The Economic Impact of Flood Zone Designations on Residential Property Valuation in Miami-Dade County

Abstract

1. Introduction

2. Methods

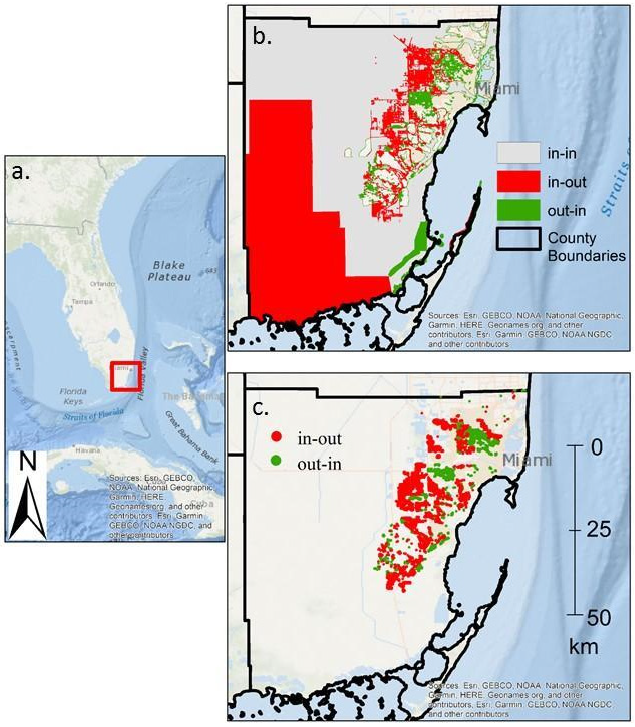

2.1. Study Area and Data

2.2. Regression Model with Interactions

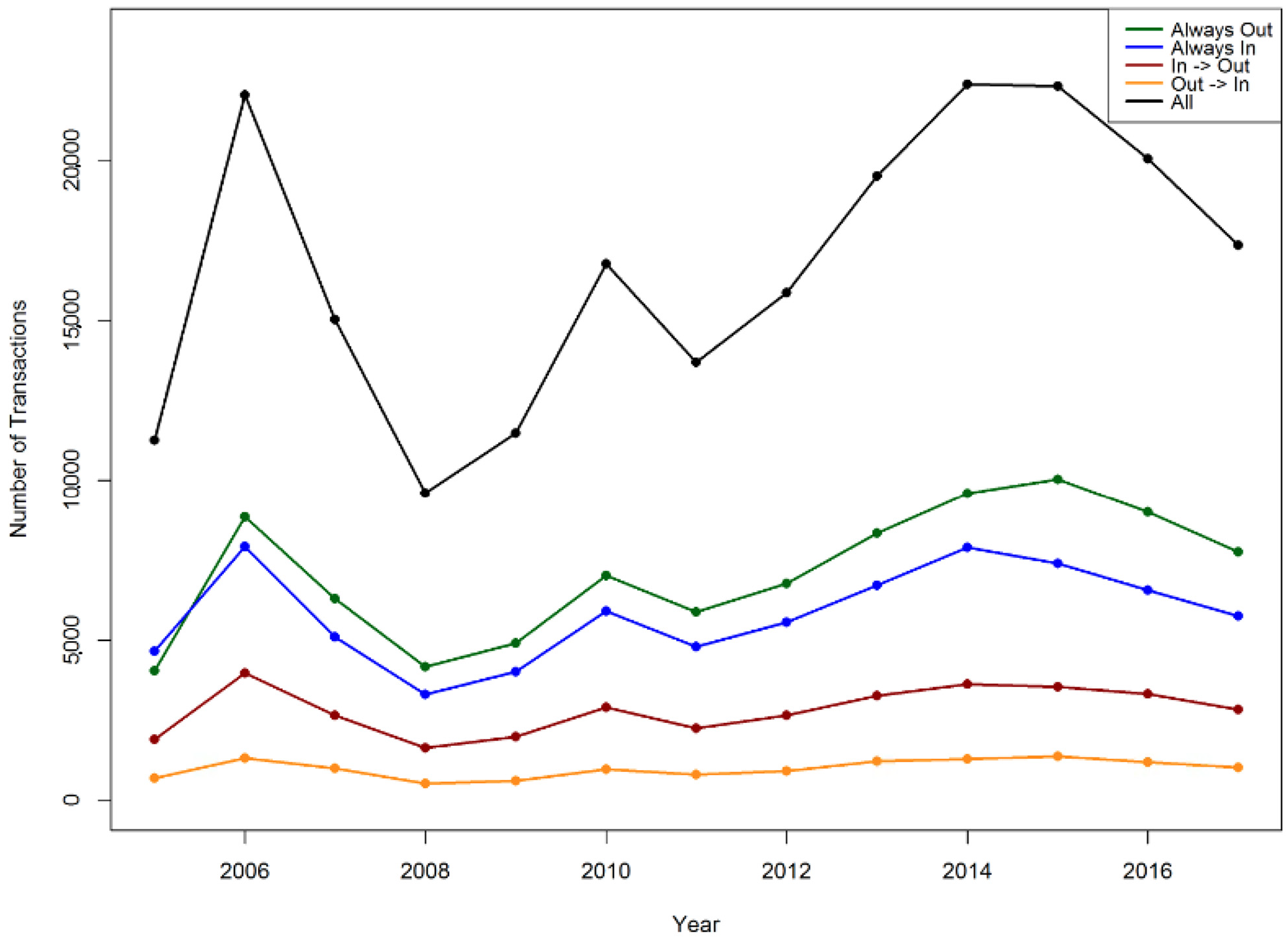

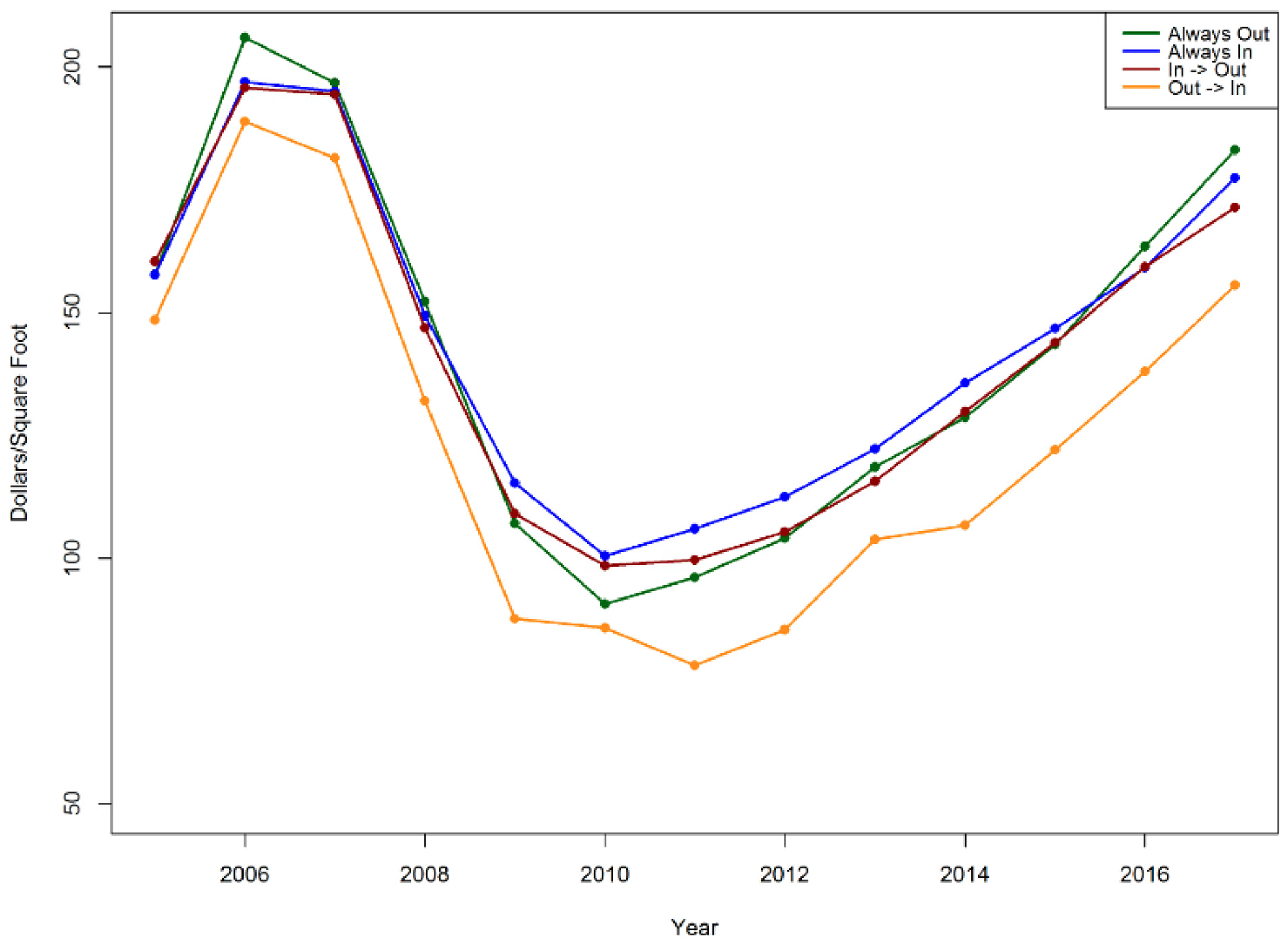

3. Results

4. Discussion

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Atreya, Ajita, Susana Ferreira, and Warren Kriesel. 2013. Forgetting the flood? An analysis of the flood risk discount over time. Land Economics 89: 577–96. [Google Scholar] [CrossRef]

- Bakkensen, Laura, and Lint Barrage. 2017. Flood Risk Belief Heterogeneity and Coastal Home Price Dynamics: Going under Water? No. w23854. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Bates, Paul, Niall Quinn, Christopher Sampson, Andy Smith, Oliver Wing, Jason Sosa, and Witek Krajewski. 2021. Combined modeling of US fluvial, pluvial, and coastal flood hazard under current and future climates. Water Resources Research 57: e2020WR028673. [Google Scholar] [CrossRef]

- Bernstein, Asaf, Matthew Gustafson, and Ryan Lewis. 2019. Disaster on the horizon: The price effect of sea level rise. Journal of Financial Economics 134: 253–72. [Google Scholar] [CrossRef]

- Bin, Okmyung, and Craig E. Landry. 2013. Changes in implicit flood risk premiums: Empirical evidence from the housing market. Journal of Environmental Economics and Management 65: 361–76. [Google Scholar] [CrossRef]

- Bin, Okmyung, and Stephen Polasky. 2004. Effects of flood hazards on property values: Evidence before and after Hurricane Floyd. Land Economics 80: 490–500. [Google Scholar] [CrossRef]

- Bin, Okmyung, Jamie Brown Kruse, and Craig Landry. 2008. Flood hazards, insurance rates, and amenities: Evidence from the coastal housing market. Journal of Risk and Insurance 75: 63–82. [Google Scholar] [CrossRef]

- Brody, Samuel D., Joshua Gunn, Walter Peacock, and Wesley E. Highfield. 2011. Examining the influence of development patterns on flood damages along the Gulf of Mexico. Journal of Planning Education and Research 31: 438–48. [Google Scholar] [CrossRef]

- Brody, Samuel D., Sammy Zahran, Praveen Maghelal, Himanshu Grover, and Wesley E. Highfield. 2007. The rising costs of floods: Examining the impact of planning and development decisions on property damage in Florida. Journal of the American Planning Association 73: 330–45. [Google Scholar] [CrossRef]

- Dottori, Francesco, Wojciech Szewczyk, Juan Carlos Ciscar, Fang Zhao, Lorenzo Alfieri, Yukuko Hirabayashi, Alessandra Bianchi, Ignazio Mongelli, Katia Frieler, Richard Betts, and et al. 2018. Increased human and economic losses from river flooding with anthropogenic warming. Nature Climate Change 8: 781–86. [Google Scholar] [CrossRef]

- First Street Foundation. 2020. The First National Flood Risk Assessment: Defining America’s Growing Risk. Available online: https://assets.firststreet.org/uploads/2020/06/first_street_foundation__first_national_flood_risk_assessment.pdf (accessed on 20 January 2022).

- Flood Insurance: Miami-Dade County. n.d. Available online: https://www.miamidade.gov/environment/flood-insurance.asp (accessed on 21 January 2022).

- Gall, Melanie, Kevin A. Borden, Christopher T. Emrich, and Susan L. Cutter. 2011. The unsustainable trend of natural hazard losses in the United States. Sustainability 3: 2157–81. [Google Scholar] [CrossRef]

- Genovese, Elisabetta, Stephane Hallegatte, and Patrice Dumas. 2011. Damage assessment from storm surge to coastal cities: Lessons from the Miami area. In Advancing Geoinformation Science for a Changing World. Berlin and Heidelberg: Springer, pp. 21–43. [Google Scholar]

- Hallegatte, Stephane, Colin Green, Robert J. Nicholls, and Jan Corfee-Morlot. 2013. Future flood losses in major coastal cities. Nature Climate Change 3: 802–6. [Google Scholar] [CrossRef]

- Indaco, Agustin, Francesc Ortega, and Süleyman Taşpınar. 2019. The effects of flood insurance on housing markets. Cityscape 21: 129–56. [Google Scholar] [CrossRef]

- Jongman, Brenden, Stefan Hochrainer-Stigler, Luc Feyen, Jeroen C. Aerts, Reinhard Mechler, Wouter W. Botzen, Laurens M. Bouwer, Georg Pflug, and Philip J. Ward. 2014. Increasing stress on disaster-risk finance due to large floods. Nature Climate Change 4: 264–68. [Google Scholar] [CrossRef]

- Keenan, Jesse, Thomas Hill, and Anurag Gumber. 2018. Climate gentrification: From theory to empiricism in Miami-Dade County, Florida. Environmental Research Letters 13: 054001. [Google Scholar] [CrossRef]

- Keller, Michael, Mira Rojanasakul, David Ingold, Christopher Flavelle, and Brittany Harris. 2017. Outdated and Unreliable: FEMA’s Faulty Flood Maps Put Homeowners at Risk” Bloomberg. Available online: www.bloomberg.com/graphics/2017-fema-faulty-flood-maps/ (accessed on 6 February 2022).

- Kousky, Carolyn, Brett Lingle, and Leonard Shabman. 2016. NFIP Premiums for Single-Family Residential Properties: Today and Tomorrow. RFF Policy Brief, Resources for the Future. No. 16-10. Available online: https://media.rff.org/archive/files/document/file/RFF-PB-16-10.pdf (accessed on 6 February 2022).

- Kulp, Scott, and Benjamin H. Strauss. 2017. Rapid escalation of coastal flood exposure in US municipalities from sea level rise. Climatic Change 142: 477–89. [Google Scholar] [CrossRef]

- McAlpine, Steven A., and Jeremy R. Porter. 2018. Estimating recent local impacts of sea-level rise on current real-estate losses: A housing market case study in Miami-Dade, Florida. Population Research and Policy Review 37: 871–95. [Google Scholar] [CrossRef]

- Mendelsohn, Robert, Kerry Emanuel, Shun Chonabayashi, and Laura Bakkensen. 2012. The impact of climate change on global tropical cyclone damage. Nature Climate Change 2: 205–9. [Google Scholar] [CrossRef]

- Ortega, Francesc, and Süleyman Taṣpınar. 2018. Rising sea levels and sinking property values: Hurricane Sandy and New York’s housing market. Journal of Urban Economics 106: 81–100. [Google Scholar] [CrossRef]

- Raimi, Daniel, Ameila Keyes, and Cora Kingdon. 2020. Florida Climate Outlook: Assessing Physical and Economic Impacts through 2040. Resources for the Future Report. 20-01. Available online: http://resp.llas.ac.cn/C666/handle/2XK7JSWQ/275194 (accessed on 6 February 2022).

- Smith, Adam B. 2020. US Billion-Dollar Weather and Climate Disasters, 1980–Present; (NCEI Accession 0209268); Asheville: NOAA National Centers for Environmental Information.

- Technical Mapping Advisory Council. 2015. TMAC 2015 Annual Report. Federal Emergency Management Agency. Available online: https://www.fema.gov/sites/default/files/documents/fema_tmac_2015_annual_report.pdf (accessed on 15 January 2022).

- Wdowinski, Shimon, Ronald Bray, Ben P. Kirtman, and Zhaohua Wu. 2016. Increasing flooding hazard in coastal communities due to rising sea level: Case study of Miami Beach, Florida. Ocean and Coastal Management 126: 1–8. [Google Scholar] [CrossRef]

- Wing, Oliver E., Paul D. Bates, Andrew M. Smith, Christopher C. Sampson, Kris A. Johnson, Joseph Fargione, and Philip Morefield. 2018. Estimates of present and future flood risk in the conterminous United States. Environmental Research Letters 13: 034023. [Google Scholar] [CrossRef]

- Wobus, Cameron, Pearl Zheng, Justin Stein, Claire Lay, Hardee Mahoney, Mark Lorie, David Mills, Bill Szafranski, and Jeremy Martinich. 2019. Projecting changes in expected annual damages from riverine flooding in the United States. Earth’s Future 7: 516–27. [Google Scholar] [CrossRef] [PubMed]

| Group | # of Homes | # of Transactions |

|---|---|---|

| out-out | 50,980 | 92,572 |

| in-in | 41,800 | 75,452 |

| in-out | 20,889 | 36,423 |

| out-in | 7024 | 12,775 |

| Total | 120,693 | 217,222 |

| Source | Information Obtained |

|---|---|

| Miami Dade County Assessor Public Records | Property transaction and assessor data |

| NOAA Tide Stations | Flood inundation information |

| US Census Bureau | Area demographics, census tracts, and proximity to highway |

| NOAA Medium Coastline File | Proximity to beach |

| USA Golf Courses (ESRI) | Proximity to golf course |

| US Energy Information Administration (EIA) | Proximity to fossil fuel plant |

| Environmental Protection Agency (EPA) | Proximity to landfills |

| USA Hospitals (ESRI) | Proximity to medical center |

| Military Bases DB (ESRI) | Proximity to military base |

| FEMA National Flood Hazard Layer (NFHL) | Designation within SFHA |

| Mean (%) | ||

|---|---|---|

| Origin In | Origin Out | |

| Dependent variable | ||

| Price per Square Foot | $144.79 | $141.70 |

| Controls | ||

| Years since 2005 (YR05) | 6.37 | 6.64 |

| Acres | 0.22 | 0.22 |

| Bedrooms | 3.44 | 3.06 |

| Near beach | 21.26% | 30.61% |

| Near golf course | 78.56% | 80.06% |

| Near fossil fuel plant | 11.15% | 3.11% |

| Near highway | 23.14% | 44.70% |

| Near landfill | 34.56% | 48.98% |

| Near medical | 98.34% | 99.87% |

| Near military base | 14.65% | 5.74% |

| Average flooding inundation of lot | ||

| Lot tidal flooding 2018 (LT18) | <1% | <1% |

| Road tidal flooding 2018 (RD18) | 1% | <1% |

| Dependent Variable | |||

|---|---|---|---|

| Price per Square Foot of Living Area | |||

| Model 1 Origin Out Slope (Beta) | Model 2 Origin In Slope (Beta) | Model 3 Full Slope (Beta) | |

| Intercept | 388.3 *** (87.3) | 484.4 *** (69.12) | 292 *** (38.82) |

| Control variables a | |||

| 2005 area property value | 19.26 *** (0.490) | 23.7 *** (0.469) | 21.68 *** (0.334) |

| Years since 2005 (YR05) | 93.03 *** (1.603) | 82.58 *** (1.294) | 87.34 *** (1.019) |

| (YR05)^2 | −61.15 *** (0.942) | −53.51 *** (0.78) | −57.05 *** (0.6072) |

| (YR05)^3 | 12.11 *** (0.194) | 10.44 *** (0.1625) | 11.22 *** (0.1258) |

| (YR05)^4 | −0.978 *** (0.017) | −0.831 *** (0.014) | −0.8995 *** (0.011) |

| (YR05)^5 | 0.028 *** (0.001) | 0.024 *** (0.000) | 0.0260 *** (0.000) |

| Acres | 13.68 *** (0.810) | 9.632 *** (0.5313) | 11 *** (0.4447) |

| Year built standardized | 0.105 *** (0.018) | 0.1612 *** (0.017) | 0.147 *** (0.012) |

| Year built standardized^2 | 0.001 ** (0.000) | 0.002 ** (0.001) | 0.002 *** (0.000) |

| Area median age | −5.082 ** (1.836) | −8.295 *** (1.663) | −3.672 *** (0.868) |

| Area percent white | 2.307 *** (0.3266) | 0.6799 (0.485) | 1.602 *** (0.256) |

| Area race diversity index | −239.4 ** (73.52) | 63.51 * (30.38) | −57.47 (39.45) |

| Near beach | 24.53 *** (3.268) | 13.2 *** (3.581) | 18.99 *** (2.219) |

| Near golf course | 39.67 *** (6.115) | 1.469 (3.959) | 14.21 *** (3.099) |

| Near fossil fuel plant | 15.62. (8.848) | −4.458 (5.559) | −1.274 (4.571) |

| Near highway | −22.93 *** (4.223) | −11.07* (4.87) | −17.46 *** (2.954) |

| Near landfill | −7.212 * (3.581) | −2.537 (3.76) | −6.675 ** (2.434) |

| Near medical | −50.27. (27.37) | −39.26 *** (10.15) | −33.54 *** (9.434) |

| Near military base | 28.34 *** (6.935) | −22.34 *** (5.193) | −8.484 * (3.776) |

| Flooding indicators b | |||

| Lot tidal flooding (LT18) | 813.3 ** (248.9) | −22.5 (29.14) | 7.307 (30.3) |

| Road tidal flooding (RD18) | −135 * (68.56) | −91.01 *** (7.964) | −81.99 *** (8.273) |

| LT18 * RD18 | −5454. (3056) | 146.7* (62.28) | 99.31 (65.15) |

| YR05 * LT18 | −106.9 ** (34.9) | 1.734 (3.288) | −1.151 (3.433) |

| YR05 * RD18 | 13.03 (8.71) | 12.49 *** (0.9532) | 11.72 *** (1.004) |

| YR05 * LT18 * RD18 | 907.6 (719.3) | −23.59** (7.21) | −18.62* (7.574) |

| DiD variables c | |||

| Sale 2009 or later (T09) | −8.246 *** (1.519) | −5.992 *** (1.319) | −10.01 *** (1.041) |

| Zoned “in-to-out” (old_fi) | −4.782 *** (0.734) | −7.832 *** (0.774) | |

| Zoned “out-to-in” (new_fi) | 2.362 * (1.18) | 3.83 *** (1.082) | |

| Zoned “always in” (always_in) | −3.427 *** (0.636) | ||

| “in-to-out” * T09 | 2.26 ** (0.747) | 7.811 *** (0.772) | |

| “out-to-in” * T09 | −2.549 * (1.242) | −2.816 * (1.178) | |

| “always-in” * T09 | 5.654 *** (0.623) | ||

| Observations | 105,347 | 111,875 | 217,222 |

| R^2 | 0.56 | 0.54 | 0.55 |

| Adjusted R^2 | 0.56 | 0.54 | 0.55 |

| Residual Standard Error | 58.21 | 51.94 | 55.25 |

| F statistic | 360.30 *** | 336.10 *** | 516.50 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shu, E.G.; Porter, J.R.; Wilson, B.; Bauer, M.; Pope, M.L. The Economic Impact of Flood Zone Designations on Residential Property Valuation in Miami-Dade County. J. Risk Financial Manag. 2022, 15, 434. https://doi.org/10.3390/jrfm15100434

Shu EG, Porter JR, Wilson B, Bauer M, Pope ML. The Economic Impact of Flood Zone Designations on Residential Property Valuation in Miami-Dade County. Journal of Risk and Financial Management. 2022; 15(10):434. https://doi.org/10.3390/jrfm15100434

Chicago/Turabian StyleShu, Evelyn G., Jeremy R. Porter, Bradley Wilson, Mark Bauer, and Mariah L. Pope. 2022. "The Economic Impact of Flood Zone Designations on Residential Property Valuation in Miami-Dade County" Journal of Risk and Financial Management 15, no. 10: 434. https://doi.org/10.3390/jrfm15100434

APA StyleShu, E. G., Porter, J. R., Wilson, B., Bauer, M., & Pope, M. L. (2022). The Economic Impact of Flood Zone Designations on Residential Property Valuation in Miami-Dade County. Journal of Risk and Financial Management, 15(10), 434. https://doi.org/10.3390/jrfm15100434