1. Introduction

Risk management is ubiquitous in the oil industry. Proper risk management and mitigation is crucial when making investment decisions at a stage of the life cycle of an investment in the oil industry. The risk is greatest in the hydrocarbon exploration phase, while in the field development phase and hydrocarbon production it is lower. For oil fields that are in the mature phase of hydrocarbon production, the cost of maintaining injection wells is crucial to profitability.

All the cited literature collectively described in this paper can be applied as a basis for risk management of injection wells. In this paper, the categories of probability of success (POS) were modified and adapted to assess the probability of workover success in injection wells. POS is related to the cost correction factor and provides data when designing future workovers in oil fields.

In risk management research in the oil industry, the focus is on risk mitigation in the hydrocarbon exploration phase. The reason is very simple, because it is a very intensive capital investment and it is necessary to reduce the risk to a minimum. As the potential for exploration work has decreased in some oil provinces, risk research in the fields in the mature phase of hydrocarbon production will increasingly come into focus. Over time, there will be investor decisions to abandon oil and gas fields within oil and gas provinces that have been in hydrocarbon production for decades.

The risks of maintaining production are crucial when making the decision to close an oil field. Maintaining costs at lower levels ensures profits for companies, thereby extending the lifespan of field production. Proper estimation of production costs and capital investment is vital for fields that have been in production a long time. Small oil fields are the focus of research in this paper, because their profitability is key to the energy independence of countries that rely on such fields.

The aim of this paper is to apply the proven POS method and modify it to assess the risk of costs of workovers on injection wells. In modified POS, all categories are tailored to actual events that may occur during workovers. Correction coefficients and probabilities were determined from the literature and empirically as a result of many years of monitoring and execution of workovers. In this paper, the calculation of capital investments in workovers in injection wells is extended and applied to oil field “B”.

2. Materials and Methods

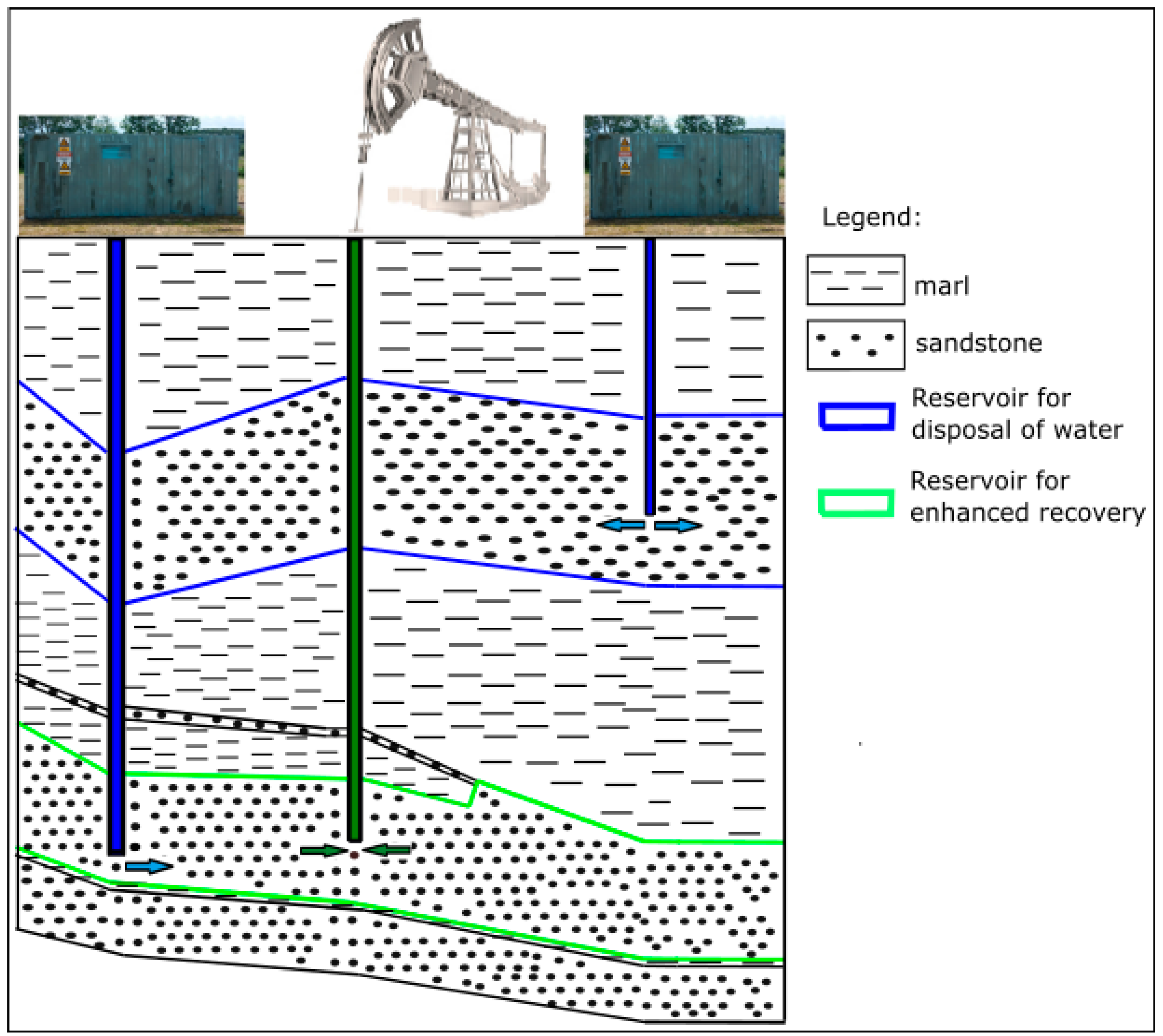

The produced formation water is used to maintain the reservoir pressure or for the purpose of disposal, as shown in

Figure 1.

The analyzed oil field “B” is located in the southwestern part of the Pannonian Basin System in the Sava Depression (Northern Croatia). Oil field “B”, according to the classification of the authors

Beltrán et al. (

2014), belongs to the class of very small oil fields, while according to the classification of the CPBS (Croatian part of Pannonian Basin) by

Velić et al. (

2012) it belongs to the medium fields class. Field development began in the 1960s and it is still in production today.

The most important parameter that affects the economy of the field is the cost of injection of formation water. Costs and analysis of injection systems have been done by various authors who have demonstrated the impact on oil and gas projects (e.g.,

Evans 2001;

Khatib and Verbeek 2002;

Palsson et al. 2003). The costs of formation water injection were calculated according to Equation (1) (

Ivšinović and Dekanić 2015):

where FWIC—formation water injection costs (USD), WWCC—workover and capital workover (USD), IDPMC—injection and dispatch pumps maintenance costs (USD), CWOC—construction work and other costs (USD), EEC—electric energy costs (USD), SIC—scale inhibitor costs (USD), and EPWIA—employees and produced water injection amortization (USD).

For the risk of workovers on injection wells to be financially valorized, it is necessary to make changes to the POS calculation and adjust the Equation (1). The cost of workover on injection wells makes up more than 60% of formation water injection costs. According to

Ivšinović and Dekanić (

2015), the costs of opex and capex workovers are calculated according to Equation (2):

where WWCC—workover and capital workover costs (USD), W—workover costs (USD), and CW—capital workover costs (USD).

In order to be able to estimate the cost as well as possible, it is necessary to modify Equation (2) with a correction factor (f) in order to calculate the risk factor, then Equation (3) is:

where WWCC—workover and capital workover costs (USD), W—workover costs (USD), CW—capital workover costs (USD), and f is the correction factor.

The correction factor depends on several factors that can occur during the workover on the injection wells. Expression (4) for the correction factor is:

where f is the correction factor, f

1—pullover injection equipment, f

2—perforation of reservoir, f

3—chemical treatment of reservoir, f

4—hydraulic fracturing of reservoir, f

5—equipping deep injection equipment.

The probability of success of the new category (workover) within the POS for injection of formation water is calculated according to the following Equation (5):

where p(WO)—probability of success for workover, p(1)—success of pullover injection equipment, p(2)—success of perforation of reservoir, p(3)—success of chemical treatment of reservoir, p(4)—success of hydraulic fracturing of reservoir, and p(5)—success of equipping of injection well.

Determining POS for workovers is in the domain of risk assessors, based on “lessons learned”, documentation of previous workovers, geological settings, etc., that are relevant to the areas analyzed.

3. Results and Discussion

In order to include risk in the calculation of formation water injection, it is necessary to analyze the geological POS (probability of success) as the basis of the analysis. The POS calculation methodology for CPBS was developed by

Malvić and Rusan (

2009) and improved by

Malvić and Velić (

2015). The value of POS for the western part of the Sava Depression is 0.5625 (

Ivšinović et al. 2020). Modification of POS for the needs of formation water injection was made by

Malvić et al. (

2020), in which they replaced the category “field water” with “injection of field water”, and the calculated POS was 0.5625. The new “workovers” category expands and upgrades the existing POS in terms of the impact of the workovers themselves on injectivity. In the worst case, according to

Table 1, the impact on injectivity would be 0.78, while in the best case there would be no impact, i.e., it would be 1.0.

The cost of formation water injection in field “B” is 1.27 ± 0.29 USD/m

3 (

Ivšinović 2017), while the total cost of disposal formation water obtained by the bootstrap method is 2.32–2.69 USD/m

3 (

Ivšinović et al. 2021). The determination of the value correction factor is based on previous workovers performed on wells and on the experience of cost engineers when designing workovers on injection wells. The long-term production of hydrocarbons significantly affects the injection costs, as the same workovers were repeated several times on these wells. Therefore, the new fields that are at the beginning of the application of the enhanced recovery method will have a significantly lower cost correction factor in the case of the maturity of the field. The value of the correction cost factor (f) (

Table 1) for the worst case is according to Equation (4) 2.2, while in the best case it is 1.0.

Using the correction factor (f), a probability of workover (p(WO)) would be calculated according to

Table 1, which was created as a modification and upgrade of the usual geological POS.

Table 1 describes the most common operations performed in injection wells. The most common operations in CPBS are acid treatment of the reservoir and re/perforation of the reservoir. In the example of oil field “B”, due to the age of the field and the frequent need to ensure the injectivity of wells, according to the probabilities from

Table 1, the value of workover performance due to workover is 0.8577 (Equation (5)). If multiplied by the geological POS (0.5625) for the investigated area, the value of the reservoir flooding success would be 0.4824, which is acceptable considering the geological structure of the investigated area. The value of the geological POS is established, and it cannot be changed because it is conditioned by the geological structure of the area, while the technical–technological part of POS (workovers) is subject to change, because it is based on the experience of a cost engineer and his team. Experts through technical documentation can assess and mitigate possible risks when performing workovers on injection wells. Proper selection of well candidates can mitigate the risk and thus the probability of success of workovers.

According to the data in

Table 1, the cost correction coefficient for the analyzed field would be 1.30 (Equation (4)), which is 30% higher than the usual cost of investing in injection wells. This is understandable given the life span of the “B” oil field, which is evident as economic and workover indicators deteriorate significantly over time. For the economic profitability of exploiting mature oil fields, it is necessary to maintain a low cost of production maintenance. The goal is to achieve lower-value breakeven oil prices. In order to achieve this, it is necessary to analyze the methods of more concrete and clear consideration of risk, and thus cost, because investments in risky injection wells reduce the profit of the oil field itself. Each disparity between costs and profits in mature oil fields works to shorten or end a profitable exploitation of fields. Failure to determine the actual POS of workovers leads to a miscalculation of economic parameters such as return on investment (RI), net present value (NPV), oil breakeven price (OBP), etc. Costs of disposal of formation water are a very important variable in production from mature hydrocarbon fields to maintain the profitability of production. By accurately determining the risk, a clearer financial framework is obtained in which one can operate profitably, in order to meet all the conditions, set by the local community and investors.

4. Conclusions

The importance of correctly determining and mitigating risk is a key for fields in the mature stage of production. Any error in risk assessment leads to financial losses and thus leads to field closure. The importance of the assessment comes to the fore in an environment of constant changes in the price of oil on the world market. Any capital investment must be targeted and cost-oriented, to ensure field profitability. Analysis of real costs and success of reservoir flooding is crucial in the analysis of oil field operations in the secondary phase of production. The cost of formation water injection is the most important input parameter in the model of hydrocarbon production by secondary methods. Any improvement in risk mitigation is important because it makes it easier for investors to decide on further investments in hydrocarbon production.

The value of workover performance due to workover on field “B” is 0.8577, while the value of the reservoir flooding success for the studied area is 0.4824, lower than the POS value for reservoir flooding for that study area. This POS modification with the “workovers” category improved on the previous model because it also considered the risk of running workovers. The cost correction coefficient for the analyzed field “B” is 1.30, which is 30% higher than usual costs. This proved that it was necessary to improve Equation (1), which was applied in the research area. The risk analysis and estimation of the cost correction factor described in this paper may change for the entire CPBS area. The analyzed modified POS method and the correction factor calculation in this paper can be applied to all small oil fields in the world where water injection methods have been applied in order to maintain reservoir pressure. Risk and cost management is a very crucial process in the oil industry. Cost engineers and other petroleum experts play key roles in risk and cost management. Experience, analysis and application of the latest methods in many cases can contribute to extending the life of small fields. This ensures the profitability of companies, and at the same time reduces the energy dependence of the country in which the company operates.

Author Contributions

Conceptualization, J.I. and V.P.; methodology, J.I.; validation, J.I. and V.P.; formal analysis, J.I.; investigation, V.P.; writing—original draft preparation, J.I. and V.P.; writing—review and editing, J.I.; visualization, J.I. and V.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ali Hatefi, Mohammad. 2017. Assessment of Risk Factors of a Completed Oil and Gas Project, with the Use of a Hybrid EVM-SAW Method. Journal of Energy Management and Technology 2: 42–53. [Google Scholar] [CrossRef]

- Beltrán, Rivas, Julian Daniel, and Carlos Alberto Vargas Jiménez. 2014. Hydrocarbon Production Scenarios in Colombia. Review of Field Sizes, Hydrocarbon Reserves and Expectations of Conventional and Unconventional Resources. Earth Sciences Research Journal 18: 77–83. [Google Scholar] [CrossRef]

- Evans, Robin. 2001. Produced water management strategy with aid of decision analysis. Paper presented at Exploration and Production Environmental Conference, San Antonio, TX, USA, February 26–28. [Google Scholar]

- Gorlenko, Nadezhda, Mikhail Murzin, and Roman Belyaevsky. 2020. Assessment of Environmental Risks at Oil and Gas Production Companies Using an Integrated Method. Paper presented at Vth International Innovative Mining Symposium, Kemerovo, Russia, October 19–21. [Google Scholar]

- Hagström, Earl L., Christopher Lyles, Mala Pattanayek, Bridgette DeShields, and Mark P. Berkman. 2016. Produced Water—Emerging Challenges, Risks, and Opportunities. Environmental Claims Journal 28: 122–39. [Google Scholar] [CrossRef]

- Ivšinović, Josip. 2017. The analysis of water injection systems in sandstone hydrocarbon reservoirs, case study from western part of the Sava Depression. Rudarsko-geološko-naftni zbornik 32: 17–24. [Google Scholar] [CrossRef]

- Ivšinović, Josip, and Igor Dekanić. 2015. The basics of model for marginal testing of costs for disposal of extracted formation water. Rudarsko-geološko-naftni zbornik 30: 85–100. [Google Scholar] [CrossRef] [Green Version]

- Ivšinović, Josip, Tomislav Malvić, Josipa Velić, and Jasenka Sremac. 2020. Geological Probability of Success (POS), case study in the Late Miocene structures of the western part of the Sava Depression, Croatia. Arabian Journal of Geosciences 13: 714. [Google Scholar] [CrossRef]

- Ivšinović, Josip, Maria Alzira Pimenta Dinis, Tomislav Malvić, and Dubravka Pleše. 2021. Application of the bootstrap method in low-sampled Upper Miocene sandstone hydrocarbon reservoirs: A case study. Energy Sources Part A-Recovery Utilization and Environmental Effects 43: 1–15. [Google Scholar] [CrossRef]

- Khadem, Mohammad Miftaur Rahman Khan, Sujan Piya, and Ahm Shamsuzzoha. 2018. Quantitative risk management in gas injection project: A case study from Oman oil and gas industry. Journal of Industrial Engineering International 14: 637–54. [Google Scholar] [CrossRef] [Green Version]

- Khatib, Zara, and Paul Verbeek. 2002. Produced water management for sustainable field development of mature and green fields. Paper presented at SPE International Conference on Health, Safety and Environment in Oil and Gas Exploration and Production, Kuala Lumpur, Malaysia, March 20–22. [Google Scholar]

- Malvić, Tomislav, and Igor Rusan. 2009. Investment risk assessment of potential hydrocarbon discoveries in a mature basin. Case study from the Bjelovar Sub-Basin, Croatia. Oil, Gas—European Magazine (Hamburg) 35: 67–72. [Google Scholar]

- Malvić, Tomislav, and Josipa Velić. 2015. Stochastically improved methodology for probability of success (POS) calculation in hydrocarbon systems. RMZ-Materials and Geoenvironment 62: 149–155. [Google Scholar]

- Malvić, Tomislav, Josip Ivšinović, Josipa Velić, Jasenka Sremac, and Uroš Barudžija. 2020. Increasing Efficiency of Field Water Re-Injection during Water- Flooding in Mature Hydrocarbon Reservoirs: A Case Study from the Sava Depression, Northern Croatia. Sustainability 12: 786. [Google Scholar] [CrossRef] [Green Version]

- Palsson, Bjarni, David Roland Davies, Adrian Christopher Todd, and James McLean Somerville. 2003. A holistic review of the water injection process. Paper presented at SPE European Formation Damage Conference, The Hague, The Netherlands, May 13–14. [Google Scholar]

- Schiozer, D. J., and E. L. Ligero. 2004. Risk Assessment for Reservoir Development under Uncertainty. The Journal of the Brazilian Society of Mechanical Sciences and Engineering 2: 21–217. [Google Scholar] [CrossRef] [Green Version]

- Suda, Khairul Azizan, Nazatul Shima Abdul Rani, Hamzah Abdul-Rahman, and Chen Wang. 2015. A Review on Risks and Project Risks Management: Oil and Gas Industry. International Journal of Scientific and Engineering Research 6: 938. [Google Scholar]

- Velić, Josipa, Tomislav Malvić, Marko Cvetković, and Boris Vrbanac. 2012. Reservoir geology, hydrocarbon reserves and production in the Croatian part of the Pannonian Basin System. Geologia Croatica 65: 91–101. [Google Scholar] [CrossRef]

- Young, Jacobus. 2009. Risk management for a typical petroleum, oil and gas company in South Africa. Corporate Ownership & Control 6: 346–56. [Google Scholar] [CrossRef]

- Zhang, Yanting, and Liyun Xing. 2011. Research on Risk Management of Petroleum Operations. Energy Procedia 5: 2330–34. [Google Scholar] [CrossRef] [Green Version]

- Zhen, Xingwei, Torgeir Moan, Zhen Gao, and Yi Huang. 2018. Risk Assessment and Reduction for an Innovative Subsurface Well Completion System. Energies 11: 1306. [Google Scholar] [CrossRef] [Green Version]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).