Earnings Management and Corporate Performance in the Scope of Firm-Specific Features

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

- The dataset’s discretionary accruals were estimated using the Kasznik model (1999), which improved the Jones model by including the annual change in cash flows as a significant element (see Equation (1)).where NDAit is the nondiscretionary accrual in a year t, Tait is the total accrual in the year t, Ait−1 is the total assets in the year t − 1, ΔREVit is the annual change of revenues in the year t, PPEit is the long-term tangible assets in a year t, ΔCFOit is the annual change of operating CF in the year t, α0, α1, α2, and α3 are regression coefficients, i is the firm index (i = 1, 2, …, N), t is the period index (t = 1, 2, …, T), and εit is the prediction error.

- To determine if the mean values of discretionary accruals were different from zero, a sample t-test was performed annually. A hallmark of neutral accounting practice is when the mean value of discretionary accruals is equal to zero. A positive value of discretionary accruals, on the other hand, represents aggressive earnings management activity, while a negative value describes conservative accounting operations.

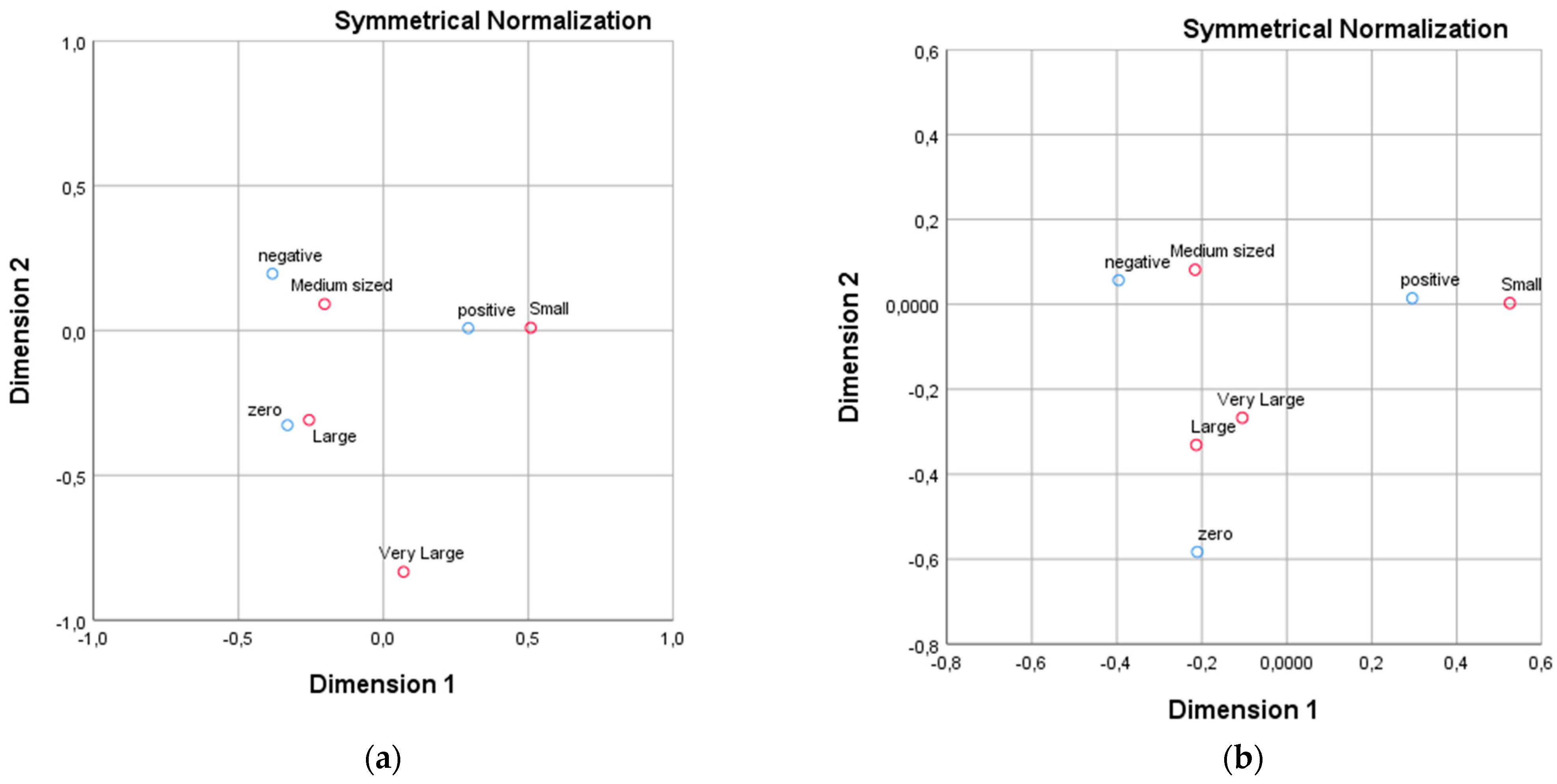

- The dataset was examined using correspondence analysis. Its principle consists of the creation of a contingency table, while the data used can also be displayed in a graph or a correspondence map. In our case, a two-factor contingency table was used. Only one variable from each of the following factors was compared in a contingency table: the firm size, sectoral classification (NACE classification), or the legal form of the business. The second factor was the level of discretionary accruals of businesses in the analyzed periods. To measure the association between factors, a dependency between the given variables was tested using Pearson’s chi-square test (at a significance level of 0.05). The following hypotheses were established:H20:There is no statistically significant relationship between the given variables (discretionary accrual category and a company descriptive factor).H21:There is a statistically significant dependency between the given variables.

- If the alternative hypothesis H1 was accepted, the associations between the categories of the variables could be investigated by transforming the results from the contingency table into a correspondence map using points. The points in the correspondence map represent the relative frequencies of the contingency table. The position of the points indicates the similarity between the individual row and column categories and, at the same time, the mutual relationship between them. To display the individual points on the map, it is necessary to determine a measure that would correspond to how well the points are drawn on the correspondence map. The degree of variability is reflected by the total inertia. In general, a closer value of the total inertia to 1 indicates a higher quality of the created correspondence map and a higher explanatory power (Greenacre 2017). All correspondence maps were created using the chi-square distance measure.

4. Results and Discussion

Overall Assessment

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ajina, Aymen, Mhamed Laouiti, and Badreddine Msolli. 2016. Guiding through the fog: Does annual report readability reveal earnings management? Research in International Business and Finance 38: 509–51. [Google Scholar] [CrossRef]

- Alareeni, Bahaaeddin. 2018. The impact of firm-specific characteristics on earnings management: Evidence from GCC countries. International Journal of Managerial and Financial Accounting 10: 85–104. [Google Scholar] [CrossRef]

- Aldahab, Mohammad, Modar Abdullatif, and Israa Mansour. 2020. Related party transactions and earnings management in Jordan: The role of ownership structure. Journal of Financial Reporting and Accounting 18: 505–31. [Google Scholar] [CrossRef]

- Al-Duais, Shaker Dahan, Mazrah Malek, Mohammad Abdul Hamid, and Amal Mohammed Almasawa. 2022. Ownership structure and real earnings management: Evidence from an emerging market. Journal of Accounting in Emerging Economies 12: 380–404. [Google Scholar] [CrossRef]

- Alhadab, Mohammad, and Bassam Eshiwi Al-Own. 2019. Earnings management and equity incentives: Evidence from the European banking industry. International Journal of Accounting and Information Management 27: 244–61. [Google Scholar] [CrossRef]

- Baatwah, Saeed Rabea, Waddah Kamal Omer, and Khaled Salmen Aljaaidi. 2021. Outsourced internal audit function and real earnings management: The role of industry and firm expertise of external providers. International Journal of Auditing 25: 206–32. [Google Scholar] [CrossRef]

- Bansal, Manish. 2021. Influence of firm size and firm age on classification shifting: An empirical study on listed firms in India. Journal of Financial Reporting and Accounting 19: 772–92. [Google Scholar] [CrossRef]

- Bassiouny, Sara, Mohamed Moustafa Soliman, and Aiman Ragab. 2016. The impact of firm characteristics on earnings management: An empirical study on the listed firms in Egypt. The Business and Management Review 7: 91–101. [Google Scholar]

- Beslic, Ivan, Dragana Beslic, Deajn Jaksic, and Mirko Andric. 2015. The Detection of Earnings Management of the Companies in the Industrial Sector of the Republic of Serbia. Industrija 43: 55–79. [Google Scholar] [CrossRef]

- Bever, Anne, Ilan Guttman, and Ivan Martinovic. 2019. Earnings management and earnings quality: Theory and Evidence. The Accounting Review 94: 77–101. [Google Scholar]

- Borralho, Joao Miguel, Dolores Gallardo Vazquez, and Remedios Hernandez-Linares. 2020. Earnings management in private family versus non-family firms. The moderating effect of family business generation. Spanish Journal of Finance and Accounting 49: 210–33. [Google Scholar] [CrossRef]

- Burgstahler, David, Luzi Hail, and Christian Leuz. 2006. The importance of reporting incentives: Earnings management in European private and public firms. Accounting Review 81: 983–1016. [Google Scholar] [CrossRef]

- Carp, Mihai, and Iuliana Georgescu. 2015. Study on the factors that influence the degree of management of the financial earnings reported by BSE-quoted companies. In Innovation Vision 2020: From Regional Development Sustainability to Global Economic Growth. Edited by Khalid S. Soliman. Norristown: International Business Information Management Association, pp. 2146–58. [Google Scholar]

- Che, Limei, and John Christian Langli. 2015. Governance structure and firm performance in private family firms. Journal of Business Finance & Accounting 42: 1216–50. [Google Scholar]

- Chen, Changling, AlanGuoming Huang, and Ranjini Jha. 2012. Idiosyncratic return volatility and the information quality underlying managerial decision. Journal of Financial and Quantitative Analysis 47: 873–89. [Google Scholar] [CrossRef]

- Chen, Haiwei, Surendranath Jory, and Thanh Ngo. 2020. Earnings management under different ownership and corporate governance structure: A natural experiment with master limited partnerships. Quarterly Review of Economics and Finance 76: 139–56. [Google Scholar] [CrossRef]

- Costa, Rui Augusto, and Jorge Mota. 2021. Earnings management in hospitality firms: Evidence from Portugal. Tourism 69: 578–94. [Google Scholar] [CrossRef]

- Cudia, Cynthia, Aeason L. Dela Cruz, and Naddeleine B. Estabillo. 2021. Effect of firm characteristics and corporate governance practices in earnings management: Evidence from publicly listed property sector firm in the Philippines. Vision-The Journal of Business Perspective 25: 77–87. [Google Scholar] [CrossRef]

- Das, Ramesh Chandra, Chandra Sekhar Mishra, and Prabina Rajib. 2018. Firm-specific parameters and earnings management: A study in the Indian context. Global Business Review 19: 1240–60. [Google Scholar] [CrossRef]

- Dechow, Patricia, and Ilia Dichev. 2002. The Quality of Accruals and Earnings: The Role of Accrual Estimation Errors. The Accounting Review 77: 35–59. [Google Scholar] [CrossRef]

- Dong, Nanyan, Fangjun Wang, Junrui Zhang, and Jian Zhou. 2020. Ownership structure and real earnings management: Evidence from China. Journal of Accounting and Public Policy 39: 106733. [Google Scholar] [CrossRef]

- Durana, Pavol, Katarina Valaskova, Anna Siekelova, and Lucia Michalova. 2022a. Appraisal of earnings management across the sectors. Journal of Business Economics and Management 23: 399–425. [Google Scholar] [CrossRef]

- Durana, Pavol, Lucia Michalkova, Andrej Privara, Josef Marousek, and Milos Tumpach. 2021a. Does the life cycle affect earnings management and bankruptcy? Oeconomia Copernicana 12: 425–61. [Google Scholar] [CrossRef]

- Durana, Pavol, Roman Blazek, Veronika Machova, and Miroslav Krasnan. 2022b. The use of Beneish M-scores to reveal creative accounting: Evidence from Slovakia. Equilibrium-Quarterly Journal of Economics and Economic Policy 17: 481–510. [Google Scholar] [CrossRef]

- Durana, Pavol, Romualdas Ginevicius, Mariusz Urbanski, Ivana Podhorska, and Milos Tumpach. 2021b. Parallels and Differences in Earnings Management of the Visegrad Four and the Baltics. Journal of Competitiveness 13: 39–55. [Google Scholar] [CrossRef]

- Enomoto, Masahiro, Fumihiko Kimura, and Tomoyasu Yamaguchi. 2018. A cross-country study on the relationship between financial development and earnings management. Journal of International Financial Management Accounting 29: 166–94. [Google Scholar] [CrossRef]

- Garfatta, Riadh. 2021. Corporate social responsibility and earnings management: Evidence from Saudi Arabia after mandatory IFRS adoption. Journal of Asian Finance Economics and Business 8: 189–99. [Google Scholar]

- Gashi Ahmeti, Hana, and Besnik Fetai. 2021. Determinants of Financing Obstacles of SMEs in Western Balkans. Management Dynamics in the Knowledge Economy 9: 331–44. [Google Scholar]

- Gavana, Giovanna, Pietro Gottardo, and Anna Maria Moisello. 2022. Related party transactions and earnings management: The moderating effect of ESG performance. Sustainability 14: 5823. [Google Scholar] [CrossRef]

- Githaiga, Peter Nderitu, Paul Muturi Kabete, and Tirisa Caroline Bonareri. 2022. Board characteristics and earnings management. Does firm size matter? Cogent Business & Management 9: 2088573. [Google Scholar]

- Goel, Sandeep, and Nimish Kapoor. 2021. Is earnings management related to board independence and gender diversity? Sector-wise evidence from India. International Journal of Disclosure and Governance, early access. [Google Scholar]

- Goncalves, Tiago, Victor Barros, and Goncalo Serra. 2022. Political elections uncertainty and earnings management: Does firm size really matter? Economic Letters 214: 110438. [Google Scholar] [CrossRef]

- Gonzalez, Jesus Saenz, and Emma Garcia-Meca. 2014. Does Corporate Governance Influence Earnings Management in Latin American Markets? Journal of Business Ethics 121: 419–40. [Google Scholar] [CrossRef]

- Greenacre, Michael. 2017. Correspondence Analysis in Practice. New York: Taylor & Francis Group. [Google Scholar]

- Gregova, Elena, Lubos Smrcka, Lucia Michalkova, and Lucia Svabova. 2021. Impact of tax benefits and earnings management on capital structures across V4 countries. Acta POlytechnica Hungarica 18: 221–44. [Google Scholar] [CrossRef]

- Guluma, Tolossa Fufa. 2021. The impact of corporate governance measures on firm performance: The influences of managerial overconfidence. Future Business Journal 7: 50. [Google Scholar] [CrossRef]

- Haga, Jasper, Henrik Hoglund, and Dennis Sundvik. 2015. Real Earnings Management in UK Private and Public Firms. SSRN Electronic Journal, forthcoming. [Google Scholar]

- Husanuddin, Rusdiah, Darman Darman, Muhammad Ybnu Taufan, Agus Salim, Muslim Muslim, and Aditya Halim Perdana Kusuma Putra. 2021. The effect of firm size, debt, current ratio, and investment opportunity set on earnings quality: An empirical study in Indonesia. Journal of Asian Finance Economics and Business 8: 179–188. [Google Scholar]

- Hussain, Iqbal Hafezali, Sebastian Kot, Fakarudin Kamarudin, and Wong Che Mun. 2020. The nexus of competition freedom and the efficiency of microfinance institutions. Journal of Competitiveness 12: 67–89. [Google Scholar] [CrossRef]

- Jeter, Debra, and Lakshmanan Shivakumar. 1999. Cross-sectional estimation of abnormal accruals using quarterly and annual data: Effectiveness in detecting event-specific earnings management. Accounting and Business Research 29: 299–319. [Google Scholar] [CrossRef]

- Jones, Jennifer. 1991. Earnings management during import relief investigations. Journal of Accounting Research 29: 193–228. [Google Scholar] [CrossRef]

- Kaldonski, Michal, Tomasz Jewartowski, and Jacek Mizerka. 2020. Capital market pressure, real earnings management, and institutional ownership stability—Evidence from Poland. International Review of Financial Analysis 71: 101315. [Google Scholar] [CrossRef]

- Kasznik, Ron. 1999. On the association between voluntary disclosure and earnings management. Journal of Accounting Research 37: 57–81. [Google Scholar] [CrossRef]

- Key, S. 1999. Toward a new theory of the firm: A critique of stakeholder theory. Management Decision 37: 317–28. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Alena Novak Sedlackova, Martin Bugaj, and Andrej Novak. 2022. Stability of profits and earnings management in the transport sector of Visegrad countries. Oeconomia Copernicana 13: 475–509. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Jaroslav Belas, Katarina Valaskova, Elvira Nica, and Pavol Durana. 2021. Earnings management in V4 countries: The evidence of earnings smoothing and inflating. Economic Research–Ekonomska Istrazivanja 34: 1452–70. [Google Scholar] [CrossRef]

- Kovacova, Maria, Vladimir Krajcik, Lucia Michalkova, and Roman Blazek. 2022. Valuing the interest tax shield in the Central European economies: Panel data approach. Journal of Competitiveness 14: 41–59. [Google Scholar] [CrossRef]

- Lee, Chia-Hao, and Pei-I Chou. 2020. Industry competition, earnings management and leader-follower effects. Applied Economics 52: 388–99. [Google Scholar] [CrossRef]

- Li, Sherry Fang. 2010. Determinants of management’s preferences or an earnings threshold. Review of Accounting and Finance 9: 33–49. [Google Scholar]

- Mantone, Pamela. 2013. Using Analytics to Detect Possible Fraud: Tools and Techniques. Hoboken: Wiley, Wiley Corporate F&A. [Google Scholar]

- Mardly, Zukaa, Zinab Badran, and Sulaiman Mouselli. 2021. Earnings management and audit quality at Damascus securities exchange: Does managerial ownership matter? Journal of Financial Reporting and Accounting 19: 725–41. [Google Scholar] [CrossRef]

- Meek, K. Gary, Ramesh Rao, and Christopher J. Skousen. 2007. Evidence on factors affecting the relationship between CEO stock option compensation and earnings management. Review of Accounting and Finance 6: 304. [Google Scholar] [CrossRef]

- Mendes, Araujo, Lima Rodrigues, and Parte Esteban. 2012. Evidence of earnings management using accruals as a measure of accounting discretion. Tékhne–Review of Applied Management Studies 10: 3–14. [Google Scholar] [CrossRef]

- Merdani, Mehdi, Naghi Fazeli, and Khosro Faghani Makrani. 2020. Evaluating the role of company life cycle for an appropriate model in predicting the quality of discretionary accruals (abnormal) based on Dickinson cash flow model approach. International Journal of Finance and Managerial Accounting 4: 75–91. [Google Scholar]

- Michalkova, Lucia, Vojtech Stehel, Elvira Nica, and Pavol Durana. 2021. Corporate management: Capital structure and tax shields. Marketing and Management of Innovations 3: 276–95. [Google Scholar]

- Mutuc, Eugene Burgos, Jen-Sin Lee, and Fu-Sheng Tsai. 2019. Doing good with creative accounting? Linking corporate social responsibility to earnings management in market economy, country and business sector contexts. Sustainability 11: 4568. [Google Scholar] [CrossRef]

- Nazir, Mian Sajid, and Talaf Afza. 2018. Does managerial behavior of managing earnings mitigate the rela-tionship between corporate governance and firm value? Evidence from an emerging market. Future Business Journal 4: 139–56. [Google Scholar] [CrossRef]

- Ngo, Diem Nhat Phuonng, and Anh Thi Hong Le. 2021. Relationship between the audit committee and earning management in listed companies in Vietnam. Journal of Asian Finance Economics and Business 8: 135–42. [Google Scholar]

- Nguyen, Anh Huu, and Chi Thi Duong. 2020. Provincial governance quality and earnings management: Empirical evidence from Vietnam. Journal of Asian Finance Economics and Business 7: 43–52. [Google Scholar] [CrossRef]

- Nguyen, Huu Anh, Quynh Lien Le, and Thi Kim Anh Vu. 2021. Ownership structure and earnings management: Empirical evidence from Vietnam. Cogent Business & Management 8: 1908006. [Google Scholar]

- O’Callaghan, Steve, John Ashton, and Lynn Hodgkinson. 2018. Earnings management and managerial ownership in private firms. Journal of Applied Accounting Research 19: 648–668. [Google Scholar] [CrossRef]

- Papik, Mario, and Lenka Papikova. 2020. Detection models for unintentional financial restatements. Journal of Business Economics and Management 21: 64–86. [Google Scholar] [CrossRef]

- Papik, Mario, and Lenka Papikova. 2021. Application of selected data mining techniques in unintentional accounting error detection. Equilibrium-Quarterly Journal of Economics and Economic Policy 16: 185–201. [Google Scholar] [CrossRef]

- Parwar, Muhammad Adnan, Shahzad Hussain, Abdul Waheed, Qaisar Ali Malik, and Muddasir Mehboob. 2021. Institutional ownership heterogeneity and earnings management practices: Empirical evidence from Pakistan. Journal of Asian Finance Economics and Business 8: 267–75. [Google Scholar]

- Paun, Tatiana, and Florina Pinzaru. 2021. Advancing Strategic Management through Sustainable Finance. Management Dynamics in the Knowledge Economy 9: 279–91. [Google Scholar]

- Perafan-Pena, Hector Fabio, Belen Gill-De-Albornoz, and Begona Giner. 2022. Earnings management of target firms and deal premiums: The role of industry relatedness. British Accounting Review 54: 101038. [Google Scholar] [CrossRef]

- Piosik, Andrzej, and Ewa Genge. 2020. The influence of a company´s ownership structure on upward real earnings management. Sustainability 12: 152. [Google Scholar] [CrossRef]

- Poradova, Monika, and Anna Siekelova. 2020. Analysis of factors with impact on earnings and their management in commercial companies. In International Scientific Conference on Hradec Economic Days. Edited by Pavel Jedlicka, Petra Maresova, Krysztof Firlej and Ivan Soukal. Hradec Kralove: University of Hradec Kralove, pp. 649–65. [Google Scholar]

- Postula, Marta, and Konrad Raczkowski. 2020. The impact of public finance management on sustainable development and competitiveness in EU Member States. Journal of Competitiveness 12: 125–44. [Google Scholar] [CrossRef]

- Salah, Wafaa. 2018. The effect of firm characteristics on earnings quality: The moderating role of firm size. Paper presented at International Conference of Industrial and Service Organizations Management, Hurghada, Egypt, September 1–3. [Google Scholar]

- Salehi, Mahdi, and Mahmoud Lari Dashtbayaz. 2020. The mediating effect of audit quality on the relationship between earnings and earnings valuation in Iran. Ekonomski Vjesnik 33: 25–38. [Google Scholar]

- Sanchez-Ballesta, Juan Pedro, and Jose Yagua. 2022. Social capital and earnings management in small and medium firms. Accounting Forum 46: 191–214. [Google Scholar] [CrossRef]

- Saona, Paolo, and Laura Muro. 2018. Firm- and country- level attributes as determinants of earnings management: An analysis for Latin American firms. Emerging Markets Finance and Trade 54: 2736–64. [Google Scholar] [CrossRef]

- Saona, Paolo, Laura Muro, and Maria Alvardo. 2020. How do the ownership structure and board of directors’ features impact earnings management? The Spanish case. Journal of International Financial Management & Accounting 31: 98–133. [Google Scholar]

- Setyoputri, Lusi Shintia, and Agus Widodo Mardijuwono. 2020. The impact of firm attributes on earnings management. Polish Journal of Management Studies 22: 502–12. [Google Scholar] [CrossRef]

- Shaoib, Adnan, and Muhammad Ayub Siddiqui. 2022. Earnings management and theoretical adjustment in capital structure performance pattern: Evidence from APTA economies. Borsa Istanbul Review 22: 20–36. [Google Scholar] [CrossRef]

- Shoaib, Adnan, Muhammad Ayub Siddiqui, and Muhammad Bilal Saeed. 2021. Leverage, firm fundamentals and earnings management under nonlinear assumptions: Evidences from APTA economies. Singapore Economic Review 9: 1–30. [Google Scholar] [CrossRef]

- Siekelova, Anna, Armenia Androniceanu, Pavol Durana, and Katarina Frajtova Michalikova. 2020. Earnings management (EM), initiatives and company size: An empirical study. Acta Polytechnica Hungarica 17: 41–56. [Google Scholar] [CrossRef]

- Siekelova, Anna, Jaroslav Belas, Ivana Podhorska, and Pavol Durana. 2021. Accrual-based earnings management: A Case study in V4 focusing on mining and quarrying sector. Acta Montanastica Slovaca 26: 70–83. [Google Scholar]

- Sloan, Richard G. 1996. Do Stock Prices Fully Reflect Information in Accruals and Cash Flows about Future Earnings? The Accounting Review 71: 289–315. [Google Scholar]

- Slovak Business Agency. 2021. Atlas MSP na Slovensku. Mapovanie vývoja MSP v priestore a čase. Available online: http://www.sbagency.sk/sites/default/files/atlas-msp.pdf (accessed on 8 July 2022).

- Souza, Joao Antonio Slavador, Wando Bellffi Costa, Jose Elias Feres Almeida, and Patricia Maria Bortolon. 2013. Determinants and consequences of delisting in earnings management. Revista Evidenciacao Contabil & Financas 1: 38–57. [Google Scholar]

- Sun, Wang, and Jiang Sun. 2008. Analysis on Factors Influencing Managers’ Earnings Management Intentions. In Logistic research and practice in China. Edited by Henry Zhang and Ruimei Zhao. Marrickville: Orient Academic Forum. [Google Scholar]

- Supardi, Supradi, and Eka Noor Asmara. 2018. Financial factors, corporate governance and earnings management: Evidence from Indonesian manufacturing industry. In Proceedings of the 1st International Conference on Economics, Business, Entrepreneurship, and Finance. Edited by Ade Gafar Abdullah, Meta Arief, Chairul Furqon, Vanessa Gaffar, Heni Mulyani, Yana Setiawan and Alfira Sofia. Paris: Atlantis Press, pp. 727–36. [Google Scholar]

- Susanto, Yulius Kurnia, Kashan Pirzada, and Sheryl Adrianne. 2019. Is tax aggressiveness an indicator of earnings management? Polish Journal of Management Studies 20: 516–27. [Google Scholar] [CrossRef]

- Svabova, Lucia, Katarina Kramarova, Jan Chutka, and Lenka Strakova. 2020a. Detecting earnings manipulation and fraudulent financial reporting in Slovakia. Oeconomia Copernicana 11: 485–508. [Google Scholar] [CrossRef]

- Svabova, Lucia, Katarina Valaskova, Pavol Durana, and Tomas Kliestik. 2020b. Dependency analysis between various profit measures and corporate total assets for Visegrad Group’s business entities. Organizacija 53: 80–90. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, Ivo Welch, and T. J. Wong. 1998. Earnings management and the long-run market performance of initial public offerings. The Journal of Finance 53: 1935–74. [Google Scholar] [CrossRef]

- Thanh, Su, Nguyen Canh, and Nguyen Tran Thai Ha. 2020. Debt structure and earnings management: A non-linear analysis from an emerging economy. Finance Research Letters 35: 101283. [Google Scholar] [CrossRef]

- Thoppan, Jose Joy, Robert Nathan, and Vijay Victor. 2021. Impact of improved corporate governance and regulations on earnings management practices—Analysis of 7 industries from the Indian National Stock Exchange. Journal of Risk and Financial Management 14: 454. [Google Scholar] [CrossRef]

- Tran, Manh Dung, and Ngoc Hung Dang. 2021. The Impact of Ownership Structure on Earnings Management: The Case of Vietnam. Sage Open 11: 21582440211047248. [Google Scholar] [CrossRef]

- Valaskova, Katarina, Peter Adamko, Katarina Frajtova Michalikova, and Jaroslav Macek. 2021. Quo Vadis, earnings management? Analysis of manipulation determinants in Central European environment. Oeconomia Copernicana 12: 631–69. [Google Scholar] [CrossRef]

- Veronica, Sylvia, and Yanici Bachtiar. 2005. Corporate governance, information asymmetry, and earnings management. Jurnal Akuntansi dan Keuangan Indonesia 2: 77–106. [Google Scholar] [CrossRef]

- Wasan, Pratibha, and Kalyani Mulchandani. 2020. Corporate governance factors as predictors of earnings management. Journal of General Management 45: 71–92. [Google Scholar] [CrossRef]

- Wijayanti, Herlina, and Soni Agus Irwandi. 2014. The effect of real earnings management through operating cashflow approach on company performance. The Indonesian Accounting Review 4: 43–52. [Google Scholar]

- Wuryani, Eni. 2012. Company size in response to earnings management and company performance. Journal of Economics, Business, and Accountancy Ventura 15: 491–506. [Google Scholar] [CrossRef]

- Yasser, Qaiset Rafique, and Abdulah Al Mamun. 2017. The impact of ownership concentration on firm performance: Evidence from an emerging market. Emerging Economy Studies 3: 34–53. [Google Scholar] [CrossRef]

- Zainuldin, Mohd Haniff, and Tze Kiat Lui. 2020. Earnings management in financial institutions: A comparative study of Islamic banks and conventional banks in emerging markets. Pacific-Basin Finance Journal 62: 101044. [Google Scholar] [CrossRef]

- Zhong, Xi, Liuyang Ren, and XiaoJie Wu. 2022. Founder domination, industry environment, and family firms’ earnings management. Baltic Journal of Management, early access. [Google Scholar]

| Country | SK |

|---|---|

| Legal form and ownership structure | % |

| Private limited companies | 82.14 |

| Public limited companies | 13.57 |

| Partnerships | 4.12 |

| Other legal forms | 0.17 |

| Firm size | % |

| Small | 32.0 |

| Medium-sized | 55.0 |

| Large | 12.0 |

| Very large | 1.00 |

| Economic sector (NACE classification) | % |

| A. Agriculture, forestry, and fishing | 6.54 |

| B. Mining and quarrying | 0.31 |

| C. Manufacturing | 15.52 |

| D. Electricity, gas, steam, and air conditioning supply | 1.98 |

| E. Water supply; sewerage, waste management, etc. | 0.96 |

| F. Construction | 6.78 |

| G. Wholesale and retail trade, repair of motor vehicles/motorcycles | 25.68 |

| H. Transportation and storage | 4.65 |

| I. Accommodation and food service activities | 2.28 |

| J. Information and communication | 2.90 |

| K. Financial and insurance activities | 0.48 |

| L. Real estate activities | 12.82 |

| M. Professional, scientific, and service activities | 10.32 |

| N. Administrative and support service activities | 6.18 |

| O. Public administration and defense; compulsory social security | 0.04 |

| P. Education | 0.34 |

| Q. Human health and social work activities | 0.97 |

| R. Arts, entertainment, and recreation | 0.93 |

| S. Other service activities | 0.32 |

| Value | df | Asymptotic Significance (2-Sided) | ||

|---|---|---|---|---|

| Pearson chi-square | 2017/2018 | 191.189 | 6 | 0.000 |

| 2018/2019 | 202.614 | 6 | 0.000 | |

| Likelihood ratio | 2017/2018 | 192.432 | 6 | 0.000 |

| 2018/2019 | 204.917 | 6 | 0.000 | |

| N of valid cases | 15,716 |

| Value | df | Asymptotic Significance (2-Sided) | ||

|---|---|---|---|---|

| Pearson chi-square | 2017/2018 | 835.491 | 36 | 0.000 |

| 2018/2019 | 752.490 | 36 | 0.000 | |

| Likelihood ratio | 2017/2018 | 845.803 | 36 | 0.000 |

| 2018/2019 | 786.993 | 36 | 0.000 | |

| N of valid cases | 15,716 |

| Value | df | Asymptotic Significance (2-Sided) | ||

|---|---|---|---|---|

| Pearson chi-square | 2017/2018 | 102.966 | 6 | 0.000 |

| 2018/2019 | 66.655 | 6 | 0.000 | |

| Likelihood ratio | 2017/2018 | 102.976 | 6 | 0.000 |

| 2018/2019 | 63.177 | 6 | 0.000 | |

| N of valid cases | 15,716 |

| NACE Classification | Negative | Zero | Positive |

|---|---|---|---|

| A. Agriculture, forestry, and fishing | 28.67% | 20.43% | 50.90% |

| B. Mining and quarrying | 23.53% | 27.45% | 49.02% |

| C. Manufacturing | 29.56% | 21.83% | 48.61% |

| D. Electricity, gas, steam, and air conditioning supply | 22.48% | 20.17% | 57.35% |

| E. Water supply; sewerage, waste management, etc. | 27.38% | 22.02% | 50.60% |

| F. Construction | 32.78% | 16.9% | 50.32% |

| G. Wholesale and retail trade, repair of motor vehicles/motorcycles | 26.32% | 19.77% | 53.91% |

| H. Transportation and storage | 50.38% | 18.24% | 31.38% |

| I. Accommodation and food service activities | 14.36% | 11.70% | 73.94% |

| J. Information and communication | 38.00% | 15.78% | 46.22% |

| K. Financial and insurance activities | 28.26% | 30.43% | 41.30% |

| L. Real estate activities | 13.22% | 9.23% | 77.55% |

| M. Professional, scientific, and service activities | 24.97% | 14.50% | 60.53% |

| N. Administrative and support service activities | 27.87% | 14.75% | 57.38% |

| O. Public administration and defense; compulsory social security | 37.50% | 12.50% | 50.00% |

| P. Education | 29.82% | 8.77% | 61.40% |

| Q. Human health and social work activities | 25.15% | 20.47% | 54.39% |

| R. Arts, entertainment, and recreation | 24.26% | 14.71% | 61.03% |

| S. Other service activities | 26.92% | 17.31% | 55.77% |

| NACE Classification | Negative | Zero | Positive |

|---|---|---|---|

| A. Agriculture, forestry, and fishing | 39.43% | 6.36% | 54.21% |

| B. Mining and quarrying | 39.22% | 3.92% | 56.86% |

| C. Manufacturing | 46.53% | 5.90% | 47.57% |

| D. Electricity, gas, steam, and air conditioning supply | 37.75% | 4.32% | 57.93% |

| E. Water supply; sewerage, waste management, etc. | 48.81% | 5.95% | 45.24% |

| F. Construction | 42.70% | 4.50% | 52.80% |

| G. Wholesale and retail trade, repair of motor vehicles/motorcycles | 39.00% | 6.13% | 54.87% |

| H. Transportation and storage | 61.61% | 4.97% | 33.42% |

| I. Accommodation and food service activities | 28.72% | 2.39% | 68.88% |

| J. Information and communication | 48.00% | 4.67% | 47.33% |

| K. Financial and insurance activities | 45.65% | 10.87% | 43.48% |

| L. Real estate activities | 17.70% | 3.78% | 78.52% |

| M. Professional, scientific, and service activities | 34.73% | 4.74% | 60.53% |

| N. Administrative and support service activities | 40.28% | 2.58% | 57.14% |

| O. Public administration and defense; compulsory social security | 50.00% | 0.00% | 50.00% |

| P. Education | 36.84% | 8.77% | 54.39% |

| Q. Human health and social work activities | 36.84% | 8.77% | 54.39% |

| R. Arts, entertainment, and recreation | 30.88% | 4.41% | 64.71% |

| S. Other service activities | 44.23% | 5.77% | 50.00% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdosikova, D.; Valaskova, K.; Durana, P. Earnings Management and Corporate Performance in the Scope of Firm-Specific Features. J. Risk Financial Manag. 2022, 15, 426. https://doi.org/10.3390/jrfm15100426

Gajdosikova D, Valaskova K, Durana P. Earnings Management and Corporate Performance in the Scope of Firm-Specific Features. Journal of Risk and Financial Management. 2022; 15(10):426. https://doi.org/10.3390/jrfm15100426

Chicago/Turabian StyleGajdosikova, Dominika, Katarina Valaskova, and Pavol Durana. 2022. "Earnings Management and Corporate Performance in the Scope of Firm-Specific Features" Journal of Risk and Financial Management 15, no. 10: 426. https://doi.org/10.3390/jrfm15100426

APA StyleGajdosikova, D., Valaskova, K., & Durana, P. (2022). Earnings Management and Corporate Performance in the Scope of Firm-Specific Features. Journal of Risk and Financial Management, 15(10), 426. https://doi.org/10.3390/jrfm15100426