Solvency Regulation—An Assessment of Basel III for Banks and of Planned Solvency III for Insurers

Abstract

1. Introduction

2. Literature Review

2.1. Solvency Regulation of Banks

2.2. Solvency Regulation of Insurers

3. The Divisions Optimize Solvency (Period 0)

3.1. The Bank’s Investment Division Selects the Optimal Solvency Level

3.2. The Insurer’s Investment and Underwriting Division Selects the Optimal Solvency Level

4. The Division Adjusts Solvency to Exogenous Shocks (Period 1)

4.1. Adjustment by Banks

- The extent to which the (negative) effect of an increase in returns on the capital market (which makes a positive value of the bank more likely) on the rate of interest that must be paid on deposits 6 is strengthened by a higher solvency level , as indicated by ;

- The extent to which the rate of interest that must be paid on deposits decreases in response to a higher level of solvency 7, somewhat conditioned by the increase in that rate in response to an increase in returns on the capital market and is diminished by a large difference between that rate and returns achievable on the capital market, as indicated by (1/) ();

- The extent to which the rate of interest that must be paid on deposits decreases in response to a higher level of solvency , conditioned by the fact that an increase in expected returns on the capital market makes a positive value of the bank more likely, so it reduces the need for solvency capital, resulting in less additional solvency capital relative to its initial value, as indicated by ;

- The extent to which the need for additional solvency capital for a higher level of solvency is reduced due to higher expected returns on the capital market (which makes a positive value of the bank more likely), relative to the initial value of , magnified by the difference between achievable returns and the rate of interest that must be paid for deposits, as indicated by the last term, .

- The extent to which the (positive) effect of an increase in volatility on the capital market on the rate of interest that must be paid on deposits 8 is mitigated by a higher solvency level , as indicated by ;

- The extent to which the rate of interest that must be paid on deposits decreases in response to a higher level of solvency , magnified by the increase in that rate in response to an increase in volatility on the capital market , and is diminished by a large difference between that rate and returns achievable on the capital market, as indicated by (1/)();

- The extent to which the rate of interest that must be paid on deposits decreases in response to a higher level of solvency , conditioned by the fact that an increase in expected returns on the capital market makes a positive value of the bank more likely, so it reduces the need for additional solvency capital relative to its initial value, as indicated by ;

- The extent to which the need for additional solvency capital for a higher level of solvency is reduced due to higher expected returns on the capital market, which makes a positive value of the bank more likely, relative to the initial value of , magnified by the difference between achievable returns and the rate of interest that must be paid for deposits, as indicated by (.

4.2. Adjustment by Insurers

- The extent to which the negative relationship between expected returns on the capital market and premium income is mitigated by a higher solvency level, conditioned by the initial value of premiums, as indicated by = ;

- The extent to which the negative relationship between expected returns on the capital market and premium income is neutralized by the positive impact of solvency on premium income , strongly conditioned by its initial value, as indicated by ;

- The extent to which the reduced need for solvency capital thanks to high expected returns on the capital market is reinforced by a high solvency level, conditioned by the initial value of capital and the amount of premium income available for investment indicated by ;

- The extent to which the need for solvency capital is reduced thanks to high expected returns on the capital market , combined with the positive relationship between the solvency level to be attained and the solvency capital, conditioned by the initial value of the capital (strongly) and the amount of premium income available for investment, as indicated by ;

- The extent to which the negative relationship between premium income and expected returns on the capital market is magnified by losses but is conditioned by a high initial value of solvency capital as well as (strongly) the amount of premium income , in conjunction with the need for additional capital for attaining a higher degree of solvency, as indicated by .

- The extent to which the positive relationship between volatility of returns on the capital market and premium income is reinforced by a higher solvency level, conditioned by the initial value of premiums, is indicated by = .

- The extent to which the positive relationship between expected returns on the capital market and premium income combines with the positive impact of solvency on premium income , strongly conditioned by its initial value, is indicated by .

- The extent to which the increased need for solvency capital due to high volatility of returns on the capital market is reinforced by a targeted high solvency level, conditioned by the initial value of capital and the amount of premium income available for investment, is indicated by .

- The extent to which the increased need for solvency capital due to high volatility of returns on the capital market combines with the positive relationship between the solvency level to be attained and solvency capital, conditioned by the initial value of capital (strongly) and the amount of premium income available for investment, is indicated by .

- The extent to which the positive relationship between premium income and volatility of returns on the capital market is magnified by losses but conditioned by a high initial value of the solvency capital, as well as (strongly) the amount of premium income in conjunction with the need for additional capital for attaining a higher degree of solvency, is indicated by .

5. The Division Derives an Endogenous Perceived Efficiency Frontier (Period 2)

5.1. The Endogenous Perceived Efficiency Frontier (EPEF) of the Bank

5.2. The Endogenous Perceived Efficiency Frontier (EPEF) of the Insurer

6. Senior Management Opts for a Point on the EPEF (Period 3)

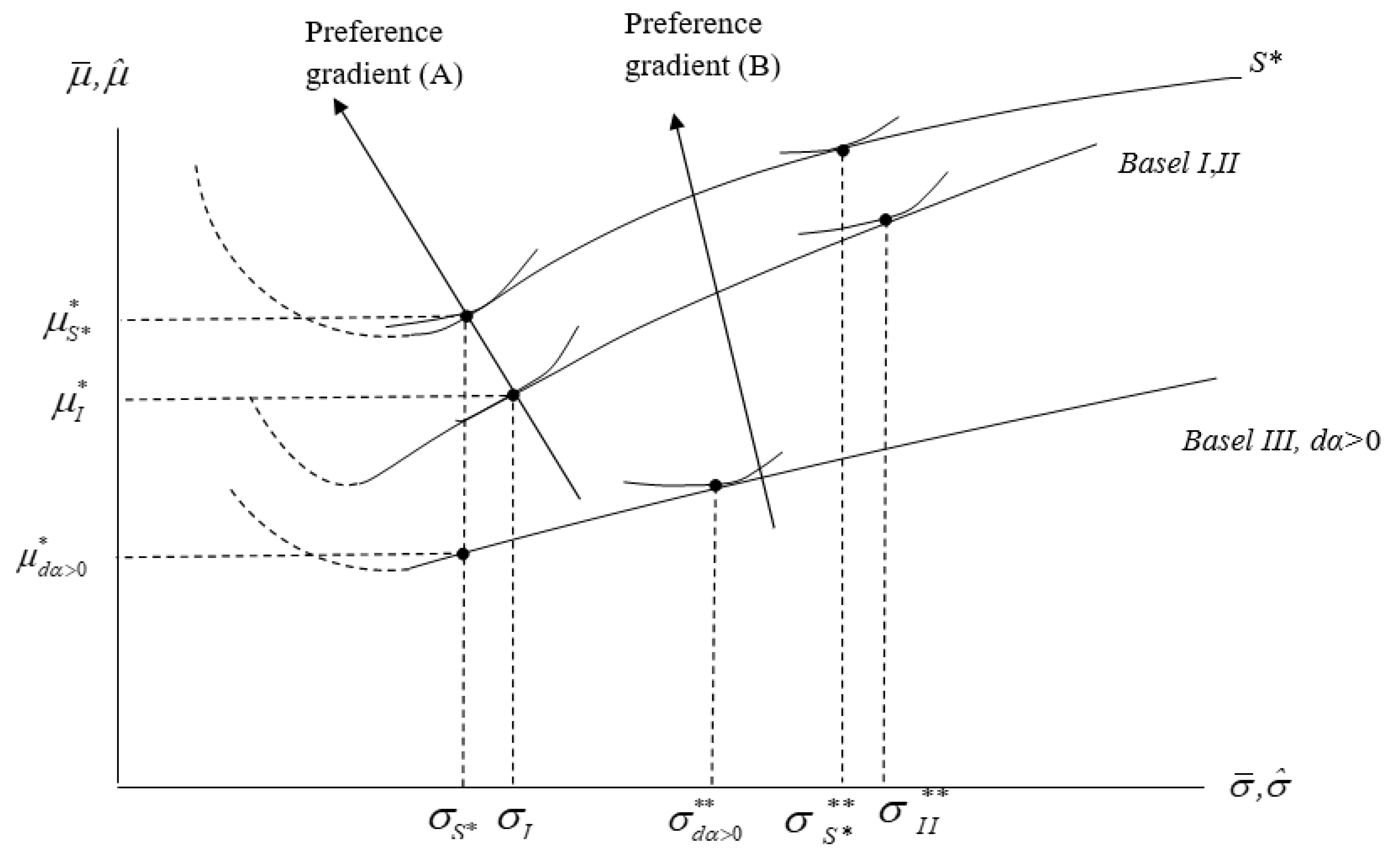

7. Solvency Regulation Affects the Perceived Endogenous Efficiency Frontier

7.1. Basel I and II

7.2. Solvency I and II

8. The New Regulation: Basel III and Planned Solvency III

8.1. Basel III

8.2. Planned Solvency III

9. Limitations

10. Summary and Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Banks | Insurers | ||

|---|---|---|---|

| Ba1 | Returns and volatility () are additive in an exogenous () component determined on the capital market and an endogenous one. | In1 | Returns and volatility () are additive in an exogenous () component determined on the capital market and an endogenous one. |

| Ba2 | The higher returns on the capital market, the less risk capital is needed to attain a given solvency level. A positive shock on returns makes positive net values of the bank more likely, therefore reducing the need for risk capital. | In2 | The higher returns on the capital market, the less risk capital is needed to attain a given solvency level. A positive shock on returns makes positive net values of the company more likely, therefore reducing the need for risk capital. |

| Ba3 | The higher the volatility in the capital market, the more risk capital is needed to attain a given solvency level. Positive net values of the bank are less likely, and this must be counteracted by more risk capital. | In3 | The (present value of) premium income depends negatively on the rate of return attainable in the capital market because policyholders now have more favorable investment alternatives. |

| Ba4 | The rate of interest that must be paid on deposits reacts to an exogenous increase of returns less than proportionally. Otherwise, the condition for an interior optimum (see Equation (4) again) would sooner or later be violated. | In4 | The (present value of) premium income depends positively on the volatility of returns in the capital market because the insurer now offers a comparatively safe investment alternative to risk-averse policyholders. |

| Ba5 | With increased volatility in the market, the bank can offer less favorable conditions to depositors. | In5 | A higher solvency level calls for more risk capital but to a lesser degree if higher market returns prevail, making positive net values of the company more likely. |

| Ba6 | According to B4, the bank must increase its interest rate on deposits when market conditions become more favorable. However, it can afford to adjust to a lesser degree if its solvency level is high. | In6 | A higher solvency level calls for more risk capital, especially when market volatility is high, making positive net values of the company less likely. |

| Ba7 | According to B5, the bank must follow the market with its interest paid on deposits. However, it can again afford to adjust to a lesser degree if its solvency level is high. The inequality derives from the fact that by B4, is bounded, while is not. | In7 | A higher solvency level calls for more risk capital, especially when market volatility is high, making positive net values of the company less likely. |

| Ba8 | A higher solvency level calls for more risk capital but to a lesser degree if higher market returns prevail, making positive net values of the bank more likely. | In8 | While a higher rate of return on the capital market depresses premium income (see In4), this effect weakens if the insurer offers a high level of solvency. |

| Ba9 | A higher solvency level calls for more risk capital, especially when market volatility is high, making positive net values less likely. | In9 | Higher volatility on the capital market serves to increase premium income (see In5); this effect is reinforced if the solvency levels is high. |

Appendix B

Appendix B.1. Banks

Appendix B.2. Insurers

| 1 | The superscript B is dropped whenever there is no risk of confusion. |

| 2 | The bracket notation points to the fact that the terms of conditions (4) (and (8), see below) have to be evaluated at some particular values of their arguments. This becomes important in the comparative-static analysis performed in Section 4 below (see also Appendix A). |

| 3 | The superscript I is dropped whenever there is no risk of confusion. |

| 4 | The financial crisis of 2007–2008 has shown that government bonds are far from risk-free (see e.g., Moody’s Investor Service (2010) for a survey of sovereign defaults). |

| 5 | The time difference between premiums written and claims paid can be substantial in life insurance, in which case the length of period 0 has to be adjusted accordingly. |

| 6 | See Bikker and Gerritson (2017) for empirical evidence. |

| 7 | Again, see Bikker and Gerritson (2017) for empirical evidence. |

| 8 | Once again, see Bikker and Gerritson (2017) for empirical evidence. |

| 9 | In view of the fact that σ is a non-convex risk measure that makes it unsuitable for deriving an efficient frontier, Krokhmal et al. (2001) argue in favor of replacing it by the CVar measure. However, since both Basel and Solvency continue to be couched in terms of VaR, banks and insurers would run into conflict with regulation if they derived their EPEF in a different way; indeed Miskolczi (2016) finds that the choice matters. |

| 10 | For empirical evidence suggesting that managers act in a risk-averse manner rather than as perfect (i.e., risk-neutral) agents on behalf of (well-diversified) investors, see Milidonis and Stathopoulos (2014) as well as Gormley and Matsa (2016). |

| 11 | Over the years, solvency regulation has expanded to include notably liquidity risk (Barth and Miller 2018). However, the maintenance of adequate solvency capital continues to be a concern of crucial importance, justifying this paper’s focus on it (Flannery 2014). |

| 12 | |

| 13 | According to Ng and Cheung (2015), the authorities of Singapore anticipate Solvency III to closely copy Basel III. |

References

- Admati, Anat R., Peter M. DeMarzo, Martin F. Hellwig, and Paul C. Fleiderer. 2013. Fallacies, Irrelevant Facts, and Myths in the Discussion of Capital Regulation: Why baNk Equity Is not Socially Expensive. Working Paper No. 23. Bonn: Max Planck Institute for Research on Collective Goods. [Google Scholar]

- Artzner, Philippe, Freddy Delbaen, Jean-Marc Eber, and David Heath. 1999. Coherent Measures of Risk. Mathematical Finance 9: 203–28. [Google Scholar] [CrossRef]

- Aymanns, Christoph, Carlos Caceres, Christina Daniel, and Liliana Schumacher. 2016. Bank Solvency and Funding Cost. Working Paper No. 16/64. Washington, DC: International Monetary Fund. [Google Scholar]

- Barth, James R., and Stephen Matteo Miller. 2018. On the Rising Complexity of Bank Regulatory Capital requirements: From Global Guidelines to their United States (US) Implementation. Journal of Financial Risk and Management 11: 77. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. 1988. International Convergence of Capital Measurement and Capital Standards. Basel: Bank for International Settlements. [Google Scholar]

- Basel Committee on Banking Supervision. 2004. Basel II: International Convergence of Capital Measurement and Capital Standards: A Revised Framework. Basel: Bank for International Settlements. [Google Scholar]

- Basel Committee on Banking Supervision. 2014. Basel III Leverage Ratio Framework and Disclosure Requirements. Basel: Bank for International Settlements. [Google Scholar]

- Basel Committee on Banking Supervision. 2016. Interest Rate Risk in the Banking Book. Basel: Bank for International Settlements. [Google Scholar]

- Basel Committee on Banking Supervision. 2017. Basel III Transitional Arrangements, 2017–2027. Basel: Bank for International Settlements. [Google Scholar]

- Bauer, Wolfgang, and Mark Ryser. 2004. Risk management strategies for banks. Journal of Banking & Finance 28: 331–52. [Google Scholar]

- Benink, Harald, and George Benston. 2005. The future of banking regulation in developed countries: Lessons from and for Europe. Financial Markets, Institutions & Instruments 14: 290–328. [Google Scholar]

- Bikker, Jacob A., and Dirk F. Gerritson. 2017. Determinants of interest rates on time deposits and savings accounts: Macro factors, bank risk, and account features. International Review of Finance 18: 169–216. [Google Scholar] [CrossRef]

- Billings, Mark, and Forrest Capie. 2007. Capital in British banking, 1920–1079. Business History 49: 139–62. [Google Scholar] [CrossRef]

- Covitz, Daniel M., Diana Hancock, and Myron L. Kwast. 2004. A reconsideration of the risk sensitivity of U.S. banking organization subordinated debt spreads: A sample selection approach. Economic Policy Review 10: 73–92. [Google Scholar]

- Cummins, J. David, and David J. Nye. 1981. Portfolio optimization models for property-liability insurance companies. An analysis and some extensions, Management Science 27: 414–30. [Google Scholar]

- Cummins, J. David, and David W. Sommer. 1996. Capital and risk in property-liability insurance markets. Journal of Banking and Finance 20: 1069–92. [Google Scholar] [CrossRef]

- Cummins, J. David, and Mary A. Weiss. 2014. Systemic risk and the U.S. insurance sector. Journal of Risk and Insurance 81: 489–528. [Google Scholar] [CrossRef]

- Cummins, J. David, and Richard D. Phillips. 2001. Applications of financial pricing models for property-liability companies. In Handbook of Insurance. Edited by George Dionne. Norwell: Kluwer, pp. 621–55. [Google Scholar]

- Cummins, J. David. 1988. Risk-based premiums for insurance guaranty funds. Journal of Finance 63: 823–39. [Google Scholar] [CrossRef]

- Diamond, Douglas W., and Philip H. Dybvig. 1983. Bank runs, deposit insurance, and liquidity. Journal of Political Economy 91: 401–19. [Google Scholar] [CrossRef]

- Epermanis, Karen, and Scott E. Harrington. 2006. Market discipline in property/liability insurance: Evidence from premium growth surrounding changes in financial strength ratings. Journal of Money Credit and Banking 38: 1515–44. [Google Scholar] [CrossRef]

- Flannery, Mark J., and Sorin M. Sorescu. 1996. Evidence of bank market discipline in subordinate debenture yields: 1983–1991. Journal of Finance 51: 1347–77. [Google Scholar]

- Flannery, Mark J. 2014. Maintaining Adequate Bank Capital. Journal of Money Credit and Banking 46: 157–80. [Google Scholar] [CrossRef]

- Furfine, Craig H. 2003. Interbank exposures: Quantifying the risk of contagion. Journal of Money, Credit, and Banking 35: 111–28. [Google Scholar] [CrossRef]

- Goldberg, Lawrence G., and Sylvia Hudgins. 1996. Response of uninsured depositors to impending S&L failures: Evidence of depositor discipline. Quarterly Review of Economics and Finance 36: 311–25. [Google Scholar]

- Goldberg, Lawrence G., and Sylvia C. Hudgins. 2002. Depositor discipline and changing strategies for regulating thrift institutions. Journal of Financial Economics 63: 263–74. [Google Scholar] [CrossRef]

- Gormley, Todd A., and David A. Matsa. 2016. Playing it safe? Managerial preferences, risk, and agency conflicts. Journal of Financial Economics 122: 431–55. [Google Scholar] [CrossRef]

- Harris, Milton, Christian C. Opp, and Marcus M. Opp. 2014. Higher Capital Requirements, Safer Banks? Macroprudential Regulation in a Competitive Financial System. Working Paper. Chicago: University of Chicago Booth School of Business. [Google Scholar]

- Heyde, Chris C., Steven G. Kou, and Xianhua H. Peng. 2006. What Is a Good Risk Measure: Bridging the Gaps between Data, Coherent Risk Measures, and Insurance Risk Measures. Working Paper. New York: Columbia University. [Google Scholar]

- Hogan, Thomas L. 2021. A Review of the Regulatory Impact Analysis of Risk-Based Capital and Related Liquidity Rules. Journal of Risk and Financial Management 14: 24. [Google Scholar] [CrossRef]

- International Monetary Fund. 2013. European Union: Publication of Financial Sector Assessment Program Documentation–Technical Note on Stress Testing of Banks. IMF Country Report No. 13/68. Washington, DC: IMF. [Google Scholar]

- Jacklin, Charles J., and Sudipto Bhattacharya. 1988. Distinguishing panics and information-based bank runs: Welfare and policy implications. Journal of Political Economy 96: 568–92. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- John, Kose, Anthony Saunders, and Lemma W. Senbet. 2000. A theory of bank regulation and management compensation. Review of Financial Studies 13: 95–125. [Google Scholar] [CrossRef]

- Jordan, John S. 2000. Depositor discipline at failing banks. New England Economic Review, 15–28. [Google Scholar]

- Kim, Daesik, and Anthony Santomero. 1988. Risk in banking and capital regulation. Journal of Finance 43: 1219–33. [Google Scholar] [CrossRef]

- Koehn, Michael, and Anthony Santomero. 1980. Regulation of bank capital and portfolio risk. Journal of Finance 35: 1235–44. [Google Scholar] [CrossRef]

- Krokhmal, Palo, Jonas Palmquist, and Stanislav Urysav. 2001. Portfolio Optimization with Conditional Value-at-Risk Objective and Constraints. Working Paper. Gainesville: University of Florida, Dept. of Industrial and Systems Engineering. [Google Scholar]

- Lang, Larry H.P., and René M. Stulz. 1992. Contagion and competitive intra-industry effects of bankruptcy announcements. Journal of Financial Economics 32: 45–60. [Google Scholar] [CrossRef]

- Leibowitz, Martin, Stanley Kogelman, and Lawrence N. Bader. 1992. Asset performance and surplus control: A dual-shortfall approach. Journal of Portfolio Management 21: 29–37. [Google Scholar] [CrossRef]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance 29: 449–70. [Google Scholar]

- Merton, Robert C. 1977. An analytical derivation of the cost of deposit insurance and loan guarantees. Journal of Banking & Finance 1: 3–11. [Google Scholar]

- Milidonis, Andreas, and Konstantinos Stathopoulos. 2014. Managerial incentives, risk aversion, and debt. Journal of Financial and Quantitative Analysis 49: 453–81. [Google Scholar] [CrossRef]

- Miskolczi, Panna. 2016. Differences between mean-variance and mean-cvar portfolio optimization models. Annals of the Faculty of Economics of Oradea University 1: 548–57. [Google Scholar]

- Moody’s Investors Service. 2010. Sovereign Default and Recovery Rates 1983–2009. Available online: https://www.moodys.com/login?ReturnUrl=http%3a%2f%2fwww.moodys.com%2fviewresearc-doc.aspx%3fWT.mc_id%3dSovDefResearch%26docid%3dPBC_124389%26lang%3 (accessed on 7 June 2021).

- Mülbert, Peter O. 2009. Corporate governance of banks. European Business Organization Law Review 10: 411–36. [Google Scholar] [CrossRef]

- Nakada, Peter, Hemant Shah, H. Ugur Koyluoglu, and Olivier Collignon. 1999. P&C RAROC: A catalyst for improved capital management in the property and casualty insurance industry. Journal of Risk Finance 1: 1–18. [Google Scholar]

- Ng, Questor, and Raymond Cheung. 2015. Development of Risk Based Capital Framework in Singapore. Available online: http://actuaries.org/FUND/singapore/IndustryUpdateRBCDevelop_Cheung.pdf (accessed on 7 June 2021).

- Park, Sangkyun, and Stavros Peristiani. 1998. Market discipline by thrift depositors. Journal of Money, Credit, and Banking 30: 347–64. [Google Scholar] [CrossRef]

- Power, Michael. 2004. The Risk Management of Everything. Rethinking the Politics of Uncertainty. London: Demos. [Google Scholar]

- Repullo, Rafael. 2004. Capital requirements, market power, and risk-taking in banking. Journal of Financial Intermediation 13: 156–82. [Google Scholar] [CrossRef]

- Rochet, Jean-Charles. 1992. Capital requirements and the behaviour of commercial banks. European Economic Review 36: 1137–78. [Google Scholar] [CrossRef]

- Shiller, Robert J. 2016. Irrational Exuberance, 3nd ed. Princeton: Princeton University Press. [Google Scholar]

- Smith, Clifford W., and René M. Stulz. 1985. The determinants of firms’ hedging policies. Journal of Financial and Quantitative Analysis 20: 391–405. [Google Scholar] [CrossRef]

- Stulz, René M. 1996. Rethinking risk management. Journal of Applied Corporate Finance 9: 8–24. [Google Scholar] [CrossRef]

- Van Hulle, Karel. 2018. From Solvency II to Solvency III? Available online: https://www.icir.de/fileadmin/Documents/Policy_Platform/4_VanHulle.pdf (accessed on 7 June 2021).

- Woehrmann, Peter, Willi Semmler, and Martin Lettau. 2004. Nonparametric Estimation of the Time-Varying Sharpe Ratio in Dynamic Asset Pricing Models. Working Paper No. 225. Zurich: University of Zurich, Institute for Empirical Research. [Google Scholar]

- Zweifel, Peter, Dieter Pfaff, and Jochen Kühn. 2015. A simple model of bank behaviour–with implications for solvency regulation. Studies in Microeconomics 3: 49–68. [Google Scholar] [CrossRef]

- Zweifel, Peter, Roland Eisen, and David L. Eckles. 2021. Insurance Economics, 2nd ed. New York: Springer, in print. [Google Scholar]

- Zweifel, Peter. 2015. Solvency regulation of insurers: A regulatory failure? Journal of Insurance Issues 37: 135–57. [Google Scholar]

| Comment | Reference | Comment | Reference | |

|---|---|---|---|---|

| Basel I, Solvency I | Due to fixed risk weights, the regulation posits a fixed relationship between solvency capital and the level of solvency. | Zweifel et al. | : A higher solvency level calls for more risk capital but to a lesser (greater) degree if a higher market return (volatility) prevails, making positive net values of the bank (insurer) more (less) likely. Neglecting these facts, results in a lower slope of the EPEF → Optimum entails more volatility, lower solvency. | Table A1, Equation (15). |

| Basel II, Solvency II | For a bank (insurer) who chooses an internal model, the relationship between solvency capital and level of solvency becomes flexible, provided the constraint on solvency level is not binding. | Zweifel et al. (2015). | This flexibility is lost if the constraint on the solvency level is binding → Basel I applies. | Zweifel et al. (2015). |

| Basel III, Solvency III | Additionally, now banks (insurers) are mandated to take risks emanating from the capital market into due account.. | and are reinserted in the EPEF → its slope increases, also due to decreased leverage → Optimum entails less volatility, higher solvency (not necessarily for highly capitalized insurers). | Equations (15), (20) and (21). |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zweifel, P. Solvency Regulation—An Assessment of Basel III for Banks and of Planned Solvency III for Insurers. J. Risk Financial Manag. 2021, 14, 258. https://doi.org/10.3390/jrfm14060258

Zweifel P. Solvency Regulation—An Assessment of Basel III for Banks and of Planned Solvency III for Insurers. Journal of Risk and Financial Management. 2021; 14(6):258. https://doi.org/10.3390/jrfm14060258

Chicago/Turabian StyleZweifel, Peter. 2021. "Solvency Regulation—An Assessment of Basel III for Banks and of Planned Solvency III for Insurers" Journal of Risk and Financial Management 14, no. 6: 258. https://doi.org/10.3390/jrfm14060258

APA StyleZweifel, P. (2021). Solvency Regulation—An Assessment of Basel III for Banks and of Planned Solvency III for Insurers. Journal of Risk and Financial Management, 14(6), 258. https://doi.org/10.3390/jrfm14060258