Corporate Investment Decision: A Review of Literature

Abstract

1. Introduction

- What are the major determinants of corporate physical investment decisions?

2. Theoretical Review

2.1. Neoclassical Theory of Investment

- No uncertainty exists in the market;

- The enterprises are operating in full perfect competition;

- There exists a maximum employment rate in an economy;

- There is an efficient financial market that can offer loans to the industrial sector at given interest rates;

- Corporate firms are able to maximize the net present value of present and future cash flows.

2.2. Accelerator Theory of Investment

2.3. Q Theory of Investment

2.4. The Internal Funds Theory of Investment

3. Material and Methods

4. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Declaration

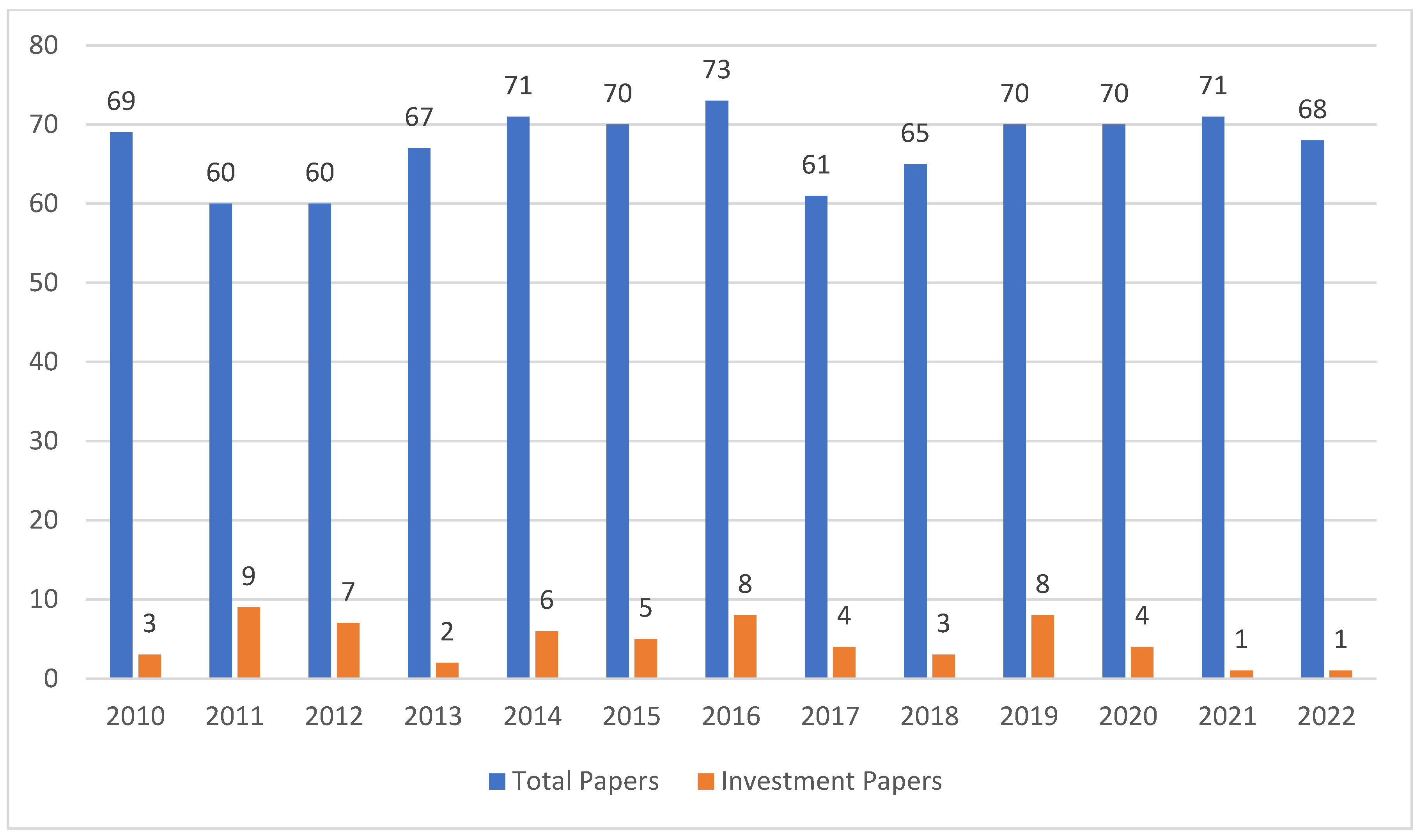

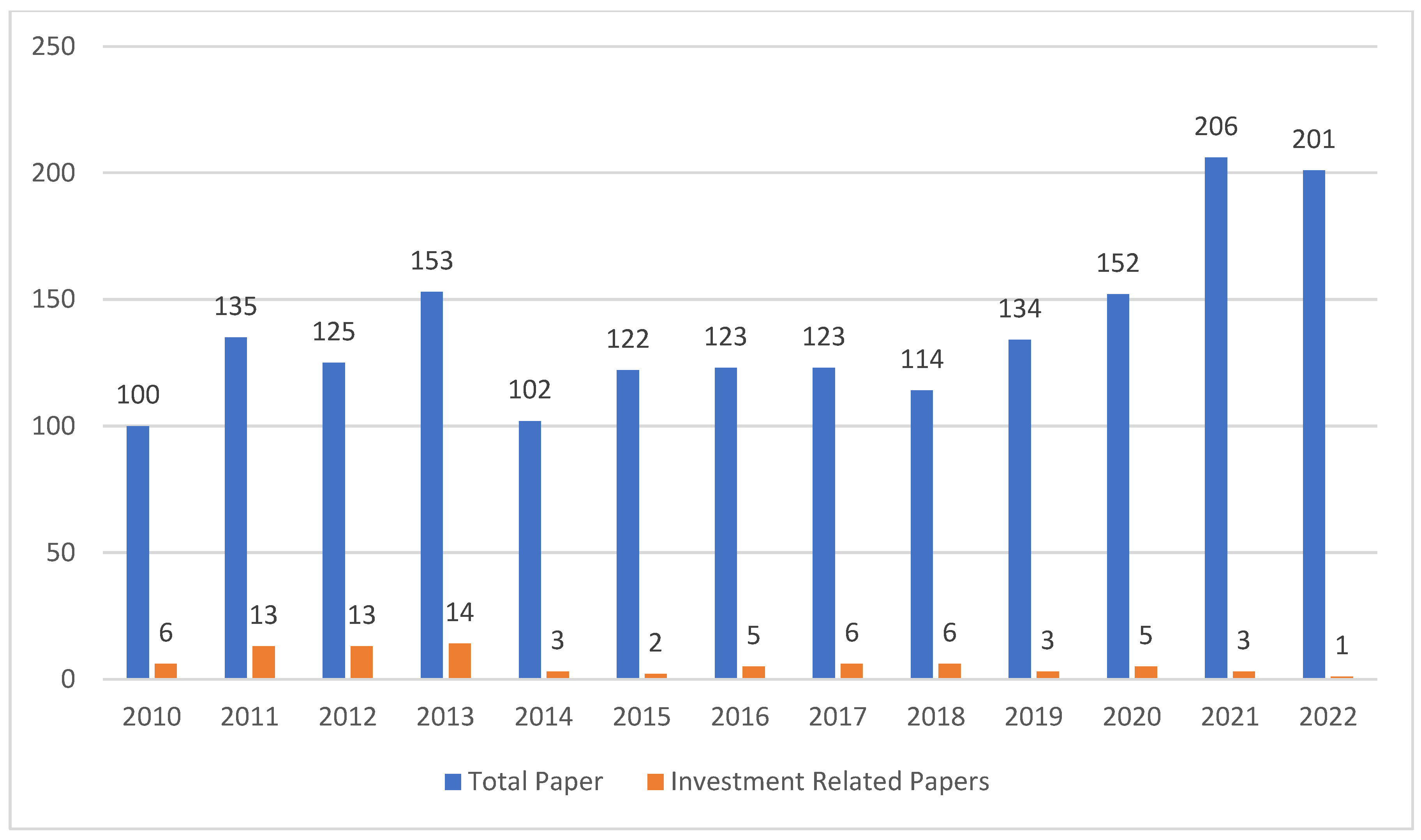

| 1 | According to JCR (journal citation report) journal lists, the top three journals of finance are The Journal of Finance (JF), The Review of Financial Studies (RFS), and The Journal of Financial Economics (JFE). |

References

- Abel, Andrew B., and Stavros Panageas. 2022. An Analytic Framework for Interpreting Investment Regressions in the Presence of Financial Constraints. The Review of Financial Studies 35: 4055–104. [Google Scholar] [CrossRef]

- Adelino, Manuel, Katharina Lewellen, and Anant Sundaram. 2015. Investment Decisions of Nonprofit Firms: Evidence from Hospitals. The Journal of Finance 70: 1583–628. [Google Scholar] [CrossRef]

- Adelino, Manuel, Song Ma, and David Robinson. 2017. Firm Age, Investment Opportunities, and Job Creation. The Journal of Finance 72: 999–1038. [Google Scholar] [CrossRef]

- Ai, Hengjie, and Rui Li. 2015. Investment and CEO compensation under limited commitment. Journal of Financial Economics 116: 452–72. [Google Scholar]

- Ajide, Folorunsho M. 2017. Firm-specific, and Institutional Determinants of Corporate Investments in Nigeria. Future Business Journal 3: 107–18. [Google Scholar] [CrossRef]

- Alti, Aydoğan, and Paul C. Tetlock. 2014. Biased Beliefs, Asset Prices, and Investment: A Structural Approach. The Journal of Finance 69: 325–61. [Google Scholar] [CrossRef]

- Arif, Salman, and Charles M. C. Lee. 2014. Aggregate Investment and Investor Sentiment. The Review of Financial Studies 27: 3241–79. [Google Scholar] [CrossRef]

- Asker, John, Joan Farre-Mensa, and Alexander Ljungqvist. 2015. Corporate Investment and Stock Market Listing: A Puzzle? The Review of Financial Studies 28: 342–90. [Google Scholar] [CrossRef]

- Babenko, Ilona, Michael Lemmon, and Yuri Tserlukevich. 2011. Employee Stock Options and Investment. The Journal of Finance 66: 981–1009. [Google Scholar]

- Bai, John, Douglas Fairhurst, and Matthew Serfling. 2020. Employment Protection, Investment, and Firm Growth. The Review of Financial Studies 33: 644–88. [Google Scholar] [CrossRef]

- Bakke, Tor-Erik, and Toni M. Whited. 2010. Which Firms Follow the Market? An Analysis of Corporate Investment Decisions. The Review of Financial Studies 23: 1941–80. [Google Scholar] [CrossRef]

- Barattieri, Alessandro, Laura Moretti, and Vincenzo Quadrini. 2021. Banks funding, leverage, and investment. Journal of Financial Economics 141: 148–71. [Google Scholar] [CrossRef]

- Bargeron, Leonce, David Denis, and Kenneth Lehn. 2018. Financing Investment Spikes in the Years Surrounding World War I. Journal of Financial Economics 130: 215–36. [Google Scholar] [CrossRef]

- Bernard, Darren, Terrence Blackburne, and Jacob Thornock. 2020. Information Flows among Rivals and Corporate Investment. Journal of Financial Economics 136: 760–79. [Google Scholar] [CrossRef]

- Bharath, Sreedhar, Amy Dittmar, and Jagadeesh Sivadasan. 2014. Do Going-Private Transactions Affect Plant Efficiency and Investment? The Review of Financial Studies 27: 1929–76. [Google Scholar] [CrossRef]

- Billett, Matthew T., Jon A. Garfinkel, and Yi Jiang. 2011. The influence of governance on investment: Evidence from a hazard model. Journal of Financial Economics 102: 643–70. [Google Scholar] [CrossRef]

- Bolton, Patrick, Hui Chen, and Neng Wang. 2011. A Unified Theory of Tobin’s q, Corporate Investment, Financing, and Risk Management. The Journal of Finance 66: 1545–78. [Google Scholar] [CrossRef]

- Bottazzi, Laura, Marco Da Rin, and Thomas Hellmann. 2016. The Importance of Trust for Investment: Evidence from Venture Capital. The Review of Financial Studies 29: 2283–318. [Google Scholar] [CrossRef]

- Brainard, William C., and James Tobin. 1968. Pitfalls in Financial Model Building. The American Economic Review 58: 99–122. [Google Scholar]

- Bustamante, M. Cecilia. 2015. Strategic Investment and Industry Risk Dynamics. The Review of Financial Studies 28: 297–341. [Google Scholar] [CrossRef]

- Butler, Alexander W., Jess Cornaggia, Gustavo Grullon, and James P. Weston. 2011. Corporate financing decisions, managerial market timing, and real investment. Journal of Financial Economics 101: 666–83. [Google Scholar] [CrossRef]

- Caggese, Andrea. 2012. Entrepreneurial risk, investment, and innovation. Journal of Financial Economics 106: 287–307. [Google Scholar] [CrossRef]

- Campello, Murillo, Erasmo Giambona, John R. Graham, and Campbell R. Harvey. 2011. Liquidity Management and Corporate Investment During a Financial Crisis. The Review of Financial Studies 24: 1944–79. [Google Scholar] [CrossRef]

- Cavagnaro, Daniel R., Berk A. Sensoy, Yingdi Wang, and Michael S. Weisbach. 2019. Measuring Institutional Investors’ Skill at Making Private Equity Investments. The Journal of Finance 74: 3089–134. [Google Scholar] [CrossRef]

- Cingano, Federico, Francesco Manaresi, and Enrico Sette. 2016. Does Credit Crunch Investment Down? New Evidence on the Real Effects of theBank-Lending Channel. The Review of Financial Studies 29: 2737–73. [Google Scholar] [CrossRef]

- Clark, J. Maurice. 1917. Business Acceleration and the Law of Demand: A Technical Factor in Economic Cycles. Journal of Political Economy 25: 217–35. [Google Scholar] [CrossRef]

- DeMarzo, Peter M., Michael J. Fishman, Zhiguo He, and Neng Wang. 2012. Dynamic Agency and the q Theory of Investment. The Journal of Finance 67: 2295–340. [Google Scholar] [CrossRef]

- Denis, David J., and Valeriy Sibilkov. 2010. Financial Constraints, Investment, and the Value of Cash Holdings. The Review of Financial Studies 23: 247–69. [Google Scholar] [CrossRef]

- Dessaint, Olivier, Thierry Foucault, Laurent Frésard, and Adrien Matray. 2019. Noisy Stock Prices and Corporate Investment. The Review of Financial Studies 32: 2626–72. [Google Scholar] [CrossRef]

- Dicks, David, and Paolo Fulghieri. 2021. Uncertainty, Investor Sentiment, and Innovation. The Review of Financial Studies 34: 1236–79. [Google Scholar] [CrossRef]

- Ding, Sai, Alessandra Guariglia, and John Knight. 2013. Investment and financing constraints in China: Does working capital management make a difference? Journal of Banking & Finance 37: 1490–507. [Google Scholar]

- Duchin, Ran, Oguzhan Ozbas, and Berk A. Sensoy. 2010. Costly external finance, corporate investment, and the subprime mortgage credit crisis. Journal of Financial Economics 97: 418–35. [Google Scholar] [CrossRef]

- Edmans, Alex, Vivian W. Fang, and Katharina A. Lewellen. 2017. Equity Vesting and Investment. The Review of Financial Studies 30: 2229–71. [Google Scholar] [CrossRef]

- Fakos, Alexandros, Plutarchos Sakellaris, and Tiago Tavares. 2022. Investment slumps during financial crises: The real effects of credit supply. Journal of Financial Economics 145: 29–44. [Google Scholar] [CrossRef]

- Farooq, Umar, and Bilal Haider Subhani. 2021. Three Corporate Finance Practices in Pakistan: A Review of Previous Studies and Way Forward. Journal of Finance and Accounting Research 3: 61–84. [Google Scholar] [CrossRef]

- Farooq, Umar, Jaleel Ahmed, and Shamshair Khan. 2021a. Do the Macroeconomic Factors Influence the Firm’s Investment Decisions? A Generalized Method of Moments (GMM) Approach. International Journal of Finance and Economics 26: 790–801. [Google Scholar] [CrossRef]

- Farooq, Umar, Jaleel Ahmed, Mosab I. Tabash, Suhaib Anagreh, and Bilal Haider Subhani. 2021b. Nexus between Government Green Environmental Concerns and Corporate real Investment: Empirical evidence from selected Asian Economies. Journal of Cleaner Production 314: 128089. [Google Scholar] [CrossRef]

- Faulkender, Michael, and Mitchell Petersen. 2012. Investment and Capital Constraints: Repatriations Under the American Jobs Creation Act. The Review of Financial Studies 25: 3351–88. [Google Scholar] [CrossRef]

- Favara, Giovanni. 2012. Agency Problems and Endogenous Investment Fluctuations. The Review of Financial Studies 25: 2301–42. [Google Scholar] [CrossRef]

- Favara, Giovanni, Erwan Morellec, Enrique Schroth, and Philip Valta. 2017. Debt enforcement, investment, and risk taking across countries. Journal of Financial Economics 123: 22–41. [Google Scholar] [CrossRef]

- Federici, Daniela, and Valentino Parisi. 2015. Do corporate taxes reduce investments? Evidence from Italian firm-level panel data. Cogent Economics & Finance 3: 1–14. [Google Scholar]

- Fisher, Irving. 1930. The Theory of Interest. New York: Macmillan Co. [Google Scholar]

- Foucault, Thierry, and Laurent Fresard. 2014. Learning from peers’ stock prices and corporate investment. Journal of Financial Economics 111: 554–77. [Google Scholar] [CrossRef]

- Frank, Murray Z., and Tao Shen. 2016. Investment and the weighted average cost of capital. Journal of Financial Economics 119: 300–15. [Google Scholar] [CrossRef]

- Frésard, Laurent, and Philip Valta. 2016. How Does Corporate Investment Respond to Increased Entry Threat? The Review of Corporate Finance Studies 5: 1–35. [Google Scholar] [CrossRef]

- Gale, Douglas, and Piero Gottardi. 2015. Capital Structure, Investment, and Fire Sales. The Review of Financial Studies 28: 2502–33. [Google Scholar] [CrossRef][Green Version]

- Gao, Shenghao, Liming Wang, Ningyue Liu, and Min Zhang. 2019. Fiscal Decentralization and Corporate Investment: Empirical Evidence from China. Journal of Economic Policy Reform 22: 51–68. [Google Scholar] [CrossRef]

- Gilje, Erik P., and Jerome P. Taillard. 2016. Do Private Firms Invest Differently than Public Firms? Taking Cues from the Natural Gas Industry. The Journal of Finance 71: 1733–78. [Google Scholar] [CrossRef]

- Goldstein, Itay, and Chong Huang. 2020. Credit Rating Inflation and Firms’ Investments. The Journal of Finance 75: 2929–72. [Google Scholar] [CrossRef]

- Grieser, William, and Zack Liu. 2019. Corporate Investment and Innovation in the Presence of Competitor Constraints. The Review of Financial Studies 32: 4271–303. [Google Scholar] [CrossRef]

- Guceri, Irem, and Maciej Albinowski. 2021. Investment responses to tax policy under uncertainty. Journal of Financial Economics 141: 1147–70. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy Uncertainty and Corporate Investment. The Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Hackbarth, Dirk, and David C. Mauer. 2012. Optimal Priority Structure, Capital Structure, and Investment. The Review of Financial Studies 25: 747–96. [Google Scholar] [CrossRef]

- Harford, Jarrad, and Vahap B. Uysal. 2014. Bond market access and investment. Journal of Financial Economics 112: 147–63. [Google Scholar] [CrossRef]

- Hugonnier, Julien, Semyon Malamud, and Erwan Morellec. 2015. Capital Supply Uncertainty, Cash Holdings, and Investment. The Review of Financial Studies 28: 391–445. [Google Scholar] [CrossRef]

- Islam, Muhammad Saif Ul, Muhammad Saeed Meo, and Muhammad Usman. 2022. The relationship between corporate investment decision and firm performance: Moderating role of cash flows. Journal of Public Affairs 22: e2445. [Google Scholar]

- Jacob, Martin, Roni Michaely, and Maximilian A. Müller. 2019. Consumption Taxes and Corporate Investment. The Review of Financial Studies 32: 3144–82. [Google Scholar] [CrossRef]

- Jens, Candace E. 2017. Political Uncertainty and Investment: Causal Evidence from U.S. Gubernatorial Elections. Journal of Financial Economics 124: 563–79. [Google Scholar] [CrossRef]

- Jorgenson, Dale Weldeau. 1963. Capital Theory and Investment Behavior. The American Economic Review 53: 247–59. [Google Scholar]

- Julio, Brandon, and Youngsuk Yook. 2012. Political Uncertainty and Corporate Investment Cycles. The Journal of Finance 67: 45–83. [Google Scholar] [CrossRef]

- Kahle, Kathleen M., and René M. Stulz. 2013. Access to capital, investment, and the financial crisis. Journal of Financial Economics 110: 280–99. [Google Scholar] [CrossRef]

- Kang, Qiang, Qiao Liu, and Rong Qi. 2010. The Sarbanes-Oxley act and corporate investment: A structural assessment. Journal of Financial Economics 96: 291–305. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 2007. The General Theory of Employment, Interest and Money. London: Palgrave Macmillan. First published 1936. [Google Scholar]

- Kim, Hyunseob, and Howard Kung. 2017. The Asset Redeployability Channel: How Uncertainty Affects Corporate Investment. The Review of Financial Studies 30: 245–80. [Google Scholar] [CrossRef]

- Kong, Qunxi, Rongrong Li, Ziqi Wang, and Dan Peng. 2022. Economic policy uncertainty and firm investment decisions: Dilemma or opportunity? International Review of Financial Analysis 83: 102301. [Google Scholar] [CrossRef]

- Kumar, Praveen, and Dongmei Li. 2016. Capital Investment, Innovative Capacity, and Stock Returns. The Journal of Finance 71: 2059–94. [Google Scholar] [CrossRef]

- Lambrecht, Bart M., and Stewart C. Myers. 2017. The Dynamics of Investment, Payout and Debt. The Review of Financial Studies 30: 3759–800. [Google Scholar] [CrossRef]

- Lerner, Josh, Morten Sorensen, and Per Strömberg. 2011. Private Equity and Long-Run Investment: The Case of Innovation. The Journal of Finance 66: 445–77. [Google Scholar] [CrossRef]

- Leuz, Christian, Karl V. Lins, and Francis E. Warnock. 2010. Do Foreigners Invest Less in Poorly Governed Firms? The Review of Financial Studies 22: 3245–85. [Google Scholar] [CrossRef]

- Li, Qingyuan, Chen Lin, and Li Xu. 2020. Political Investment Cycles of State-Owned Enterprises. The Review of Financial Studies 33: 3088–129. [Google Scholar] [CrossRef]

- Lin, Xiaoji, Chong Wang, Neng Wang, and Jinqiang Yang. 2018. Investment, Tobin’s q, and interest rates. Journal of Financial Economics 130: 620–40. [Google Scholar] [CrossRef]

- Livdan, Dmitry, and Alexander Nezlobin. 2021. Investment, capital stock, and replacement cost of assets when economic depreciation is non-geometric. Journal of Financial Economics 142: 1444–69. [Google Scholar] [CrossRef]

- Lyandres, Evgeny, Maria-Teresa Marchica, Roni Michaely, and Roberto Mura. 2019. Owners’ Portfolio Diversification and Firm Investment. The Review of Financial Studies 32: 4855–904. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. Portfolio Selection. The Journal of Finance 7: 77–91. [Google Scholar]

- McLean, R. David, and Mengxin Zhao. 2014. The Business Cycle, Investor Sentiment, and Costly External Finance. The Journal of Finance 69: 1377–409. [Google Scholar] [CrossRef]

- McLean, R. David, Tianyu Zhang, and Mengxin Zhao. 2012. Why Does the Law Matter? Investor Protection and its Effects on Investment Finance. The Journal of Finance 67: 313–50. [Google Scholar] [CrossRef]

- Meeuwis, Maarten, Jonathan A. Parker, Antoinette Schoar, and Duncan Simester. 2022. Belief Disagreement and Portfolio Choice. The Journal of Finance 77: 3191–247. [Google Scholar] [CrossRef]

- Morellec, Erwan, and Norman Schürhoff. 2010. Dynamic Investment and Financing under Personal Taxation. The Review of Financial Studies 23: 101–46. [Google Scholar] [CrossRef]

- Morellec, Erwan, and Norman Schürhoff. 2011. Corporate investment and financing under asymmetric information. Journal of Financial Economics 99: 262–88. [Google Scholar] [CrossRef]

- Ouimet, Paige, and Geoffrey Tate. 2020. Learning from Coworkers: Peer Effects on Investment Decisions. The Journal of Finance 75: 133–72. [Google Scholar] [CrossRef]

- Ozdagli, Ali K. 2012. Financial Leverage, Corporate Investment, and Stock Returns. The Review of Financial Studies 25: 1033–69. [Google Scholar] [CrossRef]

- Panousi, Vasia, and Dimitris Papanikolaou. 2012. Investment, Idiosyncratic Risk, and Ownership. The Journal of Finance 67: 1113–48. [Google Scholar] [CrossRef]

- Peters, Ryan H., and Lucian A. Taylor. 2017. Intangible capital and the investment-q relation. Journal of Financial Economics 123: 251–72. [Google Scholar] [CrossRef]

- Rahayu, Sri Mangesti. 2019. Mediation Effects Financial Performance toward Influences of Corporate Growth and Assets Utilization. International Journal of Productivity and Performance Management 68: 981–96. [Google Scholar] [CrossRef]

- Rantala, Ville. 2019. How Do Investment Ideas Spread through Social Interaction? Evidence from a Ponzi Scheme. The Journal of Finance 74: 2349–89. [Google Scholar] [CrossRef]

- Rossi, Alberto G., David Blake, Allan Timmermann, Ian Tonks, and Russ Wermers. 2018. Network centrality and delegated investment performance. Journal of Financial Economics 128: 183–206. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Grzegorz Zimon, Arash Arianpoor, and Fatemeh Eidi Gholezoo. 2022. The Impact of Investment Efficiency on Firm Value and Moderating Role of Institutional Ownership and Board Independence. Journal of Risk and Financial Management 15: 170. [Google Scholar] [CrossRef]

- Schneider, Christoph, and Oliver Spalt. 2016. Conglomerate Investment, Skewness, and the CEO Long-Shot Bias. The Journal of Finance 71: 635–72. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset Prices: A Theory of Market Equilibrium under Conditions of Risk. Journal of Finance 19: 425–42. [Google Scholar]

- Tinbergen, Jan. 1938. Statistical Evidence on the Acceleration Principle. Economica 5: 164–76. [Google Scholar] [CrossRef]

- Tobin, James. 1969. A General Equilibrium Approach To Monetary Theory. Journal of Money, Credit and Banking 1: 15–29. [Google Scholar] [CrossRef]

- Tsoutsoura, Margarita. 2015. The Effect of Succession Taxes on Family Firm Investment: Evidence from a Natural Experiment. The Journal of Finance 70: 649–88. [Google Scholar] [CrossRef]

- Ungeheuer, Michael, and Martin Weber. 2021. The Perception of Dependence, Investment Decisions, and Stock Prices. Journal of Finance 76: 797–844. [Google Scholar] [CrossRef]

- Warusawitharana, Missaka, and Toni M. Whited. 2016. Equity Market Misvaluation, Financing, and Investment. The Review of Financial Studies 29: 603–54. [Google Scholar]

| Sr No. | Authors | Title | Sample | Journal | Findings |

|---|---|---|---|---|---|

| 1 | (Bolton et al. 2011) | A Unified Theory of Tobin’s q, Corporate Investment, Financing, and Risk Management | Not specific | J. of fin. | Investment depends upon the marginal q ratio. |

| 2 | (Babenko et al. 2011) | Employee Stock Options and Investment | 1773 firms listed at NASDAQ over the period 2000 to 2005 | J. of fin. | Corporate firms enhance equity financing by responding to increments in external financing which further has a positive influence. |

| 3 | (Lerner et al. 2011) | Private Equity and Long-Run Investment: The Case of Innovation | 472 leveraged buyouts transactions | J. of fin. | Leveraged buyouts (LBOs) have no effect on long-term investment. |

| 4 | (Demarzo et al. 2012) | Dynamic Agency and the q Theory of Investment | Not specific | J. of fin. | Idiosyncratic risk led to impede the investment, while past profit, investment, and managerial compensation enhance the investment. |

| 5 | (Panousi and Papanikolaou 2012) | Investment, Idiosyncratic Risk, and Ownership | 1987–2009, publicly traded firms of US | J. of fin. | Idiosyncratic risk has a negative effect on investment. However, this adverse is mitigated by offering options to executives. |

| 6 | (Julio and Yook 2012) | Political Uncertainty and Corporate Investment Cycles | Firm level observations for period 1980 to 2005 from 48 countries. | J. of fin. | Corporate firms reduce investment expenditures by 4.8% during an election year, corroborating the hypothesis that political uncertainty impedes investment. |

| 7 | (Mclean et al. 2012) | Why Does the Law Matter? Investor Protection and Its Effects on Investment, Finance | Firms listed on World scope for the year 1990 to 2007. | J. of fin. | Investor protections are positively associated with investment, reducing financial constraints and achieving investment efficiency. |

| 8 | (Alti and Tetlock 2014) | Biased Beliefs, Asset Prices, and Investment: A Structural Approach | A cross-section of 1000 firms, containing 20 samples of 40 years each. | J. of fin. | Information processing biases may cause mispricing, which can further distort investment decisions. |

| 9 | (Mclean and Zhao 2014) | The Business Cycle, Investor Sentiment, and Costly External Finance | 1965 to 2010 of all U.S. firms | J. of fin. | Responding to external finance, investment and employment is less sensitive to Tobin’s q while more sensitive to investor sentiments and cash flow. |

| 10 | (Tsoutsoura 2015) | The Effect of Succession Taxes on Family Firm Investment: Evidence from a Natural Experiment | 1999 to 2005, Greek | J. of fin. | The succession taxes lead to a more than 40% decline in investment volume. It further affects sales growth and cash reserves. |

| 11 | (Adelino et al. 2015) | Investment Decisions of Nonprofit Firms: Evidence from Hospitals | 1999 to 2006, Non-profit hospitals of U.S. | J. of fin. | The cash flow from financial assets can increase the investment by 10 to 28%. |

| 12 | (Kumar and Li 2016) | Capital Investment, Innovative Capacity, and Stock Returns | 1976 to 2011. NASDAQ listed firms | J. of fin. | Capital investment has strong implications for innovative behavior, future stock returns, and profitability. |

| 13 | (Schneider and Spalt 2016) | Conglomerate Investment, Skewness, and the CEO Long-Shot Bias | period not specified, U.S. | J. of fin. | Behavioral biases have a strong impact on capital investment. Additionally, CEOs allocate more funds for capital investment, responding to long-shot bias. |

| 14 | (Gilje and Taillard 2016) | Do Private Firms Invest Differently than Public Firms? Taking Cues from the Natural Gas Industry | 74,670 individual projects in the U.S. | J. of fin. | Private firms invest differently from public firms. Additionally, external capital access plays a key role in investment decisions. |

| 15 | (Adelino et al. 2017) | Firm Age, Investment Opportunities, and Job Creation | 2000 to 2007 | J. of fin. | Firm age has a significant role in investment decisions that further generate new jobs. This effect is equally applicable to newly established firms. |

| 16 | (Rantala 2019) | How Do Investment Ideas Spread through Social Interaction? Evidence from a Ponzi Scheme | data set from a large Ponzi scheme | J. of fin. | Social connection has strong connectivity with investment decisions. This effect is more explicit across the age, education, and income of the inviter. |

| 18 | (Cavagnaro et al. 2019) | Measuring Institutional Investors’ Skill at Making Private Equity Investments | 1991 and 2011 | J. of fin. | Institutional investors’ skills matter in achieving a higher return on investment. |

| 19 | (Goldstein and Huang 2020) | Credit Rating Inflation and Firms’ Investments | Not specified | J. of fin. | The high rating ranked by credit rating agencies has a positive effect on investment volume. |

| 20 | (Ouimet and Tate 2020) | Learning from Coworkers: Peer Effects on Individual Investment Decisions | J. of fin. | Peer effect exists in investment decisions making. This effect magnifies when co-workers have high information and are well educated. | |

| 21 | (Ungeheuer and Weber 2021) | The Perception of Dependence, Investment Decisions, and Stock Prices | 1963–2015 | J. of fin. | Investors perceive dependence, and this perception of stocks further affects investment decisions. |

| 22 | (Meeuwis et al. 2022) | Belief Disagreement and Portfolio Choice | 2016 | J. of fin. | Political beliefs play a vital role in selecting the portfolio of investment |

| Sr No. | Authors | Title | Sample | Journal | Findings |

|---|---|---|---|---|---|

| 1 | (Bakke and Whited 2010) | Which Firms Follow the Market? An Analysis of Corporate Investment Decisions | 1862 and 2647 observations per year | Rev. Fin. Std. | Stock market mispricing does not affect corporate investment decisions. |

| 2 | (Leuz et al. 2010) | Do Foreigners Invest Less in Poorly Governed Firms? | 4409 firms from twenty-nine countries | Rev. Fin. Std. | Corporate firms residing in bad governance countries attract fewer investors. Additionally, earning capacity and information asymmetric have key roles in investment attractiveness. |

| 3 | (Morellec and Schürhoff 2010) | Dynamic Investment and Financing under Personal Taxation | 1970 and 2008, U.S. industrial firms | Rev. Fin. Std. | The asymmetric taxation on capital gains and losses may enhance Investment. |

| 4 | (Denis and Sibilkov 2010) | Financial Constraints, Investment, and the Value of Cash Holdings | 1985–2006, U.S. public companies | Rev. Fin. Std. | Cash holdings allow constrained firms to make more investment decisions. |

| 5 | (Campello et al. 2011) | Liquidity Management and Corporate Investment During a Financial Crisis | 2008–2009, U.S. sample (397 non-financial, for-profit firms) | Rev. Fin. Std. | The availability of credit lines when companies face internal liquidity problems can enhance investment spending. |

| 6 | (Favara 2012) | Agency Problems and Endogenous Investment Fluctuations | Not specified | Rev. Fin. Std. | Agency problem arising from too much control or too less control jeopardizes firm productivity, which negatively influences real investment. |

| 7 | (Ozdagli 2012) | Financial Leverage, Corporate Investment, and Stock Returns | monthly data of all firms in the NYSE, AMEX, and NASDAQ from 1962 to 2008. | Rev. Fin. Std. | Deducting the tax due to interest payments can enhance investment irreversibility. |

| 8 | (Faulkender and Petersen 2012) | Investment and Capital Constraints: Repatriations Under the American Jobs Creation Act | firm’s 10-Ks from 2004, 2005, and 2006, U.S. | Rev. Fin. Std. | Responding to the American Job Creation Act, the reduction in taxation costs of corporate firms can lead to more investment. However, this effect does not exist in financially unconstrained firms. |

| 9 | (Hackbarth and Mauer 2012) | Optimal Priority Structure, Capital Structure, and Investment | Not specified | Rev. Fin. Std. | Financially constrained firms prefer more senior debts, while unconstrained firms prefer junior debt. Such preferences further have a dynamic effect on investment decisions. |

| 10 | (Arif and Lee 2014) | Aggregate Investment and Investor Sentiment | U.S. financial statement data over the period 1962–2009 | Rev. Fin. Std. | Corporate investment is positively related to investor sentiments. |

| 11 | (Bharath et al. 2014) | Do Going-Private Transactions Affect Plant Efficiency and Investment? | 1981 to 2005 | Rev. Fin. Std. | Privatization has little effect on corporate investment efficiency due to restrictions on control groups, including age, size, and past productivity. |

| 12 | (Gale and Gottardi 2015) | Capital Structure, Investment, and Fire Sales | Not specified | Rev. Fin. Std. | Due to tax advantages on debt financing, corporate firms prefer more debt which enhances the liquidity of firms and thus results in fire sales of assets. Responding to fire sales, corporate firms face underinvestment. |

| 13 | (Hugonnier et al. 2015) | Capital Supply Uncertainty, Cash Holdings, and Investment | Not specified | Rev. Fin. Std. | Capital supply uncertainty and cash holdings have significant roles in determining the investment costs that differ in firms facing higher costs as compared to firms having low costs. |

| 14 | (Asker et al. 2015) | Corporate Investment and Stock Market Listing: A Puzzle? | 409,762 firm-years for 99,040 private firms over the period from 2001 to 2011. | Rev. Fin. Std. | Publicly listed firms invest less as compared to private firms and are less responsive to any investment opportunities. |

| 15 | (Bustamante 2015) | Strategic Investment and Industry Risk Dynamics | 1968 to 2008, CRSP listed firms | Rev. Fin. Std. | In an imperfect market, the firm’s systematic risk is not only affected by its own investment strategies but also by its peers’ strategies. |

| 16 | (Cingano et al. 2016) | Does Credit Crunch Investment Down? New Evidence on the Real Effects of the Bank-Lending Channel | sample of 38,797 non-financial incorporated firms active in 2006 | Rev. Fin. Std. | A bank lending channel has a positive association with investment expenditures. |

| 17 | (Warusawitharana and Whited 2016) | Equity Market Mis valuation, Financing, and Investment | 1994 to 2013. Firms listed at COMPUSTAT | Rev. Fin. Std. | Different financing options, e.g., debt, equity, or cash, have a dynamic relationship with investment decisions. |

| 18 | (Gulen and Ion 2016) | Policy Uncertainty and Corporate Investment | January 1987 to December 2013 | Rev. Fin. Std. | Policy uncertainty has a strong negative impact on capital investment. |

| 19 | (Bottazzi et al. 2016) | The Importance of Trust for Investment: Evidence from Venture Capital | A survey of 685 VC firms in fifteen European Union countries | Rev. Fin. Std. | Trust has a positive relationship with investment decisions. |

| 20 | (Edmans et al. 2017) | Equity Vesting and Investment | Q1 2008–Q4 2009 | Rev. Fin. Std. | Equity vesting has a negative link with capital investment expenditures. |

| 21 | (Kim and Kung 2017) | The Asset Redeployability Channel: How Uncertainty Affects Corporate Investment | November 1989 to July 1991 | Rev. Fin. Std. | During a high uncertainty period, the utilization of redeployable capital can uplift the investment. |

| 22 | (Lambrecht and Myers 2017) | The Dynamics of Investment, Payout and Debt | Not specified | Rev. Fin. Std. | Risk-averse managers follow the debt level and payout while making decisions about investment. |

| 23 | (Jacob et al. 2019) | Consumption Taxes and Corporate Investment | 2009–2015, Dutch firms | Rev. Fin. Std. | Consumption taxes would lead to a decrease in capital investment due to a reduction in demand for industrial goods. |

| 24 | (Grieser and Liu 2019) | Corporate Investment and Innovation in the Presence of Competitor Constraints | 2010–2012, Patent data at Harvard Patent Database | Rev. Fin. Std. | In the presence of financially constrained competitors, corporate firms increase their investment to compete with competitors. |

| 25 | (Dessaint et al. 2019) | Noisy Stock Prices and Corporate Investment | All firms present in TNIC from 1996 to 2011. | Rev. Fin. Std. | Stock market inefficiencies reduce investment. This effect is parallel even for those firms that are not facing any financial constraints and agency problems. |

| 26 | (Lyandres et al. 2019) | Owners’ Portfolio Diversification and Firm Investment | 1999–2010, European publicly traded firms | Rev. Fin. Std. | Portfolio diversification has a positive link with the capital investment of public firms while negatively associated with private firms. |

| 27 | (Bai et al. 2020) | Employment Protection, Investment, and Firm Growth | 1969–2003, CRSP firms founded in U.S. | Rev. Fin. Std. | The adoption of employment protection laws can impede capital investment, following negative sales growth and cash flow. |

| 28 | (Li et al. 2020) | Political Investment Cycles of State-Owned Enterprises | 2001–2015, 140,000 state-owned enterprises from 25 European countries | Rev. Fin. Std. | State-owned firms increase their capital investment during the national election years. |

| 29 | (Dicks and Fulghieri 2021) | Uncertainty, Investor Sentiment, and Innovation | Not specified | Rev. Fin. Std. | Risk-averse investors pay more intention to innovation and thus have more investment. |

| 30 | (Abel and Panageas 2022) | An Analytic Framework for Interpreting Investment Regressions in the Presence of Financial Constraints | Not specified | Rev. Fin. Std. | In the presence of financial constraints, the average q and cash flow are the main determinants of investment. |

| Sr No. | Authors | Title | Sample | Journal | Findings |

|---|---|---|---|---|---|

| 1 | (Duchin et al. 2010) | Costly external finance, corporate investment, and the subprime Mortgage credit crisis | July 2007 to March 2009. | J. fin. Econ. | Following the recent financial crisis, corporate firms face a decline in investment due to an increment in external financing costs. This negative effect was more explicit in firms having low cash reserves, short-term debt, and being financially constrained. |

| 2 | (Kang et al. 2010) | The Sarbanes-Oxley act and corporate investment: A structural assessment | 1998 to 2005, U.S. and U.K. | J. fin. Econ. | The Sarbanes-Oxley Act of 2002 has an asymmetric impact on corporate investment and is significant across small firms. |

| 3 | (Butler et al. 2011) | Corporate financing decisions, managerial market timing, and real investment | 1971–2008, all firms on CRSP | J. fin. Econ. | Net financing matters more rather than the composition of financing for future stock returns and corporate investment decisions. |

| 4 | (Morellec and Schürhoff 2011) | Corporate investment and financing under asymmetric information | Using a sample of 60,000 artificial firms | J. fin. Econ. | Asymmetric information induces firms to make more investments due to the distortion of options stocks. |

| 5 | (Billett et al. 2011) | The influence of governance on investment: Evidence from a hazard model | 1990–2007, firms listed at Compustat | J. fin. Econ. | Firms with good governance indulge in long-term investment and have low over-investment. |

| 6 | (Caggese 2012) | Entrepreneurial risk, investment, and innovation | 1995, 1998, and 2001 Mediocrities Centrale Surveys | J. fin. Econ. | Investment risk has a negative impact on the innovation investment of entrepreneurial firms, while it has no effect on other firms. |

| 7 | (Kahle and Stulz 2013) | Access to capital, investment, and the financial crisis | Multiple sampling, U.S. firms | J. fin. Econ. | Financial crises have a negative impact on investment. However, bank-dependent firms do not decrease their investment during a financial crisis. |

| 8 | (Harford and Uysal 2014) | Bond market access and investment | 1990–2001, firms at CRSP | J. fin. Econ. | Lack of debt market access has a negative effect not only volume of investment but also on the quality of investment decisions. |

| 9 | (Foucault and Fresard 2014) | Learning from peers’ stock prices and corporate investment | 1996–2008, U.S. public firms | J. fin. Econ. | Peer effect exists in investment decisions. A 1% change in peers’ valuation could change corporate investment by 5.9%. |

| 10 | (Ai and Li 2015) | Investment and CEO compensation under limited commitment | 1992–2009, all firms listed in Execucomp and Compustat | J. fin. Econ. | Under optimal cost contract function, the smaller firms invest more, have high Tobin’s q, and enjoy better growth rates as compared to larger firms. |

| 11 | (Frank and Shen 2016) | Investment and the weighted average cost of capital | CRSP listed firms | J. fin. Econ. | The measurement of the weighted average cost of capital through CAPM has a negative effect, while measurement through the implied cost of capital has a positive effect on investment, implying that the implied cost of capital better reflects the cost of capital. |

| 12 | (Favara et al. 2017) | Debt enforcement, investment, and risk taking across countries | 2000–2010, 41 countries | J. fin. Econ. | The link between debt enforcement, risk exposure, and investment decisions is exposed to firm characteristics of default. |

| 13 | (Peters and Taylor 2017) | Intangible capital and the investment-q relation | 1975–2011, Compustat firms | J. fin. Econ. | Total physical investment is more sensitive to Tobin’s q and less sensitive to cash flow. At the macro level, Tobin’s q explains that intangible investment is better than physical investment. |

| 14 | (Jens 2017) | Political Uncertainty and Investment: Causal Evidence from U.S. Gubernatorial Elections | Q1 1984–2008 | J. fin. Econ. | Before election years, firms delay debt and equity issuance, which negatively determines the physical investment. |

| 15 | (Bargeron et al. 2018) | Financing Investment Spikes in the Years Surrounding World War I | 1914–1921, U.S. firms listed as public firms in 1905. | J. fin. Econ. | During World War 1, corporate firms increase their investments due to spikes in demand for industrial goods. Additionally, firms largely acquire external debt due to tax advantages and to meet investment objectives. |

| 16 | (Lin et al. 2018) | Investment, Tobin’s q, and interest rates | 1963–2014 | J. fin. Econ. | The credit spread and Tobin’s q have significant ability to predict investment efficiency. |

| 17 | (Rossi et al. 2018) | Network centrality and delegated investment performance | 1984–2004, U.K. firms | J. fin. Econ. | Greater network connections have a favorable impact on investment efficiency and the exploitation of more investment opportunities. |

| 18 | (Bernard et al. 2020) | Information Flows among Rivals and Corporate Investment | 2004–2015 | J. fin. Econ. | The analysis corroborated the existence of peer effect in investment decisions and vowed that rival information derives more investment. It further facilitates product differentiation strategies and mergers and acquisitions. |

| 19 | (Barattieri et al. 2021) | Banks funding, leverage, and investment | 1994–2014, 14,000 financial institutions from 30 OECD economies | J. fin. Econ. | Non-core funding provides insurance against risk, which further makes the leverage more attractive. Such an increase in leverage enhances the investment. |

| 20 | (Guceri and Albinowski 2021) | Investment responses to tax policy under uncertainty | 2005–2016, | J. fin. Econ. | In low uncertainty, tax incentives enhance investment. |

| 21 | (Livdan and Nezlobin 2021) | Investment, capital stock, and replacement cost of assets when economic depreciation is non-geometric | 1971–2017, firms in Compustat | J. fin. Econ. | Non-geometric efficiency changes the fundamental investment stocks and replacement costs. |

| 22 | (Fakos et al. 2022) | Investment slumps during financial crises: The real effects of credit supply | 2008–2015, Greek firms | J. fin. Econ. | The reduction in credit supply during depression impedes the investment. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Farooq, U.; Tabash, M.I.; Al-Naimi, A.A.; Drachal, K. Corporate Investment Decision: A Review of Literature. J. Risk Financial Manag. 2022, 15, 611. https://doi.org/10.3390/jrfm15120611

Farooq U, Tabash MI, Al-Naimi AA, Drachal K. Corporate Investment Decision: A Review of Literature. Journal of Risk and Financial Management. 2022; 15(12):611. https://doi.org/10.3390/jrfm15120611

Chicago/Turabian StyleFarooq, Umar, Mosab I. Tabash, Ahmad A. Al-Naimi, and Krzysztof Drachal. 2022. "Corporate Investment Decision: A Review of Literature" Journal of Risk and Financial Management 15, no. 12: 611. https://doi.org/10.3390/jrfm15120611

APA StyleFarooq, U., Tabash, M. I., Al-Naimi, A. A., & Drachal, K. (2022). Corporate Investment Decision: A Review of Literature. Journal of Risk and Financial Management, 15(12), 611. https://doi.org/10.3390/jrfm15120611