Abstract

This paper investigates the relationship between accounting comparability, executive compensation, conditional and unconditional conservatism, and accounting information quality. The findings suggest that conditional conservatism and accounting comparability have a positive and significant impact on executive compensation. Moreover, accrual earnings management can strengthen the relationship between accounting comparability and executive compensation, whereas this is not the case with actual earnings management. Unconditional conservatism, however, does not significantly influence executive compensation. In the end, determining the correlation between earnings management and conservatism reveals that executives use conditional conservatism to perform opportunistic behaviours and gain more compensation. In light of the current results, it is expected that the assimilation of standardisation processes and their use in conjunction with existing features will enhance information quality, greater reliability of financial reports, and protect public interests.

1. Introduction

Recent corporate scandals in the UK, and the accounting profession’s involvement, have led to a rethinking of the profession’s role, prompting the UK government to ask Sir Brydon to prepare an investigation report. In its 136 pages and 64 recommendations, the Brydon report (Brydon 2019) and the white report, Restoring trust in audit and corporate governance (2021), emphasised the consistency of financial reporting and comparability between companies. The current trend regarding comparability characteristics of accounting information is reflected in the content of this paper.

The quality of financial statements is one of the conceptual frameworks of financial reporting, which has always been important to internal and external users. Qualitative characteristics related to financial information are the ones that lead the information in the financial statements to be useful in assessing financial position, performance, and flexibility (FASB 2010). Previous studies have shown that the firm’s financial information affects the firm’s financial decisions (De Franco et al. 2011; Kim et al. 2013; Chen et al. 2014). A qualitative characteristic of information is its comparability. The comparability of information means that a firm’s financial information should be prepared according to the rules and principles that could be compared to that of similar firms, and thus enable the users of the financial information to determine the differences and similarities among economic events more easily. (Sloan 1993; Zang 2012; Xie 2001; Revsin et al. 2011). Accounting information comparability refers to the characteristic which helps users realise and understand the similarities and differences, reduces the cost of acquiring and processing information, and increases the quality and quantity of the current information around the firms (De Franco et al. 2011). For example, firms may use FIFO, LIFO, or weighted average methods for assessing their costs of goods sold and inventories, which could affect their net profits and financial performance. Accounting standards require firms to disclose their implemented methods for inventory assessments and discourage organisations from changing their adopted accounting methods every year by requiring them to follow the principle of consistency. Such rules and standards can lead to accounting information comparability between different firms and within the firms when they conform to a firm’s performance in different periods. Therefore, it could be argued that comparability improves the accuracy and precision of the information published in the management’s forecasts, and probably reduces the inconsistency and asymmetry of the information in the stock market.

Accounting information comparability is defined in the proximity of stock price, stock return, and the cash flows of the reporting operating activities on the grounds of the similarity of the rules and principles used in peer firms. Accounting information comparability in peer firms (that work in the same industry) and firms with a more similar capital structure is greater than those which operate in various sectors. So, firms try to compare their financial position and performance with the job and performance of their competition (peers) in the industry, or other active firms on the market level. By doing so, firms attempt to take peer firms as a model in forming contracts to be comparable with them. Albuquerque (2009) indicated that the assessment of the firm’s performance based on the stock price is conducted compared to the peer firms. As a result, firms evaluate their performance by comparing their accounting system output with the output from other companies. Considering the management’s compensation payment contract is designed based on their performance assessment, which is based on the information assessment of the accounting system, companies will likely utilise the information compared to the accounting system when formulating their management’s compensation payment contract. Comparability of the accounting information is considered a supervisory mechanism to control and constrain earnings manipulation by the management (Yu 2008). The significance of an evaluation of the relationship between a company’s accounting information and the creation of its executives’ compensation package lies in the fact that the company’s performance assessment is viewed as a significant factor that influences the management’s compensation (De Franco et al. 2011; DeFond et al. 2011; Neel 2017; Ahmed et al. 2017). In the United States, it is generally accepted that the determination of the management’s compensation is based on financial performance criteria. (De Angelis and Grinstein 2015) demonstrate that 98 percent of American firms utilise accounting information-based criteria to assess performance and, therefore, to determine management compensation. Due to the increase in financial comparability, we expect that executive compensation-performance will be used more widely, and a closer alignment will be made between executive compensation-performance and the firm’s performance. The fact that a number of characteristics of an enterprise influence the efficiency of compensation contracts are also of great importance. Therefore, it is necessary to investigate whether these relationships are also connected to other factors and characteristics of financial reporting quality. The Tehran Stock Exchange (TSE) is Iran’s largest stock exchange in Iran. The most crucial advantage of TSE is that it includes 37 industries, and all firms listed on the TSE must follow the accounting standards making the information presented in their financial statements comparable and more reliable. So, we use firms’ information listed on the TSE for this study.

The first factor investigated in the study is conservatism. Accounting conservatism is an important topic in the literature (Nassir Zadeh et al. 2022). Management uses conservative accounting measures as a signalling mechanism. Using conservatism enhances the quality and credibility of the reported information (Watts 2003; Kravet 2014; Zhang et al. 2019a). As a result, it could be argued that conservatism facilitates financial information comparability (Namakavarani et al. 2021). The second factor influencing the relationship between comparability and compensation is earnings management. A high level of earnings management weakens the relationship between economic events and reported figures in financial statements, reducing the financial statement’s comparability among firms. If other firms are involved in earnings management, the reduction of comparability will be exacerbated (Ross et al. 2020). Thus, it is difficult to estimate the performance and compensation of the management. Due to two research dilemmas, we have been motivated to conduct this study in particular.

Firstly, we are interested in whether the financial reporting quality could be productive on the relationship between the accounting information comparability and the management’s compensation in an emerging market such as Iran. Suppose this is the case; how could this effect be assessed and predicted? In other words, the probable contradictory relationship between comparability and compensation could be expressed through moderator variables. Secondly, contrary to prior research, particularly on emerging economies, which did not provide a comprehensive analysis of the possible relationship between the three factors of the financial reporting quality and the relationship between the comparability of the accounting information and the management compensation. This study aims to fill this experiential gap by applying the agency theory, which suggests compensation payment mechanisms motivate management and align the interests of stakeholders, firms, and agents (Kato and Kubo 2006).

2. Literature Review and Hypotheses Development

2.1. Accounting Comparability

Comparability is one of the unique qualitative characteristics of financial information, which increases its use of data (FASB 2010). As noted in the FASB Statement No.8, a rise in the comparability of accounting information is cited as one of the most compelling reasons for the need for financial reporting guidelines. It is stated in the conceptual framework of Iran’s financial reporting (2014) that even if the information is data-driven and reliable, its value is compromised in the absence of comparability and understandability (Mehrvarz and Marfou 2017). To accurately understand the differences and similarities between investment opportunities, FASB (2010) emphasises the importance of comparable accounting information by raising the fact that a reasonable decision requires comparable accounting information. The comparability of accounting information is of great importance to external users, such as analysts, creditors, and investors (for instance: Kim et al. 2013; Choi et al. 2018), and internal users of the firm (for instance: Sohn 2016; Chen et al. 2018). De Franco et al. (2011) state that accounting information comparability is determined by the proximity of two firms’ accounting systems. Generating the exact accounting figures in response to economic events enhances comparability (Sohn 2016; Choi et al. 2018). The concept of accounting information comparability was entered into the experimental studies by Van-der Tas for the first time (1992 and 1998) and then by Tay and Parker (1990). Previous studies were conducted mainly by the input-based criteria of the accounting system (accounting standards and procedures). Cascino and Gassen (2010) and De Franco et al. (2011) examined several studies based on the output criteria of the accounting information. Following De Franco et al. (2011), several studies have been conducted based on the output criteria of the accounting system (Yip and Young 2012; Barth et al. 2012; Sohn 2016; Chen et al. 2018; Lobo et al. 2018; Choi et al. 2018). Numerous studies evaluated the comparability of accounting information based on one criterion. Barth et al. (2012) calculated the accounting information by considering the cash flows generated by operating activities, stock returns, and prices.

Nevertheless, none of the previous studies have examined the simultaneous interaction of variables addressed in this study. In other words, they have not examined the effect of conservatism and earnings management on the relationship between accounting information comparability and compensation. The following section describes how the stated variables in this study are related theoretically, and how they might influence the relationship between accounting information comparability and compensation.

2.2. Accounting Comparability and Executive Compensation-Performance

Accounting comparability is an important factor in assessing firms’ performance (Bourveau et al. 2022; Januarsi and Yeh 2022; Khuong et al. 2022; Peng et al. 2022). Currently, the main concern lies in protecting public interest and maintaining the quality of accounting information. The capability of users of financial information to monitor how managers generate information is out of their reach. In this regard, they can only benefit from the accomplishments of their agents as verified by external auditors. By creating adequate monitoring and controlling mechanisms, they will be able to maintain their interests and provide optimal control over their agents. Among the most common schemes in this regard is the payment of performance-based compensation to the agents (management). Based on the agency theory, compensation payment mechanisms motivate management and align the interests of stakeholders, firms, and agents. In developed countries, Kato and Kubo (2006) show that performance-based compensations to management lead to increased motivation. In other words, management compensation reduces the conflict between management and stakeholders. An effective controlling and monitoring mechanism is aligning the interests of management and stockholders (Jensen and Murphy 1990). Many firms determine compensation based on performance. Accordingly, firms attempt to compare their position and performance with their competitors in the industry and with other firms in the market on an economic level (Lobo et al. 2018; Nam 2020).

As a result of such an approach, firms can take their peer firms as a model in the subject of their contracts to maintain their comparability. Contracts relating to the board of directors’ compensation are closed based on the performance assessment of management. Additionally, management’s performance evaluation in firms is based on the output of the accounting system. The accounting systems of firms presumed to be peers are likely to be the same (Lobo et al. 2018). The study by Albuquerque (2009) reveals that the assessment of a firm’s performance is based on price. Because the contracts of the compensation paid to the board of directors are based on their performance assessment, and the performance assessment itself is formed based on the data collected from the accounting system (output of the accounting system), it could be said that firms utilise the comparable output information of the accounting system when negotiating the contracts of the management’s compensation.

Accounting information quality is an important factor in the accounting literature. The current high demand for high information quality has, in turn, led to an increase in data analytics and high forecast accuracy, another advantage of comparability (Horton et al. 2013). Comparing accounting information is a way of controlling and constraining a company’s earnings manipulation (Yu 2008). There are three reasons accounting information comparability is important for the development of executive compensation contracts. The organisation’s performance evaluation determines management compensation. Based on the concept of using accounting information comparability in management’s performance assessment, it can be assumed that comparability might impact management’s compensation. Performance evaluation criteria are commonly incorporated into the contracts for compensation that managers receive. In their research, De Angelis and Grinstein (2015) found that 98% of US companies use accounting information to assess performance and ultimately determine how much compensation to pay to management.

The primary purpose of ‘comparability’ in this paper is about ‘accounting information comparability’, which we explained with some examples. The term comparability in this paper is not about ‘comparable compensation’. Previous studies (De Franco et al. 2011; Young and Zeng 2015; Neel 2017; Ahmed et al. 2017) have emphasised the importance of comparability of accounting information for users of financial statements. However, we suggest that the remuneration paid to the board of directors depends on comparing the company’s performance with peer companies.

Therefore, the following first hypothesis is proposed:

H1.

Accounting comparability is positively associated with executive compensation performance.

2.3. Accounting Comparability, Financial Reporting Quality and Executive Compensation-Performance

2.3.1. Accounting Comparability, Accounting Conservatism and Executive Compensation-Performance

Cohen (2003) argues that by providing and presenting high-quality and comparable financial information, asymmetric information is likely to be reduced. In contrast, conservatism reduces management’s motivation and ability to manipulate accounting information. Therefore, it lowers agency costs, which is a result of asymmetrical information. Accordingly, asymmetric information is at the basis of the arguments regarding accounting comparability and conservatism. Several factors may contribute to asymmetric information after an agreement between a manager and a representative. Firstly, shareholders cannot monitor management’s behaviour directly due to the high oversight cost. This situation imposes an ethical risk caused by management, a form of hidden action. One of the reasons for this is the shareholders’ inability to observe the amount of management effort since supervision is costly, and they do not have access to the details of the management’s activities. The second reason is the high cost of searching for information, and management has access to more (distinctive) information than shareholders. This case poses an ethical risk known as “hidden action”. The term “hidden action” refers to situations in which the manager has superior knowledge when making decisions on behalf of the shareholders. Third, several unforeseen scenarios motivate the management to make the most of the situation. Therefore, it seems crucial to design an executive compensation contract (Zhang et al. 2019a).

Conservatism results in understating assets and revenues and the overstatement of liabilities and expenditures. As a result, as part of the financial reporting policy, it reduces the asset value to the economic value (Ruch and Taylor 2015). It can be argued that it could be used to increase financial statements’ credibility, quality, accuracy, and precision (Kim et al. 2013). In accounting estimates, conservatism reduces asymmetric information (Kim et al. 2013) and limits the manipulative area for important information, such as earnings, revenue, and asset value (Bertomeu et al. 2017). Therefore, it may be argued that, when influenced by conservatism, accounting performance reveals more reliable financial information, which in turn contributes to more reliable financial estimates in connection with the performance, which is a measure of compensation (Iatridis and Kadorinis 2009).

Accounting performance plays a significant role in determining executive compensation packages in many countries. Additionally, recent research has shown that a firm’s accounting performance is a good indicator of its operating condition. Therefore, managers are motivated to overstate the value of assets, revenues, and profits to maximise their remuneration and personal welfare (Bertomeu et al. 2017). As a result of several large financial scandals, investors have lost trust in the accounting profession. This issue has caused growing concerns in the literature concerning quality measures included in the compensation contracts of executive managers (Al-Dhamari and Ismail 2014; Li and Wang 2016).

The argument could be made that comparability enables users to understand a firm, its environment, and the accounting system. Conservatism improves the accuracy and precision of published information and management’s estimates. Moreover, conservatism and comparability reduce asymmetric information and inconsistency in the stock market. In sum, it may be concluded that maintaining a conservative accounting approach and enhancing comparability will be beneficial and effective for both users and stakeholders of financial statements (Kim et al. 2013; Chen et al. 2018).

An organisation’s management in today’s competitive economy attempts to compare their own firm’s performance and position with that of the competition, the industry trend, the economic climate, and its impact on the organisation to come to a more comprehensive, accurate assessment of their performance and their remuneration policies. It is expected that comparability and conservative accounting practices will enable management to conduct more accurate futuristic checks and forecast future performance with much higher precision and clarity. Thus, it can be concluded that accounting comparability is directly related to financial reporting quality (Chen and Gong 2019). Moreover, as the discrepancy between the managers’ and the shareholders’ interests increases, shareholders need a higher level of conservatism as an alternative mechanism for corporate governance to protect themselves from the ambitions of managers (for instance, overpayment of compensation and inefficient investments). Similarly, the level of accounting conservatism at a company is directly proportional to the compensation of its executive management.

We consider both conditional and unconditional conservatism in this study. Due to the delayed recognition of earnings compared to losses, conditional conservatism reduces risky management decisions such as risky investments. Generally, riskier areas are more attractive to management due to their dramatic shifts; as a result, they may overlook the fact that the greater the risk, the greater the probability of heavy losses and significant earnings. Conservatism reduces this tendency and ultimately leads to more secure financial investments by managers and other users (Bertomeu et al. 2017). Under conditional conservatism, bad news, losses, and expenses would be recognised immediately, but stricter standards would be applied to good news and revenues. In conditional conservatism, management tends to offset favourable publishing information when an adverse event occurs. Therefore, it could be concluded that conservatism can promote honesty, accuracy, quality, and comparability of financial information. In contrast, Ball and Shivakumar (2005) define unconditional conservatism as the tendency toward reporting shareholder equity at the minimum book value.

Beaver and Ryan (2005) define unconditional conservatism as a practice of reducing earnings and book value of net assets regardless of economic conditions. Using asset book value as a metric, there is a positive and meaningful correlation between unconditional conservatism and executive compensation performance (Zhang et al. 2019b). Therefore, when unconditional conservatism increases, management’s compensation based on performance increases, indicating that unconditional conservatism may serve as a check on managerial ambition. There should be a low level of direct supervision of the executive management and a high (or low) level of reliance on contracts for companies with a high (or low) level of unconditional conservatism, which, in turn, affects the executive management’s compensation for performance appraisal.

In summary, accounting conservatism can contribute to the reduction of information risk (Meshki Miavaghi and Mohammadi 2019), the control of agency costs (Hashemi et al. 2018), and the increase in entity value (Ruhi and Pakmaram 2018). Thus, conservatism can be named an effective governance mechanism (LaFond and Watts 2008; Lara et al. 2012; Soliman 2014; Caskey and Laux 2017), as well as a disciplinary mechanism that limits the earnings-seeking motives of the management (Moradi et al. 2012; Daryaei et al. 2020). As a result, conservatism is expected to improve the positive association between accounting information comparability and management compensation.

In light of this, the second hypothesis is the following:

H2.

Accounting conservatism affects the association between accounting comparability and executive compensation.

2.3.2. Accounting Comparability, Earnings Management, and Executive Compensation-Performance

Numerous studies have confirmed the existence of earnings management in Iranian firms (Mashayekhi et al. 2006; Noravesh et al. 2005). According to Matsuura (2008) and Sanjaya and Saragih (2012), accrual and real earnings management are the most prevalent methods of managing earnings. This study focuses on accrual and real earnings management in Iranian firms. According to Sanjaya and Saragih (2012), real earnings management usually occurs during the current period. It generates an increase in the firm’s loss at the end of the period, and the management controls the earnings through discretionary accruals to avoid losses. It is expected that management’s decisions regarding manipulating actual activities throughout the period will impact the accrual earnings management at the end of the period.

Due to its impact on the entity’s cash flows, earnings management imposes constraints and responsibilities on the management. When deciding on accruals management, the management considers the manipulation conducted on actual activities and utilises various earnings management techniques. When an entity’s accounting is comparable to the operations of other entities in the same industry, earnings management should be constrained. Management’s primary objective in using opportunistic accruals earnings management is to devalue the organisation’s actual performance to gain a personal advantage (Shleifer and Vishny 1997). In the case of greater comparability between the accounting figures of an entity and its peer entities in the same industry, there would be lower amounts of accrued expenses for external users (such as shareholders, creditors, the government, etc.) regarding the collection and processing of accounting information within peer entities. As a result, they can assess the actual performance of the entity with greater accuracy due to the additional valuable information provided by the financial statements of comparable firms. Increasing accounting comparability makes the entity’s accounting information more understandable to market participants. Thus, there would be a reduction in the potential motivation for accrual earnings management activities.

It has been observed that when an environment is filled with more stringent regulations, entities switch from accrual earnings management to real earnings management to achieve their target earnings (Cohen et al. 2008; Cohen and Zarowin 2010). In applying this reasoning to this study, it can be argued that if management’s ability to utilise accrual earnings management is strongly restricted for improved accounting comparability, they will rely more heavily on real earnings management. Using real earnings management, the management will be highly motivated to eliminate the accrual earnings management, which is declining due to the higher level of accounting comparability. Therefore, it is reasonable to expect that an increase in accounting information comparability would result in a decrease in accrual earnings management and an increase in real earnings management.

The inefficiency of compensation schemes and contracts can be attributed to various factors. A key factor is the lack of a reliable measure of performance and its associated precision. Because accounting figures and reports are utilised for creating compensation contracts, accruals play an essential role in contracts with creditors and managers (Shivakumar 2013). Due to this, the management can benefit by utilising the accounting options and measures through the accrual management and manipulation of the actual activities, which impacts the compensation arrangements. Accordingly, it may be expected that by limiting accruals earnings management and decreasing upward earnings management, there will be a decline in paid compensation to management. However, the management focuses on managing real earnings to compensate for its inability to manage accruals, and as a result, upward earnings management will most likely increase. The management’s compensation will likely increase as a result. The contradictory effect concerning the comparability and compensation may be explained by using the moderator variable. According to Hadani et al. (2011), there is a positive relationship between compensation performance and earnings management. For example, managers whose compensation contracts are based on reported earnings may choose an accounting procedure to smooth payments or increase earnings. Given the above, and considering H1 and H2, our third hypothesis about accounting comparability, earnings management, and executive compensation-performance is as follows:

H3.

Accounting comparability and executive compensation performance are positively associated with earnings management.

2.4. Simultaneous Interaction of Earnings Management and Accounting Conservatism

To assess the contradictory relationship between comparability and earnings management, we demonstrate the relationship between earnings management and conservatism. This assessment is in line with the relationship between three proxies of financial reporting quality, which include earnings management and conservatism, with a view to better understanding the link between comparability and executive compensation. Lin et al. (2014) assessed the impact of conservatism on earnings management. Their findings indicated that conservative reporting entities are less likely to engage in earnings management. Nevertheless, Lara et al. (2012) found that accounting conservatism negatively affected earnings management using accruals while positively impacting real earnings management.

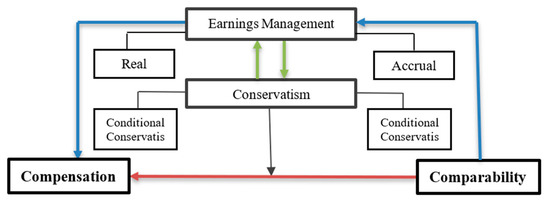

Li (2018) also discovered in a piece of research that conservatism and earnings management has a significant negative relationship. Chen et al. (2014) examined the influence of conservatism on earnings consistency. They concluded that earnings under higher levels of conservatism are less consistent than earnings under lower levels of conservatism. Etemadi et al. (2012) examined the relationship between earnings management and conservatism in Iran’s economic environment, and the results showed a negative relationship between earnings management and conservatism. Haque et al. (2016) also found a negative association between earnings management and conservatism in their studies. Al-asyari et al. (2013) examined the link between earnings management and conservatism in a study and concluded that earnings management has a meaningful and positive influence on accounting conservatism. Previous research has documented a reciprocal relationship between earnings management and conservatism. Figure 1 illustrates our conceptual model.

Therefore, the following hypothesis will be tested:

H4.

The positive relationship between accounting comparability and executive compensation performance results from the simultaneous interaction of earnings management and accounting conservatism.

Following the discussion, the conceptual model is presented in Figure 1:

Figure 1.

Earnings management and accounting conservatism model.

H4 is not an independent hypothesis. H4 is a suggested model driven by H1, H2, and H3, which propose a simultaneous association among variables that are already expected to be interrelated in those hypotheses.

3. Data Collection Describes the Sample and Research Variables

The required data to test the hypotheses is collected from the companies listed on the Tehran Stock Exchange (TSE). All listed companies, banks, insurance companies, and other financial institutions are required to use IFRS Standards. Data is primarily based on audited financial statements and board reports of the TSE, a reliable source of information (Shandiz et al. 2022); despite political disputes with Western countries that eventually ended, Iran occupies a unique position globally and is highly interested in international investing. The study population includes all TSE companies for the period 2010–2019. Despite this, the study compiles a purposive sample; therefore, financial firms, such as banks and insurance firms, are not included as they have different conditions regarding their characteristics. In addition, the listing firms must have continuously operated during the study period, and their information must be available. Based on these criteria, the study includes 164 firms (1640 firm-years). The feathers of the companies that are considered in the sample selection are as follows:

- (A)

- For purposes of similarity, firms whose fiscal year does not match 20th March have been excluded;

- (B)

- Due to the differences in conditions governing banks and insurance firms, the study did not include these institutions;

- (C)

- The firms with Trading Interruptions of more than three months were excluded to ensure that firms conduct business in a balanced manner during a fiscal year; and

- (D)

- Companies with incomplete data were excluded from the study.

The sample of this research includes companies active in manufacturing industries, which were sampled based on the above conditions, and the information of the final companies was used as the research sample. The number of sectors includes 15, and the final sample consists of 1545 observations. Finally, all the variables are winsorised at the 1st and 99th percentiles to minimise the effect of outliers.

Statistical Results

Table 1 shows the descriptive statistics of research variables. The average executive compensation, taken from that natural logarithm, is 4.534. The difference between the maximum (12.004) and minimum (0.000) reward variable indicates the difference in companies’ policies and reward plans. The comparability criteria include three criteria (COMPCFO, COMPRET, and COMPPRC), respectively, showing that the investigated companies did not have much comparability with each other. Because the proximity of the comparability criterion number to zero indicates the high comparability of accounting information. Of course, it should be noted that the basis for calculating these criteria is different.

Table 1.

Descriptive statistics of variables.

Nevertheless, the significant difference between the minimum and maximum of each criterion indicates the difference in the ability to compare companies and industries with each other. As mentioned, the measurement basis of each of these criteria is different. The COMPPRC criterion number shows a high value. This number, which is the output of the third criterion of comparability, represents the currency of Iran (Rial), which shows a more significant number than the common currency of other countries. According to Lobo et al. (2018), the descriptive statistics of this measure in the United States shows a value of −23.525, representing the dollar unit. The average financial leverage, calculated through the ratio of liabilities to assets, is 0.588. This number shows that the left side of the financial statement of the research sample companies is made up of debts, and Iranian companies can be considered leveraged to some extent. The maximum of this number is related to Iran Khodro Company (the most prominent car manufacturing company in Iran), whose equity is negative due to accumulated losses. Therefore, the number of its debts exceeds the total assets. Additionally, the descriptive statistics of other variables are described in Table 1.

The following table provides a summary of the variables. The one-way analysis of variance (ANOVA) and the Kruskal-Wallis test have been used to determine the difference between industrial sectors based on the explanatory and control variables (see Table 2, Panel A). After collecting data, we must ensure that it is both stationary and non-stationary to avoid the possibility of a false regression. Since the regression method used is based on ordinary data, the ADF-Fisher test was used. The results are presented in Table 2.

Table 2.

Panel A. ANOVA and Kruskal-Wallis of variables across 24 industrial sectors. Panel B. ADF-Fisher, Null: Unit root (assume common Unit root test).

4. Empirical Models and Econometrics Results

4.1. Hypothesis 1

The model shown in Equation (1) is based on prior research (Lobo et al. 2018; Nam 2020). To examine H1, we estimated Equation (1) without the interaction term. A significant positive β1 indicates support for H1.

The dependent variable, COMP_C, is an indicator equal to the natural cash compensation logarithm. We use three measures of accounting comparability (COMP_I is the annual decile rank of COMPCFO_I, COMPRET_I, COMPPRC_I), which is based on the underlying logic that the accounting of two firms is more comparable if they report similar accounting amounts when they experience similar economic outcomes (De Franco et al. 2011; Barth et al. 2012 and Lobo et al. 2018).

Measure 1: The relationship between the profit in year t and the cash flow operation from year t − 1 is calculated based on Equation (2).

- CFO(i,t): is cash flow from operations divided by beginning total assets.

- NI(i,t): is net income after deducting the current year’s tax divided by beginning total assets.

The first step in the firm’s analysis is to calculate the coefficients for each year, using Equation (2) and 14 years of data. The coefficients for each firm in each year reflect the accounting characteristics of that firm. The following step involves putting the calculated coefficients into Equation (2) and estimating the cash flows from the firm i’s expected operating activities for the same year. Based on the similarity of the firms i and j’s accounting systems, the estimate of cash flows from the anticipated operations of firm i must display similar values to those of the firm j’s coefficients (Equation (3)).

Equation (3): The following are the estimated future cash flows for firm i based on its coefficients:

Equation (4): the estimate of the future cash flows for firm i based on the firm j’s coefficients:

Accordingly, the closer the two firms’ accounting systems are, the smaller the difference in expected cash flows between them. Given the above, the comparability between the firms i and j is calculated as follows:

In the industry under assessment, comparisons are calculated between each pair of firms. According to Equation (4), the cash flows from the expected operations for firm i are estimated corresponding to that firm’s equation and that of firm j, which is its peer firm, as well as calculating the cash flow difference between each firm and its peers. The COMP variable can be calculated for the COMPi,j,t by calculating the average of all the obtained combinations for firm i. This provides the comparative figure for each firm.

Measurement 2: The (6) model calculates the accounting comparability by using the firm’s schedule around the level and changes in EPS and stock returns.

RETURN (i,t): Annual stock return of the firm i in the current year.

NI/P (i,t): Net income after deducting tax per share in the current year, divided by the beginning share price for the firm i.

ΔNI/P (i,t): changes in net income per share in the current year compared to the previous year, divided by the beginning share price for the firm i.

LOSS (i,t): an artificial measure of a firm’s loss. If the firm is unprofitable, it equals one. Otherwise, it equals zero.

To calculate accounting comparability through the measure (2), the processes in Equations (2) and (3) are conducted. Therefore, comparability through measurement (2) is calculated by using Equation (7):

Measure (3): in this measure, by using model (8), the relationship between net income per share and book value of the shareholder’s equity per share with the closing price per share in the current year is used to calculate accounting comparability.

Price (i,t): closing price per share in the current year.

NIPS (i,t): net income after deducting tax per share for the firm i in the current year.

BVPS (i,t): book value of the shareholder’s equity per share at the end of the period for the firm i.

To calculate financial information through the measure (3), the processes in Equations (2) and (3) are conducted. Therefore, financial information comparability through the measure (3) is calculated by using Equation (9):

CORR_ROA (i,t−1): correlation between the average return of the current assets in the current year in firm i and its peer firms in the industry (Lobo et al. 2018; Nam 2020).

CORR_CF (i,t−1): correlation between the average cash flows from operations in the current year in firm i and its peer firms in the industry (Lobo et al. 2018; Nam 2020).

CORR_RET (i,t−1): correlation between the average annual return of the share in firm i and its peer firms in the industry (Lobo et al. 2018; Nam 2020).

HHI (i,t−1): Herfindahl-Hirschman Index (Lobo et al. 2018; Nam 2020), which is calculated by adding a market share of all active firms in the industry to the power of 2 by using Equation (10):

HHI: Herfindahl-Hirschman Index. K is the number of active firms in the market, and Si is the market share of firm i, which is calculated by Equation (11):

Xj: indicates sales of the firm j, and 1 represents industry type.

SIZE (i,t−1): firm size equals the natural logarithm of the total closing assets (Lobo et al. 2018; Nam 2020).

BM (i,t−1): dividing the book value of the shareholder’s equity by the market value of the firm i’s shareholder’s equity (Lobo et al. 2018; Nam 2020).

LEV (i,t−1): dividing total liabilities by total closing assets (Lobo et al. 2018; Nam 2020).

ROA (i,t−1): assets return obtained by dividing current year operating profit by the average of the firm’s total assets i (Lobo et al. 2018; Nam 2020).

ADJROA (i,t−1): firm i’s assets return minus the average of the assets return of the peer firm’s assets return (Lobo et al. 2018; Nam 2020).

RET (i,t−1): annual return of the firm i (Lobo et al. 2018; Nam 2020).

ADJRET (i,t−1): annual return of the firm i’s share minus the average yearly return of the peer firm’s share in the industry (Lobo et al. 2018; Nam 2020).

GROWTH (i,t−1): firm growth equals the annual sales return (Lobo et al. 2018; Nam 2020), calculated by Equation (12):

Sales i,t: a total of the firm sales in the current year.

Sales i,t−1: a total of the firm sales in the previous year.

DIVYIELD (i,t−1): dividing the total approved dividend in the current year by the market value of the firm i’s shares (Lobo et al. 2018; Nam 2020).

RETVOL (i,t−1): standard deviation of the firm i’s annual return of the shares. A three-year measure of the standard deviation of the annual return is used to calculate the firm i’s yearly return on the shares (Lobo et al. 2018; Nam 2020).

CFVOL (i,t−1): dividing the standard deviation of the cash flows from operations in the current year by the total beginning assets of the firm i. A three-year measure of the standard deviation of the cash flows from operations is used to calculate the standard deviation of the cash flows from the firm i (Lobo et al. 2018; Nam 2020).

Table 3 presents the results of the first hypothesis test. As a result of these findings, it can be argued that accounting comparability (accounting information system) has a positive and significant impact on compensation. Moreover, accounting comparability, a measure of the quality of the information in financial statements, indicates that management’s efforts are aligned with the interests of the firm’s stakeholders. Despite this fact, it is essential to observe that standardisation and regulation of peer firms can reduce opportunistic activities of the management, ultimately increasing the firm’s value. So, when making board compensation contracts and approving the amount of the cash compensation, the firm’s owners compare the accounting system’s results, which show the firm’s management efforts, with those of the peer firms and incorporate them in the determination of the management’s compensation. The findings of this experimental test confirm these hypotheses and contribute to the literature on agency theory.

Table 3.

Compensation and Accounting Comparability.

4.2. Hypothesis 2

To examine H2, we estimate Equation (13) with the interaction term.

where CONS_C, is a measure of conditional conservatism. Basu (1997) model is used to measure conditional conservatism.

EARN is earnings per share divided by the beginning-of-period stock price; RET is the annual stock return, and DUM is the dummy variable. It is zero for firms with negative returns, one for firms with positive returns, and two for firms with no returns.

Table 4 presents the results of the first hypothesis. Conditional conservatism appears to have a positive and meaningful impact on management’s compensation. This finding suggests that, in conditional conservatism, risks associated with management decisions are reduced, partly due to the subsequent recognition of gains compared to losses. Thus, the management participates in highly-reliable activities, and as a result, the firm earns reliable revenues. As a result of the management’s efforts, quality earnings are generated, resulting in stable profitability of the firm and, therefore, increased board compensation.

Table 4.

Compensation and accounting comparability: conditional conservatism.

Furthermore, the results of the hypothesis tests indicate that conditional conservatism is an essential factor in improving the relationship between accounting comparability and management compensation. A principal motivation for conditional conservatism is to counteract the tendency of management to publishing favourable information at a time when an adverse event is taking place. Therefore, conditional conservatism can ensure accounting information’s accuracy, honesty, quality, and comparability. Likewise, it can be stated that conditional conservatism has improved the relationship between these two variables on account of its positive impact on accounting comparability.

To examine H2, we estimate Equation (15) with the interaction term.

MB is a measure of unconditional conservatism (Ismail and Elbolok 2011). M represents market value, and B represents book value.

Table 5 presents the results of the second hypothesis test. Findings indicate that unconditional conservatism does not directly impact the board’s compensation. As shown in Table 5, unconditional conservatism does not affect the accounting comparability through the first and second criteria (the relationship between cash flow and earnings per share and the relationship between return and profit). Yet, unconditional conservatism has influenced the relationship between accounting comparability (between share price and book value and earnings per share) and management’s compensation and has improved this relationship. Unconditional conservatism has been associated with higher-quality accounting information and lower capital expenditures. The argument presented here suggests that unconditional conservatism facilitates quality evaluation of the accounting information through the scope of information’s informativeness to the market and market reaction. It implies that the findings demonstrate that the accounting information in the third measure of comparability affects the stock price information and that conditional conservatism has been effective in this matter, consequently promoting the relationship between comparability and management’s compensation.

Table 5.

Compensation and accounting comparability: unconditional conservatism.

4.3. Hypothesis 3

To examine H3, we estimate Equation (16) with the interaction term.

where EM_ACC corresponds to accrual earnings management, to evaluate the earnings management, the absolute value of McNichols (2002) model is used as the discretionary accruals.

The results of the third secondary hypothesis are presented in Table 6. The results indicate that accrual earnings management positively affects board compensation, reinforcing the agency theory hypothesis of conflict of interest. Moreover, earnings management has improved the relationship between accounting comparability and board management.

Table 6.

Accruals earnings management and accounting comparability.

The coefficients of the accrual earnings management variable and its interaction with the comparability of accounting information are positive and significant. In the sense that, firstly, accrual earnings management has led to an increase in remuneration. Secondly, it has strengthened the positive relationship between the comparability of ac-counting information and remuneration. These findings state that managers have managed and manipulated accruals to make their company’s financial reporting information more comparable with other peer companies.

In light of these findings, it could be argued that management manipulates accounting information to increase compensation through accruals. As a result, they made an accounting information system that is the result of this effort closely similar to the competitors. The management emphasises this because there is a substantial likelihood that their performance will be compared with that of peers in the same industry, and their compensation will be determined based on comparing their performance with their peers.

We estimate Equation (17) to examine H4 with the interaction term.

In this case, the AEM criterion indicates actual earnings management, calculated below based on abnormal cash flows and modifying the Roychowdhury (2006) model.

CFO: Denotes the operating cash flows from t; A: Total assets at the end of period.

Sales: Sales during the period; ΔSales: Change in sales from year t − 1 to year t.

The rest of this model represents the actual earnings management. Table 7 summarises the results of the fourth secondary hypothesis. The test results of this hypothesis indicate that actual earnings management has no impact on board compensation. Furthermore, according to these findings, actual earnings management has not affected the relationship between accounting comparability and board compensation. According to these findings, the management of actual earnings in Iranian firms has not proven effective on accounting information. A company is willing to switch from accrual earnings management to actual earnings management in an environment with tighter regulation. In doing so, it offsets its desire to pursue personal interests. Based on these findings and the arguments presented, it can be concluded that, in Iran’s economic environment, due to the lack of strict regulations, management executes earnings management through accruals and adheres to its personal goals.

Table 7.

Actual earnings management and accounting comparability.

These findings can be seen objectively in Iran’s economic environment. This is because Mobarakeh Sepahan Steel Company, the largest steel company in the country, recently committed a big scandal of 3 billion dollars. After a complete inspection of the financial situation of this company, it was found that this was done years ago due to the lack of laws and regulations. Without adequate supervision, this situation is established for most companies. Additionally, reporting unstable profits by other companies can be another piece of evidence that can be seen in the long run.

4.4. Hypothesis 4

The previous sections indicated that by reviewing the literature and the obtained results, it could be concluded that there is a reciprocal relationship between the variables of accrual earnings management and accounting conservatism, and it is more effective to use a simultaneous equation system instead of a single equation system to determine how these two variables influence each other. First, the Granger causality test is performed to obtain more evidence around the reciprocal relationship between these two variables. A simultaneous equation system is utilised if the experimental method verifies the causality between two variables.

4.5. Granger Test

By presenting this model, Granger (1969) established a method for determining the causal relationship between two variables (Equations (19) and (20)).

As a result of estimating the model above, if coefficients are meaningful from a statistical point of view, it is stated that the variable is the granger causality of the second variable. If the coefficients are significant from a statistical point of view, then the second variable is also the granger causality of the first variable. In the case where only one coefficient is meaningful, the causal relationship between two variables is unilateral. In contrast, if both coefficients are significant, the causal relationship between the two variables is reciprocal, which is the definition of the feedback relationship between the two variables. As shown in Table 8, the Granger causality test results are presented based on accrual earnings management and accounting conservatism. The null hypothesis of this test and the influential obtained figures indicate that null hypotheses have been rejected. Therefore, there is a reciprocal relationship between two variables; thus, using a simultaneous equations system in determining the relationship between two variables is preferable.

Table 8.

Granger causality test.

The following equations can be utilised to estimate the reciprocal relationship between primary variables based on the simultaneous equation system for evaluating the reciprocal impact of accrual management and conditional conservatism on each other.

In this model, CONC_C represents the conditional conservatism calculated using the residual of the Basu (1997) model. The variables used in this model are defined in Equation (14). EM_ACC refers to accrual earnings management and is measured using the residual of McNicol’s model (2002). The element of McNicol’s model and the reason for its use are described in H3. Other variables have already been established.

The results from the fourth hypothesis are presented in Table 9. In addition, the results from the Hausman test are shown in Table 9, indicating that the simultaneous equations between accrual earnings management and conditional conservatism are painted through the fixed effect model estimates. The concurrent equation system is estimated by using the two-stage Least-Squares method. Table 9 indicates that the variable coefficient of conditional conservatism is positive and meaningful, which means that conditional conservatism has a positive effect on the accrual of earnings management. According to the dependent conservatism coefficient, conditional conservatism in approved firms in TSE positively correlates with increased accrual earning management methods. Table 9 indicates that the accrual management coefficient is positive and meaningful. In other words, accrual earnings management positively affects conditional conservatism. Based on the positive accrual earnings management coefficient, companies that manage earnings employ conditional conservatism procedures to prefer and present financial information. These findings are consistent with the views of the opponents of conservatism. In principle, they believe that accounting conservatism reduces the quality of accounting. In other words, the management demonstrates opportunistic behaviour by using conditional conservatism.

Table 9.

Panel A: Empirical results of simultaneous equations between accounting conservatism and earnings management (EM_ACC is the dependent variable, 2SLS test). Panel B: Empirical results of simultaneous equations between accounting conservatism and earnings management (CONC_C is the dependent variable, 2SLS test).

Table 9 indicates that the variable coefficient of conditional conservatism is positive and meaningful, which means that conditional conservatism has a positive effect on the accrual of earnings management. According to the dependent conservatism coefficient, conditional conservatism in approved firms in TSE positively correlates with increased accrual earning management methods. Table 9 indicates that the accrual management coefficient is positive and meaningful. In other words, accrual earnings management positively affects conditional conservatism. Based on the positive accrual earnings management coefficient, companies that manage earnings employ conditional conservatism procedures to prefer and present financial in-formation. These findings are consistent with the views of the opponents of conservatism. In principle, they believe that accounting conservatism reduces the quality of ac-counting. In other words, the management demonstrates opportunistic behaviour by using conditional conservatism.

5. Discussion and Conclusions

This study contributes to the literature by providing practical evidence of the associations among accounting comparability, executive compensation performance, earnings management, and accounting conservatism. It further offers a conceptual model of the simultaneous interactions of earnings management, accounting conservatism, compensation, and comparability. According to the results of this study, accounting comparability has a positive and significant impact on executive compensation. In light of these findings, it can be concluded that accounting comparability, which describes the quality of financial statements, is a sign of management efforts. These efforts are aligned with the interests of stakeholders. The risk is similar when two companies have high accounting comparability. This fact demonstrates that higher accounting comparability increases the accounting system output. Thus, it can be argued that the executives imitate their peer companies, and in terms of economic competition, they strive to enhance their function and succeed in the market. As a result, companies may be able to compare accounting output functions with their competitors’ organisational efforts. Likewise, since the pay for executives is also determined according to their operations, the comparability of accounting system outputs influences the determination of the amount of this compensation. The fact that identical standards and regulations are applied consistently across the industry allows executives to minimise their opportunistic activities, increasing the value of organisations over time. The empirical results of this study confirm these speculations and can enrich the literature on agency theory. It is consistent with the findings of Lobo et al. (2018) and Nam (2020). They found that evaluating the performance of executives based on accounting comparability with peers in the industry positively impacted their compensation. Accordingly, the higher the comparability of accounting for a company to its peers, the higher the pay for its executives.

Based on the results of the H2 test, conditional conservatism has a positive and significant effect on executive compensation. Thus, conditional conservatism detects losses earlier than earnings, reducing executive decisions’ riskiness. Without high-risk choices, there will be no possible negative consequences for the company’s future, resulting in a reliable income for the company. In other words, the efforts of executives that improve the firm value and owners’ wealth and stabilise a sustainable income for the commercial unit have paid off. This factor contributes to the rise in executive compensation. The findings are consistent with conservative perspectives.

Moreover, the results of the H2 test indicate that conditional conservatism can strengthen the relationship between accounting comparability and executive compensation. The primary goal of conditional conservatism is to neutralise the tendency for executives to publish favourable information when an adverse event occurs. Therefore, it could be concluded that conditional conservatism makes honesty possible, and executives use identical standards and regulations across peer companies to reach this goal, which improves accounting comparability and quality.

The findings indicate that conditional conservatism can enhance the relationship between accounting comparability and executive compensation by positively influencing these variables. Based on these findings, Francis et al. (2013) and Ruch and Taylor (2015) believe that conditional conservatism leads to high-quality and valuable information for shareholders. These findings, however, contradict the views of the opponents of conservatism. Based on the information system deviation perspective (LaFond and Watts 2008), this group believes conservatism degrades accounting comparability quality.

The results of the H2 test, however, indicate that unconditional conservatism does not have a significant impact on executive compensation. In addition, unconditional conservatism does not influence the accounting comparability through the first and second factors (the relationship between cash flows and earnings of each share and the relationship between share return and earnings and losses of each share). Penman and Zhang (2002), Ismail and Elbolok (2011), and Didar et al. (2016), have reported similar results. Their findings show that unconditional conservatism has no impact on the quality of reporting. However, unconditional conservatism can impact the relation of the accounting comparability third factor (the association of share price with official value and the profit of each share) and executive compensation. In this way, it can strengthen the mentioned relationship. As per the existing literature, unconditional conservatism leads to higher-quality accounting comparability and lower capital costs.

Furthermore, these findings show that unconditional conservatism facilitates the evaluation of accounting information by determining the informing amount of the data for the market and the market reaction. Thus, accounting information in the third factor of comparability, which is based on share market information, is influenced by conditional conservatism and, as a result, will strengthen the link between accounting comparability and executive compensation. The results of this study confirm those of Li et al. (2019), who found that executives who make conservative decisions earn increased compensation.

Further, the results of H3 indicate that accruals earnings management positively impacts executive compensation, which confirms the theory of conflict of interest. In contrast, according to the findings, earnings management strengthens the connection between accounting comparability and executive compensation by utilising accruals. The results of this study demonstrate that executives try to manipulate accounting information to gain additional compensation and assimilate this information with their peers through accruals as part of the accounting system. Executives probably believe in comparing their function with their peers in other companies and try to provide and present similar information. Despite this, research from H3 indicates that actual earnings management has no effect on executive compensation and does not affect the relationship between accounting comparability and executive compensation. These findings are in line with Su et al. (2016). Based on their results, accruals earnings management leads to an increase in comparability. However, actual earnings management does not impact comparability.

Regarding their economic facts, there is substantial evidence that emerging markets are innovative in accepting and adopting financial reporting standards. Therefore, it is expected that the assimilation process of standardisation and use of them in conjunction with the existing features will enhance information quality, increase the reliability of financial reports, develop capital and investment flows, enhance operational functions and, therefore, encourage economic development.

As mentioned throughout the research text, in emerging economies due to the insufficient experience of managers and even law-making organisations, it is necessary to update the laws based on the conditions and apply more supervision on these laws and standards. One of these ways is to strengthen the dimension of corporate governance. For example, more and more optimal training for auditors can lead to preparing and presenting more accurate information from companies, which minimises the mistakes of investors and other stakeholders in making decisions. In addition, it is necessary for the development of emerging markets to adhere to existing laws and monitor the implementation of these laws.

This study has the following limitations:

- There were some companies in the Iranian capital market whose information was not accessible, which reduced the sample size.

- Several factors, such as economic uncertainties and organisational cultures, which can affect executive function and compensation, are inaccessible and anonymous.

- Due to limitations associated with smooth panel transition regression, most potential influential factors cannot be included in the model.

Future research could investigate the following topics:

- Study domestic and foreign corporate governance mechanisms that may impact executive compensation and the quality of financial reporting.

- There is an impact of international sanctions as an external political economy factor on the manner and amount of determining executive compensation. Furthermore, standardisation under these sanctions and financial reporting records are influential factors.

Author Contributions

Conceptualization, A.A.D. and Y.F.; methodology, D.A.; S.A. and M.M.; software, A.A.D.; Y.F. and M.M.; validation, S.A. and D.A.; formal analysis, A.A.D.; Y.F. and M.M.; investigation, A.A.D.; Y.F. and M.M.; resources, A.A.D.; Y.F. and M.M.; data collection, A.A.D.; Y.F. and M.M.; writing—original draft preparation, A.A.D.; Y.F. and M.M.; writing—review and editing, D.A.; visualization, S.A.; supervision, D.A. and S.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The required data to test the hypotheses is collected from the companies listed on the Tehran Stock Exchange (TSE).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmed, Akbar, Neel Michael, and Safdar Irfan. 2017. Evidence on the Association between Accounting Comparability and Stock Price Efficiency. In 10th Annual Lone Star Accounting Research Conference. Richardson: The University of Texas at Dallas. [Google Scholar]

- Al-asyari, Ammar, Prihatni Rida, and Gurendrawati Etty. 2013. The effects of earnings management on accounting conservatism moderated by corporate governance mechanism. Journal Ilmiah Wahana Akuntansi 8: 52–79. [Google Scholar]

- Albuquerque, Ana. 2009. Peer firms in relative performance evaluation. Journal of Accounting and Economics 48: 69–89. [Google Scholar] [CrossRef]

- Al-Dhamari, Redhwan Ahmed, and Ku Nor Lzah Ku Ismail. 2014. An investigation into the effect of surplus free cash flow, corporate governance and firm size on earnings predictability. International Journal of Accounting and Information Management 22: 118–33. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2005. Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics 39: 83–128. [Google Scholar] [CrossRef]

- Barth, Mary E., Wayne R. Landsman, Mark Lang, and Christopher Williams. 2012. Are IFRS-based and US GAAP-based accounting amounts comparable? Journal of Accounting and Economics 54: 68–93. [Google Scholar] [CrossRef]

- Basu, Sudipta. 1997. The conservatism principle and the asymmetric timeliness of earnings1. Journal of Accounting and Economics 24: 3–37. [Google Scholar] [CrossRef]

- Beaver, William H., and Stephen G. Ryan. 2005. Conditional and unconditional conservatism: Concepts and modelling. Review of Accounting Studies 10: 269–309. [Google Scholar] [CrossRef]

- Bertomeu, Jeremy, Masako Darrough, and Wenjie Xue. 2017. Optimal conservatism with earnings manipulation. Contemporary Accounting Research 34: 252–84. [Google Scholar] [CrossRef]

- Bourveau, Thomas, Jason V. Chen, Ferdinand Elfers, and Jochen Pierk. 2022. Public peers, accounting comparability, and value relevance of private firms’ financial reporting. Review of Accounting Studies, 1–35. [Google Scholar] [CrossRef]

- Brydon, Donald. 2019. Assess, Assure and Inform Improving Audit Quality and Effectiveness; London: APS Group. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/852960/brydon-review-final-report.pdf (accessed on 20 April 2021).

- Cascino, Stefano, and Joachim Gassen. 2010. Mandatory IFRS Adoption and Accounting Comparability. London: London School of Economics. Berlin: Humboldt-Universität zu Berlin. [Google Scholar]

- Caskey, Judson, and Volker Laux. 2017. Corporate governance, accounting conservatism, and manipulation. Management Science 63: 424–37. [Google Scholar] [CrossRef]

- Chen, Anthony, and James Jianxin Gong. 2019. Accounting comparability, financial reporting quality, and the pricing of accruals. Advances in Accounting 45: 100415. [Google Scholar] [CrossRef]

- Chen, Ciao Wei, Daniel W. Collins, Todd D. Kravet, and Richard D. Mergenthaler. 2018. Financial statement comparability and the efficiency of acquisition decisions. Contemporary Accounting Research 35: 164–202. [Google Scholar] [CrossRef]

- Chen, Lucy Huajing, David M. Folsom, Wonsun Paek, and Heibatollah Sami. 2014. Accounting conservatism, earnings persistence, and pricing multiples on earnings. Accounting Horizons 28: 233–60. [Google Scholar] [CrossRef]

- Choi, Ahrum, Jong Hag Choi, and Byungcherl Charlie Sohn. 2018. The joint effect of audit quality and legal regimes on the use of real earnings management: International evidence. Contemporary Accounting Research 35: 2225–57. [Google Scholar] [CrossRef]

- Cohen, Daniel A. 2003. Quality of Financial Reporting Choice: Determinants and Economic Consequences. Available online: https://ssrn.com/abstract=422581 (accessed on 15 November 2018).

- Cohen, Daniel A., and Paul Zarowin. 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50: 2–19. [Google Scholar] [CrossRef]

- Cohen, Daniel A., Aiyesha Dey, and Thomas Z. Lys. 2008. Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The Accounting Review 83: 757–87. [Google Scholar] [CrossRef]

- Daryaei, Abbas Ali, Yasin Fattahi, Ramazan Hasani, and Hamed Sadeqi. 2020. Value of Cash and Accounting Conservatism: The Role of Audit Quality and Firm Growth. Cogent Economics & Finance 8: 1–23. [Google Scholar]

- De Angelis, David, and Yaniv Grinstein. 2015. Performance terms in CEO compensation contracts. Review of Finance 19: 619–51. [Google Scholar] [CrossRef]

- De Franco, Gus, S. P. Kothari, and Rodrigo Verdi. 2011. The benefits of financial statement comparability. J. Account. Research 49: 895–931. [Google Scholar] [CrossRef]

- DeFond, Mark, Xuesong Hu, Mingyi Hung, and Siqi Li. 2011. The impact of mandatory IFRS adoption on foreign mutual fund ownership: The role of comparability. Journal of Accounting and Economics 51: 240–58. [Google Scholar] [CrossRef]

- Didar, Hamzeh, Gholamreza Mansourfar, and Maziyar Hasan Babaei. 2016. Examining Effects of Conditional and Unconditional Conservatism on Financial Reporting Quality. Journal of Knowledge Accounting 7: 145–66. (In Persian). [Google Scholar]

- Etemadi, Hosein, Mansor Momeni, and Hasan Farajzadeh. 2012. Earnings management, how it affects earnings quality firms? Journal of Financial Accounting Research 2: 101–22. (In Persian). [Google Scholar]

- Financial Accounting Standards Board (FASB). 2010. Statement of financial accounting concepts no. 8: A conceptual framework for financial reporting. [Google Scholar]

- Francis, Rick N, Steven Harrast, James Mattingly, and Lori Olsen. 2013. The relation between accounting conservatism and corporate social performance: An empirical investigation. Business and Society Review 118: 193–222. [Google Scholar] [CrossRef]

- Granger, Cwj. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society, 424–438. [Google Scholar]

- Hadani, Michaeal, Maria Goranova, and Raihan Khan. 2011. Institutional investors, shareholder activism, and earnings management. Journal of Business Research 64: 1352–60. [Google Scholar] [CrossRef]

- Haque, Abdua, Azhar Mughal, and Zohaib Zahid. 2016. Earning management and the role of accounting conservatism at firm level. International Journal of Economics and Finance 8: 197–205. [Google Scholar] [CrossRef]

- Hashemi, Seyed Abbas, Hadi Amiri, and Ali Hassanzadeh. 2018. The Effect of Conditional Accounting Conservatism on the Debt Maturity and Growth through External Financing Considering Corporate Governance Mechanisms. Journal of Financial Accounting Research 9: 39–60. (In Persian). [Google Scholar]

- Horton, Joanne, George Serafeim, and Ioanna Serafeim. 2013. Does mandatory IFRS adoption improve the information environment? Contemporary Accounting Research 30: 388–423. [Google Scholar] [CrossRef]

- Iatridis, George, and George Kadorinis. 2009. Earnings management and firm financial motives: A financial investigation of UK listed firms. International Review of Financial Analysis 18: 164–73. [Google Scholar] [CrossRef]

- Ismail, Tariq Hassaneen, and Rasha Elbolok. 2011. Do conditional and unconditional conservatism impact earnings quality and stock prices in Egypt? Research Journal of Finance and Accounting 2: 7–22. [Google Scholar]

- Januarsi, Yeni, and Tsung-Ming Yeh. 2022. Accounting Comparability and Earnings Management Strategies: Evidence from Southeast Asian Countries. Emerging Markets Finance and Trade, 1–15. [Google Scholar] [CrossRef]

- Jensen, Michaael C, and Kevin J. Murphy. 1990. Performance pay and top-management incentives. Journal of Political Economy 98: 225–64. [Google Scholar] [CrossRef]

- Kato, Takao, and Katsuyuki Kubo. 2006. CEO compensation and firm performance in Japan: Evidence from new panel data on individual CEO pay. Journal of the Japanese and International Economies 20: 1–19. [Google Scholar] [CrossRef]

- Khuong, Nguyen Vinh, Abdul Aziz Aabdul Rahman, Abdelrman Meero, Le Huu Tuan Anh, Nguyen Thanh Liem, Cao Thi Mien Thuy, and Huynh Thi Ngoc Ly. 2022. The Impact of Corporate Social Responsibility Disclosure and Accounting Comparability on Earnings Persistence. Sustainability 14: 2752. [Google Scholar] [CrossRef]

- Kim, Seil, Pepa Kraft, and Stephen Ryan. 2013. Financial statement comparability and credit risk. Review of Accounting Studies 18: 783–823. [Google Scholar] [CrossRef]

- Kravet, Todd D. 2014. Accounting conservatism and managerial risk-taking: Corporate acquisitions. Journal of Accounting and Economics 57: 218–40. [Google Scholar] [CrossRef]

- LaFond, Ryan, and Ross L. Watts. 2008. The information role of conservatism. The Accounting Review 83: 447–78. [Google Scholar] [CrossRef]

- Lara, Juna Manuel Garcia, Beatriz García, and Fernando Penalva. 2012. Accounting Conservatism and the Limits to Earnings Management. Working Paper. Madrid: Universidad Autónoma de Madrid. [Google Scholar] [CrossRef]

- Li, Han. 2018. Unconditional accounting conservatism and real earnings management. International Journal of Financial Research 9: 203–15. [Google Scholar] [CrossRef][Green Version]

- Li, Hui, Darren Henry, and Xiaohui Wu. 2019. The effects of accounting conservatism on executive compensation. International Journal of Managerial Finance 16: 393–411. [Google Scholar] [CrossRef]

- Li, Zhi, and Lingling Wang. 2016. Executive compensation incentives contingent on long-term accounting performance. The Review of Financial Studies 29: 1586–633. [Google Scholar] [CrossRef]

- Lin, Fengyi, Chung-Min Wu, Tzu Yi Fang, and Jheng-Ci Wun. 2014. The relations among accounting conservatism, institutional investors and earnings manipulation. Economic Modelling 37: 164–74. [Google Scholar] [CrossRef]

- Lobo, Gerald J., Michael Neel, and Aadrienne Rhodes. 2018. Accounting comparability and relative performance evaluation in CEO compensation. Review of Accounting Studies 23: 1137–76. [Google Scholar] [CrossRef]

- Mashayekhi, Bita, Sasan Mehrani, Kaveh Mehrani, and Gholam Reza Karami. 2006. The role of discretionary accruals in earnings management of listed firms in Tehran Stock Exchange (TSE). Accounting and Auditing Review 12: 61–74. (In Persian). [Google Scholar]

- Matsuura, Souichi. 2008. On the relation between real earnings management and accounting earnings management: Income smoothing perspective. Journal of International Business Research 7: 63. [Google Scholar]

- McNichols, Maureen F. 2002. Discussion of the quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review 77: 61–69. [Google Scholar] [CrossRef]

- Mehrvarz, Fatemeh, and Mohammad Marfou. 2017. The Relationship between Financial Statements Comparability with Stock Price in Formativeness about Future Earnings. Empirical Studies in Financial Accounting 13: 83–110. (In Persian). [Google Scholar]

- Meshki Miavaghi, Mehdi, and Roya Mohammadi. 2019. Investigating the effect of conditional conservatism on earnings quality based on price value relevance and the earnings response coefficients. Journal of Financial Accounting Research 11: 61–74. (In Persian). [Google Scholar]

- Moradi, Mehdi, Mehdi Salehi, and Masomeh Najari. 2012. A study of the effective variables on earning management: Iranian evidence. Research Journal of Applied Sciences, Engineering and Technology 4: 3088–94. (In Persian). [Google Scholar]

- Nam, Jonathan Sangwook. 2020. Financial Reporting Comparability and Accounting-Based Relative Performance Evaluation in the Design of CEO Cash Compensation Contracts. The Accounting Review 95: 343–70. [Google Scholar] [CrossRef]

- Namakavarani, Omid Mehri, Abbas Ali Daryaei, Davood Askarany, and Saeed Askary. 2021. Audit committee characteristics and quality of financial information: The role of the internal information environment and political connections. Journal of Risk and Financial Management 14: 273. [Google Scholar] [CrossRef]

- Nassir Zadeh, Farzaneh, Davood Askarany, and Solmaz Arefi Asl. 2022. Accounting Conservatism and Earnings Quality. Journal of Risk and Financial Management 15: 1–18. [Google Scholar]