A Study of Banks’ Systemic Importance and Moral Hazard Behaviour: A Panel Threshold Regression Approach

Abstract

1. Introduction

1.1. Moral Hazard

1.2. Systemic Importance and Moral Hazard Behaviour

2. Overview of the Indian Banking Industry and History of Government Support

3. Review of Literature

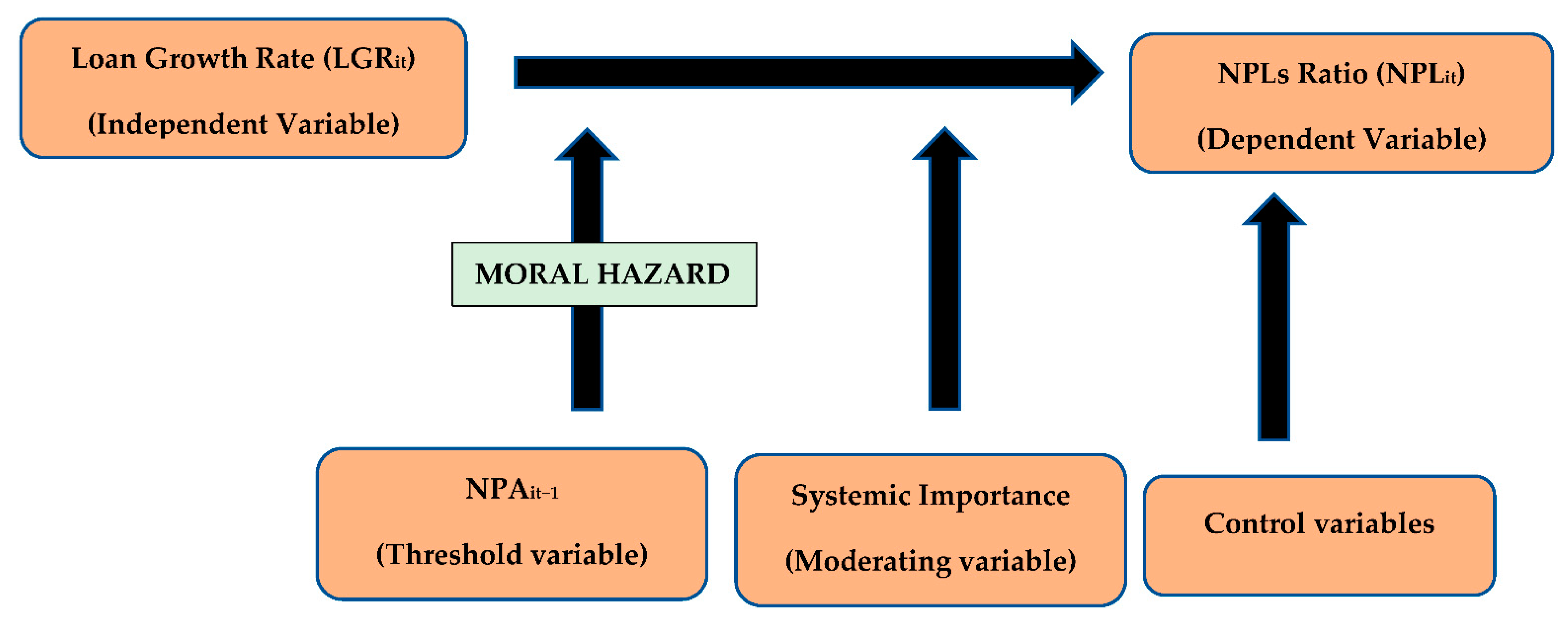

4. Hypotheses Development

- Existence of Moral Hazard in the Indian banking industry.

- Existence of Moral Hazard with respect to the systemic importance of the banks.

5. Data and Variables

5.1. Systemic Importance (Moderating Variable)

5.2. Indicators

5.3. Quantifying Moral Hazard Behaviour through Lending Behaviour

6. Research Methodology

6.1. Systemic Importance of the Banks

6.2. Evidence of Moral Hazard through Threshold Regression

6.3. Panel Threshold Regression

- H0: β1 = β2

- H1: β1 ≠ β2

- Model 2 sets k = 0, contemporaneous LGR.

- Model 3 sets k = 1

- Model 4 sets k = 2

- Model 5 combines models 2, 3 and 4.

- Capital Adequacy (CRAR) is measured by the ratio of capital to risk-weighted assets. It has a negative relationship with the riskiness of the banks. It is used as one of the potential NPA determinants, with a detrimental effect anticipated. This assumption is based on the claims made by Swami et al. (2019) and Salas and Saurina (2002) that a bank with a greater capital adequacy ratio (CRAR) (or equity ratio) will typically have fewer NPLs (NPAs) and be viewed as a safer organisation when compared to its peers.

- Deposit growth is calculated as (deposits of the current year − deposits of the previous year)*100/deposits of the previous year. Deposits here include demand deposits (other than inter-bank), term deposits, and savings deposits.

- Model 6 sets k = 0 which includes no lags of the LGR but just the contemporaneous LGR.

- Model 7 sets k = 1 includes the lagged LGR.

- Model 8 sets k = 2 includes the lagged LGR

- Capital Adequacy (CRAR)

- Deposit growth

7. Empirical Results

- Existence of Moral Hazard in the Indian banking industry

- Existence of Moral Hazard with respect to the different systemic importance of the banks.

8. Robustness Analysis

9. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Allen, Franklin, and Douglas Gale. 2001. Comparative Financial Systems: A Survey. Philadelphia: University of Pennsylvania, Wharton School Center for Financial Institutions. [Google Scholar]

- Azgad-Tromer, Shlomit. 2017. Too important to fail: Bankruptcy versus bailout of socially important non-financial institutions. Harvard Business Law Review 7: 159. [Google Scholar] [CrossRef]

- Banerjee, Saugata, Benoit Leleux, and Theo Vermaelen. 1997. Large shareholdings and corporate control: An analysis of stake purchases by French holding companies. European Financial Management 3: 23–43. [Google Scholar] [CrossRef]

- Bardhan, Samaresh, Rajesh Sharma, and Vivekananda Mukherjee. 2019. Threshold effect of bank-specific determinants of non-performing assets: An application in Indian banking. Journal of Emerging Market Finance 18: S1–S34. [Google Scholar] [CrossRef]

- Barr, Richard S., Lawrence M. Seiford, and Thomas F. Siems. 1994. Forecasting bank failure: A non-parametric frontier estimation approach. Recherches Économiques de Louvain/Louvain Economic Review 60: 417–29. [Google Scholar] [CrossRef]

- Berger, Allen N., and Gregory F. Udell. 1994. Did risk-based capital allocate bank credit and cause a ”credit crunch” in the United States? Journal of Money, Credit and Banking 26: 585–628. [Google Scholar] [CrossRef]

- Berger, Allen N., and Robert DeYoung. 1997. Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance 21: 849–70. [Google Scholar]

- Boyd, John H., and Gianni De Nicolo. 2005. The theory of bank risk taking and competition revisited. The Journal of Finance 60: 1329–43. [Google Scholar] [CrossRef]

- Boyd, John H., and Stanley L. Graham. 1998. Consolidation in US banking: Implications for efficiency and risk. In Bank Mergers & Acquisitions. Boston: Springer, pp. 113–35. [Google Scholar]

- Bruche, Max, and Gerard Llobet. 2011. Walking Wounded or Living Dead? Making Banks Foreclose Bad Loans. London: London School of Economics, Financial Markets Group. [Google Scholar]

- Chan, Kung-Sik. 1993. Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. The Annals of Statistics 21: 520–33. [Google Scholar] [CrossRef]

- Chavan, Pallavi, and Leonardo Gambacorta. 2016. Bank Lending and Loan Quality: The Case of India. BIS Working Papers 595. Basel: Bank for International Settlements. [Google Scholar]

- Chen, Yibing, Yong Shi, Xianhua Wei, and Lingling Zhang. 2014. Domestic systemically important banks: A quantitative analysis for the Chinese banking system. Mathematical Problems in Engineering 2014: 819371. [Google Scholar] [CrossRef]

- Clair, Robert T. 1992. Loan growth and loan quality: Some preliminary evidence from Texas banks. Economic and Financial Policy Review 1992: 9–22. [Google Scholar]

- Cumming, Douglas J., and Sofia A. Johan. 2013. Venture Capital and Private Equity Contracting: An International Perspective. Cambridge: Academic Press. [Google Scholar]

- Dell’Ariccia, Giovanni, Paolo Mauro, Andre Faria, Jonathan D. Ostry, Julian Di Giovanni, Martin Schindler, Ayhan Kose, and Marco Terrones. 2008. Reaping the Benefits of Financial Globalization. Washington, DC: International Monetary Fund, pp. 1–50. [Google Scholar]

- Demirgüç-Kunt, Asli. 1989. Deposit-institution failures: A review of empirical literature. Economic Review 25: 2–19. [Google Scholar]

- Dionne, Georges, Pierre-Carl Michaud, and Maki Dahchour. 2004. Separating Moral Hazard from Adverse Selection in Automobile Insurance: Longitudinal Evidence from France. Tilburg: Tilburg University. [Google Scholar]

- Duran, Miguel A., and Ana Lozano-Vivas. 2015. Moral hazard and the financial structure of banks. Journal of International Financial Markets, Institutions and Money 34: 28–40. [Google Scholar] [CrossRef]

- Financial Crisis Inquiry Commission. 2011. The Financial Crisis Inquiry Report: The Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States Including Dissenting Views. New York: Cosimo Inc. [Google Scholar]

- Flannery, Mark J. 1989. Capital regulation and insured banks choice of individual loan default risks. Journal of Monetary Economics 24: 235–258. [Google Scholar] [CrossRef]

- Flannery, Mark, and Stanislava Nikolova. 2004. Market discipline of US financial firms: Recent evidence and research issues. In Market Discipline across Countries and Industries. Cambridge: MIT Press, pp. 87–100. [Google Scholar]

- Foos, Daniel, Lars Norden, and Martin Weber. 2010. Loan growth and riskiness of banks. Journal of Banking & Finance 34: 2929–40. [Google Scholar]

- Gorton, Gary, and Richard Rosen. 1995. Corporate control, portfolio choice, and the decline of banking. The Journal of Finance 50: 1377–420. [Google Scholar] [CrossRef]

- Hansen, Bruce E. 1999. Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics 93: 345–68. [Google Scholar] [CrossRef]

- Haq, Mamiza, and Richard Heaney. 2012. Factors determining European bank risk. Journal of International Financial Markets, Institutions and Money 22: 696–718. [Google Scholar] [CrossRef]

- Hellman, Joel S. 2000. Measuring Governance, Corruption, and State Capture: How Firms and Bureaucrats Shape the Business Environment in Transition Economies. Washington, DC: World Bank Publications, vol. 2312. [Google Scholar]

- Hett, Florian, and Alexander Schmidt. 2017. Bank rescues and bailout expectations: The erosion of market discipline during the financial crisis. Journal of Financial Economics 126: 635–51. [Google Scholar] [CrossRef]

- Honohan, Patrick. 1997. Banking System Failures in Developing and Transition Countries: Diagnosis and Predictions. Available online: https://www.bis.org/publ/work39.htm (accessed on 14 October 2022).

- Husted, Bryan W. 2007. Agency, information, and the structure of moral problems in business. Organization Studies 28: 177–95. [Google Scholar] [CrossRef]

- Jeanne, Oliver, and Anton Korinek. 2020. Macroprudential regulation versus mopping up after the crash. The Review of Economic Studies 87: 1470–97. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1976. Reflections on the State of Accounting Research and the Regulation of Accounting. Stanford Lectures in Accounting 1976: 11–19. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Amos Tversky. 1979. On the interpretation of intuitive probability: A reply to Jonathan Cohen. Cognition 7: 409–11. [Google Scholar] [CrossRef]

- Kaufmanh, George G. 1996. Bank failures, systemic risk, and bank regulation. Cato Journal 16: 17. [Google Scholar]

- Keeley, Michael C. 1990. Deposit insurance, risk, and market power in banking. The American Economic Review 80: 1183–200. [Google Scholar]

- Kornai, Janos. 1979. Economists and Economic Thought: The Oeuvre of Kenneth J. Arrow. Acta Oeconomica 23: 193–203. [Google Scholar]

- Louzis, Dimitrios P., Angelos T. Vouldis, and Vasilios L. Metaxas. 2012. Macroeconomic and bank-specific determinants of NPLs in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking & Finance 36: 1012–27. [Google Scholar]

- Machina, Mark, and Kip Viscusi, eds. 2013. Handbook of the Economics of Risk and Uncertainty. Newton: Newnes. [Google Scholar]

- Maclachlan, Fiona C. 2001. Market discipline in bank regulation: Panacea or paradox? The Independent Review 6: 227–34. [Google Scholar]

- Mishkin, Frederic S. 2006. How big a problem is too big to fail? A review of Gary Stern and Ron Feldman’s too big to fail: The hazards of bank bailouts. Journal of Economic Literature 44: 988–1004. [Google Scholar] [CrossRef]

- Moosa, Imad. 2010. The myth of too big to fail. Journal of Banking Regulation 11: 319–33. [Google Scholar] [CrossRef]

- Nguyen, Quang Khai. 2020. Ownership structure and bank risk-taking in ASEAN countries: A quantile regression approach. Cogent Economics & Finance 8: 1809789. [Google Scholar]

- Nguyen, Quang Khai, and Van Cuong Dang. 2022. Does the country’s institutional quality enhance the role of risk governance in preventing bank risk? Applied Economics Letters 2022: 1–4. [Google Scholar] [CrossRef]

- Nier, Erlend, and Ursel Baumann. 2006. Market discipline, disclosure and moral hazard in banking. Journal of Financial Intermediation 15: 332–61. [Google Scholar] [CrossRef]

- Piatti, Dpmenico, and Peter Cincinelli. 2018. Does the threshold matter? The impact of the monitoring activity on NPLs: Evidence from the Italian banking system. Managerial Finance 45: 190–221. [Google Scholar] [CrossRef]

- Salas, Vicente, and Jesus Saurina. 2002. Credit risk in two institutional regimes: Spanish commercial and savings banks. Journal of Financial Services Research 22: 203–24. [Google Scholar] [CrossRef]

- Samantaraya, Amaresh. 2016. Procyclical credit growth and bank NPAs in India. Economic and Political Weekly 51: 112–19. [Google Scholar]

- Schooner, Heidi Mandanis, and Michael W. Taylor. 2009. Global Bank Regulation: Principles and Policies. Cambridge: Academic Press. [Google Scholar]

- Shen, ChungHua, and Chih-Yuan Lin. 2012. Why government banks underperform: A political interference view. Journal of Financial Intermediation 21: 181–202. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1997. The limits of arbitrage. The Journal of Finance 52: 35–55. [Google Scholar] [CrossRef]

- Shrieves, Ronald E., and Drew Dahl. 2003. Discretionary accounting and the behavior of Japanese banks under financial duress. Journal of Banking & Finance 27: 1219–43. [Google Scholar]

- Sironi, Andrea. 2003. Testing for market discipline in the European banking industry: Evidence from subordinated debt issues. Journal of Money, Credit and Banking 35: 443–72. [Google Scholar] [CrossRef]

- Stern, Gary H. 1999. Managing Moral Hazard with Market Signals: How Regulation Should Change with Banking (No. 153). Available online: https://www.minneapolisfed.org/article/1999/managing-moral-hazard-with-market-signals-how-regulation-should-change-with-banking (accessed on 14 October 2022).

- Swami, Onkar Shivraj, Arindam Sarkar, and Jyoti Prakash Sharma. 2019. Bank Consolidation in India: An Empirical Study to Identify Leading Indicators of Acquired Banks. Prajnan 48: 179–94. [Google Scholar]

- Thomas, Robin, and Shailesh Singh Thakur. 2020. NPLs and Moral Hazard in the Indian Banking Sector: A Threshold Panel Regression Approach. Global Business Review 2020: 0972150920926135. [Google Scholar]

- Tong, Howell. 1983. Threshold models. In Threshold Models in Non-linear Time Series Analysis. New York: Springer, pp. 59–121. [Google Scholar]

- Yamamoto, Shinichi, Takau Yoneyama, and W. Jean Kwon. 2012. An Experimental Study on Adverse Selection and Moral Hazard. Hitotsubashi Journal of Commerce and Management 46: 51–64. [Google Scholar]

- Zhang, Dayong, Jing Cai, David G. Dickinson, and Ali M. Kutan. 2016. NPLs, moral hazard and regulation of the Indian commercial banking system. Journal of Banking & Finance 63: 48–60. [Google Scholar]

| Bucket | Additional Common Equity Tier1 (CET1) Requirement (as a Percentage of Risk Weighted Assets) |

|---|---|

| 5 | 1% |

| 4 | 0.8% |

| 3 | 0.6% |

| 2 | 0.4% |

| 1 | 0.2% |

| S. No. | Indicator | References | Variable | References | Weightage |

|---|---|---|---|---|---|

| 1 | Size (20%) | BCBS approach & DSIB criteria by RBI | Total assets | Chen et al. (2014) | 20% |

| 2 | Interconnectedness (20%) | BCBS approach & DSIB criteria by RBI | Intra-financial system assets | BCBS approach & DSIB criteria by RBI | 6.67% |

| Intra-financial system liabilities | BCBS approach & DSIB criteria by RBI | 6.67% | |||

| Securities outstanding | BCBS approach & DSIB criteria by RBI | 6.67% | |||

| 3 | Substitutability (20%) | BCBS approach & DSIB criteria by RBI | Bank branches | Author’s choice | 6.67% |

| Payments made in INR using RTGS and NEFT systems | BCBS approach & DSIB criteria by RBI | 6.67% | |||

| Number of ATMs | Author’s choice | 6.67% | |||

| 4 | Complexity (20%) | BCBS approach & DSIB criteria by RBI | Cross-Jurisdictional assets | Chen et al. (2014) | 6.67% |

| Cross-Jurisdictional Liabilities | BCBS approach & DSIB criteria by RBI | 6.67% | |||

| Liability on forward contracts | Author’s choice | 6.67% | |||

| 5 | Ownership (20%) | (Sironi 2003) | Public | 20% | |

| Private | 0% |

| Variable | Sub-Categories |

|---|---|

| Intra financial system assets | Lending to financial institutions |

| Investments in India | |

| Intra-financial system liabilities | Borrowings from other financial institutions |

| Deposits of other financial institution | |

| Cross Jurisdictional assets | Advances outside India |

| Foreign currency assets | |

| Invest outside India | |

| Cross Jurisdictional Liabilities | Deposits from branch outside India |

| Borrowings outside India | |

| Foreign currency liabilities |

| Variables | Description | Abbreviation | Period |

|---|---|---|---|

| Systemic importance | Dummy variable with M1—most important banks. M3- least important bank. | m1 m2 m3 | 2011–2020 |

| Asset quality | The ratio of net NPA To net advances | NNPL | 2011–2020 |

| LGR | (loanst − loanst−1)*100/loans of PY | LGR | 2011–2020 |

| Deposit growth | deposits of the current year − deposits of previous year*100/deposits of the previous year. | Deposit growth | 2012–2020 |

| Capital Adequacy | The capital adequacy ratio includes both tier 1 and tier 2 capital | CRAR | 2011–2020 |

| Equity Ratio | (Tier 1 + Tier 2 capital)/Total assets | Equity ratio | 2011–2020 |

| Variable | Observations | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| M1 | 380 | 0.326 | 0.469 | 0 | 1 |

| M2 | 380 | 0.368 | 0.483 | 0 | 1 |

| M3 | 380 | 0.305 | 0.461 | 0 | 1 |

| NNPL | 380 | 13.201 | 15.011 | −31.215 | 116.89 |

| LGR | 380 | 12.772 | 14.69 | −31.215 | 116.89 |

| Deposit Growth | 380 | 9.078 | 15.690 | −56.91 | 132.074 |

| CRAR | 380 | 13.011 | 2.657 | 9.5 | 23.2 |

| Equity Ratio | 380 | 13.568 | 1.235 | 10.2 | 22 |

| M1 | M2 | M3 | NNPL | LGR | Deposit Growth | CRAR | |

|---|---|---|---|---|---|---|---|

| M1 | 1.0000 | ||||||

| M2 | −0.5316 | 1.0000 | |||||

| M3 | −0.4613 | −0.5063 | 1.0000 | ||||

| NNPL | −0.0696 | −0.1014 | 0.1771 | 1.0000 | |||

| LGR | −0.1004 | −0.0911 | 0.1976 | 0.9671 | 1.0000 | ||

| Deposit Growth | −0.0526 | −0.0549 | 0.1111 | 0.4840 | 0.5373 | 1.0000 | |

| CRAR | −0.0668 | −0.1848 | 0.1255 | 0.4699 | 0.4681 | 0.3282 | 1.0000 |

| Estimation Model | Dependent Variable | Independent Variables (Like Control Variables) | Regime Dependent Variable | Threshold Variable |

|---|---|---|---|---|

| Model 2–5 | NNPL ratio | Deposit growth, CRAR (Capital adequacy ratio) | LGR with 0, 1 and 2 lagged periods | NPLt−1 |

| Model 6–8 | NNPL ratio | Deposit growth, CRAR (Capital adequacy ratio) | LGR, LGR*m1, LGR*m3 with 0, 1 and 2 lagged periods | NPLt−1 |

| Model 9–12 | NNPL ratio | Deposit growth, equity ratio | LGR with 0, 1 and 2 lagged periods | CRARt−1 |

| Model 13–15 | NNPL ratio | Deposit growth, equity ratio | LGR, LGR*m1, LGR*m3 with 0, 1 and 2 lagged periods | CRARt−1 |

| Model | NNPL (Threshold Variable) | Confidence Interval (95%) | Residual Sum of Squares | p-Value |

|---|---|---|---|---|

| 2 | 2.96 | [2.44%–3.08%] | 1171.2312 | 0.040 ** |

| 3 | 0.75 | [0.73%–0.76%] | 11800 | 0.140 |

| 4 | 4.48 | [3.74%–4.72%] | 10200 | 0.160 |

| 5 | 2.88 | [2.42%–2.93%] | 918.39 | 0.088 * |

| 6 | 2.9 | [2.53%–2.96%] | 1036.7931 | 0.000 *** |

| 7 | 5.73 | [5.68%–6.16%] | 11500 | 0.041 ** |

| 8 | 4.48 | [4.07%–4.72%] | 9660.5425 | 0.01 *** |

| Explanatory Variables | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Intercept | −0.4528 (0.8498) | −0.7728 (0.8185) | −2.5010 (2.5781) | −3.7149 (2.7747) | −1.0054 (0.8448) |

| LGR | 0.9487 *** (0.0187) | ||||

| LGRt−1 | 0.0142 ** (0.0067) | ||||

| LGRt−2 | 0.0165 (0.0107) | ||||

| Deposit growth | 0.0569 *** (0.0196) | 0.0308 (0.0195) | 0.8609 *** (0.0349) | 0.8209 *** (0.0373) | 0.0312 (0.0207) |

| CRAR | −0.0218 ** (0.0107) | 0.0287 * (0.0147) | 0.2711 ** (0.1055) | 0.3218 (0.2172) | 0.01587 (0.0665) |

| LGR (NNPLt−1 < γ) | 0.0026 ** (0.0013) | 0.9954 *** (0.0239) | |||

| LGR (NNPLt−1 > γ) | 1.0137 *** (0.0202) | 0.9255 *** (0.0202) | |||

| LGRt−1 (NNPLt−1 < γ) | −0.0315 (0.0428) | 0.0225 ** (0.0147) | |||

| LGRt−1 (NNPLt−1 > γ) | 0.0681 ** (0.0324) | 0.0135 * (0.007) | |||

| LGRt−2 (NNPLt−1 < γ) | 0.0662 ** (0.0351) | 0.0060 (0.0124) | |||

| LGRt−2 (NNPLt−1 > γ) | −0.1858 *** (0.0828) | 0.0251 (0.0185) | |||

| No. of Observations | 304 | 342 | 342 | 304 | 304 |

| R2 | 0.9701 | 0.9733 | 0.7317 | 0.6858 | 0.9716 |

| Explanatory Variables | 6 | 7 | 8 |

|---|---|---|---|

| LGR (NPLt−1 < γ) | 0.0579 ** (0.0245) | ||

| LGR (NPLt−1 > γ) | −0.0763 ** (0.0321) | ||

| LGR*m1 (NNPLt−1 < γ) | 0.1100 *** 0.1679 (0.0263) | ||

| LGR*m1 (NNPLt−1 > γ) | 0.1246 *** 0.0483 (0.0388) | ||

| LGR*m2 (NNPLt−1 < γ) | 0.0255 0.0834 (0.0242) | ||

| LGR*m2 (NNPLt−1 > γ) | −0.0147 −0.091 (0.0413) | ||

| LGRt−1 (NPLt−1 < γ) | 0.0874 * (0.0517) | ||

| LGRt−1 (NPLt−1 > γ) | −0.4511 * (0.2669) | ||

| LGRt−1*m1 (NPLt−1 < γ) | 0.1865 ** 0.2739 (0.0883) | ||

| LGRt−1*m1 (NPLt−1 > γ) | 0.5607 ** 0.1096 (0.1241) | ||

| LGRt−1*m2 (NPLt−1 < γ) | 0.2062 *** 0.2936 (0.0766) | ||

| LGRt−1*m2 (NPLt−1 > γ) | −0.4710 −0.9221 (0.3321) | ||

| LGRt−2 (NPLt−1 < γ) | 0.0553 (0.0560) | ||

| LGRt−2 (NPLt−1 > γ) | 0.7007 *** (0.1932) | ||

| LGRt−2*m1 (NPLt−1 < γ) | 0.0434 (0.0878) | ||

| LGRt−2*m1 (NPLt−1 > γ) | 0.7862 (0.2337) | ||

| LGRt−2*m2 (NPLt−1 < γ) | 0.0052 (0.0764) | ||

| LGRt−2*m2 (NPLt−1 > γ) | 0.5072 *** (0.2324) | ||

| Intercept | 0.4239 (1.2068) | 2.5469 (4.1363) | 1.7171 (4.5505) |

| Deposit growth | 0.0380 ** (0.0186) | 0.8528 *** (0.0354) | 0.8077 *** (0.0378) |

| CAR | −0.0442 * (0.0226) | 0.2596 ** (0.1124) | 0.3287 *** (0.1183) |

| M1 | −1.3739 (1.4935) | −6.7135 (5.0530) | −8.9486 (5.6063) |

| M2 | −0.7973 (1.3816) | −7.3072 (4.6206) | −6.7416 (5.1461) |

| No. of observation | 342 | 342 | 304 |

| R2 | 0.9763 | 0.7379 | 0.7016 |

| Model | CRAR (Threshold Variable) | Confidence Interval (95%) | Residual Sum of Squares | p-Value |

|---|---|---|---|---|

| 9 | 12.92 | (12.91%–13.00%) | 1224.63 | 0.04 ** |

| 10 | 15.36 | (13.81%–15.46%) | 11.7 | 0.06 * |

| 11 | 12.32 | (12.29%–12.38%) | 10400 | 0.67 |

| 12 | 12.84 | (12.78%–12.86%) | 953.652 | 0.09 * |

| 13 | 10.14 | (9.97%–10.22%) | 1211.9013 | 0.04 ** |

| 14 | 10.70 | (10.63%–10.78%) | 11500 | 0.09 * |

| 15 | 12.78 | (12.73%–12.84%) | 10100 | 0.61 |

| Model | 9 | 10 | 11 | 12 |

|---|---|---|---|---|

| Variables | ||||

| Intercept | −1.605 (0.7591) | −2.9737 (2.3309) | −2.2206 (2.5231) | −0.3653 (0.7774) |

| LGR (CARt−1 < γ) | 0.9656 *** (0.0192) | 0.9598 *** (0.0201) | ||

| LGR (CARt−1 > γ) | −0.9229 *** (0.0224) | −0.9304 *** (0.0247) | ||

| LGRt−1 (CARt−1 < γ) | 0.0621 * (0.0361) | 0.0336 * (0.0177) | ||

| LGRt−1 (CARt−1 > γ) | −0.0561 ** (0.0257) | 0.0159 ** (0.0075) | ||

| LGRt−2 (CARt−1 < γ) | −0.0231 (0.0507) | 0.0288 * (0.0158) | ||

| LGRt−2 (CARt−1 > γ) | 0.0657 * (0.0393) | 0.0066 (0.0141) | ||

| Equity Ratio | −0.0068 (0.0663) | −0.3374 * (0.2045) | 0.2280 (0.2181) | −0.0234 (0.0673) |

| Deposit growth | 0.0754 *** (0.0196) | 0.8569 *** (0.0345) | 0.8358 *** (0.0374) | 0.0641 (0.0210) |

| No. of observation | 342 | 342 | 304 | 304 |

| R2 | 0.9720 | 0.7337 | 0.6785 | 0.9705 |

| Model | 13 | 14 | 15 |

|---|---|---|---|

| Variables | |||

| Intercept | 0.2606 (1.2765) | 2.2677 (3.9168) | 1.8071 (4.5208) |

| LGR (CARt−1 < γ) | 0.9596 *** (0.0604) | ||

| LGR (CARt−1 > γ) | −0.9344 *** (0.0251) | ||

| LGR*m1 (CARt−1 < γ) | −0.3301 ** 0.6295 (0.1429) | ||

| LGR*m1 (CARt−1 > γ) | 0.0342 −0.9002 (0.0262) | ||

| LGR*m2 (CARt−1 < γ) | −0.0429 (0.1211) | ||

| LGR*m2 (CARt−1 > γ) | 0.0222 (0.0244) | ||

| LGRt−1 (CARt−1 < γ) | 0.1034 (0.1363) | ||

| LGRt−1 (CARt−1 > γ) | −0.0823 (0.0584) | ||

| LGRt−1*m1 (CARt−1 < γ) | −0.0893 (0.1914) | ||

| LGRt−1*m1 (CARt−1 > γ) | 0.1522 * (0.0886) | ||

| LGRt−1*m2 (CARt−1 < γ) | −0.3703 * (0.2122) | ||

| LGRt−1*m2 (CARt−1 > γ) | 0.2086 *** (0.0747) | ||

| LGRt−2 (CARt−1 < γ) | −0.0839 (0.0867) | ||

| LGRt−2 (CARt−1 > γ) | 0.0668 (0.0611) | ||

| LGRt−2*m1 (CARt−1 < γ) | 0.1033 (0.1175) | ||

| LGRt−2*m1 (CARt−1 > γ) | 0.1298 (0.1127) | ||

| LGRt−2*m2 (CARt−1 < γ) | 0.1518 (0.1114) | ||

| LGRt−2*m2 (CARt−1 > γ) | −0.0773 (0.0876) | ||

| M1 | −0.6382 (1.6102) | −7.1093 (5.0551) | −8.0352 (5.7457) |

| M2 | −0.7996 (1.4891) | −7.4321 (4.6099) | −5.5077 (5.2895) |

| Deposit growth rate | 0.0641 *** (0.0191) | 0.8547 *** (0.0353) | 0.8445 *** (0.0383) |

| Equity Ratio | −0.0023 (0.0689) | 0.3236 (0.2074) | 0.2665 (0.2235) |

| No. of observation | 342 | 342 | 304 |

| R2 | 0.9723 | 0.7378 | 0.6877 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gupta, C.P.; Jain, A. A Study of Banks’ Systemic Importance and Moral Hazard Behaviour: A Panel Threshold Regression Approach. J. Risk Financial Manag. 2022, 15, 537. https://doi.org/10.3390/jrfm15110537

Gupta CP, Jain A. A Study of Banks’ Systemic Importance and Moral Hazard Behaviour: A Panel Threshold Regression Approach. Journal of Risk and Financial Management. 2022; 15(11):537. https://doi.org/10.3390/jrfm15110537

Chicago/Turabian StyleGupta, C. P., and Arushi Jain. 2022. "A Study of Banks’ Systemic Importance and Moral Hazard Behaviour: A Panel Threshold Regression Approach" Journal of Risk and Financial Management 15, no. 11: 537. https://doi.org/10.3390/jrfm15110537

APA StyleGupta, C. P., & Jain, A. (2022). A Study of Banks’ Systemic Importance and Moral Hazard Behaviour: A Panel Threshold Regression Approach. Journal of Risk and Financial Management, 15(11), 537. https://doi.org/10.3390/jrfm15110537