Abstract

Since the inauguration of cryptocurrencies, Bitcoin has been under pressure from competing tokens. As Bitcoin is a public open ledger blockchain coin, it has its weaknesses in privacy and anonymity. In the recent decade numerous coins have been initiated as privacy coins, which try to tackle these weaknesses. This research compares mostly mature privacy coins to Bitcoin, and comparison is made from a price perspective. It seems that Bitcoin is leading privacy coins in price terms, and correlation is typically high and positive. From the earlier crypto market peak of 2017–18, only a very small number of coins are showing positive returns in 2021. It is typical that many privacy coins have lost substantial amounts of their value (ranging 80–90%) or that they do not exist anymore at all. Only Horizen and Monero have shown long-term sustainability in their value; however, their price changes follow that of Bitcoin very closely. The role of privacy coins in the future remains as an open issue.

1. Introduction

Crypto coins and their global as well as digital money world is starting to mature as leading cryptocurrency, Bitcoin (BTC), is more than decade old (Eldefrawy et al. 2019). In the very beginning, cryptos were providing a revolution through their blockchain style hash databases (Herskind et al. 2020), which have proven to be rather functional. After all, transactions are executed around the world, and compared to commercial banks, securing of transfers do not need an army of direct labour (which is used to supervise and possibly correct transfers). Executed wrong transfers are rather rare in the crypto world, and they typically arise due to some human error by making an incorrect transfer and not by the malfunctioning of the technology itself (e.g., Böhme et al. 2015; Shoffman 2021). It is no wonder that crypto popularized blockchain databases are increasingly used in other branches of economy, like logistics and supply chains (Tsiulin et al. 2020). Blockchain is trustworthy, reliable, and it functions rather well. This saves time in cross-border transactions as additional checks, retyping and rechecks are avoided, and time as well as resources are released to other duties. Cryptos are nowadays getting much of their valuation from free access and carrying of them around the world, even across country borders (Harvey and Branco-Illodo 2020; Hilmola 2014). For example, there are clear limits to carrying cash across borders, and the same applies to, e.g., precious metals. It could be argued that Bitcoin (or cryptos in general) are modern day gold, which assures individual liberty and safety throughout the globalized world (Hilmola 2014). Currently, commercial development of large-scale cryptocurrencies is on the agenda of the likes of Facebook (Giudici et al. 2021), and these are supposed to be connected to fiat currencies in their valuation (that they shall remain stable in price and provide maximum usage as speculation is not beneficial). In addition, the derivative market of cryptos is under development too (Pagnottoni 2019; Szalay 2021).

It is not that big a surprise that many countries have been trying to ban partially or completely Bitcoin as it challenges current power structures—typical first move in regulation is to limit crypto exchanges and to ask people to identify themselves (Kim 2018; Heavens 2021; Baydakova 2021; Handagama 2021). In the end, throughout the world, country or region level, fiat currencies were in a monopolistic position for a long time and have enabled many policies such as overspending of public funds, running continuous trade deficits, and having continuous massive governmental budget deficits (Burnham 2020).

In the beginning, there were very few cryptocurrencies available, and Bitcoin was the first very serious and functional coin. However, during the evolution of Bitcoin, some other derivative currencies have been established from it such as Bitcoin Cash and Bitcoin SV. Therefore, investing in original Bitcoin, these could have been treated as dividends or as new divested businesses as each Bitcoin holder received same amount of Bitcoin Cash in the 2017 split (Bitcoin SV in turn is originally based on ownership of Bitcoin Cash, and the split took place in 2018). Based on Wayback Machine (2021) and CoinMarketCap (2021) listings, in 2013, there were well below 100 cryptocurrencies listed in exchange. Currently, CoinMarketCap (2021) lists 5380 different tokens, and portal mentions that in the world exist 10,557 cryptocurrencies. Before the first crypto hype period of 2017, listed crypto coins were below 2000, but the spike in prices of 2017–18 caused many new projects to be initiated. This development led to the current high level as in 2020 there were already more than 8000 cryptocurrencies available for sale. As one major concern in projects was the anonymity and privacy issues of leading cryptocurrencies, this has been tackled by numerous alternatives in previous years (Eldefrawy et al. 2019; Herskind et al. 2020; Harvey and Branco-Illodo 2020).

The objective of this study is to examine established privacy coins and compare their price development over Bitcoin. Research uses earlier research findings in spotting suitable privacy coins; however, some of the past news and privacy coin successes are also included. However, in general, the study examines privacy coins, which have history and some sort of establishment and community in their background. For the purposes of the study, it is important to have long period price data available so the comparison with Bitcoin is sensible. Although Bitcoin is considered nowadays as a liquid as well as a global cryptocurrency, which is also very well known, it is still open question whether its markets are efficient (Urquhart 2016). Bitcoin exchanges around the world provide all the time pricing for this currency; however, these prices differ, and leading exchanges do change over time (e.g., governmental bans and restrictions affect these; Giudici and Pagnottoni 2019; Pagnottoni and Dimpfl 2019; Giudici and Pagnottoni 2020). However, making comparisons to Bitcoin is the best that can be done in the crypto-world.

The research problem of this study could be stated through the following questions: Are privacy coins different in their price development as compared to Bitcoin? Do we have some coins which have much better returns than Bitcoin? Have all privacy coins been long-term success stories?

2. Literature Review

Although, cryptocurrency history typically starts since the global financial crisis time of 2008–2009 and since the establishment of Bitcoin as well as the following publication of a white paper under the name of Satoshi Nakamoto, this is actually not the initial launch time. In the 1990s (Chaum 1993) and in the dot-com era (Wright 1997; Hwang et al. 2001), there was actually a trial of so called ecash (or digicash), which lasted for several years and was spread among some banks between the USA and Europe. However, financial institutions found this new currency complicated, competing with money cryptographically signed by the bank and enabling anonymity in payments anywhere. Finally, the financial industry decided to abandon this system, banks actually grew larger, and eventually bigger support was given for credit cards and payment methods derived from these. However, it did not take that long time that communities invented to use decentralized blockchain in this new anonymous digital money, and the entire branch of cryptocurrencies was born. Crypto coins were not superior when making transactions—it is still rather costly to pay with Bitcoin (in 2021 until late June miners earned in the range of 100–300 USD per transaction; Blockchain.com 2021), and it takes some time (typically minutes or tens of minutes; e.g., Böhme et al. 2015); however, this payment function is available throughout the world (wherever Internet is literally available), and even in the case of losing the Internet and/or electricity in the entire world, Bitcoin will come back alive after systems have been restored. Blockchain is just extremely functional, immutable and in the end, reliable (Casino et al. 2019; Iansiti and Lakhani, 2017). It offers a method of payment anywhere, any time and anonymously. Crypto coins are also highly portable—passengers can travel throughout the world just knowing their crypto wallet security keys and do not need to make any declaration of them to customs or different governments. Iansiti and Lakhani (2017) compare blockchain to the email revolution in communications—functionality and consequences of blockchain are rather similar. It is not surprising that cryptocurrencies and blockchains have been associated with freedom of movement and 1960s hippie lifestyle (Harvey and Branco-Illodo 2020). However, large public blockchains require massive amounts of energy and are not environmentally friendly (Casino et al. 2019). It should be noted that crypto coins do not provide interest within the ownership period (Schilling and Uhlig 2019), which is rather similar to central bank fiat currencies under zero interest rate policies. If interest rates would exist, this would give a competitive advantage to traditional fiat currencies and would without a doubt decrease the popularity of cryptos. It could be said that cryptos are poster or portrait of a new zero interest rate era.

Bitcoin’s weakness is simultaneously its strength—the entire blockchain is publicly open ledger, and all transactions and their history could be followed (Herskind et al. 2020; Harvey and Branco-Illodo 2020). If a person pays, e.g., to an online store by giving identification information (what is typically required so the retailer knows who their customers are), then the retailer has information about the wallet, its ID and also the network address of the used device. With this information, the retailer may follow all the payments from and deposits to the wallet out of long public records. If the retailer’s information systems are attacked and hacked, then this information is available to a very large audience. There are also other ways to capture wallet identification numbers (like forcing wallet providers to reveal customer details to government and ask them to gather detailed information, as with banks). Therefore, new solutions have been developed. Some of the new crypto coins use mixers or swaps in payments (that particular wallets could not be followed that easily). Some use the Dark Web. These enhancements are also partly available for Bitcoin (Böhme et al. 2015). However, follow-ups from criminal activity and/or chasing of Nakamoto tell that different countries and authorities are nowadays very well aware of who is using Bitcoin, when, where and how. Just only by following graphical form transactions of one unknown wallet and then seeing what is purchased, where, when and if known wallets are also used in the screening, much of the “unknown” wallet user is already known (Orcutt 2017; Eldefrawy et al. 2019; Herskind et al. 2020). Although, Bitcoin is increasingly popular nowadays, its ownership is extremely concentrated. Eldefrawy et al. (2019) argued that 0.06% of wallets own over 99% of Bitcoin. Later on, Kharif (2020) reported that 2% of wallets own 95% out of Bitcoin, where more than 70% of wallets have less than 0.01 Bitcoin stored. This considerably decreases the examination work to identify critical or active wallets. It is also a safety and security issue as very few nodes play a critical role in the entire crypto coin value and use. High concentration of Bitcoin holdings could also be one reason why the “buy and hold” strategy has been so successful, even comparing to popular technical analysis based short-term trading systems (Resta et al. 2020).

3. Related Literature and Analysis

This research is a quantitative study of the price development of the leading cryptocurrency, Bitcoin, and 23 other selected so-called privacy coins. These privacy coins were selected based mostly on the study by Harvey and Branco-Illodo (2020) but also on parts of the research of Herskind et al. (2020). In addition to these, also personal following of the branch led to the inclusion of Pirate Chain (ARRR), which has shown impressive price development in a short period of time—this coin is also argued to own exceptional anonymity features (Rearick 2021). Privacy coins were originally developed to compete with Bitcoin for providing better anonymity and security in payments. Actually, it is so that Bitcoin itself is one of the most open currencies, where wallets, transactions and transfers can be tracked and traced as well as followed on the basis of open access from its blockchain. Little by little, Bitcoin has lost its shine in these anonymity features (Eldefrawy et al. 2019), and it is important to examine whether we do have in privacy coins some sort of well-developing (in price terms) competitors (already established, some having years of history, as Appendix A shows earliest price information from 2014). However, it should be highlighted that for the selection of privacy coins for this study from the initial pool of coins (46 coins), 23 were excluded (50%). This was basically due to the reason that some coins had simply ceased to exist as others did not have pricing information from 2021, and others argued that they were completely private and were not available in public exchanges. This only illustrates how intensive and fast is the creative destruction in this branch. Even if crypto-investing is considered a major success area in the past decade, it also contains numerous coin or token failures and major losses carried by investors.

Data for 24 cryptocurrencies was collected from two sources—the primary source was Yahoo Finance (2021), and information from 22 crypto coins was accessed through it. In the case of two coins, Coindesk was used (2021). Data started for some well-established cryptos from September 2014 and ended for all on 18th of June 2021. However, the dataset consists of some very young cryptos too, for example, STORJ and ARRR (see Appendix A). In addition, BAT crypto also had a rather short data period availability, but this was not due to the reason that it had just been introduced. Data were in this case not available in Yahoo Finance (2021) at all, and in Coindesk (2021), it was also rather limited. The data used in this research were measuring prices with daily frequency and using the closing price.

As a research environment, cryptocurrencies are led by only two currencies (Bitcoin, BTC, and Ethereum, ETH). As Table 1 illustrates, these two coins took 62% from market capitalization of CoinMarketCap (2021) in 21st of June 2021. In the past, it has always been so that Bitcoin has owned the largest market capitalization, and this was challenged by ETH only in May 2017 as valuations became rather close to each other (Watorek et al. 2021). The ten largest coins have a share of 82%, and twenty largest coins in turn 88%. Typically, the largest cryptocurrencies have positive correlation in their price development, and Giudici et al. (2020) found that it is led by Ethereum (ETH). Watorek et al. (2021) in turn emphasized the central role of both BTC and ETH. However, Tether (USDT) is the exception to all this as it is a so-called stable coin and its price changes very little (as its pricing is based on the value changes of the US dollar).

Table 1.

Cryptocurrencies and their valuations on the 21st of June 2021 (bill. USD). Source (data): CoinMarketCap (2021).

However, dominance by a few largest crypto coins does not mean that crypto markets would not have other alternatives. CoinMarketCap (2021) lists 5380 different tokens and argues that the entire crypto market currently has 10,557 tokens. It should be highlighted that the selected 23 privacy coins in this study are among the twenty highest market capitalization coins. The largest market capitalization of this privacy coin group is held by Monero (XMR), which is currently the 26th largest cryptocurrency with market capitalization of around USD 4 billion, and it is followed by Dash and Zcash with market caps of above USD one billion. At the time of this study (crypto market having correction phase), Pirate Chain (ARRR), Basic Attention Token (BAT) and Horizen (ZEN) were all below USD one billion in their valuation. The smallest privacy coin of this study is Nix, which has a market capitalization of around USD 10 million.

4. Results

The watershed moment of cryptocurrencies was 2017 and early 2018, when most of these coins reached all-time highs, and valuations were widely debated in the news. However, this peak in valuations was followed by a steep decline and lower market capitalizations until the late 2020. This development is clearly present in Table 2. If the valuation in June 2021 is compared with early 2018, then only Bitcoin (BTC) and Horizen (ZEN) show positive yields. The rest of the coins, and all privacy coins, show negative yields. Apart from Monero (XMR), investing losses in early 2018 are really substantial, ranging from 73.5 to 96.9%.

Table 2.

Price development of Bitcoin and privacy coins from the beginning of different years to 18 June 2021.

From Table 2, it is also apparent that early mover advantage has been huge within crypto coins. All long-term existing currencies in this study have yielded extremely well, the earlier the investment has been made. On a class of its own is Verge (XVG), which provided astronomical returns (+670,350%) if purchased in the early 2015. Verge was actually one of the steepest growing cryptocurrencies in 2017, and if purchased in early 2015 and sold at the end of 2017, the investor would have gained even steeper returns, 5,564,900% (in the early 2015 Verge was trading at USD 0.000004, and at the peak of 2017 on 24th of December, its valuation was USD 0.255). Similar extraordinary returns are no longer available in the post-2018 crypto world—only Pirate Chain (ARRR) has some sort of extreme returns, but they remind merely of the Bitcoin (BTC) investment of early 2015. However, it should be noted that returns are higher than 1000% in the case of having purchased Horizen in early 2019 or Civic (CVC) coin in early 2020.

Although, privacy coins are considered as an alternative and competing currency to Bitcoin, their price development has followed in general that of Bitcoin. As shown in Table 3, correlations of Bitcoin and 23 privacy coins are positive and statistically significant (Table 3, grey shaded area of table). In contrast to this, Aion (AION) and Particl (PART) had slightly negative correlations in the entire observation period. QRL and SKY had no relation at all with Bitcoin, positive or negative (and, of course, did not have statistical significance). However, in the shorter period of time (starting from 2019) all privacy coins apart of PART had a positive correlation (see Table 4). All BTC correlation coefficients in Table 4 were statistically significant too. Figure 1, Figure 2, Figure 3 and Figure 4 illustrate and elaborate the situation further.

Table 3.

Correlation coefficients of analyzed cryptocurrencies in the time period from 17 September 2014 to 18 June 2021 (apart of QRL and SKY, all other privacy coins did have a statistically significant correlation with BTC, which had a p value of <0.05 in AION and <0.01 in the rest of the cryptos).

Table 4.

Correlation coefficients of analyzed cryptocurrencies in time period from 1 January 2019 to 18 June 2021 (all privacy coins have statistically significant correlation with BTC and this with p value of <0.01).

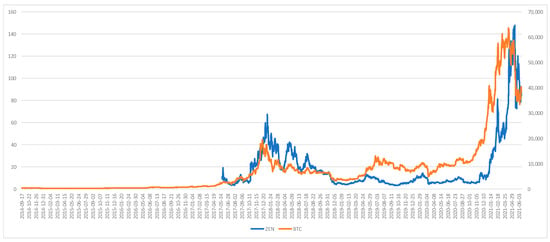

Figure 1.

Price development in USD of Bitcoin, BTC (right-side y-axis) and Horizen, ZEN (left-side y-axis).

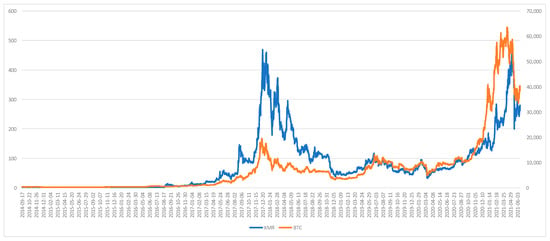

Figure 2.

Price development in USD of Bitcoin, BTC (right-side y-axis) and Monero, XMR (left-side y-axis).

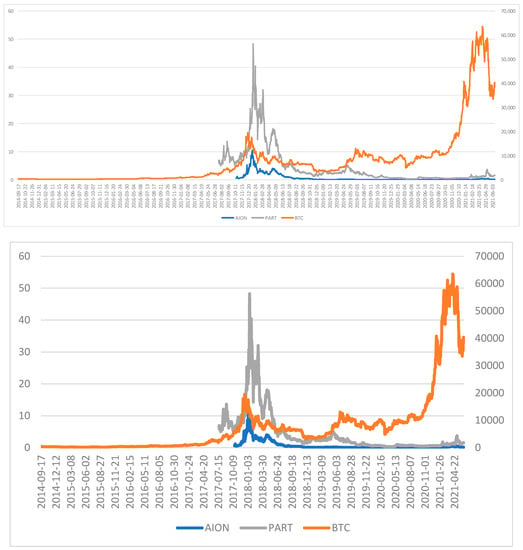

Figure 3.

Price development in USD of Bitcoin, BTC (right-side y-axis), Aion, AION and Partcl, PART (two latter in left-side y-axis).

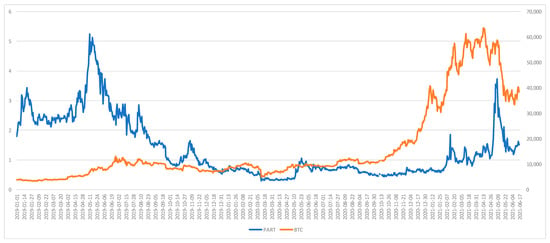

Figure 4.

Price development in USD of Bitcoin, BTC (right-side y-axis) and Partcl, PART (left-side y-axis) since 1 January 2019.

Another view, and a more dynamic one, than correlations could be made with rolling correlations. In Table 5 and Table 6 are shown results of rolling correlations of 100 days out of analyzed privacy coins and Bitcoin. Here, it is worthwhile examining the share of observations from correlations of classes 0.1 to −1 (these are actually the classes, which are not statistically significant in positive correlation terms with Bitcoin). Interestingly, Bytecoin (BCN) had 31% out of time not being positively correlated with Bitcoin. In Table 3 and Table 4, Bytecoin shows low positive correlation. Together with this, such privacy coins as Basic Attention Token (BAT), Navcoin (NAV), Particl (PART), DigitalNote (XDN), Stakenet (XSN) and Verge (XVG) all had 20% or higher number of observations in rolling correlations within the area of 0.1 to −1. Out of these, PART already earlier was found not to be following Bitcoin prices (having slightly negative correlation). In contrary to these, all highest market capitalization privacy coins (XMR, Dash and Zcash) in Table 5 and Table 6 had an exceptionally low number of days in the area from 0.1 to −1, together with new entrants such as ARRR and STORJ.

Table 5.

Rolling 100 days correlation distribution in different correlation classes (0.2 correlation is below p value of 0.05, and 0.26 is below p value of 0.01).

Table 6.

Rolling 100 days correlation distribution in different correlation classes (continued; 0.2 correlation is below p value of 0.05, and 0.26 is below p value of 0.01).

The strongest positive correlation in Table 3 between Bitcoin was that of Horizen (+0.772), which is further illustrated in Figure 1. Pricing of these two currencies follows each other rather closely, and in general, top valuations take place in the same time periods. Both of these cryptocurrencies reached higher valuations in the 2020–2021 price rally as compared to 2017–18.

The situation is a little bit different with Bitcoin (BTC) and Monero (XMR). Their correlation in Table 3 is also highly positive (+0.737). However, what is different in Figure 2 as compared to Figure 1 is the highest valuation period of Monero—it is still that of 2017–18. Monero was really doing well and developing in price terms much stronger until the 2017–18 peak; however, thereafter, its development remained in a sideways pattern but, of course, had a favorable increase in 2020–21.

Slightly negative correlations with Bitcoin, being also statistically significant, are present in Figure 3. Both Aion (AION) and Partcl (PART) repeated spike in 2017–18; however, they both continued their decline until only small growth in value in the late 2020 and in 2021. This is the real danger in cryptocurrency investing as most of the valuation is based on popularity and utility, and if these are not met, then values can continue to decline to very low levels. In a shorter period of time (Table 4), only Partcl still held a slightly negative correlation (also being statistically significant). The reason can be found by examining Figure 4. In 2019 Partcl was still showing signs of upwards momentum, while Bitcoin did not do so, and as Partcl started to decline thereafter, it was the opposite with Bitcoin (somewhat strong momentum). The latest spike in 2020–21 did not catch Partcl significantly as only some late spike attempts could be detected.

In the analysis no potentially challenging privacy coin for Bitcoin was found. In the earlier period, it was clearly Verge, which had the highest potential, but this was only until 2017–18. After this period, Pirate Chain showed a somewhat similar development but with a smaller magnitude. In retrospective, privacy coins have been mixed in their yields—if someone purchased these at the height of 2017–18, then most probably this investment is still substantially at a loss. Bitcoin in contrast has consistently produced returns. Only Horizen is similar to it; if bought at its peak of 2017–2018, it is still showing positive yields. Rather close to this is also Monero, which is somewhat below (or 22.4% in Table 1). Horizen and Monero are both potential coins to challenge the dominance of Bitcoin; however, their weakness is their considerable positive correlation to Bitcoin. Further analysis of Figure 1 and Figure 2 does not imply that dominance of Bitcoin would be gone—Horizen and Monero follow its changes very closely.

5. Conclusions

Cryptocurrencies could be considered nowadays a crowded marketplace as so many alternatives exist for investors to invest in. However, as this research showed, Bitcoin is rather dominant in this area, and it, together with Ethereum, holds two thirds of the entire crypto space market value. Bitcoin has numerous weaknesses, but it is still clearly the dominant one, and as this research showed, it is also leading in price movements. Nearly all other privacy coins of this study just followed Bitcoin price development. It was found that few private coins did not follow Bitcoin, but typically, these were coins which were extremely highly valued in 2017–18 and have thereafter faced difficulties in gaining back their price levels and possibly going above their earlier highs.

Of the privacy coins with a longer history, it seems Horizen and Monero have been the best at sustaining their value. In the earlier period, Verge really showed impressive price movement; however, it lost this in the decline period after the 2017–18 peak. At the moment, there exist, e.g., Pirate Chain, which is similar to Verge in its valuation development, but it is too early to tell how this privacy coin shall develop. The price peak of 2020–2021 in cryptos will be followed again by a depressive price period, and it is unclear what currencies will hold and provide the next boom market. This research has clearly showed that many cryptocurrencies from the boom period will not gain the price level they reached earlier, and they will struggle to gain valuation in future boom periods. Of course, as it is evident that privacy will become a very important feature in the future, it is difficult to say how Bitcoin or Ethereum will survive in this environment.

As for further research in the privacy coin area, it would be interesting to examine how the expansion of privacy coins offered in different exchanges has an effect on their pricing. Even many of the tokens analyzed in this study, being more established privacy coins, are not that easy to purchase or acquire. They are only sold in certain exchanges. There must be price dynamics as these coins become more known and more widely available. In this respect, many cryptocurrencies have something to learn from Bitcoin as it is so widely available everywhere.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Research data set is available from author by email request.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A

Cryptocurrencies and Their Respective Data Starting Point

AION (2017-10-18), ARK (2017-03-22), ARRR (2019-09-18), BAT (2020-04-21), BCN (2014-09-17), BTC (2014-09-17), CVC (2017-07-17), Dash (2014-09-17), IOTX (2018-05-25), KMD (2017-02-05), NAV (2014-09-17), NIX (2018-07-28), PART (2017-07-20), PIVX (2016-02-13), QRL (2017-06-10), SKY (2017-04-17), STORJ (2020-11-12), WAN (2018-03-23), XDN (2014-09-17), XMR (2014-09-17), XSN (2018-04-13), XVG (2014-10-25), ZEC (2016-10-29), ZEN (2017-06-01)

References

- Baydakova, Anna. 2021. Russian public officials banned from holding cryptocurrency. Coindesk. January 25. Available online: https://www.coindesk.com/russian-public-officials-banned-crypto-holdings (accessed on 22 June 2021).

- Blockchain.com. 2021. Cost Per Transaction. Available online: https://www.blockchain.com/charts/cost-per-transaction (accessed on 23 June 2021).

- Burnham, Terence C. 2020. Stephanie Kelton, The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy: PublicAffairs, New York. Journal of Bioeconomics, 1–7. [Google Scholar] [CrossRef]

- Böhme, R., N. Christin, B. Edelman, and T. Moore. 2015. Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef] [Green Version]

- Casino, Fran, Thomas K. Dasaklis, and Constantinos Patsakis. 2019. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telematics and Informatics 36: 55–81. [Google Scholar] [CrossRef]

- Chaum, David. 1993. Numbers can be a better form of cash than paper. In Computer Security and Industrial Cryptography. Edited by Bart Preneel, René Govaerts and Joos Vandewalle. Lecture Notes in Computer Science. Berlin/Heidelberg: Springer, vol. 741. [Google Scholar]

- Coindesk. 2021. Media Platform for the Cryptocurrencies and Digital Assets. June 18. Available online: https://www.coindesk.com/ (accessed on 18 June 2021).

- CoinMarketCap. 2021. Today’s Cryptocurrency Prices by Market Cap. June 21. Available online: https://coinmarketcap.com/ (accessed on 21 June 2021).

- Eldefrawy, Karim, Ashish Gehani, and Alexandre Matton. 2019. Longitudinal Analysis of Misuse of Bitcoin. In Applied Cryptography and Network Security. Edited by Robert Deng, Valérie Gauthier-Umaña, Martin Ochoa and Moti Yung. ACNS 2019. Lecture Notes in Computer Science. Cham: Springer, vol. 11464. [Google Scholar] [CrossRef]

- Giudici, Paolo, and Paolo Pagnottoni. 2019. High frequency price change spillovers in Bitcoin markets. Risks 7: 111. [Google Scholar] [CrossRef] [Green Version]

- Giudici, Paolo, and Paolo Pagnottoni. 2020. Vector error correction models to measure connectedness of Bitcoin exchange markets. Appl Stochastic Models Bus Indian 36: 95–109. [Google Scholar] [CrossRef] [Green Version]

- Giudici, Paolo, Paolo Pagnottoni, and Gloria Polinesi. 2020. Network models to enhance automated cryptocurrency portfolio management. Frontiers in Artificial Intelligence 3: 22. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Giudici, Paolo, T. Leach, and Paolo Pagnottoni. 2021. Libra or Librae? Basket based stablecoins to mitigate foreign exchange volatility spillovers. Finance Research Letters. in press, corrected proof. [Google Scholar] [CrossRef]

- Handagama, Sandali. 2021. Egyptians are buying Bitcoin despite prohibitive new banking laws. Coindesk. March 5. Available online: https://www.coindesk.com/egyptians-are-buying-bitcoin-despite-prohibitive-new-banking-laws (accessed on 22 June 2021).

- Harvey, John, and Ines Branco-Illodo. 2020. Why Cryptocurrencies want privacy: A review of political motivations and branding expressed in “Privacy Coin” whitepapers. Journal of Political Marketing 19: 107–36. [Google Scholar] [CrossRef]

- Heavens, Andrew. 2021. China bans financial, payment institutions from cryptocurrency business. Reuters. May 18. Available online: https://www.reuters.com/technology/chinese-financial-payment-bodies-barred-cryptocurrency-business-2021-05-18/ (accessed on 22 June 2021).

- Herskind, Lasse, Panagiota Katsikouli, and Nicola Dragoni. 2020. Privacy and Cryptocurrencies—A Systematic Literature Review. IEEE Access 8: 54044–59. [Google Scholar] [CrossRef]

- Hilmola, Olli-Pekka. 2014. Labile Fiat Currencies: Sketch of Future Alternatives. In Innovation in Financial Services: A Dual Ambiguity. Edited by Anne-Laure Mention and Marko Torkkeli. Newcastle upon Tyne: Cambridge Scholars Publishing, pp. 12–31. [Google Scholar]

- Hwang, Min-Shiang, Iuon-Chang Lin, and Li-Hua Li. 2001. A simple micro-payment scheme. The Journal of Systems and Software 55: 221–29. [Google Scholar] [CrossRef]

- Iansiti, Marco, and Karim R. Lakhani. 2017. The truth about blockchain. Harvard Business Review 95: 118–27. [Google Scholar]

- Kharif, Olga. 2020. Bitcoin whales’ ownership concentration is rising during rally. Bloomberg News. November 18. Available online: https://www.bloomberg.com/news/articles/2020-11-18/bitcoin-whales-ownership-concentration-is-rising-during-rally (accessed on 24 June 2021).

- Kim, Cynthia. 2018. South Korea to ban cryptocurrency traders from using anonymous bank accounts. Reuters. January 23. Available online: https://www.reuters.com/article/us-southkorea-bitcoin-idUKKBN1FC069 (accessed on 22 June 2021).

- Orcutt, Mike. 2017. Criminals thought Bitcoin was the perfect hiding place, but they thought wrong. MIT Technology Review. September 11. Available online: https://www.technologyreview.com/2017/09/11/149211/criminals-thought-bitcoin-was-the-perfect-hiding-place-they-thought-wrong/ (accessed on 24 June 2021).

- Pagnottoni, Paulo. 2019. Neural network models for Bitcoin option pricing. Frontiers in Artificial Intelligence 2: 5. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Pagnottoni, Paulo, and Thomas Dimpfl. 2019. Price discovery on Bitcoin markets. Digital Finance 1: 139–61. [Google Scholar] [CrossRef] [Green Version]

- Rearick. 2021. Pirate Chain (ARRR) Price Predictions: Where Will the ARRR Crypto Go After Sky-High Gains? InvestorsPlace. April 23. Available online: https://investorplace.com/2021/04/pirate-chain-arrr-price-predictions-where-will-the-arrr-crypto-go-after-sky-high-gains/ (accessed on 24 June 2021).

- Resta, Marina, Paulo Pagnottoni, and Maria Elena De Giuli. 2020. Technical analysis on the Bitcoin market: Trading opportunities or investors’ pitfall? Risks 8: 44. [Google Scholar] [CrossRef]

- Shoffman, Marc. 2021. Cryptocurrency novice got £185,000 Bitcoin in his account by MISTAKE. The Sun. May 21. Available online: https://www.thesun.co.uk/money/15027543/cryptocurrency-novice-got-185000-bitcoin-by-mistake/ (accessed on 24 June 2021).

- Schilling, Linda, and Harald Uhlig. 2019. Some simple bitcoin economics. Journal of Monetary Economics 106: 16–26. [Google Scholar] [CrossRef]

- Szalay, Eva. 2021. Goldman Sachs executes its first bitcoin derivatives trades. Financial Times. May 7. Available online: https://www.ft.com/content/5ec1d0aa-7992-4fb8-8011-9d7f7b44faac (accessed on 16 July 2021).

- Tsiulin, Sergey, Kristian Hegner Reinau, Olli-Pekka Hilmola, and Nikolay Goryaev. 2020. Blockchain in maritime port management: Defining key conceptual framework. Review of International Business and Strategy 30: 201–24. [Google Scholar] [CrossRef]

- Urquhart, Andrew. 2016. The inefficiency of Bitcoin. Economics Letters 148: 80–82. [Google Scholar] [CrossRef]

- Watorek, Marcin, Stanislaw Drożdż, Jaroslaw Kwapień, Ludvico Minati, Pawel Oświęcimka, and Marek Stanuszek. 2021. Multiscale characteristics of the emerging global cryptocurrency market. Physics Reports 901: 1–82. [Google Scholar] [CrossRef]

- Wayback Machine. 2021. Internet Archive. Available online: https://archive.org/web/ (accessed on 21 June 2021).

- Wright, Marie. 1997. Authenticating electronic cash transactions. Computer Fraud & Security 4: 10–13. [Google Scholar] [CrossRef]

- Yahoo Finance. 2021. All screeners/Matching cryptocurrencies. June 18. Available online: https://finance.yahoo.com/cryptocurrencies/ (accessed on 18 June 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).