Financial Leverage and Debt Maturity Targeting: International Evidence

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Literature Review

2.2. Hypotheses Development

3. Sample and Methods

3.1. Sample

3.2. Methods

- is the ith firm’s target leverage for the end of the year t in country j;

- is a coefficient vector;

4. Results

4.1. Leverage Targets

4.2. International Variations in Target Capital Structures

4.2.1. Leverage Targets, Institutions, and the Financial Environment

4.2.2. Institutional Influences on Targets during the Global Financial Crisis

4.2.3. Institutional Influences on Targets Using the Composition of Debt

4.2.4. Target Deviations, Financial Development, and the Financial Crisis

4.2.5. Other Considerations

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acharya, Viral V., Yakov Amihud, and Lubomir Litov. 2011. Creditor Rights and Corporate Risk Taking. Journal of Financial Economics 102: 150–66. [Google Scholar] [CrossRef] [Green Version]

- Admati, Anat R., Paul Pfleiderer, and Josef Zechner. 1994. Large Shareholder Activism, Risk Sharing, and Financial Market Equilibrium. Journal of Political Economy 102: 1097–130. [Google Scholar] [CrossRef]

- Almeida, Heitor, Murillo Campello, Bruno Laranjeira, and Scott Weisbenner. 2009. Corporate Debt Maturity and the Real Effects of the 2007 Credit Crisis. Working Paper 14990. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Anton, Sorin Gabriel. 2019. Leverage and Firm Growth: An Empirical Investigation of Gazelles from Emerging Europe. International Entrepreneurship and Management Journal 15: 209–32. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2002. Market Timing and Capital Structure. Journal of Finance 57: 1–32. [Google Scholar] [CrossRef]

- Barnea, Amir, Robert A. Haugen, and Lemma W. Senbet. 1980. A Rationale for Debt Maturity Structure and Call Provisions in the Agency Theoretic Framework. Journal of Finance 35: 1223–34. [Google Scholar] [CrossRef]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Ross Levine. 2000. A New Database on Financial Development and Structure. World Bank Economic Review 14: 597–605. [Google Scholar] [CrossRef]

- Bernanke, Ben, Mark Gertler, and Simon Gilchrist. 1996. The Financial Accelerator and the Flight to Quality. Review of Economics & Statistics 78: 1–15. [Google Scholar]

- Blundell, Richard, and Stephen Bond. 1998. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef] [Green Version]

- Booth, Laurence, Varouj Aivazian, Asli Demirgüç-Kunt, and Vojislav Maksomovic. 2001. Capital Structure in Developing Countries. Journal of Finance 56: 87–130. [Google Scholar] [CrossRef]

- Brennan, Michael, and Alan Kraus. 1987. Efficient Financing Under Asymmetric Information. Journal of Finance 42: 1246–60. [Google Scholar] [CrossRef]

- Brick, Ivan E., and Oded Palmon. 1992. Interest Rate Fluctuations and the Advantage of Long-Term Debt Financing: A Note on the Effect of the Tax Timing Option. Financial Review 27: 467–74. [Google Scholar] [CrossRef]

- Campello, Murillo, John Graham, and Campbell R. Harvey. 2010. The Real Effects of Financial Constraints: Evidence from a Financial Crisis. Journal of Financial Economics 97: 470–87. [Google Scholar] [CrossRef] [Green Version]

- Crane, Alan D. 2011. The Litigation Environment of a Firm and Its Impact on Financial Policy. Working Paper. Houston: Rice University. [Google Scholar]

- Dangl, Thomas, and Josef Zechner. 2021. Debt Maturity and the Dynamics of Leverage. The Review of Financial Studies, hhaa148. [Google Scholar] [CrossRef]

- DeAngelo, Harry, and Richard Roll. 2015. How Stable are Corporate Capital Structures? Journal of Finance 70: 373–418. [Google Scholar] [CrossRef]

- DeAngelo, Harry, Linda DeAngelo, and Toni M. Whited. 2011. Capital Structure Dynamics and Transitory Debt. Journal of Financial Economics 99: 235–61. [Google Scholar] [CrossRef]

- DeMarzo, Peter M., and Zhiguo He. 2021. Leverage Dynamics without Commitment. Journal of Finance 3: 1195–250. [Google Scholar] [CrossRef]

- Diamond, Douglas W. 1991. Debt Maturity Structure and Liquidity Risk. Quarterly Journal of Economics 106: 709–37. [Google Scholar] [CrossRef]

- Djankov, Simeon, Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2002. The Regulation of Entry. Quarterly Journal of Economics 1: 1–37. [Google Scholar] [CrossRef]

- Djankov, Simeon, Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2003. Courts. Quarterly Journal of Economics 118: 453–517. [Google Scholar] [CrossRef] [Green Version]

- Djankov, Simeon, C. McLiesh, and Andrei Shleifer. 2007. Private Credit in 129 Countries. Journal of Financial Economics 84: 299–329. [Google Scholar] [CrossRef] [Green Version]

- Djankov, Simeon, Oliver Hart, Caralee McLiesh, and Andrei Shleifer. 2008a. Debt Enforcement Around the World. Journal of Political Economy 116: 1105–50. [Google Scholar] [CrossRef] [Green Version]

- Djankov, Simeon, Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2008b. The Law and Economics of Self-Dealing. Journal of Financial Economics 88: 430–65. [Google Scholar] [CrossRef] [Green Version]

- Donaldson, Gordon. 1961. Corporate Debt Capacity: A Study of Corporate Debt Policy and the Determination of Corporate Debt Capacity. Boston: Division of Research, Harvard School of Business Administration. [Google Scholar]

- Fama, Eugene F. 1985. What’s Different About Banks? Journal of Monetary Economics 15: 29–39. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1997. Industry Costs of Equity. Journal of Financial Economics 43: 153–193. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2002. Testing Trade-Off and Pecking Order Predictions About Dividends and Debt. The Review of Financial Studies 15: 1–33. [Google Scholar] [CrossRef]

- Fama, Eugene F., and James D. MacBeth. 1973. Risk, Return, and Equilibrium: Empirical Tests. Journal of Political Economy 81: 607–36. [Google Scholar] [CrossRef]

- Fan, Joseph P. H., Sheridan Titman, and Garry J. Twite. 2012. An International Comparison of Capital Structure and Debt Maturity Choices. Journal of Financial and Quantitative Analysis 47: 23–56. [Google Scholar] [CrossRef] [Green Version]

- Faulkender, Michael, Mark J. Flannery, Kristine W. Hankins, and Jason M. Smith. 2012. Cash Flows and Leverage Adjustments. Journal of Financial Economics 103: 632–46. [Google Scholar] [CrossRef]

- Flannery, Mark J., and Kristine W. Hankins. 2013. Estimating Dynamic Panels in Corporate Finance. Journal of Corporate Finance 19: 1–19. [Google Scholar] [CrossRef]

- Flannery, Mark J., and Kasturi P. Rangan. 2006. Partial Adjustment Toward Target Capital Structures. Journal of Financial Economics 79: 469–506. [Google Scholar] [CrossRef]

- Frank, Murray Z., and Vidhan K. Goyal. 2003. Testing the Pecking Order Theory of Capital Structure. Journal of Financial Economics 67: 217–48. [Google Scholar] [CrossRef] [Green Version]

- Frank, Murray Z., and Vidhan K. Goyal. 2009. Capital Structure Decisions: Which Factors Are Reliably Important? Financial Management 38: 1–37. [Google Scholar] [CrossRef] [Green Version]

- Frank, Murray Z., and Vidhan K. Goyal. 2015. The Profits–Leverage Puzzle Revisited. Review of Finance 19: 1415–53. [Google Scholar] [CrossRef] [Green Version]

- Graham, John R. 1996. Debt and the Marginal Tax Rate. Journal of Financial Economics 41: 41–73. [Google Scholar] [CrossRef]

- Graham, John, and Campbell R. Harvey. 2001. The Theory and Practice of Corporate Finance: Evidence from the Field. Journal of Finance 60: 187–243. [Google Scholar] [CrossRef]

- Green, Richard C. 1984. Investment incentives, Debt, and Warrants. Journal of Financial Economics 13: 115–36. [Google Scholar] [CrossRef]

- Gungoraydinoglu, Ali, and Özde Öztekin. 2011. Firm- and Country-Level Determinants of Corporate Leverage: Some New International Evidence. Journal of Corporate Finance 17: 1457–74. [Google Scholar] [CrossRef]

- Harris, Milton, and Artur Raviv. 1991. The Theory of Capital Structure. Journal of Finance 46: 297–355. [Google Scholar] [CrossRef]

- Hart, Oliver, and John Moore. 1998. Default and Renegotiation: A Dynamic Model of Debt. Quarterly Journal of Economics 113: 1–41. [Google Scholar] [CrossRef]

- Heaton, James B. 2002. Managerial Optimism and Corporate Finance. Financial Management 31: 33–45. [Google Scholar] [CrossRef]

- Hennessy, Christopher A., and Toni M. Whited. 2005. Debt Dynamics. Journal of Finance 55: 1129–65. [Google Scholar] [CrossRef]

- Huang, Rongbing, and Jay Ritter. 2009. Testing theories of Capital Structure and Estimating the Speed of Adjustment. Journal of Financial and Quantitative Analysis 44: 237–71. [Google Scholar] [CrossRef] [Green Version]

- Jensen, Michael C. 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review 76: 323–29. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kane, Alex, Alan J. Marcus, and Robert L. McDonald. 1985. Debt Policy and the Rate of Return Premium to Leverage. Journal of Financial and Quantitative Analysis 20: 479–99. [Google Scholar] [CrossRef]

- Kiyotaki, Nobuhiro, and John Moore. 1997. Credit cycles. Journal of Political Economy 105: 211–48. [Google Scholar] [CrossRef]

- Kraus, Alan, and Robert H. Litzenberger. 1973. A State-Preference Model of Optimal Financial Leverage. Journal of Finance 28: 911–22. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, Andrei Shleifer, and Robert W. Vishny. 1997. Legal Determinants of External Finance. Journal of Finance 52: 1131–50. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 1998. Law and Finance. Journal of Political Economy 106: 1113–55. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, and Andrei Shleifer. 1999. Corporate Ownership Around the World. Journal of Finance 54: 471–517. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2006. What Works in Securities Laws? Journal of Finance 61: 1–32. [Google Scholar] [CrossRef] [Green Version]

- Leary, Mark T., and Michael R. Roberts. 2005. Do Firms Rebalance Their Capital Structures? Journal of Finance 60: 2575–619. [Google Scholar] [CrossRef] [Green Version]

- Lemmon, Michael L., Michael R. Roberts, and Jaime Zender. 2008. Back to the Beginning: Persistence and the Cross-Section of Corporate Capital Structure. Journal of Finance 63: 1575–608. [Google Scholar] [CrossRef]

- Levi, Shai, and Benjamin Segal. 2015. The Impact of Debt-Equity Reporting Classifications on the Firm’s Decision to Issue Hybrid Securities. European Accounting Review 24: 801–22. [Google Scholar] [CrossRef]

- Levine, Ross. 2002. Bank-Based or Market-Based Financial Systems: Which Is Better? Journal of Financial Intermediation 11: 1–30. [Google Scholar] [CrossRef] [Green Version]

- Mayers, David. 1998. Why Firms Issue Convertible Bonds: The Matching of Financial and Real Investment Options. Journal of Financial Economics 47: 83–102. [Google Scholar] [CrossRef]

- McLean, David R., and Mengxin Zhao. 2014. The Business Cycle, Investor Sentiment, and Costly External Finance. Journal of Finance 69: 1377–409. [Google Scholar] [CrossRef]

- Miller, Merton H. 1977. Debt and Taxes. Journal of Finance 32: 261–75. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1958. The Cost of Capital, Corporate Finance and the Theory of Investment. American Economic Review 48: 261–97. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1963. Corporate Income Taxes and the Cost of Capital: A Correction. American Economic Review 53: 433–43. [Google Scholar]

- Myers, Stewart C. 1977. Determinants of Corporate Borrowing. Journal of Financial Economics 52: 147–75. [Google Scholar] [CrossRef] [Green Version]

- Myers, Stewart C. 1984. The Capital Structure Puzzle. Journal of Finance 39: 574–92. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef] [Green Version]

- Özer, Gökhan, and İlhan Çam. 2020. Financing Decisions of Firms: The Roles of Legal Systems, Shareholder Rights and Creditor Rights. Accounting & Finance 61: 2717–57. [Google Scholar] [CrossRef]

- Öztekin, Özde. 2015. Capital Structure Decisions Around the World: Which Factors Are Reliably Important? Journal of Financial and Quantitative Analysis 50: 301–23. [Google Scholar] [CrossRef] [Green Version]

- Öztekin, Özde, and Mark J. Flannery. 2012. Institutional Determinants of Capital Structure Adjustment Speeds. Journal of Financial Economics 103: 88–112. [Google Scholar] [CrossRef]

- Qi, Yaxuan, Lukas Roth, and John K. Wald. 2011. How Legal Environments Affect the Use of Bond Covenants. Journal of International Business Studies 42: 235–62. [Google Scholar] [CrossRef]

- Rajan, Raghuram G., and Luigi Zingales. 1995. What Do We Know About Capital Structure? Some Evidence from International Data. Journal of Finance 50: 1421–60. [Google Scholar] [CrossRef]

- Scheffé, Henry. 1953. A Method for Judging All Contrasts in the Analysis of Variance. Biometrika 40: 87–104. [Google Scholar]

- Sidak, Zbynek. 1967. Rectangular Confidence Regions for the Means of Multivariate Normal Distributions. Journal of the American Statistical Association 62: 626–33. [Google Scholar] [CrossRef]

- Simes, Robert John. 1986. An Improved Bonferroni Procedure for Multiple Tests of Significance. Biometrika 73: 751–54. [Google Scholar] [CrossRef]

- Stein, Jeremy C. 1992. Convertible Bonds As Backdoor Equity Financing. Journal of Financial Economics 32: 3–21. [Google Scholar] [CrossRef] [Green Version]

- Stulz, René M., and Herb Johnson. 1985. An Analysis of Secured Debt. Journal of Financial Economics 14: 501–21. [Google Scholar] [CrossRef]

| Panel A. Definitions, Source, and Summary Statistics of Variables | ||||||||||||

| Variable: Definition (Factor Loading in the Principal Component Analysis) (Source) | Mean | Median | Std. Dev. | |||||||||

| Total book debt ratio: (Long-term debt+Short-term debt)/Total assets (Global Vantage). | 0.2349 | 0.2084 | 0.1983 | |||||||||

| Long-term book debt ratio: Long-term debt/Total assets (Global Vantage). | 0.1424 | 0.0953 | 0.1571 | |||||||||

| Profit: (Operating Income+Interest and related expense+Current Income Taxes)/Total assets (Global Vantage). | 0.0352 | 0.0617 | 0.1803 | |||||||||

| Market-to-book: (Long-term debt+Short-term debt+Preferred capital+Market value of equity)/Total assets (Global Vantage). | 1.1904 | 0.8380 | 1.2686 | |||||||||

| Depreciation: Total Depreciation and Amortization/Total assets (Global Vantage). | 0.0436 | 0.0369 | 0.0322 | |||||||||

| Size: Log[Lagged sales]/Sales (Global Vantage). | 0.0035 | 0.0091 | 0.4345 | |||||||||

| Tangibility: Fixed assets/Total assets (Global Vantage). | 0.3102 | 0.2738 | 0.2162 | |||||||||

| R&D dummy: A dummy variable equal to 1 if R&D expenditures are not reported and 0 if otherwise (Global Vantage). | 0.3941 | 0.0000 | 0.4887 | |||||||||

| R&D expenses: R&D expense/Total assets (Global Vantage). | 0.0228 | 0.0000 | 0.0596 | |||||||||

| Industry median total book debt ratio: Median total book debt ratio for the firm’s industry (Global Vantage). | 0.2027 | 0.2044 | 0.0966 | |||||||||

| Industry median long-term book debt ratio: Median total long-term book debt ratio for the firm’s industry (Global Vantage). | 0.0843 | 0.0924 | 0.0344 | |||||||||

| Dividend payer: A dummy variable equal to 1 if the firm has paid dividends and 0 if otherwise (Global Vantage). | 0.7605 | 1.0000 | 0.4268 | |||||||||

| Capital expenditures: Capital expenditures/Total assets (Global Vantage). | 0.0538 | 0.0359 | 0.0591 | |||||||||

| Stock market capitalization: The value of listed shares divided by GDP (Beck et al. 2000). | 0.9767 | 0.9692 | 0.4359 | |||||||||

| Bond market capitalization: Outstanding domestic debt securities divided by GDP (Beck et al. 2000). | 0.6107 | 0.4871 | 0.4526 | |||||||||

| Private credit: Private credit by deposit money banks and other financial institutions to GDP (Beck et al. 2000). | 0.8452 | 0.8308 | 0.4042 | |||||||||

| Crisis: A dummy variable equal to 1 for the years 2007 and 2008; 0 if otherwise (Global Vantage). | 0.1334 | 0.0000 | 0.3400 | |||||||||

| Legal origin: Categorical variables (for common law and civil law) equal to unity if the firm operates under the named legal origin, and zero if otherwise (La Porta et al. 1998). | 0.3868 | 0.0000 | 0.4870 | |||||||||

| Financial development: Dummy variable equal to unity if the financial system is developed and 0 if otherwise (Levine 2002). | 0.9234 | 1.0000 | 0.2660 | |||||||||

| Financial structure: Dummy variable equal to 1 if the financial structure is market-based and 0 if otherwise (Levine 2002). | 0.9158 | 1.0000 | 0.2777 | |||||||||

| Shareholder protection: Principal component of shareholder rights (0.88) (La Porta et al. 1998) and their enforcement (0.88) (Djankov et al. 2008a). | 0.0000 | 0.5423 | 1.0000 | |||||||||

| Internal governance: Principal component of executive constraints (0.73) (Djankov et al. 2002) and corporate governance (0.73) (World Bank). | 0.0000 | 0.3953 | 1.0000 | |||||||||

| External governance: Principal component of corruption (0.86), risk of expropriation (0.92), repudiation (0.89) by government (La Porta et al. 1998); law and order (0.95); and enforceability of contracts (0.88) (Djankov et al. 2003). | 0.0000 | 0.5347 | 1.0000 | |||||||||

| Tax benefits: Statutory tax rate (Djankov et al. 2008b). | 0.3759 | 0.4210 | 0.7788 | |||||||||

| Bankruptcy procedures: Principal component of time (−0.85), cost (−0.85), and efficiency (0.92) to resolve insolvency (Djankov et al. 2008b). | 0.0000 | −0.0405 | 1.0000 | |||||||||

| Creditor protection: Principal component of creditor rights (0.30) (La Porta et al. 1998) and their enforcement (0.30) (Djankov et al. 2003). | 0.0000 | −0.1249 | 1.0000 | |||||||||

| Ownership and control: Principal component of widely held firm (−0.56), family firm (0.53), and state firm (0.84) variables. A firm is treated as having a controlling shareholder if the sum of a shareholder’s direct and indirect voting rights exceeds 20%. Firms are defined as widely held if they have no controlling shareholder; firms are defined as family firms if a person is the controlling shareholder; firms are defined as and state firms if a domestic or foreign state is the controlling shareholder (La Porta et al. 1999). The widely held firm, family firm, and state firm variables denote the fraction of each type of firm in a given country. | 0.0000 | −0.3054 | 1.0000 | |||||||||

| Equity information asymmetry: Principal component of accounting standards (0.73) (La Porta et al. 1998), disclosure requirements (0.86), liability standards (0.81), public enforcement (0.79), and the prevalence of insider trading (0.64) (La Porta et al. 2006). | 0.0000 | 0.4217 | 1.0000 | |||||||||

| Debt information asymmetry: Principal component of accounting standards (0.76) and the public credit registry (0.76) (Djankov et al. 2007). | 0.0000 | 0.4052 | 1.0000 | |||||||||

| Panel B. Correlation Matrix for the Institutional Indices | ||||||||||||

| Legal Origin | Financial Development | Financial Structure | Shareholde Protection | Internal Governance | External Governance | Tax Benefits | Bankruptc Procedures | Creditor Protection | Ownership And Control | Equity Informatio Asymmetry | Debt Informatio Asymmetry | |

| Legal Origin | 1.0000 | |||||||||||

| Financial Development | −0.2876 | 1.0000 | ||||||||||

| Financial Structure | −0.3950 | 0.1388 | 1.0000 | |||||||||

| Shareholder Protection | −0.5712 | 0.3862 | 0.1070 | 1.0000 | ||||||||

| Internal Governance | −0.1314 | 0.3706 | 0.1627 | 0.1438 | 1.0000 | |||||||

| External Governance | −0.1210 | 0.2811 | 0.0974 | 0.0393 | 0.7321 | 1.0000 | ||||||

| Tax Benefits | 0.0963 | 0.0936 | 0.0949 | 0.0402 | 0.0714 | 0.0625 | 1.0000 | |||||

| Bankruptcy Procedures | −0.1129 | 0.3459 | 0.0692 | 0.0673 | 0.6455 | 0.6682 | 0.3405 | 1.0000 | ||||

| Creditor Protection | −0.3974 | 0.2892 | 0.3547 | 0.4135 | 0.3188 | 0.1022 | 0.0933 | 0.2156 | 1.0000 | |||

| Ownership and Control | 0.3653 | −0.1293 | −0.2984 | −0.4485 | −0.1196 | −0.0091 | −0.0262 | −0.0612 | −0.3258 | 1.0000 | ||

| Equity Information Asymmetry | −0.3444 | 0.3894 | 0.3797 | 0.2607 | 0.3783 | 0.3393 | 0.0625 | 0.1116 | 0.2054 | −0.4193 | 1.0000 | |

| Debt Information Asymmetry | −0.3648 | 0.3258 | 0.2284 | 0.3267 | 0.5345 | 0.2547 | 0.0012 | 0.3333 | 0.2673 | −0.1576 | 0.6446 | 1.0000 |

| Total Debt Ratio | Long-Term Debt Ratio | |||

|---|---|---|---|---|

| Blundell and Bond (1998) | Fama and French (2002) | Blundell and Bond (1998) | Fama and French (2002) | |

| Leverage | 0.8200 *** | 0.6781 *** | ||

| (0.000) | (0.000) | |||

| Profit | −0.0138 *** | −0.2031 *** | −0.0146 *** | −0.0737 *** |

| (0.004) | (0.000) | (0.000) | (0.000) | |

| Market-to-book | −0.0026*** | −0.0002 | −0.0020 *** | 0.0012 |

| (0.000) | (0.919) | (0.000) | (0.410) | |

| Depreciation | −0.1643 *** | −0.1021 ** | −0.1006 *** | −0.0949 ** |

| (0.000) | (0.021) | (0.000) | (0.045) | |

| Size | −0.0010 | 0.0188 *** | 0.0026 | 0.0099*** |

| (0.617) | (0.000) | (0.106) | (0.000) | |

| Tangibility | 0.0603 *** | 0.1379 *** | 0.0531 *** | 0.1992 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| R&D dummy | −0.0029 | −0.0015 | −0.0010 | −0.0156*** |

| (0.168) | (0.618) | (0.554) | (0.000) | |

| R&D expenses | −0.0197 | −0.3076 *** | −0.0328 * | −0.2442 *** |

| (0.372) | (0.000) | (0.071) | (0.000) | |

| Median industry leverage | 0.0713 *** | 0.5478 *** | −0.1410 | 1.0315 *** |

| (0.000) | (0.000) | (0.719) | (0.000) | |

| Constant | 0.0243 *** | 0.1080 *** | 0.0405 ** | 0.0150 *** |

| (0.000) | (0.000) | (0.024) | (0.000) | |

| Observations | 183,071 | 183,071 | 183,124 | 183,124 |

| R-Squared | 0.780 | 0.163 | 0.490 | 0.129 |

| F | 349.42 | 1038.69 | 358.976 | 938.61 |

| Prob > F | 0.000 | 0.000 | 0.000 | 0.000 |

| Panel Structure | Total Debt Ratio (%) | Long-Term Debt Ratio (%) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Countries | Firms | Average | Actual | Target 1 | Target 2 | Target 3 | Actual | Target 1 | Target 2 | Target 3 | |

| 1 | Argentina | 35 | 9 | 21.14 | 22.16 | 24.30 *** | 17.77 *** | 11.27 | 11.24 | 14.78 *** | 7.36 *** |

| 2 | Australia | 774 | 9 | 18.67 | 21.31 *** | 20.68 *** | 13.77 *** | 12.31 | 12.91 *** | 7.20 *** | 8.28 *** |

| 3 | Austria | 62 | 11 | 24.62 | 28.83 *** | 25.35 | 23.37 ** | 13.16 | 14.38 *** | 17.24 *** | 11.78 *** |

| 4 | Belgium | 85 | 11 | 24.28 | 21.89 *** | 25.29 *** | 23.40 * | 14.65 | 14.33 | 17.94 *** | 13.24 *** |

| 5 | Brazil | 66 | 7 | 27.24 | 28.89** | 25.97 | 23.11 *** | 13.58 | 13.89 | 18.11 *** | 10.61 *** |

| 6 | Canada | 189 | 10 | 22.32 | 23.72 *** | 24.97 *** | 20.27 *** | 17.24 | 17.75 ** | 16.48 ** | 14.81 *** |

| 7 | Chile | 38 | 8 | 23.60 | 23.32 | 28.46 *** | 23.59 | 15.03 | 15.99 ** | 23.05 *** | 14.22 |

| 8 | Denmark | 103 | 11 | 27.07 | 27.74 | 26.95 | 25.66 *** | 15.98 | 16.13 | 19.19 *** | 14.57 *** |

| 9 | Finland | 114 | 11 | 25.63 | 26.05 | 24.90 * | 23.48 *** | 17.31 | 16.98 | 20.87 *** | 14.84 *** |

| 10 | France | 502 | 10 | 22.81 | 22.57 | 22.85 | 21.38 *** | 13.50 | 13.44 | 14.18 *** | 10.78 *** |

| 11 | Germany | 536 | 10 | 20.45 | 21.66 *** | 21.16 *** | 17.30 *** | 11.39 | 12.06 *** | 11.04 ** | 8.08 *** |

| 12 | Greece | 100 | 8 | 32.82 | 41.00 *** | 31.52 ** | 32.99 | 16.60 | 18.84 *** | 20.50 *** | 14.36 *** |

| 13 | India | 550 | 7 | 30.11 | 29.99 | 29.85 | 30.13 | 19.84 | 19.28 *** | 23.33 *** | 17.45 *** |

| 14 | Indonesia | 179 | 10 | 38.19 | 36.53 *** | 32.71 *** | 34.95 *** | 17.48 | 17.50 | 18.46 ** | 12.80 *** |

| 15 | Ireland | 33 | 11 | 25.54 | 25.74 | 27.71 *** | 24.53 | 18.19 | 18.66 | 19.93 ** | 16.46 *** |

| 16 | Israel | 23 | 9 | 37.73 | 39.52 * | 31.32 *** | 37.52 | 25.92 | 27.92 *** | 13.79 *** | 25.67 |

| 17 | Italy | 168 | 10 | 25.85 | 28.95 *** | 26.18 | 25.62 | 13.65 | 14.77 *** | 15.60 *** | 11.55 *** |

| 18 | Japan | 2848 | 11 | 23.83 | 22.35 *** | 26.54 *** | 21.07 *** | 10.29 | 10.02 *** | 14.91 *** | 7.76 *** |

| 19 | Latvia | 10 | 7 | 17.94 | 20.97* | 24.44 *** | 16.08 | 11.02 | 11.91 | 10.89 | 9.90 |

| 20 | Lithuania | 19 | 6 | 26.09 | 25.23 | 29.83 *** | 26.60 | 13.89 | 11.84 ** | 23.50 *** | 10.93 *** |

| 21 | Luxemburg | 11 | 8 | 21.93 | 19.69 ** | 27.05 *** | 20.61 | 15.75 | 15.63 | 23.39 *** | 15.91 |

| 22 | Malaysia | 739 | 10 | 24.41 | 26.99 *** | 25.56 *** | 21.36 *** | 8.88 | 9.08 * | 11.59 *** | 4.67 *** |

| 23 | Mexico | 57 | 10 | 26.71 | 27.56 * | 28.85 *** | 26.21 | 18.14 | 18.78 * | 24.53 *** | 18.25 |

| 24 | Netherlands | 128 | 12 | 22.18 | 23.86 *** | 22.99 ** | 19.95 *** | 13.00 | 13.73 *** | 16.72 *** | 10.80 *** |

| 25 | New Zealand | 67 | 10 | 22.92 | 23.55 | 26.48 *** | 21.86 * | 15.79 | 15.34 | 21.20 *** | 14.35 *** |

| 26 | Nigeria | 11 | 7 | 22.00 | 25.04 * | 20.66 | 18.48 ** | 4.74 | 4.85 | 8.58 *** | 2.66 ** |

| 27 | Norway | 113 | 10 | 27.37 | 27.73 | 28.31 ** | 27.45 | 21.35 | 21.19 | 25.61 *** | 20.41 ** |

| 28 | Pakistan | 83 | 9 | 30.98 | 29.43 *** | 30.69 | 29.77 ** | 14.04 | 13.59 | 18.04 *** | 12.00 *** |

| 29 | Peru | 25 | 9 | 22.20 | 19.07 *** | 25.95 *** | 19.76 *** | 11.46 | 10.36 ** | 17.76 *** | 8.80 *** |

| 30 | Philippines | 66 | 10 | 26.14 | 26.02 | 25.79 | 23.29 *** | 14.08 | 14.78 * | 11.02 *** | 10.51 *** |

| 31 | Poland | 112 | 8 | 18.12 | 21.45 *** | 21.28 *** | 15.58 *** | 7.58 | 8.90 *** | 9.82 *** | 5.16 *** |

| 32 | Portugal | 43 | 10 | 36.68 | 41.38 *** | 32.74 *** | 36.05 | 21.28 | 23.22 *** | 26.68 *** | 20.13 * |

| 33 | Russian Federation | 15 | 7 | 27.27 | 34.05 *** | 27.81 | 27.05 | 17.70 | 21.18 *** | 19.96 * | 17.34 |

| 34 | Singapore | 386 | 10 | 20.49 | 20.30 | 23.80 *** | 17.70 *** | 8.65 | 8.42 * | 10.59 *** | 5.03 *** |

| 35 | Slovenia | 15 | 9 | 26.47 | 34.69 *** | 28.07 | 26.54 | 12.32 | 15.17 *** | 20.00 *** | 10.53 ** |

| 36 | South Africa | 175 | 10 | 16.84 | 19.58 *** | 19.08 *** | 13.98 *** | 9.49 | 10.45 *** | 10.41 *** | 6.22 *** |

| 37 | South Korea | 366 | 10 | 31.97 | 29.47 *** | 32.32 | 31.75 | 12.29 | 11.40 *** | 17.96 *** | 9.86 *** |

| 38 | Spain | 99 | 11 | 24.89 | 26.89 *** | 27.05 *** | 23.90 ** | 14.41 | 15.28 *** | 18.12 *** | 12.16 *** |

| 39 | Sri Lanka | 25 | 8 | 25.36 | 22.30 *** | 28.45 *** | 24.83 | 10.32 | 9.52 ** | 16.78 *** | 9.07 *** |

| 40 | Sweden | 245 | 10 | 19.31 | 20.02 *** | 20.85 *** | 16.85 *** | 13.27 | 13.09 | 11.82 *** | 10.29 *** |

| 41 | Switzerland | 167 | 12 | 22.74 | 19.90 *** | 24.86 *** | 21.41 *** | 15.63 | 14.58 *** | 20.01 *** | 13.24 *** |

| 42 | Taiwan | 743 | 7 | 22.52 | 21.89 *** | 24.60 *** | 21.67 *** | 8.53 | 8.26 *** | 9.57 *** | 5.64 *** |

| 43 | Thailand | 335 | 10 | 28.61 | 26.81 *** | 29.92 *** | 26.10 *** | 11.81 | 11.85 | 13.34 *** | 7.58 *** |

| 44 | Turkey | 58 | 8 | 20.23 | 20.97 | 21.70 ** | 18.34 *** | 9.38 | 10.17 ** | 10.47 ** | 7.00 *** |

| 45 | United Kingdom | 1299 | 11 | 18.96 | 20.72 *** | 21.42 *** | 16.30 *** | 11.81 | 12.58 *** | 10.87 *** | 8.10 *** |

| 46 | United States | 5376 | 12 | 23.58 | 24.91 *** | 22.68 *** | 19.97 *** | 18.25 | 18.50 *** | 15.88 *** | 14.00 *** |

| 47 | 1989–2017 | 2905 | 11 | 23.50 | 24.13 *** | 24.25 *** | 20.72 *** | 14.24 | 14.41 *** | 14.69 *** | 10.83 *** |

| 48 | 1989–2006 | 2668 | 11 | 23.99 | 24.29 *** | 24.22 *** | 20.61 *** | 14.85 | 14.98 *** | 15.01 *** | 11.20 *** |

| 49 | 2007–2008 | 1989 | 10 | 22.29 | 26.78 *** | 23.93 *** | 20.89 *** | 12.55 | 13.14 *** | 13.66 *** | 9.75 *** |

| 50 | 2009–2017 | 2186 | 10 | 22.23 | 21.12 *** | 24.67 *** | 21.07 *** | 12.87 | 12.86 | 14.10 *** | 10.04 *** |

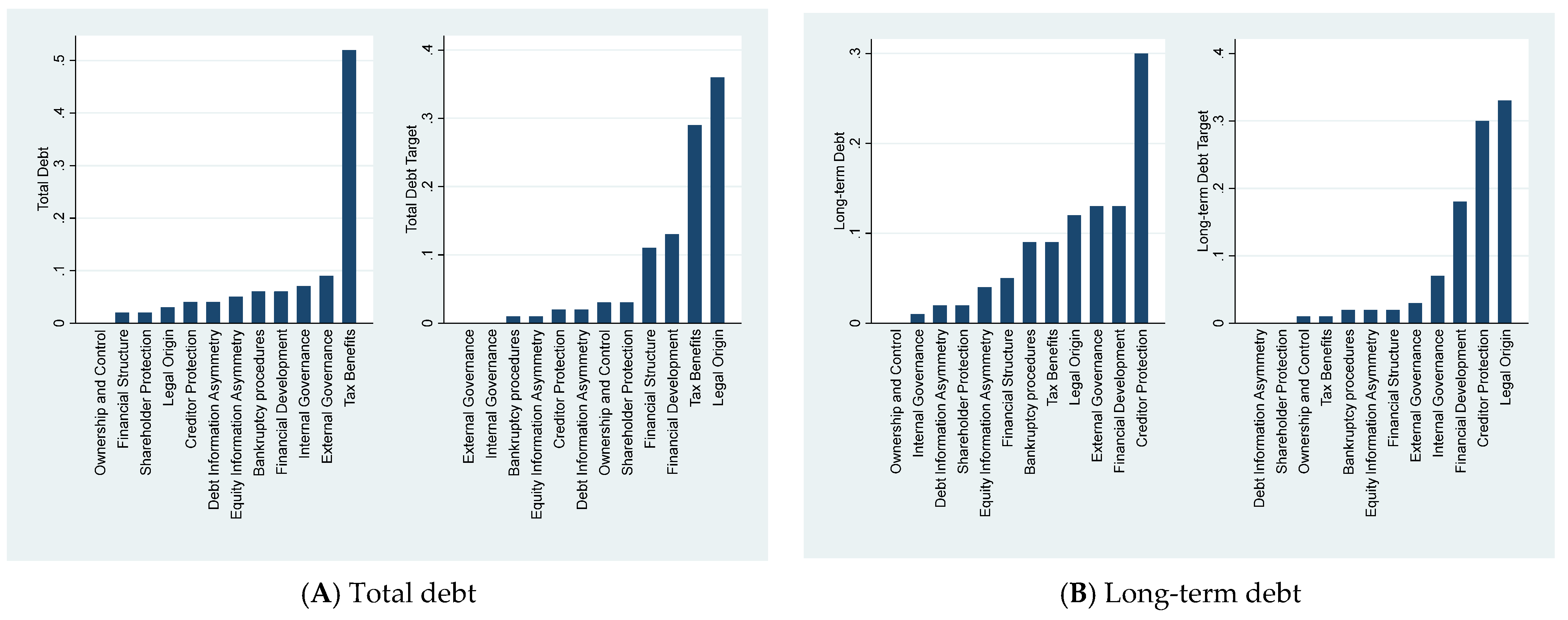

| Panel A: Total Debt | ||||

| Institutions and Financial Development | Actual | Target 1 | Target 2 | Target 3 |

| Legal Origin | 0.03 | 0.36 | 0.24 | 0.02 |

| Financial Development | 0.06 | 0.13 | 0.15 | 0.01 |

| Financial Structure | 0.02 | 0.11 | 0.00 | 0.03 |

| Shareholder Protection | 0.02 | 0.03 | 0.00 | 0.09 |

| Internal Governance | 0.07 | 0.00 | 0.17 | 0.14 |

| External Governance | 0.09 | 0.00 | 0.01 | 0.10 |

| Tax Benefits | 0.52 | 0.29 | 0.13 | 0.40 |

| Bankruptcy procedures | 0.06 | 0.01 | 0.10 | 0.08 |

| Creditor Protection | 0.04 | 0.02 | 0.12 | 0.01 |

| Ownership and Control | 0.00 | 0.03 | 0.04 | 0.00 |

| Equity Information Asymmetry | 0.05 | 0.01 | 0.04 | 0.08 |

| Debt Information Asymmetry | 0.04 | 0.02 | 0.00 | 0.05 |

| Panel B: Long-Term Debt | ||||

| Institutions and Financial Development | Actual | Target 1 | Target 2 | Target 3 |

| Legal Origin | 0.12 | 0.33 | 0.25 | 0.02 |

| Financial Development | 0.13 | 0.18 | 0.18 | 0.13 |

| Financial Structure | 0.05 | 0.02 | 0.00 | 0.09 |

| Shareholder Protection | 0.02 | 0.00 | 0.00 | 0.06 |

| Internal Governance | 0.01 | 0.07 | 0.03 | 0.01 |

| External Governance | 0.13 | 0.03 | 0.01 | 0.10 |

| Tax Benefits | 0.09 | 0.01 | 0.03 | 0.09 |

| Bankruptcy procedures | 0.09 | 0.02 | 0.02 | 0.04 |

| Creditor Protection | 0.30 | 0.30 | 0.42 | 0.37 |

| Ownership and Control | 0.00 | 0.01 | 0.01 | 0.00 |

| Equity Information Asymmetry | 0.04 | 0.02 | 0.05 | 0.06 |

| Debt Information Asymmetry | 0.02 | 0.00 | 0.00 | 0.02 |

| Supply Channel Portfolios | Legal Origin | Financial Development | Financial Structure | Shareholder Protection | Internal Governance | External Governance | ||||||

| Civil | Common | Developing | Developed | Bank | Market | Poor | Strong | Poor | Strong | Poor | Strong | |

| Panel A: Total Debt | ||||||||||||

| Panel A1. Target 1 | ||||||||||||

| Mean | 26.96 | 24.32 | 28.15 | 23.63 | 26.47 | 23.74 | 24.72 | 24.02 | 26.89 | 23.42 | 27.13 | 23.93 |

| Difference | 2.64 | *** | 4.52 | *** | 2.73 | *** | 0.69 | *** | 3.46 | *** | 3.73 | *** |

| Panel A2. Target 2 | ||||||||||||

| Mean | 25.88 | 23.21 | 27.89 | 23.68 | 25.77 | 23.84 | 24.86 | 24.13 | 26.72 | 23.42 | 27.00 | 23.47 |

| Difference | 2.67 | *** | 4.21 | *** | 1.93 | *** | 0.73 | *** | 3.31 | *** | 3.54 | *** |

| Panel A3. Target 3 | ||||||||||||

| Mean | 22.29 | 19.74 | 26.60 | 19.90 | 24.41 | 20.05 | 22.66 | 20.35 | 24.26 | 19.54 | 24.56 | 19.65 |

| Difference | 2.55 | *** | 6.70 | *** | 4.36 | *** | 2.31 | *** | 4.71 | *** | 4.91 | *** |

| Panel B: Long-Term Debt | ||||||||||||

| Panel B1. Target 1 | ||||||||||||

| Mean | 11.91 | 16.00 | 16.25 | 14.47 | 15.26 | 14.55 | 13.65 | 14.58 | 13.08 | 15.09 | 12.61 | 14.89 |

| Difference | 4.09 | *** | 1.78 | *** | 0.71 | *** | 0.93 | *** | 2.02 | *** | 2.28 | *** |

| Panel B2. Target 2 | ||||||||||||

| Mean | 13.75 | 16.01 | 19.46 | 14.29 | 17.58 | 14.42 | 13.96 | 15.40 | 13.85 | 15.62 | 13.94 | 15.41 |

| Difference | 2.25 | *** | 5.17 | *** | 3.16 | *** | 1.44 | *** | 1.46 | *** | 1.47 | *** |

| Panel B3. Target 3 | ||||||||||||

| Mean | 9.38 | 11.74 | 14.02 | 10.74 | 12.75 | 10.83 | 10.82 | 10.98 | 9.70 | 11.36 | 9.21 | 11.20 |

| Difference | 2.36 | *** | 3.28 | *** | 1.92 | *** | 0.16 | *** | 1.66 | *** | 1.99 | * |

| Demand Channel Portfolios | Tax Benefits | Bankruptcy Procedures | Creditor Protection | Ownership and Control | Equity Information Asymmetry | Debt Information Asymmetry | ||||||

| Low | High | Poor | Strong | Poor | Strong | Low | High | Low | High | Low | High | |

| Panel A. Total Debt | ||||||||||||

| Panel A1. Target 1 | ||||||||||||

| Mean | 23.60 | 24.40 | 26.11 | 23.58 | 26.52 | 23.74 | 25.23 | 23.53 | 23.60 | 26.59 | 23.61 | 25.61 |

| Difference | 0.80 | *** | 2.53 | *** | 2.77 | *** | 1.70 | *** | 2.99 | *** | 2.00 | *** |

| Panel A2. Target 2 | ||||||||||||

| Mean | 23.56 | 25.17 | 25.79 | 23.77 | 26.27 | 23.92 | 25.25 | 23.60 | 23.72 | 26.85 | 23.64 | 26.19 |

| Difference | 1.62 | *** | 2.03 | *** | 2.35 | *** | 1.65 | *** | 3.13 | *** | 2.55 | *** |

| Panel A3. Target 3 | ||||||||||||

| Mean | 20.30 | 20.91 | 23.06 | 19.97 | 24.76 | 20.06 | 22.95 | 19.47 | 19.95 | 24.51 | 19.75 | 23.85 |

| Difference | 0.61 | *** | 3.09 | *** | 4.70 | *** | 3.49 | *** | 4.56 | *** | 4.10 | *** |

| Panel B. Long-Term Debt | ||||||||||||

| Panel B1. Target 1 | ||||||||||||

| Mean | 11.95 | 15.59 | 12.56 | 14.64 | 15.40 | 14.24 | 12.94 | 15.23 | 14.51 | 13.67 | 14.63 | 13.41 |

| Difference | 3.64 | *** | 2.08 | *** | 1.15 | *** | 2.29 | *** | 0.84 | *** | 1.22 | *** |

| Panel B2. Target 2 | ||||||||||||

| Mean | 12.50 | 15.73 | 14.33 | 14.50 | 17.63 | 14.21 | 14.28 | 14.96 | 15.26 | 14.18 | 15.32 | 14.24 |

| Difference | 3.23 | *** | 0.17 | *** | 3.42 | *** | 0.68 | *** | 1.07 | *** | 1.08 | *** |

| Panel B3. Target 3 | ||||||||||||

| Mean | 8.32 | 12.02 | 9.00 | 10.99 | 12.75 | 10.51 | 9.94 | 11.32 | 10.82 | 10.73 | 10.87 | 10.55 |

| Difference | 3.70 | *** | 1.99 | *** | 2.24 | *** | 1.37 | *** | 0.09 | * | 0.33 | ** |

| Supply Channel Portfolios | Legal Origin | Financial Development | Financial Structure | Shareholder Protection | Internal Governance | External Governance | ||||||

| Civil | Common | Developing | Developed | Bank | Market | Poor | Strong | Poor | Strong | Poor | Strong | |

| Panel A: Total Debt | ||||||||||||

| Panel A1. Target 1 | ||||||||||||

| Mean | 30.84 | 26.74 | 32.56 | 25.75 | 31.07 | 26.04 | 28.60 | 26.31 | 30.49 | 25.24 | 29.96 | 25.38 |

| Difference | 4.10 | ***/*** | 6.80 | ***/*** | 5.02 | ***/*** | 2.30 | ***/*** | 5.25 | ***/*** | 4.58 | ***/*** |

| Panel A2. Target 2 | ||||||||||||

| Mean | 25.34 | 22.86 | 27.64 | 23.09 | 25.11 | 23.47 | 24.09 | 23.89 | 26.31 | 22.65 | 26.42 | 22.70 |

| Difference | 2.48 | ***/*** | 4.54 | ***/*** | 1.64 | ***/*** | 0.20 | ***/*** | 3.66 | ***/*** | 3.72 | ***/*** |

| Panel A3. Target 3 | ||||||||||||

| Mean | 24.55 | 19.88 | 27.12 | 19.63 | 24.34 | 20.09 | 22.61 | 20.49 | 24.51 | 18.99 | 24.58 | 19.15 |

| Difference | 4.67 | ***/*** | 7.50 | ***/*** | 4.25 | ***/*** | 2.11 | ***/*** | 5.52 | ***/*** | 5.43 | ***/*** |

| Panel B: Long-Term Debt | ||||||||||||

| Panel B1. Target 1 | ||||||||||||

| Mean | 11.52 | 14.71 | 16.82 | 12.88 | 15.09 | 13.11 | 13.66 | 13.03 | 13.37 | 13.66 | 12.55 | 13.48 |

| Difference | 3.16 | ***/*** | 3.93 | ***/*** | 2.36 | ***/*** | 0.63 | ***/*** | 0.29 | ***/*** | 0.93 | ***/*** |

| Panel B2. Target 2 | ||||||||||||

| Mean | 16.10 | 13.17 | 19.40 | 12.82 | 16.90 | 13.24 | 14.82 | 13.38 | 13.63 | 13.70 | 13.47 | 13.65 |

| Difference | 2.93 | ***/*** | 6.58 | ***/*** | 3.67 | ***/*** | 1.44 | ***/*** | 0.07 | ***/*** | 0.18 | */*** |

| Panel B3. Target 3 | ||||||||||||

| Mean | 10.69 | 11.62 | 14.16 | 9.31 | 12.22 | 9.62 | 10.58 | 9.58 | 9.95 | 10.11 | 9.30 | 9.93 |

| Difference | 0.93 | ***/*** | 4.84 | ***/*** | 2.59 | ***/*** | 1.00 | ***/*** | 0.16 | ***/*** | 0.63 | ***/*** |

| Demand Channel Portfolios | Tax Benefits | Bankruptcy Procedures | Creditor Protection | Ownership and Control | Equity Information Asymmetry | Debt Information Asymmetry | ||||||

| Low | High | Poor | Strong | Poor | Strong | Low | High | Low | High | Low | High | |

| Panel A: Total Debt | ||||||||||||

| Panel A1. Target 1 | ||||||||||||

| Mean | 26.35 | 27.07 | 29.33 | 25.62 | 30.58 | 25.88 | 28.59 | 25.14 | 25.85 | 30.48 | 25.52 | 29.75 |

| Difference | 0.72 | ***/*** | 3.71 | ***/*** | 4.70 | ***/*** | 3.44 | ***/*** | 4.62 | ***/*** | 4.23 | ***/*** |

| Panel A2. Target 2 | ||||||||||||

| Mean | 23.12 | 24.70 | 25.15 | 23.22 | 25.80 | 23.48 | 25.06 | 22.90 | 23.31 | 26.26 | 23.07 | 25.84 |

| Difference | 1.58 | ***/*** | 1.93 | ***/*** | 2.32 | ***/*** | 2.15 | ***/*** | 2.95 | ***/*** | 2.77 | ***/*** |

| Panel A3. Target 3 | ||||||||||||

| Mean | 20.20 | 21.34 | 22.88 | 19.72 | 25.04 | 19.90 | 23.00 | 18.97 | 19.93 | 24.46 | 19.45 | 24.18 |

| Difference | 1.14 | ***/*** | 3.16 | ***/*** | 5.15 | ***/*** | 4.03 | ***/*** | 4.53 | ***/*** | 4.73 | ***/*** |

| Panel B: Long-Term Debt | ||||||||||||

| Panel B1. Target 1 | ||||||||||||

| Mean | 10.95 | 14.58 | 12.35 | 12.97 | 15.77 | 12.51 | 12.59 | 13.77 | 13.04 | 13.43 | 12.87 | 13.78 |

| Difference | 3.63 | ***/*** | 0.62 | ***/*** | 3.26 | ***/*** | 1.18 | ***/*** | 0.38 | ***/*** | 0.91 | ***/*** |

| Panel B2. Target 2 | ||||||||||||

| Mean | 11.35 | 15.16 | 13.59 | 13.07 | 17.40 | 12.76 | 13.15 | 14.22 | 13.23 | 15.34 | 12.87 | 15.61 |

| Difference | 3.81 | ***/*** | 0.52 | ***/*** | 4.65 | ***/*** | 1.07 | ***/*** | 2.10 | ***/*** | 2.74 | ***/*** |

| Panel B3. Target 3 | ||||||||||||

| Mean | 7.64 | 11.13 | 8.72 | 9.56 | 12.77 | 9.03 | 9.40 | 10.18 | 9.61 | 10.25 | 9.38 | 10.66 |

| Difference | 3.49 | ***/*** | 0.84 | ***/*** | 3.74 | ***/*** | 0.78 | ***/*** | 0.64 | ***/*** | 1.28 | ***/*** |

| Supply Channel Portfolios | Legal Origin | Financial Development | Financial Structure | Shareholder Protection | Internal Governance | External Governance | ||||||

| Civil | Common | Developing | Developed | Bank | Market | Poor | Strong | Poor | Strong | Poor | Strong | |

| Panel A. Target 1 | ||||||||||||

| Mean | 46.10 | 62.89 | 54.70 | 57.44 | 55.09 | 57.43 | 53.05 | 56.82 | 46.02 | 60.39 | 43.34 | 59.51 |

| Difference | 16.80 | *** | 2.74 | *** | 2.34 | *** | 3.78 | *** | 14.37 | *** | 16.17 | *** |

| Panel B. Target 2 | ||||||||||||

| Mean | 46.90 | 62.90 | 55.44 | 57.60 | 53.57 | 57.81 | 52.54 | 57.21 | 45.28 | 60.85 | 43.28 | 59.66 |

| Difference | 16.34 | *** | 2.16 | *** | 4.24 | *** | 4.68 | *** | 15.57 | *** | 16.38 | *** |

| Panel C. Target 3 | ||||||||||||

| Mean | 46.74 | 70.74 | 56.65 | 63.57 | 57.20 | 63.57 | 55.63 | 62.83 | 45.09 | 67.65 | 41.79 | 66.43 |

| Difference | 23.81 | *** | 6.92 | *** | 6.37 | *** | 7.20 | *** | 22.56 | *** | 24.64 | *** |

| Demand Channel Portfolios | Tax Benefits | Bankruptcy Procedures | Creditor Protection | Ownership and Control | Equity Information Asymmetry | Debt Information Asymmetry | ||||||

| Low | High | Poor | Strong | Poor | Strong | Low | High | Low | High | Low | High | |

| Panel A. Target 1 | ||||||||||||

| Mean | 48.20 | 59.90 | 46.33 | 58.02 | 55.29 | 56.23 | 48.74 | 60.48 | 57.57 | 48.55 | 58.17 | 49.16 |

| Difference | 11.69 | *** | 11.68 | *** | 0.94 | *** | 11.73 | *** | 9.02 | *** | 9.02 | *** |

| Panel B. Target 2 | ||||||||||||

| Mean | 48.26 | 60.24 | 45.74 | 58.36 | 55.82 | 56.42 | 48.49 | 60.98 | 57.86 | 47.98 | 58.64 | 48.10 |

| Difference | 11.98 | *** | 12.61 | *** | 0.60 | *** | 12.49 | *** | 9.88 | *** | 10.54 | *** |

| Panel C. Target 3 | ||||||||||||

| Mean | 50.42 | 66.84 | 45.42 | 64.64 | 58.07 | 62.10 | 49.44 | 68.27 | 63.90 | 48.79 | 64.83 | 49.81 |

| Difference | 16.41 | *** | 19.21 | *** | 4.03 | *** | 18.83 | *** | 15.11 | *** | 15.01 | *** |

| Supply Channel Portfolios | Legal Origin | Financial Development | Financial Structure | Shareholder Protection | Internal Governance | External Governance | ||||||

| Civil | Common | Developing | Developed | Bank | Market | Poor | Strong | Poor | Strong | Poor | Strong | |

| Panel A: Total Debt Deviation | ||||||||||||

| Panel A1. Deviation from Target 1 | ||||||||||||

| Mean | 12.03 | 9.91 | 11.95 | 11.06 | 11.13 | 11.11 | 11.25 | 10.92 | 12.29 | 10.95 | 12.44 | 10.92 |

| Difference | 2.12 | *** | 0.89 | *** | 0.03 | *** | 0.33 | *** | 1.34 | *** | 1.52 | *** |

| Panel A2. Deviation from Target 2 | ||||||||||||

| Mean | 14.31 | 13.40 | 14.04 | 12.68 | 14.16 | 11.41 | 14.35 | 12.05 | 14.07 | 14.02 | 14.11 | 13.96 |

| Difference | 0.91 | *** | 1.36 | *** | 2.76 | *** | 2.30 | *** | 0.05 | *** | 0.15 | *** |

| Panel A3. Deviation from Target 3 | ||||||||||||

| Mean | 14.27 | 13.43 | 14.08 | 12.30 | 14.20 | 11.18 | 14.39 | 11.82 | 14.07 | 13.87 | 14.05 | 13.98 |

| Difference | 0.83 | *** | 1.78 | *** | 3.02 | *** | 2.57 | *** | 0.20 | *** | 0.07 | *** |

| Panel B: Total Long-Term Debt Deviation | ||||||||||||

| Panel B1. Deviation from Target 1 | ||||||||||||

| Mean | 7.64 | 5.38 | 7.05 | 6.76 | 6.79 | 6.68 | 6.83 | 6.45 | 6.89 | 6.74 | 6.83 | 6.63 |

| Difference | 2.26 | *** | 0.29 | *** | 0.12 | *** | 0.38 | *** | 0.15 | *** | 0.20 | *** |

| Panel B2. Deviation from Target 2 | ||||||||||||

| Mean | 12.08 | 9.56 | 11.50 | 11.12 | 11.23 | 10.31 | 11.38 | 9.82 | 11.40 | 10.69 | 11.25 | 10.58 |

| Difference | 2.52 | *** | 0.37 | *** | 0.93 | *** | 1.56 | *** | 0.71 | *** | 0.67 | *** |

| Panel B3. Deviation from Target 3 | ||||||||||||

| Mean | 11.37 | 8.21 | 10.31 | 9.49 | 10.41 | 8.56 | 10.52 | 8.39 | 10.64 | 8.97 | 10.50 | 8.90 |

| Difference | 3.16 | *** | 0.83 | *** | 1.84 | *** | 2.12 | *** | 1.67 | *** | 1.60 | *** |

| Demand Channel Portfolios | Tax Benefits | Bankruptcy Procedures | Creditor Protection | Ownership and Control | Equity Information Asymmetry | Debt Information Asymmetry | ||||||

| Low | High | Poor | Strong | Poor | Strong | Low | High | Low | High | Low | High | |

| Panel A: Total Debt Deviation | ||||||||||||

| Panel A1. Deviation from Target 1 | ||||||||||||

| Mean | 14.24 | 13.37 | 14.00 | 13.95 | 11.76 | 11.12 | 0.76 | 0.48 | 13.23 | 14.04 | 13.10 | 14.12 |

| Difference | 0.87 | *** | 0.05 | *** | 0.64 | *** | 0.28 | *** | 0.81 | *** | 1.02 | *** |

| Panel A2. Deviation from Target 2 | ||||||||||||

| Mean | 25.17 | 23.56 | 25.79 | 23.77 | 14.17 | 12.65 | 0.93 | 0.68 | 23.72 | 26.85 | 23.64 | 26.19 |

| Difference | 1.62 | *** | 2.03 | *** | 1.52 | *** | 0.25 | *** | 3.13 | *** | 2.55 | *** |

| Panel A3. Deviation from Target 3 | ||||||||||||

| Mean | 14.05 | 13.87 | 14.02 | 13.45 | 14.20 | 12.36 | 3.27 | 1.80 | 12.91 | 14.09 | 12.94 | 14.17 |

| Difference | 0.18 | *** | 0.57 | *** | 1.84 | *** | 1.47 | *** | 1.18 | *** | 1.24 | *** |

| Panel B: Long-Term Debt Deviation | ||||||||||||

| Panel B1. Deviation from Target 1 | ||||||||||||

| Mean | 6.88 | 6.52 | 6.77 | 6.65 | 7.16 | 6.71 | 0.21 | 0.07 | 6.57 | 6.75 | 6.40 | 6.84 |

| Difference | 0.36 | *** | 0.12 | *** | 0.46 | *** | 0.14 | *** | 0.19 | *** | 0.36 | *** |

| Panel B2. Deviation from Target 2 | ||||||||||||

| Mean | 11.63 | 10.02 | 11.19 | 10.35 | 11.17 | 11.10 | 2.08 | 0.48 | 10.34 | 11.18 | 10.16 | 11.28 |

| Difference | 1.61 | *** | 0.85 | *** | 0.07 | *** | 1.60 | *** | 0.83 | *** | 1.12 | *** |

| Panel B3. Deviation from Target 3 | ||||||||||||

| Mean | 11.19 | 8.43 | 10.40 | 8.52 | 10.24 | 9.56 | 3.68 | 2.93 | 8.42 | 10.40 | 8.69 | 10.49 |

| Difference | 2.76 | *** | 1.88 | *** | 0.68 | *** | 0.75 | *** | 1.98 | *** | 1.80 | *** |

| Panel A: All Firms | |||||||||

| Total Debt to Total Assets | Total Long-Term Debt to Total Assets | Total Long-Term Debt to Total Debt | |||||||

| Target 1 | Target 2 | Target 3 | Target 1 | Target 2 | Target 3 | Target 1 | Target 2 | Target 3 | |

| Stock market capitalization | −0.0359 ** | 0.0041 | −0.1236 *** | 0.0172 | −0.0546 *** | −0.1488 *** | −0.0688 *** | −0.1763 *** | −0.0105 |

| (0.013) | (0.781) | (0.000) | (0.234) | (0.000) | (0.000) | (0.000) | (0.000) | (0.486) | |

| Bond market capitalization | −0.0884 *** | −0.0954 *** | −0.0494 *** | −0.0297 ** | −0.2212 *** | −0.2423 *** | −0.0628 *** | −0.0105 | −0.0632 *** |

| (0.000) | (0.000) | (0.000) | (0.021) | (0.000) | (0.000) | (0.000) | (0.447) | (0.000) | |

| Private credit | −0.0391 *** | −0.0448 *** | −0.1539 *** | −0.1370 *** | −0.0920 *** | −0.2854 *** | −0.0631 *** | −0.1994 *** | −0.0295 * |

| (0.007) | (0.002) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.053) | |

| Financial crisis | 0.5376 *** | 0.7871 *** | 0.9720 *** | 0.5587 *** | 1.0952 *** | 1.4132 *** | 0.5133 *** | 0.8254 *** | 0.9725 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Lagged target deviation | 0.4161 *** | −1.0605 *** | −1.6299 *** | 0.0291 | −2.8641 *** | −2.8755 *** | 0.0117 | 0.6471 *** | 0.4914 *** |

| (0.000) | (0.000) | (0.000) | (0.514) | (0.000) | (0.000) | (0.622) | (0.000) | (0.000) | |

| Observations | 152,994 | 152,994 | 152,994 | 152,994 | 152,994 | 152,994 | 136,125 | 136,125 | 139,308 |

| Odd Ratios: Financial crisis | 1.7118 | 2.1970 | 2.6432 | 1.7481 | 1.6707 | 2.2828 | 2.6444 | 2.9897 | 1.6707 |

| Panel B: Financially Constrained Firms | |||||||||

| Total Debt to Total Assets | Total Long-Term Debt to Total Assets | Total Long-Term Debt to Total Debt | |||||||

| Target 1 | Target 2 | Target 3 | Target 1 | Target 2 | Target 3 | Target 1 | Target 2 | Target 3 | |

| Stock market capitalization | −0.0190 | 0.2003 | −0.1431 *** | 0.0178 | −0.0391 ** | −0.1679 *** | −0.0795 *** | −0.1601 *** | −0.0225 |

| (0.291) | (0.182) | (0.000) | (0.322) | (0.033) | (0.000) | (0.000) | (0.000) | (0.224) | |

| Bond market capitalization | −0.0855 *** | 0.0038 | −0.0560 *** | −0.0485 *** | −0.2277 *** | −0.2502 *** | −0.0656 *** | 0.0010 | −0.0873*** |

| (0.000) | (0.988) | (0.000) | (0.001) | (0.000) | (0.000) | (0.000) | (0.950) | (0.000) | |

| Private credit | −0.0842 *** | −0.1698 | −0.1527 *** | −0.1488 *** | −0.1170 *** | −0.3463 *** | −0.0593 *** | −0.1322 *** | −0.0663 *** |

| (0.000) | (0.110) | (0.000) | (0.000) | (0.000) | (0.000) | (0.003) | (0.000) | (0.001) | |

| Financial crisis | 0.5942 *** | 0.9759 *** | 1.1267 *** | 0.7526 *** | 1.1425 *** | 1.5761 *** | 0.6873 *** | 0.9881 *** | 1.1763 *** |

| (0.000) | (0.009) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Lagged target deviation | 0.3008 *** | −1.7146 *** | −1.4197 *** | −0.1056 | −2.3908 *** | −3.1301 *** | −0.0020 | 0.4543 *** | 0.3332 *** |

| (0.000) | (0.000) | (0.000) | (0.169) | (0.000) | (0.000) | (0.951) | (0.000) | (0.000) | |

| Observations | 152,994 | 152,994 | 152,994 | 152,994 | 152,994 | 152,994 | 136,125 | 136,125 | 139,308 |

| Odd Ratios: Financial crisis | 1.8115 | 2.6535 | 3.0855 | 2.1224 | 3.1344 | 4.8361 | 1.5880 | 2.6860 | 3.2424 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gungoraydinoglu, A.; Öztekin, Ö. Financial Leverage and Debt Maturity Targeting: International Evidence. J. Risk Financial Manag. 2021, 14, 437. https://doi.org/10.3390/jrfm14090437

Gungoraydinoglu A, Öztekin Ö. Financial Leverage and Debt Maturity Targeting: International Evidence. Journal of Risk and Financial Management. 2021; 14(9):437. https://doi.org/10.3390/jrfm14090437

Chicago/Turabian StyleGungoraydinoglu, Ali, and Özde Öztekin. 2021. "Financial Leverage and Debt Maturity Targeting: International Evidence" Journal of Risk and Financial Management 14, no. 9: 437. https://doi.org/10.3390/jrfm14090437

APA StyleGungoraydinoglu, A., & Öztekin, Ö. (2021). Financial Leverage and Debt Maturity Targeting: International Evidence. Journal of Risk and Financial Management, 14(9), 437. https://doi.org/10.3390/jrfm14090437