Improvement of Service Quality in the Supply Chain of Commercial Banks—A Case Study in Vietnam

Abstract

:1. Introduction

2. Literature Review

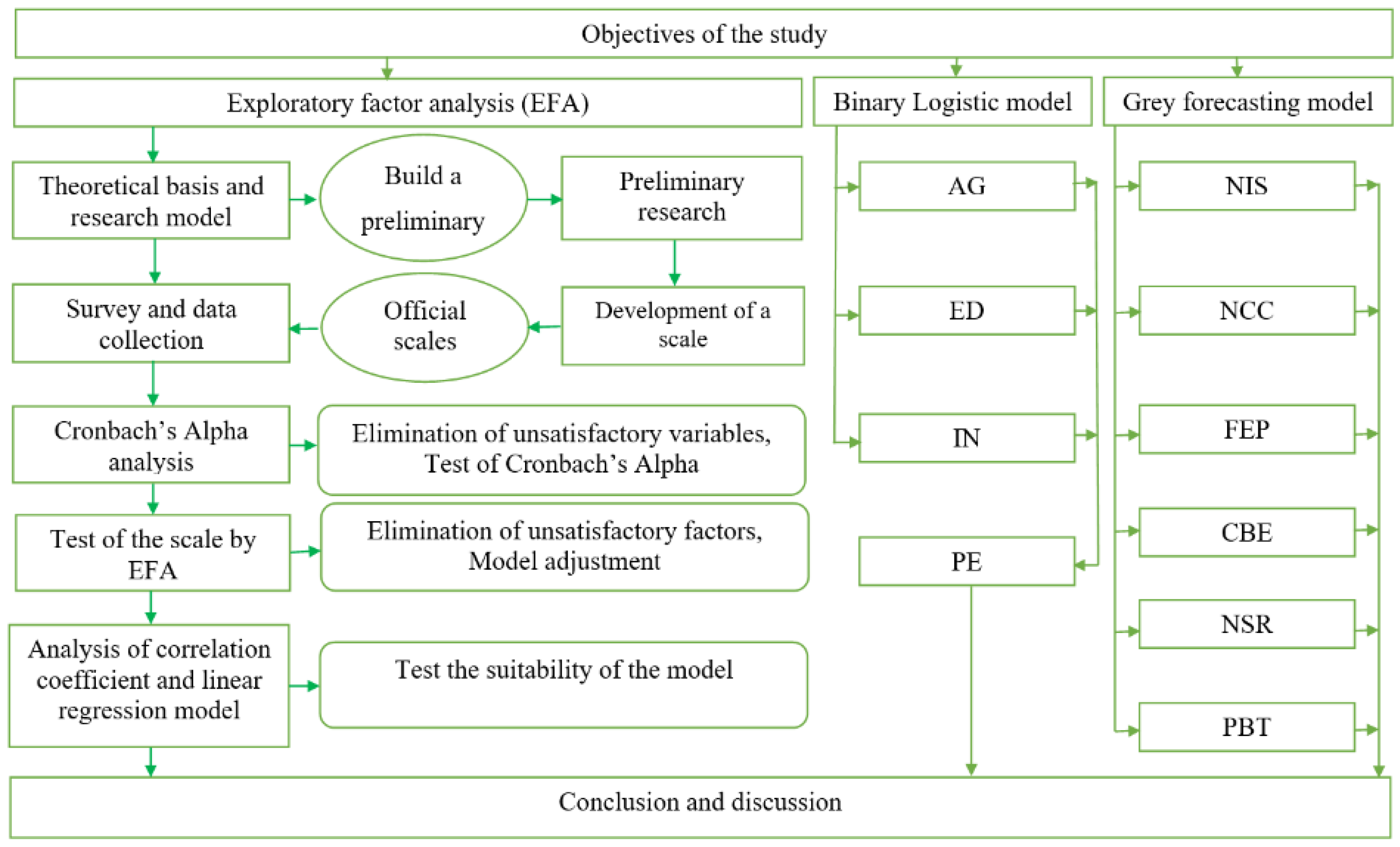

3. Research Development and Methods

3.1. Qualitative Research

3.2. Exploratory Factor Analysis

3.2.1. Development of a Scale

3.2.2. Sampling Method

3.2.3. Data Analysis and Processing Methods

3.3. Binary Logistic Model

3.4. Grey Forecasting Model

3.5. Evaluation of Volatility Forecasts

4. Results

4.1. Results and Analysis from the Exploratory Factor Analysis Method

4.1.1. Evaluation of Reliability of the Scale Using Cronbach’s Alpha

4.1.2. Exploratory Factor Analysis (EFA) of Independent Variables

4.1.3. Exploratory Factor Analysis (EFA) of Dependent Variables

4.1.4. Correlation Analysis

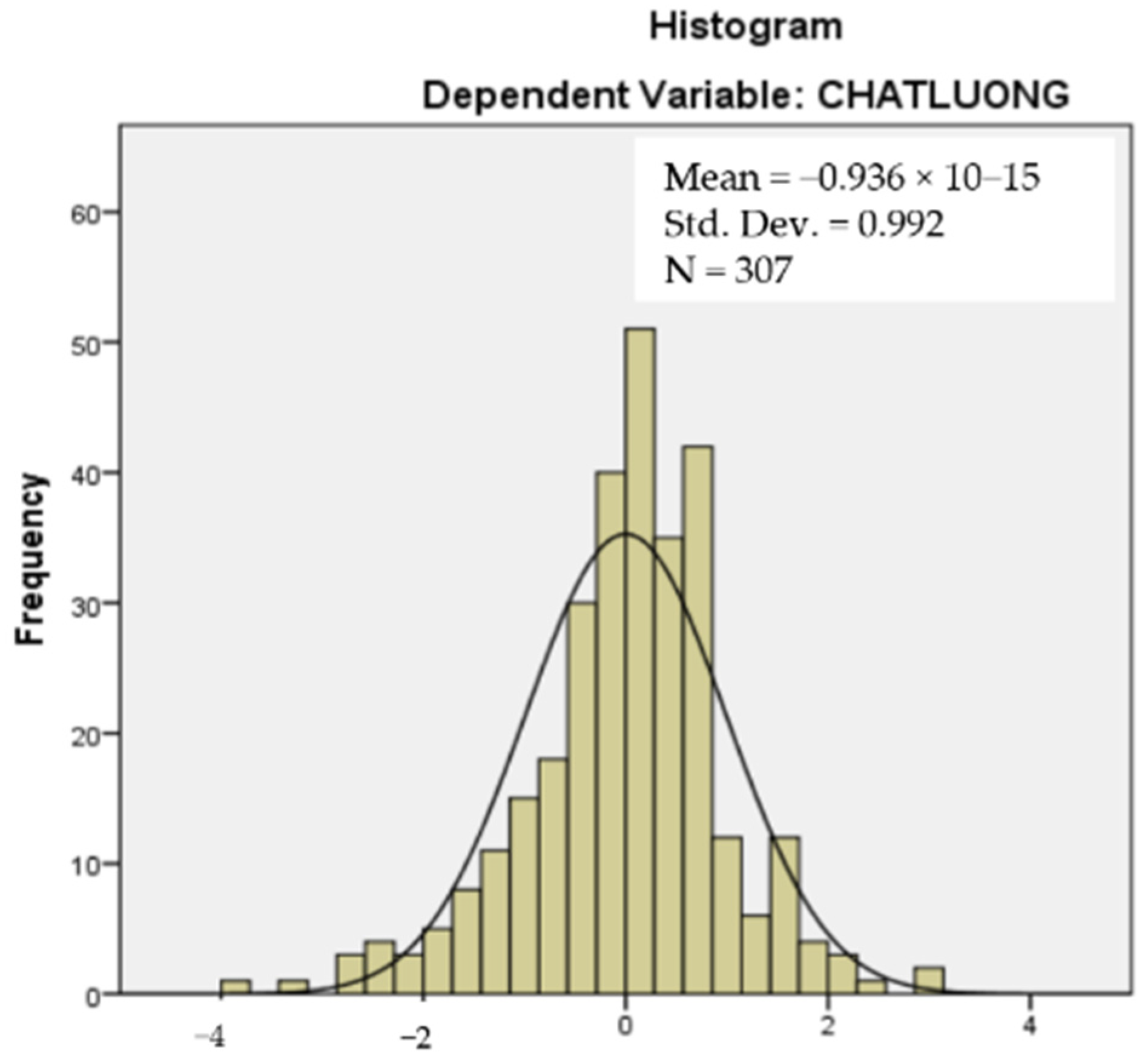

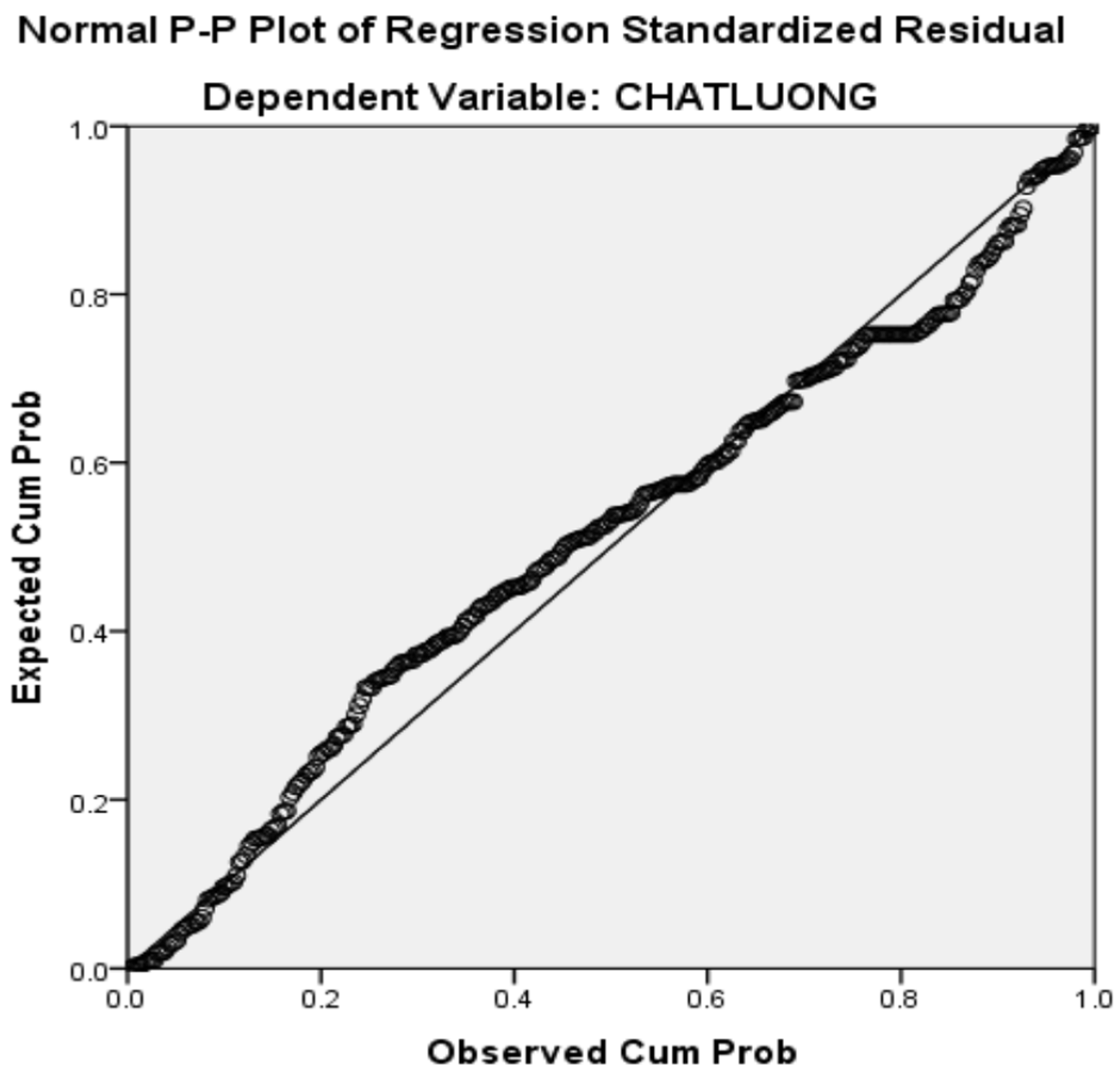

4.1.5. Linear Regression Analysis

- Y: Quality of savings deposit service

- X1: Customer service

- X2: Reliability

- X3: Responsiveness

- X4: Interest rate

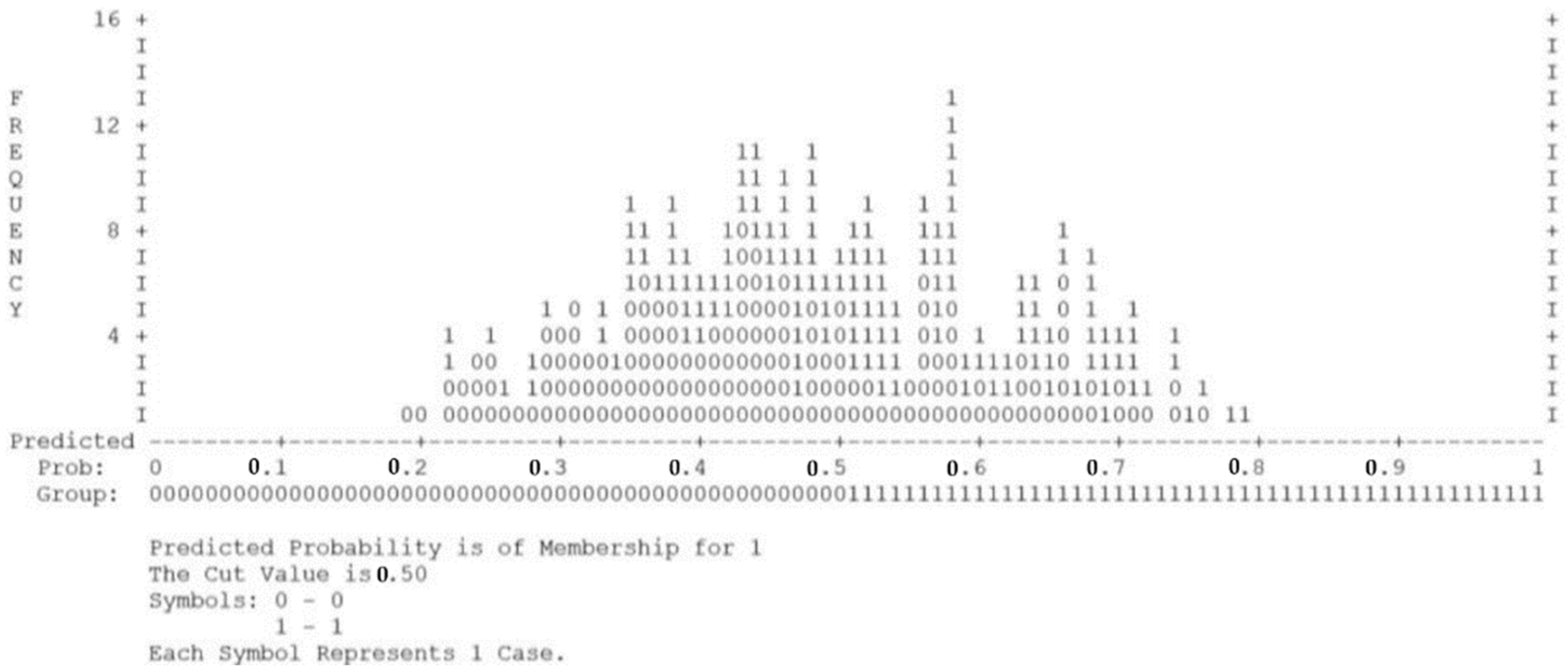

4.2. Results of Binary Logistic Model

4.3. Results and Analysis of the GM (1,1) Model

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmed, Mobin. 2017. Service Quality Measurement regarding Banking Sector. International Journal of Business and Social Science 8: 116–27. [Google Scholar]

- Al Nageim, Hassan, Ravindra Nagar, and Paulo Lisboa. 2007. Comparison of neural network and binary logistic regression methods in conceptual design of tall steel buildings. Construction Innovation 7: 240–53. [Google Scholar] [CrossRef]

- Anand, Vijay, and M. Selvaraj. 2013. Evaluation of service quality and its impact on customer satisfaction in Indian banking sector-A comparative study using Servperf. Life Science Journal 10: 3267–74. [Google Scholar]

- Araveeporn, Autcha. 2021. The Higher-Order of Adaptive Lasso and Elastic Net Methods for Classification on High Dimensional Data. Mathematics 9: 1091. [Google Scholar] [CrossRef]

- Bente, Corneliu. 2012. Concepts of Service Quality Measurement in Banks. Oradea: University of Oradea, pp. 889–94. [Google Scholar]

- Chandra, Mahesh, and James P. Neelankavil. 2008. Product development and innovation for developing countries: Potential and challenges. Journal of Management Development 27: 1017–25. [Google Scholar] [CrossRef]

- Chen, Yuan Chen, Hsien Chueh Peter Yang, Cheng Wu Chen, and Tsung Hao Chen. 2008. Diagnosing and revising logistic regression models: Effect on internal solitary wave propagation. Engineering Computations 25: 121–39. [Google Scholar] [CrossRef]

- Cristian, Negrutiu, Cristinel Vasiliu, and Calcedonia Enache. 2020. Sustainable Entrepreneurship in the Transport and Retail Supply Chain Sector. Risk Financial Manag 13: 267. [Google Scholar] [CrossRef]

- De Gaetano, Davide. 2018. Forecast Combinations for Structural Breaks in Volatility: Evidence from BRICS Countries. Journal of Risk Financial Manage 11: 64. [Google Scholar] [CrossRef] [Green Version]

- Durst, Susanne, and Wolfgang Gerstlberger. 2021. Financing Responsible Small- and Medium-Sized Enterprises: An International Overview of Policies and Support Programmes. Journal Risk Financial Manage 14: 10. [Google Scholar] [CrossRef]

- Eboli, Laura, and Gabriella Mazzulla. 2009. An ordinal logistic regression model for analysing airport passenger satisfaction. EuroMed Journal of Business 4: 40–57. [Google Scholar] [CrossRef]

- Financial Report. 2021. Available online: https://www.bidv.com.vn/ (accessed on 5 June 2021).

- Gerbing, W. David, and James C. Anderson. 1988. An Updated Paradigm for Scale Development Incorporating Unidimensionality and Its Assessment. Journal of Marketing Research 25: 186–92. [Google Scholar] [CrossRef]

- Hair, F. Joseph, Rolph E. Anderson, Ronald L. Tatham, and William Cormack Black. 1998. Multivariate Data Analysis, 5th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Hair, F. Joseph, William Cormack Black, Barry J. Babin, and Rolph E. Anderson. 2009. Multivariate Data Analysis. Upper Saddle River: Prentice Hall. [Google Scholar]

- Jabnoun, Naceur, and Hussein A. Hassan Al-Tamimi. 2003. Measuring perceived service quality at UAE commercial banks. International Journal of Quality & Reliability Management 20: 458–72. [Google Scholar] [CrossRef]

- Kaiser, F. Henry. 1974. An index of factorial simplicity. Psychometrika 39: 31–36. [Google Scholar] [CrossRef]

- Karimi, Tooraj, and Arvin Hojati. 2020. Designing a medical rule model system by using rough–Grey modeling. Grey Systems: Theory and Application 10: 513–27. [Google Scholar] [CrossRef]

- Ke, Zhang. 2013. Random simulation method for accuracy test of grey prediction model. Grey Systems: Theory and Application 3: 26–34. [Google Scholar] [CrossRef]

- Lee, Chi Chuan, Chien Chiang Lee, and Yizhong Wu. 2021. The impact of COVID-19 pandemic on hospitality stock returns in China. International Journal of Finance & Economics, 1–14. [Google Scholar] [CrossRef]

- Li, Shuliang, Ke Gong, Bo Zeng, Wenhao Zhou, Zhouyi Zhang, Aixing Li, and Zhang Li. 2021. Development of the GM(1,1) model with a trapezoidal possibility function and its application. Grey Systems: Theory and Application. [Google Scholar] [CrossRef]

- Li, Xiaoning, Xinbo Liao, Xuerui Tan, and Haijing Wang. 2014. Using grey relational analysis to evaluate resource configuration and service ability for hospital on public private partnership model in China. Grey Systems: Theory and Application 4: 260–72. [Google Scholar] [CrossRef]

- Nguyen, Dinh Tho. 2011. Scientific Research Methods in Business. Hanoi: Social Labor Publication. [Google Scholar]

- Nguyen, Han Khanh. 2020. Combining DEA and ARIMA Models for Partner Selection in the Supply Chain of Vietnam’s Construction Industry. Mathematics 8: 866. [Google Scholar] [CrossRef]

- Nguyen, Han Khanh. 2021. Applications Optimal Math Model to Solve Difficult Problems for Businesses Producing and Processing Agricultural Products in Vietnam. Axioms 10: 90. [Google Scholar] [CrossRef]

- Nunnally, C. Jum, and Ira H. Bernstein. 1994. Psychometric Theory, 3rd ed. New York: McGraw-Hill. [Google Scholar]

- Oguz, Fatih, and Shimelis Assefa. 2014. Faculty members’ perceptions towards institutional repository at a medium-sized university: Application of a binary logistic regression model. Library Review 63: 189–202. [Google Scholar] [CrossRef]

- Omondi, Ochieng Peter. 2019. Resource-based theory of college football team competitiveness. International Journal of Organizational Analysis 27: 834–56. [Google Scholar] [CrossRef]

- Omondi, Ochieng Peter. 2021. Financial performance of the United Kingdom’s national non-profit sport federations: A binary logistic regression approach. Managerial Finance 47: 868–86. [Google Scholar] [CrossRef]

- Parasuraman, Valarie, Zeithaml Zeithaml, and Leonard Berry. 1985. A Conceptual Model of Service Quality and its Implication for Future Research (SERVQUAL). Journal of Marketing 49: 41–50. [Google Scholar] [CrossRef]

- Shetty, H. Shilpa, and Theresa Nithila Vincent. 2021. The Role of Board Independence and Ownership Structure in Improving the Efficacy of Corporate Financial Distress Prediction Model: Evidence from India. Journal Risk Financial Manage 14: 333. [Google Scholar] [CrossRef]

- Silvestro, Rhian, and Paola Lustrato. 2014. Integrating financial and physical supply chains: The role of banks in enabling supply chain integration. International Journal of Operations & Production Management 34: 298–324. [Google Scholar] [CrossRef]

- Thu, Hoa. 2020. Average Life Expectancy of Vietnam through the Results of the 2019 Population and Housing Census–Issues. Available online: http://consosukien.vn/ (accessed on 5 June 2021).

- Uddin, Md Rasel, Akash Saha, Md Julfikar Ali, and Md Jewel Rana. 2016. Determinants of Service Quality Factors towards the Public Specialized Banks of Bangladesh, Global Journal of Management and Business Research: A Administration and Management. Global Journals 6: 42–50. [Google Scholar]

- Wang, Chia Nan, Han Khanh Nguyen, and Ruei Yuan Liao. 2017. Partner Selection in Supply Chain of Vietnam’s Textile and Apparel Industry: The Application of a Hybrid DEA and GM (1,1) Approach. Mathematical Problems in Engineering 2017: 1–16. [Google Scholar] [CrossRef] [Green Version]

- Wang, Chia Nan, Tien Muoi Le, Han Khanh Nguyen, and Hong Ngoc Nguyen. 2019. Using the Optimization Algorithm to Evaluate the Energetic Industry: A Case Study in Thailand. Processes 7: 87. [Google Scholar] [CrossRef] [Green Version]

- Wood, H. Emma. 2006. The internal predictors of business performance in small firms: A logistic regression analysis. Journal of Small Business and Enterprise Development 13: 441–53. [Google Scholar] [CrossRef]

- Xuemei, Li, Yun Cao, Junjie Wang, Yaoguo Dang, and Yin Kedong. 2019. A summary of grey forecasting and relational models and its applications in marine economics and management. Marine Economics and Management 2: 87–113. [Google Scholar] [CrossRef]

- Zhang, Dayong, Min Hua, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef] [PubMed]

| Year | NIC | NCC | FEP | CBE | NSR | PBT |

|---|---|---|---|---|---|---|

| 2017 | 234,649 | 3597 | 17,662 | 17,828 | 53,553,400 | 463,200 |

| 2018 | 270,076 | 3967 | 19,200 | 17,710 | 57,613,115 | 541,500 |

| 2019 | 284,260 | 4119 | 12,701 | 16,451 | 74,804,002 | 618,450 |

| 2020 | 299,837 | 5606 | 20,984 | 18,960 | 99,434,200 | 623,220 |

| Factors | Encode | Cronbach’s Alpha |

|---|---|---|

| Reliability | REL | 0.809 |

| Responsiveness | RES | 0.760 |

| Service capacity | SER | 0.760 |

| Empathy | EMP | 0.732 |

| Tangibles | TAN | 0.797 |

| Interest rate | INT | 0.744 |

| Customer service | CUS | 0.768 |

| Quality | QUA | 0.840 |

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.926 | |

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 2859.275 |

| df | 300 | |

| Sig. | 0.000 | |

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | |||

| 1 | 8.752 | 35.007 | 35.007 | 8.752 | 35.007 | 35.007 | 3.437 | 13.749 | 13.749 |

| 2 | 1.678 | 6.713 | 41.720 | 1.678 | 6.713 | 41.720 | 2.891 | 11.563 | 25.312 |

| 3 | 1.234 | 4.937 | 46.657 | 1.234 | 4.937 | 46.657 | 2.807 | 11.227 | 36.539 |

| 4 | 1.103 | 4.410 | 51.067 | 1.103 | 4.410 | 51.067 | 2.739 | 10.957 | 47.496 |

| 5 | 1.087 | 4.346 | 55.414 | 1.087 | 4.346 | 55.414 | 1.979 | 7.918 | 55.414 |

| 6 | 0.888 | 3.550 | 58.964 | ||||||

| 7 | 0.813 | 3.251 | 62.215 | ||||||

| 8 | 0.787 | 3.148 | 65.363 | ||||||

| 9 | 0.734 | 2.934 | 68.297 | ||||||

| 10 | 0.706 | 2.826 | 71.123 | ||||||

| 11 | 0.687 | 2.746 | 73.869 | ||||||

| 12 | 0.676 | 2.705 | 76.574 | ||||||

| 13 | 0.631 | 2.525 | 79.099 | ||||||

| 14 | 0.570 | 2.278 | 81.378 | ||||||

| 15 | 0.557 | 2.227 | 83.604 | ||||||

| 16 | 0.541 | 2.163 | 85.767 | ||||||

| 17 | 0.517 | 2.070 | 87.837 | ||||||

| 18 | 0.476 | 1.904 | 89.741 | ||||||

| 19 | 0.441 | 1.766 | 91.507 | ||||||

| 20 | 0.409 | 1.637 | 93.144 | ||||||

| 21 | 0.383 | 1.532 | 94.675 | ||||||

| 22 | 0.371 | 1.485 | 96.161 | ||||||

| 23 | 0.365 | 1.458 | 97.619 | ||||||

| 24 | 0.305 | 1.221 | 98.840 | ||||||

| 25 | 0.290 | 1.160 | 100.000 | ||||||

| Component | |||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| CS1 | 0.642 | ||||

| CS3 | 0.641 | ||||

| CS2 | 0.616 | ||||

| CS4 | 0.574 | ||||

| CS5 | 0.548 | ||||

| PT3 | 0.546 | ||||

| PT1 | 0.542 | ||||

| TC5 | 0.654 | ||||

| TC6 | 0.647 | ||||

| TC4 | 0.630 | ||||

| TC3 | 0.629 | ||||

| TC2 | 0.553 | ||||

| DU1 | 0.719 | ||||

| DU2 | 0.652 | ||||

| DU3 | 0.633 | ||||

| DU4 | 0.548 | ||||

| DU5 | 0.547 | ||||

| LS2 | 0.811 | ||||

| LS1 | 0.591 | ||||

| LS3 | 0.564 | ||||

| PT2 | 0.532 | ||||

| LS4 | 0.530 | ||||

| PT5 | 0.756 | ||||

| PT6 | 0.601 | ||||

| PT7 | 0.524 | ||||

| KMO and Bartlett’s Test | ||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.879 | |

| Bartlett’s Test of Sphericity | Approximately Chi-Square | 688.849 |

| df | 21 | |

| Sig. | 0.000 | |

| Total Variance Explained | ||||||

|---|---|---|---|---|---|---|

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 3.585 | 51.212 | 51.212 | 3.585 | 51.212 | 51.212 |

| 2 | 0.782 | 11.175 | 62.386 | |||

| 3 | 0.654 | 9.337 | 71.723 | |||

| 4 | 0.614 | 8.774 | 80.497 | |||

| 5 | 0.505 | 7.218 | 87.715 | |||

| 6 | 0.494 | 7.055 | 94.769 | |||

| 7 | 0.366 | 5.231 | 100.000 | |||

| QUA | CUS | REL | RES | INT | TAN | ||

|---|---|---|---|---|---|---|---|

| QUA | Pearson Correlation | 1 | 0.551 ** | 0.548 ** | 0.517 ** | 0.511 ** | 0.371 ** |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 307 | 307 | 307 | 307 | 307 | 307 | |

| CUS | Pearson Correlation | 0.551 ** | 1 | 0.590 ** | 0.573 ** | 0.647 ** | 0.578 ** |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 307 | 307 | 307 | 307 | 307 | 307 | |

| REL | Pearson Correlation | 0.548 ** | 0.590 ** | 1 | 0.630 ** | 0.567 ** | 0.489 ** |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 307 | 307 | 307 | 307 | 307 | 307 | |

| RES | Pearson Correlation | 0.517 ** | 0.573 ** | 0.630 ** | 1 | 0.487 ** | 0.479 ** |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 307 | 307 | 307 | 307 | 307 | 307 | |

| INT | Pearson Correlation | 0.511 ** | 0.647 ** | 0.567 ** | 0.487 ** | 1 | 0.574 ** |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 307 | 307 | 307 | 307 | 307 | 307 | |

| TAN | Pearson Correlation | 0.371 ** | 0.578 ** | 0.489 ** | 0.479 ** | 0.574 ** | 1 |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 307 | 307 | 307 | 307 | 307 | 307 | |

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

|---|---|---|---|---|---|

| 1 | 0.644 | 0.414 | 0.405 | 0.43199 | 1.695 |

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 39.763 | 5 | 7.953 | 42.615 | 0.000 |

| Residual | 56.172 | 301 | 0.187 | |||

| Total | 95.935 | 306 | ||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Beta | B | |||||

| 1 | (Constant) | 0.773 | 0.229 | 3.372 | 0.001 | |||

| CUS | 0.255 | 0.072 | 0.234 | 3.547 | 0.000 | 0.448 | 2.234 | |

| REL | 0.219 | 0.062 | 0.222 | 3.518 | 0.001 | 0.489 | 2.044 | |

| RES | 0.195 | 0.064 | 0.186 | 3.074 | 0.002 | 0.530 | 1.888 | |

| INT | 0.184 | 0.064 | 0.180 | 2.859 | 0.005 | 0.489 | 2.046 | |

| TAN | −0.066 | 0.059 | −0.065 | −1.121 | 0.263 | 0.576 | 1.737 | |

| Unweighted Cases a | N | Percent | |

|---|---|---|---|

| Selected Cases | Included in analysis | 307 | 100.0 |

| Missing cases | 0 | 0.0 | |

| Total | 307 | 100.0 | |

| Unselected cases | 0 | 0.0 | |

| Total | 307 | 100.0 | |

| Chi-Square | df | Sig. | ||

|---|---|---|---|---|

| Step 1 | Step | 22.807 | 3 | 0.000 |

| Block | 22.807 | 3 | 0.000 | |

| Model | 22.807 | 3 | 0.000 | |

| Step | −2 Log likelihood | Cox & Snell R Square | Nagelkerke R Square |

|---|---|---|---|

| 1 | 402.235 a | 0.072 | 0.096 |

| Observed | Predicted | ||||

|---|---|---|---|---|---|

| PM | Percentage Correct | ||||

| 0 | 1 | ||||

| Step 1 | PM | 0 | 111 | 49 | 69.4 |

| 1 | 65 | 82 | 55.8 | ||

| Overall Percentage | 62.9 | ||||

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

|---|---|---|---|---|---|---|---|

| Step 1 a | AG | 0.033 | 0.011 | 9.526 | 1 | 0.002 | 1.034 |

| ED | −0.209 | 0.061 | 11.742 | 1 | 0.001 | 0.812 | |

| IN | −0.012 | 0.010 | 1.346 | 1 | 0.246 | 0.988 | |

| Constant | 2.172 | 0.989 | 4.825 | 1 | 0.028 | 8.779 | |

| YEAR | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|

| NIS | 234,649 | 270,076 | 284,260 | 299,837 |

| YEAR | NIS | NCC | FEP | CBE | NSR | PBT |

|---|---|---|---|---|---|---|

| 2021 | 315,749.84 | 6536.69 | 19,780.00 | 19,039.60 | 128,997,134.58 | 678,829.58 |

| 2022 | 332,700.87 | 7889.57 | 20,971.11 | 19,748.94 | 169,534,757.96 | 726,120.81 |

| 2023 | 350,561.92 | 9522.46 | 22,233.95 | 20,484.71 | 222,811,415.55 | 776,706.61 |

| 2024 | 369,381.85 | 11,493.29 | 23,572.83 | 21,247.88 | 292,830,375.88 | 830,816.52 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, H.-K.; Nguyen, T.-D. Improvement of Service Quality in the Supply Chain of Commercial Banks—A Case Study in Vietnam. J. Risk Financial Manag. 2021, 14, 357. https://doi.org/10.3390/jrfm14080357

Nguyen H-K, Nguyen T-D. Improvement of Service Quality in the Supply Chain of Commercial Banks—A Case Study in Vietnam. Journal of Risk and Financial Management. 2021; 14(8):357. https://doi.org/10.3390/jrfm14080357

Chicago/Turabian StyleNguyen, Han-Khanh, and Thuy-Dung Nguyen. 2021. "Improvement of Service Quality in the Supply Chain of Commercial Banks—A Case Study in Vietnam" Journal of Risk and Financial Management 14, no. 8: 357. https://doi.org/10.3390/jrfm14080357

APA StyleNguyen, H.-K., & Nguyen, T.-D. (2021). Improvement of Service Quality in the Supply Chain of Commercial Banks—A Case Study in Vietnam. Journal of Risk and Financial Management, 14(8), 357. https://doi.org/10.3390/jrfm14080357