2.1. The Concept and Application of Industry 4.0

Industry 4.0, or I4.0 or I4, is based on automated technology networked via sensors and communication elements (

Blunck and Werthmann 2017), which thus connects the real and virtual world in the form of a cyber-physical system, such as, e.g., autonomous robots. Unlike traditional production systems with centralized control, which consider each individual machine as an independent unit, the so-called 4.0 factory connects machines into a type of community that is interacting and collaborating autonomously and “intelligently”. The use of advanced prediction tools enables continuous processing of big data for the purpose of decision making that is based on all available information at all times, which is the basis for the development of artificial intelligence (AI).

There are different definitions of Industry 4.0, but what they have in common is that they include technologies that lead to the automation of certain processes in production and/or provision of services. These are (

Dalenogare et al. 2018;

Lu 2017;

Wan et al. 2015;

Posada et al. 2015, cited in

Bai et al. 2020) 3D printing, artificial intelligence, augmented reality, robots, big data, Blockchain, cloud technology, “cobotic” systems involving human–robot cooperation, collaborative systems, cybersecurity and drones. Additionally, Global Positioning System (GPS), the Industrial Internet of Things, mobile technology, nanotechnology, RFID (technology that uses wireless communication and automatically tracks and identifies specific objects), sensors and simulations are related to Industry 4.0.

In this paper, companies that use certain elements of the fourth industrial revolution or plan to modify their business operations in line with the concept of Industry 4.0 are identified based on the following technologies (

BCG 2020—Boston Consulting Group). These include big data and analytics, autonomous robots, simulations, horizontal and vertical system integration, the Industrial Internet of Things, cybersecurity, the cloud, 3D printing and augmented reality.

A holistic approach to the technologies it uses is important for determining whether a company is an I4.0 company. Certain companies use some of these technologies, but this does not mean that they are fully considered part of Industry 4.0. Depending on the degree of application of these technologies, we can conclude whether a certain company is on track to realize the I4.0 concept. Differences among companies can be significant, ranging from a fully automated company that uses robots to manufacture robots (Japan as a synonym for robots and robotics) to companies that are gradually embracing certain segments of the new industrial revolution.

The technology characteristic of each of the previous three industrial revolutions (steam engines, electricity and information technology) was an extraordinary discovery and advancement, which is also the case in the current revolution. These changes will affect a number of areas, such as business administration, finance, the health sector, energy, transport, industry, service activities, intellectual services and many other areas such as genetics and biotechnology. The research conducted by

Frey and Osborne (

2013) assesses the susceptibility of current jobs to technological development. According to that estimate, 47% of total US employment is in the high-risk category. The model applied in the aforementioned paper predicts a different trend of polarization of the labor market from the existing one. As technology advances, according to the aforementioned research on the future of employment, workers with a lower level of skills are reallocated to tasks that require creative and social intelligence. However, the changes will also affect highly educated professionals (the example of IBM Watson), which will influence the field of law or healthcare (diagnostics). Google has utilized artificial intelligence as Google Duplex, a virtual assistant that can schedule meetings or appointments by communicating with real people, even those who do not know the language well. Due to the topic of this paper, it is necessary to emphasize the area of creative artificial intelligence that can provide new creative technological solutions by processing big data. For example, in the aerospace industry, when designing profiles that are extremely strong and light (for example, the Airbus A-320 concept, which reduces the weight of certain components by up to 45% compared to traditional models, which in turn significantly reduces fuel consumption and CO

2 and other GHG emissions, and in combination with the use of 3D printing, it also reduces the consumption of raw materials up to 95%).

Economic benefits cited as a kind of “drivers” of the fourth industrial revolution (McKinsey, cited in

Blunck and Werthmann 2017) include using resources and optimizing business processes. An example of this is decreasing material costs due to real-time monitoring of the production process, reduction of waiting time between different production steps in manufacturing and acceleration of research and development processes, which result in increased productivity. Optimal utilization of assets, management of inventories, increased productivity, improvement of the quality of products and services, reducing the time to market, reducing the costs of aftersales and customer support, service and product maintenance using virtual assistants and the like are just some of the benefits of Industry 4.0.

The industrial revolution of the fourth generation is mostly characterized by technologies listed and shortly described below. Description of each technology is short and sufficient for the purpose of this paper.

Artificial intelligence is mostly used for interaction with the environment, image recognition (static or in motion), human speech and the state of the environment (temperature, humidity, position, speed, direction of movement, etc.) and processing of collected data in real time with the aim of autonomous and experientially optimized management of a process. There is no generally accepted definition of artificial intelligence. The widest application of artificial intelligence is in robotics, which is used mostly in production processes, transport, design, engineering, finance, IT and diagnostics, as well as increasingly in households and the entertainment industry.

Big data are becoming the standard in real-time support in decision making. Data are collected from multiple sources, such as production equipment and systems and company and customer management systems. In order for the use of big data to be meaningful in terms of utilization, it is necessary to consolidate and evaluate such data in an intelligent way (

Sauter et al. 2015, p. 5, cited in

Blunck and Werthmann 2017).

Robots interact with each other and operate “in collaboration” with people and learn from them. Costs will be lower and opportunities more plentiful than in today’s production. Robotics is one of the foundations of Industry 4.0, and robots and humans are increasingly becoming equal in business processes.

Simulation is mostly used to transpose the physical world to a virtual model for the purpose of reducing costs and increasing quality. They allow for operators to test and optimize machine settings for the next product before physical production.

Horizontal and vertical system integration allows for better cohesion between departments and functions, as comprehensive data networks develop automated value chains.

The Internet of Things (IoT) in Industry 4.0 means that computers will be integrated into devices in order to enable them to communicate with each other.

Blunck and Werthmann (

2017) describe it as an “ecosystem” of technologies monitoring the status of physical objects. At the same time, they capture meaningful data and communicate that information through networks to software applications. Each definition of the Internet of Things includes smart objects, machine to machine communication (M2M) and radio frequency technologies (

Thrasher 2014, cited in

Blunck and Werthmann 2017).

Cybersecurity is a necessity arising from increased connectivity and the use of standard communication protocols. Secure, reliable communications as well as identity and access management of machines are essential. According to the latest available European Investment Bank Activity Report (

EIB 2018), the topic of cybersecurity was highlighted. The report points out that over the past period, cyber attacks have threatened thousands of companies and the data of billions of people.

Cloud technology enables connectivity in production and requires greater data exchange. The performance of cloud technologies will improve in terms of response time, resulting in the provision of more data services.

Furthermore, 3D printing is increasingly used due to its construction advantages for the production of prototypes and individual components or for the production of small batches of customized products. The possibilities of 3D printing are impressive, from utilizing it for NASA technology in the aerospace industry to manufacturing of organs (e.g., ear, kidney, etc.) using patient’s cells. The 3D printing of food is another economically interesting area.

Augmented reality supports a variety of services and provides real-time information. This technology can result in better decision making and/or performance.

2.2. Previous Research and Overview of Literature

The study conducted by

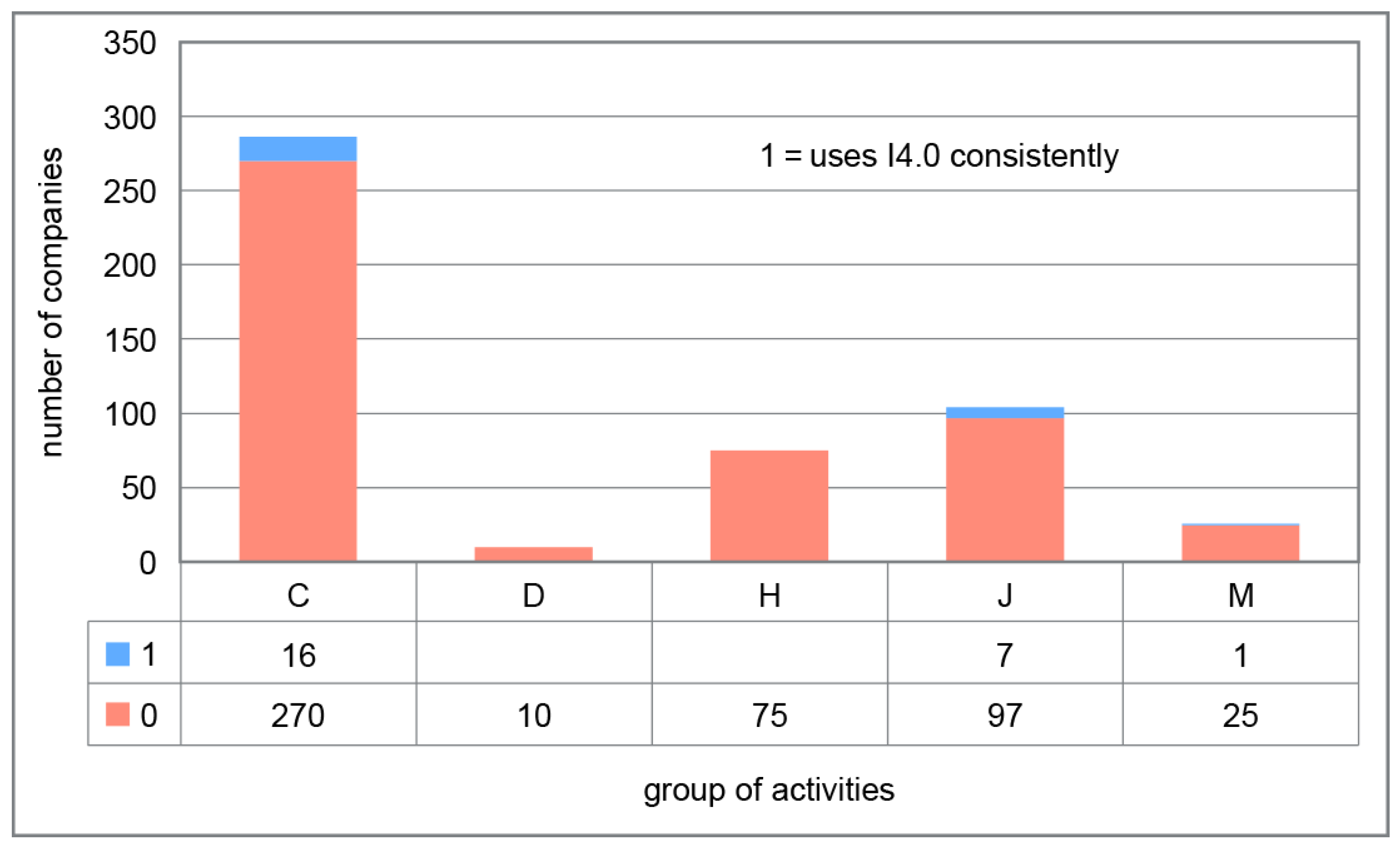

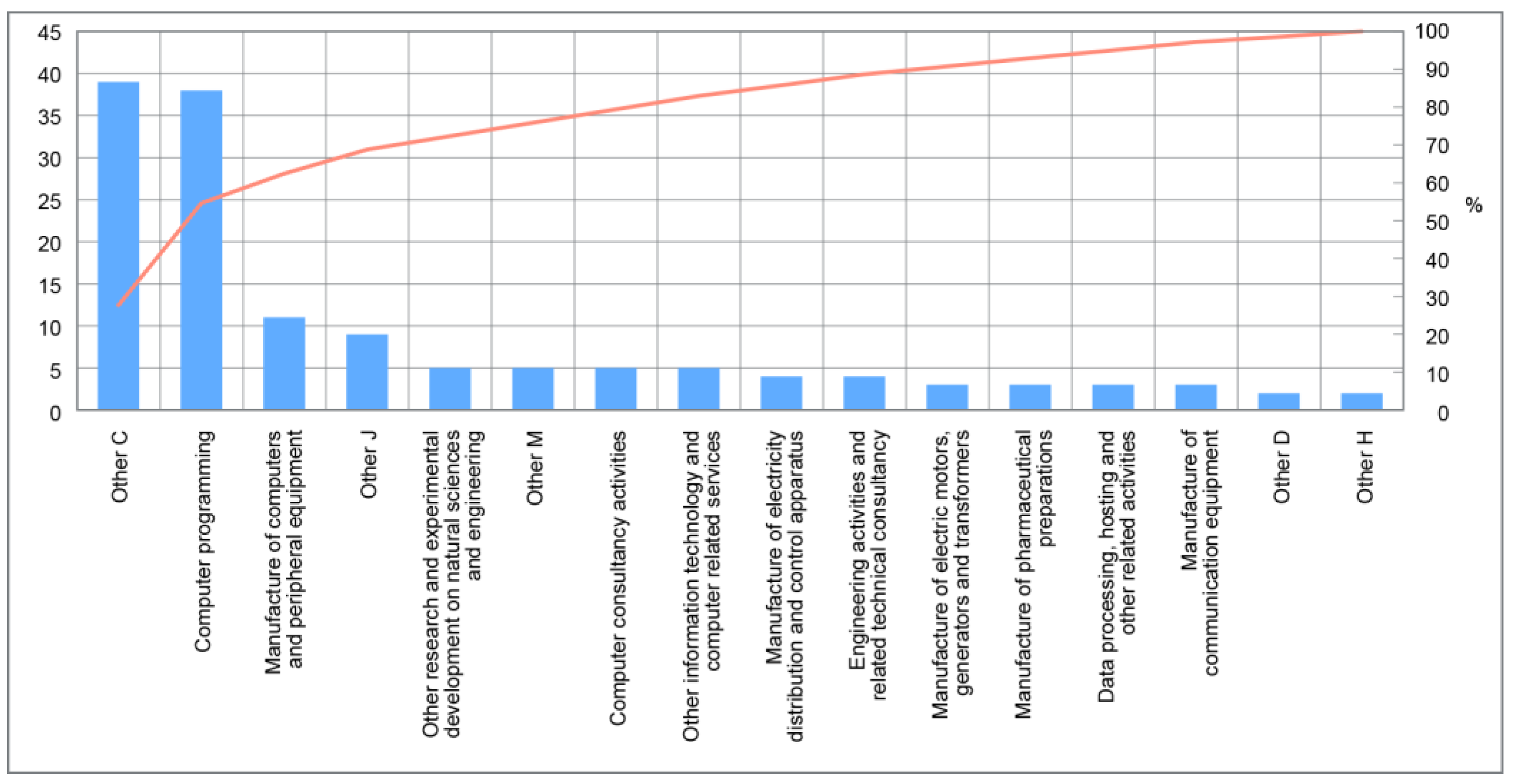

PwC (

2014) not only demonstrates how industrial companies can create new opportunities for economic development using I4, but also discusses possible challenges. The study was conducted in the form of a survey of five core industrial sectors (C—manufacturing; D—electricity, gas, steam and air conditioning supply; H—transportation and storage; J—information and communication; and M—professional, scientific and technical activities, which are the activities in which advanced I4.0 technologies are introduced the most) using a database of 235 German industrial companies. The authors estimate that the share of investments in I4.0 technology will account for more than 50% of planned capital investments in the five-year period. Likewise, German industry will invest approximately 40 billion euro in I4 every year by 2020. The companies surveyed expect an 18% increase in productivity over the next five years. The Internet of Things or Services will contribute to an increase in revenues of 2% to 3% per year, which will represent an increase of 30 billion euro at the level of German industry.

The

Cerved (

2017) SMEs Report analyzes the Italian government’s plan for I4.0 to stimulate innovation, investment and research and development. A method of dividing companies into clusters based on the inclination of companies towards innovation and investments was applied, and companies that are inclined towards innovation generally generate higher revenue growth and better profit margins, while at the same time, they can face higher bankruptcy rates and higher labor turnover.

In addition to the aforementioned research on the future of employment (

Frey and Osborne 2013), it is also important to point out the

Acemoglu and Restrepo (

2017) research. They examine the impact of robots and computer technology on the future of the labor market based on data on the increase in the use of robots between 1990 and 2007 in the US. By using a model in which robots compete against people in performing various jobs and tasks, they demonstrate that the introduction of robots can reduce employment and wages depending on the industry. Therefore, they conclude that automation, robotization and artificial intelligence have a strong adverse impact on the labor market. According to their estimates, the introduction of an additional robot per 1000 employees reduces the employment rate by 0.18–0.34% and wages by 0.25–0.5%.

Veža et al. (

2018) examine the position of Croatian manufacturing companies in relation to Industry 4.0, i.e., “whether a company can survive in the market without taking strategic guidelines towards Industry 4.0 by 2020”. According to the research, the industrial maturity of Croatian companies is at a very low level (only slightly higher than the level of the second industrial revolution). A fundamental weakness was also expressed, namely insufficient monitoring of developments in technology due to the low level of employee training, established on the sample of surveyed companies (rarely more than five days per year). The results obtained are in line with the conclusion presented in the study by Roland Berger (cited in

Veža et al. 2018), according to which Croatia has a very low Industry 4.0 readiness index (measured by the degree of production complexity of the business process, automation, innovation and knowledge—readiness of the labor force) and belongs to the group of hesitators, along with Bulgaria, Poland, Portugal, Estonia, Spain and Italy. Such a conclusion stems from the relationship between the share of manufacturing in GDP and the readiness of European countries to introduce Industry 4.0, of which only Bulgaria had a weaker result than Croatia.

The McKinsey study (

Novak et al. 2018) mentions digitization as a new impetus in the development of Central and Eastern European (CEE) countries, which they call digital challengers. CEE is one of the most attractive regions for investments at the global level, providing an opportunity that Croatia must seize in order to reduce the gap with regard to developed Western European countries. The attractiveness of these countries stems from high mathematical literacy (which is almost identical to that of front-runner countries), a large STEM (science, technology, engineering and mathematics) talent pool and high-quality digital infrastructure with excellent 4G network coverage. They call the CEE region a “vibrant emerging digital ecosystem” and estimate that digitization could be a driver for the region, which could contribute 200 billion euro in additional GDP by 2025 (8.3 billion euro, or approximately 2000 euro of GDP per capita for Croatia (

McKinsey 2018)).

Authors (

Hughes et al. 2022) claim that “the technological choices facing the manufacturing industry are vast and complex as the industry contemplates the increasing levels of digitization and automation in readiness for the modern competitive age.” Additionally, changes related with Industry 4.0 offer “transformation challenges and opportunities, impacting a multitude of operational aspects of manufacturing organizations.”

According to authors (

Grabowska and Saniuk 2022) who have been researching business models in the I4.0 environment, “Dynamic technological development and solutions implemented in modern companies result in a change in management paradigms and the need to build new business models based on maintaining a balance between the development of autonomous (intelligent) technology and remote communication systems and the quality of life, and recognized values in different societies”. Thus, we have the creation of new business models that allow for the “introduction of open innovations, rapid reorganization of processes and very flexible adjustment of the functioning of companies to new conditions and dynamically changing competitive and common environments.”

Hughes et al. (

2022), in reference to perspective on the future manufacturing within the I4.0 era, said that “the concept of increasing levels of automation with a human in the loop seems to be the consensus within the literature where machines are likely to augment human skills and endeavours within the production environment. The successful migration towards I4.0 requires strategic institutional support and significant sector-wide financial investment.”

Researchers (

Mourtzis et al. 2022) revealed three key issues that need to be addressed when bridging Society 5.0 and Industry 4.0, and they include the following: human-oriented action, sustainable development and the physical to digital to physical loop.