listed banks: A multi-support analysis. Social Responsibility Journal 13: 552–84. [Google Scholar] [CrossRef]

- Charumathi, Balakrishnan, and Latha Ramesh. 2020. Impact of voluntary disclosure on valuation of firms: Evidence from Indian companies. Vision 24: 194–203. [Google Scholar] [CrossRef]

- Damodaran, Aswath. 2007. Information transparency and valuation: Can you value what you cannot see. Managerial Finance 33: 877–92. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Maria Soledad Martínez Pería. 2010. A framework for analysing competition in the banking sector: An application to the case of Jordan. World Bank Policy Research Working Paper 23: 1–24. [Google Scholar]

- DesJardine, Mark R., Wei Shi, and Zhihui Sun. 2022. Different horizons: The effects of hedge fund activism versus corporate shareholder activism on strategic actions. Journal of Management 48: 1858–87. [Google Scholar] [CrossRef]

- Dewi, Rosiyana R. 2020. Building reputation through environmental disclosure. Indonesian Management and Accounting Research 18: 1–16. [Google Scholar] [CrossRef]

- Dias, Alexandra. 2013. Market capitalisation and Value-at-Risk. Journal of Banking and Finance 37: 5248–60. [Google Scholar] [CrossRef]

- Durnev, Art, Kan Li, Randall Morck, and Bernard Yyeung. 2004. Capital markets and capital allocation: Implications for economies in transition. Economies of Transition 12: 593–634. [Google Scholar] [CrossRef]

- Durnev, Art, and E. Han Kim. 2005. To steal or not to steal: Firm attributes, legal environment, and valuation. The Journal of Finance 60: 1461–93. [Google Scholar] [CrossRef]

- Fischer, Paul E., and Robert E. Verrecchia. 2004. Disclosure bias. Journal of Accounting and Economics 38: 223–50. [Google Scholar] [CrossRef]

- Fosu, Samuel, Collins G. Ntim, William Coffie, and Victor Murinde. 2017. Bank opacity and risk-taking: Evidence from analysts’ forecasts. Journal of Financial Stability 33: 81–95. [Google Scholar] [CrossRef]

- Grosman, Anna. 2022. Mitigating financing constraints on investment: Ownership and transparency in Russia. Journal of East European Management Studies 27: 434–61. [Google Scholar] [CrossRef]

- Hanifa, Mohammed H., and Hafiz Majdi Ab Rashid. 2005. The determinants of voluntary disclosures in Malaysia: The case of internet financial reporting. Unitar E-Journal 2: 22–42. [Google Scholar]

- Hassan, Omaima A.G., Peter Romilly, Gianluigi Giorgioni, and David Power. 2009. The value relevance of disclosure: Evidence from the emerging capital market of Egypt. The International Journal of Accounting 44: 79–102. [Google Scholar] [CrossRef]

- Hossain, Mohammed. 2008. The Extent of Disclosure in Annual Reports of Banking Companies: The Case of India. European Journal of Scientific Research 23: 660–81. [Google Scholar]

- Hsiao, Cheng. 1985. Benefits and limitations of panel data. Econometric Reviews 4: 121–74. [Google Scholar] [CrossRef]

- Hsiao, Cheng. 2007. Panel data analysis—Advantages and challenges. Test 16: 1–22. [Google Scholar] [CrossRef]

- Hutton, Amy P., Gregory S. Miller, and Douglas J. Skinner. 2003. The role of supplementary statements with management earnings forecasts. Journal of Accounting Research 41: 867–90. [Google Scholar] [CrossRef]

- Jain, Ameeta, Monica Keneley, and Dianne Thomson. 2015. Voluntary CSR disclosure works! Evidence from Asia-Pacific banks. Social Responsibility Journal 11: 2–18. [Google Scholar] [CrossRef]

- Jayadev, M. 2013. Basel III implementation: Issues and challenges for Indian banks. IIMB Management Review 25: 115–30. [Google Scholar] [CrossRef]

- Jayaraman, Sudarshan, and Joanna Shuang Wu. 2019. Is silence golden? Real effects of mandatory disclosure. The Review of Financial Studies 32: 2225–59. [Google Scholar] [CrossRef]

- Jensen, Michael A., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jiao, Yawen. 2011. Corporate disclosure, market valuation, and firm performance. Financial Management 40: 647–76. [Google Scholar] [CrossRef]

- Jones, Jeffrey S., Wayne Y. Lee, and Timothy J. Yeager. 2012. Opaque banks, price discovery, and financial instabilit. Journal of Financial Intermediation 211: 383–408. [Google Scholar] [CrossRef]

- Kanoujiya, Jagjeevan, Venkata M. Bhimavarapu, and Shailesh Rastogi. 2021. Banks in India: A Balancing Act Between Profitability, Regulation and NPA. Vision. [Google Scholar] [CrossRef]

- Kim, Eun-Hee, and Thomas P. Lyon. 2015. Greenwash vs. brownwash: Exaggeration and undue modesty in corporate sustainability disclosure. Organization Science 26: 705–23. [Google Scholar] [CrossRef]

- Lang, Mark, Karly V. Lins, and Mark Maffett. 2012. Transparency, liquidity, and valuation: International evidence on when transparency matters most. Journal of Accounting Research 50: 729–74. [Google Scholar] [CrossRef]

- Lev, Baruch. 1992. Information disclosure strategy. California Management Review 34: 9–32. [Google Scholar] [CrossRef]

- Lev, Baruch, and Stephen H. Penman. 1990. Voluntary forecast disclosure, nondisclosure, and stock prices. Journal of Accounting Research 28: 49–76. [Google Scholar] [CrossRef]

- Liu, Shasha, and Robin Sickles. 2021. The agency problem revisited: A structural analysis of managerial productivity and CEO compensation in large US commercial bank. Empirical Economics 60: 391–418. [Google Scholar] [CrossRef]

- Longo, Manolina, Matteo Mura, and Alessandra Bonoli. 2005. Corporate social responsibility and corporate performance: The case of Italian SMEs. Corporate Governance: The International Journal of Effective Board Performance 5: 28–42. [Google Scholar] [CrossRef]

- Marquis, Christopher, Michael W. Toffel, and Yanhua Zhou. 2016. Scrutiny, norms, and selective disclosure: A global study of greenwashing. Organization Science 27: 483–504. [Google Scholar] [CrossRef]

- MendezDa-Silva, Wesley, and Luciana Massaro Onusic. 2014. Corporate e-disclosure determinants: Evidence from the Brazilian market. International Journal of Disclosure and Governance 11: 54–73. [Google Scholar] [CrossRef]

- Moreno, Diego, and Tikalo Takalo. 2016. Optimal bank transparency. Journal of Money, Credit and Banking 48: 203–31. [Google Scholar] [CrossRef]

- Oktaviani, Rachmawati M., Desy T. Susanti, Sunarto Sunarto, and Udin Udin. 2019. The effect of profitability, tax avoidance and information transparency on firm value: An empirical study in Indonesia. International Journal of Scientific and Technology Research 8: 3777–80. [Google Scholar]

- Pae, Suil. 2005. Selective disclosures in the presence of uncertainty about information endowment. Journal of Accounting and Economics 39: 383–409. [Google Scholar] [CrossRef]

- Panayi, Evridiki, Konstantinos Bozos, and Gianluca Veronesi. 2021. Corporate governance “bundles” and firm acquisitiveness. Corporate Governance: An International Review 29: 402–26. [Google Scholar] [CrossRef]

- Patel, Sandeep A., and George S. Dallas. 2002. Transparency and Disclosure: Overview of Methodology and Study Results-United States. SSRN 422800. Available online: http://repository.binus.ac.id/content/f0024/f002455955.pdf (accessed on 18 March 2020).

- Rashed, Ahmed, Ebitihj El-Rahman, Ezra Isamil, and Doaa Abd El-Samea. 2018. Ownership structure and investment efficiency: Evidence from Egypt. International Journal of Accounting and Financial Reporting 8: 1–22. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, and Jagjeevan Kanoujiya. 2022. Does transparency and disclosure (T&D) improve the performance of banks in India? International Journal of Productivity and Performance Management. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, Rajani Gupte, and R. Meenakshi. 2021. A holistic perspective on bank performance using regulation, profitability, and risk-taking with a view on ownership concentration. Journal of Risk and Financial Management 14: 111. [Google Scholar] [CrossRef]

- Repková, Iveta. 2012. Market power in the Czech banking sector. Journal of Competitiveness 4: 143–55. [Google Scholar] [CrossRef]

- Salehi, Mehdi, and Hussein Alkhyyoon. 2022. The relationship between managerial entrenchment, social responsibility, and firm’s risk-taking and shareholders’ activity. Social Responsibility Journal 18: 1035–49. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Bahman Jamalikazemini, and Shayan Farhangdoust. 2018. Board compensation and disclosure quality: Corporate governance interference. Contaduría y Administración 63: 1–30. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Grezgorz Zimon, Avinash Arianpoor, and Fatemeh Eidi Gholezoo. 2022. The impact of investment efficiency on firm value and moderating role of institutional ownership and board independence. Journal of Risk and Financial Management 15: 170. [Google Scholar] [CrossRef]

- Sampong, Frank, Na Song, Kingsley Osei Boahene, and Kwame Ansong Wadie. 2018. Disclosure of CSR performance and firm value: New evidence from South Africa on the basis of the GRI guidelines for sustainability disclosure. Sustainability 10: 4518. [Google Scholar] [CrossRef]

- Sengupta, Partha, and Suning Zhang. 2015. Equity-based compensation of outside directors and corporate disclosure quality. Contemporary Accounting Research 32: 1073–98. [Google Scholar] [CrossRef]

- Sheu, Her-Jiun, Huimin Chung, and Chih-Liang Liu. 2010. Comprehensive disclosure of compensation and firm value: The case of policy reforms in an emerging market. Journal of Business Finance and Accounting 37: 1115–44. [Google Scholar] [CrossRef]

- Shingade, Sudam, Shailesh Rastogi, Venkata M. Bhimavarapu, and Abhijit Chirputkar. 2022. Shareholder Activism and its impact on profitability, return, and valuation of the firms in India. Journal of Risk and Financial Management 15: 148. [Google Scholar] [CrossRef]

- Stein, Jeremy C. 2003. Agency, information, and corporate investment. In The Handbook of the Economics of Finance. Edited by George M. Constantinides, Milton Harris and Renee M. Stultz. Amsterdam: Elsevier, pp. 111–65. [Google Scholar]

- Sudha, S. 2015. Risk-return and volatility analysis of Sustainability Index in India. Environment, Development and Sustainability 17: 1329–42. [Google Scholar] [CrossRef]

- Taylor, Joseph, Joseph Vithayathil, and Dobin Yim. 2018. Are corporate social responsibility (CSR) initiatives such as sustainable development and environmental policies value-enhancing or window dressing? Corporate Social Responsibility and Environmental Management 25: 971–80. [Google Scholar] [CrossRef]

- Vargas, Luiz Henrique F., Patricia M. Bortolon, Lucan A. Barros, and Ricardo P. Leal. 2018. Recent activism initiatives in Brazil. International Journal of Disclosure and Governance 15: 40–50. [Google Scholar] [CrossRef]

- Vishwanath, Tara, and Daniel Kaufmann. 1999. Towards Transparency in Finance and Governance. Available online: https://ssrn.com/abstract=258978 (accessed on 5 June 2020). [CrossRef]

- Wagner, Wolf. 2007. Financial development and the opacity of banks. Economics Letters 97: 6–10. [Google Scholar] [CrossRef]

- Waymire, Gregory. 1984. Additional evidence on the information-content of management earnings forecasts. Journal of Accounting Research 22: 703–18. [Google Scholar] [CrossRef]

- Wibowo, Agus Adi, Didit Supriyadi, and Nunung Nurhasanah. 2022. Pengaruh Current Ratio Terhadap Harga Saham dengan Price to Book Value sebagai Variabel Intervening pada Perusahaan Terklasifikasi SIC-3711 yang Terdaftar di NYSE Periode 2016–2020. Business Innovation and Entrepreneurship Journal 4: 108–17. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2015. Introductory Econometrics: A Modern Approach. Boston: Cengage Learning. [Google Scholar]

- Xu, Shen, Bichao Yin, and Chungjie Lou. 2022. Minority shareholder activism and corporate social responsibility. Economic Modelling 116: 106045. [Google Scholar] [CrossRef]

- Zhang, Yi, Gin Chong, and Ruixin Jia. 2019. Fair value, corporate governance, social responsibility disclosure and banks’ performance. Review of Accounting and Finance 19: 30–47. [Google Scholar] [CrossRef]

| SN | Variable | Type | Symbol | Definition | Citations |

|---|---|---|---|---|---|

| 1 | Financial Performance | DV | mpbp | The bank’s financial performance is proxied by the performance ratio, measured as the market price ratio to the book price (mpbp) of the bank’s share. | Rastogi et al. (2021), Wibowo et al. (2022) |

| 2 | Transparency and Disclosures | EV | Tdi | It represents the transparency and disclosure level of a bank, and it is computed by developing a TD index as discussed in Appendix A, Appendix B, Appendix C and Appendix D. | Arsov and Bucevska (2017), Rastogi and Kanoujiya (2022) |

| 3 | Shareholders’ Activism | MV | Shai | It shows the degree of shareholders’ activism practices in a bank. Please see the detail for the measurement of SHA index (shai) formation in the Appendix A, Appendix B, Appendix C and Appendix D. | DesJardine et al. (2022), Xu et al. (2022) |

| 4 | Environmental, social, and governance | MV | Esgi | It shows the level of ESG engagement in a bank. An ESG index is developed for measuring ESG practices in a bank. | Kanoujiya et al. (2021), Rastogi et al. (2021) |

| 5 | Competition (Lerner index) | MV | Li | It shows the competition level of banks in India. The Lerner index is used to quantify the competition. Higher values show the greater monopoly power of a bank. See Appendix A, Appendix B, Appendix C and Appendix D. | Kanoujiya et al. (2021) |

| 6 | Assets | CV | ln_Assets | It is the total amount (in INR) of assets in a bank. The log value (natural) was taken due to extreme value inconsistencies. | Rastogi et al. (2021), Jayadev (2013) |

| 7 | Sales | CV | ln_Sales | It refers to the bank’s value. The amount (in INR) of sales is taken in INR. The log value (natural) is taken for extreme value inconsistencies. | Jayadev (2013), Dias (2013) |

| Variables | Mean | SD | Min | Max |

|---|---|---|---|---|

| mpbp | 1.293143 | 1.277247 | 0 | 12.11 |

| tdi | 0.502087 | 0.096445 | 0 | 0.843137 |

| shai | 0.529862 | 0.105252 | 0 | 0.714286 |

| esgi | 0.27182 | 0.064807 | 0 | 0.435484 |

| li | −0.35129 | 6.49438 | −51.2025 | 1.875981 |

| Assets | 307,270.8 | 446,877.3 | 3229.69 | 3,680,914 |

| Sales | 20,564.07 | 38,199.26 | 50 | 321,006.7 |

| Variables | tdi | Dtdi | dtdi2 | dshai | desgi | dli | dtdi_dshai | dtdi_desgi | dtdi_dli | ln_Assets | ln_Sales |

|---|---|---|---|---|---|---|---|---|---|---|---|

| tdi | 1.0000 | ||||||||||

| dtdi | 1.0000 * | 1.0000 | |||||||||

| (0.0000) | |||||||||||

| dtdi2 | 0.077 | 0.077 | 1.0000 | ||||||||

| (0.1762) | (0.1762) | ||||||||||

| dshai | 0.4469 * | 0.4469 * | −0.0547 | 1.0000 | |||||||

| (0.0000) | (0.0000) | (0.3375) | |||||||||

| desgi | 0.3711 * | 0.3711 * | 0.0128 | 0.1261 * | 1.0000 | ||||||

| (0.0000) | (0.0000) | (0.8225) | (0.0264) | ||||||||

| dli | 0.2315 * | 0.2315 * | −0.0898 | 0.1551 * | 0.1682 * | 1.0000 | |||||

| (0.0000) | (0.0000) | (0.1144) | (0.0062) | (0.003) | |||||||

| dtdi_dshai | −0.0718 | −0.0718 | 0.8293 * | −0.2966 * | −0.1552 * | −0.1011 | 1.0000 | ||||

| (0.2075) | (0.2075) | (0.0000) | (0.0000) | (0.0062) | (0.0754) | ||||||

| dtdi_desgi | 0.0185 | 0.0185 | 0.8584 * | −0.1710 * | −0.0832 | −0.1131 * | 0.8470 * | 1.0000 | |||

| (0.7455) | (0.7455) | (0.0000) | (0.0025) | (0.1441) | (0.0466) | (0.0000) | |||||

| dtdi_dli | −0.1349 * | −0.1349 * | 0.1087 | −0.1156 * | −0.1174 * | −0.9856 * | 0.0962 | 0.1287 * | 1.0000 | ||

| (0.0175) | (0.0175) | (0.0559) | (0.0419) | (0.0388) | (0.0000) | (0.0908) | (0.0234) | ||||

| ln_Assets | 0.4760 * | 0.4760 * | −0.0287 | 0.3619 * | 0.0549 | 0.3203 * | −0.1647 * | −0.0473 | −0.2860 * | 1.0000 | |

| (0.0000) | (0.0000) | (0.6147) | (0.0000) | (0.3357) | (0.0000) | (0.0036) | (0.4062) | (0.0000) | |||

| ln_Sales | 0.5193 * | 0.5193 * | −0.0159 | 0.3768 * | 0.0981 | 0.2800 * | −0.1557 * | −0.0166 | −0.2409 * | 0.8255 * | 1.0000 |

| (0.0000) | (0.0000) | (0.7806) | (0.0000) | (0.0848) | (0.0000) | (0.006) | (0.7714) | (0.0000) | (0.0000) |

| Model 1 (Base Model) | Model 2 (Quadratic Model) | Model 3 (Interaction Model) | Model 4 (Interaction Model) | Model 5 (Interaction Model) | |

|---|---|---|---|---|---|

| Durbin Chi-2 | 6.2653 * (0.0123) | 5.38234 * (0.0203) | 0.002612 (0.9592) | 0.333322 (0.5637) | 7.46166 * (0.0063) |

| Wu-Hausman Test | 6.29426 * (0.0127) | 5.38984 * (0.0210) | 0.002547 (0.9598) | 0.325377 (0.5689) | 7.4743 * (0.0067) |

| DV: mp_bp | Model 1 (Base Model) | Model 2 (Quadratic Model) | Model 3 (Interaction Model) (Robust) | Model 4 (Interaction Model) (Robust) | Model 5 (Interaction Model) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Coeff. | SE. | Coeff. | SE. | Coeff. | SE. | |||||

| tdi | −75.2 | 176.5 | ||||||||

| dtdi | 5.31 * | 0.317 | 3.96 * | 0.431 | 4.54 | 3.18 | ||||

| dtdi2 | 109.2 | 89.1 | ||||||||

| dshai | −0.233 | 0.477 | ||||||||

| desgi | 4.13 * | 1.05 | ||||||||

| dli | 9.60 | 26.77 | ||||||||

| dtdi_shai | 5.94 * | 1.65 | ||||||||

| dtdi_esgi | 9.78 * | 3.47 | ||||||||

| dtdi_dli | 63.56 | 177.42 | ||||||||

| ln_Assets | 1.020 | 2.82 | −0.10 | 0.211 | −0.24 * | 0.04 | −0.21 * | 0.05 | 0.41 | 2.04 |

| ln_Sales | 2.044 | 3.99 | 0.31 | 0.17 | 0.22 * | 0.04 | 0.22 * | 0.04 | 0.47 | 0.92 |

| Cons. | 9.495 | 22.1 | −1.27 | 1.86 | 2.11 * | 0.74 | 1.87 * | 0.77 | −16.82 | 53.83 |

| BP-test (Random effect) | 0.00 (1.0000) | 0.00 (1.0000) | 0.00 (1.0000) | 0.00 (1.0000) | 0.00 (1.0000) | |||||

| Hausman Test | 4.95 (0.1752) | 1.59 (0.6609) | 5.48 (0.3596) | 6.60 (0.2522) | 5.83 (0.3233) | |||||

| Wald test for Heteroscedasticity | 19.04 (0.0398) * | 18.92 (0.0053) * | ||||||||

| Chi- square | 1.17 (0.7601) | 7.88 (0.0485) * | 1356.24 (0.0000) * | 3283.73 (0.0000) * | 1.24 (0.9413) | |||||

| Wooldridge Autocorrelation Test AR (1) | 0.800 (0.3943) | 0.316 (0.5879) | ||||||||

| Max | Min | Mean | AvgSTD | PercSigni | Perc+ | Perc− | AvgT | Obs | |

|---|---|---|---|---|---|---|---|---|---|

| Core var (Model 3) | |||||||||

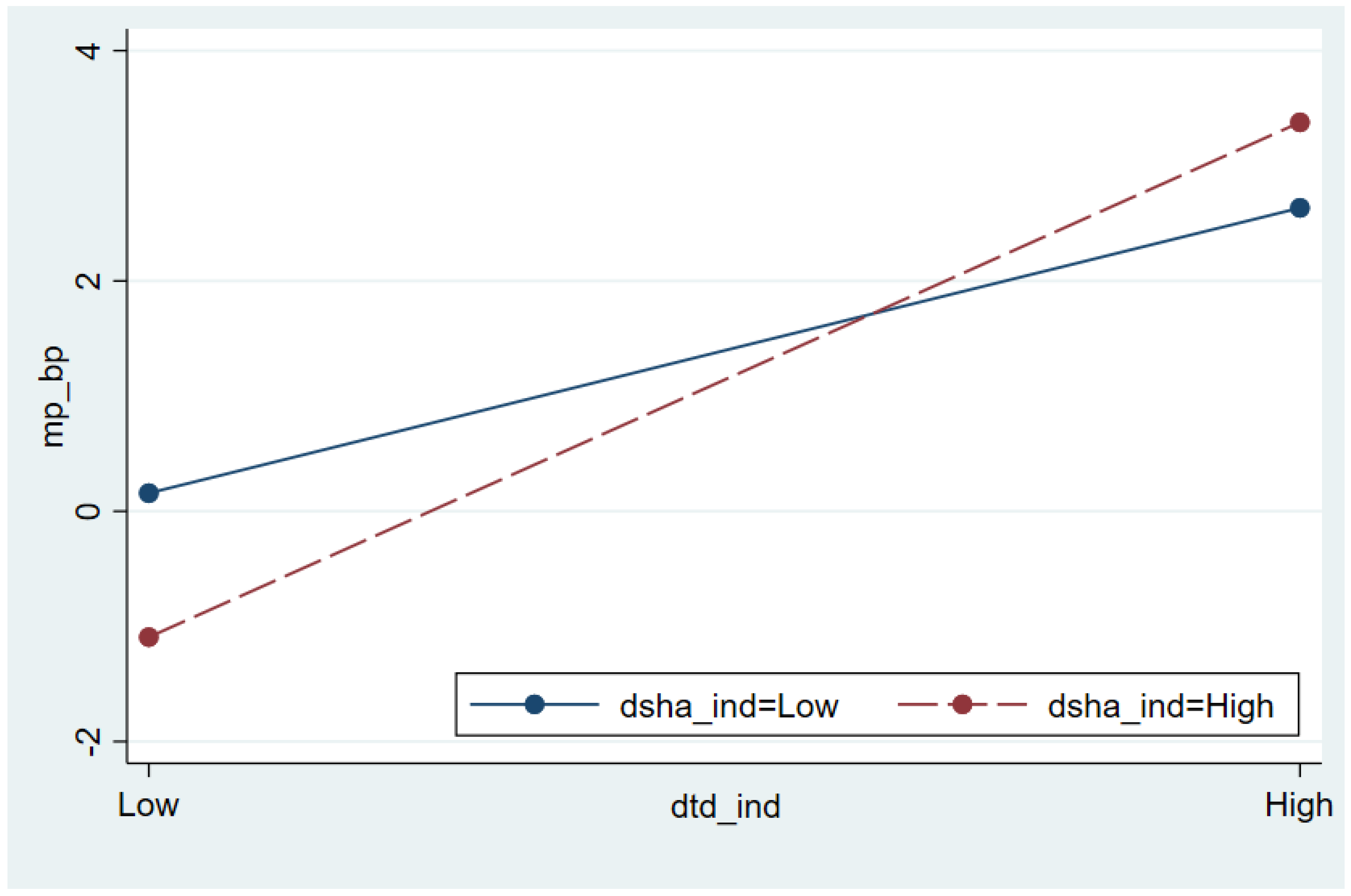

| dtd_ind | 5.53593 | 5.195344 | 5.406721 | 0.715016 | 1 | 1 | 0 | 7.567673 | 4 |

| dshai | −0.10074 | −0.34168 | −0.21696 | 0.740387 | 0 | 0 | 1 | 0.29305 | 4 |

| i_dtd_ind_dsha_ind | 6.342666 | 5.881461 | 6.144044 | 3.660206 | 0 | 1 | 0 | 1.678435 | 4 |

| ln_Assets | −1.48 × 10−8 | −8.90 × 10−7 | −4.53 × 10−7 | 2.41 × 10−7 | 0.5 | 0 | 1 | 1.413062 | 2 |

| ln_Sales | 1.16 × 10−5 | 2.48 × 10−6 | 7.05 × 10−6 | 2.82 × 10−6 | 0.5 | 1 | 0 | 2.204106 | 2 |

| Core var (Model 4) | |||||||||

| dtd_ind | 5.787833 | 4.993371 | 5.353114 | 0.767497 | 1 | 1 | 0 | 7.010221 | 4 |

| desgi | −0.10074 | −0.34168 | −0.21696 | 0.740387 | 0 | 0 | 1 | 0.29305 | 4 |

| i_dtd_ind_desg_s | 8.31176 | 7.156984 | 7.816695 | 6.546699 | 0 | 1 | 0 | 1.193792 | 4 |

| ln_Assets | −0.05713 | −0.24755 | −0.15234 | 0.072361 | 0.5 | 0 | 1 | 1.910644 | 2 |

| ln_Sales | 0.21926 | 0.050502 | 0.134881 | 0.064112 | 0.5 | 1 | 0 | 1.909064 | 2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bhimavarapu, V.M.; Rastogi, S.; Abraham, R. The Influence of Transparency and Disclosure on the Valuation of Banks in India: The Moderating Effect of Environmental, Social, and Governance Variables, Shareholder Activism, and Market Power. J. Risk Financial Manag. 2022, 15, 612. https://doi.org/10.3390/jrfm15120612

Bhimavarapu VM, Rastogi S, Abraham R. The Influence of Transparency and Disclosure on the Valuation of Banks in India: The Moderating Effect of Environmental, Social, and Governance Variables, Shareholder Activism, and Market Power. Journal of Risk and Financial Management. 2022; 15(12):612. https://doi.org/10.3390/jrfm15120612

Chicago/Turabian StyleBhimavarapu, Venkata Mrudula, Shailesh Rastogi, and Rebecca Abraham. 2022. "The Influence of Transparency and Disclosure on the Valuation of Banks in India: The Moderating Effect of Environmental, Social, and Governance Variables, Shareholder Activism, and Market Power" Journal of Risk and Financial Management 15, no. 12: 612. https://doi.org/10.3390/jrfm15120612

APA StyleBhimavarapu, V. M., Rastogi, S., & Abraham, R. (2022). The Influence of Transparency and Disclosure on the Valuation of Banks in India: The Moderating Effect of Environmental, Social, and Governance Variables, Shareholder Activism, and Market Power. Journal of Risk and Financial Management, 15(12), 612. https://doi.org/10.3390/jrfm15120612